1. Introduction

Ship exhaust emission is at the root of coastal air pollution [

1]. Over 70% of shipping emissions can be detected up to 400 km inshore [

2]. In the past, particulate matter 2.5 emissions from ships, which cause cardiovascular cancer and lung cancer, have resulted in as many as 64,000 annual deaths [

3]. In this context, keeping in mind public health and environmental protection concerns, the International Maritime Organization (IMO) has strengthened ship exhaust gas regulations [

4].

The issue of air pollution by ships was first discussed in 1973, when the International Convention for the Prevention of Pollution from Ships (MARPOL 73/78) was adopted [

5]. In 1997, the MARPOL Diplomatic Conference, which investigated ships’ carbon dioxide emissions as part of preparing an inventory of such emissions at a global level, adopted Resolution 8 to explore the issue of air pollution caused by ships in the context of climate change. It is important to note that the international community showed an understanding of the relevance of ship exhaust emissions to climate change. MARPOL Annex VI was implemented as an environmental regulation in 2005. With effect from January 2020, the IMO Marine Environment Protection Committee has reduced the accpetable sulfur content in ship fuel to 0.5% m/m [

6,

7,

8].

The IMO has also presented policy goals regulating greenhouse gas emissions. Based on the 2008 figures, the goal is to reduce emissions by half by 2050 and to zero by 2100 [

9]. Several governments are implementing these policies. The European Union (EU) has made carbon neutrality by 2050 as a top priority, and South Korea has declared that the country will achieve complete carbon neutrality by 2050.

In the past, numerous industry policies prioritizing the environment have been implemented. However, at present, the dichotomy between industrial and environmental benefits is not acceptable. The paradigm shift in the international community, which is known as sustainability, is leading to changes in the behavior of industries. For instance, Totalenergies is looking for business opportunities by linking LNG as a ship fuel to achieve the IMO’s decarbonisation target [

10], and DNV-GL, which accounts for 43% of LNG-fuelled ships [

11], is very optimistic about the LNG demand forecast compared to other forecasting agencies [

9,

12,

13,

14,

15,

16,

17,

18]. In addition, it is believed that the problem of methane slip caused by the use of LNG ship fuels will soon be resolved [

19].

There are three kinds of measures for international shipping companies: the use of LSFO, scrubber installation, and the use of LNG. In comparison to diesel, LNG can reduce sulfur emissions by 99–100%, nitrogen oxides by 80–95%, and particulate matter by 90–99% as well as limiting carbon dioxide emissions to less than 20% [

6,

20,

21,

22,

23,

24,

25,

26]. For the other two options, LSFO’s production capacity is insufficient. With LSFO there is still the need for treatment of nitrate oxides and greenhouse gases, and it is 30% more expensive than heavy fuel oil [

5,

6]. Whereas, scrubbers are expensive to install and difficult to apply to small vessels [

6]. Comparatively, therefore, LNG is the most beneficial [

6,

8,

27].

For accurate LNG bunkering market growth prediction, it is essential to consider the energy content of each marine fuel [

28]. The energy content of heavy fuel oil, marine gas oil and LNG is 40 MJ/kg, 43 MJ/kg, and 48 MJ/kg, respectively [

29]. LNG’s energy efficiency is increasing its appeal compared to traditional petroleum fuels [

27]. Previous research has shown a rapid decline of heavy fuel oil in marine fuel mix [

9,

17]. In contrast, LNG trade, which accounted for 28.6% of the natural gas trade in 2000, increased to 45.7% in 2018 [

30]. For the reasons mentioned above, it is quite likely that the LNG bunkering industry will grow in the near future.

Peng et al. (2021) conducted a systematic review of existing LNG bunkering studies [

6]. These can be classified into five groups: (i) LNG bunkering network planning, (ii) general layout of LNG bunkering stations, (iii) scheme design of LNG bunkering stations, (iv) risk management of LNG bunkering stations, and (v) strategy formulation for LNG promotion in the shipping industry. As demonstrated by these categories, although there has been extensive research on LNG bunkering, quantitative analyses of LNG bunkering demand prediction utilizing detailed methodologies are limited.

