Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers

Abstract

:1. Introduction

- It provides a blockchain-based crop insurance solution based on smart contracts.

- It also covers the aspects of the application that is developed for the farmers which can be hosted on the cloud environment.

- Deployment of the proposed algorithms for the crop insurance system on the solidity and the analysis of the same.

2. Related Work

3. Significance of Study

- Fraud identification: Both insurance providers and consumers have financial benefits in committing fraud that render identification of fraud important but difficult and expensive.

- Insurance experience providers: People tend to buy several insurances to protect a range of properties that usually come from various insurance firms. Thus, the past of consumer policy is dispersed among various firms that make establishing the policy background time-consuming and costly.

- Delay in identifying the perpetrator: The period required to compensate the consumers for their negligence is attributable to the difficulty in locating the party responsible. The collecting of data mainly helps the insurance agency to send specialists to assess the loss. It is therefore risky for the insurance company and inevitably impacts insurance rates.

- Transparency: Consumers do not necessarily have access to the details collected by the insurance company so that they cannot check the authenticity of the details and, thus, the judgment of the insurance insurer. Therefore there is no certainty that the proof gathered is right which restricts the integrity of the mechanism of liability.

4. Suggested Architecture and Working of System

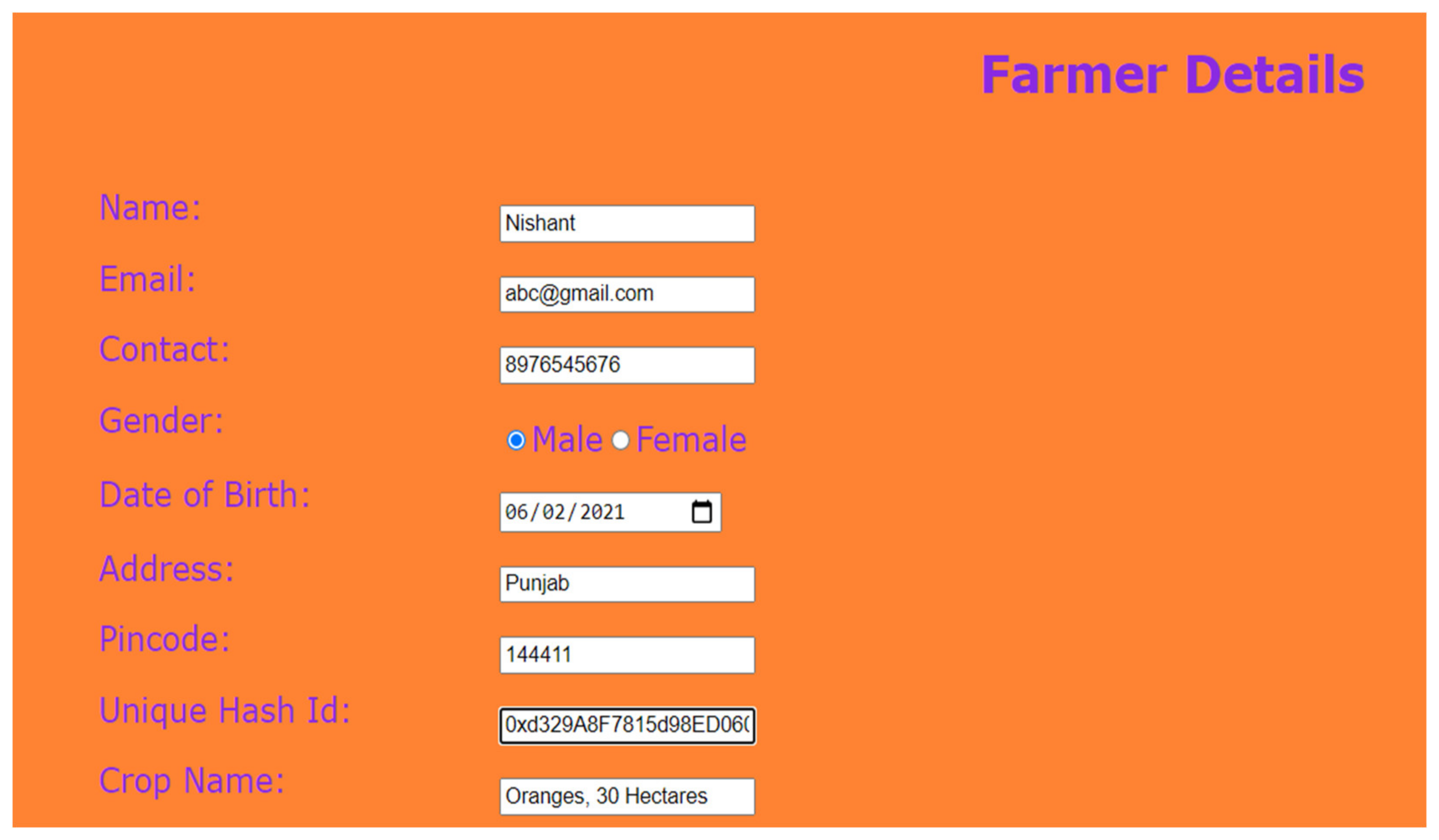

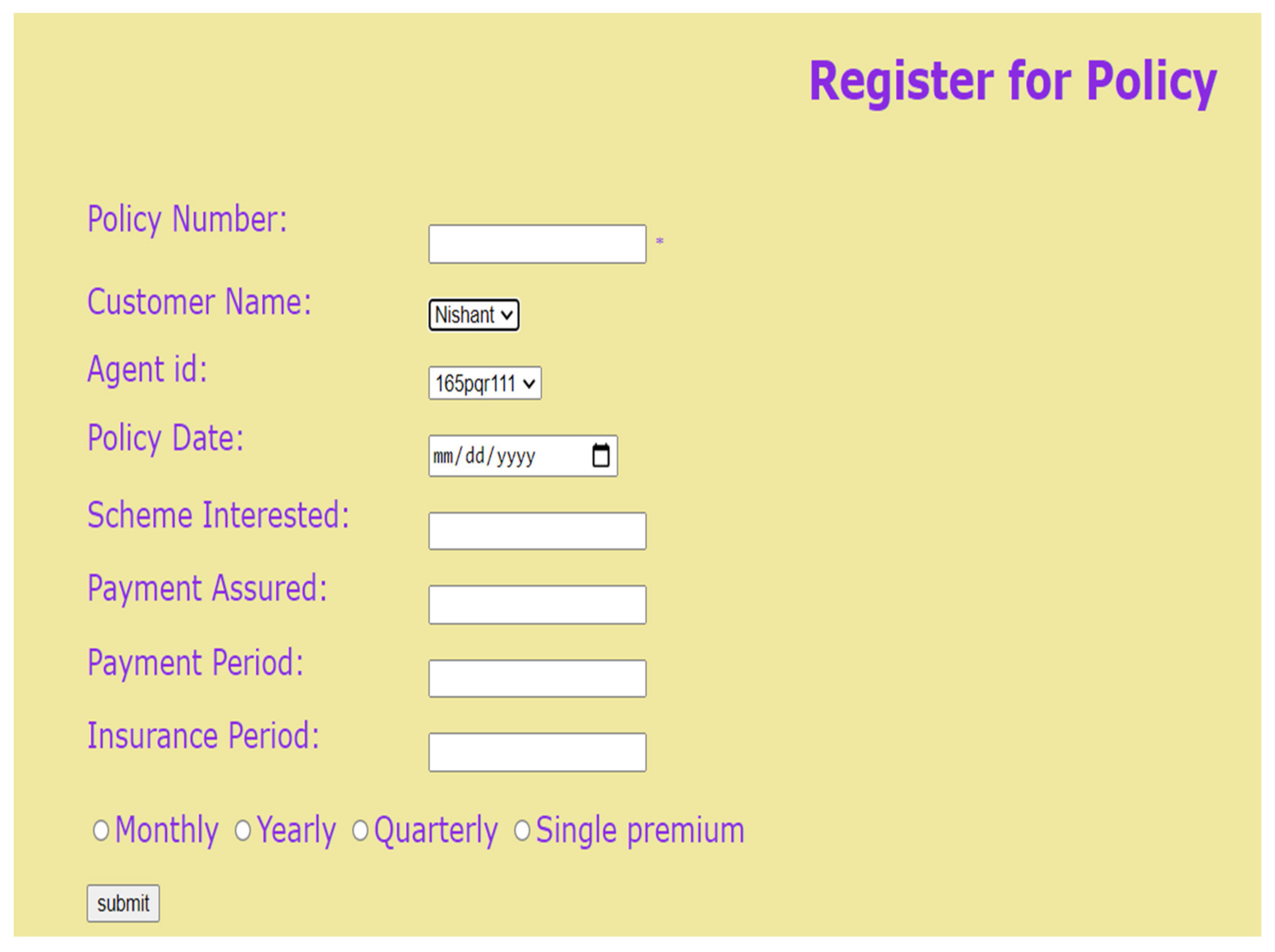

