The Relationship between the Implementation of ERP Systems and the Financial and Non-Financial Reporting of Organizations

Abstract

1. Introduction

2. Materials and Methods

2.1. Theoretical Background

- the replacement of the in-house legacy system;

- to increase business process efficiency;

- to decrease operating cost;

- to redesign some business processes.

- integration—interconnecting the functions of the organization in a database;

- standardization—the rules of the organization are based on good practices;

- centralization and real-time data generation;

- automation of daily tasks.

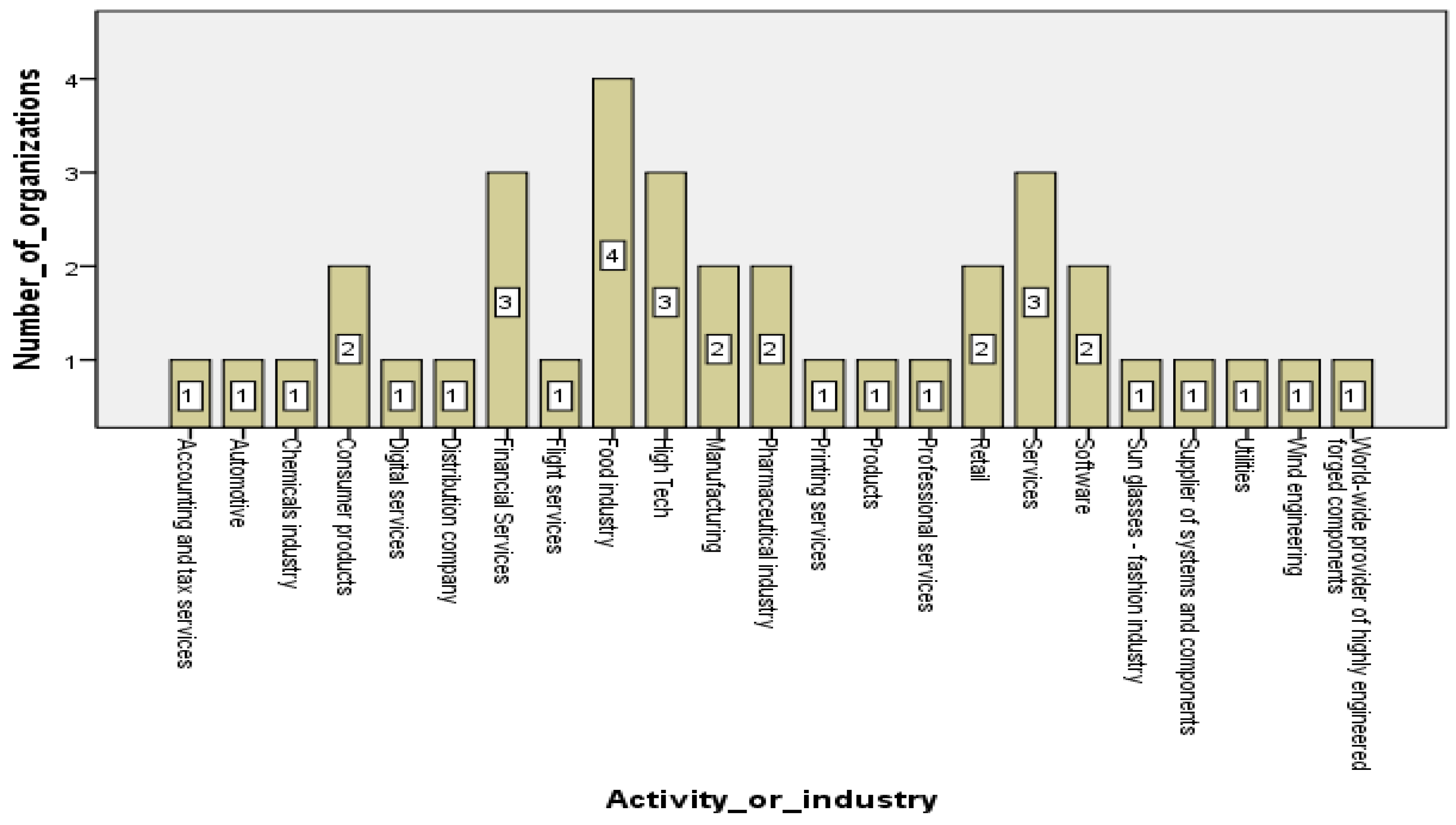

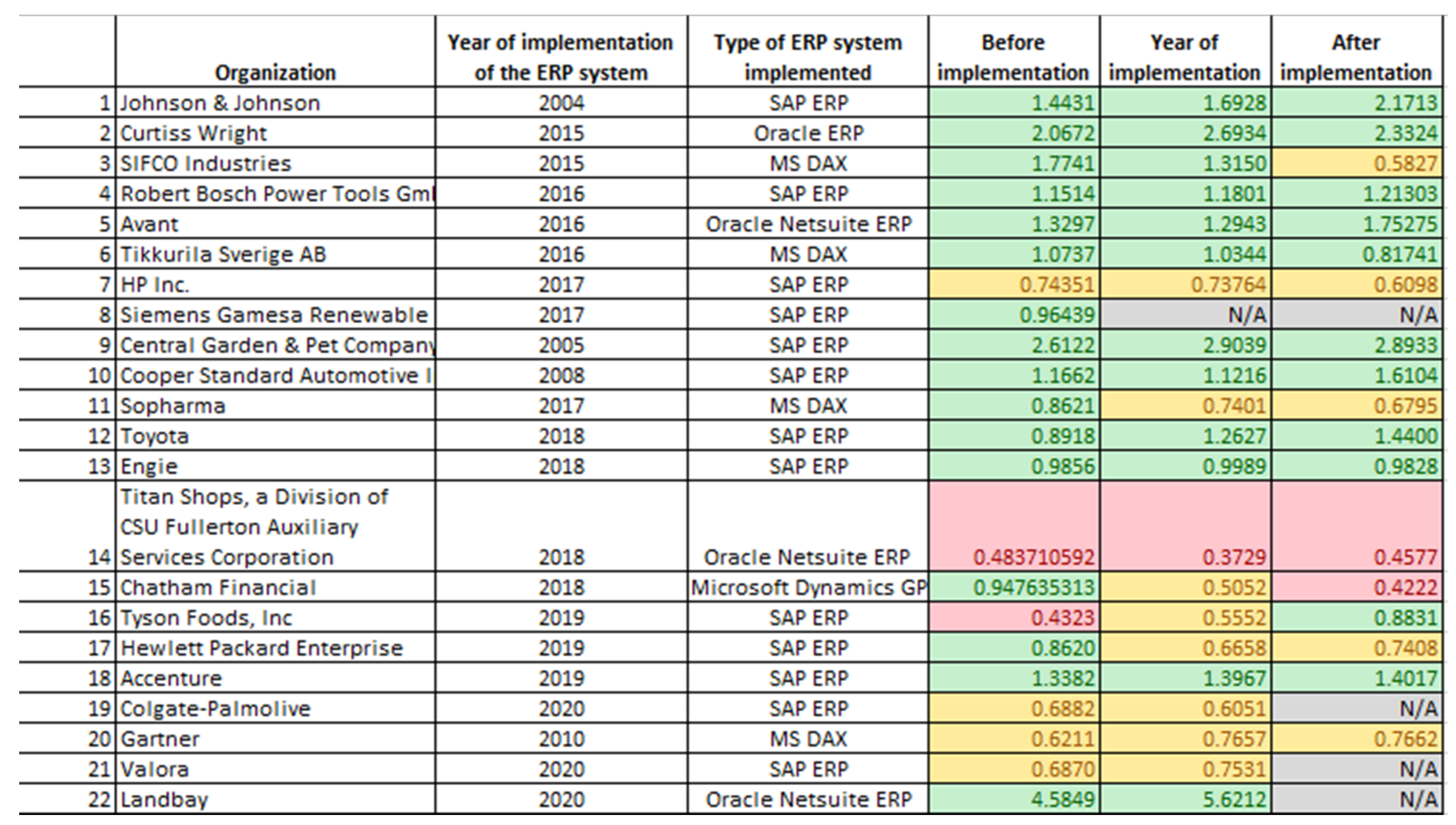

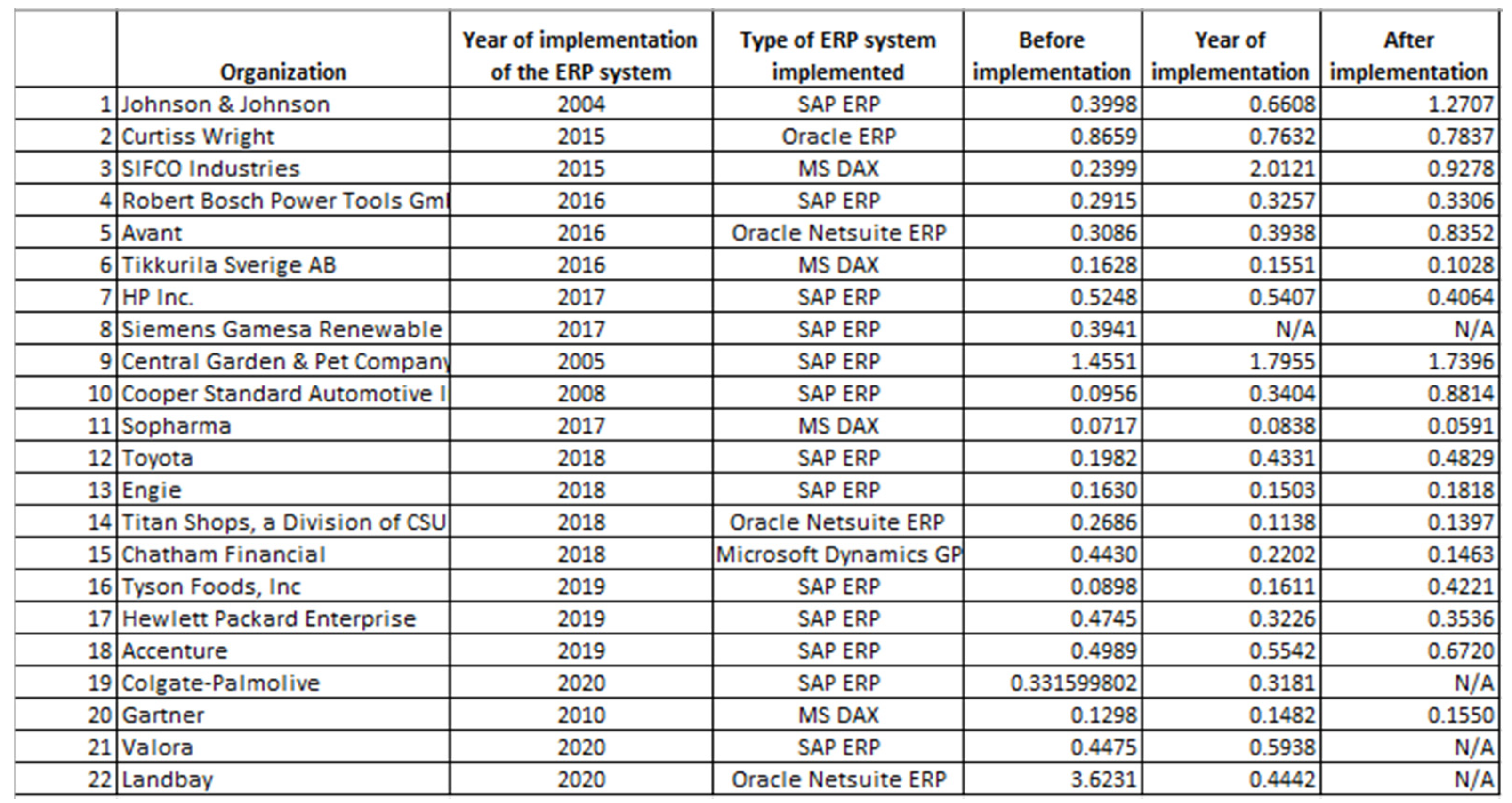

