The Convergence between Sustainability and Conventional Stock Indices. Are We on the Right Track?

Abstract

:1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology

3. Results

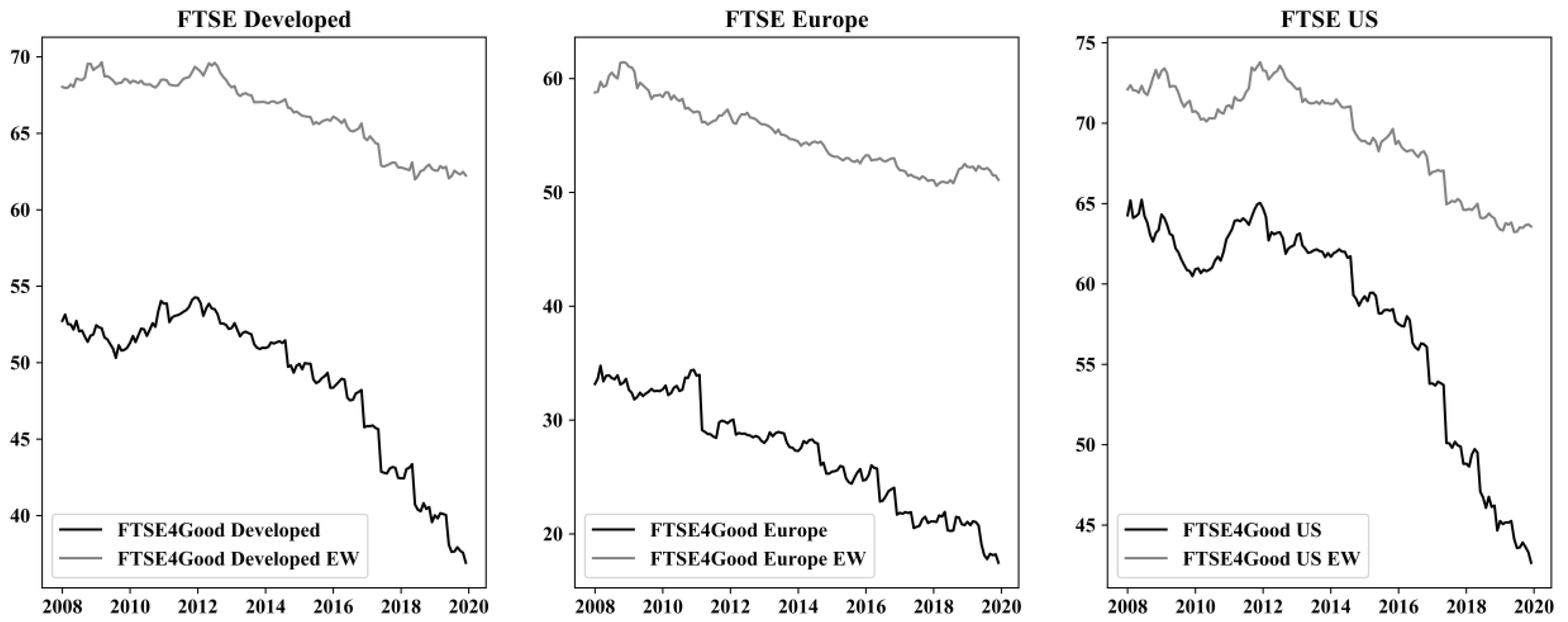

3.1. Results Related to Hypothesis 1: Sustainability Share

3.2. Results Related to Hypothesis 2: SW and EW ESG Scores

3.3. Results Related to Hypothesis 3: FTSE4Good Criteria

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Escrig-Olmedo, E.; Fernández-Izquierdo, Á.M.; Ferrero-Ferrero, I.; Rivera-Lirio, M.J.; Muñoz-Torres, J.M. Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef] [Green Version]

- Doh, J.P.; Howton, S.D.; Howton, S.W.; Siegel, D.S. Does the market respond to an endorsement of social responsibility? The role of institutions, information, and legitimacy. J. Manag. 2010, 36, 1461–1485. [Google Scholar] [CrossRef] [Green Version]

