Board Composition and Social & Environmental Accountability: A Dynamic Model Analysis of Chinese Firms

Abstract

:1. Introduction

2. Theoretical Discussions and Hypothesis Development

2.1. Board Composition and Accountability

2.2. Board Independence

2.3. Board Gender Diversity

2.4. Board Size

2.5. CEO Duality

3. Data and Methodology

3.1. Data and Sample

3.2. Dynamic Research Model

3.3. Variables Definitions and Measurement

3.3.1. Dependent Variables

3.3.2. Independent Variables

3.3.3. Control Variables

4. Results and Discussion

4.1. System GMM Parameter Estimates

4.2. Testing the Moderating Effect of CEO Gender on the CG–SEA Nexus

5. Conclusions and Policy Implementations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Obs | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| Sustainability Performance | 20,643 | 23.331 | 14.961 | −3.82 | 73.31 |

| Environmental Information Disclosures (EID) | 20,643 | 0.046 | 0.151 | 0 | 0.767 |

| Environmental Performance | 20,643 | 1.391 | 4.537 | 0 | 23 |

| Board Size | 20,651 | 8.569 | 1.699 | 0 | 20 |

| Board Independence | 20,633 | 0.374 | 0.052 | 0.333 | 0.571 |

| CEO Duality | 20,651 | 0.291 | 0.454 | 0 | 1 |

| Number of Board Meeting | 20,651 | 9.611 | 3.941 | 0 | 56 |

| CEO Gender | 20,651 | 0.938 | 0.242 | 0 | 1 |

| Retiring CEO | 20,651 | 0.023 | 0.149 | 0 | 1 |

| CEO Duality | 20,651 | 0.291 | 0.454 | 0 | 1 |

| Debt to Assets Ratio | 20,651 | 0.415 | 0.215 | 0.049 | 0.944 |

| Return on Assets | 20,651 | 0.037 | 0.065 | −0.299 | 0.191 |

| Size (Total Assets) | 20,651 | 21.941 | 1.204 | 19.639 | 25.565 |

References

- Griggs, D.; Stafford-Smith, M.; Gaffney, O.; Rockström, J.; Öhman, M.C.; Shyamsundar, P.; Steffen, W.; Glaser, G.; Kanie, N.; Noble, I. Sustainable development goals for people and planet. Nature 2013, 495, 305–307. [Google Scholar] [CrossRef] [PubMed]

- Jain, T.; Jamali, D. Looking inside the black box: The effect of corporate governance on corporate social responsibility. Corp. Gov. Int. Rev. 2016, 24, 253–273. [Google Scholar] [CrossRef]

- Chan, M.C.; Watson, J.; Woodliff, D. Corporate governance quality and CSR disclosures. J. Bus. Ethics 2014, 125, 59–73. [Google Scholar] [CrossRef]

- Gray, R.; Dey, C.; Owen, D.; Evans, R.; Zadek, S. Struggling with the praxis of social accounting: Stakeholders, accountability, audits and procedures. Account. Audit. Account. J. 1997. [Google Scholar] [CrossRef]

- Parker, L.D. Social and environmental accountability research: A view from the commentary box. Account. Audit. Account. J. 2005. [Google Scholar] [CrossRef]

- Wang, S.; Li, J.; Zhao, D. Institutional pressures and environmental management practices: The moderating effects of environmental commitment and resource availability. Bus. Strategy Environ. 2018, 27, 52–69. [Google Scholar] [CrossRef]

- Wang, L.; Juslin, H. The effects of value on the perception of corporate social responsibility implementation: A study of Chinese youth. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 246–262. [Google Scholar] [CrossRef]

- Moon, J.; Shen, X. CSR in China research: Salience, focus and nature. J. Bus. Ethics 2010, 94, 613–629. [Google Scholar] [CrossRef]

- Yang, H.H.; Craig, R.; Farley, A. A review of Chinese and English language studies on corporate environmental reporting in China. Crit. Perspect. Account. 2015, 28, 30–48. [Google Scholar] [CrossRef] [Green Version]

