1. Introduction

According to the Administration of Energy Information [

1], ‘renewable energy is energy from sources that are naturally replenishing […] virtually inexhaustible in duration’. The importance of renewable energy comes from several perspectives: environment protection by reducing greenhouse-gas (GHG) emissions; people’s health by reducing air pollution; jobs creation in renewable-energy sectors; and the decrease in dependency on traditional energy sources that are becoming even more expensive considering their scarcity and the fact that they are often imported [

2,

3].

According to the Center for Climate Energy Solutions [

4], the impact of various renewable-energy sources on the environment in terms of GHG emissions that they produce varies: for biomass, the impact is ‘neutral’; the impact is ‘zero’ for wind, solar, and water; and it is ‘low’ for geothermal energy. Ritchie and Roser [

5] stated that these sources represent 11% of primary global energy. According to Eurostat [

2], renewable-energy consumption represents 19.7% of total energy consumption in EU-27. The European Parliament and the Council of the European Union [

6] established a target of 32% for the percentage of renewable energy in the total energy produced at the EU level.

The percentage of renewable-energy sources in global electricity consumption is higher (approximately 25%), compared to the percentage of renewable-energy sources in transportation and heating [

5]. On the level of the EU states, the percentage of renewable energy in electricity consumption was 32% in 2018. Among renewable-energy sources, wind takes a consumption percentage of 35.8%, water is at 33.3%, solar energy is at 12.2%, solid biofuels are at 9.5%, and other renewable-energy sources represent up to 9.2% [

7].

Sustainable development means ‘fulfilling the needs of the present generations without compromising the future of the generations to come’ [

8]. One of the Sustainable Development Goals (SDGs) of the 2030 Agenda is SDG 7–Affordable and Clean Energy, a goal linked to renewable energy. The UNDP [

9] provided data regarding energy and the renewable-energy sector, highlighting that energy generates 73% of GHG emissions; the renewable-energy industry comprised 11.5 million employees in 2019.

There is a need for more efficient technologies in order to globally reduce GHG emissions and mitigate climate change. The role played by green technologies and renewable-energy sources in producing energy is important; therefore, renewable energy was part of the SDGs of the 2030 Agenda. Its achievement would help the world reach the target established by the Paris Agreement to keep global warming at below 20 degrees Celsius. The United Nations [

10] emphasized that this goal could be achieved only through a concerted effort of all individuals, companies, and governments, as ‘this affects everyone, not just a few’.

The objective of our research is to offer directions for decision factors from emerging economies regarding the impact of fiscal policies on the development of the renewable-energy sector. There are many variables impacting renewable-energy consumption. Our research focuses on the connection between public performance, economic development, and renewable energy. The choice of these specific variables comes from their importance to the achievement of SDG7. We also based our approach on the results of other researchers in this field, but with an original approach, adding a new variable to the proposed model.

The current research focuses on the relations between public debt (DEBT), budget deficit (DEF), and renewable-energy consumption (REN) in the emerging countries of the EU. The results underline the adequate measures that governments could implement in order to stimulate the renewable-energy sector, with public-finance measures directly impacting this.

According to the International Labor Organization [

11], ‘emerging economies are (mostly) middle-income countries that have been or are growing and developing rapidly’. The Corporate Finance Institute [

12] defines emerging countries (also known as emerging markets or developing countries) as countries with low and middle income per capita that are in a ‘process of developing’ their economies. The institute mentions some of the most important characteristics of these economies: annual growth that is higher than that in developed countries; ‘high production levels’ because of the low level of wages; development of the middle class; transition towards ‘an open economy’; lack of stability, especially regarding exchange currency, inflation, and interest rates; and attractiveness for foreign investors, because the possibilities for higher profits are higher than those in developed countries.

This research has the following structure:

Section 2 is the literature review;

Section 3 discusses the methodology, where the used method and variables are explained;

Section 4 presents and discusses the analytical results; and

Section 5 presents the conclusions, where the impact of various factors on the renewable-energy sector is highlighted.

