Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic

Abstract

1. Introduction

2. Literature Review

3. Data and Research Methodologies

3.1. Panel Data Regression for Credit Channel Factors

3.2. Methodology for Assessment of the COVID-19 Pandemic Impact on Financial Stability

4. Results and Discussion

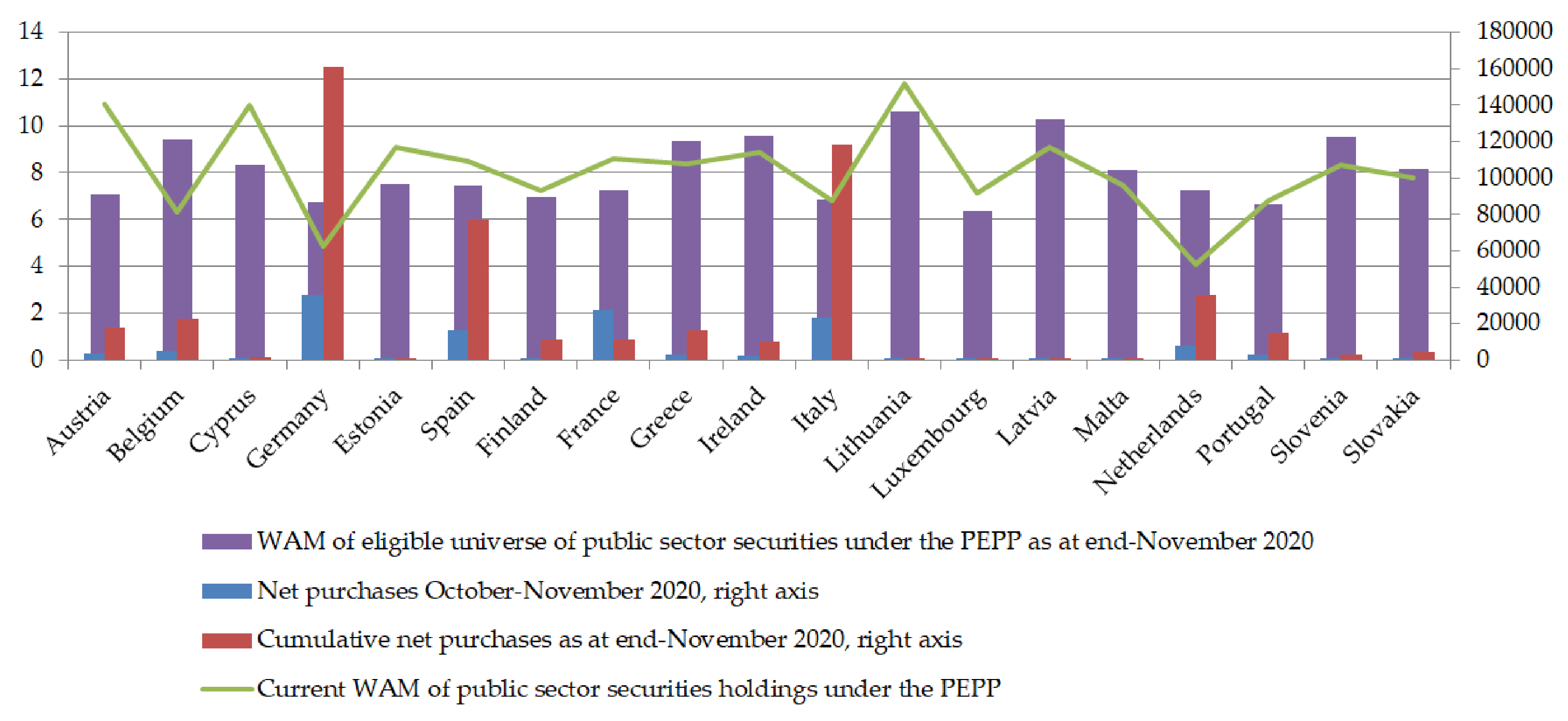

4.1. Participation in PEPP in Different Euro Area Countries

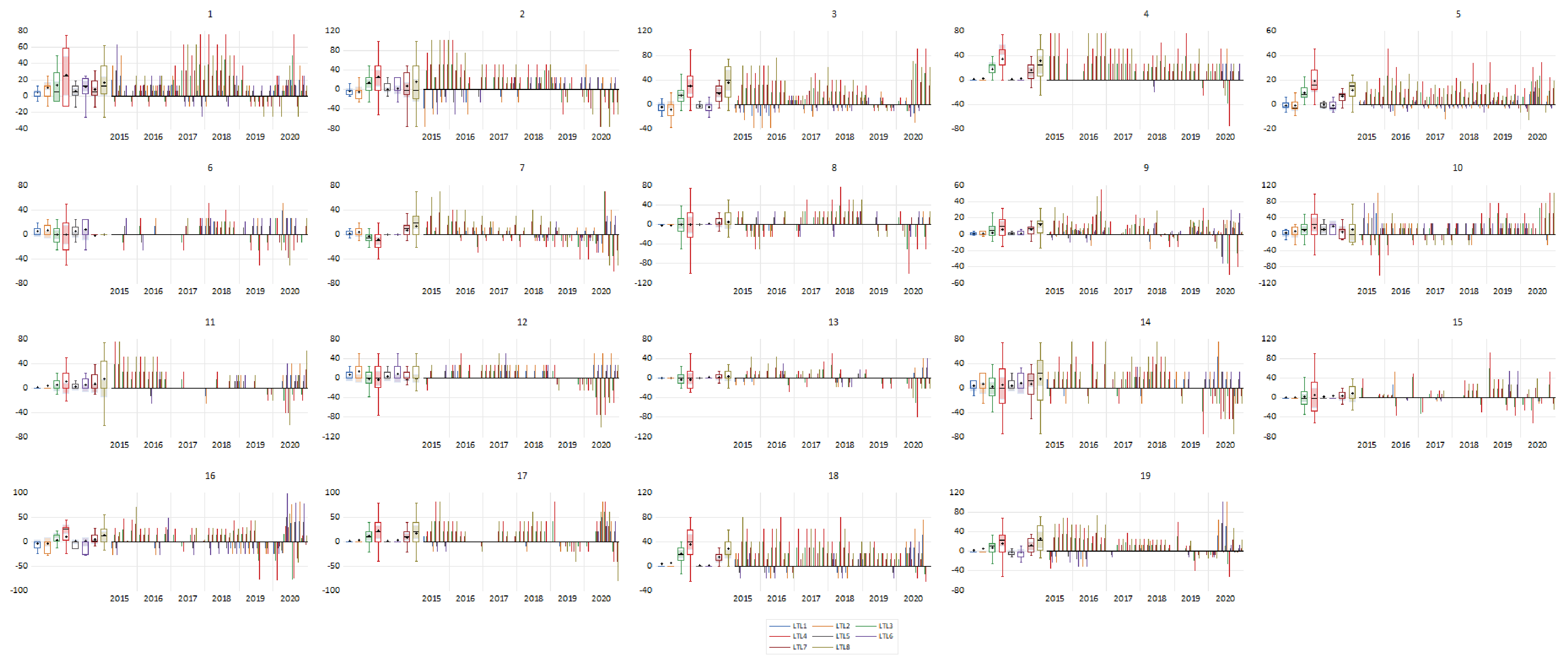

