1. Introduction

A widely accepted argument is that information communication technologies (ICTs) raise economic growth [

1] by fostering productivity growth and, consequently, changing how business and international trade is done in manifold ways [

2]. The charm of ICT gave rise to the adoption of corresponding ICT policies in developed and developing nations. Global connectivity is at an all-time high, and more users than ever before are participating in Internet [

3]. In China, the State Council formally declared the “Internet Plus” action plan in 2015, which is to make use of ICT, including the Internet of Things, big data, and cloud computing, to support China’s economic growth. The number of Internet users in China had reached 854 million, with an Internet penetration rate of 61.2 percent by 2019 according to the report of China Internet Network Information Center (CNNIC). During the Coronavirus Disease 2019 (COVID-19) pandemic, ICT supported online life model to meet “non-contact” epidemic prevention requirements and might be a key to restore economic growth after epidemic in China.

However, not all regions and cities shared the same digital dividend from ICT in the world. In the case of China, investment of ICT in small cites lagged behind metropolis at the beginning of ICT springing up characterized by a decline of ICT development index values from the east to the west as well as from core cities to more peripheral ones [

4]. The digital divide would shift to differences in usage [

5], while China’s infrastructure miracle filled the “access gap” among cities. The diverse economic conditions and great digital divide in usage in Chinese cities imply that the national-level analysis of ICT effect on economic growth would generate misleading results as it might hide the heterogeneous impacts of ICT on economic performance. Knowledge and information are posited the panacea to drive sustainable and equitable growth [

6], but heterogeneous impacts of ICT might hide a risk or an opportunity of sustainability and equitableness for the whole cities. In the worst case, according to selection effects proposed by Ottaviano [

7], we can guess that ICT would only have effect on developed cities and increase the concentration of human capital with high digital literacies in just a few urban areas, while the other cites would lose or obtain a less sustainable developing driver of ICT. In the meantime, ICTs enable to overcome the barrier of geographical distance and improve the distribution of knowledge [

8]. In the best case, whole cities obtain sustainable power of economic growth from knowledge sharing driven by ICT, and undeveloped cities would reap more knowledge spillover from ICT as a result of the catch-up role. To the urban development path of sustainability and equitableness, or to the other path, depending on the empirical study on heterogeneous economic effects of ICT across different cities.

The ICT-related story can go back to the Solow Paradox saying, “You can see the computer anywhere but in the productivity statistics”. Many empirical articles studied quantify the impact of ICT on economic growth at the national level [

2,

9] and evaluate the general purpose technology (GPT) hypothesis, which implies that ICT has an influence on economic development beyond the effect of normal capital investment [

10,

11].

As the world’s most productive economy and the largest market for ICT goods and services, USA is an important object of studying the ICT–economy relationship. Colecchia and Schreyer [

12] compared the impact of ICT capital accumulation on output growth between USA and some developed nations and ICT contributed between 0.3 and 0.9 percentage point per year to economic growth during the second half of 1990s. Varnavskii [

13] noted that the large-scale investments into the ICT provided a great portion of U.S. economic growth and productivity since mid-1990, but then, the contribution of ICT reduced from its maximum value in 1995–2004. Sarmir [

14] concluded the “new economy” driven by ICT is more a myth than a reality. A study on OECD (Organization for Economic Co-operation and Development) authored by Maggi [

15] considered ICT capital as a driver of economic growth. Ceccobelli et al. [

16] conducted a non-parametric analysis on 14 OECD countries and the results indicated that ICT capital would cause a technological regress due to the absence of complementary investments and temporal lags to achieve a productivity benefit. Most European countries experienced a significant impact of this component, while the USA suffered the least from the impact. Edquist and Henrekson [

17] estimated output elasticity based on data for 47 different industries in Swedish and found that ICT is associated with greater value added. Based on the fixed effects model, the study found heterogeneous interaction effects between hours worked by high-skill versus low-skill employees and ICT. Ishida [

