When Land Meets Finance in Latin America: Some Intersections between Financialization and Land Grabbing in Argentina and Brazil

Abstract

:1. Introduction

2. The Financialization Process and Its Manifestations in the Peripheries

2.1. Financialization: A Brief Conceptual Approach

2.2. Financialization in the Peripheries. Some Peculiarities Regarding Latin America

3. Financialization and Land Grabbing in Latin America

3.1. The Financialization of Land

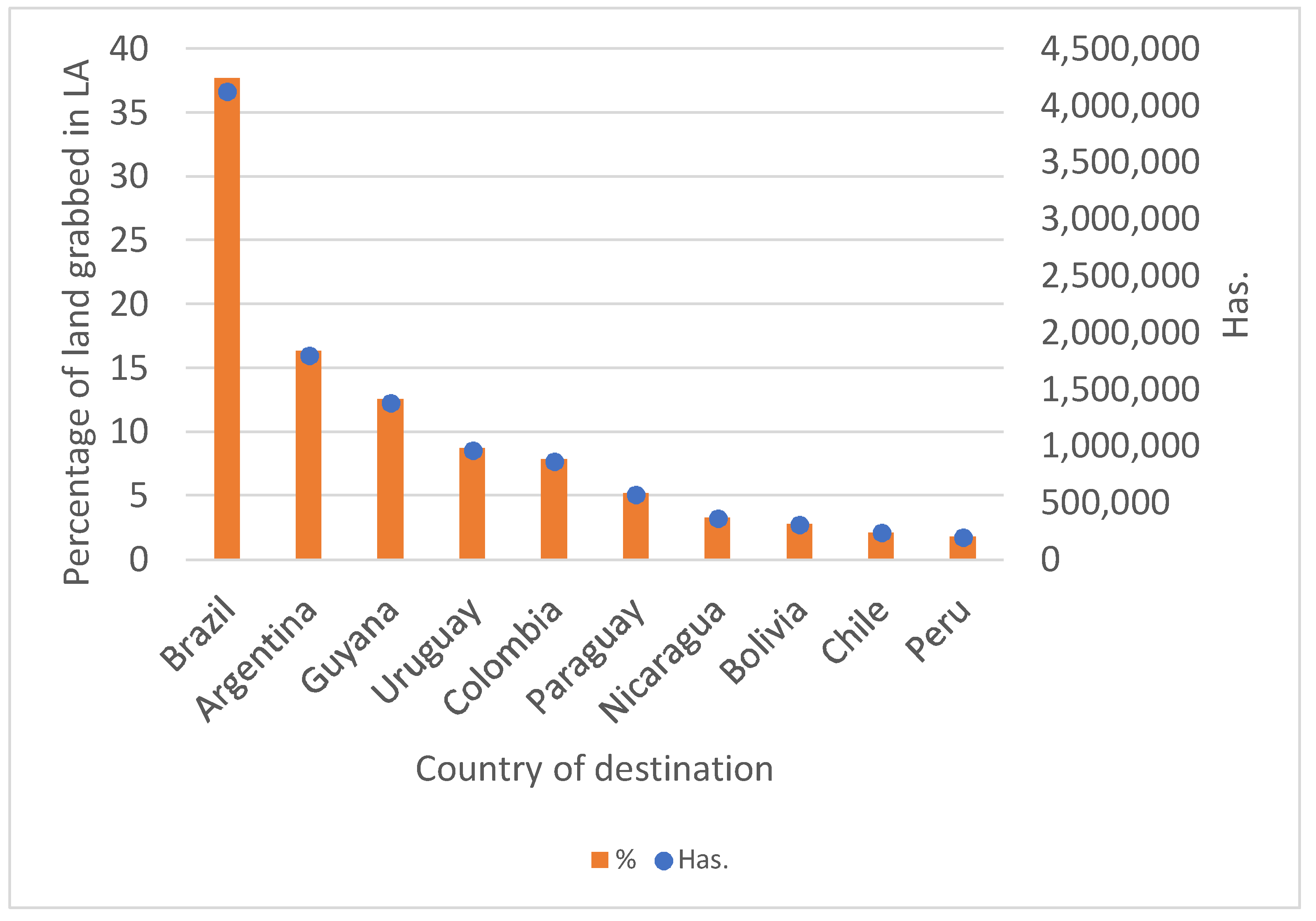

3.2. Land Grabbing in Latin America

4. Two Case Analyses

4.1. Argentina: From ‘Silent Exclusion’ to the Commodification (and Foreignization) of Country Land

4.2. Brazil: Internal Frontier Expansion and Finance Capital Investing in Farmland

5. Discussion

6. Final Considerations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Deininger, K. Challenges posed by the new wave of farmland investment. J. Peasant Stud. 2011, 38, 217–247. [Google Scholar] [CrossRef]

- De Schutter, O. How not to think of land-grabbing: Three critiques of large-scale investments in farmland. J. Peasant Stud. 2011, 38, 249–279. [Google Scholar] [CrossRef]

- Brenner, R. The Economics of Global Turbulence; Verso: London, UK, 2006. [Google Scholar]

