Current Readiness Status of Electric Vehicles in Indonesia: Multistakeholder Perceptions

Abstract

:1. Introduction

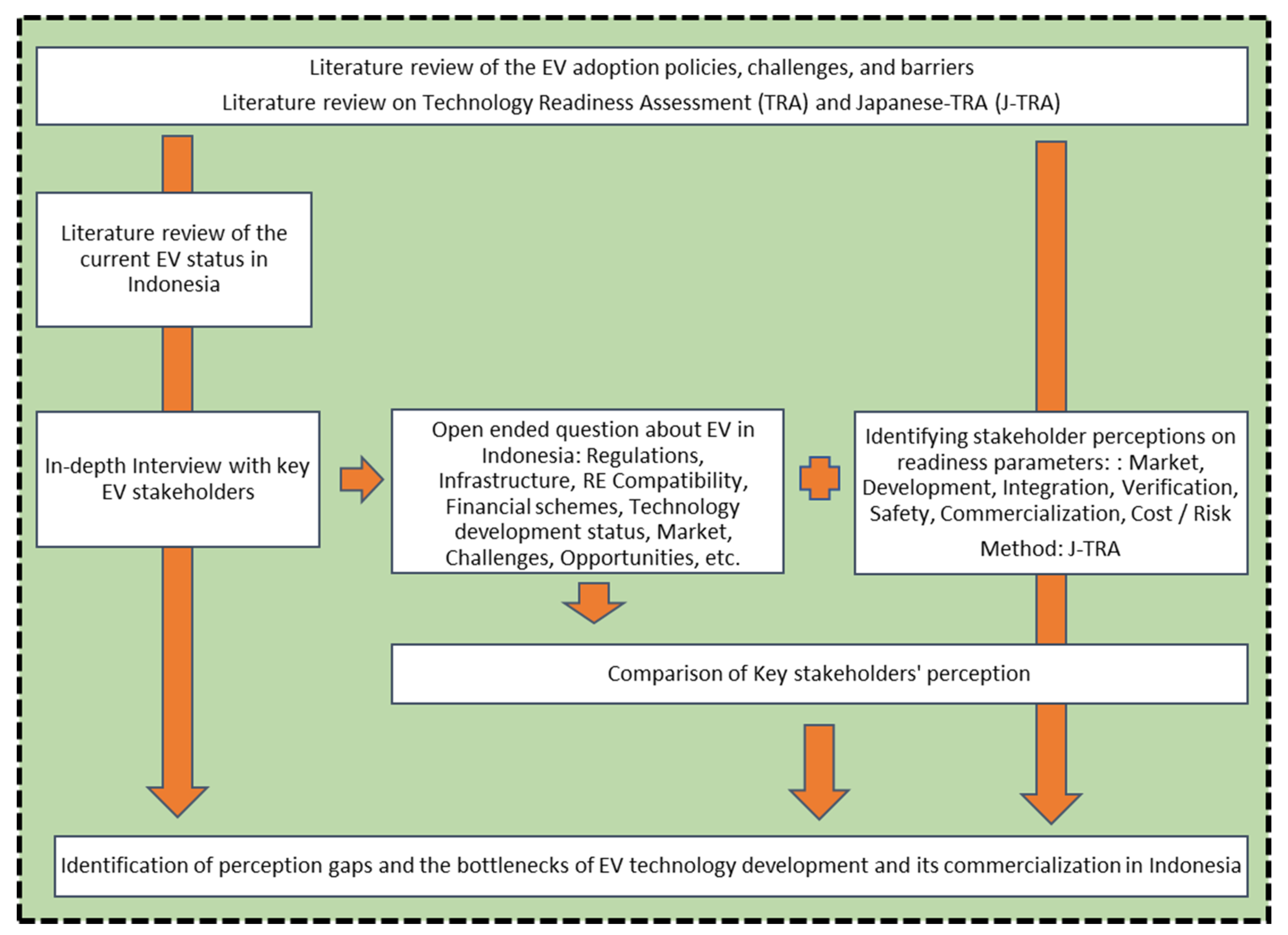

2. Methods

2.1. Study Framework

2.2. Literature Review Method

2.3. The J-TRA Methodology

3. Results and Discussion

3.1. Review on Electric Vehicle Adoption

3.1.1. Electric Vehicle Adoption in Countries with Strong Policies and Incentives

3.1.2. Study on Customer Preferences on Electric Vehicle

3.1.3. Barriers to Electric Vehicle Adoption

3.2. Current Trend of Indonesia’s Electric Vehicle Development

- Ministerial Regulation, Ministry of Home Affairs Number 8 Year 2020, regarding Basic Calculation of the Imposition of Motor Vehicle Tax and Motor Vehicle Transfer Fee [110];

- Ministerial Regulation, Ministry of Transportation Number 44 Year 2020, regarding Physical Type Testing of Motorized Vehicles with Motor Propulsion Using Electric Motors [111];

- Ministerial Regulation, Ministry of Ministry of Energy and Mineral Resources (MEMR) Number 13 Year 2020, regarding Provision of Electricity Charging Infrastructure for Battery-Based Electric Motor Vehicles [112];

- Ministerial Regulation, Ministry of Industry Number 27 Year 2020, regarding Specifications, Development Road Map, and Conditions for Calculation of Domestic Component Level Value for Domestic Battery Electric Vehicles [113];

- Ministerial Regulation, Ministry of Industry Number 28 Year 2020, regarding Battery-Based Electric Motor Vehicles in Completely Decomposed and Incomplete Decomposed State [114].

