Sustainability Reporting Disclosure in Islamic Corporates: Do Human Governance, Corporate Governance, and IT Usage Matter?

Abstract

:1. Introduction

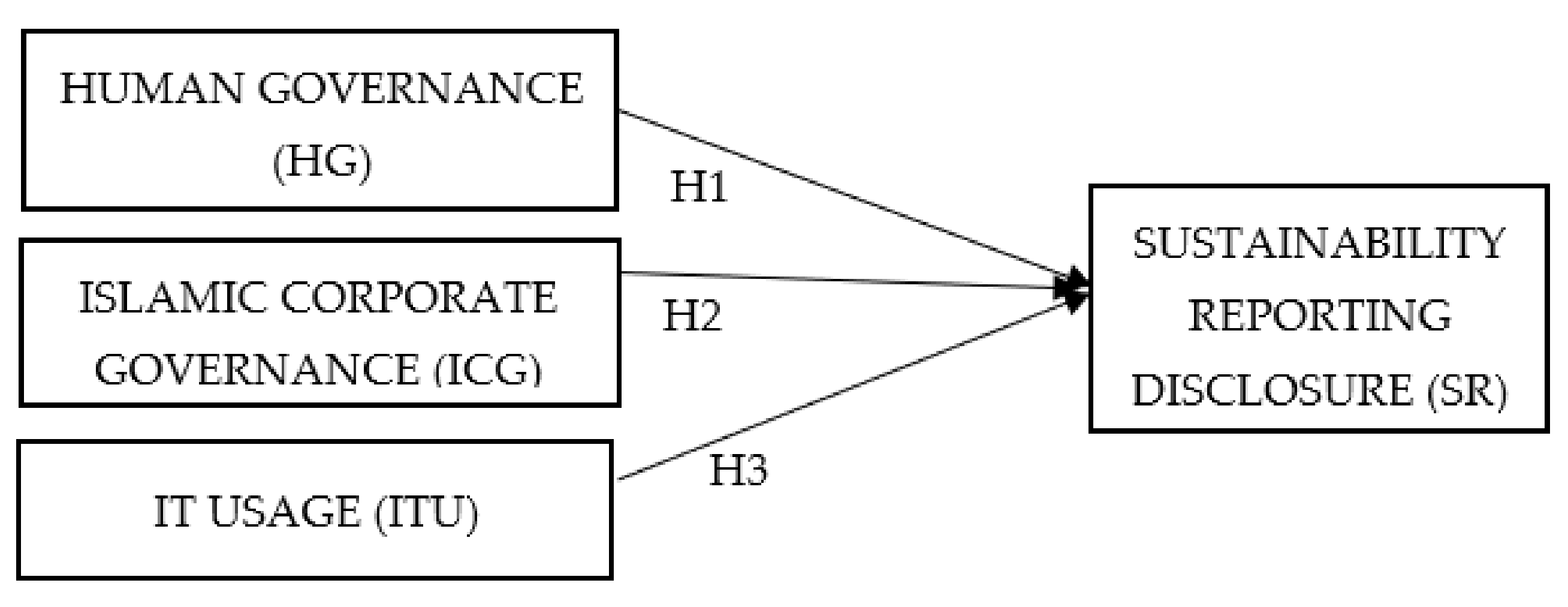

- Does human governance influence sustainability reporting disclosure?

- Does Islamic corporate governance influence sustainability reporting disclosure?

- Does information technology usage (IT) influence sustainability reporting disclosure?

2. Literature Review and Hypotheses Development

2.1. Theories Related to This Research

2.1.1. Stakeholder Theory

2.1.2. Agency Theory

2.1.3. Technology–Organization–Environment Theory (TOE)

2.2. Variables Related to This Research

2.2.1. Islamic Corporate Governance (ICG)

2.2.2. Sustainability Reporting (SR) Disclosure

2.2.3. Human Governance

2.3. Hypotheses Development

3. Research Methodology

3.1. Index of Sustainability Reporting

3.2. Index of Islamic Corporate Governance

3.3. Index of Human Governance

3.4. Index of IT Usage

3.5. Control Variables

3.6. Data Instrument

4. Results

4.1. Relationship Analysis of Human Governance, Islamic Corporate Governance, and Information Technology Usage with Sustainability Reporting Disclosure

4.2. Relationship Analysis between Information Technology Usage and Sustainability Reporting Disclosure

4.3. Relationship Analysis between Islamic Corporate Governance and Sustainability Reporting Disclosure

4.4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Arestis, P.; Karakitsos, E. The Current Financial Crisis and the Origins of Excessive Liquidity. In The Post Great Recession US Economy; Palgrave Macmillan: London, UK, 2010; pp. 41–57. [Google Scholar] [CrossRef]

- Grusky, D.B.; Western, B.; Wimer, C. The great recession. Soc. Psychol. Personal. Sci. 2011, 5, 310–318. [Google Scholar] [CrossRef]

- Alam Choudhury, M.; Nurul Alam, M. Corporate governance in Islamic perspective. Int. J. Islamic Middle East. Financ. Manag. 2013, 6, 180–199. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.W.; Tahir, M. Developing an Islamic Corporate Governance framework to examine sustainability performance in Islamic Banks and Financial Institutions. J. Clean. Prod. 2021, 315, 128099. [Google Scholar] [CrossRef]