18] performed an autoregressive distributed lag (ARDL) bounds testing approach to estimate the long-run relationship between ICT, energy consumption, and economic growth in Japan during a period from 1980 to 2010. The results indicated that ICT investments contribute directly to energy consumption reductions, not to GDP growth. Fukao et al. [

19] investigated why ICT investment in Japan stagnated and concluded that smaller and older firms, which play a much greater role in Japan, tend to have a lower ICT intensity than other firms. Moshiri [

20] focused on the heterogeneous impacts of ICT on productivity across provinces and industries over time in Canada. This research performed a panel data model based on the Cobb–Douglas production function and found the effect of ICT on productivity is weak in some provinces owing to the dominance of agricultural and natural resource sectors in their economic structures.

Compared with developed countries, developing countries reaped less from ICT as the return to ICT is smaller [

21]. Haftu [

22] empirically analyzed the impact of mobile phone and the Internet on per capita income of Sub-Saharan Africa (SSA) of 40 countries. The study using the robust two-step system GMM (Generalized Method of Moments) reported that a 10% increase in mobile phone penetration results in a 1.2% change in GDP per capita, while the Internet has not contributed to the per capita GDP. David and Grobler [

23] used a single index for ranking ICT development in 46 African countries and confirmed that ICT penetration has more impact on economic growth in South Africa, which has the highest average real GDP than other countries. Kumar et al. [

24] used ARDL bounds approach to cointegration and granger non-causality tests to examine short-run and long-run contribution of ICT on economic growth of China over the sample period 1980–2013. They explored that ICTs are co-integrated with economic growth, duly supporting the presence of a long-run association, and a 1% change in ICT will result in changes in output per worker between 0.01 and 0.08 percent.

Research on the effect of ICT on economic growth in developed and developing countries is already extensive, and most empirical results indicate a larger digital dividend in developed countries than in developing countries. However, the heterogeneity of the ICT effect across cities has been only minimally explored. A large number of articles have investigated differences in ICT adoption globally owing to complementary factors, such as education, culture, and policy. Nevertheless, it is not easy to control for those factors in ICT adoption studies at the national level. The case of cities can help us better understand the ICT–economy relationship because all cities share the same education system, culture, and national strategy. Therefore, any heterogeneity of the ICT effect on economy across cities can be attributed to differences of urban economy.

Gaspar and Glaeser [

25] raised the question two decades ago of whether will ICTs make the cities obsolete. We see both fast development of ICT and growth of metropolis, which seemingly has answered the question, but the answer becomes uncertain if we focus on ICT and less developed cites. The hypothesis of this research considers that contributions of ICT to urban economy vary significantly across urban economic development. Two inverse results may happen under heterogeneity of the ICT effect: (1) ICT contributes more to less developed cities than developed cities versus (2) ICT contributes more to developed cities than less developed cities. We hope the former would happen, which means not only will ICT promote economic development for the whole cities, but also it would be an antidote to the great economic gap between rich and poor cities. The aim of this research is to estimate the effect of ICT on urban economy, and to explore the heterogeneous effect across Chinese cities. Specifically, the article addresses the following questions: (1) Have local ICTs contributed to urban economic growth? (2) Is there an intercity spillover or siphonic effect of ICT in Chinese cities? (3) How has the ICT effect varied across urban economic development levels? The answers to these questions help to deeply understand the relationship between ICT and economic development at the city level. Though a large number of articles find evidence on ICT promoting economic development in developed and developing nations, we still cannot clearly investigate the possible “dark side” of ICT as new energy of economic development, namely would ICT be more beneficial to the rich or the poor.

