Knowledge Management in the Esports Industry: Sustainability, Continuity, and Achievement of Competitive Results

Abstract

:1. Introduction

- (a)

- There is almost a nonexistence of studies carried out on this industry’s characteristics and development in this country.

- (b)

- Spain has very high youth unemployment rates (from the Spanish Labor Force survey, 45% in 2020 and continuously growing due to COVID-19) [18], making it very difficult for them to emancipate from the family home at an early age by converting esports into something more than mere entertainment and fun.

- (c)

- The economic, social, and historical relationship between Spain and Latin America is vital at all levels, depicting a particular type of leadership, and thus facilitating the expansion of multinationals with implications for the future growth of this region [19,20]. Previous studies have supplied evidence that Spain is ideally positioned as a proximal cultural nation for Latin American countries [21,22]. Besides the linguistic similarities with the Latin American region, authors have compared qualitative and quantitative indicators using GLOBE, Hofstede’s cultural dimensions, and the Lewis model and found that Spanish cultural experience only not bridges but propels other countries to Latin American culture [21]. As a result, Spain has been used as a springboard to enter Latin America to reduce cultural, psychic, and performance risks [23,24]. In this regard, Spanish esports firms’ participation and influence in Latin America is continuously growing. An example of this fact is so the Latin edition of the University esports, a tournament organized by the Spanish company GGTech in collaboration with 300 universities located in Latin American countries to promote educational learning through electronic sports in Mexico, Argentina, Colombia, Peru, Chile, and Uruguay [11,25].

- (d)

- The growing participation of female esports teams. An example of this fact is the push made by Vodafone Spain after the creation on 6 March 2019 of the first all-women professional esports team in Spain. As a result, the new five-strong Vodafone Giants team comprises players from Spain, Germany, Russia, and Belgium. They compete in both mixed and female Counter-Strike: Global Offensive (CS: GO) tournaments.

- (e)

- Spain is a strategic market for the big companies in the sector and is one of the European countries with the most activity in esports, so much so that, for the first time in history, in 2019, Madrid hosted two world championships: the quarterfinals of the 2019 Worlds’ League of Legends (LoL), hosted at Vistalegre Palace, and the Rocket League World Championship final.

- (f)

- Spain also participates in the FIBA esports Open. Formed by seven players, five on court and two bookings, FIBA has taken a historic step in its modernization and approach to fans. FIBA has just announced its first esports tournament (FIBA esports Open), based on the NBA 2K video game, where seventeen national teams, including Spain, compete (Argentina, Australia, Austria, Brazil, Cyprus, Indonesia, Italy, Latvia, Lebanon, Lithuania, New Zealand, Philippines, Russia, Saudi Arabia, Spain, Switzerland, and Ukraine) [26].

