Beyond the Socio-Economic Impact of Transport Megaprojects

Abstract

:1. Introduction

The root of the asymmetric information issues in megaproject management comes from the enhanced enthusiasm of project promoters, directed towards successful advancement in project implementation.

2. Literature Analysis

2.1. Affects of Over-Estimation in Megaprojects

2.2. Cost–Benefit Analysis of Megaprojects

3. Data and Research Methodology

3.1. Main Characteristics of Megaprojects

3.2. Cost–Benefit Indicators of Megaprojects

3.3. Research Methodology

- Exposure to potential cost overruns (Table 2) evaluated by applying the relevant information from scholar literature, external evidence, the sensitivity benchmarks stressed by CBA developers, and the CBA type.

- A combination of ERR, discount rate, B/C value, and sensitivity results of each megaproject’s CBA (in Table 2) cross-evaluated to define a combination of conditions, which turn the overall project’s economic results into negative:

- ERR larger than the discount rate, together with a B/C ratio of more than 1, show the positive socio-economic impact estimation of a megaproject. The sensitivity issue column of Table 2 shows the main findings of the CBA developers that might lead the project socio-economic impact results to turn negative from positive. It also suggests the discount rate, assumed by CBA developers, in case it was not presented clearly in the CBA results.

- Check whether the OPEX period that was taken into account in the CBA assessment is rational in the context of the operational lifetime of constructed assets elaborated in the scholar.

- The validity of estimated forecasts in comparison with the currently-available actual statistical data.

- Main benefits of each megaproject retrieved from their CBAs. Their extent within the project’s overall socio-economic impact and their determinants identified.

- The economic impact evaluated by cross-comparing their determinants against the same determinants of the other megaprojects.

4. Results

4.1. Øresund Bridge

4.1.1. Total Investments

4.1.2. Socio-Economic Results of CBA

4.1.3. Main Benefits

4.2. Brenner–Base Tunnel

4.2.1. Total Investments

4.2.2. Socio-Economic Results of CBA

4.2.3. Main Benefits

- will save travel time on their trips;

- less cars/trucks on the roads of Alps will cause less car accidents;

- less cars/trucks on the roads will cause less environmental pollution due to reduced emissions;

- trains traveling through the tunnel do not produce noise, whereas cars/trucks on the roads do.

- takes over and maintains a large portion of freight and passenger transportation through the Alps, and

- the society will value the green (less polluting) transport mode significantly more than today.

4.3. Rail Baltica

4.3.1. Total Investments

4.3.2. Socio-Economic Results of CBA

4.3.3. Main Benefits

- Air pollution reduction;

- Climate change mitigation benefits;

- Freight travel time savings;

- Passenger travel time savings;

- Additional personal transport savings;

- Freight carrier operating profit;

- Safety improvement;

- Noise reduction;

- Additional freight transportation savings/expenses.

- Ref. [23] concluded a concern over export/import figures. For example, the fact that trains may be full from east to west (from Russia to Germany or to the Baltic countries) or north to south, but not on their return journeys because it is not cost-effective. This implies a large portion of empty freight trains running upwards as shown in Figure A7 with less foreseen possible revenues for the undertakers.

