Digitization of the Customs Revenue Administration as a Factor of the Enhancement of the Budget Efficiency of the Russian Federation

Abstract

:1. Introduction

- Challenges and issues in the electronic business and digital technologies caused by the transboundary movement of goods and capital

- Management of the taxation of the controlled foreign companies;

- Counteraction against tax evasion through the diversity of the taxation and customs rules in different countries

- Counteraction against the use of the specialized shell companies (special purpose vehicles—SPVs) to minimize tax and customs payments

- Identification of the mechanisms of transfer pricing to minimize tax and customs payments

- Elaboration of the international standards of the collection, storage, and exchange of the fiscal and financial information

- Convention on Mutual Administrative Assistance in Tax Matters

- OECD Model Tax Convention

- Agreements approved in the framework of the realization of the BEPS Plan [16]

2. Literature Review

3. Materials and Methods

4. Results

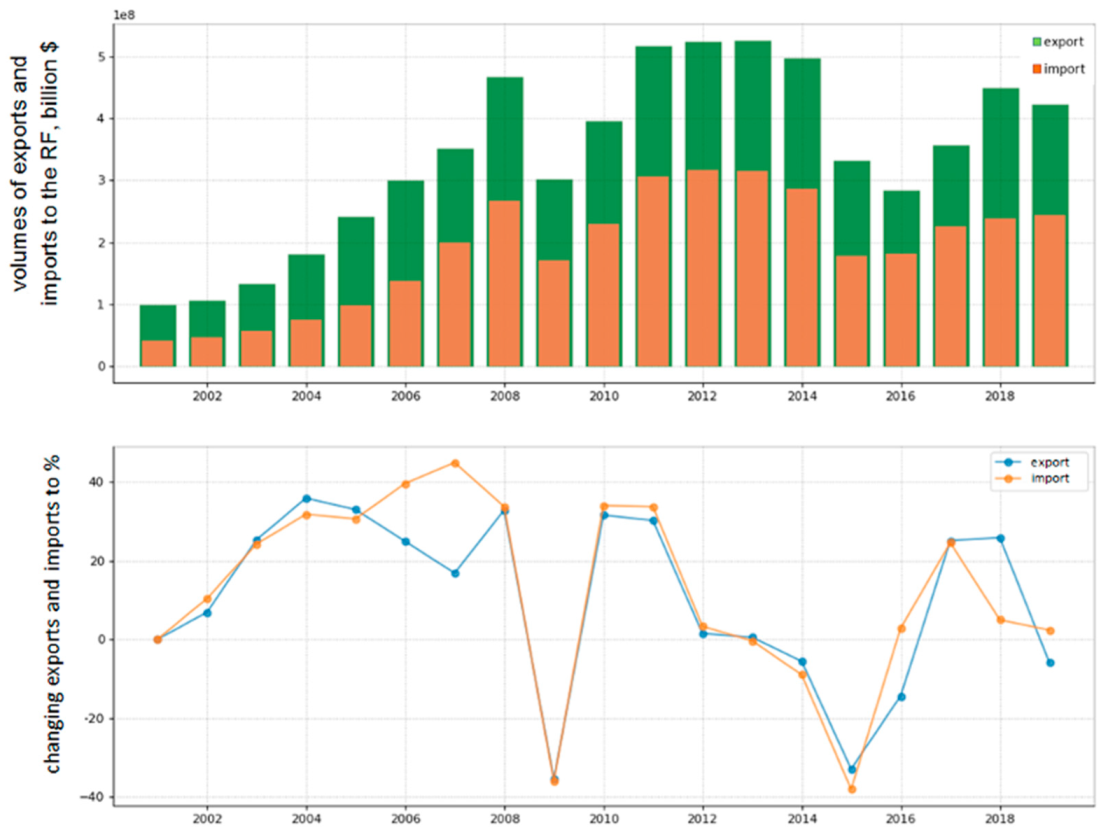

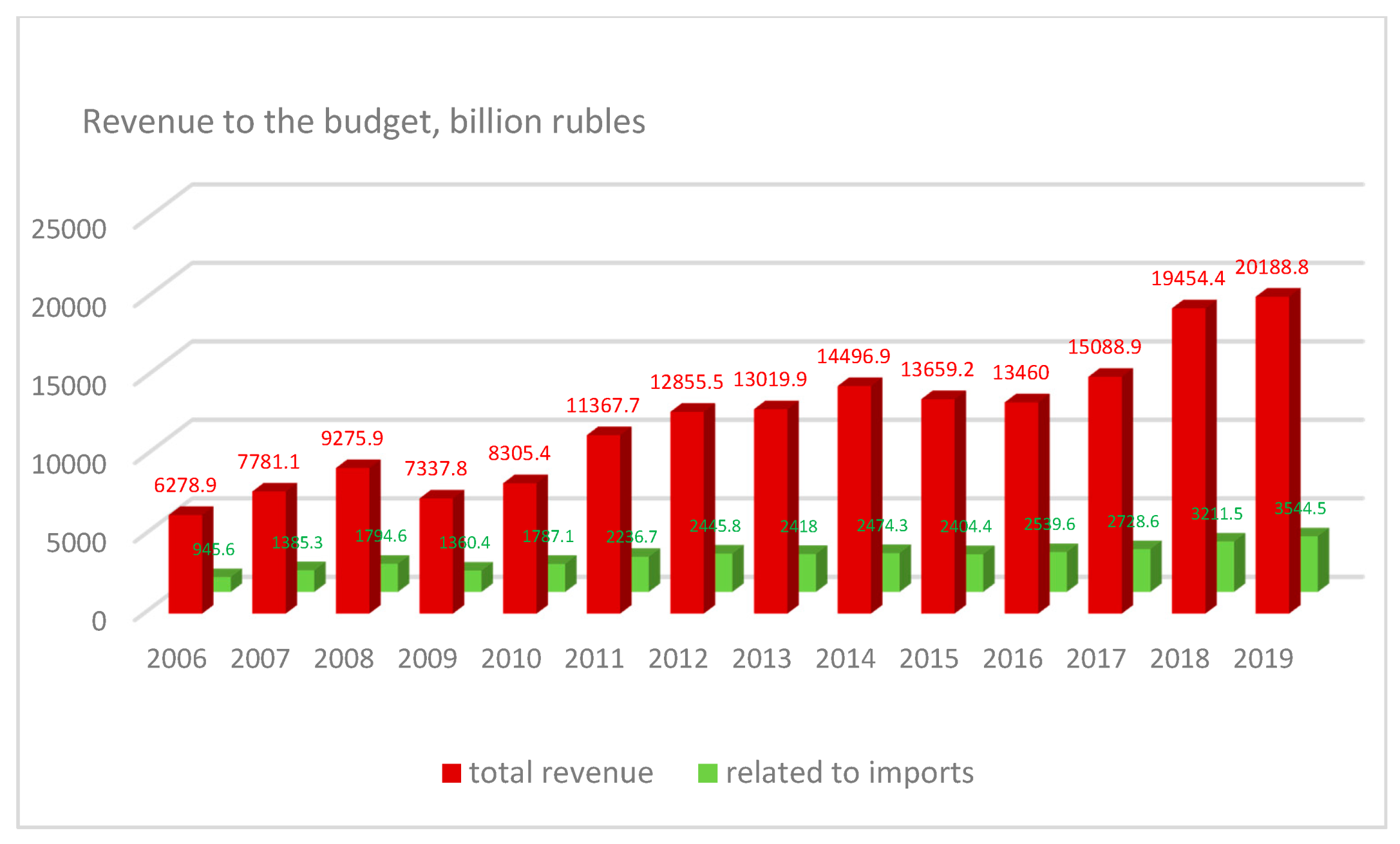

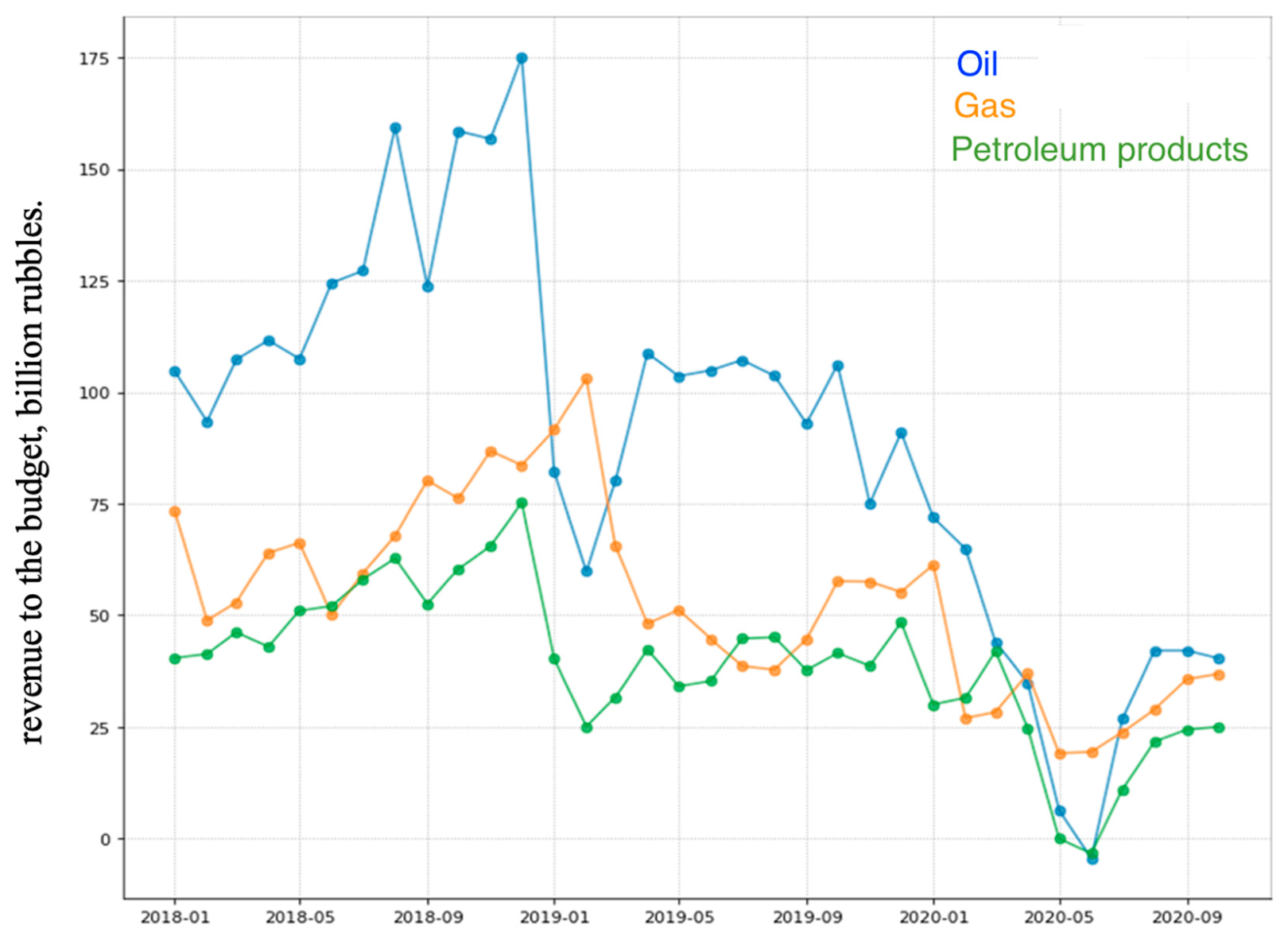

4.1. Analysis of the Customs Payments Role in the Formation of the Budget of the Russian Federation

4.2. The Definition of the Basic Technological Points of the Digital Modernization Project of the Information Exchange System between Tax and Customs Authorities

- A criterion of the reduction of capital and time expenditures for the collection, treatment, and storage of the interdepartmental information of the customs and tax authorities.

- A criterion of the increase of the speed and complication of the identification of customs and tax transgressions.

- A criterion of the reduction of transaction expenditures during the procedure of the informational exchange between the customs and tax authorities.

- A criterion of the improvement of the mobility of the customs and tax authorities personnel.

- A criterion of the enlargement of the coverage range of the interdepartmental informational exchange.

- A criterion of the enhancement of the level of predictability of the introduced informational solutions.

- A criterion of the reduction of the influence of human factor upon the algorithm of identification and prevention of the customs and tax transgressions.

- A criterion of the improvement of the efficiency of the administration of taxes and customs payments (improvement of the level of their collectability).

- A criterion of the correspondence of the informational solution to the priority areas of the scientific and technological development of the Russian economy.

- A criterion of the correspondence of the informational solution to the advanced scientific and technological tendencies in the development of the global digital economy.

