A Systematic Literature Review on Pricing Strategies in the Sharing Economy

Abstract

:1. Introduction

2. Background

3. Methodology

4. Findings

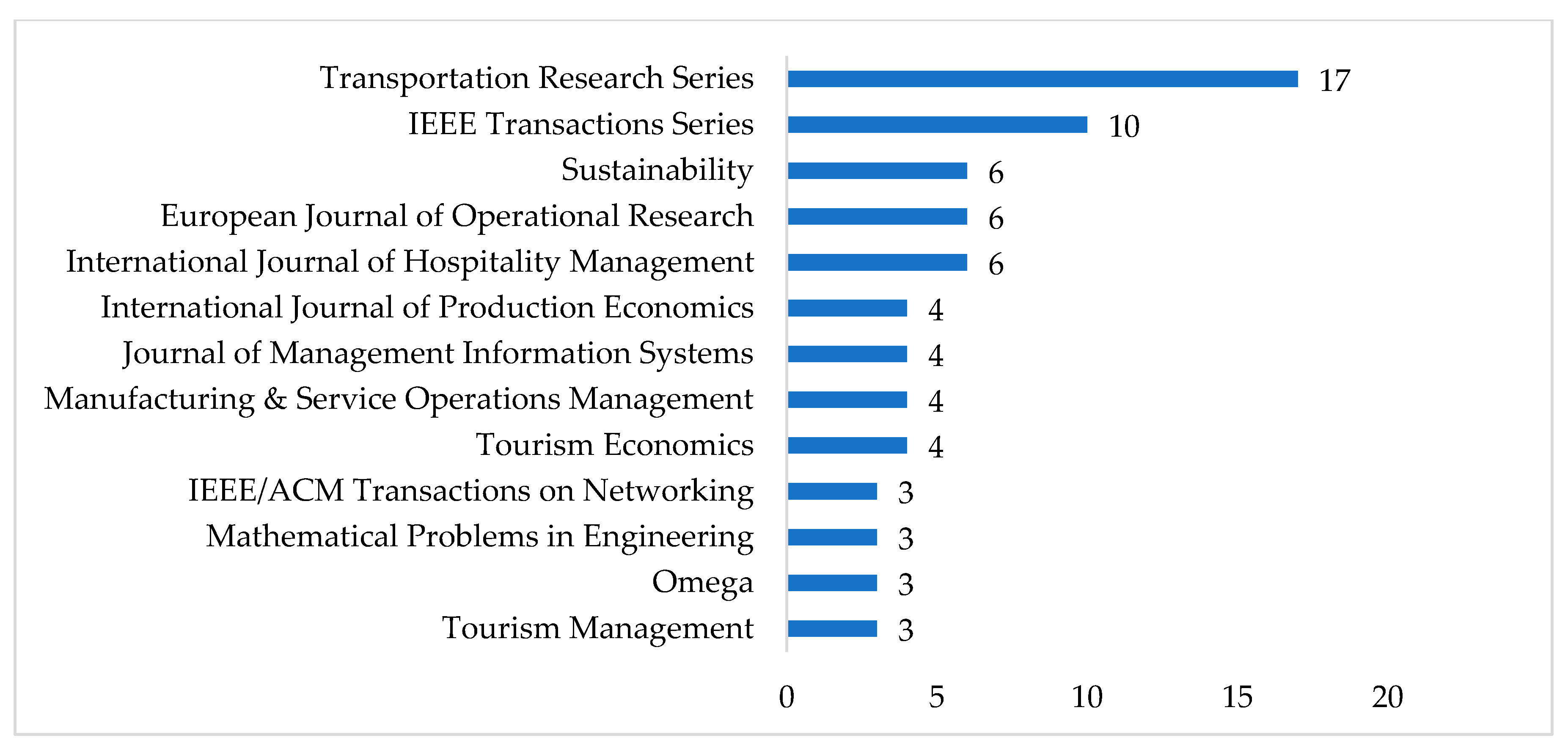

4.1. General Characteristics of Existing Research

4.2. Content Analysis

4.2.1. Manufacturer Pricing

4.2.2. Firm Pricing

4.2.3. Provider Pricing

4.2.4. Intermediary Pricing

4.2.5. Requester Pricing

5. Discussions

5.1. Research Gaps

5.1.1. Manufacturer Pricing

5.1.2. Firm Pricing

5.1.3. Provider Pricing

5.1.4. Intermediary Pricing

5.1.5. Requester Pricing

5.2. Research Extension

5.2.1. Scenario Extension

5.2.2. Under COVID-19

5.3. Limitations

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Theme | Source |

|---|---|

| Framework and Scenario Distribution | [3,8,23,183,184,185,186,187,188,189,190] |

| Definition and Conceptualization | [14,24,191,192,193] |

| Business Models | [21,194,195,196] |

| Sharing Practices | [197,198] |

| Tourism and Hospitality | [8,199,200] |

| Peer-to-Peer(P2P) Accommodation | [9,10,11,26,182,201,202,203,204,205] |

| Airbnb | [11,184] |

| Home Sharing | [182,205] |

| Computing | [7] |

| Digital Platforms | [206] |

| Ride-Sharing and Ride-Sourcing | [12,22,207,208,209,210] |

| Matching | [208] |

| Collaborative Fashion Consumption | [25,211] |

| Motivation | [13,212,213] |

| Trust | [13,213] |

| Impacts and Externalities | [200,207,211,214] |

| Sustainability | [193,196,209,214] |

| Citation Analysis | [215,216,217] |

| Category | Variable | Effect | Reference | Count | Total | |

|---|---|---|---|---|---|---|

| Listing Attribute | Room Type | House | - | [88] | 1 | 1 |

| Number of Bedrooms | + | [88,89,91,94,96,97,99,101,106,110,111,112,114,117,121,123] | 16 | 16 | ||

| Number of Beds | - | [90] | 1 | 3 | ||

| + | [94,103] | 2 | ||||

| Number of Bathroom | + | [88,89,90,91,94,99,101,106,110,111,112,114,120,123] | 14 | 14 | ||

| Amenity Index | + | [120,123] | 2 | 2 | ||

| Hot Tub | + | [94] | 1 | 1 | ||

| Lock on Bedroom Door | - | [90] | 1 | 1 | ||

| Free Parking | + | [88,89,94,99,114] | 5 | 6 | ||

| - | [90] | 1 | ||||

| Paid Parking | - | [90] | 1 | 1 | ||

| Pool | + | [94,99] | 2 | 2 | ||

| Gym | + | [99] | 1 | 1 | ||

| Real Bed | + | [88,114] | 2 | 2 | ||

| WIFI | + | [88] | 2 | 2 | ||

| Number of Accommodation Photos | + | [96,99,111] | 3 | 3 | ||

| Perceived Value of Apartment Photos | + | [97] | 1 | 1 | ||

| Accommodating Capacity | + | [88,89,90,91,99,101,110,111,114,117,120,123] | 12 | 12 | ||

| Accommodation Type | Entire Home | + | [88,89,96,103,111,114,120,121] | 8 | 18 | |

