Exploration of the Impact of China’s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative

Abstract

:1. Introduction

The Application of IDP Theory for Chinese Economy

- To examine whether China’s outflow of direct investment in the services sector and other investment sectors are impacting the economic growth of Belt and Road Initiative (BRI) countries;

- To investigate if China’s outflow of direct investment in the infrastructure and energy sectors is impacting the economic growth of Belt and Road Initiative (BRI) countries;

- To explore whether trade openness is impacting the economic growth of Belt and Road Initiative (BRI) countries; and

- To test for the direction of causality between the different combinations of the factors under the investigation.

2. Literature Review

3. Methodology

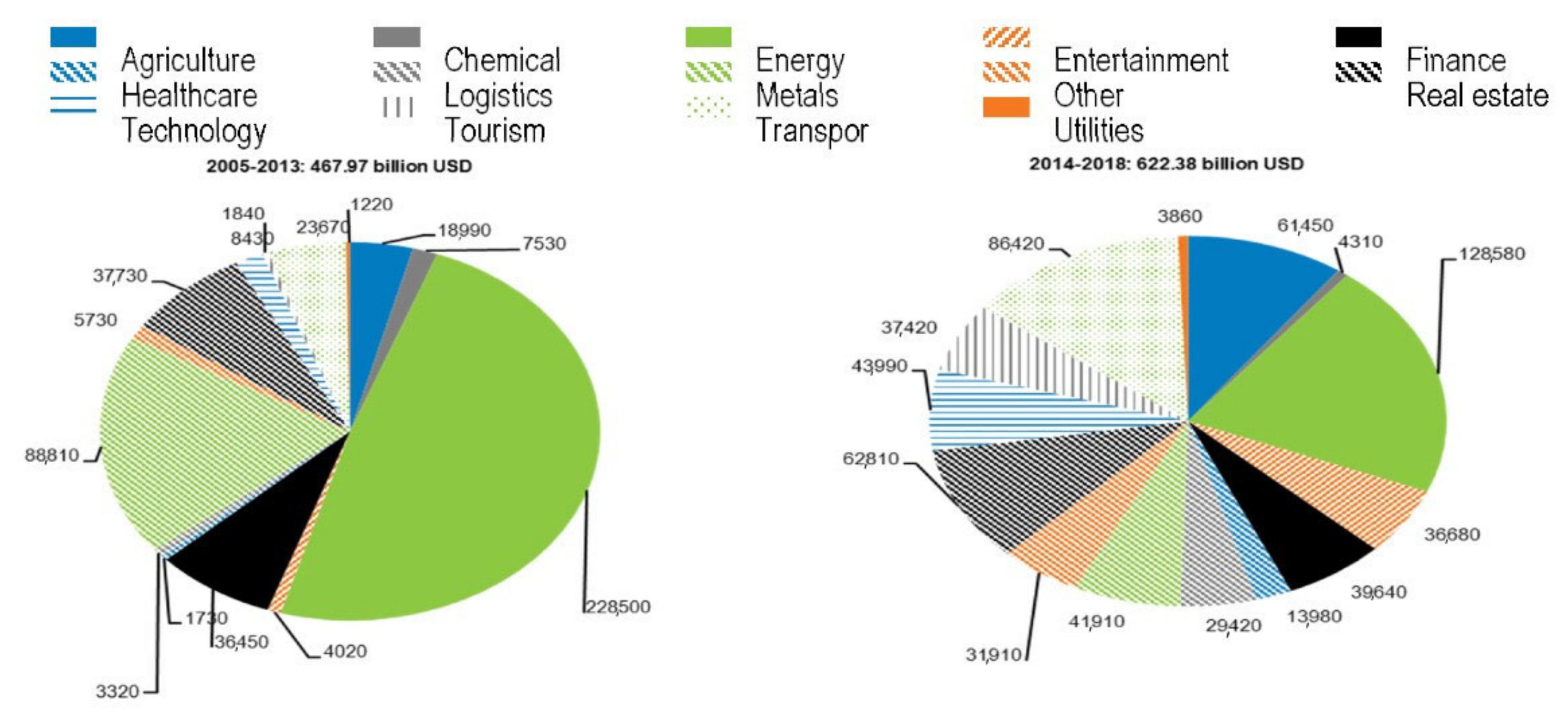

3.1. Data and Its Sources

3.2. Estimation Techniques

3.2.1. Panel Unit Root Tests

3.2.2. Panel Co-Integration Test

3.2.3. Panel Dynamic Ordinary Least Squares (PDOLS) Model

3.2.4. Testing for Causality

4. Empirical Findings

5. Conclusions and Recommendation

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Significance of the Variables in the Model | Source |