- Kaspereit, T.; Lopatta, K. The value relevance of SAM’s corporate sustainability ranking and GRI sustainability reporting in the european stock markets. Bus. Ethics Eur. Rev. 2016, 25, 1–24. [Google Scholar] [CrossRef]

- Chatterji, A.K.; Mitchell, W. Do investors actually value sustainability? New evidence from investor reactions to the dow jones sustainability index (DJSI). Strateg. Manag. J. 2018, 39, 949–976. [Google Scholar] [CrossRef]

- Keskin, A.İ.; Dincer, B.; Dincer, C. Exploring the impact of sustainability on corporate financial performance using discriminant analysis. Sustainability 2020, 12, 2346. [Google Scholar] [CrossRef] [Green Version]

- Schröder, M. Is there a difference? The performance characteristics of SRI equity indices. J. Bus. Financ. Account. 2007, 34, 331–348. [Google Scholar] [CrossRef]

- Ortas, E.; Moneva, J.M.; Salvador, M. Do social and environmental screens influence ethical portfolio performance? Evidence from Europe. BRQ Bus. Res. Q. 2014, 17, 11–21. [Google Scholar] [CrossRef] [Green Version]

- Cunha, F.A.F.D.S.; de Oliveira, E.M.; Orsato, R.J.; Klotzle, M.C.; Cyrino Oliveira, F.L.; Caiado, R.G.G. Can sustainable investments outperform traditional benchmarks? Evidence from global stock markets. Bus. Strategy Environ. 2019, 29, 682–697. [Google Scholar] [CrossRef]

- Chiappini, H.; Vento, G.; De Palma, L. The impact of covid-19 lockdowns on sustainable indexes. Sustainability 2021, 13, 1846. [Google Scholar] [CrossRef]

- Barnett, M.L.; Henriques, I.; Husted, B.W. Beyond good intentions: Designing CSR initiatives for greater social impact. J. Manag. 2020, 46, 937–964. [Google Scholar] [CrossRef]

- Chatterji, A.; Levine, D. Breaking down the wall of codes: Evaluating non-financial performance measurement. Calif. Manag. Rev. 2006, 48, 29–51. [Google Scholar] [CrossRef] [Green Version]

- Petry, J.; Fichtner, J.; Heemskerk, E. Steering capital: The growing private authority of index providers in the age of passive asset management. Rev. Int. Political Econ. 2019, 28, 1–25. [Google Scholar] [CrossRef] [Green Version]

- Camilleri, M.A. The market for socially responsible investing: A review of the developments. Soc. Responsib. J. 2020. [Google Scholar] [CrossRef]

- Ziegler, A.; Schröder, M. What determines the inclusion in a sustainability stock index? A panel data analysis for European firms. Ecol. Econ. 2010, 69, 848–856. [Google Scholar] [CrossRef] [Green Version]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Pineiro-Chousa, J.; Romero-Castro, N.; Vizcaíno-González, M. Inclusions in and exclusions from the S&P 500 environmental and socially responsible index: A fuzzy-set qualitative comparative analysis. Sustainability 2019, 11, 1211. [Google Scholar] [CrossRef] [Green Version]

- Ziegler, A. Is it beneficial to be included in a sustainability stock index? A panel data study for European firms. Environ. Resour. Econ. 2012, 52, 301–325. [Google Scholar] [CrossRef] [Green Version]

- Arribas, I.; Espinós-Vañó, M.D.; García, F.; Morales-Bañuelos, P.B. The inclusion of socially irresponsible companies in sustainable stock indices. Sustainability 2019, 11, 2047. [Google Scholar] [CrossRef] [Green Version]

- Arribas, I.; Espinós-Vañó, M.D.; García, F.; Riley, N. Do irresponsible corporate activities prevent membership in sustainable stock indices? The case of the dow jones sustainability index world. J. Clean. Prod. 2021, 298. [Google Scholar] [CrossRef]

- Belghitar, Y.; Clark, E.; Deshmukh, N. Does it pay to be ethical? Evidence from the FTSE4Good. J. Bank. Financ. 2014, 47, 54–62. [Google Scholar] [CrossRef] [Green Version]

- El Ouadghiri, I.; Guesmi, K.; Peillex, J.; Ziegler, A. Public attention to environmental issues and stock market returns. Ecol. Econ. 2021, 180. [Google Scholar] [CrossRef]