- Khan, M.K.; He, Y.; Akram, U.; Sarwar, S. Financing and monitoring in an emerging economy: Can investment efficiency be increased? China Econ. Rev. 2017, 45, 62–77. [Google Scholar] [CrossRef]

- Ruan, L.; Liu, H. Environmental, Social, Governance Activities and Firm Performance: Evidence from China. Sustainability 2021, 13, 767. [Google Scholar] [CrossRef]

- Jizi, M. The influence of board composition on sustainable development disclosure. Bus. Strategy Environ. 2017, 26, 640–655. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Black economic empowerment disclosures by South African listed corporations: The influence of ownership and board characteristics. J. Bus. Ethics 2013, 116, 121–138. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations: New empirical insights from a Neo-Institutional framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Nguyen, T.H.; Elmagrhi, M.H.; Ntim, C.G.; Wu, Y. Environmental performance, sustainability, governance and financial performance: Evidence from heavily polluting industries in China. Bus. Strategy Environ. 2021. [Google Scholar] [CrossRef]

- Elmagrhi, M.H.; Ntim, C.G.; Elamer, A.A.; Zhang, Q. A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Bus. Strategy Environ. 2019, 28, 206–220. [Google Scholar] [CrossRef]

- Shahab, Y.; Ntim, C.G.; Chen, Y.; Ullah, F.; Li, H.X.; Ye, Z. Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Bus. Strategy Environ. 2020, 29, 1–16. [Google Scholar] [CrossRef]

- Lau, C.; Lu, Y.; Liang, Q. Corporate social responsibility in China: A corporate governance approach. J. Bus. Ethics 2016, 136, 73–87. [Google Scholar] [CrossRef]

- McGuinness, P.B.; Vieito, J.P.; Wang, M. The role of board gender and foreign ownership in the CSR performance of Chinese listed firms. J. Corp. Financ. 2017, 42, 75–99. [Google Scholar] [CrossRef] [Green Version]

- Noronha, C.; Tou, S.; Cynthia, M.; Guan, J.J. Corporate social responsibility reporting in China: An overview and comparison with major trends. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 29–42. [Google Scholar] [CrossRef]

- Rahdari, A.H.; Rostamy, A.A.A. Designing a general set of sustainability indicators at the corporate level. J. Clean. Prod. 2015, 108, 757–771. [Google Scholar] [CrossRef]

- Hossain, M.M.; Alam, M.; Hecimovic, A.; Hossain, M.A.; Lema, A.C. Contributing barriers to corporate social and environmental responsibility practices in a developing country: A stakeholder perspective. Sustain. Account. Manag. Policy J. 2016. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P.; Phan, P.H. Corporate governance and environmental performance: Is there really a link? Strateg. Manag. J. 2012, 33, 885–913. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Huang, C.-L.; Kung, F.-H. Drivers of environmental disclosure and stakeholder expectation: Evidence from Taiwan. J. Bus. Ethics 2010, 96, 435–451. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Gray, R.; Owen, D.; Adams, C. Some theories for social accounting?: A review essay and a tentative pedagogic categorisation of theorisations around social accounting. Sustain. Environ. Perform. Discl. 2009. [Google Scholar] [CrossRef]

- Jamali, D.; Mirshak, R. Corporate social responsibility (CSR): Theory and practice in a developing country context. J. Bus. Ethics 2007, 72, 243–262. [Google Scholar] [CrossRef]

- Rao, K.; Tilt, C. Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. J. Bus. Ethics 2016, 138, 327–347. [Google Scholar] [CrossRef]

- Kiel, G.; Nicholson, G. Boards that Work: A New Guide for Directors; McGraw-Hill Australia: New Yrok, NY, USA, 2003. [Google Scholar]

- De Graaf, F.J.; Stoelhorst, J.W. The role of governance in corporate social responsibility: Lessons from Dutch finance. Bus. Soc. 2013, 52, 282–317. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Pucheta-Martínez, M.C. Corporate social responsibility reporting and corporate governance mechanisms: An international outlook from emerging countries. Bus. Strategy Dev. 2020, 3, 77–97. [Google Scholar] [CrossRef]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Cespa, G.; Cestone, G. Corporate social responsibility and managerial entrenchment. J. Econ. Manag. Strategy 2007, 16, 741–771. [Google Scholar] [CrossRef]