4.2. Valuation of Tendencies of Loans to Enterprises

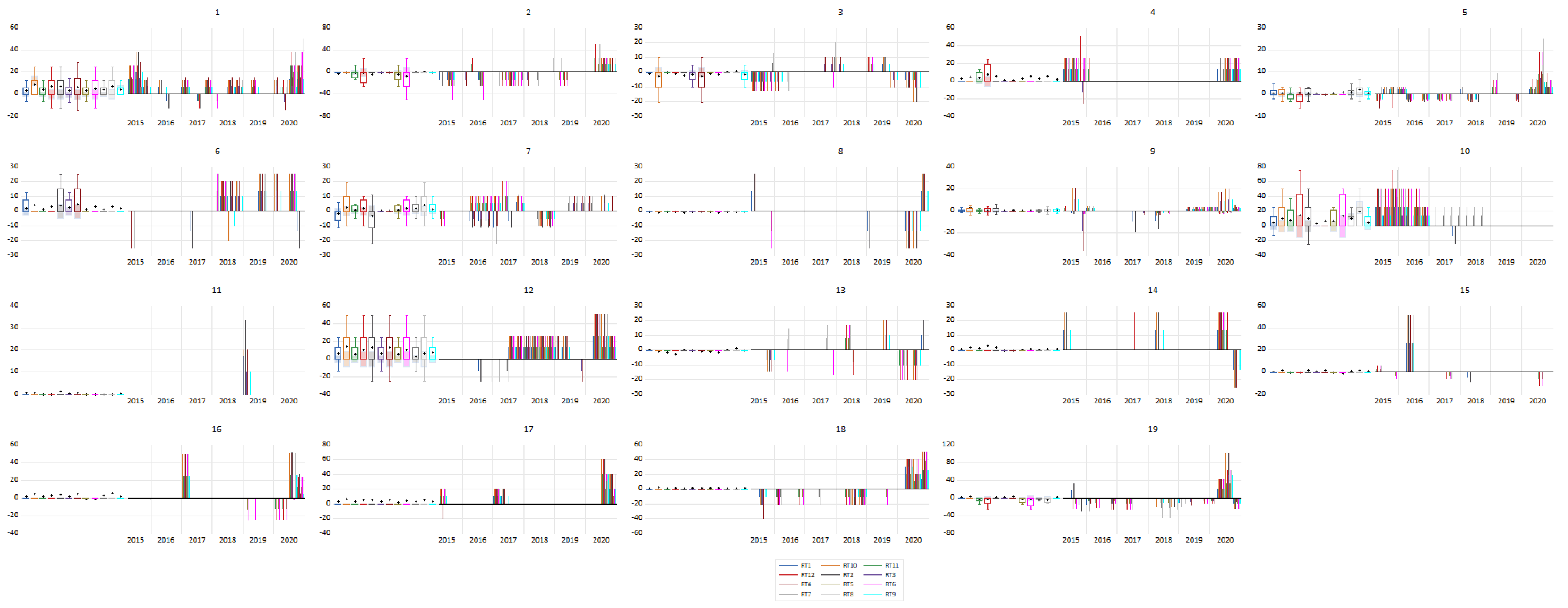

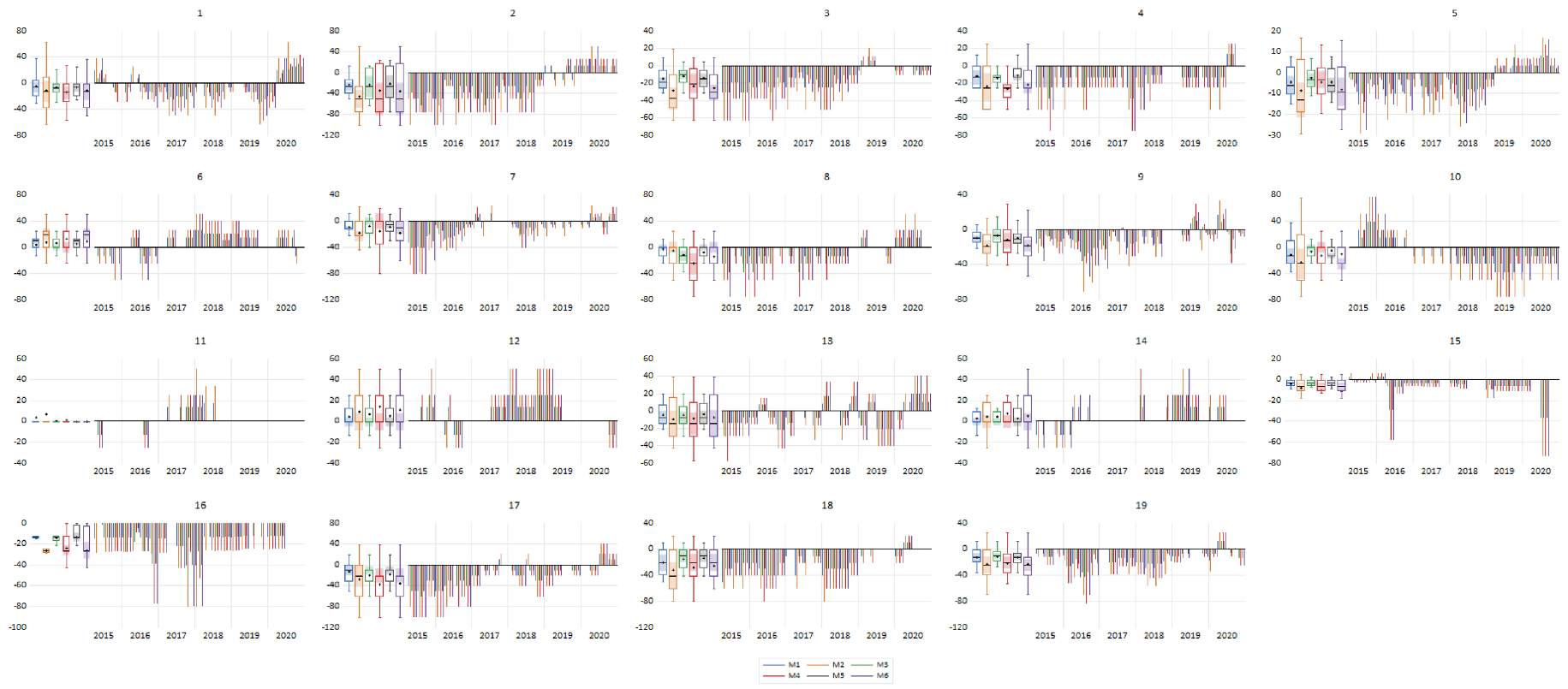

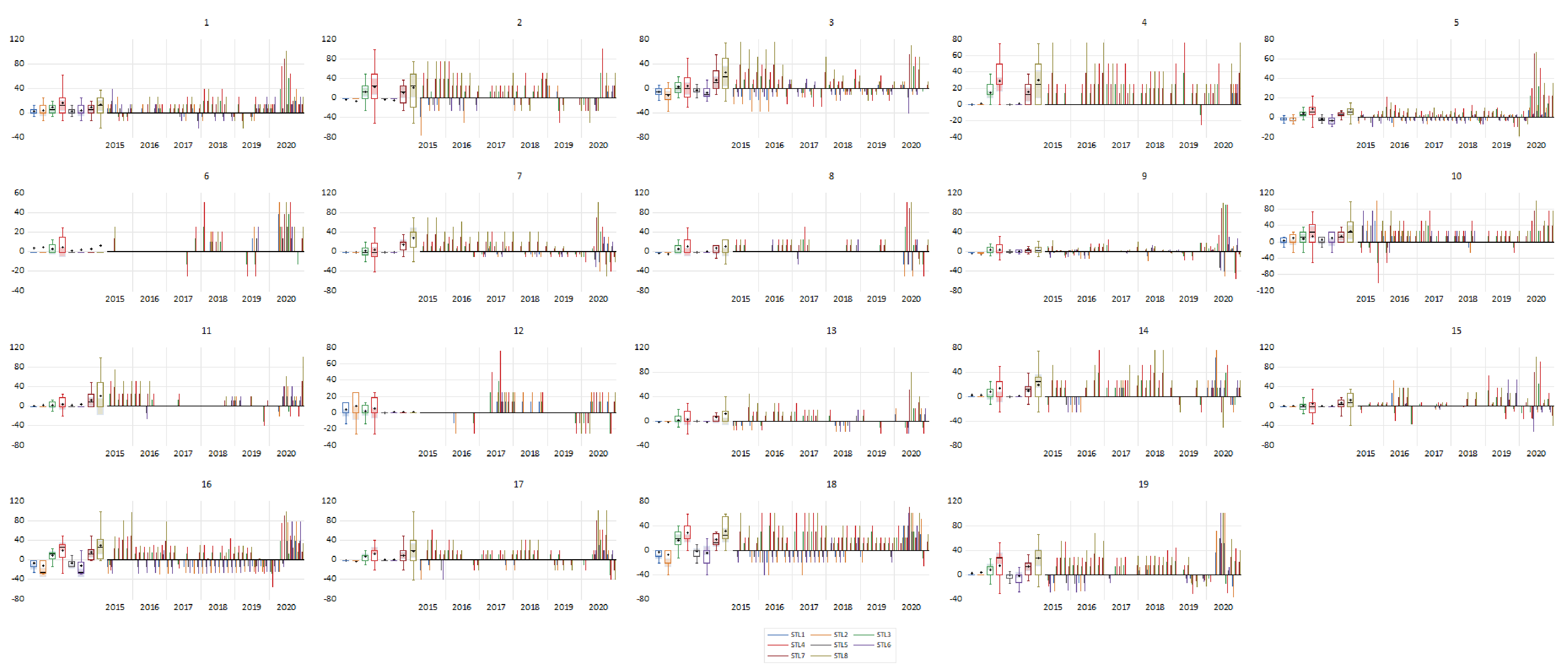

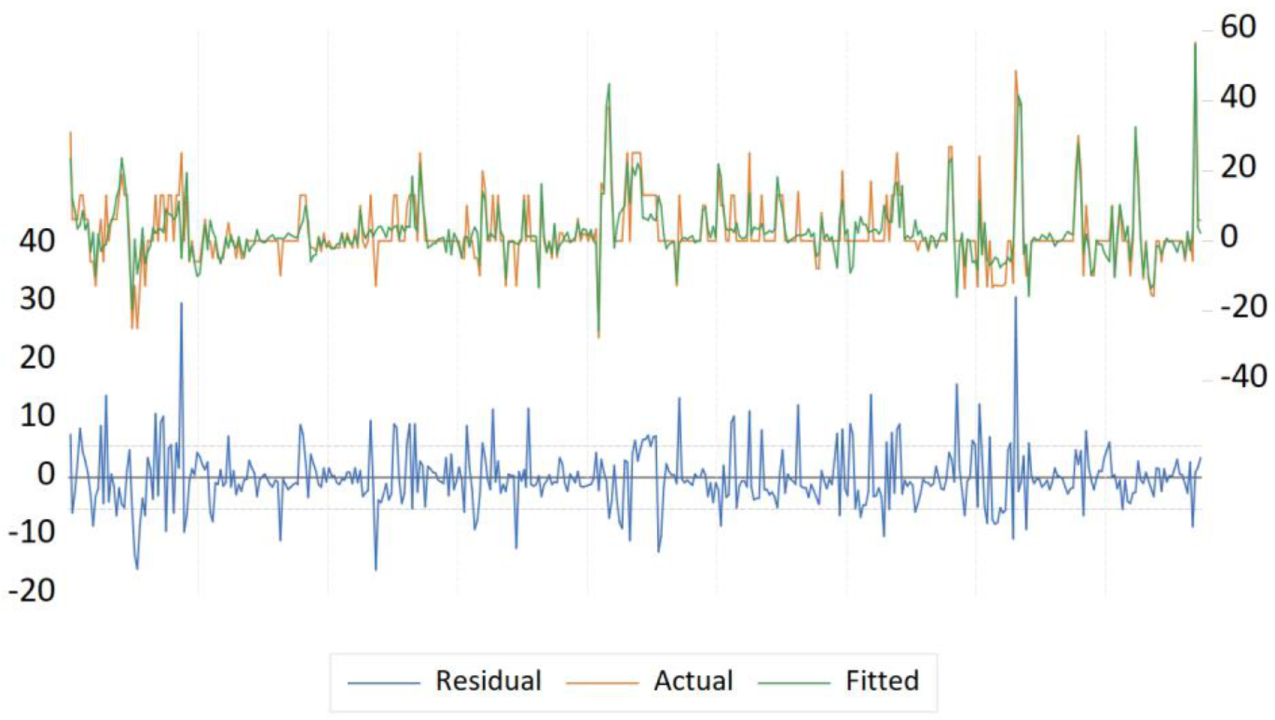

4.3. Pool Data Regression Models’ Application for Euro-Area Credit Market

- A pooled OLS regression model is appropriate (all dummy variables equal zero).

- A fixed-effect model is appropriate (all dummy variables do not equal zero).

