Natural Assurance Schemes Canvas: A Framework to Develop Business Models for Nature-Based Solutions Aimed at Disaster Risk Reduction

Abstract

:1. Introduction

2. Materials and Methods

2.1. The NAS Canvas: A Framework and Tool to Identify and Describe NAS Business Models

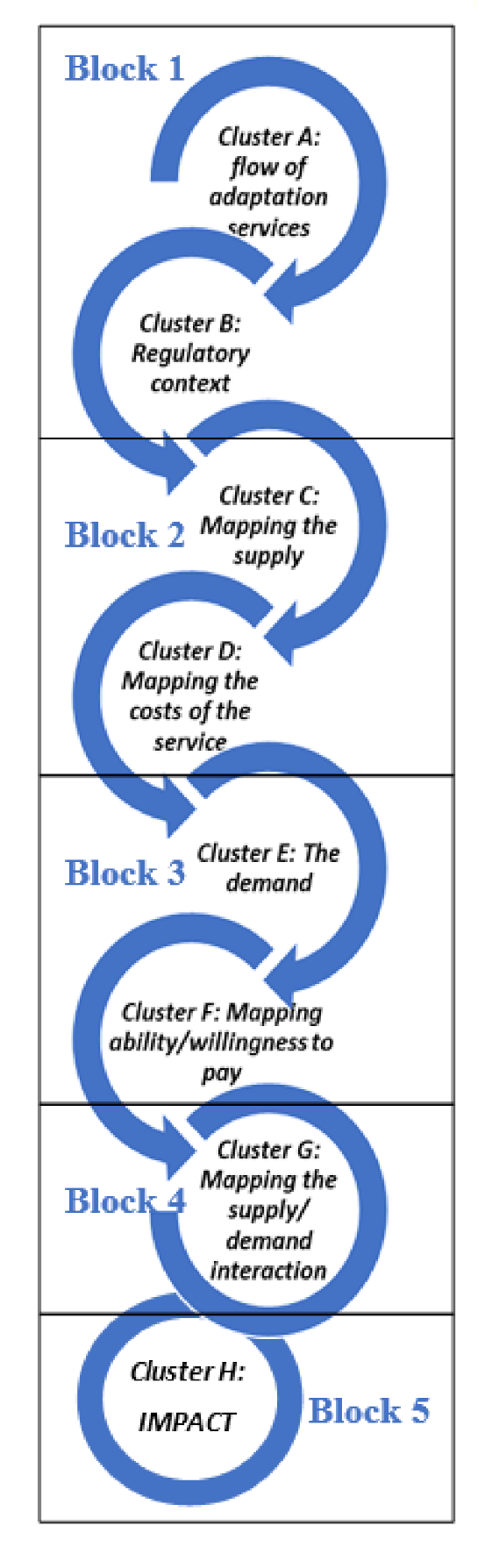

2.2. The NAS Canvas Methodological Framework: A Sequential Flow Process to Facilitate the NAS Canvas Understanding and Application

2.3. The NAS Canvas Tool: A Visual Representation of NAS’ Service Delivery and Value Capture Logic

2.4. Application of the NAS Canvas to Demonstration Cases and Validation/Co-Development with Stakeholders

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- WEF. World Economic Forum: Global Risks Report, 2019; World Economic Forum: Geneva, Switzerland, 2019. [Google Scholar]

- EEA. Floodplain Management: Reducing Flood Risks and Restoring Healthy Ecosystems; European Economic Area: Brussels, Belgium, 2016; Available online: http://www.eea.europa.eu/highlights/floodplain-management-reducing-flood-risks (accessed on 15 January 2019).

- WEF. Water Crises Are a Top Global Risk; World Economic Forum: Geneva, Switzerland, 2019; Available online: https://www.weforum.org/agenda/2015/01/why-world-water-crises-are-a-top-global-risk/ (accessed on 15 January 2019).

- Topoxeus, H.S.; Polzin, F. DELIVERABLE 1.3 Part V: Characterizing Nature-Based Solutions from a Business Model and Financing Perspective. EU Horizon 2020 Naturvation Project Grant agreement No. 730243. 2017. Available online: https://naturvation.eu/sites/default/files/news/files/naturvation_characterizing_nature-based_solutions_from_a_business_model_and_financing_perspective.pdf (accessed on 30 January 2019).

