Sustainability & CSR: The Relationship with Hofstede Cultural Dimensions

Abstract

:1. Introduction

2. Literature Review and Research Goals

2.1. Studies on Hofstede Cultural Dimensions

2.2. Research Goals

- There is a significant positive relationship between the market value of publicly traded companies and appearance on the DJSIs in countries characterized with the femininity cultural dimension (Hofstede’s masculinity score of ≤42).

- 2.

- Publicly traded companies added to the DJSIs between the years 2010–2019 from the corresponding European countries with the femininity cultural dimension are expected to see a higher significant positive impact on their market value compared to listed companies from the corresponding emerging countries.

- 3.

- There is a mixed significant negative or positive relationship between the market value of publicly traded French companies and their appearance on the DJSIs in France, a country with a Hofstede’s masculinity score of 43, halfway between the femininity and masculinity cultural dimensions.

- 4.

- There is a significant negative relationship between the market value of publicly traded Japanese companies and appearance on the DJSIs in Japan, a country with the highest Hofstede’s masculinity score of 92.

3. Methodology

3.1. Selected Countries

3.2. Statistical Analyses

4. Results

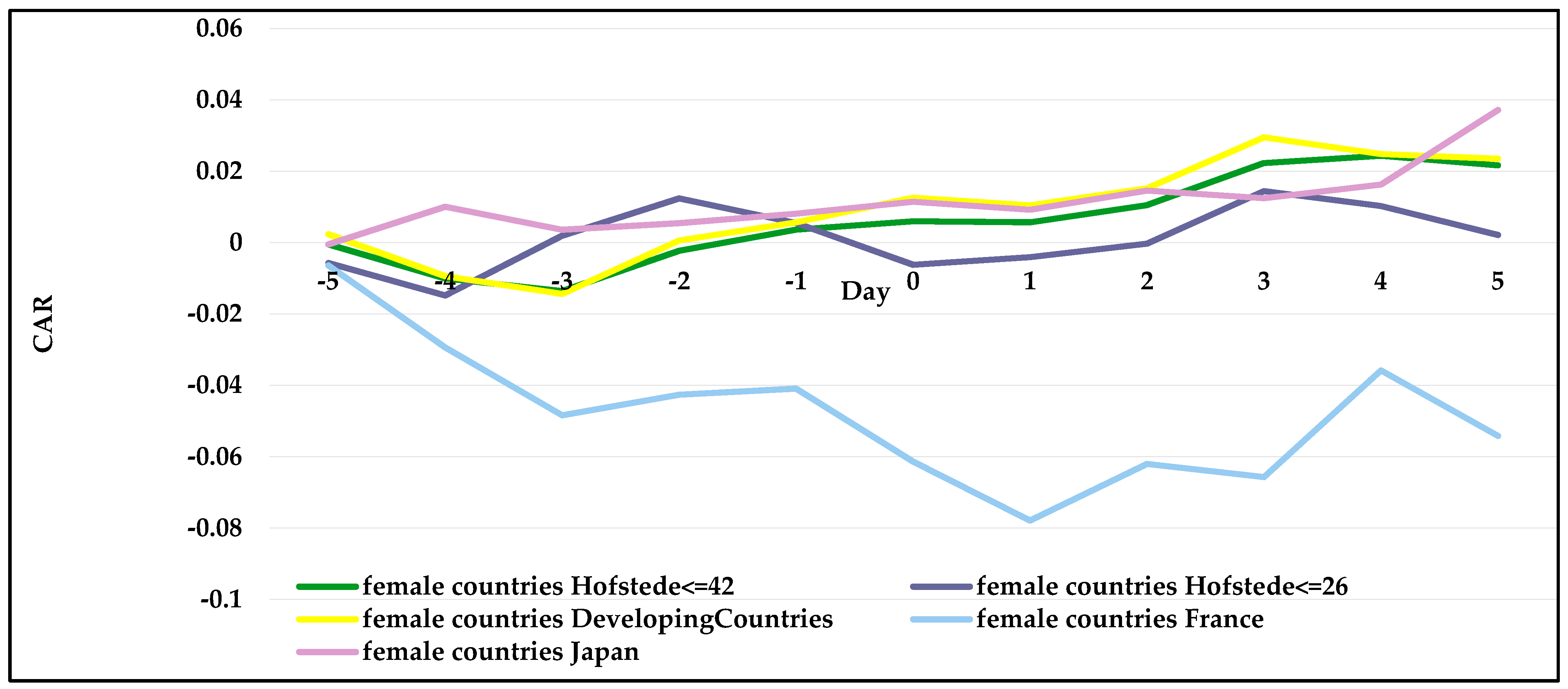

- To further investigate the results indicated in Figure 6, France was compared with countries having Hofstede’s masculinity scores close to 43, but within the femininity cultural dimension, Spain (42) and South Korea (39). In addition, Sweden, with the lowest masculinity score (5), and Japan, with highest masculinity score (92), were included. Figure 7 shows a visualization of this comparison.