4.4. Assessment of Euro Area Financial Stability in the Face of the COVID-19 Pandemic

- Two of three selected COVID-19 related variables (the total number of COVID-19 cases reported (TCe) and the number of total cases of COVID-19 per million population in Euro area (TCperMe)) are significantly related to the changes in level ITRX EUR CDSI GEN 5Y Corp index and the probability of simultaneous default of two more large banks in the euro area;

- Both of the previously mentioned variables (TCe and TCperMe) proved to have a statistically significant negative relationship with variables measuring the risk premiums and large banks default probability in the euro area, i.e., although surprisingly, in the presence of COVID-19 spread, risk premiums and default probability decreased;

- It is worth mentioning that the comparative dynamic analysis of ITRXCDI and DP shows that these variables demonstrated a sharp increase in March and April (see Appendix C) and a sufficiently steady decline in subsequent months.

- Two variables (TCe and TCperMe) proved to have a statistically significant negative impact on the level ITRX EUR CDSI GEN 5Y Corp index (ITRXCDI);

- All three COVID-19 related variables appeared to have a statistically significant negative impact on the default probability of large banks (DP);

- There is a statistically significant relationship between the total number of COVID-19 cases in euro-area countries (TCi) and all four dependent variables (FDIi, LGi, MOi, and MNi);

- Interestingly, the relationship with the financial distress index, as well as with lending margins on both outstanding and new loans to businesses and households, is inverse, while the relationship between total COVID-19 cases and growth of banking sector lending is direct, showing that, on average, the banking sector lending growth increases in the face of COVID-19 pandemic;

- The results of correlation analysis also show that the number of new COVID-19 cases (NCi) is statistically significantly related to the financial distress index and lending margins on the new loans (inversely in both cases);

- The total number of COVID-19 cases per million population (TCperMi) is statistically significantly related to the financial distress index as well as to lending margins on the outstanding loans (inversely in both cases).

- The total number of COVID-19 cases reported (TCi) appeared to have a statistically significant negative effect on the financial distress index (FDIi) in eurozone countries (OLS model) and a statistically significant positive effect on the lending margin on new loans for businesses and households (MNi) (fixed effects model);

- The number of new monthly cases of COVID-19 reported (NCi) proved to have a statistically significant effect on only one of four dependent variables—financial distress index (FDIi), and this effect is of a negative nature (random-effects model);

- The total number of COVID-19 cases reported per million population (TCperMi) seemed to have a statistically significant negative effect on the financial distress index (FDIi) (fixed-effect models).

- Interestingly, the COVID-19 pandemic impact on financial distress in eurozone countries is of an inverse nature, meaning that increasing COVID-19 variables are related to the decrease of financial distress in eurozone countries. As in the case of banking sector risks, the effect on financial distress was short-lived and, most likely, it reduced by monetary policy and other economic policy measures.

- Nine of 14 financial soundness indicators demonstrated a statistically significant change in value during the period analyzed (in at least one pair of periods);

- On the one hand, banking sectors of euro-area countries experienced the decrease of (i) profitability (expressed as return on assets and return on equity), (ii) solvency, and resiliency (expressed as capital to assets ratio), during the period of 2019 Q4–2020 Q3;

- The decrease of non-interest expenses and gross income ratio was statistically significant only during the period 2019 Q4–2020 Q2; in subsequent periods, significant change is no longer observed;

- On the other hand, banking sectors of euro-area countries experienced a statistically significant increase of (i) the liquidity (expressed as liquid assets and total assets ratio and liquid assets to short-term liabilities ratio) during the period 2019 Q4–2020 Q3.

- The statistically significant increase of regulatory capital (expressed as regulatory capital and risk-weighted assets ratio and regulatory Tier I capital and risk-weighted assets ratio) is observed in recent quarters.

5. Conclusions

- PEPP is a non-standard monetary policy tool created to minimize risks posed by the COVID-19 pandemic to the monetary policy transmission channels and the euro area’s economic growth. This program was initiated in March 2020 as a part of an asset purchase program of private and public sector securities. The program will continue depending on the COVID-19 pandemic situation and will end not earlier than March 2022. The principal payments of securities purchased under the program will be reinvested at least until the end of 2023. So, the banking sector will have support from monetary policy for a longer time and could support business through the credit channel.

- The ECB tries to protect credit supply and encourages commercial banks to give loans, but commercial banks do not want to take credit risk and do not actively participate in PEPP.

- Despite the pandemic situation, banks must support business with government or central banks’ help, but the reality is different: banks tightened credit standards in most countries of the euro area.

- Banks’ collateral requirements for short-term and long-term loans to firms increased significantly, reflecting concerns about firms’ business outlook.

- Long-term loan credit standards can mostly be explained by the impact of bank’s risk tolerance, so ECB cannot manage this, as banks are afraid to take credit risk because they had good lessons during the 2008–2009 financial crisis. From the methodological side, we conclude that from panel data regression models, the fixed-effect model suits better for credit channel explanation.

- Finally, we think that at this stage, monetary policy has limited tools and possibilities to support business and the economy during the COVID-19 pandemic and add value to sustainable economic growth through the credit transmission channel.

- COVID-19 related variables proved to have a statistically significant negative impact on the level ITRX EUR CDSI GEN 5Y Corp index and on the probability of the simultaneous default of several large banks in the euro area, so it can be stated that the results of this research do not indicate the unambiguous and longer-lasting impact on credit and systemic risks of the commercial banking sector in the eurozone in the face of the COVID-19 pandemic

- The spread of the COVID-19 pandemic has had a statistically significant negative effect on the financial distress index in the eurozone countries, which means that the results of this research does not reveal the unambiguous and longer-lasting impact on financial distress in the eurozone countries in the face of the COVID-19 pandemic.

- The results of the research revealed that the impact of the spread of the COVID-19 pandemic on banking sector lending growth is statistically insignificant, while the impact on lending margins is mixed.

- The results of the research have also revealed that the impact of the spread of COVID-19 pandemic on the financial soundness of banking sectors in the euro zone countries is twofold: on the one hand, banking sector profitability and solvency decreased during the period analyzed; on the other hand, an increase in liquidity is observed over the same period.

- The absence of an unequivocal negative effect of the COVID-19 pandemic on the financial sector may indicate the impact of widespread monetary policy measures.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Notation | Variable Explanation |

|---|---|

| CR1 | CR, LE, BWL three months, CTC, LS, DI (Collateral requirements, Large enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| CR2 | CR, LE, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Collateral requirements, Large enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| CR3 | CR, SME, BWL three months, CTC, LS, DI (Collateral requirements, Small and medium-sized enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| CR4 | CR, SME, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Collateral requirements, Small and medium-sized enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| CR5 | CR, BWL three months, CTC, LS, DI (Collateral requirements, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| CR6 | CR, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Collateral requirements, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| LTL1 | LTL, BWL three months, CS, LS, DI (Long-term loans, Backward-looking three months, Credit standards, Loan supply, Diffusion index) |

| LTL2 | LTL, BWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Long-term loans, Backward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| LTL3 | LTL, BWL three months, LD, DI (Long-term loans, Backward-looking three months, Loan demand, Diffusion index) |

| LTL4 | LTL, BWL three months, LD, Net percentage (frequency of tightened minus that of eased or reverse) (Long-term loans, Backward-looking three months, Loan demand, Net percentage (frequency of tightened minus that of eased or reverse)) |

| LTL5 | LTL, FWL three months, CS, LS, DI (Long-term loans, Forward-looking three months, Credit standards, Loan supply, Diffusion index) |

| LTL6 | LTL, FWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Long-term loans, Forward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| LTL7 | LTL, FWL three months, LD, DI (Long-term loans, Forward-looking three months, Loan demand, Diffusion index) |

| LTL8 | LTL, FWL three months, LD, Net percentage (frequency of tightened minus that of eased or reverse) (Long-term loans, Forward-looking three months, Loan demand, Net percentage (frequency of tightened minus that of eased or reverse)) |

| M1 | MOAL, LE, BWL three months, CTC, LS, DI (Margin on average loans, Large enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| M2 | MOAL, LE, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Margin on average loans, Large enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| M3 | MOAL, SME, BWL three months, CTC, LS, DI (Margin on average loans, Small and medium-sized enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| M4 | MOAL, SME, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Margin on average loans, Small and medium-sized enterprises, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| M5 | MOAL, BWL three months, CTC, LS, DI (Margin on average loans, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| M6 | MOAL, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Margin on average loans, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT1 | IBRT, LE, BWL three months, CS, LS, DI (Impact of bank’s risk tolerance, Large enterprises, Backward-looking three months, Credit standards, Loan supply, Diffusion index) |

| RT2 | IBRT, LE, BWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Large enterprises, Backward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT3 | IBRT, SME, BWL three months, CS, LS, DI (Impact of bank’s risk tolerance, Small and medium-sized enterprises, Backward-looking three months, Credit standards, Loan supply, Diffusion index) |

| RT4 | IBRT, SME, BWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Small and medium-sized enterprises, Backward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT5 | IBRT, BWL three months, MOAL, LS, DI (Impact of bank’s risk tolerance, Backward-looking three months, Margins on average loans, Loan supply, Diffusion index) |

| RT6 | IBRT, BWL three months, MOAL, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Backward-looking three months, Margins on average loans, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT7 | IBRT, BWL three months, Margins on riskier loans, LS, DI (Impact of bank’s risk tolerance, Backward-looking three months, Margins on riskier loans, Loan supply, Diffusion index) |

| RT8 | IBRT, BWL three months, Margins on riskier loans, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Backward-looking three months, Margins on riskier loans, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT9 | IBRT, BWL three months, CS, LS, DI (Impact of bank’s risk tolerance, Backward-looking three months, Credit standards, Loan supply, Diffusion index) |

| RT10 | IBRT, BWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Backward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| RT11 | IBRT, BWL three months, CTC, LS, DI (Impact of bank’s risk tolerance, Backward-looking three months, Credit terms and conditions, Loan supply, Diffusion index) |

| RT12 | IBRT, BWL three months, CTC, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Impact of bank’s risk tolerance, Backward-looking three months, Credit terms and conditions, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| STL1 | STL, BWL three months, CS, LS, DI (Short-term loans, Backward-looking three months, Credit standards, Loan supply, Diffusion index) |

| STL2 | STL, BWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Short-term loans, Backward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| STL3 | STL, BWL three months, LD, DI (Short-term loans, Backward-looking three months, Loan demand, Diffusion index) |

| STL4 | STL, BWL three months, LD, Net percentage (frequency of tightened minus that of eased or reverse) (Short-term loans, Backward-looking three months, Loan demand, Net percentage (frequency of tightened minus that of eased or reverse)) |

| STL5 | STL, FWL three months, CS, LS, DI (Short-term loans, Forward-looking three months, Credit standards, Loan supply, Diffusion index) |

| STL6 | STL, FWL three months, CS, LS, Net percentage (frequency of tightened minus that of eased or reverse) (Short-term loans, Forward-looking three months, Credit standards, Loan supply, Net percentage (frequency of tightened minus that of eased or reverse)) |

| STL7 | STL, FWL three months, LD, DI (Short-term loans, Forward-looking three months, Loan demand, Diffusion index) |

| STL8 | STL, FWL three months, LD, Net percentage (frequency of tightened minus that of eased or reverse) (Short-term loans, Forward-looking three months, Loan demand, Net percentage (frequency of tightened minus that of eased or reverse)) |