| Private Room | + | [88,89,96,114] | 4 | |||

| - | [91,99,110,123] | 4 | ||||

| Shared Room | - | [99,101] | 2 | |||

| Breakfast | + | [88,89] | 2 | 3 | ||

| - | [114] | 1 | ||||

| Kids and Family Friendly | + | [89,90] | 2 | 2 | ||

| Doorman | + | [89] | 1 | 1 | ||

| Elevator | + | [90,91,94] | 3 | 3 | ||

| Indoor Fireplace | + | [90] | 1 | 1 | ||

| Cable TV | + | [90] | 1 | 1 | ||

| Suitable for Events | + | [90] | 1 | 1 | ||

| Carbon Monoxide Detector | + | [90] | 1 | 1 | ||

| First Aid Kit | + | [90] | 1 | 1 | ||

| Host Attribute | Number of Listings | + | [89] | 3 | 4 | |

| - | [94,110,114] | 1 | ||||

| Verification | + | [88,114] | 2 | 2 | ||

| Profile Picture | - | [114] | 1 | 1 | ||

| Perceived Value of Profile Picture | Trustworthy | + | [88,96,97] | 3 | 7 | |

| - | [121] | 1 | ||||

| Attractive | + | [88,121] | 2 | |||

| Smile Intensity | + | [121] | 1 | |||

| Response Time | - | [91] | 1 | 1 | ||

| Response Rate | + | [110,111] | 2 | 2 | ||

| Race | Black | - | [121] | 1 | 1 | |

| Superhost Badge | + | [88,89,94,96,99,101,110,111,114,120,123] | 11 | 11 | ||

| Professional (Multi-Listings) | + | [99,103] | 2 | 3 | ||

| - | [111] | 1 | ||||

| Host Membership Month | + | [89] | 1 | 1 | ||

| Listing Reputation | Guest Rating Percent | - | [94] | 1 | 1 | |

| Number of Reviews | U-Shape | [88] | 1 | 14 | ||

| - | [89,90,94,96,99,101,103,110,111,114,116,120,123] | 13 | ||||

| Overall Rating | + | [88,89,99,110,111,114,117] | 7 | 12 | ||

| - | [90,91,101,116,123] | 5 | ||||

| Rental Policy | Rental Policy Index | + | [120] | 1 | 1 | |

| Cancellation Policy | Strict | + | [101] | 3 | 4 | |

| - | [110,111,114] | 1 | ||||

| Moderate | + | [110,111,114] | 3 | 3 | ||

| Flexible | + | [88] | 1 | 1 | ||

| Guest’s Profile Photo Required | + | [114,120] | 2 | 3 | ||

| - | [88] | 1 | ||||

| Guest’s Phone Verification | + | [88,114] | 2 | 2 | ||

| Instant Bookable | + | [111] | 1 | 7 | ||

| - | [88,89,94,99,114,123] | 6 | ||||

| Smoking Allowed | - | [88,114] | 2 | 2 | ||

| Pets Allowed | - | [94] | 1 | 1 | ||

| Cleaning Fee | + | [91] | 1 | 1 | ||

| Minimum Stay | - | [110] | 1 | 1 | ||

| Listing Location | Neighborhood Value | - | [101] | 1 | 1 | |

| Average Rental Price in District | + | [121] | 1 | 1 | ||

| Number of Airbnb Listings in the Same District | + | [88,89] | 2 | 3 | ||

| - | [101] | 1 | ||||

| Price of Surrounding Hotels | + | [106] | 1 | 1 | ||

| Price of Surrounding Airbnb Listings | + | [120] | 1 | 1 | ||

| Number of Surrounding Competitors | - | [112] | 1 | 1 | ||

| Number of Surrounding Airbnb Listings | + | [117,120] | 2 | 2 | ||

| Distance to Tourism Attraction | + | [101,106] | 2 | 7 | ||

| - | [89,94,116,120,123] | 5 | ||||

| Located within Sightseeing | + | [112] | 1 | 1 | ||

| Distance to City Center | - | [94,99,106,111,114] | 5 | 5 | ||

| Distance to the Nearest Highway | - | [88] | 1 | 1 | ||

| Pedestrian Density | + | [94] | 1 | 1 | ||

| Noise | - | [94] | 1 | 1 | ||

| Distance to Subway | - | [123] | 1 | 1 | ||

| Macro Factors | Population | - | [117] | 1 | 1 | |

| Unemployment Rate | - | [117] | 1 | 1 | ||

| Disposable Income | + | [117] | 1 | 1 |

References

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Liu, Z.; Feng, J.; Liu, B. Pricing and Service Level Decisions under a Sharing Product and Consumers’ Variety-Seeking Behavior. Sustainability 2019, 11, 6951. [Google Scholar] [CrossRef]

- Hossain, M. Sharing economy: A comprehensive literature review. Int. J. Hosp. Manag. 2020, 87, 102470. [Google Scholar] [CrossRef]

- Hu, M.; Li, X.; Shi, M. Product and Pricing Decisions in Crowdfunding. Mark. Sci. 2015, 34, 331–345. [Google Scholar] [CrossRef]

- Gonen, R.; Raban, D.; Brady, C.; Mazor, M. Increased efficiency through pricing in online labor markets. J. Electron. Commer. Res. 2014, 15, 58. [Google Scholar]

- Guda, H.; Subramanian, U. Your Uber Is Arriving: Managing On-Demand Workers Through Surge Pricing, Forecast Communication, and Worker Incentives. Manag. Sci. 2019, 65, 1995–2014. [Google Scholar] [CrossRef]

- Dillahunt, T.R.; Wang, X.; Wheeler, E.; Cheng, H.F.; Hecht, B.; Zhu, H. The Sharing Economy in Computing. Proc. ACM Hum. Comput. Interact. 2017, 1, 1–26. [Google Scholar] [CrossRef]

- Altinay, L.; Taheri, B. Emerging themes and theories in the sharing economy: A critical note for hospitality and tourism. Int. J. Contemp. Hosp. Manag. 2019, 31, 180–193. [Google Scholar] [CrossRef]

- Belarmino, A.; Koh, Y. A critical review of research regarding peer-to-peer accommodations. Int. J. Hosp. Manag. 2020, 84, 102315. [Google Scholar] [CrossRef]

- Sainaghi, R. The current state of academic research into peer-to-peer accommodation platforms. Int. J. Hosp. Manag. 2020, 89, 102555. [Google Scholar] [CrossRef]

- Guttentag, D. Progress on Airbnb: A literature review. J. Hosp. Tour. Technol. 2019, 10, 814–844. [Google Scholar] [CrossRef]

- Wang, H.; Yang, H. Ridesourcing systems: A framework and review. Transp. Res. Part B Methodol. 2019, 129, 122–155. [Google Scholar] [CrossRef]

- Ter Huurne, M.; Ronteltap, A.; Corten, R.; Buskens, V. Antecedents of trust in the sharing economy: A systematic review. J. Consum. Behav. 2017, 16, 485–498. [Google Scholar] [CrossRef]

- Schlagwein, D.; Schoder, D.; Spindeldreher, K. Consolidated, systemic conceptualization, and definition of the “sharing economy”. J. Assoc. Inf. Sci. Technol. 2019, 71, 817–838. [Google Scholar] [CrossRef]

- Kwok, L.; Xie, K.L. Pricing strategies on Airbnb: Are multi-unit hosts revenue pros? Int. J. Hosp. Manag. 2019, 82, 252–259. [Google Scholar] [CrossRef]

- Tian, L.; Jiang, B. Effects of Consumer-to-Consumer Product Sharing on Distribution Channel. Prod. Oper. Manag. 2018, 27, 350–367. [Google Scholar] [CrossRef]

- Ren, X.; Herty, M.; Zhao, L. Optimal price and service decisions for sharing platform and coordination between manufacturer and platform with recycling. Comput. Ind. Eng. 2020, 147, 106586. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Group, P. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Petticrew, M.; Roberts, H. Systematic Reviews in the Social Sciences: A Practical Guide; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Falagas, M.E.; Pitsouni, E.I.; Malietzis, G.A.; Pappas, G. Comparison of PubMed, Scopus, Web of Science, and Google Scholar: Strengths and weaknesses. FASEB J. 2007, 22, 338–342. [Google Scholar] [CrossRef] [PubMed]

- Ritter, M.; Schanz, H. The sharing economy: A comprehensive business model framework. J. Clean. Prod. 2019, 213, 320–331. [Google Scholar] [CrossRef]

- Si, H.; Shi, J.-g.; Wu, G.; Chen, J.; Zhao, X. Mapping the bike sharing research published from 2010 to 2018: A scientometric review. J. Clean. Prod. 2019, 213, 415–427. [Google Scholar] [CrossRef]

- Plewnia, F.; Guenther, E. Mapping the sharing economy for sustainability research. Manag. Decis. 2018, 56, 570–583. [Google Scholar] [CrossRef]

- Sánchez-Pérez, M.; Rueda-López, N.; Marín-Carrillo, M.B.; Terán-Yépez, E. Theoretical dilemmas, conceptual review and perspectives disclosure of the sharing economy: A qualitative analysis. Rev. Manag. Sci. 2020. Available online: https://doi.org/10.1007/s11846-020-00418-9 (accessed on 26 October 2020). [CrossRef]

- Becker-Leifhold, C.; Iran, S. Collaborative fashion consumption—Drivers, barriers and future pathways. J. Fash. Mark. Manag. Int. J. 2018, 22, 189–208. [Google Scholar] [CrossRef]

