Low-Carbon Development for the Iron and Steel Industry in China and the World: Status Quo, Future Vision, and Key Actions

Abstract

:1. Introduction

- ●

- This paper provides a timely and comprehensive overview of the low-carbon technology roadmap around the main steel production countries in the world, covering status quo, future vision, and key actions.

- ●

- Referring to the low-carbon technology roadmaps published by other steel-producing countries and to the actual situation in China, key actions available for the decarbonization of China’s ISI are evaluated one by one, including improving energy efficiency, shifting to Scrap/EAF route, promoting material efficiency strategy, and deploying radical innovation technologies.

- ●

- Suggestions on policy recommendations and next-step research priorities are given for the low-carbon development of China’s ISI.

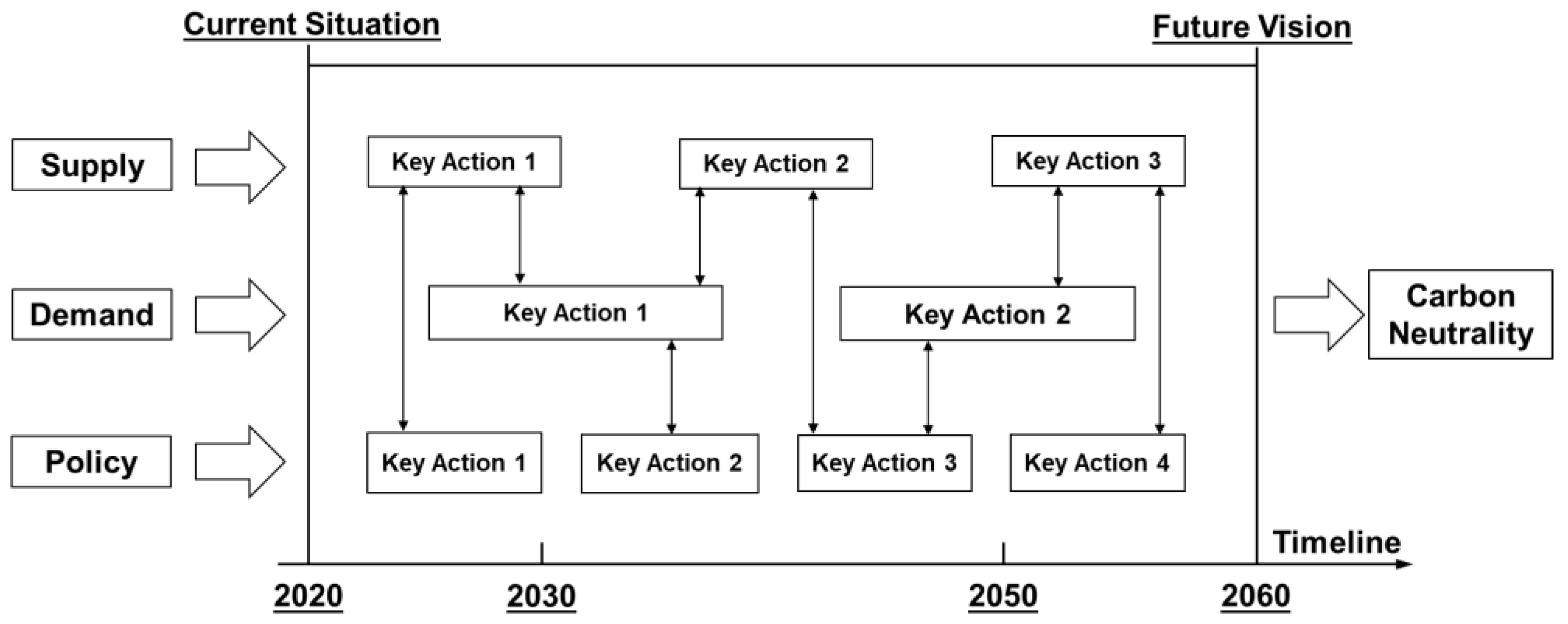

2. The Technology Roadmap Framework

- ●

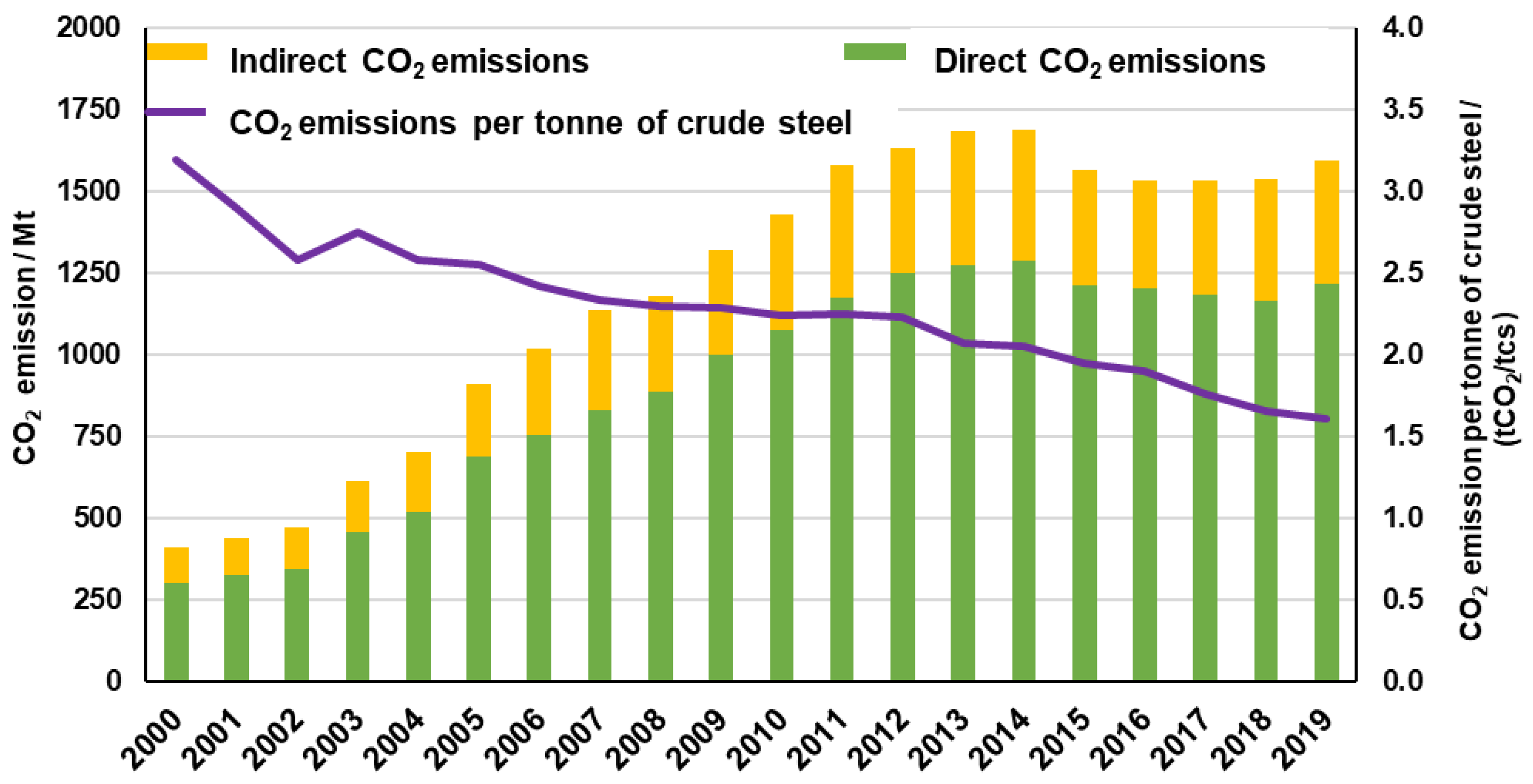

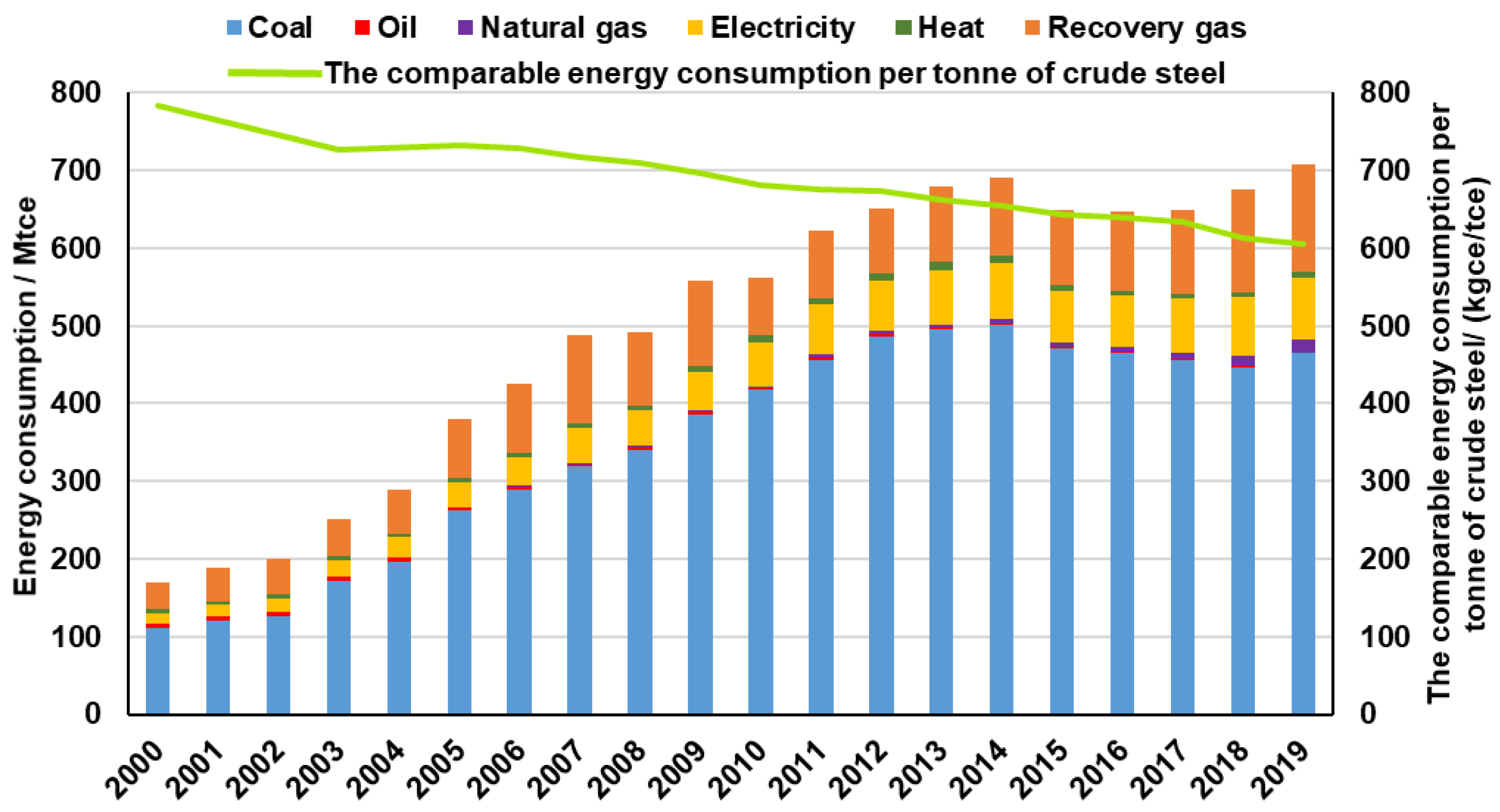

- What is the current status of CO2 emissions for the global and China’s the ISI?

- ●