Appendix B

| Country Code | Country |

|---|---|

| 1 | Austria |

| 2 | Belgium |

| 3 | Italy |

| 4 | Cyprus |

| 5 | Germany |

| 6 | Estonia |

| 7 | Spain |

| 8 | Finland |

| 9 | France |

| 10 | Greece |

| 11 | Ireland |

| 12 | Lithuania |

| 13 | Luxembourg |

| 14 | Latvia |

| 15 | Malta |

| 16 | Netherlands |

| 17 | Portugal |

| 18 | Slovenia |

| 19 | Slovakia |

Appendix C

Appendix D

| Variable | Period | Observations | Mean | St. Deviation | Shapiro–Wilk | |

|---|---|---|---|---|---|---|

| Statistic | p | |||||

| R/CAi | 2019 Q4 | 19 | 19.795 | 2.625 | 0.884 | 0.356 * |

| 2020 Q1 | 18 | 19.844 | 2.887 | 0.914 | 0.503 * | |

| 2020 Q2 | 17 | 19.912 | 2.742 | 0.897 | 0.416 * | |

| 2020 Q3 | 4 | 20.125 | 3.998 | 0.842 | 0.201 * | |

| RT/CAi | 2019 Q4 | 19 | 18.026 | 2.852 | 0.871 | 0.303 * |

| 2020 Q1 | 18 | 18.306 | 3.349 | 0.892 | 0.392 * | |

| 2020 Q2 | 17 | 17.971 | 3.052 | 0.877 | 0.328 * | |

| 2020 Q3 | 4 | 18.450 | 4.769 | 0.833 | 0.175 * | |

| NLPi | 2019 Q4 | 19 | 22.700 | 30.649 | 0.986 | 0.936 * |

| 2020 Q1 | 18 | 21.839 | 32.162 | 0.998 | 0.992 * | |

| 2020 Q2 | 17 | 21.518 | 28.667 | 0.998 | 0.994 * | |

| 2020 Q3 | 4 | 5.350 | 3.563 | 0.966 | 0.814 * | |

| NP/TLi | 2019 Q4 | 19 | 6.0842 | 8.715 | 0.905 | 0.456 * |

| 2020 Q1 | 18 | 6.150 | 8.294 | 0.907 | 0.467 * | |

| 2020 Q2 | 17 | 6.159 | 9.160 | 0.909 | 0.475 * | |

| 2020 Q3 | 4 | 1.875 | 1.875 | 0.922 | 0.551 * | |

| ROAi | 2019 Q4 | 19 | 1.537 | 3.641 | 0.783 | 0.075 * |

| 2020 Q1 | 18 | 1.339 | 3.741 | 0.953 | 0.734 * | |

| 2020 Q2 | 17 | 1.200 | 4.025 | 0.990 | 0.957 * | |

| 2020 Q3 | 4 | 0.500 | 0.627 | 0.972 | 0.855 * | |

| ROEi | 2019 Q4 | 19 | 8.353 | 3.961 | 0.830 | 0.167 * |

| 2020 Q1 | 18 | 5.539 | 6.212 | 0.959 | 0.775 * | |

| 2020 Q2 | 17 | 3.188 | 7.148 | 0.820 | 0.144 * | |

| 2020 Q3 | 4 | 3.050 | 3.959 | 0.923 | 0.551 * | |

| IM/GIi | 2019 Q4 | 19 | 51.021 | 13.708 | 0.999 | 0.997 * |

| 2020 Q1 | 18 | 52.028 | 16.739 | 0.160 | 0.160 * | |

| 2020 Q2 | 17 | 53.224 | 14.876 | 0.142 | 0.142 * | |

| 2020 Q3 | 4 | 62.150 | 2.453 | 0.800 | 0.800 * | |

| NE/GIi | 2019 Q4 | 19 | 64.547 | 13.711 | 0.972 | 0.577 * |

| 2020 Q1 | 18 | 64.450 | 18.004 | 0.979 | 0.895 * | |

| 2020 Q2 | 17 | 59.494 | 14.979 | 0.899 | 0.428 * | |

| 2020 Q3 | 4 | 59.650 | 4.901 | 0.913 | 0.496 * | |

| LA/TAi | 2019 Q4 | 19 | 25.353 | 12.793 | 0.828 | 0.163 * |

| 2020 Q1 | 18 | 26.383 | 13.731 | 0.862 | 0.267 * | |

| 2020 Q2 | 17 | 26.382 | 10.678 | 0.822 | 0.148 * | |

| 2020 Q3 | 4 | 23.225 | 4.332 | 0.809 | 0.119 * | |

| LA/SLi | 2019 Q4 | 19 | 45.753 | 32.019 | 0.834 | 0.178 * |

| 2020 Q1 | 18 | 43.322 | 30.453 | 0.813 | 0.128 * | |

| 2020 Q2 | 17 | 49.282 | 33.643 | 0.810 | 0.120 * | |

| 2020 Q3 | 4 | 45.475 | 23.032 | 0.826 | 0.157 * | |

| C/Ai | 2019 Q4 | 19 | 8.558 | 2.119 | 0.869 | 0.411 * |

| 2020 Q1 | 18 | 8.367 | 2.088 | 0.930 | 0.595 * | |

| 2020 Q2 | 17 | 7.953 | 2.054 | 0.937 | 0.638 * | |

| 2020 Q3 | 4 | 8.900 | 2.157 | 0.925 | 0.567 * | |

| LE/Ci | 2019 Q4 | 19 | 55.705 | 76.299 | 0.881 | 0.342 * |

| 2020 Q1 | 18 | 47.939 | 64.031 | 0.886 | 0.365 * | |

| 2020 Q2 | 16 | 44.406 | 50.890 | 0.880 | 0.449 * | |

| 2020 Q3 | 4 | 25.625 | 18.788 | 0.879 | 0.334 * | |

| LDSi | 2019 Q4 | 12 | 204.192 | 132.082 | 0.966 | 0.648 * |

| 2020 Q1 | 10 | 227.050 | 119.715 | 0.971 | 0.672 * | |

| 2020 Q2 | 9 | 215.697 | 122.571 | 0.963 | 0.628 * | |

| 2020 Q3 | 3 | 146.400 | 99.837 | 0.962 | 0.623 * | |

| CL/TLi | 2019 Q4 | 16 | 90.088 | 16.172 | 0.769 | 0.057 * |

| 2020 Q1 | 15 | 90.419 | 18.129 | 0.841 | 0.199 * | |

| 2020 Q2 | 13 | 95.031 | 20.628 | 0.935 | 0.626 * | |

| 2020 Q3 | 4 | 92.500 | 13.680 | 0.965 | 0.811 * | |

Appendix E

| The Difference of Indicators Means | Paired Differences | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean. | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | ||||||

| Pair | Lower | Upper | t | df | Sig. | ||||

| R/CAi | Pair I | 0.094 | 1.292 | 0.305 | −0.548 | 0.737 | 0.310 | 17 | 0.760 ** |

| Pair II | −0.353 | 0.764 | 0.185 | −0.746 | 0.039 | −1.904 | 16 | 0.075 ** | |

| Pair III | −0.675 | 0.499 | 0.248 | −1.469 | 0.119 | −2.705 | 3 | 0.074 ** | |

| Pair IV | −0.563 | 0.631 | 0.158 | −0.899 | −0.226 | −3.564 | 15 | 0.003 * | |

| Pair V | −0.650 | 0.387 | 0.194 | −1.266 | −0.034 | −3.357 | 3 | 0.044 * | |

| Pair VI | −0.100 | 0.294 | 0.147 | −0.568 | 0.368 | −0.679 | 3 | 0.546 ** | |

| RT/CAi | Pair I | −0.106 | 1.342 | 0.316 | −0.773 | 0.562 | −0.334 | 17 | 0.743 ** |

| Pair II | −0.271 | 0.802 | 0.195 | −0.683 | 0.142 | −1.391 | 16 | 0.183 ** | |

| Pair III | −0.575 | 0.499 | 0.249 | −1.369 | 0.219 | −2.304 | 3 | 0.105 ** | |

| Pair IV | −0.275 | 0.629 | 0.157 | −0.611 | 0.061 | −1.747 | 15 | 0.101 ** | |

| Pair V | −0.575 | 0.320 | 0.160 | −1.084 | −0.066 | −3.592 | 3 | 0.037 * | |

| Pair VI | −0.050 | 0.311 | 0.155 | −0.545 | 0.445 | −0.322 | 3 | 0.769 ** | |

| NLPi | Pair I | 0.482 | 2.347 | 0.569 | −0.724 | 1.689 | 0.847 | 16 | 0.409 ** |

