3.1. Economic Analysis for the Bench Scale Extraction

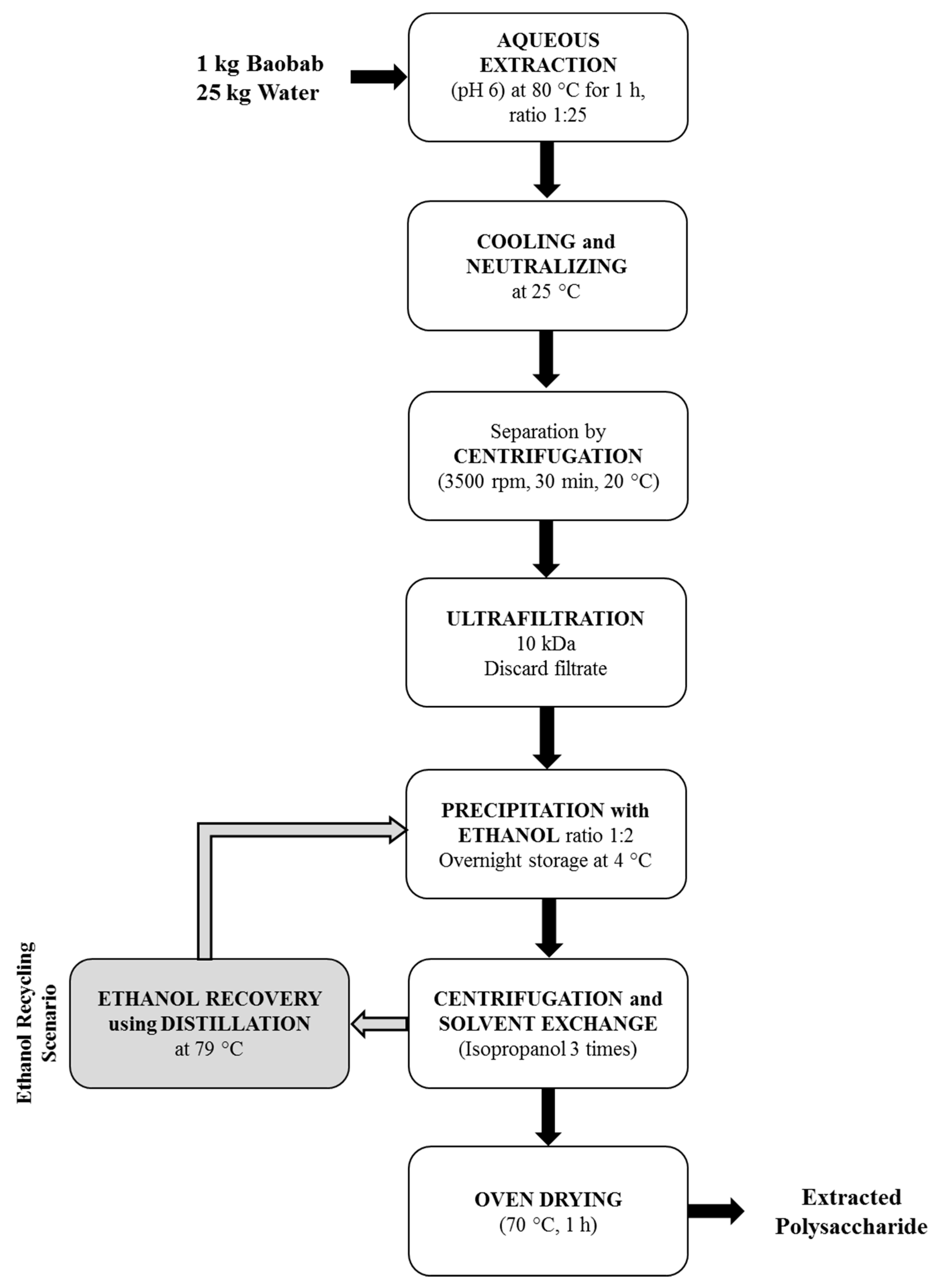

A preliminary economic analysis for both scenarios (with/without ethanol recycling) was been performed to determine the economic viability of the process, based on the bench scale extraction. In addition,

Table 2 reports the operating costs of the raw materials, utilities and chemicals that were used during the extraction. The prices of the chemicals were extracted from the websites of common industrial suppliers for the largest quantity available, industrial use prices were assumed for the utilities, and the price of baobab for bulk purchase for the UK was quoted from an online seller (Source: Personal Communication in 2019). It was also assumed that steam is being produced onsite by a gas fired boiler with a typical efficiency of 85%. Natural gas price was taken as 2 p per kWh [

15] whereas the calorific value was assumed to be 40 MJ/m

3.