- What is the future vision set for the low-carbon development of the ISI in China and the world?

- ●

- How can the ISI, in China and the world, achieve the low-carbon development vision?

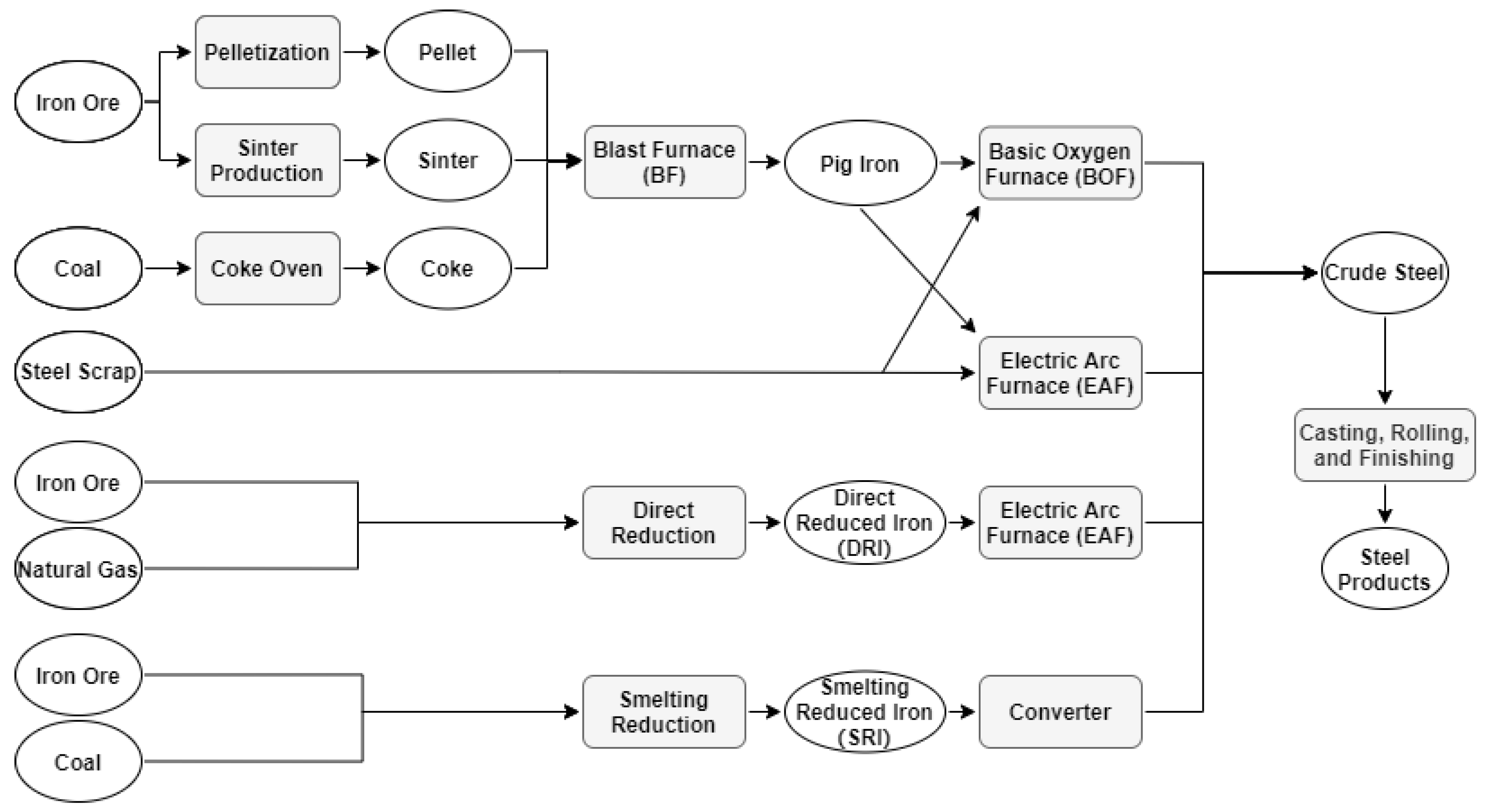

3. Iron and Steel Metallurgical Process

- ●

- The BF/BOF route is the most common primary steel production route around the world, accounting for a 72% share of the world’s steel production, as listed in Table 1. It is a two-stage process composed of ironmaking in the blast furnace (BF) and steelmaking in the basic oxygen furnace (BOF). First, the iron ore is sintered or pelletized and then fed to the blast furnace. Second, in the blast furnace (BF), iron ore is reduced to pig iron with coke. Then, in the basic oxygen furnace (BOF), the pig iron is refined into crude steel, where impurities (such as C and Si) are removed under high purity oxygen at a temperature above 1600 °C. The blast furnace (BF) is the most energy-intensive step in the BF/BOF route, and generates large quantities of CO2, accounting for approximately 72% of the total energy expended in the BF/BOF route, or around 16 GJ per ton of crude steel [32].

