Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil

Abstract

:1. Introduction

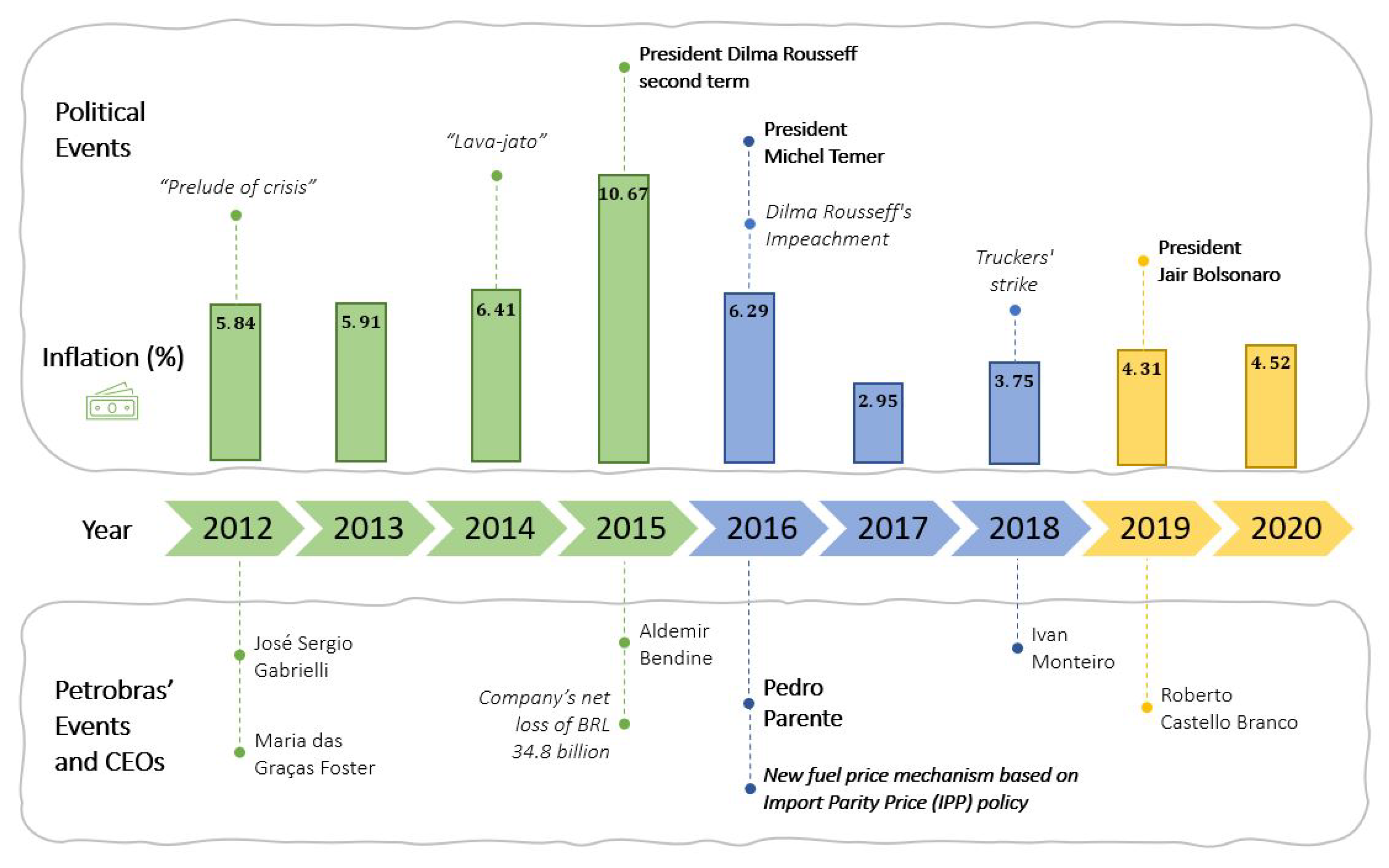

1.1. Brazilian Fossil Fuel Policy Framework

1.2. Ethanol and the Transition from Oil-Based Economy to the Use of Renewable Energy Resources

2. Materials and Methods

2.1. Data

2.2. Statistical Method

3. Results and Discussion

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- The Economist. Brazil Takes off. 2009. Available online: https://www.economist.com/leaders/2009/11/12/brazil-takes-off (accessed on 20 June 2021).

- The Economist. Has Brazil Blown It? 2013. Available online: https://www.economist.com/leaders/2013/09/27/has-brazil-blown-it (accessed on 20 June 2021).

