Application of Blockchain Hierarchical Model in the Realm of Rural Green Credit Investigation

Abstract

:1. Introduction

1.1. Development, Status Quo and Problems of China’s Rural Green Credit Investigation

1.2. Thinking Analysis of Applying Blockchain Technology on Rural Green Credit Investigation

2. Materials and Methods

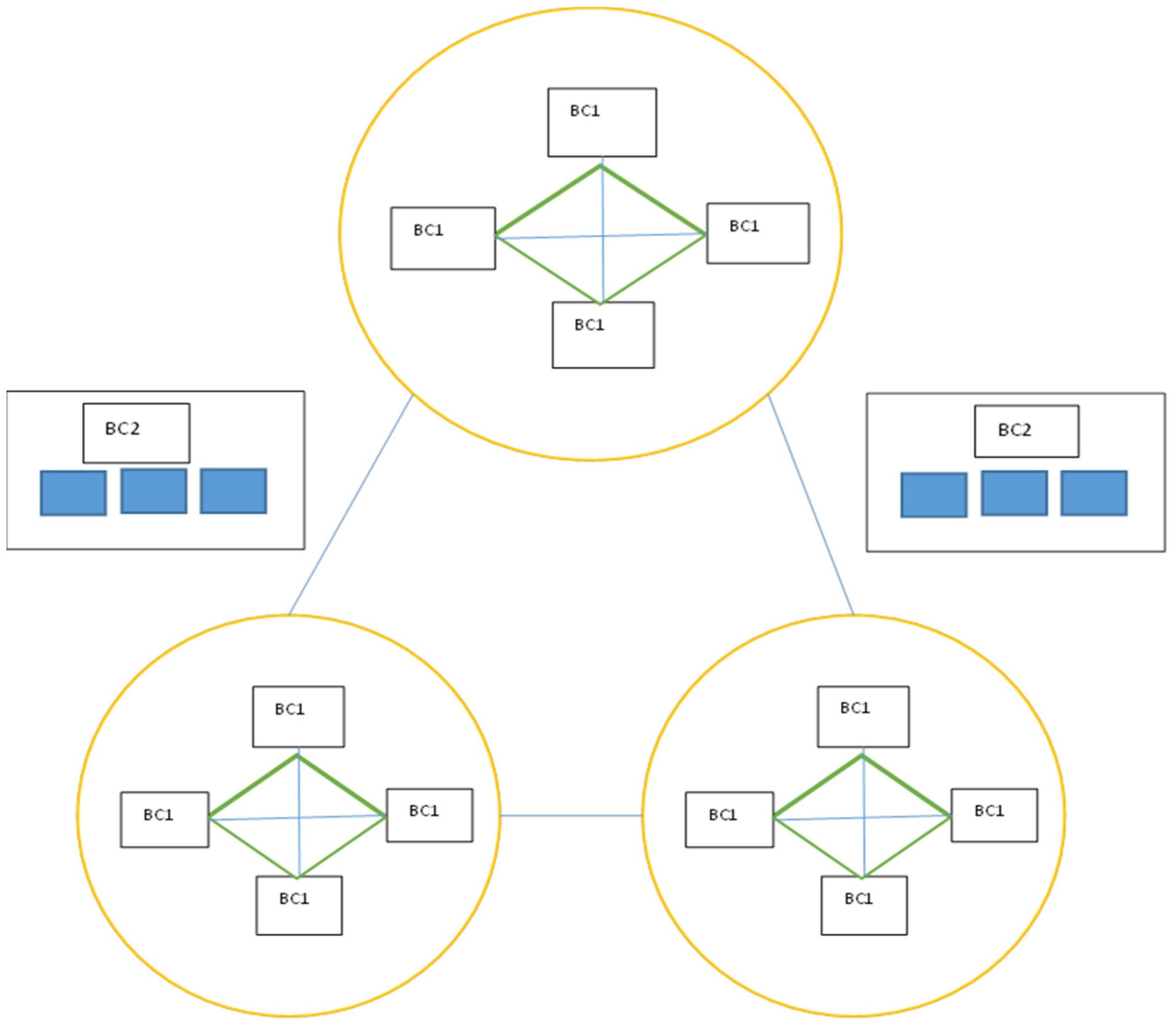

2.1. Rural Green Credit Investigation Hierarchical Model Structure Design

2.2. Data Characteristics

3. Results

3.1. Empirical Analysis

3.2. Calculation Process

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Su, D.; Lian, L. Does Green Credit Policy Affect Corporate Financing and Investment of Pollution-Intensive Industries? J. Financ. Res. 2018, 462, 127–141. [Google Scholar]

