The Effects of Tax Reduction and Fee Reduction Policies on the Digital Economy

Abstract

:1. Overview of the Digital Economy

1.1. The Definition of Digital Economy

1.2. The Significance of Developing the Digital Economy

1.2.1. Acceleration of the Development of the Digital Economy Due to International Competition

1.2.2. Acceleration of the Development of the Digital Economy to Restart Economic Momentum after COVID-19

2. Literature Review on Tax and Fee Reduction

2.1. Most Countries Focus on the Study of Individual Income Tax, Corporate Income Tax, Dividend Tax and Value-Added Tax Reduction Policies and Their Effects

2.2. A Large Number of Previous Studies Have Examined the Impact of Tax Reductions on Innovation, Corporate Investment, Employment (Labor Supply), Savings and Consumption

2.3. The Research Can Be Divided Into Macroscopic and Microscopic Aspects Based on the Perspective of Research Methods and Research Data

3. The Impact of Tax and Fee Reduction on China’s Digital Economy from an International Perspective

3.1. The Top 100 List Reflects the Global Digital Economy

3.1.1. The United States Ranks First, in Terms of the Number of Companies on the List, While China Ranks Second

3.1.2. US Companies Dominate the List, While Chinese Companies Are among the Top 10

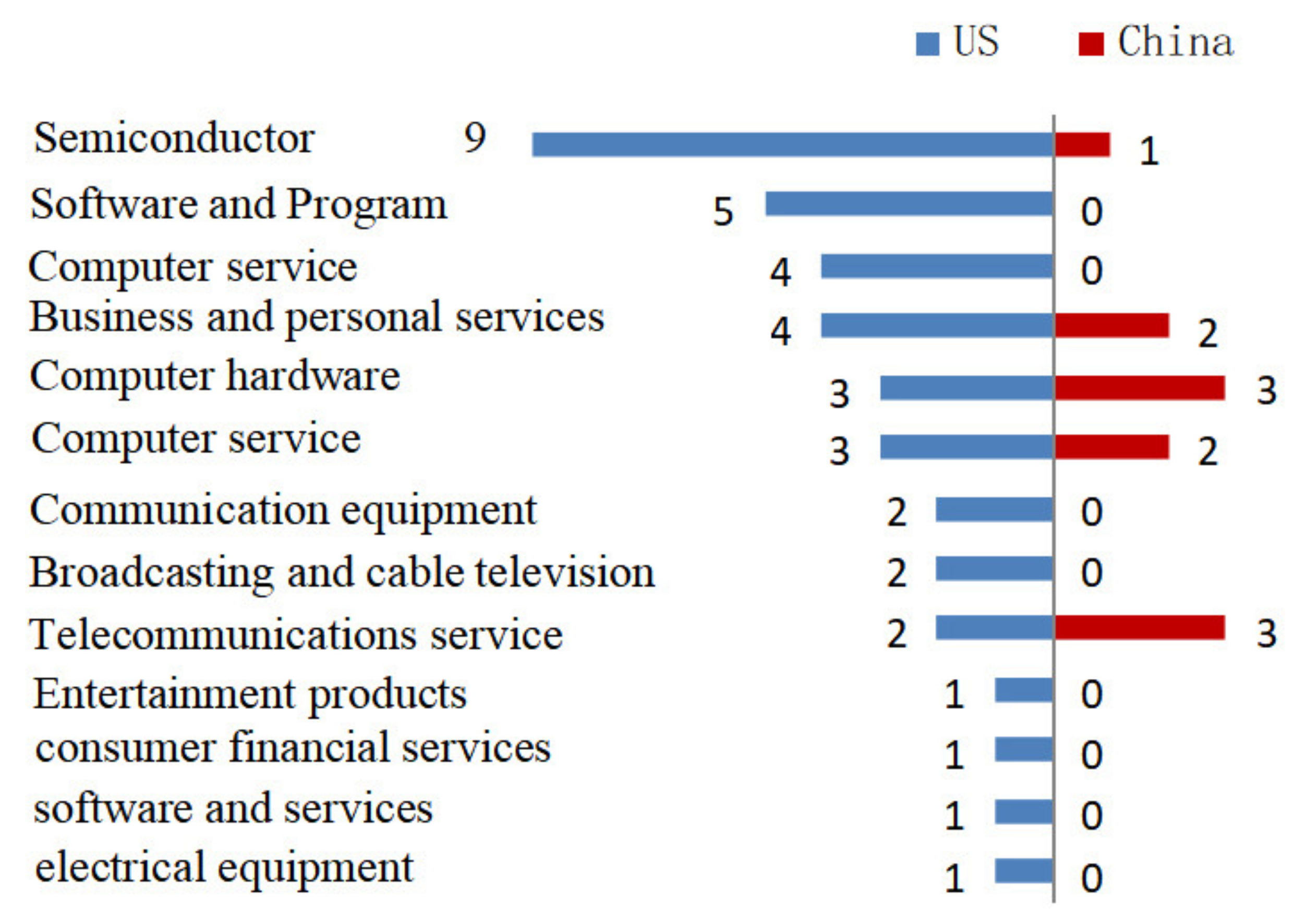

3.1.3. The US Enterprise Industry Classification Is Extensive, While the Chinese Enterprise Industry Classification Is Relatively Concentrated

3.2. Tax Cuts and Fee Reductions Help Enhance the International Competitiveness of China’s Digital Economy

3.2.1. China’s Digital Economy’s Main Revenue Growth Rate Is Faster Than That of the United States

3.2.2. China’s Digital Economy Is Growing Faster Than That of the United States in Terms of Net Profit

3.2.3. China’s Digital Economy R&D Investment Is Growing Faster Than That in the United States

3.2.4. The Income Tax Burden of China’s Digital Economy Has Dropped Significantly

3.3. Empirical Analysis of the Impact of Tax and Fee Reduction on Digital Economy Enterprises from the International Perspective

4. Analysis of the Effects of Tax and Fee Reduction Policies in the Digital Economy

4.1. Analysis of Tax and Fee Reduction Policies in the Digital Economy

4.2. Macro Analysis of Tax Cuts and Fee Reductions in the Digital Economy

4.2.1. The Direct Effect of “from Tax-to-Tax Base”