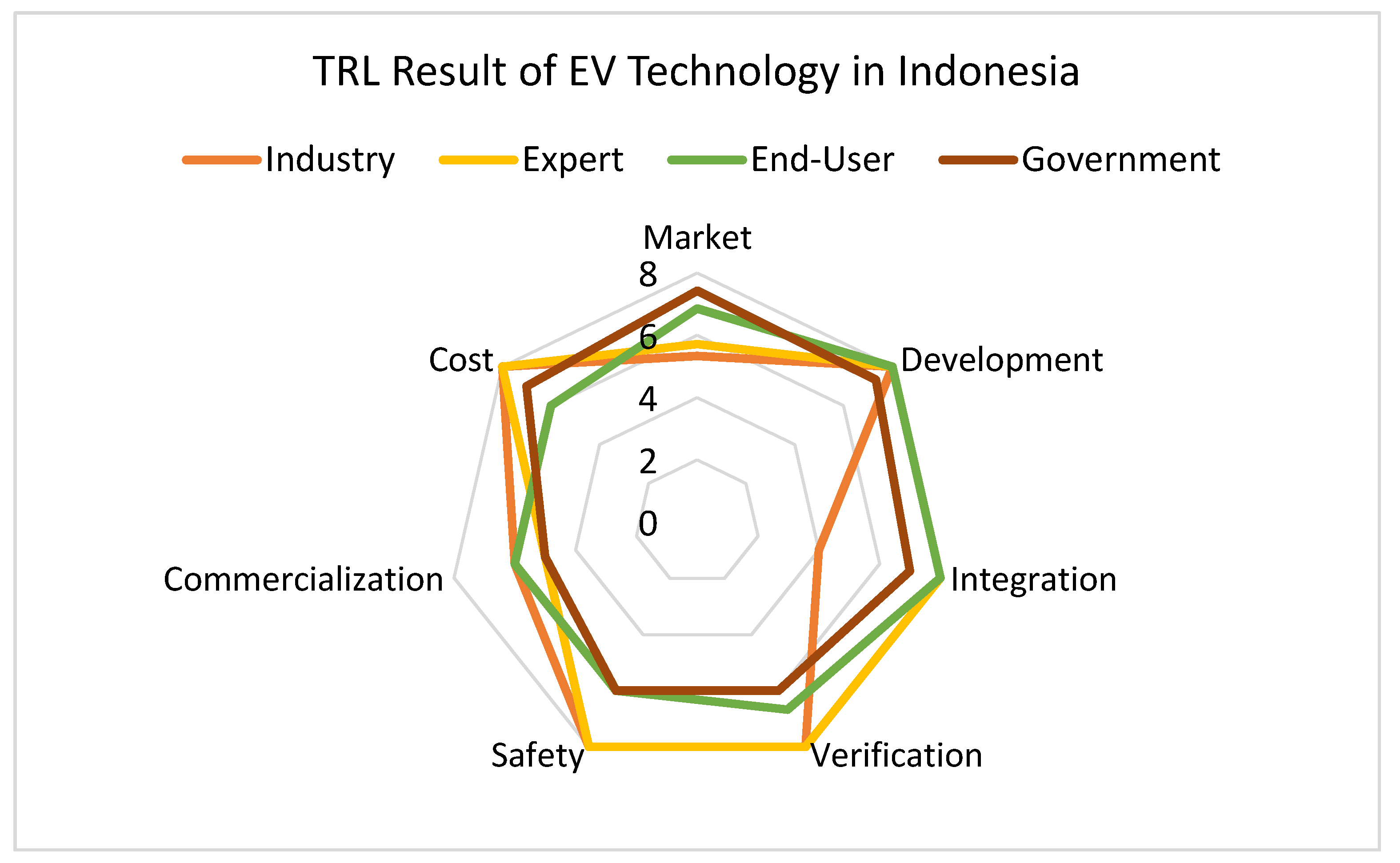

3.3. Multi-Stakeholders Perception

3.3.1. Industry Perception

3.3.2. Experts Perception

3.3.3. Government Perception

3.3.4. End-Users Perception

3.3.5. Multistakeholder Analysis

4. Policy Recommendations and Conclusions

- To create more EV markets through collaboration between government and industries. First, the public procurement of EVs can be used for public buses or official vehicles to build an initial market. Second, public awareness of EV technologies and incentives for EV users should be raised by giving enough information to the public. Third, the current EV industries in Indonesia must comply with government regulations, including quality standards, vehicle certificates from the Ministry of Transportation, and legally registered license plates. Fourth, the appropriate business plan for early EV penetration is B-to-B collaborations. Finally, price appropriateness with the purchasing power of the general population in Indonesia is key to reaching its commercialization optimum readiness level.

- To achieve the goals of the government road map to produce both two-wheelers and four-wheelers EVs domestically, collaboration and integration between multiple stakeholders should be performed. The Indonesian government has started to speed up the nickel ore ban as part of its green road map by 2022. If batteries can be produced domestically, EV production can be optimized, and EV production costs can be reduced significantly. Therefore, collaborations between nickel ore mining companies, nickel purification and processing companies, and battery manufacturer companies should be encouraged from the battery industry side.

- To increase charging infrastructure investment, a collaboration between the government and related industries is necessary. In addition, infrastructural support, such as a network of public charging stations and after-sale service centers, must be established. It is still the initial days for EV adoption in Indonesia, but the potential for a positive impact on the economy and environment is significant. Collaboration between government stakeholders, state-owned enterprises, and the private sectors will be needed to build a local EV ecosystem—one with the potential to transform environments and economies.

- To provide financial and nonfinancial incentives for EV users. The current incentives should be reverberated to increase public awareness. Examples are free parking and road-toll exemption.

- The government should improve EV competitiveness in the market by implementing carbon prices, so that competing ICE vehicles and FF fuel prices reflect their true cost to the environment.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Asian Development Bank. Indonesia’s Economy to Return Growth in 2021. Available online: https://www.adb.org/news/indonesia-economy-return-growth-2021-adb (accessed on 1 September 2021).

- Indonesian Central Bureau of Statistics. Development of Motor Vehicles by Type 1949–2018. 2018. Available online: https://www.bps.go.id/linkTableDinamis/view/id/1133 (accessed on 30 June 2021).

- Aziz, M.; Oda, T.; Kashiwagi, T. Extended utilization of electric vehicles and their re-used batteries to support the building energy management system. Energy Procedia 2015, 75, 1938–1943. [Google Scholar] [CrossRef] [Green Version]

- Aziz, M.; Oda, T. Simultaneous quick-charging system for electric vehicle. Energy Procedia 2017, 142, 1811–1816. [Google Scholar] [CrossRef]

- Aziz, M.; Huda, M. Application opportunity of vehicles-to-grid in Indonesian electrical grid. Energy Procedia 2019, 160, 621–626. [Google Scholar] [CrossRef]

- GAIKINDO. Indonesian Automobile Industry Data. 2021. Available online: https://www.gaikindo.or.id/indonesian-automobile-industry-data/ (accessed on 30 June 2021).

