Abstract

Using data from 2003 to 2020, this study uses a scientometric approach to investigate the nexus between Corporate Social Responsibility (CSR) and corporate tax aggressiveness research. The objective is to identify under-explored regions, variables, citation patterns, theories, and unexplored topics in the body of knowledge to establish trends in publications on issues about corporate social responsibility and corporate tax aggressiveness. In addition, the study also considers publication journal areas of focus. Research linking CSR and tax avoidance using VOSviewer and triangulating with CiteSpace, by way of approach, is not found in the literature. The findings suggest that CSR and corporate tax aggressiveness researchers do not use far-reaching relevant theories and applicable findings from studies beyond their clusters. Another finding is that African countries remain under-explored due to the absence of institutional representation and an adequate number of investigators regarding CSR and corporate tax aggressiveness research. Finally, the study reveals a number of research topics to be explored. Governments, particularly in developing economies, should create policies that define taxes as part of an entity’s CSR narrative to enhance transparency and legitimacy. In addition, the study is of immense significance to master and PhD students since it provides an agenda for future research.

1. Introduction

The practical concern of the association between corporate social responsibility (CSR) and the extent of corporate tax aggressiveness or avoidance has been developing recently and with it comes a corresponding interest in academic research in the field of knowledge [1,2,3]. Recent developments in the corporate arena call for a broader look into corporations’ role in society, leading to the emergence of different perspectives to include stakeholders’ ideas [4]. The broader perspective has therefore changed the CSR narrative. In particular, the stakeholder perspective acknowledges other groups, too, rather than the shareholders to whom the corporation is responsible [4]. Thus, corporate social responsibility is increasingly becoming significant to companies’ competitive strategies as it brings many benefits such as risk management, access to low-cost capital, excellent customer relations, cost savings, capacity to manage human resources, and the ability to innovate and grow [5]. While there are many definitions associated with the concept of CSR, Carroll [6] notes that CSR refers to the society’s expectation that corporations provide contentment in their operations to the broader stakeholders out of narrow shareholders or investors by voluntarily incorporating the economic, ethical, legal, and philanthropic responsibilities in their operations.

In recent years, the European Commission has stated that large public interest entities must include in their management report the non-financial statement that will be essential for the understanding of:

Entity’s development, performance, position and impact of its activity, relating to, at the very minimum: environmental, social and employee matters, respect for human rights, anti-corruption and bribery issues. Such statement should include a description of the policies, outcomes and risks related to those matters and should be included in the management report of the undertaking concerned.([7], p. 4)

Thus, the above assertion captures businesses’ moral responsibilities beyond maximising shareholder value and abiding by the law to include taking care of people, the environment, and society.

An equally important subject is corporate tax avoidance in the tax planning industry, which makes entities’ claim to corporate social responsibility a mockery. Tax aggressiveness refers to all corporate tax planning activities, whether legal, illegal, or anything in between the grey area [8,9]. It is used interchangeably in the literature with tax avoidance, aggressive tax behaviour, tax planning, tax sheltering, tax management, irresponsible tax aggressiveness, and in some extreme cases, tax evasion [1,9]. Tax aggressiveness means executive actions with the objective to reduce or minimise corporate tax payment through tax planning activities, using all legal and illegal means available. Dietsch [10] posits that asking entities that engage in conscious tax minimisation strategies to pay more taxes is like “asking the fox to guard the henhouse”. Indeed, these are common the world over, even in advanced economies, where economic systems effectively control such behaviours [11]. Ironically, CSR disclosure reports do not always consider corporate tax payments as part of an entity’s CSR agenda.

Many literature review studies have explored the association between CSR and environmental management accounting [12]; theory development regarding CSR [13,14]; CSR at institutional, organisational, and individual levels of analysis [15]; CSR and corporate financial performance [16]; variability in measures of corporate tax avoidance and tax research [17,18]; and determinants of effective tax rate (ETR), a proxy for measuring tax avoidance [19]. However, to the best of our knowledge, no study has attempted to juxtapose CSR and tax aggressiveness using the scientometric technique. At best, the closest is a recent study by Whait et al. [20], in an integrative literature review on the relationship between CSR and tax aggressiveness, yet without the superior scientific and analytical advantage associated with VOSviewer software in a scientometric approach to literature review. What is more, a scientometric analysis on the evolution of CSR responsibility by Ferramosca and Verona [21] and another on environmental concerns and social responsibility by Zeng and Hengsadeekul [22] did not include corporate tax aggressiveness in the analysis, still leaving a gap in the body of knowledge. Especially now, entities espouse their CSR credentials and turn around to minimally comply with tax obligations, affecting an entity’s moral and ethical decision-making in the context of aggressive tax planning. Thus, when designing and executing a corporate strategy and making tax-related decisions, socially responsible entities must consider ethical factors in addition to legal and economic ones [23]. As posited by Gribnau and Jallai [24], corporations that already claim to have a CSR policy or strategy must meet the requirements for good tax governance, as taxes are a societal contribution, and to the extent that good tax governance is founded on a deep desire to be transparent, which goes well beyond a cost-benefit analysis, reputation, and market value of an entity. In response, this study uses VOSviewer together with CiteSpace by way of triangulation (in a complement role) to establish the relationship between CSR and tax aggressiveness. In addition, using multiple measures to triangulate the results is advantageous because if results across various measures are consistent, then one can be more confident that they are robust.

To establish the trends in publication on corporate social responsibility and corporate tax aggressiveness, this study maps out co-occurrence of keywords, co-authorships, co-citations, and direct citations analysis. We gathered data from articles of the Scopus databases that were published from 2003 to 2020. It is worth mentioning that scientometric technique is perhaps one of the most influential and advanced techniques used in co-citation reviews [25]. Employing such a technique in this study is not expected to attempt to solve the CSR–corporate tax aggressiveness puzzle though; instead, it is to provide a basis for subsequent review into the scope and complexity inherent in CSR and tax avoidance principles [21]. The study identifies under-explored regions, variables, and theories and unexplored topics in the body knowledge to establish their relationship with other fields of study and citations patterns. All these help to address the main weakness of mainstream review [26].

The study found that researchers in the discipline of CSR and tax aggressiveness traditionally do no borrow appropriate and applicable ideas and results from studies outside their clusters. The findings also suggest that African countries remain under-explored due to a lack of institutional involvement and influential investigators regarding CSR and corporate tax aggressiveness research. The remaining sections are structured as follows: after the literature review, research design, and data analysis, we present discussions and conclusions, which include the implications to practice.

2. Literature Review

Corporate tax behaviour has developed into a high-profile issue of global public policy [27]. Scholars have been concerned about the impact of corporate tax aggressiveness and evasion in the midst of increasing CSR and sustainability disclosures [9,22,28]. CSR is associated with different terminologies to include corporate social responsiveness, corporate social performance (CSP), business ethics, corporate citizenship, stakeholder management, corporate accountability (CA), triple bottom line (TBL), and sustainability [6,29]. More so, involvement of the entity in CSR has both ethical and moral issues when it comes to the corporate decisions and actions and therefore attracts the attention of a variety of stakeholders, since these decisions can have a positive or negative impact on society [30]. Corporate tax aggressiveness/avoidance, on the other hand, is where a corporation is not paying its fair share of taxes and shifting a more significant portion of the tax burden onto others [31,32]. The relationship between CSR and corporate tax behaviour has recently been a contentious one. Although taxation can lead to socially desirable ends, Davis et al. [33] note that some corporations claim in their sustainability reports that tax payment is deleterious/damaging to innovation, production, job creation, and economic development. Indeed, company failure to reduce tax liability can be seen as incompetent tax management [34].

The absence of consensus on corporations’ responsibility may be influenced mainly by the overriding view of corporations in accounting and business research that the role of corporation is to make profit [35]. This view is mainly espoused by agency theorists, where CSR has limited relevance in corporate operations [36,37]. Additionally, using evidence from non-governmental organisations, newspaper investigative reports, International Monetary Fund reports, UNCTAD and US senate enquiry reports, among others, Christensen and Murphy [38] argue that the increasing activities in corporate tax avoidance is promoted largely by “shadow economy operating in majority of globalized sectors” due to its secretive environment, where “profit-laundering” mechanisms are formed without the involvement of these corporations in any economic activities in those locations. The effects are believed to have been felt much in developing economies, where tax laws and regulations are weak, allowing multinationals to transfer or repatriate vast sums of money as profit. This scenario is worsened by an ever-increasing competition to attract foreign direct investments (FDIs) by these emerging economies through tax incentives [38,39,40,41].

Different researchers have used several theoretical perspectives and reviews to explain the association between CSR and tax aggressiveness. These theories include ethics theory, which highlights the contradiction between rhetoric and corporate behaviour when it comes to the payment of taxes [40,41]. Another is corporate culture theory [1,38,39]. In essence, these authors posit that firms engage in CSR for ethical reasons, operating for their shareholders’ benefit and the impact of their operations on extended stakeholders, including the environment. In addition to the ethical stance, research evidence shows a growing focus on the implication of firms engaging in irresponsible behaviour, which will likely affect their reputation [42]. To avoid the adverse effects of reputational damage, entities or corporations tend to minimise the risk associated with damage to their image using risk management strategies [1]. Thus, these researchers have found a negative association between CSR and tax aggressiveness: entities with severe social and environmental concerns are less tax aggressive [38]. However, using a hand-collected unique sample of 20 Australian corporations accused by the Australian Taxation Office of engaging in aggressive tax activities from 2001 to 2006, comparing them to a control sample of 20 non-aggressive entities, Lanis and Richardson [43] test legitimacy theory. The authors found a positive and statistically significant relationship between corporate tax aggressiveness and CSR disclosure, thereby confirming legitimacy theory in corporate tax aggressiveness. That is, firms that disclosed more CSR activities were highly engaged in aggressive tax practices. Gulzar et al. [2] found a significant negative relationship between CSR and corporate tax avoidance proxies in China, indicating that firms with higher CSR scores are more willing to pay less in corporate taxes, which contradicts the existing literature. Thus, this suggests that corporate tax payments and CSR act as substitutes among Chinese firms, as espoused by the risk management perspective [44]. CSR provides insurance-like protection (which depends on an effective firm’s communication strategy) for firm value by reducing the risk associated with firms’ reputation in terms of bad media reportage, penalties from tax authorities, and boycotts when companies engage in aggressive tax avoidance activities [3,45].

The inconsistent results of the limited inquiries show that it is essential to examine CSR strategies to recognise and prioritise areas that need improvement to increase performance along different stakeholder dimensions. Following this, it is recommended that CSR be measured along the various dimensions of CSR to include economic, social, environmental, stakeholders, and voluntariness [42]. Predictably, Laguir et al. [5] argue that the mixed result is a widening association between corporate tax behaviours and CSR’s various components. The researchers contend that an aggregated/overall CSR score, which indicates any numerical strength of the items, has a high probability of diluting the association between CSR and tax aggressiveness. They conclude that an increasing CSR in the social dimension reduces the level of corporate tax aggressiveness. In contrast, high activity in the economic dimension is associated with a high level of tax aggressiveness. It is suggested that some CSR dimensions may be more relevant than others. Firms are likely to react to each dimension differently for diverse reasons [6,8]. Thus, the association between CSR and corporate tax aggressiveness has been expanded to include the economic, social, environmental, and governance dimensions of CSR [46,47]. These dimensions of CSR are the result of instrumental approaches and methodologies [43] in stakeholder theory, which sees entities’ operations according to the demands of stakeholders. Indeed, Gulzar et al. [2] suggest that the relationship between tax aggressiveness and CSR needs to be studied further to identify more dimensions.