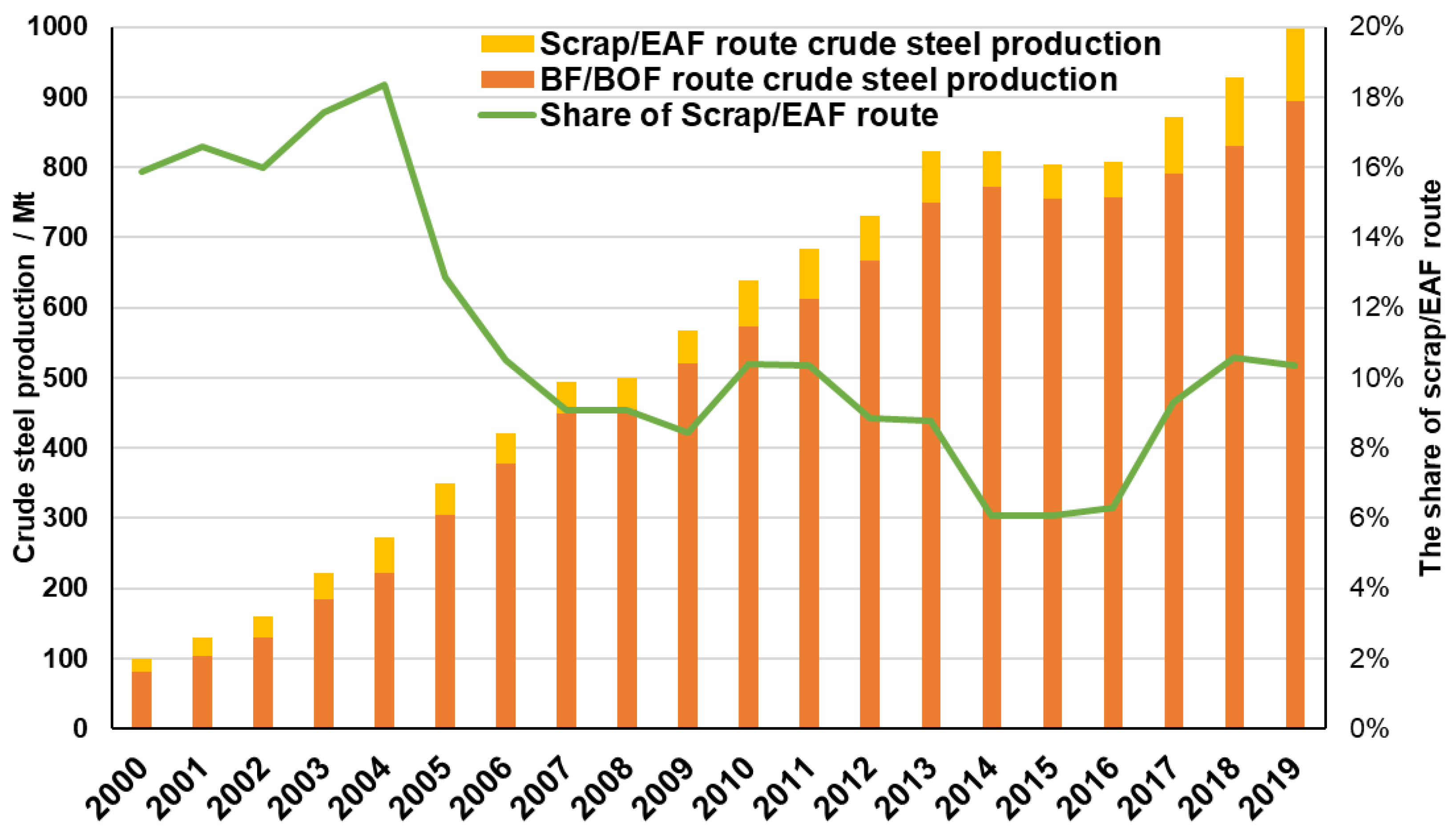

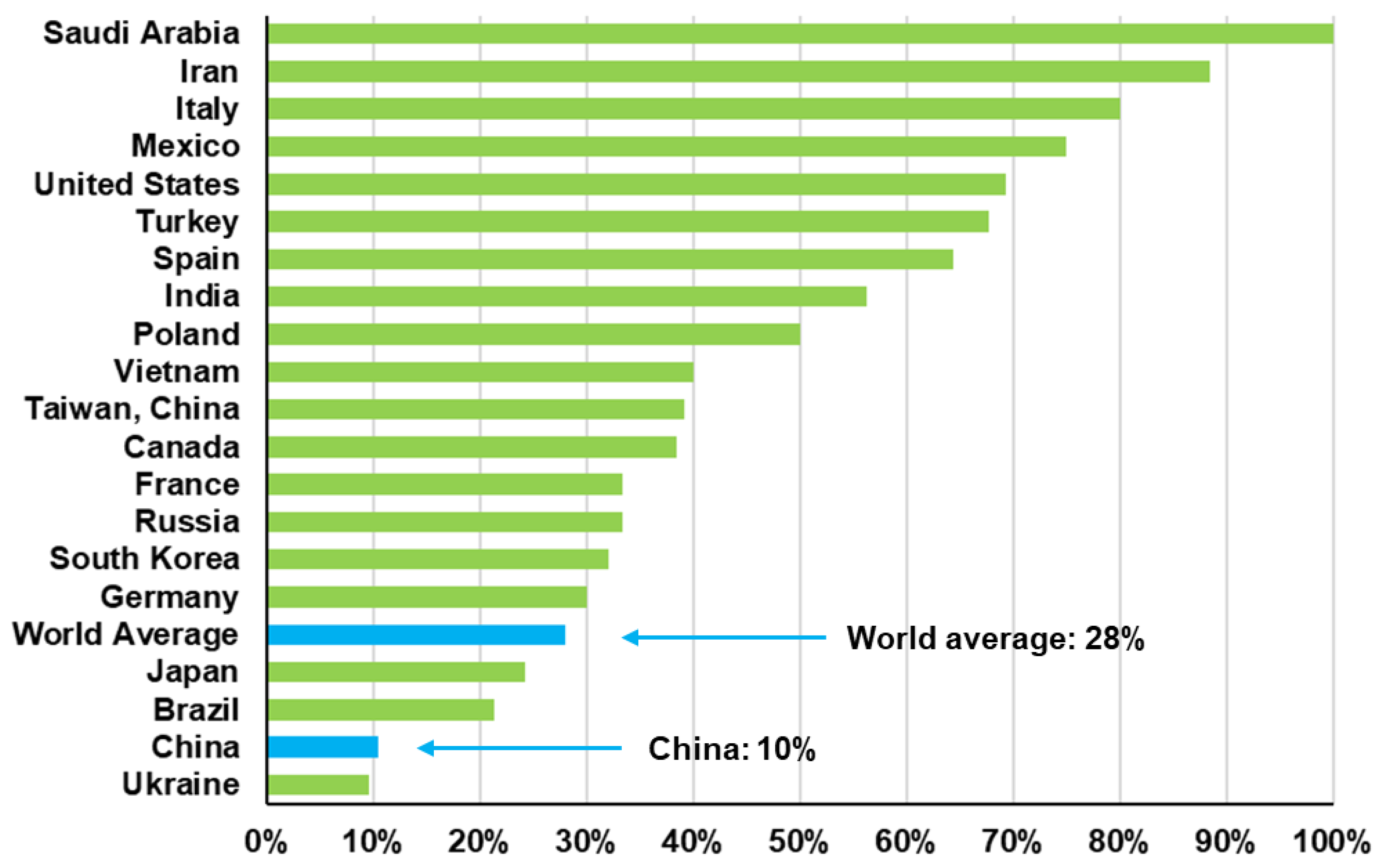

- ●

- The scrap/EAF route is the main secondary steel-production route, accounting for a 28% share of the world’s steel production, as listed in Table 1. The recycled scrap steel is melted by high-power electric arcs to produce crude steel in the electric arc furnace (EAF) at a very high temperature of above 4000 °C. The scrap/EAF route uses recycled scrap steel to produce crude steel and does not require coke as a reducing agent, which consumes less energy and emits significantly lower CO2 than the BF/BOF route. As evaluated by Zhang, et al., [33], the average energy consumed in the scrap/EAF route is about 0.30 tce/tcs (tonne coal equivalent per ton of crude steel), whereas that for the BF/BOF route is 0.50 tce/tcs. As for CO2 emission, the steel produced by the scrap/EAF route leads to 0.6 tCO2/tcs (ton CO2 per tonne of crude steel), while the integrated BF/BOF route emits 2.1 tCO2/tcs. Furthermore, if the electricity used in the scrap/EAF route can be generated by net-zero emission renewable energy sources, the scrap/EAF route will be deeply decarbonized. Hence, the scrap/EAF route is considered a promising steel-production route with huge CO2 emission reduction potential.

- ●

- The Direct Reduced Iron (DRI)/EAF route is an alternative to the primary steel production of the BF/BOF route. In the direct reduction process, the iron ore is reduced by natural gas (or coal in some cases) directly to iron in its solid state at a low temperature. Unlike in the blast furnace (BF), the iron ore is not melted, and the removal of oxygen leaves large numbers of micropores in the direct reduced iron, also called “sponge iron”. Direct reduced iron generally has higher purity than pig iron from the blast furnace (BF) process, and is a better raw material for electric arc furnaces (EAF), usable as an alternative to scrap steel.

- ●

- Smelting reduced iron (SRI) is an alternative to the blast furnace (BF) and is developed to overcome the consumption of energy-intensive coke. In this process, the iron ore is reduced in its molten state at a very high temperature, resulting in hot liquid iron. Unlike in the blast furnace (BF), the coal is gasified and used as the reducing agent. Several SRI processes have been commercially proven, such as HIsarna, COREX, FINEX, and the ITmK3 project [30].

