Understanding Farm-Level Incentives within the Bioeconomy Framework: Prices, Product Quality, Losses, and Bio-Based Alternatives

Abstract

:1. Introduction

2. Materials and Methods

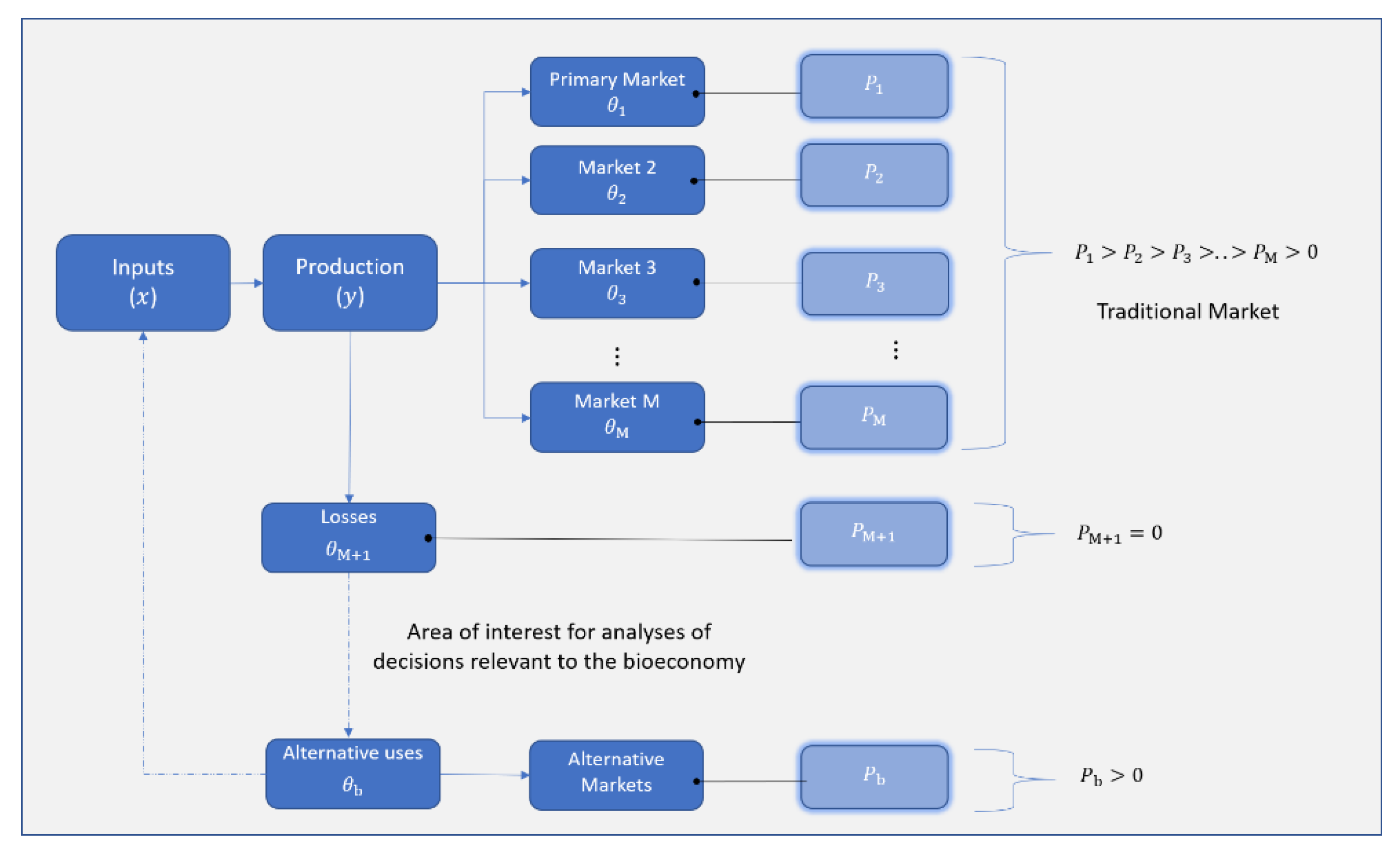

2.1. A Model of Farmer Decisions Regarding the Distribution of Product Quality

2.2. The Case of Three Qualities: High, Low, and Loss

2.3. A Graphical Illustration

3. Results and Discussion

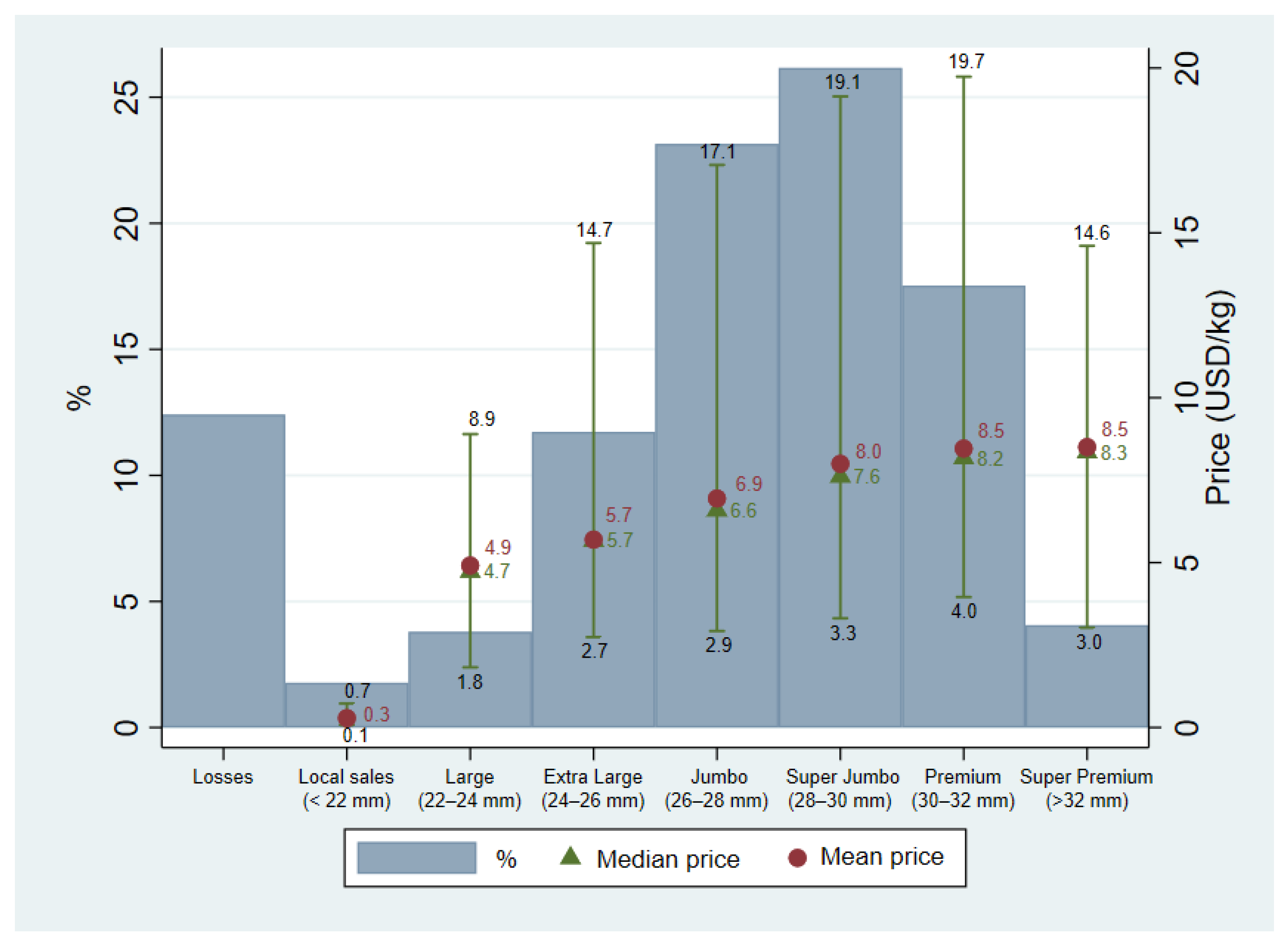

3.1. The Distribution of Quality Levels and Prices in Export-Oriented Chilean Cherries

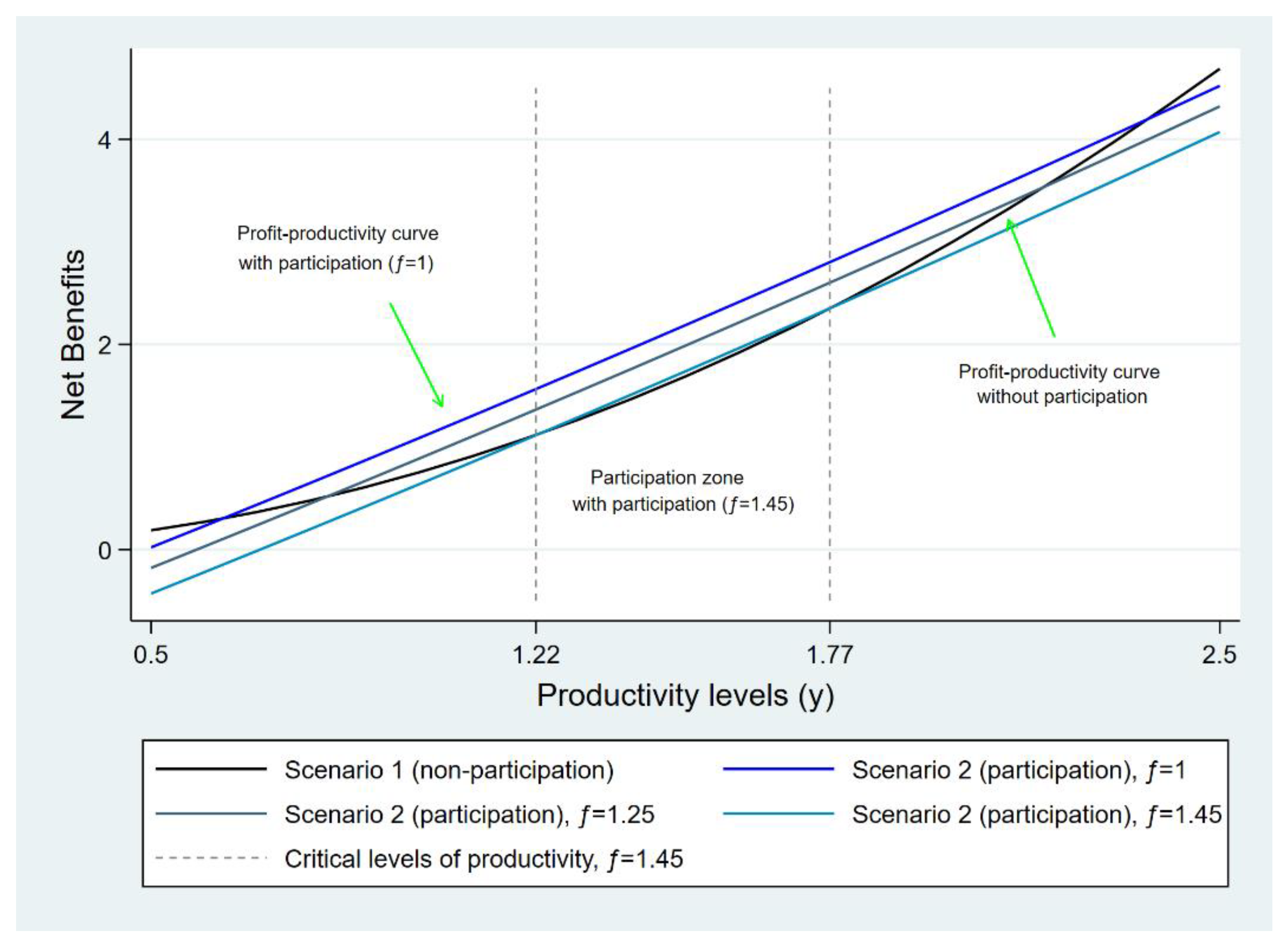

3.2. A Numerical Example

3.3. Practical Implications and Consequences for Public Policy

