The Social Balance Sheet as Part of the Annual Report in Financial Institutions. A Case Study: Banco Bilbao Vizcaya Argentaria (BBVA)

Abstract

:1. Introduction

2. Literature Review

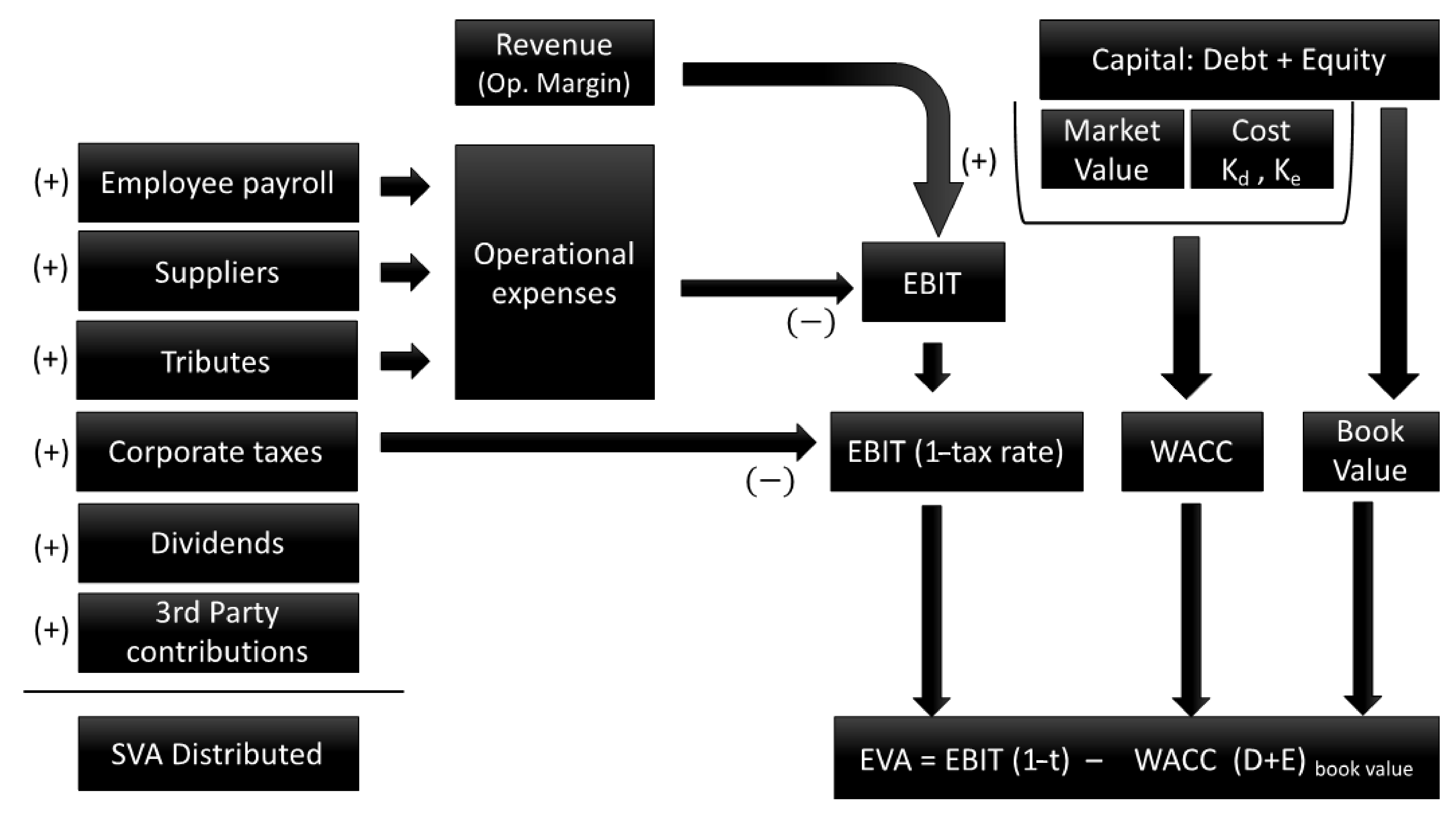

Social Balance Sheet Report Monetization

3. Social Balance Sheet Report Evolution in BBVA

4. BBVA Social Balance Sheet Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- García-Marzá, D. Trust and dialogue: Theoretical approaches to ethics auditing. J. Bus. Ethics 2005, 57, 209–219. [Google Scholar] [CrossRef]