- Falck, O.; Heblich, S. Corporate social responsibility: Doing well by doing good. Bus. Horiz. 2007, 50, 247–254. [Google Scholar] [CrossRef]

- Jensen, M.C. Value maximization, stakeholder theory, and the corporate objective function. J. Appl. Corp. Financ. 2001, 14, 8–21. [Google Scholar] [CrossRef]

- Calton, J.M.; Payne, S.L. Coping with paradox: Multistakeholder learning dialogue as a pluralist sensemaking process for addressing messy problems. Bus. Soc. 2003, 42, 7–42. [Google Scholar] [CrossRef]

- Scherer, A.G.; Palazzo, G.; Baumann, D. Global rules and private actors: Toward a new role of the transnational corporation in global governance. Bus. Ethics Q. 2006, 16, 505–532. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The Causal Effect of Corporate Governance on Corporate Social Responsibility. J. Bus. Ethics 2012, 4, 454–460. [Google Scholar] [CrossRef]

- Martins, A.; Gomes, D.; Branco, M.C. Managing corporate social and environmental disclosure: An accountability vs. impression management framework. Sustainability 2021, 13, 296. [Google Scholar] [CrossRef]

- Wong, C.W.; Wong, C.Y.; Boon-itt, S.; Tang, A.K. Strategies for Building Environmental Transparency and Accountability. Sustainability 2021, 13, 9116. [Google Scholar] [CrossRef]

- Patten, D.M. Exposure, legitimacy, and social disclosure. J. Account. Public Policy 1991, 10, 297–308. [Google Scholar] [CrossRef]

- Cho, C.H.; Laine, M.; Roberts, R.W.; Rodrigue, M. The frontstage and backstage of corporate sustainability reporting: Evidence from the Arctic National Wildlife Refuge Bill. J. Bus. Ethics 2018, 152, 865–886. [Google Scholar] [CrossRef]

- Yadav, P.L.; Han, S.H.; Rho, J.J. Impact of environmental performance on firm value for sustainable investment: Evidence from large US firms. Bus. Strategy Environ. 2016, 25, 402–420. [Google Scholar] [CrossRef]

- Porter, M.; Kramer, M.; Randall-Raconteur, J. 9. So What Now? Harvard Business Review: Boston, MA, USA, 2006. [Google Scholar]

- Medina-Salgado, M.S.; Sacristán-Navarro, M.; Guerras-Martín, L.Á. Do Boards of Directors Really Matter in the Cooperation Behavior of Firms? An Exploratory Analysis in Spain. Sustainability 2020, 12, 10114. [Google Scholar] [CrossRef]

- Rowe, A.L.; Nowak, M.; Quaddus, M.; Naude, M. Stakeholder engagement and sustainable corporate community investment. Bus. Strategy Environ. 2014, 23, 461–474. [Google Scholar] [CrossRef]

- Ben-Amar, W.; McIlkenny, P. Board effectiveness and the voluntary disclosure of climate change information. Bus. Strategy Environ. 2015, 24, 704–719. [Google Scholar] [CrossRef]

- Agrawal, A.; Knoeber, C.R. Firm performance and mechanisms to control agency problems between managers and shareholders. J. Financ. Quant. Anal. 1996, 31, 377–397. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Angelidis, J.P. The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors? J. Bus. Ethics 1995, 14, 405–410. [Google Scholar] [CrossRef]

- Ibrahim, N.A.; Howard, D.P.; Angelidis, J.P. Board members in the service industry: An empirical examination of the relationship between corporate social responsibility orientation and directorial type. J. Bus. Ethics 2003, 47, 393–401. [Google Scholar] [CrossRef]

- Herda, D.N.; Taylor, M.E.; Winterbotham, G. The Effect of Board Independence on the Sustainability Reporting Practices of Large US Firms. Soc. Environ. Account. 2012, 6, 178–197. [Google Scholar]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- Chau, G.; Gray, S.J. Family ownership, board independence and voluntary disclosure: Evidence from Hong Kong. J. Int. Account. Audit. Tax. 2010, 19, 93–109. [Google Scholar] [CrossRef]