- Murphy, M.J.; Smolarski, J.M. Religion and CSR: An Islamic “Political” Model of Corporate Governance. Bus. Soc. 2020, 59, 823–854. [Google Scholar] [CrossRef]

- Siswanti, I.; Salim, U.; Sukoharsono, E.G.; Aisjah, S. Sustainable Business of Islamic Bank Through on the Islamic Corporate Governance and Islamic Financial Performance. GATR J. Financ. Bank. Rev. 2017, 2, 15–20. [Google Scholar] [CrossRef]

- Bin Ismail, A.F. The Principles of Shariah Governance as Practiced by Islamic Financial Institutions. Ph.D. Thesis, University of Leeds, Leeds, UK, 2018. Available online: http://etheses.whiterose.ac.uk/23551/ (accessed on 10 November 2021).

- Lewis, M.K. Principles of Islamic Corporate Governance; Edward Elgar Publishing: Cheltenham, UK, 2014; pp. 243–267. [Google Scholar] [CrossRef]

- Saputra, N.; Saputra, A.M. Transforming into Digital Organization by Orchestrating Culture, Leadership, and Competence in Digital Context. GATR Glob. J. Bus. Soc. Sci. Rev. 2020, 8, 208–216. [Google Scholar] [CrossRef]

- Pirzada, K.; Mustapha, M.Z.; Alfan, E. The role of nomination committee in selecting female directors: A case of Malaysia. Pertanika J. Soc. Sci. Humanit. 2016, 24, 105–118. [Google Scholar]

- Hanapiyah, Z.M.; Daud, S.; Wan Abdullah, W.M.T. Institutionalising Human Governance Determinant: Steering Organizations towards Sustainability. IOP Conf. Ser. Earth Environ. Sci. 2016, 32, 012056. [Google Scholar] [CrossRef] [Green Version]

- Hospes, O. Marking the success or end of global multi-stakeholder governance? The rise of national sustainability standards in Indonesia and Brazil for palm oil and soy. Agric. Hum. Values 2014, 31, 425–437. [Google Scholar] [CrossRef]

- Salb, D.; Friedman, H.H.; Friedman, L. The role of information technology in fulfilling the promise of corporate social responsibility. Comput. Inf. Sci. 2011, 4, 2–9. [Google Scholar] [CrossRef] [Green Version]

- Fuchs, C. The implications of new information and communication technologies for sustainability. Environ. Dev. Sustain. 2008, 10, 291–309. [Google Scholar] [CrossRef]

- Miraz, M.H.; Hassan, M.G.; Mohd Sharif, K.I. Factors affecting implementation of blockchain in retail market in Malaysia. Int. J. Supply Chain Manag. 2020, 9, 385–391. [Google Scholar]

- Kauffman, R.J.; Riggins, F.J. Information and communication technology and the sustainability of microfinance. Electron. Commer. Res. Appl. 2012, 11, 450–468. [Google Scholar] [CrossRef]

- Nizam, H.A.; Zaman, K.; Khan, K.B.; Batool, R.; Khurshid, M.A.; Shoukry, A.M.; Sharkawy, M.A.; Aldeek, F.; Khader, J.; Gani, S. Achieving environmental sustainability through information technology: “Digital Pakistan” initiative for green development. Environ. Sci. Pollut. Res. 2020, 27, 10011–10026. [Google Scholar] [CrossRef]

- Silvius, A.J.G.; Van den Brink, J.; Smit, J. Sustainability in Information and Communications Technology (ICT) Projects. Commun. IIMA San Bernadino 2009, 9, 33–44. [Google Scholar]

- Ferrantino, M.J.; Koten, E.E. Understanding Supply Chain 4.0 and Its Potential Impact on Global Value Chains. 2017. Available online: https://www.wto-ilibrary.org/content/component/10529e69-en/citation (accessed on 10 November 2021).

- Hilty, L.M.; Arnfalk, P.; Erdmann, L.; Goodman, J.; Lehmann, M.; Wäger, P.A. The relevance of information and communication technologies for environmental sustainability—A prospective simulation study. Environ. Model. Softw. 2006, 21, 1618–1629. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Value creation in e-business. Strateg. Manag. J. 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Faller, C.; Feldmúller, D. Industry 4.0 learning factory for regional SMEs. Proc. CIRP 2015, 32, 88–91. [Google Scholar] [CrossRef] [Green Version]

- Hilton, T.; Hughes, T.; Little, E.; Marandi, E. Adopting self-service technology to do more with less. J. Serv. Mark. 2013, 27, 3–12. [Google Scholar] [CrossRef]

- Khuntia, J.; Saldanha, T.J.V.; Mithas, S.; Sambamurthy, V. Information Technology and Sustainability: Evidence from an Emerging Economy. Prod. Oper. Manag. 2018, 27, 756–773. [Google Scholar] [CrossRef]

- Charumathi, B.; Padmaja, G. The Impact of Regulations and Technology on Corporate Social Responsibility Disclosures-Evidence from Maharatna Central Public Sector Enterprises in India. Australas. Account. Bus. Financ. J. 2018, 12, 5–28. [Google Scholar] [CrossRef] [Green Version]