- Bianchi, M.T.; Nardecchia, A. The role of voluntary disclosure in listed company: An alternative model. Corp. Ownersh. Control. 2016, 13, 55–65. [Google Scholar] [CrossRef] [Green Version]

- Elvira Cruvinel, F.V. Banks and social responsibility: Incorporating social practice in organizational structures. Soc. Responsib. J. 2007, 3, 74–89. [Google Scholar] [CrossRef]

- Stewart, G.B. The Quest for Value: The EVA Management Guide; Harper Business: New York, NY, USA, 1991. [Google Scholar]

- Geobey, S.; Westley, F.R.; Weber, O. Enabling social innovation through developmental social finance. J. Soc. Entrep. 2012, 3, 151–165. [Google Scholar] [CrossRef]

- Drexler, M.; Noble, A.; Bryce, J. From the margins to the mainstream. In Assessment of the Impact Investment Sector and Opportunities to Engage Mainstream Investors; World Economic Forum: Geneva, Switzerland, 2013. [Google Scholar]

- Tajani, F.; Morano, P.; Anelli, D.; Torre, C.M. A model to support the investment decisions through social impact bonds as effective financial instruments for the enhancement of social welfare policies. In International Conference on Computational Science and its Applications; Springer: Cham, Germany, 2020; pp. 941–951. [Google Scholar]

- Social Business Initiative. Communication from the Commission to the European Parliament, the Council, the european Economic and Social Committeeand the Committee of the Regions. Creating a favourable climate for social enterprises, key stakeholders in the social economy and innovation. 2011. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52011DC0682&from=EN (accessed on 30 December 2020).

- Salatheé-Beaulieu, G. Sustainable Development Impact Indicators for Social and Solidarity Economy; UNRISD: Geneva, Switzerland, 2019; State of the Art. Working Paper 2019-4. [Google Scholar]

- Gond, J.-P.; Igalens, J.; Brès, L. Producing social accounting. The Art of Performative Compromise. Rev. Fr. Gest. 2013, 237, 201–226. [Google Scholar] [CrossRef]

- European Union. Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014, Amending Directive 2013/34/EU as Regards Disclosure of Non-financial and Diversity Information by Certain large Undertakings and Groups. Code du Travail—Article R2323-17 (Legislation of the Republic of France). 2014. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014L0095&from=ES (accessed on 6 February 2021).

- European Commission. Internal Market, Industry, Entrepreneurship and SMEs. Available online: https://ec.europa.eu/growth/sectors/social-economy/enterprises_en (accessed on 30 January 2021).

- European Commission. GECES Sub-group on Impact Measurement. 2014. Available online: https://ec.europa.eu/docsroom/documents/12966/attachments/5/translations/en/renditions/pdf (accessed on 29 December 2020).

- Official Gazette of the Italian Republic. Decreto Legislativo 30 December 2016, n. 254—Attuazione della Direttiva 2014/95/UE. 2016. Available online: https://www.gazzettaufficiale.it/eli/id/2017/01/10/17G00002/sg (accessed on 6 February 2021).

- Caputo, F.; Leopizzi, R.; Pizzi, S.; Milone, V. The Non-Financial Reporting Harmonization in Europe: Evolutionary Pathways Related to the Transposition of the Directive 95/2014/EU within the Italian Context. Sustainability 2020, 12, 92. [Google Scholar] [CrossRef] [Green Version]

- Campra, M.; Esposito, P.; Lombardi, R. The engagement of stakeholders in nonfinancial reporting: New information-pressure, stimuli, inertia, under shorttermism in the banking industry. Corp Soc. Responsib Environ. Manag. 2020, 27, 1436–1444. [Google Scholar] [CrossRef]

- ISO. ISO 26000:2010(en) Guidance on Social Responsibility. Available online: https://www.iso.org/obp/ui#iso:std:iso:26000:ed-1:v1:en (accessed on 26 January 2021).