- As mentioned before, the interesting finding of the study is that Japanese companies, as indicated by the pinkish line in Figure 6 and Figure 7, show a positive impact on their market value when added to the DJSIs. This is an indication that the Japanese cultural dimension has shifted. Based on research [34], investors need to be more involved and engaged in interactive relationships with firms in order to value and understand their CSR and sustainability strategies.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hofstede, G. Motivation, leadership, and organization: Do American theories apply abroad? Organ. Dyn. 1980, 9, 42–63. [Google Scholar] [CrossRef]

- Hofstede, G. What did GLOBE really measure? Researchers’ minds versus respondents’ minds. J. Int. Bus. Stud. 2006, 37, 882–896. [Google Scholar] [CrossRef] [Green Version]

- Beugelsdijk, S.; Kostova, T.; Roth, K. An overview of Hofstede-inspired country-level culture research in international business since 2006. J. Int. Bus. Stud. 2017, 48, 30–47. [Google Scholar] [CrossRef] [Green Version]

- Kim, K.I.; Park, H.-J.; Suzuki, N. Reward allocations in the United States, Japan, and Korea: A comparison of individualistic and collectivistic cultures. Acad. Manag. J. 1990, 33, 188–198. [Google Scholar]

- Nelson, M.R.; Brunel, F.F.; Supphellen, M.; Manchanda, R.V. Effects of Culture, Gender, and Moral Obligations on Responses to Charity Advertising Across Masculine and Feminine Cultures. J. Consum. Psychol. 2006, 16, 45–56. [Google Scholar] [CrossRef]

- Sørnes, J.-O.; Stephens, K.K.; Sætre, A.S.; Browning, L.D. The reflexivity between ICTs and business culture: Applying Hofstede’s theory to compare Norway and the United States. Inf. Sci. J. 2004, 7, 1–30. [Google Scholar]

- Venaik, S.; Brewer, P. Avoiding uncertainty in Hofstede and GLOBE. J. Int. Bus. Stud. 2010, 41, 1294–1315. [Google Scholar] [CrossRef]

- Brewer, P.; Venaik, S. Individualism–Collectivism in Hofstede and GLOBE. J. Int. Bus. Stud. 2011, 42, 436–445. [Google Scholar] [CrossRef]

- Shi, W.; Veenstra, K. The Moderating Effect of Cultural Values on the Relationship between Corporate Social Performance and Firm Performance. J. Bus. Ethics 2021, 174, 89–107. [Google Scholar] [CrossRef]

- Ates, S. Membership of sustainability index in an emerging market: Implications for sustainability. J. Clean. Prod. 2020, 250, 119465. [Google Scholar] [CrossRef]

- Durand, R.; Paugam, L.; Stolowy, H. Do investors actually value sustainability indices? Replication, development, and new evidence on CSR visibility. Strat. Manag. J. 2019, 40, 1471–1490. [Google Scholar] [CrossRef]

- Hawn, O.; Chatterji, A.K.; Mitchell, W. Do investors actually value sustainability? New evidence from investor reactions to the Dow Jones Sustainability Index (DJSI). Strat. Manag. J. 2018, 39, 949–976. [Google Scholar] [CrossRef]

- De Santis, P.; Albuquerque, A.; Lizarelli, F. Do sustainable companies have a better financial performance? A study on Brazilian public companies. J. Clean. Prod. 2016, 133, 735–745. [Google Scholar] [CrossRef]

- Schmutz, B.; Tehrani, M.; Fulton, L.; Rathgeber, A. Dow Jones Sustainability Indices, Do They Make a Difference? The U.S. and the European Union Companies. Sustainability 2020, 12, 6785. [Google Scholar] [CrossRef]

- Zhao, X.; Murrell, A.J. Revisiting the corporate social performance-financial performance link: A replication of Waddock and Graves. Strat. Manag. J. 2016, 37, 2378–2388. [Google Scholar] [CrossRef]

- Cheung, A.W.K. Do Stock Investors Value Corporate Sustainability? Evidence from an Event Study. J. Bus. Ethics 2010, 99, 145–165. [Google Scholar] [CrossRef]

- Cheung, A.; Wai, K.; Roca, E. The effect on price, liquidity and risk when stocks are added to and deleted from a sustainability index: Evidence from the Asia Pacific context. J. Asian Econ. 2013, 24, 51–65. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.; Kim, I.; Hong, C.-H. Who Values Corporate Social Responsibility in the Korean Stock Market? Sustainability 2019, 11, 5924. [Google Scholar] [CrossRef] [Green Version]