- Harvey, D. The New Imperialism; Oxford University Press: New York, NY, USA, 2003. [Google Scholar]

- Araghi, F. The Invisible Hand and the Visible Foot: Peasants, Dispossession and Globalization. In Peasants and Globalization. Political Economy, Rural Transformation and the Agrarian Question; Akram-Lodhi, A.H., Kay, C., Eds.; Routledge: London, UK, 2009; pp. 111–147. [Google Scholar]

- Bernstein, H. Class Dynamics of Agrarian Change; Fernwood Press: Halifax, NS, Canada; Kumarian Press: Winnipeg, MB, Canada, 2010. [Google Scholar]

- Keucheyan, R. Insuring climate change: New risks and the financialization of nature. Dev. Chang. 2018, 49, 484–501. [Google Scholar] [CrossRef]

- Borrás, S.; Franco, J. Global land grabbing and political reactions ‘from below’. Third World Q. 2013, 34, 1723–1747. [Google Scholar] [CrossRef]

- Lapavitsas, C.; Soydan, A. Financialisation in Developing Countries: Approaches, Concepts and Metrics; SOAS Department of Economics Working Paper No. 240; SOAS, University of London: London, UK, 2020. [Google Scholar]

- Krippner, G. The Financialization of the American Economy. Soc. Econ. Rev. 2005, 3, 173–208. [Google Scholar] [CrossRef]

- Cibils, A.; Allami, C. Financialization of Commodities, Reserve Accumulation and Debt: The Case of Argentina. In Challenges of Financialization in the Latin American Export-Led Growth Model; Levy, N., Bustamante, J., Eds.; Routledge: London, UK; New York, NY, USA, 2019; pp. 120–138. [Google Scholar]

- Ouma, S. Situating global finance in the Land Rush Debate: A critical review. Geoforum 2014, 57, 162–166. [Google Scholar] [CrossRef]

- Fairbairn, M. ‘Like gold with yield’: Evolving intersections between farmland and finance. J. Peasant Stud. 2014, 41, 777–795. [Google Scholar] [CrossRef] [Green Version]

- Genoud, C. Flex crops neverland-finding access to large scale land investments. Globalizations 2018, 15, 685–701. [Google Scholar] [CrossRef]

- Borrás, S.M.; Franco, J.C.; Gómez, S.; Kay, C.; Spoor, M. Land grabbing in Latin America and the Caribbean. J. Peasant Stud. 2012, 39, 845–872. [Google Scholar] [CrossRef]

- Yang, B.; He, J. Global Land Grabbing: A Critical Review of Case Studies across the World. Land 2021, 10, 324. [Google Scholar] [CrossRef]

- Soto Baquero, F.; Gómez, S. (Eds.) Dinámicas del Mercado de la Tierra en América Latina y el Caribe: Concentración y Extranjerización; FAO Regional Office for Latin America: Santiago, Chile, 2012. [Google Scholar]

- Gómez, S. (Ed.) The Land Market in Latin America and the Caribbean: Concentration and Foreignization; FAO Regional Office for Latin America: Santiago, Chile, 2014. [Google Scholar]

- Cotula, L. The international political economy of the global land rush: A critical appraisal of trends, scale, geography and drivers. J. Peasant Stud. 2012, 39, 649–680. [Google Scholar] [CrossRef]

- Bruff, I. The Rise of Authoritarian Neoliberalism. Rethink. Marx. 2014, 26, 113–129. [Google Scholar] [CrossRef]

- Tansel, C.B. (Ed.) States of Discipline: Authoritarian Neoliberalism and the Contested Reproduction of Capitalist Order; Rowman & Littlefield: London, UK, 2017. [Google Scholar]

- Wolford, W.; Borrás, S.M.; Hall, R.; Scoones, I.; White, B. Governing Global Land Deals: The Role of the State in the Rush for Land. Dev. Chang. 2013, 44, 189–210. [Google Scholar] [CrossRef] [Green Version]

- Stockhammer, E. Some Stylized Facts on the Finance-dominated Accumulation Regime. Compet. Chang. 2008, 12, 189–207. [Google Scholar] [CrossRef]

- Jessop, B. The Developmental State in the Era of Finance-Dominated Accumulation. In The Asian Developmental State; Chu, Y., Ed.; Palgrave Macmillan: New York, NY, USA, 2016; pp. 27–55. [Google Scholar]

- Epstein, G. (Ed.) Financialization and the World Economy; Edward Elgar: Cheltenham, UK, 2005. [Google Scholar]

- Epstein, G. Financialization: There’s Something Happening Here; Political Economy Research Institute (PERI), Working Paper 394; University of Massachusetts: Amherst, MA, USA, 2015. [Google Scholar]

- Van der Zwan, N. Making Sense of Financialization. Soc. Econ. Rev. 2014, 12, 99–129. [Google Scholar] [CrossRef]

- Boyer, R. Is a Finance-Led Growth Regime a Viable Alternative to Fordism? A Preliminary Analysis. Econ. Soc. 2000, 29, 111–145. [Google Scholar] [CrossRef]