- Farmer—The insurance service is requested by the farmer from the insurers. The farmer should gather his personal data, crop information; land coordinates so that quality services should be available for them. The already insured farmers should make sure that they should upload their insurance policies for better service.

- Smart Contracts—Upon updation of the insurance policy, the important details such as Unique ID (UID) of the policy, beginning date of the policy, expiration date of the policy, insured amount, and the geological coordinates of the land as the vertices of a polygon. The details extracted get verified by the farmers and it should be written on the blockchain as a service that is hosted on a Cloud Platform such as Azure, AWS, Google Cloud etc., as a smart contract with a document of insurance policy. Once the details are updated and smart contract is created, it will consult an expert and if the insurance policy is valid i.e., if it is in between the beginning date and expiration date, then the geo-coordinates are verified whether these coordinates are within the location which is marked as the location of a natural calamity (such as, drought, heavy rainfall) by the insurers (the insurers will return a set of polygon vertices of the locations under a natural calamity). With the help of machine learning, the users can analyze the weather conditions for the land coordinates. It is of basic use in our system as mostly the weather analysis and predictions are provided by the local weather departments.

- Insurance Providers—They will verify the weather conditions from the weather department of the state at the land coordinates where any natural calamity has occurred in a given period of time. Once the verification is done, they determine the amount that has to be paid to the farmer on the basis of several factors including, insurance policy, type of crop, weather conditions and the location of land. Based on these factors, the illustrative evaluation of crop insurance is as follows:

| Algorithm 1 Initialization |

| Input ← Nodes (node1, node2…… nodeN), Insurance Policy (ip) x ← (Contact details, age, name...), insurance agent ID (id) x created, stored in Y (database) if key (k)← id, UserID and User ∈ x then k, x stored ← Y End |

| Algorithm 2 Registration Process |

| Process User Register 1. User structure created//client structure contains details like age, id, gender, contact etc.) 2. D ← structure stored in a database 3. K ← f(uid1, uid2)//uid1, uid2 are insurance agent id’s created by agent key K 4. B ←f′(D)//Client object B created by client object key D 5. Info stored in a database |

| Algorithm 3 Issue of policy |

| 1. Search UID of purchased policy in database 2. If UID belongs to Database 3. return B 4. Else 5. return error 6. If client is registered with agent X with UID y 7. K ← f(UIDy1, UIDy2, UIDy3)//checks if UID really exists with the agent 8. B ← f′(D) 9. Info stored in a database 10. Else 11. return no policy issued |

| Algorithm 4 Claiming of Policy |

| 1. K ← f(UIDy1, UIDy2, UIDy3) 2. Check if B ←f′(D) exists 3. if existence = TRUE 4. do Account open ← B 5. if Account = TRUE then 6. if amount + claim ≤ Premium paid then 7. return refund (UIDy1, UIDy2, UIDy3, balance) 8. end 9. else 10. return refund (UIDy1, UIDy2, UIDy3, balance–Amount) 11. Update account ← B 12. end 13. End |

5. Results, Analysis and Testing

- Does the system resolves the challenges faced by conventional insurance systems?