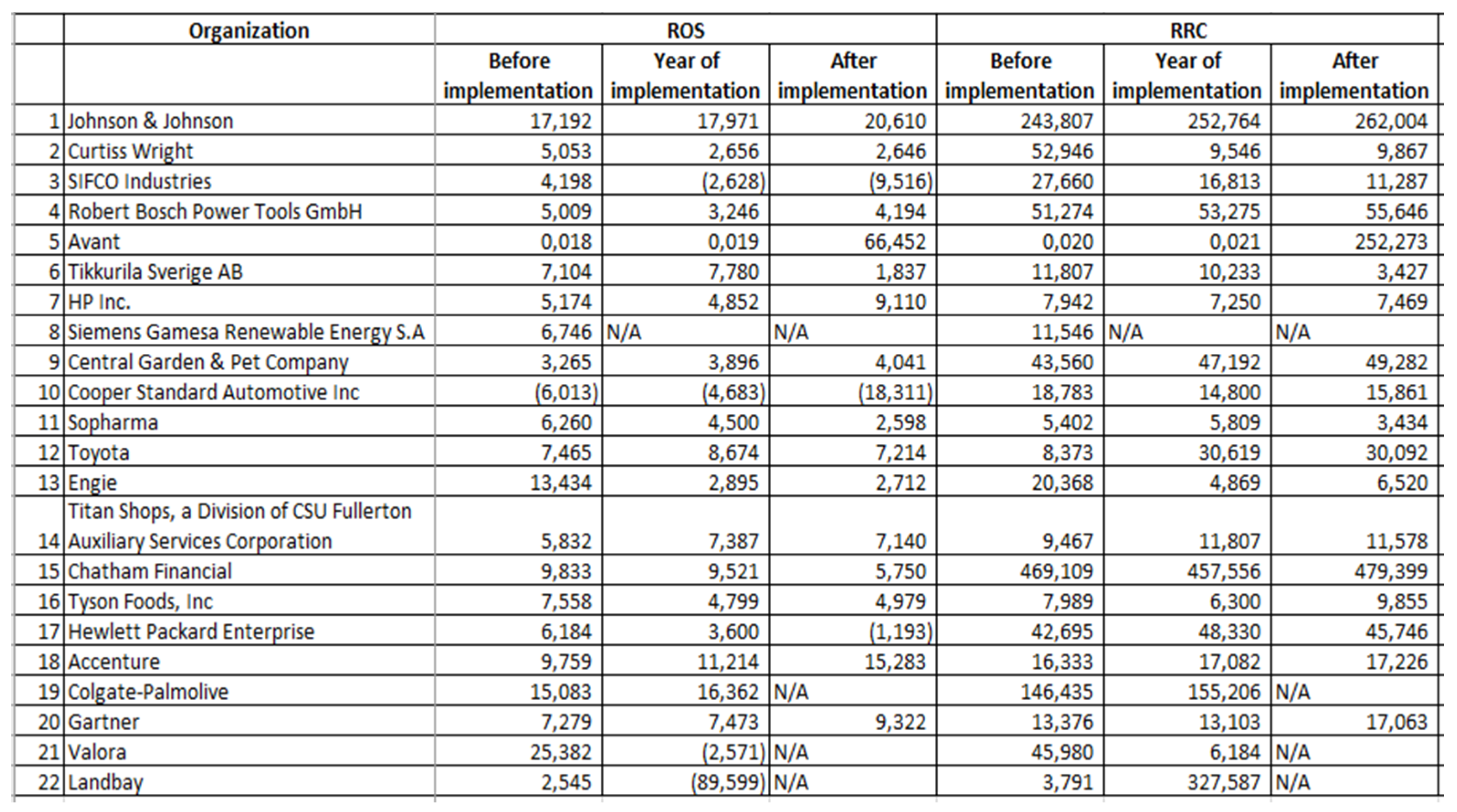

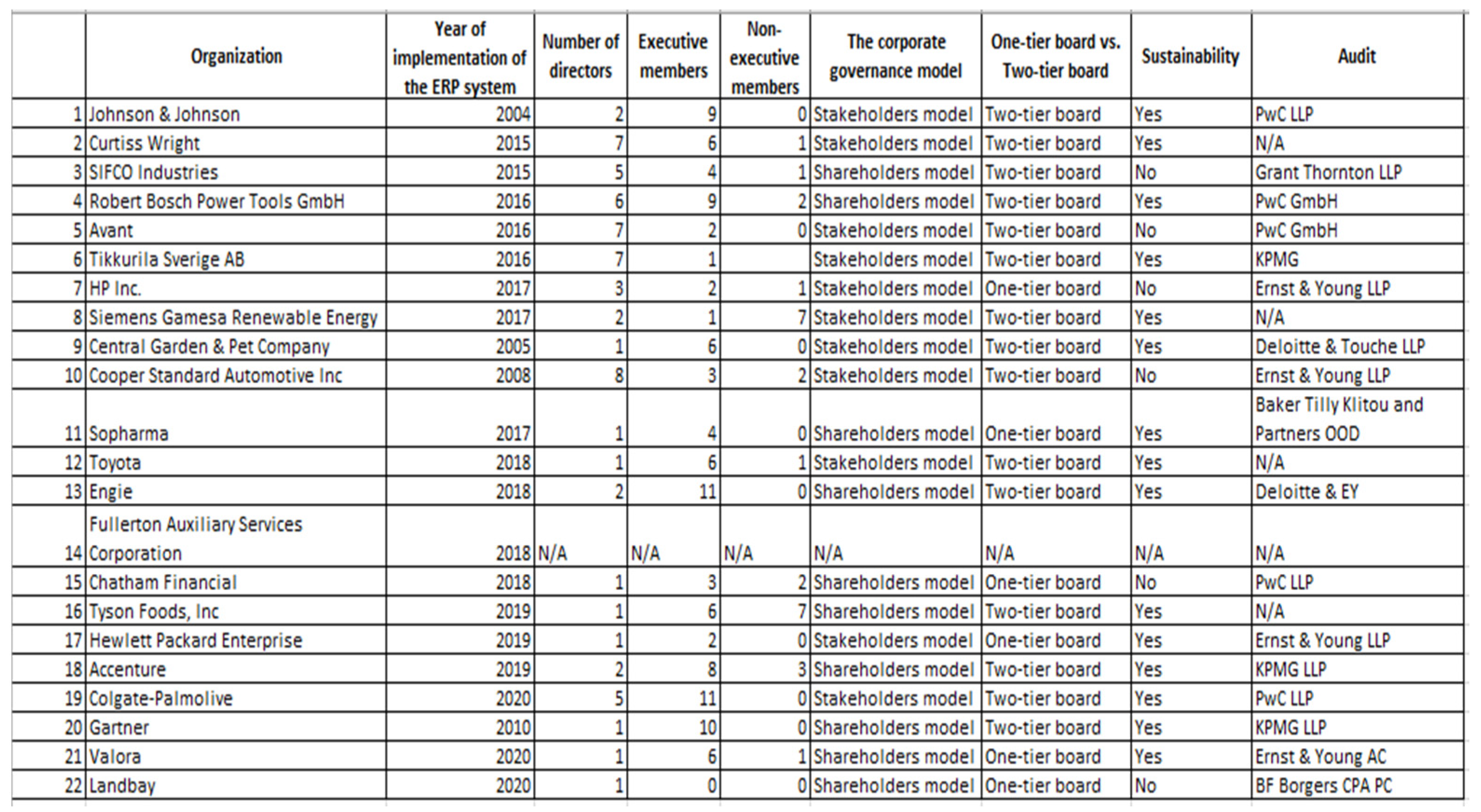

2.2. Research Methodology

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Implications and Limitations

References

- Galy, E.; Sauceda, M.J. Post-implementation practices of ERP systems and their relationship to financial performance. Inf. Manag. 2014, 51, 310–319. [Google Scholar] [CrossRef]

- Hadidi, M.; Al-Rashdan, M.; Hadidi, S.; Soubhi, Y. Comparison between Cloud ERP and traditional. ER J. Crit. Rev. 2020, 7, 140–142. [Google Scholar]

- Lee, D.; Lee, S.M.; Olson, D.L. The effect of organizational support on ERP implementation. Ind. Manag. Data Syst. 2010, 110, 269–283. [Google Scholar] [CrossRef]