- Wilestari, M.; Syakhroza, A.; Djakman, C.D.; Diyanty, V. The Influence of Regulation and Financial Performance on The Disclosure of Corporate Social Responsibility and Corporate Reputation Moderated by Ownership Structure. GATR Account. Financ. Rev. 2021, 5. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Fosso Wamba, S.; Roubaud, D.; Foropon, C. Empirical investigation of data analytics capability and organizational flexibility as complements to supply chain resilience. Int. J. Prod. Res. 2019, 59, 110–128. [Google Scholar] [CrossRef]

- Karim, M.R.; Shetu, S.A. Level of Shariah Compliance in the Operation of Islamic Banks in Bangladesh: An Empirical Study. Int. J. Islamic Econ. Financ. Stud. 2020, 6, 293–317. [Google Scholar] [CrossRef]

- Rosman, R.; Wahab, N.A.; Zainol, Z. Efficiency of Islamic banks during the financial crisis: An analysis of Middle Eastern and Asian countries. Pac. Basin Financ. J. 2014, 28, 76–90. [Google Scholar] [CrossRef]

- Budi, I.S.; Rahmawati, R.; Falikhatun, F.; Muthmainah, M.; Gunardi, A. Financial Performance Mediation in the Influence of Islamic Corporate Governance Disclosure on the Islamic Social Reporting. Indones. J. Sustain. Account. Manag. 2019, 3, 75. [Google Scholar] [CrossRef]

- Zain, N.S.; Muhamad Sori, Z. An exploratory study on Musharakah SRI Sukuk for the development of Waqf properties/assets in Malaysia. Qual. Res. Financ. Mark. 2020, 12, 301–314. [Google Scholar] [CrossRef]

- Anthony, B., Jr.; Abdul Majid, M.; Romli, A. Green information technology adoption towards a sustainability policy agenda for government-based institutions: An administrative perspective. J. Sci. Technol. Policy Manag. 2019, 10, 274–300. [Google Scholar] [CrossRef]

- Bae, S.M.; Masud, M.A.K.; Kim, J.D. A cross-country investigation of corporate governance and corporate sustainability disclosure: A signaling theory perspective. Sustainability 2018, 10, 2611. [Google Scholar] [CrossRef] [Green Version]

- Khattak, M.A. Corporate Sustainability and Financial Performance of Banks in Muslim Economies: The Role of Institutions. J. Public Aff. 2021, 21, e2156. [Google Scholar] [CrossRef]

- Rudyanto, A.; Pirzada, K. The role of sustainability reporting in shareholder perception of tax avoidance. Soc. Responsib. J. 2020, 17. [Google Scholar] [CrossRef]

- Weerakkody, V.; Sivarajah, U.; Mahroof, K.; Maruyama, T.; Lu, S. Influencing subjective well-being for business and sustainable development using big data and predictive regression analysis. J. Bus. Res. 2020, 131, 793–802. [Google Scholar] [CrossRef] [PubMed]

- Theresia, T.; Indrastuti, D.K.; Alexander, N. Corporate Governance and Earnings Management: Empirical Evidence of the Distress and Non-Distress Companies. GATR Account. Financ. Rev. 2021, 5. [Google Scholar] [CrossRef]

- Nosita, F.; Pirzada, K.; Lestari, T.; Cahyono, R. Impact of demographic factors on risk tolerance. J. Secur. Sustain. Issues 2020, 9, 1–10. [Google Scholar] [CrossRef]

- Janah, M.; Rahayu, A.Y.S. Collaborative Governance Approaches in Dealing with Financial Deficits in the JKN-KIS Program in Indonesia. GATR Glob. J. Bus. Soc. Sci. Rev. 2020, 8, 124–131. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleisher, M. The Processes of Technological Innovation; Lexington Books: Lexington, KY, USA, 1990. [Google Scholar]

- Ackermann, F.; Eden, C. Strategic Management of Stakeholders: Theory and Practice. Long Range Plan. 2011, 44, 179–196. [Google Scholar] [CrossRef]

- Someh, I.; Davern, M.; Breidbach, C.F.; Shanks, G. Ethical issues in big data analytics: A stakeholder perspective. Commun. Assoc. Inf. Syst. 2019, 44, 718–747. [Google Scholar] [CrossRef]

- Barney, J.; Wright, M.; Ketchen, D.J. The resource-based view of the firm: Ten years after 1991. J. Manag. 2001, 27, 625–641. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manage. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Kraaijenbrink, J.; Spender, J.C.; Groen, A.J. The Resource-based view: A review and assessment of its critiques. J. Manag. 2010, 36, 349–372. [Google Scholar] [CrossRef]

- Deegan, C. Financial Accounting Theory; McGraw-Hill Book Company: New York, NY, USA, 2004. [Google Scholar]

- Tonay, C.; Sutrisno, P. Are Corporate Governance Mechanisms, Corporate Strategy, and Corporate Financial Characteristics Related to Earnings Management? GATR J. Financ. Bank. Rev. 2020, 5, 48–57. [Google Scholar] [CrossRef]

- Fajriyanti, N.; Sukoharsono, E.G.; Abid, N. Examining the effect of diversification, corporate governance and intellectual capital on sustainability performance. Int. J. Res. Bus. Soc. Sci. 2021, 10, 12–20. [Google Scholar] [CrossRef]

- Jensen, T.; Sandström, J. Stakeholder theory and globalization: The challenges of power and responsibility. Organ. Stud. 2011, 32, 473–488. [Google Scholar] [CrossRef]