- Coffman, M.; Bernstein, P.; Wee, S. Electric vehicles revisited: A review of factors that affect adoption. Transp. Rev. 2017, 37, 79–93. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H.; Geng, J. A review of factors influencing consumer intentions to adopt battery electric vehicles. Renew. Sustain. Energy Rev. 2017, 79, 318–328. [Google Scholar] [CrossRef]

- Yang, Z.; Slowik, P.; Lutsey, N.; Searle, S. Principles for Effective Electric Vehicle Incentive Design. 2016. Available online: https://theicct.org/sites/default/files/publications/ICCT_IZEV-incentives-comp_201606.pdf (accessed on 16 November 2021).

- Zhou, Y.; Wang, M.; Hao, H.; Johnson, L.; Wang, H.; Hao, H. Plug-in electric vehicle market penetration and incentives: A global review. Mitig. Adapt. Strateg. Glob. Chang. 2015, 20, 777–795. [Google Scholar] [CrossRef]

- Ihara, I.; Pandyaswargo, A.H.; Onoda, H. Development and the Effectiveness of the J-TRA: A Methodology to Assess Energy Technology R&D Programs in Japan. Proc. EcoDePS 2018, 1, 109–117. Available online: https://researchmap.jp/?action=cv_download_main&upload_id=219915 (accessed on 30 June 2021).

- US Government Accountibility Office. Technology Readiness Assessment Guide; Washington, DC, USA, 2020. Available online: https://www.gao.gov/assets/gao-20-48g.pdf (accessed on 30 June 2021).

- Briner, R.B.; Denyer, D. Systematic review and evidence synthesis as a practice and scholarship tool. In The Oxford Handbook of Evidence-Based Management: Companies, Classrooms, and Research; Rousseau, D., Ed.; Oxford University Press: Oxford, England, 2012; pp. 112–129. [Google Scholar]

- Scimago. Scimago Journal & Country Rank. 2021. Available online: www.scimagojr.com (accessed on 20 October 2021).

- Ministry of Environment Japan. Manual for TRL Calculation, 3rd Edition. 2016. Available online: https://www.env.go.jp/earth/ondanka/biz_local/29_a01/7_trlmanual.pdf (accessed on 30 June 2021).

- IEA. Global EV Outlook 2019. 2019. Available online: https://www.iea.org/reports/global-ev-outlook-2019 (accessed on 30 July 2021).

- Sierzchula, W.; Bakker, S.; Maat, K.; Van Wee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Brückmann, G.; Willibald, F.; Blanco, V. Battery Electric Vehicle adoption in regions without strong policies. Transp. Res. Part D Transp. Environ. 2021, 90, 102615. [Google Scholar] [CrossRef]

- Wolbertus, R.; Kroesen, M.; van den Hoed, R.; Chorus, C.G. Policy effects on charging behaviour of electric vehicle owners and on purchase intentions of prospective owners: Natural and stated choice experiments. Transp. Res. Part D Transp. Environ. 2018, 62, 283–297. [Google Scholar] [CrossRef] [Green Version]

- Münzel, C.; Plötz, P.; Sprei, F.; Gnann, T. How large is the effect of financial incentives on electric vehicle sales?—A global review and European analysis. Energy Econ. 2019, 84, 104493. [Google Scholar] [CrossRef]

- Qiao, Q.; Lee, H. The Role of Electric Vehicles in Decarbonizing China’s Transportation Sector. 2019. Available online: https://www.belfercenter.org/sites/default/files/files/publication/RoleEVsDecarbonizingChina.pdf (accessed on 16 November 2021).

- Giannopoulos, G.A.; Munro, J.F. The Accelerating Transport Innovation Revolution: A Global, Case Study-Based Assessment of Current Experience, Cross-Sectorial Effects, and Socioeconomic Transformations; Giannopoulos, G.A., Munro, J.F., Eds.; Elsevier: Amsterdam, The Netherlands, 2019. [Google Scholar]

- Li, W.; Long, R.; Chen, H.; Chen, F.; Zheng, X.; Yang, M. Effect of Policy Incentives on the Uptake of Electric Vehicles in China. Sustainability 2019, 11, 3323. [Google Scholar] [CrossRef] [Green Version]

- Li, W.; Long, R.; Chen, H. Consumers’ evaluation of national new energy vehicle policy in China: An analysis based on a four paradigm model. Energy Policy 2016, 99, 33–41. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, K.; Hao, Y.; Fan, J.L.; Wei, Y.M. The impact of government policy on preference for NEVs: The evidence from China. Energy Policy 2013, 61, 382–393. [Google Scholar] [CrossRef]

- Zhang, X.; Xie, J.; Rao, R.; Liang, Y. Policy incentives for the adoption of electric vehicles across countries. Sustainability 2014, 6, 8056–8078. [Google Scholar] [CrossRef] [Green Version]

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for promoting Battery Electric Vehicle (BEV) adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef] [Green Version]

- Mersky, A.C.; Sprei, F.; Samaras, C.; Qian, Z. Effectiveness of incentives on electric vehicle adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 46, 56–68. [Google Scholar] [CrossRef] [Green Version]

- Kempton, W.; Perez, Y.; Petit, M. Public Policy for Electric Vehicles and for Vehicle to GridPower. Rev. D’écon. Ind. 2014, 148, 263–290. [Google Scholar] [CrossRef] [Green Version]

- Habla, W.; Huwe, V.; Kesternich, M. Electric and conventional vehicle usage in private and car sharing fleets in Germany. Transp. Res. Part D Transp. Environ. 2021, 93, 102729. [Google Scholar] [CrossRef]

- Melton, N.; Axsen, J.; Moawad, B. Which plug-in electric vehicle policies are best? A multi-criteria evaluation framework applied to Canada. Energy Res. Soc. Sci. 2020, 64, 101411. [Google Scholar] [CrossRef]

- Transport Canada. Zero-Emission Vehicles. Government Website. 2019. Available online: https://tc.canada.ca/en/road-transportation/innovative-technologies/zero-emission-vehicles (accessed on 12 October 2021).