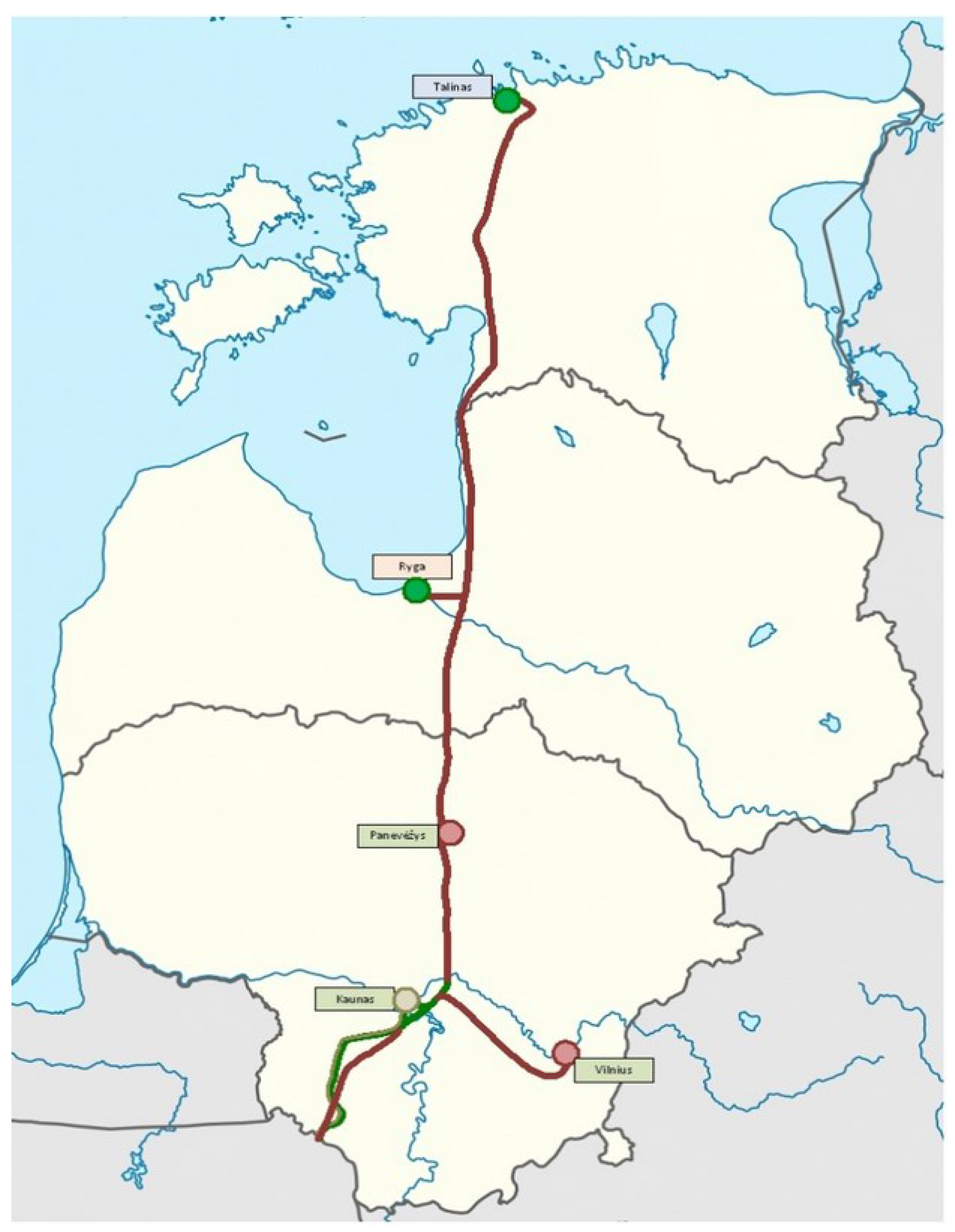

- Figure 4 reveals the potential sources of freight flows streaming either from trans-Siberian Railway, Northern Russia, or Finland. Russia recently has been developing the operating capacities of the Ust Luga port (in the Gulf of Finland, close to St. Petersburg). Statistics show that, in 2020, Ust Luga port handled 102.6 million tons of freight (Statista.com accessed on 25 July 2021). This implies that the northern part Russia is bound to use its own port for logistics activities instead of giving up freight flows to the ports in the Baltic states. Finland, meanwhile, has been successfully completing the country’s railway infrastructure development projects on the Scandinavian-Mediterranean TEN-T corridor (Figure 5). Finland’s road and rail infrastructure is also included in the scope of the European Union’s Nordic Triangle railway/road axis, which extends through the Øresund Bridge down to the Southern Europe along the Scandinavian-Mediterranean TEN-T corridor to Italy via the Brenner–Base tunnel. By using the EU funds, the Nordic countries have been intensively developing the infrastructure on the Nordic Triangle railway/road axis since 2007. As visible in Figure 5, the Scandinavian-Mediterranean TEN-T corridor with its upgraded rail and road infrastructure is the prevailing direct competitor over freight flows from the Nordic countries against the Rail Baltica line, which is a part of the North Sea-Baltic TEN-T corridor. This implies that the Nordic countries have stronger interest in exploiting their own transport infrastructure along the Scandinavian-Mediterranean TEN-T corridor rather than to use the Rail Baltica line. An implication concludes that the freight flow source from Finland would be questionable to travel through the Rail Baltica line in the future.