- Donnelly, R.; Mulcahy, M. Board structure, ownership, and voluntary disclosure in Ireland. Corp. Gov. Int. Rev. 2008, 16, 416–429. [Google Scholar] [CrossRef]

- Akpan, E.O.; Amran, N.A. Board characteristics and company performance: Evidence from Nigeria. J. Financ. Account. 2014, 2, 81–89. [Google Scholar] [CrossRef] [Green Version]

- Galbreath, J. Drivers of corporate social responsibility: The role of formal strategic planning and firm culture. Br. J. Manag. 2010, 21, 511–525. [Google Scholar] [CrossRef]

- Gul, F.A.; Srinidhi, B.; Ng, A.C. Does board gender diversity improve the informativeness of stock prices? J. Account. Econ. 2011, 51, 314–338. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef] [Green Version]

- Kim, H. Glass fence thicker than glass ceiling: The puzzling gaps of women’s leadership in Korea. In Culture and Gender in Leadership; Palgrave Macmillan: London, UK, 2013; pp. 253–274. [Google Scholar]

- Hillman, A.J.; Cannella, A.A., Jr.; Harris, I.C. Women and racial minorities in the boardroom: How do directors differ? J. Manag. 2002, 28, 747–763. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I.; Lee, R. Board diversity and corporate social responsibility. J. Bus. Ethics 2015, 132, 641–660. [Google Scholar] [CrossRef]

- Colaco, H.M.; Myers, P.; Nitkin, M.R. Pathways to leadership: Board independence, diversity and the emerging pipeline in the United States for women directors. Int. J. Discl. Gov. 2011, 8, 122–147. [Google Scholar] [CrossRef]

- Bowrin, A.R. Corporate social and environmental reporting in the Caribbean. Soc. Res. J. 2013. [Google Scholar] [CrossRef]

- Tamimi, N.; Sebastianelli, R. Transparency among S&P 500 companies: An analysis of ESG disclosure scores. Manag. Decis. 2017. [Google Scholar] [CrossRef]

- Amran, A.; Lee, S.P.; Devi, S.S. The influence of governance structure and strategic corporate social responsibility toward sustainability reporting quality. Bus. Strategy Environ. 2014, 23, 217–235. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Zhu, H.; Ding, H.-B. Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. J. Bus. Ethics 2013, 114, 381–392. [Google Scholar] [CrossRef]

- Naveed, K.; Voinea, C.L.; Ali, Z.; Rauf, F.; Fratostiteanu, C. Board Gender Diversity and Corporate Social Performance in Different Industry Groups: Evidence from China. Sustainability 2021, 13, 3142. [Google Scholar] [CrossRef]

- Muttakin, M.B.; Khan, A.; Subramaniam, N. Firm characteristics, board diversity and corporate social responsibility: Evidence from Bangladesh. Pac. Account. Rev. 2015. [Google Scholar] [CrossRef] [Green Version]

- Liao, L.; Luo, L.; Tang, Q. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Huse, M.; Solberg, A.G. Gender-related boardroom dynamics: How Scandinavian women make and can make contributions on corporate boards. Women Manag. Rev. 2006. [Google Scholar] [CrossRef]

- Ahmed, K.; Hossain, M.; Adams, M.B. The effects of board composition and board size on the informativeness of annual accounting earnings. Corp. Gov. Int. Rev. 2006, 14, 418–431. [Google Scholar] [CrossRef]

- Dey, A. Corporate governance and agency conflicts. J. Account. Res. 2008, 46, 1143–1181. [Google Scholar] [CrossRef]

- Beiner, S.; Drobetz, W.; Schmid, F.; Zimmermann, H. Is board size an independent corporate governance mechanism? Kyklos 2004, 57, 327–356. [Google Scholar] [CrossRef]

- Guest, P.M. The impact of board size on firm performance: Evidence from the UK. Eur. J. Financ. 2009, 15, 385–404. [Google Scholar] [CrossRef]

- Krishnan, G.; Visvanathan, G. Do auditors price audit committee’s expertise? The case of accounting versus nonaccounting financial experts. J. Account. Audit. Financ. 2009, 24, 115–144. [Google Scholar] [CrossRef]

