4.1. Operating Features and Energy Consumption

Table 5 presents the selected results for regression models relating LEED EBOM to source energy consumption levels. The complete set of results can be found in

Table A6 in the

Appendix B. Specifically, this part investigates energy performance of LEED EBOM certified buildings compared to a non-certified building group using a whole sample of energy observations while employing sample weights generated by a GBM (

n = 5428). The reference category is comprised of Class A masonry buildings operating under gross/full service gross leasing structures in San Francisco. Model 1 demonstrates the results of using a DiD approach: LEED EBOM certification results in a 2.7% decrease in source energy use intensity. Additionally, the level of source energy consumption of LEED EBOM certified buildings is lower in the pre-certification period compared to the reference group (−3.1%). As expected, the most tangible impact on energy usage occurs due to an increase in vacancy rates (−52.9%) and in the presence of a data centre (63.5%). Single tenant buildings consume on average 9.9% more energy than their multi-tenant counterparts. As expected, a split incentive problem is evident from these findings, which occurs when the tenant’s marginal cost of energy consumption is zero, thus causing more energy wasted in gross than net leases. As such, buildings adopting net leases consume on average 4.0% less source energy than their gross lease counterparts under a DiD specification. Finally, buildings made from steel use 7.5% more energy than masonry buildings. This is also expected, since masonry buildings’ thermal envelope and insulation properties (R-values) mean their glazing ratio is lower than in curtainwall buildings. Meanwhile, structural steel properties have uncovered slab edges that provide little insulation [

29]. An adjusted-R

2 is used to determine if the inclusion of additional lease- and building-level variables results in a better predictive power of the OLS model. In addition, the variables are checked for multicollinearity using their variance inflation factors (VIFs). A Breusch–Pagan [

76] test detects heteroscedasticity issues, as the null hypothesis of constant variance is rejected at 90% significance level. Furthermore, Wooldridge test for first order autocorrelation firmly rejects the null hypothesis of no first order autocorrelation. Cluster-robust standard errors are therefore used, allowing for building-level intragroup correlation [

77]. Finally, no substantial deviation from normality is observed in the distribution of the residuals.

In the next stage, we utilise this dataset’s panel characteristics. A Hausman [

78] test rejects the null hypothesis of the difference in random and fixed effects not being systematic. Researchers frequently interpret this result as an indication that a fixed effect model should be used [

69]. Yet Fielding [

79] notes that this is a test for the presence of a contextual effect, or whether there is a difference between a within and between-unit variation [

69]. Since a mixed effects specification would give the same results for the within effect (in both coefficient and standard error) as the fixed effects model, while retaining the between effect, we proceed with this approach [

80,

81]. Because the intraclass correlation coefficient (ICC) at city-level (20%) is closer to the lower bound recommended for running a multi-level model [

82], where a minimum of 5 levels is usually required [

83], city fixed effects are employed instead. Meanwhile, building-level ICC coefficient is high (85%), justifying building-level random effects. The results show that using a mixed effects approach, LEED EBOM certification yields a reduction in energy consumption by 3.2%. In the following regression (Model 3), we investigate if there is evidence of heterogenous certification effects over time using a sample of LEED EBOM certified buildings 5 years prior and during the certification period. Although coefficients vary from year to year in the periods before and after certification, only the first certification year yields a significant result.

For comparative purposes and as a robustness check, we conduct a fixed effects analysis that removes any bias arising from contextual effects. Specifically, we focus on comparing energy consumption of LEED EBOM buildings on an individual basis compared to their own energy consumption levels before certification occurs. This specification allows to eliminate any confounding factors arising from the between variation, which may be causing selection bias into the treatment (certification) group. A fixed effects regression with a reduced sample for buildings (where information available before and after certification) shows that LEED EBOM results in a 3.0% reduction in source energy. This finding is nearly identical to our main set of reported results in

Table 5.

