An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance?

Abstract

1. Introduction

2. Literature Review

2.1. Firm Performance

2.2. Corporate Social Responsibility

2.3. Strategy Competitiveness

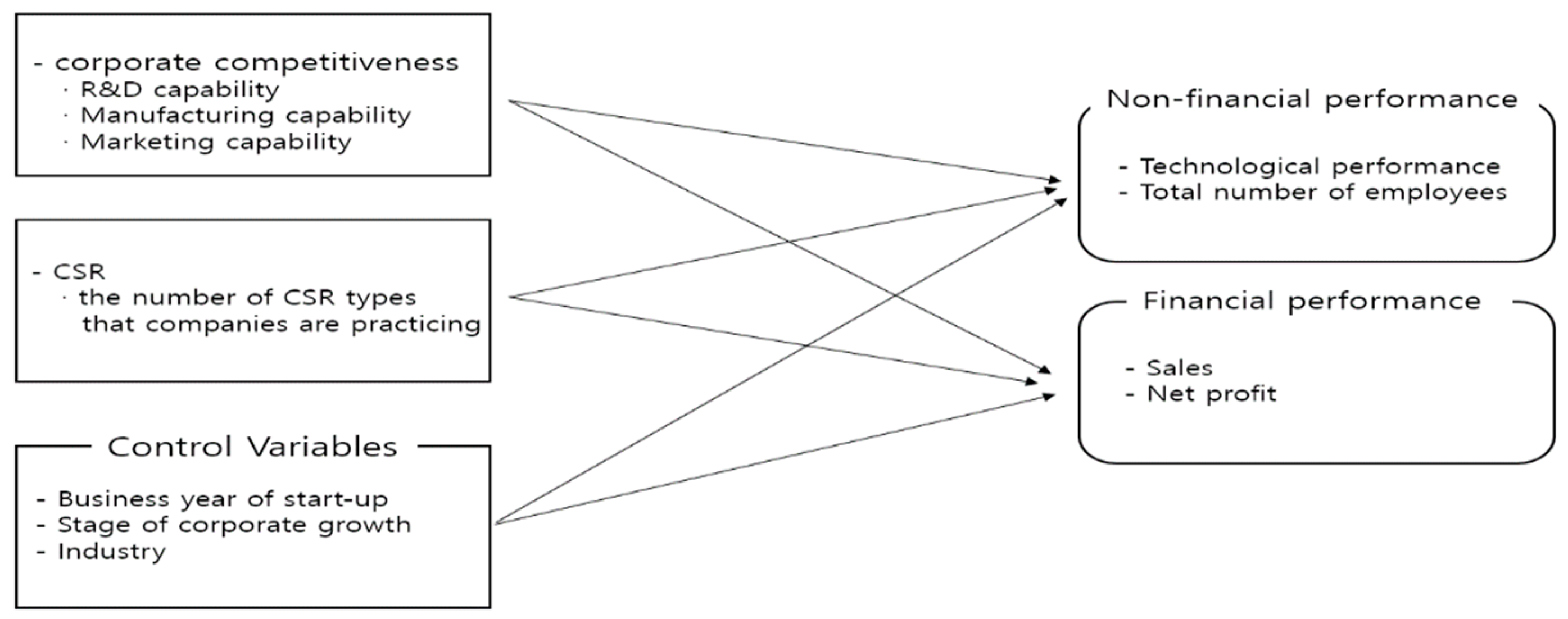

3. Methodology

3.1. Measurement

3.2. Data

4. Results

5. Conclusions

5.1. Implication and Contribution

5.2. Limitations and Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Bahta, D.; Yun, J.; Islam, M.R.; Bikanyi, K.J. How does CSR Enhance the Financial Performance of SMEs? The Mediating Role of Firm Reputation. Econ. Res. Ekon. Istraživanja 2021, 34, 1428–1451. [Google Scholar] [CrossRef]

