Scoring Sufficiency Economy Philosophy through GRI Standards and Firm Risk: A Case Study of Thai Listed Companies

Abstract

:1. Introduction

2. Literature Review and Research Hypotheses

2.1. SEP in a Business Context and Business Sustainable Development

2.2. SEP and Information Transparency

2.3. SEP and Risk

2.4. SEP and Business Alliance

3. Sample and Methodology

3.1. Sample

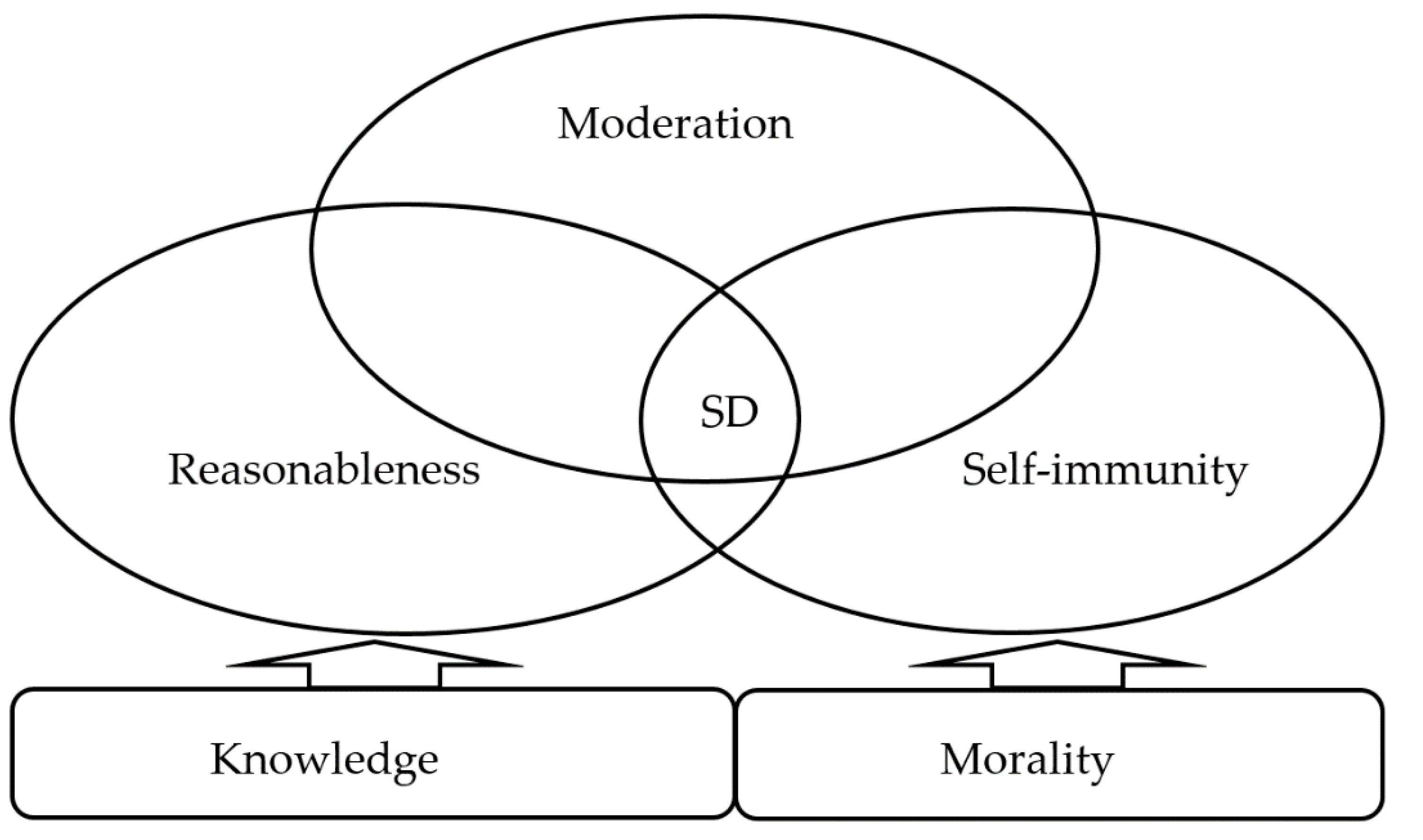

3.2. Measuring Sufficiency Economy Philosophy (SEP)

3.3. Data Collection Process

3.4. The Relation between SEP and Firm-Specific Risk

3.4.1. Measuring Firm-Specific Risk

3.4.2. Selection of Control Variables

3.4.3. Modeling Framework

4. Results and Discussion

4.1. SEP and GRI Alignment

4.2. Descriptive Statistics

4.3. Main Results

4.3.1. Hausman Test for Panel Data

4.3.2. Three Aspects of SD, Five SEP Elements, and Firm Risk

4.3.3. SEP Performance and Firm Risk

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kantabutra, S.; Siebenhuner, T. Predicting corporate sustainability: A Thai approach. J. Appl. Bus. Res. (JABR) 2011, 27, 123–134. [Google Scholar] [CrossRef]

- Kantabutra, S. Measuring corporate sustainability: A Thai approach. Meas. Bus. Excel. 2014, 18, 73–88. [Google Scholar] [CrossRef]

- Kantabutra, S. Relating vision-based leadership to sustainable business performance: A Thai perspective. Kravis Leader. Inst. Leader. Rev. 2006, 6, 37–53. [Google Scholar]

- Khunthongjan, S.; Wiboonpongse, A. A study of performance of SMEs in their application of sufficiency economy philosophy. GMSARN Int. J. 2010, 4, 177–182. [Google Scholar]

- Suttipun, M.; Arwae, A. The influence of sufficiency economy philosophy practice on SMEs’ performance in Thailand. Entrep. Bus. Econ. Rev. 2020, 8, 179–198. [Google Scholar] [CrossRef]

- Suttipun, M. The longitudinal study of sufficiency economy philosophy reporting of listed companies in the Stock Exchange of Thailand. Asia-Pac. J. Bus. Adm. 2019, 11, 187–206. [Google Scholar] [CrossRef]

- Kantabutra, S. Development of the sufficiency economy philosophy in the Thai business sector: Evidence, future research & policy implications. In Seminar on Sufficiency Economy, Crown Property Bureau, Bangkok, Thailand). For a Fuller Discussion of the Concept, See UNDP, Thailand Human Development Report; Citeseer: Princeton, NJ, USA, 2007. [Google Scholar]