- Vartanian, P.R.; de Souza Garbe, H. The Brazilian economic crisis during the period 2014–2016: Is there precedence of internal or external factors? J. Int. Glob. Econ. Stud. 2019, 12, 66–86. [Google Scholar]

- The Economist. The Great Betrayal. 2016. Available online: https://www.economist.com/leaders/2016/04/23/the-great-betrayal (accessed on 20 June 2021).

- The Economist. Deathwatch for the Amazon. 2019. Available online: https://www.economist.com/leaders/2019/08/01/deathwatch-for-the-amazon (accessed on 23 June 2021).

- Sicsú, J.; de Melo Modenesi, A.; Pimentel, D. Severe recession with inflation: The case of Brazil. J. Post Keynes. Econ. 2021, 44, 89–111. [Google Scholar]

- IBGE. Instituto Brasileiro de Geografia e Estatística—(IBGE). Available online: www.ibge.gov.br (accessed on 10 May 2021).

- Nascimento Filho, A.; Pereira, E.; Ferreira, P.; Murari, T.; Moret, M. Cross-correlation analysis on Brazilian gasoline retail market. Phys. Stat. Mech. Appl. 2018, 508, 550–557. [Google Scholar] [CrossRef]

- Murari, T.B.; Nascimento Filho, A.S.; Pereira, E.J.; Ferreira, P.; Pitombo, S.; Pereira, H.B.; Santos, A.A.; Moret, M.A. Comparative analysis between hydrous ethanol and gasoline c pricing in brazilian retail market. Sustainability 2019, 11, 4719. [Google Scholar]

- Pennerstorfer, D. Spatial price competition in retail gasoline markets: Evidence from Austria. Ann. Reg. Sci. 2009, 43, 133–158. [Google Scholar] [CrossRef]

- Lewis, M. Price dispersion and competition with differentiated sellers. J. Ind. Econ. 2008, 56, 654–678. [Google Scholar]

- Balaguer, J.; Ripollés, J. Do classes of gas stations contribute differently to fuel prices? Evidence to foster effective competition in Spain. Energy Policy 2020, 139, 111315. [Google Scholar] [CrossRef]

- Davis, L.W. The economic cost of global fuel subsidies. Am. Econ. Rev. 2014, 104, 581–585. [Google Scholar] [CrossRef] [Green Version]

- Victor, D.G. The Politics of Fossil-Fuel Subsidies; International Institute for Sustainable Development: Geneva, Switzerland, 2009; pp. 26–28. [Google Scholar]

- Del Granado, F.J.A.; Coady, D.; Gillingham, R. The unequal benefits of fuel subsidies: A review of evidence for developing countries. World Dev. 2012, 40, 2234–2248. [Google Scholar]

- Parry, I. Fossil-Fuel Subsidies Assessed. Nature 2018, 554, 175–176. [Google Scholar] [CrossRef] [Green Version]

- Arzaghi, M.; Squalli, J. How price inelastic is demand for gasoline in fuel-subsidizing economies? Energy Econ. 2015, 50, 117–124. [Google Scholar] [CrossRef]

- Aucott, M.; Hall, C. Does a change in price of fuel affect GDP growth? An examination of the US data from 1950–2013. Energies 2014, 7, 6558–6570. [Google Scholar] [CrossRef] [Green Version]

- El Montasser, G.; Gupta, R.; Martins, A.L.; Wanke, P. Are there multiple bubbles in the ethanol–gasoline price ratio of Brazil? Renew. Sustain. Energy Rev. 2015, 52, 19–23. [Google Scholar] [CrossRef] [Green Version]

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Boletim Abastecimento em Números—63. 2019. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/publicacoes/boletins-anp/ban/boletim-n63.pdf (accessed on 25 July 2021).

- Petrobras. Composição Acionária. 2021. Available online: https://www.investidorpetrobras.com.br/visao-geral/composicao-acionaria/ (accessed on 25 July 2021).

- Petrobras. Divulgação de Resultados do Exercício de 2015. 2016. Available online: https://petrobras.com.br/fatos-e-dados/divulgacao-de-resultados-do-exercicio-de-2015.htm (accessed on 26 July 2021).

- Khan, K.; Su, C.W.; Umar, M.; Yue, X.G. Do crude oil price bubbles occur? Resour. Policy 2021, 71, 101936. [Google Scholar] [CrossRef]

- Petrobras. Adotamos Nova Política de Preços de Diesel e Gasolina. 2016. Available online: https://petrobras.com.br/fatos-e-dados/adotamos-nova-politica-de-precos-de-diesel-e-gasolina.htm (accessed on 27 July 2021).