- Aglietta, M. Shareholder and Corporate Governance: Some Tricky Questions. Econ. Soc. 2000, 29, 146–159. [Google Scholar] [CrossRef]

- Crotty, J. The Effects of Increased Market. Competition and Changes in Financial Markets and the Structure of Nonfinancial Corporations in the Neoliberal Era; Political Economy Research Institute, Working Paper 44; University of Massachusetts: Amherst, MA, USA, 2002. [Google Scholar]

- Erturk, I.; Froud, J.; Sukhdev, J.; Leaver, A.; Williams, K. The Democratisation of Finance? Promises, Outcomes and Conditions. Rev. Int. Political Econ. 2007, 14, 553–575. [Google Scholar] [CrossRef]

- Martin, R. Financialization of Daily Life; Temple University Press: Philadelphia, PA, USA, 2002. [Google Scholar]

- Stockhammer, E. Financialization and the Slowdown of Accumulation. Camb. J. Econ. 2004, 28, 719–741. [Google Scholar] [CrossRef]

- Orhangazi, Ö. Financialization and Capital Accumulation in the Non-Financial Corporate Sector: A Theoretical and Empirical Investigation of the US Economy 1973–2003; Political Economy Research Institute, Working Paper 149; University of Massachusetts: Amherst, MA, USA, 2007. [Google Scholar]

- Demir, F. The Rise of Rentier Capitalism and the Financialization of Real Sectors in Developing Countries. Rev. Radic. Political Econ. 2007, 39, 351–359. [Google Scholar] [CrossRef] [Green Version]

- Miotti, L.; Plihon, D. Libéralisation financière, spéculation et crises bancaires. Écon. Int. 2001, 85, 3–36. [Google Scholar] [CrossRef]

- Palley, T. Financialization: The Economics of Finance Capital Domination; Palgrave McMillan: London, UK, 2013. [Google Scholar]

- Lapavitsas, C. Financialisation, or the Search for Profits in the Sphere of Circulation. Ekonomiaz 2009, 72, 98–117. [Google Scholar]

- Lapavitsas, C. Financialization Embroils Developing Countries; Research on Money and Finance Discussion Papers, No. 14; University of London, SOAS: London, UK, 2009. [Google Scholar]

- Skott, P.; Ryoo, S. Macroeconomic Implications of Financialization; Department of Economics Working Paper 2007–2008; University of Massachusetts: Amherst, MA, USA, 2007. [Google Scholar]

- Powell, J. Subordinate Financialisation: A Study of Mexico and Its Non-financial Corporations. Ph.D. Dissertation, SOAS University of London, London, UK, 2013. [Google Scholar]

- Nkrumah, K. Neo-Colonialism the Last Stage of Imperialism; International Publishers: New York, NY, USA, 1965. [Google Scholar]

- Langan, M. Neo-Colonialism and the Poverty of ‘Development’ in Africa; Palgrave Macmillan: Basingstoke, UK, 2018. [Google Scholar]

- Kaltenbrunner, A.; Painceira, J.P. Subordinated Financial Integration and Financialisation in Emerging Capitalist Economies: The Brazilian Experience. New Political Econ. 2018, 23, 290–313. [Google Scholar] [CrossRef]

- Cruz, M.; Walters, B. Is the Accumulation of International Reserves good for Development? Camb. J. Econ. 2008, 32, 665–681. [Google Scholar] [CrossRef]

- Bortz, P.G.; Kaltenbrunner, A. The International Dimension of Financialization in Developing and Emerging Economies. Dev. Chang. 2018, 49, 375–393. [Google Scholar] [CrossRef]

- Quijano, A. Colonialidad del poder, eurocentrismo y América Latina. In La Colonialidad del Saber: Eurocentrismo y Ciencias Sociales. Perspectivas Latinoamericanas; Lander, E., Ed.; CLACSO: Buenos Aires, Argentina, 2000; pp. 123–152. [Google Scholar]

- Mignolo, W. Local Histories/Global Designs: Coloniality, Subaltern Knowledges, and Border Thinking; Princeton University Press: Princeton, NJ, USA, 2012. [Google Scholar]

- Mignolo, W.; Walsh, C.E. On Decoloniality: Concepts, Analytics, Praxis; Duke University Press: Durham, NC, USA, 2018. [Google Scholar]

- Bonizzi, B.; Kaltenbrunner, A.; Powell, J. Subordinate Financialization in Emerging Capitalist Economies. In The Routledge International Handbook of Financialization; Mader, P., Mertens, D., van der Zwan, N., Eds.; Routledge: London, UK, 2020; pp. 177–187. [Google Scholar]

- Becker, J.; Jäger, J.; Leubolt, B.; Weissenbacher, R. Peripheral financialization and vulnerability to crisis: A Regulationist perspective. Compet. Chang. 2010, 14, 225–247. [Google Scholar] [CrossRef]

- Becker, J. The Periphery in the Present International Crisis: Uneven Development, Uneven Impact and Different Responses. Spectr. J. Glob. Stud. 2013, 5, 21–41. [Google Scholar]