- Varzazu, A.A.; Varzazu, M. Management Control. and Social Balance, Instruments of Company’s Performance; Ovidius University Annals: Constanța, Romania, 2014; Economic Sciences Series; Volume XIV, Issue 1. [Google Scholar]

- The Social Reporting Initiative (SRI). Social Reporting Standard. 2014. Available online: https://www.social-reporting-standard.de/en/ (accessed on 1 January 2021).

- Social Audit Network. 2011. Available online: http://www.socialauditnetwork.org.uk/about-us/ (accessed on 1 January 2021).

- Cavazotte, F.; Chang, N.C. Internal corporate social responsibility and performance: A study of publicly traded companies. Braz. Adm. Rev. 2016, 13, e160083. [Google Scholar] [CrossRef] [Green Version]

- Machado, J.; Volney, C. Social responsibility: A comparative study of the company eletrocar’s Social Balance. Gestão Soc. 2009, 3, 6. Available online: https://www.gestaoesociedade.org/gestaoesociedade/article/view/680/715 (accessed on 1 February 2021).

- Silva, G.D.; Gonçalves, M.N. Bibliometric study on the Gri Sustainability Report: An analysis of the focus of research topics up to 2014. Espacios 2016, 37, 21. Available online: https://www.revistaespacios.com/a16v37n37/16373722.html (accessed on 9 March 2021).

- De Souza Gonçalves, R.; Rodrigues, A.P.; Santana, C.M.; De Oliveira Gonçalves, A. The influence of the origin of equity control in the level of social disclosure in brazilian companies. Rev. Gest. Soc. Ambient. 2013, 7, 53–70. [Google Scholar]

- Da Silveira, M.L.G.; Pfitscher, E.D. Case study: Analysis of a balance sheet of an electricity holding. Rev. Agronegocio Meio Ambiente 2013, 6, 463–477. [Google Scholar]

- Prieto, A.B.T.; Shin, H.; Lee, Y.; Lee, C.W. Relationship among CSR initiatives and financial and non-financial corporate performance in the Ecuadorian banking environment. Sustainability 2020, 12, 1621. [Google Scholar] [CrossRef] [Green Version]

- BOE. Ley 2/2011 de Economía Sostenible del Reino de España. Available online: https://www.boe.es/buscar/act.php?id=BOE-A-2011-4117 (accessed on 6 March 2021).

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate Social and Financial Performance: A Meta-Analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Mittal, R.K.; Sinha, N.; Singh, A. An analysis of linkage between economic value added and corporate social responsibility. Manag. Decis. 2008, 46, 1437–1443. [Google Scholar] [CrossRef]

- Weber, M. The business case for corporate social responsibility: A company-level measurement approach for CSR. Eur. Manag. J. 2008, 26, 247–261. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Wood, D.J. Measuring Corporate Social Performance: A Review. Int. J. Manag. Rev. 2010, 12, 50–84. [Google Scholar] [CrossRef]

- Lin, C.-H.; Yang, H.-L.; Liou, D.-Y. The impact of corporate social responsibility on financial performance: Evidence from business in Taiwan. Technol. Soc. 2009, 31, 56–63. [Google Scholar] [CrossRef]

- Mishra, S.; Suar, D. Does Corporate Social Responsibility Influence Firm Performance of Indian Companies? J. Bus. Ethics. 2010, 95, 571–601. [Google Scholar] [CrossRef]

- Lima Crisóstomo, V.; de Souza Freire, F.; Cortes de Vasconcellos, F. Corporate social responsibility, firm value and financial performance in Brazil. Soc. Responsib. J. 2011, 7, 295–309. [Google Scholar] [CrossRef]

- Galbreath, J.; Shum, P. Do customer satisfaction and reputation mediate the CSR–FP link? Evidence from Australia. Aust. J. Manag. 2012, 37, 211–229. [Google Scholar] [CrossRef]

- Kalender, Z.; Vayvay, Ö. The Fifth Pillar of the Balanced Scorecard: Sustainability. Proc. Soc. Behav. Sci. 2016, 235, 76–83. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard-Measures that Drive Performance. 1992. Available online: https://hbr.org/1992/01/the-balanced-scorecard-measures-that-drive-performance-2 (accessed on 1 February 2021). Harvard Business Review.