- ChargeHub. Rebates for Home EV Chargers in Canada (2021 Update). 2021. Available online: https://chargehub.com/en/charging-stations-incentives-in-canada.html (accessed on 27 October 2021).

- Hartman, K.; Shields, L. State Policies Promoting Hybrid and Electric Vehicles. National Conference of State Legislatures US. 2021. Available online: https://www.ncsl.org/research/energy/state-electric-vehicle-incentives-state-chart.aspx (accessed on 28 October 2021).

- Rasti-Barzoki, M.; Moon, I. A game theoretic approach for analyzing electric and gasoline-based vehicles’ competition in a supply chain under government sustainable strategies: A case study of South Korea. Renew. Sustain. Energy Rev. 2021, 146, 111139. [Google Scholar] [CrossRef]

- Ministry of Environment South Korea Ministry of Environment Holds an Eco-Friendly Vehicle Dissemination Policy Presentation. 2019. Available online: http://www.me.go.kr/home/web%0A/board/read.do?boardMasterId=1&boardId=935880&menuId=286 (accessed on 12 October 2021).

- Randall, C. South Korea Announces New EV Subsidies for 2020. 2019. Available online: https://www.electrive.com/2019/09/02/south-korea-announces-ev-subsidies/ (accessed on 24 October 2021).

- Chua, S.T.; Nakano, M. Design of a Taxation System to Promote Electric Vehicles in Singapore. In Advances in Production Management Systems. Competitive Manufacturing for Innovative Products and Services; Emmanouilidis, C., Taisch, M., Kiritsis, D., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 359–367. [Google Scholar]

- Saygin, D.; Bülent Tor, O.; Teimourzadeh, S.; Koç, M.; Hildermeier, J.; Kolokathis, C. Transport sector transformation: Integrating electric vehicles into Turkey’s distribution grids. Energy Sources Part B Econ. Plan. Policy 2021, 16, 1–22. [Google Scholar]

- Jreige, M.; Abou-Zeid, M.; Kaysi, I. Consumer preferences for hybrid and electric vehicles and deployment of the charging infrastructure: A case study of Lebanon. Case Stud. Transp. Policy 2021, 9, 466–476. [Google Scholar] [CrossRef]

- Bani Mustafa, A. Car Dealers Alarmed by ‘Surprise’ Tax Increase on Elecctric Vehicles. 2019. Available online: http://www.jordantimes.com/news/%0Alocal/car-dealers-alarmed-‘surprise’-tax-increase-electric%02vehicles (accessed on 27 October 2021).

- CMS. Expert Guide to Electric Vehicles. 2018. Available online: https://cms.law/en/%0Aint/expert-guides/cms-expert-guide-to-electric-vehicles/united-arab-emirates (accessed on 27 October 2021).

- IEA. Global EV Outlook 2021—Accelerating Ambitions Despite the Pandemic. 2021. Available online: https://iea.blob.core.windows.net/assets/ed5f4484-f556-4110-8c5c-4ede8bcba637/GlobalEVOutlook2021.pdf (accessed on 16 November 2021).

- IEA. Electric Vehicles. 2019. Available online: https://www.iea.org/reports/electric-vehicles (accessed on 16 November 2021).

- IEA. Global EV Outlook 2020—Analysis. 2020. Available online: https://www.iea.org/reports/global-ev-outlook-2020 (accessed on 16 November 2021).

- Cui, H.; Hall, D.; Lutsey, N. Update on the Global Transition to Electric Vehicles through 2019. Int. Counc. Clean Transp. 2020, 1–15. Available online: https://theicct.org/publications/update-global-ev-transition-2019 (accessed on 16 November 2021).

- IEA. Southeast Asia Energy Outlook 2019. 2019. Available online: https://www.iea.org/reports/southeast-asia-energy-outlook-2019 (accessed on 10 October 2021).

- Shin, J.; Hong, J.; Jeong, G.; Lee, J. Impact of electric vehicles on existing car usage: A mixed multiple discrete–continuous extreme value model approach. Transp. Res. Part D Transp. Environ. 2012, 17, 138–144. [Google Scholar] [CrossRef]

- Tanaka, M.; Ida, T.; Murakami, K.; Friedman, L. Consumers’ willingness to pay for alternative fuel vehicles: A comparative discrete choice analysis between the US and Japan. Transp. Res. Part A Policy Pract. 2014, 70, 194–209. [Google Scholar] [CrossRef]

- Helveston, J.P.; Liu, Y.; Feit, E.M.; Fuchs, E.; Klampfl, E.; Michalek, J.J. Will subsidies drive electric vehicle adoption? Measuring consumer preferences in the US and China. Transp. Res. Part A Policy Pract. 2015, 73, 96–112. [Google Scholar] [CrossRef] [Green Version]

- Hess, S.; Fowler, M.; Adler, T. A joint model for vehicle type and fuel type choice: Evidence from a cross-nested logit study. Transportation 2012, 39, 593–625. [Google Scholar] [CrossRef] [Green Version]

- Valeri, E.; Danielis, R. Simulating the market penetration of cars with alternative fuel power train technologies in Italy. Transp. Policy 2015, 37, 44–51. [Google Scholar] [CrossRef] [Green Version]

- Glerum, A.; Stankovikj, L.; Bierlaire, M. Forecasting the demand for electric vehicles: Accounting for attitudes and perceptions. Transp. Sci. 2014, 48, 483–499. [Google Scholar] [CrossRef] [Green Version]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- Kim, E.; Heo, E. Key drivers behind the adoption of electric vehicle in Korea: An analysis of the revealed preferences. Sustainability 2019, 11, 6854. [Google Scholar] [CrossRef] [Green Version]

- Higgins, C.D.; Mohamed, M.; Ferguson, M.R. Size matters: How vehicle body type affects consumer preferences for electric vehicles. Transp. Res. Part A Policy Pract. 2017, 100, 182–201. [Google Scholar] [CrossRef]

- Aravena, C.; Denny, E. The impact of learning and short-term experience on preferences for electric vehicles. Renew. Sustain. Energy Rev. 2021, 152, 111656. [Google Scholar] [CrossRef]