- Is the system easy to operate and will the insurance providers and farmers will use the system, if improved based upon their suggestions?

- Does the system create a revolution in agricultural and insurance sector?

6. Discussion and Future Scope of the Study

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wikipedia Contributors. Farmers’ Suicides in India. In Wikipedia, The Free Encyclopedia. Available online: https://en.wikipedia.org/w/index.php?title=Farmers%27_suicides_in_India&oldid=1030026013 (accessed on 23 June 2021).

- Blog, R.; Concern, F. Farmer’s Suicides-An Issue of Great Concern. Available online: https://timesofindia.indiatimes.com/readersblog/hail-to-feminism/farmers-suicides-an-issue-of-great-concern-27472/ (accessed on 23 June 2021).

- Crop Insurance Schemes in India: Need, Importance and Benefits to Farmers. Available online: https://krishijagran.com/crop-insurance-schemes-in-india-need-importance-and-benefits-to-farmers/ (accessed on 23 June 2021).

- Scherer, M. Performance and Scalability of Blockchain Networks and Smart Contracts; Diva, Springer Umea University: Umeå, Sweden, 2017. [Google Scholar]

- Rahim, S.R.M.; Mohamad, Z.Z.; Abu Bakar, J.; Mohsin, F.H.; Isa, N.M. Artificial Intelligence, Smart Contract and Islamic Finance. Asian Soc. Sci. 2018, 14, 145. [Google Scholar] [CrossRef]

- Nguyen, T.Q.; Das, A.K.; Tran, L.T. NEO Smart Contract for Drought-Based Insurance. In Proceedings of the 2019 IEEE Canadian Conference of Electrical and Computer Engineering (CCECE), Edmonton, AB, Canada, 5–8 May 2019; pp. 1–4. [Google Scholar]

- Iyer, V.; Shah, K.; Rane, S.; Shankarmani, R. Decentralised Peer-to-Peer Crop Insurance. In Proceedings of the 3rd ACM International Symposium on Blockchain and Secure Critical Infrastructure, Virtual Event, Hong Kong, China, 7–11 June 2021; pp. 3–12. [Google Scholar]

- Kevorchian, C.; Gavrilescu, C.; Hurduzeu, G. A Peer-to-Peer (p2p) Agricultural Insurance Approach Based on Smart Contracts in Blockchain Ethereum. Agric. Econ. Rural Dev. New Ser. 2020, XVII, 29–45. Available online: ftp://www.ipe.ro/RePEc/iag/iag_pdf/AERD2001_29-45.pdf (accessed on 20 July 2021).

- Sharifinejad, M.; Dorri, A.; Rezazadeh, J. BIS-A Blockchain-based Solution for the Insurance Industry in Smart Cities. arXiv 2020, arXiv:2001.05273. [Google Scholar]

- Gera, J.; Palakayala, A.R.; Rejeti, V.K.K.; Anusha, T. Blockchain Technology for Fraudulent Practices in Insurance Claim Process. In Proceedings of the 2020 5th International Conference on Communication and Electronics Systems (ICCES), Coimbatore, India, 10–12 June 2020; pp. 1068–1075. [Google Scholar]

- Khalaf, O.I.; Abdulsahib, G.M. Optimized dynamic storage of data (ODSD) in IoT based on blockchain for wireless sensor networks. Peer-to-Peer Netw. Appl. 2021, 1–16. [Google Scholar] [CrossRef]

- Kumar, A.; Prasad, A.; Murthy, R. Application of Blockchain in Usage Based Insurance. Int. J. Adv. Res. Ideas Innov. Technol. 2019, 5, 1574–1577. [Google Scholar]

- Khalaf, O.I.; Abdulsahib, G.M.; Kasmaei, H.D.; Ogudo, K.A. A New Algorithm on Application of Blockchain Technology in Live Stream Video Transmissions and Telecommunications. Int. J. e-Collab. 2020, 16, 16–32. [Google Scholar] [CrossRef]