- Chen, H.; Liu, C.; Xie, F.; Zhang, T.; Guan, F. Green Credit and Company R&D Level: Empirical Research Based on Threshold Effects. Sustainability 2019, 11, 1918. [Google Scholar]

- Wang, Z. The Characteristics, Current Situation, Problems and Measures of the Development of Internet Finance in China. J. Bus. Econ. 2019, 6, 158–160. [Google Scholar]

- Ji, Z.; Wang, X.; Cao, M.; Jin, Z.; Wu, X.; Huang, Y. Internet credit, credit risk management and credit investigation. Financ. Res. 2014, 10, 133–147. [Google Scholar]

- Tsung-Ting, K.; Jihoon, K.; Gabriel, R. A Privacy-preserving model learning on a blockchain network-of-networks. J. Am. Med. Inform. Assoc. 2020, 27, 22–32. [Google Scholar]

- Karamchandani, A.; Srivastava, S.K.; Srivastava, R.K. Perception-based model for analyzing the impact of enterprise blockchain adoption on SCM in the Indian service industry. Int. J. Inf. Manag. 2019, 28, 31–36. [Google Scholar] [CrossRef]

- Chen, T.; Wang, D. Combined application of blockchain technology in fractional calculus model of supply chain financial system. J. Agric. Econ. 2020, 21, 12–21. [Google Scholar] [CrossRef]

- Hyun, W.; Sik, J. Centric Scheme for trusting personal resource information on mobile cloud computing with blockchain. Hum. Cent. Comput. Inf. Sci. 2018, 3, 8–11. [Google Scholar]

- Fen, X. Pruneable sharding-based blockchain protocol. Peer Netw. Appl. 2019, 3, 934–950. [Google Scholar]

- Nakamoto, S. A Peer-to-Peer Electronic Cash System. Cryptography Mailing List. Exp. Technol. Manag. 2019, 31, 22–26. [Google Scholar]

- Tang, H.; Jiao, Y. Learning to Classify Blockchain Peers According to Their Behavior Sequences. IEEE Access 2018, 11, 208–215. [Google Scholar] [CrossRef]

- Sahoo, S.; Fajge, A.M.; Halder, R.; Cortesi, A. A Hierarchical and Abstraction-Based Blockchain Model. Agric. Financ. Rev. 2019, 4, 2343. [Google Scholar] [CrossRef] [Green Version]

- Liang, W. Financial credit data sharing: Realistic dilemma and future prospect. Credit Ref. 2019, 245, 20–25. [Google Scholar]

- Chen, J. The development of Chinese rural financial problems and countermeasures. South. Agric. 2020, 14, 54–56. [Google Scholar]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Liu, H. In the construction of social credit reporting system of China credit information sharing analysis and selection mode. Mod. Financ. Econ. 2009, 7, 23–26. [Google Scholar]

- Chang, Z. Big data environment of credit reporting system. China Financ. 2017, 6, 41–43. [Google Scholar]

- Li, Z.; Geng, D. How to implement the credit information sharing. Credit Rep. 2015, 33, 37–41. [Google Scholar]

- Smith, K.J.; Colvin, L. An Employer’s Guide to the Fair Credit Reporting Act. Agric. Econ. 2017, 4, 100–114. [Google Scholar] [CrossRef] [Green Version]

- Gong, F.; Hu, L. Scheme Based on Blockchain with High Credibility. J. Financ. Res. 2012, 27, 87–93. [Google Scholar]

- Belotti, M.; Bozic, N. The Research on Blockchain Technologies Financing Credit Det. China Soft Sci. 2019, 21, 59–63. [Google Scholar]

- Xin, M.L. A Scalable Blockchain Framework on Hadoop Ecosystem. Int. J. Inf. Manag. 2014, 1, 102–118. [Google Scholar]

- Ma, M.; Shi, G.; Li, F. Privacy-Oriented Blockchain-based Distributed Key Management Architecture for Hierarchical Access Control in Agriculture. Agric. Financ. Rev. 2019, 2, 31–48. [Google Scholar]

- Liu, F.; Su, Q.; Li, J. Credit data storage and query scheme integrating double block chain. Comput. Eng. Appl. 2021, 1, 1–7. [Google Scholar]

- Chen, W.; Zheng, Z.; Zhou, Y. Efficient Blockchain-Based Software Systemsvia Hierarchical Bucket Tree. Econ. Res. J. 2018, 28, 59–67. [Google Scholar]

