Piloting a Weather-Index-Based Crop Insurance System in Bangladesh: Understanding the Challenges of Financial Instruments for Tackling Climate Risks

Abstract

1. Introduction

2. Key Concepts

2.1. Crop Insurance

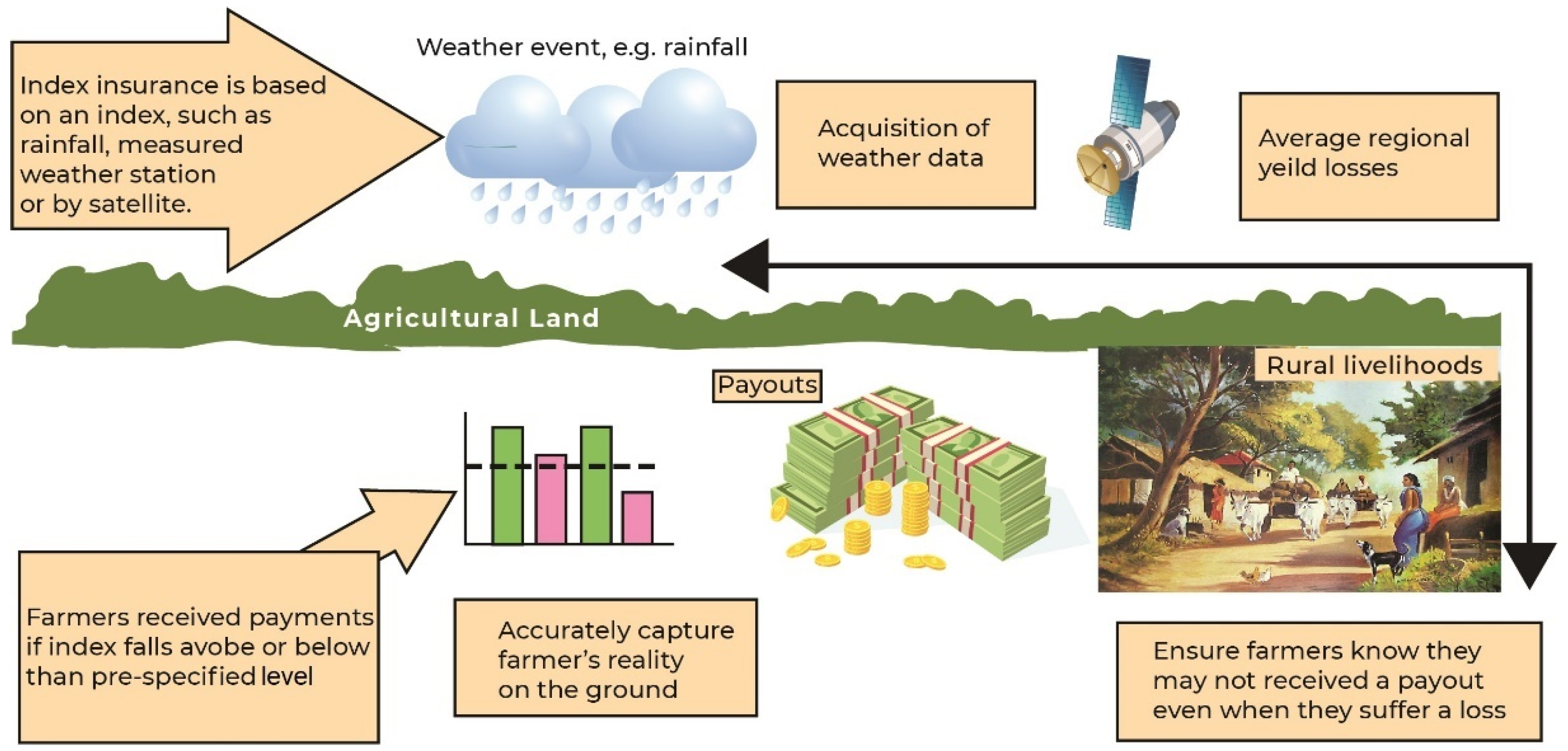

2.2. Transformation of Risk and Increasing Demand for Index-Based Crop Insurance

3. Materials and Methods

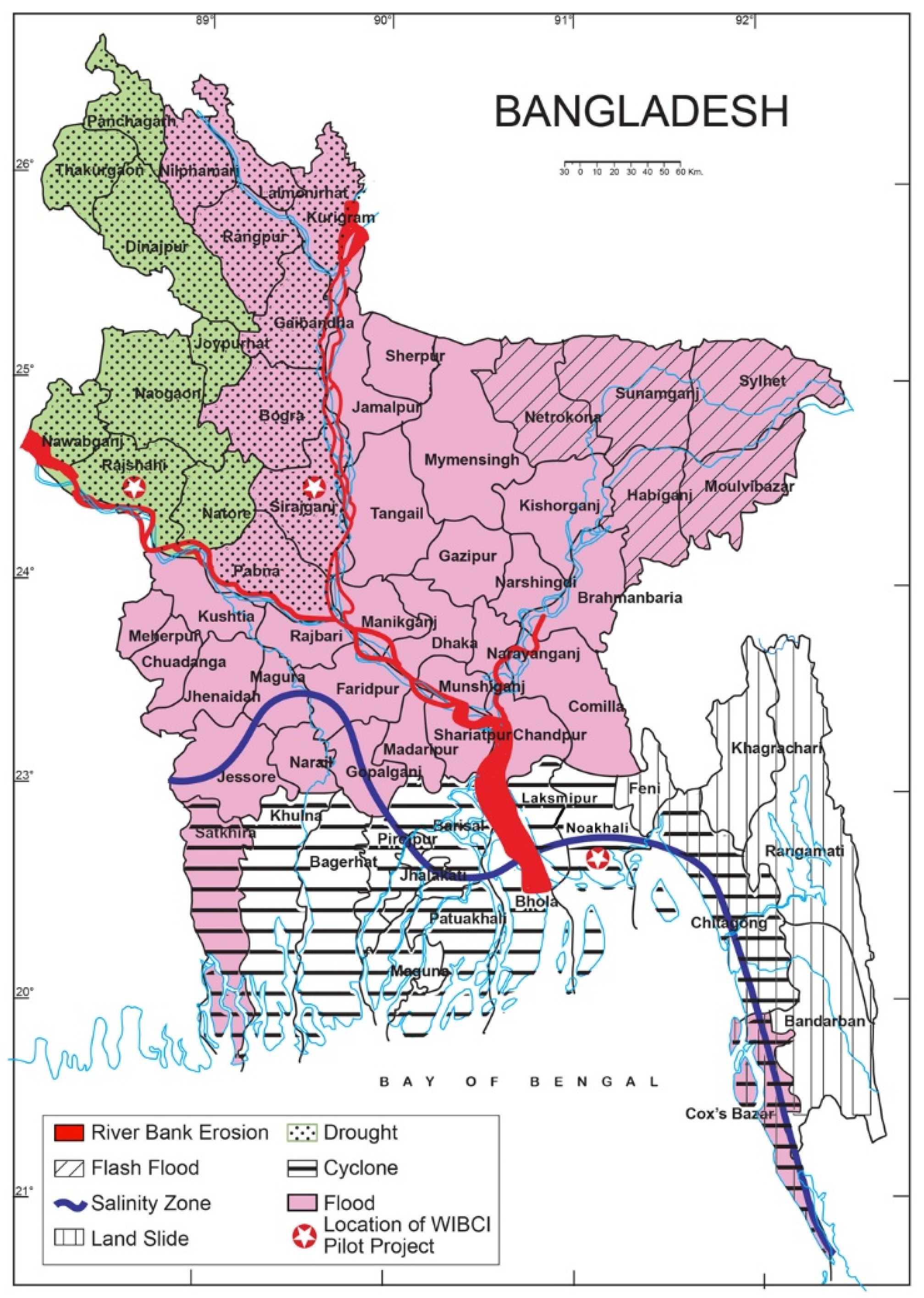

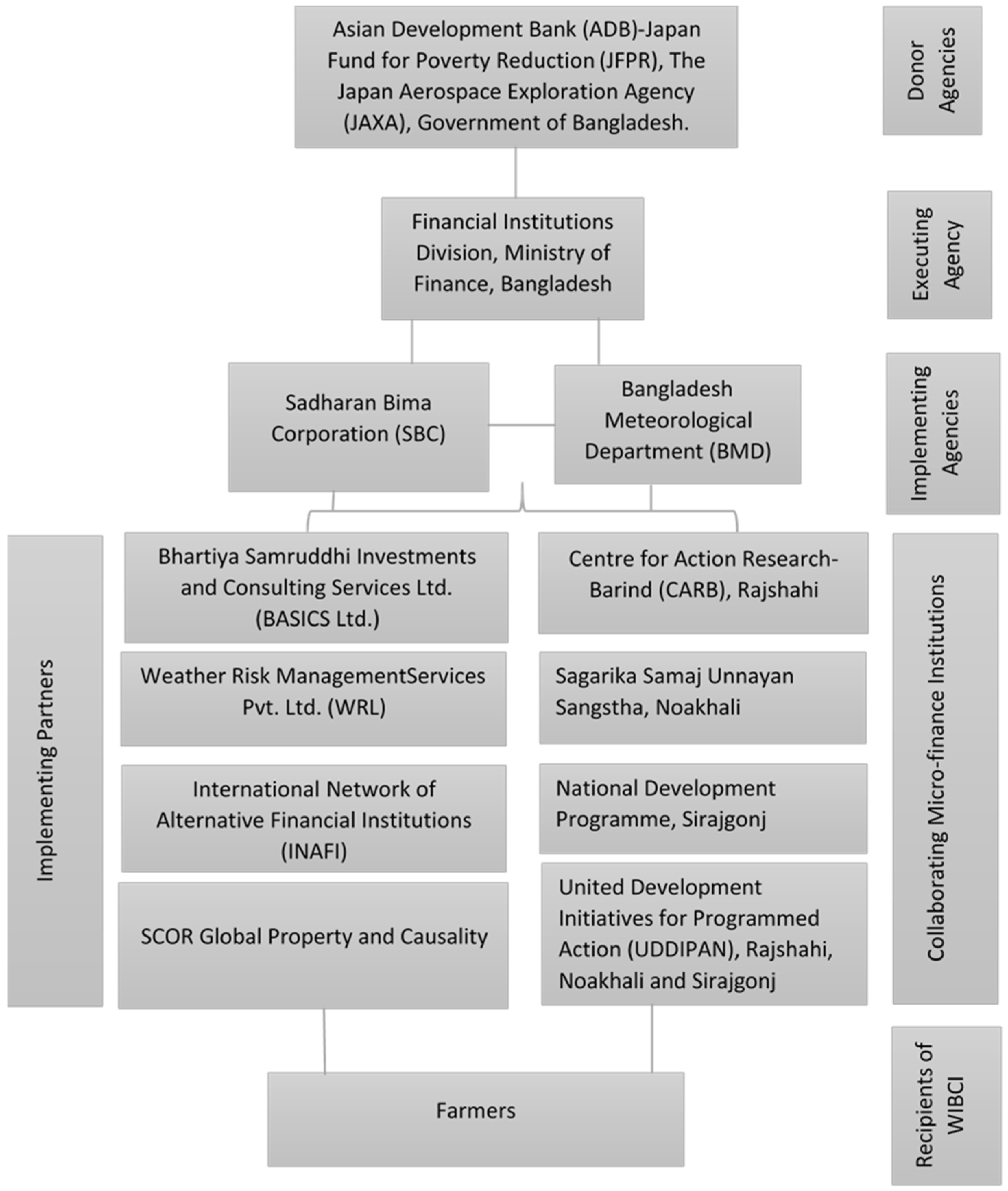

4. Case Study: The WIBCI Pilot in Bangladesh

5. Results and Discussion

5.1. Limitation of Farmer Knowledge, Trust, and Premium Payment Abilities

5.2. Limitation of Weather Data Acquisition

5.3. Challenges of Automation

5.4. Administrative Problems and Bridging the Agency-Farmer Link

5.5. Uncertainty of Insurance Policy to Farmers