2. The Industry of Esports

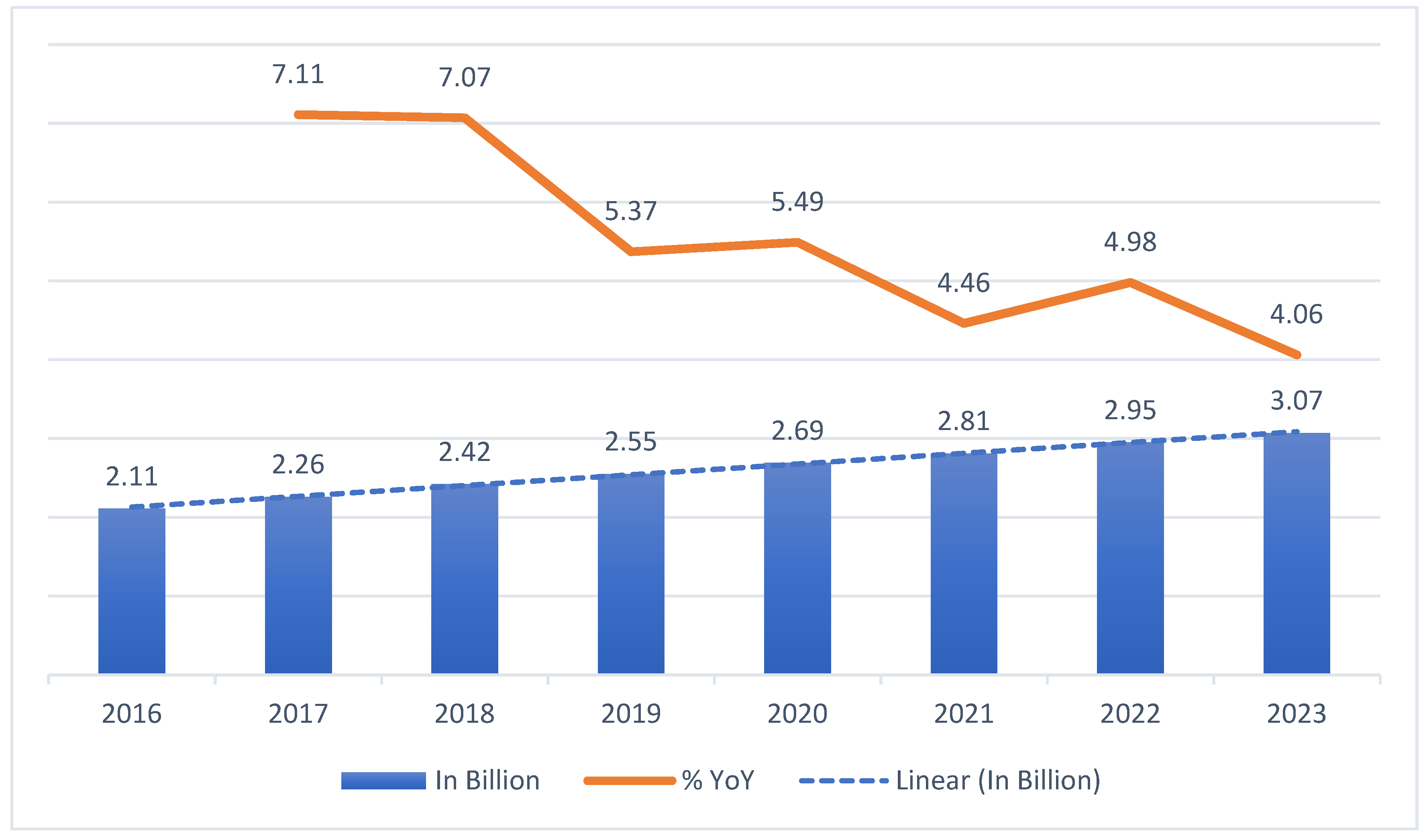

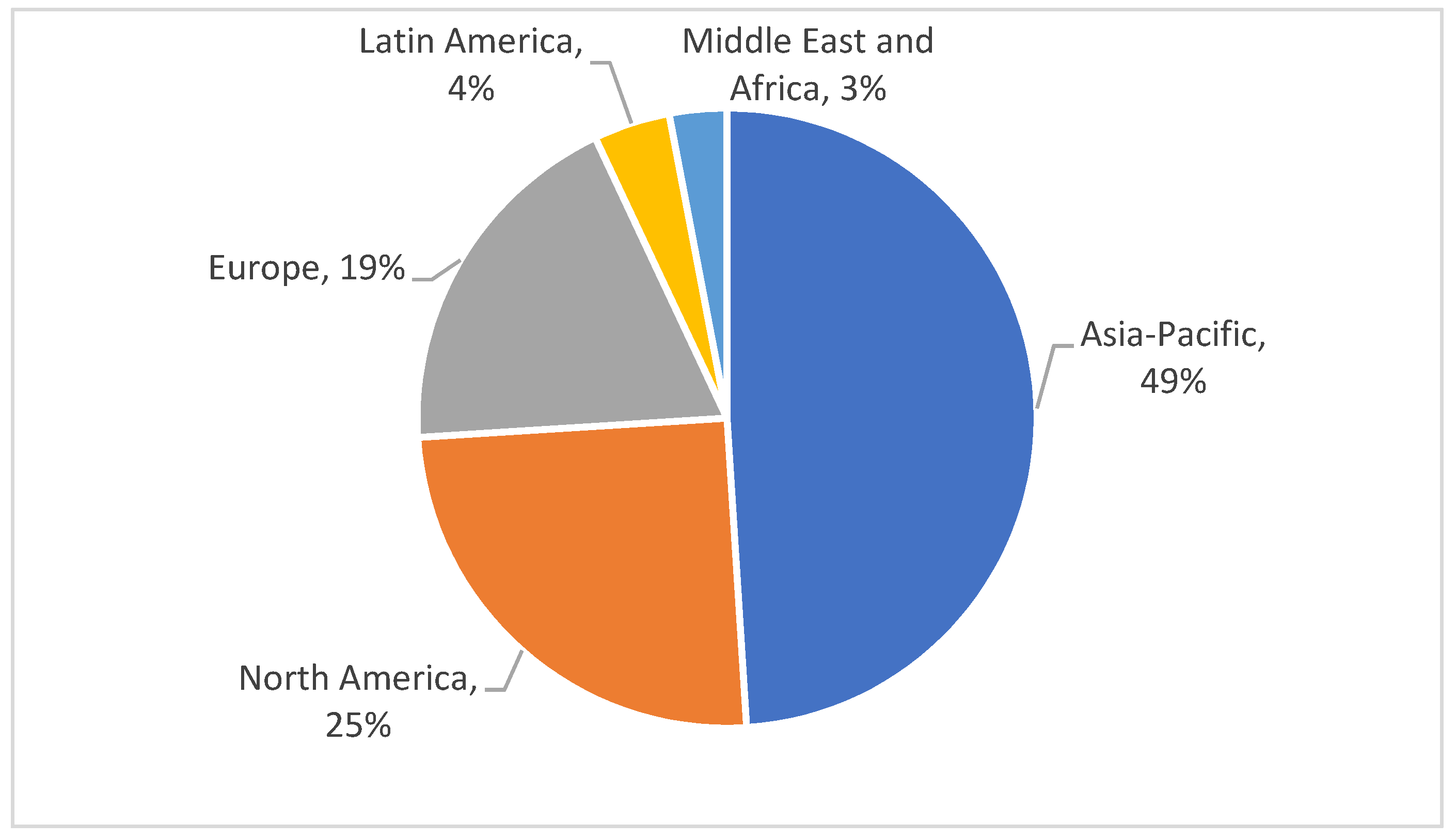

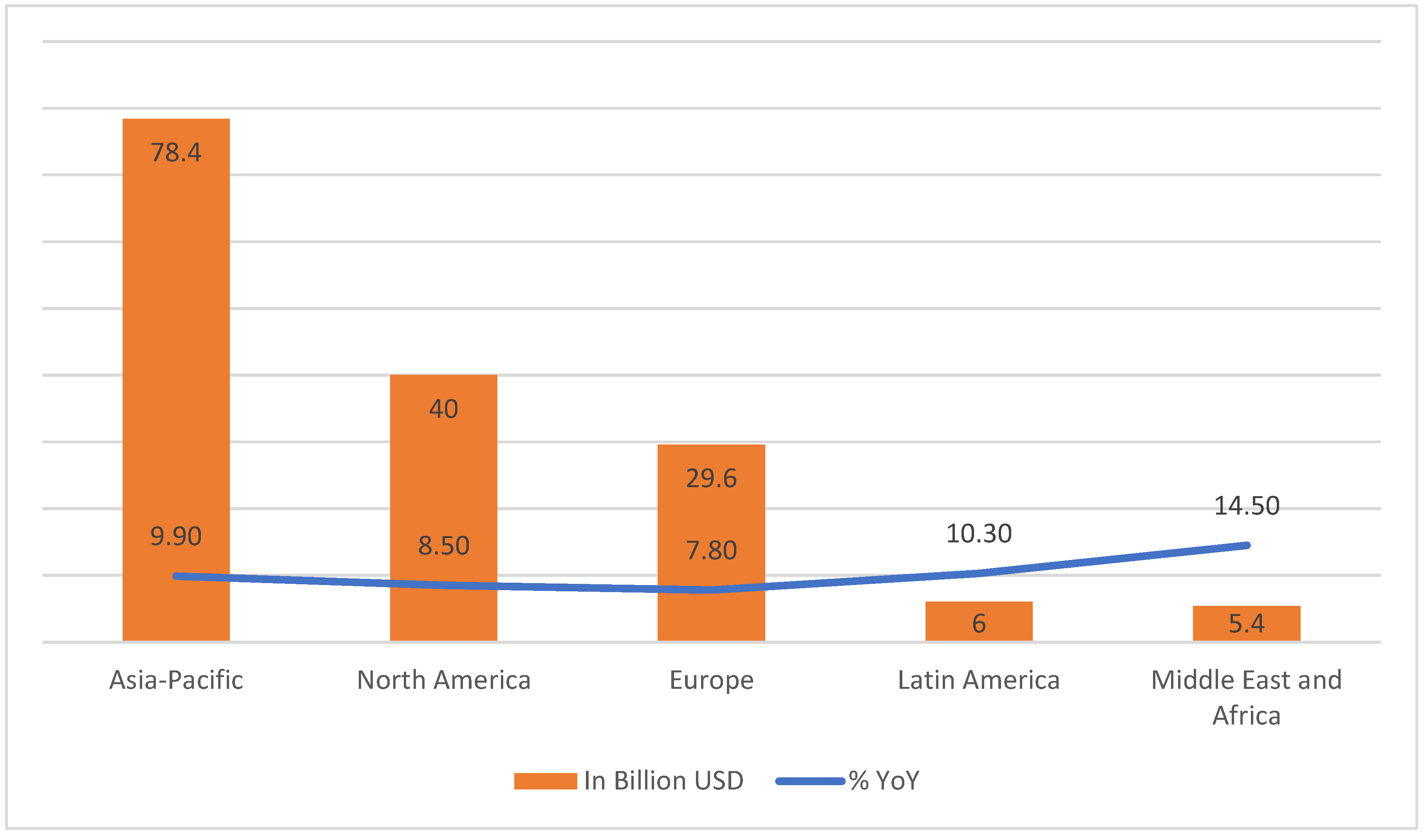

2.1. A Fast-Growing Global Industry

2.2. The Esports Industry Value Chain

2.2.1. Hardware and IT Providers

2.2.2. Publishers

2.2.3. Competition Organizers

2.2.4. Broadcasters

2.2.5. Sponsors

2.2.6. Gamers Personas

3. The Esports Industry in Spain

4. SWOT Analysis

4.1. Strengths

- (a)

- Industry growth can be achieved by creating many games, making the player’s range of choice wide. As a result, a win–win effect is created, as both game designers and players benefit from this creation.

- (b)

- The esports sector is a rapidly growing industry, which leads to the creation of new opportunities and attracting investment, both domestic and foreign. This investment creates a push effect within the industry, allowing its rapid development.

- (c)

- The spirit of teamwork and competitiveness for continuous improvement (kaizen) and the desire to improve and a job well done is strengthened in firms due to young people’s pressure. In this sense, individual actions conditioned on estimated win probability changes correlate almost entirely to team performance [51]. Therefore, the development of esports in this industry and the profits generated have a learning effect that continues in time.

- (d)

- When developed within a country, the esports industry contributes to generating highly specialized engineering and design jobs. Therefore, there is a multiplier effect that positively impacts HEIs (higher education institutions) in the world [9].

4.2. Weaknesses

- (a)

- The esports industry has a bad image in society in general and in families, considering that this leisure time generates psychological dependence, which harms young people studying for high school and undergraduate studies. As a result, families tend to discourage their children from participating in tournaments organized by this industry.

- (b)

- The high initial investment to design a high-quality game capable of competing with those created by the industry’s most prominent companies discourage SMEs from developing new games.

- (c)

- The payback period for games is usually relatively short, given the high number of existing games and the increased competition.