- Sasin Graduate Institute of Business Admisitration of Chulalongkorn University. Corporate Sustainability under the Sufficiency Economy Philosophy; The National Economic and Social Development Board of Thailand: Bangkok, Thailand, 2010. [Google Scholar]

- Buranapin, S.; Ratthawatankul, T. Philosophy of sufficiency economy and business sustainability: A framework for operational implications. J. Bus. Behav. Sci. 2015, 27, 115. [Google Scholar]

- Isarangkun, C.; Pootrakool, K. Sustainable Economic Development through the Sufficiency Economy Philosophy; National Economic and Social Development Board of Thailand: Bangkok, Thailand, 2001; pp. 1–14. [Google Scholar]

- Mongsawad, P. The philosophy of the sufficiency economy: A contribution to the theory of development. Asia Pac. Dev. J. 2012, 17, 123–143. [Google Scholar] [CrossRef] [Green Version]

- Song, H. Sufficiency economy philosophy: Buddhism-based sustainability framework in Thailand. Bus. Strat. Environ. 2020, 29, 2995–3005. [Google Scholar] [CrossRef]

- Sornsri, S. The possibility of applying the philosophy of sufficiency economy in organizational purchasing. UWF Umw. 2016, 24, 393–407. [Google Scholar] [CrossRef]

- Suttipun, M.; Saefu, S. Investigation of sufficiency economy philosophy reporting in Thailand. DLSU Bus. Econ. Rev. 2017, 26, 53–65. [Google Scholar]

- Wibulswasdi, C.; Piboolsravut, P.; Pootrakool, K. Sufficiency Economy Philosophy and Development; Sufficiency Economy Research Project, Bureau of the Crown Property: Bangkok, Thailand, 2011. [Google Scholar]

- Kantabutra, S. Achieving corporate sustainability: Toward a practical theory. Sustainability 2019, 11, 4155. [Google Scholar] [CrossRef] [Green Version]

- Kantabutra, S. Putting Rhineland principles into practice in Thailand: Sustainable leadership at Bathroom Design Company. Glob. Bus. Organ. Excel. 2012, 31, 6–19. [Google Scholar] [CrossRef]

- Unger, D. Sufficiency economy and the bourgeois virtues. Asian Aff. Am. Rev. 2009, 36, 139–156. [Google Scholar] [CrossRef]

