The Impact of Uncertainty on State-Level Housing Markets of the United States: The Role of Social Cohesion

Abstract

:1. Introduction

2. Data and Methodology

2.1. Data

2.2. Methodology

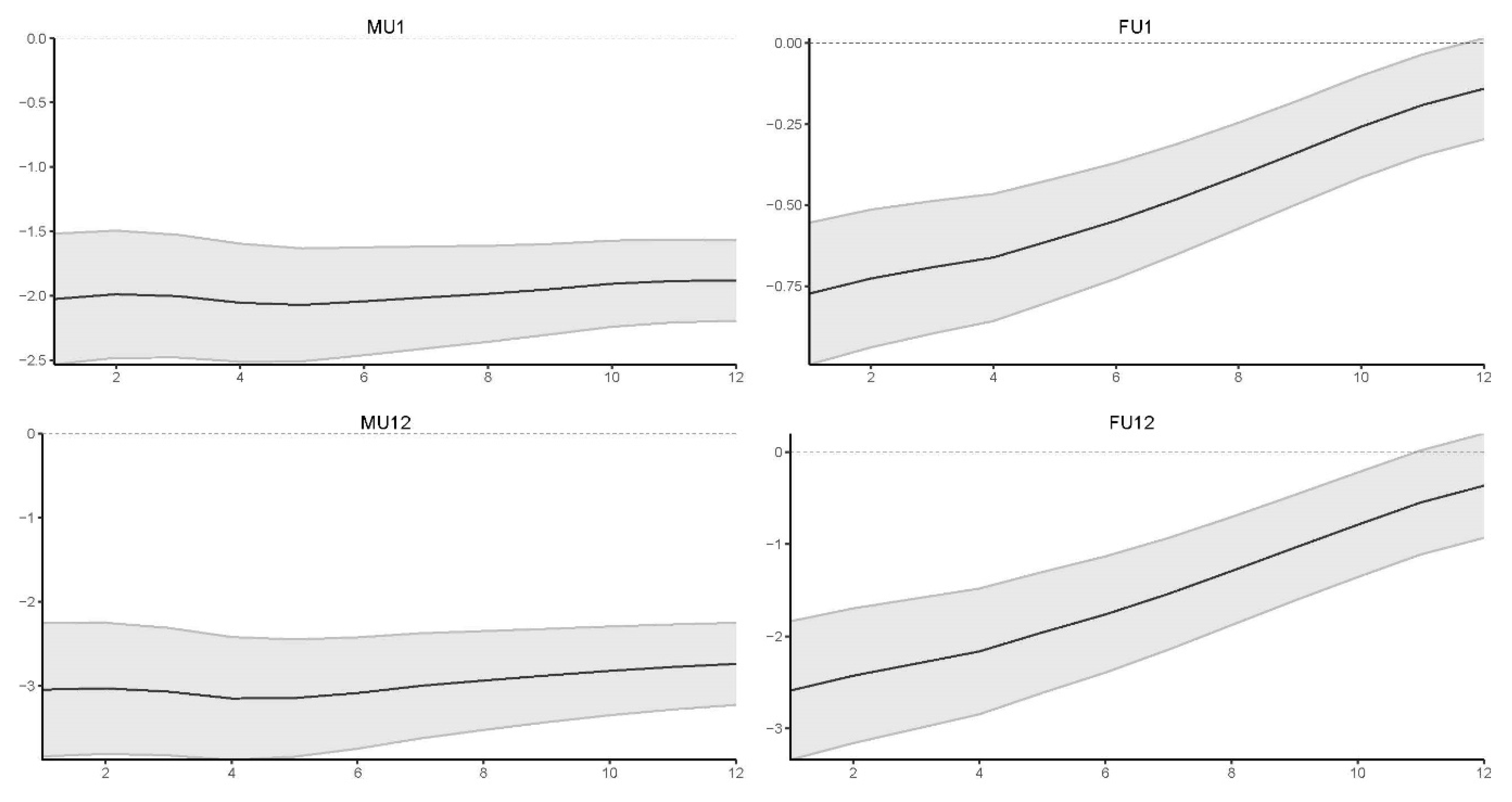

3. Empirical Results

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Gupta, R.; Ma, J.; Risse, M.; Wohar, M.E. Common business cycles and volatilities in US states and MSAs: The role of economic uncertainty. J. Macroecon. 2018, 57, 317–337. [Google Scholar] [CrossRef] [Green Version]

