Robust Management of Systemic Risks and Food-Water-Energy-Environmental Security: Two-Stage Strategic-Adaptive GLOBIOM Model

Abstract

1. Introduction

2. Robust Decision Analysis: Strategic and Adaptive Decisions

2.1. Robustness Concept

2.1.1. Robustness in Statistics

2.1.2. Robust Decision-Making under Uncertainty

2.2. Robust Two-Stage Strategic–Adaptive Production Planning Model, Critical Quantiles, and Security Constraints

3. Two-Stage Strategic–Adaptive GLOBIOM Model

3.1. Two-Regional GLOBIOM: Systemic Risks, Risk Exposure, and Risk Sharing

3.2. Robust Systemic Risks Management in a Two-Stage Strategic–Adaptive GLOBIOM

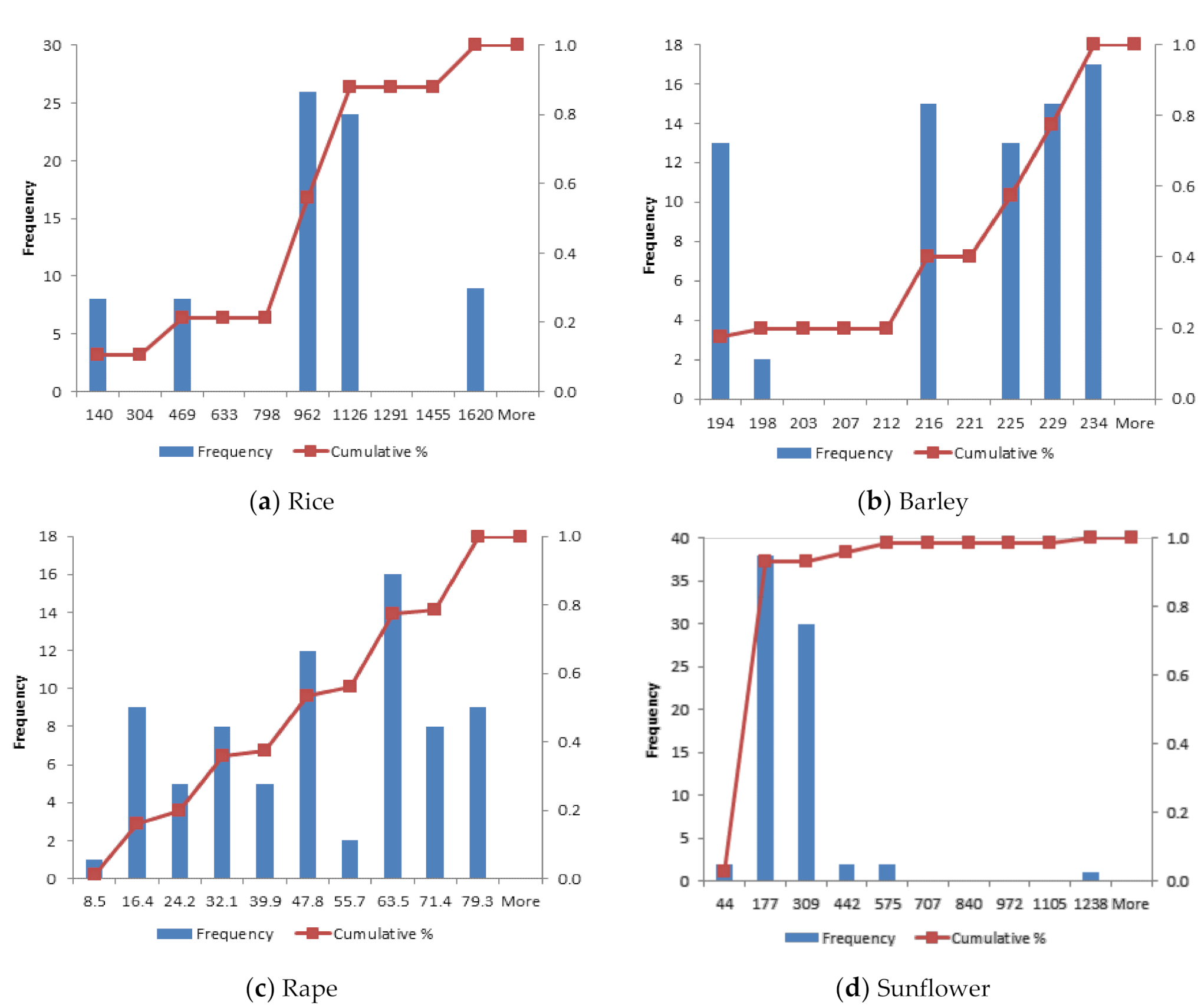

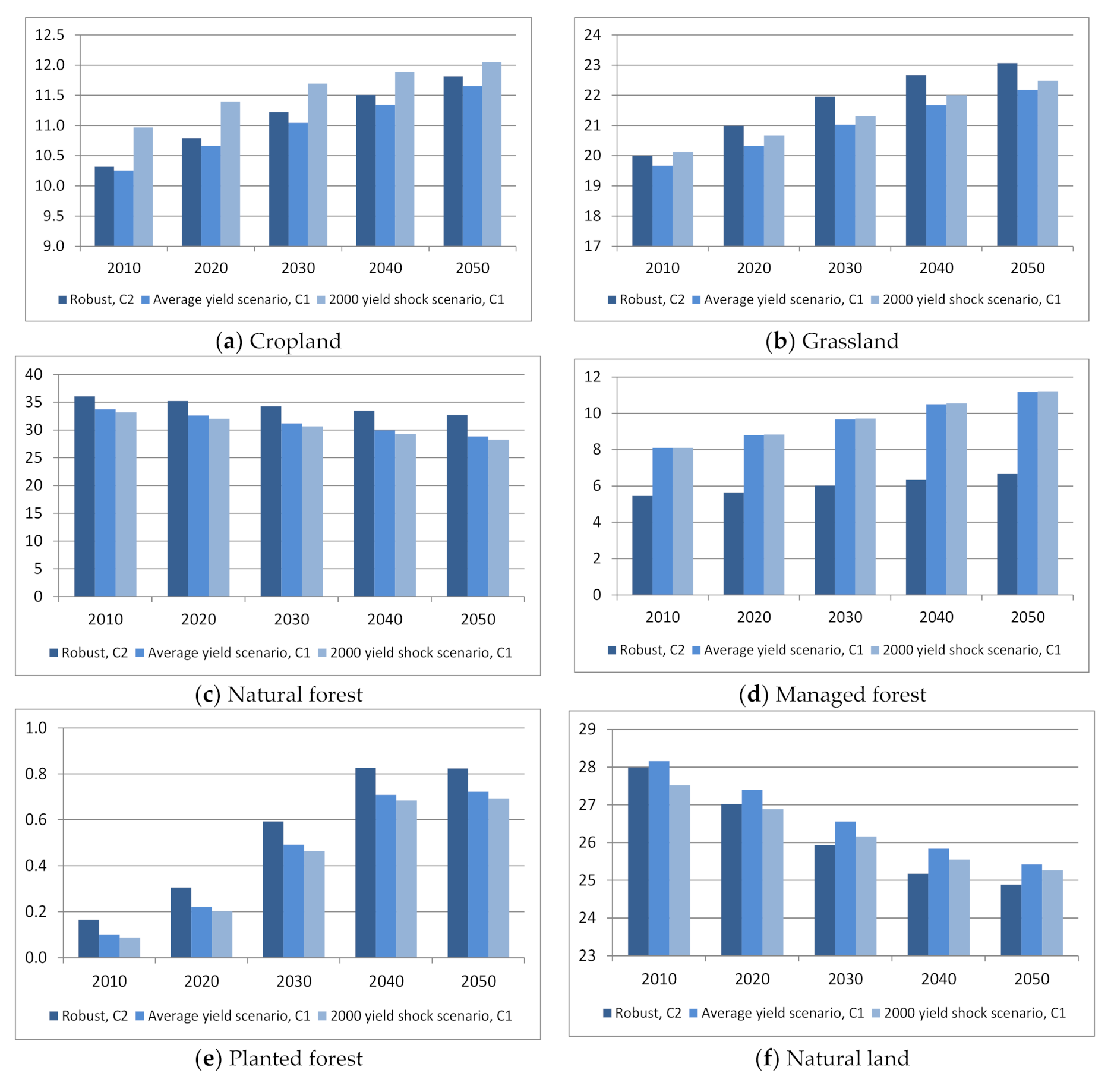

4. Selected Numerical Results: Strategic and Adaptive Decisions

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abrar, M. Power cut off and power blackout in India a major threat. An overview. Int. J. Adv. Res. Technol. 2016, 5, 8–15. [Google Scholar]

- U.S. Department of Commerce. U.S. Department of Commerce, National Oceanic and Atmospheric Administration (NOAA), National Weather Service (NWS). In Hurricane Katrina Service Assessment Report; U.S. Department of Commerce: Silver Spring, MD, USA, 2006. [Google Scholar]