- Quarter, J.; Mook, L.; Armstrong, A. Understanding the Social Economy: A Canadian Perspective, 2nd ed.; University of Toronto Press: Toronto, Canada, 2017. [Google Scholar]

- Ramos, T.M.; Santos, T.R. The Social Balance as an influence for a sustainable business society: A bibliometric analysis. ConTexto Porto Alegre 2020, 20, 13–28. Available online: https://seer.ufrgs.br/ConTexto/article/view/94741 (accessed on 1 February 2021).

- Fernández, P. Valoración de Empresas, 3rd ed.; Gestion: Barcelona, Spain, 2000. [Google Scholar]

- Fernández, P. Valuing Companies by Cash Flow Discounting: 10 Methods and 7 Theories. 2018. Available online: https://ssrn.com/abstract=1266623 (accessed on 10 December 2020).

- Arangies, G.; Mlambo, C.; Hamman, W.D.; Steyn-Bruwer, B. The value-added statement: An appeal for standardisation. Manag. Dyn. 2008, 17, 31–43. [Google Scholar]

- Bassi, A.; Vincenti, G. Toward a new metrics for the evaluation of the social added value of social enterprises. Ciriec Esp. 2015, 83, 9–42. [Google Scholar]

- Wnuczak, P. Social value added (SVA) as an adaptation of economic value added (EVA) to the specificity of cultural institutions. J. Manag. Bus. Adm. Cent. Eur. 2018, 26, 100–120. [Google Scholar] [CrossRef]

- Rajnoha, R.; Sujova, A.; Dobrovic, J. Management and Economics of Business Processes Added Value. Proc. Soc. Behav. Sci. 2012, 62, 1292–1296. [Google Scholar] [CrossRef] [Green Version]

- Horvath, P. Balanced Scorecard v Praxi; Schaffer-Poeschel Verlag: Stuttgart, Germany, 2000. [Google Scholar]

- Damodaran, A. Data Archives. 2020. Available online: http://pages.stern.nyu.edu/~adamodar/ (accessed on 27 January 2021).

| (Million Euros) | 2007 | 2006 | 2005 |

|---|---|---|---|

| SVA (Economic Value added) | 27,815 | 21,882 | 18,062 |

| Social economic value generated (SEV-G) | 18,419 | 16,821 | 13,227 |

| Net interest income | 9769 | 8374 | 7208 |

| Net fee income | 4723 | 4335 | 394 |

| Income for insurance activities | 729 | 650 | 487 |

| Other ordinary income | 3099 | 2473 | 1514 |

| Other net gains and losses | 98 | 989 | 77 |

| Social economic value distributed (SEV-D) | 12,285 | 10,991 | 9463 |

| Shareholders: Dividends | 2717 | 222 | 1801 |

| Minority interests | 289 | 235 | 264 |

| Suppliers and other administrative expenses (excluding wages and salaries) | 2864 | 2488 | 2275 |

| Society: Tax | 208 | 2059 | 1521 |

| Employees: Personnel expenses | 4335 | 3989 | 3602 |

| Social economic value retained (SEV-R = SEV-G − SEV-D) | 6134 | 583 | 3763 |

| Provisions and amortization | 2725 | 3314 | 1757 |

| Reserves | 3409 | 2516 | 2006 |

| Number of people living in homes financed by BBVA | 4.7 million |

| Clients in Spain with new credit conditions adapted to their needs | 105,000 |

| Entrepreneurs in Latin America financed with microcredits from the BBVA Microfinance Foundation | 948,500 |

| People with deposits receiving an average interest of 863€ (millions of people) | 2.7 million |