LNG bunkering demand estimation is essential for LNG bunkering network planning, scheme design of LNG bunkering stations, and developing industry revitalization strategies [

6]. What is important in global bunkering network planning is detailed country-wise demand forecasts [

6]. Thus, an objective of this study was to investigate global LNG bunkering demand prediction and forecast LNG bunkering demand by country and region. Previous studies on demand forecasts regarding LNG bunkering have been mainly conducted by international organizations and business groups but no forecasting methodology is presented.

In this study, we consider various methodologies, such as meta-regression, analogy, and artificial intelligence, to predict LNG bunkering demand. This investigation takes a top-down approach and makes two contributions as compared to existing studies. First, it reduces the uncertainty present in existing research results. We analyze the relationship between year and LNG demand through the regression model utilizing previous findings. Meta-regression is used to integrate different predictions by agencies. Second, it improves the accuracy of prediction by selecting, out of the five forecasting methods that have been actively used in the field in recent years, the one that is best suited to the study condition in order to secure the scientific soundness.

This study offers LNG demand information that can facilitate the implementation of environmental policies by governments and investment decision making by industries. LNG demand forecasting is needed to verify the feasibility of the sub-policy measures of international organizations and governments to address climate change. It is also important for LNG infrastructure investment decisions such as the selection of LNG-powered ships and building facilities of LNG bunkering terminals.

The remaining part of the paper proceeds as follows.

Section 2 presents an overview of the relevant literature.

Section 3 presents methodologies for estimating LNG bunkering demand.

Section 4 present the LNG bunkering demand outlook.

Section 5 concludes this study and offers policy implications.

4. Results

4.1. Global LNG Bunkering Demand Forecast

Table 4 shows the statistical results of the global LNG bunkering demand forecast. The global LNG bunkering demand forecast model (Equation (1)) has the coefficient of determination of 0.63. The constant was not statistically significant. The coefficient of the independent variable

was significantly estimated at the 1% level.

We utilized the regression equation derived from the meta-regression analysis to predict demand.

Figure 2 presents the results of the three scenarios. According to the Scenario 1, the most likely, global demand for LNG bunkering is expected to reach 6.9 million tons in 2021, 16.6 million tons in 2025, 28.8 million tons in 2030, 41.0 million tons in 2035, and 53.2 million tons in 2040. Scenario 2, the industry friendly scenario, predicted demand to reach 8.2 million tons in 2021, 20.6 million tons in 2025, 36.0 million tons in 2030, 51.5 million tons in 2035, and 66.9 million tons in 2040. Scenario 3, the environmentally friendly scenario, predicted demand to reach to 5.6 million tons in 2021, 12.7 million tons in 2025, 21.6 million tons in 2030, 30.5 million tons in 2035, and 39.4 million tons in 2040.

4.2. LNG Bunkering Demand Estimation by Country and Region

We analyzed five forecasting models. Forecasting error rate is measured as the out-of-sample performance with one-step-ahead forecast. As measure of forecasting accuracy, the mean absolute percentage error (MAPE) are used widely in the following manner:

where

and

are actual data and forecasts for

L periods.

The MAPE results obtained from the error rate of each prediction model are shown in

Table 5. The MAPE is the indicator to assess the effectiveness of the model [

59]. The smaller the values of metrics, the better the forecasting performance of the model [

59]. The deep learning model had the highest goodness of fit and was selected because of its reliability. We utilized the RapidMiner 9.9 statistical package for data analysis.

The result of deep learning analysis is shown in

Figure 3. The horizontal axis is the actual value and the vertical axis is the prediction. The root mean square error value was 5482.4316. In

Figure 3, the red dotted line indicates that the actual and predicted values were completely coincident. The results of the estimates were concentrated around the red dotted line; hence, the actual and predicted values are very similar.

Table 6 provides the forecast of oil bunkering by country and region from 2015 to 2030 using deep learning and data from 2000 to 2014 (

Table 2). The share of oil bunkering from 2031 to 2040 was assumed to remain constant from 2030, because the data for cargo volume processing performance is available for forecasting until 2030 (

Table 3).

