Abstract

The forestry supply chain in the southeast of England is characterized by a diverse set of independent businesses and a sector strongly driven by personal connections and trust. Yet, the opportunity exists to increase the amount of wood product through bringing currently unmanaged woodlands to the market, a result that should have environmental as well as economic benefits. Previous research has indicated that agents play a key linking role between woodland owners and contractors, offering services ranging from consultancy support, grant aid access, and the writing of management plans to the scheduling and delivery of thinning and felling activity, with a unique and important position in the sector in terms of facilitating change. This study, through interviews with 18 woodland agents, was designed to explore collaboration across the sector. The results suggest that current levels of collaboration are low and use predominantly horizontal mechanisms, focusing on information sharing rather than joint operation. This is despite a positive market opportunity and a growth aspiration, as well as an enthusiasm for increased collaboration that is particularly prevalent in smaller businesses. Four main features of the sector are limiting the amount of collaboration: a traditional handshake culture strongly embedded within rural life; the construct, mechanisms, and frameworks of the sector; the value set of those operating at this critical juncture of supply and demand; and the lack of positive examples of collaboration. Higher levels of collaboration were seen by woodland agents to be positive for increasing the sustainable and productive management of woodlands but achieving this will be challenging to established practice.

1. Introduction

Woodland makes up 17% of the ground cover in the southeast of England [1], the most wooded region of the country, with twice the coverage of the UK average [2]. A steeply increasing percentage of this is broadleaved trees, largely within private ownership, which will reach maturity over the next 20–30 years, yet indicators suggest that only a relatively small percentage is currently under active management, defined as clearance or felling in the woodland in the last 3 years [3]. This lack of woodland management has a negative impact on both ecosystems and the regional economy, with undermanaged woodlands (where trees are not thinned or felled, understorey cleared, or woodland fauna prevented from damaging growing trees) having less biodiversity [4] and less overall potential for carbon storage [5]. Economically, a sustainable resource is not being exploited, and instead, 49.9 million m3 of wood product is imported to the UK each year, 88% of the national wood consumption, despite the abundant presence of potential resources in local woodlands [6]. The high levels of unmanaged woodland therefore represent both an economic and environmental missed opportunity, for woodland owners and the wider forestry sector. Whilst this problem may appear to be a regionally localized challenge, it has much wider global ramifications for sustainability, with the lack of utilization of local wood resources resulting in increased reliance on the import of product [6] and missed ‘localism’ benefits from diverse co-products, employment, and knowledge. The reasons for the lack of management are complex and multifaceted, springing from economic, physical, environmental, and human sources [7]. For example, decisions to not manage woodland can be a result of a poor market return for timber [8], challenges of accessing woodland on marginal land [9], or poor wood quality due to diseases [10] or because the motivations for owning woodland are not linked to felling outcomes [11]. In many cases, the reasons are overlapping and interconnected [7,12,13]. Whilst this situation is largely consistent across the United Kingdom and reflects similar challenges in wider Europe [14], the situation in Southeast England is acute due to its particular characteristics. The region is heavily populated, in close proximity to urbanized areas including the capital, London, and as a result has a relatively high cost of land, which has forced woodland onto marginal land. Whilst regional infrastructure and transport links are good, woodlands themselves often suffer from poor access, are frequently dispersed, and have a distributed ownership pattern [15].

Within the southeast of England, conifers make up only 26% of woodland (defined as areas of trees greater than 2 hectares) [16], with the remaining broadleaved woodlands being mostly between 20–60 years old, indicating they are at a prime opportunity for felling at mean annual increment [3]. For the broadleaved resource, 93% of woods are outside of public ownership, with around 44% owned by private personal owners, 13% by charities, and the remainder by local authorities and private business. Forestry in the UK is heavily influenced by the government and its agency, the Forestry Commission, which have a responsibility for “protecting, expanding and promoting the sustainable management of woodlands” [17] and which jointly manage and deliver a policy and incentivization scheme to apply good forestry practice to both private and state forestry. Within the business sector supporting forestry, there are a range of different entities involved, from individual felling, chipping, or haulage contractors to sawmills or large organizations involved in mainstream commercial forestry [18]. Evidence suggests that the sector is populated by an aging workforce, with shortages in contractors, particularly as the market has increased in the past five years. The sector is generally segmented into three key loci of activity: contractor resources, which undertake the physical work in the woodlands; woodland owners; and processing facilities such as sawmills. Woodland agents act as intermediaries between these three components, including organizing transport from ride-side to customer, which is sometimes, but not always, provided by the sawmills themselves. The estimated employment levels for the UK (from 2018) are 16,000 people in the wood products sector (sawmilling and pulp milling) with 7300 people involved in primary wood processing [16]. Private landowners’ perspectives on woodland have been greatly impacted by changes in land tax structures and financial incentives, particularly related to property tax and death duties, and changes in these in 1988 led to a reduction in woodland management. This, as well as widespread storm damage in 1987, was considered by some to be the ‘death knell’ for an actively managed private woodland sector in the UK, and in the southeast in particular, as the quantity of wood on the market, as well as the large cost of clearing woodland, led many to ‘lock up the gates and walk away’ [19]. More recently, an increasing demand for amenity ownership of woodlands has seen the rise of small parcels of woodland broken up from original larger plots, resulting in a woodland profile where 7% of woodland area is less than 2 hectares, 24% is between 2 and 20 hectares, 27% between 20 and 100 hectares, and 43% more than 100 hectares [2]. This has resulted in an increase in the number of small woodland owners, often with no history of management, and frequently without motivation to actively manage woodland, particularly for large-scale felling [13]. This changing pattern of rural land ownership, outlined in Munton [20], has seen the increasing ‘urbanisation’ of the rural, with land now valued for provision of multiple, rather than single, goods and services. Only 18% of broadleaved sections in the South East show evidence of management [2], resulting in over 52% of the standing volume over the age of maximum mean annual increment with that proportion predicted only to increase over the next thirty years [13]. This set of characteristics results in a forestry sector in the southeast of England that is not highly connected with the economic life of the region and with limited local processing of wood product, with much product sent outside the region for finishing. There are local markets for product, with an increase in the fuelwood and biomass sector in the past five years, driven by the development of a biomass power plant in the South East.

There are significant challenges currently impacting the forestry sector’s ability to grow and change. Greenslade et al. identified 38 factors influencing the performance of the sector and resulting in unmanaged woodland in the South East [21]. A key factor identified was the importance of the nexus of supply and demand and the critical role played by woodland and forestry agents (henceforth in this paper referred to as ‘woodland agents’) at this point in the supply chain. The term ‘woodland agent’ is in widespread use in the UK forestry sector to recognize a set of actors who fulfil a role as a key interlocutor between woodland owners and the contractors who supply services such as felling and woodland management tasks including thinning, ground clearance, and infrastructure provision [22]. Woodland agents are key providers of consultancy services relating to grant applications and submission of management plans and often support the complex administration required to register and manage land. Using the FAO definitions for forestry and logging employment, agents cover the functions included within ‘support services to forestry’ but do not deliver ‘logging’ or ‘gathering of non-wood forest products’ functions [23]. Woodland agents have no required qualifications, but are generally educated and skilled in forestry, have undertaken relevant training, and hold professional accreditations. The more general term ‘forester’ is also well-recognized in the UK as applying to professional and trained individuals with specialist skills in the organization, management, and operation of forestry, which could encompass those engaged in advisory roles as well as production and processing, and a single individual may be involved in a number of these activities. The presence of the UK Institute of Chartered Foresters (ICF) illustrates the role and profession of forestry, and it should be noted that many of the woodland agents of the present research have forestry qualifications and are chartered members of the ICF. Thus, there is usually a very high degree of similarity in professional background between foresters and woodland agents, and, indeed, there is little in terms of a hard ‘boundary’ between these two terms. We use the term woodland agents here because the role is clearly recognized by the sector locally, and those individuals also recognize themselves as performing the advisory role in particular within the sector. The terminology is not controversial, and neither does it mean that an ‘agent’ necessarily has lesser credentials. Woodland agents normally engage with private owners rather than the public estate as this role is managed within the Forestry Commission for public forests. Despite their critical role in the supply chain, there is little literature on the attitudes and values of woodland agents [13]. Indeed, Greenslade et al. note that they appeared to be operating largely independently with little indication of collaboration [21], defined as when “two or more entities form a coalition and exchange or share resources (including information), with the goal of making decisions or realizing activities that will generate benefits that they cannot (or only partially) generate individually” [24,25]. This is an important issue, as other studies suggest that where collaboration in the forestry sector has occurred, either between actors at different levels in the supply chain or with peers, then there can be a range of benefits, including increased innovation and dynamism [26,27,28], improved logistical coordination through the supply chain [29,30], and increased productivity in harvesting plans [31] and wood transportation [32,33,34]. In fact, Lähtinen et al. found, for larger Finnish sawmills, that the raw material in the processing chain did not in itself create enough profit for a sustained competitive advantage, but collaboration was the only factor that did drive profitability and performance [35]. This, therefore, indicates that if collaboration could be better harnessed within the forestry sector in the southeast of England, increases in capacity could be created through improved productivity. This increased capacity could offer opportunities for increasing management levels of woodland, thereby increasing sustainable harvesting of local wood resources. In addition, the disaggregation of woodland ownership implies potential benefits from collaboration through improving economies of scale in the coordination of harvesting activity when neighboring woodland owners work together.