Ostensibly, discussions on sustainability, CSR disclosures, and reporting has witnessed an increasing trend and essentially rely on two competing theoretical frameworks such as legitimacy and signalling theories, which more often result in apparent contradictory conclusions regarding the relevance and impacts of such disclosures [48]. Therefore, the constructs of organizational façade and coordinated hypocrisy, described as rich and nuanced theoretical perspectives [49,50], are valuable to the discourse on sustainability and CSR disclosures since they provide intellectual space for a more systematic understanding and integration of the demands of the dominant economic landscape and the competing stakeholders to limit the choices made by individual companies.

More so, the differing findings of these studies, using a unitary construct of CSR [8], combined with the over-concentration of the studies in advanced economic setting, call for more research on the missing link between CSR dimensions and tax aggressiveness [8,9]. The relationship of these dimensions to the corporate tax aggressiveness and the ethics of tax aggressive behaviour will be invaluable, especially where corporations respond to and place premiums on these dimensions differently. In addition, a trend analysis of these studies to discover areas of focus in this current dispensation will be an added advantage to the body of knowledge.

3. Methodology

Scientometrics is a field of study concerned with measuring and assessing scientific and scholarly literature. It is thus a quantitative analysis tool for analysing the evolution of research as an information mechanism. Saka and Chan [51] note that scientometric is a technique that involves the visualization and analysis of a large corpus of paper to present the intellectual evolution and mapping of structural patterns in a research domain. Scientometric has a significant overlap and similar methodologies with bibliometrics and informetrics [52,53,54]. Thus, bibliometrics, scientometrics, and informetrics apply to subfields, which are all concerned with the analysis of subject interactions as reflected in their literature output. The research areas range from tracking trends in a scientific field’s production over time and across countries to the library collection issue of retaining output control and most scholars’ low publication performance [54]. As a method of literature review, scientometric has a superior advantage over manual, traditional or systematic reviews because scientometric is performed to map and visualize scientific fields for new researchers, to measure and evaluate research performance, to decompose scientific literature into disciplinary and sub-disciplinary structures, and to understand the structural, temporal, and dynamic development of a discipline [54]. In addition, and in contrast to other similar literature review techniques, it provides a less biased or subjective overview of bibliographic data. Indeed, Markoulli et al. [26] argue that manual review of articles generally identifies some of the “trees” but do not provide a comprehensive assessment of the “forest”, which is registered as a weakness in the literature. Besides, in identifying overlooked research niches, the findings can inform potential research directions on the association between CSR and tax avoidance and promote research direction and financing efforts by practitioners and policymakers.

More so, scientometrics—besides encompassing all quantitative dimensions of research, science communication, and science policy—is primarily used in information sciences to analysis trends in research. It can be described as more nuanced compared to other systematic literature reviews, which require the use of manual and intellectual analysis. In addition, the advantage of using scientometrics and one of the reasons for it being the fundamental choice for this study is its ability to make amorphous data very meaningful and sensible. In all, scientometrics is most preferred because of its quantitative attributes and scientific approach to data analysis. This method is now gaining prominence in the social sciences in the area of analysing trends in publicised data sets [54].

Knowledge domains are now easily visualized due to rapid advancements in visualization techniques in scientometrics. There is a wide range of bibliometric mapping tools available for scientometric and bibliometric analysis used to map and visualise large scholarly datasets in the body of knowledge [55,56]. Examples include BibExcel, Science of Science (Sci2) Tool, VantagePoint, VOSviewer, CiteSpace, CopalRed, IN-SPIRE, Leydesdorff’s Software, Network and Workbench, and each comes with its strengths and weaknesses, and of course, analyse data with different techniques and algorithms. For this study, an assessment of the various tools was conducted based on their characteristics, including advantages and drawbacks. We chose VOSviewer [56] and CiteSpace [57] for the synergies they provide to execute science mapping [55]. Visualisation of Similarities Viewer (VOSviewer) is a freely accessible application that provides the essential features required to visualise scientometric networks [56,58]. CiteSpace, on the other hand, is a science mapping tool capable of visualising various network architectures, cluster identification, and emerging patterns, including sudden shifts in academic knowledge domain. Above all, it also generates and displays network distribution and time-zone [55]. Indeed, labelling co-citation clusters algorithmically is an important step towards enhancing the efficiency of citation analysis [59].

More so, CiteSpace, for instance, recommends labels for identified clusters, as exhibited in Figure 5. Chen et al. [59] posit that the concentration of this type of analysis is on the structure instead of the clusters’ content. In order to ensure clustering accuracy, the weighting algorithm, which indicates the importance of the items, follows the log-likelihood ratio (LLR) [22]. The colour of the module in the CiteSpace network reflects the corresponding average co-citation study year of each node, and the colour of the label corresponds to the colour of the module. Burst words/terms extracted from titles, abstracts, descriptors, and CiteSpace define bibliometric record identifiers. These terms are subsequently used in heterogeneous networks of terms and papers as names of clusters referred to as cluster focus/labels. Thus, emerging patterns and rapid changes in the foreground should be separated from more persistent themes in the context by an effective labelling method [60].

The scale and complexity of the scientometrics field have expanded exponentially, far outstripping conventional review methods. The domain visualization toolkit includes all of the techniques needed to perform studies quickly and efficiently. Researchers can now streamline the practice with unparalleled scalability and repeatability thanks to these new techniques [61]. More so, science mapping has progressed to the point that it is no longer solely an academic endeavour, but rather is being motivated by and applied to real-world problems. Although such mapping is sometimes confused, the visuals are simply a reflection of the layout and partitioning of bibliographic units (e.g., papers, terms, authors, journals) that are the primary output of the mathematics behind the mapping. Decision-makers are generally much more interested in the partitions themselves, as well as thorough study of the partitions, than in visuals of the layout. When these maps are used for real-world research planning and assessment of problems, the accuracy of these partitions becomes essential [25].

The aim of this study is to create bibliometric maps that will explain how CSR and tax aggressiveness are conceptually and empirically constructed [55]. This paper therefore performs a scientometric analysis of the nexus between CSR and corporate tax aggressiveness. Accordingly, an empirical, semi-automated method of quantitatively evaluating a large number of articles presents an accurate and unbiased assessment of the current state and trends/patterns. It reveals the structure and dynamics of CSR and corporate tax aggressiveness nexus [62] from 2003 to 2020.

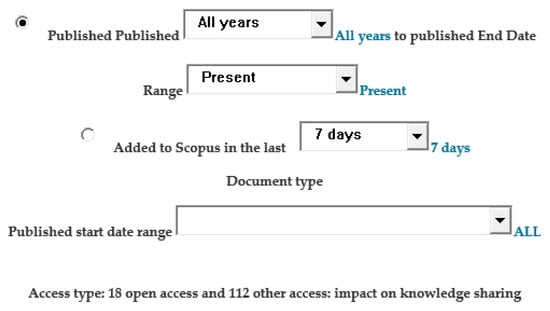

For the process, bibliographic documents were imported directly from the Scopus database, which offered a significantly broader coverage of high-computer interactions (HCI) literature than its counterparts, such as the Web of Science (WoS), would have offered. Additionally, Scopus helps to differentiate between authors more distinctly than the WoS would have in both citations and h-index. Scopus also produces substantially different maps of individual scholars’ citation networks [63], which is a set of items connected together with links. Furthermore, for data triangulation purposes, VOSviewer and CiteSpace were separately used because they deploy different algorithms to enhance the quality, reliability (data validation) and reproducibility of the results. The keywords for CSR used in the research criteria were corporate social responsibility, corporate social reporting, corporate social performance, environmental disclosure, sustainability disclosure, and sustainability reporting. These terminologies were combined with tax aggressiveness, tax avoidance, tax sheltering, tax evasion, tax management, and tax risk management [1,9,20,64]. Specifically, the search terminologies in the Scopus database used to extract the bibliographic data about published research on CSR and corporate tax aggressiveness were: “corporate social” OR “environmental disclosure” OR “environmental reporting” OR “sustainability disclosure” OR “sustainability reporting”, AND “tax aggressiveness” OR “tax avoidance” OR “tax sheltering” OR “tax evasion” OR “tax management” OR “tax risk management”. The search of the keywords was carried out in the titles, abstracts and keyword aspects of the scientific literature. The search was not time-bound and was with the date range criteria set for “All years to current” as can be seen in Figure 1. Thus, the article selection method exported from Scopus are the following: (TITLE-ABS-KEY (“corporate social” OR “environmental disclosure” OR “environmental reporting”) OR TITLE-ABS-KEY (“sustainability reporting” OR “sustainability disclosure”) AND TITLE-ABS-KEY (“tax aggressiveness” OR “tax avoidance” OR “tax shelter’“ OR “tax evasion” OR “tax management” OR “tax risk management”) AND ( LIMIT-TO LANGUAGE, “English”.

Figure 1.

Pictoral representation of the search criteria in Scopus.

In the search criteria, “corporate social” was used to capture corporate social responsibility, corporate social reporting, corporate social disclosure, and corporate social performance. The document type was set to “All” to ensure that all relevant publications were captured since the topic under discussion was on a relatively new area. The resulting statistics were as follows: Article (119) = 85.6%, Review (8) = 5.8%, Book Chapter (6) = 4.3%, Conference Paper (5) = 3.6%, and Book 1 = 0.7%. Thus, the total sample of bibliographic data was 139 (comprised of 134 published and five included in press documents) after limiting the search to only documents published in English. A cursory look at the titles and abstracts was performed to ensure the information retrieved contained the two concepts of CSR and corporate tax aggressiveness or any of their equivalent terminology as captured in the search criteria. The resultant bibliographic data extracted was imported into VOSviewer v1.6.15 (Centre for Science and Technology Studies Leiden University, Leiden, The Netherlands, https://www.vosviewer.com/, accessed on 30 October 2020) and CiteSpace v5.7.R2 (College of Information Science and Technology, Drexel University, Philadelphia, US, http://cluster.cis.drexel.edu/~cchen/citespace/, accessed on 20 November 2020) to visualise bibliographic networks/clusters and densities, which extracted other pieces of information to be looked at in Microsoft Excel. A cursory sort of the data extracted to excel indicated that the data range spans 2003 to 2020 with a total of 139 documents.

For the pre-processing phase, we used OpenRefine software to manage and clean the raw data obtained. At this stage, some missing names and similar terminologies, which are used interchangeably by scholars in the CSR and tax avoidance conception across the globe, were merged to avoid duplication. Eventually, the main topics, sources, references, and countries of publication were determined using retrospective statistical evaluation of emerging trends for almost two decades.

4. Data Analysis

Given the quantum of data collected for analysis, it can only be better analysed and discussed when summarised, as seen in Table 1, which shows a substantial number of the articles published in the social sciences with very few papers published in the life and physical sciences, such as energy, computer, and environmental sciences. This observation suggests that most physical and life science researchers do not traditionally consider corporate tax avoidance as an important issue in corporations’ social commitments to their environment. For instance, the lower numbers of articles are for the physical sciences: two for decision science and 12 for energy are testimonies. The reverse is true for the social sciences, with higher numbers of publications in, for example, business, management, and accounting, which have a total of 84 articles. Social sciences, including psychology, have a total of 51 articles and economics, econometrics, and finance have a total of 54 articles. There is evidence of a lack of drawing on theories from other disciplines to explain an entity’s tax aggressive behaviour in the midst of increasing CSR disclosure and activities. It is worth noting that papers do not add up to the subject categories because a number of the articles have been classified into more than one theme.