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Harring, N.; Jagers, S. Should We Trust in Values? Explaining Public Support for Pro-Environmental Taxes. Gov. Policy Sustain. 2013, 5, 210–227. [Google Scholar] [CrossRef] [Green Version]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Environ. Sustain. Compet. Strateg. 2018, 10, 940. [Google Scholar]

- Popescu, N. FDI and Economic Growth in Central and Eastern Europe. Sustain. Dev. Entrep. Contemp. Econ. 2014, 6, 8149–8163. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.; Tao, F.; Shi, Y.; Wen, H. Optimization of Vehicle Routing Problem with Time Windows for Cold Chain Logistics Based on Carbon Tax. Energy Sustain. 2017, 9, 694. [Google Scholar] [CrossRef] [Green Version]

- Hassan, M.A.; Shukur, Z.; Hasan, M.K.; Al-Khaleefa, A.S. A Review on Electronic Payments Security. Symmetry 2020, 12, 1344. [Google Scholar] [CrossRef]

- Hassan, M.A.; Shukur, Z.; Hasan, M.K. An Efficient Secure Electronic Payment System for E-Commerce. Computers 2020, 9, 66. [Google Scholar] [CrossRef]

- Kim, K.; Yoon, S. Taxpayer’s Perception to Tax Payment in Kind System in Support of SMEs’ Sustainability: Case of the South Korean Government’s Valuation of Unlisted Stocks. Sustainability 2017, 9, 1523. [Google Scholar] [CrossRef] [Green Version]

- Gao, X.; Zheng, H.; Zhang, Y.; Golsanami, N. Tax Policy, Environmental Concern and Level of Emission Reduction. Sustainability 2019, 11, 1047. [Google Scholar] [CrossRef] [Green Version]

- Kazakova, N.A.; Fedchenko, E.A. Analysis and control of budget efficiency in the context of public sector reform. Financ. Anal. Probl. Solut. 2013, 3, 10–18. [Google Scholar]

- Isaev, E.A.; Fedchenko, E.A.; Gusarova, L.V.; Polyakova, O.A.; Vasyunina, M.L. Performance audit in the public sector: Domestic and foreign experience Auditoría de gestión en el sector público: Experiencia nacional y extranjera. Estud. Econ. Apl. 2021, 39, 24. [Google Scholar] [CrossRef]

- Kim, J.; Im, C. Study on Corporate Social Responsibility (CSR): Focus on Tax Avoidance and Financial Ratio Analysis. Sustainability 2017, 9, 1710. [Google Scholar] [CrossRef] [Green Version]

- Noked, N. Tax Evasion and Incomplete Tax Transparency. Laws 2018, 7, 31. [Google Scholar] [CrossRef] [Green Version]

- Convention on Mutual Administrative Assistance in Tax Matters. Consultant Plus. Available online: http://www.consultant.ru/document/cons_doc_LAW_186124/ (accessed on 15 February 2020).

- Government of Russia. 834-r 30.04.2016 Order No. 834-r “on Signing the Multilateral Agreement of Competent Authorities on Automatic Exchange of Financial Information”. Available online: http://static.government.ru/media/files/2HLPVzTTn9WApGOpAm2zNjRWLJFp3VAy.pdf (accessed on 15 February 2021).

- Federal Tax Service of Russia. Countering International Tax Evasion. Available online: https://www.nalog.ru/rn77/about_fts/inttax/oppintevasion/ (accessed on 17 February 2021).

- Shakhmametyev, A.A. Legal Basis for International Exchange of Tax Information: OECD Activities and Practice of Russia. Taxes Tax. 2017, 29–38. [Google Scholar] [CrossRef]

- Tax Code of the Russian Federation/Consultant Plus. Available online: http://www.consultant.ru/document/cons_doc_LAW_19671/ (accessed on 15 December 2020).

- ООН. United Nations Model Double Taxation Convention. United Nations. 2013. Available online: https://www.un.org/esa/ffd/wp-content/uploads/2014/09/UN_Model_2011_UpdateRu.pdf (accessed on 20 February 2021).

- Federal Tax Service of Russia. Order of the Federal Tax Service of 03.11.2020 No ED-7-17/788@ “on Approval of the List of States (Territories) with Which the Automatic Exchange of Financial Information Is Carried Out”/Official Internet Portal of Legal Information. Available online: http://publication.pravo.gov.ru/Document/View/0001202012100019?index=2&rangeSize=1 (accessed on 21 February 2021).

- Okanga, O. The Political Economy of Nigeria’s Digital Tax Experiment. Available online: https://ssrn.com/abstract=3640318 (accessed on 1 July 2020).

- Littlewood, M. Taxing Highly Digitalised Firms: The OECD and New Zealand’s Proposed Digital Services Tax. Available online: https://ssrn.com/abstract=3692899 (accessed on 15 September 2020).

- Harpaz, A. Taxation of the Digital Economy: Adapting a Twentieth-Century Tax System to a Twenty-First-Century Economy. 2021. Available online: https://ssrn.com/abstract=3593936 (accessed on 1 January 2021).

- Olbert, M.; Spengel, C. Taxation in the Digital Economy—Recent Policy Developments and the Question of Value Creation. ZEW—Centre for European Economic Research Discussion Paper No. 19-010. 2019. Available online: https://ssrn.com/abstract=3368092 (accessed on 7 July 2021).

- Siimon, Õ.R.; Lukason, O. A Decision Support System for Corporate Tax Arrears Prediction. Sustainability 2021, 13, 8363. [Google Scholar] [CrossRef]

- Schwab, C.M.; Stomberg, B.; Williams, B. Effective Tax Planning. The Accounting Review, Forthcoming. Available online: https://ssrn.com/abstract=3781011 (accessed on 7 February 2021).

- Klein, D.; Ludwig, C.; Nicolay, K. Internal Digitalization and Tax-Efficient Decision Making. ZEW—Centre for European Economic Research Discussion Paper No. 20-051. Available online: https://ssrn.com/abstract=3716119 (accessed on 1 June 2021).

- Lee, J.; Kim, S.; Kim, E. Designation as the Most Admired Firms to the Sustainable Management of Taxes: Evidence from South Korea. Sustainability 2021, 13, 7994. [Google Scholar] [CrossRef]

- Noonan, C.; Plekhanova, V. Taxation of Digital Services Under Trade Agreements. J. Int. Econ. Law 2020, 23, 1015–1039. [Google Scholar] [CrossRef]

- Sumper, M.; Estebanez, C. Digitization and New Business Models: The Concept of the Permanent Establishment Today and Tomorrow. Available online: https://ssrn.com/abstract=3799852 (accessed on 1 July 2017).

