The Relationship between Consumption and CO2 Emissions: Evidence for Portugal

Abstract

1. Introduction

2. The Methodological Approach

2.1. The Basic Framework

2.2. The Empirical Model

3. Data Sources and Summary Statistics

3.1. Data Sources

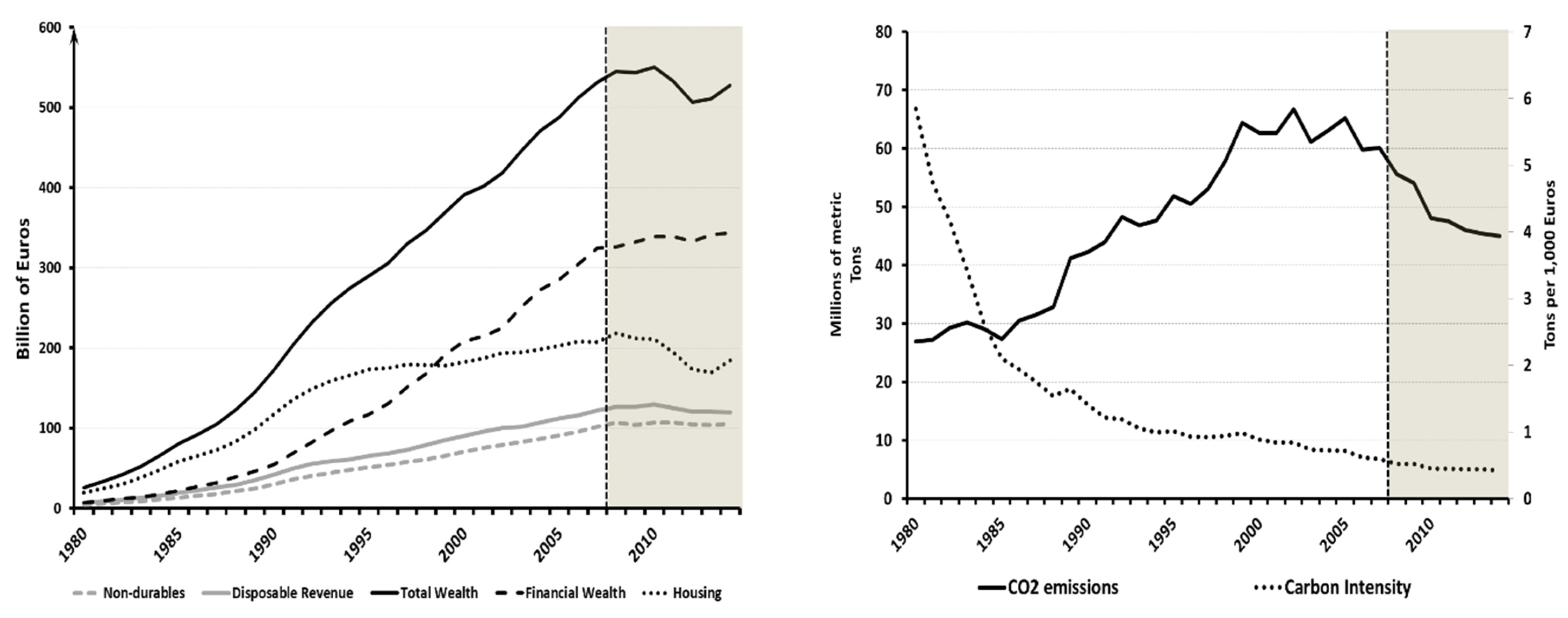

3.2. Summary Statistics

4. Preliminary Data Analysis

4.1. Unit Roots Tests

4.2. Cointegration Tests

5. On the Effects of Economic Variables and CO2 Emissions

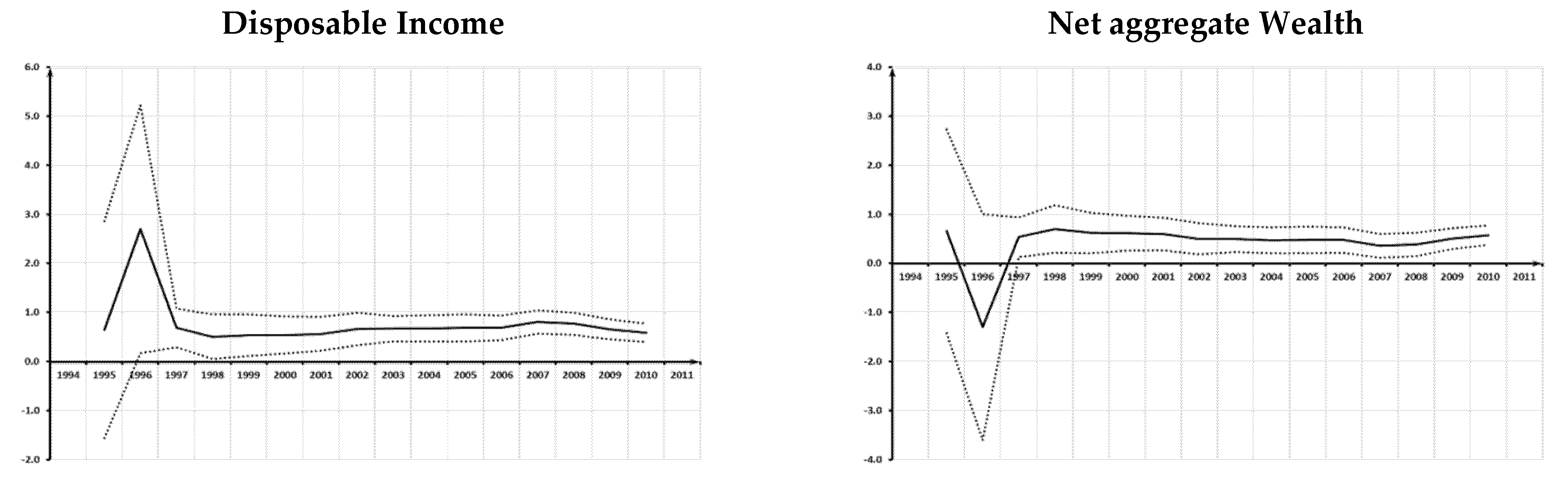

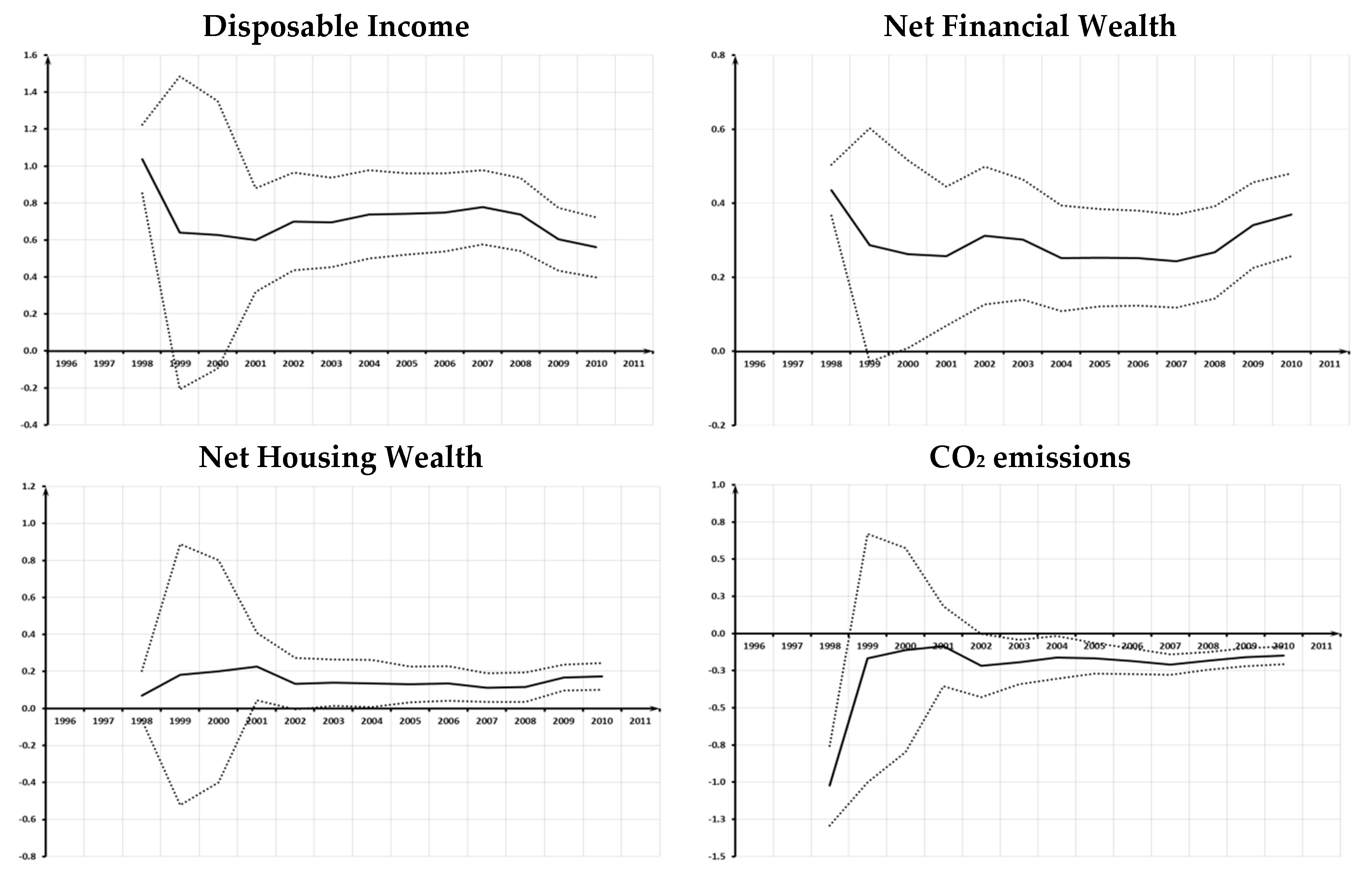

5.1. Empirical Estimates: On the Effects of the Economic Variables

5.2. Empirical Estimates: On the Effects of Carbon Emissions

6. On the Robustness of the Empirical Estimates

6.1. Diagnostic Analysis

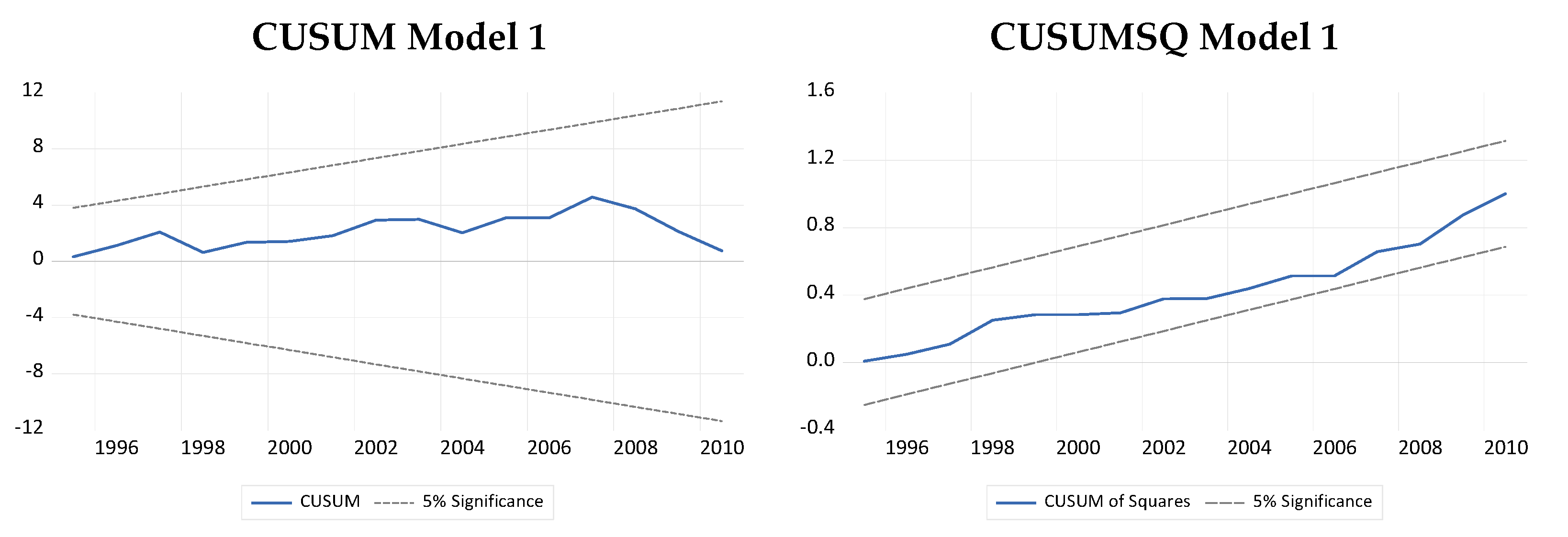

6.2. On the Stability of the Estimated Parameters

7. Summary and Conclusions

8. Policy Implications