|---|---|---|

| Real Gross Domestic Product Per Capita (GDPPC) | GDP per capita (GDPPC) represents the synthetic economic development level of a country. It is widely used proxy for Economic Growth in nearly all empirical studies of FDI [74,75] (Barrell and Nahhas, 2018; Head and Mayer 2014) | WDI |

| Investment in Infrastructure (INRET) | The B&R initiative covers a number of regions of economic integration and worldwide governance [32]; it is particularly an infrastructure-led economic integration and planned for integrating China’s trading partners by developing their infrastructure such as roads, railways, ports and airports [76] | AEI (HF.) |

| Investment in Energy (INE) | China’s reliance on natural resources has changed a lot. Natural resources are slowly and gradually losing their significance in China’s ODI. Latest research studies suggest that oil and metals are two key contributing factors of China’s ODI during 2003–2009 [77] | AEI (HF.) |

| Investment in Services (INS) | The percentage of ODI in financial services, leasing, and business services is rapidly increasing over time [78]. Advanced technology, finance, agribusiness and health care sectors have become more preferred and focused areas of investment [79]. | AEI (HF.) |

| Investment in Others (INO) | Natural resources contribute to the institutional development in a complex way. Some scholars argue that natural resources are among the key drivers of China’s ODI [80,81] | AEI (HF.) |

| Trade openness (OP) | Trade openness is directly linked to FDI inflows. Open countries are more subject to external shocks, therefore they need a better institution for stabilizing their economy. Increase in FDI inflows also stabilize the financial institution which resultantly increase trade flows and economic development [82]. | UNCTAD |

References

- OECD. The Organization for Economic Co-Operation and Development Guidelines for Multinational Enterprises; OECD Publishing: Paris, France, 2011. [Google Scholar] [CrossRef] [Green Version]

- Bajo-Rubio, O.; Díaz-Mora, C.; Díaz-Roldán, C. Foreign direct investment and regional growth: An analysis of the Spanish case. Reg. Stud. 2010, 44, 373–382. [Google Scholar] [CrossRef]

- Peres, M.; Ameer, W.; Xu, H. The impact of institutional quality on foreign direct investment inflows: Evidence for developed and developing countries. Econ. Res-Ekon Istraživanja 2018, 31, 626–644. [Google Scholar] [CrossRef] [Green Version]

- De Mello, L.R. Foreign direct investment in developing countries and growth: A selective survey. J. Dev. Stud. 1997, 34, 1–34. [Google Scholar] [CrossRef]

- Borensztein, E.; De Gregorio, J.; Lee, J.W. How does foreign direct investment affect economic growth? J. Int. Econ. 1998, 45, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Hermes, N.; Lensink, R. Foreign direct investment, financial development and economic growth. J. Dev. Stud. 2003, 40, 142–163. [Google Scholar] [CrossRef] [Green Version]

- Buckley, P.J.; Clegg, L.J.; Cross, A.R.; Liu, X.; Voss, H.; Zheng, P. The determinants of Chinese outward foreign direct investment. J. Int. Bus. Stud. 2007, 38, 499–518. [Google Scholar] [CrossRef]

- Du, J.; Zhang, Y. Does One Belt One Road initiative promote Chinese overseas direct investment? China Econ. Rev 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Umbach, F. China’s Belt and Road Initiative and its Energy-Security Dimensions; S. Rajaratnam School of International Studies: Singapore, 2019; Available online: http://hdl.handle.net/11540/9582 (accessed on 25 May 2020).