- (d)

- Many times, esports have become an escape route to solve personal problems. In these cases, addiction problems begin, added to aggressive behavior [52,53,54], especially when gamers are in massive tournaments where pressure and emotional tension are high. As with video games, esports is decidedly dominant in modern culture, particularly among young people, and a safe hobby for most users. However, excessive esports and video gaming may lead to manifest functional damage and psychological distress for a marginal number of players [55].

- (e)

- When esports interfere in the player’s personal life, affecting their family, educational, and emotional stability. Regarding emotions and mental health, after having analyzed 15 top esports clubs in the Chinese cities of Shanghai, Guangzhou, Suzhou, and Chengdu, find that esports is perceived as non-secure, casual, and irregular by the Chinese public [56]. Additionally, esports professionals’ mental changes throughout their careers have been significantly influenced by cognitive cultural beliefs, economic stimulation, and authority attributions.

4.3. Opportunities

- (a)

- The development of esports can foster greater public–private collaboration, especially in the organization and celebration of indie esports festivals to attract new players, especially the youngest.

- (b)

- It is a growing industry, which can lead to future unicorn companies within the sector.

- (c)

- The esports industry’s development requires constant technological improvement, which has induced in gamers a growing demand for increasing virtual reality, higher speed, and game complexity.

- (d)

- The esports industry contributes to developing creativity, specialization, and the increase in new professions in digital strategy (CDO or Chief Digital Officer, and CTO or Chief Technology Officer), digital marketing (DMM or Digital Marketing Manager, Inbound Marketing, Trafficker Digital), big data and business analytics, techno creativity (digital designers and UI/UX designers), and tech and business innovators specialized in agile technologies.

- (e)

- The development of esports can ease the building of triple helix entrepreneurial ecosystems [57], defined by collaboration between public administrations, private companies, and HEIs to develop this industry.

- (f)

- In the case of increasing CSR (corporate social responsibility) policies in the esports industry, it could generate social change and fight against poverty in the most economically disadvantaged environments, particularly in times of upheaval amid the pandemic [58].

4.4. Threats

- (a)

- In today’s economic world, rapid technological advances can change young people’s tastes as new technologies change consumer habits. With the constant introduction of technological improvements in the esports industry, the life cycle of games tends to be smaller and smaller, leading to shorter payback periods, except in disruptive gaming, and incorporates features that are difficult to imitate by competitors.

- (b)

- The use and development of graphene can give a great turn to the esports industry due to its greater malleability, faster transmission capacity, reduced heating, and lower weight. Graphene has high thermal and electrical conductivity, high elasticity and flexibility, excellent hardness and resistance, is not affected by ionizing radiation, can generate electricity by exposure to sunlight, and is transparent. In practice, graphene will replace aluminum when manufacturing costs are reduced, leading to lower prices.

- (c)

- The current economic and health crisis caused by COVID-19 may impact gamers’ consumption habits, which generates a slowdown in this industry’s development, as it is no longer fashionable. Therefore, they must continue holding tournaments, even online, so that the game’s habit continues over time.

- (d)

- The equipment’s high prices can discourage starting in the industry, especially when there is an economic crisis, as is currently the case (except in China) in the world due to COVID-19.

- (e)

- The high cost of acquiring games encourages gamers, with exceptions, to carry out illicit activities, such as piracy of games and data trading in parallel markets. The rise of video games such as Fortnite, Minecraft, or Roblox is such that a user account of one of these, with their respective credentials, can be sold in 2020 for up to 10,000 dollars in private Telegram groups or call channels on the deep web. As a result, it is estimated that the black market for gaming has already reached 1 billion dollars [59]. An account with a first season skin costs between USD 25 and USD 250, and an expert skin is for sale at USD 2500. The most expensive are independent accounts; that is, they are hacked to not link to a specific account of a PlayStation Network user, which can cost up to USD 10,000.

- (f)

- Given the esports industry’s success, it can encourage new technologies or new leisure industries that compete with this industry.

- (g)

- The onset and persistence of an ongoing economic crisis, except for China, for countries affected by the COVID-19 pandemic, including Spain, can negatively impact this industry’s growth.

- (h)

- The high competition between teams and the tremendous desire to win and compete sometimes leads to attempts to cheat. A process that is defined by the so-called boosting is expressed when high-skilled players access lower-skilled players’ accounts to increase the rank of the account for monetary gain [60].

5. Discussion

5.1. Esports for the Industry

5.2. Esports for the Public Administration

6. Conclusions

Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cacho-Elizondo, S.; Álvarez, J.-D.L.; Garcia, V.-E. The emerging esport market: Analyzing the impact of virtual and augmented reality. Chin. Bus. Rev. 2020, 19, 37–54. [Google Scholar] [CrossRef]

- Newzoo Global Esports & Live Streaming Market Report. Available online: https://newzoo.com/insights/trend-reports/newzoos-global-esports-live-streaming-market-report-2021-free-version/ (accessed on 9 March 2021).