Fraynet et al. [36] proposed a collaboration framework (reported in [37]), which defined five phases in a relationship moving from cooperation to collaboration, with increasing amounts of information sharing and a resultant increase in the strength of the business interaction. This framework moves from a transactional relationship, through an information exchange relationship, joint planning, collaborative planning, and execution, finally into co-evolution. The amount, sensitivity, and type of data exchanged increases through this framework with resultant increases in risk and potential profit at stake [38]. This evolutionary approach is supported by Cruijssen et al.’s description of three types of horizontal collaboration [39]. Type I covers partners that coordinate activities and planning, but only for limited duration and breadth. Type II covers integrated business planning, with a longer (although still finite) length. Type III collaborations integrate their operations and have no fixed end date, often called a ‘strategic alliance’. Collaborations can be either horizontal, vertical, or lateral [40,41], depending on whether they involve actors at different points in the same supply chain (vertical), between competitors at the same level (horizontal), or a combination of both (lateral) [41]. For the forestry sector, examples of horizontal collaborations are considerably less well-documented compared to vertical collaboration [42], but a telling example is that of Lehoux et al. [43], who studied a set of sawmills who collaborated together and found that they could improve their profit by up to 44% by better managing inventories jointly and undertaking joint forward planning. Internal improvement outcomes are also documented with Guerrero and Hansen’s review of cross-sector collaboration in the forest products chain, finding increased learning, development or production of intellectual property, and culture change as the outcomes of collaboration, regardless of the ultimate success of the endeavor [44]. However, forest companies have been found to be individualistic and often family-led, with a strong competitive drive, a low risk tolerance, and a traditional business culture that is resistant to change [45]. This strong individualistic culture results in managers in the forest industry sometimes not considering collaboration as a business strategy to deliver competitive advantage [46], which has been found to negatively impact the ability of the sector to innovate [44,47,48]. This is exacerbated by an emphasis on interpersonal relationships, with the sector characterized as a ‘handshake industry’ [44] with a reliance on trust to build deals without written contracts [28]. Within the UK, the forestry sector is strongly embedded within the rural community, recognizing that rurality is more than simply a definition of location but also covers local area interaction and the importance of landscape to shaping rural business [49]. As stated by the Country Land and Business Association (CLA), a membership organization for owners of rural land, property, and businesses, there is something “intrinsically different about rural businesses” [50]. These characteristics, namely linkages to the countryside, the often-localized nature of the business and interactions, and isolation from wider global dynamics, increase the importance of collaboration but perversely decrease the likelihood of it occurring [51]. A better understanding of how collaboration may address challenges in the rural economy has implications for wider sustainability as rurality can be seen to be a key influence for sustainable outcomes [52].

The research reported here therefore aims to explore the perception of collaboration amongst woodland agents in the southeast of England in order to understand whether increasing levels of collaboration might increase market size (for timber, agent consultancy services, and other related wood products and services) by positively impacting on increasing levels of woodland management. The two research questions are:

How can increasing levels of collaboration have a positive impact on levels of woodland management in the southeast of England?

What are the factors impacting collaboration between the key actors in the sector, with a specific focus on the perception of market opportunity, desire for growth, and organization size?

With specific focus areas to be explored:

- Current levels of collaboration in the forestry sector

- Perceived benefits and disadvantages of collaboration

- Perceived barriers and enablers for collaboration

- The impact of size of business on levels of collaboration

- Wider perspectives on the culture and ways of working of the sector from the perspective of woodland agents.

2. Materials and Methods

Data collection was via a series of semi-structured interviews with woodland agents operating in the southeast of England, within the three counties of Surrey, West Sussex, and Hampshire—the study area selected as these counties are the most wooded in England [53] and have the highest amount of ‘overdue’ biomass (with between 360,000–520,000 m3 of mixed broadleaved and softwood available every 5 years across the area for the next 40 years) and with low private-sector management levels [16]. The focus for identification of participants was the South East Woodland Advisors’ group, a network of woodland agents aiming to actively tackle the improvement of management of woodlands as well as share ideas and best practice, which had been recently established in June 2017. The list of agents involved in the group was reviewed via the website (www.woodlandadvisorsgroup.co.uk, accessed on 12 September 2021), and of the 43 agents listed, 31 had a cited area of operation within the study area. Once duplicates of organizations were removed, 21 agents were contacted, each representing a separate business. Of the 21 invitations issued, 14 were accepted (an acceptance rate of 67%), with 2 referrals on to colleagues who subsequently accepted. The set of participants was reviewed by the Forestry Commission southeast office to assess its representativeness of the sector as a whole and two additional participants were approached in order to ensure balance from an organizational size perspective and to bring in some particularly relevant experience. Both accepted the invitation resulting in a final set of 18 participants: 17 male and 1 female, with only one participant being under the age of 40 and 15 being over the age of 50. The southeast office of the Forestry Commission considered the list to be representative of the population of agents in the South East through examination and comparison against the names of agents submitting management plans (a process undertaken in discussion with the authors).

A breakdown of the selected agents defined by the size of their business and three criteria (financial turnover was not included as a criterion due to sensitivity of sharing this information with the researchers) is provided as Table 1.

Table 1.

Allocation of size of business to participants, with numbers in categories.

Table 1 indicates that the number of individual organizations in each group is not balanced, with more participants in the ‘small’ category (8) compared with the ‘medium’ (5) or ‘large’ (5). However, this is representative of the distribution of agents in the South East, where there are a higher number of small organizations, often with only a single agent offering services.

All interviews were held at the participants’ place of work or home between January and May 2018, and the interviews lasted between 45 min to 1 h. All interviews were recorded, undertaken by the same interviewer, and followed the standardized semi-structured format in three sections, set out in Table 2. The two primary discussion sections explored the participant’s perspective on collaboration within the forestry sector and perspective on the market, as well as their own business growth. Participants also answered five questions where they were asked to submit an ordinal response on (1) how they perceived collaboration in general, (2) collaboration in forestry and its impact on unmanaged woodlands, (3) the impact of the Woodland Advisors’ Group on unmanaged woodland, (4) their perspective on the current market opportunity, and (5) their desire to grow their business. All subjects gave their informed consent to inclusion before they participated in the study. The study was conducted in accordance with the Declaration of Helsinki, and the protocol was approved by the Ethics Committee of the University of Surrey.

Table 2.

Semi-structured interview format.

The audio recordings from the interviews were transcribed and then content analyzed using NVivo™ with the quantitative responses analyzed via Microsoft Excel™. At the start of the coding process, a simple coding framework was used that followed the structure of the interview questions, and as responses were analyzed, further codes were added to the structure. Once all interviews had been analyzed, the coding framework was reviewed and simplified and a second analysis of all interviews was undertaken against the final coding framework. All coding was undertaken by a single coder.

Analysis of results was structured around a simple comparison of the percentage of participants who referenced a particular topic, in each section, compared with business size, and answers to the ordinal response questions.