In the EU, oil bunkering is expected to increase from 43.0 to 46.0 million tons. In Singapore, it is anticipated to rise from 38.2 to 38.9 million tons. In the rest of Asia, it is expected to grow from 29.5 to 49.7 million tons. China’s outlook is high: the predicted growth is from 20.9 to 42.5 million tons. In Hong Kong, the forecast is from 12.5 to 12.7 million tons. In the Americas, there is an expected increase from 36.6 to 39.0 million tons. In the Middle East, the anticipated growth is from 31.0 to 32.5 million tons. In Africa, the predicted increase is from 18.0 to 21.0 million tons. In South Korea, the expected increase is from 13.7 to 15.9 million tons. In Japan, the expected rise is from 6.8 to 9.0 million tons.

4.3. LNG Bunkering Demand Forecast by Country and Region Based on the Scenarios

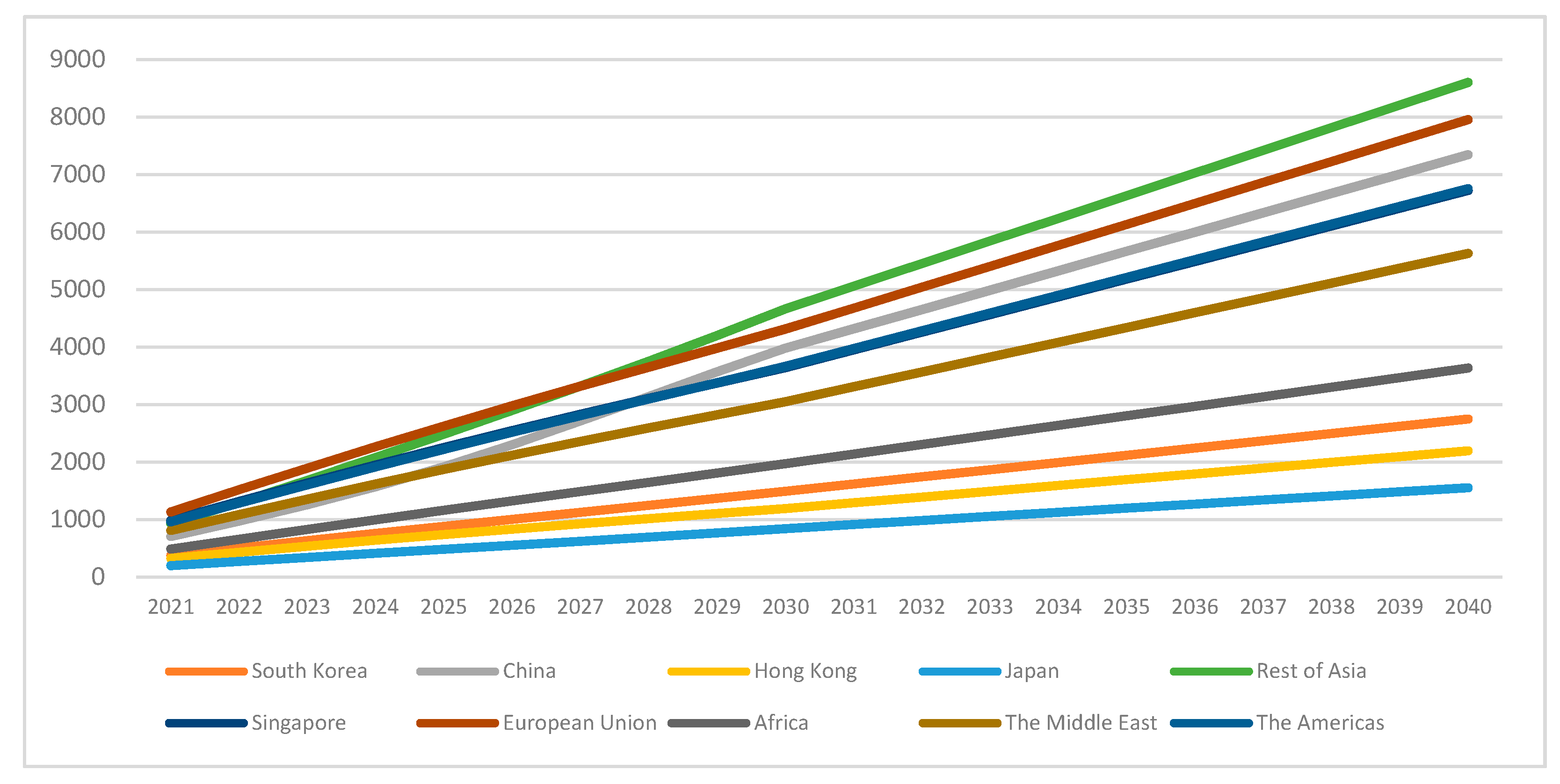

LNG bunkering demand by country and region was estimated using the results of the global LNG bunkering demand forecast and the LNG bunkering ratios by country and region. First, the results of Scenario 1 (the most likely) for the 2021–2040 period are as shown in

