A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value

Abstract

:1. Introduction

2. Literature Review

3. Problem Description and Model Assumptions

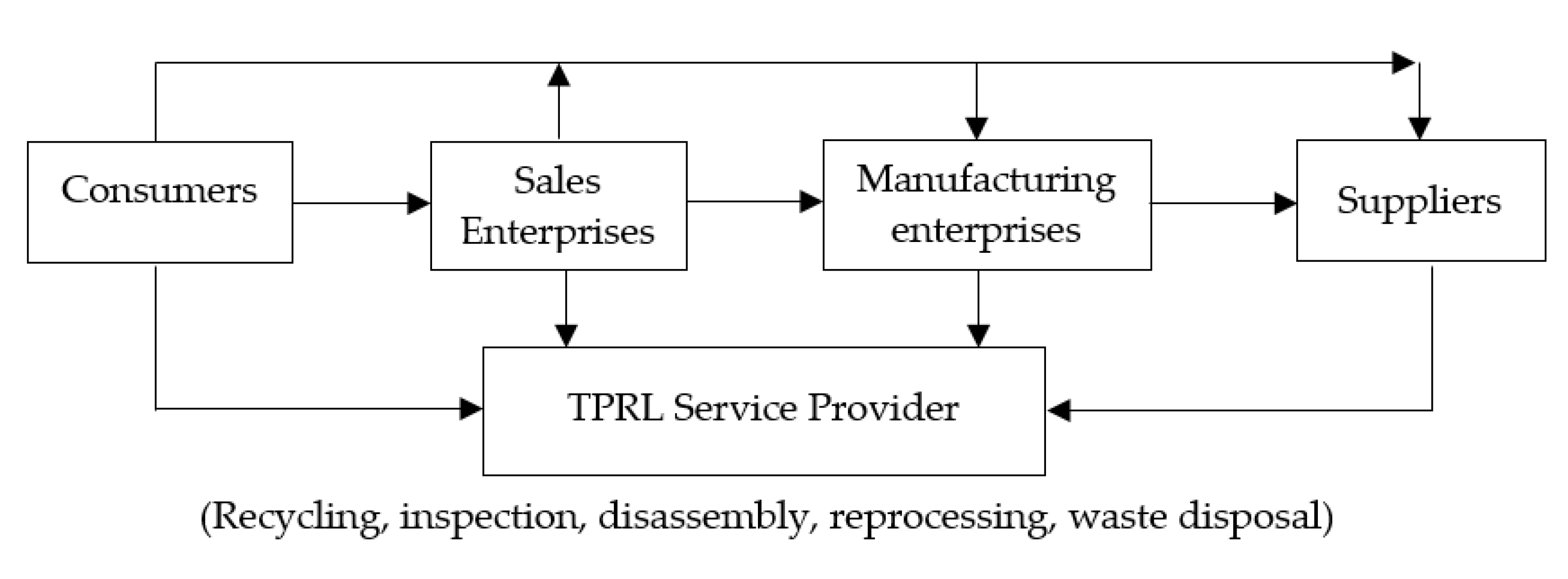

- Manufacturing enterprises: deliver the abandoned inventory, waste products, waste materials, or defective returned products to the TPRL service provider.

- Sales enterprises: deliver defective returned products, outdated inventory, or waste packaging to TPRL service provider.

- TPRL service provider: deliver the recycled raw materials or the reprocessed semi-finished products to the manufacturing enterprises and deliver the reprocessed products or packaging to the sales enterprises.