- Pathan, S. Strong boards, CEO power and bank risk-taking. J. Bank. Financ. 2009, 33, 1340–1350. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Dahya, J.; Lonie, A.A.; Power, D. The case for separating the roles of chairman and CEO: An analysis of stock market and accounting data. Corp. Gov. Int. Rev. 1996, 4, 71–77. [Google Scholar] [CrossRef]

- Tuggle, C.S.; Sirmon, D.G.; Reutzel, C.R.; Bierman, L. Commanding board of director attention: Investigating how organizational performance and CEO duality affect board members’ attention to monitoring. Strateg. Manag. J. 2010, 31, 946–968. [Google Scholar] [CrossRef] [Green Version]

- Dias, A.; Lima Rodrigues, L.; Craig, R. Corporate Governance Effects on Social Responsibility Disclosures. Australas. Account. Bus. Financ. J. 2017, 11, 3–22. [Google Scholar] [CrossRef]

- Gul, F.A.; Leung, S. Board leadership, outside directors’ expertise and voluntary corporate disclosures. J. Account. Public Policy 2004, 23, 351–379. [Google Scholar] [CrossRef]

- Al-Janadi, Y.; Rahman, R.A.; Omar, N.H. Corporate governance mechanisms and voluntary disclosure in Saudi Arabia. Res. J. Financ. Account. 2013, 4, 25–35. [Google Scholar]

- Ho, S.S.; Wong, K.S. A study of the relationship between corporate governance structures and the extent of voluntary disclosure. J. Int. Account. Audit. Tax. 2001, 10, 139–156. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate governance and corporate social responsibility disclosures: Evidence from an emerging economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Cheng, E.C.; Courtenay, S.M. Board composition, regulatory regime and voluntary disclosure. Int. J. Account. 2006, 41, 262–289. [Google Scholar] [CrossRef]

- Said, R.; Zainuddin, Y.H.; Haron, H. The relationship between corporate social responsibility disclosure and corporate governance characteristics in Malaysian public listed companies. Soc. Responsib. J. 2009. [Google Scholar] [CrossRef] [Green Version]

- Haque, F.; Ntim, C.G. Environmental policy, sustainable development, governance mechanisms and environmental performance. Bus. Strategy Environ. 2018, 27, 415–435. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef] [Green Version]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Meng, X.H.; Zeng, S.X.; Tam, C.M.; Xu, X.D. Whether top executives’ turnover influences environmental responsibility: From the perspective of environmental information disclosure. J. Bus. Ethics 2013, 114, 341–353. [Google Scholar] [CrossRef]

- Zeng, S.; Xu, X.; Dong, Z.; Tam, V.W. Towards corporate environmental information disclosure: An empirical study in China. J. Clean. Prod. 2010, 18, 1142–1148. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT press: Cambridge, MA, USA, 2010. [Google Scholar]

- Harjoto, M.A.; Jo, H. Corporate governance and CSR nexus. J. Bus. Ethics 2011, 100, 45–67. [Google Scholar] [CrossRef]

- Petra, S.T. Do outside independent directors strengthen corporate boards? Corp. Gov. Int. J. Bus. Soc. 2005. [Google Scholar] [CrossRef]

- Katmon, N.; Mohamad, Z.Z.; Norwani, N.M.; Al Farooque, O. Comprehensive board diversity and quality of corporate social responsibility disclosure: Evidence from an emerging market. J. Bus. Ethics 2019, 157, 447–481. [Google Scholar] [CrossRef]

- Khan, H.U.Z. The effect of corporate governance elements on corporate social responsibility (CSR) reporting: Empirical evidence from private commercial banks of Bangladesh. Int. J. Law Manag. 2010, 52, 82–109. [Google Scholar] [CrossRef]

- Akbaş, H.E. The relationship between board characteristics and environmental disclosure: Evidence from Turkish listed companies. South East Eur. J. Econom. Bus. 2016, 11, 7–19. [Google Scholar] [CrossRef] [Green Version]