- Mainu, R.O.; Twum, A.D.; Konadu, A.; Ohene-Amoako, D. Assessing the Impact of Implementing ERP Systems on the Operational Performance of Businesses. Int. J. Econ. Manag. Sci. 2019, 8, 1–10. [Google Scholar]

- Nicolaou, A.I.; Bhattacharya, S. Organizational performance effects of ERP systems usage: The impact of post-implementation changes. Int. J. Account. Inf. Syst. 2006, 7, 18–35. [Google Scholar] [CrossRef]

- Ammar, S.; Mardini, G.H. Enterprise resource planning enabling segmental information reporting practices of UK-FTSE 100. Account. Financ. 2020, 61, 1205–1237. [Google Scholar] [CrossRef]

- Chen, H.-J.; Huang, S.Y.; Chiu, A.-A.; Pai, F.-C. The ERP system impact on the role of accountants. Ind. Manag. Data Syst. 2012, 112, 83–101. [Google Scholar] [CrossRef]

- HassabElnaby, H.R.; Hwang, W.; Vonderembse, M.A. The impact of ERP im-plementation on organizational capabilities and firm performance. Bench-Marking: Int. J. 2012, 19, 618–633. [Google Scholar] [CrossRef]

- Wier, B.; Hunton, J.; HassabElnaby, H.R. Enterprise resource planning systems and non-financial performance incentives: The joint impact on corporate performance. Int. J. Account. Inf. Syst. 2007, 8, 165–190. [Google Scholar] [CrossRef]

- Azan, W.; Bollecker, M. Management control competencies and ERP: An empirical analysis in France. J. Model. Manag. 2011, 6, 178–199. [Google Scholar]

- Velcu, O. Exploring the effects of ERP systems on organizational performance. Ind. Manag. Data Syst. 2007, 107, 1316–1334. [Google Scholar] [CrossRef]

- Anita, I.; Sharbani, H. The effect of Enterprise Resource Planning (ERP) systems implementation on organizational performance. In Proceedings of the International Conference on Economics, Entrepreneurship and Management 2021 (ICEEM 2021), Istanbul, Turkey, 20–21 December 2021. [Google Scholar]

- Senior Software. Available online: https://www.seniorsoftware.ro/demonstratie-gratuita-erp/?utm_source=adwords&utm_term=senior%20software%20erp&utm_content=353865631881&Network=Search&SiteTarget=&gclid=EAIaIQobChMI1ey2r6nF8gIVSuuyCh2u4QmeEAAYASAAEgLhNfD_BwE (accessed on 10 June 2021).

- Shaker, A. What is an ERP? Available online: https://ro.linkedin.com/pulse/ce-este-un-erp-alina-shaker (accessed on 25 July 2021).