Next, we analyse the effect of energy management features on energy consumption using a sample of LEED EBOM certified buildings in the post certification period and present the results in

Table 6 (

n = 1377). The complete set of results can be found in

Table A7 in the

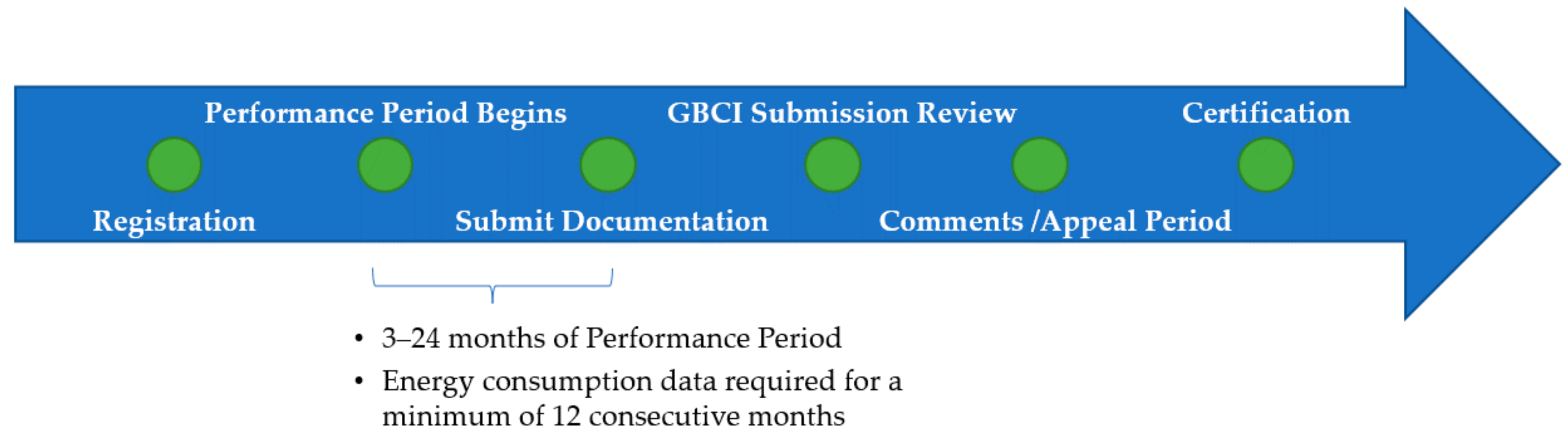

Appendix B. Model 4 demonstrates that a 1-point (equivalent to 10%) increase in the energy management variable results in an increase in source energy consumption by 0.4%. The effect of this variable is broken down into its components in Model 5, measurement and commissioning, demonstrating that commissioning is a significant driver of this effect: a 1-point increase in these credits (equivalent to an increase by 1/3rd) results in a 1.1% rise in source energy. Since the relationship between energy management (including commissioning) and energy consumption is contrary to the expectations laid out in our hypotheses, we postulate that there may be reverse causality issues at play. Having only utilised information in the certification period, it is possible that buildings with higher-than-average energy performance pursue energy management principles either to increase their total LEED score (to make up for a low number of points achieved in the energy optimisation category which is directly proportional to energy consumption), while possibly expecting to reap energy savings in the future. To account for this possibility, the whole panel of observations before and after LEED EBOM certification is employed in the next stage. Although information on the exact duration of the performance period, or when the measures of interest are implemented, is unavailable, we compare periods before and after the performance period. Given that the effect of LEED EBOM certification should start taking place at the onset of the performance period (in order to attain LEED EBOM certification and for reasons other than energy management), we exclude observations 1 year prior to the date of certification. Observations corresponding to the year of certification are also excluded in order to remove any ambiguity with respect to the end of the performance period, which results in a sample of 1580 observations. Assuming that all energy management principles are implemented during the performance period and lagged by one year, we find that a 10% increase in this category results in a 0.5% fall in source energy (Model 6). This decrease is again underpinned by energy commissioning: a 1/3rd increase in the number of points scored reduces energy consumption by 1.0% (Model 7). As a robustness check, a further exclusion of observations 2 years prior to the date of certification to allow for a longer performance period does not produce results notably deviating from the coefficients reported in Model 6 and Model 7.

In

Table 6, we also present our findings involving the effect of the Indoor Environment: a 1-point (equivalent to 10%) increase in this variable results in a 0.8% rise in source energy consumption (Model 8). This variable is an aggregation of credits representing air quality and occupant comfort, which we proceed to investigate separately. Among the variables driving the increase in energy is IAQ Outdoor Monitoring (9.9%), which is one of the five components of indoor air quality. Finally, the presence of comfort surveys is associated with a 1.8% increase in source energy, as demonstrated in Model 9.