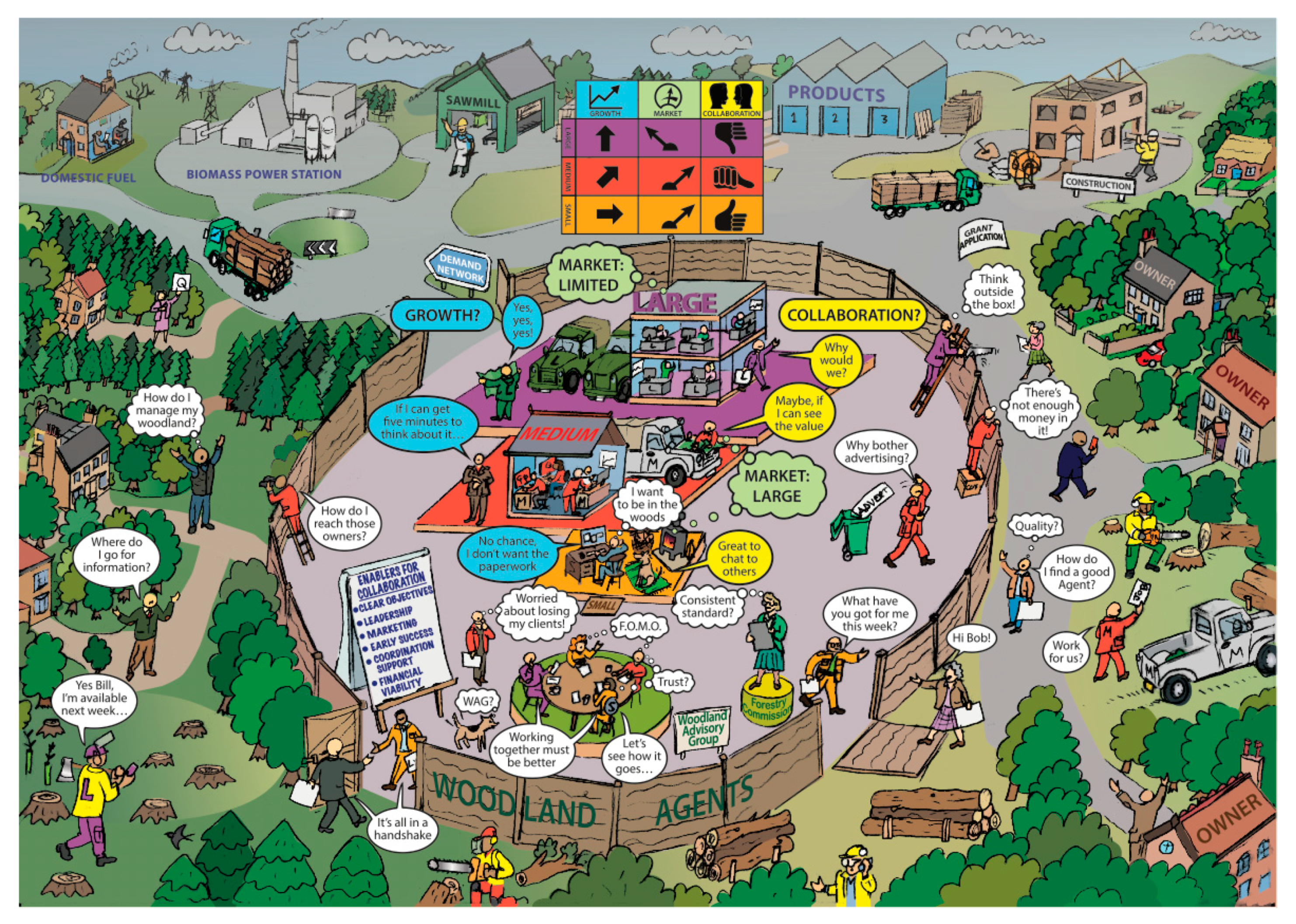

In order to aid interpretation, the set of issues and factors identified through the content analysis was brought together by an artist to build a graphic representation that captured the key points. The first draft was shared with key stakeholders in the forestry sector to test and validate the authors’ interpretation of the findings, and this resulted in some changes to ensure that points were appropriately represented to reflect their importance. The next version of the graphic was used to communicate the findings to the annual meeting of a large forestry organization, and feedback resulted in some additional minor changes, again to ensure appropriate emphasis, which were incorporated into the final version.

3. Results

The results below summarize the findings from the analysis of the transcripts from the 18 woodland agents who were interviewed in relation to their experiences and perception of collaboration. The results are presented under the five key focus areas, which were identified in the introduction: current levels of collaboration in the forestry sector, perceived benefits and disadvantages of collaboration, perceived barriers and enablers for collaboration, impact of size of business, and wider perspectives on the culture and ways of working of the sector from the perspective of woodland agents.

3.1. Current Levels of Collaboration

When current activity was considered, every agent was able to identify instances of collaboration. These ranged from informal collaborations occurring in parallel to attendance at industry events, such as those organized by industry associations and bodies including CONFOR (an industry body to promote forestry and wood-using businesses) and the Royal Forestry Society (RFS) (a membership organization that shares information on woodland management), to more formal collaborations around sharing work for contractors or shared haulage (Table 3). The higher proportion of references to the Woodland Advisors’ Group is to be expected given that this was the mechanism by which participants had been recruited to the research.

Table 3.

Current methods of collaboration: number and percentage of participants referencing each type.

There is more reporting of collaboration at ‘earlier’ stages in the collaboration frameworks, for example at the information exchange level in the framework of Fraynet et al. [36], which is potentially unsurprisingly given that these reflect evolutionary frameworks. However, it is noteworthy, when compared against the Cruijssen et al. framework [38], that there were no ‘Type III’ collaborations of a long-time duration and combined planning and operation.

There were significantly more reports of horizontal collaboration (agents engaging with other agents) than vertical collaborations (agents engaging in a collaborative, rather than contractual, manner with other parts of the supply chain). When individual responses were analyzed, there were 33 references to horizontal collaborations and only 11 references to vertical collaborations. Even if the references to the Woodland Advisors’ Group are removed from the data (n = 11), as these may have been artificially inflated with the specific questions about the group from the interviewer, there still remain twice as many references to horizontal collaborations than vertical. Interestingly, however, the agents generally placed a higher degree of value in the vertical collaborations than in the horizontal ones, as illustrated in the following quote:

“I went to a CONFOR South East regional meeting the other day, which was mainly other professionals in the business, and I thought what a waste of time. I don’t know, other than just a personal relationship of interest, which you can get through other professional bodies … it’s interesting but I’m not sure how valuable it is … when we do horizontal collaboration it’s great. Whether it’s essential that’s a different question.”(Participant 16, agent from a medium-sized business, interviewed on 2 May 2018)