- Searcy, C.; Elkhawas, D. Corporate sustainability ratings: An investigation into how corporations use the Dow Jones Sustainability Index. J. Clean. Prod. 2012, 35, 79–92. [Google Scholar] [CrossRef]

- Hofstede, G. Cultural differences in teaching and learning. Int. J. Intercult. Relat. 1986, 10, 301–320. [Google Scholar] [CrossRef]

- Yilmaz, M.K.; Aksoy, M.; Tatoglu, E. Does the Stock Market Value Inclusion in a Sustainability Index? Evidence from Borsa Istanbul. Sustainability 2020, 12, 483. [Google Scholar] [CrossRef] [Green Version]

- Hofstede, G.; Bond, M.H. Hofstede’s culture dimensions: An independent validation using Rokeach’s value survey. J. Cross-Cult. Psychol. 1984, 15, 417–433. [Google Scholar] [CrossRef]

- Climate Focus. The Paris Agreement Summary 2015. 2015. Available online: https://climatefocus.com/sites/default/files/20151228%20COP%2021%20briefing%20FIN.pdf (accessed on 1 September 2021).

- 2050 Long-Term Strategy 2020. 2020. Available online: https://ec.europa.eu/clima/policies/strategies/2050_en (accessed on 1 September 2021).

- Hostede Insights 2021. 2021. Available online: https://www.hofstede-insights.com/product/virtual-certification-in-organisational-culture-2021-1/ (accessed on 1 September 2021).

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Kothari, S.; Warner, J.B. Econometrics of Event Studies**We thank Espen Eckbo, Jon Lewellen, Adam Kolasinski, and Jay Ritter for insightful comments, and Irfan Safdar and Alan Wancier for research assistance. In Handbook of Empirical Corporate Finance; Elsevier BV: Amsterdam, The Netherlands, 2007; pp. 3–36. [Google Scholar]

- Kothari, S.P.; Warner, J.B. The Econometrics of Event Studies. 2006. Available online: https://www.bu.edu/econ/files/2011/01/KothariWarner2.pdf (accessed on 1 September 2021).

- MacKinlay, A.C. Event studies in economics and finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Chan, W.S. Stock price reaction to news and no-news: Drift and reversal after headlines. J. Financ. Econ. 2003, 70, 223–260. [Google Scholar] [CrossRef]

- Brown, S.; Warner, J.B. Measuring security price performance. J. Financ. Econ. 1980, 8, 205–258. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lo, A.W.; MacKinlay, A.C. Event-Study Analysis, The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1997. [Google Scholar]

- Strand, R.; Freeman, R.E.; Hockerts, K. Corporate social responsibility and sustainability in Scandinavia: An overview. J. Bus. Ethics 2015, 127, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Hockerts, K.; Moir, K. Communicating corporate responsibility to investors: The changing role of the investor relations function. J. Bus. Ethics 2004, 52, 85–98. [Google Scholar] [CrossRef]

- UNESCO. UNESCO and Sustainable Development Goals 2019. 2019. Available online: https://en.unesco.org/sustainabledevelopmentgoals (accessed on 1 September 2021).