- Prayag, G.; Ozanne, L.K. A systematic review of peer-to-peer (P2P) accommodation sharing research from 2010 to 2016: Progress and prospects from the multi-level perspective. J. Hosp. Mark. Manag. 2018, 27, 649–678. [Google Scholar] [CrossRef]

- Wang, X.; Ng, C.T.; Dong, C. Implications of peer-to-peer product sharing when the selling firm joins the sharing market. Int. J. Prod. Econ. 2020, 219, 138–151. [Google Scholar] [CrossRef]

- Razeghian, M.; Weber, T.A. The advent of the sharing culture and its effect on product pricing. Electron. Commer. Res. Appl. 2019, 33, 100801. [Google Scholar] [CrossRef]

- Pei, J.; Yan, P.; Kumar, S.; Liu, X. How to React to Internal and External Sharing in B2C and C2C. Prod. Oper. Manag. 2020, 30, 145–170. [Google Scholar] [CrossRef]

- Galbreth, M.R.; Ghosh, B.; Shor, M. Social Sharing of Information Goods: Implications for Pricing and Profits. Mark. Sci. 2012, 31, 603–620. [Google Scholar] [CrossRef]

- Wen, X.; Siqin, T. How do product quality uncertainties affect the sharing economy platforms with risk considerations? A mean-variance analysis. Int. J. Prod. Econ. 2020, 224, 107544. [Google Scholar] [CrossRef]

- Wang, X.; Duan, L.; Zhang, J. Mobile Social Services with Network Externality: From Separate Pricing to Bundled Pricing. IEEE Trans. Netw. Sci. Eng. 2019, 6, 379–390. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, D.; Chen, K.; Zha, Y.; Bi, G. Optimal pricing and availability strategy of a bike-sharing firm with time-sensitive customers. J. Clean. Prod. 2019, 228, 208–221. [Google Scholar] [CrossRef]

- Chen, Y.; Zha, Y.; Wang, D.; Li, H.; Bi, G. Optimal pricing strategy of a bike-sharing firm in the presence of customers with convenience perceptions. J. Clean. Prod. 2020, 253, 119905. [Google Scholar] [CrossRef]

- Haider, Z.; Nikolaev, A.; Kang, J.E.; Kwon, C. Inventory rebalancing through pricing in public bike sharing systems. Eur. J. Oper. Res. 2018, 270, 103–117. [Google Scholar] [CrossRef]

- Pfrommer, J.; Warrington, J.; Schildbach, G.; Morari, M. Dynamic Vehicle Redistribution and Online Price Incentives in Shared Mobility Systems. IEEE Trans. Intell. Transp. Syst. 2014, 15, 1567–1578. [Google Scholar] [CrossRef]

- You, P.-S.; Hsieh, Y.-C.; Hsieh, W.-H. A heuristic approach to bicycle repositioning problems with dynamic pricing. J. Intell. Fuzzy Syst. 2019, 36, 1273–1285. [Google Scholar] [CrossRef]

- Zhang, J.; Meng, M.; Wang, D.Z.W. A dynamic pricing scheme with negative prices in dockless bike sharing systems. Transp. Res. Part B Methodol. 2019, 127, 201–224. [Google Scholar] [CrossRef]

- Cheng, Y.; Deng, X.; Zhang, M. Two-Tier Sharing in Electric Vehicle Service Market. IEEE Trans. Cloud Comput. 2019, 1. [Google Scholar] [CrossRef]

- Ren, S.; Luo, F.; Lin, L.; Hsu, S.-C.; Li, X.I. A novel dynamic pricing scheme for a large-scale electric vehicle sharing network considering vehicle relocation and vehicle-grid-integration. Int. J. Prod. Econ. 2019, 218, 339–351. [Google Scholar] [CrossRef]

- Xie, R.; Wei, W.; Wu, Q.; Ding, T.; Mei, S. Optimal Service Pricing and Charging Scheduling of an Electric Vehicle Sharing System. IEEE Trans. Veh. Technol. 2020, 69, 78–89. [Google Scholar] [CrossRef]

- Jiao, Z.; Ran, L.; Liu, X.; Zhang, Y.; Qiu, R.G. Integrating Price-Incentive and Trip-Selection Policies to Rebalance Shared Electric Vehicles. Serv. Sci. 2020, 12, 148–173. [Google Scholar] [CrossRef]

- Jian, S.; Liu, W.; Wang, X.; Yang, H.; Waller, S.T. On integrating carsharing and parking sharing services. Transp. Res. Part B Methodol. 2020, 142, 19–44. [Google Scholar] [CrossRef]

- Guan, L.; Mu, Y.; Xu, X.; Zhang, L.; Zhuang, J. Keep it or give back? Optimal pricing strategy of reward-based crowdfunding with a hybrid mechanism in the sharing economy. Int. J. Prod. Res. 2019, 58, 6868–6889. [Google Scholar] [CrossRef]

- Wei, J. Joint Production and Pricing Strategy in Robust Model of Crowdfunding Considering Uncertain Preference. Int. J. Fuzzy Syst. 2020, 22, 1342–1355. [Google Scholar] [CrossRef]

- Chen, M.; Liu, Z.; Ma, C. Early bird or versioning: Which pricing strategy is better for creators in reward-based crowdfunding? Asia Pac. J. Mark. Logist. 2019, 32, 769–792. [Google Scholar] [CrossRef]

- Chen, M.; Liu, Z.; Ma, C.; Gong, X. A distinctive early bird price in reward-based crowdfunding. Electron. Commer. Res. 2019, 21, 347–370. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, R.; Liu, B. Joint Decisions on Production and Pricing with Strategic Consumers for Green Crowdfunding Products. Int. J. Environ. Res. Public Health 2017, 14, 1090. [Google Scholar] [CrossRef] [PubMed]

- Chen, Y.; Zhang, R.; Liu, B. Pricing Decisions on Reward-Based Crowdfunding with Bayesian Review System Facing Strategic Consumers. Discret. Dyn. Nat. Soc. 2019, 2019, 1–14. [Google Scholar] [CrossRef]

- Chu, T.; Wei, X.; Zhou, Y. The pricing and efficiency of pre-Sale crowdfunding. Finan. Res. Lett. 2020. Available online: https://doi.org/10.1016/j.frl.2020.101793 (accessed on 6 October 2020). [CrossRef]

- Du, S.; Peng, J.; Nie, T.; Yu, Y. Pricing strategies and mechanism choice in reward-based crowdfunding. Eur. J. Oper. Res. 2020, 284, 951–966. [Google Scholar] [CrossRef]

- Guan, X.; Deng, W.-J.; Jiang, Z.-Z.; Huang, M. Pricing and advertising for reward-based crowdfunding products in E-commerce. Decis. Support Syst. 2020, 131, 113231. [Google Scholar] [CrossRef]

- Guo, X.; Bi, G.; Lv, J. Crowdfunding mechanism comparison if there are altruistic donors. Eur. J. Oper. Res. 2020, 291, 1198–1211. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, H.; Xi, N.; Juho, H. Financing Target and Product Line Design on the Flexible and Fixed Reward Crowdfunding. Math. Probl. Eng. 2020, 2020, 1–10. [Google Scholar] [CrossRef]

- Nie, T.; Wang, X.; Zhu, Y.; Du, S. Crowdfunding mechanism comparison when product quality is uncertain. Int. Trans. Oper. Res. 2020, 27, 2616–2657. [Google Scholar] [CrossRef]

- Peng, J.; Zhang, J.; Nie, T.; Zhu, Y.; Du, S. Pricing and package size decisions in crowdfunding. Transp. Res. Part E Logist. Transp. Rev. 2020, 143, 102091. [Google Scholar] [CrossRef]

- Zhang, Z.; Ling, L.; Yang, F. Pricing strategy and campaign design in flight crowdfunding: A creative way to sell flight tickets. Nav. Res. Logist. 2020. Available online: https://doi:10.1002/nav.21970 (accessed on 27 December 2020).