3.2. Benefits and Disadvantages of Collaboration

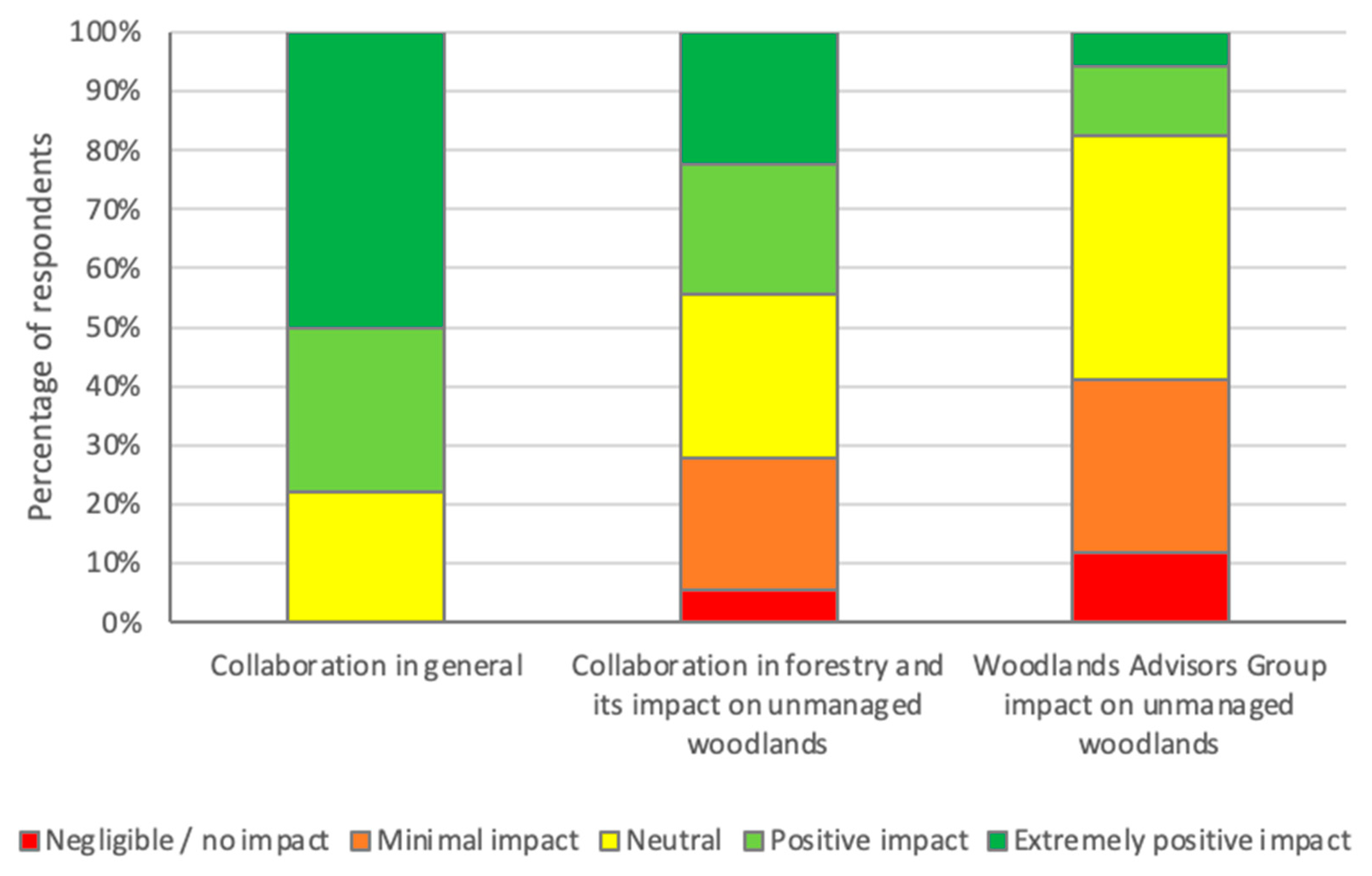

The majority of participants were positive about the benefits of collaboration, with over three quarters (14 out of 18) responding that they believed collaboration had either an extremely positive or positive impact with no participants responding negatively (Figure 1).

Figure 1.

Participants and the impact they perceive of collaboration in different configurations.

There was a general perception that those working in the forestry sector had broadly the same goals, and collaboration was an important factor in making the sector work effectively, as can be seen in the following quote from a participant:

“What does collaboration mean to me? All working to a common goal. I think we all want the same thing; we all want more trees in the ground and those that are in the ground managed properly. I think we all want the same thing.”(Participant 02, agent from a medium-sized business, interviewed on 3 January 2018)

The perspectives on the benefit of collaboration in forestry on unmanaged woodlands were more mixed, with less than half (8 out of 18) believing there was a potential benefit from increased collaboration and just over a quarter (5 out of 18) believing it would have a negligible or minimal impact (Figure 1).

“If you collaborated, could you improve woodland management of the South East? The answer’s no. It would make no difference whatsoever.”(Participant 16, agent from a medium-sized business, interviewed on 2 May 2018)

The level of positive response fell further when participants were asked to rate the Woodland Advisors’ Group, the particular example of horizontal collaboration that most were members of, with only 5/18 believing this would have a positive impact on unmanaged woodlands in the South East and 8/18 believing it would have a negligible or minimal impact (Figure 1). Most believed that collaboration should have some component of vertical integration as well as horizontal and include some element of knowledge and technology sharing.

“If you are just collaborating amongst agents and contractors and people within the immediate forestry management industry, I don’t think it would have much of an impact … but if that were wider and you’re looking at new technologies, new products, new markets that would then create an economic driver to bring those under management, then perhaps that collaboration would have an impact, but it has to be a wider collaboration not just within the immediate management industry.”(Participant 13, agent from a large-size business, interviewed on 4 May 2018)

The benefits and disadvantages of collaboration, as identified by agents and classified into three groups, are shown in Table 4.

Table 4.

Grouping of benefits and disadvantages of collaboration by frequency of mention by agents.

The most frequently cited benefit of collaboration was winning new business or making contacts that could lead to new business. This was perceived to be the primary reason for undertaking collaborations, and of the highest value to woodland agents. Mentioned less frequently, but still perceived to have value, was sharing best practice and sharing information; this was more often mentioned by the smaller businesses and was particularly relevant for technical information relating to the knowledge necessary to undertake work. The ability to form loose collaborations in order to increase informal lobbying on topics of interest was also mentioned; this appears to relate to engagement with the Forestry Commission, other NGOs operating in the sector, and other industry bodies.

Reflecting the findings summarized above, there were many fewer references to collaborations where businesses worked together to deliver work, although several people mentioned it as an aspiration, or a goal, but not one that was routinely achieved in the sector at present.

“The long-term aim is I’ll have half a load of timber left over because that’s all there is left, and I can ring somebody in the group and say, ‘Have you got a half a load? Well next time you get a lorry can you scoot past and pick my half load up as well and let’s put them into the same sawmill, or firewood mill or wherever it is’. And I think logically that’s where the circle really works.”(Participant 02, agent from a medium-sized business, interviewed on 3 January 2018)

The most frequently mentioned disadvantage of collaboration was the risk of competition, or losing work to a competitor, or of sharing information that resulted in the loss of work. The second most important disadvantage identified was the loss of time. Other, less frequently cited, disadvantages were risking the loss of key contractors to competitors, losing the ability to respond with agility, and the lack of specialism or focus that comes from combining different skillsets and capabilities under a single collaborative enterprise.

When the size of organization was factored into the perception of collaboration, there was a slight size effect, with 50% of small businesses being positive about the potential benefits of collaboration in forestry on unmanaged woodlands, and only 40% of medium and large businesses being positive. This size effect was more strongly reflected in the analysis of the responses to the perceived impact of the Woodland Advisors’ Group. Only one of the seven small-scale agent businesses felt it would have only a negligible or minimal impact (i.e., most felt it would have an impact), but two out of five and four out of five, respectively, medium- and large-scale businesses thought that collaboration via the Woodland Advisors’ Group would have little or no impact on the management of unmanaged woodland. It appears that those in large businesses see less value in collaboration, potentially because they have less need for it to achieve business outcomes that require knowledge sharing or resource specialization, as described by this participant:

“I’d say being part of a bigger company means there’s stuff which we share and do within our own company, and I benefit from that. And that’s different from your average small one-man-band outfit who don’t get as much of that, and for whom a bit more collaboration just gives a bit more almost like camaraderie. If you’re a one-man band, there’s not that many opportunities or other people to call on to get a second opinion.”(Participant 06, agent from a large-sized business, interviewed on 16 January 2018)

Part of the size effect may be related to perspectives on market opportunity in the sector. Smaller businesses saw greater market opportunity, with about half (three out of seven) of small businesses perceiving the market to have ‘high’ levels of opportunity, compared with just a fifth (one out of five) of large businesses. Across all participants, half (9 out of 18) saw the current market opportunity as ‘high’, with only 2 out of 17 seeing the level of opportunity as ‘low’. The reasons for market opportunity cited were the increase in the biomass market, increase in woodland coming into management that had not been previously managed, stronger prices for timber, and increased public awareness and acceptance of woodland management.

Medium- and large-scale businesses had a higher aspiration for growth, with over half of participants (three out of five), in both groups responding that they had a ‘high’ growth aspiration, compared with just one out of eight small businesses. As most small businesses were single-operator enterprises, the caution about growth was particularly related to the impact of bringing on new staff, as outlined by this agent:

“I guess that I’m kind of happy with how it is. The first step to starting to employ people formally seems to be quite a big step and involves a lot of costs and additional aggravation. Probably once you’re over that hump then it’s easier to go for.”(Participant 05, agent from a small-size business, interviewed on 16 January 2018)

In addition, most small businesses felt that they had enough work for themselves currently, likely impacting their more positive perspective on the market opportunity. Even in cases where smaller businesses described an interest in growth, it was of a relatively limited nature and not necessarily requiring hiring new staff or diversification.

Regardless of size, those who saw a higher level of market opportunity and those who had a higher aspiration for growth were generally more likely to see benefits in collaboration. Those who were negative about the market opportunity appear to be less convinced about the value of collaboration, as demonstrated by this quote from a participant:

“If life in general got easier, you’d be more likely—because everything’s so tight at the moment and the lack of labour, this, that, and the other... But if there was more of it available, then people would be quite a lot happier with sharing things. While life’s difficult, if you’ve got something going, you’ll guard it with your life, I think.”(Participant 01, agent from a small-sized business, interviewed on 2 January 2018)

However, this view was not universal, and, in contrast, some agents proposed a counter view—that collaboration was a tool to unlock the market when it was challenging—and therefore was less needed when perceptions of a positive market opportunity existed.