- MOFCOM. Statistical Bulletin of China’s Outward Foreign Direct Investment. In Ministry of Commerce of the People’s Republic of China 2008. Available online: http://www.mofcom.gov.cn/article/tongjiziliao/dgzz/201309/20130900295526.shtml (accessed on 30 May 2020).

- Xinhuanet. He Jiankui Jailed for Illegal Human Embryo Gene-Editing. Available online: http://www.xinhuanet.com/english/2019-12/30/c_138666754.htm (accessed on 30 December 2019).

- Mofcom, P.; China-Norway, F.T.A. China FTA Network, Ministry of Commerce of the People’s Republic of China. Available online: http://fta.mofcom.gov.cn/topic/ennorway.Shtml (accessed on 20 June 2016).

- Bhattacharya, A. Conceptualizing the Silk Road Initiative in China’s Periphery Policy. East Asia 2016, 33, 309–328. [Google Scholar] [CrossRef]

- Dunning, J.H. Explaining the International Direct Investment Position of Countries: Towards a Dynamic or Developmental Approach; Review of World Economics: London, UK, 1981; Volume 117, No. 1; pp. 30–64. [Google Scholar]

- Dunning, J.H. The Investment Development Cycle Revisited. Weltwirtschaftliches Archiv. 1986, 122, 667–676. [Google Scholar] [CrossRef]

- Dunning, J.H. The eclectic paradigm of international production: A restatement and some possible extensions. J. Int. Bus. Stud. 1988, 19, 1–31. [Google Scholar] [CrossRef]

- Dunning, J.H. Multinational Enterprises and the Global Economy; Addison-Wesley Reading: Boston, MA, USA, 1993. [Google Scholar]

- Dunning, J.H. Alliance Capitalism and Global Business; Routledge: London, UK, 1997. [Google Scholar]

- Dunning, J.H.; Narula, R. Foreign Direct Investment and Governments: Catalysts for Economic Restructuring; Taylor & Francis: London, UK, 1996. [Google Scholar]

- Liu, X.; Buck, T.; Shu, C. Chinese economic development, the next stage: Outward FDI? Int. Bus. Rev. 2005, 14, 97–115. [Google Scholar] [CrossRef]

- Buckley, P.J.; Clegg, J.; Wang, C.; Cross, A.R. FDI, regional differences and economic growth: Panel data evidence from China. Transnatl. Corp. 2002, 11, 1–28. [Google Scholar]

- Fukasaku, K.; Wall, D.; Wu, M. China’s Long March to An Open Economy; Development Centre of the Organisation for Economic Co-operation and Development: Paris, France, 1994. [Google Scholar]

- Lardy, N.R. China in the World Economy; Institute for International Economics: Washington, WA, USA, 1994. [Google Scholar]

- Naughton, B. (Ed.) The China Circle: Economics and Electronics in the PRC, Taiwan, and Hong Kong; Brookings Institution Press: Washington, DC, USA, 1997. [Google Scholar]

- Usman, A.; Wang, J.-J. Does Outbound Foreign Direct Investment Crowd Out Domestic Investment in China? Evidence from Time Series Analysis. Glob. Econ. Rev. 2018, 47, 419–433. [Google Scholar]

- Ameer, W.; Xu, H.; Alotaish MS, M. Outward Foreign Direct Investment and Domestic Investment: Evidence from China. Econ. Res. Ekon. Istraživanja 2017, 30, 777–788. [Google Scholar] [CrossRef] [Green Version]

- You, K.; Solomon, O.H. China’s outward foreign direct investment and domestic investment: An industrial level analysis. China Econ. Rev. 2015, 34, 249–260. [Google Scholar] [CrossRef]

- Lee, C.G. Outward foreign direct investment and economic growth: Evidence from Japan. Glob. Econ. Rev. 2010, 39, 317–326. [Google Scholar] [CrossRef]

- Hansen, H.; Rand, J. On the causal links between FDI and growth in developing countries. World Econ. 2006, 29, 21–41. [Google Scholar]