- Bi, G.; Xiang, Q.; Geng, B.; Xia, Q. Decision strategies in reward-based crowdfunding: The role of crowdfunding platforms. J. Model. Manag. 2019, 14, 569–589. [Google Scholar] [CrossRef]

- Sun, Y.; Lin, F.; Zhang, N.; Patnaik, S. An incentive to share resource-based crowdfunding and repeated game in green cloud computing. J. Intell. Fuzzy Syst. 2018, 35, 75–86. [Google Scholar] [CrossRef]

- Ellman, M.; Hurkens, S. Optimal crowdfunding design. J. Econ. Theory 2019, 184, 104939. [Google Scholar] [CrossRef]

- Chang, J.-W. The economics of crowdfunding. Am. Econ. J. Microecon. 2020, 12, 257–280. [Google Scholar] [CrossRef]

- Pahwa, D.; Starly, B. Network-based pricing for 3D printing services in two-sided manufacturing-as-a-service marketplace. Rapid Prototyp. J. 2020, 26, 82–88. [Google Scholar] [CrossRef]

- Sun, L.; Qiu, J.; Han, X.; Yin, X.; Dong, Z. Per-use-share rental strategy of distributed BESS in joint energy and frequency control ancillary services markets. Appl. Energy 2020, 277, 115589. [Google Scholar] [CrossRef]

- Zhou, Z.; Chen, R.; Wang, C.; Zhang, C. Dynamic pricing in profit-driven task assignment: A domain-of-influence based approach. Int. J. Mach. Learn. Cybern. 2020, 12, 1015–1030. [Google Scholar] [CrossRef]

- Hao, F.; Guo, H.; Park, D.-S.; Kang, J. An efficient pricing strategy of sensing tasks for crowdphotographing. J. Supercomput. 2019, 75, 4443–4458. [Google Scholar] [CrossRef]

- Li, Q.; Wu, F.; Chen, G. An Efficient, Fair, and Robust Image Pricing Mechanism for Crowdsourced 3D Reconstruction. IEEE Trans. Serv. Comput. 2020, 1. [Google Scholar] [CrossRef]

- Li, Z.; Li, Y.; Lu, W.; Huang, J. Crowdsourcing Logistics Pricing Optimization Model Based on DBSCAN Clustering Algorithm. IEEE Access 2020, 8, 92615–92626. [Google Scholar] [CrossRef]

- Liu, C.; Cao, Y. Task re-pricing model based on density-based spatial clustering of applications. Appl. Soft Comput. 2020, 96, 106608. [Google Scholar] [CrossRef]

- Liu, J.-X.; Ji, Y.-D.; Lv, W.-F.; Xu, K. Budget-Aware Dynamic Incentive Mechanism in Spatial Crowdsourcing. J. Comput. Sci. Technol. 2017, 32, 890–904. [Google Scholar] [CrossRef]

- Shi, P.; Zhao, M.; Wang, W.; Zhou, Y.; Jiang, J.; Zhang, J.; Jiang, Y.; Hao, Z. Best of both worlds: Mitigating imbalance of crowd worker strategic choices without a budget. Knowl. Based Syst. 2019, 163, 1020–1031. [Google Scholar] [CrossRef]

- Xu, C.; Si, Y.; Zhu, L.; Zhang, C.; Sharif, K.; Zhang, C. Pay as How You Behave: A Truthful Incentive Mechanism for Mobile Crowdsensing. IEEE Internet Things J. 2019, 6, 10053–10063. [Google Scholar] [CrossRef]

- Azaria, A.; Aumann, Y.; Kraus, S. Automated agents for reward determination for human work in crowdsourcing applications. Auton. Agents Multi Agent Syst. 2013, 28, 934–955. [Google Scholar] [CrossRef]

- Han, K.; Huang, H.; Luo, J. Quality-Aware Pricing for Mobile Crowdsensing. IEEE ACM Trans. Netw. 2018, 26, 1728–1741. [Google Scholar] [CrossRef]

- Ho, C.-J.; Slivkins, A.; Vaughan, J.W. Adaptive contract design for crowdsourcing markets: Bandit algorithms for repeated principal-agent problems. J. Artif. Intell. Res. 2016, 55, 317–359. [Google Scholar] [CrossRef]

- Hu, Y.; Wang, Y.; Li, Y.; Tong, X. An Incentive Mechanism in Mobile Crowdsourcing Based on Multi-Attribute Reverse Auctions. Sensors 2018, 18, 3453. [Google Scholar] [CrossRef] [PubMed]

- Jin, H.; He, B.; Su, L.; Nahrstedt, K.; Wang, X. Data-Driven Pricing for Sensing Effort Elicitation in Mobile Crowd Sensing Systems. IEEE ACM Trans. Netw. 2019, 27, 2208–2221. [Google Scholar] [CrossRef]

- Phuttharak, J.; Loke, S. Exploring incentive mechanisms for mobile crowdsourcing: Sense of safety in a Thai city. Int. J. Urban Sci. 2019, 24, 13–34. [Google Scholar] [CrossRef]

- Duan, Z.; Yan, M.; Cai, Z.; Wang, X.; Han, M.; Li, Y. Truthful Incentive Mechanisms for Social Cost Minimization in Mobile Crowdsourcing Systems. Sensors 2016, 16, 481. [Google Scholar] [CrossRef]

- Luo, T.; Kanhere, S.S.; Das, S.K.; Tan, H.-P. Incentive mechanism design for heterogeneous crowdsourcing using all-pay contests. IEEE Trans. Mob. Comput. 2015, 15, 2234–2246. [Google Scholar] [CrossRef]

- Yu, H.; Miao, C.; Leung, C.; Chen, Y.; Fauvel, S.; Lesser, V.R.; Yang, Q. Mitigating herding in hierarchical crowdsourcing networks. Sci. Rep. 2016, 6, 4. [Google Scholar] [CrossRef]

- Liu, Z.; Feng, J.; Wang, J. Effects of the Sharing Economy on Sequential Innovation Products. Complexity 2019, 2019, 3089641. [Google Scholar] [CrossRef]

- Bellos, I.; Ferguson, M.; Toktay, L.B. The Car Sharing Economy: Interaction of Business Model Choice and Product Line Design. Manuf. Serv. Oper. Manag. 2017, 19, 185–201. [Google Scholar] [CrossRef]

- Weber, T.A. Product Pricing in a Peer-to-Peer Economy. J. Manag. Inf. Syst. 2016, 33, 573–596. [Google Scholar] [CrossRef]

- Weber, T.A. Smart Products for Sharing. J. Manag. Inf. Syst. 2017, 34, 341–368. [Google Scholar] [CrossRef]

- Weber, T.A. How to Market Smart Products: Design and Pricing for Sharing Markets. J. Manag. Inf. Syst. 2020, 37, 631–667. [Google Scholar] [CrossRef]

- Jiang, B.; Tian, L. Collaborative Consumption: Strategic and Economic Implications of Product Sharing. Manag. Sci. 2018, 64, 1171–1188. [Google Scholar] [CrossRef]

- Razeghian, M.; Weber, T.A. Strategic durability with sharing markets. Sustain. Prod. Consum. 2019, 19, 79–96. [Google Scholar] [CrossRef]

- Barnes, S.J.; Kirshner, S.N. Understanding the impact of host facial characteristics on Airbnb pricing: Integrating facial image analytics into tourism research. Tour. Manag. 2021, 83, 104235. [Google Scholar] [CrossRef]

- Cai, Y.; Zhou, Y.; Ma, J.; Scott, N. Price Determinants of Airbnb Listings: Evidence from Hong Kong. Tour. Anal. 2019, 24, 227–242. [Google Scholar] [CrossRef]

- Chattopadhyay, M.; Mitra, S.K. Do airbnb host listing attributes influence room pricing homogenously? Int. J. Hosp. Manag. 2019, 81, 54–64. [Google Scholar] [CrossRef]

- Chattopadhyay, M.; Mitra, S.K. What Airbnb Host Listings Influence Peer-to-Peer Tourist Accommodation Price? J. Hosp. Tour. Res. 2020, 44, 597–623. [Google Scholar] [CrossRef]

- Chen, Y.; Xie, K. Consumer valuation of Airbnb listings: A hedonic pricing approach. Int. J. Contemp. Hosp. Manag. 2017, 29, 2405–2424. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, R.; Liu, B. Fixed, flexible, and dynamics pricing decisions of Airbnb mode with social learning. Tour. Econ. 2020. Available online: https://doi:10.1177/1354816619896956 (accessed on 8 January 2020). [CrossRef]

- Chica-Olmo, J.; González-Morales, J.G.; Zafra-Gómez, J.L. Effects of location on Airbnb apartment pricing in Málaga. Tour. Manag. 2020, 77, 103981. [Google Scholar] [CrossRef]