Some possible contribution of this paper is as follows. Firstly, using city data from China as a case is particularly interesting, because China has expanded Internet access quickly. The number of Internet users reached 854 million in 2019, with an Internet penetration rate of 61.2% according to CNNIC, and China’s first regional 5G network has been completed and put into trial use in Shanghai, indicating the beginning of the 5G age in China. At the same time, China faces great digital divide and diversified economic development across its cities. Most developed cities are concentrated in the East of China and the Internet penetration rate in these cities is much higher than in less developed cities. Additionally, some empirical issues are considered in the paper to answer the questions above. We consider the spatial dependence of the urban economy, which is usually necessary in a large number of relevant studies for a high degree of accuracy. The paper further investigates the value of ICT in local and neighboring cities at different quantiles rather than the average effect. Therefore, we study the heterogeneity of ICT effects on urban economy across multiple economic development levels in cities, which is seldom studied. As far as the authors know, only few articles consider both spatial dependence and the heterogeneous effects of ICT in one empirical study [

2,

9,

26].

This paper is structured as follows.

Section 2 defines the analytical framework and traces some empirical models including spatial autoregressive (SAR) model and quantile spatial autoregressive (QSAR) model. Variables description and summary statistics are provided in

Section 3.

Section 3 also describes the economic development distribution of China to account for the necessity to induce the quantile estimation method. Econometric issues and results are presented in

Section 4. The final section concludes the study.

2. Methodology

This study estimates the economic effects of ICT on developed cities and metropolis, compared with those on less developed cities. For this purpose, we introduce a conventional Solow framework in which the total production of a city

i (

) is dependent on the aggregate stock of technology

, capital stock

Ki, and labor stock

of a city

i. The initial equation is defined as follows:

where

and

are the capital and labor shares and

. Using (1) with the Hicks-neutral technical progress, the output per capital (

) is defined as

where

is the capital per worker. As ICT can drive total factor productivity (TFP) from externalities related to the use of ICT [

27,

28],

Ai in Equation (2) can be augmented with ICT as a shift variable, which is proxied by the Internet penetration rate of a city

i (%, Internet users of total population). Hence,

where

refers to the stock of knowledge enjoyed by the whole cities including other catch-all factors related to TFP and

refers to the externality of ICT. Consequently,

Taking the log of Equation (4), we obtain the basic multiple log-linear regression model. Under the basic model, the output per capital of a city

i (

yi) is regressed on ICT and the capital per capital in city

i using Equation (5).

Equation (5) can be estimated using ordinary least square (OLS) with assumption of homoscedasticity that for all i.

However, there are some possible drawbacks to using OLS. Initially, ignorance of the spatial dependence results in biased coefficient estimates, especially, the spatial nature of data increases the likelihood of spatial lag dependence. For example, in this study, the output per capital in city

i might be influenced by the output per capital in its neighboring cities owing to the spatial interaction. The presence of spatial lag dependence violates the assumptions of uncorrelated errors as well as the independence of observations, so it could induce biased and inefficient estimates. Therefore, it is necessary to test for spatial independence using the global Moran’s

I statistic, which is defined as follows:

where

is the element of standard spatial matrix

W;

W is an

patial matrix for

observation; and

is the mean of explained variable. As ICT overcomes the limitation of geographical distance on the spatial interaction to a great extent, we use the differences in the economies of neighboring cities to reflect their “economic distance”, which can be calculated by

and

where

refers to aggregate economic output of city

i represented by GDP. The magnitude of weight decays with economic distance more than with geographic distance owing to ICT; thus, the cities with a similar economic scale are assigned higher weights than those with economic gaps. Hence, the element

of

W describes the strength of spatial economic inaction between cities

i and

j.

Additionally, for our case, ICTs have a spillover or siphonic effect on neighboring cities. The spatial autocorrelation and network effect of ICT is likely to be complex and significant [

29]. On the one hand, ICT may construct a channel of knowledge spillover to promote adjacent regions to quickly absorb and adopt the new technology for economic development [

26]. On the other hand, developed cities would attract more intelligent manufacturing enterprises and ICT providers with excellent Internet infrastructure, while less developed cities may lose some Internet business attracted by neighboring developed cities. In rare cases, Noh and Yoo [

30] and Billon et al. [

31] report that ICTs have a negative effect on economic growth in countries with high economic inequality or high educational inequality. The logical divergence is called “the paradoxical geographies of the digital economy”. Thus, we need to estimate the spatial lag of ICT and spatial lag of the dependent variable in our spatial model. In our case, a spatial autoregression (SAR) model can be used in Equation (7):

where

is a spatially lagged dependent variable for the spatial weight matrix

;

is a spatially lagged independent variable; and

and

are spatially lagged parameters.