- Ashman, S.; Fine, B.; Newman, S. The Crisis in South Africa: Neoliberalism, Financialization and Uneven and Combined Development. Soc. Regist. 2011, 47, 174–195. [Google Scholar]

- Araujo, E.; Bruno, M.; Pimentel, D. Financialization against Industrialization: A Regulationist Approach of the Brazilian Paradox. Rev. Régul. 2012, 11. [Google Scholar] [CrossRef] [Green Version]

- Correa, E.; Vidal, G. Financialization and Global Financial Crisis in Latin American Countries. J. Econ. Issues 2012, 46, 541–548. [Google Scholar] [CrossRef]

- Garcia-Arias, J. International Financialization and the Systemic Approach to International Financing for Development. Glob. Policy 2015, 6, 24–33. [Google Scholar] [CrossRef]

- Bruff, I.; Tansel, C.B. Authoritarian neoliberalism: Trajectories of knowledge production and praxis. Globalizations 2019, 16, 233–244. [Google Scholar] [CrossRef] [Green Version]

- Brown, A.; Spencer, D.A.; Veronese Passarella, M. The Extent and Variegation of Financialisation in Europe: A Preliminary Analysis. Rev. Econ. Mund. 2017, 46, 49–69. [Google Scholar]

- Garcia-Arias, J.; Horn, L.; Toporowski, J. Perspectives on financialisation and crises in Europe. Rev. Econ. Mund. 2017, 46, 17–26. [Google Scholar]

- Karwowski, E.; Stockhammer, E. Financialisation in Emerging Economies: A Systematic Overview and Comparison with Anglo-Saxon Economies. Econ. Political Stud. 2017, 5, 60–86. [Google Scholar] [CrossRef] [Green Version]

- Bonizzi, B. Financialization in Developing and Emerging Countries: A Survey. Int. J. Political Econ. 2014, 42, 83–107. [Google Scholar] [CrossRef]

- Garcia-Arias, J. Mundialización y sector público. Mitos y enseñanzas de la globalización financiera. Comer. Exter. 2004, 54, 856–873. [Google Scholar]

- Dos Santos, P. On the content of banking in contemporary capitalism. Hist. Mater. 2009, 17. [Google Scholar] [CrossRef] [Green Version]

- Cibils, A.; Allami, C. Financialization vs. development finance: The case of the post-crisis Argentine banking system. Rev. Régul. 2013, 13. [Google Scholar] [CrossRef] [Green Version]

- Aitken, R. The financialization of micro-credit. Dev. Chang. 2013, 44, 473–499. [Google Scholar] [CrossRef]

- Bond, P. Debt, uneven development and capitalist crisis in South Africa: From Moody’s macroeconomic monitoring to Marikana microfinance mahonisas. Third World Q. 2013, 34, 569–592. [Google Scholar] [CrossRef]

- Lavinas, L. The collateralization of social policy under financialised capitalism. Dev. Chang. 2018, 49, 502–517. [Google Scholar] [CrossRef]

- Mader, P. Explaining and Quantifying the extractive success of financial systems: Microfinance and the financialization of poverty. Econ. Res. Ekon. Istraz. 2013, 26, 13–28. [Google Scholar] [CrossRef] [Green Version]

- Mader, P. Financialisation through Microfinance: Civil Society and Market-building in India. Asian Stud. Rev. 2014, 38, 601–619. [Google Scholar] [CrossRef]

- Soderberg, S. Universalising financial inclusion and the securitisation of development. Third World Q. 2013, 34, 593–612. [Google Scholar] [CrossRef]

- Cibils, A.; Pinazo, G. The periphery in the productive globalization: A new dependency? In The Financialization Response to Economic Disequilibria: European and Latin American Experiences; Levy-Orlik, N., Ortiz Cruz, E., Eds.; Edward Elgar: Cheltenham, UK, 2016; pp. 69–89. [Google Scholar]

- Levy-Orlik, N. Financialization and Economic Growth in Developing Countries: The Case of the Mexican Economy. Int. J. Political Econ. 2013, 42, 108–127. [Google Scholar] [CrossRef]

- Bresser-Pereira, L.C.; de Paula, L.F.; Bruno, M. Financialization, coalition of interests and interest rate in Brazil. Rev. Régul. 2020, 27. [Google Scholar] [CrossRef]

- Oreiro, J.L.; Feijó, C.A.; Punzo, L.F.; Heringer Machado, J.P. Peripherical Financialization and Premature Deindustrialization: A Theory and the Case of Brazil (2003–2015); Mimeo: New York, NY, USA, 2020. [Google Scholar]

- Bresser-Pereira, L.C. Rentier-financier capitalism. Estud. Avançados 2018, 32, 17–29. [Google Scholar] [CrossRef]

- De Paula, L.F.; Bruno, M. Financeirização, coalizão de interesses e taxa de juros no Brasil. Rev. Princ. 2017, 151, 66–71. [Google Scholar]