5.6. Lack of Actuaries, Crop Scientists, and Meteorologists in Bangladesh

5.7. Insurance Product Design and Administrative Costs

5.8. An Improved Business Platform

6. Conclusions and Recommendations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Githeko, A.K.; Woodward, A. International Consensus on the Science of Climate and Health: The IPCC Third Assessment Report. In Climate Change and Human Health: Risks and Responses; WHO: Geneva, Switzerland, 2003; pp. 43–60. [Google Scholar]

- Hossain, S. Problems and prospects of weather index-based crop insurance for rural farmers in Bangladesh. Dev. Ctry. Stud. 2013, 3, 208–220. [Google Scholar]

- Al-Maruf, A.; Jenkins, J.C.; Bernzen, A.; Braun, B. Measuring Household Resilience to Cyclone Disasters in Coastal Bangladesh. Climate 2021, 9, 97. [Google Scholar] [CrossRef]

- Al-Maruf, A. Enhancing Disaster Resilience through Human Capital: Prospects for Adaptation to Cyclones in Coastal Bangladesh. Ph.D. Thesis, Universität zu Köln, Köln, Germany, 2017. [Google Scholar]

- BBS—Bangladesh Bureau of Statistics; Ministry of Planning, Government of the People’s Republic of Bangladesh Household Income and Expenditure Survey (HIES). 2016. Available online: https://bbs.portal.gov.bd/sites/default/files/files/bbs.portal.gov.bd/page/b343a8b4_956b_45ca_872f_4cf9b2f1a6e0/Comparative%20Matrix%20HIES_fnl.pdf/ (accessed on 13 July 2019).

- Habiba, U.; Shaw, R. Crop insurance as risk management strategy in Bangladesh. In Disaster Risk Reduction Approaches in Banglades; Springer: Tokyo, Japan, 2013; pp. 281–305. [Google Scholar]