- The Stock Exchange of Thailand. Disclosure Guidelines for Listed Companies’ Management; The Stock Exchange of Thailand: Bangkok, Thailand, 2005. [Google Scholar]

- The Stock Exchange of Thailand. Fixed income and other product department. In Ground Rules for SET Index Series; The Stock Exchange of Thailand: Bangkok, Thailand, 2019. [Google Scholar]

- The Stock Exchange of Thailand. Distribution of Minority Shareholdings (Free Float); The Stock Exchange of Thailand: Bangkok, Thailand, 2019; pp. 1–9. [Google Scholar]

- Jiraporn, P.; Kim, Y.S.; Davidson, W.N.; Singh, M. Corporate governance, shareholder rights and firm diversification: An empirical analysis. J. Bank. Financ. 2006, 30, 947–963. [Google Scholar] [CrossRef]

- Jiraporn, P.; Ning, Y. Dividend Policy, Shareholder Rights, and Corporate Governance. Shareholder Rights, and Corporate Governance. 18 September 2006. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=931290 (accessed on 10 December 2020). [CrossRef]

- Global Reporting Initiative. Full Set of GRI Standards—English; Global Reporting Initiative: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Morhardt, J.E.; Baird, S.; Freeman, K. Scoring corporate environmental and sustainability reports using GRI 2000, ISO 14031 and other criteria. Corp. Soc. Responsib. Environ. Manag. 2002, 9, 215–233. [Google Scholar] [CrossRef]

- Yadava, R.N.; Sinha, B. Scoring sustainability reports using GRI 2011 guidelines for assessing environmental, economic, and social dimensions of leading public and private Indian companies. J. Bus. Ethic. 2016, 138, 549–558. [Google Scholar] [CrossRef]

- Chalmers, J.M.; Dann, L.Y.; Harford, J. Managerial opportunism? Evidence from directors’ and officers’ insurance purchases. J. Financ. 2002, 57, 609–636. [Google Scholar]

- Rajverma, A.K.; Misra, A.; Mohapatra, S.; Chandra, A. Impact of ownership structure and dividend on firm performance and firm risk. Manag. Financ. 2019, 45, 1041–1061. [Google Scholar] [CrossRef]

- Janmaimool, P.; Denpaiboon, C. Rural villagers’ quality of life improvement by economic self-reliance practices and trust in the philosophy of sufficiency economy. Societies 2016, 6, 26. [Google Scholar] [CrossRef] [Green Version]

- Jitsuchon, S. Thailand’s sufficiency economy philosophy as an alternative path to sustainable development. Eur. J. Sustain. Dev. 2019, 8, 191. [Google Scholar] [CrossRef]

- Piboolsravut, P. Sufficiency economy. Asean Econ. Bull. 2004, 21, 127–134. [Google Scholar] [CrossRef]

- Isarangkun, C.; Pootrakool, K. Sustainable economic development through the sufficiency economy philosophy. Natl. Econ. Soc. Dev. Board Thail. 2005, 6, 2006. [Google Scholar]

- Chatjuthamard, P.; Lawatanatrakul, V.; Pisalyaput, N.; Srivibha, V. Sufficiency economy philosophy and firm risks. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Supawadee, K.; Apichai, P.; Aree, W. A complete report of small and medium enterprises according to the royal initiative sufficiency economy principles: Present to Thailand research fund. J. Hum. Soc. Sci. 2011, 2, 111–121. [Google Scholar]

- Kantabutra, S.; Ketprapakorn, N. Toward a theory of corporate sustainability: A theoretical integration and exploration. J. Clean. Prod. 2020, 270, 122292. [Google Scholar] [CrossRef]

- Naciti, V. Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. J. Clean. Prod. 2019, 237, 117727. [Google Scholar] [CrossRef]

- Clarkson, P.M. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Hart, S.L.; Ahuja, G. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strat. Environ. 1996, 5, 30–37. [Google Scholar]

- Li, D.; Cao, C.; Zhang, L.; Chen, X.; Ren, S.; Zhao, Y. Effects of corporate environmental responsibility on financial performance: The moderating role of government regulation and organizational slack. J. Clean. Prod. 2017, 166, 1323–1334. [Google Scholar] [CrossRef]

- Miller, J.S.; Wiseman, R.M.; Gomez-Mejia, L.R. The fit between CEO compensation design and firm risk. Acad. Manag. J. 2002, 45, 745–756. [Google Scholar]