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Dasgupta, P.; Heal, G. The Optimal Depletion of Exhaustible Resources. Rev. Econ. Stud. 1974, 3, 28. [Google Scholar] [CrossRef]

- Tahvonen, O.; Kuuluvainen, J. Economic Growth, Pollution and Renewable Resources. J. Environ. Econ. Manag. 1993, 24, 101–118. [Google Scholar] [CrossRef]

- Eakin, D.; Selde, T. Stoking the fires? CO2 emissions and economic growth. J. Public Econ. 1995, 57, 85–101. [Google Scholar] [CrossRef]

- Michell, P.; Rotillon, G. Disutility of Pollution and Endogenous Growth. Environ. Resour. Econ. 1995, 6, 279–300. [Google Scholar]

- Smulders, S. Endogenous Growth Theory and the Environment. In Handbook of Environmental and Resource Economics; van der Berg, J.C.J.M., Ed.; Edward Elgar: Cheltenham, UK, 1999. [Google Scholar]

- Smulders, S. Economic Growth and Environmental Quality. In Principles of Environmental Economics; Folmer, H., Gabel, L., Eds.; Edward Elgar: Cheltenham, UK, 2000. [Google Scholar]

- Xepapadeas, A. Economic Growth and the Environment. In Handbook of Environmental Economics, 1st ed.; Mäler, K., Vincent, J., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume 3, pp. 1219–1271. [Google Scholar]

- Belbute, J.; Brito, P. On Sustainable Endogenous Growth Under Intertemporally Dependent Preferences. Icfai J. Environ. Econ. 2008, VI, 7–28. [Google Scholar]

- Kijima, M.; Nishide, K.; Ohyama, A. Economic models for the environmental Kuznets curve: A survey. J. Econ. Dyn. Control 2010, 34, 1187–1201. [Google Scholar] [CrossRef]

- Heal, G. The use of common property resources. In Explorations in Natural Resource Economics; Smith, V.K., Krutilla, J.V., Eds.; The Johns Hopkins University Press for Resources for the Future: Baltimore, MD, USA, 1982. [Google Scholar]

- Bosi, S.; Desmarchelier, D. Limit Cycles Under a Negative Effect of Pollution on Consumption Demand: The role of an environmental Kuznets Curve. Environ. Resour. Econ. 2018, 69, 343–363. [Google Scholar] [CrossRef]

- Carroll, C.D.; Overland, J.; Weil, D.N. Saving and Growth with Habit Formation. Am. Econ. Rev. 2000, 90, 341–355. [Google Scholar] [CrossRef]

- Finkelstein, A.; Luttmer, E.; Notowidigdo, M. What good is wealth without health? The effect of health on the marginal utility of consumption. J. Eur. Econ. Assoc. 2013, 11, 221–258. [Google Scholar] [CrossRef]

- WHO. World Health Organization Global Ambient Air Quality Database (Update 2018); WHO: Geneva, Switzerland, 2018. [Google Scholar]

- WHO. COP24 Special Report: Health and Climate Change; Licen/ce: CC BY-NC-SA 3.0 IGO; World Health Organization: Geneva, Switzerland, 2018. [Google Scholar]