- Fitzherbert, E.B.; Struebig, M.J.; Morel, A.; Danielsen, F.; Bruhl, C.A.; Donald, P.F.; Phalan, B. How will oil palm expansion affect biodiversity? Trends Ecol. Evol. 2008, 23, 538–545. [Google Scholar]

- Germer, J.; Sauerborn, J. Estimation of the impact of oil palm plantation establishment on greenhouse gas balance. Environ. Dev. Sustain. 2008, 10, 697–716. [Google Scholar]

- Kaufman, G.G.; Scott, K.E. What is Systemic Risk, and do Bank Regulators Retard or Contribute to it? Indep. Rev. 2003, 7, 371–391. [Google Scholar]

- Cassidy, A.; Feinstein, Z.; Nehorai, A. Risk measures for power failures in transmission systems. Chaos Interdiscip. J. Nonlinear Sci. 2016, 26, 113110. [Google Scholar] [CrossRef]

- Haldane, A.G.; May, R.M. Systemic risk in banking ecosystems. Nature 2011, 469, 351–355. [Google Scholar]

- Glasserman, P.; Young, H.P. How likely is contagion in financial networks? J. Bank. Financ. 2015, 50, 383–399. [Google Scholar]

- Markose, S.; Giansante, S.; Shaghaghi, A.R. Too interconnected to fail’ financial network of US CDS market: Topological fragility and systemic risk. J. Econ. Behav. Organ. 2012, 83, 627–646. [Google Scholar]

- Cummins, D.; Weiss, M. Systemic Risk and The U.S. insurance sector. J. Risk Insur. 2014, 81, 489–528. [Google Scholar]

- Hellström, T. New Vistas for Technology and Risk Assessment? The OECD Programme on Emerging Systemic Risks and beyond. Technol. Soc. 2009, 31, 325–331. [Google Scholar]

- OECD (Organisation for Economic Co-operation and Development). Emerging risks in the 21st century. In An Agenda for Action; OECD: Paris, France, 2003. [Google Scholar]

- Ermoliev, Y.; Hordijk, L. Global Changes: Facets of Robust Decisions. In Coping with Uncertainty, Modeling and Policy Issues; Marti, K., Ermoliev, Y., Makowski, M., Pflug, G., Eds.; Springer: Berlin/Heidelberg, Germany, 2006; pp. 4–28. [Google Scholar]

- Ermoliev, Y.; von Winterfeldt, D. Systemic risk and security management. In Managing Safety of Heterogeneous Systems: Lecture Notes in Economics and Mathematical Systems; Ermoliev, Y., Makowski, M., Marti, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2012; pp. 19–49. [Google Scholar]