2. Literature Review

The use of renewable-energy sources is a must for states that focus on achieving climate-mitigation goals. Research in the field focuses on the best practices to control greenhouse-gas emissions with the use of a set of variables that influence this matter. The perspective of our analysis underlines emerging countries globally.

Several researchers emphasized both the negative and positive impact of public debt on renewable-energy consumption. Wang et al. [

13] analyzed the impact of public debt on REN, showing that a high ratio of public debt in GDP does not encourage consumers to incorporate renewable energy in their lives. Similar research conducted by Hashemizadeh et al. [

14] highlighted the lack of studies analyzing the connection between public debt and REN, globally applying their method to emerging countries. The authors showed that the purpose of increased public debt influences this connection. If this is used to invest in clean energy, the impact is positive; however, if the debt is too high, it might be an important obstacle, with the population not being inclined to change consumption behavior for greener technologies. Climate-change mitigation through renewable energy implies greener technologies and changes in consumer behavior.

The urbanization of the population also impacts the adoption of renewable energy. Therefore, Akintande et al. [

15] conducted research on key factors that influence REN. Among analyzed variables, the highest impact was determined to be from factors related to population (its growth and percentage living in urban areas), but also to the inherent increase in energy consumption. ‘Urban population and human capital’ are mentioned as among the most important factors influencing REN [

16] (p. 96). Florea et al. [

17] underlined that the standard of living of a population ‘assesses the economic dimension of a country and the quality of life for a population’. Salim and Shafiei [

18] showed that urbanization does not have an important impact on REN, influencing mostly nonrenewable-energy use. Nathaniel et al. [

19] (p. 19616) mention urbanization as one of the ‘contributors to environmental degradation’, while renewable-energy sources protect the environment. Yazdi and Shakouri [

20] (p. 121) showed that urbanization in Europe considerably increased, thus raising the level of CO

2 emissions; there is ‘no causality’ between renewable energy use and these emissions. Salim et al. [

21] (p. 1) highlighted that, for a cleaner environment and a more sustainable development, there is the need for a transition to renewable-energy sources and for the ‘cautious and planned urbanization programs’. Furthermore, Creutzig et al. [

22] presented the potential of the renewable-energy sector in the periphery of Europe, showing that the mentioned countries are also having important ‘public debt and unemployment’. The authors underline that an increase in REN can be obtained by an increase in public expenses in this sector. Thus, increased expenditure could lead to a budget deficit and an increase in public debt. Public debt can stimulate the sector if it is used for investments, or may be an obstacle if the population and companies are not encouraged by fiscal and energy policies to support the sector [

14].

Another strand in the literature finds a connection among GDP per capita, trade openness, foreign direct investments, human development index and democracy. Thus, Ergun et al. [

23] analyzed the impact of these variables on the share of renewable energy in energy consumption. Among them, only foreign direct investments have a positive ‘unidirectional causality’ [

20] (p. 15401). Akar [

24] (p. 594) highlights that factors impacting the development of the renewable-energy sector depend on market forces and on specific forces to each country, such as economic development, trade openness, or reliance on fossil fuels. The authors concluded that trade openness has ‘a positive effect on renewable-energy consumption’ for the countries within the study.

Public policies represent incentives towards the acceptance and increased use of renewable energy. Lam and Law [

25] did not specifically mention public debt or budget deficit, but highlight the importance of governments in financially supporting the development of the renewable-energy sector, especially ‘at the start-up stage’. Przychodzen and Przychodzen [

26] analyzed the driving factors for renewable-energy production for transitional economies in Europe and Asia. They concluded that ‘higher economic growth, and rising level of unemployment and government debt’ have led to the development of the renewable-energy sector. The authors explain that economic growth, measured by GDP, can provide needed finances to support this sector. Unemployment and public debt also represent important goals for governments and the population because the renewable-energy sector can contribute to job creation. In terms of the nexus between renewable energy and budget deficit, Tugcu et al. [