4. The Establishment and Solution of Model

4.1. Fuzzy DEA Model

4.1.1. Input and Output Index Screening Based on Rough Set

4.1.2. DEA Model with L-R Fuzzy Numbers

4.1.3. Transformation of Fuzzy DEA Model

4.2. Modified Shapley Value Model

4.2.1. Traditional Shapley Value Model

4.2.2. A Modified Shapley Value Model Based on Fuzzy DEA

5. Numerical Example

5.1. The Basic Numerical Example

5.2. Comparison with Other Models

5.3. Sensitivity Analysis

5.3.1. On Confidence Level

5.3.2. On the Number of Member Enterprises

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Li, Y.J.; Feng, L.P.; Zhao, X.K.; Xu, F.C. Overview on RL management research in new era of operations management. Syst. Eng. Theory Pract. 2020, 40, 2008–2022. [Google Scholar]

- Stock, J.R. Reverse Logistics; Council of Logistics Management: OAK Brook, IL, USA, 1992; Volume 2. [Google Scholar]

- Zhang, T.; Yu, X.M. Analysis and reference on the experience of foreign RL development. Pract. Foreign Econ. Relat. Trade 2015, 9, 86–88. [Google Scholar]

- Ke, J.L.; Jiang, W.J.; Yang, X.R. Comparison of the development gap of green logistics between China and Japan and experience reference. Pract. Foreign Econ. Relat. Trade 2018, 12, 87–91. [Google Scholar]

- Dong, R. Discuss how to choose RL operation mode in manufacturing enterprises. China Bus. Trade 2013, 27, 115–116. [Google Scholar]

- Gan, J.W.; Luo, L.; Kou, R. Progress and prospects of sustainable RL network design. Control Decis. 2020, 35, 2561–2577. [Google Scholar]

- Li, J. Analysis on the operation mode of enterprise RL. Mark. Mod. 2006, 34, 140. [Google Scholar]

- Karam, A.; Tsiulin, S.; Reinau, K.H.; Eltawil, A. An Improved Two-Level Approach for the Collaborative Freight Delivery in Urban Areas, LISS2019; Zhang, J., Dresner, M., Zhang, R., Hua, G., Shang, X., Eds.; Springer: Singapore, 2020; pp. 775–787. [Google Scholar] [CrossRef]

- Azab, A.; Karam, A.; Eltawil, A. Impact of Collaborative External Truck Scheduling on Yard Efficiency in Container Terminals. In Operations Research and Enterprise Systems. ICORES 2017. Communications in Computer and Information Science; Parlier, G., Liberatore, F., Demange, M., Eds.; Springer: Cham, Switzerland, 2017. [Google Scholar] [CrossRef]

- Xu, X.F.; Hao, J.; Zheng, Y. Multi-objective artificial bee colony algorithm for multi-stage resource leveling problem in sharing logistics network. Comput. Ind. Eng. 2020, 142, 106338. [Google Scholar] [CrossRef]

- Xu, X.F.; Wei, Z.F.; Ji, Q.; Wang, C.L.; Gao, G.W. Global renewable energy development: Influencing factors, trend predictions and countermeasures. Resour. Policy 2019, 63, 63. [Google Scholar] [CrossRef]

- Xu, X.F.; Lin, Z.R.; Li, X.; Shang, C.J. Multi-objective robust optimisation model for MDVRPLS in refined oil distribution. Int. J. Prod. Res. 2021, 5, 1–21. [Google Scholar]

- Xu, X.F.; Lin, Z.R.; Zhu, J. DVRP with limited supply and variable neighborhood region in refined oil distribution. Ann. Oper. Res. 2020, 1–25. [Google Scholar] [CrossRef]

- Ahmed, K.; Awady, A.E. Integrating collaborative and outsourcing strategies for yard trucks assignment in ports with multiple container terminals. Int. J. Logist. Manag. 2019, 32, 3–4. [Google Scholar]

- Xu, X.F.; Hao, J.; Yu, L.; Deng, Y.R. Fuzzy optimal allocation model for task-resource assignment problem in collaborative logistics network. IEEE. Trans. Fuzzy Syst. 2019, 27, 1112–1125. [Google Scholar] [CrossRef]

- Croce, A.I.; Musolino, G.; Rindone, C.; Vitetta, A. Route and path choices of freight vehicles: A case study with floating car data. Sustainability 2020, 12, 8557. [Google Scholar] [CrossRef]