- Kelly, S.J.; Van der Leij, D. A new frontier: Alcohol sponsorship activation through esports. Mark. Intell. Plan. 2021, 39, 533–558. [Google Scholar] [CrossRef]

- Hamari, J.; Sjöblom, M. What is eSports and why do people watch it? Internet Res. 2017, 27, 211–232. [Google Scholar] [CrossRef]

- Cranmer, E.E.; Han, D.-I.D.; van Gisbergen, M.; Jung, T. Esports matrix: Structuring the esports research agenda. Comput. Hum. Behav. 2021, 117, 106671. [Google Scholar] [CrossRef]

- Finch, D.J.; O’Reilly, N.; Abeza, G.; Clark, B.; Legg, D. Implications and Impacts of eSports on Business and Society, 1st ed.; Advances in E-Business Research; IGI Global: Hershey, PA, SUA, 2020; ISBN 9781799815389. [Google Scholar]

- Merwin, C.; Masura, S.; Piyush, M.; Toschiya, H.; Terry, H.; Alexander, D. The World of Games: eSports: From Wild West to Mainstream. Available online: https://www.goldmansachs.com/insights/pages/infographics/e-sports/report.pdf (accessed on 18 March 2021).

- Lee, D.; Schoenstedt, L.J. Comparison of eSports and traditional sports consumption motives, ICHPER-SD. ICHPER-SD J. Res. 2011, 6, 39–44. [Google Scholar]

- CDW.com. It’s Game on for eSports in Education. Available online: https://cdw-prod.adobecqms.net/content/dam/cdw/on-domain-cdw/tech-solutions-library/electronics/mkt38244-esports-wp.pdf (accessed on 20 January 2021).

- Tjønndal, A.; Skauge, M. Youth sport 2.0? The development of eSports in Norway from 2016 to 2019. Qual. Res. Sport Exerc. Health 2021, 13, 166–183. [Google Scholar] [CrossRef]

- Esports Bureau. GGTech Entertainment Arranca su Expansión en América Latina con Delegaciones en México y Argentina. Available online: https://esportsbureau.com/ggtech-entertainment-expansion-en-america-latina/ (accessed on 21 June 2020).

- Brady, M.; Fellenz, M.R.; Brookes, R. Researching the role of information and communications technology (ICT) in contemporary marketing practices. J. Bus. Ind. Mark. 2008, 23, 108–114. [Google Scholar] [CrossRef]

- Chen, H.; Chiang, R.H.L.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- Davenport, T. Analytics 3.0. Harv. Bus. Rev. 2013, 91, 64–72. [Google Scholar]

- Stone, M.D.; Woodcock, N.D. Interactive, direct and digital marketing: A future that depends on better use of business intelligence. J. Res. Interact. Mark. 2014, 8, 4–17. [Google Scholar] [CrossRef]

- Fisher, T. ROI in social media: A look at the arguments. J. Database Mark. Cust. Strateg. Manag. 2009, 16, 189–195. [Google Scholar] [CrossRef] [Green Version]

- Leskovec, J.; Rajaraman, A.; Ullman, J.D. Mining of Massive Datasets, 3rd ed.; Cambridge University Press: Cambridge, UK, 2020; ISBN 9781108476348. [Google Scholar]

- INE. Encuesta de Población Activa. Últimos Datos. Available online: https://www.ine.es/dyngs/INEbase/es/operacion.htm?c=Estadistica_C&cid=1254736176918&menu=ultiDatos&idp=1254735976595 (accessed on 1 May 2021).

- Chaves, F.Q. The springboard network: Multinationals in Latin America. Int. J. Emerg. Mark. 2018, 13, 855–874. [Google Scholar] [CrossRef]

- Villar, C.; Pla-Barber, J.; Domingo, L.S.; Madhok, A. ¿cómo mejorar la expansión interregional de las multinacionales? El caso de las filiales trampolín para Latinoamérica. Universia Bus. Rev. 2017, 2017, 188–225. [Google Scholar] [CrossRef]

- Prabhudesai, R.S.; Prasad, C.V.V.S.N.V.; Ang, B.C. Exploring emerging Latin America: Implications for german companies using spain as a springboard country. Glob. Bus. Rev. 2017, 18, 993–1009. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Castillo-Apraiz, J.; Palma-Ruiz, J.M. Organisational learning as a mediator in the host-home country similarity–international firm performance link: The role of exploration and exploitation. Eur. Bus. Rev. 2020, 33, 409–426. [Google Scholar] [CrossRef]

- Pla-Barber, J.; Camps, J. Springboarding: A new geographical landscape for European foreign investment in Latin America. J. Econ. Geogr. 2012, 12, 519–538. [Google Scholar] [CrossRef]

- Magomedova, N.; Achcaoucaou, F.; Miravitlles, P. Reducing psychic distance through springboard subsidiaries: An exploratory case study. In Distance in International Business: Concept, Cost and Value; Verbeke, A., Puck., J., van Tulder, R., Eds.; Emerald Publishing Limited: Bingley, UK, 2017; Volume 12, pp. 471–493. [Google Scholar]

- García, F. Riot Games y GGTech Latam Anuncian UNIVERSITY Esports e IESports para Estudiantes de Latinoamérica. Available online: https://universityesports.mx/news/riot-games-y-ggtech-latam-anuncian-university-esports-e-ies (accessed on 15 October 2020).

- FIBA Basketball. 17 National Teams to Participate in Inaugural FIBA Esports Open 2020. Available online: https://www.fiba.basketball/news/17-national-teams-to-participate-in-inaugural-fiba-esports-open-2020 (accessed on 12 June 2020).