- Werner, F.M. The Rise and Fall of Finance and the End of the Society of Organizations by Gerald F Davis (Academy of Management Perspectives, August 2009). Organ. Manag. J. 2010, 7, 307–309. [Google Scholar] [CrossRef]

- Sasongko, G.; Huruta, A.D.; Pirzada, K. Why labor force participation rate rises? new empirical evidence from Indonesia. Entrep. Sustain. Issues 2019, 7, 166. [Google Scholar] [CrossRef]

- Laplume, A.O.; Sonpar, K.; Litz, R.A. Stakeholder theory: Reviewing a theory that moves us. J. Manag. 2008, 34, 1152–1189. [Google Scholar] [CrossRef]

- Mallin, C.; Farag, H.; Ow-Yong, K. Corporate social responsibility and financial performance in Islamic banks. J. Econ. Behav. Organ. 2014, 103, S21–S38. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 72, 1671–1696. [Google Scholar] [CrossRef]

- Adedeji, B.S.; Ong, T.S.; Uzir, M.U.H.; Abdul Hamid, A.B. Corporate governance and performance of medium-sized firms in Nigeria: Does sustainability initiative matter? Corp. Gov. 2020, 20, 401–427. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate Governance and Corporate Social Responsibility Disclosure: Evidence from the US Banking Sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef] [Green Version]

- Cuervo-Cazurra, A.; Inkpen, A.; Musacchio, A.; Ramaswamy, K. Governments as owners: State-owned multinational companies. J. Int. Bus. Stud. 2014, 45, 919–942. [Google Scholar] [CrossRef] [Green Version]

- Salleh, A.; Ahmad, A.; Kumar, N. Human Governance: A neglected mantra for continuous Performance Improvement. Perform. Improv. 2009, 48, 26–30. [Google Scholar] [CrossRef]

- Serravalle, F.; Ferraris, A.; Vrontis, D.; Thrassou, A.; Christofi, M. Augmented reality in the tourism industry: A multi-stakeholder analysis of museums. Tour. Manag. Perspect. 2019, 32, 100549. [Google Scholar] [CrossRef]

- Hanif, H.; Rakhman, A.; Nurkholis, M.; Pirzada, K. Intellectual capital: Extended VAIC model and building of a new HCE concept: The case of padang restaurant Indonesia. Afr. J. Hosp. Tour. Leis. 2019, 8, 1–8. [Google Scholar]

- Nishino, N.; Akai, K.; Tamura, H. Product differentiation and consumer’s purchase decision-making under carbon footprint scheme. Proc. CIRP 2014, 16, 116–121. [Google Scholar] [CrossRef] [Green Version]

- Thomaz, F.; Salge, C.; Karahanna, E.; Hulland, J. Learning from the Dark Web: Leveraging conversational agents in the era of hyper-privacy to enhance marketing. J. Acad. Mark. Sci. 2020, 48, 43–63. [Google Scholar] [CrossRef] [Green Version]

- Xu, Y.; Jeong, E.; Baiomy, A.E.; Shao, X. Investigating onsite restaurant interactive self-service technology (ORISST) use: Customer expectations and intentions. Int. J. Contemp. Hosp. Manag. 2020, 32, 3335–3360. [Google Scholar] [CrossRef]

- Gu, B.; Yang, M.; Huo, L. The impact of information technology usage on supply chain resilience and performance: An ambidexterous view. Int. J. Prod. Econ. 2020, 232, 107956. [Google Scholar] [CrossRef]

- Dong, S.; Xu, L.; McIver, R. China’s financial sector sustainability and “ green finance ” disclosures. Sustain. Account. Manag. Policy J. 2021, 12, 353–384. [Google Scholar] [CrossRef]

- Corsini, F.; Rizzi, F.; Frey, M. Institutional legitimacy of non-profit innovation facilitators: Strategic postures in regulated environments. Technol. Soc. 2018, 53, 69–78. [Google Scholar] [CrossRef]

- Schrempf-Stirling, J.; Palazzo, G.; Phillips, R.A. Historic corporate social responsibility. Acad. Manag. Rev. 2016, 41, 700–719. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Hassan, R. Sustainable business practices and firm’s financial performance in islamic banking: Under the moderating role of islamic corporate governance. Sustainability 2019, 11, 6606. [Google Scholar] [CrossRef] [Green Version]

- Jordão, R.V.D.; de Almeida, V.R. Performance measurement, intellectual capital and financial sustainability. J. Intellect. Cap. 2017, 18, 643–666. [Google Scholar] [CrossRef]

- Datta, P.P. Hidden costs in different stages of advanced services—A multi-actor perspective of performance based contracts. J. Bus. Res. 2020, 121, 667–685. [Google Scholar] [CrossRef]

- Pavlou, P.; Liang, H.; Xue, Y. Understanding and mitigating uncertainty in online environments: A longitudinal analysis of the role of trust and social presence. In Academy of Management 2005 Annual Meeting: A New Vision of Management in the 21st Century, AOM 2005; Academy of Management: Briarcliff Manor, NY, USA, 2005; pp. H1–H6. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency Theory: An Assessment and Review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M. Board characteristics and integrated reporting quality: An agency theory perspective. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1152–1163. [Google Scholar] [CrossRef]