- Xu, X.F.; Wang, C.L.; Zhou, P. GVRP considered oil-gas recovery in refined oil distribution: From an environmental perspective. Int. J. Prod. Econ. 2021, 235, 108078. [Google Scholar] [CrossRef]

- Li, W.H.; Chen, Q.; Wang, Q. R&D cooperation and profit coordination between upstream and downstream firms based on NASH negotiation model. JIEM 2012, 26, 65–71. [Google Scholar]

- Sheu, J.B.; Gao, X.Q. Alliance or no alliance—Bargaining power in competing reverse supply chains. Eur. J. Oper. Res. 2014, 233, 313–325. [Google Scholar] [CrossRef]

- Kato, W.; Arizono, I.; Takemoto, Y. A proposal of bargaining solution for cooperative contract in a supply chain. J. Intell. Manuf. 2018, 29, 559–567. [Google Scholar] [CrossRef]

- Jiang, N.; Zhang, L.L.; Yu, Y. Optimizing cooperative advertizing, profit sharing, and inventory policies in a VMI Supply chain: A Nash bargaining model and hybrid algorithm. IEEE. Trans. Eng. Manag. 2015, 62, 449–461. [Google Scholar] [CrossRef]

- Atay, A.; Solymosi, T. On bargaining sets of supplier-firm-buyer games. Econ. Lett. 2018, 167, 99–103. [Google Scholar] [CrossRef] [Green Version]

- Zhu, X.D.; Wang, J.; Tang, J. Recycling pricing and coordination of WEEE dual-channel closed-loop supply chain considering consumers’ bargaining. Int. J. Environ. Res. Public Health 2017, 14, 1578. [Google Scholar] [CrossRef] [Green Version]

- Gong, W.W.; Ge, C.C.; Chen, J.X.; Pan, J.G. Division models of profit in three-echelon reverse supply chain cooperation based on Nash models. Ind. Eng. Manag. 2011, 16, 16–21. [Google Scholar]

- Wei, G.X.; Huang, X.Y.; Qin, Y.H. Carbon emission reduction of supply chain based on revenue sharing contract and Nash bargaining fairness. Ecol. Econ. 2017, 33, 63–68. [Google Scholar]

- Panda, S.; Modak, N.M.; Basu, M.; Goyal, S.K. Channel coordination and profit distribution in a social responsible three-layer supply chain. Int. J. Prod. Econ. 2015, 168, 224–233. [Google Scholar] [CrossRef]

- Mahmoodi, A. Stackelberg-Nash equilibrium of pricing and inventory decisions in duopoly supply chains using a nested evolutionary algorithm. Appl. Soft Comput. 2019, 86, 105922. [Google Scholar] [CrossRef]

- Li, B.Z.; Luo, X.F. Study on profit allocation of enterprise’s original innovation with an industry-university-research cooperative mode based on the Shapley value. Oper. Res. Manag. Sci. 2013, 22, 220–224. [Google Scholar]

- Wang, Y.; Yuan, Y.Y.; Assogba, K.; Gong, K.; Wang, H.Z.; Xu, M.Z.; Wang, H.Y.; Ibeas, A. Design and profit allocation in two-echelon heterogeneous cooperative logistics network optimization. J. Adv. Transport. 2018, 2018, 4607493. [Google Scholar] [CrossRef] [Green Version]

- Wang, X.; Zhang, P.W.; Sun, H. Research on profit distribution plan of supply chain alliance based on resource input. Stat. Decis. 2018, 34, 55–59. [Google Scholar]

- Jin, B. Construction of game model of supply chain financing income distribution. Stat. Deci. 2013, 5, 51–54. [Google Scholar]

- Guo, H.W.; Zhao, R.; Pu, L.; Wu, J.; Tan, Z.F. The improved Shapley model of multi-party cooperation profit distribution in trans-provincial power transactions. Math. Pract. Theory 2019, 49, 46–53. [Google Scholar]