27] (p. 1100) reported that ‘there is a unidirectional effect from budget deficit towards renewable-energy consumption’. The authors mentioned that the renewable-energy sector is a ‘burden’, affecting ‘financial stability’ because it is mainly ‘subsidized but not taxed’ [

27] (p. 1111). The solutions envisioned by the authors are cutting subsidies and taxing REN in time. Moreover, Yildirim and Yasa [

28] showed that the budget deficit increases when governments have to import energy sources from other countries, and because the demand is higher than the supply. Still, the authors acknowledge that some countries choose to support the need for more energy by private investment and not necessarily by public expenditures. Their research refers to renewable energy as part of energy in general, but does not establish a direct relationship between renewable-energy consumption and budget deficit.

Other studies indicate the nexus among renewable-energy consumption, trade openness, and CO

2 emissions. Omri and Nguyen [

29] (p. 554) concluded that ‘CO

2 emissions and trade openness’ are the most important determinants for an increase in the consumption of renewable energy. Zeren and Akkus [

30] analyzed the relationship between REN and trade openness for 14 emerging countries. They concluded that a higher REN leads to a decrease in trade openness, while the opposite is valid for nonrenewable-energy sources. The authors mentioned that there is a cycle in which nonrenewable-energy consumption is translated into higher imports of sources of traditional energy from other countries, thus raising trade openness. In time, this pressure could act as a trigger for the development of the renewable-energy sector. Murshed [

31] reached a similar conclusion after conducting research on five South Asian countries, stating that trade openness triggers a higher REN. Furthermore, Khan et al. [

32] analyzed the global impact of REN, trade openness, and other variables on CO

2 emissions in developed and developing countries. Their results showed that REN leads to a decrease in CO

2 emissions in both types of countries, but trade openness only leads to this decrease in developed countries, having the opposite effect in developing countries. Alam and Murad [

33] highlighted that trade openness is an important driving force for REN among other factors, such as the economic and technological development of a country.

Drivers towards a cleaner economy depend on variables influenced by the economic development of a country. Therefore, EU member states ‘implement fiscal measures and commit budgetary expenditures to ensure sustainable economic development’ [

34]. In light of the aforementioned research papers, and limited by the available data, our paper focuses on the impact of GDP, public debt, budget deficit, and trade openness on the renewable-energy consumption in emerging EU countries.

4. Results

As mentioned in

Section 3, it was necessary to logarithm the values associated with the variables used in the analysis except for the negative values of net lending or borrowing in order to obtain robust results.

The descriptive statistics of the variables used in the model are presented in

Table 2 and cover the following elements: lnREN, lnGDP, lnDEBT, DEF, and lnTO. Skewness and kurtosis statistics give further information about the measures of normality. Kurtosis measures the peakness or flatness of the distribution, while skewness measures the asymmetry of the distribution. In our case, skewness indicates values between –1 and 1, which underlines an approximate bell-shaped curve. Kurtosis indicates values between +1 and +3, underlining that the distribution has a tendency to be peaked. The Jarque–Bera test was run in order to confirm normality. The hypothesis of normal distribution was rejected for variables lnREN, lnGDP, lnDEBT, DEF. The null hypothesis could not be rejected for the lnTO variable.

So, our analysis focused on the group of countries and not individual units in the group, which is why less information was lost by taking the panel perspective. The use of the panel to the detriment of time-series data was indicated both because this increases the number of observations and their variation, and because it reduces noise coming from individual time series. Therefore, heteroscedasticity is not an issue in panel data analysis [

50].