- Ghatak, A.; Halicioglu, F. Foreign direct investment and economic growth: Some evidence from across the world. Glob. Bus. Econ. Rev. 2007, 9, 381–394. [Google Scholar] [CrossRef] [Green Version]

- Roy, A.; Berg, H. Foreign Direct Investment and Economic Growth: A Time-Series Approach. Glob. Econ. J. 2006, 6, 7–26. [Google Scholar]

- Murari, K. Financial development–economic growth nexus: Evidence from South Asian middle-income countries. Glob. Bus. Rev. 2017, 18, 924–935. [Google Scholar] [CrossRef]

- Udoh, E.; Obiora, K.I. Determinants of foreign direct investment and economic growth in the West African monetary zone: A system equations approach. In Proceedings of the GTAP, Paper Presented at the 9th Annual Conference on Global Economic Analysis, Addis Ababa, Ethiopia, 1 May 2006. [Google Scholar]

- Sahoo, K.; Sethi, N. Impact of foreign capital on economic development in India: An econometric investigation. Glob. Bus. Rev. 2017, 18, 766–780. [Google Scholar] [CrossRef]

- Aschauer, D.A. Genuine economic returns to infrastructure investment. Policy Stud. J. 1993, 21, 380–391. [Google Scholar] [CrossRef]

- Krugman, P. History versus expectations. Q. J. Econ. 1991, 106, 651–667. [Google Scholar] [CrossRef]

- Munnell, A.H. How Does Public Infrastructure Affect Regional Economic Performance. N. Engl. Econ. Rev. 1990, 6, 11–32. [Google Scholar]

- Munnell, A.H. Policy watch: Infrastructure investment and economic growth. J. Econ. Perspect. 1992, 6, 189–198. [Google Scholar] [CrossRef]

- Lucas, R. On the mechanics of economic growth. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Barro, R.J. Government Spending in a Simple Model of Endogenous Growth. J. Pol. Econ. 1990, 98, S103–S125. [Google Scholar] [CrossRef] [Green Version]

- Badr, O.M.; Ayed, T.L. The mediator role of FDI in North Africa: Case of Egypt. J. Adv. Manag. Sci. 2015, 3, 1–7. [Google Scholar] [CrossRef]

- Morck, R.; Yeung, B.; Zhao, M. Perspectives on China’s outward foreign direct investment. J. Int. Bus. Stud. 2008, 39, 337–350. [Google Scholar] [CrossRef]

- Quer, D.; Claver, E.; Rienda, L. Political risk, cultural distance, and outward foreign direct investment: Empirical evidence from large Chinese firms. Asia Pac. J. Manag. 2012, 29, 1089–1104. [Google Scholar] [CrossRef]

- Lecraw, D.J. Outward direct investment by Indonesian firms: Motivation and effects. J. Int. Bus. Stud. 1993, 24, 589–600. [Google Scholar] [CrossRef]

- Wang, B. The misunderstood official data—The real OFDI of China. Int. Econ. Rev. 2013, 1, 61–74. [Google Scholar]

- Wang, S.; Tian, T.; Xie, R. The trade effect research of Chinese FDI. World Econ. Stud. 2014, 10, 80–86. [Google Scholar]

- Wang, S.; Xiang, J. Creation or substitution—The mechanism research of Chinese FDI on trade. World Econ. Res. 2014, 6, 66–72. [Google Scholar]

- Mekhdiev, E.; Pashkovskaya, I.; Takmakova, E.; Smirnova, O.; Sadykova, K.; Poltorykhina, S. Conjugation of the Belt and Road Initiative and Eurasian Economic Union: Problems and Development Prospects. Economies 2019, 7, 118. [Google Scholar] [CrossRef] [Green Version]

- Umbach, F. China’s Belt and Road Initiative and its Energy-Security Dimensions. RSIS Working Paper, no 320. Available online: https://hdl.handle.net/10356/81308 (accessed on 14 April 2019).