- IPCC. Special Report on Global Warming of 1.5 °C (SR15); Intergovernmental Panel on Climate Change Annual Report, UNEP; UN: New York, NY, USA, 2018. [Google Scholar]

- Kampa, M.; Castanas, E. Human health effects of air pollution. Environ. Pollut. 2008, 151, 362–367. [Google Scholar] [CrossRef]

- Borowski, P.F. Environmental pollution as a threats to the ecology and development in Guinea Conakry. Environ. Prot. Nat. Resour. 2017, 28, 27–32. [Google Scholar] [CrossRef]

- Munksgaard, J.; Pedersen, K.; Wien, M. Impact of household consumption on CO2 emissions. Energy Econ. 2000, 22, 423–440. [Google Scholar] [CrossRef]

- Salo, M.; Nissinen, A. Consumption Choices to Decrease Personal Carbon Footprints of Finns; Report of the Finnish Environmental Institute, 30/2017; Finnish Environment Institute: Helsinki, Finland, 2017. [Google Scholar]

- QEPiC 2030. Quadro Estratégico da Política Climática; Agência Portuguesa do Ambiente: Lisboa, Portugal, 2015. [Google Scholar]

- RNC2050. Roteiro para a Neutralidade Carbónica/Roadmap for Carbon Neutrality; Agência Portuguesa do Ambiente: Lisboa, Portugal, 2019. [Google Scholar]

- UNFCC. The United Nations Framework Convention on Climate Change; COP24, COP25 and COP26; UN: New York, NY, USA, 1992. [Google Scholar]

- Żelaziński, T.; Ekielski, A.; Siwek, A.; Dardziński, L. Characterisation of corn extrudates with the addition of brewers’ spent grain as a raw material for the production of functional batters. Acta Sci. Polonorum. Technol. Aliment. 2017, 16, 247–254. [Google Scholar]

- Friedman, M. A Theory of the Consumption Function; Milton General Series No. 63; Princeton University Press: Princeton, NJ, USA, 1957. [Google Scholar]

- Ando, A.; Modigliani, F. The Life Cycle Hypothesis of Saving: Aggregate Implications and tests. Am. Econ. Rev. 1963, 53, 55–84. [Google Scholar]

- Hall, R.E. Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence. J. Political Econ. 1978, 86, 971–987. [Google Scholar] [CrossRef]

- Phillips, P.; Durlauf, S. Multiple time series regression with integrated process. Rev. Econ. Stud. 1986, 53, 473–495. [Google Scholar] [CrossRef]

- Stock, J.; Watson, M. A Simple Estimator of Cointegrating Vectors in Higher Order Integrated Systems. Econometrica 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Le Quére, C.; Moriarty, R.; Andrew, R.M.; Canadell, J.G.; Sitch, S.; Korsbakken, J.I.; Friedlingstein, P.; Peters, G.P.; Andres, R.J.; Boden, T.A.; et al. Global Carbon Budget 2015. Earth System Science Data 2015, 7, 349–396. [Google Scholar] [CrossRef]

- Boden, T.A.; Marland, G.; Andres, R.J. Global, Regional, and National Fossil-Fuel CO2 Emissions; Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy: Oak Ridge, TN, USA, 2016. [CrossRef]

- Lettau, M.; Ludvigson, S. Understanding trend and cycle in asset values: Reevaluating the wealth effect on consumption. Am. Econ. Rev. 2004, 94, 276–299. [Google Scholar] [CrossRef]

- Castro, G. The wealth effect on consumption in the Portuguese economy. Econ. Bull. 2007, 13, 37–55. Available online: https://www.bportugal.pt/sites/default/files/anexos/papers/ab200713_e.pdf (accessed on 12 August 2021).