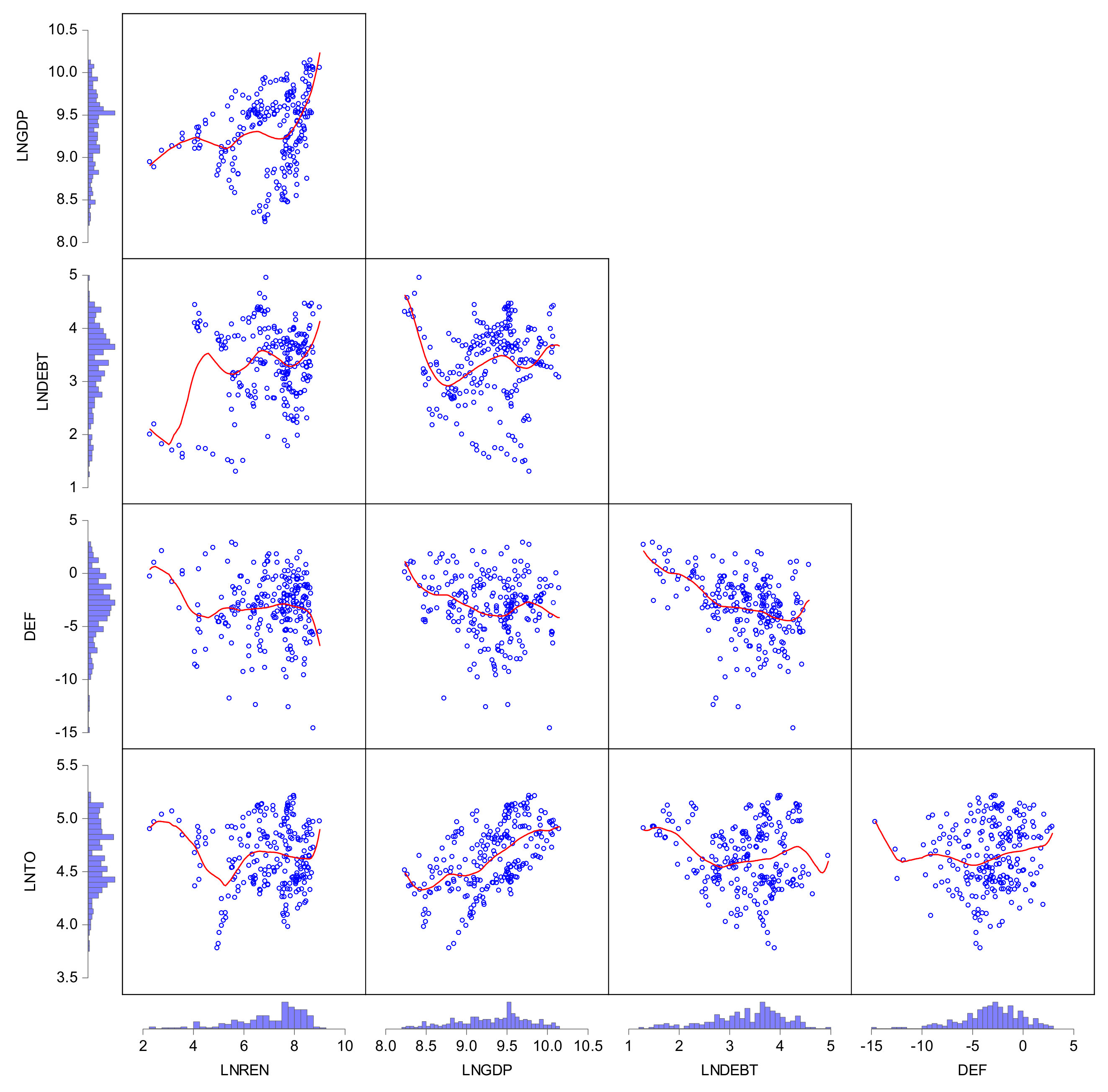

The scatter plots and histograms used pairwise combinations for the variables and did not include the series of a variable against itself (

Figure 1).

It is necessary to check if there was cross-sectional dependence among variables in the model before applying stationarity tests. The null hypothesis stated that there was no cross-sectional dependence (correlation) in the residuals.