- Dudás, G.; Kovalcsik, T.; Vida, G.; Boros, L.; Nagy, G. Price determinants of Airbnb listing prices in lake balaton touristic region, Hungary. Eur. J. Tour. Res. 2020, 24, 1–18. [Google Scholar]

- Ert, E.; Fleischer, A. The evolution of trust in Airbnb: A case of home rental. Ann. Tour. Res. 2019, 75, 279–287. [Google Scholar] [CrossRef]

- Ert, E.; Fleischer, A.; Magen, N. Trust and reputation in the sharing economy: The role of personal photos in Airbnb. Tour. Manag. 2016, 55, 62–73. [Google Scholar] [CrossRef]

- Faye, B. Methodological discussion of Airbnb’s hedonic study: A review of the problems and some proposals tested on Bordeaux City data. Ann. Tour. Res. 2021, 86, 103079. [Google Scholar] [CrossRef]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Morton, J.; Goodwill, A. Pricing in the sharing economy: A hedonic pricing model applied to Airbnb listings. J. Travel Tour. Mark. 2017, 35, 46–56. [Google Scholar] [CrossRef]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Yao, L.; Morton, J. Use of dynamic pricing strategies by Airbnb hosts. Int. J. Contemp. Hosp. Manag. 2018, 30, 2–20. [Google Scholar] [CrossRef]

- Hong, I.; Yoo, C. Analyzing Spatial Variance of Airbnb Pricing Determinants Using Multiscale GWR Approach. Sustainability 2020, 12, 4710. [Google Scholar] [CrossRef]

- Lorde, T.; Jacob, J.; Weekes, Q. Price-setting behavior in a tourism sharing economy accommodation market: A hedonic price analysis of AirBnB hosts in the caribbean. Tour. Manag. Perspect. 2019, 30, 251–261. [Google Scholar] [CrossRef]

- Magno, F.; Cassia, F.; Ugolini, M.M. Accommodation prices on Airbnb: Effects of host experience and market demand. TQM J. 2018, 30, 608–620. [Google Scholar] [CrossRef]

- Moreno-Izquierdo, L.; Ramón-Rodríguez, A.B.; Such-Devesa, M.J.; Perles-Ribes, J.F. Tourist environment and online reputation as a generator of added value in the sharing economy: The case of Airbnb in urban and sun- and-beach holiday destinations. J. Destin. Mark. Manag. 2019, 11, 53–66. [Google Scholar] [CrossRef]

- Moreno-Izquierdo, L.; Rubia-Serrano, A.; Perles-Ribes, J.F.; Ramón-Rodríguez, A.B.; Such-Devesa, M.J. Determining factors in the choice of prices of tourist rental accommodation. New evidence using the quantile regression approach. Tour. Manag. Perspect. 2020, 33, 100632. [Google Scholar] [CrossRef]

- Önder, I.; Weismayer, C.; Gunter, U. Spatial price dependencies between the traditional accommodation sector and the sharing economy. Tour. Econ. 2018, 25, 1150–1166. [Google Scholar] [CrossRef]

- Oskam, J.; van der Rest, J.-P.; Telkamp, B. What’s mine is yours—But at what price? Dynamic pricing behavior as an indicator of Airbnb host professionalization. J. Revenue Pricing Manag. 2018, 17, 311–328. [Google Scholar] [CrossRef]

- Perez-Sanchez, V.; Serrano-Estrada, L.; Marti, P.; Mora-Garcia, R.-T. The What, Where, and Why of Airbnb Price Determinants. Sustainability 2018, 10, 4596. [Google Scholar] [CrossRef]

- Proserpio, D.; Xu, W.; Zervas, G. You get what you give: Theory and evidence of reciprocity in the sharing economy. Quant. Mark. Econ. 2018, 16, 371–407. [Google Scholar] [CrossRef]

- Sainaghi, R.; Abrate, G.; Mauri, A. Price and RevPAR determinants of Airbnb listings: Convergent and divergent evidence. Int. J. Hosp. Manag. 2021, 92, 102709. [Google Scholar] [CrossRef]

- Tong, B.; Gunter, U. Hedonic pricing and the sharing economy: How profile characteristics affect Airbnb accommodation prices in Barcelona, Madrid, and Seville. Curr. Issues Tour. 2020, 1–20. [Google Scholar] [CrossRef]

- Voltes-Dorta, A.; Inchausti-Sintes, F. The spatial and quality dimensions of Airbnb markets. Tour. Econ. 2020, 27, 668–702. [Google Scholar] [CrossRef]

- Voltes-Dorta, A.; Sánchez-Medina, A. Drivers of Airbnb prices according to property/room type, season and location: A regression approach. J. Hosp. Tour. Manag. 2020, 45, 266–275. [Google Scholar] [CrossRef]

- Wang, D.; Nicolau, J.L. Price determinants of sharing economy based accommodation rental: A study of listings from 33 cities on Airbnb.com. Int. J. Hosp. Manag. 2017, 62, 120–131. [Google Scholar] [CrossRef]

- Weber, T.A. Intermediation in a Sharing Economy: Insurance, Moral Hazard, and Rent Extraction. J. Manag. Inf. Syst. 2015, 31, 35–71. [Google Scholar] [CrossRef]

- Zhang, Z.; Chen, R.; Han, L.; Yang, L. Key Factors Affecting the Price of Airbnb Listings: A Geographically Weighted Approach. Sustainability 2017, 9, 1635. [Google Scholar] [CrossRef]

- Tang, L.; Kim, J.; Wang, X. Estimating spatial effects on peer-to-peer accommodation prices: Towards an innovative hedonic model approach. Int. J. Hosp. Manag. 2019, 81, 43–53. [Google Scholar] [CrossRef]

- Suárez-Vega, R.; Hernández, J.M. Selecting Prices Determinants and Including Spatial Effects in Peer-to-Peer Accommodation. ISPRS Int. J. Geo-Inf. 2020, 9, 259. [Google Scholar] [CrossRef]

- López, F.A.; Mínguez, R.; Mur, J. ML versus IV estimates of spatial SUR models: Evidence from the case of Airbnb in Madrid urban area. Ann. Reg. Sci. 2019, 64, 313–347. [Google Scholar] [CrossRef]

- Lladós-Masllorens, J.; Meseguer-Artola, A.; Rodríguez-Ardura, I. Understanding Peer-to-Peer, Two-Sided Digital Marketplaces: Pricing Lessons from Airbnb in Barcelona. Sustainability 2020, 12, 5229. [Google Scholar] [CrossRef]

- Jaeger, B.; Sleegers, W.W.A.; Evans, A.M.; Stel, M.; van Beest, I. The effects of facial attractiveness and trustworthiness in online peer-to-peer markets. J. Econ. Psychol. 2019, 75, 102125. [Google Scholar] [CrossRef]

- Falk, M.; Larpin, B.; Scaglione, M. The role of specific attributes in determining prices of Airbnb listings in rural and urban locations. Int. J. Hosp. Manag. 2019, 83, 132–140. [Google Scholar] [CrossRef]

- Arvanitidis, P.; Economou, A.; Grigoriou, G.; Kollias, C. Trust in peers or in the institution? A decomposition analysis of Airbnb listings’ pricing. Curr. Issues Tour. 2020, 1–18. [Google Scholar] [CrossRef]

- Koh, Y.; Belarmino, A.; Kim, M.G. Good fences make good revenue: An examination of revenue management practices at peer-to-peer accommodations. Tour. Econ. 2020, 26, 1108–1128. [Google Scholar] [CrossRef]

- Bonafé-Pontes, A.A.; Oliveira-Castro, J.M.; Foxall, G.R. When individuals behave as marketing firms: Probability discounting and reputation in peer-to-peer markets. Manag. Decis. Econ. 2020, 41, 185–190. [Google Scholar] [CrossRef]

- Farajallah, M.; Hammond, R.G.; Pénard, T. What drives pricing behavior in Peer-to-Peer markets? Evidence from the carsharing platform BlaBlaCar. Inf. Econ. Policy 2019, 48, 15–31. [Google Scholar] [CrossRef]

- Huurne, M.T.; Ronteltap, A.; Guo, C.; Corten, R.; Buskens, V. Reputation Effects in Socially Driven Sharing Economy Transactions. Sustainability 2018, 10, 2674. [Google Scholar] [CrossRef]