5. Comparative Analysis

“marred by the use of obsolescent data, various methodological errors, over-estimation of benefits, and under-estimation of costs.”

- The EC fully supports this project with all the previous financial commitments;

- The EC may base its decisions on financial commitments not necessarily in line with the formally accepted basis of CBA guidelines (strategic misrepresentation, as elaborated in Section 2.1).

6. Discussion

7. Conclusions

The root of the asymmetric information issues in megaproject management comes from the enhanced enthusiasm of project promoters, directed towards successful advancement in project implementation.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| MDPI | Multidisciplinary Digital Publishing Institute |

| DOAJ | Directory of Open Access Journals |

| TLA | Three Letter Acronym |

| LD | Linear Dichroism |

Appendix A

References

- Nocera, S.; Cavallaro, F.; Galati, O.I. Options for reducing external costs from freight transport along the Brenner corridor. Eur. Transp. Res. Rev. 2018, 10, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Bruzelius, N.; Flyvbjerg, B.; Rothengatter, W. Big decisions, big risks. Improving accountability in mega projects. Transp. Policy 2002, 9, 143–154. [Google Scholar] [CrossRef]

- Flyvbjerg, B.; Bruzelius, N.; Rothengatter, W. Megaprojects and Risk: An Anatomy of Ambition; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar] [CrossRef]

- Love, P.E.; Ahiaga-Dagbui, D.D. Debunking fake news in a post-truth era: The plausible untruths of cost underestimation in transport infrastructure projects. Transp. Res. Part A Policy Pract. 2018, 113, 357–368. [Google Scholar] [CrossRef]

- Lehtonen, M. Evaluating megaprojects: From the ‘iron triangle’ to network mapping. Evaluation 2014, 20, 278–295. [Google Scholar] [CrossRef] [Green Version]

- Gopinath, G. The Great Lockdown: Worst Economic Downturn Since the Great Depression. 2020. Available online: https://blogs.imf.org/2020/04/14/the-great-lockdown-worst-economic-downturn-since-the-great-depression/ (accessed on 25 July 2021).

- Makin, A.J.; Layton, A. The global fiscal response to COVID-19: Risks and repercussions. Econ. Anal. Policy 2021, 69, 340–349. [Google Scholar] [CrossRef]

- Denicol, J.; Davies, A.; Krystallis, I. What Are the Causes and Cures of Poor Megaproject Performance? A Systematic Literature Review and Research Agenda. Proj. Manag. J. 2020, 51, 328–345. [Google Scholar] [CrossRef]

- Pitsis, A.; Clegg, S.; Freeder, D.; Sankaran, S.; Burdon, S. Megaprojects redefined–complexity vs cost and social imperatives. Int. J. Manag. Proj. Bus. 2018, 11, 7–34. [Google Scholar] [CrossRef]

- Ferrari, M.; Giovannini, A.; Pompei, M. The challenge of infrastructure financing. Oxf. Rev. Econ. Policy 2016, 32, 446–474. [Google Scholar] [CrossRef]

- Transport in the European Union. Current Trends and Issues. 2019. Available online: https://ec.europa.eu/transport/sites/default/files/2019-transport-in-the-eu-current-trends-and-issues.pdf (accessed on 25 July 2021).

- Flyvbjerg, B. What you Should Know about Megaprojects and Why: An Overview. Proj. Manag. J. 2014, 45, 6–19. [Google Scholar] [CrossRef] [Green Version]

- Commission, E. Sustainable Mobility. The European Green Deal. 2019. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwiV3cT_g7DxAhUXgf0HHeUTA4AQFjABegQICBAD&url=https%3A%2F%2Fec.europa.eu%2Fcommission%2Fpresscorner%2Fapi%2Ffiles%2Fattachment%2F860070%2FSustainable_mobility_en.pdf.pdf&usg=AOvVaw1mPrcThG9i0CwwLUkBQiB5 (accessed on 25 July 2021).