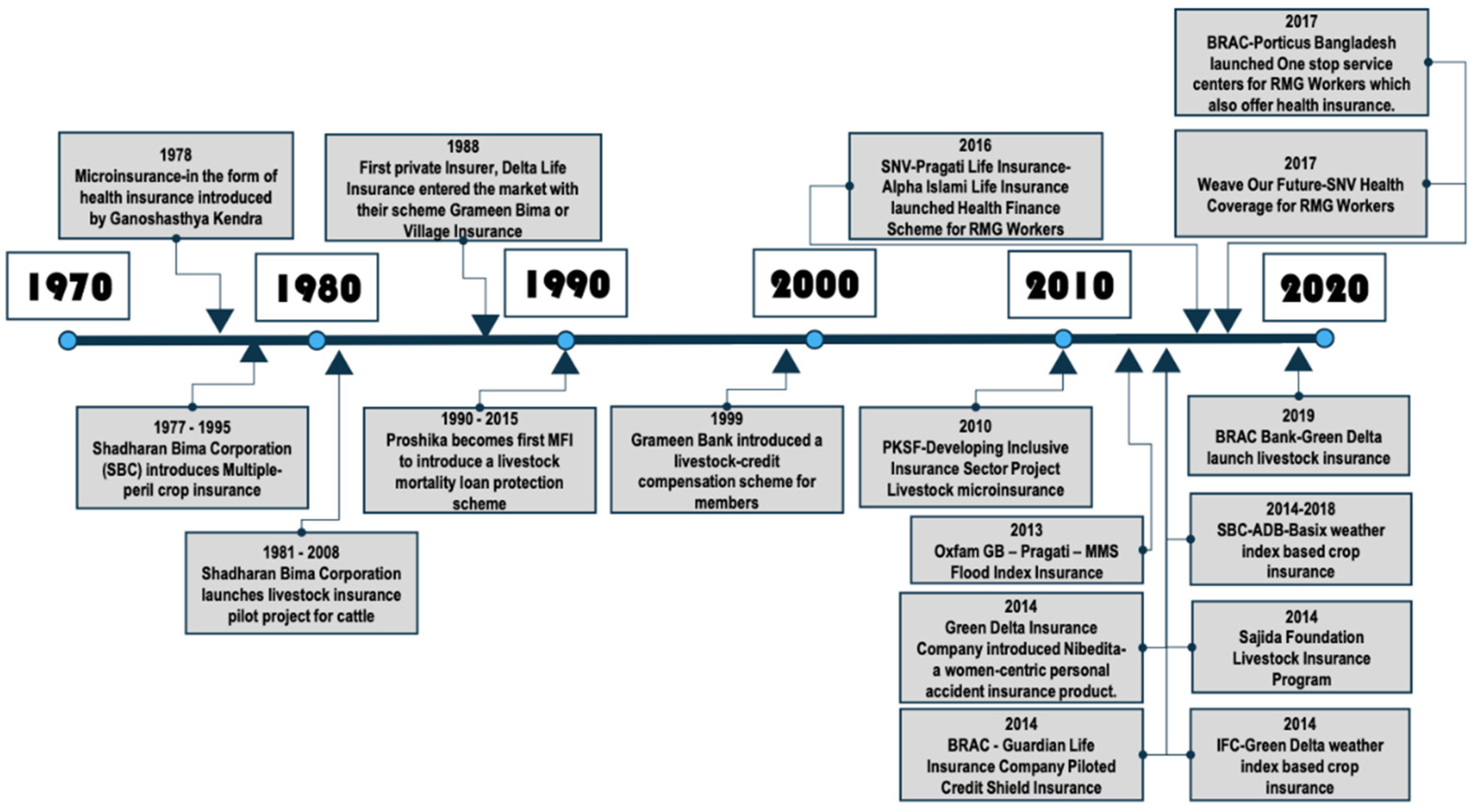

- Sultana, D.; Kaisar, F. Evolution of Micro Insurance in Bangladesh: Financial Cushion for the Bottom of the Pyramid Population. LightCastle Partners. 2021. Available online: https://www.lightcastlebd.com/insights/2021/05/evolution-of-micro-insurance-in-bangladesh-financial-cushion-for-the-bottom-of-the-pyramid-population?utm_source=rss&utm_medium=rss&utm_campaign=evolution-of-micro-insurance-in-bangladesh-financial-cushion-for-the-bottom-of-the-pyramid-population (accessed on 24 July 2021).

- Bokhtiar, M.; Delowar, M.; Wahid, A.N. Application of Forward Contract and Crop Insurance as Risk Management Tools of Agriculture: A Case Study in Bangladesh. Asian Econ. Financ. Rev. 2018, 8, 1394–1405. [Google Scholar]

- World Bank Group. Bangladesh: Agriculture Insurance Situation Analysis; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Carter, M.R.; Galarza, F.; Boucher, S. Underwriting Area-Based Yield Insurance to Crowd-in Credit Supply and Demand; Savings and Development; Department of Agricultural and Resource Economics University of California: Davis, CA, USA, 2007; pp. 335–362. [Google Scholar]

- Carter, M.; de Janvry, A.; Sadoulet, E.; Sarris, A. Index insurance for developing country agriculture: A reassessment. Annu. Rev. Resour. Econ. 2017, 9, 421–438. [Google Scholar] [CrossRef]

- Clement, K.Y.; Botzen, W.W.; Brouwer, R.; Aerts, J.C. A global review of the impact of basis risk on the functioning of and demand for index insurance. Int. J. Disaster Risk Reduct. 2018, 28, 845–853. [Google Scholar] [CrossRef]

- Mortaza, M.G. BAN: Pilot Project on Weather Index Based Crop Insurance. Bangladesh Resident Mission, Asian Development Bank. 2018. Available online: https://events.development.asia/system/files/materials/2018/10/201810-pilot-project-weather-index-based-crop-insurance.pdf (accessed on 8 July 2021).