- Christians, A.; Magalhaes, T.D. A New Global Tax Deal for the Digital Age. Can. Tax J. Rev. Fisc. Can. 2019, 67, 1153–1178. Available online: https://ssrn.com/abstract=3510271 (accessed on 27 December 2019).

- Boboshko, D.Y. Digitalization in Small Business Tax Administration. In Industry Competitiveness: Digitalization, Management, and Integration, Proceedings of the International Scientific and Practical Forum “Industry. Science, Competence, Integration”, Moscow, Russia, 28 November 2019; Springer: Cham, Switzerland, 2019; pp. 675–687. [Google Scholar]

- Gulzar, M.A.; Cherian, J.; Sial, M.S.; Badulescu, A.; Thu, P.A.; Badulescu, D.; Khuong, N.V. Does Corporate Social Responsibility Influence Corporate Tax Avoidance of Chinese Listed Companies? Sustainability 2018, 10, 4549. [Google Scholar] [CrossRef] [Green Version]

- Vacca, A.; Iazzi, A.; Vrontis, D.; Fait, M. The Role of Gender Diversity on Tax Aggressiveness and Corporate Social Responsibility: Evidence from Italian Listed Companies. Sustainability 2020, 12, 2007. [Google Scholar] [CrossRef] [Green Version]

- Lebid, V.; Anufriyeva, T.; Savenko, H.; Skrypnyk, V. Study of Efficiency of Simplication of Customs Formalities on the Digitalization Basis. Technol. Audit Prod. Reserves 2021, 1, 49–53. [Google Scholar] [CrossRef]

- Edet, B., Jr. Digital Tax: Significant Economic Presence in Nigeria and The ‘Ahmed Order’. Available online: https://ssrn.com/abstract=3630299 (accessed on 16 June 2020).

- Dai, Y.; Rizzo, A. How Will the Italian Digital Services Tax Affect the Trade Relations with the U.S. and China? Fiscalità e Commercio Internazionale, n. 7/2020. Available online: https://ssrn.com/abstract=3653438 (accessed on 16 July 2020).

- Cui, W. The Superiority of the Digital Services Tax Over Significant Digital Presence Proposals. Natl. Tax J. 2019, 72, 839–856. Available online: https://ssrn.com/abstract=3427313 (accessed on 26 July 2019). [CrossRef]

- Criqui, P.; Jaccard, M.; Sterner, T. Carbon Taxation: A Tale of Three Countries. Sustainability 2019, 11, 6280. [Google Scholar] [CrossRef] [Green Version]

- He, Q.; Chen, L.; Zhou, X.; Li, S.; Shen, H.; Jian, J. Energy Taxes, Carbon Dioxide Emissions, Energy Consumption and Economic Consequences: A Comparative Study of Nordic and G7 Countries. Sustainability 2019, 11, 6100. [Google Scholar] [CrossRef] [Green Version]

- Shu, T.; Huang, C.; Chen, S.; Wang, S.; Lai, K.K. Trade-Old-for-Remanufactured Closed-Loop Supply Chains with Carbon Tax and Government Subsidies. Sustainability 2018, 10, 3935. [Google Scholar] [CrossRef] [Green Version]

- Yu, W.; Han, R. Coordinating a Two-Echelon Supply Chain under Carbon Tax. Sustainability 2017, 9, 2360. [Google Scholar] [CrossRef] [Green Version]

- Chen, W.; Zhou, J.; Li, S.; Li, Y. Effects of an Energy Tax (Carbon Tax) on Energy Saving and Emission Reduction in Guangdong Province-Based on a CGE Model. Sustainability 2017, 9, 681. [Google Scholar] [CrossRef] [Green Version]

- Gurdgiev, C. OECD-Led Tax Reforms: A Prescription for a Less Competitive Economy. Available online: https://ssrn.com/abstract=3406260 (accessed on 18 June 2019).

- De Wilde, M.F.; Wisman, C. OECD Consultations on the Digital Economy: ‘Tax Base Reallocation’ and ‘I’ll Tax If You Don’t’? Available online: https://ssrn.com/abstract=3349078 (accessed on 8 March 2019).

- Báez, A.; Brauner, Y. Taxing the Digital Economy Post BEPS … Seriously. University of Florida Levin College of Law Research Paper No. 19-16. Available online: https://ssrn.com/abstract=3347503 (accessed on 1 March 2019).

- Cabelkova, I. Sustainability of State Budgetary Expenses: Tax Compliance of Low-, Middle-, and High-Income Groups—The Evidence from the Czech Republic. Sustainability 2021, 13, 8966. [Google Scholar] [CrossRef]

- Laković, T.; Mugoša, A.; Čizmović, M.; Radojević, G. Impact of Taxation Policy on Household Spirit Consumption and Public-Finance Sustainability. Sustainability 2019, 11, 5858. [Google Scholar] [CrossRef] [Green Version]

- Pogorletsky, A.I.; Pokrovskaya, N.V. Comparative analysis of measures of fiscal regulation of the G20 countries in the era of corona crisis and in the post-coronavirus perspective. J. Appl. Econ. Res. 2021, 20, 31–61. [Google Scholar] [CrossRef]

- Mainali, R. Spatial Fiscal Interactions in Colombian Municipalities: Evidence from Oil Price Shocks. J. Risk Financ. Manag. 2021, 14, 248. [Google Scholar] [CrossRef]

- Government of the Russian Federation. Order of 17.01.2019 No. 20-r “Action Plan “Transformation of the Business Climate”. 2019. Available online: http://static.government.ru/media/files/RDLjpvAMGczA7PfJJ8PXN2MIjC9VvJNA.pdf (accessed on 28 November 2020).

- President of Russia. Decree of 07.05.2018 No. 204 “on the National Development Goals of Russia until 2030”. President of Russia. Available online: http://kremlin.ru/events/president/news/63728 (accessed on 20 May 2021).

- Passport of the National Program “Digital Economy”. Available online: http://static.government.ru/media/files/urKHm0gTPPnzJlaKw3M5cNLo6gczMkPF.pdf (accessed on 28 November 2020).