- Hallack, L.N.; Kaufmann, R.; Szklo, A.S. Price discovery in Brazil: Causal relations among prices for crude oil, ethanol, and gasoline. Energy Sources Part Econ. Plan. Policy 2020, 15, 230–251. [Google Scholar]

- Moura, H.N.; Neto, J.B.L.; da Silva Santos, V.É.; Tavares, F.B.R. Resultantes da greve dos caminhoneiros (2018): Um hibridismo de estatística bilionária e o óleo diesel em face à macroeconomia. Res. Soc. Dev. 2019, 8, e50871164. [Google Scholar] [CrossRef]

- Leirião, L.F.L.; Debone, D.; Pauliquevis, T.; do Rosário, N.M.É.; Miraglia, S.G.E.K. Environmental and public health effects of vehicle emissions in a large metropolis: Case study of a truck driver strike in Sao Paulo, Brazil. Atmos. Pollut. Res. 2020, 11, 24–31. [Google Scholar]

- Vargas-Hernández, J.G.; Pallagst, K.; Hammer, P. Bio economy’s institutional and policy framework for the sustainable development of nature’s ecosystems. Econ. Coyunt. 2017, 2, 51–104. [Google Scholar]

- Renewable Fuels Association. Annual Fuel Ethanol Production. 2021. Available online: https://ethanolrfa.org/statistics/annual-ethanol-production/ (accessed on 29 July 2021).

- Karp, S.G.; Medina, J.D.; Letti, L.A.; Woiciechowski, A.L.; de Carvalho, J.C.; Schmitt, C.C.; de Oliveira Penha, R.; Kumlehn, G.S.; Soccol, C.R. Bioeconomy and biofuels: The case of sugarcane ethanol in Brazil. Biofuels Bioprod. Biorefining 2021, 15, 899–912. [Google Scholar] [CrossRef]

- David, S.A.; Quintino, D.D.; Inacio, C., Jr.; Machado, J.T. Fractional dynamic behavior in ethanol prices series. J. Comput. Appl. Math. 2018, 339, 85–93. [Google Scholar]

- Dutta, A. Cointegration and nonlinear causality among ethanol-related prices: Evidence from Brazil. GCB Bioenergy 2018, 10, 335–342. [Google Scholar] [CrossRef] [Green Version]

- Kristoufek, L.; Janda, K.; Zilberman, D. Comovements of ethanol-related prices: Evidence from Brazil and the USA. GCB Bioenergy 2016, 8, 346–356. [Google Scholar] [CrossRef] [Green Version]

- Cardoso, L.C.; Bittencourt, M.V.; Litt, W.H.; Irwin, E.G. Biofuels policies and fuel demand elasticities in Brazil. Energy Policy 2019, 128, 296–305. [Google Scholar] [CrossRef]

- Da Silva Lima, N.D.; de Alencar Nääs, I.; Reis, J.G.M.d.; Silva, R.B.T.R.d. Classifying the Level of Energy-Environmental Efficiency Rating of Brazilian Ethanol. Energies 2020, 13, 2067. [Google Scholar] [CrossRef] [Green Version]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do gasoline prices respond asymmetrically to crude oil price changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Peltzman, S. Prices rise faster than they fall. J. Political Econ. 2000, 108, 466–502. [Google Scholar] [CrossRef]

- Ray, S.; Chen, H.; Bergen, M.E.; Levy, D. Asymmetric wholesale pricing: Theory and evidence. Mark. Sci. 2006, 25, 131–154. [Google Scholar] [CrossRef]

- Rodrigues, N.; Losekann, L.; Silveira Filho, G. Demand of automotive fuels in Brazil: Underlying energy demand trend and asymmetric price response. Energy Econ. 2018, 74, 644–655. [Google Scholar]

- Laurini, M.P. The spatio-temporal dynamics of ethanol/gasoline price ratio in Brazil. Renew. Sustain. Energy Rev. 2017, 70, 1–12. [Google Scholar] [CrossRef]

- Khanna, M.; Nuñez, H.M.; Zilberman, D. Who pays and who gains from fuel policies in Brazil? Energy Econ. 2016, 54, 133–143. [Google Scholar]

- Empresa de Pesquisa Energética—EPE. Análise de Conjuntura dos Biocombustíveis—Ano 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-615/NT-EPE-DPG-SDB-2021-03_Analise_de_Conjuntura_dos_Biocombustiveis_ano_2020.pdf (accessed on 22 June 2021).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Série Histórica do Levantamento de preçOs. 2020. Available online: http://www.anp.gov.br/precos-e-defesa-da-concorrencia/precos/levantamento-de-precos/serie-historica-levantamento-precos (accessed on 13 May 2021).