- Rios, A.R.; Peters, S.; Meirovich, H. Financial Instruments and Mechanisms for Climate Change Programs in Latin America and the Caribbean: A Guide for Ministries of Finance. 2013. Available online: https://www.cbd.int/financial/mainstream/idb-climate-finstruments.pdf (accessed on 8 July 2021).

- Al-Maruf, A.; Jenkins, C.; Islam, A.; Sarmin, S. 2020. Coastal Zone of Bangladesh: A Tale of Pessimism and Optimism. In Climate Adaptation for a Sustainable Economy: Lessons from Bangladesh, an Emerging Tiger of Asia. Asian Political, Economic and Social Issues; Hossain, M., Kholikuzzaman, B., Islam, C., Eds.; Nova Science Publishers: New York, NY, USA, 2020; ISBN 978-1-5361-6927-0. [Google Scholar]

- Alam, A.F.; Begum, H.; Masud, M.M.; Al-Amin, A.Q.; Leal Filho, W. Agriculture insurance for disaster risk reduction: A case study of Malaysia. Int. J. Disaster Risk Reduct. 2020, 47, 101626. [Google Scholar] [CrossRef]

- Hazell, P.; Anderson, J.; Balzer, N.; Clemmensen, A.H.; Hess, U.; Rispoli, F. The Potential for Scale and Sustainability in Weather Index Insurance for Agriculture and Rural Livelihoods; World Food Programme (WFP): Rome, Italy, 2010; Available online: https://www.ifad.org/documents/38714170/40239486/The+potential+for+scale+and+sustainability+in+weather+index+insurance+for+agriculture+and+rural+livelihoods.pdf/7a8247c7-d7be-4a1b-9088-37edee6717ca (accessed on 1 January 2021).

- Johnson, L.; Wandera, B.; Jensen, N.; Banerjee, R. Competing expectations in an index-based livestock insurance project. J. Dev. Stud. 2019, 55, 1221–1239. [Google Scholar] [CrossRef]

- Giné, X.; Townsend, R.; Vickery, J. Patterns of rainfall insurance participation in rural India. World Bank Econ. Rev. 2008, 22, 539–566. [Google Scholar] [CrossRef]

- Aheeyar, M.; de Silva, S.; Senaratna-Sellamuttu, S.; Arulingam, I. Unpacking barriers to socially inclusive weather index insurance: Towards a framework for inclusion. Water 2019, 11, 2235. [Google Scholar] [CrossRef]

- Clarke, D.J.; Grenham, D. Microinsurance and natural disasters: Challenges and options. Environ. Sci. Policy 2013, 27, S89–S98. [Google Scholar] [CrossRef]

- Carter, M.R.; Janzen, S.A. Social protection in the face of climate change: Targeting principles and financing mechanisms. Environ. Dev. Econ. 2018, 23, 369–389. [Google Scholar] [CrossRef]

- Akter, S.; Krupnik, T.J.; Rossi, F.; Khanam, F. The influence of gender and product design on farmers’ preferences for weather-indexed crop insurance. Glob. Environ. Chang. 2016, 38, 217–229. [Google Scholar] [CrossRef]

- Mahul, O.; Stutley, C.J. Government Support to Agricultural Insurance: Challenges and Options for Developing Countries; World Bank Publications: Washington, DC, USA, 2010. [Google Scholar]

- Miranda, M.J.; Farrin, K. Index insurance for developing countries. Appl. Econ. Perspect. Policy 2012, 34, 391–427. [Google Scholar] [CrossRef]

- Greatrex, H.; Hansen, J.; Garvin, S.; Diro, R.; Le Guen, M.; Blakeley, S.; Rao, K.; Osgood, D. Scaling Up Index Insurance for Smallholder Farmers: Recent Evidence and Insights. 2015. Available online: https://cgspace.cgiar.org/bitstream/handle/10568/53101/CCAFS_Report14.pdf?sequence=1 (accessed on 1 March 2021).

- Akter, S.; Krupnik, T.J.; Khanam, F. Climate change skepticism and index versus standard crop insurance demand in coastal Bangladesh. Reg. Environ. Chang. 2017, 17, 2455–2466. [Google Scholar] [CrossRef] [PubMed]

- Carter, M.; De Janvry, A.; Sadoulet, E.; Sarris, A. Index-Based Weather Insurance for Developing Countries: A Review of Evidence and a Set of Propositions for Up-Scaling; Development Policies Working Paper; FERDI: Paris, France, 2014; Volume 111. [Google Scholar]

- Born, L.; Spillane, C.; Murray, U. Integrating gender into index-based agricultural insurance: A focus on South Africa. Dev. Pract. 2019, 29, 409–423. [Google Scholar] [CrossRef]

- Ahmed, K.F.; Mo, Y. Current Crop Risk in India: How Can It Be Managed Effectively? 2019. Available online: https://www.air-worldwide.com/publications/air-currents/2019/Current-Crop-Risk-in-India--How-Can-It-Be-Managed-Effectively-/ (accessed on 21 June 2020).