“Me personally, I think I quite like collaboration but if I would have my pure company hat on, I would say it’s not as important because, touch wood, we’re doing okay at the moment, we’ve got enough work to keep us going, so don’t need to do it.”(Participant 02, agent from a medium-sized business, interviewed on 3 January 2018)

3.3. Barriers and Enablers to Collaboration

Participants were asked for their perspective on factors that blocked and enabled collaborations to operate effectively. A summary of the issues raised in response to this question and from wider analysis of the interview transcripts is given in Table 5. The table has eight categories reflecting the key characteristics raised.

Table 5.

Barriers and enablers to collaboration.

Trust, shared objectives, examples of success, and financial return were all identified as factors that operated as enablers when they were present and were identified as blockers when absent. A culturally conservative sector with risk aversion and change inertia was identified as a significant blocker, with few cultural enablers identified. The practical limitations of a lack of workforce and limitations of the market were also identified as blockers. Effective leadership of the collaboration was identified as a key enabler.

3.4. Characteristics of the Sector

It was apparent from analysis of the interview transcripts that the forestry sector operates with a strong degree of person-to-person interaction, social engagement, interpersonal trust, and relationships that are built and developed over long periods of time. For example, participants frequently referenced the length of time they had worked with other organizations, identified by workers’ name rather than by business name, often with relationships continuing between different business structures. Participants frequently explicitly stated ‘trust’ as a key requirement for collaborations. This trust appears to require strong relationships built up over long amounts of time, and this requirement engenders an inherent wariness of working with others who are less well-known.

“Well, they’re not like a normal business. I don’t think they’re inherently untrustworthy, I think they will be... You know, a lot’s done on a handshake still, so therefore you’ve got to be trusting, but I think it’s taking that next bold step, isn’t it, you’re trusting your competitor.”(Participant 09, agent from a medium-sized business, interviewed on 18 January 2018)

This cultural challenge extends to landowners who were also mentioned as having cultural resistance to sharing best practice, for example, in different modes of harvesting such as the introduction of continuous cover forestry, new techniques for managing pests and diseases, and the planting of new species for climate change adaptation. This resistance was also noted as a form of ‘change inertia’ associated with a reluctance to adopt new ways of operating, including alliances and shared operations. The traditional ways of working mean that there is often little formal documentation and few contracts in place. Only four agents mentioned having formal contracts or a standard process for signing off budgets. Of those, one was delivering work for the County Council, and therefore a greater degree of process oversight is unsurprising. Two others had joined forestry from other parallel sectors (land management and ecology) and had brought these more formalized ways of working with them into the sector. A higher proportion of agents had a process for capturing the forward plan for a year (eight agents), and larger businesses were more likely (but not always) to be working on a longer-term basis, with a formal management fee relationship in place with landowners.

This traditional approach to contracting was rarely considered to be a problem from the perspective of the agent and was more often felt to encourage a greater depth of personal relationship and enhanced flexibility.

“We are very informal. A lot of the business I do is basically on a handshake. I’m not getting three quotes for every job and all of that. If I find myself working with local authorities and people like that, I find all those rules and regulations to do with how they have to do business terribly restricting.”(Participant 03, agent from a medium-sized business, interviewed on 9 January 2018)

In particular, it was felt to stem from, and reinforce, the traditional roles of landowner and estate worker that would have been prevalent 100–200 years ago. Many agents noted that this way of working suited their preferences and made them feel ‘part of the estate’. Others noted that they believed this was a preferred way of working for the landowner for the same reason.

“I’ve worked for people for over 20 years and I’d be quite upset now if they took their business elsewhere, because you almost feel like you’re part of—it’s a bit of the old estate sort of thing and you become a bit of a fixture on the place. I quite enjoy that feeling of being part of the estate. They can’t employ a full-time forester now, so they employ you for a tenth of your time or whatever it is.”(Participant 07, agent from a medium-sized business, interviewed on 16 January 2018)

These ways of working are deeply culturally embedded within the sector and serve a function to reinforce and deepen internal sector ties. They do, however, offer the potential to limit the scope of the sector to diversify, rapidly adapt, dynamically alter, or otherwise change to meet new demands and opportunities.

An overriding conclusion is that access to woodland owners is the single biggest factor impacting the ability to increase the amount of woodland under management, with 12/18 agents mentioning it as a blocker on the sector. Agents stated that they struggle to bridge the gap to owners, and some felt that owners themselves may be keen to do something but do not know the routes to pursue it. Strong existing relationships between agents and owners skew work, with most agents preferring to do work for those they have worked for before. Agents felt that they could build the rapport and strength of relationship with owners if they were able to contact them, but often the blocker was identifying who owned a particular piece of woodland.

“If you put those two people, woodland owner and the forester, together and then stuff can happen. But for different reasons, that’s not always a dead easy thing to do. Because there’s not many of them and they’re all spread out.”(Participant 06, agent from a large-sized business, interviewed on 16 January 2018)

Business development in the sector makes little use of advertising, at least for the small- and medium-scale businesses. Of the 14 agents who referenced advertising, 10 were negative, 3 were neutral and 1 was (guardedly) positive. Those who were negative felt that advertising was not the primary business development source for work in the sector and that most work was won on the basis of personal contacts and relationships. Some of these had never tried advertising and had no belief in the benefit of it, and some had tried it and found no return from it.

“Advertising? I did it once and it was the biggest waste of money ever. It’s not worth it, no. You know, the forestry world is very small. Yeah, it’s just doing a good job regularly and consistently.”(Participant 16, agent from a medium-sized business, interviewed on 2 May 2018)

Whilst this lack of formal business development is unlikely to be a limiting factor in the broadest sense, there is an impact of the heavy reliance on the rural culture and way of doing business, demonstrated by this woodland agent summarizing where most new business comes from:

“It could have been at a point-to-point, it could have been at a shoot, it could have been at Saturday just going down to the livestock market on a Saturday morning or, yes, whatever it might be so it’s that, it’s the rural economy, it’s the rural culture that we’re embedded in and we all enjoy, we’ll enjoy shooting or whatever, you know, riding out on the local hunt, whatever it might be, but that’s how you make the contacts and that how we sort of try and develop relationships and then it’s all about trust and understanding because the advice we’re giving potentially won’t actually perpetuate or be evident for years in advance, so it takes a long time.”(Participant 13, agent from a large-sized business, interviewed on 4 May 2018)

Nine agents made a reference to game shooting as a relevant driver in the sector. Of these, there were eight specific references to business development and the role that the shooting business plays in encouraging woodland management through sharing best practice and making links within the rural economy.

“My boss shoots a lot so that is another way of getting business because they all go and... it is not my cup of tea but they go and wander round other people’s woods but then shoot and drink a lot and so there is a lot of networking going on through that.”(Participant 09, agent from a medium-sized business, interviewed on 18 January 2018)

In addition, there were six references to how shooting practice drives objectives and decision-making for owners and woodland managers.

“A shoot on the place is pretty typical, with everything geared really to running the shoot and approving the shoot and the amenity value of the estate, as opposed to getting money out of the forest. Mostly our brief is, manage the woods, improve the shoot, if we can, make it look nice and don’t cost anything.”(Participant 15, agent from a large-sized business, interviewed on 9 May 2018)

There were indications that the shoot may be hindering or delaying change that is considered necessary in the woodland.

“A lot of estates, shooting estates, don’t really get management, some do and some don’t, so I mean shoots can be a big barrier if the keepers aren’t sensible, and they can be a big barrier to management.”(Participant 09, agent from a medium-sized business, interviewed on 18 January 2018)

This same emphasis on personal contacts extended to contractors in the business. Participants noted that there is a key sector limitation around the availability of skilled resources in the supply chain, particularly associated with contractors for forestry work. Almost all agents interviewed had an informal relationship with contractors, rather than having an in-house arrangement. This was the case even for the large-scale agencies. Fifteen out of eighteen agents mentioned contractors as a key constraint in the sector, particularly relating to the desire to protect preferred contractors and keep them employed on projects so as not to lose them to competitors.

Most agents expressed views that indicated their primary motivation for working in the sector was not financial. Most expressed their primary interest as spending time in nature, engaging with trees, and positively developing the landscape for long-term benefit, all of which are in conflict with the increased level of administration and computer-based working that is necessary in order to upscale businesses.

“I like the contracting side of the business as well, so personally I much prefer to be out there working or supervising work than I do being stuck in here. This wasn’t why I got into forestry.”(Participant 07, agent from a medium-sized business, interviewed on 16 January 2018)

Most expressed a desire to earn enough to survive, but not more.