Figure 4. Demand in the EU increased 604% from 1.1 to 8.0 million tons. Demand in Singapore grew 585% from 1.0 to 6.7 million tons. In the Americas, demand grew 604% from 1.0 to 6.8 million tons. In the rest of Asia, demand grew 827% from 0.9 to 8.6 million tons, exceeding the demand in the EU in 2027. In the Middle East, demand rose 595% from 0.8 million tons to 5.6 million tons. In China, demand showed an increase of 941% from 0.7 million tons to 7.3 million tons, surpassing the Middle East in 2025 and Singapore in 2028. Demand in South Korea increased 635% from 0.4 to 2.7 million tons. In Japan, demand rose 684% from 0.2 to 1.6 million tons.

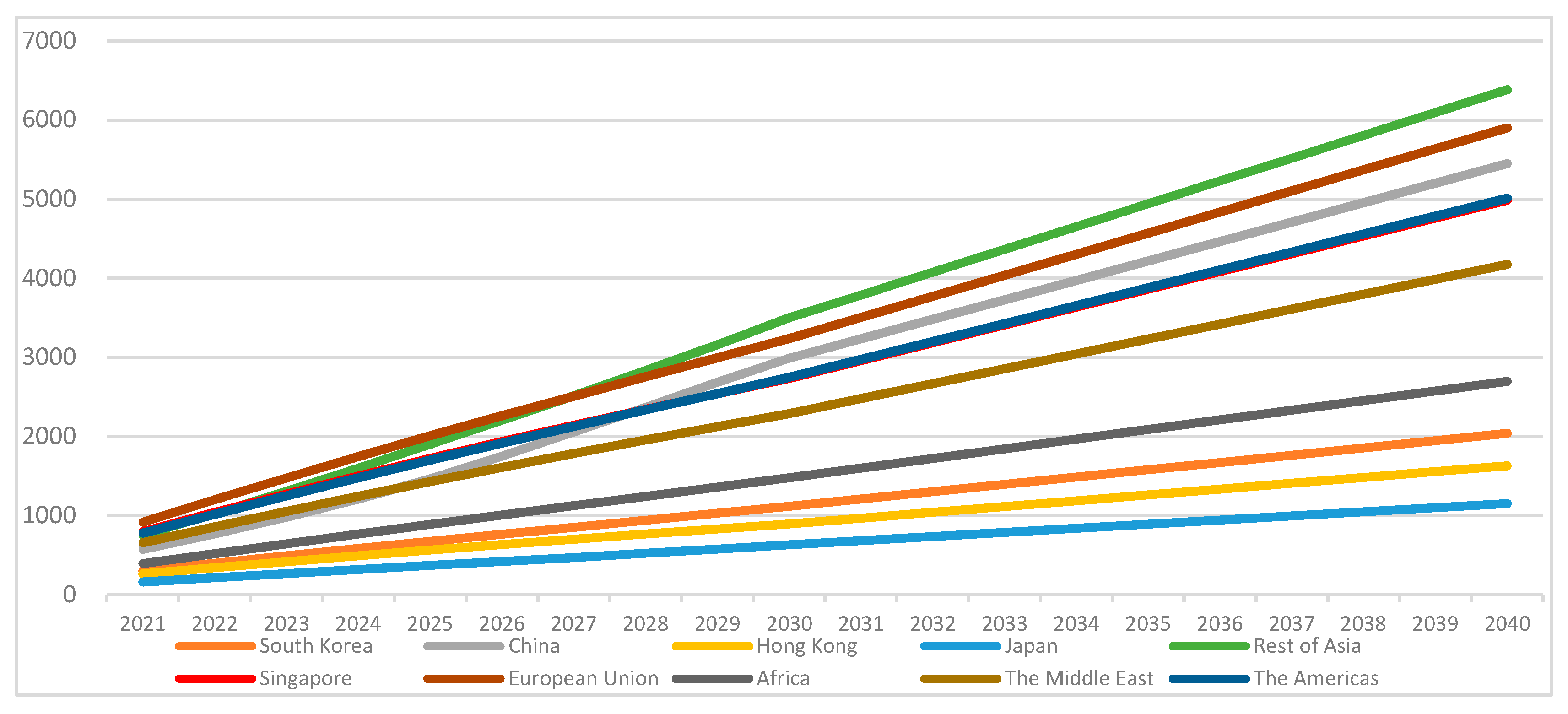

Second, the results of Scenario 2 (the industry friendly scenario) for the 2021–2040 period are as shown in

Figure 5. In the EU, demand increased 644% from 1.3 to 10.0 million tons. In Singapore, demand rose 624% from 1.2 to 8.5 million tons. Demand in the Americas grew 645% from 1.1 to 8.5 million tons. In the rest of Asia, demand grew 880% from 1.1 to 10.8 million tons, exceeding demand in the EU in 2027. In the Middle East, demand rose 635% from 1.0 million tons to 7.1 million tons. In China, demand increased 1002% from 0.8 to 9.2 million tons, surpassing the Middle East in 2025 and Singapore in 2028. In South Korea, demand increased 678% from 0.4 to 3.5 million tons. Demand in Japan rose 730% from 0.2 to 2.0 million tons.

Last, the results of Scenario 3 (the environmentally friendly scenario) for the 2021–2040 period are as follows (see

Figure 6). In the EU, LNG bunkering demand increased 544% from 0.9 to 5.9 million tons. Singapore experienced a 527% increase from 0.8 to 5.0 million tons. The Americas experienced a 544% increase from 0.8 to 5.0 million tons. In the rest of Asia, demand grew 748% from 0.8 to 6.4 million tons. In 2027, the LNG bunkering demand in the rest of Asia was found to exceed of the EU. The Middle East’s demand rose 536% from 0.7 to 4.2 million tons. China’s demand grew 853% from 0.6 to 5.4 million tons, surpassing that of the Middle East in 2025 and Singapore in 2028. Demand in South Korea experienced a 573% increase from 0.3 to 2.0 million tons; that in Japan showed an increase of 618% from 0.2 to 1.2 million tons.