- Khattak, M.S.; Anwar, M.; Claub, T. The Role of Entrepreneurial Finance in Corporate Social Responsibility and New Venture Performance in an Emerging Market. J. Entrep. 2021, 30, 336–366. [Google Scholar] [CrossRef]

- Wang, T.; Bansal, P. Social Responsibility in New Ventures: Profiting from a Long-term Orientation. Strateg. Manag. J. 2012, 33, 1135–1153. [Google Scholar] [CrossRef]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An Empirical Examination of the Relationship between Social Responsibility and Profitabiligy. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- Chun, D.P.; Woo, C.W. The Effect of CSR on Venture Companies’ Managerial Performance: Considering Corporate Growth Stage. Asia Pac. J. Bus. Ven. Entrep. 2020, 15, 225–235. [Google Scholar]

- Cummings, L.S. The Financial Performance of Ethical Investment Trusts: An Australian Perspective. J. Bus. Ethics 2000, 25, 79–82. [Google Scholar] [CrossRef]

- Pava, M.L.; Krausz, J. The Association between Corporate Social Responsibility and Financial Performance: The paradox of Social Cost. J. Bus. Ethics 1996, 15, 221–257. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.G. The Corporate Social Performance-Financial Performance Link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Westphal, J.D. Collaboration in the boardroom: Behavioral and Performance Consequences of CEO-board Social Ties. Aca. Manag. J. 1999, 42, 7–24. [Google Scholar]

- Nash, L. Good Intentions Aside a Manager’s Guide to Resolving Ethical Problems; Harvard Business School Press: Boston, MA, USA, 1990; pp. 21–48. [Google Scholar]

- Weaver, G.R.; Trevino, L.K.; Cochran, P.L. Corporate Ethical Programs as Control System: Influences of Executive Commitment and Environmental Factors. Aca. Man. J. 1999, 42, 41–58. [Google Scholar]

- Yoon, H.D.; Sung, J.S. The Impact of Social Responsibility Managment Certification on Venture company’s Formation of Orgaizational Trust. J. Kor. Soc. Qua. Manag. 2012, 40, 126–144. [Google Scholar] [CrossRef][Green Version]

- Porter, M.; Kramer, M. Strategy & Society: The Link between Competitive Advantage and Corporate Social Responsibility. Har. Bus. Rev. 2008, 80, 56–68. [Google Scholar]

- Brammer, S.; Brooks, C.; Pavelin, S. Corporate Social Performance and Stock Returns: UK Evidence from Disaggregate Measures. Fin. Manag. 2006, 35, 97–116. [Google Scholar] [CrossRef]

- Nelling, E.; Webb, E. Corporate Social Responsibility and Financial Performance: The “virtuous circle” revisited. Rev. Qua. Fin. Acc. 2009, 32, 197–209. [Google Scholar] [CrossRef]

- Hammann, E.M.; Habisch, A.; Pechlaner, H. Values that Create Value: Socially Responsible Business Practices in SME-empirical Evidence from German Companies. Bus. Ethics. A Euro. Rev. 2009, 18, 37–51. [Google Scholar] [CrossRef]

- Lee, C.G.; Yang, D.W. An Empirical Study on the Effect of SME’s Management Strategies and Corporate Social Responsibility (CSR) on Business Performance: Focusing on Mediated Effect of Types of Corporate Organizational Culture. J. Sma. Bus. Inn. 2018, 21, 77–92. [Google Scholar] [CrossRef]

- Mize, K.J.; Stanforth, N.; Johnson, C. Perceptions of Retail Supervisors’ Ethical Behavior and Front-line Managers’ Organizational Commitment. Col. Tex. Res. J. 2000, 18, 100–110. [Google Scholar] [CrossRef]

- Jenkins, H. A Critique of Conventional CSR theory: An SME Perspective. J. Gen. Manag. 2004, 29, 37–57. [Google Scholar] [CrossRef]

- Kim, E.J.; Moon, Y.E.; Kim, J.W. Impact of CSR Activity and the Fitness in Small and Medium Enterprises on Corporate Image and Purchase Intention. J. Int. Elec. Com. Res. 2016, 16, 195–213. [Google Scholar]