- Ogudo, K.A.; Nestor, D.M.J.; Khalaf, O.I.; Kasmaei, H.D. A Device Performance and Data Analytics Concept for Smartphones’ IoT Services and Machine-Type Communication in Cellular Networks. Symmetry 2019, 11, 593. [Google Scholar] [CrossRef] [Green Version]

- Feng, H.; Wang, X.; Duan, Y.; Zhang, J.; Zhang, X. Applying blockchain technology to improve agri-food traceability: A review of development methods, benefits and challenges. J. Clean. Prod. 2020, 260, 121031. [Google Scholar] [CrossRef]

- Khalaf, O.I.; Sokiyna, M.; Alotaibi, Y.; Alsufyani, A.; Alghamdi, S. Web Attack Detection Using the Input Validation Method: DPDA Theory. Comput. Mater. Contin. 2021, 68, 3167–3184. [Google Scholar] [CrossRef]

- Nizamuddin, N.; Abugabah, A. Blockchain for automotive: An insight towards the IPFS blockchain-based auto insurance sector. Int. J. Electr. Comput. Eng. 2021, 11, 2443–2456. [Google Scholar] [CrossRef]

- Paul, S.; Joy, J.I.; Sarker, S.; Shakib, A.-A.-H.; Ahmed, S.; Das, A.K. An Unorthodox Way of Farming without Intermediaries Through Blockchain. In Proceedings of the 2019 International Conference on Sustainable Technologies for Industry 4.0 (STI), Dhaka, Bangladesh, 24–25 December 2019; pp. 1–6. [Google Scholar]

- Amponsah, A.A.; Weyori, B.A.; Adekoya, A.F. Blockchain in Insurance: Exploratory Analysis of Prospects and Threats. Int. J. Adv. Comput. Sci. Appl. 2021, 12. Available online: https://pdfs.semanticscholar.org/1c3f/5f21a72a68bb281292c38e0c59547735285e.pdf (accessed on 20 July 2021).

- Salmon, J.; Myers, G. Blockchain and Associated Legal Issues for Emerging Markets. 2019. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/31202/133877-EMCompass-Note-63-Blockchain-and-Legal-Issues-in-Emerging-Markets.pdf?sequence=1 (accessed on 20 July 2021).

- Ali, D. Blockchain for Insurance and Claims Fraud Detection. Available online: https://d1wqtxts1xzle7.cloudfront.net/64357619/Blockchain%20for%20Insurance%20and%20Claims%20Fraud%20Detection-with-cover-page-v2.pdf?Expires=1628320139&Signature=IKxix4KwRohZERety2ZhEP5RdameoPq~2S9fZaSeLHWqX4kDxjQK6ZOkeyRo13sQGacExk0W1qxrrfp4b-L8U9P5osdG1nGA3AGm9556mZpSznwy0S1Yz~XiMSi9oHZq~D40899Q19-MqQ~IK8fscVGMKXwtbrCvR6kD3RM9M~RDqxjf6t5VHsFo6p2AL8OFevsAPypveUQz5PRUZu8M4gntAOQHzG3Cngju1R1SyWf5T1jjcfVDvwbWWRLuJcoCt0n8Ola2q1z66dDgqDERw~lKrp2QNSQ2aHFRUZHCPHnCiqZQqJZFrHerQnUX1Qr5pt4tx-085ZG2tIIrtIKgdA__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA (accessed on 20 July 2021).

- Kantur, H.; Bamuleseyo, C. How Smart Contracts Can Change the Insurance Industry-Benefits and Challenges of Using Blockchain Technology. Master’s Thesis, Jönköping International Business School, Jönköping, Sweden, 2018. [Google Scholar]

- Aleksieva, V.; Valchanov, H.; Huliyan, A. Application of Smart Contracts based on Ethereum Blockchain for the Purpose of Insurance Services. In Proceedings of the 2019 International Conference on Biomedical Innovations and Applications (BIA), Varna, Bulgaria, 8–9 November 2019; pp. 1–4. [Google Scholar]

- Liu, S.-H.; Liu, X.F. Co-Investment Network of ERC-20 Tokens: Network Structure Versus Market Performance. Front. Phys. 2021, 9, 55. [Google Scholar] [CrossRef]

- Insurance Disruption Using Blockchain Tech l CB Insights. Available online: https://www.cbinsights.com/research/blockchain-insurance-disruption/ (accessed on 25 June 2021).