- Ayuso, S.; Argandoña, A. Responsible Corporate Governance: Towards a Stakeholder Board of Directors? SSRN Electron. J. 2011, 3, 701. [Google Scholar] [CrossRef] [Green Version]

- Hillman, A.J.; Cannella, A.A.; Paetzold, R.L. The Resource Dependence Role of Corporate Directors: Strategic Adaptation of Board Composition in Response to Environmental Change. J. Manag. Stud. 2000, 37, 235–256. [Google Scholar] [CrossRef]

- Ullah, F.; Qayyum, S.; Thaheem, M.J.; Al-Turjman, F.; Sepasgozar, S.M.E. Risk management in sustainable smart cities governance: A TOE framework. Technol. Forecast. Soc. Chang. 2021, 167, 120743. [Google Scholar] [CrossRef]

- Olutoyin, O.; Flowerday, S. Successful IT governance in SMES: An application of the Technology–Organisation–Environment theory. SA J. Inf. Manag. 2016, 18, 1–9. [Google Scholar] [CrossRef]

- Awa, H.O.; Ukoha, O.; Igwe, S.R. Revisiting technology-organization-environment (T-O-E) theory for enriched applicability. Bottom Line 2017, 30, 2–22. [Google Scholar] [CrossRef]

- Ahmadi, H.; Nilashi, M.; Shahmoradi, L.; Ibrahim, O. Hospital Information System adoption: Expert perspectives on an adoption framework for Malaysian public hospitals. Comput. Hum. Behav. 2017, 67, 161–189. [Google Scholar] [CrossRef]

- Wati, L.N. Board of commissioner’s effectiveness on politically connected conglomerates: Evidence from Indonesia. Pertanika J. Soc. Sci. Humanit. 2017, 25, 255–270. [Google Scholar]

- Machado, M.C.; Hourneaux, F., Jr.; Sobral, F.A. Sustainability in Information Technology: An Analysis of the Aspects Considered in the Model Cobit. J. Inf. Syst. Technol. Manag. 2017, 14, 88–110. [Google Scholar] [CrossRef] [Green Version]

- Cantele, S.; Zardini, A. Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability–financial performance relationship. J. Clean. Prod. 2018, 182, 166–176. [Google Scholar] [CrossRef]

- Eriandani, R.; Pirzada, K.; Kurniawan, M.K. The role of auditor characteristics: Earnings management and audit committee effectiveness. Entrep. Sustain. Issues 2020, 7, 3242–3252. [Google Scholar] [CrossRef]

- Said, R.; Abdul Rahim, A.A.; Hassan, R. Exploring the effects of corporate governance and human governance on management commentary disclosure. Soc. Responsib. J. 2018, 14, 843–858. [Google Scholar] [CrossRef]

- Pirzada, K.; Mustapha, M.Z.; Alfan, E.B. Antecedents of ethnic diversity: The role of nomination committees. Int. J. Econ. Manag. 2017, 11, 103–119. [Google Scholar] [CrossRef] [Green Version]

- Hue, T.T. The determinants of innovation in Vietnamese manufacturing firms: An empirical analysis using a technology–organization–environment framework. Eurasian Bus. Rev. 2019, 9, 247–267. [Google Scholar] [CrossRef]

- Husaini, P.; Kashan, S. Risk management, sustainable governance impact on corporate performance. J. Secur. Sustain. Issues 2020, 9, 993–1004. [Google Scholar]

- Hosseini, M.R.; Banihashemi, S.; Rameezdeen, R.; Golizadeh, H.; Arashpour, M.; Ma, L. Sustainability by Information and Communication Technology: A paradigm shift for construction projects in Iran. J. Clean. Prod. 2017, 168, 121584. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Vaccaro, V.L. B2B green marketing and innovation theory for competitive advantage. J. Syst. Inf. Technol. 2009, 11, 315–330. [Google Scholar] [CrossRef]

- Rambu Atahau, A.D.; Huruta, A.D.; Lee, C.W. Rural microfinance sustainability: Does local wisdom driven-governance work? J. Clean. Prod. 2020, 267, 122153. [Google Scholar] [CrossRef]

- Ravasi, D.; Turati, C. Exploring entrepreneurial learning: A comparative study of technology development projects. J. Bus. Ventur. 2005, 20, 137–164. [Google Scholar] [CrossRef]

- Siqueira, A.C.O.; Bruton, G.D. High-technology entrepreneurship in emerging economies: Firm informality and contextualization of resource-based theory. IEEE Trans. Eng. Manag. 2010, 57, 39–50. [Google Scholar] [CrossRef]

- Gössling, S. Tourism, information technologies and sustainability: An exploratory review. J. Sustain. Tour. 2017, 25, 1024–1041. [Google Scholar] [CrossRef]

- Jamil, A.; Mohd Ghazali, N.A.; Puat Nelson, S. The influence of corporate governance structure on sustainability reporting in Malaysia. Soc. Responsib. J. 2020, 17, 1251–1278. [Google Scholar] [CrossRef]

- Haniffa, R.M.; Cooke, T.E. The impact of culture and governance on corporate social reporting. J. Account. Public Policy 2005, 24, 391–430. [Google Scholar] [CrossRef]