4.4. Comparison with Previous Findings

The results of this study were compared with the relevant literature. As depicted in

Table 7, IHS Markit and the IEA recently released two forecasting results. Both organizations’ forecasts are increasing in demand for LNG bunkering from 2025 to 2040. The forecasting demand of IHS (2017) increased from 16,500 thousand tons to 70,000 thousand tons, and expected result of IHS (2020) showed a growth from 19,300 thousand tons to 65,700 thousand tons. LNG bunkering demand of IEA (2017) rose from 23,900 thousand tons to 41,300 thousand tons, and prediction result of IEA (2019) grew from 7800 thousand tons to 37,000 thousand tons.

Table 7 shows the Global LNG bunkering demand forecast, comparison with previous studies.

However, the latest forecast is lower than the previous one. The reason seems to be due to each country’s official reduction pledges to Paris Climate Change Accord, expansion of energy transition policies, and the development of energy technology [

60].

First, we compared our results with the IHS forecast. Our estimates for 2025 and 2030 were consistent with those of the IHS (2017), but the present result for 2035 and 2040 was lower than the IHS’s prediction (2017, 2020).

Second, we compared our results from scenario 1 (most likely) with those of the IEA (2017). While the numbers for 2025 and 2030 predicted lower demand than the IEA (2017), our forecasts for 2035 and 2040 were higher than those of the IEA (2017). We showed higher demand than the IEA (2019) forecast. This study also presented higher demand than the MOF in South Korea’s forecast. Overall, the present estimates fall in the middle of those of existing studies.

As mentioned in the literature review, the predicted results appear differently according to the assumptions, methodology, data, and human skills in question. Predictions assume that past causal relationships will continue in the future. In general, prediction has intrinsic properties not only the actual result and the predicted value are different but also prediction accuracy decreases as the time passes. Therefore, repeatedly performing predictions are essential for reducing errors. It is for this reason that international organizations perform forecasts several times.