- Sachinjegaonkar/Crop Insurance Solution. Available online: https://github.com/sachinjegaonkar/CropInsuranceSolution (accessed on 24 May 2021).

- Raikwar, M.; Mazumdar, S.; Ruj, S.; Gupta, S.S.; Chattopadhyay, A.; Lam, K.-Y. A Blockchain Framework for Insurance Processes. In Proceedings of the 2018 9th IFIP International Conference on New Technologies, Mobility and Security (NTMS), Paris, France, 26–28 February 2018; pp. 1–4. [Google Scholar]

- Gatteschi, V.; Lamberti, F.; DeMartini, C.; Pranteda, C.; Santamaría, V. Blockchain and Smart Contracts for Insurance: Is the Technology Mature Enough? Futur. Internet 2018, 10, 20. [Google Scholar] [CrossRef] [Green Version]

- Oham, C.; Jurdak, R.; Kanhere, S.S.; Dorri, A.; Jha, S. B-FICA: BlockChain based Framework for Auto-Insurance Claim and Adjudication. In Proceedings of the 2018 IEEE International Conference on Internet of Things (iThings) and IEEE Green Computing and Communications (GreenCom) and IEEE Cyber, Physical and Social Computing (CPSCom) and IEEE Smart Data (SmartData), Halifax, NS, Canada, 30 July–3 August 2018; pp. 1171–1180. [Google Scholar]

- Mazzoccoli, A.; Naldi, M. The Expected Utility Insurance Premium Principle with Fourth-Order Statistics: Does It Make a Difference? Algorithms 2020, 13, 116. [Google Scholar] [CrossRef]

- Chark, R.; Mak, V.; Muthukrishnan, A.V. The premium as informational cue in insurance decision making. Theory Decis. 2020, 88, 369–404. [Google Scholar] [CrossRef]

- Kaas, R.; Goovaerts, M.; Dhaene, J.; Denuit, M. Utility Theory and Insurance; Springer Science and Business Media LLC: Berlin, Germany, 2008; pp. 1–16. [Google Scholar]

- Subahi, A.F.; Alotaibi, Y.; Khalaf, O.I.; Ajesh, F. Packet Drop Battling Mechanism for Energy Aware Detection in Wireless Networks. Comput. Mater. Contin. 2021, 66, 2077–2086. [Google Scholar] [CrossRef]

- Alotaibi, Y. Automated Business Process Modelling for Analyzing Sustainable System Requirements Engineering. In Proceedings of the 2020 6th International Conference on Information Management (ICIM), London, UK, 27–29 March 2020; pp. 157–161. [Google Scholar]

- Rajasoundaran, S.; Prabu, A.; Subrahmanyam, J.; Rajendran, R.; Kumar, G.S.; Kiran, S.; Khalaf, O.I. Secure Watchdog Selection Using Intelligent Key Management in Wireless Sensor Networks. Mater. Today Proc. 2021, in press. Available online: https://www.sciencedirect.com/science/article/pii/S221478532040745X?via%3Dihub (accessed on 20 July 2021). [CrossRef]

- Suryanarayana, G.; Chandran, K.; Khalaf, O.I.; Alotaibi, Y.; Alsufyani, A.; Alghamdi, S.A. Accurate Magnetic Resonance Image Super-Resolution Using Deep Networks and Gaussian Filtering in the Stationary Wavelet Domain. IEEE Access 2021, 9, 71406–71417. [Google Scholar] [CrossRef]

- Tavera, C.A.; Ortiz, J.H.; Khalaf, O.I.; Saavedra, D.F.; Aldhyani, T.H. Wearable Wireless Body Area Networks for Medical Applications. Comput. Math. Methods Med. 2021, 9. Available online: https://www.hindawi.com/journals/cmmm/2021/5574376/ (accessed on 20 July 2021).