- Law, C.C.; Ngai, E.W. ERP systems adoption: An exploratory study of the organizational factors and impacts of ERP success. Inf. Manag. 2007, 44, 418–432. [Google Scholar] [CrossRef]

- Elhasnaoui, S. Analysis of the role of IT Governance on ERP Systems implementation. Int. J. Web-Based Learn. Teach. Technol. 2021, 16, 18–26. [Google Scholar] [CrossRef]

- Rom, A.; Rohde, C. Enterprise resource planning systems, strategic enterprise management systems and management accounting: A Danish study. J. Enterp. Inf. Manag. 2006, 19, 50–67. [Google Scholar] [CrossRef]

- Sheik, P.A.; Sulphey, M. Enterprise Resource Planning (ERP) As a Potential Tool for Organizational Effectiveness. Webology 2020, 17, 317–327. [Google Scholar] [CrossRef]

- Dashtbayaz, M.L.; Salehi, M.; Safdel, T. The effect of internal controls on financial reporting quality in Iranian family firms. J. Fam. Bus. Manag. 2019, 9, 254–270. [Google Scholar] [CrossRef]

- Rodriguez, C.S.; Spraakman, G. ERP systems and management accounting: A multiple case study. Qual. Res. Account. Manag. 2012, 9, 398–414. [Google Scholar] [CrossRef]

- Granlund, M.; Malmi, T. Moderate impact of ERPS on management accounting: A lag or permanent outcome? Manag. Account. Res. 2002, 13, 299–321. [Google Scholar] [CrossRef]

- Pohludka, M.; Stverkova, H.; ´ Slusarczyk, B. Implementation and Unification of the ERP System in a Global Company as a Strategic Decision for Sustainable Entrepreneur. Sustainability 2018, 10, 2916. [Google Scholar] [CrossRef]

- Ciocan, C.C.; Carp, M.; Georgescu, I. The Determinants of the Financial Re-porting Quality: Empirical Evidence for Romania. Audit. Financ. 2021, 2, 301–319. [Google Scholar] [CrossRef]

- Nechita, E. The Value Relevance of Non-Financial Reporting in Determining the Market Value of Equity. Audit. Financ. 2021, 19, 320–336. [Google Scholar] [CrossRef]

- Gärtner, B.; Feldbauer-Durstmüller, B.; Duller, C. Enterprise Size Impact on the ERP System Implementation. Int. J. Strateg. Manag. 2013, 13, 17–30. [Google Scholar] [CrossRef]

- Elragal, A.A.; Al-Serafi, A.M. The Effect of ERP System Implementation on Business Performance: An Exploratory Case-Study. Commun. IBIMA 2011, 670212, 1–20. [Google Scholar] [CrossRef][Green Version]

- Dumitru, V.F.; Albu, N.; Albu, C.N.; Dumitru, M. ERP implementation and organizational performance. A Romanian case study of best practices. Amfiteatru Econ. J. 2013, 15, 518–531. [Google Scholar]

- Mandal, P.; Gunasekaran, A. Issues in implementing ERP: A case study. Eur. J. Oper. Res. 2003, 146, 274–283. [Google Scholar] [CrossRef]

- Luciana, D.; Soewarno, N. Isnalita impact of enterprise resource planning systems on the accounting information relevance and firm performance. Russ. J. Agric. Socio-Econ. Sci. 2018, 80, 81–87. [Google Scholar] [CrossRef]

- Epicor. Available online: https://www.epicor.com/en/ (accessed on 11 June 2021).

- Microsoft Dynamics AX, Nav, G. Available online: https://dynamics.microsoft.com/en-us/ (accessed on 10 June 2021).

- Oracle. Available online: https://www.oracle.com/ro/erp/ (accessed on 10 June 2021).

- Oracle Netsuite. Available online: https://www.netsuite.com/portal/products/erp.shtml (accessed on 10 June 2021).

- SAP ERP. Available online: https://www.sap.com/products/enterprise-management-erp.html (accessed on 10 June 2021).

- CECCAR. Analiza Rentabilității și Riscul Întreprinderii. Available online: https://www.ceccarbusinessmagazine.ro/analiza-rentabilitatii-si-riscul-intreprinderii-a5226/ (accessed on 17 August 2021).

- Robu, V.; Anghel, I.; Șerban, E.C. Analiză Economico-Financiară a Firmei; Editura Economica: Bucharest, România, 2014; pp. 349–372. [Google Scholar]

- Mohagheghi, P.; Gilani, W.; Stefanescu, A.; Fernandez, M.A. An empirical study of the state of the practice and acceptance of model-driven engineering in four industrial cases. Empir. Softw. Eng. 2012, 18, 89–116. [Google Scholar] [CrossRef]

- Accenture—Annual Reports 2018, 2019 and 2020. Available online: https://www.accenture.com/us-en/about/company/annual-report (accessed on 10 August 2021).