In the final stage, we conduct some general robustness checks to examine the impact of some missing variables. Since one of the main operating characteristics, worker density per unit area, is reported by the city of New York, a separate set of regressions is conducted for New York to include this variable. Despite this variable being highly significant under this setting, the coefficients of interest do not deviate substantially from those reported in the above tables.

4.2. Operating Features and Rental Premium

Table 7 shows the second set of regression results with the logarithm of starting rent as a dependent variable. As before, the starting point of the analysis is a DiD regression, aggregated at a LEED EBOM certification group level, using the whole sample of leases signed in both LEED EBOM and non-certified buildings with GBM weights applied (

n = 7686). Overall, the regression is highly significant with an R

2 of 80.4%. LEED EBOM certification incurs a 3.0% premium; however, no significant LEED EBOM premium is observed for a net lease, as demonstrated in Model 2. An equivalent set of checks as described in the previous section is conducted to test the validity of the OLS approach and determine the inclusion of variables. A graphical inspection of the residuals against the time variable (transaction quarter) does not reveal any autocorrelation issues. However, a Breush–Pagan [

76] test rejects the null hypothesis of constant varaince in the error terms. Huber–White error estimation is therefore used, which ensures that standard errors are robust to heteroscedasticity [

84,

85]. Additionally, the residuals are mostly normally distributed. A scatterplot of residuals versus fitted values, however, indicates that the independence of errors assumption is violated. These findings are expected in light of this dataset’s hierarchical data structure, thus supporting a multi-level approach. The Hausman test once again indicates the lack of equivalence between the within and between estimators [

78]. The use of the mixed effects approach with the specified levels is further reinforced by high intraclass coefficients for building and submarket levels of 58% and 23%, respectively. In a multi-level setting, as Model 3 demonstrates, the effect of LEED EBOM certification does not deviate substantially from the DiD specification (2.7%). However, the interaction term between net lease type and LEED EBOM certificate is significant at 10% level in a MLM (Model 4): net leases in LEED EBOM certified properties incur a 5.0% premium (in addition to a 2.1% premium in all lease types). The signs and magnitudes of building-level coefficients are as expected and reported in

Table A8 in the

Appendix B. The lack of significance in variables such as class and the number of storeys in some models is not unexpected after employing propensity score balancing procedures.

Next, we use a restricted sample of leases signed under version 3 (v2009) of LEED EBOM by applying this label’s scorecard data. Such information is available for 3287 leases in 303 buildings. The results of these regressions are presented in

Table 8 and the complete set of results can be found in

Table A9 in the

Appendix B. Overall, a 1-point (equivalent to 10%) increase in energy management results in a 0.4% increase in the rental premium for all lease types (Model 5). However, no significant interaction effect is observed between this variable and the type of lease signed (Model 6). A separate regression examining this variable’s individual components uncovered a positive relationship between the number of commissioning points earned and rental premium: a 1-point (equivalent to 1/3rd) increase incurs a 1.2% rise in the premium (Model 7). The presence of measurement technologies, such as building automation systems (BAS) and system measurements, does not yield a significant result.

Using the same restricted sample, a separate set of regressions is conducted for the Indoor Environment variable. As per Model 8, a 1-point (equivalent to 10%) increase in this variable results in a 1.3% premium in all types of leases. No significant difference in the premium of net and gross leases occurs for the incidence of indoor environment features (Model 9). To understand the effect of the specific attributes driving this premium, the effect of a set of dummy variables which constitute this category is analysed. Once again, the significance stems from the presence of IAQ Outdoor Monitoring features (13.3%) and Thermal Monitoring (7.8%) credits are found to underpin the positive effect.

We finalise our analysis with further robustness checks. Since LEED EBOM certification may not be priced in immediately upon certifying, we explore whether the above results hold using lagged terms of LEED EBOM status as well as energy management and indoor environment practices. The results of the lagged status of LEED EBOM are not significant. Using the restricted sample to study scorecard effects, only the lagged indoor environment variable bears significance, with a 1-point increase resulting in a rental premium of 1.6%.