| Pair II | 2.219 | 4.787 | 1.197 | −0.332 | 4.769 | 1.854 | 15 | 0.084 ** | |

| Pair III | 1.000 | 0.931 | 0.465 | −0.481 | 2.481 | 2.148 | 3 | 0.121 ** | |

| Pair IV | 2.207 | 5.208 | 1.345 | −0.678 | 5.091 | 1.641 | 14 | 0.123 ** | |

| Pair V | 0.575 | 0.427 | 0.214 | −0.105 | 1.255 | 2.692 | 3 | 0.074 ** | |

| Pair VI | 0.475 | 0.350 | 0.175 | −0.082 | 1.032 | 2.714 | 3 | 0.073 ** | |

| NP/TLi | Pair I | −0.129 | 1.547 | 0.375 | −0.925 | 0.666 | −0.345 | 16 | 0.735 ** |

| Pair II | 0.331 | 1.313 | 0.328 | −0.368 | 1.031 | 1.009 | 15 | 0.329 ** | |

| Pair III | 0.150 | 0.129 | 0.065 | −0.055 | 0.355 | 2.324 | 3 | 0.103 ** | |

| Pair IV | 0.553 | 1.699 | 0.439 | −0.388 | 1.495 | 1.261 | 14 | 0.228 ** | |

| Pair V | 0.100 | 0.082 | 0.041 | −0.029 | 0.229 | 2.449 | 3 | 0.092 ** | |

| Pair VI | 0.075 | 0.050 | 0.025 | −0.005 | 0.155 | 3.000 | 3 | 0.058 ** | |

| ROAi | Pair I | 0.253 | 0.420 | 0.102 | 0.037 | 0.469 | 2.483 | 16 | 0.024* |

| Pair II | 0.494 | 0.433 | 0.108 | 0.263 | 0.724 | 4.564 | 15 | 0.000 * | |

| Pair III | 0.350 | 0.332 | 0.166 | −0.178 | 0.878 | 2.111 | 3 | 0.125 ** | |

| Pair IV | 0.233 | 0.324 | 0.084 | 0.054 | 0.413 | 2.786 | 14 | 0.015 * | |

| Pair V | 0.025 | 0.330 | 0.165 | −0.501 | 0.551 | 0.151 | 3 | 0.889 ** | |

| Pair VI | 0.253 | 0.420 | 0.102 | 0.037 | 0.469 | 2.483 | 16 | 0.024 * | |

| ROEi | Pair I | 3.147 | 4.443 | 1.077 | 0.863 | 5.431 | 2.921 | 16 | 0.010 * |

| Pair II | 5.738 | 3.996 | 0.999 | 3.608 | 7.867 | 5.744 | 15 | 0.000 * | |

| Pair III | 5.300 | 3.004 | 1.502 | 0.519 | 10.081 | 3.528 | 3 | 0.039 * | |

| Pair IV | 2.507 | 3.184 | 0.822 | 0.743 | 4.269 | 3.049 | 14 | 0.009 * | |

| Pair V | 1.000 | 4.586 | 2.293 | −6.297 | 8.297 | 0.436 | 3 | 0.692 ** | |

| Pair VI | 3.147 | 4.442 | 1.077 | 0.863 | 5.431 | 2.921 | 16 | 0.010 * | |

| IM/GIi | Pair I | −0.923 | 8.187 | 1.986 | −5.133 | 3.286 | −0.465 | 16 | 0.648 ** |

| Pair II | −0.638 | 6.943 | 1.736 | −4.337 | 3.062 | −0.367 | 15 | 0.719 ** | |

| Pair III | −2.100 | 5.531 | 2.766 | −10.901 | 6.701 | −0.759 | 3 | 0.503 ** | |

| Pair IV | 0.067 | 5.738 | 1.482 | −3.111 | 3.244 | 0.045 | 14 | 0.965 ** | |

| Pair V | 1.925 | 15.121 | 7.561 | −22.136 | 25.986 | 0.255 | 3 | 0.815 ** | |

| Pair VI | −3.375 | 9.096 | 4.548 | −17.848 | 11.098 | −0.742 | 3 | 0.512 ** | |

| NE/GIi | Pair I | 0.018 | 9.312 | 2.258 | −4.769 | 4.805 | 0.008 | 16 | 0.994 ** |

| Pair II | 4.156 | 6.816 | 1.704 | 0.524 | 7.788 | 2.439 | 15 | 0.028 * | |

| Pair III | 1.700 | 7.193 | 3.596 | −9.745 | 13.145 | 0.473 | 3 | 0.669 ** | |

| Pair IV | 4.267 | 6.244 | 1.612 | 0.809 | 7.725 | 2.646 | 14 | 0.019 * | |

| Pair V | 3.175 | 14.919 | 7.459 | −20.564 | 26.914 | 0.426 | 3 | 0.699 ** | |

| Pair VI | −3.575 | 9.604 | 4.802 | −18.857 | 11.707 | −0.744 | 3 | 0.511 ** | |

| LA/TAi | Pair I | −0.182 | 1.469 | 0.356 | −0.938 | 0.573 | −0.512 | 16 | 0.616 ** |

| Pair II | −2.125 | 2.146 | 0.537 | −3.269 | −0.981 | −3.961 | 15 | 0.001 * | |

| Pair III | −3.600 | 0.983 | 0.492 | −5.164 | −2.036 | −7.323 | 3 | 0.005 * | |

| Pair IV | −1.960 | 1.299 | 0.335 | −2.679 | −1.241 | −5.845 | 14 | 0.000 * | |

| Pair V | −2.975 | 0.263 | 0.132 | −3.393 | −2.557 | −22.624 | 3 | 0.000 * | |

| Pair VI | −0.700 | 0.439 | 0.219 | −1.399 | −0.0003 | −3.184 | 3 | 0.050 * | |

| LA/SLi | Pair I | −0.182 | 1.469 | 0.357 | −0.938 | 0.573 | −0.512 | 16 | 0.616 ** |

| Pair II | −2.125 | 2.146 | 0.537 | −3.269 | −0.981 | −3.961 | 15 | 0.001 * | |

| Pair III | −3.600 | 0.983 | 0.492 | −5.164 | −2.036 | −7.323 | 3 | 0.005 * | |

| Pair IV | −1.960 | 1.299 | 0.336 | −2.679 | −1.241 | −5.845 | 14 | 0.000 * | |

| Pair V | −2.975 | 0.263 | 0.132 | −3.393 | −2.557 | −22.624 | 3 | 0.000 * | |

| Pair VI | −0.700 | 0.439 | 0.219 | −1.399 | −0.0003 | −3.184 | 3 | 0.050 * | |

| C/Ai | Pair I | 0.294 | 0.456 | 0.107 | 0.068 | 0.521 | 2.742 | 17 | 0.014 * |

| Pair II | 0.606 | 0.419 | 0.102 | 0.390 | 0.821 | 5.962 | 16 | 0.000 * | |

| Pair III | 0.600 | 0.408 | 0.204 | −0.049 | 1.249 | 2.939 | 3 | 0.061 ** | |

| Pair IV | 0.275 | 0.272 | 0.068 | 0.130 | 0.419 | 4.044 | 15 | 0.001 * | |

| Pair V | 0.550 | 0.311 | 0.155 | 0.055 | 1.045 | 3.538 | 3 | 0.038 * | |

| Pair VI | −0.025 | 0.150 | 0.075 | −0.264 | 0.214 | −0.333 | 3 | 0.761 ** | |

| LE/Ci | Pair I | −1.627 | 10.588 | 3.193 | −8.741 | 5.486 | −0.510 | 10 | 0.621 ** |

| Pair II | −3.750 | 8.775 | 2.775 | −10.027 | 2.527 | −1.351 | 9 | 0.210 ** | |

| Pair III | 1.250 | 3.465 | 2.450 | −29.880 | 32.380 | 0.510 | 1 | 0.700 ** | |

| Pair IV | 0.011 | 7.305 | 2.435 | −5.604 | 5.626 | 0.005 | 8 | 0.996 ** | |

| Pair V | 0.750 | 1.061 | 0.750 | −8.779 | 10.279 | 1.000 | 1 | 0.500 ** | |

| Pair VI | 2.600 | 2.546 | 1.800 | −20.271 | 25.471 | 1.444 | 1 | 0.386 ** | |

| LDSi | Pair I | 4.010 | 7.394 | 2.338 | −1.279 | 9.299 | 1.715 | 9 | 0.120 ** |

| Pair II | 4.211 | 6.379 | 2.126 | −0.692 | 9.114 | 1.981 | 8 | 0.083 ** | |

| Pair III | 7.067 | 6.900 | 3.984 | −10.074 | 24.208 | 1.774 | 2 | 0.218 ** | |

| Pair IV | 2.111 | 2.816 | 0.939 | −0.053 | 4.276 | 2.249 | 8 | 0.055 ** | |

| Pair V | 5.233 | 4.131 | 2.385 | −5.028 | 15.495 | 2.194 | 2 | 0.159 ** | |

| Pair VI | 2.133 | 0.808 | 0.467 | 0.125 | 4.141 | 4.571 | 2 | 0.045 * | |

| CL/TLi | Pair I | −0.331 | 5.528 | 1.382 | −3.277 | 2.615 | −0.240 | 15 | 0.814 ** |

| Pair II | −3.650 | 13.364 | 3.858 | −12.141 | 4.841 | −0.946 | 11 | 0.364 ** | |

| Pair III | −0.200 | 7.199 | 3.599 | −11.656 | 11.256 | −0.056 | 3 | 0.959 ** | |

| Pair IV | −3.243 | 7.415 | 2.141 | −7.953 | 1.469 | −1.514 | 11 | 0.158 ** | |

| Pair V | −1.550 | 6.259 | 3.129 | −11.509 | 8.409 | −0.495 | 3 | 0.654 ** | |

| Pair VI | −0.225 | 1.559 | 0.779 | −2.705 | 2.255 | −0.289 | 3 | 0.792 ** | |

References

- Baziki, S.B.; Capacioglu, T. Bank Lending and Maturity: The Anatomy of the Transmission of Monetary Policy; Central Bank of Turkey: Ankara, Turkey, 2020. [Google Scholar]

- Black, L.K.; Rosen, R.J. How the Credit Channel Works: Differentiating the Bank Lending Channel and the Balance Sheet Channel; Working Paper Series, WP-07-13; Federal Reserve Bank of Chicago: Chicago, IL, USA, 2007. [Google Scholar]