- Somarakis, G.; Stagakis, S.; Chrysoulakis, N. (Eds.) Thinknature Nature-Based Solutions Handbook. ThinkNature Project Funded by the EU Horizon 2020 Research and Innovation Programme. 2019. Available online: https://platform.think-nature.eu/system/files/thinknature_handbook_final_print_0.pdf (accessed on 30 September 2019).

- Beltramello, A.; Haie-Fayle, L.; Pilat, D. Why New Business Models Matter for Green Growth. In OECD Green Growth Papers, No. 2013/01; OECD Publishing: Paris, France, 2013. [Google Scholar] [CrossRef]

- Coles, N.A.; Tyllianakis, E. Deliverable D7.3NBS Market Potential through Synergies at International Level: Business Plan Case Studies and Scope for International Mainstreaming; EU Horizon 2020 Think Nature Project, Grant Agreement No. 730338. 2019. Available online: https://www.researchgate.net/publication/338951938_NBS_Market_Potential_through_Synergies_at_International_Level_An_assessment_of_case_studies_and_the_scope_for_international_mainstreaming (accessed on 12 March 2020).

- McQuaid, S. Nature-Based Solutions Business Model Canvas Guidebook; EU Horizon 2020 Connecting Nature Project, Grant Agreement No. 730222. 2019. Available online: https://connectingnature.eu/sites/default/files/downloads/NBC-BMC-Booklet-Final-%28for-circulation%29.pdf (accessed on 12 March 2020).

- Le Coent, P.; Hérivaux, C.; Farina, G.; Forey, I.; Zi-Xiang, W.; Graveline, N.; Calatrava, J.; Martinez-Granados, D.; Marchal, R.; Moncoulon, D.; et al. Deliverable D6.3: DEMO Insurance Value Assessment Report. H2020 NAIAD Project Grant Agreement No. 730497. 2019. Available online: http://naiad2020.eu/wp-content/uploads/2020/10/D6.3.pdf (accessed on 12 March 2020).

- Denjean, B.; Altamirano, M.A.; Graveline, N.; Giordano, R.; van der Keur, P.; Moncoulon, D.; Weinberg, J.; Máñez Costa, M.; Kozinc, Z.; Mulligan, M.; et al. Natural Assurance Scheme: A level playing field framework for Green-Grey infrastructure development. Environ. Res. 2017, 159, 24–38. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Baumgärtner, S. The insurance value of biodiversity in the provision of ecosystem services. Nat. Resour. Model. 2007, 20, 87–127. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation; Wiley & Sons: Toronto, ON, Canada, 2010. [Google Scholar]

- Graveline, N.; Joyce, J.; Calatrava, J.; Douai, A.; Arfaoui, N.; Moncoulon, D.; Manez, M.; De Ryke, H.; Zdravko, K. DELIVERABLE 4.1: General Framework for the Economic Assessment of Nature Based Solutions and Their Insurance value. EU Horizon 2020 NAIAD Project, Grant Agreement N°730497. 2017. Available online: http://naiad2020.eu/wp-content/uploads/2018/11/4.1-2.pdf (accessed on 30 January 2019).

- IBAN. PPPCanvas: A Simple Tool to Tackle Complex Business Models of Public-Private Partnerships. 2016. Available online: https://www.inclusivebusiness.net/ib-voices/pppcanvas-simple-tool-tackle-complex-business-models-public-private-partnerships (accessed on 20 January 2018).

- Altamirano, M.A.; de Rijke, H.; Basco Carrera, L.; Benitez-Avila, C.; Arellano Jaimerena, B.; Angulo, M.; Nanu, F.; Dartée, K.; Peña, K.; Lopez-Gunn, E.; et al. DELIVERABLE 7.3: Handbook for the Implementation of Nature-Based Solutions for Water Security: Guidelines for Designing an Implementation and Financing Arrangement; EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination; EU: Brussels, Belgium, 2020. [Google Scholar]

- Egusquiza, A. Nature4Cities Deliverable 1.2—NBS Implementation Models Typology. EU Horizon 2020 Nature 4 Cities Project Grant Agreement No. 730468. 2018. Available online: https://www.nature4cities.eu/n4c-publications-and-results (accessed on 16 March 2020).

- Vewin. Dutch Drinking Water Statistics 2017: From Source to Tap. 2017. Available online: https://www.vewin.nl/SiteCollectionDocuments/Publicaties/Cijfers/Drinkwaterstatistieken-2017-EN.pdf (accessed on 15 August 2019).