- Chuliá, H.; Gupta, R.; Uribe, J.M.; Wohar, M.E. Impact of US uncertainties on emerging and mature markets: Evidence from a quantile-vector autoregressive approach. J. Int. Financ. Mark. Inst. Money 2017, 48, 178–191. [Google Scholar] [CrossRef]

- Gupta, R.; Hammoudeh, S.; Modise, M.P.; Nguyen, D.K. Can economic uncertainty, financial stress and consumer sentiments predict US equity premium? J. Int. Financ. Mark. Inst. Money 2014, 33, 367–378. [Google Scholar] [CrossRef] [Green Version]

- Gupta, R.; Jooste, C. Unconventional monetary policy shocks in OECD countries: How important is the extent of policy uncertainty? Int. Econ. Econ. Policy 2018, 15, 683–703. [Google Scholar] [CrossRef]

- Gupta, R.; Lau, C.K.M.; Wohar, M.E. The impact of US uncertainty on the Euro area in good and bad times: Evidence from a quantile structural vector autoregressive model. Empirica 2019, 46, 353–368. [Google Scholar] [CrossRef] [Green Version]

- Pierdzioch, C.; Gupta, R. Uncertainty and forecasts of US recessions. Stud. Nonlinear Dyn. Econom. 2019, 24. [Google Scholar] [CrossRef]

- Mumtaz, H. Does uncertainty affect real activity? Evidence from state-level data. Econ. Lett. 2018, 167, 127–130. [Google Scholar] [CrossRef] [Green Version]

- Mumtaz, H.; Sunder-Plassmann, L.; Theophilopoulou, A. The State-Level Impact of Uncertainty Shocks. J. Money Credit Bank. 2018, 50, 1879–1899. [Google Scholar] [CrossRef] [Green Version]

- Antonakakis, N.; André, C.; Gupta, R. Dynamic spillovers in the United States: Stock market, housing, uncertainty, and the macroeconomy. South. Econ. J. 2016, 83, 609–624. [Google Scholar] [CrossRef] [Green Version]

- Antonakakis, N.; Gupta, R.; André, C. Dynamic co-movements between economic policy uncertainty and housing market returns. J. Real Estate Portf. Manag. 2015, 21, 53–60. [Google Scholar] [CrossRef]

- André, C.; Bonga-Bonga, L.; Gupta, R.; Muteba Mwamba, J.W. Economic policy uncertainty, US real housing returns and their volatility: A nonparametric approach. J. Real Estate Res. 2017, 39, 493–514. [Google Scholar] [CrossRef]

- Aye, G.C.; Clance, M.W.; Gupta, R. The effect of economic uncertainty on the housing market cycle. J. Real Estate Portf. Manag. 2019, 25, 67–75. [Google Scholar] [CrossRef]

- Chow, S.C.; Cunado, J.; Gupta, R.; Wong, W.K. Causal relationships between economic policy uncertainty and housing market returns in China and India: Evidence from linear and nonlinear panel and time series models. Stud. Nonlinear Dyn. Econom. 2017, 22. [Google Scholar] [CrossRef] [Green Version]

- Christou, C.; Gupta, R.; Nyakabawo, W. Time-varying impact of uncertainty shocks on the US housing market. Econ. Lett. 2019, 180, 15–20. [Google Scholar] [CrossRef]

- Huang, W.L.; Lin, W.Y.; Ning, S.L. The effect of economic policy uncertainty on China’s housing market. N. Am. J. Econ. Financ. 2018, 54, 100850. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A.; Vespignani, J.L. Oil price shocks and policy uncertainty: New evidence on the effects of US and non-US oil production. Energy Econ. 2017, 66, 536–546. [Google Scholar] [CrossRef] [Green Version]

- Ludvigson, S.C.; Ma, S.; Ng, S. Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response? Am. Econ. J. Macroecon. 2019. [Google Scholar] [CrossRef]

- Ozturk, E.O.; Sheng, X.S. Measuring global and country-specific uncertainty. J. Int. Money Financ. 2018, 88, 276–295. [Google Scholar] [CrossRef]

- Jurado, K.; Ludvigson, S.C.; Ng, S. Measuring Uncertainty. Am. Econ. Rev. 2015, 105, 1177–1216. [Google Scholar] [CrossRef]

- Hulse, K.; Stone, W. Social cohesion, social capital and social exclusion: A cross cultural comparison. Policy Stud. 2007, 28, 109–128. [Google Scholar] [CrossRef]

- Larsen, C.A. Social Cohesion: Definition, Measurement and Developments. 2014. Available online: http://www.forskningsdatabasen.dk/en/catalog/2262055869 (accessed on 29 January 2021).