- Bottero, M.; Lenzu, S.; Mezzanotti, F. Sovereign debt exposure and the bank lending channel: Impact on credit supply and the real economy. J. Int. Econ. 2020, 126, 103328. [Google Scholar] [CrossRef]

- Caporale, G.M.; Çatık, A.N.; Helmi, M.H.; Ali, F.M.; Tajik, M. The bank lending channel in the Malaysian Islamic and conventional banking system. Glob. Financ. J. 2020, 45, 100478. [Google Scholar] [CrossRef]

- Chirinos-Leañez, A.M.; Pagliacci, C. Credit Supply in Venezuela: A Non-Conventional Bank Lending Channel? Inter-American Development Bank: Washington, DC, USA, 2017; p. 8256. [Google Scholar]

- Ciccarelli, M.; Maddaloni, A.; Peydró, J.L. Trusting the Bankers a New Look at the Credit Channel of Monetary Policy; Elsevier: Amsterdam, The Netherlands, 2010. [Google Scholar]

- Elliott, D.; Meisenzahl, R.R.; Peydro, J.-L.; Turner, B.C. Nonbanks, Banks, and Monetary Policy: U.S. Loan-Level Evidence since the 1990s. SSRN Electron. J. 2019, 14989. [Google Scholar] [CrossRef]

- Filardo, A.J.; Siklos, P.L. The cross-border credit channel and lending standards surveys. J. Int. Financ. Mark. Inst. Money 2020, 67, 101206. [Google Scholar] [CrossRef]

- Fisera, B.; Kotlebova, J. Expansionary monetary policy and bank lending: The case of new Euro Area member states. Int. J. Monet. Econ. Financ. 2020, 13, 383–416. [Google Scholar] [CrossRef]

- Gonzalez, R.B. Monetary Policy Surprises and Employment: Evidence from Matched Bank-Firm Loan Data on the Bank Lending-Channel; Research Department Working Papers Series; Central Bank of Brazil: Brasilia, Brazil, 2020; p. 518.

- Greenwald, D.L.; Krainer, J.; Paul, P. The Credit Line Channel; Federal Reserve Bank of San Francisco Working Paper 2020-26; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2020.

- Ivashina, V.; Laeven, L.; Moral-Benito, E. Loan Types and the Bank Lending Channel; CEPR Discussion Paper; Banco de España: Madrid, Spain, 2020; pp. 1–55. [Google Scholar] [CrossRef]

- Lane, P.R. Monetary Policy in a Pandemic: Ensuring Favourable Financing Conditions. Available online: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201126~c5c1036327.en.html (accessed on 16 December 2020).

- Zhang, M.; Zhang, Y. Monetary Stimulus Policy in China: The Bank Credit Channel; Working Papers 2001; Department of Economics, University of Windsor: Windsor, ON, Canada, 2020. [Google Scholar]

- Naiborhu, E.D. The lending channel of monetary policy in Indonesia. J. Asian Econ. 2020, 67, 101175. [Google Scholar] [CrossRef]

- Saibal, G. Bank Lending and Monetary Transmission: Does Politics Matter? J. Quant. Econ. 2020, 18, 359–381. [Google Scholar]

- Bergant, K.; Grigoli, F.; Hansen, N.J.; Sandri, D. Dampening Global Financial Shocks: Can Macroprudential Regulation Help (More than Capital Controls)? IMF Working Paper No. 20/106; IMF: Washington, DC, USA, 2020. [Google Scholar] [CrossRef]

- Duquerroy, A.; Mazet-Sonilhac, C. Funding Shock: How Will the Investment of Large French Firms Be Affected? Available online: https://publications.banque-france.fr/en/funding-shock-how-will-investment-large-french-firms-be-affected (accessed on 9 December 2020).

- Endrész, M. The Bank Lending Channel during Financial Turmoil; Central Bank of Hungary: Budapest, Hungary, 2020. [Google Scholar]

- Hsieh, M.-F.; Lee, C.-C. Foreign bank lending during a crisis: The impact of financial regulations. Econ. Syst. 2020, 44. [Google Scholar] [CrossRef]

- Kehoe, P.J.; Lopez, P.; Midrigan, V.; Pastorino, E. On the Importance of Household versus Firm Credit Frictions in the Great Recession; Federal Reserve Bank of Cleveland Working Papers, No. 20-28; Federal Reserve Bank of Cleveland: Cleveland, OH, USA, 2020. [Google Scholar]

- Diao, X. Do the Capital Requirements Affect the Effectiveness of Monetary Policy from the Credit Channel? J. Appl. Financ. Bank. 2020, 10, 1–6. [Google Scholar]

- Maruyama, Y. A Model of Monetary Transmission Mechanism; Center for Open Science: Charlottesville, VA, USA, 2020. [Google Scholar]

- Ons, M. The Impact of Real Economic Activity on the Effectiveness of Monetary Policy Transmission: The Case of Tunisia; IHEID Working Papers, No. 12-2020; Graduate Institute of International and Development Studies: Geneva, Switzerland, 2020. [Google Scholar]

- Rashid, A.; Hassan, M.K.; Shah, M.A.R. On the role of Islamic and conventional banks in the monetary policy transmission in Malaysia: Do size and liquidity matter? Res. Int. Bus. Financ. 2020, 52, 101123. [Google Scholar] [CrossRef]

- Mian, A.; Sufi, A.; Verner, E. How Does Credit Supply Expansion Affect the Real Economy? The Productive Capacity and Household Demand Channels. J. Finance 2020, 75, 949–994. [Google Scholar] [CrossRef]

- Occhino, F. Quantitative Easing and Direct Lending in Response to the COVID-19 Crisis. SSRN Electron. J. 2020, 202029. [Google Scholar] [CrossRef]

- Urbschat, F.; Watzka, S. Quantitative easing in the Euro Area—An event study approach. Q. Rev. Econ. Financ. 2020, 77, 14–36. [Google Scholar] [CrossRef]

- Al Dhaheri, A.; Nobanee, H. Financial Stability and Sustainable Finance: A Mini-Review. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Dang, V.D. The conditioning role of performance on the bank risk-taking channel of monetary policy: Evidence from a multiple-tool regime. Res. Int. Bus. Financ. 2020, 54, 101301. [Google Scholar] [CrossRef]

- Foglia, M.; Cartone, A.; Fiorelli, C. Structural Differences in the Eurozone: Measuring Financial Stability by FCI. Macroecon. Dyn. 2018, 24, 69–92. [Google Scholar] [CrossRef]

- Kawamoto, T.; Matsuda, T.; Takahashi, K.; Tamanyu, Y. Bank Risk Taking and Financial Stability: Evidence from Japan’s Loan Market; Bank of Japan Working Paper Series, 20-E-1; Bank of Japan: Tokyo, Japan, 2020. [Google Scholar]

- Zulkhibri, M.; Rizky Prima Sakti, M. Macroprudential policy and financing behaviour in emerging markets: Bank-level evidence from Indonesian dual banking. Afro-Asian J. Financ. Account. 2020, 10, 514–536. [Google Scholar] [CrossRef]

- Das, U.S.; Surti, J.; Ahmed, F.; Papaioannou, M.G.; Pedras, G. Managing Public Debt and its Financial Stability Implications; IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar] [CrossRef]

- Giese, J.; Haldane, A. COVID-19 and the financial system: A tale of two crises. Oxf. Rev. Econ. Policy 2020, 36, S200–S214. [Google Scholar] [CrossRef]

- ECB. Progress Towards a Framework for Financial Stability Assessment. Speech by José-Manuel González-Páramo, Member of the Executive Board. ECB, OECD World Forum on “Statistics, Knowledge and Policy,” 28 June 2007. Available online: http://www.ecb.int/press/key/date/2007/html/sp070628.en.html#fnid4 (accessed on 12 June 2020).

- Schinasi, G.J. Defining Financial Stability (October 2004). IMF Working Paper No. 04/187. Available online: https://ssrn.com/abstract=879012 (accessed on 9 December 2020).

- Gnan, E. The Interaction of Political, Fiscal and Financial Stability: Lessons from the Crisis. Main Findings from the 2012 SUERF Annual Lecture and Joint/OeNB Workshop in Vienna 2012. Available online: http://imap.suerf.org/download/nl/0712.pdf (accessed on 24 June 2020).

- Tumpel-Gugerell, G. European Integration and the Financial System. In Proceedings of the Third Conference of the Monetary Stability Foundation: Chalenges to the Financial System Ageing and Low Growth, Frankfurt am Main, Germany, 6–7 July 2006; Available online: http://www.bundesbank.de/vfz/vfz_konferenzen_2006.en.php#monetary (accessed on 8 May 2020).

- Cecchetti, S. Fiscal Policy and Its Implications for Monetary and Financial Stability; BIS Papers, No. 59; Bank for International Settlements: Basel, Switzerland, 2011; pp. 1–5. [Google Scholar]

- Parisi, F. But This Time IS Different—COVID Recession. J. Struct. Financ. 2020, 26, 63–70. [Google Scholar] [CrossRef]

- Phillips, G.; Adelson, M. PERSPECTIVES: CLO Credit Ratings Gone Awry. J. Struct. Financ. 2020, 26, 10–17. [Google Scholar] [CrossRef]

- Nothaft, F.E. The Pandemic’s Effect on the Housing Market and Mortgage Delinquency. J. Struct. Financ. 2020, 26, 41–51. [Google Scholar] [CrossRef]

- Kiseľáková, D.; Filip, P.; Onuferová, E.; Valentiny, T. The Impact of Monetary Policies on the Sustainable Economic and Financial Development in the Euro Area Countries. Sustainability 2020, 12, 9367. [Google Scholar] [CrossRef]

- Pinshi, C.P. Monetary Policy, Uncertainty and COVID-19. J. Appl. Econ. Sci. 2020, 3, 579–593. [Google Scholar] [CrossRef]

- Benmelech, E.; Tzur-Ilan, N. The Determinants of Fiscal and Monetary Policies During the COVID-19 Crisis. SSRN Electron. J. 2020, 27461. [Google Scholar] [CrossRef]

- Sarker, P.K. COVID Crisis: Fiscal, Monetary and Macro-financial Policy Responses. SSRN Electron. J. 2020, XXVII, 41–45. [Google Scholar] [CrossRef]

- Bauer, G.H.; Granziera, E. Monetary Policy, Private Debt and Financial Stability Risks. SSRN Electron. J. 2016, 2869044. [Google Scholar] [CrossRef][Green Version]

- Healey, J.; Mosser, P.; Rosen, K.; Tache, A. The Future of Financial Stability and Cyber Risk. The Brookings Institution Cybersecurity Project, 1–18 October 2018. Available online: https://www.brookings.edu/research/the-future-of-financial-stability-and-cyber-risk/ (accessed on 9 December 2020).