Table 1.

Distribution of scientific literature by subject category.

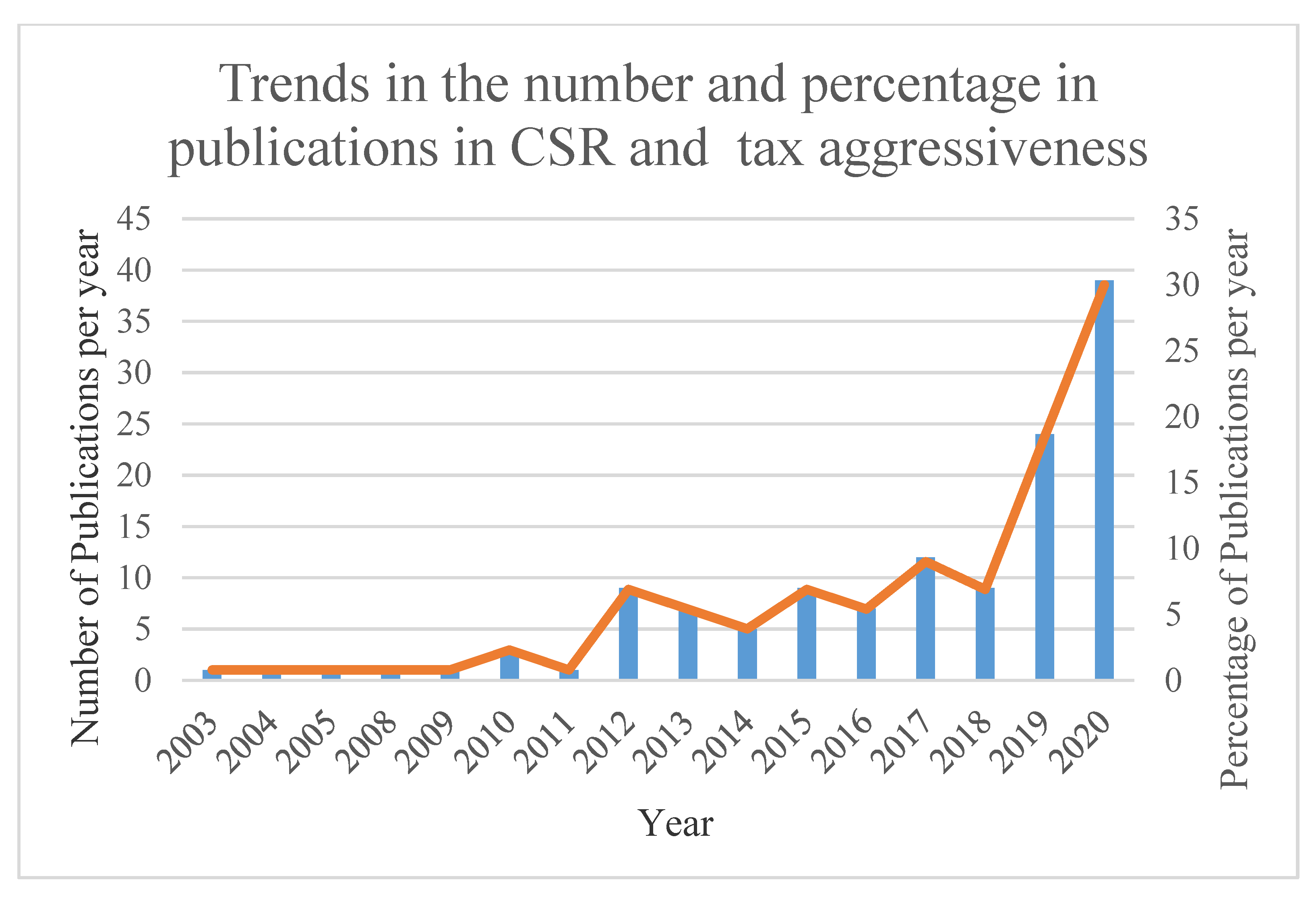

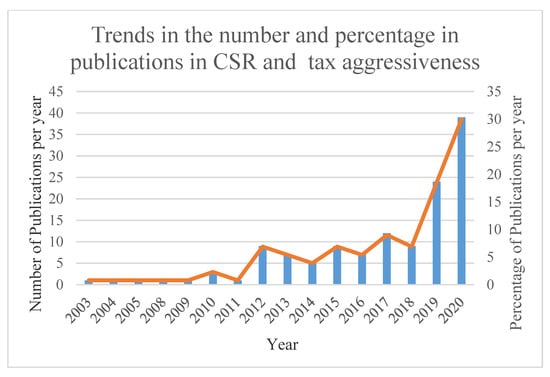

Not much was discussed in academia before 2012 according to the trend on the relationship between CSR and tax aggressiveness, as depicted in Figure 2. The data show that only one paper was published per year from 2003 to 2009, given an average of 0.8% publication per year until 2010, when the number of publications jumped to three. After this low trend from 2003 through to 2011, there was a marginal increased in publications between 4% and 9% per year from 2012 to 2018, with an average of 5–12 papers per year. There was a jump in 2019 from nine papers in 2018 to beyond 24 publications for 2019 and 39 articles in 2020, representing 18.5% and 30 percent%, respectively. The spiral between 2018 and 2019 indicates more than a 100% increase. This scenario is possibly due to increasing research interest in corporations’ role in society when it comes to corporate tax payments amid increasing trends in CSR and sustainability disclosures/reporting by corporations. The publication by the Global Reporting Initiative of the Tax standard in 2019 perhaps can also have drawn the attention of academics to the topic.

Figure 2.

Trends in the publications on CSR and corporate tax aggressiveness.

4.1. Area of Focus of Research: Co-Occurrence of Keywords—The “New” and “Hot” Topics

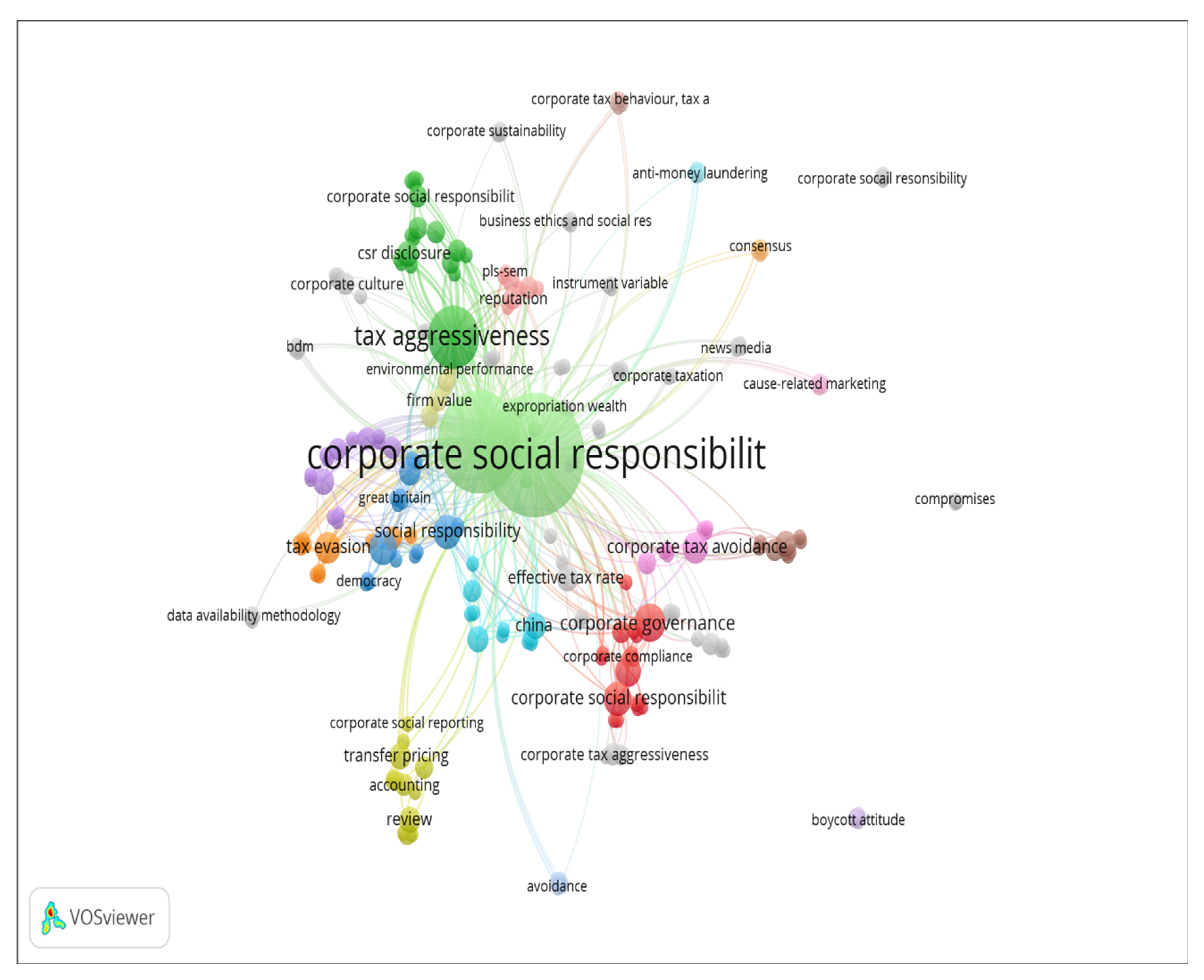

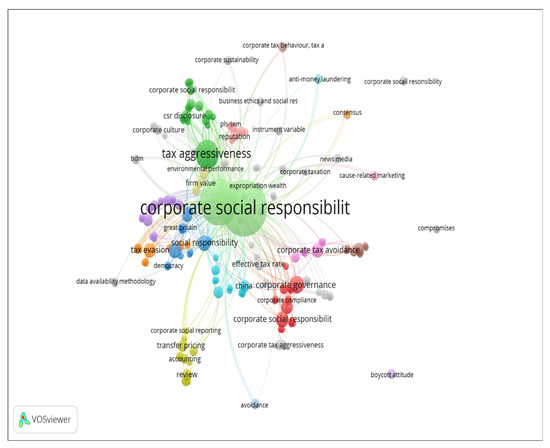

To generate the key issues and most researched variables or themes in CSR and tax aggressiveness for the period under study, this study generated a network of related keywords obtained to offer an accurate depiction of scientific knowledge and understanding of patterns. These keywords also presented the critical subject area of publications in the study field [65] and a co-occurrence of authors’ keywords that were created using VOSviewer. We used the fractional counting method to obtain a network visualisation, which gave connections, and intellectual organisation of the themes [58]. Put into context, co-occurrence explains the number of times particular terms occur together in a publication. The minimum number of keywords was set at 1 to capture all possible keywords and to ensure that the techniques capture all the possible theories used in explaining corporate tax behaviour in the realm of CSR, with Figure 3 showing the network visualisation while Table 2 displays the itemised keywords generated by VOSviewer. The results show 231 items/keywords, which define the object of interest and include publications, researchers, and terms. It is sometimes called a node or vertex. There are 37 clusters represented by different colours in the visualisation map, and they constitute a set of items included in a map.

Figure 3.

Network visualisation of authors’ keywords in clusters.

Table 2.

List of theories included in author’s keyword co-occurrence analysis.