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Organisation for Economic Cooperation and Development. The Bioeconomy to 2030: Designing a Policy Agenda; OECD: Paris, France, 2009; ISBN 978-92-64-03853-0. [Google Scholar]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Innovating for Sustainable Growth: A Bioeconomy for Europe; SWD: Brussels, Belgium, 2012. [Google Scholar]

- Albrecht, K.; Ettling, S. Bioeconomy strategies across the globe. Rural 21 2014, 48, 10–13. [Google Scholar]

- Priefer, C.; Jörissen, J.; Frör, O. Pathways to Shape the Bioeconomy. Resources 2017, 6, 10. [Google Scholar] [CrossRef] [Green Version]

- Zilberman, D.; Kim, E.; Kirschner, S.; Kaplan, S.; Reeves, J. Technology and the future bioeconomy. Agric. Econ. 2013, 44, 95–102. [Google Scholar] [CrossRef]

- Johnson, T.G.; Altman, I. Rural development opportunities in the bioeconomy. Biomass Bioenergy 2014, 63, 341–344. [Google Scholar] [CrossRef]

- Zilberman, D.; Gordon, B.; Hochman, G.; Wesseler, J. Economics of sustainable development and the bioeconomy. Appl. Econ. Perspect. Policy 2018, 40, 22–37. [Google Scholar] [CrossRef] [Green Version]

- Vega, M.M.; Madrigal, O.Q. International Bioeconomy Innovations in Central America. In Knowledge-Driven Developments in the Bioeconomy; Springer: Cham, Switzerland, 2017; pp. 83–96. [Google Scholar] [CrossRef]

- Lal, R. Managing Soils for Food Security and Climate Change. J. Crop Improv. 2008, 19, 37–41. [Google Scholar] [CrossRef]

- Pfau, S.F.; Hagens, J.E.; Dankbaar, B.; Smits, A.J.M. Visions of sustainability in bioeconomy research. Sustainability 2014, 6, 1222–1249. [Google Scholar] [CrossRef] [Green Version]

- Lewandowski, I. Securing a sustainable biomass supply in a growing bioeconomy. Glob. Food Secur. 2015, 6, 34–42. [Google Scholar] [CrossRef]

- Marazza, D.; Merloni, E.; Balugani, E. Indirect Land Use Change and Bio-based Products. In Transition towards a Sustainable Biobased Economy Published; Morone, P., Clark, J., Eds.; The Royal Society of Chemistry: London, UK, 2020; p. 242. [Google Scholar]

- Searchinger, T.; Heimlich, R.; Houghton, R.A.; Dong, F.; Elobeid, A.; Fabiosa, J.; Tokgoz, S.; Hayes, D.; Yu, T. Use of U.S. Croplands for Biofuels Increases Greenhouse Gases Through Emissions from Land-Use Change. Science 2008, 423, 1238–1241. [Google Scholar] [CrossRef]

- Hertel, T.; Steinbuks, J.; Baldos, U. Competition for land in the global bioeconomy. Agric. Econ. 2013, 44, 129–138. [Google Scholar] [CrossRef]