- Ferreira, P.C.G. Post-cartel behavior: Assessing the effects of antitrust policy on brazilian fuel market. REM Work. Pap. Ser. 2020, 152. [Google Scholar]

- Bauer, D.F. Constructing confidence sets using rank statistics. J. Am. Stat. Assoc. 1972, 67, 687–690. [Google Scholar] [CrossRef]

- Brown, M.B.; Forsythe, A.B. Robust tests for the equality of variances. J. Am. Stat. Assoc. 1974, 69, 364–367. [Google Scholar] [CrossRef]

- Observatório da Cana. Consumo de combustíveis. 2020. Available online: https://observatoriodacana.com.br/ (accessed on 22 August 2021).

- Mens, J.; van Bueren, E.; Vrijhoef, R.; Heurkens, E. A typology of social entrepreneurs in bottom-up urban development. Cities 2021, 110, 103066. [Google Scholar] [CrossRef]

- Pallagst, K.; Vargas-Hernández, J.; Hammer, P. Green Innovation Areas—En Route to Sustainability for Shrinking Cities? Sustainability 2019, 11, 6674. [Google Scholar] [CrossRef] [Green Version]

- Scheidgen, K.; Gümüsay, A.A.; Günzel-Jensen, F.; Krlev, G.; Wolf, M. Crises and entrepreneurial opportunities: Digital social innovation in response to physical distancing. J. Bus. Ventur. Insights 2021, 15, e00222. [Google Scholar] [CrossRef]

| Distribution | Retail | |||||||

|---|---|---|---|---|---|---|---|---|

| City | Median | Mann–Whitney Test | Median | Mann–Whitney Test | ||||

| Before | After | Delta | p-Value | Before | After | Delta | p-Value | |

| POA | 0.824 | 0.917 | 11.25% | 0.0000 | 0.814 | 0.908 | 11.46% | 0.0000 |

| FOR | 0.817 | 0.840 | 2.85% | 0.0060 | 0.795 | 0.858 | 7.93% | 0.0000 |

| RIO | 0.806 | 0.826 | 2.56% | 0.0126 | 0.804 | 0.864 | 7.44% | 0.0007 |

| FLN | 0.835 | 0.846 | 1.29% | 0.4412 | 0.825 | 0.858 | 4.04% | 0.0002 |

| CWB | 0.696 | 0.699 | 0.36% | 0.4669 | 0.685 | 0.709 | 3.44% | 0.0159 |

| BEL | 0.875 | 0.886 | 1.30% | 0.3510 | 0.862 | 0.875 | 1.54% | 0.0820 |

| GYN | 0.681 | 0.672 | −1.25% | 0.1280 | 0.691 | 0.700 | 1.43% | 0.3852 |

| SSA | 0.751 | 0.757 | 0.81% | 0.4187 | 0.767 | 0.775 | 1.09% | 0.5347 |

| RBR | 0.897 | 0.885 | −1.28% | 0.1564 | 0.914 | 0.922 | 0.89% | 0.6572 |

| SAO | 0.629 | 0.625 | −0.71% | 0.5333 | 0.624 | 0.630 | 0.83% | 0.4374 |

| BSB | 0.826 | 0.803 | −2.75% | 0.0830 | 0.824 | 0.820 | −0.43% | 0.7184 |

| MAO | 0.880 | 0.866 | −1.63% | 0.0504 | 0.844 | 0.837 | −0.85% | 0.3274 |

| REC | 0.799 | 0.772 | −3.28% | 0.0000 | 0.781 | 0.754 | −3.37% | 0.0002 |

| BHZ | 0.725 | 0.687 | −5.32% | 0.0009 | 0.726 | 0.691 | −4.87% | 0.0016 |

| CGB | 0.619 | 0.612 | −1.12% | 0.0646 | 0.682 | 0.621 | −8.87% | 0.0000 |

| Distribution | Retail | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| City | IQR | CoefVar | Levene’s Test | IQR | CoefVar | Levene’s Test | ||||||||

| Before | After | Delta | Before | After | Delta | p-Value | Before | After | Delta | Before | After | Delta | p-Value | |

| BSB | 0.070 | 0.111 | 58.14% | 5.52 | 8.88 | 60.87% | 0.0000 | 0.053 | 0.113 | 112.37% | 5.22 | 9.08 | 73.95% | 0.0000 |

