Video Platforms’ Value-Added Service Investments and Pricing Strategies for Advertisers

Abstract

:1. Introduction

2. Literature Review

2.1. Media Platforms’ Pricing Strategies

2.2. Platforms’ Investment Strategies

3. Models

3.1. Viewers

3.2. Advertisers

3.3. Platforms

3.4. Timing

4. Equilibrium Analysis

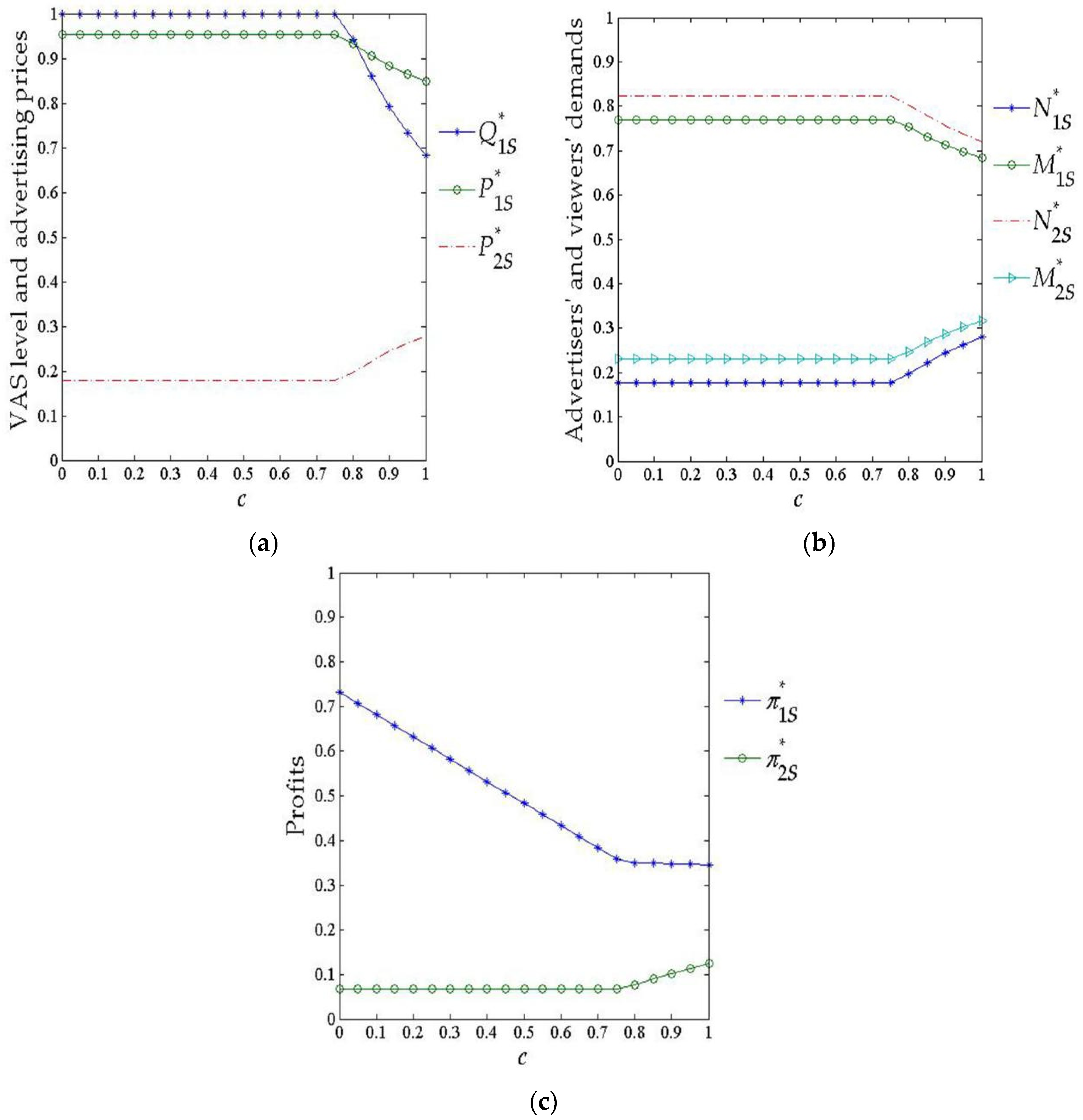

4.1. S-Model

- If ,

- If ,

- If ,

- If ,

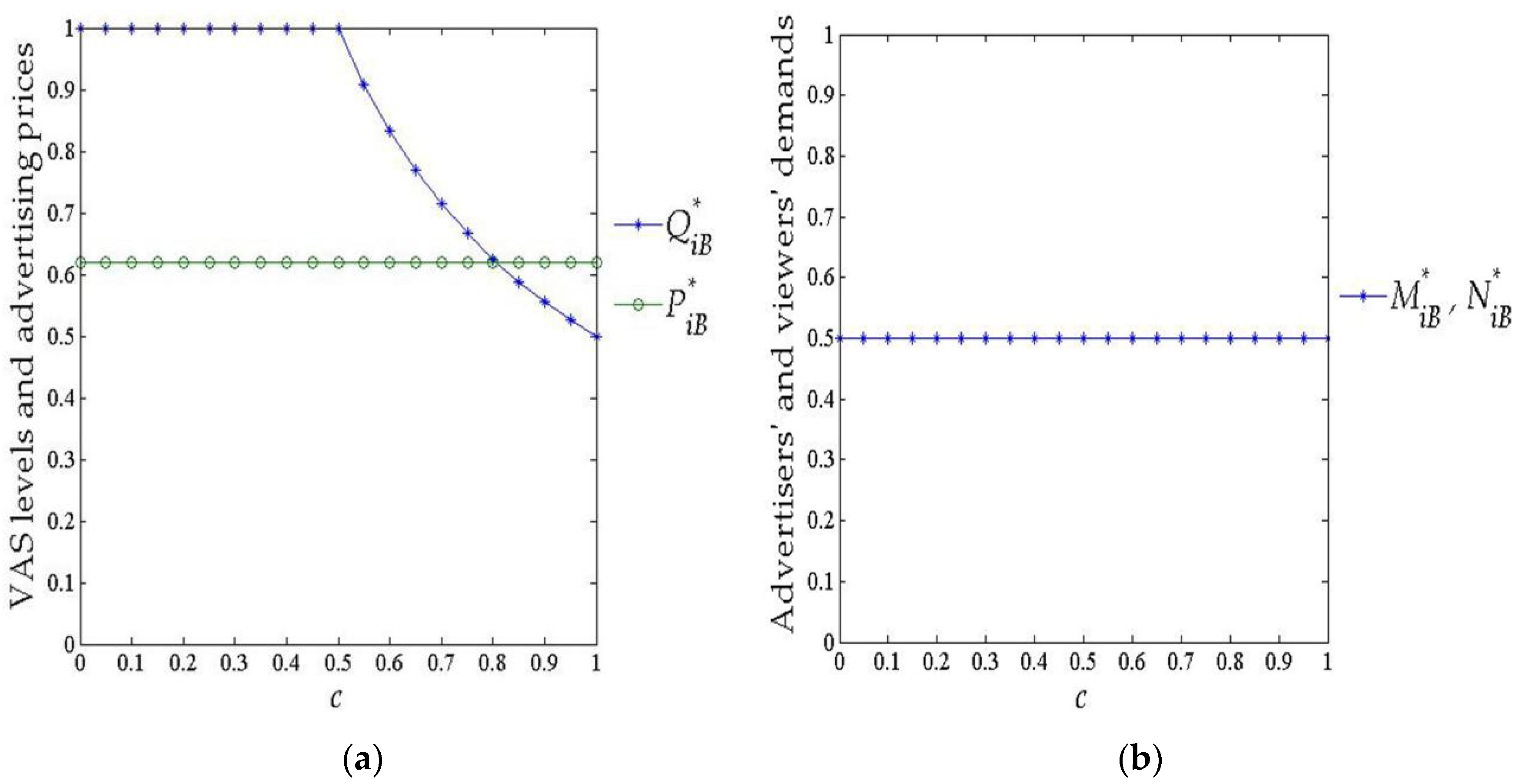

4.2. B-Model

- If ,

- If ,

- If ,

- If ,

5. Comparison of the Equilibrium Outcomes

5.1. S-Model vs. B-Model

- If , ; if , .