- Jo, H.; Na, H. Does CSR reduce firm risk? Evidence from controversial industry sectors. J. Bus. Ethics 2012, 110, 441–456. [Google Scholar]

- Irvine, P.J.; Pontiff, J. Idiosyncratic return volatility, cash flows, and product market competition. Rev. Financ. Stud. 2009, 22, 1149–1177. [Google Scholar] [CrossRef]

- Goyal, A.; Santa-Clara, P. Idiosyncratic risk matters! J. Financ. 2003, 58, 975–1007. [Google Scholar] [CrossRef]

- Cao, C.; Simin, T.; Zhao, J. Can growth options explain the trend in idiosyncratic risk? Rev. Financ. Stud. 2008, 21, 2599–2633. [Google Scholar] [CrossRef] [Green Version]

- Cai, L.; Cui, J.; Jo, H. Corporate environmental responsibility and firm risk. J. Bus. Ethic. 2016, 139, 563–594. [Google Scholar] [CrossRef]

- Bouslah, K.B.H.; Kryzanowski, L.; M’Zali, B. Social performance and firm risk: Impact of the financial crisis. J. Bus. Ethic. 2018, 149, 643–669. [Google Scholar] [CrossRef] [Green Version]

- Benlemlih, M.; Shaukat, A.; Qiu, Y.; Trojanowski, G. Environmental and social disclosures and firm risk. J. Bus. Ethic. 2018, 152, 613–626. [Google Scholar] [CrossRef]

- Brown, G.; Kapadia, N. Firm-specific risk and equity market development. J. Financ. Econ. 2007, 84, 358–388. [Google Scholar] [CrossRef]

- Ben-Zion, U.; Shalit, S.S. Size, leverage, and dividend record as determinants of equity risk. J. Financ. 1975, 30, 1015–1026. [Google Scholar] [CrossRef]

- Hu, H.; Dou, B.; Wang, A. Corporate social responsibility information disclosure and corporate fraud—“Risk Reduction” effect or “Window Dressing” effect? Sustainability 2019, 11, 1141. [Google Scholar] [CrossRef] [Green Version]

- Mishra, S.; Modi, S.B. Positive and negative corporate social responsibility, financial leverage, and idiosyncratic risk. J. Bus. Ethics 2013, 117, 431–448. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.D. Corporate social performance and firm risk: A meta-analytic review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- Sila, V.; Gonzalez, A.; Hagendorff, J. Women on board: Does boardroom gender diversity affect firm risk? J. Corp. Financ. 2016, 36, 26–53. [Google Scholar] [CrossRef] [Green Version]

- Ullmann, A.A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; De Colle, S. Stakeholder Theory: The State of the Art; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Multifactor explanations of asset pricing anomalies. J. Financ. 1996, 51, 55–84. [Google Scholar] [CrossRef]

- Perez-Quiros, G.; Timmermann, A. Firm size and cyclical variations in stock returns. J. Financ. 2000, 55, 1229–1262. [Google Scholar] [CrossRef]

- Miller, M.H.; Rock, K. Dividend policy under asymmetric information. J. Financ. 1985, 40, 1031–1051. [Google Scholar] [CrossRef]

- Maydeu-Olivares, A.; Shi, D.; Rosseel, Y. Instrumental variables two-stage least squares (2SLS) vs. maximum likelihood structural equation modeling of causal effects in linear regression models. Struct. Equ. Model. A Multidiscip. J. 2019, 26, 876–892. [Google Scholar] [CrossRef]

| Industry | SET100 (2008–2018) | SETTHSI (2015–2018) | SET100 and SETTHSI | Firms Disclose Sustainable Development Reports from 2013 to 2018 |

|---|---|---|---|---|

| Agriculture and Food | 17 | 4 | 21 | 4 |

| Consumer Products | 2 | 4 | 6 | 0 |

| Industrials | 16 | 5 | 21 | 3 |

| Property and Construction | 57 | 3 | 60 | 5 |

| Resources | 30 | 4 | 34 | 11 |

| Services | 47 | 1 | 48 | 8 |

| Technology | 22 | 2 | 24 | 3 |

| Total companies | 191 | 23 | 214 | 34 |

| Variable | Definition |

|---|---|

| SEP_eco | SEP performance for the economic aspect according to GRI 201–206. that covers

|

| SEP_env | SEP performance on environmental aspects according to GRI 301–308. that covers