Table 3 shows the results of the three tests that we used. The first line contains results for the Breusch–Pagan LM test and shows the statistical test value, the degree-of-freedom test, and the associated

p value. Here, the value of the statistical test, 375.14, was well into the upper tail of a X255, which was why we strongly rejected the null of no correlation at conventional significance levels. The next line presents results for the scaled Breusch–Pagan test. The scaled Pesaran Breusch–Pagan LM was asymptotically standard normal, and statistical test results (29.47) strongly rejected the null at conventional levels. Since T was relatively small, we instead wished to focus on the results for the asymptotically standard normal Pesaran CD test, which are presented in the last line of the table. While the statistical test value (3.76) was significantly below that of the scaled LM tests, the Pesaran CD test still rejected the null at conventional significance levels.

As the cross-sectional dependence tests proved that cross-sectional dependence existed among variables, change in any country generates effects in the other states included in the panel. CIPS is the unit root test suited for our analysis. The results of this test are presented in

Table 4, which shows that the null hypothesis was rejected at first difference on the 1% and 5% significance levels, so all variables were stationary and integrated at order 1.

After confirming the stationarity of the variables, we could check the cointegration among variables in the model. Two cointegration tests were used to check the cointegration relationships. Pedroni is one of the most important and widely used test of cointegration for panel data, and its results are illustrated in

Table 5.

With the first test (Pedroni residual-cointegration test), we noticed that the null hypothesis of no cointegration was only rejected for 5 of the 11 tests. This determined the need to apply a second cointegration test (Johansen Fisher panel-cointegration test). The null hypothesis stated that there was a cointegration relationship, whereas the alternative hypothesis involved the existence of a cointegration relationship among variables. Results from

Table 6 point out the existence of a strong cointegration relationship among variables.

As at least one cointegration relationship was found among model variables, the long-term cointegration coefficients were determined using FMOLS to examine REN elasticity to economic growth, public debt, net lending or borrowing (budget deficit), and trade openness (

Table 7).

This study uses the weighted pooled FMOLS estimator, as it accounts for heterogeneity by using cross-sectional-specific estimates of the long-run covariances to reweight the data prior to computing the pooled FMOLS [

51] (p. 12). Results show that all variables used in the model were statistically significant at the 5% level for the panel FMOLS. First, the long-run elasticity of REN to GDP was 1.63, showing that if GDP went up with one unit, then REN would go up with 1.63 units. Second, the long-run elasticity of REN to public debt was 0.11, indicating that a 1 unit increase in public debt leads to 0.11 units increase in REN. As for the budget deficit, the long-run elasticity of REN to this is 0.09, indicating that a 1 unit increase in budget deficit leads to 0.09 unit increase in REN. Regarding the long-run elasticity of REN to trade openness, its value was 0.29, showing that one unit increase in trade openness leads to 0.29 unit increase in REN.

We further checked if there was a causality relation among variables in the model and established the direction of causality. We used the causality test proposed by Granger for panel data. Results are expressed in

Table 8.

Eight unidirectional causality relations and a bidirectional causality relation were identified. All variables included in the model generate influences on REN in the long run. Thus, there were unidirectional causality relations from the main performance indicators of public finances (public debt and budget deficit) towards REN. The fact that emerging economies pay closer attention to the environment and raise investments for this purpose explained this connection. Investments in renewable-energy sources are both from their own funds and from public loans, which leads to an increase in both public debt and budget deficit.

5. Discussion

The paper analysed the impact of variables public debt, DEF, GDP, and trade openness on REN in emerging countries of the EU. Corroborating the obtained results from long-run FMOLS analysis with those obtained after applying the Granger causality test, we found that both public debt and budget deficit raise REN for the emerging economies included in this panel. Similar influences were found for GDP and trade openness, both variables having positive effects on REN for the emerging economies of the EU. The research revealed that there is positive correlation between the first four variables and REN. Public debt and budget deficit can lead to sustainable development if they are oriented towards investments in renewable-energy sectors (

Figure 2).