- Wang, C.; Wang, D.; Duan, K.; Mubeen, R. Global financial crisis, smart lockdown strategies, and the COVID-19 spillover impacts: A global perspective implications from Southeast Asia. Front. Psychiatry 2021, 12, 1–14. [Google Scholar] [CrossRef]

- Azizi, M.R.; Atlasi, R.; Ziapour, A.; Naemi, R. Innovative human resource management strategies during the COVID-19 pandemic: A systematic narrative review approach. Heliyon 2021, 7, e07233. [Google Scholar] [CrossRef] [PubMed]

- Abbas, J.; Mubeen, R.; Iorember, P.T.; Raza, S.; Mamirkulova, G. Exploring the impact of COVID-19 on tourism: Transformational potential and implications for a sustainable recovery of the travel and leisure industry. Curr. Res. Behav. Sci. 2021, 2, 100033. [Google Scholar] [CrossRef]

- Magalhaes, T.D.; Christians, A. Rethinking Tax for the Digital Economy after COVID-19. 11 Harvard Business Law Review. 2021. Available online: https://ssrn.com/abstract=3635907 (accessed on 26 June 2020).

- Mariani, P. Export Control and Measures Affecting Trade in Goods in Global COVID-19 Crisis: The Emergence of Sanitary Protectionism in the European Union. Available online: https://ssrn.com/abstract=3901944 (accessed on 2 July 2021).

- Pauwelyn, J. Export Restrictions in Times of Pandemic: Options and Limits under International Trade Agreements. Available online: https://ssrn.com/abstract=3579965 (accessed on 30 April 2020).

- Fiedler, A.; Fath, B.; Sinkovics, N.; Sinkovics, R.R. Exporting from a Remote, Open Economy During COVID-19: Challenges and Opportunities for SMEs. In Management Perspectives on the COVID-19 Crisis: Lessons from New Zealand; Husted, K., Sinkovics, R.R., Eds.; IEdward Elgar Publishing: Cheltenham, UK, 2021; Available online: https://ssrn.com/abstract=3787988 (accessed on 3 September 2021).

- ConsultantPlus (The Official Website). Available online: http://www.consultant.ru/online/ (accessed on 11 September 2021).

- Ministry of Economic Development of the Russian Federation (The Official Website). Available online: https://www.economy.gov.ru/ (accessed on 11 May 2020).

- Ministry of Finance of the Russian Federation (The Official Website). Available online: https://minfin.gov.ru/ru/ (accessed on 19 May 2020).

- Federal Customs Service (The Official Website). Available online: https://customs.gov.ru/ (accessed on 20 May 2020).

- Federal Taxation Service (The Official Website). Available online: https://www.nalog.gov.ru/rn77/ (accessed on 20 May 2020).

- Raza Abbasi, K.; Hussain, K.; Fatai Adedoyin, F.; Ahmed Shaikh, P.; Yousaf, H.; Muhammad, F. Analyzing the role of industrial sector’s electricity consumption, prices, and GDP: A modified empirical evidence from Pakistan. AIMS Energy 2021, 9, 29–49. [Google Scholar] [CrossRef]

- Guglyuvatyy, E.; Stoianoff, N.P. Applying the Delphi Method as a Research Technique in Tax Law and Policy. Aust. Tax Forum 2015, 30, 179–204. Available online: https://ssrn.com/abstract=2597916 (accessed on 4 December 2014).

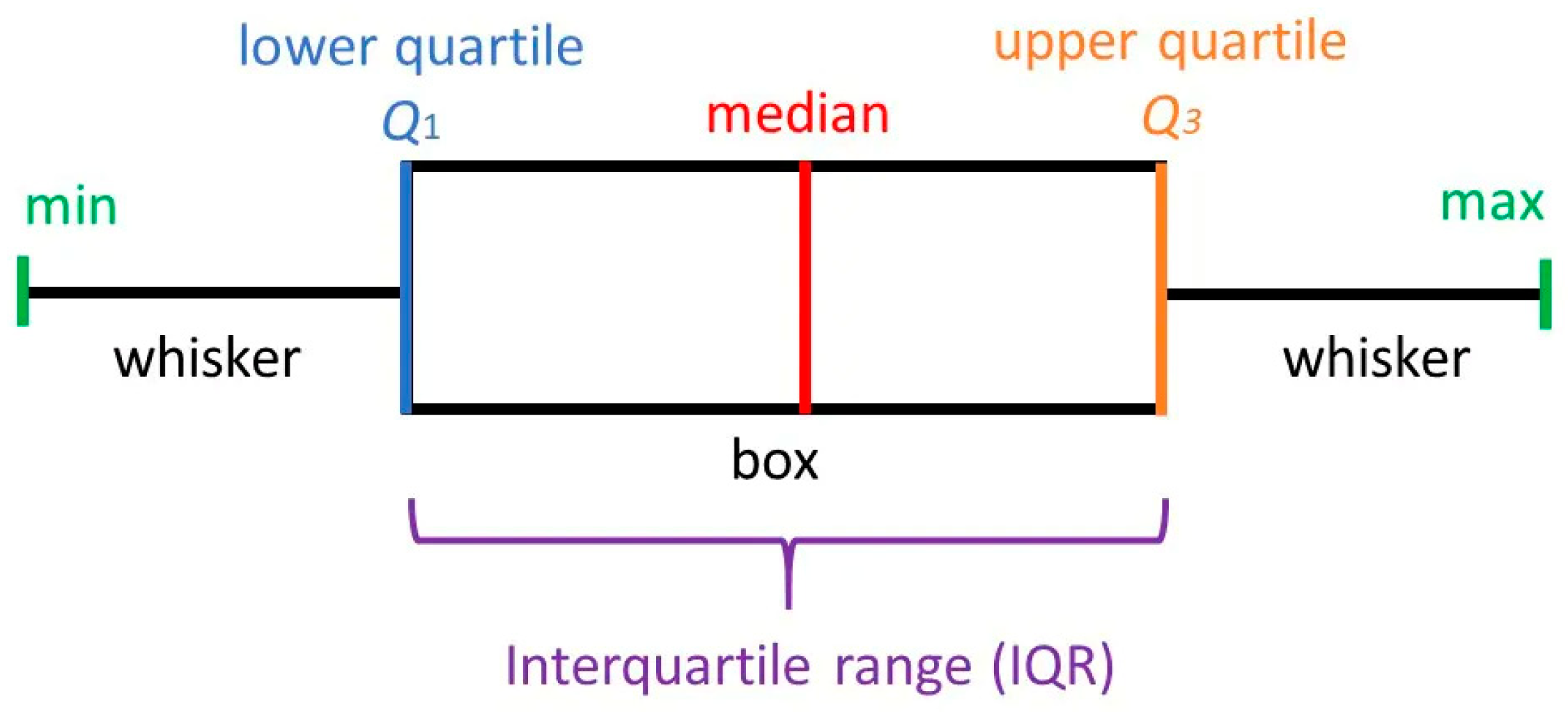

- Saul McLeod. What Does a Box Plot Tell You? 2019. Available online: https://www.simplypsychology.org/boxplots.html (accessed on 27 September 2021).