- Rotterdam City Council, Rotterdam, The Netherlands. Personal communication, 2019.

- Arcadis. MKBA Klimaatbestendige Inrichting Pilotwijken: Pilot Spangen (Rotterdam) en Mariahoeve (Den Haag); Arcadis: Amsterdam, The Netherlands, 2019. [Google Scholar]

- Moro, A.; Lonza, L. Electricity carbon intensity in European Member States: Impacts on GHG emissions of electric vehicles. Transp. Res. Part D Transp. Environ. 2018, 64, 5–14. [Google Scholar] [CrossRef] [PubMed]

- High-Level Commission on Carbon Prices. Report of the High-Level Commission on Carbon Prices; Carbon Pricing Leadership: Washington, DC, USA, 2017. [Google Scholar]

- Bervaes, J. De Invloed van Groen en Water op de Transactieprijzen van Woningen; Altera-Rapport 959; Altera: Wageningen, The Netherlands, 2004. [Google Scholar]

- The Nature Conservancy. Strategies for Operationalizing Nature-Based Solutions in the Private Sector; The Nature Conservancy Business Council: Arlington, VA, USA, 2019. [Google Scholar]

- Credit Suisse and McKinsey & Company. Conservation Finance from Niche to Mainstream: The Building of an Institutional Asset Class; Credit Suisse and McKinsey & Company: Zurich, Switzerland, 2016. [Google Scholar]

- EDF & Business and Meister Consultants Group. Unlocking Private Capital to Finance Sustainable Infrastructure; EDF & Business and Meister Consultants Group: Paris, France, 2016. [Google Scholar]

- European Commission (EC). Investing in Nature: Financing Conservation and Nature-Based Solutions; Joint Report by the European Commission and the European Investment Bank; EU: Brussels, Belgium, 2019. [Google Scholar]

- Joyce, A.; Paquin, R.L. The triple layered business model canvas: A tool to design more sustainable business models. J. Clean. Prod. 2016, 135, 1474–1486. [Google Scholar] [CrossRef]

- Mačiulytė, E.; Cioffi, M.; Zappia, F.; Duce, E.; Ferrari, A.; Kelson Batinga de Mendoca, M.F.; Loriga, G.; Suška, P.; Vaccari Paz, B.L.; Zangani, D.; et al. Deliverable 6.3: Business Models & Financing Strategies. UNALAB Project, Grant Agreement No. 730052. 2019. Available online: https://unalab.eu/index.php/system/files/2020-05/d63-business-models-and-financing-strategies2020-05-18.pdf (accessed on 15 March 2020).

- Naturvation. Business Model Puzzle: A Dialogue Tool for Realizing Urban Nature-Based Solutions. EU Horizon 2020 Naturvation Project Grant Agreement No. 730243. 2019. Available online: https://www.naturvation.eu/sites/default/files/results/content/files/nbs_business_model_puzzle_download.pdf (accessed on 15 Augest 2020).

- Mayor, B.; Benítez, C.; Angulo, M.; Nanu, F.; Groza, I.; Schrieu, A.; Marchal, M.; Le Coent, P.; Graveline, N.; Marouner, A.; et al. Deliverable 7.4: International Good Practices in Financing and Funding Nature Restoration. H2020 NAIAD Project. Grant Agreement No. 730497. 2019. Available online: http://naiad2020.eu/wp-content/uploads/2020/07/D7.4-NAIAD_International-Good-practices_FINAL.pdf (accessed on 15 March 2020).

- Toxopeus, H.S. Taking Action for Urban Nature: Business Model Catalogue for Urban Nature Based Solutions, NATURVATION Guide. EU Horizon 2020 Naturvation Project Grant Agreement No. 730243. 2019. Available online: https://www.naturvation.eu/sites/default/files/results/content/files/business_model_catalogue.pdf (accessed on 15 Augest 2020).

- Le Coent, P.; Hérivaux, C.; Calatrava, J.; Marchal, R.; Moncoulon, D.; Benitez-Avila, C.; Altamirano, M.A.; Graveline, N.; Piton, G.; Dartee, K. Is-It Worth Investing in NBS Aiming at Mitigating Water Risks? Insights from the Economic Assessment of NAIAD Case Studies. Presented in the 22nd EGU General Assembly, Held Online 4–8 May 2020, Id. 22537. Available online: https://meetingorganizer.copernicus.org/EGU2020/EGU2020-22537.html (accessed on 20 September 2020).