- Ziolo, M.; Filipiak, B.Z.; Bąk, I.; Cheba, K. How to Design More Sustainable Financial Systems: The Roles of Environmental, Social, and Governance Factors in the Decision-Making Process. Sustainability 2019, 11, 5604. [Google Scholar] [CrossRef]

- Davies, H. The $19,000 Question: How Will the Economic Consequences of the Coronavirus Pandemic Affect the Financial System? Glob. Perspect. 2020, 1. [Google Scholar] [CrossRef]

- Reinders, H.J.; Schoenmaker, D.; Van Dijk, M.A. Is COVID-19 a Treat to Financial Stability in Europe? CEPR Discussion Paper DP14922; Centre for Economic Policy Research: London, UK, 2020; p. DP14922. [Google Scholar]

- Jackson, H.E.; Schwarcz, S.L. Protecting Financial Stability: Lessons from the Coronavirus Pandemic. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Boot, A.; Carletti, E.; Haselman, R.; Kotz, H.; Krahnen, J.P.; Pelizzon, L.; Schaeffer, S.; Subrahmanyam, M. The Coronavirus and Financial Stability; SAFE Policy Letter No. 78; SAFE: Frankfurt am Main, Germany, 2020. [Google Scholar]

- Haldane, A.; Saporta, V.; Hall, S.; Tanaka, M. Financial Stability and Macroeconomic Models. In Financial Stability Review; Bank of England: London, UK, 2004. [Google Scholar]

- Adrian, T.; Natalucci, F. Covid-19 Crisis Poses Threat to Financial Stability. International Monetary Fund Blog. 14 April 2020. Available online: https://blogs.imf.org/2020/04/14/covid-19-crisis-poses-threat-to-financial-stability/ (accessed on 15 November 2020).

- Ito, T. Impact of the coronavirus pandemic crisis on the financial system in the eurozone. J. Corp. Acc. Financ. 2020, 31, 15–20. [Google Scholar] [CrossRef]

- Disemadi, H.S.; Shaleh, A.I. Banking credit restructuring policy amid COVID-19 pandemic in Indonesia. J. Inov. Ekon. 2020, 5, 63–70. [Google Scholar] [CrossRef]

- Tokic, D. Long-term consequences of the 2020 coronavirus pandemics: Historical global-macro context. J. Corp. Account. Finance 2020, 31, 9–14. [Google Scholar] [CrossRef]

- Lopotenco, V. The Financial System Challenges of the Republic of Moldova in the Pandemic COVID 19 Context. Int. J. Innov. Technol. Econ. 2020, 4, 1–5. [Google Scholar] [CrossRef]

- Korzeb, Z.; Niedziółka, P. Resistance of commercial banks to the crisis caused by the COVID-19 pandemic: The case of Poland. Equilibrium 2020, 15, 205–234. [Google Scholar] [CrossRef]

- Yi-Wei, L. Impact of Covid-19 on Interest Rates. J. Asian Multicult. Res. Econ. Manag. Study 2020, 1, 7–11. [Google Scholar] [CrossRef]

- Barua, B.; Barua, S. COVID-19 implications for banks: Evidence from an emerging economy. SN Bus. Econ. 2021, 1, 1–28. [Google Scholar] [CrossRef]

- Eich, F.; Kuspert, T.; Schulz, P. The Corona Crisis and the Stability of the European Banking Sector. A Repeat of the Great Financial Crisis? Bertelsmann Stiftung Repair and Prepare Strengthening Europe 2020. Available online: https://www.bertelsmann-stiftung.de/en/publications/publication/did/the-corona-crisis-and-the-stability-of-the-european-banking-sector-all (accessed on 21 April 2020).

- Albulescu, C.T. Assessing Romanian Financial Sector Stability: The Importance of the International Economic Climate. MPRA Paper 16581. 2008. Available online: http://mpra.ub.unimuenchen.de/16581/1/MPRA_paper_16581.pdf (accessed on 1 November 2020).

- Nelson, W.R.; Perli, R. Selected Indicators of Financial Stability. In Proceedings of the 4th Joint Central Bank Research Conference on Risk Measurement and Systemic Risk, Frankfurt am Main, Germany, 8–9 November 2005; pp. 343–365. Available online: https://www.ecb.europa.eu/pub/pdf/other/riskmeasurementandsystemicrisk200704en.pdf (accessed on 12 November 2020).

- Gray, D.; Merton, R.; Bodie, Z. New Framework for Measuring and Managing Macrofinancial Risk and Financial Stability; Working Paper 13607; National Bureau of Economic Research: Cambridge, MA, USA, 2007. [Google Scholar] [CrossRef]

- Financial Soundness Indicators and the IMF. 2019. Available online: https://www.imf.org/external/np/sta/fsi/eng/fsi.htm (accessed on 9 December 2020).

| Value | Count | Percent | Cumulative Count | Cumulative Percent |

|---|---|---|---|---|

| [0, 50,000) | 17 | 85.00 | 17 | 85.00 |

| [50,000, 100,000) | 1 | 5.00 | 18 | 90.00 |

| [100,000, 150,000) | 1 | 5.00 | 19 | 95.00 |

| [150,000, 200,000) | 1 | 5.00 | 20 | 100.00 |

| Total | 20 | 100.00 | 20 | 100.00 |

| Value | Count | Percent | Cumulative Count | Cumulative Percent |

|---|---|---|---|---|

| [4, 6) | 2 | 10.00 | 2 | 10.00 |

| [6, 8) | 7 | 35.00 | 9 | 45.00 |

| [8, 10) | 8 | 40.00 | 17 | 85.00 |

| [10, 12) | 3 | 15.00 | 20 | 100.00 |

| Total | 20 | 100.00 | 20 | 100.00 |

| Value | Count | Percent | Cumulative Count | Cumulative Percent |

|---|---|---|---|---|

| [6, 7) | 5 | 25.00 | 5 | 25.00 |

| [7, 8) | 6 | 30.00 | 11 | 55.00 |

| [8, 9) | 3 | 15.00 | 14 | 70.00 |

| [9, 10) | 4 | 20.00 | 18 | 90.00 |

| [10, 11) | 2 | 10.00 | 20 | 100.00 |

| Total | 20 | 100.00 | 20 | 100.00 |

| Value | Count | Percent | Cumulative Count | Cumulative Percent |

|---|---|---|---|---|

| [0, 10,000) | 16 | 80.00 | 16 | 80.00 |

| [10,000, 20,000) | 1 | 5.00 | 17 | 85.00 |

| [20,000, 30,000) | 2 | 10.00 | 19 | 95.00 |

| [30,000, 40,000) | 1 | 5.00 | 20 | 100.00 |

| Total | 20 | 100.00 | 20 | 100.00 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 2.223 | 0.0578 | 38.460 | 0 |

| RT11 | 3.152 | 0.235 | 13.428 | 0 |

| RT10 | 2.100 | 0.122 | 17.275 | 0 |

| RT3 | 1.796 | 0.173 | 10.361 | 0 |

| STL5 | 1.557 | 0.035 | 44.207 | 0 |

| CR3 | 1.097 | 0.272 | 4.032 | 0.0001 |

| RT6 | 1.002 | 0.077 | 12.960 | 0 |

| CR6 | 0.945 | 0.137 | 6.880 | 0 |

| RT1 | 0.821 | 0.110 | 7.465 | 0 |

| RT8 | 0.426 | 0.043 | 9.795 | 0 |

| M5 | 0.414 | 0.023 | 17.701 | 0 |

| LTL2 | 0.373 | 0.022 | 16.799 | 0 |

| STL7 | 0.289 | 0.009 | 29.957 | 0 |

| STL1 | 0.252 | 0.034 | 7.417 | 0 |

| LTL3 | 0.137 | 0.011 | 12.180 | 0 |

| STL4 | 0.084 | 0.007 | 11.777 | 0 |

| M2 | 0.074 | 0.013 | 5.719 | 0 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| RT9 | −4.261 | 0.239 | −17.847 | 0 |