4.3. Discussion

This section draws on the results from all the above regressions and evaluates them in the context of the original hypotheses. Throughout this section, we focus on the results using the MLM specification which can account for autocorrelation and heteroscedasticity of residuals, as opposed to OLS with clustering of standard errors [

86]. Modelling the clustering of data using multilevel methods is considered to be a better approach than adjusting the standard errors of the OLS estimates [

87] because one-level OLS is likely to underestimate the standard errors and overestimate the statistical significance of the parameters. The results of the multi-level approach show that energy savings in the magnitude of 3.2% are achieved in the LEED EBOM post-certification period over non-certified buildings. Some past studies highlight that the effect of green certification on energy consumption is likely to vary over time in the certification phase due to technical and behavioural factors, such as the rebound effect [

63]. In the following regression (Model 3 in

Table 5), we investigate the presence of heterogenous certification effects over time using a sample of LEED EBOM certified buildings 5 years prior and during the certification period of up to 5 years. However, only the first year of certification yields significant results, showing a decrease in source energy use intensity by 8.0%. The lack of significance could be attributed to a relatively low number of observations corresponding to LEED EBOM certified buildings in each year.

The fact that LEED EBOM certification reduces energy consumption and consequently energy costs is expected to be priced in via a premium in leases where tenants pay directly for operating expenses. By exploring the interaction effect between lease type and LEED EBOM certificate, we find it to be the case: in addition to a 2.1% premium, tenants pay a further premium of 5.0% under such lease structures using a mixed effects specification. This finding is in support of a study conducted by Szumilo and Fuerst [

88] who discovered increased rents in both gross and net-leased properties. In our case, however, this effect is significant despite controlling for energy consumption, which is expected to act as a mediating channel. One possible explanation is that since energy costs represent ~30% of total operating expenses [

37,

48], LEED EBOM may also affect other operating expenses such as maintenance costs. Understanding the effect of this certification on various operating expenses components presents a potential area for future research.

Next, we focus on studying the effects of individual scorecard features that form the basis of LEED EBOM label. The lack of information on these variables in the period prior to the certification drives the initial decision to exclude those observations from the set. In investigating the combined effect of energy management credits, comprised of commissioning and measurement, we find that these practices have an adverse effect on energy consumption. The unexpected sign could arise due to reverse causality if buildings with higher-than-average energy consumption are incentivised to pursue energy management credits to reap energy saving benefits in the future and/or attain a higher LEED score. To overcome this bias, we utilise observations before and after LEED EBOM certification. By assuming that a decrease in energy consumption occurs at least 1 year prior to the year of certification (for reasons other than energy management), that energy management principles are implemented during the performance period and their effect is delayed by 1 year, we find a significant negative association between energy management and source energy consumption. The presence of commissioning credits is driving this effect. Although these findings support Hypothesis 1, the observed reduction in energy consumption is trivial (1.0% decrease in energy for a 1/3 increase in the number of commissioning points). To put this in the absolute terms, with the average source energy consumption of an office building being ~200 kBtu/sqft/year [

58], implementing one of the commissioning principles (investigation, implementation or ongoing commissioning) would result in a decrease in source energy usage of ~2 kBtu/sqft/year. Further research could elucidate the effectiveness of these practices from a cost-benefit perspective.

A negative association between energy consumption and energy management principles (increase in energy savings) does not translate into a premium for net leases, as postulated by Hypothesis 3. This could be due to the relatively small decrease in energy usage as described above. However, an observed premium for these features in all types of leases could be indicative of the perceived productivity benefits of these credits. For example, the presence of commissioning may not only address energy performance issues in buildings with energy management systems and equipment failures, but also identify and correct flaws regarding indoor air quality conditions. However, it is also possible that building owners bundle energy management practices with other productivity-related features, which have been omitted from our regression. Yet given the average number of energy management points in our sample (3.73), the average premium achieved for the presence of these features is not very large (~1.5%).

In the final part of the analysis, the effect of indoor environment features is explored. Implementation of these practices results in a significant increase in source energy consumption, a finding in support of Hypothesis 2. It occurs due to the incidence of comfort features (Comfort Survey) and indoor air quality (IAQ Outdoor Monitoring). Specifically, energy increase in the presence of outdoor air monitoring is substantial (~10%), especially compared to the energy rise for a Comfort Survey credit (1.8%). Productivity advantages of superior air quality are also shown to translate into a fairly substantial premium for the IAQ Outdoor Monitoring credit (~13%). This credit mandates the installation of permanent, continuous monitoring systems that inform building operators when external airflow falls below the minimum set point by more than 15%. The likely invisible nature of this credit in the eyes of the tenants, however, casts doubt on whether the size of the coefficient is attributable to this feature alone. Similarly, IAQ Outdoor Monitoring (and Comfort Survey) should not per se have an adverse effect on energy. Rather, this credit could trigger an increase in a ventilation rate throughout the building or a range of actions that would address occupants’ comfort concerns, resulting in an increase in HVAC energy consumption and associated costs [