- Qian, L.; Soopramanien, D. Heterogeneous consumer preferences for alternative fuel cars in China. Transp. Res. Part D Transp. Environ. 2011, 16, 607–613. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L. Consumer preferences for electric vehicles in lower tier cities of China: Evidences from south Jiangsu region. Transp. Res. Part D Transp. Environ. 2018, 63, 482–497. [Google Scholar] [CrossRef]

- Jang, S.; Choi, J.Y. Which consumer attributes will act crucial roles for the fast market adoption of electric vehicles?: Estimation on the asymmetrical & heterogeneous consumer preferences on the EVs. Energy Policy 2021, 156, 112469. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L.; Tyfield, D.; Soopramanien, D. On the heterogeneity in consumer preferences for electric vehicles across generations and cities in China. Technol. Forecast. Soc. Chang. 2021, 167, 120687. [Google Scholar] [CrossRef]

- Qian, L.; Grisolía, J.M.; Soopramanien, D. The impact of service and government-policy attributes on consumer preferences for electric vehicles in China. Transp. Res. Part A Policy Pract. 2019, 122, 70–84. [Google Scholar] [CrossRef] [Green Version]

- Mandys, F. Electric vehicles and consumer choice. Renew. Sustain. Energy Rev. 2021, 142, 110874. [Google Scholar] [CrossRef]

- Potoglou, D.; Kanaroglou, P.S. Household demand and willingness to pay for clean vehicle. Transp. Res. Part D Transp. Environ. 2007, 12, 264–274. [Google Scholar] [CrossRef]

- Chorus, C.G.; Koetse, M.J.; Hoen, A. Consumer preferences for alternative fuel vehicles: Comparing a utility maximization and a regret minimization model. Energy Policy 2013, 61, 901–908. [Google Scholar] [CrossRef]

- Jensen, A.F.; Cherchi, E.; Mabit, S.L. On the stability of preferences and attitudes before and after experiencing an electric vehicle. Transp. Res. Part D Transp. Environ. 2013, 25, 24–32. [Google Scholar] [CrossRef] [Green Version]

- Mau, P.; Eyzaguirre, J.; Jaccard, M.; Collins-Dodd, C.; Tiedemann, K. The “neighbor effect”: Simulating dynamics in consumer preferences for new vehicle technologies. Ecol. Econ. 2008, 68, 506–514. [Google Scholar] [CrossRef]

- Liao, F.; Molin, E.; van Wee, B. Consumer preferences for electric vehicles: A literature review. Transp. Rev. 2017, 37, 252–275. [Google Scholar] [CrossRef] [Green Version]

- Hoen, A.; Koetse, M.J. A choice experiment on alternative fuel vehicle preferences of private car owners in the Netherlands. Transp. Res. Part A Policy Pract. 2014, 61, 199–215. [Google Scholar] [CrossRef]

- Hackbarth, A.; Madlener, R. Consumer preferences for alternative fuel vehicles: A discrete choice analysis. Transp. Res. Part D Transp. Environ. 2013, 25, 5–17. [Google Scholar] [CrossRef] [Green Version]

- Rasouli, S.; Timmermans, H. Influence of social networks on latent choice of electric cars: A mixed logit specification using experimental design data. Netw. Spat. Econ. 2016, 16, 99–130. [Google Scholar] [CrossRef]

- Yang, J.; Chen, F. How are social-psychological factors related to consumer preferences for plug-in electric vehicles? Case studies from two cities in China. Renew. Sustain. Energy Rev. 2021, 149, 111325. [Google Scholar] [CrossRef]

- Achtnicht, M.; Bühler, G.; Hermeling, C. The impact of fuel availability on demand for alternative-fuel vehicles. Transp. Res. Part D Transp. Environ. 2012, 17, 262–269. [Google Scholar] [CrossRef]

- Briseño, H.; Ramirez-Nafarrate, A.; Araz, O.M. A multivariate analysis of hybrid and electric vehicles sales in Mexico. Socioecon. Plann. Sci. 2021, 76, 100957. [Google Scholar] [CrossRef]

- Jung, J.; Yeo, S.; Lee, Y.; Moon, S.; Lee, D.J. Factors affecting consumers’ preferences for electric vehicle: A Korean case. Res. Transp. Bus. Manag. 2021, 40, 100666. [Google Scholar] [CrossRef]

- Lashari, Z.A.; Ko, J.; Jang, J. Consumers’ intention to purchase electric vehicles: Influences of user attitude and perception. Sustainability 2021, 13, 6778. [Google Scholar] [CrossRef]

- Nayum, A.; Klöckner, C.A.; Mehmetoglu, M. Comparison of socio-psychological characteristics of conventional and battery electric car buyers. Travel Behav. Soc. 2016, 3, 8–20. [Google Scholar] [CrossRef]

- Priessner, A.; Sposato, R.; Hampl, N. Predictors of electric vehicle adoption: An analysis of potential electric vehicle drivers in Austria. Energy Policy 2018, 122, 701–714. [Google Scholar] [CrossRef]

- Asadi, S.; Nilashi, M.; Samad, S.; Abdullah, R.; Mahmoud, M.; Alkinani, M.H.; Yadegaridehkordi, E. Factors impacting consumers’ intention toward adoption of electric vehicles in Malaysia. J. Clean. Prod. 2021, 282, 124474. [Google Scholar] [CrossRef]

- Hidrue, M.; Parsons, G.; Kempton, W.; Gardner, M. Willingness to pay for electric vehicles and their attributes. Resour. Energy Econ. 2011, 33, 686–705. [Google Scholar] [CrossRef] [Green Version]

- Graham-Rowe, E.; Gardner, B.; Abraham, C.; Skippon, S.; Dittmar, H.; Hutchins, R.; Stannard, J. Mainstream consumers driving plug-in battery-electric and plug-in hybrid electric cars: A qualitat_ive analysis of responses and evaluations. Transp. Res. Part A Policy Pract. 2012, 46, 140–153. [Google Scholar] [CrossRef]