4. The Low-Carbon Development of the ISI around the World

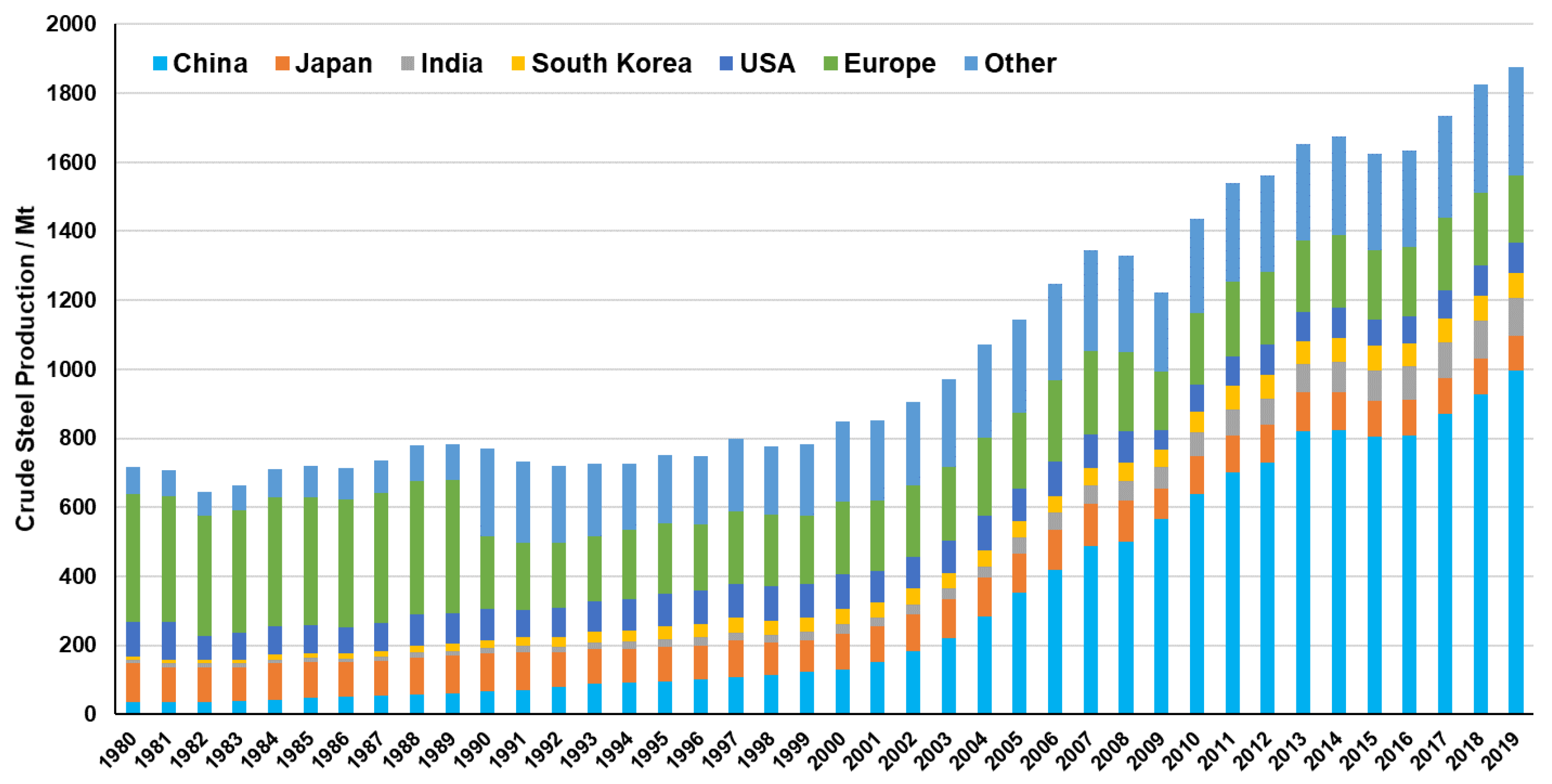

4.1. The Whole World

4.1.1. Overview of the World ISI

4.1.2. Low-Carbon Technology Roadmap for the Whole World

4.2. Main Steel Production Countries

4.2.1. India

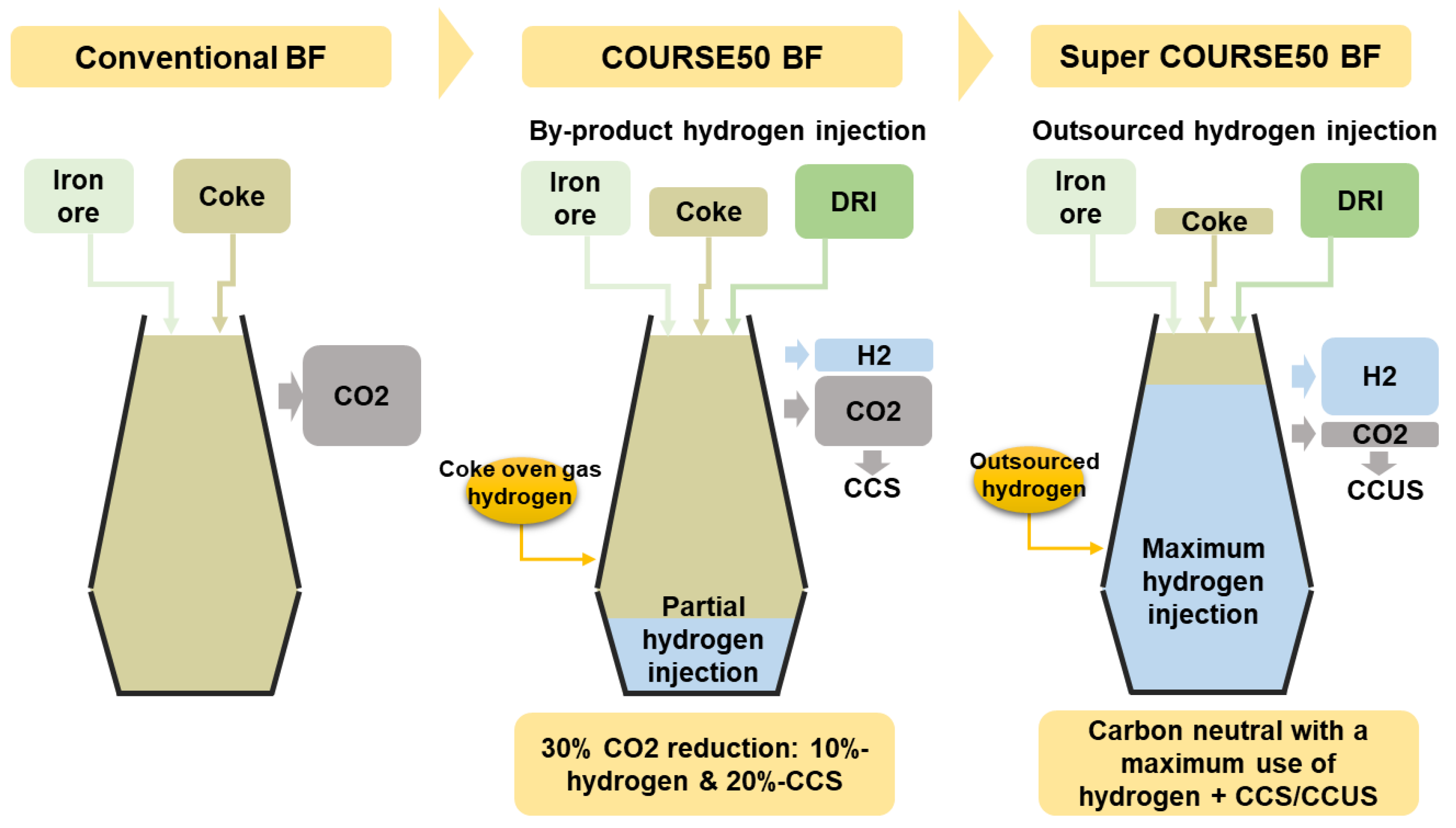

4.2.2. Japan

4.2.3. The United States

4.2.4. South Korea

4.2.5. Germany

4.2.6. Summary

5. The Low-Carbon Development of the ISI of China

5.1. Current Status of the ISI in China

5.2. The Goal for the Low-Carbon Development of the ISI in China

5.3. Key Actions for the Low-Carbon Development of the ISI in China

5.3.1. Improving Energy Efficiency

- ●

- Switching to more efficient processing equipment, such as improving the blast furnace efficiency and phasing out backward production equipment.

- ●

- Increased recovery of by-products and waste, such as power generation from recovered blast furnace gas (BFG) and preheating from process waste heat.

- ●

- Adopting more efficient methods for casting and rolling of final steel product, such as intelligent monitoring and controlling of the process.

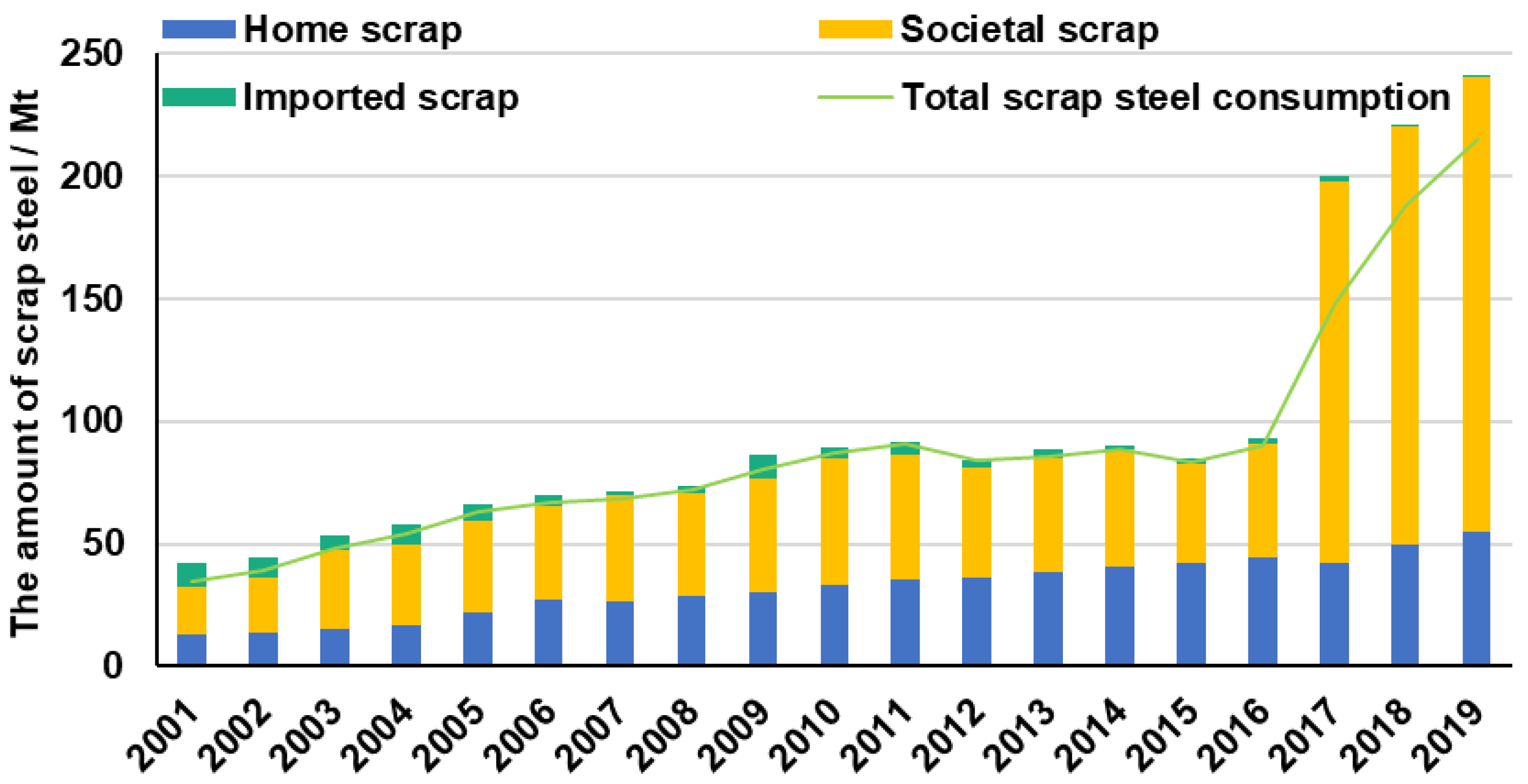

5.3.2. Shifting to Scrap/EAF Route

- ●

- Home (or return) scrap. This scrap comes from waste steel generated in the steel-making process including rolling, cutting, conditioning, and trimming.