4.2.2. Analysis of the Indirect Effects of “from Tax Base to Tax Source”

4.2.3. Analysis of the Macro Effects of “from Tax Source to Economy”

4.3. Empirical Analysis of Tax and Fee Reductions in the Digital Economy

4.3.1. Impact on Operating Income

4.3.2. Impact on Profits

4.3.3. Impact on Investment

4.3.4. Impact on Employment

4.3.5. Impact on Revenue of High-Tech Products

4.3.6. Impact on R&D Investment

5. Problems of Tax and Fee Reduction and Policies in China’s Digital Economy

5.1. Lack of Specialized Preferential Tax Policies for the Digital Economy

5.2. Improvement on Preferential Tax Policies Needed to Encourage Innovation

5.3. High Marginal Tax Rate for Personal Income Tax Unappealing to Talents

5.4. A Big Enterprise Income Tax Burden against International Competition

6. Policy Recommendations for Tax and Fee Reductions in the Digital Economy

6.1. Optimizing the Tax and Fee Policy System Should Be Done in Coordination with the Digital Economy Development Strategy

6.2. Increase Tax Incentives for New Enterprises

6.3. Increase Tax Incentives for Employment-Related High-Level Talent

6.4. Increase Tax Incentives for Independent Innovation Based on Research and Development

6.5. Increase Investment to Promote the Transformation and Upgrading of Manufacturing

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- China Institute of Information and Communications Technology. White Paper on Digital Economic Development and Employment in China; China Institute of Information and Communications Technology: Beijing, China, 2019. [Google Scholar]

- Brandt, L.; Biesebroeck, J.V.; Zhang, Y. Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 2012, 97, 339–351. [Google Scholar] [CrossRef] [Green Version]

- Yang, Y.; Zheng, L.; Xiaoqian, Y. Challenges and Solutions of Enterprise Income Tax in Digital Economy—Based on the International Comparative Perspective. Friends Account. 2018, 7, 73–79. [Google Scholar]

- Auerbach, A.J. The Bush Tax Cut and National Saving. Natl. Tax J. 2002, 55, 387–407. [Google Scholar] [CrossRef] [Green Version]

- Reed, W.R. The Robust Relationship between Taxes and US State Income Growth. Natl. Tax J. 2008, 61, 57–80. [Google Scholar] [CrossRef]

- Lisan, Z.; Zinan, W. Analysis on the Relationship between Income Tax Incentives and R&D investment based on Enterprise Profitability. Tax Res. 2020, 5, 113–119. [Google Scholar] [CrossRef]