- Frias-Aceituno, J.V.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. The role of the board in the dissemination of integrated corporate social reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- Fernandez-Feijoo, B.; Romero, S.; Ruiz-Blanco, S. Women on boards: Do they affect sustainability reporting? Corp. Soc. Responsib. Environ. Manag. 2014, 21, 351–364. [Google Scholar] [CrossRef]

- Giannarakis, G. The determinants influencing the extent of CSR disclosure. Int. J. Law Manag. 2014. [Google Scholar] [CrossRef]

- Sundarasen, S.D.D.; Je-Yen, T.; Rajangam, N. Board composition and corporate social responsibility in an emerging market. Corp. Gov. Int. J. Bus. Soc. 2016. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorn, L. An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. J. Bus. Ethics 2006, 69, 149–162. [Google Scholar] [CrossRef]

- Huafang, X.; Jianguo, Y. Ownership structure, board composition and corporate voluntary disclosure: Evidence from listed companies in China. Manag. Audit. J. 2007. [Google Scholar] [CrossRef]

- Uyar, A.; Kuzey, C.; Kilic, M.; Karaman, A.S. Board structure, financial performance, corporate social responsibility performance, CSR committee, and CEO duality: Disentangling the connection in healthcare. Corp. Soc. Responsib. Environ. Manag. 2021. [Google Scholar] [CrossRef]