- Park, D.I.; Park, C.H. Impact of External Cooperation by Enterprise Growth Stage and Government Certification Support System on Performance. In Proceeding of the Conference on Business Venturing and Entrepreneurship, Seoul, Korea, 27 April 2018. [Google Scholar]

- Baporikar, N. Influence of Business Competitiveness on SMEs Performance. Res. Anth. Sma. Busi. Strateg. Suc. Sur. 2021, 1, 1054–1075. [Google Scholar]

- Man, T.W.; Lau, T.; Snape, E. Entrepreneurial Competencies and the Performance of Small and Medium Enterprises: An Investigation through a Framework of Competitiveness. J. Sma. Bus. Entrep. 2008, 21, 257–276. [Google Scholar] [CrossRef]

- O’Farrell, P.N.; Hitchens, D.M. The Relative Competitiveness and Performance of Small Manufacturing Firms in Scotland and the Mid-West of Ireland: An Analysis of Matched Pairs. Reg. Stud. 1988, 22, 399–415. [Google Scholar] [CrossRef]

- Lee, H.; Kim, R. Comparative Analysis of Age Effect, Period Effect, and Cohort Effect through Time Series Data Analysis—Focus on Changes in Consumer Perception of Corporate Social Responsibility. J. Con. Stud. 2021, 32, 49–73. [Google Scholar] [CrossRef]

- Jun, Y. The study of effects on corporate financial performance and sustainable management by Corporate Social Responsibility. Master’s Thesis, Seoul National University, Seoul, Korea, 2015. [Google Scholar]

| Type of Variables | Items | ||

|---|---|---|---|

| Dependent variable | Non-financial performance | Technological performance | Number of patent applications and registrations (patent rights, utility model rights, design rights, trademark rights, etc.) |

| Total number of employees | Total number of employed workers (regular workers + non-regular workers) | ||

| Financial performance | Sales | Sales of a company (1 Mil.) | |

| Net profit | Net profit of a company (1 Mil.) | ||

| Independent variable | Corporate competitiveness (Compared to the competitor) | R&D capability | The level of competitiveness of a company compared to its perceived competitors (choose: 1—very low, 2—low, 3—average, 4—high, 5—very high) |

| Manufacturing capability | |||

| Marketing capability | |||

| CSR | The number of CSR types that companies are practicing (range: 0~6) (choose all relevant items: donation, talent donation, creating shared value, community service, sponsorship, etc.) | ||

| Control variable | Business year of start-up | (choose: 1—under 3 years after establishment, 2—4–10 years, 3—11–20 years, 4—Over 21 years) | |

| The stage of corporate growth | What do you think is the growth stage of a company? (choose: 1—founding period, 2—early growth period, 3—rapid growth period, 4—maturity period, 5—decline period) | ||

| Industry | (choose: 1—self-manufacturing, 2—manufacturing + outsourcing, 3—all outsourcing, 4—non-manufacturing) | ||

| N = 2200 | N | % | |

|---|---|---|---|

| Business year | under 3 years | 128 | 5.8 |

| 4–10 years | 846 | 38.5 | |

| 11–20 years | 872 | 39.6 | |

| over 21 years | 354 | 16.1 | |

| Business growth stage | founding period | 34 | 1.5 |

| early growth period | 398 | 18.1 | |

| rapid growth period | 771 | 35.0 | |

| maturity period | 982 | 44.6 | |

| decline period | 15 | 0.7 | |

| Industry | Self-manufacturing | 739 | 33.6 |

| Manufacturing + Outsourcing (M&O) | 620 | 28.2 | |

| All-outsourcing | 100 | 4.5 | |

| Non-manufacturing | 741 | 33.7 | |

| Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2.66 | 0.81 | 1 | ||||||||||