- Dai, X.; Chow, P.-S.; Zheng, J.-H.; Chiu, C.-H. Crowdsourcing New Product Design on the Web: An Analysis of Online Designer Platform Service. Math. Probl. Eng. 2013, 2013, 248170. [Google Scholar] [CrossRef]

- Kalathil, D.; Wu, C.; Poolla, K.; Varaiya, P. The Sharing Economy for the Electricity Storage. IEEE Trans. Smart Grid 2019, 10, 556–567. [Google Scholar] [CrossRef]

- Han, X.; Sun, L.; Tao, Y.; Zhao, J.; Wang, G.; Yuan, D. Distributed Energy-Sharing Strategy for Peer-to-Peer Microgrid System. J Energy Eng. 2020, 146, 04020033. [Google Scholar] [CrossRef]

- Orman, L.V. Information markets over trust networks. Electron. Commer. Res. 2016, 16, 529–551. [Google Scholar] [CrossRef]

- Okaie, Y.; Nakano, T. A game theoretic framework for peer-to-peer market economy. Int. J. Grid Util. Comput. 2011, 2, 183–195. [Google Scholar] [CrossRef]

- Lin, X.; Zhou, Y.-W. Pricing policy selection for a platform providing vertically differentiated services with self-scheduling capacity. J. Oper. Res. Soc. 2018, 70, 1203–1218. [Google Scholar] [CrossRef]

- Bai, J.; So, K.C.; Tang, C.S.; Chen, X.; Wang, H. Coordinating Supply and Demand on an On-Demand Service Platform with Impatient Customers. Manuf. Serv. Oper. Manag. 2019, 21, 556–570. [Google Scholar] [CrossRef]

- Fang, Z.; Huang, L.; Wierman, A. Prices and subsidies in the sharing economy. Perform. Eval. 2019, 136, 102037. [Google Scholar] [CrossRef]

- Choi, J.P.; Zennyo, Y. Platform market competition with endogenous side decisions. J. Econ. Manag. Strategy 2019, 28, 73–88. [Google Scholar] [CrossRef]

- Chen, Y.; Hu, M. Pricing and Matching with Forward-Looking Buyers and Sellers. Manuf. Serv. Oper. Manag. 2020, 22, 717–734. [Google Scholar] [CrossRef]

- Mahavir Varma, S.; Bumpensanti, P.; Theja Maguluri, S.; Wang, H. Dynamic pricing and matching for two-sided queues. ACM SIGMETRICS Perform. Eval. Rev. 2020, 48, 105–106. [Google Scholar] [CrossRef]

- Zhou, Y.-W.; Lin, X.; Zhong, Y.; Xie, W. Contract selection for a multi-service sharing platform with self-scheduling capacity. Omega 2019, 86, 198–217. [Google Scholar] [CrossRef]

- Zimmermann, S.; Angerer, P.; Provin, D.; Nault, B.R. Pricing in C2C sharing platforms. J. Assoc. Inf. Syst. 2018, 19, 4. [Google Scholar] [CrossRef]

- Choi, T.-M.; He, Y. Peer-to-peer collaborative consumption for fashion products in the sharing economy: Platform operations. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 49–65. [Google Scholar] [CrossRef]

- Ke, J.; Yang, H.; Li, X.; Wang, H.; Ye, J. Pricing and equilibrium in on-demand ride-pooling markets. Transp. Res. Part B Methodol. 2020, 139, 411–431. [Google Scholar] [CrossRef]

- Bian, Z.; Liu, X. Mechanism design for first-mile ridesharing based on personalized requirements part I: Theoretical analysis in generalized scenarios. Transp. Res. Part B Methodol. 2019, 120, 147–171. [Google Scholar] [CrossRef]

- Liu, Y.; Li, Y. Pricing scheme design of ridesharing program in morning commute problem. Transp. Res. Part C Emerg. Technol. 2017, 79, 156–177. [Google Scholar] [CrossRef]

- Yan, P.; Lee, C.-Y.; Chu, C.; Chen, C.; Luo, Z. Matching and pricing in ride-sharing: Optimality, stability, and financial sustainability. Omega 2020, 102, 102351. Available online: https://doi.org/10.1016/j.omega.2020.102351 (accessed on 23 October 2020). [CrossRef]

- Zhang, J.; Wen, D.; Zeng, S. A Discounted Trade Reduction Mechanism for Dynamic Ridesharing Pricing. IEEE Trans. Intell. Transp. Syst. 2016, 17, 1586–1595. [Google Scholar] [CrossRef]

- Cao, B.; Hou, C.; Zhao, L.; Alarabi, L.; Fan, J.; Mokbel, M.F.; Basalamah, A. SHAREK*: A Scalable Matching Method for Dynamic Ride Sharing. GeoInformatica 2020, 24, 881–913. [Google Scholar] [CrossRef]

- Zhang, C.; Xie, J.; Wu, F.; Gao, X.; Chen, G. Pricing and allocation algorithm designs in dynamic ridesharing system. Comput. Sci. 2020, 803, 94–104. [Google Scholar] [CrossRef]

- Yan, C.; Zhu, H.; Korolko, N.; Woodard, D. Dynamic pricing and matching in ride-hailing platforms. Nav. Res. Logist. 2019, 67, 705–724. [Google Scholar] [CrossRef]

- Nourinejad, M.; Ramezani, M. Ride-Sourcing modeling and pricing in non-equilibrium two-sided markets. Transp. Res. Part B Methodol. 2020, 132, 340–357. [Google Scholar] [CrossRef]

- Sun, L.; Teunter, R.H.; Babai, M.Z.; Hua, G. Optimal pricing for ride-sourcing platforms. Eur. J. Oper. Res. 2019, 278, 783–795. [Google Scholar] [CrossRef]

- Ding, Z.-J.; Dai, Z.; Chen, X.; Jiang, R. Simulating on-demand ride services in a Manhattan-like urban network considering traffic dynamics. Phys. A Stat. Mech. Appl. 2020, 545, 123621. [Google Scholar] [CrossRef]

- Sun, Z.; Xu, Q.; Shi, B. Dynamic Pricing of Ride-Hailing Platforms considering Service Quality and Supply Capacity under Demand Fluctuation. Math. Probl. Eng. 2020, 2020, 5620834. [Google Scholar] [CrossRef]

- Zha, L.; Yin, Y.; Du, Y. Surge pricing and labor supply in the ride-sourcing market. Transp. Res. Part B Methodol. 2018, 117, 708–722. [Google Scholar] [CrossRef]

- Zha, L.; Yin, Y.; Xu, Z. Geometric matching and spatial pricing in ride-sourcing markets. Transp. Res. Part C Emerg. Technol. 2018, 92, 58–75. [Google Scholar] [CrossRef]

- Bimpikis, K.; Candogan, O.; Saban, D. Spatial Pricing in Ride-Sharing Networks. Oper. Res. 2019, 67, 744–769. [Google Scholar] [CrossRef]

- Cachon, G.P.; Daniels, K.M.; Lobel, R. The Role of Surge Pricing on a Service Platform with Self-Scheduling Capacity. Manuf. Serv. Oper. Manag. 2017, 19, 368–384. [Google Scholar] [CrossRef]

- Dong, Z.; Leng, M. Managing on-demand ridesharing operations: Optimal pricing decisions for a ridesharing platform. Int. J. Prod. Econ. 2021, 232, 107958. [Google Scholar] [CrossRef]

- Lei, C.; Jiang, Z.; Ouyang, Y. Path-based dynamic pricing for vehicle allocation in ridesharing systems with fully compliant drivers. Transp. Res. Part B Methodol. 2020, 132, 60–75. [Google Scholar] [CrossRef]

- Özkan, E. Joint pricing and matching in ride-sharing systems. Eur. J. Oper. Res. 2020, 287, 1149–1160. [Google Scholar] [CrossRef]

- Battifarano, M.; Qian, Z. Predicting real-time surge pricing of ride-sourcing companies. Transp. Res. Part C Emerg. Technol. 2019, 107, 444–462. [Google Scholar] [CrossRef]

- Chen, X.; Zheng, H.; Ke, J.; Yang, H. Dynamic optimization strategies for on-demand ride services platform: Surge pricing, commission rate, and incentives. Transp. Res. Part B Methodol. 2020, 138, 23–45. [Google Scholar] [CrossRef]