The dominant keywords used in a publication were CSR (occurring 61 times), tax avoidance (43 times), tax aggressiveness (16 times), and tax evasion (4 times). The number of occurrences is captured based on the size of the network node/label. The node sizes and occurrence of tax avoidance and tax aggressiveness compared to tax evasion are bigger and show more occurrences or prominence. This possibly means that corporations have been involved in tax minimisation strategies instead of outright tax evasion, thus not directing research to criminalised corporate tax behaviour, hence reflecting in the choice of terms, or it could mean that it is easier to research tax avoidance than tax evasion.

It is essential to note that it is difficult to view all the over 200-plus keywords from a bibliographic map since the most prominent nodes with high-occurrence terms usually overshadow the less prominent ones.

In order to fulfil one of the objectives of this study, to know the theories that have been used to examine the relationship between CSR and corporate tax behaviour, Table 2 was extracted in addition to the author keyword network visualisation above (Figure 3). The results show that some theories have been used to try to explain CSR and corporate tax behaviour. Examples include agency theory [66]; organizational legitimacy and legitimacy theory [43]; organised hypocrisy; organizational façades [49,50]; Hofstede’s cultural dimensions [67]; political theory; moral foundations theory [68]; strategic trade-offs as well as regulatory, moral, cognitive, and pragmatic legitimacy [69]; shareholder theory [70]; and stakeholders theory. Considering the limited number of theories/perspectives used, there is the possibility for more theories to be exploited to aid in explaining the CSR–tax aggressiveness nexus in under-explored regions and different economic and institutional settings. It is worth noting that developing countries such as those in Africa have economies and institutional settings that are characterised by large governments, low tax culture of the populace, the absence of adequate accountability in the allocation of public funds, and the prevalence of underground and high cash transaction economies, among others [71]. Key variables identified include firm size, leverage, profitability, firm value, and capital intensity, among others linking CSR to tax aggressiveness.

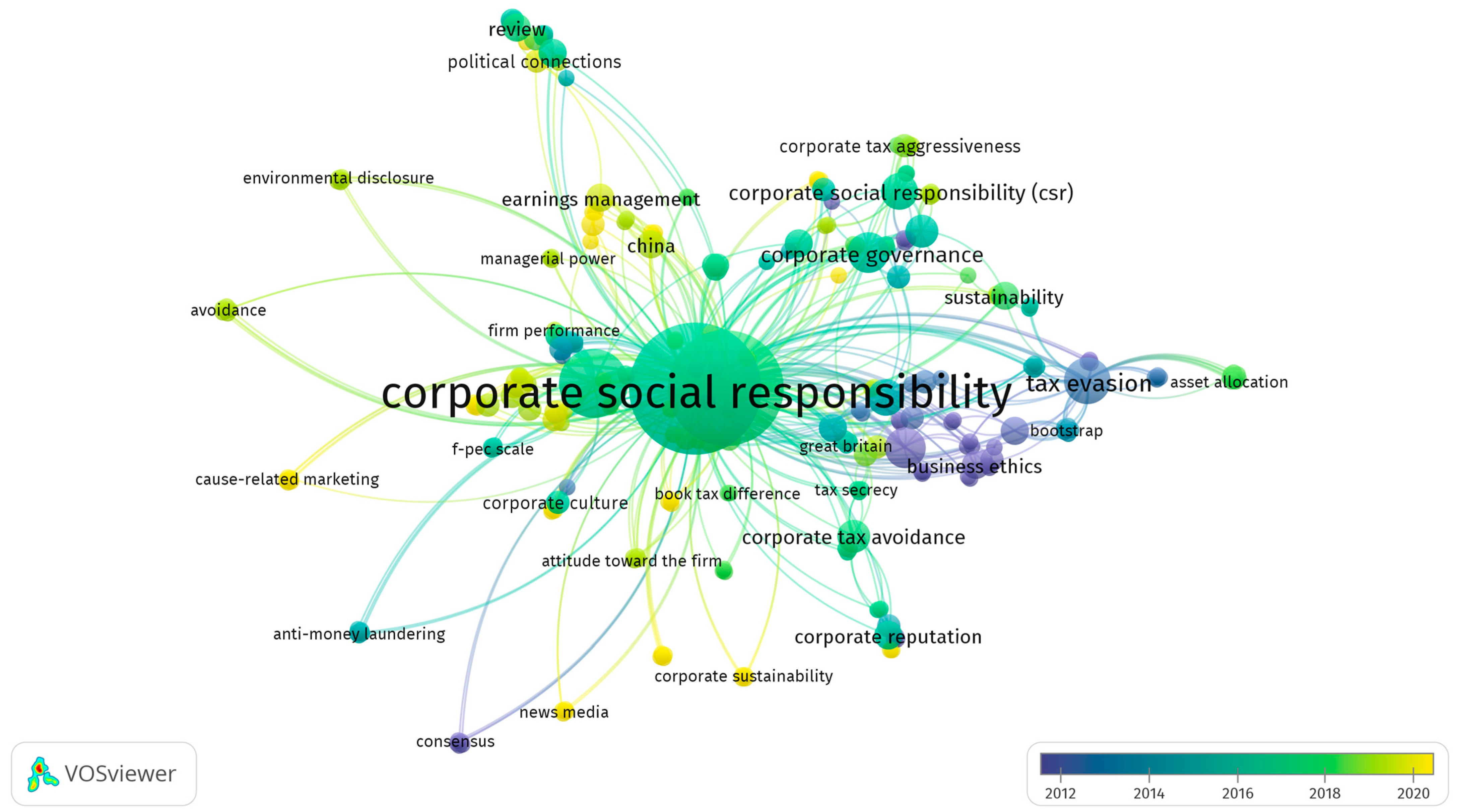

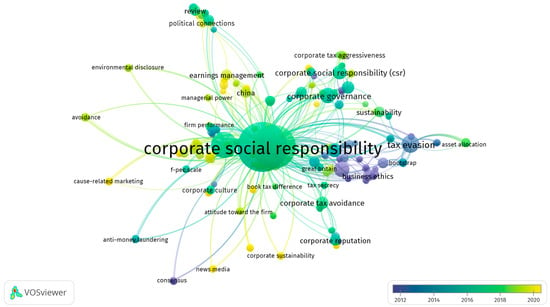

In addition to the above analysis, VOSviewer was again used to determine the focus of research over the years under review. In the process, an overlay visualisation of CSR and tax aggressiveness network was generated, as displayed in Figure 4. The results show that from 2003 to 2013, published literature focused on tax evasion, business ethics, expatriation, and organisational legitimacy, shown in violet colours in the figure and the summary key to the visualisation below the network. From 2016, the focus changed to the relationship between CSR and corporate governance, corporate tax aggressiveness, tax avoidance, corporate social disclosures, as captured in green and orange colours in the map. This is most likely due to the possibility that corporations exploited the loopholes in tax laws to avoid taxes. The topic “tax evasion”, which is an offence in the law and will be difficult to substantiate in the court of law, is difficult to research, especially when deliberate evasion cannot be proven. The overlay visualisation shows that the movement of the colour codes towards yellow indicates new topics that need further investigation. Thus, from the overlay network display and year-scale of the network visualisation, 2019 and beyond results, the possible new topics that can be exploited to further enhance corporate tax behaviour and CSR include earning management, which is linked to managers’ opportunistic behaviour [72]; board gender diversity, tax fees, and CSR; the role of the media in corporate tax avoidance; political connections in under-explored regions such as sub-Saharan countries such as Ghana and their impact on tax avoidance discourse; and, of course, the use of other new theories/perspectives. Paradoxically, neither the network display nor the key terminologies extracted above mention or show the different dimensions of CSR, indicating that most of the studies use a unitary construct of CSR. This gives an opportunity to explore the dimensions of CSR and their relationship with tax aggressiveness.

Figure 4.

Overlay visualisation of trends in authors’ keyword.