- Bin, D. The Politics of Financialization in Brazil. World Rev. Political Econ. 2016, 7, 106–126. [Google Scholar] [CrossRef]

- Schorr, M.; Wainer, A. Financiarización y dinámica inversora de las grandes empresas en la Argentina durante el ciclo de gobiernos kirchneristas. Real. Econ. 2020, 49, 39–72. [Google Scholar]

- Gunnoe, A. The political economy of institutional land ownership: Non rentier society and the financialization of land. Rural Sociol. 2014, 79, 478–504. [Google Scholar] [CrossRef]

- Knuth, S.E. Global finance and the land grab-Mapping 21st century strategies. Can. J. Dev. Stud. 2015, 36, 163–178. [Google Scholar] [CrossRef]

- Fairbairn, M. Foreignization, Financialization and Land Grab Regulation: Foreignization, Financialization and Land Grab Regulation. J. Agrar. Chang. 2015, 15, 581–591. [Google Scholar] [CrossRef]

- Reydon, B.P.; Fernandes, V.B. Financialization, land prices and land grab: A study based on the Brazilian reality. Econ. Soc. 2017, 26, 1149–1179. [Google Scholar] [CrossRef] [Green Version]

- Cotula, L. Land Rights and Investment Treaties: Exploring the Interface; International Institute for Environment and Development: London, UK, 2015. [Google Scholar]

- Sauer, S.; Pereira Leite, S. Agrarian structure, foreign investment in land, and land prices in Brazil. J. Peasant Stud. 2012, 39, 873–898. [Google Scholar] [CrossRef]

- Sosa Varrotti, A.; Gras, C. Network companies, land grabbing and financialization in South America. Globalizations 2020, 18, 482–497. [Google Scholar] [CrossRef]

- McMichael, P. The land grab and corporate food regime restructuring. J. Peasant Stud. 2012, 39, 681–701. [Google Scholar] [CrossRef]

- Visser, O. Finance and the global land rush Understanding the growing role of investment funds in land deals and large-scale farming. Can. Food Stud. 2015, 2, 278–286. [Google Scholar] [CrossRef] [Green Version]

- Ghosh, J. Commodity speculation and the food crisis. J. Agrar. Chang. 2010, 10, 72–86. [Google Scholar] [CrossRef]

- HLPE. Land Tenure and International Investments in Agriculture (July); Committee on World Food Security, The High Level Panel of Experts on Food Security and Nutrition: Rome, Italy, 2011. [Google Scholar]

- Cibils, A. Argentina: Macroeconomics, Re-primarization and the Environment. Policy Matters 2011, 18, 48–71. [Google Scholar]

- Giarracca, N.; Teubal, M. (Eds.) Actividades Extractivas en Expansión: ¿Reprimarización de la Economía Argentina? Antropofagia: Buenos Aires, Argentina, 2013. [Google Scholar]

- Grigera, J. Desindustrialización, ¿agresión a la manufactura o reestructuración capitalista? In El País Invisible: Debates Sobre la Argentina Reciente; Bonnet, A., Ed.; Peña Lilo/Ediciones Continente: Buenos Aires, Argentina, 2011; pp. 81–102. [Google Scholar]

- Rezende Spadotto, B.; Martenauer Saweljew, Y.; Federico, S.; Teixeira Pitta, F. Unpacking the finance-farmland nexus: Circles of cooperation and intermediaries in Brazil. Globalizations 2021, 18, 461–481. [Google Scholar] [CrossRef]

- Cousins, B.; Borrás, S., Jr.; Sauer, S.; Ye, J. BRICS, middle-income countries (MICs), and global agrarian transformations: Internal dynamics, regional trends, and international implications. Globalizations 2018, 15, 1–11. [Google Scholar] [CrossRef]

- Lavers, T. Patterns of agrarian transformation in Ethiopia: State-mediated commercialisation and the ‘land grab’. J. Peasant Stud. 2012, 39, 795–822. [Google Scholar] [CrossRef]

- Quizon, A. Land Governance in Asia. Understanding the Debates on Land Tenure Rights and Land Reforms in the Asian Context; Framing the Debate Series, No. 3; ILC: Rome, Italy, 2013; Available online: https://namati.org/resources/land-governance-in-asia-understanding-the-debates-on-land-tenure-rights-and-land-reforms-in-the-asian-context/ (accessed on 24 March 2021).