- Abdullah, W.N.; Said, R. The influence of corporate governance and human governance towards corporate financial crime: A conceptual paper. Dev. Corp. Gov. Responsib. 2018, 13, 193–215. [Google Scholar]

- Owens, B.P.; Hekman, D.R. How does leader humility influence team performance? Exploring the mechanisms of contagion and collective promotion focus. Acad. Manag. J. 2016, 59, 1088–1111. [Google Scholar] [CrossRef]

- Lidyah, R. Islamic Corporate Governance, Islamicity financial performance index.pdf. J. Akunt. 2018, 22, 437–453. [Google Scholar] [CrossRef] [Green Version]

- Hashim, F.; Mahadi, N.D.; Amran, A. Corporate Governance and Sustainability Practices in Islamic Financial Institutions: The Role of Country of Origin. Proc. Econ. Financ. 2015, 31, 36–43. [Google Scholar] [CrossRef] [Green Version]

- Nasreem, M.A.; Riaz, S.; Rehman, R.U.; Ikram, A.; Malik, F. Impact of Board Characteristics on CSR Disclosure. J. Appl. Bus. Res. 2017, 33, 801–810. [Google Scholar]

- Donnelly, R.; Mulcahy, M. Board Structure, Ownership, and Voluntary Disclosure in Ireland. Corp. Gov. Int. Rev. 2008, 16, 416–429. [Google Scholar] [CrossRef]

- Frias-Aceituno, J.-V.; Rodríguez-Ariza, L.; Sánchez, I. The Role of the Board in the Dissemination of Integrated Corporate Social Reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- García-Meca, E.; Uribe-Bohórquez, M.-V.; Cuadrado-Ballesteros, B. Culture, Board Composition and Corporate Social Reporting in the Banking Sector. Adm. Sci. 2018, 8, 41. [Google Scholar] [CrossRef] [Green Version]

- Bansal, S.; Lopez-Perez, M.; Rodriguez-Ariza, L. Board Independence and Corporate Social Responsibility Disclosure: The Mediating Role of the Presence of Family Ownership. Adm. Sci. 2018, 8, 33. [Google Scholar] [CrossRef] [Green Version]

- Vitolla, F.; Raimo, N.; Rubino, M.; Garzoni, A. How pressure from stakeholders affects integrated reporting quality. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1591–1606. [Google Scholar] [CrossRef]

| Variable | Measurements | Number of Items |

|---|---|---|

| Sustainability Reporting Disclosure | Content Analysis, 1 for disclose and 0 not disclose | Total: 48 items |

| Economic Performance | 7 items | |

| Economic Performance | 4 items | |

| Market Presence | 2 items | |

| Indirect Economic Impact | 1 | |

| Environmental Performance | 16 items | |

| Materials | 2 items | |

| Energy | 2 items | |

| Water | 1 item | |

| Biodiversity | 2 items | |

| Emission, effluent and waste | 6 items | |

| Products and Service Compliance | 3 items | |

| Social Performance | 25 items | |

| Labor practices and decent work | 9 items | |

| Human rights | 6 items | |

| Society | 6 items | |

| Health and Safety | 4 items |

| Variable | Measurements | Number of Items |

|---|---|---|

| Islamic Corporate Governance | Total: 4 items | |

| Number of Muslims on BOD | Number of Muslims on BOD/Total number of people on BOD | |

| Number of Muslim independent non-executive directors (INEDs) | Muslim INEDs/Total number of INEDs | |

| Muslim chairperson | 1 if Muslim chairperson, 0 if not | |

| Muslim CEO | 1 if Muslim CEO, 0 if not |

| Variable | Measurement | Number of Items | |

|---|---|---|---|

| Human Governance | 37 Items | ||

| Leadership of BOD | 5 items | ||

| Job experience | Score 1 if >10 years, otherwise 0 | ||

| Education background | Business 1, Non-Business 0 | ||

| Education Level | Ph.D. | 4 | |

| Master | 3 | ||

| Professional Certification | 2 | ||

| Degree | 1 | ||

| Below Degree | 0 | ||

| Age | ≥ 60 years | 3 | |

| 50–59 years | 2 | ||

| 40–49 years | 1 | ||

| ≤ 39 years | 0 | ||

| Gender Diversity | Percentage of Female BOD/Total BOD Female 1, Male 0 | ||

| Integrity | Disclose, 1, Not Disclosed, 0; 10 items | ||

| Corporate Ethics Value, | 1 item | ||

| Action to promote ethics | 3 items | ||

| Code of ethics | 2 items | ||

| Ethics Committee | 2 items | ||

| Whistleblowing policy | 2 items | ||

| Training and Development of BOD | More than 5, score 1 is given Less than 5, score 0 is given | ||

| Internal Control Quality | Disclose, 1, Not Disclosed, 0; 21 items | ||

| Content of internal control disclosure | 5 items | ||

| Implementation of ICS | 6 items | ||

| ICS and its role | 5 items | ||

| Objective of ICS | 3 items | ||

| Framework of ICS | 1 item | ||

| A separate section of ICS | 1 item | ||

| Variable | Measurement | |

|---|---|---|

| IT Usage | 1 if disclosed and 0 if not | 6 items |

| Using ICT for Corporate Information and Communication (such as website/portal/social media/official email) (CW) | 1 item | |

| Using ICT for Human Resources Management (such as digital app/HRIS/payroll/etc.) (HRM) | 1 item | |