| Country | Masculinity Cultural Score |

|---|---|

| Sweden | 5 |

| Norway | 8 |

| The Netherlands | 14 |

| Denmark | 16 |

| Finland | 26 |

| Chile | 28 |

| Portugal | 31 |

| Thailand | 34 |

| South Korea | 39 |

| Spain | 42 |

| e | Index | Company | Country |

|---|---|---|---|

| 2010 | DJSI World | Aegon N.V. | The Netherlands |

| 2010 | DJSI Europe | Aegon N.V. | The Netherlands |

| 2010 | DJSI Europe | Royal KPN N.V. | The Netherlands |

| 2010 | DJSI Europe | Portugal Telecom SGPS S/A | Portugal |

| 2010 | DJSI World | Gamesa Corporacion Tecnologica S.A. | Spain |

| 2010 | DJSI World | Red Electrica Corp. S.A | Spain |

| 2011 | DJSI Europe | Orkla ASA | Norway |

| 2011 | DJSI Europe | Atlas Copco AB | Sweden |

| 2011 | DJSI Europe | Svenska Cellulosa AB | Sweden |

| 2012 | DJSI Europe | UPM-Kymmene OYJ | Finland |

| 2012 | DJSI Europe | Aegon NV | The Netherlands |

| 2012 | DJSI Europe | Koninklijke Ahold NV | The Netherlands |

| 2012 | DJSI Europe | Telenor ASA | Norway |

| 2012 | DJSI Europe | Amadeus IT Holding SA | Spain |

| 2012 | DJSI World | Hennes & Mauritz AB | Sweden |

| 2013 | DJSI World | ING Groep NV | The Netherlands |

| 2013 | DJSI Europe | ASML Holding NV | The Netherlands |

| 2013 | DJSI Europe | ING Groep NV | The Netherlands |

| 2013 | DJSI World | Telefonica SA | Spain |

| 2014 | DJSI World | Telefonica SA | Spain |

| 2015 | DJSI World | Telefonica SA | Spain |

| 2016 | DJSI Europe | Novo Nordisk A/S | Denmark |

| 2016 | DJSI Europe | Iberdrola SA | Spain |

| 2017 | DJSI World | ASML Holding NV | The Netherlands |

| 2018 | DJSI World | Banco Bilbao Vizcaya Argentaria SA | Spain |

| 2018 | DJSI Europe | Banco Bilbao Vizcaya Argentaria SA | Spain |

| 2018 | DJSI Europe | Essity AB | Sweden |

| 2019 | DJSI Europe | Telfonaktiebolaget LM Ericsson | Sweden |

| Year | Index | Company | Country |

|---|---|---|---|

| 2010 | DJSI World | KT&G Corp. | S. Korea |

| 2011 | DJSI World | Hyundai Mobis Co. Ltd. | S. Korea |

| 2011 | DJSI Korea | Hynix Semiconductor Inc. | S. Korea |

| 2011 | DJSI Korea | Samsung Engineering Co. Ltd. | S. Korea |

| 2011 | DJSI Korea | Samsung Heavy Industries Co. Ltd. | S. Korea |

| 2012 | DJSI Korea | Hanjin Shipping Co Ltd. | S. Korea |

| 2012 | DJSI Korea | KCC Corp. | S. Korea |

| 2012 | DJSI Korea | Samsung Life Insurance Co Ltd. | S. Korea |

| 2012 | DJSI Asia Pacific | Samsung Life Insurance Co Ltd. | S. Korea |

| 2013 | DJSI World | Shinhan Financial Group Co Ltd. | S. Korea |

| 2013 | DJSI Korea | Hanwha Chemical Corp. | S. Korea |

| 2013 | DJSI Korea | LG Household & Health Care Ltd. | S. Korea |

| 2013 | DJSI Korea | Samsung C&T Corp. | S. Korea |

| 2013 | DJSI Asia Pacific | Samsung Fire & marine Insurance Co Ltd. | S. Korea |