- Sousa, R. Wealth Effects on Consumption: Evidence from the Euro Area. Banks Bank Syst. 2010, 5, 70–78. [Google Scholar]

- Belbute, J.; Pereira, A. An Alternative Reference Scenario for Global CO2 Emissions from Fuel Consumption: An ARFIMA Approach. Econ. Lett. 2015, 135, 108–111. [Google Scholar] [CrossRef]

- Belbute, J.; Pereira, A. Do Global CO2 Emissions from Fossil-Fuel Consumption Exhibit Long Memory? A Fractional Integration Analysis. Appl. Econ. 2017, 49, 4055–4070. [Google Scholar] [CrossRef]

- Shin, Y. A Residual–based test of the null of cointegration against the alternative of no cointegration. Econom. Theory 1994, 10, 91–115. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C. Cointegration and error correction representation: Estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Newey, W.; West, K. A Simple, Positive Semi-definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica. 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Charemza, W. Cointegration in Small Samples: Empirical Percentiles, Drifting Moments and Customized Testing. Oxf. Bull. Econ. Stat. 1990, 52, 303–315. [Google Scholar]

- Mackinnon, J. Critical Values for Cointegration Tests. In Long Run Economic Relationships, Readings in Cointegration; Granger, C., Engle, R., Eds.; Oxford University Press: Oxford, UK, 1991. [Google Scholar]

- Johansen, S. Statistical Analysis of Cointegration Vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Osterwald-Lenum, M. A Note with Quantiles of the Asymptotic Distribution of the Maximum Likelihood Cointregration Rank Test Statistics. Oxf. Bull. Econ. Stat. 1992, 54, 461–472. [Google Scholar] [CrossRef]

- Cardoso, F.; Farinha, L.; Lameira, R. Household Wealth in Portugal, Revised Series; Occasional Papers, 1/2008; Bank of Portugal: Lisboa, Portugal, 2008. [Google Scholar]

- Poterba, J.; Samwick, A. Stock Ownership Patterns, Stock Market Fluctuations and Consumption. Brook. Pap. Econ. Act. 1995, 2, 295–372. [Google Scholar] [CrossRef]

- Case, K.; Shiller, R.; Quigley, J. Comparing Wealth Effects: The Stock Market Versus the Housing Market. Adv. Macroecon. 2005, 5, 1–32. [Google Scholar] [CrossRef]

- Jarque, C.; Bera, A. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ. Lett. 1980, 6, 255–259. [Google Scholar] [CrossRef]

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Breusch, T.; Pagan, A. A Simple Test for Heteroskedasticity and Random Coefficient Variation. Econometrica 1979, 47, 1287–1294. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. inflation. Econometrica 1982, 50, 987–1008. [Google Scholar] [CrossRef]

- Breusch, T. Testing for Autocorrelation in Dynamic Linear Models. Aust. Econ. Pap. 1978, 17, 334–355. [Google Scholar] [CrossRef]

- Godfrey, L. Testing Against General Autoregressive and Moving Average Error Models when the Regressors Include Lagged Dependent Variables. Econometrica 1978, 46, 1293–1301. [Google Scholar] [CrossRef]

- Agenda 2030. The EU Strategy on Adaptation to Climate Change, European Commission (2014). A Policy Framework for Climate and Energy in the Period 2020 up to 2030. Communication from the Commission. Available online: http://bit.ly/1Qs1ZKx (accessed on 17 March 2017).

| Disposable Income | Nondurable Consumption | Total Net Wealth | Shares (%) | CO2 Emissions (106 Tons) | Carbon Intensity 1 | ||

|---|---|---|---|---|---|---|---|

| 106 Euros | Net Finantial Wealth | Nonmortage Housing Wealth | |||||

| 1980–1985 | 12,254.03 | 8412.30 | 49,943.93 | 27.29 | 72.71 | 28.33 | 3.80 |

| 1986–1990 | 31,138.38 | 21,998.52 | 127,447.67 | 31.04 | 68.96 | 35.67 | 1.66 |

| 1991–1995 | 57,969.16 | 43,981.90 | 251,332.27 | 37.39 | 62.61 | 47.71 | 1.10 |

| 1996–2000 | 79,156.98 | 61,760.26 | 348,464.25 | 48.42 | 51.58 | 57.68 | 0.93 |

| 2001–2005 | 103,168.50 | 82,926.64 | 444,950.14 | 55.97 | 44.03 | 63.79 | 0.77 |