4.2. Co-Citation Analysis

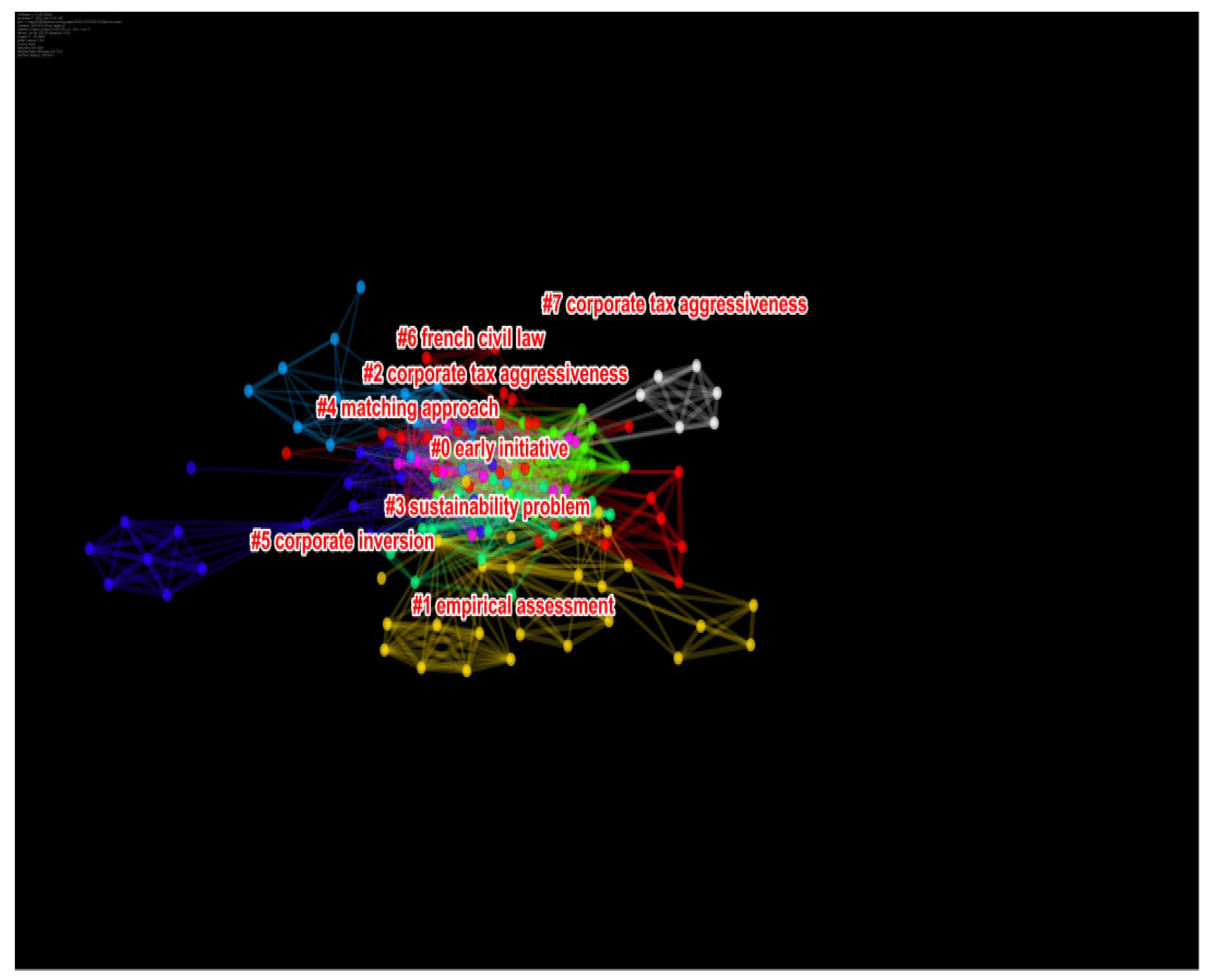

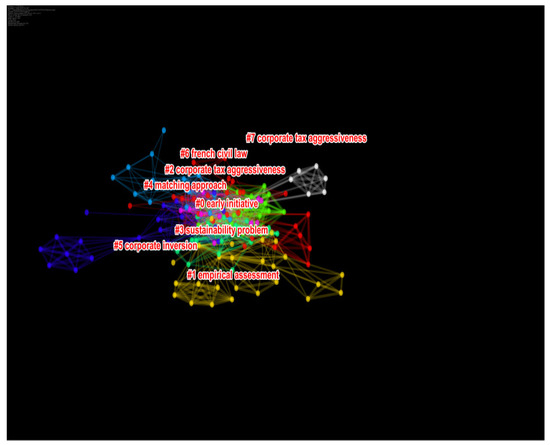

Insights into the trends in citations among published research on CSR and tax aggressiveness, especially in clusters formed using co-citation, revealed the formation of knowledge development in particular disciplines [59]. The co-citation link is a link between two items that are both cited by the same document. This study performed a document co-citation analysis to develop clusters of citations. CiteSpace was thus used since it is the most effective tool in generating patterns in this regard [59,73]. It also serves as a robustness check on citation patterns. The output is shown in Figure 5, which demonstrates the formation of eight prominent clusters in CSR–tax aggressiveness research, with cluster #0 as the first and largest cluster and cluster #7 as the last and smallest cluster. Depending on the cluster size, the labels of a cluster are displayed or generated automatically by the CiteSpace algorithms after the amorphous bibliographic data are uploaded onto the software.

Figure 5.

Patterns of citations and main citation clusters.

There are a total of eight clusters in this study and the cluster size is determined based on the number of articles in a cluster. For instance, in Table 3, the largest cluster (#0) has 34 members or articles and a silhouette value of 0.594. In CiteSpace, a silhouette value is useful in determining the uncertainty associated with defining the essence of a cluster. It also defines how close to or separate from articles are to a cluster, thus indicating which papers are within the cluster and those that are loosely within clusters. The silhouette value ranges from −1 to 1 and suggests the uncertainty that must be considered when interpreting the cluster’s essence [59]. For instance, while values close to 1 indicate that articles have been assigned to the appropriate cluster, a silhouette score close to −1 indicates a misclassification of that particular article in the worst-case scenario. In this study, Table 3 shows that all articles belong to a cluster, indicating homogeneity in CSR and tax avoidance literature.

Table 3.

Clustering structure for CSR–Corporate tax aggressiveness research.

The “hottest” or “new” topics are also extracted using the clusters as defined by CiteSpace. The mean or average year represents the average publishing year and indicates whether a cluster covers older or more recent publications in the study. For example, the mean year of clusters #0, #2, and #5 is 2007; clusters #6 and #7 have a mean year of around 2007; while clusters #1 and #3 have a mean year of 2011; and cluster #4 has 2003 as the mean year. More significantly, cluster #7 has a mean year of 2007 and a high silhouette value of 0.977. These measures suggest that studies that are part of cluster #7 are highly consistent, the representative articles are central for the cluster, and the representative publication is the most frequent co-cited publication.

The paragraphs below present a detailed explanation of the top/major three displayed clusters, as was automatically generated and summarised in CiteSpace and the possible topics that can be extracted from these eight clusters.

Cluster #0 labelled as “early initiative” contains 34 articles with Ylönen [74] as the most active citer to this cluster. The author historically and comprehensively demonstrates the policy initiatives by agencies and groups under the United Nations (UN) aimed at tackling corporate tax avoidance and evasion from the 1970s by the United Nations Commission and Centre for Transnational Corporations (UNCTC), contrary to the widely held view that country-by-country initiatives against corporate tax behaviour started in the 1990s. The author illustrates how the United Nations and its Centre for Transnational Corporations (UNCTC) initially developed and promoted several of the policy initiatives that have gained popularity in the post-financial crisis period in particular. Thus, the paper by Ylönen [74] titled “Back from oblivion? The rise and fall of the early initiatives against corporate tax avoidance from the 1960s to the 1980s” is the most active citer to cluster #0. The second most cited to cluster #0 is Fallan and Fallan [68] in “Corporate tax behaviour and environmental disclosure: strategic trade-offs across elements of CSR”? Fallan and Fallan [68] investigated Norwegian entities and found a significant and negative relationship between mandatory environmental disclosures and the level of tax aggressiveness, consistent with regulatory legitimacy theory, indicating no trade-offs between mandatory and voluntary CSR components. There was, however, the possibility of trade-offs between corporate tax behaviour and the voluntary environmental disclosures indicating that, to satisfy their shareholders, entities that have the most extensive voluntary environmental disclosure also engage in extensive tax-aggressive behaviour.

The second-largest cluster (#1) has 26 articles and a silhouette value of 0.818. It is labelled as “empirical assessment”. The most active citer to the cluster is Hardeck and Kirn [75] in “Taboo or technical issue? An empirical assessment of taxation in sustainability reports”. Hardeck and Kirn [75] examined the extent of tax disclosures in sustainability reports of entities in the US, UK, and Germany between 2007 and 2012. The findings show a low level of tax disclosures in sustainability reports with the exception of UK. Largely, the prevalent silence on tax issues and the contradictory treatment of taxes in sustainability studies demonstrate the complex role of tax payments in CSR. The second most active citer in this cluster is Darcy [27] in “‘The Elephant in the Room’: Corporate tax avoidance and business and human rights”. Darcy [27] positioned corporate tax avoidance from the perspective of the business and human rights agenda, drawing on the experience of Ireland as a tax haven and supporter of United Nations Guiding Principles. Darcy [27] concluded that firmly putting corporate tax avoidance on the business and human rights agenda can help since it can stimulate further discussion on tax avoidance and human rights in the global arena; sustain the interest of states, corporate entities, civil society, and human rights bodies; and, perhaps, encourage human rights-oriented developments aimed at tackling this deleterious practice. Darcy [27] underscored the role the OECD and the three pillars of the UN Guiding Principles on business and human rights.

The third-largest cluster (#2) has 21 members and a silhouette value of 0.775. It is labelled as “corporate tax aggressiveness”. Accordingly, the most active citer to the cluster is Lanis and Richardson [64] in “Outside directors, corporate social responsibility performance, and corporate tax aggressiveness: An empirical analysis”. Lanis and Richardson [64] maintain that as CSR performance increases, a high number of outside boards of directors should be able to understand the cost and benefits of the trade-offs of a tax aggressive policy as part of an overall corporate strategy aiming to improve corporate reputation. Lanis and Richardson [64] find that a high number of outside directors “magnify” the negative relationship between CSR performance and tax aggressiveness. Chircop, Fabrizi, Ipino, and Parbonetti [76] in “Does social capital constrain firms’ tax avoidance?” is also the second active citer to this cluster. The authors empirically examine whether the level of social capital (defined as mutual trust in society) of the region in which a firm has its headquarters impacts its tax avoidance activities. They found that firms that have their headquarters in high social capital areas engage significantly less in tax avoidance activities. The findings support the idea that managers consider the payment of corporate taxes a socially responsible behaviour.

In addition to visualising the clustering structure, CiteSpace was used to evaluate the entire citation networks specifics with a modularity value of Q = 0.9. Accordingly, modularity Q measures the degree to which the network can be separated into different autonomous blocks or modules, ranging between 0 and 1. Low modularity implies a network that cannot be reduced to clusters with distinct boundaries, whereas high modularity can mean a well-structured network [59]. The networks with modularity ratings very close to 1 represent relatively insignificant specific instances where individual elements are separated [59]. Implicitly, CSR and corporate tax aggressiveness research represents a network with dense connections between the studies in each cluster, but a sparse link between the studies in the different clusters. The values in Table 3 confirm the results based on the modularity value of Q = 0.9 for the network. As per the reference values given by the Rousseeuw [81] seminal study, silhouette values close to 1 indicate that cluster labels are homogeneous; that is, the value of 1 is a perfect distinction from other existing cluster labels. For instance, the results in Table 3 show that all but cluster #0 (with a silhouette value of 0.594) have a silhouette value close to 1, indicating that the clusters are well separated without intersections. This suggests that almost all parts of the studies belong to citation clusters, which indicates that CSR–tax aggressiveness research is focused, full of excellent exchange of ideas, and embroiled in debate among other scholars. In addition, the silhouette values computed for each cluster—0.594 for cluster #0 and 0.755 and 0.733 for clusters #2 and #3, respectively, to mention but a few—show that clusters in the network are entirely linked. Such homogeneous networks are formed when scholars do not reference research outside the cluster [82]. Therefore, the research studies produced in each cluster will not span a wide range of research sources [83]. The trend seems to point to a research culture that is isolated regarding other disciplines and areas of studies.

We identified the topics corporate tax aggressiveness, social responsibility, and sustainability reports as possible “hot” research topics since they are covered by the most dominant clusters in the CSR and tax aggressiveness literature and include clusters #2, #3, #5, and #7.