- ●

- Societal scrap. This scrap includes prompt (or industrial) scrap from the downstream manufacturing process, and obsolete (or postconsumer) scrap recovered from end-of-life steel products, such as machines, buildings, and cars.

- ●

- Imported scrap. This scrap is imported from other countries.

5.3.3. Promoting Material Efficiency Strategy

- ●

- Light-weight design;

- ●

- Reducing yield losses;

- ●

- Diverting manufacturing scrap;

- ●

- Re-using components;

- ●

- Longer-life products;

- ●

- More intense use.

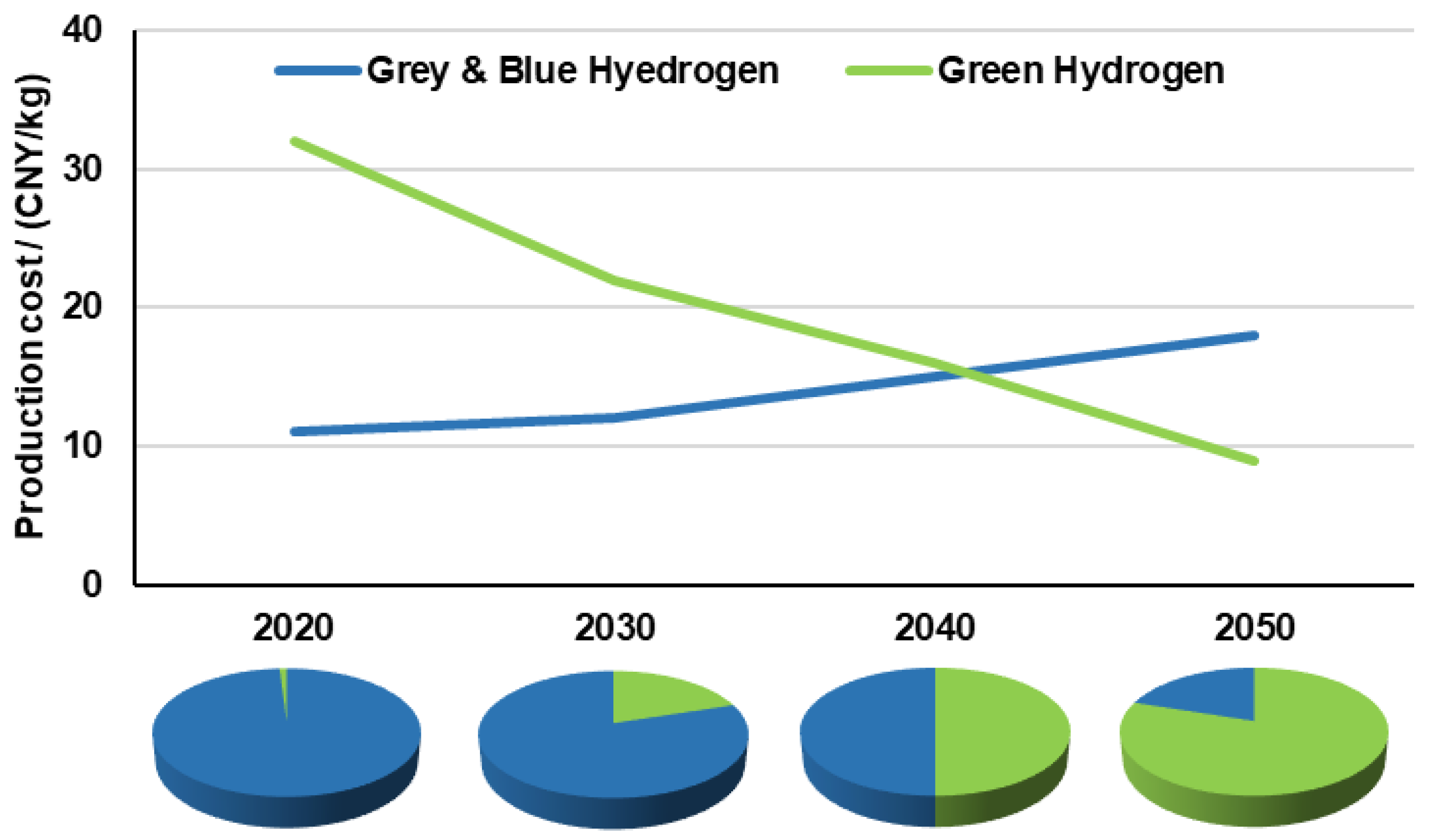

5.3.4. Deploying Radical Innovation Technologies

- ●

- CO2 management technology. Those keep fossil fuels as the main reducing agent in the ironmaking process, but abate the CO2 emissions that occur, among which the carbon capture, utilization and storage (CCUS) technology is the key representative.

- ●

- CO2 direct avoidance. Those seek to prevent the generation of CO2 emissions via minimizing the use of fossil carbon, where rising attention is paid to hydrogen-based steelmaking.

- ●

- Grey hydrogen: Hydrogen produced from gas or coal. It is still with large CO2 emissions.

- ●

- Blue hydrogen: Hydrogen produced from gas or cola equipped with CCUS. This hydrogen will result in a radical emission reduction.

- ●

- Green hydrogen: Hydrogen generated from renewable energy sources, such as hydrogen produced from the electrolysis of water with renewable electricity.

6. Policy Recommendations

- ●

- Fully exploiting the potential for energy efficiency in the short term. There is still a certain gap between China’s energy consumption per ton of steel and the world advanced level, which can be further reduced by means of technology improvement, process optimization, waste energy recovery, and smart digital management. Meanwhile, backward production technologies still exist in China [86], and the elimination of these backward production capacities should be accelerated.

- ●

- Promoting the layout of Scrap/EAF steel production capacity. The government should adopt policy incentives to ensure the cost advantages of the Scrap/EAF route so that it can compete with the existing BF/BOF route, such as subsidies to the electricity price. Moreover, the government should support the industry to establish a centralized and standardized scrap recycling system to ensure the supply of scrap steel for the Scrap/EAF, for example, mandate recycling for cars, houses, and buildings.

- ●

- Accelerating the efficient use of steel. The efficient use of steel is important for increasing the value of each ton of steel and slowing down demand growth. Work can be done by the government including coordinating recycling networks, modify design regulation towards lightweight, incentives for refurbishment building to extend lifetimes, and advocating the lifestyle of sharing economy.

- ●

- Financial support for the innovative net-zero technologies. Financial support from the government is important for the innovation of these net-zero technologies, from lab-scale experiments and pilots, to demonstrations. For example, continuous financial support should be given to hydrogen-based steelmaking, since it is still in the stage of prototype and pilot.

- ●

- Including the ISI in the carbon trading market. At present, China has included the power industry in the carbon trading market, and in the future, the ISI will be further included. The carbon trading market will force the whole industry to carry out the low-carbon transition and stimulate the steel-producer’s willingness for low-carbon development.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- UNFCCC. The Paris Agreement. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement (accessed on 13 October 2021).

- BP. BP Statistical Review of World Energy 2021; BP: London, UK, 2021. [Google Scholar]

- Ministry of Foreign Affairs of the People’s Republic of China. Xi Jinping Delivers an Important Speech at the General Debate of the 75th Session of the United Nations (UN) General Assembly. Available online: https://www.fmprc.gov.cn/mfa_eng/zxxx_662805/t1817766.shtml (accessed on 15 April 2021).