| 2006–2010 | 124,121.80 | 103,042.34 | 536,522.48 | 60.59 | 39.41 | 55.54 | 0.54 |

| 2011–2014 | 121,452.53 | 105,214.23 | 519,635.47 | 65.29 | 34.71 | 45.99 | 0.44 |

| Overall sample | |||||||

| μ | 72,488.81 | 58,282.26 | 312,051.13 | 45.49 | 54.51 | 47.31 | 1.42 |

| seμ | 7016.99 | 6073.32 | 30,534.06 | 2.36 | 2.36 | 2.12 | 0.21 |

| CV | 0.10 | 0.10 | 0.10 | 0.05 | 0.04 | 0.04 | 0.15 |

| Variables | Deterministic Component | Lags | t-Stat ADF | BIC | |

|---|---|---|---|---|---|

| Logs | |||||

| Consumption of nondurables | Constant and trend | 0 | −3.041 | −147.153 | |

| Disposable income | Constant and trend | 1 | −2.101 | −142.136 | |

| Net total wealth | None | 1 | 0.516 | −140.927 | |

| Net finantial wealth | Constant and trend | 0 | −1.094 | −132.537 | |

| Non finantial wealth (housing) | None | 1 | 0.652 | −108.157 | |

| Per capita CO2 emissions | Constant | 0 | −1.870 | −83.047 | |

| First Differences (Logs) | |||||

| Consumption of nondurables | Constant and trend | 1 | −3.564 | ** | −137.999 |

| Disposable income | None | 0 | −2.283 | ** | −141.462 |

| Net total wealth | None | 0 | −2.507 | ** | −144.142 |

| Net finantial wealth | Constant and trend | 1 | −5.700 | *** | −128.928 |

| Non finantial wealth (housing) | None | 0 | −2.105 | ** | −111.204 |

| Percapita CO2 emissions | Constant and trend | 0 | −6.124 | *** | −79.558 |

| Lags | Cμ | |

|---|---|---|

| Model 1 | Model 2 | |

| 1 | 0.081 | 0.037 |

| 2 | 0.086 | 0.050 |

| 3 | 0.109 | 0.063 |

| 4 | 0.141 | 0.087 |

| Critical value (5%) | 0.159 | |

| Deterministic Component | Lags | t-Stat ADF | BIC | |

|---|---|---|---|---|

| Model 1 | ||||

| None | 0 | −4.932 | *** | −164.356 |

| Constant | 0 | −4.823 | ** | −161.137 |

| Constant and trend | 3 | −4.930 | ** | −143.678 |

| Model 2 | ||||

| None | 0 | −6.293 | *** | −168.912 |

| Constant | 0 | −6.150 | *** | −165.875 |

| Constant and trend | 0 | −6.145 | *** | −163.795 |

| Eigenvalues | λ-Trace Test | λ-Max Test | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| H0 | HA | Statistic | Critical Value | H0 | HA | Statistic | Critical Value | |||

| Model 1 (Aggregate Wealth) | ||||||||||

| 0.976 | r = 0 | r ≥ 1 | 157.28 | 53.12 | * | r = 0 | r = 1 | 127.02 | 28.14 | * |

| 0.414 | r ≤ 1 | r = 2 | 30.26 | 34.91 | r ≤ 1 | r = 2 | 18.16 | 22.00 | ||

| 0.255 | r ≤ 2 | r = 3 | 12.10 | 19.96 | r ≤ 2 | r = 3 | 10.03 | 15.67 | ||

| 0.059 | r ≤ 3 | r = 4 | 2.07 | 9.24 | r ≤ 3 | r = 4 | 2.07 | 9.24 | ||

| Model 2 (Disaggregate Wealth) | ||||||||||

| 0.661 | r = 0 | r ≥ 1 | 92.68 | 76.07 | * | r = 0 | r = 1 | 35.68 | 34.40 | * |