- Tang, S.; Huang, X.; Xu, L. Achieving simple, secureand efficient hierarchical access control in cloud computing. Comput. Res. 2016, 142, 52–61. [Google Scholar]

- Johannes, M.; Matthias, F. Do remotely-sensed vegetation health indices explain credit risk in agricultural microfinance? World Dev. 2020, 127, 17–23. [Google Scholar]

- Wang, Y.; Lei, X.; Long, R.; Zhao, J. Green Credit, Financial Constraint, and Capital Investment: Evidence from China’s Energy-intensive Enterprises. Environ. Manag. 2020, 66, 1059–1071. [Google Scholar] [CrossRef]

- Ling, S.; Han, G.; An, D.; Hunter, W.C.; Li, H. The Impact of Green Credit Policy on Technological Innovation of Firms in Pollution-Intensive Industries: Evidence from China. Sustainability 2020, 12, 4493. [Google Scholar] [CrossRef]

- Ke, L. The Development and Innovation of China’s Green Credit. Finance 2018, 8, 49–54. [Google Scholar]

- Liu, B. The development, difficulties and responses of Chinese financial institutions to green credit in Africa. Bus. Res. 2020, 10, 64–72. [Google Scholar]

- Yang, M.; Chang, K. Research on Innovating Green Credit Rating Model of Domestic Commercial Banks. North China Financ. 2011, 8, 25. [Google Scholar]

- Zhu, L. Problems existing in the construction of green credit standards in China and reference of international experience. Times Financ. 2020, 26, 12–13. [Google Scholar]

- Zhao, Y.; Ji, Y.; Lu, D.; Gao, S. Referencing international experience to develop China’s Green Credit. Credit. Ref. 2013, 31, 87–89. [Google Scholar]

| Target Layer | δ | Rate | Verification Results in Abstract Blockchain | ||||

|---|---|---|---|---|---|---|---|

| No. of Inputs for Verification | No. of Inputs | Exists in CB? | % of EDR | % of PDR | |||

| Comparison of Empirical Results of EDR and PDR | 2 | 0.8 | 500 | 250 250 | Ture False | 25.2 | 46 |

| 1 | 500 | 250 250 | Ture False | 20.2 | 48.8 | ||

| 1.25 | 500 | 250 250 | Ture False | 13.4 | 49.6 | ||

| 5 | 0.8 | 500 | 250 250 | Ture False | 19 | 48 | |

| 7 | 1 | 500 | 250 250 | Ture False | 14.2 | 49.4 | |

| 1.25 | 500 | 250 250 | Ture False | 17.2 | 49.8 | ||

| 1.4 | 500 | 250 250 | Ture False | 18.2 | 49.9 | ||

| 0.8 | 500 | 250 250 | Ture False | 12.8 | 49.2 | ||

| 9 | 1 | 500 | 250 250 | Ture False | 9.2 | 50 | |

| Test Result | Number | Percentage |

|---|---|---|

| Correct Prediction | 9317 | 77.6% |

| Wrong Prediction | 2683 | 22.4% |

| Total | 100% |

| Test Result | Number | Percentage |

|---|---|---|

| Correct Prediction | 9056 | 75.5% |

| Wrong Prediction | 2944 | 24.5% |

| Total | 100% |

| Index System | Group | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| Current account status | 0.35 | 0.35 | 0.3 | 0.29 | 0.3 |

| Loan history | 0.25 | 0.25 | 0.2 | 0.18 | 0.2 |

| Financial status | 0.1 | 0.09 | 0.1 | 0.09 | 0.08 |

| Individual status and gender | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| Percentage of installment in monthly income | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tan, H.; Zhang, Q. Application of Blockchain Hierarchical Model in the Realm of Rural Green Credit Investigation. Sustainability 2021, 13, 1324. https://doi.org/10.3390/su13031324

Tan H, Zhang Q. Application of Blockchain Hierarchical Model in the Realm of Rural Green Credit Investigation. Sustainability. 2021; 13(3):1324. https://doi.org/10.3390/su13031324

Chicago/Turabian StyleTan, Haoyang, and Qiang Zhang. 2021. "Application of Blockchain Hierarchical Model in the Realm of Rural Green Credit Investigation" Sustainability 13, no. 3: 1324. https://doi.org/10.3390/su13031324

APA StyleTan, H., & Zhang, Q. (2021). Application of Blockchain Hierarchical Model in the Realm of Rural Green Credit Investigation. Sustainability, 13(3), 1324. https://doi.org/10.3390/su13031324