- Budget Code of the Russian Federation. Available online: http://www.consultant.ru/document/cons_doc_LAW_19702/ (accessed on 29 November 2020).

- Suslina, A.L.; Leukhin, R.S. Struggle with the shadow economy of Russia: Private aspects of general problems. Financ. J. 2016, 34, 46–61. [Google Scholar]

- Law of the Russian Federation “on Customs Tariff” of 21.05.1993 N 5003-1 (Last Edition)/Consultant Plus. Available online: http://www.consultant.ru/document/cons_doc_LAW_1995/ (accessed on 4 November 2020).

- Press Center of the Ministry of Finance of Russia. Information Message: On the Mechanism of the Budget Rule with a Decrease in Oil Prices below the Base Level. 2020. Available online: https://minfin.gov.ru/ru/press-center/?id_4=36986-informatsionnoe_soobshchenie (accessed on 30 November 2020).

- Siddiqui, A.M.; Siddiqui, D.A. Relationship between Custom Duties and Profitability of Automobile Industry: A Cross Country Analysis. Available online: https://ssrn.com/abstract=3400726 (accessed on 7 June 2019).

- Weerth, C. Tariff Rates of the World: Are Customs Duties Really Growing Unimportant? Glob. Trade Cust. J. 2009, 4, 53–60. Available online: https://ssrn.com/abstract=3022243 (accessed on 15 February 2009).

- McFaddin, C. Evaluating the Tax Veto in a Digital Age: Legislative Efficiency and National Sovereignty in the European Union. Va. J. Int. Law 2022, 62. Available online: https://ssrn.com/abstract=3800939 (accessed on 29 March 2021).

- Local Burden of Disease HIV Collaborators. Mapping subnational HIV mortality in six Latin American countries with incomplete vital registration systems. BMC Med. 2021, 19, 4. [Google Scholar] [CrossRef]

- Paulson, K.R.; Kamath, A.M.; Alam, T.; Bienhoff, K.; Abady, G.G.; Kassebaum, N.J. Global, regional, and national progress towards Sustainable Development Goal 3.2 for neonatal and child health: All-cause and cause-specific mortality findings from the Global Burden of Disease Study 2019. Lancet 2021, 398, 870–905. [Google Scholar] [CrossRef]

| Year | Revenues, Total, Billion Rubles | Oil and Gas Revenues, Billion Rubles | Not-Oil-and-Gas Revenues, Billion Rubles |

|---|---|---|---|

| 2006 | 10,625.8 | 2943.5 | 7682.3 |

| 2007 | 13,368.3 | 2897.4 | 10,470.9 |

| 2008 | 16,169.1 | 4389.4 | 11,779.7 |

| 2009 | 13,599.7 | 2984.0 | 10,615.8 |

| 2010 | 16,031.9 | 3830.7 | 12,201.3 |

| 2011 | 20,855.4 | 5641.8 | 15,213.6 |

| 2012 | 23,435.1 | 6453.2 | 16,981.9 |

| 2013 | 24,442.7 | 6534.0 | 17,908.6 |

| 2014 | 26,766.1 | 7433.8 | 19,332.3 |

| 2015 | 26,922.0 | 5862.7 | 21,059.4 |

| 2016 | 28,181.5 | 4844.0 | 23,337.5 |

| 2017 | 31,046.7 | 5971.9 | 25,074.8 |

| 2018 | 37,320.3 | 9017.8 | 28,302.5 |

| 2019 | 39,497.6 | 7924.3 | 31,573.3 |

| Values | 2018 Billion Rubles | 2019 Billion Rubles | 2018 % | 2019 % | Growth Rate |

|---|---|---|---|---|---|

| Export duty, total, including from: | 3007.90 | 2276.00 | 13.35 | 9.19 | −24.33% |

| Oil | 1550.00 | 1115.50 | 6.88 | 4.51 | −28.03% |

| Gas | 809.20 | 695.70 | 3.59 | 2.81 | −14.03% |

| Oil products | 648.70 | 464.90 | 2.88 | 1.88 | −28.33% |

| Connected with imports revenues, total, including: | 19,528.02 | 22,478.94 | 86.65 | 90.81 | 15.11% |

| VAT on the imported goods | 14,881.85 | 17,477.67 | 66.04 | 70.60 | 17.44% |

| Excises on the imported goods | 555.90 | 539.12 | 2.47 | 2.18 | −3.02% |

| Import duties | 4090.27 | 4462.15 | 18.15 | 18.03 | 9.09% |

| All customs revenues | 22,535.92 | 24,754.94 | 100.00 | 100.00 | 9.85% |

| Index | Factor |

|---|---|

| K1 | Criterion of the reduction of capital and time expenditures |

| K2 | Criterion of the increase of the speed and complication of the identification of customs and tax transgressions |

| K3 | Criterion of the reduction of transaction expenditures |

| K4 | Criterion of the improvement of the mobility of the personnel |

| K5 | Criterion of the enlargement of the coverage range of the informational exchange |

| K6 | Criterion of the enhancement of the level of predictability of the informational solutions |

| K7 | Criterion of the improvement of the efficiency of the administration of the taxes and customs payments |

| K8 | Criterion of the improvement of the automation level |

| K9 | Criterion of the correspondence of the informational solution to the priority directions in the scientific and technological development of the Russian economy |

| K10 | Criterion of the correspondence of the informational solution to the advanced scientific and technological tendencies in the development of the global digital economy |

| K1 | K2 | K3 | K4 | K5 | K6 | K7 | K8 | K9 | K10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| E1 | 25 | 98 | 11 | 40 | 41 | 59 | 78 | 50 | 55 | 99 |

