Dynamic Adjustment Mechanism and Differential Game Model Construction of Mask Emergency Supply Chain Cooperation Based on COVID-19 Outbreak

Abstract

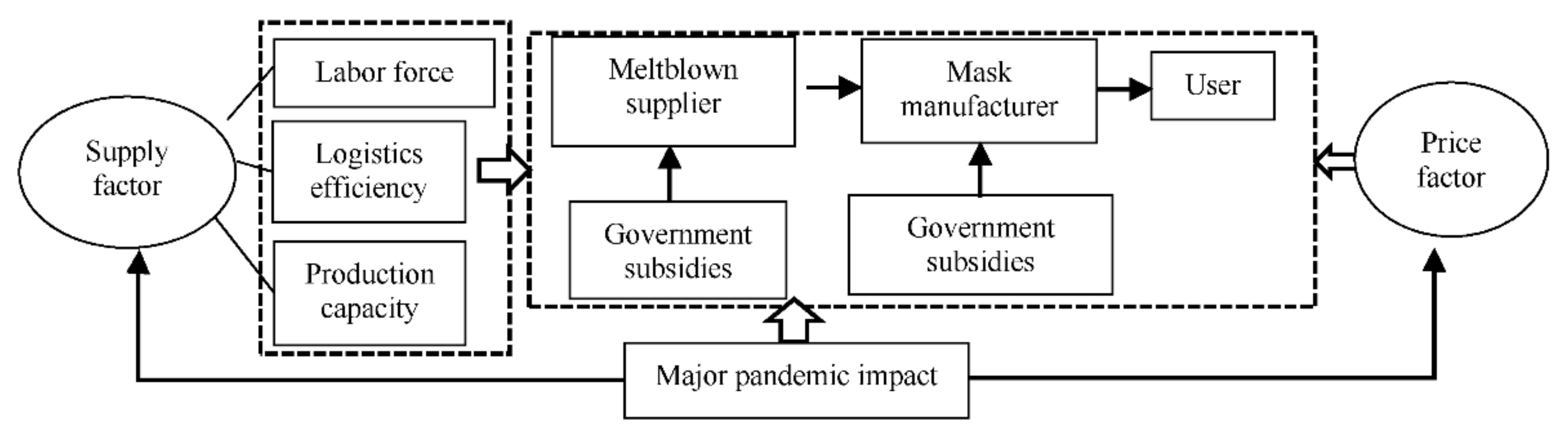

1. Introduction

- (1)

- How does the trajectory of mask production shift over time?

- (2)

- How do parameters affect supply chain decisions? These parameters consist of the supplier and manufacturer’s production technology investment cost coefficients, the sensitivity coefficients of production volume to the production technology investment efforts of the supply chain members, the sensitivity coefficient of mask demand to mask production volume, and government subsidies.

- (3)

- How does the joint contract affect the optimal strategy and coordinate the mask emergency supply chain?

2. Literature Review

3. Model Assumptions and Symbol Description

4. Differential Game Model for Joint Production of the Supplier and the Manufacturer Based on COVID-19 Pandemic

4.1. Differential Game Model of Decentralized Decision

- (1)

- The optimal trajectory of mask production is expressed as:where.

- (2)

- The optimum equilibrium strategies for supply chain members are expressed as:

- (3)

- The optimum profit values of supplier and manufacturer are given respectively as:

4.2. Differential Game Model of Centralized Decision

- (1)

- The optimal trajectory of mask production is expressed aswhere.

- (2)

- The optimum equilibrium strategies for both supplier and manufacturer are expressed as

- (3)

- The optimum profit values of supplier and manufacturer are given respectively as

4.3. Decision Model in Joint Contracts Decision Scenario

- (1)

- The optimal trajectory of mask production is expressed aswhere.

- (2)

- The optimal production technology investment effort cost ratio is shared by the supplier for manufacturer. Meanwhile, the optimum production technology investment effort cost ratio is shared by the manufacturer for the supplier, and the optimal equilibrium strategies for the production technology investment of the supplier and manufacturer are given as

- (3)

- The optimal profit values of supplier and manufacturer are expressed respectively as

5. Numerical Analysis

5.1. Comparison Results of Numerical Examples

- (1)

- The production technology investment efforts, the mask production, and product demand under the joint contract decision scenario have reached the level of the centralized decision scenario.