| People with investments managed by pension fund administrators of the Group in Latin America (millions of people) | 13.3 million |

| Small shareholders receiving an average dividend of 490€ | 935,406 |

| Jobs created in 2011 | 3200 |

| Total taxes paid and collected by BBVA (mill€) | 8012 |

| Total payments to 6654 suppliers in 2011 (mill€) | 5498 |

| Attributable profit after tax dedicated to social programs (%) | 2.50% |

| Children receiving education grants in Latin America | 61,436 |

| Persons receiving financial literacy programs | 814,483 |

| 2013 | 2012 | 2011 | |

|---|---|---|---|

| Contribution to social development and welfare | |||

| Number of people who live in homes financed by BBVA | 4,939,731 | 4,742,622 | 4,744,654 |

| No. of families with difficulties in meeting their loan repayments that BBVA has helped through new financing conditions adapted to their needs | 139,709 | 117,481 | n.a. |

| No. of SMEs supported or financed by BBVA | 348,445 | 321,918 | 300,759 |

| Number of micro-enterprises and self-employed people supported or financed by BBVA | 1,117,411 | 999,107 | 993,489 |

| No. of entrepreneurs in Latin America financed via microcredits by the BBVA Microfinance Foundation | 1,493,709 | 1,293,514 | 948,508 |

| Total microloan volume of the BBVA Microfinance Foundation (million euros) | 861 | 887 | n.a. |

| Number of people with mobile banking account in Latin America | 1,973,407 | 1,810,530 | 944,592 |

| Number of banking correspondents in Latin America | 27,722 | 22,756 | 19,684 |

| Wealth creation | |||

| Total taxes accrued and collected by BBVA’s business activity (million euros) | 9848 | 9408 | 8012 |

| Total investment in technology and innovation (million euros) | 891 | 866 | 833 |

| Economic value generated (million euros) | 21,112 | 22,120 | 20,055 |

| BBVA’s share of total economic value generated in the countries where it operates (%; weighted) | 0.5% | 0.5% | 0.5% |

| Number of individual shareholders | 994,846 | 1,008,099 | 967,175 |

| Average dividend received per individual shareholder (euros) | 1100 | 1066 | 1057 |

| Job creation | |||

| Net jobs created at BBVA | 619 | 3773 | 32 |

| New permanent hires | 6493 | 7045 | 7734 |

| New permanent hires under 30 years old (%) | 51 | 50 | 50 |

| Number of people hired through the “Yo Soy Empleo” (I am employment) program | 3397 | n.a. | n.a. |

| Number of people employed by SMEs and micro-enterprises financed or supported by BBVA in Spain | 1,364,883 | 1,387,070 | 1,459,575 |

| Number of disabled people or at risk of exclusion employed by companies supported by BBVA | 892 | 694 | 504 |

| Contributions to society | |||

| Investment in social programs (million euros) | 97.1 | 81.3 | 74.2 |

| Net attributable profit allocated to social programs (%) | 4.4% | 4.8% | 2.5% |

| Number of financial literacy program beneficiaries | 256,359 | 251,637 | 123,768 |

| Number of basic financial skills acquired by beneficiaries of the financial literacy program | 829,643 | 689,881 | 413,596 |

| Number of recipients of integration scholarships in Latin America | 92,264 | 62,887 | 59,986 |

| Number of beneficiaries of education for society programs (million) | 1.5 | 1.2 | 1.1 |

| No. of beneficiaries from BBVA Microfinance Foundation activity in Latin America (million) | 6.0 | 5.2 | 3.7 |

| 2015 Target | Progress 2013–2015 | ||

|---|---|---|---|

| Education | Number of beneficiaries of the financial program | 3,000,000 | 4,140,346 |

| Number of SME companies from growth program | 8000 | 5348 | |

| Number of SME companies with education programs | 120,559 | ||

| Number of grants for underprivileged children | 200,000 | 215,171 | |

| Number of beneficiaries of other education for society programs | 110,752 | ||

| Social impact products | Consolidate the presence of Microfinance Foundation in Latin America | To increase the number of participants | 419,287 |