- Dantzig, G. The Role of Models in Determining Policy for Transition to a More Resilient Technological Society. In IIASA Distinguished Lecture Series 1; IIASA: Laxenburg, Austria, 1979. [Google Scholar]

- Ermoliev, Y.; Wets, R.J.-B. Numerical Techniques for Stochastic Optimization; Springer: Berlin/Heidelberg, Germany, 1988. [Google Scholar]

- Marti, K. Stochastic Optimization Methods; Springer: Berlin/Heidelberg, Germany, 2005. [Google Scholar]

- Ermoliev, Y.; Robinson, S.; Rovenskaya, E.; Ermolieva, T. Integrated catastrophic risk management: Robust balance between Ex-ante and Ex-post measures. Siam News 2018, 51, 4. [Google Scholar]

- Ermolieva, T.; Filatova, T.; Ermoliev, Y.; Obersteiner, M.; de Bruijn, K.M.; Jeuken, A. Flood Catastrophe Model for Designing Optimal Flood Insurance Program: Estimating Location-Speciffic Premiums in the Netherlands. Risk Anal. 2016, 37, 1–17. [Google Scholar]

- Ermoliev, Y.; Ermolieva, T.; Fischer, G.; Makowski, M.; Nilsson, S.; Obersteiner, M. Discounting, catastrophic risks management and vulnerability modeling. Math. Comput. Simul. 2008, 79, 917–924. [Google Scholar]

- Ermolieva, T.; Ermoliev, Y.; Fischer, G.; Galambos, I. The role of financial instruments in integrated catastrophic flood management. Multinatl. Financ. J. 2003, 7, 207–230. [Google Scholar]

- Ermoliev, Y.; Ermolieva, T.; MacDonald, G.; Norkin, V. Stochastic optimization of insurance portfolios for managing exposure to catastrophic risks. Ann. Oper. Res. 2000, 99, 207–225. [Google Scholar]

- Amendola, A.; Ermolieva, T.; Linnerooth-Bayer, J.; Mechler, R. Integrated Catastrophe Risk Modeling: Supporting Policy Processes; Springer: Dordrecht, The Netherlands, 2013. [Google Scholar]

- Borodina, O.; Borodina, E.; Ermolieva, T.; Ermoliev, Y.; Fischer, G.; Makowski, M.; van Velthuizen, H. Sustainable agriculture, food security, and socio-economic risks in Ukraine. In Managing safety of heterogeneous systems, Lecture Notes in Economics and Mathematical Systems; Ermoliev, Y., Makowski, M., Marti, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2012; pp. 169–185. [Google Scholar]

- Borodina, O.; Kyryziuk, S.; Fraier, O.; Ermoliev, Y.; Ermolieva, T.; Knopov, P.; Horbachuk, V. Mathematical Modeling of Agricultural Crop Diversification in Ukraine: Scientific Approaches and Empirical Results. Cybern. Syst. Anal. 2020, 56, 213–222. [Google Scholar]

- Fischer, G.; Ermolieva, T.; Ermoliev, Y.; Sun, L. Risk-adjusted approaches for planning sustainable agricultural development. Stoch. Environ. Res. Risk Assess. 2009, 23, 441–450. [Google Scholar]

- Gritsevskii, A.; Ermoliev, Y. Modeling technological change under increasing returns and uncertainty. In Managing Safety of Heterogeneous Systems; Ermoliev, Y., Makowski, M., Marti, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2012; pp. 109–136. [Google Scholar]

- Gritsevskyi, A.; Nakicenovic, N. Modeling uncertainty of induced technological change. Energy Policy 2000, 26, 907–921. [Google Scholar]

- Cano, E.L.; Moguerza, J.M.; Ermolieva, T.; Yermoliev, Y. A strategic decision support system framework for energy-efficient technology investments. TOP 2016, 25, 249–270. [Google Scholar]