- (2)

- Compared with the case of no government subsidies, under the influence of government subsidy policies, the profits of the supplier, the manufacturer, and the supply chain system in these three decision situations have increased. Besides, under the influence of the government subsidy policy, the cost-sharing ratio among supply chain members is inconsistent with that under the case of no government subsidies. It represents that government subsidies can change the cost composition of supply chain members, thereby affecting the profits of supply chain members under the game relationship.

- (3)

- In the case of no government subsidies, compared with the centralized decision scenario, the production technology investment efforts of suppliers and manufacturers under the decentralized decision scenario have decreased by 75.51% and 26.53%, respectively. The mask production has decreased by 62.07%, product demand has decreased by 64.66%, and the total profit of the supply chain system has been reduced by 51.52%.In the case of government subsidies, the production technology investment efforts of suppliers and manufacturers under the decentralized decision situation have decreased by 75.51% and 26.53%, respectively. The mask production has decreased by 60.61%, the production demand has decreased by 59.23%, and the total profit of the supply chain system has decreased by 48.92%.It is indicated that, regardless of whether there are government subsidies, the supplier and the manufacturer are willing to cooperate in production. Moreover, supply chain members are more profitable, and their enthusiasm for cooperation tends to be higher in the case of government subsidies.

- (4)

- In the case of no government subsidies, compared with the decentralized decision scenario, the production technology investment efforts, mask production, and product demand have all been found to increase after the introduction of the joint contract. The manufacturer’s profit has increased by 32.50%, the total profit of the supply chain has increased by 49.88%, and the supplier’s profit has doubled.In the case of government subsidies, the production technology investment efforts, mask production, and product demand tend to increase. The profits of suppliers and manufacturers have increased by 81.07% and 31.15%, respectively, and the total profit of the supply chain has increased by 44.1%, achieving the centralized decision situation.It denotes that there is a double marginal effect in the mask emergency supply chain under the decentralized decision scenario, and the joint contract can achieve supply chain coordination.

5.2. Optimal Trajectory Analysis of State Variables

5.3. Influence Analysis of Government Subsidies

5.4. Coordination Effect Analysis of Joint Contract

6. Conclusions

- (1)

- The production technology investment exertions of supplier and manufacturer, the simultaneous optimum trajectory of production, and the profits of supply chain members are amplified in the joint contract decision scenario. The overall profit of the joint contract decision model reached the level of the centralized decision scenario. Therefore, our joint contract introduction can maximize supply chain profits and meet mask market demand under the COVID-19 pandemic. At the same time, the balance strategies of production technology investment effort under the three decisions do not change with time.

- (2)

- With the growth in the impact of the supplier’s production technology investment effort sensitivity coefficient on production volume and the increase in mask demand sensitivity coefficient to mask production volume, mask production volume showed an increasing trend, indicating that the more sensitive production volume is to the supplier’s production technology investment effort, the more apparent cooperative production effects of supply chain members are. With the growth in the impact of the supplier’s production technology investment cost coefficient on mask production and the increase in the self-decay rate of mask production, mask production represents a downward trend, indicating that high input costs will weaken the cooperative enthusiasm of the supplier and the manufacturer. The effect of long-term collaborative output will deteriorate as the natural aging speed of invested production equipment accelerates. At this point, the government can subsidize the production inputs of the supplier and the manufacturer to increase cooperation enthusiasm. Additionally, government subsidies can increase the profits of supply chain members and their partners more than in the case of no government subsidies.

- (3)

- Compared with the decentralized decision model, production technology investment efforts in the centralized decision scenario, the optimum trajectory of mask production, and the supply chain’s general profit are favorably improved.