- Montoya-Cruz, E.; Ramos-Requena, J.P.; Trinidad-Segovia, J.E.; Sánchez-Granero, M.Á. Exploring arbitrage strategies in corporate social responsibility companies. Sustainability 2020, 12, 6293. [Google Scholar] [CrossRef]

- Oberndorfer, U.; Schmidt, P.; Wagner, M.; Ziegler, A. Does the stock market value the inclusion in a sustainability stock index? An event study analysis for German firms. J. Environ. Econ. Manag. 2013, 66, 497–509. [Google Scholar] [CrossRef] [Green Version]

- Kappou, K.; Oikonomou, I. Is there a gold social seal? The financial effects of additions to and deletions from social stock indices. J. Bus. Ethics 2016, 133, 533–552. [Google Scholar] [CrossRef]

- Gómez-Bezares, F.; Przychodzen, W.; Przychodzen, J. Bridging the gap: How sustainable development can help companies create shareholder value and improve financial performance. Bus. Ethics Eur. Rev. 2017, 26, 1–17. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. European banks’ reputation for corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 14–24. [Google Scholar] [CrossRef]

- Cremers, K.J.M.; Petajisto, A. How active is your fund manager? A new measure that predicts performance. Rev. Financ. Stud. 2009, 22, 3329–3365. [Google Scholar] [CrossRef]

- Sushko, V.; Turner, G. The Implications of Passive Investing for Securities Markets. BI Q. Rev. 2018, 113–131. Available online: https://ssrn.com/abstract=3139242 (accessed on 29 June 2021).

- US SIF. Report on US Sustainable, Responsible and Impact Investing Trends 2018. Available online: https://www.ussif.org/files/Trends/Trends%202018%20executive%20summary%20FINAL.pdf (accessed on 29 June 2021).

- EUROSIF. European SRI Study 2018. Available online: http://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study.pdf (accessed on 29 June 2021).

- Humphrey, J.E.; Lee, D.D.; Shen, Y. Does it cost to be sustainable? J. Corp. Financ. 2012, 18, 626–639. [Google Scholar] [CrossRef]

- Halbritter, G.; Dorfleitner, G. The wages of social responsibility—where are they? A critical review of ESG investing. Rev. Financ. Econ. 2015, 26, 25–35. [Google Scholar] [CrossRef]

- Yen, M.; Shiu, Y.; Wang, C. Socially responsible investment returns and news: Evidence from Asia. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1565–1578. [Google Scholar] [CrossRef]

- Ferrell, A.; Liang, H.; Renneboog, L. Socially responsible firms. J. Financ. Econ. 2016, 122, 585–606. [Google Scholar] [CrossRef] [Green Version]

- Liang, H.; Renneboog, L. On the foundations of corporate social responsibility. J. Financ. 2017, 72, 853–910. [Google Scholar] [CrossRef]

- Garcia, A.S.; Orsato, R.J. Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance. Bus. Strategy Environ. 2020, 29, 3261–3272. [Google Scholar] [CrossRef]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Borgers, A.C.; Pownall, R.A. Attitudes towards socially and environmentally responsible investment. J. Behav. Exp. Financ. 2014, 1, 27–44. [Google Scholar] [CrossRef]

- Gutsche, G.; Ziegler, A. Which private investors are willing to pay for sustainable investments? Empirical evidence from stated choice experiments. J. Bank. Financ. 2019, 102, 193–214. [Google Scholar] [CrossRef]

- Krüger, P. Corporate goodness and shareholder wealth. J. Financ. Econ. 2015, 115, 304–329. [Google Scholar] [CrossRef]