| RT5 | −2.108 | 0.152 | −13.855 | 0 |

| CR5 | −1.763 | 0.271 | −6.515 | 0 |

| RT12 | −1.533 | 0.118 | −12.992 | 0 |

| RT4 | −0.905 | 0.089 | −10.113 | 0 |

| CR4 | −0.656 | 0.138 | −4.762 | 0 |

| RT7 | −0.612 | 0.084 | −7.264 | 0 |

| LTL1 | −0.565 | 0.042 | −13.586 | 0 |

| RT2 | −0.395 | 0.057 | −6.992 | 0 |

| STL6 | −0.371 | 0.018 | −20.153 | 0 |

| M1 | −0.242 | 0.024 | −10.019 | 0 |

| STL2 | −0.179 | 0.019 | −9.298 | 0 |

| STL8 | −0.168 | 0.006 | −28.802 | 0 |

| M6 | −0.146 | 0.013 | −11.680 | 0 |

| STL3 | −0.106 | 0.012 | −8.675 | 0 |

| LTL4 | −0.090 | 0.006 | −14.232 | 0 |

| Root MSE | 5.342964 | R-squared | 0.694426 |

| Mean dependent var | 2.468650 | Adjusted R-squared | 0.693865 |

| S.D. dependent var | 9.665766 | S.E. of regression | 5.348014 |

| Akaike info criterion | 6.193214 | Sum squared resid | 499006.1 |

| Schwarz criterion | 6.207880 | Log likelihood | −54095.69 |

| Hannan-Quinn criter. | 6.198044 | F-statistic | 1239.025 |

| Durbin-Watson stat | 1.820454 | Prob (F-statistic) | 0.000000 |

| Effects Specification | |||

|---|---|---|---|

| Cross-Section Fixed (Dummy Variables) | |||

| Root MSE | 5.133577 | R-squared | 0.717907 |

| Mean dependent var | 2.468650 | Adjusted R-squared | 0.683824 |

| S.D. dependent var | 9.676568 | S.E. of regression | 5.441091 |

| Akaike info criterion | 6.329162 | Sum squared resid | 11516.53 |

| Schwarz criterion | 6.777301 | Log likelihood | −1334.922 |

| Hannan-Quinn criter. | 6.506003 | F-statistic | 21.06335 |

| Durbin-Watson stat | 1.995636 | Prob (F-statistic) | 0.000000 |

| Variable | ITRXCDI | DP | TCe | NCe | TCperMe |

|---|---|---|---|---|---|

| Mean | 68.345 | 2.938 | 1,181,452 | 20,855.94 | 2824.766 |

| Median | 62.982 | 2.715 | 1,069,676 | 70,653.500 | 2481.808 |

| Maximum | 138.549 | 5.690 | 4,978,723 | 241412.0 | 12,957.80 |

| Minimum | 41.277 | 1.640 | 0.000 | 0.0000 | 0.0000 |

| Std. Dev. | 19.601 | 0.887 | 1,034,022 | 35,098.13 | 2571.426 |

| Skewness | 0.982 | 0.717 | 1.340 | 3.2028 | 1.5351 |

| Kurtosis | 3.628 | 2.701 | 5.134 | 15.0996 | 5.9922 |

| Jarque-Bera | 31.868 | 18.081 | 98.778 | 1577.544 | 154.691 |

| Probability | 0.000 | 0.0001 | 0.000 | 0.000 | 0.000 |

| Observations | 180 | 202 | 202 | 202 | 202 |

| Variable | Correlation | Probability | Correlation | Probability | Correlation | Probability |

|---|---|---|---|---|---|---|

| TCe | NCe | TCperMe | ||||

| ITRXCDI | −0.235 | 0.002 * | 0.094 | 0.208 *** | −0.259 | 0.001 * |

| DP | −0.179 | 0.016 ** | 0.052 | 0.487 *** | −0.204 | 0.006 * |

| Independent Variable | |||

|---|---|---|---|

| ITRXCDI | DP | ||

| TCe | Model constant | 74.864 | 3.205 |

| Coefficient | −7.23 × 10−6 | −2.26 × 10−7 | |

| t-value | −3.231 | −3.865 | |

| p-statistics | 0.002 * | 0.0002 * | |

| R squared | 0.056 | 0.069 | |

| Observations | 108 | 202 | |

| NeC | Model constant | 66.788 | 3.015 |

| Coefficient | 0.0001 | −3.60 × 10−6 | |

| t-value | 1.264 | −2.081 | |

| p-statistics | 0.208 *** | 0.039 ** | |

| R squared | 0.009 | 0.021 | |

| Observations | 108 | 202 | |

| TCperMe | Model constant | 75.428 | 3.203 |

| Coefficient | −0.003 | −9.36 × 10−5 | |

| t-value | −3.569 | −3.991 | |

| p-statistics | 0.001 * | 0.0001 * | |

| R squared | 0.067 | 0.074 | |

| Observations | 180 | 202 | |

| FDIi | LGi | MOi | MNi | TCi | NCi | TCperMi | |

|---|---|---|---|---|---|---|---|

| Mean | 0.155 | 2.595 | 1.978 | 1.801 | 72,840.38 | 19,524.02 | 3365.660 |

| Median | 0.131 | 4.076 | 2.036 | 1.627 | 4421.500 | 1047.000 | 1536.675 |

| Maximum | 0.484 | 61.086 | 4.338 | 3.640 | 1,412,709.00 | 416,490.0 | 37,035.70 |

| Minimum | 0.051 | −24.308 | 0.268 | −0.150 | 0.000 | 0.000 | 0.000 |

| St. deviation | 0.092 | 11.964 | 0.926 | 0.697 | 177,606.00 | 58,825.31 | 5123.041 |

| Skewness | 1.353 | 0.284 | 0.412 | 0.185 | 4.528 | 4.643 | 3.192 |

| Kurtosis | 4.547 | 5.129 | 2.821 | 2.624 | 28.443 | 25.835 | 16.317 |

| Jarque–Bera | 72.880 | 38.459 | 5.619 | 2.200 | 5773.792 | 4810.614 | 1726.620 |

| Probability | 0.000 | 0.000 | 0.000 | 0.333 | 0.000 | 0.000 | 0.000 |

| Observations | 180 | 190 | 190 | 190 | 190 | 190 | 190 |

| Variable | Correlation | Probability | Correlation | Probability | Correlation | Probability |

|---|---|---|---|---|---|---|

| TCi | NCi | TCperMi | ||||

| FDIi | −0.193 | 0.009 * | −0.149 | 0.046 ** | −0.302 | 0.000 * |

| LGi | 0.192 | 0.010 * | 0.052 | 0.485 *** | −0.069 | 0.352 *** |

| MOi | −0.284 | 0.0001 * | −0.124 | 0.097 *** | −0.102 | 0.010 * |

| MNi | −0.252 | 0.001 * | −0.169 | 0.023 ** | −0.136 | 0.068 *** |

| Independent Variable | |||||

|---|---|---|---|---|---|

| FDIi | LGi | MOi | MNi | ||

| TCi | C | 0.163 | 2.3253 | 1.979 | 1.786 |

| Coefficient | −1.09 × 10−7 | 3.70 × 10−6 | −2.39 × 10−8 | 2.00 × 10−7 | |

| t-value | −2.807 | 0.8612 | −0.514 | 1.976 | |

| p-statistics | 0.006 * | 0.3902 *** | 0.608 *** | 0.049 ** | |

| R squared | 0.042 | 0.0039 | 0.992 | 0.929 | |

| Observations | 180 | 190 | 190 | 190 | |

| Wald test | F(17.161) = 1.625 p = 0.063 (c) | F(18.170) = 10.743 p = 0.000 (f) | F(18.170) = 1026.312 p = 0.000 (f) | F(18.170) = 116.697 p = 0.000 (f) | |

| Hausman test | Chi−Sq.(1) = 1.743 p = 0.187 (r) | Chi−Sq.(1) = 2.027 p = 0.155 (r) | Chi−Sq.(1) = 4.499 p = 0.034 (f) | Chi−Sq.(1) = 5.687 p = 0.017 (f) | |

| F-statistics | 7.844 | 0.738 | 1059.745 | 118.713 | |

| DW | 1.237 | 0.227 | 0.668 | 1.442 | |

| NCi | C | 0.159 | 2.599 | 1.977 | 1.798 |

| Coefficient | −2.34 × 10−7 | −2.23 × 10−7 | 1.42 × 10−8 | 1.47 × 10−7 | |

| t-value | −2.015 | −0.018 | 0.109 | 0.516 | |

| p-statistics | 0.045 ** | 0.985 *** | 0.913 *** | 0.607 *** | |

| R squared | 0.022 | 0.0001 | 0.0001 | 0.001 | |

| Observations | 180 | 190 | 190 | 190 | |

| Wald test | F(17.161) = 1.427 p = 0.129 (c) | F(18.170) = 11.377 p = 0.000 (f) | F(18.170) = 1098.851 p = 0.000 (f) | F(18.170) = 118.705 p = 0.000(f) | |

| Hausman test | Chi−Sq.(1) = 0.116 p = 0.734 (r) | Chi−Sq.(1) = 0.359 p = 0.549 (r) | Chi−Sq.(1) = 1.097 p = 0.295(r) | Chi−Sq.(1) = 2.664 p = 0.103 (r) | |

| F-stat | 4.080 | 0.0003 | 0.012 | 0.608 | |

| DW | 1.230 | 0.225 | 0.611 | 1.267 | |

| TCperMi | C | 0.175 | 2.707 | 1.972 | 1.782 |

| Coefficient | −5.70 × 10−6 | −3.33 × 10−5 | 1.72 × 10−6 | 5.52 × 10−6 | |

| t-value | −4.519 | −0.249 | 1.211 | 1.777 | |

| p-statistics | 0.000 * | 0.803 *** | 0.228 *** | 0.077 *** | |

| R squared | 0.102 | 0.0003 | 0.992 | 0.016 | |

| Observations | 180 | 190 | 190 | 190 | |

| Wald test | F(17.161) = 1.805 p = 0.031 (f) | F(18.170) = 11.341 p = 0.000 (f) | F(18.170) = 1083.876 p = 0.000 (f) | F(18.170) = 122.521 p = 0.000 (f) | |

| Hausman test | Chi−Sq.(1) = 2.161 p = 0.142 (r) | Chi−Sq.(1) = 0.469 p = 0.493 (r) | Chi−Sq.(1) = 4.234 p = 0.039 (f) | Chi−Sq.(1) = 3.239 p = 0.072 (r) | |

| F-statistics | 20.287 | 0.062 | 1067.292 | 3.120 | |

| DW | 1.337 | 0.225 | 0.669 | 1.289 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teresienė, D.; Keliuotytė-Staniulėnienė, G.; Kanapickienė, R. Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic. Sustainability 2021, 13, 2692. https://doi.org/10.3390/su13052692

Teresienė D, Keliuotytė-Staniulėnienė G, Kanapickienė R. Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic. Sustainability. 2021; 13(5):2692. https://doi.org/10.3390/su13052692

Chicago/Turabian StyleTeresienė, Deimantė, Greta Keliuotytė-Staniulėnienė, and Rasa Kanapickienė. 2021. "Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic" Sustainability 13, no. 5: 2692. https://doi.org/10.3390/su13052692

APA StyleTeresienė, D., Keliuotytė-Staniulėnienė, G., & Kanapickienė, R. (2021). Sustainable Economic Growth Support through Credit Transmission Channel and Financial Stability: In the Context of the COVID-19 Pandemic. Sustainability, 13(5), 2692. https://doi.org/10.3390/su13052692