- Avant—Annual Report 2015. Available online: https://www.avant.org.au›annual-report-2015 (accessed on 10 August 2021).

- Avant—Annual Report 2016. Available online: https://www.avant.org.au>DownloadAsset (accessed on 10 August 2021).

- Avant—Annual Report 2017. Available online: https://www.avant.org.au>DownloadAsset (accessed on 10 August 2021).

- Central Garden & Pet Company—Annual Reports 2004, 2005 and 2006. Available online: https://ir.central.com/sec-filings/annual-reports (accessed on 10 August 2021).

- Chatham Financial—Annual Reports 2017, 2018 and 2019. Available online: https://www.chathamfinancial.com/insights/2019-annual-european-business-review (accessed on 10 August 2021).

- Colgate-Palmolive—Annual Reports 2019 and 2020. Available online: https://investor.colgatepalmolive.com/financial-information/annual-reports/ (accessed on 11 August 2021).

- Cooper Standard Automotive Inc.—Annual Reports 2007, 2008 and 2009. Available online: https://www.annualreports.com/Company/cooper-standard-holdings-inc (accessed on 11 August 2021).

- Curtiss Wright—Annual Reports 2014, 2015 and 2016. Available online: https://investors.curtisswright.com/financials/annual-reports-and-proxy/default.aspx (accessed on 11 August 2021).

- Engie—Annual Reports 2017, 2018 and 2019. Available online: https://www.engie.com/en/financial-results (accessed on 11 August 2021).

- Gartner—Annual Report 2009, 2010 and 2011. Available online: https://investor.gartner.com/financial-information/sec-filings/default.aspx (accessed on 11 August 2021).

- Hewlett Packard Enterprise—Annual Reports 2018, 2019 and 2020. Available online: https://investors.hpe.com/financial/annual-reports (accessed on 11 August 2021).

- HP Inc.—Annual Reports 2016, 2017 and 2018. Available online: https://investor.hp.com/financials/annual-reports-and-proxies/default.aspx (accessed on 11 August 2021).

- Johnson & Johnson—Annual Reports 2003, 2004 and 2005. Available online: https://www.annualreports.com/Company/johnson-johnson (accessed on 11 August 2021).

- Landbay—Annual Reports 2019. Available online: https://sec.report/Document/0001672572-19-000006/ (accessed on 11 August 2021).

- Landbay—Annual Reports 2020. Available online: https://sec.report/Document/0001017386-20-000187/ (accessed on 11 August 2021).

- Robert Bosch Power Tools GmbH—Annual Report 2015. Available online: https://assets.bosch.com/media/en/global/bosch_group/our_figures/publication_archive/pdf_1/gb2015.pdf (accessed on 11 August 2021).

- Robert Bosch Power Tools GmbH—Annual Report 2016. Available online: https://www.annualreports.com/HostedData/AnnualReportArchive/b/bosch_2016.pdf (accessed on 11 August 2021).

- Robert Bosch Power Tools GmbH—Annual Report 2017. Available online: https://www.annualreports.com/HostedData/AnnualReportArchive/b/bosch_2017.pdf (accessed on 11 August 2021).

- Siemens Gamesa Renewable Energy S.A—Annual Report 2016. Available online: https://www.siemensgamesa.com/-/media/siemensgamesa/downloads/en/investors-and-shareholders/annual-reports/2016/2016-annual-report.pdf (accessed on 12 August 2021).

- SIFCO Industries Inc.—Annual Reports 2014, 2015 and 2016. Available online: https://sifco.com/investor-relations/annual-reports/ (accessed on 12 August 2021).

- Sopharma—Annual Reports 2016, 2017 and 2018. Available online: https://www.sopharmagroup.com/en/investor/financial-reports (accessed on 12 August 2021).

- Tikkurila Sverige AB—Annual Reports 2015, 2016 and 2017. Available online: https://www.tikkurilagroup.com/investorsreports-and-presentations/annual-reports (accessed on 12 August 2021).

- Titan Shops, a Division of CSU Fullerton Auxiliary Services Corporation—Annual Report 2017. Available online: https://www.titancompany.in/sites/default/files/Titan%20Annual%20Report%202017-18_0_0.pdf (accessed on 12 August 2021).

- Titan Shops, a Division of CSU Fullerton Auxiliary Services Corporation—Annual Report 2018. Available online: https://www.titancompany.in/sites/default/files/Titan%2035th%20ANNUAL%20REPORT%202018-19_1.pdf (accessed on 12 August 2021).