- Ekdahl, Å. Climate Change and the Production of Iron and Steel: An Industry View; World Steel Association: Brussels, Belgium, 2021. [Google Scholar]

- International Energy Agency. Iron and Steel Technology Roadmap; IEA: Paris, France, 2020. [Google Scholar]

- China Iron and Steel Association. China Steel Yearbook 2020; China Iron and Steel Association: Beijing, China, 2020. [Google Scholar]

- World Steel Association. World Steel Statistical Yearbook 2020; World Steel Association: Brussels, Belgium, 2020. [Google Scholar]

- Yang, H.; Ma, L.; Li, Z. A Method for Analyzing Energy-Related Carbon Emissions and the Structural Changes: A Case Study of China from 2005 to 2015. Energies 2020, 13, 2076. [Google Scholar] [CrossRef]

- Long, W.; Wang, S.; Lu, C.; Xue, R.; Liang, T.; Jiang, N.; Zhang, R. Quantitative Assessment of Energy Conservation Potential and Environmental Benefits of an Iron and Steel Plant in China. J. Clean. Prod. 2020, 273, 123163. [Google Scholar] [CrossRef]

- He, K.; Wang, L. A Review of Energy Use and Energy-Efficient Technologies for the Iron and Steel Industry. Renew. Sustain. Energy Rev. 2017, 70, 1022–1039. [Google Scholar] [CrossRef]

- Bo, X.; Jia, M.; Xue, X.; Tang, L.; Mi, Z.; Wang, S.; Cui, W.; Chang, X.; Ruan, J.; Dong, G.; et al. Effect of Strengthened Standards on Chinese Ironmaking and Steelmaking Emissions. Nat. Sustain. 2021, 4, 811–820. [Google Scholar] [CrossRef]

- Zhou, K.; Yang, S. Emission Reduction of China׳S Steel Industry: Progress and Challenges. Renew. Sustain. Energy Rev. 2016, 61, 319–327. [Google Scholar] [CrossRef]

- Zeng, S.; Zhou, Y. Foreign Direct Investment’s Impact on China’s Economic Growth, Technological Innovation and Pollution. Int. J. Environ. Res. Public Health 2021, 18, 2839. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Q.; Wei, Z.; Ma, J.; Qiu, Z.; Du, T. Optimization of Energy Use with CO2 Emission Reducing in an Integrated Iron and Steel Plant. Appl. Therm. Eng. 2019, 157, 113635. [Google Scholar] [CrossRef]

- Chen, Q.; Gu, Y.; Tang, Z.; Wei, W.; Sun, Y. Assessment of Low-Carbon Iron and Steel Production with CO2 Recycling and Utilization Technologies: A Case Study in China. Appl. Energy 2018, 220, 192–207. [Google Scholar] [CrossRef]

- Nechifor, V.; Calzadilla, A.; Bleischwitz, R.; Winning, M.; Tian, X.; Usubiaga, A. Steel in a Circular Economy: Global Implications of a Green Shift in China. World Dev. 2020, 127, 104775. [Google Scholar] [CrossRef]

- Ren, L.; Zhou, S.; Peng, T.; Ou, X. A Review of CO2 Emissions Reduction Technologies and Low-Carbon Development in the Iron and Steel Industry Focusing on China. Renew. Sustain. Energy Rev. 2021, 143, 110846. [Google Scholar] [CrossRef]

- Tan, X.; Li, H.; Guo, J.; Gu, B.; Zeng, Y. Energy-Saving and Emission-Reduction Technology Selection and CO2 Emission Reduction Potential of China’s Iron and Steel Industry under Energy Substitution Policy. J. Clean. Prod. 2019, 222, 823–834. [Google Scholar] [CrossRef]

- Phaal, R.; Farrukh, C.J.; Probert, D.R. Technology Roadmapping—A Planning Framework for Evolution and Revolution. Technol. Forecast. Soc. Chang. 2004, 71, 5–26. [Google Scholar] [CrossRef]

- Galvin, R. Science Roadmaps. Science 1998, 280, 803. [Google Scholar] [CrossRef]

- Linton, J.D. Determining Demand, Supply, and Pricing for Emerging Markets Based on Disruptive Process Technologies. Technol. Forecast. Soc. Chang. 2004, 71, 105–120. [Google Scholar] [CrossRef]

- Petrick, I.J.; Echols, A.E. Technology Roadmapping in Review: A Tool for Making Sustainable New Product Development Decisions. Technol. Forecast. Soc. Chang. 2004, 71, 81–100. [Google Scholar] [CrossRef]

- IEA. Energy Technology Roadmaps: A Guide to Development and Implementation; IEA: Paris, France, 2014. [Google Scholar]

- Gonzalez-Salazar, M.A.; Venturini, M.; Poganietz, W.-R.; Finkenrath, M.; Kirsten, T.; Acevedo, H.; Spina, P.R. Development of a Technology Roadmap for Bioenergy Exploitation including Biofuels, Waste-to-Energy and Power Generation & CHP. Appl. Energy 2016, 180, 338–352. [Google Scholar]

- Hao, H.; Cheng, X.; Liu, Z.; Zhao, F. China’s Traction Battery Technology Roadmap: Targets, Impacts and Concerns. Energy Policy 2017, 108, 355–358. [Google Scholar] [CrossRef]

- Assunção, L.R.C.; Mendes, P.A.S.; Matos, S.; Borschiver, S. Technology Roadmap of Renewable Natural Gas: Identifying Trends for Research and Development to Improve Biogas Upgrading Technology Management. Appl. Energy 2021, 292, 116849. [Google Scholar] [CrossRef]

- Wei, X.; Qiu, R.; Liang, Y.; Liao, Q.; Klemeš, J.J.; Xue, J.; Zhang, H. Roadmap to Carbon Emissions Neutral Industrial Parks: Energy, Economic and Environmental Analysis. Energy 2022, 238, 121732. [Google Scholar] [CrossRef]

- Phaal, R.; Muller, G. An Architectural Framework for Roadmapping: Towards Visual Strategy. Technol. Forecast. Soc. Chang. 2009, 76, 39–49. [Google Scholar] [CrossRef]

- Quader, M.A.; Ahmed, S.; Ghazilla, R.A.R.; Ahmed, S.; Dahari, M. A Comprehensive Review on Energy Efficient CO2 Breakthrough Technologies for Sustainable Green Iron and Steel Manufacturing. Renew. Sustain. Energy Rev. 2015, 50, 594–614. [Google Scholar] [CrossRef]

- Hasanbeigi, A.; Arens, M.; Price, L. Alternative Emerging Ironmaking Technologies For Energy-Efficiency And Carbon Dioxide Emissions Reduction: A Technical Review. Renew. Sustain. Energy Rev. 2014, 33, 645–658. [Google Scholar] [CrossRef]

- Napp, T.; Gambhir, A.; Hills, T.; Florin, N.; Fennell, P. A Review of the Technologies, Economics and Policy Instruments for Decarbonising Energy-Intensive Manufacturing Industries. Renew. Sustain. Energy Rev. 2014, 30, 616–640. [Google Scholar] [CrossRef]

- Yellishetty, M.; Mudd, G.; Ranjith, P.; Tharumarajah, A. Environmental Life-Cycle Comparisons of Steel Production and Recycling: Sustainability Issues, Problems and Prospects. Environ. Sci. Policy 2011, 14, 650–663. [Google Scholar] [CrossRef]

- Zhang, Q.; Xu, J.; Wang, Y.; Hasanbeigi, A.; Zhang, W.; Lu, H.; Arens, M. Comprehensive Assessment of Energy Conservation and CO2 Emissions Mitigation in China’s Iron and Steel Industry Based on Dynamic Material Flows. Appl. Energy 2018, 209, 251–265. [Google Scholar] [CrossRef]

- World Steel Association. World Steel Statistical Yearbook Collections 1978 to 2020. Available online: https://www.worldsteel.org/steel-by-topic/statistics/steel-statistical-yearbook.html (accessed on 22 September 2021).

- European Commission. Climate Action. Available online: https://ec.europa.eu/clima/policies/strategies/2050_en (accessed on 3 October 2021).

- The Government of the Republic of Korea. Carbon Neutral Strategy of the Republic of Korea. Available online: https://unfccc.int/sites/default/files/resource/LTS1_RKorea.pdf (accessed on 24 September 2021).

- The Government of Japan. Carbon Neutrality. Available online: https://www.japan.go.jp/key_policies_of_the_suga_cabinet/carbon_neutrality.html (accessed on 26 September 2021).

- The Energy and Resources Institute (TERI) India. Towards a Low Carbon Steel Sector: Overview of the Changing Market, Technology and Policy Context for Indian Steel; The Energy and Resources Institute (TERI) India: New Delhi, India, 2020. [Google Scholar]

- ArcelorMittal. ArcelorMittal Launches XCarb™, Signalling Its Commitment to Producing Carbon Neutral Steel. Available online: https://corporate.arcelormittal.com/media/press-releases/arcelormittal-launches-xcarb-signalling-its-commitment-to-producing-carbon-neutral-steel#%E3%80%91 (accessed on 27 September 2021).

- TATA STEEL. Sustainability—TATA STEEL. Available online: https://www.tatasteel.com/tata-steel-brochure-19-20/sustainability.html (accessed on 27 September 2021).

- Argus. India’s JSW Steel Sets 2030 Carbon Emissions Target. Available online: https://www.argusmedia.com/en/news/2247147-indias-jsw-steel-sets-2030-carbon-emissions-target (accessed on 27 September 2021).

- Ministry of New and Renewable Energy, Government of India. Hydrogrn Energy. Available online: https://mnre.gov.in/new-technologies/hydrogen-energy (accessed on 27 September 2021).

- Ministry of the Environment Japan. Greenhouse Gas Inventory Office of Japan 2020; Ministry of the Environment Japan: Tokyo, Japan, 2020.

- Japan Iron and Steel Federation (JISF). Basic Policy of the Japan Steel Industry on 2050 Carbon Neutrality Aimed by the Japanese Government. Available online: https://www.jisf.or.jp/en/activity/climate/index.html (accessed on 26 September 2021).