- Markus, A.; Kirpitchenko, L. Conceptualising social cohesion. Soc. Cohes. Aust. 2007, 21–32. [Google Scholar] [CrossRef]

- Bernard, P. Social Cohesion: A Critique; Canadian Policy Research Network Discussion Paper No. F-09; CPRN: Ottawa, ON, Canada, 1999. [Google Scholar]

- Dekker, K.; Bolt, G. Social cohesion in post-war estates in the Netherlands: Differences between socioeconomic and ethnic groups. Urban Stud. 2005, 42, 2447–2470. [Google Scholar] [CrossRef]

- Forrest, R.; Kearns, A. Social cohesion, social capital and the neighbourhood. Urban Stud. 2001, 38, 2125–2143. [Google Scholar] [CrossRef]

- Acket, S.; Borsenberger, M.; Dickes, P.; Sarracino, F. Measuring and Validating Social Cohesion: A Bottom-Up Approach; Luxembourg Institute of Socio-Economic Research: Esch-sur-Alzette, Luxembourg, 2011. [Google Scholar]

- Osberg, L. Introduction. In The Economic Implications of Social Cohesion. Studies in Comparative Political Economy and Public Policy; Osberg, L., Ed.; Toronto University Press: Toronto, ON, Canada, 2003. [Google Scholar]

- Jordà, Ò. Estimation and Inference of Impulse Responses by Local Projections. Am. Econ. Rev. 2005, 95, 161–182. [Google Scholar] [CrossRef]

- Ahmed, M.I.; Cassou, S.P. Does consumer confidence affect durable goods spending during bad and good economic times equally? J. Macroecon. 2016, 50, 86–97. [Google Scholar] [CrossRef]

- Dayton-Johnson, J. Social capital, social cohesion, community: A microeconomic analysis. In The Economic Implications of Social Cohesion; Osberg, L., Ed.; University of Toronto Press: Toronto, ON, Canada, 2003; pp. 43–78. [Google Scholar]

- Klein, C. Social capital or social cohesion: What matters for subjective well-being? Soc. Indic. Res. 2013, 110, 891–911. [Google Scholar] [CrossRef]

| Name of Variable | Description | Unit of Measure | Source |

|---|---|---|---|

| The real housing returns of U.S. states calculated by taking the first log difference of monthly index values of the Freddie Mac House Price Indexes, deflated by using the seasonally adjusted Consumer Price Index (CPI). | In percentage | www.freddiemac.com/research/indices/house-price-index.page (accessed on 27 January 2021) | |

| Uncertainty for the broader macroeconomy in the U.S. | In percentage | www.sydneyludvigson.com/data-and-appendixes (accessed on 27 January 2021) | |

| Uncertainty for the financial sector in the U.S. | In percentage | www.sydneyludvigson.com/data-and-appendixes (accessed on 27 January 2021) | |

| A vector of control variables for macro-economic fundamentals in the U.S., including interest rates, industrial production growth rates, and inflation rates. | In percentage | https://fred.stlouisfed.org (accessed on 27 January 2021) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dai, L.; Sheng, X. The Impact of Uncertainty on State-Level Housing Markets of the United States: The Role of Social Cohesion. Sustainability 2021, 13, 3065. https://doi.org/10.3390/su13063065

Dai L, Sheng X. The Impact of Uncertainty on State-Level Housing Markets of the United States: The Role of Social Cohesion. Sustainability. 2021; 13(6):3065. https://doi.org/10.3390/su13063065

Chicago/Turabian StyleDai, Linyan, and Xin Sheng. 2021. "The Impact of Uncertainty on State-Level Housing Markets of the United States: The Role of Social Cohesion" Sustainability 13, no. 6: 3065. https://doi.org/10.3390/su13063065