- For , , .

5.2. S-Model vs. the Scenario without VAS Investment

5.3. B-Model vs. the Scenario without VAS Investment

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- If ,

- If ,

- If ,

- If ,

| Platform 2 | |||

|---|---|---|---|

| platform 1 | |||

- If , , , , , .

- If , , , , , .

- If , , , .

- If , , , .

- If ,

- If , , .

- If , , .

References

- Yang, Z.; Diao, Z.; Kang, J. Customer management in Internet-based platform firms: Review and future research directions. Mark. Intell. Plan. 2020, 38, 957–973. [Google Scholar] [CrossRef]

- Jullien, B.; Sand-Zantman, W. The economics of platforms: A theory guide for competition policy. Inf. Econ. Policy 2021, 54, 100880. [Google Scholar] [CrossRef]

- Xie, J.; Zhu, W.; Wei, L.; Liang, L. Platform competition with partial multi-homing: When both same-side and cross-side network effects exist. Int. J. Prod. Econ. 2021, 233, 108016. [Google Scholar] [CrossRef]

- Ge, J.; Li, T. Entrepreneurial resources, complementary assets, and platform sustainability. Sustainability 2019, 11, 4359. [Google Scholar] [CrossRef] [Green Version]

- Amaldoss, W.; Du, J.; Shin, W. Media platforms’ content provision strategies and sources of profits. Mark. Sci. 2021, 40, 527–547. [Google Scholar] [CrossRef]

- Lin, Z. Commercialization of creative videos in China in the digital platform age. Telev. New Media 2020, 21, 1527476420953583. [Google Scholar] [CrossRef]

- Xu, S.; Ling, L. Which is the optimal commercial mode for a video site: Paid, free, or hybrid? Asia Pac. J. Oper. Res. 2020, 37, 2050022. [Google Scholar] [CrossRef]

- Kodera, T. Discriminatory pricing and spatial competition in two-sided media markets. BE J. Econ. Anal. Policy 2015, 15, 891–926. [Google Scholar] [CrossRef]

- Zennyo, Y. Freemium competition among ad-sponsored platforms. Inf. Econ. Policy 2020, 50, 100848. [Google Scholar] [CrossRef]

- Annual and Transition Report of Foreign Private Issuers. Available online: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001722608/000156459021011590/iq-20f_20201231.htm (accessed on 31 December 2020).

- Sato, S. Freemium as optimal menu pricing. Int. J. Ind. Organ. 2019, 63, 480–510. [Google Scholar] [CrossRef] [Green Version]

- Liu, H.; Liu, S. Considering in-app advertising mode, platform-app channel coordination by a sustainable cooperative advertising mechanism. Sustainability 2020, 12, 145. [Google Scholar] [CrossRef] [Green Version]

- Reisinger, M. Platform competition for advertisers and users in media markets. Int. J. Ind. Organ. 2012, 30, 243–252. [Google Scholar] [CrossRef]

- Dietl, H.; Lang, M.; Lin, P. Advertising pricing models in media markets: Lump-sum versus per-consumer charges. Inf. Econ. Policy 2013, 25, 257–271. [Google Scholar] [CrossRef] [Green Version]

- Pan, L. Endogenous choice on advertising pricing of media platforms: Lump-sum fee vs. proportional fee. Hitotsubashi J. Econ. 2017, 58, 21–40. [Google Scholar] [CrossRef] [Green Version]

- Pan, L. Pricing of media platforms with vertical differentiation. Econ. Comput. Econ. Cybern. Stud. 2017, 51, 249–262. [Google Scholar]

- Chen, M.; Rennhoff, A.D.; Serfes, K. Bundling, à la carte pricing and vertical bargaining in a two-sided model. Inf. Econ. Policy 2016, 35, 30–44. [Google Scholar] [CrossRef]

- Greiner, T.; Sahm, M. How effective are advertising bans? On the demand for quality in two-sided media markets. Inf. Econ. Policy 2018, 43, 48–60. [Google Scholar] [CrossRef] [Green Version]