| 2 | 3.25 | 0.81 | 0.618 ⁑ | 1 | |||||||||

| 3 | 2.38 | 1.26 | −0.139 ⁑ | −0.030 | 1 | ||||||||

| 4 | 3.72 | 0.65 | 0.104 ⁑ | 0.059 ⁑ | −0.124 ⁑ | 1 | |||||||

| 5 | 3.41 | 0.81 | 0.190 ⁑ | 0.114 ⁑ | −0.233 ⁑ | 0.453 ⁑ | 1 | ||||||

| 6 | 3.29 | 0.69 | 0.156 ⁑ | 0.092 ⁑ | −0.143 ⁑ | 0.560 ⁑ | 0.476 ⁑ | 1 | |||||

| 7 | 0.33 | 0.56 | 0.165 ⁑ | 0.143 ⁑ | −0.100 ⁑ | 0.175 ⁑ | 0.236 ⁑ | 0.197 ⁑ | 1 | ||||

| 8 | 12.98 | 24.53 | 0.294 ⁑ | 0.193 ⁑ | −0.199 ⁑ | 0.242 ⁑ | 0.238 ⁑ | 0.217 ⁑ | 0.227 ⁑ | 1 | |||

| 9 | 52.18 | 67.46 | 0.326 ⁑ | 0.227 ⁑ | −0.069 ⁑ | 0.217 ⁑ | 0.245 ⁑ | 0.286 ⁑ | 0.262 ⁑ | 0.367 ⁑ | 1 | ||

| 10 | 17605.29 | 28480.94 | 0.277 ⁑ | 0.186 ⁑ | −0.143 ⁑ | 0.121 ⁑ | 0.213 ⁑ | 0.241 ⁑ | 0.251 ⁑ | 0.335 ⁑ | 0.696 ⁑ | 1 | |

| 11 | 429.47 | 4571.62 | 0.027 | 0.017 | −0.041 | 0.040 | 0.044 ⁕ | 0.053 ⁕ | 0.060 ⁑ | 0.094 ⁑ | 0.215 ⁑ | 0.354 ⁑ | 1 |

| Β(t) | Non-Financial Performance | Financial Performance | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Technological Performance | Total Number of Employees | Sales | Net Profit | |||||||

| M1 | M2 | M1 | M2 | M1 | M2 | M1 | M2 | |||

| Control variable | Business year of start-up | 0.250 ⁂ (9.656) | 0.212 ⁂ (8.368) | 0.293 ⁂ (11.308) | 0.241 ⁂ (9.678) | 0.240 ⁂ (9.127) | 0.194 ⁂ (7.607) | 0.022 (0.789) | 0.011 (0.383) | |

| Business growth stage | 0.033 (1.291) | 0.023 (0.918) | 0.040 (1.551) | 0.026 (1.083) | 0.033 (1.262) | 0.019 (0.755) | 0.004 (0.153) | 0.000 (0.018) | ||

| Industry | Self-manufacturing | del. | 0.137 ⁂ (5.920) | del. | −0.027 (−1.206) | del. | 0.076 ⁑ (3.254) | del. | 0.040 (1.572) | |

| Manufacturing+outsorcing | −0.049 ⁕ (−2.112) | 0.087 ⁂ (3.823) | −0.043 † (−1.882) | −0.059 ⁑ (−2.607) | −0.045† (−1.925) | 0.037 (1.582) | −0.057 ⁕ (−2.329) | −0.017 (−0.685) | ||

| All-outsourcing | −0.053 ⁕ (−2.521) | 0.029 (1.440) | −0.078 ⁂ (−3.678) | −0.066 ⁑ (−3.308) | −0.055 ⁑ (−2.586) | −0.005 (−0.262) | −0.021 (−0.952) | 0.001 (0.045) | ||

| Non-manufacturing | −0.182 ⁂ (−7.780) | del. | −0.030 (−1.263) | del. | −0.122 ⁂ (−5.131) | del. | −0.051 ⁕ (−2.055) | del. | ||

| Corporate competitivenes | R&D capability | 0.134 ⁂ (5.512) | 0.042 † (1.767) | −0.064 ⁑ (−2.615) | 0.008 (0.286) | |||||