5. Discussion

In 2020, the IMO strengthened regulations pertaining to ship emissions to protect public health and the environment. Governments are also strengthening their policies to cope with climate change. Currently, there is great emphasis on sustainability among all stakeholders. Therefore, social awareness to LNG-powered ships and LNG bunkering is increasing. Compared to other alternatives, LNG fuel can help avoid air pollution such as that caused by sulfur oxide, nitrogen oxides, and fine dust. Additionally, it has the benefits of carbon reduction and low costs. Despite these benefits, the international community no longer considers it a solution to address climate change [

61,

62]. Nevertheless, LNG bunkering has become the industry’s most realistic alternative. The aim of the present study was to predict LNG bunkering demand globally and by individual country and/or region.

This paper predicted LNG bunkering demand using a top-down approach. First, global LNG bunkering demand was estimated through meta-regression analysis. Second, LNG bunkering demand by country and region was estimated. The analogy method, which reflected the oil bunkering ratio of each country as the LNG bunkering ratio, was applied. The oil bunkering demand forecast by country and region used existing data to predict demand from 2015 to 2040.

This study has identified that demand for LNG bunkering is expected to grow rapidly. This finding broadly supports other studies in the LNG bunkering forecast field [

6,

8,

27]. Regarding global LNG bunkering demand, the results predicted an increase from 6.9 million tons in 2021 to 53.2 million tons by 2040. The results of each country/region’s forecasts were interesting. One unanticipated finding was that the LNG bunkering demand in the rest of Asia countries will overtake that of the EU in 2027. This is a significant finding when considering the fact that, at present, the EU is the hotspot of LNG bunkering infrastructure [

6]. It seems possible that this result is due to the steady economic growth of Southeast Asian countries. The governments and industry, which want to secure industrial leadership, need to consider the growth of Southeast Asian countries. The development of Southeast Asian economies and their effect on the LNG bunkering industry may be a fruitful area for further research. China’s LNG bunkering growth, even without Hong Kong, will overtake Singapore in 2028. In the Asian region, markets will be formed in the order of China, Singapore, South Korea and Japan. Liquified natural gas bunkering demand in Asia will surpass the demand outside of Asia; however, the EU will remain a traditional power in the future. Market growth in the Middle East and Africa will be steady.

The forecast for LNG bunkering demand is largely influenced by policy implementations and economic conditions [

14]. Demand for LNG fuel depends on the intensity of policy implementations by the IMO and governments in response to climate change. The economic conditions include the LNG ships chosen by shipping companies, the adoption of LNG bunkering infrastructure, oil prices, the size of new ships, and the changes in the employment of the ships [

5,

6,

12,

63]. LNG Demand forecasting results of the IEA (2019) was lower than those of the IEA (2017). Although there was no clear explanation of the prediction gap, the IEA (2019) mentioned some reasons for the uncertainty of LNG vessel growth and the fact that methane slip makes little difference between LNG and marine diesel with regards to greenhouse gas benefits. Therefore, it is evident that LNG demand forecasting is sensitive to various conditions. Overall, if many conglomerates choose LNG-powered ships, LNG will play a major role as a ship fuel over the next 20 years [

14].

Two limitations of this study deserve mentioning. First, as the LNG bunkering market is in an early stage, there are no historical data for analysis. To counter this problem, we used the analogy method, however it is difficult to say that demand for oil bunkering and LNG bunkering behave in the same way. Second, it is important to consider other variables. International organizations’ and governments’ willingness to enforce environmental policies will be a major variable. At the same time, the willingness of business groups to follow these policies is also important. In addition, the results of this study may change depending on LNG supply, demand, and price.

Despite these limitations, this study can be used as an important data for the implementation of environmental policies by international organizations and governments. It also suggests strategic moves for the LNG bunkering industry. Demand forecasting is essential for investment to vitalize the LNG bunkering industry. For example, predictions are vital for governments to properly establish LNG bunkering port networks to facilitate the smooth operation of LNG-powered ships. In addition, this study establishes a quantitative framework for LNG bunkering demand predictions, which has not been presented in previous research. The results of this study will reduce the inherent uncertainty of the future LNG bunkering market and improve its forecasting power.