Furthermore, SAR suffers from the same limitations as OLS. Both SAR and OLS only measure the average relationship between and lnX based on the conditional mean function , but the result does not describe the relationship at different points in the distribution of lny. Because the quantile regression approach can effectively describe a complete picture of the heterogeneous effects of the driving forces, the paper uses it to investigate how ICTs contribute to urban economy. For instance, if coefficients of ICT-related variables under different quantiles vary greatly, it means that the influence of ICT on urban economy is significantly diverse under different quantiles. The th quantile of lny is represented by lny(τ), which means the probability that lny is less than or equal to lny(τ) is τ, and the larger the τ, the larger the lny(τ).

Following the quantile spatial autoregressive (QSAR) model proposed by Kostov [

32] and Mathur [

33], we embed the quantile regression theory into the spatial model and the quantile spatial Durbin (QSAR) model can be written as follows:

where

,

,

,

, and

are a group of coefficients estimated from a quantile regression at

τ th quantile,

τ ∈ (0, 1).

In spite of the advantages, standard quantile regression approach cannot address the spatial lag dependence because of the clear endogeneity issue of

. As spatial lag terms of explanatory variables and other explanatory variables are exogenous, standard quantile regression can address them. Therefore, we implement two-stage quantile regression (2SQR) proposed by Kim and Muller [

34], which has been broadly applied in spatial study [

35,

36]. In the first stage of 2SQR, we use explanatory variables and their spatial lag terms to perform quantile regression on

. The predicted value

of

at each quantile is calculated with the first stage. In the second stage of 2SQR,

is replaced by

at the same quantile. The initial QSAR model of interpreted variable

performed by

and exogenous variables.

3. Data

The Chinese data of 275 cities in year 2017 are obtained from China City Statistical Yearbook of 2018. The yearbook is published by National Bureau of Statistics of China and supported by departments at the provincial and county level. The dependent variable lnyi is the log of constant regional GDP per capital, referring to the final products at market prices produced by all resident units in a city divided by the number of resident units. The capital per worker variable lnki is the log of fixed asset stock per worker referring to the total fixed assets, which is the ending balance after deducting the depreciation and impairment divided by the average number of employed staff and workers.

The key explanatory variable ln

ICTi is the log of all subscribers at year-end who have gone through registration procedures in the operation points of enterprises engaged in telecommunications and are hence connected to Chinese Internet. The spatial lagged term ln

ICTi* is to examine the spatial effect of ICT—whether the local ICTs promote the economy of neighboring cities. If the estimated parameter of ln

ICTi* is greater than 0, there is a positive spillover effect of ICT; otherwise, there is a negative siphonic effect of ICT. The spatial lagged term of dependent variable ln

yi* is similar with ln

ICTi*. The variable definitions seen in

Table 1 and

Table 2 show the summary statistics on the major variables used in the research.

Further insights into economy distribution of Chinese cities can be obtained based on the rank–frequency distribution model. There are a large number of applications of the rank–frequency distribution model as a method to investigate the distribution and overall gap of economy between cities. Eaton and Eckstein [

37] use the model to describe relative populations of the top 40 urban areas of Japan from 1876 to 1990 and 39 urban areas of France, and urbanization consequently appears to have taken the form of the parallel growth of cities consistent with Zipf’s Law. According to Zipf’s Law, the indicator frequency changes following its sort order change in different units [

38]. Similarly, Sharma [

39] describes the scale distribution of cities in India and Black and Henderson [