- Gan, M.; Yang, S.; Li, D.D.; Wang, M.F.; Chen, S.; Xie, R.H.; Liu, J.Y.; Gershenson, C. A novel intensive distribution logistics network design and profit allocation problem considering sharing economy. Complexity 2018, 2018, 4678358. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.F. Profit distribution mechanism of agricultural products supply chain based on improved Shapley value model. Stat. Decis. 2017, 23, 52–54. [Google Scholar]

- Huang, X.M.; Yang, S. The research on profit allocation strategy of cooperative green supply chain—Application of modified Shapley value based on blockchain. J. Econ. Manag. Strat. 2020, 8, 14–19. [Google Scholar]

- Russo, F.; Corrado, R. Data Envelopment Analysis (DEA) For Evacuation Planning. In Proceedings of the 7th International Conference on Computer Simulation in Risk Analysis & Hazard Mitigation, Algarv, Portugal, 13–15 September 2010. [Google Scholar]

- Musolino, G.; Rindone, C.; Vitetta, A. Evaluation in transport Schemening: A comparison between data envelopment analysis and multi criteria decision making methods. In Proceedings of the 31st European Simulation and Modelling Conference, Lisbon, Portugal, 25–27 October 2017. [Google Scholar]

- Yang, Z.H.; Zhang, Q.W. Resource allocation based on DEA and modified Shapley value. Appl. Math. Comput. 2015, 263, 280–286. [Google Scholar] [CrossRef]

- An, Q.; Wen, Y.; Ding, T.; Li, Y. Resource sharing and payoff allocation in a three-stage system: Integrating network DEA with the Shapley value method. Omega 2019, 85, 16–25. [Google Scholar] [CrossRef]

- Liu, P.; Gao, G.J. P-DEA and Shapley value models based on green supply chain profit distribution. J. Railw. Sci. Eng. 2018, 15, 2448–2454. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Hammes, G.; Souda, E.D.D.; Rodriguez, C.M.T.; Millan, R.H.R.; Herazo, J.C.M. Evaluation of the RL performance in civil construction. J. Clean. Prod. 2020, 248, 119212. [Google Scholar] [CrossRef]

- Bottani, E.; Montanari, R.; Rinaldi, M. Simulation and performance improvement of a RL system for waste electrical and electronic equipment: A case study in Italy. Int. J. Simul. Process Model. 2019, 14, 308–323. [Google Scholar] [CrossRef]

- Wang, Z.; Hao, H.; Gao, F.; Zhang, Q.; Zhang, J.; Zhou, Y. Multi-attribute decision making on RL based on DEA-TOPSIS: A study of the Shanghai End-of-life vehicles industry. J. Clean. Prod. 2019, 214, 730–737. [Google Scholar] [CrossRef]

- Slowinski, R.; Vanderpooten, D. A generalized definition of rough approximations based on similarity. IEEE. Trans. Knowl. Data Eng. 2000, 12, 331–336. [Google Scholar] [CrossRef]

- Ramík, J.; Ímánek, J. Inequality relation between fuzzy numbers and its use in fuzzy optimization. Fuzzy Sets Syst. 1985, 16, 123–138. [Google Scholar] [CrossRef]

- Tanaka, H.; Ichihashi, H.; Asai, K. A formulation of fuzzy linear programming problem based on comparison of fuzzy numbers. Control. Cybern. 1984, 13, 41–52. [Google Scholar]

- Wang, M.Q.; Liang, L.; Li, Y.J. Fuzzy super-efficiency DEA model. Chin. J. Manag. Sci. 2009, 17, 117–124. [Google Scholar]

- Yang, Z.H.; Zhang, Q.W. Resource allocation among decision making units with fuzzy data—Based on DEA and Shapley value. Syst. Eng. Theory Pract. 2016, 36, 719–725. [Google Scholar]

- Xu, X.; Liu, Y.B.; Fan, X.X. Data mining with rough set based on fuzzy toolbox and ROSETTA. Microcomput. Inf. 2007, 23, 174–175. [Google Scholar]