- (4)

- When the joint contract meets certain conditions, the optimal production technology investments of both supplier and manufacturer and overall profit are improved compared with the decentralized decision scenario, reaching a certain level of the centralized decision scenario. At the same time, it also makes the profits of the supplier and the manufacturer achieve double Pareto improvement.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Morales-Narváez, E.; Dincer, C. The impact of biosensing in a pandemic outbreak: COVID-19. Biosens. Bioelectron. 2020, 163, 112274. [Google Scholar] [CrossRef] [PubMed]

- Phan, T.L.; Ching, C.T.-S. A Reusable Mask for Coronavirus Disease 2019 (COVID-19). Arch. Med. Res. 2020, 51, 455–457. [Google Scholar] [CrossRef] [PubMed]

- Kampf, G.; Scheithauer, S.; Lemmen, S.; Saliou, P.; Suchomel, M. COVID-19-associated shortage of alcohol-based hand rubs, face masks, medical gloves, and gowns: Proposal for a risk-adapted approach to ensure patient and healthcare worker safety. J. Hosp. Infect. 2020, 105, 424–427. [Google Scholar] [CrossRef] [PubMed]

- Carnino, J.M.; Ryu, S.; Ni, K.; Jin, Y. Pretreated household materials carry similar filtration protection against pathogens when compared with surgical masks. Am. J. Infect. Control 2020, 48, 883–889. [Google Scholar] [CrossRef]

- Abedrabboh, K.; Pilz, M.; Al-Fagih, Z.; Al-Fagi, O.S.; Nebel, J.C.; Al-Fagih, L. Game theory to enhance stock management of personal protective equipment (PPE) supply during the COVID-19 outbreak. arXiv 2020, arXiv:2009.11838. [Google Scholar]

- Santini, A. Optimising the assignment of swabs and reagent for PCR testing during a viral epidemic. Omega 2020, 102341. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, D.-D.; Xu, Q. A supply chain coordination mechanism with suppliers’ effort performance level and fairness concern. J. Retail. Consum. Serv. 2020, 53, 101950. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Nasab, H.R.E.; Taleizadeh, A.A. Coordination by quantity flexibility contract in a two-echelon supply chain system: Effect of outsourcing decisions. Int. J. Prod. Econ. 2020, 225, 107586. [Google Scholar] [CrossRef]

- Chen, X.; Wan, N.; Wang, X. Flexibility and coordination in a supply chain with bidirectional option contracts and service requirement. Int. J. Prod. Econ. 2017, 193, 183–192. [Google Scholar] [CrossRef]

- Yang, J.; Liu, H.; Yu, X.; Xiao, F. Emergency Coordination Model of Fresh Agricultural Products’ Three-Level Supply Chain with Asymmetric Information. Math. Probl. Eng. 2016, 2016, 1–9. [Google Scholar] [CrossRef]

- Wang, S.; Choi, S.H. Pareto-efficient coordination of the contract-based MTO supply chain under flexible cap-and-trade emission constraint. J. Clean. Prod. 2020, 250, 119571. [Google Scholar] [CrossRef]

- Liu, R.; Dan, B.; Zhou, M.; Zhang, Y. Coordinating contracts for a wind-power equipment supply chain with joint efforts on quality improvement and maintenance services. J. Clean. Prod. 2020, 243, 118616. [Google Scholar] [CrossRef]

- Li, J.; Luo, X.; Wang, Q.; Zhou, W. Supply chain coordination through capacity reservation contract and quantity flexibility contract. Omega 2021, 99, 102195. [Google Scholar] [CrossRef]

- Fan, Y.; Feng, Y.; Shou, Y. A risk-averse and buyer-led supply chain under option contract: CVaR minimization and channel coordination. Int. J. Prod. Econ. 2020, 219, 66–81. [Google Scholar] [CrossRef]

- Zhou, C.; Tang, W.; Lan, Y. Supply chain contract design of procurement and risk-sharing under random yield and asymmetric productivity information. Comput. Ind. Eng. 2018, 126, 691–704. [Google Scholar] [CrossRef]

- Wang, X.; Guo, H.; Wang, X. Supply chain contract mechanism under bilateral information asymmetry. Comput. Ind. Eng. 2017, 113, 356–368. [Google Scholar] [CrossRef]

- He, J.; Ma, C.; Pan, K. Capacity investment in supply chain with risk averse supplier under risk diversification contract. Transp. Res. Part E Logist. Transp. Rev. 2017, 106, 255–275. [Google Scholar] [CrossRef]

- Adhikari, A.; Bisi, A.; Avittathur, B. Coordination mechanism, risk sharing, and risk aversion in a five-level textile supply chain under demand and supply uncertainty. Eur. J. Oper. Res. 2020, 282, 93–107. [Google Scholar] [CrossRef]