- Fiore, R.; Zampaglione, D.; Murazzi, E.; Bucchieri, F.; Cappello, F.; Fucarino, A. The eSports conundrum: Is the sports sciences community ready to face them? A perspective. J. Sports Med. Phys. Fitness 2020, 60, S0022–S4707. [Google Scholar] [CrossRef] [PubMed]

- Block, F.; Hodge, V.; Hobson, S.; Sephton, N.; Devlin, S.; Ursu, M.F.; Drachen, A.; Cowling, P.I. Narrative bytes: Data-driven content production in esports. In Proceedings of the 2018 ACM International Conference on Interactive Experiences for TV and Online Video, held in Seoul, Korea, 26–28 June 2018; ACM: New York, NY, USA, 2018; pp. 29–41. [Google Scholar]

- Qian, T.Y.; Wang, J.J.; Zhang, J.J.; Lu, L.Z. It is in the game: Dimensions of esports online spectator motivation and development of a scale. Eur. Sport Manag. Q. 2020, 20, 458–479. [Google Scholar] [CrossRef]

- Qian, T.Y.; Zhang, J.J.; Wang, J.J.; Hulland, J. Beyond the game: Dimensions of esports online spectator demand. Commun. Sport 2020, 8, 825–851. [Google Scholar] [CrossRef] [Green Version]

- Howard, M.J. Esport: Professional League of Legends as a Cultural History. Master’s Thesis, University of Houston, Houston, TX, USA, 2018. [Google Scholar]

- Chikish, Y.; Carreras, M.; García, J. eSports: ¿Una nueva era para el sector del deporte y un nuevo impulso a la investigación sobre Economía del Deporte? Pap. Econ. Española 2019, 159, 294–313. [Google Scholar]

- Holden, J.T.; Rodenberg, R.M.; Kaburakis, A. Esports corruption: Gambling, doping, and global governance. Maryl. J. Int. Law 2017, 32, 236–273. [Google Scholar] [CrossRef] [Green Version]

- Saiz-Álvarez, J.M. Economía Audiovisual. Claves para la Venta y Distribución de Una Película; Libros en Red: Buenos Aires, Argentina, 2004. [Google Scholar]

- Pérez-Pérez, M.; López-Férnandez, M.C.; Obeso, M.; Pérez, P.; Férnandez, L. Knowledge, renewal and flexibility: Exploratory research in family firms. Adm. Sci. 2019, 9, 87. [Google Scholar] [CrossRef] [Green Version]

- Serrano-Bedia, A.M.; López-Fernández, M.C.; Garcia-Piqueres, G. Analysis of the relationship between sources of knowledge and innovation performance in family firms. Innovation 2016, 18, 489–512. [Google Scholar] [CrossRef]

- Alavi, M.; Leidner, D.E. Knowledge systems: Management knowledge and foundations conceptual. MIS Q. 2001, 25, 107–136. [Google Scholar] [CrossRef]

- Donate, M.J.; de Pablo, J.D.S. The role of knowledge-oriented leadership in knowledge management practices and innovation. J. Bus. Res. 2015, 68, 360–370. [Google Scholar] [CrossRef]

- García-Piqueres, G.; Serrano-Bedia, A.-M.; Pérez-Pérez, M. Knowledge management practices and innovation outcomes: The moderating role of risk-taking and proactiveness. Adm. Sci. 2019, 9, 75. [Google Scholar] [CrossRef] [Green Version]

- Nonaka, I.; von Krogh, G.; Voelpel, S. Organizational knowledge creation theory: Evolutionary paths and future advances. Organ. Stud. 2006, 27, 1179–1208. [Google Scholar] [CrossRef]

- Barros-Contreras, I.; Palma-Ruiz, J.M. Knowledge accumulation and its effects on organizational effectiveness in family firms. In Intrapreneurship and Sustainable Human Capital. Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Leitão, J., Nunes, A., Pereira, D., Ramadani, V., Eds.; Springer: Cham, Switzerland, 2020; pp. 155–167. ISBN 9783030494100. [Google Scholar]

- Barros-Contreras, I.; Palma-Ruiz, J.M.; Torres-Toukoumidis, A. Organizational capabilities for family firm sustainability: The role of knowledge accumulation and family essence. Sustainability 2021, 13, 5607. [Google Scholar] [CrossRef]

- Raisch, S.; Birkinshaw, J. Organizational ambidexterity: Antecedents, outcomes, and moderators. J. Manag. 2008, 34, 375–409. [Google Scholar] [CrossRef] [Green Version]

- AEVI. La Industria del Videojuego en España. Available online: http://www.eldiario.es/juegoreviews/noticias/industria-videojuego-Espana-crecido-ano-pasado_0_369563649.html (accessed on 12 February 2021).

- Vasilyeva, O.A. Influence of digitalization on cognitive and social orientations of generation, Z. In Socio-Economic Systems: Paradigms for the Future. Studies in Systems, Decision and Control; Popkova, E.G., Ostrovskaya, V.N., Bogoviz, A.V., Eds.; Springer: Cham, Switzerland, 2021; Volume 314, pp. 1279–1289. [Google Scholar]

- Peláez, A.L.; Erro-Garcés, A.; Gómez-Ciriano, E.J. Young people, social workers and social work education: The role of digital skills. Soc. Work Educ. 2020, 39, 825–842. [Google Scholar] [CrossRef]

- Kravchenko, S. Digital risks, metamorphoses and centrifugal trends among the young people. Sotsiologicheskie Issled. 2019, 10, 48–57. [Google Scholar] [CrossRef]

- Telefónica, S.A. Telefónica Promotes eSports Talents in Spain with the Creation of the Movistar Riders Academy. Available online: https://www.telefonica.com/en/web/press-office/-/telefonica-promotes-esports-talents-in-spain-with-the-creation-of-the-movistar-riders-academy (accessed on 18 March 2021).