- Liu, B.; Zhao, R.; Wang, G. Uncertain Programming with Applications; Tsinghua University Press: Beijing, China, 2003. [Google Scholar]

| Expert Serial Number | Conditional Attributes | Decision Attributes | |||

|---|---|---|---|---|---|

| … | D | ||||

| 1 | … | ||||

| 2 | … | ||||

| p | … | ||||

| Expert Serial Number | Number of Employees | Total Employee Wages | Fixed Asset Investment | Investment in R&D | Storage Cost | Management Cost | Efficiency |

|---|---|---|---|---|---|---|---|

| 1 | 5 | 5 | 2 | 2 | 5 | 3 | 3 |

| 2 | 4 | 4 | 3 | 2 | 5 | 4 | 5 |

| 3 | 4 | 5 | 3 | 2 | 4 | 4 | 4 |

| 4 | 3 | 4 | 2 | 3 | 4 | 3 | 3 |

| 5 | 4 | 4 | 4 | 2 | 4 | 4 | 4 |

| 6 | 5 | 4 | 3 | 3 | 5 | 3 | 5 |

| 7 | 5 | 5 | 2 | 3 | 5 | 4 | 3 |

| 8 | 4 | 4 | 3 | 4 | 4 | 4 | 4 |

| 9 | 5 | 4 | 2 | 3 | 5 | 3 | 3 |

| 10 | 3 | 5 | 3 | 4 | 3 | 5 | 4 |

| Expert Serial Number | Net Profit | Amount of Cost Savings | Resource Reuse Income | Reputation | Customer Satisfaction | Efficiency |

|---|---|---|---|---|---|---|

| 1 | 4 | 4 | 5 | 4 | 3 | 3 |

| 2 | 5 | 5 | 4 | 3 | 5 | 5 |

| 3 | 5 | 4 | 4 | 3 | 4 | 4 |

| 4 | 4 | 5 | 4 | 4 | 2 | 3 |

| 5 | 4 | 4 | 4 | 2 | 3 | 4 |

| 6 | 5 | 4 | 5 | 4 | 4 | 5 |

| 7 | 4 | 4 | 4 | 2 | 3 | 3 |

| 8 | 5 | 4 | 4 | 4 | 4 | 4 |

| 9 | 5 | 4 | 5 | 4 | 5 | 3 |

| 10 | 3 | 4 | 4 | 3 | 4 | 4 |

| Member Enterprises | A | B | C | D |

|---|---|---|---|---|

| Total Employee Wages/104$ | (79.8, 9.1) | (57.2, 2.1) | (87.6, 6.9) | (81.5, 7.3) |

| Fixed Asset Investment/104$ | (41.2, 44.5, 3.3) | (29.3, 33.6, 2.1) | (31.1, 35.2, 3.7) | (45.6, 47.5, 2.1) |

| Investment in R&D/104$ | (51.5, 54.3, 2.3, 2.5) | (43.3, 45.4, 2.1, 1.9) | (21.2, 24.5, 1.3, 0.7) | (57.6, 62.3, 3.7, 2.5) |

| Resource Reuse Income/104$ | (81.2, 2.5, 4.7) | (69.5, 3.3, 2.5) | (51.3, 1.5, 3.7) | (113.7, 5.3, 2.1) |

| Customer Satisfaction/% | (74.5, 5.1) | (80.3, 6.2) | (85.7, 2.3) | (87.2, 3.4) |