- Lin, X.; Sun, C.; Cao, B.; Zhou, Y.-W.; Chen, C. Should ride-sharing platforms cooperate with car-rental companies? Implications for consumer surplus and driver surplus. Omega 2020, 102, 102309. Available online: https://doi.org/10.1016/j.omega.2020.102309 (accessed on 14 July 2020). [CrossRef]

- He, S.; Shin, K.G. Spatio-temporal Adaptive Pricing for Balancing Mobility-on-Demand Networks. ACM Trans. Intell. Syst. Technolog. 2019, 10, 1–28. [Google Scholar] [CrossRef]

- Gupta, A.; Saha, B.; Banerjee, P. Pricing decisions of car aggregation platforms in sharing economy: A developing economy perspective. J. Revenue Pricing Manag. 2018, 17, 341–355. [Google Scholar] [CrossRef]

- Turan, B.; Pedarsani, R.; Alizadeh, M. Dynamic pricing and fleet management for electric autonomous mobility on demand systems. Transp. Res. Part C Emerg. Technol. 2020, 121, 102829. [Google Scholar] [CrossRef]

- Al-Kanj, L.; Nascimento, J.; Powell, W.B. Approximate dynamic programming for planning a ride-hailing system using autonomous fleets of electric vehicles. Eur. J. Oper. Res. 2020, 284, 1088–1106. [Google Scholar] [CrossRef]

- Mo, D.; Yu, J.; Chen, X.M. Modeling and managing heterogeneous ride-sourcing platforms with government subsidies on electric vehicles. Transp. Res. Part B Methodol. 2020, 139, 447–472. [Google Scholar] [CrossRef]

- Özkan, E.; Ward, A.R. Dynamic matching for real-time ride sharing. Stoch. Syst. 2020, 10, 29–70. [Google Scholar] [CrossRef]

- Zhang, F.; Liu, W.; Wang, X.; Yang, H. Parking sharing problem with spatially distributed parking supplies. Transp. Res. Part C Emerg. Technol. 2020, 117, 102676. [Google Scholar] [CrossRef]

- Li, Y.; Courcoubetis, C.A.; Duan, L.; Weber, R. Optimal Pricing for Peer-to-Peer Sharing with Network Externalities. IEEE ACM Trans. Netw. 2020, 29, 148–161. [Google Scholar] [CrossRef]

- Ma, Q.; Gao, L.; Liu, Y.-F.; Huang, J. Economic Analysis of Crowdsourced Wireless Community Networks. IEEE Trans. Mob. Comput. 2017, 16, 1856–1869. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, Q.; Zhu, H.; Wang, X. Enabling Collaborative Computing Sustainably Through Computational Latency-Based Pricing. IEEE Trans. Sustain. Comput. 2020, 5, 541–551. [Google Scholar] [CrossRef]

- Meng, H.; Zhu, Y.; Deng, R. Optimal Computing Resource Management Based on Utility Maximization in Mobile Crowdsourcing. Wirel. Commun. Mob. Comput. 2017, 2017, 1494851. [Google Scholar] [CrossRef]

- Mostafavi, S.; Dehghan, M. Game-theoretic auction design for bandwidth sharing in helper-assisted P2P streaming. Int. J. Commun. Syst. 2016, 29, 1057–1072. [Google Scholar] [CrossRef]

- Kung, L.-C.; Zhong, G.-Y. The optimal pricing strategy for two-sided platform delivery in the sharing economy. Transp. Res. Part E Logist. Transp. Rev. 2017, 101, 1–12. [Google Scholar] [CrossRef]

- Tan, B.Q.; Xu, S.X.; Zhong, R.; Cheng, M.; Kang, K. Sequential auction based parking space sharing and pricing mechanism in the era of sharing economy. Ind. Manag. Data Syst. 2019, 119, 1734–1747. [Google Scholar] [CrossRef]

- Li, G.; Zheng, H.; Sethi, S.P.; Guan, X. Inducing downstream information sharing via manufacturer information acquisition and retailer subsidy. Decis. Sci. 2020, 51, 691–719. [Google Scholar] [CrossRef]

- Liu, Z.; Zhang, D.J.; Zhang, F. Information sharing on retail platforms. Manuf. Serv. Oper. Manag. 2020, 23, 547–730. [Google Scholar] [CrossRef]

- Li, G.; Zheng, H.; Tian, L. Information Sharing in an Online Marketplace with Co-opetitive Sellers. Prod. Oper. Manag. 2021. Available online: https://doi.org/10.1111/poms.13460 (accessed on 11 May 2021).

- Coase, R.H. The problem of social cost. In Classic Papers in Natural Resource Economics; Springer: Berlin/Heidelberg, Germany, 1960; pp. 87–137. [Google Scholar]

- Lim, W.M.; Yap, S.-F.; Makkar, M. Home sharing in marketing and tourism at a tipping point: What do we know, how do we know, and where should we be heading? J. Bus. Res. 2020, 122, 534–566. [Google Scholar] [CrossRef]

- Laurenti, R.; Singh, J.; Cotrim, J.M.; Toni, M.; Sinha, R. Characterizing the Sharing Economy State of the Research: A Systematic Map. Sustainability 2019, 11, 5729. [Google Scholar] [CrossRef]

- Ozdemir, G.; Turker, D. Institutionalization of the sharing in the context of Airbnb: A systematic literature review and content analysis. Anatolia 2019, 30, 601–613. [Google Scholar] [CrossRef]

- Gupta, D.P.; Chauhan, P.S. Mapping intellectual structure and sustainability claims of sharing economy research—A literature review. Sustain. Prod. Consum. 2021, 25, 347–362. [Google Scholar] [CrossRef]

- Wang, X.; Lin, X.; Abdullat, A. Sharing economy: A review of the literature and a framework for future research. VINE J. Inf. Knowl. Manag. Syst. 2020, 51, 418–437. [Google Scholar] [CrossRef]

- Agarwal, N.; Steinmetz, R. Sharing Economy: A Systematic Literature Review. Int. J. Innov. Technol. Manag. 2019, 16, 1930002. [Google Scholar] [CrossRef]

- Trabucchi, D.; Muzellec, L.; Ronteau, S. Sharing economy: Seeing through the fog. Internet Res. 2019, 29, 996–1013. [Google Scholar] [CrossRef]

- Cheng, M. Sharing economy: A review and agenda for future research. Int. J. Hosp. Manag. 2016, 57, 60–70. [Google Scholar] [CrossRef]

- Köbis, N.C.; Soraperra, I.; Shalvi, S. The Consequences of Participating in the Sharing Economy: A Transparency-Based Sharing Framework. J. Manag. 2020, 47, 317–343. [Google Scholar] [CrossRef]

- Weili, L.I.U.; Khan, H. A Literature Review on the Definition of Sharing Economy. Glob. Econ. J. 2020, 20, 2030001. [Google Scholar] [CrossRef]

- Ranjbari, M.; Morales-Alonso, G.; Carrasco-Gallego, R. Conceptualizing the Sharing Economy through Presenting a Comprehensive Framework. Sustainability 2018, 10, 2336. [Google Scholar] [CrossRef]

- Curtis, S.K.; Lehner, M. Defining the Sharing Economy for Sustainability. Sustainability 2019, 11, 567. [Google Scholar] [CrossRef]

- Soltysova, Z.; Modrak, V. Challenges of the Sharing Economy for SMEs: A Literature Review. Sustainability 2020, 12, 6504. [Google Scholar] [CrossRef]

- Sari, R.; Meyliana, M.; Nizar Hidayanto, A.; Prabowo, H. Sharing Economy in People, Process and Technology Perspective: A Systematic Literature Review. Int. J. Mech. Eng. Technol. 2019, 10, 100–116. [Google Scholar] [CrossRef]

- Laukkanen, M.; Tura, N. The potential of sharing economy business models for sustainable value creation. J. Clean. Prod. 2020, 253, 120004. [Google Scholar] [CrossRef]

- Trenz, M.; Frey, A.; Veit, D. Disentangling the facets of sharing. Internet Res. 2018, 28, 888–925. [Google Scholar] [CrossRef]

- Ryu, H.; Basu, M.; Saito, O. What and how are we sharing? A systematic review of the sharing paradigm and practices. Sustain. Sci. 2018, 14, 515–527. [Google Scholar] [CrossRef]

- Cheng, M.; Edwards, D. A comparative automated content analysis approach on the review of the sharing economy discourse in tourism and hospitality. Curr. Issues Tour. 2017, 22, 35–49. [Google Scholar] [CrossRef]