| Manufacturing capability | 0.058 ⁕ (2.466) | 0.067 ⁑ (2.900) | 0.066 ⁑ (2.777) | 0.009 (0.345) | ||||||

| Marketing capability | 0.036 (1.466) | 0.161 ⁂ (6.615) | 0.169 ⁂ (6.780) | 0.030 (1.103) | ||||||

| CSR | The number of CSR types that companies are practicing | 0.133 ⁂ (6.537) | 0.165 ⁂ (8.292) | 0.171 ⁂ (8.353) | 0.048 ⁕ (2.146) | |||||

| Adj. R2 | 0.111 | 0.171 | 0.111 | 0.200 | 0.087 | 0.154 | 0.002 | 0.004 | ||

| F(Sig) | 55.810 ⁂ | 51.450 ⁂ | 56.082 ⁂ | 62.226 ⁂ | 42.821 ⁂ | 45.513 ⁂ | 1.662 | 2.012 ⁕ | ||

| Dependent Variable | Independent Variable | St. Estimate | S.E. | C.R. | p | |

|---|---|---|---|---|---|---|

| Non-financial performance | Technological performance (0.108) | R&D capability | 0.129 | 0.944 | 5.121 | *** |

| Manufacturing capability | 0.112 | 0.727 | 4.681 | *** | ||

| Marketing capability | 0.059 | 0.904 | 2.302 | 0.021 | ||

| The number of CSR types that companies are practicing | 0.166 | 0.906 | 7.973 | *** | ||

| Total number of employees (0.136) | R&D capability | 0.038 | 2.546 | 1.542 | 0.123 | |

| Manufacturing capability | 0.095 | 1.963 | 4.038 | *** | ||

| Marketing capability | 0.181 | 2.438 | 7.202 | *** | ||

| The number of CSR types that companies are practicing | 0.198 | 2.445 | 9.645 | *** | ||

| Financial performance | Sales (0.111) | R&D capability | −0.068 | 1087.635 | −2.723 | 0.006 |

| Manufacturing capability | 0.107 | 838.351 | 4.484 | *** | ||

| Marketing capability | 0.189 | 1041.490 | 7.423 | *** | ||

| The number of CSR types that companies are practicing | 0.201 | 1044.400 | 9.676 | *** | ||

| Net profit (0.006) | R&D capability | 0.007 | 185.671 | 0.265 | 0.791 | |

| Manufacturing capability | 0.013 | 143.115 | 0.523 | 0.601 | ||

| Marketing capability | 0.033 | 177.793 | 1.235 | 0.217 | ||

| The number of CSR types that companies are practicing | 0.049 | 178.290 | 2.246 | 0.025 | ||

| CMIN = 12.300, DF = 10, p = 0.000, CMIN/DF = 1.230, GFI = 0.999, NFI = 0.997, IFI = 0.997, CFI = 0.997, RMSEA = 0.072 | ||||||

| x2 | ∆x2 | p of ∆x2 | ||

|---|---|---|---|---|

| Business Year | Unconstrained Model | 20.164 | 128.797 | 0.000 |

| Measurement Weights Model | 148.961 | |||

| Industry | Unconstrained Model | 9.317 | 148.143 | 0.000 |

| Measurement Weights Model | 157.460 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, B.; Kim, B.-G. An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance? Sustainability 2021, 13, 13106. https://doi.org/10.3390/su132313106

Kim B, Kim B-G. An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance? Sustainability. 2021; 13(23):13106. https://doi.org/10.3390/su132313106

Chicago/Turabian StyleKim, Boine, and Byoung-Goo Kim. 2021. "An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance?" Sustainability 13, no. 23: 13106. https://doi.org/10.3390/su132313106

APA StyleKim, B., & Kim, B.-G. (2021). An Explorative Study of Korean Venture Companies: Do CSR and Company Competitiveness Improve Non-Financial and Financial Performance? Sustainability, 13(23), 13106. https://doi.org/10.3390/su132313106