- Joint Communication to the European Parliament and the Council on the Action Plan on Military Mobility. 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=JOIN%3A2018%3A5%3AFIN (accessed on 25 July 2021).

- Yanushevsky, C.; Yanushevsky, R. Is Infrastructure Spending an Effective Fiscal Policy? Metroeconomica 2014, 65, 123–135. [Google Scholar] [CrossRef]

- Bianchi, J.; Ottonello, P.; Presno, I. Fiscal Stimulus under Sovereign Risk; Working Paper 26307; National Bureau of Economic Research: Cambridge, MA, USA, 2019. [Google Scholar] [CrossRef] [Green Version]

- Benmelech, E.; Tzur-Ilan, N. The Determinants of Fiscal and Monetary Policies during the COVID-19 Crisis; Working Paper 27461; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Knudsen, M.; Rich, J. Ex post socio-economic assessment of the Oresund Bridge. Transp. Policy 2013, 27, 53–65. [Google Scholar] [CrossRef]

- Zanon, B. Infrastructure Network Development, Re-territorialization Processes and Multilevel Territorial Governance: A Case Study in Northern Italy. Plan. Pract. Res. 2011, 26, 325–347. [Google Scholar] [CrossRef]

- Flyvbjerg, B. Truth and lies about megaprojects. In Inaugural Speech for Professorship and Chair at Faculty of Technology, Policy, and Management; Delft University of Technology: Delft, The Netherlands, 2007. [Google Scholar]

- Priemus, H. Mega-projects: Dealing with Pitfalls. Eur. Plan. Stud. 2010, 18, 1023–1039. [Google Scholar] [CrossRef]

- Helm, D.; Mayer, C. Infrastructure: Why it is under provided and badly managed. Oxf. Rev. Econ. Policy 2016, 32, 343–359. [Google Scholar] [CrossRef]

- Schade, W.; Mejia-Dorantes, L.; Rothengatter, W.; Meyer-Rühle, O.; Kritzinger, S. Update on Investments in Large Ten-t Projects. Annex. Case Studies. 2014. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2014/529081/IPOL_STU(2014)529081(ANN01)_EN.pdf (accessed on 25 July 2021).

- Falbe-Hansen, K.; Kevan, E.; Munch-Petersen, C. Concrete for the Oresund Bridge. Concrete 1998, 32, 29–31. [Google Scholar] [CrossRef]

- Peeters, B.; Couvreur, G.; Razinkov, O.; Kündig, C.; der Auweraer, H.V.; Roeck, G.D. Continuous monitoring of the Øresund Bridge: System and data analysis. Struct. Infrastruct. Eng. 2009, 5, 395–405. [Google Scholar] [CrossRef]

- Stenström, C.; Norrbin, P.; Parida, A.; Kumar, U. Preventive and corrective maintenance–cost comparison and cost–benefit analysis. Struct. Infrastruct. Eng. 2016, 12, 603–617. [Google Scholar] [CrossRef]

- CASE Study: The Øresund Fixed Link. 2020. Available online: https://cdn.gihub.org/umbraco/media/3755/the-oeresund-fixed-link.pdf (accessed on 25 July 2021).

- Gopinath, G. Managing Divergent Recoveries. 2021. Available online: https://blogs.imf.org/2021/04/06/managing-divergent-recoveries/ (accessed on 25 July 2021).

- Aiuto, D.; Valli, M.; Castaldo, F.M.; Pedicini, P.; Corrao, I. Question for Written Answer E-011139-14 to the Commission Rule 130K. 2014. Available online: https://www.europarl.europa.eu/doceo/document/E-8-2014-011139_EN.html (accessed on 25 July 2021).

- Bulc, V. Answer Given by Ms Bulc on Behalf of the Commission. Question Reference: E-011139/2014. 2014. Available online: https://www.europarl.europa.eu/doceo/document/E-8-2014-011139-ASW_EN.html (accessed on 25 July 2021).