40] estimate urban scale distribution in the USA from 1900 to 1990, and their results are also consistent with Zipf’s Law. Following the previous studies, when we change the linear x–y coordinate system into a log(x)–log(y) coordinate system, the curve of point range in the x–y coordinate system usually becomes the beeline, namely

where

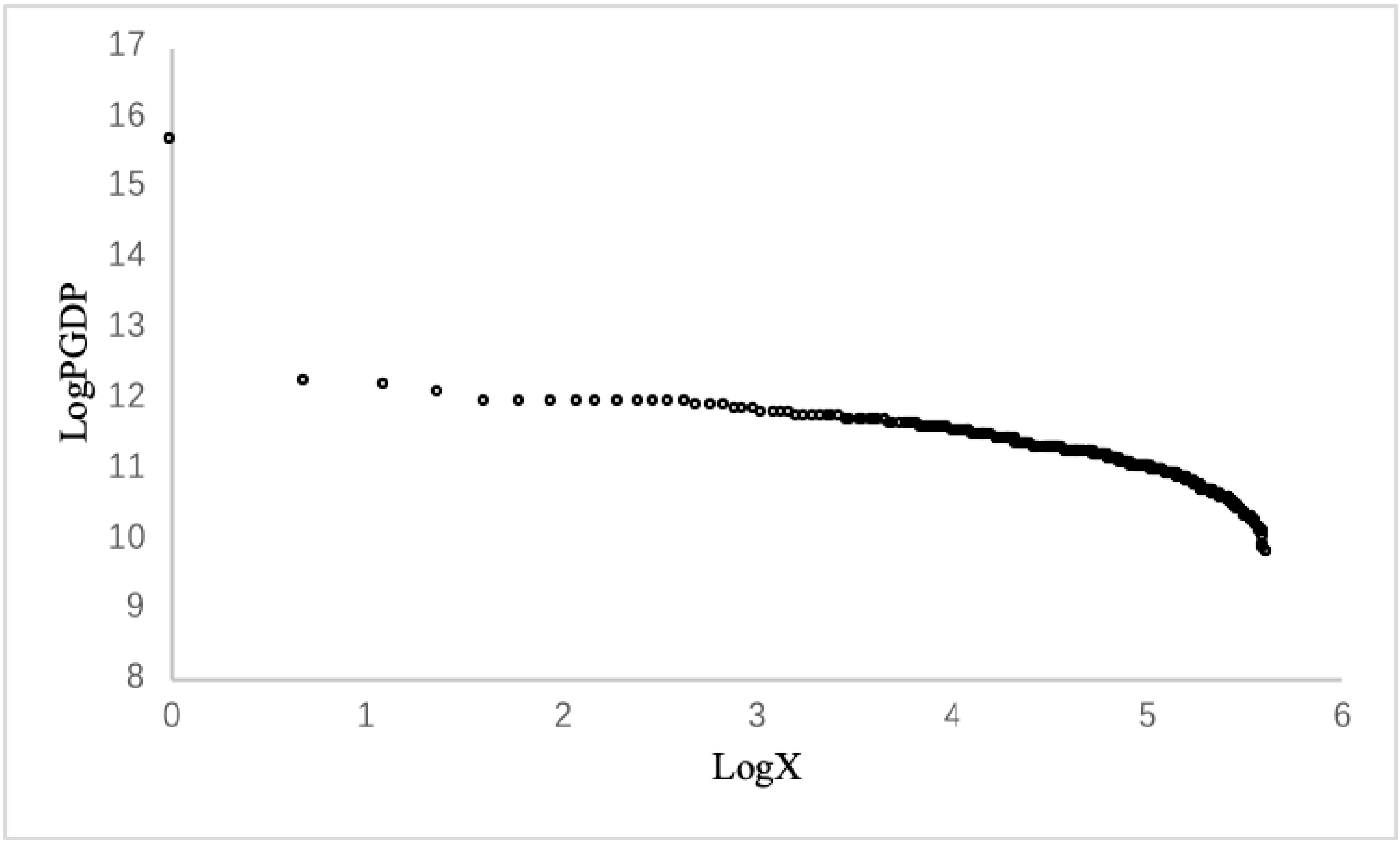

. For instance, we map out the rank–frequency distribution of GDP per capital of cities in China in the double logarithmic coordinate system.