| 2015 | DJSI Emerging Markets | SACI Falabella | Chile |

| 2015 | DJSI Emerging Markets | Advanced Info Service PCL | Thailand |

| 2016 | DJSI Emerging Markets | Kasikornbank PCL | Thailand |

| 2016 | DJSI Emerging Markets | Thai Beverage PCL | Thailand |

| 2017 | DJSI World | Samsung Electronics Co Ltd. | S. Korea |

| 2017 | DJSI Asia Pacific | Samsung Electronics Co Ltd. | S. Korea |

| 2017 | DJSI Emerging Markets | CP ALL PCL | Thailand |

| 2018 | DJSI MILA Pacific Alliance | Enel Americas SA | Chile |

| 2018 | DJSI MILA Pacific Alliance | Enel Chile SA | Chile |

| 2018 | DJSI MILA Pacific Alliance | Inversiones La Construccion SA | Chile |

| 2018 | DJSI Emerging Markets | Enel Americas SA | Chile |

| Year. | Index | Company | Country |

|---|---|---|---|

| 2010 | DJSI Europe | Klepierre S.A. | France |

| 2011 | DJSI World | Schneider Electric S.A | France |

| 2011 | DJSI World | Societe Generale S.A | France |

| 2011 | DJSI Europe | Alcatel-Lucent | France |

| 2011 | DJSI Europe | Alstom S.A | France |

| 2011 | DJSI Europe | Societe Generale S.A. | France |

| 2013 | DJSI Europe | Kering | France |

| 2013 | DJSI Europe | LVMH-Moët Hennessy Louis Vuitton SA | France |

| 2013 | DJSI Europe | Societe Generale SA | France |

| 2015 | DJSI World | GDF Suez | France |

| 2015 | DJSI World | Societe Generale SA | France |

| 2015 | DJSI World | Vinci SA | France |

| 2015 | DJSI Europe | BNP Paribas SA | France |

| 2015 | DJSI Europe | Sanofi | France |

| 2015 | DJSI Europe | Societe Generale SA | France |

| 2016 | DJSI World | Essilor International SA | France |

| 2016 | DJSI Europe | Essilor International SA | France |

| 2016 | DJSI Europe | TOTAL SA | France |

| 2017 | DJSI Europe | CapgeminiSA | France |

| 2019 | DJSI Europe | BNP Paribas SA | France |

| 2019 | DJSI Europe | Sanofi | France |

| Year | Index | Company | Country |

|---|---|---|---|

| 2010 | DJSI World | Nippon Yusen K.K | Japan |

| 2010 | DJSI Asia Pacific | Seiko Epson Corp. | Japan |

| 2010 | DJSI Asia Pacific | Yokogawa Electric Corp. | Japan |

| 2011 | DJSI Asia Pacific | Asahi Glass Co. Ltd. | Japan |

| 2011 | DJSI Asia Pacific | Astellas Pharma Inc. | Japan |