| S | A | B | C | D |

|---|---|---|---|---|

| — | — | — | — | |

| {A} | 1.000 | — | — | — |

| {B} | — | 1.000 | — | — |

| {C} | — | — | 1.000 | — |

| {D} | — | — | — | 1.000 |

| {A, B} | 0.993 | 1.000 | — | — |

| {A, C} | 1.000 | — | 1.000 | — |

| {A, D} | 0.994 | — | — | 1.000 |

| {B, C} | — | 1.000 | 1.000 | — |

| {B, D} | — | 1.000 | — | 1.000 |

| {C, D} | — | — | 1.000 | 1.000 |

| {A, B, C} | 0.962 | 1.000 | 1.000 | — |

| {A, B, D} | 0.891 | 1.000 | — | 1.000 |

| {A, C, D} | 0.915 | — | 1.000 | 1.000 |

| {B, C, D} | — | 1.000 | 1.000 | 1.000 |

| {A, B, C, D} | 0.856 | 1.000 | 1.000 | 1.000 |

| {} | 0 | 1.000 | = 0.814 | |

| {B} | 0.993 | |||

| {B, C} | 0.962 | |||

| {B, C, D} | 0.856 | |||

| {C}, {D}, {B, D}, {C, D} | ||||

| Member Enterprises | A | B | C | D |

|---|---|---|---|---|

| Efficiency Value | 0.856 | 1.000 | 1.000 | 1.000 |

| Normalized ratio | 0.222 | 0.259 | 0.259 | 0.259 |

| Distribution of Profit | 22.199 | 25.934 | 25.934 | 25.934 |

| Indexes | A | B | C | D |

|---|---|---|---|---|

| Total Employee Wages/104$ | 79.8 | 57.2 | 87.6 | 81.5 |

| Fixed Asset Investment/104$ | 42.85 | 31.45 | 33.15 | 46.55 |

| Investment in R&D/104$ | 52.95 | 44.3 | 22.7 | 59.65 |

| Resource Reuse Income/104$ | 81.75 | 69.3 | 51.85 | 112.9 |

| Customer Satisfaction/% | 74.5 | 80.3 | 85.7 | 87.2 |

| Indexes | A | B | C | D |

|---|---|---|---|---|

| Resource Reuse Income per Total Employee Wage | 1.024 | 1.212 | 0.592 | 1.385 |

| Resource Reuse Income per Fixed Asset Investment | 1.908 | 2.203 | 1.564 | 2.425 |

| Resource Reuse Income per Investment in R&D | 1.544 | 1.564 | 2.284 | 1.893 |

| Customer Satisfaction per Total Employee Wage | 0.934 | 1.404 | 0.978 | 1.070 |

| Customer Satisfaction per Fixed Asset Investment | 1.739 | 2.553 | 2.585 | 1.873 |