89]. Therefore, it is possible that these coefficients are inflated by omitted factors that are positively correlated with these features. Finally, Thermal Monitoring is the only comfort feature that is found to yield a significant in addition to a substantial premium (7.8%). This credit requires continuous monitoring of air temperature and humidity in addition to periodic measurements of air speed and humidity to assess the conditions experienced by building occupants [

89]. The relatively large size of the premium is hardly surprising since getting the temperature right is vital for occupants’ comfort. Besides, acquisition of this credit often relies on installation of automatic sensors in the building automation system (BAS) infrastructure, which may be costly to building owners. Overall, these results reveal some interesting insights into the prominence of monitoring technologies to ensure that both air and thermal conditions are optimal and therefore conducive to employee productivity.

Contrary to the expectations laid out in Hypothesis 4b, the adverse energy consumption effect associated with indoor environment attributes does not translate into rent reduction for leases where tenants pay for utilities. We do not find it to be the case upon exclusion of the logarithm of source energy consumption, the proposed mediating channel. Meanwhile, a substantial premium emerges under gross lease structures (as per Hypothesis 4a) where such attributes are present: a 10% increase in this category yields a 1.3% premium. These results further reinforce the notion that productivity aspects may be more prominent in LEED EBOM buildings and may overshadow any adverse energy ramifications.

The findings of this paper are important for policy makers seeking to lower greenhouse gas emissions as well as property investors interested in reducing operating expenses to improve their bottom line. These stakeholders would unequivocally benefit from considering productivity-boosting features that do not come at the expense of higher energy consumption. One uncovered strategy is associated with the implementation of Thermal Monitoring since it resulted in a significant rent premium without a significant (adverse) effect on energy consumption. Another strategy, although not supported empirically in this study, is the provision of task lighting controls for occupants. This strategy can theoretically reduce energy usage by allowing occupants to adjust lighting levels to their specific needs without depending on over-lit space of the whole building. Future research, involving more granular datasets with high-frequency energy data collected in a RCT setting, is needed to draw more decisive conclusions to determine which productivity-boosting features can have such an effect. Based on the results of such findings, USGBC could consider re-weighting the scorecard to incentivise the adoption of thise productivity-related credits that do not harm the environment.

There are several limitations of this study which may question the results obtained in this study. The low coefficient magnitudes obtained for some variables of interest may be trivial considering the imperfections of the real estate market and the high degree of uncertainty associated with energy predictions. Different implementation windows of energy benchmarking policies in the cities studied and the minimum affected floor area result in varying data availability for each city. Specifically, availability of energy data skews our sample towards San Francisco and New York, which were some of the first to initiate energy benchmarking policies for non-residential buildings. Additionally, verification of energy data is not required by every city [

90], exposing our sample to some degree of error. However, as long as such errors are randomly distributed, the validity of the generated results should not be compromised. Additionally, with a relatively scarce availability of buildings under certain certification levels in the studied cities, we cannot examine the extent of heterogeneity in the outcomes for equivalent certification levels between these cities. Furthermore, key occupational variables (such as worker density and number of computers per person and operating hours), which are known to influence energy consumption considerably [

91], are absent from this study. Although a set of separate regressions with worker density included for the city of New York does not produce a significant deviation in the coefficients, the model’s overall predicting power would be improved upon the inclusion of such variables. Another noteworthy limitation is the lack of information on the features represented by the scorecards prior to LEED EBOM certification. Thus, we cannot precisely isolate the effect of mandatory prerequisites and individual features constituting the LEED EBOM label from the aggregate effect using the period before and after certification. Furthermore, aside from the traditional hedonic variables (class, building size, etc.), key information on the type of equipment installed in a building (such as HVAC systems) is missing. Information on the tenant firm type, credit rating, size, and behaviour is not included, reducing the explanatory power of our models. If environmentally conscious tenants systematically choose to locate in a building with LEED EBOM certification, any reduction in energy consumption (increase in savings) achieved due to certification would suffer from a negative (positive) bias. There may be a selection bias in the types of businesses that choose net leases over gross leases, a decision that could be based on the tenant’s projected intensity of space usage [

38].