- Latief, R.; Lefen, L. The effect of exchange rate volatility on international trade and foreign direct investment (FDI) in developing countries along one belt and one road. Int. J. Financ. Stud. 2018, 6, 86. [Google Scholar]

- Kang, L.; Peng, F.; Zhu, Y.; Pan, A. Harmony in diversity: Can the one belt one road initiative promote China’s outward foreign direct investment? Sustainability 2018, 10, 3264. [Google Scholar] [CrossRef] [Green Version]

- Deng, P. Why do Chinese firms tend to acquire strategic assets in international expansion? J. World Bus. 2009, 44, 74–84. [Google Scholar] [CrossRef]

- Pedroni, P. Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis: New Results; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Phillips, P.C.; Moon, H.R. Linear regression limit theory for nonstationary panel data. Econometrica 1999, 67, 1057–1111. [Google Scholar] [CrossRef] [Green Version]

- Kao, C.; Chiang, M.H. On the estimation and inference of a cointegrated regression in panel data. In Nonstationary Paznels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bingley, UK, 2001. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Statist. Assoc. 1979, 74, 427–431. [Google Scholar]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- De Jong, P.; Greeven, M.J.; Ebbers, H. Getting the Numbers Right on China’s Actual Overseas Investment: The Case of the Netherlands. J. Curr. Chin. Aff. 2017, 46, 187–209. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Rudebusch, G.D. A nonparametric investigation of duration dependence in the American business cycle. J. Pol. Econ. 1990, 98, 596–616. [Google Scholar] [CrossRef]

- Larsson, R.; Lyhagen, J.; Löthgren, M. Likelihood-based cointegration tests in heterogeneous panels. Econom. J. 2001, 4, 109–142. [Google Scholar] [CrossRef]

- Johansen, S. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models; Oxford University Press: Oxford, UK, 1995. [Google Scholar]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels; Emerald Group Publishing Limited: Bingley, UK, 2001. [Google Scholar]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector auto-regressions with possibly integrated processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Alıcı, A.A.; Ucal, M.Ş. Foreign direct investment, exports and output growth of Turkey: Causality analysis. In Proceedings of the European Trade Study Group (ETSG) Fifth Annual Conference, Madrid, Spain, 11–13 September 2003; pp. 11–13. [Google Scholar]

- Hamdi, H.; Sbia, R.; Abdelaziz, H. Multivariate Granger causality between foreign direct investment and economic growth in Tunisia. Econ. Bull. 2013, 33, 1193–1203. [Google Scholar]

- Hundie, S.K. Savings, investment and economic growth in Ethiopia: Evidence from ARDL approach to cointegration and TYDL Granger-causality tests. J. Econ. Int. Finan. 2014, 6, 232–248. [Google Scholar]

- Rambaldi, A.N.; Doran, H.E. Testing for Granger Non-Causality in Cointegrated System Made Easy (Working Papers in Econometrics and Applied Statistics No. 88); Department of Econometrics, University of New England: New York, NY, USA, 1996. [Google Scholar]

- Kuzozumi, E.; Yamamoto, T. Modified lag augmented auto-regressions. Econ. Rev. 2000, 19, 207–231. [Google Scholar] [CrossRef]

- Gonzalo, J. Comparison of Five Alternative Methods of Estimating Long-Run Equilib- rium Relationships. Discussion Paper 89-55; University of California: San Diego, CA, USA, 1989. [Google Scholar]

- Li, J.; Liu, B.; Qian, G. The belt and road initiative, cultural friction and ethnicity: Their effects on the export performance of SMEs in China. J. World Bus. 2019, 54, 350–359. [Google Scholar] [CrossRef]

- MOFCOM (Ministry of Commerce of P. R. C.). Statistics Bulletin of China’s Outward Foreign Direct Investment; China Statistics Press: Beijing, China, 2017. [Google Scholar]

- Li, Y.; Zhu, X. The 2030 Agenda for Sustainable Development and China’s Belt and Road Initiative in Latin. America and the Caribbean. Sustainability 2019, 11, 2297. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Yu, X.; Zhang, H. Addressing the Insufficiencies of the Traditional Development Aid Model by Utilizing the One Belt, One Road Initiative to Sustain Development in Afghanistan. Sustainability 2019, 11, 312. [Google Scholar] [CrossRef] [Green Version]

- Barrell, R.; Nahhas, A. Trade Blocks, Common Markets, Currency Unions and FDI stocks: The impacts of NAFTA and the EU. Common Mark. Curr. Unions FDI Stock. Impacts NAFTA EU (27 March 2018). 2018. Available online: https://ssrn.com/abstract=3163122 (accessed on 14 April 2019).