- Hennings, N. Everything You Need to Know about eSports. Available online: https://agcpartners.com/insights/everything-you-need-to-know-about-esports/ (accessed on 1 July 2021).

- Valentin, E.K. Swot analysis from a resource-based view. J. Mark. Theory Pract. 2001, 9, 54–69. [Google Scholar] [CrossRef]

- Maymin, P.Z. Smart kills and worthless deaths: eSports analytics for League of Legends. J. Quant. Anal. Sport. 2021, 17, 11–27. [Google Scholar] [CrossRef]

- Ohno, S. The link between battle royale games and aggressive feelings, addiction, and sense of underachievement: Exploring eSports-related genres. Int. J. Ment. Health Addict. 2021, 1–9. [Google Scholar] [CrossRef]

- Dickmeis, A.; Roe, K. Genres matter: Video games as predictors of physical aggression among adolescents. Communications 2019, 44, 105–129. [Google Scholar] [CrossRef]

- Cho, H.; Lee, S.-K.; Choi, J.-S.; Choi, S.-W.; Kim, D.-J. An exploratory study on association between Internet game contents and aggression in Korean adolescents. Comput. Hum. Behav. 2017, 73, 257–262. [Google Scholar] [CrossRef]

- Chung, T.; Sum, S.; Chan, M.; Lai, E.; Cheng, N. Will esports result in a higher prevalence of problematic gaming? A review of the global situation. J. Behav. Addict. 2019, 8, 384–394. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Y.; Zhu, Y. Identity transformation, stigma power, and mental wellbeing of Chinese eSports professional players. Int. J. Cult. Stud. 2021, 24, 485–503. [Google Scholar] [CrossRef]

- Saiz-Álvarez, J.M.; Palma-Ruiz, J.M. Entrepreneurship in the Solidarity Economy: A valuation of models based on the quadruple helix and civil society. In Subsistence Entrepreneurship in Contributions to Management Science Series; Ratten, V., Jones, P., Braga, V., Marques, C.S., Eds.; Springer International Publishing AG: Zug, Switzerland, 2019; pp. 33–50. [Google Scholar]

- Palma-Ruiz, J.M.; Castillo-Apraiz, J.; Gómez-Martínez, R. Socially responsible investing as a competitive strategy for trading companies in times of upheaval amid COVID-19: Evidence from Spain. Int. J. Financ. Stud. 2020, 8, 41. [Google Scholar] [CrossRef]

- Chávez, G. El Mercado Negro del Gaming Suma ya 1.000 Millones de Dólares. Available online: https://expansion.mx/tecnologia/2020/08/31/el-mercado-negro-del-gaming-suma-ya-1-000-millones-de-dolares (accessed on 31 August 2020).

- Conroy, E.; Kowal, M.; Toth, A.J.; Campbell, M.J. Boosting: Rank and skill deception in esports. Entertain. Comput. 2021, 36, 100393. [Google Scholar] [CrossRef]

- Romeijn, O. Games Market Estimates Methodology. Available online: http://help.platform.newzoo.com/en/articles/3612990-games-market-estimates-methodology (accessed on 3 June 2021).

- Jenny, S.E.; Manning, R.D.; Keiper, M.C.; Olrich, T.W. Virtual(ly) athletes: Where eSports fit within the definition of “Sport”. Quest 2017, 69, 1–18. [Google Scholar] [CrossRef]

- Lu, B.; Fa, H.; Yang, Y. Beijing E-Sports industry development based on SWOT analysis. In Proceedings of the International Innovation Design and Management Forum; Scientific Research, Tianjin, China, 11–15 December 2010; pp. 105–109. [Google Scholar]

- Miroff, M. Tiebreaker: An antitrust analysis of eSports. Columbia J. Law Soc. Probl. 2018, 52, 177–223. [Google Scholar]

- Kim, Y.H.; Nauright, J.; Suveatwatanakul, C. The rise of E-Sports and potential for Post-COVID continued growth. Sport Soc. 2020, 23, 1861–1871. [Google Scholar] [CrossRef]

| Esport Game | Hours | In % | Esport Game | Hours | In % | ||

|---|---|---|---|---|---|---|---|

| 1 | League of Legends | 988 | 100 | 6 | Overwatch | 230 | 23.28 |

| 2 | Playerunknown’s Battlegrounds | 519 | 52.53 | 7 | World of Warcraft | 130 | 13.16 |

| 3 | Dota 2 | 435 | 44.02 | 8 | Grand Theft Auto V | 117 | 11.84 |

| 4 | Hearthstone | 416 | 42.10 | 9 | EA SPORTS FIFA | 89 | 9.01 |

| 5 | Counter-Strike: Global Offensive | 400 | 40.48 | 10 | Destiny | 88 | 8.90 |

| Game | Hours Watched (in Millions) | 2017–18 Change | Compared to 2017 Ranking |