- Sengan, S.; Rao, G.R.; Khalaf, O.I.; Babu, M.R. Markov mathematical analysis for comprehensive real-time data-driven in healthcare. Math. Eng. Sci. Aerosp. 2021, 12, 77–94. [Google Scholar]

- Li, G.; Liu, F.; Sharma, A.; Khalaf, O.I.; Alotaibi, Y.; Alsufyani, A.; Alghamdi, S. Research on the Natural Language Recognition Method Based on Cluster Analysis Using Neural Network. Math. Probl. Eng. 2021, 2021, 1–13. [Google Scholar] [CrossRef]

- Alotaibi, Y. A New Database Intrusion Detection Approach Based on Hybrid Meta-heuristics. Comput. Mater. Contin. 2021, 66, 1879–1895. [Google Scholar] [CrossRef]

- Blockchain Climate Risk Crop Insurance-The Global Innovation Lab for Climate Finance. Available online: https://www.climatefinancelab.org/project/climate-risk-crop-insurance/ (accessed on 29 June 2021).

| Technology Used in System | Purpose of Technology |

|---|---|

| HTML/JavaScript | Used for developing the web app |

| Truffle | Development environment for ethereum smart contracts. Apart from development environment, it is also a testing framework for Dapps i.e., Decentralized Applications |

| Metamask | It is a software that act as a cryptocurrency wallet for interacting with the Ethereum blockchain |

| Machine Learning | Machine Learning has a basic use in the application. It analysis and predicts the weather, wind speed, sunlight, etc., from the weather data providers which is helpful for crop cultivation (Supervised Machine Learning) |

| Ethereum Blockchain (Ganache) | Personal Testing Platform for Ethereum smart contrac |

| Network Name | Ganache |

|---|---|

| Network Id | 5777 |

| Block Gas Limit | 6721975 (0x6691b7) |

| Transaction Hash Value | 0xddb977abe698419a5aa8bdd61826801e4075c908e2a837c0ecf55d9337dd3c44 |

| Contract Address | 0x9e68F06c220781d770984f7D5e2a96158f1c5231 |

| Mined at | Block 2 |

| Block Timestamp | 1595630390 |

| User Account | 0xd329A8F7815d98ED06083C3e02e3924c69FCf76a |

| Balance Fee | 99.99 |

| Gas Price | 20 gwei |

| Instances | vCPU | Memory |

|---|---|---|

| f1-micro | 1 | 614 MB |

| g1-small | 1 | 1.7 GB |

| n1-standard-2 | 4 | 7.5 GB |

| n1-standard-4 | 4 | 15 GB |

| n1-standard-8 | 8 | 30 GB |

| n1-highmem-2 | 2 | 13 GB |

| n1-highmem-8 | 8 | 52 GB |

| n1-highmem-16 | 16 | 104 GB |

| n1-highmem-32 | 32 | 208 GB |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jha, N.; Prashar, D.; Khalaf, O.I.; Alotaibi, Y.; Alsufyani, A.; Alghamdi, S. Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers. Sustainability 2021, 13, 8921. https://doi.org/10.3390/su13168921

Jha N, Prashar D, Khalaf OI, Alotaibi Y, Alsufyani A, Alghamdi S. Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers. Sustainability. 2021; 13(16):8921. https://doi.org/10.3390/su13168921

Chicago/Turabian StyleJha, Nishant, Deepak Prashar, Osamah Ibrahim Khalaf, Youseef Alotaibi, Abdulmajeed Alsufyani, and Saleh Alghamdi. 2021. "Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers" Sustainability 13, no. 16: 8921. https://doi.org/10.3390/su13168921

APA StyleJha, N., Prashar, D., Khalaf, O. I., Alotaibi, Y., Alsufyani, A., & Alghamdi, S. (2021). Blockchain Based Crop Insurance: A Decentralized Insurance System for Modernization of Indian Farmers. Sustainability, 13(16), 8921. https://doi.org/10.3390/su13168921