| 2011 | DJSI Asia Pacific | Itochu Corp. | Japan |

| 2011 | DJSI Asia Pacific | Mitsubishi Corp. | Japan |

| 2011 | DJSI Asia Pacific | Mitsubishi Estate Co. Ltd. | Japan |

| 2011 | DJSI Asia Pacific | Mitsubishi UFJ Financial Group Inc. | Japan |

| 2011 | DJSI Asia Pacific | NTT DoCoMo Inc. | Japan |

| 2011 | DJSI Asia Pacific | Sumitomo Mitsui Trust Holdings Inc. | Japan |

| 2012 | DJSI Asia Pacific | JSR Corp. | Japan |

| 2012 | DJSI Asia Pacific | Kirin Holdings Co Ltd. | Japan |

| 2012 | DJSI Asia Pacific | Nitto Denko Corp. | Japan |

| 2012 | DJSI Asia Pacific | Sysmex Corp. | Japan |

| 2012 | DJSI Asia Pacific | Tokyu Land Corp. | Japan |

| 2013 | DJSI World | ITOCHU Corp. | Japan |

| 2013 | DJSI Asia/Pacific | Daiwa House Industry Co Ltd. | Japan |

| 2013 | DJSI Asia/Pacific | Eisai Co Ltd. | Japan |

| 2013 | DJSI Asia/Pacific | Inpex Corp. | Japan |

| 2013 | DJSI Asia/Pacific | ITOCHU Corp. | Japan |

| 2013 | DJSI Asia/Pacific | Sumitomo Electric Industries Ltd. | Japan |

| 2015 | DJSI World | Mitsubishi Corp. | Japan |

| 2015 | DJSI World | Nomura Holdings Inc. | Japan |

| 2015 | DJSI Asia Pacific | Honda Motor Co Ltd. | Japan |

| 2015 | DJSI Asia Pacific | Mizuho Financial Group | Japan |

| 2015 | DJSI Asia Pacific | Terumo Corp. | Japan |

| 2016 | DJSI World | Bridgestone Corp. | Japan |

| 2016 | DJSI World | Nissan Motor Co Ltd. | Japan |

| 2016 | DJSI Asia Pacific | Fast Retailing Co Ltd. | Japan |

| 2016 | DJSI Asia Pacific | Mitsui & Co Ltd. | Japan |

| 2016 | DJSI Asia Pacific | MS&AD Insurance Group Japan Holdings Inc. | Japan |

| 2016 | DJSI Asia Pacific | NTT DOCOMO Inc. | Japan |

| 2016 | DJSI Asia Pacific | Tokyo Electron Ltd. | Japan |

| 2017 | DJSI World | Honda Motor Co Ltd. | Japan |

| 2017 | DJSI World | NTT Docomo Inc. | Japan |

| 2017 | DJSI Asia Pacific | Kubota Corp. | Japan |

| 2017 | DJSI Asia Pacific | Mitsubishi Heavy Industries Ltd. | Japan |

| 2017 | DJSI Asia Pacific | Sekisui House Ltd. | Japan |

| 2018 | DJSI World | Nippon Telegraph & Telephone Corp. | Japan |

| 2018 | DJSI Asia Pacific | Chugai Pharmaceutical Co Ltd. | Japan |

| 2018 | DJSI Asia Pacific | Ricoh Co Ltd. | Japan |

| 2018 | DJSI Asia Pacific | Tokio Marine Holdings Inc. | Japan |