“We’re not in this industry to make lots of money, I think as long as everybody makes a comfortable living that’s all they want out of it; they enjoy the job. We all want to pay our way, but we don’t want to drive Ferraris round really, I don’t think anybody in the industry does. So as long as I think we all get a fair wedge, we’re happy.”(Participant 02, agent from a medium-sized business, interviewed on 3 January 2018)

Several mentioned an opportunity to work together more and share some of the office-based tasks, but only one had attempted this (unsuccessfully). Another opportunity raised was to bring new skills into the industry through apprenticeships and to work more closely with land agents to develop new opportunities.

4. Discussion

This study has found that, despite an overwhelmingly positive perception of collaboration in general and a strong belief that those working in the forestry sector had similar goals and aspirations, there is a relatively weak level of collaboration currently occurring. Whilst a range of different collaboration mechanisms were identified, they were predominantly focused on more transactional aspects. For example, when mapped against Basso et al.’s framework [38], most of the current mechanisms used in the sector are ‘information exchange relationships’ with only a few operating at the higher levels of ‘joint planning’, or ‘collaborative planning and execution’. When compared to Cruijssen et al.’s framework [39] for horizontal cooperation, none of the examples given can be considered ‘Type III’, the most developed collaborations, involving integrated operations, with no fixed end date. Where collaborations do exist, evidence suggests that whilst there is a good degree of engagement, most participants are cautious, unconvinced, and engaging primarily for fear of being excluded. This is particularly true for larger businesses. Indeed, participants saw the advantages of collaboration as being primarily centered around winning new business, as well as sharing information and best practice—all functions at the lower end of collaboration—and not as a way of working together more effectively to deliver new or improved services to a broader market of customers. There were very few references, or perspectives of benefit, of moving to more developed joint operations. Tellingly, the ability to share information effectively was not mentioned as an enabler, only as an outcome. This may indicate a weakness in current collaborative structures, as research has previously found this can be a key blocker to effective collaborations [54].

Figure 2 shows a graphic visualization of these findings, produced in conjunction with a graphic artist, and based on the findings from interviews, and using direct quotes. This visualization was used to test the findings with participants, validate the conclusions, and communicate the key attributes of this aspect of the sector. The visualization captures the key attributes of this element of the sector, as highlighted by participants. The woodland agents are depicted separated from the woodland owners and seeking to find opportunities to break through the barriers separating them. Within the woodland agent area, there are marked differences between sizes of businesses. The collaborative components of the sector are shown at the bottom of the picture, with the key enablers highlighted. The visualization uses as its background the same context from the Greenslade et al. visualization [21], highlighting the wider context around woodland management.

Figure 2.

Visual representation of the factors impacting collaboration of woodland agents in the forestry sector, built from the analysis of results and used to test conclusions with the participants. Developed in conjunction with graphic artist P. Shorrock.

In terms of business outlook, most woodland agents saw opportunities for growth, although this was dependent on the size of the business, with medium- and large-scale businesses having a higher growth aspiration than small-scale businesses. Smaller agents appear to be restricted by the perceived administrative and bureaucratic overhead of taking on more staff. Regardless of size, those who saw a higher level of market opportunity and those who had a higher aspiration for growth were more likely to see benefits in collaboration. This reflects the findings from others about opportunities for collaboration relating to perceptions of market competition and risk [55,56]. The sector would fall into the pro-collaboration category, described by Peng and Bourne [57], of a less-competitive sector, with a limited number of competitors and a clear need for innovation [58]. These market characteristics should indicate a high opportunity for collaboration. The lack of actual collaboration may be due to a low risk of market entry, which may be restricting collaborative pressure [56], limiting innovation potential and inhibiting the realization of benefits from business networks that have been demonstrated in the parallel agri-food domain [59]. Furthermore, the research indicates that there are four main factors preventing the sector from being able to harness the power of collaboration to address the opportunity of greater woodland management and market potential:

- The traditional handshake culture strongly embedded within rural life.

- The construct, mechanisms, and frameworks of the sector.

- The value set of those operating at this critical juncture of supply and demand.

- The lack of positive examples of collaboration.

The forestry sector in the southeast of England, supportive of conclusions drawn in other forestry sectors worldwide [45,60], is dominated by traditional values, emphasizing interpersonal relationships and trust, and highly embedded as a way of life within traditional rural culture. There is a strong ‘handshake culture’ with low levels of formal documentation, contracts, or business agreements and a heavy emphasis on trust built up between individuals over long periods of time. There is also a strong change inertia within the sector, at varying levels along the value chain. Despite all the benefits that collaboration has been shown to deliver in the forestry sector in other countries, and despite a strong inclination towards collaboration within the studied participants, these broader factors result in a weak driver for change and reduced mechanisms for collaboration, with nervousness about competition risk inhibiting collaboration and learning from examples outside the sector. Owners who are not currently managing their woodland and who are out of the traditional rural network are unlikely to be contacted or accessed through traditional routes. Encouraging new ways of working, seizing opportunities of new technology, and making approaches through other routes, including increasing the amount of advertising undertaken in non-traditional forums, is likely to be necessary to access these stakeholders. Previous research found that areas with higher amounts of shooting have more managed woodlands [61,62], but this is not necessarily the experienced reality of this cohort, who saw some potentially negative impacts. Given the heavy increase of sport shooting in the South East in recent years, and the key role it plays in the sector, fully exploring how it can be both harnessed and developed in the management of unmanaged woodlands is a key consideration for future work.

The sector has a highly independent set of businesses, with little vertical integration or supply-chain consolidation outside the largest agencies and a highly mobile, in-demand, contractor segment that is protectively guarded by agents. Most organizations can operate independently of each other so the motivation for collaboration is low, with little need for shared resources. The sector has a heavy reliance on grant aid that is highly bureaucratic, slow, and difficult to access, meaning there is not much dynamism in the sector or impetus for rapid action. The greatest constraint is that the ‘new market opportunity’ of unmanaged woodlands requires the identification and access to landowners who are not currently within the traditional rural sector, and agents find it difficult or challenging to identify them. Even once identified and contacted, each owner has very different objectives for owning and managing woodland, which means the services provided to them must be highly personalized.

This study has found that individuals within the sector are largely motivated by spending time in nature—they joined the sector to be in the woods and engaged either in the physical activity of felling timber or in the long-term improvement and development of landscapes. They are predominantly unmotivated by business outcomes, unwilling business administrators, and broadly unexcited by increased financial gain for themselves or their businesses. This value set was reported to be highly compatible with the industry culture and matches the values displayed by woodland owners, and this congruence has benefited individuals and their businesses for many decades. However, it is not encouraging increased levels of collaboration within the industry, as it does not encourage a ‘working together’ mentality or a culture of experimentation and development. In addition, the focus on traditional routes for business development, combined with the lack of business growth objectives, may be limiting the identification and targeting of owners of unmanaged woodlands. Woodland agents are not, in general, motivated to explore novel approaches to target owners who sit outside established rural relationships or to pursue new opportunities or engagements with new woodland owners.

Finally, there is a lack of existing positive examples of collaboration that can show the value of new ways of working together. Opportunities for increased horizontal collaboration were identified in areas such as shared apprenticeships, combined back-office functions, and increased coordination with land agents, but there are no widely publicized and successful case studies for these within the sector. Whilst there are a few instances of vertical integration, which participants considered to be more attractive, the examples are again not well-publicized.

Implications from this study for forestry, and broader sustainable production of natural resources in other parts of the UK, Europe, and the wider world lie less in the specific characteristics of the sector in the southeast of England and more in the findings relating to collaboration. These findings have shown that operators within a rural environment must overcome particular challenges to work collaboratively, not least a heavy cultural reluctance to engaging in cooperation, as well as practical issues such as a lack of positive examples to model. These findings are likely to be more a feature of the rurality of the study area, rather than to its specific geography, and thus relevant for wider geographic regions.

It should be noted that this study was, by its nature, exploratory, and therefore there are limitations in the extrapolation of the findings. It was a small participant group, which, although representative of this segment of the sector in this geographic area, is still a small sample, with the potential to be influenced by strong opinions in one or two individuals. In addition, the group may be biased in its selection, as participants were identified from within an existing collaborative mechanism and there was a further element of self-selection in agreeing to participate. Indeed, this may indicate a more positive bias towards collaboration than would be found in a wider sector sample. The small sample size issue is exacerbated once participants are allocated to size-of-business groups, and so drawing conclusions about the implications for company size should be treated with caution. The frameworks for collaboration used in this study stem predominantly from the more heavily researched logistics and supply chain management sectors. Some aspects of the forestry business at the agent level may not be fully comparable to these more procedural and systematic logistical operations, and although the findings indicate these frameworks are generic enough to be relevant here, it is an area to be addressed with caution. Finally, the research was undertaken in 2018 and as such reflects perceptions and perspectives of the market and opportunity at that point in time. Whilst the financial market for timber has continued to rise from 2017 to the present time, with increasing volumes and prices, there has been disruption to the sector by the coronavirus pandemic. Furthermore, the policy landscape in the UK is in a period of significant change with the development of British forestry policy separate from the European Union Common Agricultural Policy and significant new tree-planting targets and incentives. These will all have impacts on ways of working and sector structures. All of these points can be addressed with future research to explore horizontal collaboration between agents in other parts of the UK, with a sample designed to have larger numbers within each of the size-of-business categories, given that this did emerge as a potential consideration.