- The Nature Conservancy & MITECO. Soluciones Basadas en la Naturaleza para la gestión del agua en España; The Nature Conservancy & MITECO: Madrid, Spain, 2019. [Google Scholar]

- Mačiulytė, E.; Durieux, E. Public Procurement of Nature-Based Solutions Addressing barriers to the procurement of urban NBS: Case Studies and Recommendations. Report by the European Commission—Directorate-General for Research and Innovation. 2020. Available online: https://op.europa.eu/en/publication-detail/-/publication/d75b2354-11bc-11eb-9a54-01aa75ed71a1/language-en/format-PDF/source-166334197 (accessed on 15 September 2020).

- UNISDR. Progress and Challenges in Disaster Risk Reduction: A Contribution towards the Development of Policy Indicators for the Post-2015 Framework on Disaster Risk Reduction; The United Nations Office for Disaster Risk Reduction (UNISDR): Geneva, Switzerland, 2014. [Google Scholar]

| Case Name | NAS Strategy Name | Scale | Main Risk | Country | Co-Benefit Valuation Method |

|---|---|---|---|---|---|

| Medina del Campo Aquifer | Change in agricultural practices and groundwater management | Large scale | Droughts, aquifer depletion | Spain | Qualitative valuation SH 1 |

| Lez basin | Development of Green Infrastructure in the Lez Basin | Medium—sub-catchment scale | Floods | France | Stated preference estimation (choice experiment) 2 |

| Rotterdam | Urban Water Buffer, Spangen, Rotterdam | Small—urban scale | Pluvial Flooding | Netherlands | Empirical assessments and value transfer using literature data 3 |

| Business Model Tool | Focus | Scale | Source |

|---|---|---|---|

| Naturvation business model catalogue and puzzle | Urban NBS: air quality, water quality, heatwaves | Urban | [29,31] |

| Connecting Nature Business model canvas | Generic for all NBS | Multiscale | [8] |

| Think Nature NBS-business Canvas | Urban NBS | Urban | [7] |

| PPP canvas by Inclusive business hub | Ecosystem services | Multiscale | [14] |

| Triple-layered business model canvas approach | Actions towards business sustainability | Multiscale | [27] |

| UNALAB approach: traditional business model canvas | Urban green measures (roofs, gardens, permeable surfaces); and urban river restoration | Urban | [28] |

| NAS Canvas | DRR- and CCA-related NBS strategies (NAS: natural assurance schemes) | Multiscale | This paper |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mayor, B.; Zorrilla-Miras, P.; Coent, P.L.; Biffin, T.; Dartée, K.; Peña, K.; Graveline, N.; Marchal, R.; Nanu, F.; Scrieciu, A.; et al. Natural Assurance Schemes Canvas: A Framework to Develop Business Models for Nature-Based Solutions Aimed at Disaster Risk Reduction. Sustainability 2021, 13, 1291. https://doi.org/10.3390/su13031291

Mayor B, Zorrilla-Miras P, Coent PL, Biffin T, Dartée K, Peña K, Graveline N, Marchal R, Nanu F, Scrieciu A, et al. Natural Assurance Schemes Canvas: A Framework to Develop Business Models for Nature-Based Solutions Aimed at Disaster Risk Reduction. Sustainability. 2021; 13(3):1291. https://doi.org/10.3390/su13031291

Chicago/Turabian StyleMayor, Beatriz, Pedro Zorrilla-Miras, Philippe Le Coent, Thomas Biffin, Kieran Dartée, Karina Peña, Nina Graveline, Roxane Marchal, Florentina Nanu, Albert Scrieciu, and et al. 2021. "Natural Assurance Schemes Canvas: A Framework to Develop Business Models for Nature-Based Solutions Aimed at Disaster Risk Reduction" Sustainability 13, no. 3: 1291. https://doi.org/10.3390/su13031291

APA StyleMayor, B., Zorrilla-Miras, P., Coent, P. L., Biffin, T., Dartée, K., Peña, K., Graveline, N., Marchal, R., Nanu, F., Scrieciu, A., Calatrava, J., Manzano, M., & López Gunn, E. (2021). Natural Assurance Schemes Canvas: A Framework to Develop Business Models for Nature-Based Solutions Aimed at Disaster Risk Reduction. Sustainability, 13(3), 1291. https://doi.org/10.3390/su13031291