| 2019 | DJSI World | Takeda Pharmaceutical Co Ltd. | Japan |

| 2019 | DJSI Asia Pacific | Eisai Co Ltd. | Japan |

| 2019 | DJSI Asia Pacific | Meiji Holdings Co Ltd. | Japan |

| 2019 | DJSI Asia Pacific | Olympus Corp. | Japan |

| 2019 | DJSI Asia Pacific | Recruit Holdings Co Ltd. | Japan |

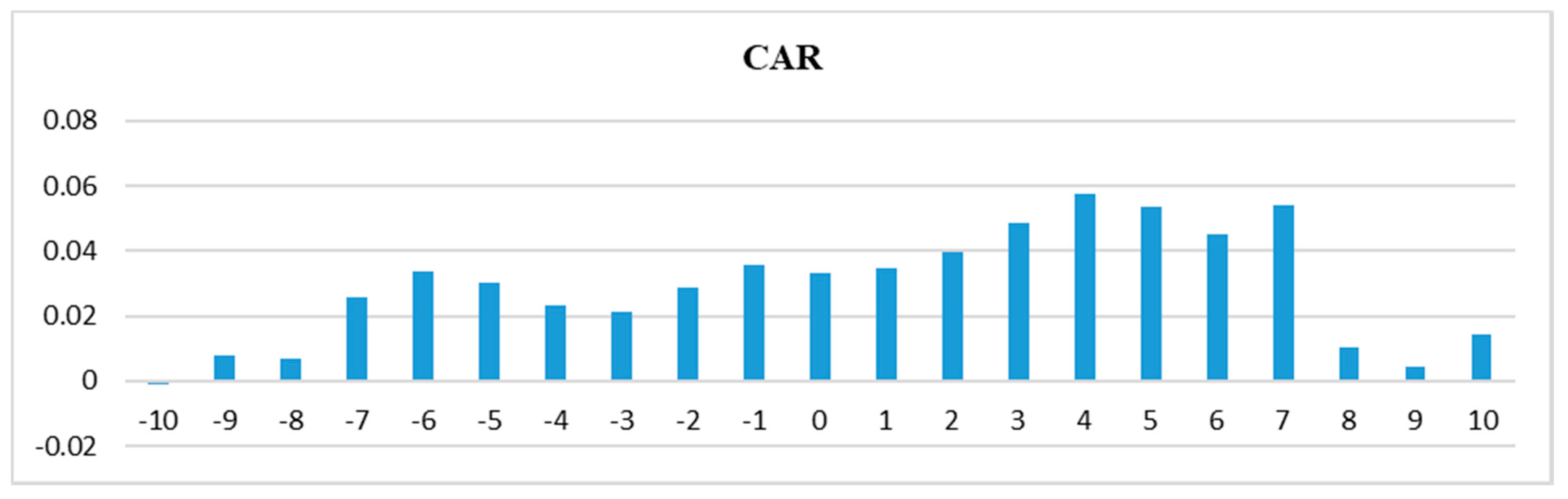

| Additions to the DJSIs 2010–2019 N = 49 | |||

|---|---|---|---|

| Day | CAR | Day | CAR |

| −10 | −0.0003 | 1 | 0.0268 |

| −9 | 0.0083 | 2 | 0.0316 |

| −8 | 0.0098 | 3 | 0.0434 |

| −7 | 0.0170 | 4 | 0.0455 |

| −6 | 0.0211 | 5 | 0.0428 |

| −5 | 0.0206 | 6 | 0.0394 |

| −4 | 0.0111 | 7 | 0.0394 |

| −3 | 0.0076 | 8 | 0.0246 |

| −2 | 0.0188 | 9 | 0.0137 |

| −1 | 0.0248 | 10 | 0.0148 |

| 0 | 0.0271 | ||

| Days | CAAR | t-Test p-Value |

|---|---|---|

| [−10, 10] | 1.480% | 0.1974 |

| [−2, 2] | 2.404% *** | 0.0031 |

| [−5, 5] | 2.166% ** | 0.0445 |

| [−1, 1] | 0.799% | 0.1129 |

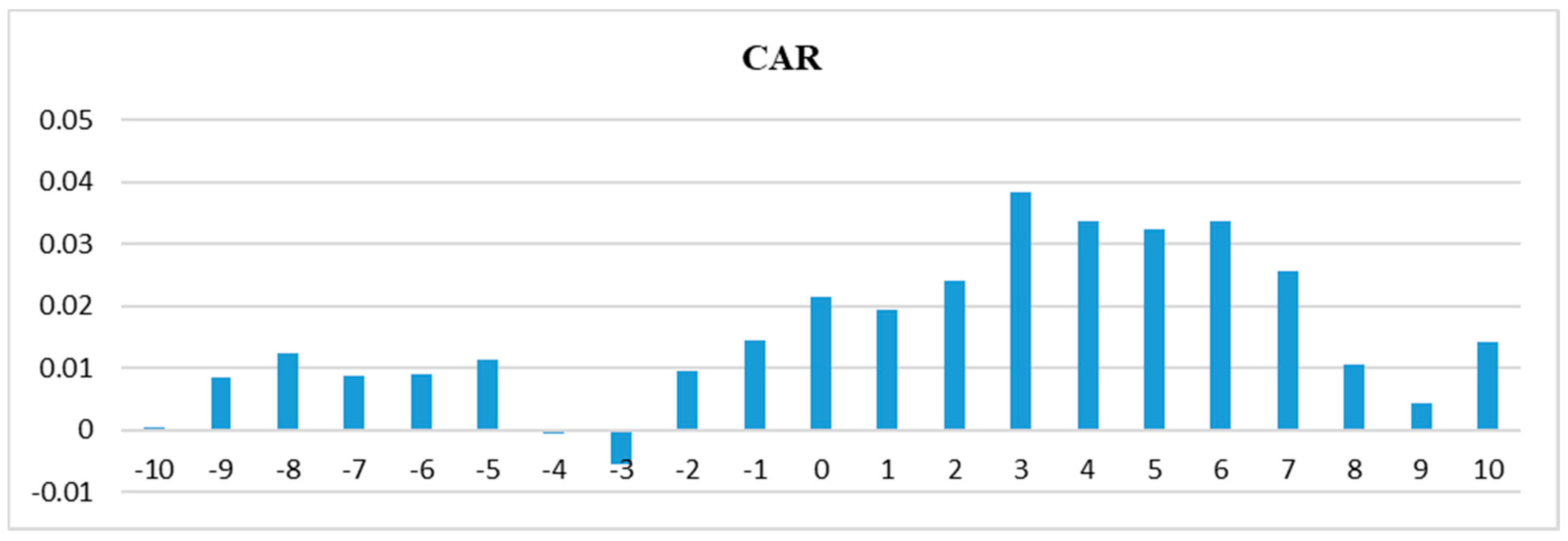

| Additions to the DJSIs, 2010–2019—Developed Countries N = 24 | |||

|---|---|---|---|

| Day | CAR | Day | CAR |

| −10 | −0.0012 | 1 | 0.0347 |

| −9 | 0.0081 | 2 | 0.0395 |

| −8 | 0.0070 | 3 | 0.0487 |

| −7 | 0.0256 | 4 | 0.0578 |

| −6 | 0.0339 | 5 | 0.0537 |

| −5 | 0.0304 | 6 | 0.0453 |

| −4 | 0.0233 | 7 | 0.0539 |

| −3 | 0.0212 | 8 | 0.0106 |

| −2 | 0.0286 | 9 | 0.0044 |

| −1 | 0.0355 | 10 | 0.0143 |

| 0 | 0.0331 | ||

| Additions to the DJSIs, 2010–2019—Emerging Countries N = 25 | |||

|---|---|---|---|

| Day | CAR | Day | CAR |

| −10 | 0.0005 | 1 | 0.0193 |

| −9 | 0.0085 | 2 | 0.0241 |

| −8 | 0.0124 | 3 | 0.0384 |

| −7 | 0.0087 | 4 | 0.0337 |

| −6 | 0.0089 | 5 | 0.0323 |

| −5 | 0.0112 | 6 | 0.0337 |

| −4 | −0.0006 | 7 | 0.0255 |

| −3 | −0.0055 | 8 | 0.0106 |

| −2 | 0.0095 | 9 | 0.0044 |

| −1 | 0.0145 | 10 | 0.0143 |

| 0 | 0.0214 | ||

| Event Window | CAAR | t-Test p-Value |

|---|---|---|

| [−10, 10] | 1.534% | 0.1214 |

| [−2, 2] | 1.826% ** | 0.0038 |

| [−5, 5] | 1.978% ** | 0.0217 |

| [−1, 1] | 0.611% | 0.1095 |

| Event Window | CAAR | t-Test p-Value |

|---|---|---|

| [−10, 10] | 1.429% | 0.3270 |

| [−2, 2] | 2.959% ** | 0.0330 |

| [−5, 5] | 2.346% | 0.1567 |

| [−1, 1] | 0.980% | 0.2091 |