Our results are similar to those obtained by Tugcu et al. [

28] (p. 1100) regarding the unidimensional relationship between budget deficit and REN. There was also similarity to the results reached by Akar [

21], Murshed [

31] and Alam and Murad [

33] related to the relationship trade openness and REN. The unidimensional relationship between GDP and REN is similar to the results underlined by Rahman and Velayutham [

52] for South Asian countries. However, our results were not similar to those obtained by Hashemizadeh et al. [

14], who identified bidirectional relationships between GDP and REN. A reason for that difference can be that the consumption of renewable energy does not influence economic growth in the analyzed countries. These results followed those of Shahbaz et al. [

53], who had identified nine countries in which the consumption of renewable energy does not have significant impact on economic growth, Romania being among these countries.

There are some limits to this research related to the implications brought by these changes in the distribution of energy sources used within a country. Thus, greener urban transport, changes in the way in which consumers heat their homes, and a more sustainable form of tourism have important consequences on the way in which people incorporate all these in their lives. The reluctance to change can be an important barrier towards sustainable development, at least in the short run. In time, emerging countries can learn from the good practices of developed countries and implement measures that can improve both financial performance and REN.

Considering these limits, future research can focus on the impact of financial performance indicators on the various subsectors of REN, such as transportation, heating, and electricity. The financial policies of a country have many consequences on the behavior of consumers, and the expected positive effects on REN might change into a negative result, as other studies show [

14]. Fiscal measures have a positive influence on people, making them inclined to switch to a greener lifestyle, but if the burden on the individual’s budget is too high, the result might be the opposite.

6. Conclusions

Identifying the influence of public finances on sustainable development is of major interest, especially for the authorities, for adopting efficient measures, with a positive long-term effect, taking into consideration that global configuration comprises ‘various local arrangements, either through standardization or adaptation’ [

54].

The main objective of this research was to explore the existent relationships among public-finance performance, economic development, and sustainable energy consumption. In this regard, we performed analysis on the basis of a data panel comprising 11 emerging economies of the European Union. The most important indicators (public debt and budget deficit) mentioned in the Maastricht Treaty were used as variables in order to characterize the performance of public finances. We used GDP and trade openness, measuring the extent to which a country is engaged in the global trading system in order to quantify economic development. We used renewable-energy consumption for measuring sustainable energy consumption.

The methodology applied in this study involves identifying the cointegration relationships using the tests proposed by Pedroni and Johansen, and the causality among the variables included in the model through the Pedroni test. The panel FMOLS method was used to examine the elasticity of renewable-energy consumption to GDP, public debt, budget deficit, and trade openness.

The obtained results indicate that all variables included in the model (GDP, public debt, budget deficit, and trade openness) impact renewable-energy consumption. Although all states included in the data panel record public debt, and most register a negative budget balance, we could identify positive correlation between these variables and sustainable energy consumption. The explanation comes from the fact that part of the debt committed by public authorities from these states is oriented towards investments in renewable-energy sources.

As was shown, emerging EU economies follow examples of good practices from developed states oriented towards sustainable economic growth, adopting measures to improve the quality of the environment through their public policies. If we focus more on the practical utility of our results, the most polluting sectors are the energy, agricultural, industrial-process, and product-use sectors. [

55] Thus, increasing renewable energy in national energy sources and energy efficiency is fundamental, ‘given that the energy sector accounts for two-thirds of global emissions’ [

56]. However, the proposed solutions also imply societal change, with implications on ’prosperity, employment, and social organization’ [

56], which is why these changes need time to be accepted and implemented. The first step is to raise awareness of the importance of this matter and, together with the development of technological innovation, ‘clean energy should be supplied at a competitive cost aimed at reducing emissions’ [

57].