- Head, K.; Mayer, T. Gravity Equations: Workhorse, Toolkit, and Cookbook. In The Handbook of International Economics; Gopinath, G., Helpman, E., Kenneth, S.R., Eds.; Elsevier Ltd. Oxford: Oxford, UK, 2014; Volume 4; p. 195. [Google Scholar]

- Pauls, R.; Gottwald, J.C. Origins and dimensions of the Belt and Road Initiative: Experimental patch-work or grand strategy. In China’s Global Political Economy—Managerial Perspectives; Taylor, R., Jaussaud, J., Eds.; Routledge: New York, NY, USA, 2018; pp. 31–54. [Google Scholar]

- Ernst and Young. Riding the Silk Road: China Sees Outbound Investment Boom. Available online: http://www.ey.com/Publication/vwLUAssets/eychina-outbound-investment-report-en/%24FILE/ey-china-outbound-investment-report-en.pdf (accessed on 19 December 2019).

- Busse, M.; Erdogan, C.; Mühlen, H. China’s impact on Africa: The role of trade, FDI and aid. Kyklos 2016, 69, 228–262. [Google Scholar] [CrossRef] [Green Version]

- Cui, L.; Jiang, F. Behind ownership decision of Chinese outward FDI: Resources and institutions. Asia Pac. J. Manag. 2010, 27, 751–774. [Google Scholar] [CrossRef]

- Rodrik, D. Why do More Open Countries Have Bigger Governments? J. Political Econ. 1998, 106, 997–1032. [Google Scholar] [CrossRef]

| Variables | Proxy | Variable Code | Data Source |

|---|---|---|---|

| Economic Growth Investment in | Real Gross Domestic Product Per Capita | GDPPC | WDI |

| Infrastructure | Real China’s Outward Investment in Real Estate and Transportation | INRET | AEI (HF.) |

| Investment in Energy | Real China’s Outward Investment in Energy | INE | AEI (HF.) |

| Investment in services | Real China’s Outward Investment in (Health, Education, Tourism, Logistics, Entertainment, Utilities) | INS | AEI (HF.) |

| Investment in Others | Real China’s Outward Investment in (Agriculture, Metals, Technology, Chemicals) | INO | AEI (HF.) |

| Trade openness | Export + Import/GDP | OP | UNCTAD |

| GDPPC | INRET | INS | INO | INE | OP | |

|---|---|---|---|---|---|---|

| Mean | 12,521.79 | 2,960,000 | 85,502,008 | 1,740,000 | 5,540,000 | 99.14 |

| Median | 4776.788 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 82.4 |

| Maximum | 69,679.09 | 6,510,000 | 23,800,000 | 5,540,000 | 8,580,000 | 395.67 |

| Minimum | 74.67575 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 24.69 |

| Std. Dev. | 17,202.09 | 6,770,000 | 2,820,000 | 501,000 | 113,000 | 69.75 |

| Observations | 249 | 249 | 249 | 249 | 249 | 249 |

| GDPPC | INRET | INS | INO | INE | OP | |

|---|---|---|---|---|---|---|

| GDPPC | 1 | |||||

| INRET | 0.093217216 | 1 | ||||

| INS | 0.170914902 | 0.134265259 | 1 | |||

| INO | 0.037802295 | 0.050972362 | 0.182173257 | 1 | ||

| INE | 0.073981387 | 0.076335744 | −0.0761768 | 0.03125011 | 1 | |

| OP | 0.047473173 | 0.018380473 | 0.227854483 | 0.000643958 | −0.033597308 | 1 |

| Variable | Fisher-ADF | Fisher-PP | ||||||

|---|---|---|---|---|---|---|---|---|

| At Level | At First Difference | At Level | At First Difference | |||||

| Cons | Cons with Trend | Cons | Cons with Trend | Cons | Cons with Trend | Cons | Cons with Trend | |