- Patt, A.; Aplyn, D.; Weyrich, P.; van Vliet, O. Availability of private charging infrastructure influences readiness to buy electric cars. Transp. Res. Part A Policy Pract. 2019, 125, 1–7. [Google Scholar] [CrossRef]

- Axsen, J.; Goldberg, S.; Bailey, J. How might potential future plug-in electric vehicle buyers differ from current “Pioneer” owners? Transp. Res. Part D Transp. Environ. 2016, 47, 357–370. [Google Scholar] [CrossRef]

- Wolf, A.; Seebauer, S. Technology adoption of electric bicycles: A survey among early adopters. Transp. Res. Part A Policy Pract. 2014, 69, 196–211. [Google Scholar] [CrossRef]

- Hardman, S.; Shiu, E.; Steinberger-Wilckens, R. Comparing high-end and low-end early adopters of battery electric vehicles. Transp. Res. Part A Policy Pract. 2016, 88, 40–57. [Google Scholar] [CrossRef] [Green Version]

- Xue, M.; Lin, B.L.; Tsunemi, K. Emission implications of electric vehicles in Japan considering energy structure transition and penetration uncertainty. J. Clean. Prod. 2021, 280, 124402. [Google Scholar] [CrossRef]

- Jain, N.K.; Bhaskar, K.; Jain, S. What drives adoption intention of electric vehicles in India? An integrated UTAUT model with environmental concerns, perceived risk and government support. Res. Transp. Bus. Manag. 2021, 100730. [Google Scholar] [CrossRef]

- Filippini, M.; Kumar, N.; Srinivasan, S. Nudging adoption of electric vehicles: Evidence from an information-based intervention in Nepal. Transp. Res. Part D Transp. Environ. 2021, 97, 102951. [Google Scholar] [CrossRef]

- Qian, L.; Soopramanien, D. Incorporating heterogeneity to forecast the demand of new products in emerging markets: Green cars in China. Technol. Forecast. Soc. Chang. 2015, 91, 33–46. [Google Scholar] [CrossRef]

- He, X.; Zhan, W.; Hu, Y. Consumer purchase intention of electric vehicles in China: The roles of perception and personality. J. Clean. Prod. 2018, 204, 1060–1069. [Google Scholar] [CrossRef]

- Huang, Y.; Qian, L.; Soopramanien, D.; Tyfield, D. Buy, lease, or share? Consumer preferences for innovative business models in the market for electric vehicles. Technol. Forecast. Soc. Chang. 2021, 166, 120639. [Google Scholar] [CrossRef]

- Lane, B.; Potter, S. The adoption of cleaner vehicles in the UK: Exploring the consumer attitude–action gap. J. Clean. Prod. 2007, 15, 1085–1092. [Google Scholar] [CrossRef]

- Krause, R.; Carley, S.; Lane, B.; Graham, J. Perception and reality: Public knowledge of plug-in electric vehicles in 21 U.S. cities. Energy Policy 2013, 63, 433–440. [Google Scholar] [CrossRef]

- Carley, S.; Krause, R.; Lane, B.; Graham, J. Intent to purchase a plug-in electric vehicle: A survey of early impressions in large US cities. Transp. Res. Part D Transp. Environ. 2013, 18, 39–45. [Google Scholar] [CrossRef]

- Goel, S.; Sharma, R.; Rathore, A.K. A review on barrier and challenges of electric vehicle in India and vehicle to grid optimisation. Transp. Eng. 2021, 4, 100057. [Google Scholar] [CrossRef]

- Goel, P.; Sharma, N.; Mathiyazhagan, K.; Vimal, K.E.K. Government is trying but consumers are not buying: A barrier analysis for electric vehicle sales in India. Sustain. Prod. Consum. 2021, 28, 71–90. [Google Scholar] [CrossRef]

- Hardman, S.; Jenn, A.; Tal, G.; Axsen, J.; Beard, G.; Daina, N.; Figenbaum, E.; Jakobsson, N.; Jochem, P.; Kinnear, N.; et al. A review of consumer preferences of and interactions with electric vehicle charging infrastructure. Transp. Res. Part D Transp. Environ. 2018, 62, 508–523. [Google Scholar] [CrossRef] [Green Version]

- Alternative Fuel Data Center Electric Vehicle Charging Station Locations. 2021. Available online: https://afdc.energy.gov/fuels/electricity_locations.html#/find/nearest?fuel=ELEC (accessed on 24 October 2021).

- Krishnan, V.V.; Koshy, B.I. Evaluating the factors influencing purchase intention of electric vehicles in households owning conventional vehicles. Case Stud. Transp. Policy 2021, 9, 1122–1129. [Google Scholar] [CrossRef]

- Gupta, R.S.; Tyagi, A.; Anand, S. Optimal allocation of electric vehicles charging infrastructure, policies and future trends. J. Energy Storage 2021, 43, 103291. [Google Scholar] [CrossRef]

- Bigerna, S.; Micheli, S. Attitudes toward electric vehicles: The case of Perugia using a fuzzy set analysis. Sustainability 2018, 10, 3999. [Google Scholar] [CrossRef] [Green Version]

- Guevara, C.A.; Figueroa, E.; Munizaga, M.A. Paving the road for electric vehicles: Lessons from a randomized experiment in an introduction stage market. Transp. Res. Part A Policy Pract. 2021, 153, 326–340. [Google Scholar] [CrossRef]

- Collett, K.A.; Hirmer, S.A.; Dalkmann, H.; Crozier, C.; Mulugetta, Y.; McCulloch, M.D. Can electric vehicles be good for Sub-Saharan Africa? Energy Strateg. Rev. 2021, 38, 100722. [Google Scholar] [CrossRef]

- Junquera, B.; Moreno, B.; Álvarez, R. Analyzing consumer attitudes towards electric vehicle purchasing intentions in Spain: Technological limitations and vehicle confidence. Technol. Forecast. Soc. Chang. 2016, 109, 6–14. [Google Scholar] [CrossRef]

- Moeletsi, M.E. Socio-Economic Barriers to Adoption of Electric Vehicles in South Africa: Case Study of the Gauteng Province. World Electr. Veh. J. 2021, 12, 167. [Google Scholar] [CrossRef]