- Perello, P.; Baietto, A.; Burger, U.; Skuk, S. Excavation of the Aica-Mules pilot tunnel for the Brenner base tunnel: Information gained on water inflows in tunnels in granitic massifs. Rock Mech. Rock Eng. 2014, 47, 1049–1071. [Google Scholar] [CrossRef]

- Foderà, G.; Voza, A.; Barovero, G.; Tinti, F.; Boldini, D. Factors influencing overbreak volumes in drill-and-blast tunnel excavation. A statistical analysis applied to the case study of the Brenner Base Tunnel–BBT. Tunn. Undergr. Space Technol. 2020, 105, 103475. [Google Scholar] [CrossRef]

- Bergmeister, K. The Brenner Base Tunnel–geological, construction and logistical challenges and innovations at half time. Geomech. Tunn. 2019, 12, 555–563. [Google Scholar] [CrossRef]

- Joint Declaration by the President of the European Council, the President of the European Commission, and the Secretary General of the North Atlantic Treaty Organization. 2016. Available online: https://www.consilium.europa.eu/media/21481/nato-eu-declaration-8-july-en-final.pdf (accessed on 25 July 2021).

- Juncker, J.C. Defending Europe: European Defense Action Plan. Improving Military Mobility in the European Union. 2017. Available online: https://ec.europa.eu/transport/sites/default/files/2018-military_mobility_factsheet.pdf (accessed on 25 July 2021).

- Fari, S.; Moraglio, M. Peripheral Flows: A Historical Perspective on Mobilities between Cores and Fringes; Cambridge Scholars Publishing: Newcastle upon Tyne, UK, 2016. [Google Scholar]

- Joint Report to the European Parliament and the Council on the Implementation of the Action Plan on Military Mobility from June 2019 to September 2020. 2020. Available online: https://ec.europa.eu/transport/sites/default/files/legislation/join20200016.pdf (accessed on 25 July 2021).

- Regulation (EU) No 1316/2013 Establishing the Connecting Europe Facility, Amending Regulation (EU) No 913/2010 and Repealing Regulations (EC) No 680/2007 and (EC) No 67/2010 Text with EEA Relevance. 2013. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32013R1316 (accessed on 25 July 2021).

- Regulation (EU) No 1301/2013 on the European Regional Development Fund and on Specific Provisions Concerning the Investment for Growth and Jobs Goal and Repealing Regulation (EC) No 1080/2006. 2013. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A32013R1301 (accessed on 25 July 2021).

| EU Priority Project | Public Investment Granted | Scope | Project Construction Phase | Project Promoter | Financial Commitment by Stakeholders * |

|---|---|---|---|---|---|

| Øresund Bridge | EUR 3.7 billion | 15.9 km of bridge + tunnel (road and rail) | 1995–2000 | Øresundsbro Konsortiet | 1991 (Denmark & Sweden) |

| Brenner–Base tunnel | EUR 8.1 billion ** | 64 km rail tunnel system | 2011–2025 | BBT SE | 2009 (Austria), 2010 (Italy) |

| Rail Baltica | EUR 5.8 billion ** | 870 km rail infrastructure | 2022 –2025 | RB Rail AS | 2014 (Estonia, Latvia, Lithuania) |

| EU Priority Project | Total Investments Considered by CBA | OPEX | ERR | Disc. Rate | B/C | Reference CBA (Year) | CBA Type | Sensitivity Issues Stressed by CBA |

|---|---|---|---|---|---|---|---|---|

| Øresund Bridge | EUR 3.824 billion | 50 years | 9% | 3.5% | 2.2 | [18] (2010) | ex-post 10 years of OPEX | ERR 6% and B/C 1.4 in case of no traffic growth |

| Brenner–Base tunnel | EUR 6 billion | 50 years | 4.7% | 0%; 2.5%; 8% | 4.2; 1.9; 0.5 | Ernst&Young Financial Business Advisors S.p.A (2007) | ex-ante | 25% investment increase reduces ERR to 3.91% |

| Rail Baltica | EUR 5.788 billion | 30 years | 6.32% | 5% | 1.19 | Ernst&Young Baltic Ltd. (2017) | ex-ante | 26% investment increase drops ERR below 5% |

| Essential Points | Øresund Bridge | Brenner–Base Tunnel | Rail Baltica |

|---|---|---|---|

| Investment cost overruns | ±50% concluded after constructions | 63% confirmed so far. Construction ongoing | 50–100% estimated. Constructions yet to start |