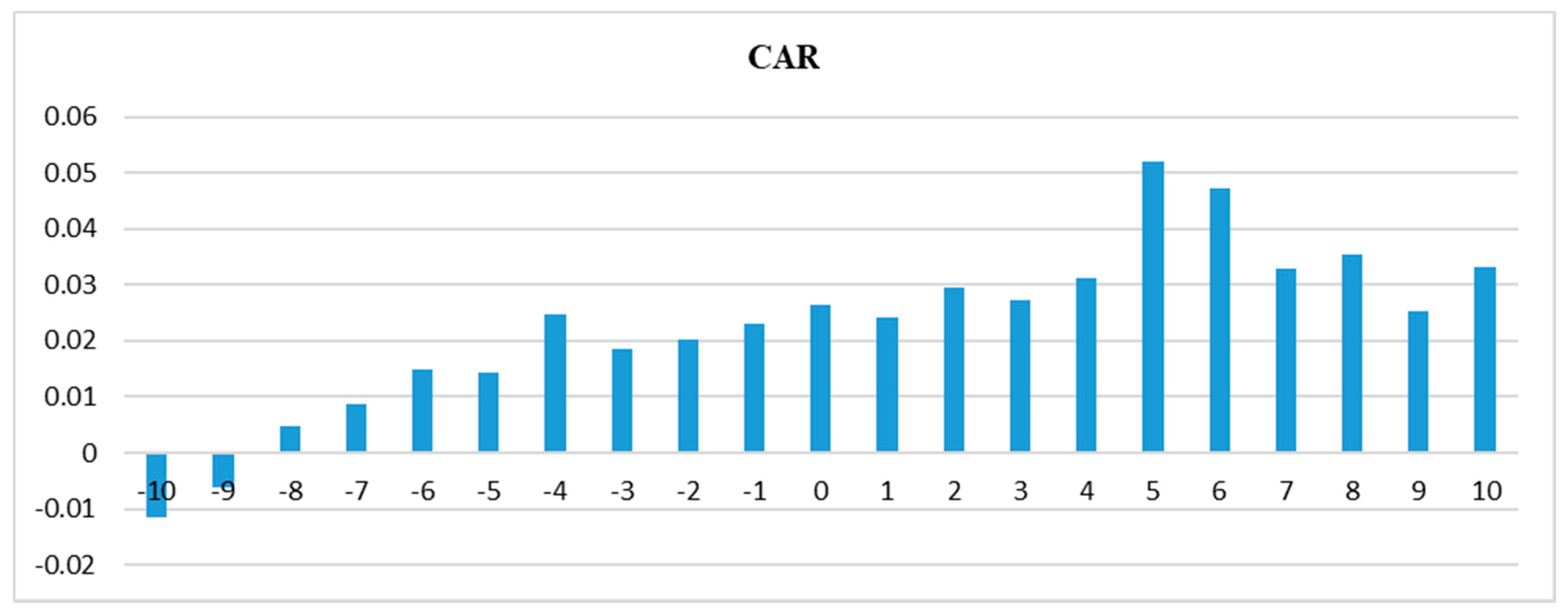

| Additions to the DJSIs, 2010–2019—French Companies N = 14 | |||

|---|---|---|---|

| Day | CAR | Day | CAR |

| −10 | −0.0281 | 1 | −0.0430 |

| −9 | −0.0094 | 2 | −0.0272 |

| −8 | 0.0089 | 3 | −0.0309 |

| −7 | 0.0248 | 4 | −0.0010 |

| −6 | 0.0348 | 5 | −0.0193 |

| −5 | 0.0284 | 6 | −0.0372 |

| −4 | 0.0054 | 7 | −0.0385 |

| −3 | −0.0135 | 8 | −0.0337 |

| −2 | −0.0078 | 9 | −0.0900 |

| −1 | −0.0061 | 10 | −0.0959 |

| 0 | −0.0265 | ||

| Event Window | CAAR | t-Test p-Value |

|---|---|---|

| [−10, 10] | −9.589% *** | 0.0001 |

| [−2, 2] | −1.367% * | 0.0818 |

| [−5, 5] | −5.419% *** | 0.0008 |

| [−1, 1] | −3.524% *** | 0.0001 |

| Additions to the DJSIs, 2010–2019—Japanese Companies N = 49 | |||

|---|---|---|---|

| Day | CAR | Day | CAR |

| −10 | −0.0116 | 1 | 0.0241 |

| −9 | −0.0063 | 2 | 0.0295 |

| −8 | 0.0049 | 3 | 0.0273 |

| −7 | 0.0087 | 4 | 0.0312 |

| −6 | 0.0149 | 5 | 0.0521 |

| −5 | 0.0144 | 6 | 0.0474 |

| −4 | 0.0249 | 7 | 0.0329 |

| −3 | 0.0185 | 8 | 0.0356 |

| −2 | 0.0203 | 9 | 0.0252 |

| −1 | 0.0230 | 10 | 0.0332 |

| 0 | 0.0264 | ||

| Event Window | CAAR | t-Test p-Value |

|---|---|---|

| [−10, 10] | 3.322% *** | 0.0015 |

| [−2, 2] | 1.100% ** | 0.0198 |

| [−5, 5] | 3.716% *** | 0.0000 |

| [−1, 1] | 0.376% | 0.1778 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tehrani, M.; Rathgeber, A.; Fulton, L.; Schmutz, B. Sustainability & CSR: The Relationship with Hofstede Cultural Dimensions. Sustainability 2021, 13, 12052. https://doi.org/10.3390/su132112052

Tehrani M, Rathgeber A, Fulton L, Schmutz B. Sustainability & CSR: The Relationship with Hofstede Cultural Dimensions. Sustainability. 2021; 13(21):12052. https://doi.org/10.3390/su132112052

Chicago/Turabian StyleTehrani, Minoo, Andreas Rathgeber, Lawrence Fulton, and Bryan Schmutz. 2021. "Sustainability & CSR: The Relationship with Hofstede Cultural Dimensions" Sustainability 13, no. 21: 12052. https://doi.org/10.3390/su132112052

APA StyleTehrani, M., Rathgeber, A., Fulton, L., & Schmutz, B. (2021). Sustainability & CSR: The Relationship with Hofstede Cultural Dimensions. Sustainability, 13(21), 12052. https://doi.org/10.3390/su132112052