| E2 | 52 | 85 | 37 | 41 | 65 | 69 | 84 | 38 | 87 | 47 |

| E3 | 55 | 81 | 36 | 62 | 75 | 71 | 91 | 39 | 65 | 49 |

| E4 | 31 | 80 | 20 | 55 | 64 | 95 | 94 | 61 | 62 | 58 |

| E5 | 41 | 78 | 25 | 53 | 67 | 70 | 76 | 50 | 72 | 36 |

| E6 | 39 | 78 | 25 | 27 | 56 | 68 | 68 | 59 | 59 | 70 |

| E7 | 21 | 52 | 43 | 48 | 33 | 75 | 61 | 61 | 46 | 86 |

| E8 | 20 | 43 | 23 | 65 | 74 | 98 | 65 | 57 | 30 | 80 |

| E9 | 42 | 55 | 49 | 66 | 33 | 81 | 76 | 19 | 37 | 77 |

| E10 | 36 | 64 | 47 | 54 | 75 | 100 | 84 | 11 | 83 | 93 |

| E11 | 43 | 99 | 29 | 25 | 52 | 55 | 82 | 64 | 63 | 30 |

| E12 | 42 | 71 | 21 | 70 | 32 | 76 | 65 | 50 | 46 | 73 |

| E13 | 17 | 68 | 21 | 47 | 47 | 100 | 87 | 13 | 66 | 34 |

| E14 | 30 | 69 | 54 | 61 | 22 | 89 | 60 | 36 | 77 | 31 |

| E15 | 26 | 53 | 11 | 65 | 27 | 70 | 84 | 32 | 88 | 97 |

| E16 | 59 | 87 | 39 | 28 | 66 | 69 | 67 | 11 | 42 | 55 |

| E17 | 33 | 87 | 58 | 53 | 55 | 62 | 100 | 35 | 95 | 92 |

| E18 | 31 | 85 | 44 | 55 | 35 | 60 | 61 | 38 | 40 | 42 |

| E19 | 24 | 45 | 52 | 37 | 77 | 89 | 83 | 53 | 81 | 47 |

| E20 | 51 | 82 | 28 | 42 | 34 | 66 | 76 | 50 | 46 | 80 |

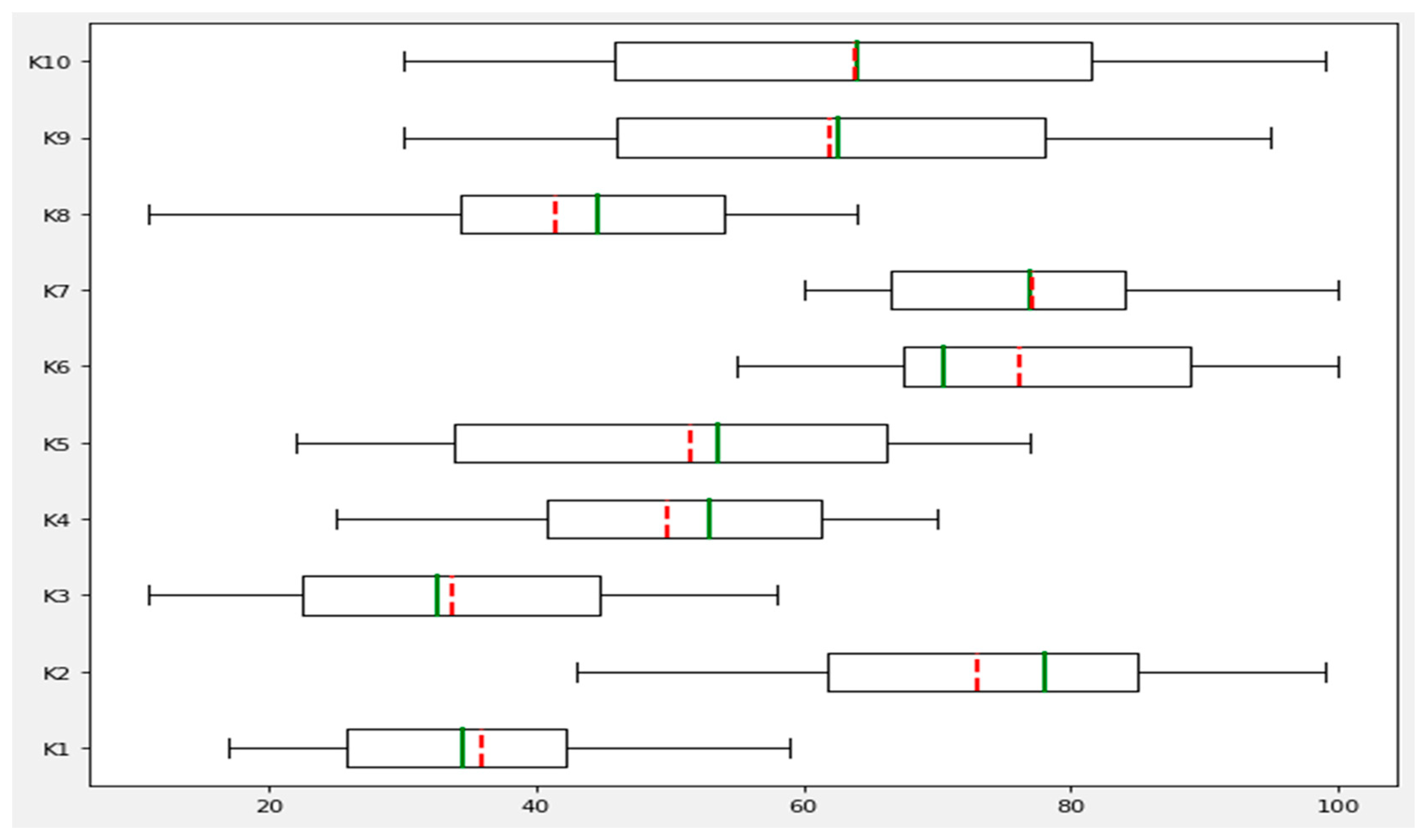

| Criterion | Average Value | Standard Deviation | Distribution among the Quartiles | ||||