- Nippon Steel Corporation. Nippon Steel Carbon Neutral Vision 2050—A Challenge of Zero-Carbon Steel; Nippon Steel Corporation: Tokyo, Japan, 2021. [Google Scholar]

- JEF Holdings, Inc. Climate Change Mitigation of JEF Group. Available online: https://www.jfe-holdings.co.jp/en/csr/environment/climate/ (accessed on 26 September 2021).

- Li, H.-W.; Nishimiya, N. Insight from Japan’s Hydrogen Strategy and Activities. Engineering 2021, 7, 722–725. [Google Scholar] [CrossRef]

- COURSE50 Project Group. COURSE50 Project. Available online: https://www.course50.com/en/message/ (accessed on 26 September 2021).

- The White House. Fact Sheet: President Biden Sets 2030 Greenhouse Gas Pollution Reduction Target Aimed at Creating Good-Paying Union Jobs and Securing U.S. Leadership on Clean Energy Technologies. Available online: https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/22/fact-sheet-president-biden-sets-2030-greenhouse-gas-pollution-reduction-target-aimed-at-creating-good-paying-union-jobs-and-securing-u-s-leadership-on-clean-energy-technologies/ (accessed on 29 September 2021).

- Feldmann, J.; Kennedy, K. Toward a Tradable, Low-Carbon Product Standard for Steel: Policy Design Considerations for the United States; World Resources Institute: Washington, DC, USA, 2021. [Google Scholar]

- Nucor Corporation. Our Greenhouse Gas Reduction Target Strategy. Available online: https://www.nucor.com/greenhouse-gas-reduction-target-strategy/ (accessed on 29 September 2021).

- United Stated Steel Corporation. Environment—Greenhouse Gas Emission; United Stated Steel Corporation: Pittsburgh, PA, USA, 2021. [Google Scholar]

- Byun, W. Steel/Metal Industry: Movement Towards Carbon Neutrality Begins in Earnest. Available online: http://www.businesskorea.co.kr/news/articleView.html?idxno=57179 (accessed on 1 October 2021).

- POSCO. POSCO Pledges to Achieve Carbon Neutrality by 2050 and Lead Low Carbon Society. Available online: https://en.wikipedia.org/wiki/List_of_steel_producers (accessed on 1 October 2021).

- Stangarone, T. South Korean Efforts to Transition to a Hydrogen Economy. Clean Technol. Environ. Policy 2021, 23, 509–516. [Google Scholar] [CrossRef]

- Federal Ministry for the Environment, Nature Conservation and Nuclear Safety. Revised Climate Change Act Sets Out Binding Trajectory towards Climate Neutrality by 2045. Available online: https://www.bmu.de/en/pressrelease/revised-climate-change-act-sets-out-binding-trajectory-towards-climate-neutrality-by-2045 (accessed on 27 September 2021).

- The Federal Government. For a Strong Steel Industry in Germany and Europe—The Steel Action Concept; The Federal Government: Berlin, Germany, 2020.

- The Federal Government. The National Hydrogen Strategy; The Federal Government: Berlin, Germany, 2020.

- ThyssenKrupp AG. Green Hydrogen for Green Steel: Paving the Way to Hydrogen Valley. Available online: https://engineered.thyssenkrupp.com/en/green-hydrogen-for-green-steel/ (accessed on 14 October 2021).

- China Iron and Steel Association. China Steel Yearbook 1985; China Iron and Steel Association: Beijing, China, 1985. [Google Scholar]

- National Bureau of Statistics of China. China Statistical Yearbook 2020; National Bureau of Statistics of China: Beijing, China, 2020.

- World Steel Association. Global Crude Steel Output Decreases by 0.9% in 2020. Available online: https://www.worldsteel.org/media-centre/press-releases/2021/Global-crude-steel-output-decreases-by-0.9--in-2020.html (accessed on 5 October 2021).

- National Bureau of Statistics of China. China Energy Statistical Yearbook 2020; National Bureau of Statistics of China: Beijing, China, 2020.

- China Baowu Group. Strive to “Carbon Peak” in 2023 and Achieve “Carbon Neutrality” in 2050—China Baowu Group, the World’s Largest Steel Company, Releases Carbon Emission Reduction Declaration. Available online: http://www.baowugroup.com/media_center/news_detail/201868 (accessed on 15 April 2021).

- HBIS Group. HBIS Announces Its Low Carbon & Green Development Action Plan. Available online: https://www.hbisco.com/site/en/groupnewssub/info/2021/15999.html (accessed on 4 October 2021).

- China Metallurgical Industry Planning Institute. Action Plan for the Carbon Peak and Carbon Reduction of the Iron and Steel Industryare Taking Shape. Available online: http://www.mpi1972.com/xwzx/xyyw_451/202103/t20210330_95674.html (accessed on 9 November 2021). (In Chinese).

- Chen, W.; Yin, X.; Ma, D. A Bottom-Up Analysis of China’s Iron and Steel Industrial Energy Consumption and CO2 Emissions. Appl. Energy 2014, 136, 1174–1183. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhang, W.; Wang, Y.; Xu, J.; Cao, X. Potential of Energy Saving and Emission Reduction and Energy Efficiency Improvement of China’s Steel Industry. Iron Steel 2019, 54, 7–14. (In Chinese) [Google Scholar]

- Li, Y.; Zhu, L. Cost of Energy Saving and CO2 Emissions Reduction in China’s Iron and Steel Sector. Appl. Energy 2014, 130, 603–616. [Google Scholar] [CrossRef]

- Mickinsey. The Growing Importance of Steel Scrap in China; Mickinsey: Chicago, IL, USA, 2017. [Google Scholar]

- China Iron and Steel Association. China Steel Yearbook 2019; China Iron and Steel Association: Beijing, China, 2019. [Google Scholar]

- China Iron and Steel Association. China Steel Yearbook 2016; China Iron and Steel Association: Beijing, China, 2016. [Google Scholar]

- China Metallurgical Industry Planning and Research Institute. Improve the Efficiency of Scrap Steel Utilization and Promote the Low-Carbon Development of the Steel Industry. Available online: http://www.mpi1972.com/xwzx/tzgg/202103/t20210305_95371.html (accessed on 6 October 2021). (In Chinese).

- Chen, J.; Li, S.; Li, X.; Li, Y. The Road to Zero Carbon for Chinese Steel under Carbon Neutrality Goal; Rocky Mountain Institute: Beijing, China, 2021. [Google Scholar]

- Wu, J.; Yang, J.; Ma, L.; Li, Z.; Shen, X. A System Analysis of the Development Strategy of Iron Ore in China. Resour. Policy 2016, 48, 32–40. [Google Scholar] [CrossRef]

- Allwood, J.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material Efficiency: A White Paper. Resour. Conserv. Recycl. 2011, 55, 362–381. [Google Scholar] [CrossRef]

- Allwood, J.M.; Cullen, J.M.; Milford, R.L. Options for Achieving a 50% Cut in Industrial Carbon Emissions by 2050. Environ. Sci. Technol. 2010, 44, 1888–1894. [Google Scholar] [CrossRef] [PubMed]

- Allwood, J.M.; Ashby, M.F.; Gutowski, T.G.; Worrell, E. Material Efficiency: Providing Material Services with Less Material Production. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2013, 371, 20120496. [Google Scholar] [CrossRef] [PubMed]

- Hertwich, E.; Lifset, R.; Pauliuk, S.; Heeren, N. Resource Efficiency and Climate Change: Material Efficiency Strategies for a Low-Carbon Future; United Nations Environment Programme: Nairobi, Kenya, 2020. [Google Scholar]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A Review on Circular Economy: The Expected Transition to a Balanced Interplay of Environmental and Economic Systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Cai, B.; Li, Q.; Zhang, X. Annual Report on Carbon Capture, Utilization and Storage (CCUS) in China (2021); Institute of Environmental Planning, Ministry of Ecology and Environment: Beijing, China, 2021. (In Chinese)

- Zhang, X. The Development Trend of and Suggestions for China’s Hydrogen Energy Industry. Engineering 2021, 7, 719–721. [Google Scholar] [CrossRef]

- Mickinsey. Decarbonization Challenge for Steel; Mickinsey: Düsseldorf, Germany, 2020. [Google Scholar]

- BJX News. Steel Industry Opens Hydrogen Age! Available online: https://chuneng.bjx.com.cn/news/20210318/1142436.shtml (accessed on 5 November 2021). (In Chinese).