|---|---|---|---|

| Fortnite | 1350 | +1558% | +9 |

| League of Legends | 983 | +0.1% | −1 |

| Dota 2 | 472 | +8% | = |

| PUBG | 453 | −13% | −2 |

| CSGO | 401 | +0.5% | −1 |

| Hearthstone | 356 | −9% | −1 |

| Overwatch | 301 | +31% | −1 |

| World of Warcraft | 260 | +99% | = |

| GTA V | 147 | +25% | = |

| Call of Duty | 139 | New | New entry |

| Play Games | Watch Gaming Video Content | Own Gaming Dedicated Hardware | High Expenses | |

|---|---|---|---|---|

| ARE | Yes | Yes | Yes | No |

| BV | No | Yes | No | No |

| CP | Yes | Yes | No | No |

| HE | Yes | No | Yes | No |

| FFA | No | No | Yes | Yes |

| LG | No | Yes, a little | No | No |

| PG | Yes, a little | Yes, a lot | No | No |

| TS | Yes, HQ only | No | Yes, if needed | No |

| TF | Yes | No | No | No |

| UG | Yes | Yes(>15 h/week) | Yes | Yes |

| Ranking | PEGI Code | Game | Platform |

|---|---|---|---|

| 1 | 3 | Mario Kart 8 Deluxe | Switch |

| 2 | 3 | Animal Crossing. New Horizons | Switch |

| 3 | 7 | Ring Fit Adventure | Switch |

| 4 | 3 | Just Dance 2021 | Switch |

| 5 | 7 | Minecraft Nintendo Switch Edition | Switch |

| 6 | 3 | Super Mario Party | Switch |

| 7 | 3 | FIFA 21 | PS4 |

| 8 | 3 | New Super Mario Bros U. de Luxe | Switch |

| 9 | 7 | Super Mario 3D All-Stars | Switch |

| 10 | 18 | Grand Theft Auto V | PS4 |

| Classification | Role | Video Game |

|---|---|---|

| Multiplayer Online Battle Arena (MOBA) | Multiplayer Arena Games | League of Legends Dota 2 Heroes of the Storm Smite |

| First Person Shooters (FPS) | First Person Shooter Games | Counter-Strike Overwatch Call of Duty Rainbow Six Siege |

| Battle Royale (BR) | Last Survivor Games | Playerunknown’s Battlegrounds Fortnite H1Z1 |

| Collective Card Games (CCG) | Trading Card Games | Hearthstone Clash Royale |

| Real-Time Strategy (RTS) | Real-Time Strategy Games | Starcraft 2 World of Tanks |

| Fighting Games | Fight Games | Tekken 7 Street Fighter 7 |

| Sport Games | Sports Simulators | FIFA 18 NBA 2K18 |

| Racing | Driving Games | MotoGP 17 F1 2017 Gran Turismo Sport Forza Motosport 7 |

| Festival | City | Country | Festival | City | Country |

|---|---|---|---|---|---|

| A MAZE Berlin | Berlin | Germany | Indie Prize USA | Los Angeles | USA |

| BIG Festival | Brazil | Indie Prize Eastern Europe | Istanbul | Turkey | |

| Busan Indie Connect Awards | Busan | South Korea | Ludicious | Zurich | Switzerland |

| Big Indie Pitch Tallinn | Tallinn | Estonia | Nordic Game Discovery Contest | Several locations | |

| Big Indie Pitch Skellefteå | Skellefteå | Sweden | Pixel Awards | Warsaw | Poland |

| Develop Brighton | Brighton | UK | Pixel Pop Festival | St Louis, Mi. | USA |

| ECGC Conf | North Caroline | USA | Play Festival | Hamburg | Germany |

| Fun&Serious | Bilbao | Spain | Reboot Develop Blue | Dubrovnik | Croatia |

| Game Connection Europe | Paris | France | Taipei Game Show Indie Award | Taipei | Taiwan |

| Gamelab | Barcelona | Spain | Valencia Indie Summit | Valencia | Spain |

| Games for Change Awards | New York | USA | Wegame | Kiev | Ukraine |

| Indie Prize Asia | Shenzhen | China | Gamepolis | Malaga | Spain |

| Indie Prize London | London | UK | Tokyo Game Show Indie Game Area | Tokyo | Japan |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saiz-Alvarez, J.M.; Palma-Ruiz, J.M.; Valles-Baca, H.G.; Fierro-Ramírez, L.A. Knowledge Management in the Esports Industry: Sustainability, Continuity, and Achievement of Competitive Results. Sustainability 2021, 13, 10890. https://doi.org/10.3390/su131910890

Saiz-Alvarez JM, Palma-Ruiz JM, Valles-Baca HG, Fierro-Ramírez LA. Knowledge Management in the Esports Industry: Sustainability, Continuity, and Achievement of Competitive Results. Sustainability. 2021; 13(19):10890. https://doi.org/10.3390/su131910890

Chicago/Turabian StyleSaiz-Alvarez, José Manuel, Jesús Manuel Palma-Ruiz, Herik Germán Valles-Baca, and Luis Alberto Fierro-Ramírez. 2021. "Knowledge Management in the Esports Industry: Sustainability, Continuity, and Achievement of Competitive Results" Sustainability 13, no. 19: 10890. https://doi.org/10.3390/su131910890

APA StyleSaiz-Alvarez, J. M., Palma-Ruiz, J. M., Valles-Baca, H. G., & Fierro-Ramírez, L. A. (2021). Knowledge Management in the Esports Industry: Sustainability, Continuity, and Achievement of Competitive Results. Sustainability, 13(19), 10890. https://doi.org/10.3390/su131910890