|

| SEP_soc | SEP performance on social aspect according to GRI 401–419. that covers

|

| MOD | Moderation score is defined as a firm which

|

| REA | Reasonableness score is defined as a firm which

|

| SEL | Self-immunity score is defined as a firm which

|

| KNO | Knowledge score is defined as a firm which

|

| ETH | Morality score is defined as a firm which

|

| SEP_score | Sufficiency economy philosophy performance |

| TA | Total assets of a firm |

| l_TA | Natural log of total assets |

| ROE | Return on equity ratio |

| TDTA | total-debt-to-total-assets ratio |

| Age | Age of the firm (years) |

| l_Age | Natural log of Age |

| DPR | Dividend payout ratio is the dividend per share divided by earning per share. |

| PB | Price-to-Book Value is the share price divided by the book value per share of a firm. |

| Firm_risk | Firm specific risk is the square of residual of Fama and French’s (1993) three factor model. |

| twocon_AVE | Average of two underlying conditions is the six-year average of KNO and ETH. |

| GRI Provisions | Alignment of GRI Provisions and Five SEP Elements | ||||||

|---|---|---|---|---|---|---|---|

| MOD | REA | SEL | KNO | ETH | AVE | ||

| Economic | 37 | 22 (59.5%) | 22 (59.5%) | 37 (100%) | 12 (32.4%) | 32 (86.5%) | 25 (67.6%) |

| Environment | 108 | 23 (21.3%) | 10 (9.3%) | 108 (100%) | 1 (0.9%) | 37 (34.3%) | 36 (33.1%) |

| Social | 90 | 49 (54.4%) | 47 (52.2%) | 90 (100%) | 15 (16.7%) | 74 (82.2%) | 55 (61.1%) |

| Total | 235 | 94 (40.0%) | 79 (33.6%) | 235 (100%) | 28 (11.9%) | 143 (60.9%) | 116 (49.3%) |

| Variable | Mean | Standard Deviation | Min | Max | N |

|---|---|---|---|---|---|

| SEP_eco | 41.5 | 11.2 | 19.7 | 68.0 | 204 |

| SEP_env | 28.6 | 15.8 | 1.06 | 65.9 | 204 |

| SEP_soc | 31.3 | 12.4 | 3.97 | 60.1 | 204 |

| MOD | 33.5 | 12.0 | 8.89 | 65.2 | 204 |

| REA | 33.3 | 12.8 | 7.92 | 64.7 | 204 |

| SEL | 33.5 | 12.0 | 10.7 | 61.6 | 204 |

| KNO | 35.8 | 14.6 | 3.70 | 66.9 | 204 |

| ETH | 33.0 | 10.9 | 11.1 | 59.3 | 204 |

| SEP_score | 33.8 | 12.0 | 8.84 | 62.7 | 204 |

| Firm_risk | 0.0015 | 0.0022 | 0.0000 | 0.0254 | 204 |

| TA | 1.88 × 108 | 3.70 × 108 | 2,468,152 | 2.33 × 109 | 204 |

| l_TA | 17.9 | 1.60 | 14.7 | 21.6 | 204 |

| PB | 2.44 | 2.60 | 0.550 | 32.0 | 204 |

| TDTA | 32.4 | 14.3 | 0.000 | 65.5 | 204 |

| ROE | 10.7 | 22.2 | −176.8 | 90.3 | 204 |

| Firm_Age | 32.6 | 18.0 | 2.00 | 105 | 204 |

| l_Age | 3.34 | 0.573 | 0.693 | 4.65 | 204 |

| DPR | 54.4 | 68.9 | −250 | 648 | 204 |

| twocon_AVE | 34.3 | 10.7 | 11.0 | 59.3 | 204 |

| Dependent Variable | Chi2 | Prob > Chi2 | Test Summary |

|---|---|---|---|

| Firm_risk | 19.2 | 0.0076 | Fixed effects |

| Panel A: SD Three Aspects and Firm Risks | Panel B: SEP Five Elements and Firm Risks | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| SEP_eco | SEP_env | SEP_soc | MOD | REA | SEL | KNO | ETH | |