- Cano, E.L.; Moguerza, J.M.; Ermolieva, T.; Ermoliev, Y. Energy efficiency and risk management in public buildings: Strategic model for robust planning. Comput. Manag. Sci. 2014, 11, 25–44. [Google Scholar]

- Ortiz-Partida, J.P.; Kahil, T.; Ermolieva, T.; Ermoliev, Y.; Lane, B.; Sandoval-Solis, S.; Wada, Y. A Two-Stage stochastic optimization for robust operation of multipurpose reservoirs. Water Resour. Manag. 2019, 33, 3815–3830. [Google Scholar]

- O’Neill, B.; Ermoliev, Y.; Ermolieva, T. Endogenous Risks and Learning in Climate Change Decision Analysis. In Coping with Uncertainty: Modeling and Policy Issues; Marti, K., Ermoliev, Y., Makowski, M., Pflug, G., Eds.; Springer: Berlin/Heidelberg, Germany; New York, NY, USA, 2006. [Google Scholar]

- Havlík, P.; Schneider, U.A.; Schmid, E.; Boettcher, H.; Fritz, S.; Skalský, R.; Aoki, K.; de Cara, S.; Kindermann, G.; Kraxner, F.; et al. Global land-use implications of first and second generation biofuel targets. Energ. Policy 2011, 39, 5690–5702. [Google Scholar]

- Ermolieva, T.; Havlík, P.; Ermoliev, Y.; Mosnier, A.; Obersteiner, M.; Leclere, D.; Khabarov, N.; Valin, H.; Reuter, W. Integrated management of land use systems under systemic risks and security targets: A Stochastic Global Biosphere Management Model. J. Agric. Econ. 2016, 67, 584–601. [Google Scholar]

- Huber, P. Robust Statistics; Wiley: New York, NY, USA, 1981. [Google Scholar]

- Koenker, R.; Bassett, G. Regression quantiles. Econometrica 1978, 46, 33–50. [Google Scholar]

- Gorbachuk, V.M.; Ermoliev, Y.; Ermolieva, T.; Dunajevskij, M.S. Quantile-based regression for the assessment of economic and ecological risks. In Proceedings of the 5th International scientific conference on Computational Intelligence. Ministry of Education and Science of Ukraine, Uzgorod, Ukraine, 15–20 April 2019; pp. 188–190. [Google Scholar]

- Ermoliev, Y.; Jastremski, A. Stochastic Models in Economics; Nauka: Moscow, Russia, 1979. [Google Scholar]

- Gao, J.; Xu, X.; Cao, Y.; Ermoliev, Y.; Ermolieva, T.; Rovenskaya, E. Optimizing Regional Food and Energy Production under Limited Water Availability through Integrated Modeling. Sustainability 2018, 10, 1689. [Google Scholar] [CrossRef]

- Ermoliev, Y.; Shor, N. On minimization of nondifferentiable functions. Kibernetika 1967, 3, 101–102. [Google Scholar]

- Rockafeller, T. The Theory of Subgradient and Its Application to Problems of Optimization: Convex and Nonconvex Functions; Springer: Berlin/Heidelberg, Germany, 1981. [Google Scholar]

- Ermoliev, Y.; Norkin, V.; Wets, R. The minimization of semicontinuous functions: Mollifier subgradients. Siam J. Control Optim. 1995, 33, 149–167. [Google Scholar] [CrossRef]

- Danielson, M.; Ekenberg, L. A Framework for analysing decisions under risk. Eur. J. Oper. Res. 1998, 104, 474–484. [Google Scholar]

- Mulvey, J.M.; Vanderbei, R.J.; Zenios, S.A. Robust optimization of large scale systems. Oper. Res. 1995, 43, 264–281. [Google Scholar]