- Skees, J.R. Challenges for use of index-based weather insurance in lower income countries. Agric. Financ. Rev. 2008, 68, 197. [Google Scholar] [CrossRef]

- Kawa, I.H.; Kaitira, L.M. Chapter Seven. Enhancing Smallholder Farmers’ Market Competitiveness in Tanzania (6–7). In Case Studies in Food Policy for Developing Countries; Cornell University Press: Ithaca, NY, USA, 2018; pp. 85–108. [Google Scholar]

- Clarke, D.; Das, N.; de Nicola, F.; Hill, R.V.; Kumar, N.; Mehta, P. The Value of (Customized) Insurance for Farmers in Rural Bangladesh. In Research Conference on Microinsurance; IFPRI: Twente, The Netherlands, 2012; Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.259.6305&rep=rep1&type=pdf (accessed on 21 June 2020).

- Ward, P.S.; Ortega, D.L.; Spielman, D.J.; Kumar, N.; Minocha, S. Demand for complementary financial and technological tools for managing drought risk. Econ. Dev. Cult. Chang. 2020, 68, 607–653. [Google Scholar] [CrossRef]

- Schickele, A. Make It Rain; Abdul Latif Jameel Poverty Action Lab, Center for Effective Global Action, and Agricultural Technology Adoption Initiative: Cambridge, MA, USA, 2016. [Google Scholar]

- Elabed, G.; Bellemare, M.F.; Carter, M.R.; Guirkinger, C. Managing basis risk with multiscale index insurance. Agric. Econ. 2013, 44, 419–431. [Google Scholar] [CrossRef]

- Omar, D. February. Focus group discussion in built environment qualitative research practice. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2018; Volume 117, p. 012050. [Google Scholar]

- Masadeh, M.A. Focus group: Reviews and practices. J. Appl. Sci. Technol. 2012, 2, 62–68. [Google Scholar]

- Short, S.E. Focus groups: Focus group interviews. In A Handbook for Social Science Field Research: Essays & Bibliographic Sources on Research Design and Methods; SAGE Publications: Thousand Oaks, CA, USA, 2006; pp. 104–117. [Google Scholar]

- ADB-Asian Development Bank. Bangladesh: Pilot Project on Weather Index-Based Crop Insurance (Financed by the Japan Fund for Poverty Reduction). 2019. Available online: https://www.adb.org/sites/default/files/project-documents/46284/46284-001-icm-en.pdf (accessed on 12 May 2021).

- SBC- Sadharan Bima Corporation. Weather Indexed-Based Crop Insurance (in Bangla). 2017. Available online: http://www.sbc.gov.bd/site/page/2392c19a-5c74-49d5-ade5-bca63989a911/%E0%A6%86%E0%A6%AC%E0%A6%B9%E0%A6%BE%E0%A6%93%E0%A7%9F%E0%A6%BE-%E0%A6%B8%E0%A7%82%E0%A6%9A%E0%A6%95%E0%A6%AD%E0%A6%BF%E0%A6%A4%E0%A7%8D%E0%A6%A4%E0%A6%BF%E0%A6%95-%E0%A6%B6%E0%A6%B8%E0%A7%8D%E0%A6%AF-%E0%A6%AC%E0%A7%80%E0%A6%AE%E0%A6%BE (accessed on 13 December 2020).

- ADB-Asian Development Bank. Proposed Grant Assistance People’s Republic of Bangladesh: Pilot Project on Weather Index-Based Crop Insurance (Financed by the Japan Fund for Poverty Reduction). 2013. Available online: https://www.adb.org/sites/default/files/project-document/76036/46284-001-ban-gar.pdf (accessed on 21 March 2020).

- Pyka, L.M.; Al-Maruf, A.; Jenkins, J.C.; Shamsuzzoha, M.; Braun, B. Floating gardening in coastal Bangladesh: Evidence of sustainable farming for food security under climate change. J. Agric. Food Environ. 2021, 1, 161–168. [Google Scholar] [CrossRef]

- Huq, S.; Kabir, F.; Khan, M.H.; Khan, M.H.I.; Hossain, T.; Hossain, J.B. National Mechanism on Loss and Damage in Bangladesh: Scoping Paper. 2016. Available online: https://www.scribd.com/document/329856845/Bangladesh-loss-and-damage-proposal (accessed on 27 June 2020).

- ADB-Asian Development Bank. Bangladesh: Pilot Project on Weather Index-Based Crop Insurance. 2018. Available online: adb-projects-46284-001.pdf (accessed on 7 January 2021).