- Abdulla, M.; Martin, R.; Gooch, M.; Jovel, E. The Importance of Quantifying Food Waste in Canada. J. Agric. Food Syst. Community Dev. 2013, 3, 137–151. [Google Scholar] [CrossRef]

- Beretta, C.; Stoessel, F.; Baier, U.; Hellweg, S. Quantifying food losses and the potential for reduction in Switzerland. Waste Manag. 2013, 33, 764–773. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chegere, M.J. Post-harvest losses reduction by small-scale maize farmers: The role of handling practices. Food Policy 2018, 77, 103–115. [Google Scholar] [CrossRef]

- Gustavsson, J.; Cederberg, C.; Sonesson, U.; van Otterdijk, R.; Meybeck, A. Global Food Losses and Food Waste: Extent, Causes and Prevention; FAO: Rome, Italy, 2011. [Google Scholar]

- Kaminski, J.; Christiaensen, L. Post-harvest loss in sub-Saharan Africa—What do farmers say? Glob. Food Sec. 2014, 3, 149–158. [Google Scholar] [CrossRef] [Green Version]

- Kummu, M.; de Moel, H.; Porkka, M.; Siebert, S.; Varis, O.; Ward, P.J. Lost food, wasted resources: Global food supply chain losses and their impacts on freshwater, cropland, and fertiliser use. Sci. Total Environ. 2012, 438, 477–489. [Google Scholar] [CrossRef]

- De Hooge, I.E.; van Dulm, E.; van Trijp, H.C.M. Cosmetic specifications in the food waste issue: Supply chain considerations and practices concerning suboptimal food products. J. Clean. Prod. 2018, 183, 698–709. [Google Scholar] [CrossRef]

- Tarasuk, V.; Eakin, J.M. Food assistance through “surplus” food: Insights from an ethnographic study of food bank work. Agric. Hum. Values 2005, 22, 177–186. [Google Scholar] [CrossRef]

- Rutten, M.M. What economic theory tells us about the impacts of reducing food losses and/or waste: Implications for research, policy and practice. Agric. Food Secur. 2013, 2, 13. [Google Scholar] [CrossRef] [Green Version]

- Bellemare, M.F.; Çakir, M.; Peterson, H.H.; Novak, L.; Rudi, J. On the Measurement of Food Waste. Am. J. Agric. Econ. 2017, 99, 1148–1158. [Google Scholar] [CrossRef]

- Ellison, B.; Lusk, J.L. Examining Household Food Waste Decisions: A Vignette Approach. Appl. Econ. Perspect. Policy 2018, 40, 613–631. [Google Scholar] [CrossRef]

- FAO. El Estado Mundial de la Agricultura y la Alimentación. Progresos en la Lucha Contra la Pérdida y el Desperdicio de Alimentos; FAO: Rome, Italy, 2019. [Google Scholar]

- House of Lords European Union Committee (HLEUC). Waste Opportunities: Stimulating a Bioeconomy; HELUC: London, UK, 2014. [Google Scholar]

- Berni, R.; Hoque, M.Z.; Legay, S.; Cai, G.; Siddiqui, K.S.; Hausman, J.F.; Andre, C.M.; Guerriero, G. Tuscan varieties of sweet cherry are rich sources of ursolic and oleanolic acid: Protein modeling coupled to targeted gene expression and metabolite analyses. Molecules 2019, 24, 1590. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Martini, S.; Conte, A.; Tagliazucchi, D. Phenolic compounds profile and antioxidant properties of six sweet cherry (Prunus avium) cultivars. Food Res. Int. 2017, 97, 15–26. [Google Scholar] [CrossRef]

- Vilas-Boas, A.A.; Campos, D.A.; Nunes, C.; Ribeiro, S.; Nunes, J.; Oliveira, A.; Pintado, M. Polyphenol extraction by different techniques for valorisation of non-compliant portuguese sweet cherries towards a novel antioxidant extract. Sustainability 2020, 12, 5556. [Google Scholar] [CrossRef]