- Li, X.; Chen, J.; Ai, X. Contract design in a cross-sales supply chain with demand information asymmetry. Eur. J. Oper. Res. 2019, 275, 939–956. [Google Scholar] [CrossRef]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar] [CrossRef]

- Jabarzare, N.; Rasti-Barzoki, M. A game theoretic approach for pricing and determining quality level through coordination contracts in a dual-channel supply chain including manufacturer and packaging company. Int. J. Prod. Econ. 2020, 221, 107480. [Google Scholar] [CrossRef]

- Fan, J.; Ni, D.; Fang, X. Liability cost sharing, product quality choice, and coordination in two-echelon supply chains. Eur. J. Oper. Res. 2020, 284, 514–537. [Google Scholar] [CrossRef]

- Zhang, T.; Wang, X. The impact of fairness concern on the three-party supply chain coordination. Ind. Mark. Manag. 2018, 73, 99–115. [Google Scholar] [CrossRef]

- Liu, F.; Chen, W.-L.; Fang, D.-B. Optimal coordination strategy of dynamic supply chain based on cooperative stochastic differential game model under uncertain conditions. Appl. Soft Comput. 2017, 56, 669–683. [Google Scholar] [CrossRef]

- Zhou, Y.; Ye, X. Differential game model of joint emission reduction strategies and contract design in a dual-channel supply chain. J. Clean. Prod. 2018, 190, 592–607. [Google Scholar] [CrossRef]

- Sharma, A.; Dwivedi, G.; Singh, A. Game-theoretic analysis of a two-echelon supply chain with option contract under fairness concerns. Comput. Ind. Eng. 2019, 137, 106096. [Google Scholar] [CrossRef]

- Nematollahi, M.; Hosseini-Motlagh, S.-M.; Ignatius, J.; Goh, M.; Nia, M.S. Coordinating a socially responsible pharmaceutical supply chain under periodic review replenishment policies. J. Clean. Prod. 2018, 172, 2876–2891. [Google Scholar] [CrossRef]

- Parsaeifar, S.; Bozorgi-Amiri, A.; Naimi-Sadigh, A.; Sangari, M.S. A game theoretical for coordination of pricing, recycling, and green product decisions in the supply chain. J. Clean. Prod. 2019, 226, 37–49. [Google Scholar] [CrossRef]

- Tian, Y.; Ma, J.; Xie, L.; Koivumäki, T.; Seppänen, V. Coordination and control of multi-channel supply chain driven by consumers’ channel preference and sales effort. Chaos Solitons Fractals 2020, 132, 109576. [Google Scholar] [CrossRef]

- Iris, Ç.; Christensen, J.; Pacino, D.; Ropke, S. Flexible ship loading problem with transfer vehicle assignment and scheduling. Transp. Res. Part B Methodol. 2018, 111, 113–134. [Google Scholar] [CrossRef]

- Verdonck, L. Collaborative logistics from the perspective of freight transport companies. 4OR 2017, 16, 107–108. [Google Scholar] [CrossRef]

- Venturini, G.; Iris, Ç.; Kontovas, C.A.; Larsen, A. The multi-port berth allocation problem with speed optimization and emission considerations. Transp. Res. Part D Transp. Environ. 2017, 54, 142–159. [Google Scholar] [CrossRef]

- Lai, M.; Cai, X.; Li, X. Mechanism design for collaborative production-distribution planning with shipment consolidation. Transp. Res. Part E Logist. Transp. Rev. 2017, 106, 137–159. [Google Scholar] [CrossRef]

- Sheu, J.-B.; Chen, Y.J. Impact of government financial intervention on competition among green supply chains. Int. J. Prod. Econ. 2012, 138, 201–213. [Google Scholar] [CrossRef]

- Ma, W.-M.; Zhao, Z.; Ke, H. Dual-channel closed-loop supply chain with government consumption-subsidy. Eur. J. Oper. Res. 2013, 226, 221–227. [Google Scholar] [CrossRef]

- Zhang, X.; Yousaf, H.A.U. Green supply chain coordination considering government intervention, green investment, and customer green preferences in the petroleum industry. J. Clean. Prod. 2020, 246, 118984. [Google Scholar] [CrossRef]