|---|---|---|---|---|---|---|---|

| Min | 25% | Median | 75% | Max | |||

| K1 | 35.90 | 12.20 | 17 | 25.75 | 34.50 | 42.25 | 59 |

| K2 | 73.00 | 16.54 | 43 | 61.75 | 78.00 | 85.00 | 99 |

| K3 | 33.65 | 14.23 | 11 | 22.50 | 32.50 | 44.75 | 58 |

| K4 | 49.70 | 13.61 | 25 | 40.75 | 53.00 | 61.25 | 70 |

| K5 | 51.50 | 18.25 | 22 | 33.75 | 53.50 | 66.25 | 77 |

| K6 | 76.10 | 14.33 | 55 | 67.50 | 70.50 | 89.00 | 100 |

| K7 | 77.10 | 11.69 | 60 | 66.50 | 77.00 | 84.00 | 100 |

| K8 | 41.35 | 17.18 | 11 | 34.25 | 44.50 | 54.00 | 64 |

| K9 | 62.00 | 19.06 | 30 | 46.00 | 62.50 | 78.00 | 95 |

| K10 | 63.80 | 23.57 | 30 | 45.75 | 64.00 | 81.50 | 99 |

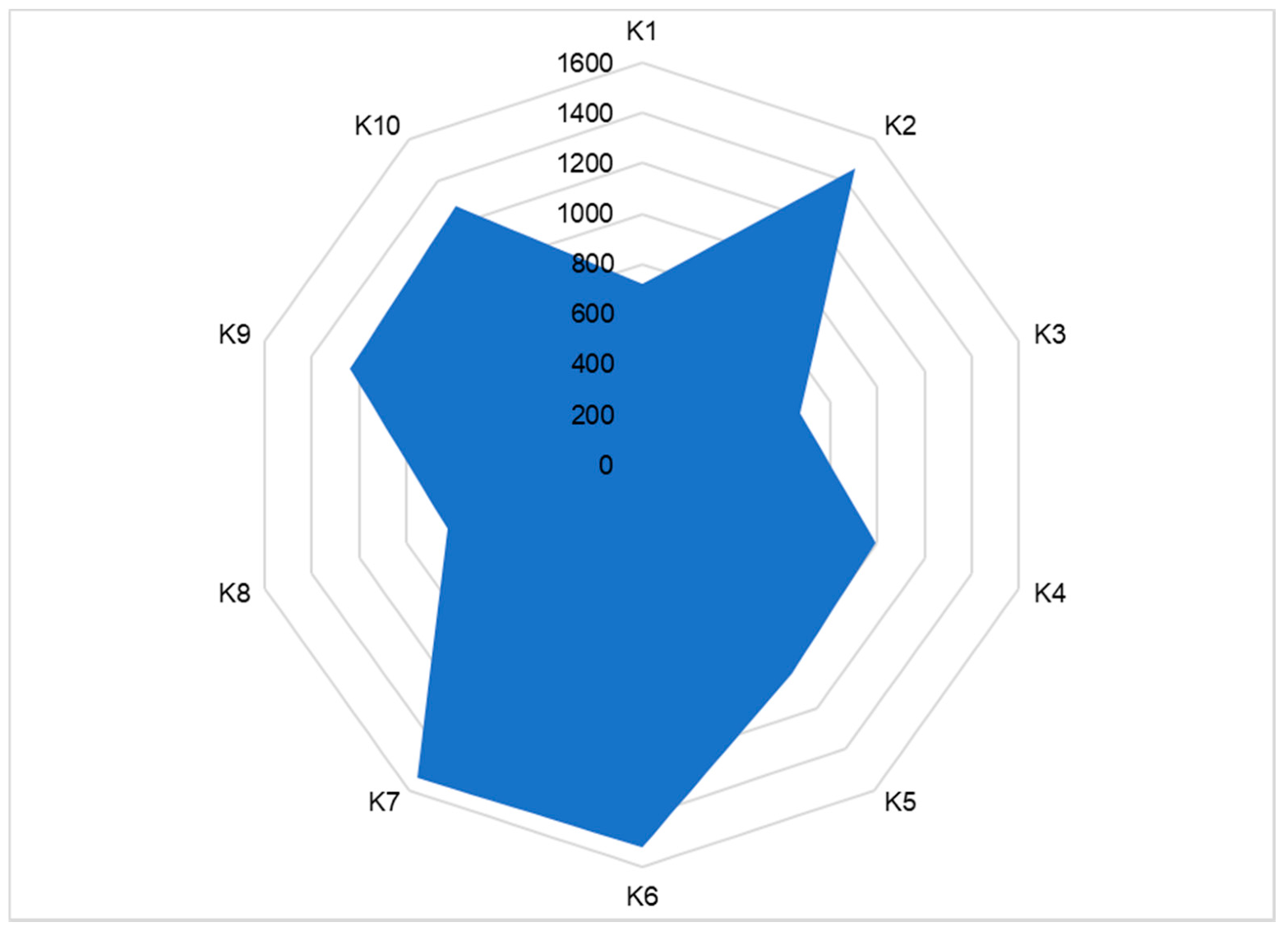

| Index | Criterion | Points |

|---|---|---|

| K7 | Criterion of the improvement of the efficiency of the administration of taxes and customs payments | 1542 |

| K6 | Criterion of the enhancement of the level of predictability of the informational solutions | 1522 |

| K2 | Criterion of the increase of the speed and complication of the identification of customs and tax transgressions | 1460 |

| K10 | Criterion of the correspondence of the informational solution to the advanced scientific and technological tendencies in the development of the global digital economy | 1276 |

| K9 | Criterion of the correspondence of the informational solution to the priority directions in the scientific and technological development of the Russian economy | 1240 |

| K5 | Criterion of the enlargement of the coverage range of the information exchange | 1030 |

| K4 | Criterion of the improvement of the mobility of the personnel | 994 |

| K8 | Criterion of the improvement of the automation level | 827 |

| K1 | Criterion of the reduction of capital and time expenditures | 718 |

| K3 | Criterion of the reduction of transaction expenditures | 673 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zasko, V.; Sidorova, E.; Komarova, V.; Boboshko, D.; Dontsova, O. Digitization of the Customs Revenue Administration as a Factor of the Enhancement of the Budget Efficiency of the Russian Federation. Sustainability 2021, 13, 10757. https://doi.org/10.3390/su131910757

Zasko V, Sidorova E, Komarova V, Boboshko D, Dontsova O. Digitization of the Customs Revenue Administration as a Factor of the Enhancement of the Budget Efficiency of the Russian Federation. Sustainability. 2021; 13(19):10757. https://doi.org/10.3390/su131910757

Chicago/Turabian StyleZasko, Vadim, Elena Sidorova, Vera Komarova, Diana Boboshko, and Olesya Dontsova. 2021. "Digitization of the Customs Revenue Administration as a Factor of the Enhancement of the Budget Efficiency of the Russian Federation" Sustainability 13, no. 19: 10757. https://doi.org/10.3390/su131910757

APA StyleZasko, V., Sidorova, E., Komarova, V., Boboshko, D., & Dontsova, O. (2021). Digitization of the Customs Revenue Administration as a Factor of the Enhancement of the Budget Efficiency of the Russian Federation. Sustainability, 13(19), 10757. https://doi.org/10.3390/su131910757