| Customer Satisfaction per Investment in R&D | 1.407 | 1.813 | 3.775 | 1.462 |

| Weighting Method | Member Enterprises | A | B | C | D |

|---|---|---|---|---|---|

| Entropy | Efficiency Value | 0.098 | 0.549 | 0.612 | 0.387 |

| Normalized ratio | 0.059 | 0.333 | 0.372 | 0.235 | |

| Distribution of Profit | 5.928 | 33.346 | 37.198 | 23.527 | |

| Average | Efficiency Value | 0.157 | 0.614 | 0.516 | 0.491 |

| Normalized ratio | 0.089 | 0.345 | 0.290 | 0.276 | |

| Distribution of Profit | 8.852 | 34.541 | 29.015 | 27.592 |

| Confidence Degree | Member Enterprises | A | B | C | D |

|---|---|---|---|---|---|

| Efficiency Value | 0.865 | 1.000 | 1.000 | 1.000 | |

| Shapley Value | 0.808 | 0.739 | 0.743 | 0.734 | |

| Distribution of Profit | 26.719 | 24.439 | 24.570 | 24.272 | |

| Efficiency Value | 0.856 | 1.000 | 1.000 | 1.000 | |

| Shapley Value | 0.814 | 0.738 | 0.742 | 0.733 | |

| Distribution of Profit | 26.891 | 24.381 | 24.513 | 24.215 | |

| Efficiency Value | 0.847 | 1.000 | 1.000 | 1.000 | |

| Shapley Value | 0.821 | 0.738 | 0.741 | 0.731 | |

| Distribution of Profit | 27.087 | 24.349 | 24.447 | 24.117 |

| Member Enterprises | E |

|---|---|

| Total Employee Wages/104$ | (90.3, 5.4) |

| Fixed Asset Investment/104$ | (42.5, 47.9, 6.4) |

| Investment in R&D/104$ | (29.7, 35.2, 3.2, 2.7) |

| Resource Reuse Income/104$ | (56.7, 6.9, 5.8) |

| Customer Satisfaction/% | (87.6, 3.2) |

| S | A | B | C | D | E |

|---|---|---|---|---|---|

| — | — | — | — | — | |

| {A} | 1.000 | — | — | — | — |

| {B} | — | 1.000 | — | — | — |

| {C} | — | — | 1.000 | — | — |

| {D} | — | — | — | 1.000 | — |

| {E} | — | — | — | — | 1.000 |

| {A, B} | 0.993 | 1.000 | — | — | — |

| {A, C} | 1.000 | — | 1.000 | — | — |

| {A, D} | 0.994 | — | — | 1.000 | |

| {A, E} | 1.000 | — | — | — | 1.000 |

| {B, C} | — | 1.000 | 1.000 | — | — |

| {B, D} | — | 1.000 | — | 1.000 | — |

| {B, E} | 1.000 | — | — | 1.000 | |

| {C, D} | — | — | 1.000 | 1.000 | — |

| {C, E} | — | — | 1.000 | — | 1.000 |

| {D, E} | — | — | — | 1.000 | 1.000 |

| {A, B, C} | 0.962 | 1.000 | 1.000 | — | — |

| {A, B, D} | 0.891 | 1.000 | — | 1.000 | — |

| {A, B, E} | 0.984 | 1.000 | — | — | 1.000 |

| {A, C, D} | 0.915 | — | 1.000 | 1.000 | — |

| {A, C, E} | 1.000 | — | 1.000 | — | 1.000 |

| {A, D, E} | 0.938 | — | — | 1.000 | 1.000 |

| {B, C, D} | — | 1.000 | 1.000 | 1.000 | — |

| {B, C, E} | — | 1.000 | 1.000 | — | 0.942 |

| {B, D, E} | — | 1.000 | 1.000 | — | 1.000 |

| {C, D, E} | — | — | 1.000 | 1.000 | 0.989 |

| {A, B, C, D} | 0.856 | 1.000 | 1.000 | 1.000 | — |

| {A, B, C, E} | 0.962 | 1.000 | 1.000 | — | 0.942 |

| {A, B, D, E} | 0.874 | 1.000 | — | 1.000 | 1.000 |

| {A, C, D, E} | 0.915 | — | 1.000 | 1.000 | 0.989 |

| {B, C, D, E} | — | 1.000 | 1.000 | 1.000 | 0.938 |

| {A, B, C, D, E} | 0.856 | 1.000 | 1.000 | 1.000 | 0.938 |

| Member Enterprises | A | B | C | D | E |

|---|---|---|---|---|---|

| Efficiency Value | 0.856 | 1.000 | 1.000 | 1.000 | 0.938 |

| Shapley Value | 0.811 | 0.738 | 0.764 | 0.940 | 0.7705 |

| Distribution of Profit | 20.156 | 18.342 | 18.988 | 23.363 | 19.151 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, J.; Ma, X.; Chen, R. A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value. Sustainability 2021, 13, 7354. https://doi.org/10.3390/su13137354

Song J, Ma X, Chen R. A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value. Sustainability. 2021; 13(13):7354. https://doi.org/10.3390/su13137354

Chicago/Turabian StyleSong, Jiekun, Xiaoping Ma, and Rui Chen. 2021. "A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value" Sustainability 13, no. 13: 7354. https://doi.org/10.3390/su13137354

APA StyleSong, J., Ma, X., & Chen, R. (2021). A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value. Sustainability, 13(13), 7354. https://doi.org/10.3390/su13137354