- Chen, Z.; Su, S.-I.I. Social welfare maximization with the least subsidy: Photovoltaic supply chain equilibrium and coordination with fairness concern. Renew. Energy 2019, 132, 1332–1347. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Jafari, A. Reverse and closed loop supply chain coordination by considering government role. Transp. Res. Part D Transp. Environ. 2017, 52, 379–398. [Google Scholar] [CrossRef]

- Peng, H.; Pang, T. Optimal strategies for a three-level contract-farming supply chain with subsidy. Int. J. Prod. Econ. 2019, 216, 274–286. [Google Scholar] [CrossRef]

- Peng, H.; Pang, T.; Cong, J. Coordination contracts for a supply chain with yield uncertainty and low-carbon preference. J. Clean. Prod. 2018, 205, 291–302. [Google Scholar] [CrossRef]

- Ranjan, A.; Jha, J. Pricing and coordination strategies of a dual-channel supply chain considering green quality and sales effort. J. Clean. Prod. 2019, 218, 409–424. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Alizadeh-Basban, N.; Sarker, B.R. Coordinated contracts in a two-echelon green supply chain considering pricing strategy. Comput. Ind. Eng. 2018, 124, 249–275. [Google Scholar] [CrossRef]

- Plambeck, E.L. Reducing greenhouse gas emissions through operations and supply chain management. Energy Econ. 2012, 34, S64–S74. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, J.; Tang, W. Strategic transfer pricing in a marketing–operations interface with quality level and advertising dependent goodwill. Omega 2015, 56, 1–15. [Google Scholar] [CrossRef]

- Zhang, J.; Chiang, W.K.; Liang, L. Strategic pricing with reference effects in a competitive supply chain. Omega 2014, 44, 126–135. [Google Scholar] [CrossRef]

- El Ouardighi, F.; Kogan, K. Dynamic conformance and design quality in a supply chain: An assessment of contracts’ coordinating power. Ann. Oper. Res. 2013, 211, 137–166. [Google Scholar] [CrossRef]

| Variables | Centralized Scenario | Decentralized Scenario | Joint Contract Scenario |

|---|---|---|---|

| 41.7076 | 14.7380 | 41.7076 | |

| 5079.30 | 1926.40 | 4353.70 | |

| 62.6420 | 15.3409 | 62.6420 | |

| 26.7273 | 19.6364 | 26.7273 | |

| 17.5 | 20 | 20 | |

| - | - | 0.2653 | |

| - | - | 0.7551 | |

| - | 7256.30 | 14,739 | |

| - | 22,234 | 29,461 | |

| 60,832 | 29,490.3 | 44,200 |

| Variables | Centralized Scenario | Decentralized Scenario | Joint Contract Scenario |

|---|---|---|---|

| 69.4784 | 28.3249 | 69.4784 | |

| 7995.20 | 3149.20 | 6853.10 | |

| 89.4886 | 21.9156 | 89.4886 | |

| 66.8182 | 49.0909 | 66.8182 | |

| 17.5 | 20 | 20 | |

| - | - | 0.1061 | |

| - | - | 0.5286 | |

| - | 12,914 | 23,383 | |

| - | 36,506 | 47,878 | |

| 96,756 | 49,421 | 71,261 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, S.; Xie, K.; Gui, P. Dynamic Adjustment Mechanism and Differential Game Model Construction of Mask Emergency Supply Chain Cooperation Based on COVID-19 Outbreak. Sustainability 2021, 13, 1115. https://doi.org/10.3390/su13031115

Zhu S, Xie K, Gui P. Dynamic Adjustment Mechanism and Differential Game Model Construction of Mask Emergency Supply Chain Cooperation Based on COVID-19 Outbreak. Sustainability. 2021; 13(3):1115. https://doi.org/10.3390/su13031115

Chicago/Turabian StyleZhu, Shufan, Kefan Xie, and Ping Gui. 2021. "Dynamic Adjustment Mechanism and Differential Game Model Construction of Mask Emergency Supply Chain Cooperation Based on COVID-19 Outbreak" Sustainability 13, no. 3: 1115. https://doi.org/10.3390/su13031115

APA StyleZhu, S., Xie, K., & Gui, P. (2021). Dynamic Adjustment Mechanism and Differential Game Model Construction of Mask Emergency Supply Chain Cooperation Based on COVID-19 Outbreak. Sustainability, 13(3), 1115. https://doi.org/10.3390/su13031115