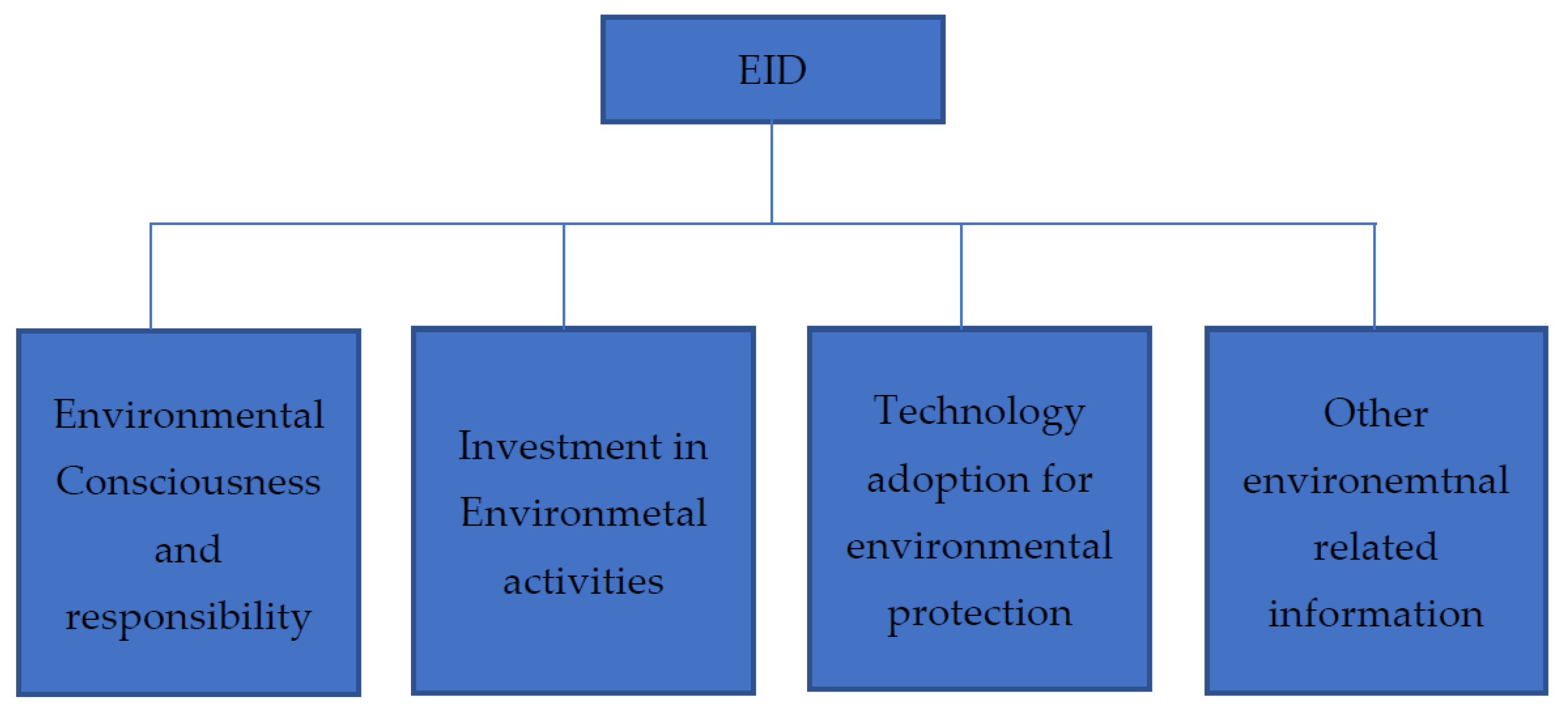

| Activity | Definition | EID-Related Central Aspect |

|---|---|---|

| A1 | Firm’s environmental investment expenditure for technology development | Investment |

| A2 | Government-appropriate funds, finance allowance, and taxes abatement related to the environment | Investment |

| A3 | Disposal and treatment of generated waste, recycling, and integrated utilization of waste products | Technology |

| A4 | Information related to ISO environmental system authentication | Consciousness and responsibility |

| A5 | Construction and operation of environmental improvement | Technology |

| A6 | Influence of government environmental protection policy | Consciousness and responsibility |

| A7 | Loans related to environmental protection | Investment |

| A8 | Lawsuit, atonement, penalty, and bounty related to environmental protection | Consciousness and responsibility |

| A9 | Firm’s environmental protection policies, strategies, and goals | Consciousness and responsibility |

| A10 | Other environmental-related information (environmental education, tree planting, biodiversity conservation, and other environmental projects to promote public welfare | Others |

| Variables | Environmental Performance | Sustainable Performance | Environmental Information Disclosure (EID) |

|---|---|---|---|

| Board Size (t + 1) | 0.159 ** | 0.760 *** | 0.00530 ** |

| (0.0727) | (0.214) | (0.00242) | |

| Board Independence (t + 1) | 0.761 | 5.069 | 0.0254 |

| (1.790) | (5.199) | (0.0597) | |

| Board Gender Diversity (t + 1) | −3.041 *** | −10.09 *** | −0.101 *** |

| (0.762) | (2.389) | (0.0254) | |

| CEO Duality (t + 1) | −0.167 | −0.391 | −0.00556 |

| (0.156) | (0.479) | (0.00521) | |

| Board Meetings (t + 1) | −0.0244 * | −0.142 *** | −0.000813 * |

| (0.0135) | (0.0424) | (0.000449) | |

| CEO Gender (t + 1) | −0.0590 | −0.407 | −0.00197 |

| (0.328) | (0.940) | (0.0109) | |

| CEO Retiring (t + 1) | −0.331 | −0.732 | −0.0110 |

| (0.287) | (0.948) | (0.00955) | |

| Debt to Assets (t + 1) | 0.706 | −6.097 *** | 0.0235 |

| (0.429) | (1.417) | (0.0143) | |

| ROA (t + 1) | 0.856 | 10.76 *** | 0.0285 |

| (0.756) | (2.422) | (0.0252) | |

| Size—Total Assets (t + 1) | −0.568 *** | −0.376 | −0.0189 *** |

| (0.0894) | (0.275) | (0.00298) |

| Variables | Environmental Performance | Sustainable Performance | Environmental Information Disclosure |