In summary, whilst the findings from this study indicate a high market potential, the forestry industry in South East England appears to be restricted by traditional culture and lacks many of the tools used in other countries to rapidly upscale, such as technology, increased innovation, and harnessing the power of intra- and inter-sector collaboration. The limitation this has on the sector is clear; without a strong motivation for growth, increasing the market size by targeting non-managing owners is unlikely. Even where businesses were looking for growth, the personal motivations and the wider sector culture are negatively aligned to this dynamic. Thus, whilst the sector looks ripe for greater collaboration, particularly to target the new market potential around bringing more unmanaged woodland into management, there are significant blockers in the construct, the value set, and the culture of the sector, and the lack of positive collaboration examples, which all present significant challenges. These findings are likely to be related to the rural nature of the sector and are having specific limitations on the sustainable nature of forestry in the UK.

5. Conclusions

This research explored the forestry sector in the southeast of England from the perspective of woodland agents, particularly to explore how increasing levels of horizontal and vertical collaboration could enable accessing and managing currently unmanaged woodlands. We conclude that:

- There is a relatively weak level of collaboration between woodland agents when compared to the potential indicated by the characteristics of the market and the scale of the opportunity that could be addressed.

- The following four groups of factors are limiting the potential to increase this collaboration:

- ∘

- the traditional handshake culture strongly embedded within rural life;

- ∘

- the construct, mechanisms, and frameworks of the sector;

- ∘

- the value set of those operating at this critical juncture of supply and demand;

- ∘

- the lack of positive examples of collaboration.

- Greater collaboration in the sector offers the opportunity to develop the new market potential of bringing more woodland into management. However, there are significant challenges to overcome to achieve this without unwanted disruption to the established culture and ways of working.

- The lack of engagement in collaboration seen here has implications for sustainability challenges of rural communities and businesses in other sectors. Recognition of collaboration as a factor affecting the extent to which sustainable management of natural resources (woodland in this example) can be achieved, and improving availability of best practice examples should inform future policy-making for sustainability.

Author Contributions

Conceptualization, C.G., R.J.M., S.M. and G.H.G.; methodology, C.G., R.J.M., S.M. and G.H.G.; formal analysis, C.G., R.J.M. and S.M.; investigation, C.G.; resources, R.J.M., S.M. and G.H.G.; data curation, C.G.; writing—original draft preparation, C.G.; writing—review and editing, C.G., R.J.M., S.M. and G.H.G.; supervision, R.J.M., S.M. and G.H.G., project administration, R.M and S.M; funding acquisition, R.J.M., S.M. and G.H.G. All authors have read and agreed to the published version of the manuscript.

Funding

The first author is supported by a PhD studentship funded by the Economic and Social Science Research Council (ESRC) South East Doctoral Training Centre, grant number G85816G.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki, and the approved by the Ethics Committee of the University of Surrey, reference: 160708-160702-22137270, date of approval: 12 April 2018.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to confidentiality requirements of the business data obtained.

Acknowledgments

The study is collaborative with the Forestry Commission whose support is gratefully acknowledged. We also wish to acknowledge the cooperation and engagement of many participants in the woodland and forestry sector.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Forestry Commission. NFI 2011 woodland map. In England National Forest Inventory Report; Forestry Commission: Farnham, UK, 2011. [Google Scholar]

- National Forest Inventory. National Forest Inventory statistics for Solent and South Downs; Forest Research: Edinburgh, UK, 2017.

- Ditchburn, B. NFI Provisional Estimates for Woodland in the Enterprise M3 and the Coast to Capital Local Enterprise Partnerships; Forestry Commission: Farnham, UK, 2014.

- Forestry Commission. Managing Ancient and Native Woodland in England: A Practice Guide; Forestry Commission: Farnham, UK, 2010.

- Hardiman, B.S.; Gough, C.M.; Halperin, A.; Hofmeister, K.L.; Nave, L.E.; Bohrer, G.; Curtis, P.S. Maintaining high rates of carbon storage in old forests: A mechanism linking canopy structure to forest function. For. Ecol. Manag. 2013, 298, 111–119. [Google Scholar] [CrossRef]

- Forestry Commission. Forestry Statistics 2020 Chapter 3: Trade; Forestry Commission: Farnham, UK, 2020.

- Eves, C.; Johnson, M.; Smith, S.; Quick, T.; White, C.; Black, J.; MacDonald, C.; Langley, E.; Jenner, M.; Richardson, W.; et al. Analysis of the Potential Effects of Various Influences and Interventions on Woodland Management and Creation Decisions, Using a Segmentation Model to Categorise Sub-Groups; Department for Environment, Food & Rural Affairs: London, UK, 2015.

- Rametsteiner, E.; Weiss, G.; Kubeczko, K. Innovation and Entrepreneurship in Forestry in Central Europe; Brill: Leiden, The Netherlands, 2005. [Google Scholar]

- Read, H.; Bengtsson, V. The management of trees in the wood pasture systems of South East England. In Silvicultures-Management and Conservation; IntechOpen: London, UK, 2019. [Google Scholar]

- Potter, C.; Urquhart, J. Tree disease and pest epidemics in the anthropocene: A review of the drivers, impacts and policy responses in the UK. For. Policy Econ. 2017, 79, 61–68. [Google Scholar] [CrossRef]

- Urquhart, J.; Courtney, P. Seeing the owner behind the trees: A typology of small-scale private woodland owners in England. For. Policy Econ. 2011, 13, 535–544. [Google Scholar] [CrossRef]

- Lawrence, A.; Dandy, N.; Urquhart, J. Landowner Attitudes to Woodland Creation and Management in the UK; Forest Research: Alice Holt, Farnham, 2010.

- Lawrence, A.; Dandy, N. Private landowners’ approaches to planting and managing forests in the UK: What’s the evidence? Land Use Policy 2014, 36, 351–360. [Google Scholar] [CrossRef]

- Forest Europe. State of Europe’s Forests 2020; Forest Europe: Bratislava, Slovakia, 2020. [Google Scholar]

- Bannister, N. The Cultural Heritage of Woodlands in the South East; South East AONBs Woodlands Programme: Farnham, UK, 2007. [Google Scholar]

- Forestry Commission. Forestry Statistics 2020 A Compendium of Statistics about Woodland, Forestry and Primary Wood Processing in the United Kingdom; Forestry Commission: Farnham, UK, 2020.

- Forestry Commission. Forestry Commission Key Performance Indicators Report for 2020-2021; Forestry Commission: Farnham, UK, 2021.

- IBIS World. Forestry & Logging in the UK—Market Research Report; IBIS World: Los Angeles, CA, USA, 2020. [Google Scholar]

- Tsouvalis, J. A Critical Geography of Britain’s State Forests; Oxford University Press: Oxford, UK, 2000. [Google Scholar]

- Munton, R. Rural land ownership in the United Kingdom: Changing patterns and future possibilities for land use. Land Use Policy 2009, 26, S54–S61. [Google Scholar] [CrossRef]

- Greenslade, C.; Murphy, R.; Morse, S.; Griffiths, G.H. Seeing the Wood for the trees: Factors limiting woodland management and sustainable local wood product use in the southeast of England. Sustainability 2020, 12, 10071. [Google Scholar] [CrossRef]

- Church, A.; Ravenscroft, N. Landowner responses to financial incentive schemes for recreational access to woodlands in South East England. Land Use Policy 2008, 25, 1–16. [Google Scholar] [CrossRef]

- Food and Agriculture Organization of the United Nations. Global Forest Resources Assessment 2020: Terms and Definitions; FAO: Rome, Italy, 2020. [Google Scholar]

- Wood, D.J.; Gray, B. Toward a comprehensive theory of collaboration. J. Appl. Behav. Sci. 1991, 27, 139–162. [Google Scholar] [CrossRef]