| BEL | 0.055 | 0.128 | 131.29% | 4.80 | 9.58 | 99.58% | 0.0000 | 0.057 | 0.120 | 110.30% | 5.54 | 9.39 | 69.49% | 0.0000 |

| MAO | 0.061 | 0.116 | 89.94% | 4.69 | 9.26 | 97.44% | 0.0000 | 0.056 | 0.084 | 50.33% | 5.35 | 8.62 | 61.12% | 0.0000 |

| RIO | 0.066 | 0.127 | 90.57% | 6.96 | 9.60 | 37.93% | 0.0000 | 0.078 | 0.139 | 78.46% | 6.72 | 9.84 | 46.43% | 0.0000 |

| FLN | 0.074 | 0.121 | 64.18% | 6.36 | 10.16 | 59.75% | 0.0000 | 0.068 | 0.095 | 38.47% | 6.13 | 8.97 | 46.33% | 0.0010 |

| SSA | 0.065 | 0.112 | 70.40% | 6.31 | 8.94 | 41.68% | 0.0000 | 0.071 | 0.104 | 45.27% | 6.72 | 8.77 | 30.51% | 0.0090 |

| RBR | 0.080 | 0.086 | 7.10% | 6.06 | 8.71 | 43.73% | 0.0130 | 0.083 | 0.098 | 18.05% | 6.39 | 8.25 | 29.11% | 0.0220 |

| SAO | 0.069 | 0.104 | 51.33% | 7.98 | 10.10 | 26.57% | 0.0040 | 0.070 | 0.100 | 42.79% | 7.83 | 9.62 | 22.86% | 0.0170 |

| CWB | 0.072 | 0.092 | 27.73% | 7.54 | 9.14 | 21.22% | 0.0770 | 0.067 | 0.082 | 22.83% | 6.89 | 8.40 | 21.92% | 0.0510 |

| GYN | 0.083 | 0.102 | 23.78% | 7.84 | 10.24 | 30.61% | 0.0240 | 0.071 | 0.092 | 29.31% | 8.00 | 9.47 | 18.38% | 0.0720 |

| REC | 0.059 | 0.073 | 24.01% | 6.06 | 7.12 | 17.49% | 0.4170 | 0.061 | 0.068 | 11.66% | 6.00 | 6.94 | 15.67% | 0.5360 |

| BHZ | 0.080 | 0.093 | 15.88% | 8.15 | 8.05 | −1.23% | 0.8370 | 0.084 | 0.094 | 11.29% | 7.82 | 8.28 | 5.88% | 0.7200 |

| FOR | 0.052 | 0.077 | 47.46% | 4.98 | 6.65 | 33.53% | 0.0010 | 0.069 | 0.061 | −11.38% | 6.30 | 6.06 | −3.81% | 0.8940 |

| CGB | 0.075 | 0.094 | 25.75% | 9.39 | 9.33 | −0.64% | 0.6130 | 0.058 | 0.101 | 75.77% | 9.87 | 9.49 | −3.85% | 0.7510 |

| POA | 0.100 | 0.066 | −34.52% | 8.63 | 7.21 | −16.45% | 0.1440 | 0.072 | 0.071 | −1.53% | 8.02 | 6.11 | −23.82% | 0.2880 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nascimento Filho, A.S.; Saba, H.; dos Santos, R.G.O.; Calmon, J.G.A.; Araújo, M.L.V.; Jorge, E.M.F.; Murari, T.B. Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil. Sustainability 2021, 13, 9899. https://doi.org/10.3390/su13179899

Nascimento Filho AS, Saba H, dos Santos RGO, Calmon JGA, Araújo MLV, Jorge EMF, Murari TB. Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil. Sustainability. 2021; 13(17):9899. https://doi.org/10.3390/su13179899

Chicago/Turabian StyleNascimento Filho, Aloisio S., Hugo Saba, Rafael G. O. dos Santos, João Gabriel A. Calmon, Marcio L. V. Araújo, Eduardo M. F. Jorge, and Thiago B. Murari. 2021. "Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil" Sustainability 13, no. 17: 9899. https://doi.org/10.3390/su13179899

APA StyleNascimento Filho, A. S., Saba, H., dos Santos, R. G. O., Calmon, J. G. A., Araújo, M. L. V., Jorge, E. M. F., & Murari, T. B. (2021). Analysis of Hydrous Ethanol Price Competitiveness after the Implementation of the Fossil Fuel Import Price Parity Policy in Brazil. Sustainability, 13(17), 9899. https://doi.org/10.3390/su13179899