|---|---|---|---|

| Board Size | 0.164 *** | 0.513 *** | 0.00547 *** |

| (0.0241) | (0.0691) | (0.000802) | |

| Board Independence | 2.816 *** | 8.607 *** | 0.0939 *** |

| (0.746) | (2.145) | (0.0249) | |

| Board Gender Diversity | −2.384 *** | −2.620 *** | −0.0795 *** |

| (0.320) | (0.917) | (0.0107) | |

| CEO Duality | −0.129 | −0.433 * | −0.00430 |

| (0.0788) | (0.226) | (0.00263) | |

| Board Meetings | −0.0334 *** | −0.0710 *** | −0.00111 *** |

| (0.00911) | (0.0262) | (0.000304) | |

| CEO Gender | −0.0592 | 0.0491 | −0.00197 |

| (0.144) | (0.415) | (0.00481) | |

| CEO Retiring | −0.258 | −0.998 | −0.00861 |

| (0.232) | (0.666) | (0.00773) | |

| Debt to Assets | 0.257 | −1.277 ** | 0.00858 |

| (0.198) | (0.573) | (0.00660) | |

| ROA | 1.723 *** | 81.72 *** | 0.0574 *** |

| (0.618) | (1.793) | (0.0206) | |

| Size—Total Assets | 0.358 *** | 2.106 *** | 0.0119 *** |

| (0.0345) | (0.102) | (0.00115) | |

| Constant | −8.678 *** | −37.91 *** | −0.289 *** |

| (0.763) | (2.213) | (0.0254) | |

| No. of Observations | 14,913 | 14,913 | 14,913 |

| Number of ID | 2838 | 2838 | 2838 |

| Variables | Environmental Performance | Sustainable Performance | Environmental Information Disclosure |

|---|---|---|---|

| Board Size | −0.0540 | −0.186 | −0.00180 |

| (0.115) | (0.330) | (0.00383) | |

| Board Independence | −3.769 | −11.98 | −0.126 |

| (3.101) | (8.912) | (0.103) | |

| BoardGender Diversity | 0.180 | 5.321 | 0.00602 |

| (1.296) | (3.726) | (0.0432) | |

| CEO Duality | −0.351 | −1.093 | −0.0117 |

| (0.325) | (0.935) | (0.0108) | |

| B_Size*CEO_Gend | 0.226 * | 0.724 ** | 0.00753 * |

| (0.117) | (0.337) | (0.00391) | |

| B_Inde*CEO_Gend | 6.939 ** | 21.75 ** | 0.231 ** |

| (3.196) | (9.185) | (0.107) | |

| B_Gend_Div*CEO_Gend | −2.716 ** | −8.454 ** | −0.0905 ** |

| (1.344) | (3.863) | (0.0448) | |

| Duality*CEO_Gend | 0.236 | 0.716 | 0.00786 |

| (0.335) | (0.962) | (0.0112) | |

| Board Meetings | −0.0334 *** | −0.0708 *** | −0.00111 *** |

| (0.00911) | (0.0262) | (0.000304) | |

| CEO Gender | −3.903 ** | −12.18 ** | −0.130 ** |

| (1.989) | (5.718) | (0.0663) | |

| CEO Retiring | −0.245 | −0.967 | −0.00817 |

| (0.232) | (0.666) | (0.00772) | |

| Debt to Assets | 0.253 | −1.278 ** | 0.00843 |

| (0.198) | (0.574) | (0.00661) | |

| ROA | 1.801 *** | 81.91 *** | 0.0600 *** |

| (0.618) | (1.793) | (0.0206) | |

| Size | 0.356 *** | 2.098 *** | 0.0119 *** |

| (0.0345) | (0.102) | (0.00115) | |

| Constant | −4.968 ** | −26.15 *** | −0.166 ** |

| (2.035) | (5.857) | (0.0678) | |

| Observations | 14,913 | 14,913 | 14,913 |

| Number of ID | 2838 | 2838 | 2838 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khan, M.K.; Zahid, R.M.A.; Saleem, A.; Sági, J. Board Composition and Social & Environmental Accountability: A Dynamic Model Analysis of Chinese Firms. Sustainability 2021, 13, 10662. https://doi.org/10.3390/su131910662

Khan MK, Zahid RMA, Saleem A, Sági J. Board Composition and Social & Environmental Accountability: A Dynamic Model Analysis of Chinese Firms. Sustainability. 2021; 13(19):10662. https://doi.org/10.3390/su131910662

Chicago/Turabian StyleKhan, Muhammad Kaleem, R. M. Ammar Zahid, Adil Saleem, and Judit Sági. 2021. "Board Composition and Social & Environmental Accountability: A Dynamic Model Analysis of Chinese Firms" Sustainability 13, no. 19: 10662. https://doi.org/10.3390/su131910662