| Number of grants for creating jobs (Yo soy empleo) | 10,000 | 10,000 | |

| Shareholders and investors | Synthetic index | 1st/2nd position in index | 1st position in index |

| Eco-efficiency | Percentage of reduction in CO2 emissions per person | −6% | −16% |

| Percentage of reduction in paper consumption per person | −3% | −43% | |

| Percentage of reduction in water consumption per person | −3% | −23% | |

| Percentage of reduction in electricity consumption per person | −3% | −14% | |

| Percentage of people working in certified buildings | 33% | 33% |

| (Mill€) | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|

| SVA (Social Value Added)—Generated | 24,692 | 22,246 | 20,724 | 20,906 | 22,120 | 21,615 |

| Employees—personnel costs | 6722 | 6273 | 5410 | 5588 | 5467 | 5311 |

| Suppliers—other administrative costs | 4211 | 4097 | 3532 | 3635 | 3466 | 3793 |

| Public Administration | 2132 | 1740 | 1316 | 405 | 65 | 285 |

| Shareholders—dividends | 1043 | 1145 | 715 | 733 | 1334 | 1124 |

| Community (not incl. foundations) | 33 | 43 | 54 | 57 | 46 | 34 |

| SVA-D—Shared and Distributed SVA (Mill€) | 14,141 | 13,298 | 11,027 | 10,418 | 10,378 | 10,547 |

| Adjustments | ||||||

| Community (Foundations) | 60 | 61 | 53 | 40 | 36 | 40 |

| Global investment in microfinance | 73 | 29 | 46 | −26 | 237 | 650 |

| Other taxes (VAT, taxes, fees, retentions) | 1630 | 1076 | 1869 | 3626 | 3486 | 2791 |

| Impact of “Yo soy empleo” | - | - | 84 | 38 | - | - |

| Contributions of third parties to social programs | 10 | 11 | 11 | 9 | 10 | - |

| Training costs | 36 | 35 | 39 | 38 | - | 37 |

| Adjusted SVA-D (Mill€) | 15,950 | 14,510 | 13,128 | 14,144 | 14,147 | 14,066 |

| Growth | 9.9% | 10.5% | −7.2% | 0.0% | 0.6% | - |

| Contributions to the community | 176 | 144 | 247 | 118 | 329 | 724 |

| % over total | 1.1% | 1.0% | 1.9% | 0.8% | 2.3% | 5.1% |

| Adjustment over EVA Distributed | 12.8% | 9.1% | 19.1% | 35.8% | 36.3% | 33.4% |

| Gross Margin | 24,653 | 23,362 | 20,725 | 20,752 | 21,824 | n.d. |

| Adjusted EVA-D over gross margin (%) | 64.7% | 62.1% | 63.3% | 68.2% | 64.8% | n.d. |

| Spain’s GDP (MM€) | 1119 | 1080 | 1038 | 1026 | 1040 | 1070 |

| %PIB | 1.4% | 1.3% | 1.3% | 1.4% | 1.4% | 1.3% |

| ROE Comm Eqty, %, FY | 6.8% | 5.0% | 5.7% | 0.5% | 3.2% | 7.4% |

| ROA Tot Assets, %, FY | 0.6% | 0.5% | 0.5% | 0.2% | 0.3% | 0.6% |

| BBVA Failed credits (MM€) | 5592 | 5027 | 4754 | 3865 | 4395 | 4093 |

| over/EVA-D | 35.1% | 34.6% | 36.2% | 27.3% | 31.1% | 29.1% |

| over/Gross Margin | 22.7% | 21.5% | 22.9% | 18.6% | 20.1% | n.d. |

| Mill. € | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|

| Total Revenue | 31,060 | 29,829 | 29,296 | 27,708 | 24,783 | 22,838 | 23,512 | 24,815 | 23,229 |

| Total Operating Expense | 16,928 | 16,219 | 15,214 | 14,246 | 13,010 | 12,796 | 15,224 | 18,200 | 14,690 |