| 0.531 | r ≤ 1 | r = 2 | 52.00 | 53.12 | r ≤ 1 | r = 2 | 24.95 | 28.14 | ||

| 0.411 | r ≤ 2 | r = 3 | 32.04 | 34.91 | r ≤ 2 | r = 3 | 17.46 | 22.00 | ||

| 0.251 | r ≤ 3 | r = 4 | 14.59 | 19.96 | r ≤ 3 | r = 4 | 9.55 | 15.67 | ||

| 0.142 | r ≤ 4 | r = 5 | 5.04 | 9.24 | r ≤ 4 | r = 5 | 5.04 | 9.24 | ||

| Parameter | Model 1 | Model 2 | ||||||

|---|---|---|---|---|---|---|---|---|

| Elasticity | MPC | Elasticity | MPC | |||||

| Contant (α) | −2.457 | (0.215) | *** | −1.273 | (0.157) | *** | ||

| Disposable Income (βyd) | 0.588 | (0.076) | *** | 0.45 | 0.561 | (0.071) | *** | 0.43 |

| Net Wealth (βw) | 0.575 | (0.077) | *** | 0.10 | ||||

| Net Financial Wealth (βwf) | 0.369 | (0.054) | *** | 0.16 | ||||

| Net Housing Wealth (βwh) | 0.174 | (0.018) | *** | 0.06 | ||||

| CO2 Emissions (βco2) | −0.121 | (0.021) | *** | −0.14 | −0.148 | (0.021) | *** | −0.17 |

| Diagnostic Analysis | ||||||||

| Residual Sum of Squares (RSS) | 0.002 | 0.001 | ||||||

| DW | 2.011 | 2.007 | ||||||

| Log-Likelihood | 87.635 | 94.003 | ||||||

| BIC | −142.689 | −146.652 | ||||||

| RESET (F-test) | 3.906 | [0.067] | 1.109 | [0.313] | ||||

| F-Test (all coefficients) | 35,166 | [0.000] | 176,189 | [0.000] | ||||

| F[m,(T-k)] test for βco2 = 0 | 29.963 | [0.000] | 27.111 | [0.000] | ||||

| Jarque-Bera | 2.967 | [0.227] | 0.360 | [0.835] | ||||

| LM-White test | 20.720 | [0.294] | 20.425 | [0.672] | ||||

| LM-Breusch-Pagan test | 4.402 | [0.883] | 7.622 | [0.814] | ||||

| LM-ARCH (1) | 1.386 | [0.239] | 1.948 | [0.163] | ||||

| LM-ARCH (5) | 2.149 | [0.828] | 4.736 | [0.449] | ||||

| LM-ARCH (10) | 8.534 | [0.577] | 7.772 | [0.651] | ||||

| LM (2) | 0.304 | [0.858] | 2.404 | [0.301] | ||||

| LM (5) | 9.154 | [0.103] | 21.639 | [0.001] | ||||

| LM (10) | 17.632 | [0.062] | 24.721 | [0.006] | ||||

| Q1 | 0.059 | [0.965] | 0.029 | [0.864] | ||||

| Q5 | 5.205 | [0.391] | 12.037 | [0.034] | ||||

| Q12 | 12.649 | [0.395] | 21.042 | [0.051] | ||||

| Q21 | 1.592 | [0.207] | 2.210 | [0.137] | ||||

| Q25 | 2.719 | [0.743] | 8.328 | [0.139] | ||||

| Q212 | 9.300 | [0.677] | 12.081 | [0.439] | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Belbute, J.M.; Pereira, A.M. The Relationship between Consumption and CO2 Emissions: Evidence for Portugal. Sustainability 2021, 13, 12153. https://doi.org/10.3390/su132112153

Belbute JM, Pereira AM. The Relationship between Consumption and CO2 Emissions: Evidence for Portugal. Sustainability. 2021; 13(21):12153. https://doi.org/10.3390/su132112153

Chicago/Turabian StyleBelbute, José M., and Alfredo M. Pereira. 2021. "The Relationship between Consumption and CO2 Emissions: Evidence for Portugal" Sustainability 13, no. 21: 12153. https://doi.org/10.3390/su132112153

APA StyleBelbute, J. M., & Pereira, A. M. (2021). The Relationship between Consumption and CO2 Emissions: Evidence for Portugal. Sustainability, 13(21), 12153. https://doi.org/10.3390/su132112153