- Anderson, S.P.; Foros, Ø.; Kind, H.J. Competition for advertisers and for viewers in media markets. Econ. J. 2018, 128, 34–54. [Google Scholar] [CrossRef]

- Carronia, E.; Dimitri, P. Business models for streaming platforms: Content acquisition, advertising and users. Inf. Econ. Policy 2020, 52, 100877. [Google Scholar] [CrossRef]

- Park, K.F.; Seamans, R.; Zhu, F. Homing and platform responses to entry: Historical evidence from the U.S. newspaper industry. Strateg. Manag. J. 2021, 42, 684–709. [Google Scholar] [CrossRef]

- Hagiu, A.; Spulber, D. First-party content and coordination in two-sided markets. Manag. Sci. 2013, 59, 933–949. [Google Scholar] [CrossRef]

- Anderson Jr, E.G.; Parker, G.G.; Tan, B. Platform performance investment in the presence of network externalities. Inf. Syst. Res. 2014, 25, 152–172. [Google Scholar] [CrossRef]

- Tan, B.; Anderson Jr, E.G.; Parker, G. Platform pricing and investment to drive third party value creation in two-sided networks. Inf. Syst. Res. 2020, 31, 217–239. [Google Scholar] [CrossRef] [Green Version]

- Lin, X.; Chen, C.; Lin, Z.; Zhou, Y. Pricing and service strategies for two-sided platforms. J. Syst. Sci. Syst. Eng. 2019, 28, 299–316. [Google Scholar] [CrossRef]

- Dou, G.; He, P.; Xu, X. One-side value-added service investment and pricing strategies for a two-sided platform. Int. J. Prod. Res. 2016, 54, 3808–3821. [Google Scholar] [CrossRef]

- Dou, G.; He, P. Value-added service investing and pricing strategies for a two-sided platform under investing resource constraint. J. Syst. Sci. Syst. Eng. 2017, 26, 609–627. [Google Scholar] [CrossRef]

- Dou, G.; Lin, X.; Xu, X. Value-added service investment strategy of a two-sided platform with the negative intra-group network externality. Kybernetes 2018, 47, 937–956. [Google Scholar] [CrossRef]

- Kim, Y.; Mo, J. Pricing of digital video supply chain: Free versus paid service on the direct distribution channel. Sustainability 2019, 11, 46. [Google Scholar] [CrossRef] [Green Version]

- Calvano, E.; Polo, M. Market power, competition and innovation in digital markets: A survey. Inf. Econ. Policy 2021, 54, 100853. [Google Scholar] [CrossRef]

- D’Annunzio, A.; Russo, A. Ad networks and consumer tracking. Manag. Sci. 2020, 66, 5040–5058. [Google Scholar] [CrossRef] [Green Version]

- Dindaroglu, B. Competitive advertising on broadcasting channels and consumer welfare. Inf. Econ. Policy 2018, 42, 66–75. [Google Scholar] [CrossRef]

- General Data Protection Regulation. Available online: https://gdpr-info.eu/ (accessed on 25 May 2018).

| Utility (or Profit) | Platform 1 | Platform 2 |

|---|---|---|

| Viewers’ utilities | ||

| Advertisers’ utilities | ||

| Platforms’ profits |

| Utility (or Profit) | Platform 1 | Platform 2 |

|---|---|---|

| Viewers’ utilities | ||

| Advertisers’utilities | ||

| Platforms’profits |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, G.; An, F. Video Platforms’ Value-Added Service Investments and Pricing Strategies for Advertisers. Sustainability 2021, 13, 13701. https://doi.org/10.3390/su132413701

Liu G, An F. Video Platforms’ Value-Added Service Investments and Pricing Strategies for Advertisers. Sustainability. 2021; 13(24):13701. https://doi.org/10.3390/su132413701

Chicago/Turabian StyleLiu, Gang, and Fengyue An. 2021. "Video Platforms’ Value-Added Service Investments and Pricing Strategies for Advertisers" Sustainability 13, no. 24: 13701. https://doi.org/10.3390/su132413701

APA StyleLiu, G., & An, F. (2021). Video Platforms’ Value-Added Service Investments and Pricing Strategies for Advertisers. Sustainability, 13(24), 13701. https://doi.org/10.3390/su132413701