- Tongwane, M.I.; Moeletsi, M.E. Status of electric vehicles in South Africa and their carbon mitigation potential. Sci. Afr. 2021, 14, e00999. [Google Scholar] [CrossRef]

- Zhou, M.; Long, P.; Kong, N.; Zhao, L.; Jia, F.; Campy, K.S. Characterizing the motivational mechanism behind taxi driver’s adoption of electric vehicles for living: Insights from China. Transp. Res. Part A Policy Pract. 2021, 144, 134–152. [Google Scholar] [CrossRef]

- Erahman, Q.F.; Reyseliani, N.; Purwanto, W.W.; Sudibandriyo, M. Modeling Future Energy Demand and CO2 Emissions of Passenger Cars in Indonesia at the Provincial Level. Energies 2019, 12, 3168. [Google Scholar] [CrossRef] [Green Version]

- President of Republic of Indonesia. Peraturan Presiden No. 55 Tahun 2019 Tentang Percepatan Program Kendaraan Bermotor Listrik Berbasis Baterai (Battery Electric Vehicle) Untuk Transportasi Jalan; Government of Indonesia: Jakarta Pusat, Indonesia, 2019.

- Ministry of Domestic Affairs. Peraturan Menteri Dalam Negeri No. 8 Tahun 2020 Tentang Penghitungan Dasar Pengenaan Pajak Kendaraan Bermotor Dan Bea Balik Nama Kendaraan Bermotor; Ministry of Domestic Affairs: Jakarta Pusat, Indonesia, 2020.

- Ministry of Transportation. Peraturan Menteri Perhubungan No. 44 Tahun 2020 Tentang Pengujian Tipe Fisik Kendaraan Bermotor dengan Motor Penggerak Menggunakan Motor Listrik; Ministry of Transportation: Jakarta Pusat, Indonesia, 2020.

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi Dan Sumber Daya Mineral Nomor 13 Tahun 2020 Tentang Penyediaan Infrastruktur Pengisian Listrik Untuk Kendaraan Bermotor Listrik Berbasis Baterai; Ministry of Energy and Mineral Resources: Jakarta Pusat, Indonesia, 2020.

- Ministry of Industry. Peraturan Menteri Perindustrian Nomor 27 Tahun 2020 Tentang Spesifikasi, Peta Jalan Pengembangan, Dan Ketentuan Penghitungan Tingkat Komponen Dalam Negeri Kendaraan Bermotor Dalam Negeri Kendaraan Bermotor Listrik Berbasis Baterai (Battery Electric Vehicl); Ministry of Industry: Jakarta Pusat, Indonesia, 2020.

- Ministry of Industry. Peraturan Menteri Perindustrian No. 28 Tahun 2020 Tentang Kendaraan Bermotor Listrik Berbasis Baterai Dalam Keadaan Terurai Lengkap Dan Keadaan Terurai Tidak Lengkap; Ministry of Industry: Jakarta Pusat, Indonesia, 2020.

- Rasyid, H. Kemenhub Rilis Jumlah Sertifikat Uji Tipe Untuk Semua Jenis Kendaraan Listrik, Masih Sedikit? 2021. Available online: https://www.gridoto.com/read/222601221/kemenhub-rilis-jumlah-sertifikat-uji-tipe-untuk-semua-jenis-kendaraan-listrik-masih-sedikit (accessed on 2 September 2021).

- Sidik, S. Beli Mobil Tesla Model X & BYD, Blue Bird Habiskan Berapa? 2019. Available online: https://www.cnbcindonesia.com/tech/20190422172541-37-68064/beli-mobil-tesla-model-x-byd-blue-bird-habiskan-berapa (accessed on 16 October 2021).

- Azka, R.M. Ini Alasan Blue Bird Tunda Beli 200 Mobil Listrik. 2020. Available online: https://ekonomi.bisnis.com/read/20200812/98/1278464/ini-alasan-blue-bird-tunda-beli-200-mobil-listrik#:~:text=Bisnis.com%2C%20JAKARTA%20%2D%20PT,2020%2C%20akhirnya%20diundur%20menjadi%202021.&text=%22Kami%20postpone%20belanja%20modal%20tahun,gara%2Dgara%20Covid%2D19 (accessed on 2 September 2021).

- Grab Indonesia. Grab dan Hyundai Luncurkan GrabCar Elektrik, Dorong Pengembangan Ekosistem Kendaraan Listrik di Indonesia. 2020. Available online: https://www.grab.com/id/press/tech-product/grab-dan-hyundai-luncurkan-grabcar-elektrik-dorong-pengembangan-ekosistem-kendaraan-listrik-di-indonesia/ (accessed on 30 June 2021).

- Grab Indonesia ESDM. Grab Indonesia dan Kymco Luncurkan SPBKLU untuk Sukseskan Perpres Nomor 55/2019. 2020. Available online: https://www.grab.com/id/press/tech-product/esdm-grab-indonesia-dan-kymco-luncurkan-spbklu-untuk-sukseskan-perpres-nomor-55-2019/ (accessed on 2 September 2021).

- Rayhand, P. Dorong Mobil Listrik, Toyota Bikin Ekosistem di Bali. 2020. Available online: https://www.cnnindonesia.com/teknologi/20210331172446-384-624541/dorong-mobil-listrik-toyota-bikin-ekosistem-di-bali (accessed on 2 September 2021).

- BPPT.go.id. Badan Pengkajian Dan Penerapan Teknologi BPPT Siap Akselerasi Pengembangan Kendaraan Listrik Berbasis Baterai. 2020. Available online: https://www.bppt.go.id/layanan-informasi-publik/4065-bppt-siap-akselerasi-pengembangan-kendaraan-listrik-berbasis-baterai (accessed on 16 October 2021).

- Nikkei Asia. Nickel-Rich Indonesia Draws Global Suppliers of EV Battery Materials. 2021. Available online: https://asia.nikkei.com/Business/Markets/Commodities/Nickel-rich-Indonesia-draws-global-suppliers-of-EV-battery-materials (accessed on 16 November 2021).

- CNBC Indonesia. Gaet CALT & LG Chem, IBC Bikin Baterai Mobil & Motor Listrik. 2021. Available online: https://www.cnbcindonesia.com/market/20210326161012-17-233171/gaet-calt-lg-chem-ibc-bikin-baterai-mobil-motor-listrik (accessed on 2 September 2021).