| GDPPC | 0.8887 (38.204) | 0.0000 (126.811) | 0.0000 *** (153.712) | 0.0000 *** (157.794) | 0.8222 (40.7285) | 0.1158 (62.1758) | 0.0000 *** (100.496) | 0.0000 *** (100.706) |

| INRET | 0.0369 (59.7585) | 0.4432 (42.6453) | 0.0000 *** (100.523) | 0.0000 *** (2.4706) | 0.0000 (196.572) | 0.0000 (195.361) | 0.0000 *** (329.057) | 0.0000 *** (286.586) |

| INE | 0.3863 (50.1994) | 0.4432 (42.6453) | 0.0001 *** (3.6613) | 0.0005 *** (86.8971) | 0.0000 (142.894) | 0.0000 (184.881) | 0.0000 *** (312.384) | 0.0000 *** (282.980) |

| INS | 0.0158 (41.2111) | 0.5996 (44.9250) | 0.0000 *** (65.0684) | 0.0001 *** (58.7131) | 0.0023 (48.2548) | 0.0003 (54.7314) | 0.0000 *** (120.106) | 0.0000 *** (124.493) |

| INO | 0.0667 (54.1700) | 0.0590 (35.6764) | 0.0048 ** (66.9129) | 0.1132 *** (51.0456) | 0.0000 (108.719) | 0.0000 93.8641 | 0.0000 *** (191.605) | 0.0000 *** (223.672) |

| OP | 0.0260 (71.1991) | 0.0054 (79.0899) | 0.0000 *** (119.787) | 0.0000 *** (108.824) | 0.1783 (59.0552) | 0.0097 (76.3290) | 0.0000 *** (176.564) | 0.0000 *** (183.341) |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 155.8923 | NA | 0.000000607 | –11.10313 | –10.81517 | –11.0175 |

| 1 | 318.1380 | 240.3640 | 0.000000567 | –20.45467 | –18.43892 | –19.85528 |

| 2 | 372.7259 | 56.60971 | 0.00000224 | –21.83155 | –18.08802 | –20.7184 |

| 3 | 488.9384 | 68.86667 * | 0.000000272 | –27.77322 * | –22.30191 * | –26.14631 * |

| Hypothesized | Fisher Stat. * | Fisher Stat. * | ||

|---|---|---|---|---|

| No. of CE (s) | (From Trace Test) | Prob. | (From the Max-Eigen Test) | Prob. |

| None * | 0.333667 | 195.2940 | 107.3466 | 0.0000 |

| At most 1 * | 0.274971 | 124.6559 | 79.34145 | 0.0000 |

| At most 2 * | 0.232723 | 68.70741 | 55.24578 | 0.0021 |

| At most 3 | 0.090465 | 22.61360 | 35.01090 | 0.5343 |

| At most 4 | 0.032303 | 6.114668 | 18.39771 | 0.8598 |

| At most 5 | 0.002303 | 0.401130 | 3.841466 | 0.5265 |

| Variables | FMOLS | DOLS | ||||

|---|---|---|---|---|---|---|

| Coef. | T | p > |t| | Coef. | z | p > |z| | |

| INRET | 0.164 | 0.94 | 0.347 | 0.129 *** | 1530.05 | 0.0000 |

| INE | 0.101 | 1.64 | 0.102 | 0.165 *** | 1520.4 | 0.0000 |

| INS | 0.615 | 0.03 | 0.976 | 0.207 *** | 834.62 | 0.0000 |

| INO | 0.125 | 1.28 | 0.201 | 0.615 *** | 1499.23 | 0.0000 |

| OP | 2.788765 | 0.25 | 0.8.02 | 0.123 *** | 1514.78 | 0.0000 |

| Cons | 10,196.03 | 5.86 | 0.0000 | 0.113 *** | 1391.63 | 0.0000 |

| R-squared | 0.0410 | 0.1605518 | ||||

| F(5, 243) | 1.43 | |||||

| Prob > F | 0.2124 | |||||

| No of obs. | 249 | 242 | ||||

| Root | Modulus |

|---|---|

| 0.921823 − 0.128101i | 0.930681 |

| 0.921823 + 0.128101i | 0.930681 |

| 0.817741 | 0.817741 |

| 0.571338 | 0.571338 |

| 0.094881 − 0.339223i | 0.352242 |

| 0.094881 + 0.339223i | 0.352242 |

| Dependent Variable: D(GDPPC) | Dependent Variable: D(INE.) | Dependent Variable: D(INS.) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Excluded | Chi-sq | df | Prob. | Excluded | Chi-sq | df | Prob. | Excluded | Chi-sq | df | Prob. |