- Meyer, R.L. The demand for flexible microfinance products: Lessons from Bangladesh. J. Int. Dev. 2002, 14, 351–368. [Google Scholar] [CrossRef]

- Akter, S.; Brouwer, R.; van Beukering, P.J.; French, L.; Silver, E.; Choudhury, S.; Aziz, S.S. Exploring the feasibility of private micro flood insurance provision in Bangladesh. Disasters 2011, 35, 287–307. [Google Scholar] [CrossRef] [PubMed]

- Rithu, M.N.A.; Rahman, M.M.; Al-Maruf, A. The Status of Geography and Environmental Studies at Secondary Level Education in Bangladesh. Arch. Curr. Res. Int. 2016, 5, 1–9. [Google Scholar] [CrossRef][Green Version]

- Shamsuzzoha, M.; Al-Maruf, A. Post SIDR life strategy: Adaptation scenario of settlements of the south. J. IBS 2011, 19, 207–222. [Google Scholar]

- Renwick, A.W.; Revoredo-Giha, C. Crop Substitution on UK Sugar Beet Farms and Its Effects on the Environment: A Multi-Product Cost Function Approach (No. 1580-2016-134039). 2005. Available online: https://ageconsearch.umn.edu/record/31933/ (accessed on 6 May 2021).

- Akter, S.; Brouwer, R.; Choudhury, S.; Aziz, S. Is there a commercially viable market for crop insurance in rural Bangladesh? Mitig. Adapt. Strateg. Glob. Chang. 2009, 14, 215–229. [Google Scholar] [CrossRef]

- Raju, K.V.; Naik, G.; Ramseshan, R.; Pandey, T.; Joshi, P.; Anantha, K.H.; Rao, A.K.; DShyam, M.; Kumara Charyulu, D. Transforming Weather Index-Based Crop Insurance in India: Protecting Small Farmers from Distress; Status and a Way Forward; Research Report IDC-8; ICRISAT: Patancheruvu, India, 2016. [Google Scholar]

- Fonta, W.M.; Sanfo, S.; Kedir, A.M.; Thiam, D.R. Estimating farmers’ willingness to pay for weather index-based crop insurance uptake in West Africa: Insight from a pilot initiative in Southwestern Burkina Faso. Agric. Food Econ. 2018, 6, 11. [Google Scholar] [CrossRef]

- Rao, K.N. Index based crop insurance. Agric. Agric. Sci. Procedia 2010, 1, 193–203. [Google Scholar] [CrossRef]

- Daron, J.D.; Stainforth, D.A. Assessing pricing assumptions for weather index insurance in a changing climate. Clim. Risk Manag. 2014, 1, 76–91. [Google Scholar] [CrossRef]

- Brunette, M.; Couture, S.; Pannequin, F. Is forest insurance a relevant vector to induce adaptation efforts to climate change? Ann. For. Sci. 2017, 74, 41. [Google Scholar] [CrossRef]

- Werner, W.J. Micro-insurance in Bangladesh: Risk protection for the poor? J. Health Popul. Nutr. 2009, 27, 563. [Google Scholar] [CrossRef]

| Country | Risk Event | Index Insurance | Year Initiated |

|---|---|---|---|

| China | Weather-related variables | Different weather variables | 2012 |

| Ethiopia | Drought | Rainfall | 2006 |

| Honduras | Drought | Rainfall | 2003 |

| India | Flood, rainfall, and drought | Rainfall | 2007 |

| Kazakhstan | Drought | Rainfall | In development |

| Malawi | Drought | Rainfall | 2005 |

| Mexico | Drought, natural disaster for small farmers | Rainfall, wind speed & temperature | 2001 |

| Morocco | Drought | Rainfall | 2018 |

| Nicaragua | Drought and excessive rain in production season | Rainfall | 2006 |

| Peru | Flood, torrential rainfall from El-Nino | Rainfall | Proposed |

| Senegal | Drought | Rainfall & crop yield | 2012 |

| Sri Lanka | Torrential rainfall, flood | Rainfall | 2011–2012 |

| Tanzania | Drought | Rainfall | 2007 |

| Thailand | Flood | Rainfall | 2007 |

| Ukraine | Drought | Rainfall | 2005 |

| Vietnam | Flood during rice harvest | River level | In development |

| Bangladesh | Flood, rainfall, and drought | Rainfall & wind flow | 2014 |

| Districts | Risk Events | Upazilas | Unions | Data Collection Methods | Respondents | Number of Participants |

|---|---|---|---|---|---|---|

| Rajshahi | Drought | Godagari | Gobari | FGD | Farmers | 8 |

| Gogram | FGD | Farmers | 10 | |||

| Mohanpur | Informal discussion | Farmers, community leaders, school teachers | 12 | |||

| Deopara | FGD | Farmers | 11 | |||

| Puthia | Baneshwar | KII | Officials of INAFI, CARB & Uddipan, Upazila agriculture extension official | 3 | ||