- NNA Bussness News Indonesia’s 1st E-Bike Sharing Service Migo Stuck in Traffic Law Debate NNA Business News Indonesia Services. 2019. Available online: https://english.nna.jp/articles/586 (accessed on 30 June 2021).

- Milovantseva, N. Are American households willing to pay a premium for greening consumption of Information and Communication Technologies? J. Clean. Prod. 2017, 127, 282–288. [Google Scholar] [CrossRef] [Green Version]

- Asian Development Bank. Renewable Energy Tariffs and Incentives in Indonesia: Review and Recommendations. 2020. Available online: https://www.adb.org/sites/default/files/publication/635886/renewable-energy-tariffs-incentives-indonesia.pdf (accessed on 31 July 2021).

- Purwadi, A. Bedah Buku, Perkembangan Dan Isu Strategis Pengembangan Kendaraan Listrik. 2020. Available online: https://gatrik.esdm.go.id/assets/uploads/download_index/files/c64cf-bahan-presentasi-bpk.-agus-purwadi.pdf (accessed on 20 September 2021).

- Meilanova, D.R. Pemerintah Dorong Konversi Sepeda Motor Konvensional Jadi Kendaraan Listrik. 2021. Available online: https://ekonomi.bisnis.com/read/20210616/44/1406123/pemerintah-dorong-konversi-sepeda-motor-konvensional-jadi-kendaraan-listrik (accessed on 30 October 2021).

- IESR. The Role of Electric Vehicles in Decarbonizing Indonesia’s Road Transport Sector. 2020. Available online: https://iesr.or.id/pustaka/the-role-of-electric-vehicles-in-decarbonizing-indonesias-road-transport-sector (accessed on 30 June 2021).

- Natural Resources Canada. 2019 Fuel Consumption Guide|Natural Resources Canada. 2019. Available online: https://www.nrcan.gc.ca/energy/efficiency/transportation/21002 (accessed on 16 November 2021).

- Mashhoodi, B.; van der Blij, N. Drivers’ range anxiety and cost of new EV chargers in Amsterdam: A scenario-based optimization approach. Ann. GIS 2021, 27, 87–98. [Google Scholar] [CrossRef]

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi dan Sumber Daya Mineral tentang Pemanfaatan Sumber Energi Terbarukan Untuk Penyediaan Tenaga Listrik; Ministry of Energy and Mineral Resources: Jakarta Pusat, Indonesia, 2017.

| TRL | A (Market) | B (Development) | C (Integration) | D (Verification) | E (Safety) | F (Commercialization) | G (Cost and Risk) |

|---|---|---|---|---|---|---|---|

| 1 | A-1 | B-1 | D-1 | ||||

| 2 | A-2 | B-2 | D-2 | ||||

| 3 | A-3 | B-3 | C-1 | D-3 | E-1 | F-1 | G-1 |

| 4 | A-4 A-5 | B-4 | C-2 | D-4 | E-2 | F-2 | G-2 |

| 5 | A-6 | B-5 | C-3 | D-5 | E-3 | F-3 | G-3 |

| 6 | A-7 | B-6 | C-4 | D-6 | E-4 | F-4 | G-4 |

| 7 | The equipment and systems have been finalized. Manufacturing and introduction processes have been completed. | ||||||

| 8 | Manufacturing and introduction processes have been completed and are in the stage of mass production of products. | ||||||

| Country/Countries | Policies and Incentives | |

|---|---|---|

| Monetary | Non-Monetary | |

| China |

|

|

| Norway |

|

|

| Denmark |

| |

| Sweden |

| |

| France |

| |

| Iceland |

| |

| Canada |

|

|

| United States |

|

|

| South Korea |

| |

| Japan |

|

|

| Middle East Countries |

| |

| India |

|

|

| Attributes | Operationalization/Factor | References |

|---|---|---|

| Financial attributes | purchase price | [40,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63] |

| operating cost | [48,49,50,51,52,53,56,58,59,61,62] | |

| Technical attributes | driving range | [40,45,47,50,52,54,55,56,57,58,59,64] |

| charging time | [54,57,65,66,67,68,69,70,71,72] | |

| engine power | [49,63,73] | |

| acceleration time | [45,46,47,65,71] | |

| maximum speed | [61] | |

| CO2 emission | [49,64,66,70,73] | |

| brand (Country of origin) | [50] | |

| warranty (car and battery) | [51,56,67] | |

| Infrastructure attributes | charging station availability (distance from home) | [51,53,54,56,58,59,60,74,75] |

| number of charging station | [50,53,55,58,67,72,75] | |

| availability in a different area | [66,68] | |

| Policy Attributes | pricing policy: Tax reduction/exemption for purchase tax, cash incentive | [46,49,51,54,56,59,62,65,72,76,77,78] |

| pricing policy: Tax reduction/exemption for the road tax | [65,70,74] |

| Decision-Making Factor | EV | Conventional Vehicle |

|---|---|---|

| Government regulation Tax-related Regulation Infrastructure planning |

|

|

| Total cost ownership |

|

|

| Other Machine Performance Handling/Comfort Charging time/Refuelling time |

2.4 kW = 18 to 20 h (full charged) 7.7 kW = 6 h (full charged) 50 kW = 50 min (80% charged) |

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maghfiroh, M.F.N.; Pandyaswargo, A.H.; Onoda, H. Current Readiness Status of Electric Vehicles in Indonesia: Multistakeholder Perceptions. Sustainability 2021, 13, 13177. https://doi.org/10.3390/su132313177

Maghfiroh MFN, Pandyaswargo AH, Onoda H. Current Readiness Status of Electric Vehicles in Indonesia: Multistakeholder Perceptions. Sustainability. 2021; 13(23):13177. https://doi.org/10.3390/su132313177

Chicago/Turabian StyleMaghfiroh, Meilinda Fitriani Nur, Andante Hadi Pandyaswargo, and Hiroshi Onoda. 2021. "Current Readiness Status of Electric Vehicles in Indonesia: Multistakeholder Perceptions" Sustainability 13, no. 23: 13177. https://doi.org/10.3390/su132313177