- Messner, S.; Golodnikov, A.; Gritsevskyi, A. A stochastic version of the dynamic linear programming model MESSAGE III. Energy 1996, 21, 775–784. [Google Scholar]

- Rockafellar, R.T.; Uryasev, S. Optimization of Conditional Value-at-Risk. J. Risk 2000, 2, 21–41. [Google Scholar]

- Arrow, K.J.; Fisher, A.C. Preservation, uncertainty and irreversibility. Q. J. Econ. 1974, 88, 312–319. [Google Scholar]

- Prekopa, A. Numerical solution of robabilistic constrained programming problems. In Numerical Techniques for Stochastic Optimization; Ermoliev, Y., Wets, R.J.-B., Eds.; Springer: Berlin/Heidelberg, Germany, 1988; pp. 123–139. [Google Scholar]

- Nelson, G.C.; Rosegrant, M.W.; Koo, J.; Robertson, R.; Sulser, T.; Zhu, T.; Ringler, C.; Msangi, S.; Palazzo, A.; Batka, M.; et al. Climate Change: Impact on agriculture and costs of adaptation. In Food Policy Report 21; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2009. [Google Scholar]

- Nelson, G.C.; Rosegrant, M.W.; Palazzo, A.; Gray, I.; Ingersoll, C.; Robertson, R.; Tokgoz, S.; Zhu, T.; Sulser, T.B.; Ringler, C.; et al. Food Security and Climate Change Challenges to 2050: Scenarios, Results and Policy Options; International Food Policy Research Institute (IFPRI): Washington, DC, USA, 2010. [Google Scholar]

- McCarl, B.A.; Adams, D.M.; Alig, R.J.; Chmelik, J.T. Analysis of biomass fueled electrical power plants: Implications in the agricultural and forestry sectors. Ann. Oper. Res. 2000, 94, 37–55. [Google Scholar]

- Koh, L.P.; Wilcove, D.S. Cashing in palm oil for conservation. Nature 2007, 448, 993–994. [Google Scholar]

- Koh, L.P.; Wilcove, D.S. Is oil palm agriculture really destroying tropical biodiversity? Conserv. Lett. 2008. [Google Scholar] [CrossRef]

- Liu, J.; Williams, J.R.; Zehnder, A.J.B.; Yang, H. GEPIC—Modelling wheat yield and crop water productivity with high resolution on a global scale. Agric. Syst. 2007, 94, 478–493. [Google Scholar]

- Deaton, A.; Laroque, G. Competitive storage and commodity price dynamics. J. Political Econ. 1996, 104, 896–923. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ermolieva, T.; Havlik, P.; Ermoliev, Y.; Khabarov, N.; Obersteiner, M. Robust Management of Systemic Risks and Food-Water-Energy-Environmental Security: Two-Stage Strategic-Adaptive GLOBIOM Model. Sustainability 2021, 13, 857. https://doi.org/10.3390/su13020857

Ermolieva T, Havlik P, Ermoliev Y, Khabarov N, Obersteiner M. Robust Management of Systemic Risks and Food-Water-Energy-Environmental Security: Two-Stage Strategic-Adaptive GLOBIOM Model. Sustainability. 2021; 13(2):857. https://doi.org/10.3390/su13020857

Chicago/Turabian StyleErmolieva, Tatiana, Petr Havlik, Yuri Ermoliev, Nikolay Khabarov, and Michael Obersteiner. 2021. "Robust Management of Systemic Risks and Food-Water-Energy-Environmental Security: Two-Stage Strategic-Adaptive GLOBIOM Model" Sustainability 13, no. 2: 857. https://doi.org/10.3390/su13020857

APA StyleErmolieva, T., Havlik, P., Ermoliev, Y., Khabarov, N., & Obersteiner, M. (2021). Robust Management of Systemic Risks and Food-Water-Energy-Environmental Security: Two-Stage Strategic-Adaptive GLOBIOM Model. Sustainability, 13(2), 857. https://doi.org/10.3390/su13020857