- Joliet, R.; Titova, Y. Equity SRI funds vacillate between ethics and money: An analysis of the funds’ stock holding decisions. J. Bank. Financ. 2018, 97, 70–86. [Google Scholar] [CrossRef]

| Family | Name | Type | Market | Index Ticker |

|---|---|---|---|---|

| FTSE Developed | FTSE4Good Developed | Sustainability | Global | LFT4GBGL |

| FTSE Developed | Conventional | Global | LAWDVLPM | |

| FTSE Europe | FTSE4Good Europe | Sustainability | Europe | LFT4GBEU |

| FTSE Developed Europe | Conventional | Europe | LAWDVERM | |

| FTSE US | FTSE4Good US | Sustainability | United States | LFT4GBUS |

| FTSE USA | Conventional | United States | LWIUSAM |

| Family | Year | Conventional | Sustainability | ||||||

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (1) | (2) | (3) | (4) | ||

| FTSE Developed | 2008 | 2015 | 2010 | 1657 | 93.1 | 695 | 695 | 606 | 93.8 |

| 2009 | 1980 | 1976 | 1678 | 94.7 | 664 | 664 | 588 | 95.0 | |

| 2010 | 2009 | 2007 | 1753 | 95.6 | 658 | 658 | 597 | 95.7 | |

| 2011 | 2079 | 2077 | 1817 | 95.6 | 710 | 710 | 648 | 96.4 | |

| 2012 | 2086 | 2083 | 1839 | 95.8 | 728 | 728 | 669 | 96.7 | |

| 2013 | 2055 | 2053 | 1826 | 96.0 | 733 | 733 | 671 | 96.6 | |

| 2014 | 2084 | 2082 | 1840 | 95.7 | 757 | 757 | 696 | 96.4 | |

| 2015 | 2115 | 2112 | 1877 | 95.3 | 787 | 787 | 733 | 96.5 | |

| 2016 | 2111 | 2109 | 1871 | 95.7 | 809 | 809 | 757 | 96.6 | |

| 2017 | 2117 | 2116 | 1895 | 96.1 | 865 | 865 | 816 | 96.4 | |

| 2018 | 2162 | 2162 | 1937 | 96.1 | 922 | 922 | 869 | 95.5 | |

| 2019 | 2182 | 2182 | 1817 | 90.2 | 995 | 995 | 870 | 89.6 | |

| FTSE Europe | 2008 | 513 | 513 | 464 | 95.7 | 287 | 287 | 263 | 95.2 |

| 2009 | 494 | 494 | 456 | 97.4 | 268 | 268 | 248 | 96.5 | |

| 2010 | 490 | 490 | 460 | 97.9 | 273 | 273 | 255 | 96.7 | |

| 2011 | 502 | 502 | 473 | 97.8 | 286 | 286 | 273 | 97.2 | |

| 2012 | 514 | 514 | 486 | 97.3 | 290 | 290 | 278 | 97.5 | |

| 2013 | 505 | 505 | 481 | 97.8 | 282 | 282 | 272 | 97.6 | |

| 2014 | 514 | 514 | 490 | 98.0 | 297 | 297 | 285 | 97.7 | |

| 2015 | 521 | 521 | 498 | 96.8 | 317 | 317 | 308 | 97.1 | |

| 2016 | 533 | 533 | 504 | 96.8 | 336 | 336 | 323 | 97.1 | |

| 2017 | 546 | 546 | 521 | 97.4 | 372 | 372 | 359 | 97.8 | |

| 2018 | 573 | 573 | 549 | 97.2 | 388 | 388 | 375 | 96.9 | |

| 2019 | 588 | 588 | 561 | 96.8 | 404 | 404 | 388 | 96.9 | |

| FTSE US | 2008 | 668 | 663 | 575 | 91.6 | 147 | 147 | 126 | 90.6 |

| 2009 | 616 | 612 | 563 | 93.9 | 138 | 138 | 125 | 93.1 | |

| 2010 | 596 | 594 | 550 | 94.8 | 131 | 131 | 124 | 94.8 | |

| 2011 | 624 | 622 | 576 | 95.0 | 144 | 144 | 137 | 96.0 | |

| 2012 | 615 | 612 | 569 | 95.6 | 155 | 155 | 147 | 96.2 | |

| 2013 | 622 | 620 | 576 | 95.5 | 161 | 161 | 149 | 95.5 | |

| 2014 | 640 | 638 | 586 | 94.6 | 167 | 167 | 156 | 94.9 | |

| 2015 | 655 | 653 | 604 | 94.7 | 176 | 176 | 166 | 95.7 | |

| 2016 | 633 | 631 | 587 | 95.4 | 183 | 183 | 172 | 96.1 | |

| 2017 | 619 | 618 | 585 | 95.9 | 214 | 214 | 200 | 95.2 | |

| 2018 | 621 | 620 | 586 | 95.8 | 243 | 243 | 227 | 94.0 | |

| 2019 | 622 | 622 | 542 | 89.9 | 264 | 264 | 222 | 87.5 | |

| Dependent Variable | Family | Intercept | EW | Time | Time × EW | R2 |

|---|---|---|---|---|---|---|

| Sustainability Share | FTSE Developed | 55.88 ** (0.312) | 14.31 ** (0.441) | −1.18 ** (0.045) | 0.55 ** (0.064) | 0.96 |