- Murmis, M.; Murmis, M.R. El caso de Argentina. In Dinámicas del Mercado de la Tierra en América Latina y el Caribe: Concentración y Extranjerización; Soto Baquero, F., Gómez, S., Eds.; FAO: Rome, Italy, 2010; pp. 15–59. [Google Scholar]

- Sauer, S.; Pereira Leite, S. Agrarian Structure, Foreign Land Ownership, and Land Value in Brazil. In Proceedings of the International Conference on Global Land Grabbing, Brighton, UK, 6–8 April 2011. [Google Scholar]

- Departamento Nacional de Planeación. Plan Nacional de Desarrollo 2010–2014 ‘Prosperidad Para Todos’; Departamento Nacional de Planeación de Colombia: Bogotá, Colombia, 2010. [Google Scholar]

- Clements, E.A.; Fernandes, B.M. Land Grabbing, agribusiness and the peasantry in Brazil and Mozambique. Agrarian South. J. Political Econ. 2013, 2, 41–69. [Google Scholar] [CrossRef] [Green Version]

- Oyhantçabal, G.; Narbondo, I. Land grabbing in Uruguay: New forms of land concentration. Can. J. Dev. Stud. 2018, 40, 201–219. [Google Scholar] [CrossRef]

- Cotula, L.; Berger, T. Land Deals and Investment Treaties. Visualising the Interface; International Institute for Environment and Development (IIED): London, UK, 2015. [Google Scholar]

- de Oliveira, G.L.T. Land regularization in Brazil and the global land grab. Dev. Chang. 2013, 44, 261–283. [Google Scholar] [CrossRef]

- Wilkinson, J.; Reydon, B.; Di Sabbato, A. Concentration and foreign ownership of land in Brazil in the context of global land grabbing. Can. J. Dev. Stud. 2012, 33, 417–438. [Google Scholar] [CrossRef]

- Fernandes, B.M.; Welch, C.A.; Goncalves, E.C. Land Governance in Brazil: A Geo-Historical Review of Land Governance in Brazil; Framing the Debate Series, no. 2; International Land Coalition Secretariat (ILC): Rome, Italy, 2012; Available online: http://www2.fct.unesp.br/grupos/nera/ltd/land_governance_brazill-bmf_caw_ecg.pdf (accessed on 24 March 2021).

- Salinas Abdala, Y. El caso de Colombia. In Dinámicas del Mercado de la Tierra en América Latina y el Carible: Concentración y Extranjerización; Soto Baquero, F., Gómez, S., Eds.; FAO: Rome, Italy, 2012; pp. 179–209. [Google Scholar]

- Azpiazu, D.; Schorr, M.; Manzanelli, P. Concentración y Extranjerización; Capital Intelectual: Buenos Aires, Argentina, 2012. [Google Scholar]

- Perrone, N.M. Restrictions to Foreign Acquisitions of Agricultural Land in Argentina and Brazil. Globalizations 2013, 10, 205–209. [Google Scholar] [CrossRef]

- Barberi, F.; Castro, Y.; Álvarez, J.M. Acaparamiento e inversión extranjera en tierras. Propuestas para su regulación en Colombia. In Reflexiones Sobre la Ruralidad y el Territorio en Colombia. Problemáticas y Retos Actuales; Pesquera, A., Ed.; OXFAM: Bogotá, Colombia, 2013; pp. 115–161. [Google Scholar]

- Goldfarb, L.; Zoomers, A. The rapid expansion of genetically modified soy production into the Chaco region of Argentina. In The Global Land Grab: Beyond the Hype; Kaag, M., Zoomers, A., Eds.; Fernwood Publishing: London, UK, 2014; pp. 71–85. [Google Scholar]

- Costantino, A. La extranjerización de la tierra en Argentina. Continuidades y cambios entre el macrismo y el kirchnerismo. Estud. Int. Rev. Relações Int. PUC Minas 2017, 5, 103–120. [Google Scholar] [CrossRef]

- Harvey, D. The Enigma of Capital: And the Crises of Capitalism; Oxford University Press: New York, NY, USA, 2010. [Google Scholar]

- Grajales, J. The rifle and the title: Paramilitary violence, land grab and land control in Colombia. J. Peasant Stud. 2011, 38, 771–792. [Google Scholar] [CrossRef]

- Busscher, N.; Vanclay, F.; Parra, C. Reflections on How State–Civil Society Collaborations Play out in the Context of Land Grabbing in Argentina. Land 2019, 8, 116. [Google Scholar] [CrossRef] [Green Version]

- Mollett, S. The Power to Plunder: Rethinking Land Grabbing in Latin America. Antipode 2016, 48, 412–432. [Google Scholar] [CrossRef]

- Aguilar-Støen, M. Beyond Transnational Corporations, Food and Biofuels: The Role of Extractivism and Agribusiness in Land Grabbing in Central America. Forum Dev. Stud. 2016, 43, 155–175. [Google Scholar] [CrossRef]

- Tellería, J.; Garcia-Arias, J. The fantasmatic narrative of ‘sustainable development’. A political analysis of the 2030 Global Development Agenda. Environ. Plan. C Politics 2021. [Google Scholar] [CrossRef]

- Frederico, S. Território, Capital Financeiro e Agricultura; Relatório Final de Pós-Doutorado; Instituto de Geociências e Ciências Exatas, Departamento de Geografia, UNESP: Rio Claro, Brazil, 2016. [Google Scholar]

- GRAIN. El Acaparamiento de Tierras Perpetrado por los Fondos de Pensión Debe Terminar; GRAIN: Barcelona, Spain, 2018; Available online: https://grain.org/es/article/6094-el-acaparamiento-de-tierras-perpetrado-por-los-fondos-de-pension-debe-terminar (accessed on 24 March 2021).