- Yeguang, C.; Jing, W. Research on the effect of Income Tax R&D Expenses Plus Deduction Policy based on China’s Three Economic Zones. Tax Res. 2020, 2, 92–98. [Google Scholar]

- Bell, A.M.; Chetty, R.; Jaravel, X.; Petkova, N.; Van Reenen, J. Do Tax Cuts Produce More Einsteins? The Impacts of Financial Incentives vs. Exposure to Innovation on the Supply of Inventors; NBER Working Paper No. 25493; NBER: Cambridge, MA, USA, 2019. [Google Scholar]

- Baum, D.N. Economic Effects of Including Services in the Sales Tax Base: An Applied General Equilibrium Analysis. Public Financ. Rev. 1991, 19, 166–192. [Google Scholar] [CrossRef]

- Surong, W.; Bo, F. Analysis of the P olicy Effect of Value-added Tax Transformation. Econ. Res. Guide 2011, 22, 16–18. [Google Scholar]

- Husheng, W. Research on the Construction of Tax Expenditure System Based on Efficiency Optimization. Tax Res. 2020, 1, 122–128. [Google Scholar]

- Helms, L.J. The Effect of State and Local Taxes on Economic Growth: A Time Series Cross Section Approach. Rev. Econ. Stat. 1985, 67, 574–582. [Google Scholar] [CrossRef]

- Jianfu, S.; Jia, H. Analysis of the Effect of Tax Preference on the Development of Integrated Circuit Enterprises in China. Tax Res. 2020, 2, 23–30. [Google Scholar]

- Chao, H. Analysis of Tax Preferential Policies in China’s Integrated Circuit Industry. Tax Res. 2020, 2, 33–36. [Google Scholar]

- Gentry, W.M.; Ladd, H.F. State Tax Structure and Multiple Policy Objectives. Natl. Tax J. 1994, 47, 747–769. [Google Scholar] [CrossRef]

- Degang, L.; Lingjiang, G. Path optimization of tax reduction and fee reduction in the new era. Tax Res. 2020, 4, 29–32. [Google Scholar]

- Daixin, H. Challenges and Countermeasures in implementing larger scale tax reduction. Tax Res. 2019, 2, 18–20. [Google Scholar]

- Surong, W.; Fang, Y. Tax reduction and fee reduction: Mechanism, measures and micro effects. Financ. Res. 2020, 1, 18–25. [Google Scholar] [CrossRef]

- Bin, Z. Theoretical dimension, policy framework and realistic choice of tax reduction and fee reduction. Financ. Res. 2019, 5, 7–16. [Google Scholar] [CrossRef]

- Romer, C.D.; Romer, D.H. Do Tax Cuts Starve the Beast? The Effect of Tax Changes on Government Spending Brookings Papers on Economic Activity; Economic Studies Program; The Brookings Institution: Washington, DC, USA, 2009; Volume 40, pp. 139–214. [Google Scholar]

- Kun, Y.; Zhen, J. Key points and policy suggestions for implementing strategic tax reduction. Tax Res. 2019, 7, 3–7. [Google Scholar]

- Auerbach, A.J. Tax Reform and Adjustment Costs: The Impact on Investment and Market Value. Int. Econ. Rev. 1989, 30, 939–962. [Google Scholar] [CrossRef] [Green Version]

- Francois, G.; Miao, J. Transitional Dynamics of Dividend and Capital Gains Tax Cuts. Rev. Econ. Dyn. 2011, 14, 368–383. [Google Scholar]

- Angelopoulos, K.; Economides, G.; Kammas, P. Tax-spending Policies and Economic Growth: Theoretical Predictions and Evidence from the OECD. Eur. J. Political Econ. 2007, 23, 885–902. [Google Scholar] [CrossRef]

- Leiming, Y.; Bo, Z.; Yu, S.; Tan, Y. Analysis of the effect of substantial tax reduction: From the perspective of preventing and resolving major economic risks. Tax Res. 2020, 4, 24–28. [Google Scholar]

- Zhang, L.; Chen, Y.; He, Z. The effect of investment tax incentives: Evidence from China’s value-added tax reform. Int. Tax Public Financ. 2018, 25, 913–945. [Google Scholar] [CrossRef]

- Pingfang, Z.; Weimin, X. Effects of the Government’s Science and Technology Incentive Policy on R&D Input and Patent Output of Large and Medium-sized Industrial Enterprises—An Empirical Study of Shanghai. Econ. Res. 2003, 6, 45–53+94. [Google Scholar]