- Audy, J.; Lehoux, N.; D’Amours, S.; Rönnqvist, M. A framework for an efficient implementation of logistics collaborations. Int. Trans. Oper. Res. 2012, 19, 633–657. [Google Scholar] [CrossRef]

- Bugge, M.M.; Hansen, T.; Klitkou, A. What is the bioeconomy? A review of the literature. Sustainability 2016, 8, 691. [Google Scholar] [CrossRef] [Green Version]

- Lehoux, N.; D’Amours, S.; Langevin, A. Inter-firm collaborations and supply chain coordination: Review of key elements and case study. Prod. Plan. Control 2014, 25, 858–872. [Google Scholar] [CrossRef]

- Näyhä, A.; Pesonen, H. Strategic change in the forest industry towards the biorefining business. Technol. Forecast. Soc. 2014, 81, 259–271. [Google Scholar] [CrossRef]

- Valverde, P.F.; Quesada, H.; Bond, B. A lean logistics framework: A case study in the wood fiber supply chain. Wood Fiber Sci. 2020, 52, 117–127. [Google Scholar] [CrossRef]

- Forsberg, M.; Frisk, M.; Rönnqvisty, M. FlowOpt–a decision support tool for strategic and tactical transportation planning in forestry. Int. J. For. Eng. 2005, 16, 101–114. [Google Scholar] [CrossRef]

- Beaudoin, D.; Frayret, J.; LeBel, L. Negotiation-based distributed wood procurement planning within a multi-firm environment. For. Policy Econ. 2010, 12, 79–93. [Google Scholar] [CrossRef]

- Palander, T.; Väätäinen, J. Impacts of interenterprise collaboration and backhauling on wood procurement in Finland. Scand. J. For. Res. 2005, 20, 177–183. [Google Scholar] [CrossRef]

- Audy, J.; D’Amours, S.; Rousseau, L.M. Collaborative planning in a log truck pickup and delivery problem. In Proceedings of the 6th Triennial Symposium on Transportation Analysis, Phuket, Thailand, 12 June 2007. [Google Scholar]

- Frisk, M.; Göthe-Lundgren, M.; Jörnsten, K.; Rönnqvist, M. Cost allocation in collaborative forest transportation. Eur. J. Oper. Res. 2010, 205, 448–458. [Google Scholar] [CrossRef] [Green Version]

- Lähtinen, K.; Toppinen, A.; Leskinen, P.; Haara, A. Resource usage decisions and business success: A case study of Finnish large-and medium-sized sawmills. J. For. Prod. Bus. Res. 2009, 6, 1–18. [Google Scholar]

- Frayret, J.; D’Amours, F.; D’Amours, S. Collaboration et Outils Collaboratifs pour la PME Manufacturière [Collaboration and Collaborative Tools for Manufacturing SMEs]; Telus: Vancouver, BC, Canada, 2003. [Google Scholar]

- Basso, F.; D’Amours, S.; Rönnqvist, M.; Weintraub, A. A survey on obstacles and difficulties of practical implementation of horizontal collaboration in logistics. Int. Trans. Oper. Res. 2019, 26, 775–793. [Google Scholar] [CrossRef]

- Leitner, R.; Meizer, F.; Prochazka, M.; Sihn, W. Structural concepts for horizontal cooperation to increase efficiency in logistics. CIRP J. Manuf. Sci. Technol. 2011, 4, 332–337. [Google Scholar] [CrossRef]

- Cruijssen, F.; Dullaert, W.; Fleuren, H. Horizontal Cooperation in Transport and Logistics: A literature review. Trans. J. 2007, 46, 22–39. [Google Scholar]

- Simatupang, T.M.; Sridharan, R. The collaborative supply chain. Int. J. Logist. Manag. 2002, 13, 15–30. [Google Scholar] [CrossRef]

- Mason, R.; Lalwani, C.; Boughton, R. Combining vertical and horizontal collaboration for transport optimisation. Supply Chain Manag. 2007, 12, 187–199. [Google Scholar] [CrossRef]

- Verdonck, L.; Caris, A.N.; Ramaekers, K.; Janssens, G.K. Collaborative logistics from the perspective of road transportation companies. Trans. Rev. 2013, 33, 700–719. [Google Scholar] [CrossRef]

- Lehoux, N.; LeBel, L.; Elleuch, M. Benefits of inter-firm relationships: Application to the case of a five sawmills and one paper mill supply chain. INFOR Inf. Syst. Oper. Res. 2016, 54, 192–209. [Google Scholar] [CrossRef]

- Guerrero, J.E.; Hansen, E. Company-level cross-sector collaborations in transition to the bioeconomy: A multi-case study. For. Policy Econ. 2021, 123, 102355. [Google Scholar] [CrossRef]

- Guerrero, J.E.; Hansen, E. Cross-sector collaboration in the forest products industry: A review of the literature. Can. J. For. Res. 2018, 48, 1269–1278. [Google Scholar] [CrossRef]

- Toppinen, A.; Lähtinen, K.; Leskinen, L.A.; Österman, N. Network co-operation as a source of competitiveness in medium-sized Finnish sawmills. Silva Fenn. 2011, 45, 743–759. [Google Scholar] [CrossRef] [Green Version]

- Hämäläinen, S.; Näyhä, A.; Pesonen, H. Forest biorefineries—A business opportunity for the finnish forest cluster. J. Clean. Prod. 2011, 19, 1884–1891. [Google Scholar] [CrossRef]

- Orozco, N.; Hansen, E.; Knowles, C.; Leavengood, S. Oregon’s forest sector innovation system: An investigation towards advanced performance. For. Chron. 2013, 89, 225–234. [Google Scholar] [CrossRef] [Green Version]

- Finke, H.B.; Bosworth, G. Exploring the character of rural businesses: Performing change and continuity. Local Econ. 2016, 31, 619–636. [Google Scholar] [CrossRef]

- Murray, R. CLA Standing up for Rural Business; Briefing Note: New York, NY, USA, 2016. [Google Scholar]

- Garette, B.; Dussauge, P. Alliances versus acquisitions: Choosing the right option. Eur. Manag. J. 2000, 18, 63–69. [Google Scholar] [CrossRef]

- Entrena-Durán, F.; Muñoz-Sánchez, V.-M.; Pérez-Flores, A.-M. Sustainability and development: From agrarian development to the paradigm of sustainability. Sustainability 2021, 13, 6175. [Google Scholar] [CrossRef]

- Forest Research. Woodland Land Cover by Country; Forest Research: Farnham, UK, 2016.

- Moberg, C.R.; Speh, T.; Freese, T.L. SCM: Making the vision a reality. Supply Chain. Manag. Rev. 2003, 7, 34–39. [Google Scholar]

- MacCarthy, B.L.; Jayarathne, P.G. Sustainable collaborative supply networks in the international clothing industry: A comparative analysis of two retailers. Prod. Plan. Control 2012, 23, 252–268. [Google Scholar] [CrossRef] [Green Version]

- Zacharia, Z.; Plasch, M.; Mohan, U.; Gerschberger, M. The emerging role of coopetition within inter-firm relationships. Int. J. Logist. Manag. 2019, 30, 414–437. [Google Scholar] [CrossRef]

- Peng, T.A.; Bourne, M. The coexistence of competition and cooperation between networks: Implications from two Taiwanese healthcare networks. Br. J. Manag. 2009, 20, 377–400. [Google Scholar] [CrossRef]

- Verstrepen, S.; Cools, M.; Cruijssen, F.; Dullaert, W. A dynamic framework for managing horizontal cooperation in logistics. Int. J. Logist. Manag. 2009, 5, 228–248. [Google Scholar] [CrossRef] [Green Version]

- Gellynck, X.; Vermeire, B.; Viaene, J. Innovation in food firms: Contribution of regional networks within the international business context. Entrep. Region. Dev. 2007, 19, 209–226. [Google Scholar] [CrossRef]

- Näyhä, A. Finnish forest-based companies in transition to the circular bioeconomy-drivers, organizational resources and innovations. For. Policy Econ. 2020, 110, 101936. [Google Scholar] [CrossRef]

- Sage, R.B.; Hoodless, A.N.; Maureen, I.A.W.; Roger, A.H.D.; Madden, J.R.; Sotherton, N.W. Summary review and synthesis: Effects on habitats and wildlife of the release and management of pheasants and red-legged partridges on UK lowland shoots. Wildl. Biol. 2020, 2020, wlb.00766. [Google Scholar] [CrossRef]

- Firbank, L.G. Lowland Game Shooting Study; Institute of Terrestrial Ecology & Centre of Ecology and Hydrology: Oxfordshire, UK, 1999. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).