| D(INE) | 2.697855 | 2 | 0.2595 | D(GDPPC) | 1.629761 | 2 | 0.4427 | D(GDPPC) | 0.092237 | 2 | 0.9549 |

| D(INS) | 0.476690 | 2 | 0.7879 | D(INS) | 10.45156 | 2 | 0.0054 *** | D(INE) | 1.268442 | 2 | 0.5303 |

| D(INO) | 1.464179 | 2 | 0.4809 | D(INO) | 19.09041 | 2 | 0.0001 *** | D(INO) | 2.519827 | 2 | 0.2837 |

| D(INRET) | 0.123061 | 2 | 0.9403 | D(INRET) | 2.731225 | 2 | 0.2552 | D(INRET) | 3.736464 | 2 | 0.1544 |

| D(OP) | 1.047690 | 2 | 0.5922 | D(OP) | 0.081894 | 2 | 0.9599 | D(OP) | 0.017137 | 2 | 0.9915 |

| All | 6.684454 | 10 | 0.7549 | All | 36.68561 | 10 | 0.0001 *** | All | 8.119419 | 10 | 0.6172 |

| Dependent variable: D(INO) | Dependent variable: D(INRET) | Dependent variable: D(OP) | |||||||||

| Excluded | Chi-sq | df | Prob. | Excluded | Chi-sq | df | Prob. | Excluded | Chi-sq | df | Prob. |

| D(GDPPC) | 1.721848 | 2 | 0.4228 | D(GDPPC) | 4.150290 | 2 | 0.1255 | D(GDPPC) | 0.948302 | 2 | 0.6224 |

| D(INE) | 4.132639 | 2 | 0.1267 | D(INE) | 3.182368 | 2 | 0.2037 | D(INE) | 0.215316 | 2 | 0.8979 |

| D(INS) | 13.96956 | 2 | 0.0009 *** | D(INS) | 2.092280 | 2 | 0.3513 | D(INS) | 0.853015 | 2 | 0.6528 |

| D(INRET) | 1.354715 | 2 | 0.5080 | D(INO) | 0.327861 | 2 | 0.8488 | D(INO) | 0.378679 | 2 | 0.8275 |

| D(OP) | 4.157306 | 2 | 0.1251 | D(OP) | 2.473090 | 2 | 0.2904 | D(INRET) | 0.273921 | 2 | 0.8720 |

| All | 22.98236 | 10 | 0.0108 *** | All | 13.12764 | 10 | 0.2166 | All | 2.819756 | 10 | 0.9854 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abdulsalam, A.; Xu, H.; Ameer, W.; Abdo, A.-B.; Xia, J. Exploration of the Impact of China’s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative. Sustainability 2021, 13, 1623. https://doi.org/10.3390/su13041623

Abdulsalam A, Xu H, Ameer W, Abdo A-B, Xia J. Exploration of the Impact of China’s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative. Sustainability. 2021; 13(4):1623. https://doi.org/10.3390/su13041623

Chicago/Turabian StyleAbdulsalam, Alnoah, Helian Xu, Waqar Ameer, AL-Barakani Abdo, and Jiejin Xia. 2021. "Exploration of the Impact of China’s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative" Sustainability 13, no. 4: 1623. https://doi.org/10.3390/su13041623

APA StyleAbdulsalam, A., Xu, H., Ameer, W., Abdo, A.-B., & Xia, J. (2021). Exploration of the Impact of China’s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative. Sustainability, 13(4), 1623. https://doi.org/10.3390/su13041623