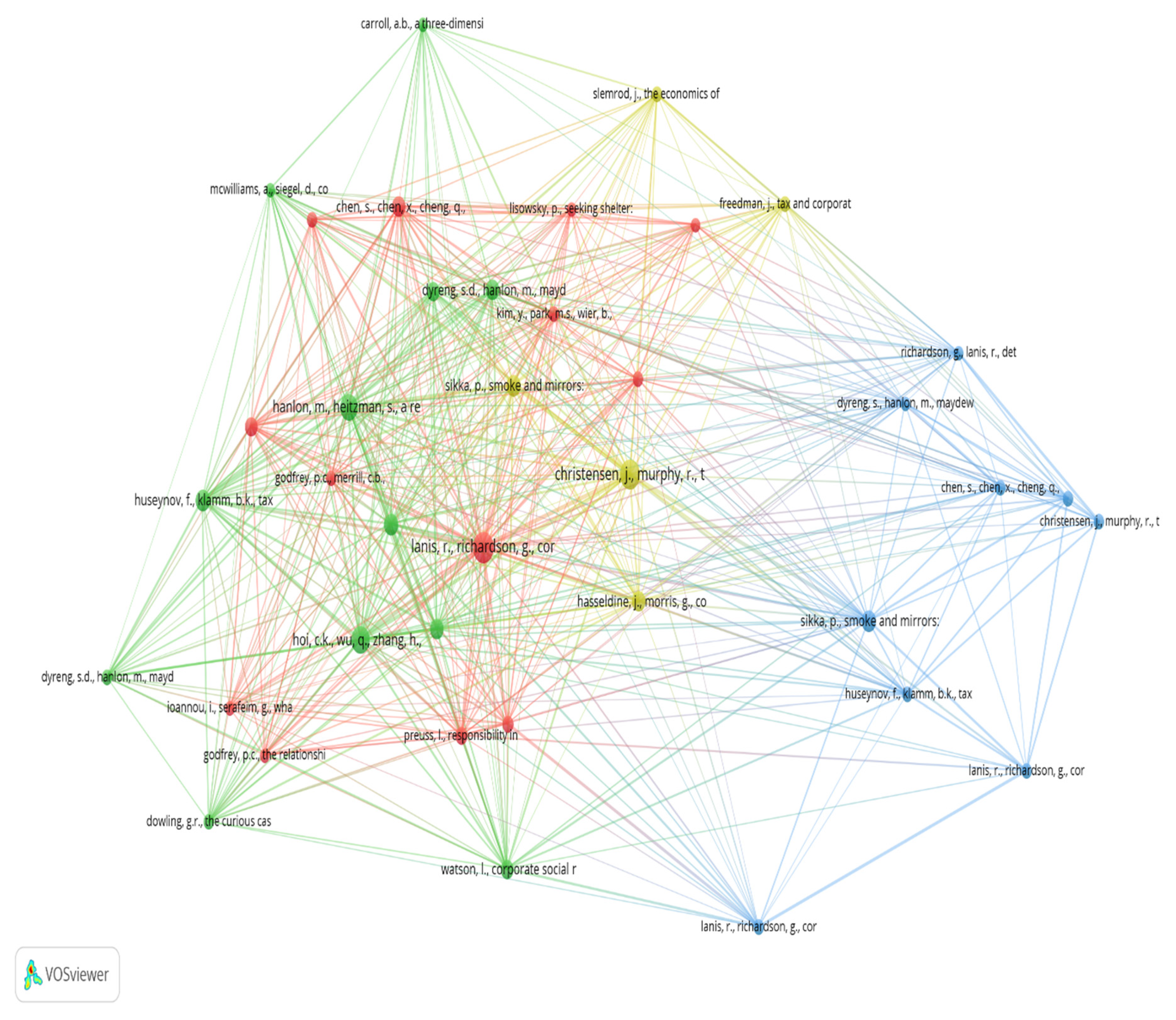

4.3. Co-Citation Analysis-VOSviewer

For triangulation and complementary purposes, we again use cited reference (author) and journal co-citation analysis, respectively, using VOSviewer to determine:

- -

- The domain’s structure, characteristics, development, and direction of CSR and corporate tax avoidance research (in the case of reference co-citation analysis); and,

- -

- A topic’s overall structure based on the journal’s defined goals and theoretical framework [21], in the case of journal co-citation analysis.

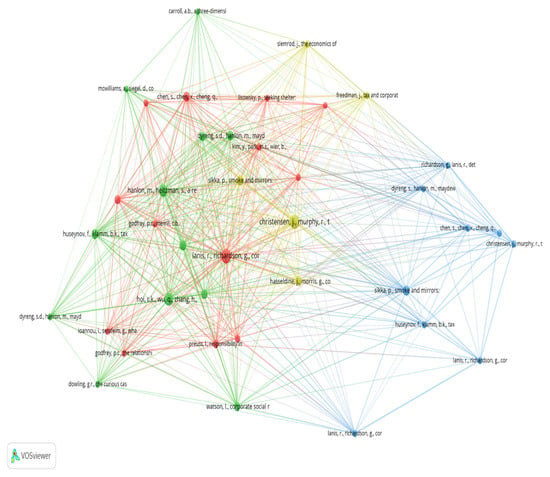

When two sources or journals have a close relationship, they are more likely to be referenced together. In this analysis, we included references and journals with a minimum of five citations for references and 20 citations for journals in the co-citation analysis. Thus, with the unit of analysis being cited references and the minimum number being five citations, out of a total of 6134 cited references, only 39 authors met the criteria. This analysis generated a network display of 39 items/authors, 4 clusters with red, yellow, green, and blue colours, 534 links, and total link strength of 162.50, as shown in Figure 6. From the network generated, the different clusters signify the relatedness of each reference to a particular author, while the nodes represent the number of citations acquired by an author. The larger the nodes/labels, the higher number of citations of the particular reference, and vice-versa. For example, the largest node is an article co-authored by Lanis and Richardson [9] published in Journal of Accounting and Public Policy and included in the red cluster. This paper titled “Corporate social responsibility and tax aggressiveness: an empirical analysis” was an attempt to address the paucity of research directly linking CSR activities of an entity to corporate tax aggressiveness. The findings show that a corporation’s public/social investment contribution and CSR strategy (which includes business ethics and conducts) are essential aspects of CSR practices that have a negative effect on tax aggressiveness. The second most frequently cited paper by Christensen and Murphy [38] was published in the Development journal titled “The social irresponsibility of corporate tax avoidance: Taking CSR to the bottom line” and is included in the yellow cluster.

Figure 6.

References in co-citation analysis.

Christensen and Murphy [38] advocated for policy initiatives to address distortions brought about by globalisation. Businesses should follow tax-related corporate social responsibility principles, such as the obligation to disclose all required accounting information and the prohibition of profit-laundering vehicles formed for no worthwhile economic purpose. The fourth most cited paper coming from the blue cluster is that of Sikka [28] published in Accounting Forum and the title of the paper is “Smoke and mirrors: corporate social responsibility and tax avoidance”. This paper exposes the difference between corporate publicly espoused credentials or talks of social responsibility or ethical business and the actual decisions and actions, otherwise known as “organised hypocrisy”. The author highlights the apparent inconsistency between business talk and actions when it comes to tax avoidance.

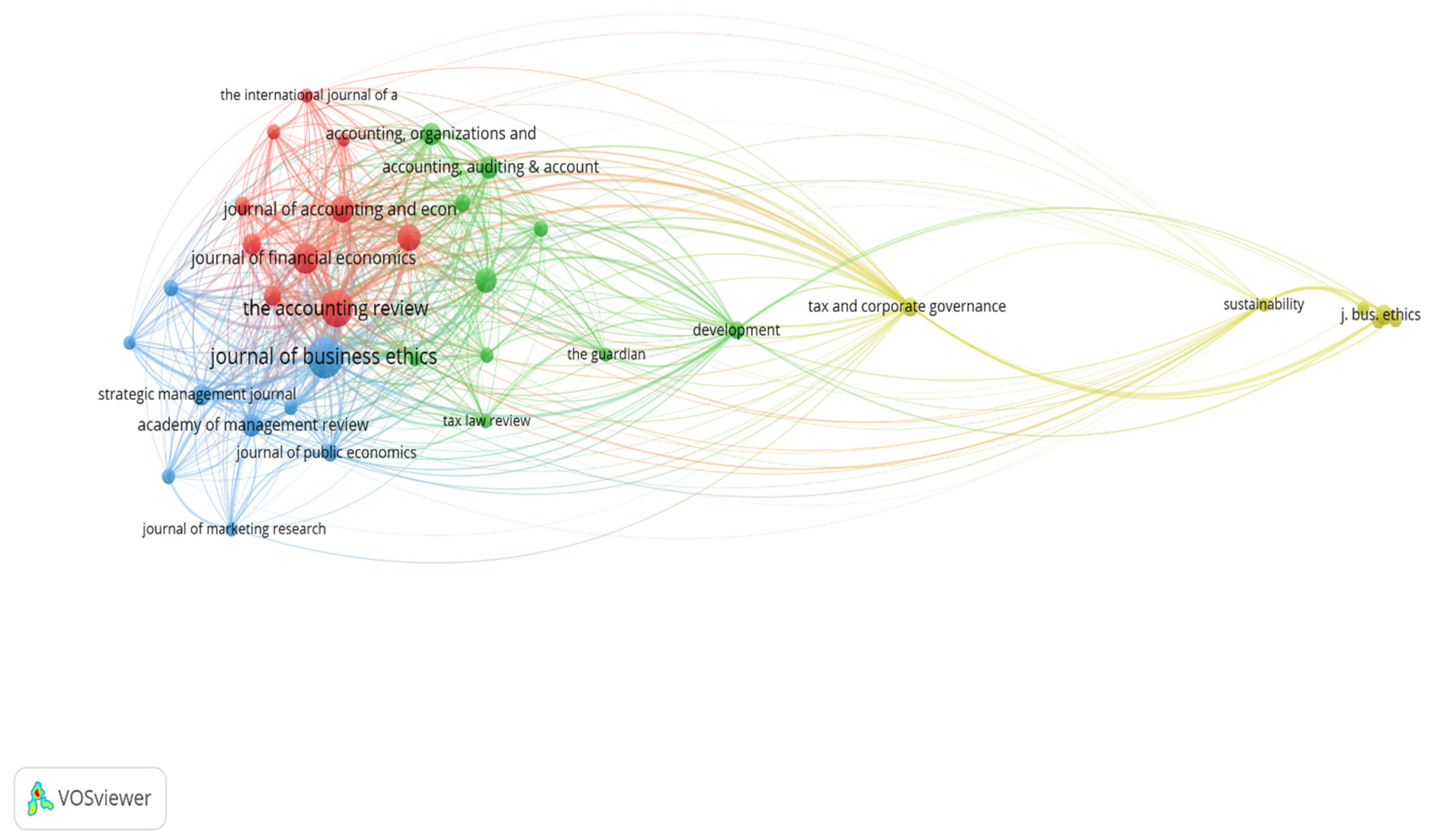

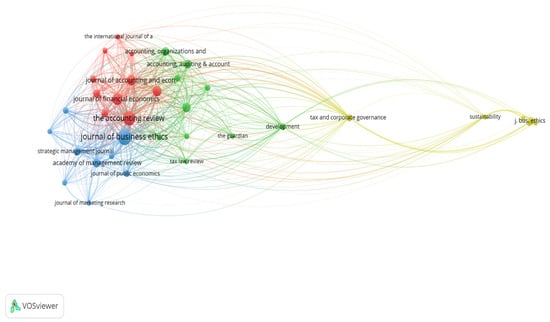

Regarding the journal co-citation analysis, it revealed a network with 35 items/sources, 4 clusters in light blue, red, green, and yellow colours, 464 links, and 852.5 total link strength, as shown in Figure 7 below. With the unit of analysis being cited sources and the minimum citations set to 20 by default, of the 2759 journals, only 35 journals met the criteria.

Figure 7.

Source of co-citation analysis.

Specifically, in the red cluster, The Accounting Review and Journal Financial Economics are the most highly co-cited sources; in the light blue cluster, Journal of Business Ethics and Academy of Management Review are the two most co-cited sources; and the Accounting, Auditing and Accountability journal and Accounting, Organizations and Society are the most frequently co-cited sources within the CSR–corporate tax aggressiveness in the green cluster. Finally, the most co-cited in the yellow cluster are Tax and Corporate Governance, Sustainability, and Journal of Business Ethics. The distance between the nodes of cited sources is relevant, since the shorter the distance, the higher the number of co-citation frequency of the source. The four clusters as enumerated above clearly reflect the various CSR–corporate tax aggressiveness research approaches’ underlying the theoretical frameworks. We note that the red cluster focuses on reporting and financial effects of tax avoidance on society; thus, we can assign the topic “financial reporting and accountability” to this cluster. The light blue cluster sources clearly focus on corporations, business strategy, the ethics of corporate tax avoidance, and the social side of tax avoidance; we can thus assign to this cluster a label of “organisations, ethics of tax avoidance and society”. In addition, the green cluster fundamentally focuses on the accounting, accountability, and responsibility perspectives of corporations to the society and environment in which they operate; hence, we can assign “accurate reporting” to this cluster. Finally, the yellow cluster emphasises the role of corporate governance in ensuring ethics and sustainability issues in the CSR and tax aggressiveness discourse; we thus assign to this cluster, “governance, ethics of tax avoidance and sustainability issues”.

4.4. Co-Authorship Analysis—Scientific Collaboration Network

This study used co-authorship analysis to determine the degree of contact and its development in countries and their impact on CSR and tax avoidance discourse [84]. The broad and contentious nature of the CSR and corporate tax avoidance makes it impossible for a single country, researcher, or institution to address a research problem. Thus, much of the literature in this area is the consequence of partnerships involving countries, researchers, and organisations.