- Allingham, M.G.; Sandmo, A. Income Tax Evasion: A Theoretical Analysis. J. Public Econ. 2010, 3, 201–202. [Google Scholar] [CrossRef] [Green Version]

- Zheng, W.P.; Zhang, J. Does tax reduction spur innovation? Firm-level evidence from China. Financ. Res. Lett. 2020, 101575. [Google Scholar] [CrossRef]

- Liping, D. The concept of tax reduction with Chinese characteristics. Contemp. Financ. Econ. 2019, 6, 28–35. [Google Scholar]

- Xu, J.; Wei, W.X. The effects of tax and fee reduction policy on mitigating shock of the COVID-19 epidemic in China. Appl. Econ. 2021. [Google Scholar] [CrossRef]

- Brennan, G.; Buchanan, J.M. The Power to Tax: Analytical Foundations of a Fiscal Constitution. South. Econ. J. 1980, 48, 221–225. [Google Scholar]

- Jiancheng, G. Tax reduction, economic growth and market interest rate. Macro Res. 2019, 8, 59–63. [Google Scholar]

- Levinsohn, J.; Petrin, A. Estimating Production Functions Using Inputs to Control for Unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Chaoji, Y. A new round of tax reduction to promote the development of private enterprises. Theor. Discuss. 2020, 1, 96–101. [Google Scholar] [CrossRef]

- Gobey, M.; Matikonis, K. Small business property tax reductions and job growth. Small Bus. Economics 2021, 56, 277–292. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Yao, Y. Sources of China’s Economic Growth 1952-1999: Incorporating Human Capital Accumulation. China Econ. Rev. 2003, 14, 32–52. [Google Scholar] [CrossRef] [Green Version]

- Cangfeng, W. Tax Relief and R&D Investment: An Empirical Analysis Based on the Data of Chinese Manufacturing Enterprises. Tax Res. 2009, 11, 25–28. [Google Scholar]

- Yang, C.-H.; Huang, C.-H.; Chang, W.-H. Does Reduction in the Tax Credit Rate Retard R&D Activity? Evidence from Taiwan’s R&D Tax Cred-It Reform in 2010. Contemp. Econ. Policy 2021, 398–415. [Google Scholar] [CrossRef]

- Liu, Y.; Mao, J. How Do Tax Incentives Affect Investment and Productivity? Firm-Level Evidence from China. Am. Econ. J. Econ. Policy 2019, 11, 261–291. [Google Scholar] [CrossRef] [Green Version]

- Khastar, M.; Aslani, A.; Nejati, M. How does carbon tax affect social welfare and emission reduction in Finland? Energy Rep. 2020, 6, 736–744. [Google Scholar] [CrossRef]

- Kim, S.; Park, J.-H. Dynamic factor adjustment and corporate tax reduction in the Japanese manufacturing industry. J. Asia Pac. Economy 2020. [Google Scholar] [CrossRef]

- Seip, K.L. Does tax reduction have an effect on gross domestic product? An empirical investigation. J. Policy Modelling 2019, 41, 1128–1143. [Google Scholar] [CrossRef]

| Groups | (1) | (2) |

|---|---|---|

| Variables | China Operating Profit Margin | United States Operating Profit Margin |

| Tax reduction area * tax reduction | 2.871 ** | 2.968 *** |

| Operating cost rate | (1.643) −0.645 *** | (0.0458) −0.584 *** |

| (0.0628) | (0.0458) | |

| Observations | 415 | 370 |

| R-squared | 0.266 | 0.425 |

| Regional fixed effects | Yes | Yes |

| Time fixed effects | Yes | Yes |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | YYSR | YYSR | YYSR |

| YYCB | 0.584 *** | 0.581 *** | 1.013 *** |

| (0.00925) | (0.039) | (0.00623) | |

| YF | 0.187 * | 0.149 * | 1.040 *** |

| (0.175) | (0.749) | (0.0468) | |

| JMSF | 0.530 * | 0.534 * | 0.285 *** |

| (0.0517) | (0.217) | (0.0453) | |

| Constant | 3,631,235 *** | 67,800,000 *** | 181.7 *** |

| (102,558.4) | (4,233,914) | (7490.80) | |

| Observations | 19,515 | 842 | 18,673 |

| R-squared | 0.9917 | 0.9915 | 0.8316 |

| Number of id | 10,354 | 319 | 10,035 |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | LRZE | LRZE | LRZE |