- Deloitte. Creating a Viable Hydrogen Economy—A Future of Energy Point of View on Hydrogen; Deloitte: Beijing, China, 2021. [Google Scholar]

- Lin, Y.; Chong, C.; Ma, L.; Li, Z.; Ni, W. Analysis of Changes in the Aggregate Exergy Efficiency of China’s Energy System from 2005 to 2015. Energies 2021, 14, 2304. [Google Scholar] [CrossRef]

- Li, T.; Liu, P.; Li, Z. Quantitative Relationship between Low-Carbon Pathways and System Transition Costs Based on a Multi-Period and Multi-Regional Energy Infrastructure Planning Approach: A Case Study of China. Renew. Sustain. Energy Rev. 2020, 134, 110159. [Google Scholar] [CrossRef]

- Chen, S.; Liu, P.; Li, Z. Low Carbon Transition Pathway of Power Sector with High Penetration of Renewable Energy. Renew. Sustain. Energy Rev. 2020, 130, 109985. [Google Scholar] [CrossRef]

- Milford, R.L.; Pauliuk, S.; Allwood, J.M.; Müller, D.B. The Roles of Energy and Material Efficiency in Meeting Steel Industry CO2 Targets. Environ. Sci. Technol. 2013, 47, 3455–3462. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Zhao, Y.; Ma, L.; Li, Z.; Ni, W. The Development of Regional Smart Energy Systems in the World and China: The Concepts, Practices, and a New Perspective. Wiley Interdiscip. Rev. Data Min. Knowl. Discov. 2021, 11, e1409. [Google Scholar] [CrossRef]

- Yang, H.; Li, X.; Ma, L.; Li, Z. Using System Dynamics to Analyse Key Factors Influencing China’s Energy-Related CO2 Emissions and Emission Reduction Scenarios. J. Clean. Prod. 2021, 320, 128811. [Google Scholar] [CrossRef]

| BF/BOF | Scrap/EAF | Other | Total | ||||

|---|---|---|---|---|---|---|---|

| Mt | Mt | Mt | Mt | ||||

| World | 1341 | 72% | 523 | 28% | 10 | 0.5% | 1874 |

| China | 893 | 90% | 103 | 10% | - | - | 996 |

| India | 49 | 44% | 63 | 56% | - | - | 112 |

| Japan | 75 | 76% | 24 | 24% | - | - | 99 |

| United States | 27 | 30% | 61 | 70% | - | - | 88 |

| Russia | 46 | 64% | 24 | 34% | 2 | 2% | 72 |

| South Korea | 49 | 68% | 23 | 32% | - | - | 72 |

| Germany | 28 | 70% | 12 | 30% | - | - | 40 |

| Turkey | 11 | 32% | 23 | 68% | - | - | 34 |

| Brazil | 25 | 76% | 7 | 22% | 0.5 | 2% | 33 |

| Iran | 3 | 10% | 23 | 90% | - | - | 26 |

| Release Authority | Status | Vision | Action | |||

|---|---|---|---|---|---|---|

| Supply | Demand | Policy | ||||

| World | International Energy Agency [5] | 7% of global total emissions | At least 50% direct intensity reduction by 2050 |

|

| (Governments will play a central role):

|

| India | The Energy and Resources Institute in India [38] | 2% of GDP; 10% of total CO2 emissions | —— |

|

| (Expected by TERI):

|

| Japan | Japan Iron and Steel Federation [44] | 15% of total CO2 emissions | Striving to realize zero-carbon steel by 2050 |

|

| (Expected by JISF):

|

| The United States | —— | 1.5% of total CO2 emissions [50]; High share of Scarp/EAF route and relatively lower emission intensity [7] |

|

| —— | |

| South Korea | The Government of the Republic of Korea [36] | 20% of total CO2 emissions | NDC: Carbon neutrality by 2050 |

|

|

|

| Germany | The Federal Government [57] | 10% of total CO2 emissions | A strong, internationally competitive and climate-neutral steel industry by 2050 |

| —— |

|

| Release Time | Goal | |

|---|---|---|

| China Baowu Group [64] | January 2021 | Peaking the CO2 emission in 2023, reducing the CO2 emission by 30% in 2035, and achieving carbon neutrality by 2050 |

| The HBIS Group [65] | March 2021 | Carbon emission peak in 2022, more than 10% carbon reduction by 2025 and 30% reduction by 2030 compared to the peak level, and carbon neutrality by 2050 |

| China Metallurgical Industry Planning and Research Institute [66] | March 2021 | Achieving carbon emission peak by 2025, reducing 30% from the peak level by 2030, and achieving decarbonization by 2060 |

| Unit: kgce/t | Coking | Sintering | BF Ironmaking | BOF Steelmaking | EAF Steelmaking | Steel Rolling |

|---|---|---|---|---|---|---|

| 2010 | 105.9 | 52.7 | 407.8 | -0.2 | 74.0 | 55.5 |

| 2011 | 107.5 | 51.9 | 406.5 | -2.6 | 70.4 | 52.6 |

| 2012 | 105.1 | 50.5 | 402.5 | -6.2 | 66.9 | 53.0 |

| 2013 | 100.0 | 49.2 | 398.1 | -7.2 | 62.2 | 51.9 |

| 2014 | 97.7 | 48.5 | 393.0 | -9.9 | 58.5 | 59.1 |

| 2015 | 96.9 | 49.4 | 390.9 | -11.4 | 59.3 | 59.9 |

| 2016 | 100.1 | 49.9 | 396.6 | -14.0 | 58.5 | 56.7 |

| 2017 | 99.7 | 48.5 | 390.8 | -13.9 | 58.1 | 56.9 |

| 2018 | 104.9 | 48.6 | 392.1 | -13.4 | 55.7 | 54.3 |

| 2019 | 105.8 | 48.2 | 387.4 | -15.0 | 57.2 | 51.9 |

| Best practice [66] | 62 | 23 | 341 | -22 | 23 | 27 |

| Process | Technology | Energy Saving Potential/(GJ/t) | CO2 Reduction Potential/(kg/t) | Annualized Investment/(CNY/t) a | Current Market Penetration b |

|---|---|---|---|---|---|

| Coking | Coke dry quenching (CDQ) | 0.37 | 42.54 | 180 | ●●● |

| Coal moisture control (CMC) | 0.06 | 1.47 | 160 | ● | |

| Sintering | Preheat of sinter plant | 0.12 | 12.85 | 22 | ●●● |

| Use of waste fuels | 0.11 | 11.78 | 1 | ●●● | |

| Low temperature sintering | 0.35 | 3.15 | 2 | ●● | |

| Sintering waste heat recovery | 0.35 | 14.77 | 33 | ● | |

| BF ironmaking | Recovery of BFG | 0.01 | 5.49 | 9 | ●●● |

| High-efficient pulverized coal injection (130kg/t) | 0.70 | 24.16 | 155 | ●● | |

| Top pressure recovery turbines (dry type) | 0.12 | 22.66 | 60 | ● | |

| Double preheating for hot stove | 0.25 | 1.30 | 16 | ● | |

| Injection of Plastic Waste | 0.10 | 11.78 | 10 | ● | |

| BOF steelmaking | BOF gas sensible heat recovery | 0.12 | 19.28 | 167 | ● |

| Converter Gas Dry Dedusting Technology (wet type transformed into dry type) | 0.14 | 5.77 | 26 | ● | |

| Increasing Thermal Efficiency by re-using BOF Exhaust Gas | 0.09 | 2.89 | 140 | ● | |

| EAF steelmaking | Scrap preheating | 0.66 | 47.91 | 200 | ● |

| Electric supply optimization techniques | 0.01 | 2.31 | 1 | ● | |

| EAF gas waste heat recovery | 0.06 | 77.10 | 38 | ● | |

| Steel casting | High-efficient continuous casting | 0.39 | 27.49 | 400 | ●●● |

| Efficient ladle preheating | 0.02 | 0.58 | 2 | ● | |

| Steel rolling | Hot rolling and hot charging | 0.23 | 26.78 | 100 | ●●● |

| Process control in hot strip mill | 0.28 | 20.49 | 20 | ●●● | |

| Automated monitoring and targeting system | 0.20 | 13.22 | 12 | ●● | |

| Waste heat recovery | 0.03 | 3.21 | 24 | ●● | |

| Endless Strip Production (ESP) | 0.28 | 6.99 | 182 | ● | |

| Other comprehensive technologies | Preventative maintenance | 0.49 | 50.40 | 10 | ●●● |

| Combined heat and power generation technology | 0.38 | 70.19 | 60 | ●●● | |

| Energy monitoring and management technology | 0.12 | 18.22 | 5 | ●● |

| Process | 2025 | 2030 | 2040 | 2050 | 2060 | |

|---|---|---|---|---|---|---|

| Carbon capture (CNY/t) | Pre-combustion | 100–180 | 90–130 | 50–70 | 30–50 | 20–40 |

| Post-combustion | 230–310 | 190–280 | 100–180 | 80–150 | 70–120 | |

| Oxygen enriched combustion | 300–480 | 160–390 | 110–230 | 90–150 | 80–130 | |

| Transportation (CNY/(t·km)) | Road | 0.9–1.4 | 0.8–1.3 | 0.6–1.1 | 0.5–1.1 | 0.5–1 |

| Pipeline | 0.8 | 0.7 | 0.5 | 0.45 | 0.4 | |

| Carbon storage (CNY/t) | 50–60 | 40–50 | 30–35 | 25–30 | 20–25 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, Y.; Yang, H.; Ma, L.; Li, Z.; Ni, W. Low-Carbon Development for the Iron and Steel Industry in China and the World: Status Quo, Future Vision, and Key Actions. Sustainability 2021, 13, 12548. https://doi.org/10.3390/su132212548

Lin Y, Yang H, Ma L, Li Z, Ni W. Low-Carbon Development for the Iron and Steel Industry in China and the World: Status Quo, Future Vision, and Key Actions. Sustainability. 2021; 13(22):12548. https://doi.org/10.3390/su132212548

Chicago/Turabian StyleLin, Yuancheng, Honghua Yang, Linwei Ma, Zheng Li, and Weidou Ni. 2021. "Low-Carbon Development for the Iron and Steel Industry in China and the World: Status Quo, Future Vision, and Key Actions" Sustainability 13, no. 22: 12548. https://doi.org/10.3390/su132212548

APA StyleLin, Y., Yang, H., Ma, L., Li, Z., & Ni, W. (2021). Low-Carbon Development for the Iron and Steel Industry in China and the World: Status Quo, Future Vision, and Key Actions. Sustainability, 13(22), 12548. https://doi.org/10.3390/su132212548