4.4.1. Most Productive Countries

To determine the most influential countries publishing in CSR and tax avoidance, “document co-authorship” analysis was conducted using VOSviewer. For this purpose, co-authorship is a short form for scientific collaboration, and a lack of communication within the scientific network is seen as a manifestation of low research productivity. Indeed, Ganzel and Schebert [85] posit that publications created by collaboration are published in more excellent impact journals and receive most citations. Table 4 shows that out of the 40 countries extracted for the network analysis, only five African countries (i.e., Morocco, South Africa, Egypt, Tunisia, Namibia, and Nigeria) had publications ranging between one and five. Then, the most influential countries accordingly, in terms of citations and the number of publications, are the United States, Australia, and the United Kingdom. While the US has 21 documents and 653 citations from the data extracted, Australia and the United Kingdom have 15 and 11 documents and 476 and 452 citations, respectively. Thus, these three countries tend to be the most significant contributors to the CSR and tax aggressiveness nexus, as depicted in Table 4. Interestingly, the total link strength, which is a metric that represents the total strength of a researcher’s co-authorship connections with other scholars, is not encouraging, likely indicating minimal collaborations among these countries in CSR and tax aggressiveness research.

Table 4.

Influential countries.

Several of the countries included in the network show limited linkages to the main streams of CSR and tax aggressiveness research and many other countries of the network (as indicated by the total link strength: the number of co-authorship connections or links with other researchers).

4.4.2. Most Productive Continents

The continent distribution in terms of publications, as captured in Table 5, show Europe (including UK) leading with 47 articles and representing about 34% in terms of number of publications in CSR and tax aggressiveness. Europe is followed closely by the Americas with 36 articles, which represent about 26% of the sampled publication, and Africa comes last as an under-explored region with only 12 publications shared among a few countries, representing about 9%.

Table 5.

Continent distribution of publications.

5. Discussion of Results

This study uses scientometric analysis to review the literature published on CSR and corporate tax aggressiveness to establish research trends in the body of knowledge and to outline an agenda for future research. It broadens our understanding and adds to previous literature in CSR and tax aggressiveness nexus with the support of a robust quantitative research method as a scientific mapping tool. It is understood from the analysis that published field studies began in the 1960s to 1980s on measures against corporate tax avoidance. However, research publications linking CSR to corporate tax payments were only seen in the early 2000s and were in single digits per year from 2003 to 2016. The number of publications has risen to double digits, albeit moderately and only for the past four years, and cannot be said to be at its peak. The absence of consensus on corporations’ responsibility could be responsible for the limited research linking CSR and corporate tax, which may be influenced mainly by the overriding view of corporations in accounting and business research that corporations’ role is to make profit [35]. In addition, corporations that publicly espouse their CSR credentials are seen by the public to not engage in tax avoidance, an assertion that is contrary to what happens in practice [28,49,50]. More so, more entities disclose information under the Global Reporting Initiative (GRI), the purpose of which is not always to enhance transparency but rather legitimacy [86]. This development confirms the continued rising attention on research in CSR and tax aggressiveness, especially from 2019–2020. As expected, over 95% of these publications come from advanced or developed nations, leaving developing countries, especially those in Africa and elsewhere, under-explored. Thus, the country co-authorship findings indicate the predominance of some Anglo-Saxon countries—the United States, Canada, the United Kingdom, and Australia—in terms of publications. Nevertheless, in the period under investigation, the proportion of foreign collaborations with other emerging countries is non-existent, as revealed by the reference (author) co-citation analysis. These results thus suggest that the discourse on CSR and corporate tax aggressiveness has not penetrated the borders of various countries and needs to be exploited to find solutions to corporate tax behaviours in the midst of rising CSR disclosures.

This study also examined the relationship between key individual researchers and countries supporting research in CSR and corporate tax aggressiveness. We found that most of the prominent researchers in CSR and corporate tax avoidance are seen to function in isolation, although some, albeit little, collaboration can be seen among them as shown by the limited numbers exhibited by the total link strength in the country and document co-citation analysis. The issue here is about the importance of partnership in research to help bring the harmful effects of tax avoidance to light. The findings show that the rate of increase is encouraging as more scholars have shown evidence linking CSR to corporate tax aggressiveness [1,9,38,43].

Furthermore, the mixed journal co-citation clusters reveal the underlying pluralistic research trends and interdisciplinary nature of CSR and tax aggressiveness research. It is evident that CSR and corporate tax behaviour research has been published in various subject areas, including social sciences, decision science, and psychology, to mention but a few. This substantiation indicates that CSR research is not only limited to the “economic, legal, ethical and discretionary” aspirations of society [23]. CSR and corporate tax aggressiveness analysis can also be appropriate for various journal outlets with different trends. In this context, this research provides evidence of the prevalence of journals publishing in CSR and tax aggressiveness, especially over the years, albeit in minimal numbers.

Moreover, the co-authorship network analysis shows that prominent scholars at the centre of clusters play an invaluable role in contributing to knowledge production in their effort to link corporate tax payment to a firm’s CSR activities. As Azoulay, Fons-Rosen, and Zivin [87] have shown in their study of eminent researchers and the viability of a particular field or discipline, co-authoring networks and clusters/patterns of collaborators in newly developed research domains can be useful in boosting the productivity of that research area. Additionally, known and reputable researchers play a vital role in fostering and encouraging international partnerships for further researchers, institutions, and countries [88].

A keyword analysis on text data of topics and abstracts shows some theories have been used to explain the CSR–corporate tax aggressiveness relationship. These theories include agency theory, corporate culture and ethics, legitimacy theory, political theory, moral foundation theory, shareholder theory, organised hypocrisy, organisational façade, and strategic trade-off. The findings indicate areas that can be exploited in further research on CSR and tax aggressiveness including organised hypocrisy, earnings management, political connection, and corporate tax behaviour, board gender diversity and their relation to CSR–tax avoidance discourse, and of course, the use of other new theories/perspectives.

Further, a cluster analysis of the text data with CiteSpace and VOSviewer also revealed several sub-topics including corporate tax aggressiveness, sustainability and corporate inversion; early policy initiatives, sustainability and corporate tax aggressiveness; propensity score matching (PSM) (it is worth noting that the PSM method pairs test and control samples, such as CSR entities and non-CSR entities. Thus, the resultant differences between tax aggressiveness can be attributed to the firm’s CSR strategy and not to the firm’s characteristics [78]) approaches in sustainability reports with corporate tax aggressiveness; empirical assessment on the early policy initiative and governance on tax aggressiveness; and organisations, ethics of tax avoidance, and society. Finally, the analysis of channels of publication indicated that CSR and corporate tax aggressiveness is viewed as a sustainability and ethical issue and thus supports the views espouse by ethical theorists [28,38] on the need for corporations to pay their fair share of taxes.

6. Conclusions

Governments, particularly in developing economies, should make policies that define taxes as part of firms’ CSR purview to enhance transparency and legitimacy, so that companies will honour tax policies in the same ways as they treat other responsibilities in the eye of the public. Corporations should also be openly and publicly rewarded for paying their taxes. Furthermore, researchers, research institutions, universities, and corporations should be funded to collaborate and conduct more research to offer understanding of how CSR and tax avoidance are interrelated, and the potential to motivate companies to achieve tax compliance in order governments can meet their revenue generation targets for sustainable economic development. Tax authorities can motivate firms to refrain from tax aggressive practices by encouraging firms to disclose their tax activities in addition to their corporate social responsibility activities [2].

Just like any other social science research, this study, without doubt, is beset with some limitations to look out for in subsequent studies. Overall, the primary constraint has been the nature and mode of sampling and data collection, which may well have excluded some research articles from being sampled based on the selection criterion that only made use of electronic research articles. Secondly, this study was delimited to structured data obtained from a bibliometric database of peer-reviewed publications; therefore, only papers published in the journals in its database were used.

Nonetheless, these limitations the study offers a basis for future study that should be explored for example by PhD researchers. For example, the Web of Science database can be used to perform scientometric analysis. It is also important to understand how CSR and tax avoidance have different characteristics in different settings, especially in under-explored regions such as sub-Saharan countries like Ghana. This includes considering new variables such as board gender diversity, tax fees, the role of the media in corporate tax avoidance, and political connections. Finally, future research should evaluate the evolution of CSR and corporate tax aggressiveness using practitioner-oriented sources to shift from scholarly “talk” to practitioner “action”. Additionally, further research should explore the relationship between CSR and tax avoidance using a more nuanced theoretical lens in different settings (namely Africa). More empirical studies can explore the relationship between the various tax avoidance proxies and the components of CSR. It should be explored whether the new requirements in terms of tax disclosures to be presented in sustainability reports or integrated reports are helping to avoid companies’ tax aggressiveness.

To conclude, tax planning in the context of CSR and good tax governance should nurture an ethical state of mind among corporate entities while also increasing transparency and accountability. Acting within the bounds of the law, it appears, is no longer sufficient to qualify as morally responsible behaviour [24].

Author Contributions

Conceptualization, O.I.; Data curation, O.I.; Formal analysis, O.I. and L.L.R.; Investigation, O.I.; Methodology, O.I. and L.L.R.; Project administration, L.L.R. and O.I.; Resources, O.I. and L.L.R.; Software, O.I.; Supervision, L.L.R.; Validation, O.I. and L.L.R.; Writing—original draft, O.I. and L.L.R.; and Writing—review and editing, O.I. and L.L.R. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was financed by National Funds of the FCT—Portuguese Foundation for Science and Technology within the project “UIDB/03182/2020”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data supporting the reported results and the dada generated for the analysis can be found with the authors. This can be made available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hoi, C.K.; Wu, Q.; Zhang, H. Is Corporate Social Responsibility (CSR) Associated with Tax Avoidance? Evidence from Irresponsible CSR Activities. Account. Rev. 2013, 88, 2025–2059. [Google Scholar] [CrossRef]

- Gulzar, M.; Cherian, J.; Sial, M.S.; Badulescu, A.; Thu, P.A.; Badulescu, D.; Khuong, N.V. Does Corporate Social Responsibility Influence Corporate Tax Avoidance of Chinese Listed Companies? Sustainability 2018, 10, 4549. [Google Scholar] [CrossRef]

- Kim, J.; Im, C. Study on Corporate Social Responsibility (CSR): Focus on Tax Avoidance and Financial Ratio Analysis. Sustainability 2017, 9, 1710. [Google Scholar] [CrossRef]

- Freeman, R.E.; Reed, D.R. Stockholders and Stakeholders: A New perspective on corporate governance. Calif. Manage. Rev. 1983, 25, 88–106. [Google Scholar] [CrossRef]

- A Renewed EU Strategy 2011–14 for Corporate Social Responsibility; European Commission: Brussels, Belgium, 2011.

- Carroll, A.B. Corporate social responsibility: The centerpiece of competing and complementary frameworks. Organ. Dyn. 2015, 44, 87–96. [Google Scholar] [CrossRef]

- DIRECTIVE 2014/95/EU (as Amended): Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups; European Commission: Brussels, Belgium, 2014.