- Borrás, S.; Franco, J. Towards a Broader View of the Politics of Global Land Grab: Rethinking Land Issues, Reframing Resistance; Working Paper Series No. 001; Initiatives in Critical Agrarian Studies (ICAS): The Hague, The Netherlands; International Institute of Social Studies (ISS): The Hague, The Netherlands, 2010. [Google Scholar]

- Hall, R. Land grabbing in Southern Africa: The many faces of the investor rush. Rev. Afr. Political Econ. 2011, 38, 193–214. [Google Scholar] [CrossRef]

- Costantino, A. ¿Quiénes Son y Para Qué? El Proceso de Extranjerización de la Tierra en Argentina a Partir del 2002. Ambiente Sostenibilidad 2015, 5, 43–56. [Google Scholar] [CrossRef]

- Cabrol, D.A.; Cáceres, D.M. Las disputas por los bienes comunes y su impacto en la apropiación de servicios ecosistémicos. La Ley de Protección de Bosques Nativos, en la Provincia de Córdoba, Argentina. Ecol. Austral 2017, 27, 134–145. [Google Scholar] [CrossRef] [Green Version]

- Sili, M.; Soumoulou, L. Problemática de la Tierra en Argentina: Conflictos y Dinámicas de Uso, Tenencia y Concentración; IFAD: Rome, Italy, 2011. [Google Scholar]

- Bidaseca, K. Procesamiento y Actualización de Datos del Estudio “Relevamiento y Sistematización de los Problemas de Tierra de los Agricultores Familiares. República Argentina” en Seis Provincias Afectadas por el Fenómeno de Land Grabbing; Documentos de Investigación Social No. 25; DAES-UNSAM: San Martin, Argentina, 2014. [Google Scholar]

- Goldfarb, L.; Van der Haar, G. The moving frontiers of genetically modified soy production: Shifts in land control in the Argentinian Chaco. J. Peasant Stud. 2016, 43, 562–582. [Google Scholar] [CrossRef]

- Gras, C.; Cáceres, D.M. El acaparamiento de tierras como proceso dinámico. Las estrategias de los actores en contextos de estancamiento económico. Poblac. Soc. 2017, 24, 163–194. [Google Scholar]

- Silva, L.O. Terras Devolutas e Latifúndio: Efeitos da Lei de 1850, 2nd ed.; Editora da Unicamp: Campinas, Brazil, 2008. [Google Scholar]

- Foweraker, J. The Struggle for Land: A Political Economy of the Pioneer Frontier in Brazil from 1930 to the Present Day; Cambridge University Press: New York, NY, USA, 1981. [Google Scholar]

- Zalles, V.; Hansen, M.C.; Potapov, P.V.; Stehman, S.V.; Tyukavina, A.; Pickens, A.; Song, X.-P.; Adusei, B.; Okpa, C.; Aguilar, R.; et al. Near doubling of Brazil’s intensive row crop area since 2000. Proc. Natl. Acad. Sci. USA 2019, 116, 428–435. [Google Scholar] [CrossRef] [Green Version]

- Reydon, B.P.; Fernandes, V.B.; Telles, T.S. Land governance as a precondition for decreasing deforestation in the Brazilian Amazon. Land Use Policy 2020, 94, 104313. [Google Scholar] [CrossRef]

- Sparovek, G.; Reydon, B.P.; Guedes Pinto, L.F.; Faria, V.; de Freitas, F.L.M.; Azevedo-Ramos, C.; Gardner, T.; Hamamura, C.; Rajão, R.; Cerignoni, F.; et al. Who owns Brazilian lands? Land Use Policy 2019, 87, 104062. [Google Scholar] [CrossRef]

- De Mollo, M.L.R.; Saad-Filho, A. Neoliberal economic policies in Brazil (1994–2005): Cardoso, Lula and the need for a democratic alternative. New Political Econ. 2006, 11, 99–123. [Google Scholar] [CrossRef]

- Advocacia-Geral da União. Parecer No. GQ–181; Advocacia-Geral da União: Brasilia, Brazil, 1998. Available online: https://wwwsistema.planalto.gov.br/asprevweb/exec/parecer/parecerAGU181.html (accessed on 24 March 2021).

- Saad-Filho, A. Varieties of Neoliberalism in Brazil (2003–2019). Lat. Am. Perspec. 2020, 47, 9–27. [Google Scholar] [CrossRef]

- Advocacia-Geral da União. Parecer No. LA-01; Advocacia-Geral da União: Brasilia, Brazil, 2010. Available online: http://www.planalto.gov.br/ccivil_03/agu/prc-la01-2010.htm (accessed on 24 March 2021).

- Vale, M.M.; Berenguer, E.; Argollo de Menezes, M.; Viveiros de Castro, E.B.; Pugliese de Siqueira, L.; de Portela, R.C.Q. The COVID-19 pandemic as an opportunity to weaken environmental protection in Brazil. Biol. Conserv. 2021, 255, 108994. [Google Scholar] [CrossRef] [PubMed]

- Mongabay. Brazil Minister Advises Using COVID-19 to Distract from Amazon; Deregulation 2020, Maio 26; Mongabay: Menlo Park, CA, USA, 2020; Available online: https://news.mongabay.com/2020/05/brazil-minister-advises-using-covid-19-to-distract-from-amazon-deregulation/ (accessed on 24 March 2021).