Table 3 presents the operating costs for each stage of the polysaccharide extraction and the overall cost for both scenarios (base case and with ethanol recycling). For the base scenario, the total operating cost is estimated to be 63.8£/kg of raw material. It is observed that the most critical stages are the precipitation (accounting for 62% of the total cost), due to large amounts of alcohol used, and the extraction (23%) stage. Finally, 13% is allocated to the pre-experiment stage, which includes the shipping costs of raw material. For the ethanol recycling scenario, the total processing cost is lower, reaching only 31.5£/kg of raw material. In this case, the most critical steps are extraction (47%) and pre-experiment (25%) with precipitation accounting only for 17% of the total cost.

Combining the operating cost with the average polysaccharide yield, which is approximately 300 g/kg of raw material, the average cost per 100 g of extracted polysaccharide is estimated to be 21.1£/100 g, for the base scenario, and 10.4£/100 g, for the ethanol recycling scenario. These values correspond to the break-even price for the final product of the extraction process, i.e., the minimum price that the extracted polysaccharide could be sold, and at the same time the total cost and the total revenues would be equal. These values are similar to the price of commercially extracted pectin at large scale. However, they are much higher compared to the actual production cost of commercial pectin. For that purpose, a scale up analysis was performed, to assess if the overall cost would drop, and, thus, the potential profit of an industrial extraction plant would be higher, rendering such an investment viable.

3.2. Profitability Analysis of a Scaled-Up Extraction Plant

It was assumed that a batch process will operate at the facility, and the daily processed mass of baobab at the plant will be 100 kg, with an expected yield of 30 kg of polysaccharide per day. The construction year was assumed to be 2018, with a construction period of six months. All the purchase costs for the plant were estimated according to [

14] and calculated in British Pounds (£). Due to lack of data, the capital cost of the ultrafiltration unit was estimated from [

16]. All capital costs have been brought forward for the construction year 2018 based on the Chemical Engineering Plant Cost Index. The indirect cost factors for the physical plant cost, the fixed capital cost, and the total investment required were also extracted from [

14] and presented in

Table 4.

Table 5 illustrates the purchase costs of the equipment (PCE), the physical plant cost (PPC), the fixed capital cost (FCE), and the total investment required for each of the two scenarios. Under ethanol recycling, all costs are slightly higher, as expected, because of the distillation column used to recover the ethanol.

Regarding the operating and variable costs, all the relevant values for labour, facility-dependent costs (e.g., maintenance, depreciation, insurance, local taxes), and other miscellaneous costs were extracted from [

17,

18] and are presented in

Table 6. The raw material, chemicals, and utilities prices presented in

Table 2 were also used in this part of the analysis, whereas the basic labour rate was extracted from [

19].

Table 7 analyses the raw materials and utilities related annual costs for each scenario, highlighting the huge difference in the cost between the base case and the ethanol recycling scenario. Clearly, it can be observed that the subtotal for raw materials in the base case is almost four times higher (1,834,500£/year) than in the ethanol recycling scenario (528,000£/year). In contrast, the total value for utilities is slightly increased in the ethanol recycling scenario, due to the higher energy requirements as a result of the distillation column.

Table 7 also summarises the raw material annual costs for each scenario as well as the utilities, the labour related and facility dependant annual operating costs for each scenario. Clearly, the ethanol recycling option and the subsequent addition of the distillation column increased the total utilities cost by approximately 10%, because of the higher energy requirements. The labour and the facility-dependent costs also increased after the implementation of the ethanol recycling scenario. However, the total annual variable costs were decreased by approximately 35%, due to the significant savings in solvent usage.