- Laguir, I.; Staglianò, R.; Elbaz, J. Does corporate social responsibility affect corporate tax aggressiveness? J. Clean. Prod. 2015, 107, 662–675. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G. Corporate social responsibility and tax aggressiveness: An empirical analysis. J. Account. Public Policy 2012, 31, 86–108. [Google Scholar] [CrossRef]

- Dietsch, P. Asking the fox to guard the henhouse: The tax planning industry and corporate social responsibility. Ethical Perspect. 2011, 18, 341–354. [Google Scholar] [CrossRef]

- Goerke, L. Corporate social responsibility and tax avoidance. J. Public Econ. Theory 2018, 21, 310–331. [Google Scholar] [CrossRef]

- Schaltegger, S.; Gibassier, D.; Zvezdov, D. Is environmental management accounting a discipline? A bibliometric literature review. Meditar Account. Res. 2013, 21, 4–31. [Google Scholar] [CrossRef]

- Lee, M.-D.P. A review of the theories of corporate social responsibility: Its evolutionary path and the road ahead. Int. J. Manag. Rev. 2008, 10, 53–73. [Google Scholar] [CrossRef]

- Garriga, E.; Melé, D. Corporate social responsibility theories: Mapping the territory. J. Bus. Ethics 2013, 53, 51–71. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What We Know and Don’t Know About Corporate Social Responsibility: A Review and Research Agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Griffin, J.J.; Mahon, J.F. The corporate social performance and corporate financial performance debate: Twenty-five years of incomparable research. Bus. Soc. 1997, 36, 5–31. [Google Scholar] [CrossRef]

- Dyreng, S.D.; Hanlon, M.; Maydew, E.L.; Thornock, J.R. Changes in corporate effective tax rates over the past 25 years. J. Financ. Econ. 2017, 124, 441–463. [Google Scholar] [CrossRef]

- Hanlon, M.; Heitzman, S. A review of tax research. J. Account. Econ. 2010, 50, 127–178. [Google Scholar] [CrossRef]

- Gupta, S.; Newsberry, K. Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. J. Account. Public Policy 1997, 16, 1–34. [Google Scholar] [CrossRef]

- Whait, R.B.; Christ, K.L.; Ortas, E.; Burritt, R.L. What do we know about tax aggressiveness and corporate social responsibility? An integrative review. J. Clean. Prod. 2018, 204, 542–552. [Google Scholar] [CrossRef]

- Ferramosca, S.; Verona, R. Framing the evolution of corporate social responsibility as a discipline (1973–2018): A large-scale scientometric analysis. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 178–203. [Google Scholar] [CrossRef]

- Zeng, Z.; Hengsadeekul, T. Environmental issues and social responsibility: A scientomeric analysis using citespace. Entrep. Sustain. Issues 2020, 8, 1419–1436. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Gribnau, H.J.; Jallai, A.-G. Good Tax Governance: A Matter of Moral Responsibility and Transparency. Nord. Tax J. 2017, 2017, 70–88. [Google Scholar] [CrossRef]

- Boyack, K.W.; Klavans, R. Co-citation analysis, bibliographic coupling, and direct citation: Which citation approach represents the research front most accurately? J. Am. Soc. Inf. Sci. Technol. 2010, 61, 2389–2404. [Google Scholar] [CrossRef]

- Markoulli, M.; Lee, C.; Byington, E.; Felps, W.A. Mapping Human Resource Management: Reviewing the field and charting future directions. Hum. Resour. Manag. Rev. 2017, 27, 367–396. [Google Scholar] [CrossRef]

- Darcy, S. The Elephant in the Room’: Corporate tax avoidance & business and human rights. Bus. Hum. Rights J. 2017, 2, 1–30. [Google Scholar]

- Sikka, P. Smoke and mirrors: Corporate social responsibility and tax avoidance. Account. Forum 2010, 34, 153–168. [Google Scholar] [CrossRef]

- Watson, L. Corporate Social Responsibility, Tax Avoidance, and Earnings Performance. J. Am. Tax Assoc. 2015, 37, 1–21. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate Social Responsibility and Resource-Based Perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Gri 207: Tax; Global Reporting Initiative (GRI): Amsterdam, The Netherlands, 2019; pp. 1–17.

- Zeng, T. Corporate Social Responsibility, Tax Aggressiveness, and Firm Market Value. Account. Perspect. 2016, 15, 7–30. [Google Scholar] [CrossRef]

- Davis, A.K.; Guenther, D.A.; Krull, L.K.; Williams, B.M. Do Socially Responsible Firms Pay More Taxes? Account. Rev. 2016, 91, 47–68. [Google Scholar] [CrossRef]

- Laud, R.L.; Schepers, D.H. Beyond transparency: Information overload and a model for intelligibility. Bus. Soc. Rev. 2009, 114, 365–391. [Google Scholar] [CrossRef]

- Avi-Yonah, R.S. Taxation, corporate social responsibility and the business enterprise. SSRN Electron. J. 2009, 5, 1–21. [Google Scholar] [CrossRef][Green Version]

- Watts, R.L.; Zimmerman, J.L. The demand for and supply of accounting theories: The market for excuses. Account. Rev. 1979, 52, 273–305. [Google Scholar]

- Watts, R.L.; Zimmerman, J.L. Positive accounting theory: A ten year perspective. Account. Rev. 1990, 65, 131–156. [Google Scholar]

- Christensen, J.; Murphy, R. The Social Irresponsibility of Corporate Tax Avoidance: Taking CSR to the bottom line. Development 2004, 47, 37–44. [Google Scholar] [CrossRef]

- Sikka, P. Smoke and mirrors: Corporate social responsibility and tax avoidance. In Corporate Social Responsibility; Haynes, K., Murray, A., Dillard, J., Eds.; Routledge: London, UK, 2012; pp. 69–210. [Google Scholar] [CrossRef]

- Preuss, L. Responsibility in Paradise? The Adoption of CSR Tools by Companies Domiciled in Tax Havens. J. Bus. Ethics 2012, 110, 1–14. [Google Scholar] [CrossRef]

- Dowling, G.R. The Curious Case of Corporate Tax Avoidance: Is it Socially Irresponsible? J. Bus. Ethics 2014, 124, 173–184. [Google Scholar] [CrossRef]

- Mao, C.-W.; Wu, W.-C. Moderated mediation effects of corporate social responsibility performance on tax avoidance: Evidence from China. Asia-Pacific J. Account. Econ. 2018, 26, 90–107. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G. Corporate social responsibility and tax aggressiveness: A test of legitimacy theory. Account. Audit. Account. J. 2012, 26, 75–100. [Google Scholar] [CrossRef]

- Godfrey, P.C. The Relationship Between Corporate Philanthropy and Shareholder Wealth: A Risk Management Perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef]

- Li, W.; Lu, Y.; Li, W. Does CSR Action Provide Insurance-Like Protection to Tax-Avoiding Firms? Evidence from China. Sustainability 2019, 11, 5297. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Huseynov, F.; Klamm, B.K. Tax avoidance, tax management and corporate social responsibility. J. Corp. Financ. 2012, 18, 804–827. [Google Scholar] [CrossRef]

- Berman, S.L.; Wicks, A.C.; Kotha, S.; Jones, T.M. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Acad. Manag. J. 1999, 42, 488–506. [Google Scholar]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. Organized hypocrisy, organizational façades, and sustainability reporting. Account. Organ. Soc. 2015, 40, 78–94. [Google Scholar] [CrossRef]

- de Andrade, E.M.; Rodrigues, L.L.; Cosenza, J.P. Corporate Behavior: An Exploratory Study of the Brazilian Tax Management from a Corporate Social Responsibility Perspective. Sustainability 2020, 12, 4404. [Google Scholar] [CrossRef]

- Saka, A.B.; Chan, D.W.M. A Scientometric Review and Metasynthesis of Building Information Modelling (BIM) Research in Africa. Buildings 2019, 9, 85. [Google Scholar] [CrossRef]

- Muñoz, L.A.; Bolívar, M.P.R. Theoretical Support for Social Media Research. A Scientometric Analysis. Lect. Notes Comput. Sci. 2015, 9248, 59–75. [Google Scholar] [CrossRef]

- Ye, F. A quantitative relationship between per capita GDP and scientometric criteria. Scientometrics 2007, 71, 407–413. [Google Scholar] [CrossRef]

- Hood, W.W.; Wilson, C.S. The Literature of Bibliometrics, Scientometrics, and Informetrics. Scientometrics 2001, 52, 291–314. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. Science mapping software tools: Review, analysis, and cooperative study among tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Chen, C. Information Visualization. Nat. Comput. Ser. 2006, 2, 387–403. [Google Scholar] [CrossRef]

- van Ech, N.L.; Waltman, L. Visualizing bibliometric networks. In Measuring Scholarly Impact: Methods and Practice; Ding, Y., Rousseau, R., Wolfram, D., Eds.; Springer: Cham, Switzerland, 2014. [Google Scholar]

- Chen, C.; Ibekwe-SanJuan, F.; Hou, J. The structure and dynamics of co-citation clusters: A multiple-perspective co-citation analysis. J. Am. Soc. Inf. Sci. Technol. 2010, 61, 1386–1409. [Google Scholar] [CrossRef]

- Chen, C. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inf. Sci. Technol. 2006, 57, 359–377. [Google Scholar] [CrossRef]

- Börner, K.; Chen, C.; Boyack, K.W. Visualizing knowledge domains. Annu. Rev. Inf. Sci. Technol. 2005, 37, 179–255. [Google Scholar] [CrossRef]

- Heilig, L.; VoB, S. A Scientometric Analysis of Cloud Computing Literature. IEEE Trans. Cloud Comput. 2014, 2, 266–278. [Google Scholar] [CrossRef]

- Meho, L.I.; Rogers, Y. Citation counting, citation ranking, and h-index of human-computer interaction researchers: A comparison of Scopus and Web of Science. J. Am. Soc. Inf. Sci. Technol. 2008, 59, 1711–1726. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G. Outside Directors, Corporate Social Responsibility Performance, and Corporate Tax Aggressiveness: An Empirical Analysis. J. Account. Audit. Financ. 2016, 33, 228–251. [Google Scholar] [CrossRef]

- Su, H.-N.; Lee, P.-C. Mapping knowledge structure by keyword co-occurrence: A first look at journal papers in Technology Foresight. Scientometrics 2010, 85, 65–79. [Google Scholar] [CrossRef]

- Afrizal, A.; Putra, E.W.; Yuliusman, Y.; Hernando, R. The effect of accounting conservatism, CSR disclosure and tax avoidance on earnings management: Some evidence from listed companies in INDONESIA. Int. J. Adv. Sci. Technol. 2020, 29, 1441–1456. [Google Scholar] [CrossRef]

- Khlif, H. Hofstede’s cultural dimensions in accounting research: A review. Meditari Account. Res. 2016, 24, 545–573. [Google Scholar] [CrossRef]

- Antonetti, P.; Anesa, M. Consumer reactions to corporate tax strategies: The role of political ideology. J. Bus. Res. 2017, 74, 1–10. [Google Scholar] [CrossRef]

- Fallan, E.; Fallan, L. Corporate tax behaviour and environmental disclosure: Strategic trade-offs across elements of CSR? Scand. J. Manag. 2019, 35, 101042. [Google Scholar] [CrossRef]

- Inger, K.K.; Vansant, B. Market valuation consequences of avoiding taxes while also being socially responsible. J. Manag. Account. Res. 2019, 31, 75–94. [Google Scholar] [CrossRef]

- Amoh, J.K.; Adafula, B. An estimation of the underground economy and tax evasion: Empirical analysis from an emerging economy. J. Money Laund. Control 2019, 22, 626–645. [Google Scholar] [CrossRef]