Figure 1 shows the frequency distribution of urban economy in China in 2017, where the horizontal coordinate denotes the rank of log(x) and the vertical coordinate the logarithm of the frequency value. As shown in

Figure 1, the head of the point range is sparse and smooth, while there is a sharp drop in the tail of the point range, proving great distribution diversity of economic development in Chinese cities. Such a great diversity shows that Chinese cities might be differentiated as far as economic development is concerned. Liu and Sun [

41] compare the spatial distribution of innovation activities, which is highly correlated with economic development in China and the United States, and the spatial distribution of patent distribution at the province level in China is similar to

Figure 1. Consequently, using only the classical statistical methods that mainly focus on mean values (like SAR model) might lead to false results. Therefore, it is necessary for this research to extend the SAR model using the QSAR model.

5. Conclusions

In this article, SAR and QSAR models were established for ICT effects on urban economic development, including the spatial dependence of urban economy. We first test whether there is spatial dependence and which form of spatial dependence should be used in our model. The test results indicate that spatial lag dependence is necessary and suitable for this research rather than spatial error autocorrelation. Therefore, using SAR and QSAR is reasonable statistically. Homogeneity analysis using the SAR model suggests that, not only do local ICTs contribute directly to urban economy, but also city can reap ICT spatial positive spillover from its neighboring cities. Then, heterogeneity analysis using the QSAR model further confirm directive and spatial spillover effects of ICT on urban economic development. Additionally, the results of QSAR indicate that estimated coefficients of local and neighboring cities’ ICT are slightly larger at low quantile and the coefficients decrease monotonically with the increase of quantile. Therefore, we conclude that the less developed cities in China can reap more digital dividends than developed cities, which would help to reduce the economic gap between cities. Generally, the most important contribution of this research is that we provide empirical evidence that (1) ICTs have positive economic effects on local and neighboring cities; and (2) ICTs are more benefitable to the economic development of less developed cities than that of developed cities in China.

Our conclusions may give good news for China that we can obtain a “double dividend” from ICT. It is possible to obtain an improvement of both overall economic growth and balanced economic development among cities. Especially, in China, it is challenging to exploit fresh economic growth energy and to eliminate regional poverty. Additionally, we conclude that ICT economic effects are larger in less developed cities, which is not consistent with the relevant research at the national level. This reminds us that the economic paradox of ICT may be beyond the economy, namely developing countries’ demand matched the education and policy system to reap digital dividends rather than the economy.

The “double dividend” from ICT can be obtained by other countries where there is a clear-cut geographical divide. The spatial inequalities in the digital development of households and individuals in Europe at the regional level have been identified [

48]. In the scenario, ICT penetration would also have a dividend on narrowing the regional gap. Musolino [

49] is concerned the “perception gap” would contribute to the regional development gap because Italian entrepreneurs have a stereotyped, far too negative image of Southern Italy. Through bridge communication channels beyond barriers of geographical distance, ICT would help to tear down the “wall in the head” of entrepreneurs. Similarly, poor peripheries grow faster than richer ones throughout Germany [

50], which could contribute to ICT development strategy partly based on the empirical study of China.

Owing to the unavailability of data, we do not take the new generation of ICT, such as cloud computing and the Internet of Things, into consideration in this article. The ICT revolution is dynamic and the new technologies will play an increasingly important role in urban economy. In future research, we will continue to accumulate data to conduct a more comprehensive and accurate analysis of ICT economic effects on cities. Additionally, a panel data QSAR model is worthy of consideration on the issue because the urban fixed effect in the panel data model could allow researchers to control the time-invariant unobserved urban characteristic.