- Babcock, B.A.; Lichtenberg, E.; Zilberman, D. Impact of Damage Control and Quality of Output: Estimating Pest Control Effectiveness. Am. J. Agric. Econ. 1992, 74, 163–172. [Google Scholar] [CrossRef]

- Lichtenberg, E. The Economics of Cosmetic Pesticide Use. Am. J. Agric. Econ. 1997, 79, 39–46. [Google Scholar] [CrossRef]

- Hurley, T.M.; Babcock, B.A. Valuing Pest Control: How Much is Due to Risk Aversion? In Risk Management and the Environment: Agriculture in Perspective; Babcock, B.A., Fraser, R.W., Lekakis, J.N., Eds.; Springer: Berlin, Germany, 2003. [Google Scholar]

- Price, D.W. Discarding Low Quality Produce with an Elastic Demand. J. Farm Econ. 1967, 49, 622–632. [Google Scholar] [CrossRef]

- Nguyen, D.; Vo, T.T. On Discarding Low Quality Produce. Am. J. Agric. Econ. 1985, 67, 614. [Google Scholar] [CrossRef]

- Alston, J.M.; Brunke, H.; Gray, R.S.; Sumner, D.A. Demand Enhancement through Food-Safety Regulation: A Case Study of the Marketing Order for California. In Commodity Promotion Programs in California: Economic Evaluation and Legal Issues; Peter Land Publishing: New York, NY, USA, 2004. [Google Scholar]

- Alchian, A.A.; Allen, W.R. University Economics: Elements of Inquiry; Wadsworth: Belmont, CA, USA, 1972. [Google Scholar]

- Razzolini, L.; Shughart, W.F.; Tollison, R.D. On the third law of Demand. Econ. Inq. 2003, 41, 292–298. [Google Scholar] [CrossRef]

- Carriquiry, M.; Babcock, B.A.; Carbone, R. Optimal Quality Assurance Systems for Agricultural Outputs; CARD Working Papers; CARD: Iowa City, IA, USA, 2003; p. 25. [Google Scholar]

- Just, R.E.; Zilberman, D. Stochastic Structure, Farm Size and Technology Adoption in Developing Agriculture. Oxf. Econ. Pap. 1983, 35, 307–328. [Google Scholar] [CrossRef]

- Feder, G.; O’Mara, G.T. Farm Size and the Diffusion of Green Revolution Technology. Econ. Dev. Cult. Chang. 1981, 30, 59–76. [Google Scholar] [CrossRef]

- Boletín de Fruta Enero. 2020. Available online: https://www.odepa.gob.cl/publicaciones/boletines/boletin-de-fruta-enero-de-2020 (accessed on 23 January 2020).

- Anriquez, G.; Foster, W.; Ortega, J.; Rocha, J.S. In search of economically significant food losses: Evidence from Tunisia and Egypt. Food Policy 2020. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jansen, S.; Foster, W.; Anríquez, G.; Ortega, J. Understanding Farm-Level Incentives within the Bioeconomy Framework: Prices, Product Quality, Losses, and Bio-Based Alternatives. Sustainability 2021, 13, 450. https://doi.org/10.3390/su13020450

Jansen S, Foster W, Anríquez G, Ortega J. Understanding Farm-Level Incentives within the Bioeconomy Framework: Prices, Product Quality, Losses, and Bio-Based Alternatives. Sustainability. 2021; 13(2):450. https://doi.org/10.3390/su13020450

Chicago/Turabian StyleJansen, Sarah, William Foster, Gustavo Anríquez, and Jorge Ortega. 2021. "Understanding Farm-Level Incentives within the Bioeconomy Framework: Prices, Product Quality, Losses, and Bio-Based Alternatives" Sustainability 13, no. 2: 450. https://doi.org/10.3390/su13020450