- Jaremen, D.E.; Nawrocka, E.; Żemła, M. Externalities of development of the sharing economy in tourism cities. Int. J. Tour. Cities 2020, 6, 138–157. [Google Scholar] [CrossRef]

- Dolnicar, S. A review of research into paid online peer-to-peer accommodation: Launching the Annals of Tourism Research Curated Collection on peer-to-peer accommodation. Ann. Tour. Res. 2019, 75, 248–264. [Google Scholar] [CrossRef]

- Medina-Hernandez, V.C.; Marine-Roig, E.; Ferrer-Rosell, B. Accommodation sharing: A look beyond Airbnb’s literature. Int. J. Cult. Tour. Hosp. Res. 2020, 14, 21–33. [Google Scholar] [CrossRef]

- Sainaghi, R.; Baggio, R. Clusters of topics and research designs in peer-to-peer accommodation platforms. Int. J. Hosp. Manag. 2020, 88, 102393. [Google Scholar] [CrossRef]

- Kuhzady, S.; Seyfi, S.; Béal, L. Peer-to-peer (P2P) accommodation in the sharing economy: A review. Curr. Issues Tour. 2020, 1–16. [Google Scholar] [CrossRef]

- Casado-Diaz, M.A.; Casado-Díaz, A.B.; Hoogendoorn, G. The home exchange phenomenon in the sharing economy: A research agenda. Scand. J. Hosp. Tour. 2020, 20, 268–285. [Google Scholar] [CrossRef]

- Sutherland, W.; Jarrahi, M.H. The sharing economy and digital platforms: A review and research agenda. Int. J. Inf. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Skok, W.; Baker, S. Evaluating the impact of Uber on London’s taxi service: A critical review of the literature. Knowl. Process Manag. 2019, 26, 3–9. [Google Scholar] [CrossRef]

- Tafreshian, A.; Masoud, N.; Yin, Y. Frontiers in Service Science: Ride Matching for Peer-to-Peer Ride Sharing: A Review and Future Directions. Serv. Sci. 2020, 12, 44–60. [Google Scholar] [CrossRef]

- Tirachini, A. Ride-hailing, travel behaviour and sustainable mobility: An international review. Transportation 2019, 47, 2011–2047. [Google Scholar] [CrossRef]

- Shoshany Tavory, S.; Trop, T.; Shiftan, Y. Self-organized ridesharing: Multiperspective annotated review. Int. J. Sustain. Transp. 2019, 14, 270–279. [Google Scholar] [CrossRef]

- Iran, S.; Schrader, U. Collaborative fashion consumption and its environmental effects. J. Fash. Mark. Manag. Int. J. 2017, 21, 468–482. [Google Scholar] [CrossRef]

- Akande, A.; Cabral, P.; Casteleyn, S. Understanding the sharing economy and its implication on sustainability in smart cities. J. Clean. Prod. 2020, 277, 124077. [Google Scholar] [CrossRef]

- Räisänen, J.; Ojala, A.; Tuovinen, T. Building trust in the sharing economy: Current approaches and future considerations. J. Clean. Prod. 2021, 279, 123724. [Google Scholar] [CrossRef]

- Boar, A.; Bastida, R.; Marimon, F. A Systematic Literature Review. Relationships between the Sharing Economy, Sustainability and Sustainable Development Goals. Sustainability 2020, 12, 6744. [Google Scholar] [CrossRef]

- Anglada, Q.M.; Hernández Lara, A.B. Research on sharing economy: Why are some articles more cited than others? Econ. Res.-Ekon. Istraž. 2019, 33, 2787–2805. [Google Scholar] [CrossRef]

- Sainaghi, R.; Köseoglu, M.A.; d’Angella, F.; Mehraliyev, F. Sharing economy: A co-citation analysis. Curr. Issues Tour. 2019, 23, 929–937. [Google Scholar] [CrossRef]

- Kraus, S.; Li, H.; Kang, Q.; Westhead, P.; Tiberius, V. The sharing economy: A bibliometric analysis of the state-of-the-art. Int. J. Entrep. Behav. Res. 2020, 26, 1769–1786. [Google Scholar] [CrossRef]

| Block | Search Term |

|---|---|

| Dependent Variable | Price or pricing |

| AND | |

| Context | “sharing economy”, “collaborative consumption”, “peer-to-peer consumption”, “p2p consumption”, or “access-based consumption” [13], “peer-to-peer accommodation” or “p2p accommodation” [11], “commercial sharing system” or “access economy” or “peer-to-peer market” or “P2P market” or “gig economy” or “piecemeal labor” or “do-it-yourself economy” or “diy economy” or “platform economy” or “crowd-based capitalism” or “on-demand economy” or “peer-to-peer economy” or “p2p economy” or “mesh economy” or “rental economy” or “community-based economy” or “commons-based peer production” [21], “bike sharing” or “bicycle sharing” [22], “ride sharing”, “ride hailing”, or “ride sourcing” [12], “car sharing” [21], “vehicle sharing”, “crowdsourcing” [23], “crowdfunding” [24], “collaborative fashion consumption” [25], “sharing platform”, “peer-to-peer platform”, or “p2p platform” [21] |

| Business Model | Pricing Party | Theme | Reference | Count | Total |

|---|---|---|---|---|---|

| B2C | Manufacturer | General model | [17] | 1 | 1 (0.6%) |

| Firm | General model | [27,28,29] | 3 | 4 (2.5%) | |

| Information Sharing | [30] | 1 | |||

| Provider | General model | [17,27,31] | 3 | 36 (22.8%) | |

| WIFI sharing | [32] | 1 | |||

| Bike sharing | [33,34,35,36,37,38] | 6 | |||

| Vehicle sharing | [39,40,41,42,43] | 5 | |||

| Crowdfunding | [4,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61] | 19 | |||

| 3D printing sharing | [62] | 1 | |||

| Electricity storage sharing | [63] | 1 | |||

| Intermediary | - | - | - | ||

| Requester | Crowdsourcing | [5,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80] | 18 | 18 (11.4%) | |

| C2C | Manufacturer | General model | [2,16,81] | 3 | 4 (2.5%) |

| Vehicle sharing | [82] | 1 | |||

| Firm | General model | [2,16,29,83,84,85,86,87] | 8 | 8 (5.1%) | |

| Provider | General model | [2,81] | 2 | 48 (30.1%) | |

| P2P accommodation | [15,88,89,90,91,92,93,94,95,96,97,98,99,100,101,102,103,104,105,106,107,108,109,110,111,112,113,114,115,116,117,118,119,120,121,122,123,124,125] | 39 | |||

| Ride sharing | [126] | 1 | |||

| Meal sharing | [127] | 1 | |||

| Crowdsourcing | [128] | 1 | |||

| Electricity storage sharing | [129,130] | 2 | |||

| Information Sharing | [131,132] | 2 | |||

| Intermediary | General model | [133,134,135,136,137,138] | 6 | 45 (28.5%) | |

| Commission fee | [139,140,141] | 3 | |||

| Ride sharing | [142,143,144,145,146,147,148,149] | 8 | |||

| Ride hailing | [6,150,151,152,153,154,155,156,157,158,159,160,161,162,163,164,165,166,167,168,169] | 21 | |||

| Parking space sharing | [170] | 1 | |||

| WIFI sharing | [171,172] | 2 | |||

| Computing resource sharing | [173,174,175] | 3 | |||

| Delivery sharing | [176] | 1 | |||

| Requester | Parking space sharing | [177] | 1 | 1 (0.6%) |

| Price Payout Ratio | Flexible | Fixed |

|---|---|---|

| Flexible | Dynamic Pricing | - |

| Fixed | Surge Pricing | Static Pricing |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, M.; Xia, E. A Systematic Literature Review on Pricing Strategies in the Sharing Economy. Sustainability 2021, 13, 9762. https://doi.org/10.3390/su13179762

Yang M, Xia E. A Systematic Literature Review on Pricing Strategies in the Sharing Economy. Sustainability. 2021; 13(17):9762. https://doi.org/10.3390/su13179762

Chicago/Turabian StyleYang, Meijian, and Enjun Xia. 2021. "A Systematic Literature Review on Pricing Strategies in the Sharing Economy" Sustainability 13, no. 17: 9762. https://doi.org/10.3390/su13179762