| Using ICT for Supply Chain Management (SCM) | 1 item | |

| Using ICT for Accounting/Finance (AF) | 1 item | |

| Using ICT for Customer Relationship Management (CRM) | 1 item | |

| Using ICT for Manufacturing (M) | 1 item |

| N | Range | Minimum | Maximum | Sum | Mean | Std. Deviation | ||

|---|---|---|---|---|---|---|---|---|

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Std. Error | Statistic | |

| SR | 70 | 0.74 | 0.00 | 0.74 | 22.02 | 0.3146 | 0.02151 | 0.18000 |

| HG | 70 | 0.59 | 0.19 | 0.78 | 27.55 | 0.3936 | 0.01749 | 0.14636 |

| ICG | 70 | 0.75 | 0.00 | 0.75 | 9.10 | 0.1300 | 0.02341 | 0.19584 |

| ITU | 70 | 0.83 | 0.17 | 1.00 | 35.50 | 0.5071 | 0.03278 | 0.27428 |

| P | 70 | 0.76 | −0.40 | 0.36 | 2.88 | 0.0411 | 0.01105 | 0.09248 |

| S | 70 | 9.50 | 8.88 | 18.38 | 1013.92 | 14.4845 | 0.20466 | 1.71233 |

| L | 70 | 0.76 | 0.07 | 0.83 | 27.96 | 0.3994 | 0.02078 | 0.17384 |

| SR1 | 70 | 1.00 | 0.00 | 1.00 | 26.71 | 0.3816 | 0.02859 | 0.23920 |

| SR2 | 70 | 0.69 | 0.00 | 0.69 | 18.50 | 0.2643 | 0.02563 | 0.21445 |

| SR3 | 70 | 0.88 | 0.00 | 0.88 | 20.86 | 0.2980 | 0.02078 | 0.17389 |

| HG1 | 70 | 0.52 | 0.28 | 0.80 | 39.94 | 0.5705 | 0.01259 | 0.10535 |

| HG2 | 70 | 0.80 | 0.00 | 0.80 | 26.60 | 0.3800 | 0.02271 | 0.19004 |

| HG3 | 70 | 1.00 | 0.00 | 1.00 | 11.00 | 0.1571 | 0.04381 | 0.36656 |

| HG4 | 70 | 0.95 | 0.00 | 0.95 | 32.67 | 0.4667 | 0.03014 | 0.25218 |

| ICG1 | 70 | 0.75 | 0.00 | 0.75 | 9.23 | 0.1318 | 0.02422 | 0.20265 |

| ICG2 | 70 | 1.00 | 0.00 | 1.00 | 13.17 | 0.1881 | 0.04262 | 0.35658 |

| ICG3 | 70 | 1.00 | 0.00 | 1.00 | 9.00 | 0.1286 | 0.04030 | 0.33714 |

| ICG4 | 70 | 1.00 | 0.00 | 1.00 | 5.00 | 0.0714 | 0.03100 | 0.25940 |

| ITU1 | 70 | 0.00 | 1.00 | 1.00 | 70.00 | 1.0000 | 0.00000 | 0.00000 |

| ITU2 | 70 | 1.00 | 0.00 | 1.00 | 46.00 | 0.6571 | 0.05714 | 0.47809 |

| ITU3 | 70 | 1.00 | 0.00 | 1.00 | 23.00 | 0.3286 | 0.05654 | 0.47309 |

| ITU4 | 70 | 1.00 | 0.00 | 1.00 | 31.00 | 0.4429 | 0.05980 | 0.50031 |

| ITU5 | 70 | 1.00 | 0.00 | 1.00 | 21.00 | 0.3000 | 0.05517 | 0.46157 |

| ITU6 | 70 | 1.00 | 0.00 | 1.00 | 22.00 | 0.3143 | 0.05589 | 0.46758 |

| Valid N | 70 | |||||||

| N | Range | Mean | Std. Deviation | Variance | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | Statistic | |

| SR | 70 | 0.74 | 0.3146 | 0.18000 | 0.032 | 0.285 | −0.852 |

| HG | 70 | 0.59 | 0.3936 | 0.14636 | 0.021 | 1.141 | 0.560 |

| ICG | 70 | 0.75 | 0.1300 | 0.19584 | 0.038 | 1.411 | 1.057 |

| ITU | 70 | 0.83 | 0.5071 | 0.27428 | 0.075 | 0.371 | −1.070 |

| P | 70 | 0.76 | 0.0411 | 0.09248 | 0.009 | −0.756 | 8.565 |

| S | 70 | 9.50 | 14.4845 | 1.71233 | 2.932 | −0.038 | 0.780 |

| L | 70 | 0.76 | 0.3994 | 0.17384 | 0.030 | 0.052 | −0.682 |

| Valid N | 70 |

| SR | HG | ICG | ITU | P | S | L | ||

|---|---|---|---|---|---|---|---|---|

| SR | Pearson Correlation | 1 | 0.316 ** | −0.183 | 0.155 | 0.184 | 0.429 ** | 0.184 |

| Sig. (2-tailed) | 0.008 | 0.129 | 0.199 | 0.126 | 0.000 | 0.126 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| HG | Pearson Correlation | 0.316 ** | 1 | 0.084 | 0.113 | 0.125 | 0.359 ** | 0.267 * |