| −4.06 × 10−5 | −4.55 × 10−5 ** | −1.36 × 10−5 | −5.55 × 10−5 * | −4.96 × 10−5 | −6.57 × 10−5 ** | −3.43 × 10−5 * | −6.96 × 10−5 ** | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| l_TA | −0.000619 | −0.00046 | −0.000765 | −0.000485 | −0.000513 | −0.000438 | −0.000502 | −0.000403 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| PB | 0.000215 | 0.000229 | 0.000214 | 0.000219 | 0.000209 | 0.000211 | 0.000218 | 0.000218 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| TDTA | 3.18 × 10−5 | 2.76 × 10−5 | 3.07 × 10−5 | 3.00 × 10−5 | 2.90 × 10−5 | 3.22 × 10−5 | 2.72 × 10−5 | 2.98 × 10−5 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| ROE | 3.33 × 10−5 | 3.34 × 10−5 | 3.29 × 10−5 | 3.48 × 10−5 | 3.43 × 10−5 | 3.39 × 10−5 | 3.40 × 10−5 | 3.38 × 10−5 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| l_Age | −0.000284 | 0.000279 | −0.000925 | 0.000272 | 0.000175 | 0.000391 | −0.000141 | 0.000425 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| DPR | 2.09 × 10−6 * | 1.70 × 10−6 | 1.78 × 10−6 * | 2.04 × 10−6 * | 1.77 × 10−6 * | 2.07 × 10−6 * | 1.90 × 10−6 | 2.03 × 10−6 * |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Constant | 0.0132 | 0.00823 | 0.0168 | 0.00916 | 0.00986 | 0.00823 | 0.0103 | 0.00765 |

| (0.012) | (0.009) | (0.011) | (0.011) | (0.011) | (0.010) | (0.010) | (0.011) | |

| Observations | 204 | 204 | 204 | 204 | 204 | 204 | 204 | 204 |

| R-squared | 0.063 | 0.076 | 0.056 | 0.066 | 0.065 | 0.069 | 0.07 | 0.069 |

| OLS | Fixed Effects | 2SLS-IV | |

|---|---|---|---|

| Model 9 | Model 10 | Model 11 | |

| SEP_score | −4.11 × 10−5 ** | −6.25 × 10−5 ** | −0.000155 ** |

| (0.000) | (0.000) | (0.000) | |

| l_TA | 3.68 × 10−5 | −0.000394 | 0.000550 * |

| (0.000) | (0.001) | (0.000) | |

| PB | −8.09 × 10−5 | 0.000214 | −0.000183 * |

| (0.000) | (0.000) | (0.000) | |

| TDTA | 2.24 × 10−5 | 2.88 × 10−5 | 2.57 × 10−5 |

| (0.000) | (0.000) | (0.000) | |

| ROE | −1.29 × 10−5 | 3.46 × 10−5 | −1.41 × 10−6 |

| (0.000) | (0.000) | (0.000) | |

| l_Age | −0.000145 | 0.000472 | −0.000526 * |

| (0.000) | (0.001) | (0.000) | |

| DPR | −8.10 × 10−7 | 2.00 × 10−6 * | 8.53 × 10−7 |

| (0.000) | (0.000) | (0.000) | |

| Constant | 0.00239 | 0.00717 | −0.00173 |

| (0.003) | (0.011) | (0.004) | |

| Observations | 204 | 204 | 204 |

| R-squared | 0.091 | 0.071 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Korphaibool, V.; Chatjuthamard, P.; Treepongkaruna, S. Scoring Sufficiency Economy Philosophy through GRI Standards and Firm Risk: A Case Study of Thai Listed Companies. Sustainability 2021, 13, 2321. https://doi.org/10.3390/su13042321

Korphaibool V, Chatjuthamard P, Treepongkaruna S. Scoring Sufficiency Economy Philosophy through GRI Standards and Firm Risk: A Case Study of Thai Listed Companies. Sustainability. 2021; 13(4):2321. https://doi.org/10.3390/su13042321

Chicago/Turabian StyleKorphaibool, Veerawin, Pattanaporn Chatjuthamard, and Sirimon Treepongkaruna. 2021. "Scoring Sufficiency Economy Philosophy through GRI Standards and Firm Risk: A Case Study of Thai Listed Companies" Sustainability 13, no. 4: 2321. https://doi.org/10.3390/su13042321

APA StyleKorphaibool, V., Chatjuthamard, P., & Treepongkaruna, S. (2021). Scoring Sufficiency Economy Philosophy through GRI Standards and Firm Risk: A Case Study of Thai Listed Companies. Sustainability, 13(4), 2321. https://doi.org/10.3390/su13042321