| YYCB | −0.472 *** | −0.475 *** | −0.026 ** |

| (0.01790) | (0.07517) | (0.01260) | |

| YF | 2.236 *** | 2.337 * | 0.0045 |

| (0.33875) | (1.448) | (0.0946) | |

| JMSF | 6.952 *** | 6.971 *** | 0.388 *** |

| (0.10001) | (0.4197) | (0.0916) | |

| Constant | 1,501,827 *** | 30,800,000 *** | −34,255.76 ** |

| (198,427.3) | (8,187,251) | (15,134.17) | |

| Observations | 19,515 | 842 | 18,673 |

| R-squared | 0.0668 | 0.0677 | 0.0012 |

| Number of id | 10,354 | 319 | 10,035 |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | LNGDZC | LNGDZC | LNGDZC |

| LNLRZE | 0.029 * | 0.035 * | 0.027 * |

| (0.01773) | (0.03816) | (0.02016) | |

| LNJMSF | 0.075 *** | 0.064 ** | 0.0809 *** |

| (0.0125) | (0.196) | (0.01600) | |

| Constant | 11.521 *** | 14.0055 *** | 10.957 *** |

| (0.235) | (0.5938) | (0.2588) | |

| Observations | 1818 | 325 | 1493 |

| R-squared | 0.1527 | 0.1722 | 0.0241 |

| Number of id | 1251 | 185 | 1066 |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | LNCYRS | LNCYRS | LNCYRS |

| LNYYSR | 0.071 *** | 0.0635 | 0.0727 *** |

| (0.0216) | (0.11674) | (0.01066) | |

| LNJMSF | 0.0109 * | 0.0875* | −0.01987 *** |

| (0.0063) | (0.5147) | (0.0056) | |

| Constant | 0.3544 ** | 0.9896 | 0.338 ** |

| (0.1582) | (2.0397) | (0.13655) | |

| Observations | 13,377 | 550 | 12,827 |

| R-squared | 0.2147 | 0.0842 | 0.1088 |

| Number of id | 8891 | 296 | 8595 |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | GXCPSR | GXCPSR | GXCPSR |

| YF | 2.849 *** | 2.915 *** | 1.987 *** |

| (0.14018) | (0.5993) | (0.1722) | |

| JMSF | 0.338 *** | 0.335 * | 2.512 *** |

| (0.04172) | (0.1751) | (0.67124) | |

| Constant | 1,029,010 *** | 2.4200000 *** | 6538.114 |

| (74,654.53) | (1,762,481) | (33,057.94) | |

| Observations | 19,515 | 842 | 18,673 |

| R-squared | 0.2844 | 0.2528 | 0.2793 |

| Number of id | 10,354 | 319 | 10,035 |

| VARIABLES | GXCPSR | GXCPSR | GXCPSR |

| YF | 2.849 *** | 2.915 *** | 1.987 *** |

| Groups | (1) | (2) | (3) |

|---|---|---|---|

| Digital Economy | Large Enterprises | Small and Medium-Sized Enterprises | |

| VARIABLES | LNYF | LNYF | LNYF |

| LNYYSR | 0.556 *** | 0.0635 * | 0.5706 *** |

| (0.0792) | (0.11674) | (0.07710) | |

| LNJMSF | 0.0253 * | 0.0875 * | 0.04424 * |

| (0.0278) | (0.5147) | (0.0311) | |

| Constant | 4.2218 *** | 0.9896 | 3.798 *** |

| (1.1720) | (2.0397) | (1.0685) | |

| Observations | 980 | 235 | 745 |

| R-squared | 0.4936 | 0.1418 | 0.3181 |

| Number of id | 623 | 114 | 509 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, T.; Yang, L. The Effects of Tax Reduction and Fee Reduction Policies on the Digital Economy. Sustainability 2021, 13, 7611. https://doi.org/10.3390/su13147611

Li T, Yang L. The Effects of Tax Reduction and Fee Reduction Policies on the Digital Economy. Sustainability. 2021; 13(14):7611. https://doi.org/10.3390/su13147611

Chicago/Turabian StyleLi, Tuochen, and Liang Yang. 2021. "The Effects of Tax Reduction and Fee Reduction Policies on the Digital Economy" Sustainability 13, no. 14: 7611. https://doi.org/10.3390/su13147611