Since the polysaccharide extraction from baobab is a novel process, it is difficult and uncertain to assume a specific price for the final product in order to calculate the expected revenues and, thus, assess the economic viability of the investment. For that reason, the production cost of the polysaccharide was calculated for a minimum acceptable economic result, as expressed by the payback period, one of the most commonly used criteria for the economic performance assessment of a plant [

17,

20].

Table 8 summarises all the costs and the expected revenue from selling the final product for both scenarios, assuming corporation tax set at 30% and linear depreciation for the 15 years of the plant life. The minimum profitable selling price in determined for payback period of six years (which would give a return on investment of approximately 16.7%).

The estimated minimum profitable selling price ranges between £23 and £35 per 100 g of polysaccharide and is comparable to the commercial selling price of high purity polysaccharides (£40–60/100 g) [

21]. However, the commercial selling price varies depending on the functionality and may be lowered down to £2/100 g (Source: Personal Communication with industrial pectin producer) for simple gelation applications. Considering that the two major components of the total annual variable costs are the raw materials (including shipping baobab from Nigeria to the UK) and the labour cost, it was decided to perform the scale-up analysis under Nigerian conditions, i.e., build the extraction plant closer to the source of the raw materials. This might make the investment more versatile, secure, and competitive in the long term, under the uncertainty of the market and the global economy and at the same time will have multiple benefits for the local economy and society.

3.3. Scale up and Implementation in Africa

Since the ethanol recycling scenario is more profitable than the base case, it was decided that only this one would be assessed for a potential scale-up installation in Nigeria. With respect to the purchase price of raw materials and utilities, appropriate values were used. When values in literature were found in Nigerian Naira (NGN), the conversion used is £1 = 450 NGN.

Electricity prices in Nigeria range from £0.01 to 0.4 per kWh [

22,

23] and an average value of £0.15 per kWh was used for the analysis. Steam prices were considered to be equal to £28.5 per m

3. It was assumed that steam is produced on site using a diesel boiler with a typical efficiency of 85%. The price for diesel in Nigeria was taken as £0.55 per litre [

24], with typical density of 0.85 kg/L and calorific value of 45.5 MJ/kg. Water price was assumed to be 0.125p per L [

25]. Finally, shipping costs for baobab were assumed to be equal to zero since the plant is going to be installed close to the baobab crop collection facilities.

The other two changes in the data used compared with the UK economic analysis were the labour cost, which was assumed to be £0.5 per hour [

26] and the corporation tax was set at 32%. The capital costs were initially assumed to be the same, since there were no detailed data for all the different components. However, a sensitivity analysis was performed to consider a potential over or underestimation of the total capital/installation cost. The minimum profitable selling price was again determined for payback period of six years (which would give a return on investment of approximately 16.7%), and was found to be £27 per 100 g. The value is comparable to the UK-based scenarios, meaning that the implementation of the plant is potentially viable and profitable in the Nigerian economy. Through the comparison presented in

Table 9, it was observed that the major component that affected the final product prices, and, thus, the viability of the plant, was the cost of utilities (mostly steam).

For that reason and due to the uncertainties in the estimation of the economic input, a sensitivity analysis was performed to estimate the overall range of the final product price. Steam price, electricity price, and capital costs were chosen as the three uncertain variables. Five alternative values were chosen for each; the base value, ±25% and ±50% compared to the base value. The results presented in

Figure 3 show that the impact of uncertainty in capital cost and price of electricity does not significantly affect the viability of the project. On the contrary, fluctuations in the steam price (and the respective fluctuations in the diesel price) play a critical role in the final decision. In the best-case scenario, the minimum profitable price might even drop below £20/100 g, leaving a bigger margin for profit and making the product more competitive than existing commercial products. Thus, it is critical to perform a more detailed market analysis regarding the steam producing unit and the fuel that would be used, considering not only the efficiency of the boiler but also parameters such as the stability of the price and its long-term variations. A biomass-fired boiler might be even considered an option in this case, with slightly lower overall efficiency but also locally sourced and cheaper fuel [

27].