- Prazeres, L. “Boiada” de Salles Incluiu Demissão de Fiscais, Anistia a Desmatadores e Submissão do Ibama a Militares na Amazônia. O Globo. 25 May 2020. Available online: https://oglobo.globo.com/brasil/boiada-de-salles-incluiu-demissao-de-fiscais-anistia-desmatadores-submissao-do-ibama-militares-na-amazonia-24443867 (accessed on 24 March 2021).

- Folha de São Paulo. Ricardo Salles Exonera Diretor de Proteção Ambiental do Ibama. Available online: https://www1.folha.uol.com.br/equilibrioesaude/2020/04/ricardo-salles-exonera-diretor-de-protecao-ambiental-do-ibama.shtml (accessed on 24 March 2021).

- Azevedo-Ramos, C.; Moutinho, P.; Arruda, V.L.; Stabile, M.C.C.; Alencar, A.; Castro, I.; Ribeiro, J.P. Lawless land in no man’s land: The undesignated public forests in the Brazilian Amazon. Land Use Policy 2020, 99. [Google Scholar] [CrossRef]

- GRAIN. Barbarians at the Barn: Private Equity Sinks Its Teeth into Agriculture; GRAIN: Barcelona, Spain, 2020; Available online: https://grain.org/en/article/6533-barbarians-at-the-barn-private-equity-sinks-its-teeth-into-agriculture (accessed on 24 March 2021).

- Rede Social de Justiça e Direitos Humanos; GRAIN; Inter Pares; Solidarity Sweden-Latin America. Foreign Pension Funds and Land Grabbing in Brazil; GRAIN: Barcelona, Spain, 2015; Available online: https://grain.org/e/5336 (accessed on 24 March 2021).

- Steinweg, T.; Kuepper, B.; Piotrowski, M. Foreign Farmland Investors in Brazil Linked to 423,000 Hectares of Deforestation; Chain Reaction Research: Washington, DC, USA, 2018. [Google Scholar]

- Scoones, I.; Hall, R.; Borrás, S.M.; White, B.; Wolford, W. The politics of evidence: Methodologies for understanding the global land rush. J. Peasant Stud. 2013, 40, 469–483. [Google Scholar] [CrossRef] [Green Version]

- Anseeuw, W.; Lay, J.; Messerli, P.; Giger, M.; Taylor, M. Creating a public tool to assess and promote transparency in global land deals: The experience of the Land Matrix. Global Land Grabbing II Forum. J. Peasant Stud. 2013. [Google Scholar] [CrossRef] [Green Version]

- Banco Central do Brasil. Tabelas Especiais, ‘Investimento Estrangeiro Direto—Matriz País x Setor’. Available online: https://www.bcb.gov.br/content/estatisticas/Documents/Tabelas_especiais/IDP_matriz_pais_vs_setor_p.xlsx (accessed on 1 April 2021).

- Flexor, G.; Leite, S. Mercado de terra, commodities boom e land grabbing no Brasil. In Questões Agrárias, Agrícolas e Rurais: Conjunturas e Políticas Públicas; Flexor, G., Maluf, R.S., Eds.; E-Papers: Rio de Janeiro, Brazil, 2017; pp. 20–38. [Google Scholar]

- HighQuest Partners. Private Financial Sector Investment in Farmland and Agricultural Infrastructure; OECD Food, Agriculture and Fisheries Working Papers No 33; OECD: Paris, France, 2010. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Garcia-Arias, J.; Cibils, A.; Costantino, A.; Fernandes, V.B.; Fernández-Huerga, E. When Land Meets Finance in Latin America: Some Intersections between Financialization and Land Grabbing in Argentina and Brazil. Sustainability 2021, 13, 8084. https://doi.org/10.3390/su13148084

Garcia-Arias J, Cibils A, Costantino A, Fernandes VB, Fernández-Huerga E. When Land Meets Finance in Latin America: Some Intersections between Financialization and Land Grabbing in Argentina and Brazil. Sustainability. 2021; 13(14):8084. https://doi.org/10.3390/su13148084

Chicago/Turabian StyleGarcia-Arias, Jorge, Alan Cibils, Agostina Costantino, Vitor B. Fernandes, and Eduardo Fernández-Huerga. 2021. "When Land Meets Finance in Latin America: Some Intersections between Financialization and Land Grabbing in Argentina and Brazil" Sustainability 13, no. 14: 8084. https://doi.org/10.3390/su13148084

APA StyleGarcia-Arias, J., Cibils, A., Costantino, A., Fernandes, V. B., & Fernández-Huerga, E. (2021). When Land Meets Finance in Latin America: Some Intersections between Financialization and Land Grabbing in Argentina and Brazil. Sustainability, 13(14), 8084. https://doi.org/10.3390/su13148084