| Project purpose identified in CBA | New fixed link transport connection (15.9 km) replacing ferry line services | New rail link across the Alps (64 km) to shift traffic volumes from road to rail | Fast rail service across the Baltic region (870 km) to shift traffic volumes from other transport modes |

| Key socio-economic determinants | Road passenger (commuter) traffic volumes/ service charges | Passenger and freight traffic volume shift from road to rail/ GHG emission cost unitary prices | Passenger and freight traffic volume shift to rail/ GHG emission cost unitary prices |

| Occurrence of over-optimism in CBA estimations | Passenger and freight volumes from 2010 over-estimated in the main scenario | Underestimated investment costs and construction term | Underestimated investment costs and construction term. Over-estimated freight and passenger flow forecasts. |

| Key conclusions of results under the CBA framework | Positive CBA result confirmed under pessimistic ’No growth’ scenario-estimation confirmed by 2010–2020 actual data. Steady volumes of commuter travels since 2010, consumer willingness to pay higher costs for services | Negative CBA result due to significant investment cost overruns. Unrealistic, significantly higher than estimated freight traffic needed throughout 50 years of tunnel operation to turn CBA result into positive. | Negative CBA result due to expected investment cost overruns and unrealistically estimated traffic volumes |

| Essential Points | Øresund Bridge | Brenner–Base Tunnel | Rail Baltica |

|---|---|---|---|

| Publicly available warnings on expected project negative socio-economic outcomes | - | 2007 (CBA sensitivity analysis), since 2014 (multiple sources) | Since 2014 (multiple sources), 2017 (CBA sensitivity analysis) |

| Financial commitments confirmed | Completed in 2000 | Since 2009–current | Since 2014–current |

| Current public communication on positive socio-economic results by Project promoter (European Commission) | Yes (Yes) | No (Yes) | Yes (Yes) |

| Essential Points | Brenner–Base Tunnel | Rail Baltica |

|---|---|---|

| EU’s parallel ongoing strategic initiatives | EU sustainable mobility goals within the European Green Deal [13] to reduce the GHG emissions by 90% by 2050 | EU Action Plan on Military Mobility [14]. Commitment to have a fully-fledged European Defense Union by 2025 |

| External factors, significantly improving the socio-economic value of the project | 1. World’s efforts to reduce the effects of global warming significantly raise the unitary values of GHG emission costs. 2. Tunnel construction lifecycle is around 200 years (150 years of project benefits omitted in 2007 CBA assessment). | Critical missing link for NATO military mobility—absence of EU standard gauge rail infrastructure on the major part of the Baltic region. |

| Pending questions for application of strategic approach | Construction works are close to completion with currently-granted funding. No current public necessity for socio-economic assessment. It should arise several years after completion of construction works when ex-post CBA will be required under EU’s legislation. Actual freight volumes transported through the tunnel would be possible to evaluate together with enhanced unitary values of GHG emission costs | Project mainly funded from EU Cohesion fund and national budgets of Estonia, Latvia, and Lithuania. Current funding model reduces economic growth potential in the Baltic region, jeopardizes the initial purpose of the EU Cohesion policy. Sensitive public issue in the Baltic region. Military mobility funding possible up to 10% only, but should fully fund the project. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Montrimas, A.; Bruneckienė, J.; Gaidelys, V. Beyond the Socio-Economic Impact of Transport Megaprojects. Sustainability 2021, 13, 8547. https://doi.org/10.3390/su13158547

Montrimas A, Bruneckienė J, Gaidelys V. Beyond the Socio-Economic Impact of Transport Megaprojects. Sustainability. 2021; 13(15):8547. https://doi.org/10.3390/su13158547

Chicago/Turabian StyleMontrimas, Andrius, Jurgita Bruneckienė, and Vaidas Gaidelys. 2021. "Beyond the Socio-Economic Impact of Transport Megaprojects" Sustainability 13, no. 15: 8547. https://doi.org/10.3390/su13158547

APA StyleMontrimas, A., Bruneckienė, J., & Gaidelys, V. (2021). Beyond the Socio-Economic Impact of Transport Megaprojects. Sustainability, 13(15), 8547. https://doi.org/10.3390/su13158547