| Belpukuria | FGD | Farmers | 8 | |||

| Bhalukgachhi | FGD | Farmers | 7 | |||

| Shirajgang | Flood | Sirajganj Sadar | Kaliya Horipur | Informal discussion | Farmers | 9 |

| Kamarkhanda | Bhdragat | FGD | Farmers | 10 | ||

| Jamtail | KII | Officials of INAFI & Uddipan | 2 | |||

| Tarash | Naogaon | FGD | Farmers | 9 | ||

| Baruhas | KII | Officials of INAFI & Uddipan | 8 | |||

| Deshigram | FGD | Farmers | 8 | |||

| Noakhali | Cyclone | Suborna Char | Char Amanullah | Informal discussion | Farmers, community leaders, school teachers, shop keepers | 8 |

| Char Bata | FGD | Farmers | 8 | |||

| Char Jabbar | Informal discussion | Farmers, community leaders, school teachers, shop keepers | 12 | |||

| Companiganj | Sirajpur | KII | Sagarika Samaj Unnayan Sangstha | 1 | ||

| Noakhali Sadar | Char Matua | KII | Official of Uddipan | 2 | ||

| Dhaka | In-depth interview | Sadharan Bima Corporation (SBC) | 2 | |||

| Dhaka | In-depth interview | Bangladesh Meteorological Department (BMD) | 2 |

| No. | Dimensions of WIBCI Pilot Project | Descriptions |

|---|---|---|

| 1. | Geographical context |

|

| 2. | Impacts analysis |

|

| 3. | Innovation |

|

| 4. | Key objectives |

|

| 5. | Key performance indicators |

|

| 6. | Location of piloting WIBCI (Districts) |

|

| 7. | Project duration and key dates |

|

| 8. | Addressed risk events |

|

| 9. | Sources of funding |

|

| 10. | Financial framework |

|

| 11. | Stages of implementation |

|

| 12. | Key aspects of regulatory framework |

|

| 13. | Results |

|

| Rajshahi | Sirajganj | Noakhali | ||||

|---|---|---|---|---|---|---|

| Familiarity with WIBCI | Willingness to Buy Insurance (%) | Willingness to Buy Insurance (%) | Willingness to Buy Insurance (%) | |||

| Yes | No | Yes | No | Yes | No | |

| Not familiar at all | 56 | 44 | 81 | 19 | 72 | 28 |

| Not familiar | 52 | 48 | 77 | 23 | 68 | 32 |

| Somewhat familiar | 45 | 55 | 34 | 66 | 25 | 75 |

| Familiar | 31 | 69 | 23 | 77 | 26 | 74 |

| Completely familiar | 27 | 63 | 18 | 82 | 20 | 80 |

| Weather-Index-Based Crop Insurance (WIBCI) | Weather Index-Based Agriculture Insurance | Flood Index-Based Crop Insurance for Haor | |

|---|---|---|---|

| Responsible organization and project duration | Sadharan Bima Corporation (SBC)-ADB (2014–2018) | Green Delta Insurance Company, (2015–Present) | Sadharan Bima Corporation and OXFAM (SBC) (2020–Present) |

| Administrative costs per client per year * | 6–10 | 8–12 | 7–14 |

| Premium and farmers payments (%) | 22–25 | 25–27 | 25–28 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Al-Maruf, A.; Mira, S.A.; Rida, T.N.; Rahman, M.S.; Sarker, P.K.; Jenkins, J.C. Piloting a Weather-Index-Based Crop Insurance System in Bangladesh: Understanding the Challenges of Financial Instruments for Tackling Climate Risks. Sustainability 2021, 13, 8616. https://doi.org/10.3390/su13158616

Al-Maruf A, Mira SA, Rida TN, Rahman MS, Sarker PK, Jenkins JC. Piloting a Weather-Index-Based Crop Insurance System in Bangladesh: Understanding the Challenges of Financial Instruments for Tackling Climate Risks. Sustainability. 2021; 13(15):8616. https://doi.org/10.3390/su13158616

Chicago/Turabian StyleAl-Maruf, Abdullah, Sumyia Akter Mira, Tasnim Nazira Rida, Md Saifur Rahman, Pradip Kumar Sarker, and J. Craig Jenkins. 2021. "Piloting a Weather-Index-Based Crop Insurance System in Bangladesh: Understanding the Challenges of Financial Instruments for Tackling Climate Risks" Sustainability 13, no. 15: 8616. https://doi.org/10.3390/su13158616

APA StyleAl-Maruf, A., Mira, S. A., Rida, T. N., Rahman, M. S., Sarker, P. K., & Jenkins, J. C. (2021). Piloting a Weather-Index-Based Crop Insurance System in Bangladesh: Understanding the Challenges of Financial Instruments for Tackling Climate Risks. Sustainability, 13(15), 8616. https://doi.org/10.3390/su13158616