- Titan Shops, a Division of CSU Fullerton Auxiliary Services Corporation—Annual Report 2019. Available online: https://www.titancompany.in/sites/default/files/Annual_Report_2019_20.pdf (accessed on 12 August 2021).

- Toyota—Annual Reports 2017, 2018 and 2019. Available online: https://global.toyota/en/ir/library/annual/ (accessed on 12 August 2021).

- Tyson Foods Inc.—Annual Reports 2018, 2019 and 2020. Available online: https://ir.tyson.com/reports/annual-reports/default.aspx (accessed on 12 August 2021).

- Valora—Annual Reports 2019 and 2020. Available online: https://www.valora.com/en/investors/publications/ (accessed on 12 August 2021).

- Bordeianu, S. Analiza Diagnostic pe baza Ratelor de Rentabilitate. Available online: http://www.oeconomica.uab.ro/upload/lucrari/820062/08.pdf (accessed on 18 August 2021).

| Variables | Formula | Short Description |

|---|---|---|

| Financial indicators | ||

| Current liquidity rate | Current assets/Short-term debts | Liquidity indicators reflect the organization’s ability to pay its short-term obligations at maturity based on current assets represented by stocks, receivables, investments. |

| Intermediate liquidity rate (Quick ratio) | Current assets and inventories/Short-term debts | |

| Liquidity rate at sight | Cash and cash equivalents + Short-term investments/Current debts | |

| Global solvency rate | Total assets/Total debts | Solvency indicators provide information on the ability to cover total debts. |

| Patrimony solvency rate | Own capital/Own capital + Bank credits | |

| Return on assets (ROA) | Operating result/Operating assets × 100 OR Gross profit/Total assets × 100 | Profitability indicators show whether the organization uses all resources to generate profit. Rates of return provide information about the efficiency of the business activity of the organization, mainly reflecting the relationship between turnover and profit or total costs related to the sale. The rate of return on assets highlights the performance when using the total asset, with respect to the invested capital to obtain the performance in the developed activity. |

| Return on equity (ROE) | Net profit/Own capital × 100 | |

| Return on sales (ROS) | Profit/Turnover × 100 | |

| Return on consumed resources (RRC) | Operating result/Operating expenses × 100 | |

| Speed of rotation of the assets | Turnover/Average of current assets, where average of current assets = (Initial sold + Final sold)/2 | These indicators measure the speed and turnover of current assets. The speed of rotation assets highlights the intensity of exploitation of the organization’s assets, thus showing how much capital has been invested to obtain annual turnover. However, from the duration of the rotation we can observe the number of days necessary for the recovery of the assets. |

| Duration of rotation of the assets | Average of current assets/Turnover × T, where T = 365 days | |

| Non-financial indicators | ||

| Number of directors | The information provided in the annual reports | These indicators are needed to observe how many members are needed in the decision-making process and whether the set objectives are met. |

| Executive members | ||

| Non-executive members | ||

| The corporate governance model | The reason we chose this indicator was to see if the selected organizations want to maximize their financial results (shareholders model) or if they incorporate corporate responsibility to protect the interests of all stakeholders (stakeholders model). | |

| One-tier board vs. two-tier board | The purpose of this indicator is to highlight the structure of the organizations selected for the sample. | |

| Sustainability | This indicator represents all the forms and methods of socio-economic development that ensure a balance between social, economic and ecological aspects and elements of natural capital. If an organization decides to be sustainable, it can obtain financial and non-financial benefits. | |

| Audit | This indicator shows the degree of credibility presented in the reports. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barna, L.-E.-L.; Ionescu, B.-Ș.; Ionescu-Feleagă, L. The Relationship between the Implementation of ERP Systems and the Financial and Non-Financial Reporting of Organizations. Sustainability 2021, 13, 11566. https://doi.org/10.3390/su132111566

Barna L-E-L, Ionescu B-Ș, Ionescu-Feleagă L. The Relationship between the Implementation of ERP Systems and the Financial and Non-Financial Reporting of Organizations. Sustainability. 2021; 13(21):11566. https://doi.org/10.3390/su132111566

Chicago/Turabian StyleBarna, Laura-Eugenia-Lavinia, Bogdan-Ștefan Ionescu, and Liliana Ionescu-Feleagă. 2021. "The Relationship between the Implementation of ERP Systems and the Financial and Non-Financial Reporting of Organizations" Sustainability 13, no. 21: 11566. https://doi.org/10.3390/su132111566

APA StyleBarna, L.-E.-L., Ionescu, B.-Ș., & Ionescu-Feleagă, L. (2021). The Relationship between the Implementation of ERP Systems and the Financial and Non-Financial Reporting of Organizations. Sustainability, 13(21), 11566. https://doi.org/10.3390/su132111566