| Sig. (2-tailed) | 0.008 | 0.488 | 0.354 | 0.304 | 0.002 | 0.025 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| ICG | Pearson Correlation | −0.183 | 0.084 | 1 | −0.084 | 0.105 | −0.112 | −0.038 |

| Sig. (2-tailed) | 0.129 | 0.488 | 0.489 | 0.386 | 0.357 | 0.752 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| ITU | Pearson Correlation | 0.155 | 0.113 | −0.084 | 1 | 0.045 | 0.111 | −0.004 |

| Sig. (2-tailed) | 0.199 | 0.354 | 0.489 | 0.709 | 0.359 | 0.971 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| P | Pearson Correlation | 0.184 | 0.125 | 0.105 | 0.045 | 1 | 0.265 * | −0.021 |

| Sig. (2-tailed) | 0.126 | 0.304 | 0.386 | 0.709 | 0.026 | 0.860 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| S | Pearson Correlation | 0.429 ** | 0.359 ** | −0.112 | 0.111 | 0.265 * | 1 | 0.092 |

| Sig. (2-tailed) | 0.000 | 0.002 | 0.357 | 0.359 | 0.026 | 0.447 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| L | Pearson Correlation | 0.184 | 0.267 * | −0.038 | −0.004 | −0.021 | 0.092 | 1 |

| Sig. (2-tailed) | 0.126 | 0.025 | 0.752 | 0.971 | 0.860 | 0.447 | ||

| N | 70 | 70 | 70 | 70 | 70 | 70 | 70 | |

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| (Constant) | −0.292 | 0.086 | −3.405 | 0.001 *** | ||

| HG | 0.209 | 0.072 | 0.170 | 2.910 | 0.004 *** | |

| ICG | −0.149 | 0.049 | −0.162 | −3.037 | 0.003 *** | |

| ITU | 0.056 | 0.035 | 0.085 | 1.611 | 0.108 | |

| Profitability | 0.191 | 0.106 | 0.098 | 1.800 | 0.073 * | |

| Size | 0.032 | 0.006 | 0.304 | 5.221 | 0.000 *** | |

| Leverage | 0.111 | 0.056 | 0.107 | 1.982 | 0.048 ** | |

| R-square | 0.265 | |||||

| Adjusted R-square | 0.249 | |||||

| F-statistic | 0.000 a | |||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 2.369 | 6 | 0.395 | 16.395 | 0.000 a |

| Residual | 6.573 | 273 | 0.024 | |||

| Total | 8.942 | 279 | ||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

|---|---|---|---|---|---|

| B | Std. Error | Beta | |||

| (Constant) | −0.371 | 0.085 | −4.364 | 0.000 *** | |

| ITU | 0.072 | 0.035 | 0.110 | 2.056 | 0.041 ** |

| Profitability | 0.159 | 0.107 | 0.082 | 1.478 | 0.140 |

| Size | 0.040 | 0.006 | 0.381 | 6.837 | 0.000 *** |

| Leverage | 0.157 | 0.055 | 0.152 | 2.836 | 0.005 ** |

| R-square | 0.223 | ||||

| Adjusted R-square | 0.176 | ||||

| F-statistic | 0.002 a | ||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Regression | 0.499 | 4 | 0.125 | 4.674 | 0.002 a,** |

| Residual | 1.736 | 65 | 0.027 | ||

| Total | 2.235 | 69 |

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | |

|---|---|---|---|---|---|

| B | Std. Error | Beta | |||

| (Constant) | −0.302 | 0.086 | −3.508 | 0.001 *** | |

| ICG | −0.135 | 0.049 | −0.147 | −2.738 | 0.007 *** |

| Profitability | 0.204 | 0.108 | 0.105 | 1.887 | 0.060 * |

| Size | 0.039 | 0.006 | 0.371 | 6.667 | 0.000 *** |

| Leverage | 0.152 | 0.055 | 0.147 | 2.762 | 0.006 *** |

| R-square | 0.232 | ||||

| Adjusted R-square | 0.221 | ||||

| F-statistic | 0.000 a | ||||

| Model | Sum of Squares | df | Mean Square | F | Sig. |

|---|---|---|---|---|---|

| Regression | 2.078 | 4 | 0.519 | 20.812 | 0.000 b |

| Residual | 6.864 | 275 | 0.025 | ||

| Total | 8.942 | 279 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

So, I.G.; Haron, H.; Gui, A.; Princes, E.; Sari, S.A. Sustainability Reporting Disclosure in Islamic Corporates: Do Human Governance, Corporate Governance, and IT Usage Matter? Sustainability 2021, 13, 13023. https://doi.org/10.3390/su132313023

So IG, Haron H, Gui A, Princes E, Sari SA. Sustainability Reporting Disclosure in Islamic Corporates: Do Human Governance, Corporate Governance, and IT Usage Matter? Sustainability. 2021; 13(23):13023. https://doi.org/10.3390/su132313023

Chicago/Turabian StyleSo, Idris Gautama, Hasnah Haron, Anderes Gui, Elfindah Princes, and Synthia Atas Sari. 2021. "Sustainability Reporting Disclosure in Islamic Corporates: Do Human Governance, Corporate Governance, and IT Usage Matter?" Sustainability 13, no. 23: 13023. https://doi.org/10.3390/su132313023