| FTSE Europe | 35.05 ** (0.161) | 24.95 ** (0.227) | −1.34 ** (0.023) | 0.51 ** (0.033) | 0.99 | |

| FTSE US | 67.85 ** (0.413) | 6.35 ** (0.585) | −1.65 ** (0.060) | 0.84 ** (0.085) | 0.90 |

| Index | Intercept | SW | Time | Time × SW | R2 | |

|---|---|---|---|---|---|---|

| ESG Score | FTSE4Good Developed | 54.77 ** (0.226) | 13.58 ** (0.320) | 1.21 ** (0.033) | −0.74 ** (0.046) | 0.94 |

| FTSE Developed | 44.96 ** (0.195) | 16.22 ** (0.276) | 1.18 ** (0.028) | −0.56 ** (0.040) | 0.97 | |

| FTSE4Good Europe | 62.48 ** (0.095) | 10.40 ** (0.134) | 0.89 ** (0.014) | −0.31 ** (0.019) | 0.99 | |

| FTSE Developed Europe | 56.29 ** (0.142) | 14.25 ** (0.201) | 1.00 ** (0.021) | −0.43 ** (0.029) | 0.98 | |

| FTSE4Good US | 53.51 ** (0.392) | 10.98 ** (0.554) | 1.11 ** (0.057) | −0.56 ** (0.080) | 0.81 | |

| FTSE USA | 43.03 ** (0.250) | 14.55 ** (0.353) | 1.33 ** (0.036) | −0.56 ** (0.051) | 0.95 |

| Dependent Variable | Family | Method | Intercept | 4Good | Time | Time × 4Good | R2 |

|---|---|---|---|---|---|---|---|

| ESG score | FTSE Developed | Equally weighted | 44.96 ** (0.216) | 9.81 ** (0.305) | 1.18 ** (0.031) | 0.03 (0.044) | 0.96 |

| Size-weighted | 61.18 ** (0.207) | 7.17 ** (0.292) | 0.62 ** (0.030) | −0.15 ** (0.042) | 0.90 | ||

| FTSE Europe | Equally weighted | 56.29 ** (0.132) | 6.19 ** (0.187) | 1.00 ** (0.019) | −0.11 ** (0.027) | 0.97 | |

| Size-weighted | 70.54 ** (0.109) | 2.34 ** (0.154) | 0.57 ** (0.016) | 0.01 (0.022) | 0.93 | ||

| FTSE US | Equally weighted | 43.03 ** (0.301) | 10.48 ** (0.425) | 1.33 ** (0.044) | −0.22 ** (0.062) | 0.92 | |

| Size-weighted | 57.58 ** (0.354) | 6.92 ** (0.501) | 0.78 ** (0.051) | −0.22 ** (0.073) | 0.75 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vilas, P.; Andreu, L.; Sarto, J.L. The Convergence between Sustainability and Conventional Stock Indices. Are We on the Right Track? Sustainability 2021, 13, 7613. https://doi.org/10.3390/su13147613

Vilas P, Andreu L, Sarto JL. The Convergence between Sustainability and Conventional Stock Indices. Are We on the Right Track? Sustainability. 2021; 13(14):7613. https://doi.org/10.3390/su13147613

Chicago/Turabian StyleVilas, Pablo, Laura Andreu, and José Luis Sarto. 2021. "The Convergence between Sustainability and Conventional Stock Indices. Are We on the Right Track?" Sustainability 13, no. 14: 7613. https://doi.org/10.3390/su13147613

APA StyleVilas, P., Andreu, L., & Sarto, J. L. (2021). The Convergence between Sustainability and Conventional Stock Indices. Are We on the Right Track? Sustainability, 13(14), 7613. https://doi.org/10.3390/su13147613