| EBIT | 14,132 | 13,610 | 14,082 | 13,462 | 11,773 | 10,042 | 8288 | 6615 | 8539 |

| Tax rate | 32.1% | 26.3% | 31.3% | 26.6% | 27.7% | 22.6% | −1.7% | −22.3% | 4.6% |

| EBIT (1−T) | 9597 | 10,033 | 9675 | 9884 | 8515 | 7776 | 8427 | 8087 | 8142 |

| WACC Estimations | |||||||||

| Market values reported | |||||||||

| Hist EV, FY | 52,320 | 34,923 | 75,899 | 88,117 | 97,966 | 90,258 | 105,976 | 112,271 | 112,471 |

| Hist Mkt Cap, FY | 33,163 | 30,690 | 47,327 | 42,072 | 42,643 | 48,144 | 51,711 | 37,870 | 32,001 |

| Net debt | 19,157 | 4233 | 28,572 | 46,045 | 55,323 | 42,114 | 54,265 | 74,401 | 80,470 |

| Estimated cost of resources | |||||||||

| Estimated industry Kd | 4.71% | 3.93% | 3.96% | 4.38% | 3.92% | 5.40% | 3.26% | 3.37% | 4.79% |

| Estimated Kd (1−t) | 3.20% | 2.90% | 2.92% | 3.01% | 2.88% | 3.91% | 2.52% | 3.43% | 5.86% |

| Estimated industry Ke | 6.75% | 6.63% | 6.58% | 7.15% | 7.68% | 7.56% | 6.24% | 6.52% | 6.82% |

| WACC | 6.32% | 5.22% | 4.67% | 4.81% | 5.44% | 5.69% | 3.78% | 4.31% | 6.13% |

| Expected return | |||||||||

| Net debt | 12,956 | −1531 | 21,593 | 37,981 | 47,331 | 39,603 | 51,894 | 72,029 | 78,577 |

| Total Equity | 48,724 | 47,110 | 46,344 | 47,364 | 47,290 | 49,098 | 42,194 | 41,430 | 38,165 |

| D+E | 61,680 | 45,579 | 67,937 | 85,345 | 94,621 | 88,701 | 94,088 | 113,459 | 116,742 |

| WACCx(D+E) | 2880 | 3550 | 3983 | 4553 | 4825 | 5352 | 4286 | 5028 | 7266 |

| EVA= EBIT (1−T) − (D+E)xWACC | 6716 | 6484 | 5692 | 5331 | 3690 | 2424 | 4141 | 3059 | 876 |

| SVA (Social Value Added)—reported | 24,692 | 22,246 | 20,724 | 20,906 | 22,120 | 21,615 | |||

| Estimated EVA/ SVA reported | 21.6% | 16.6% | 11.7% | 19.8% | 13.8% | 4.1% | |||

| Adjusted SVA-D | 15,950 | 14,510 | 13,128 | 14,144 | 14,189 | 14,066 | |||

| Estimated EVA/ Adjusted SVA-D | 33.4% | 25.4% | 18.5% | 29.3% | 21.6% | 6.2% | |||

| Failed credits | 5592 | 5027 | 4754 | 3865 | 4395 | 4093 | |||

| Failed credits/EVA | 104.9% | 136.2% | 196.1% | 93.3% | 143.7% | 467.2% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valmayor, M.Á.M.; Duarte Monedero, B.; Gil-Alana, L.A. The Social Balance Sheet as Part of the Annual Report in Financial Institutions. A Case Study: Banco Bilbao Vizcaya Argentaria (BBVA). Sustainability 2021, 13, 3075. https://doi.org/10.3390/su13063075

Valmayor MÁM, Duarte Monedero B, Gil-Alana LA. The Social Balance Sheet as Part of the Annual Report in Financial Institutions. A Case Study: Banco Bilbao Vizcaya Argentaria (BBVA). Sustainability. 2021; 13(6):3075. https://doi.org/10.3390/su13063075

Chicago/Turabian StyleValmayor, Miguel Ángel Martín, Beatriz Duarte Monedero, and Luis A. Gil-Alana. 2021. "The Social Balance Sheet as Part of the Annual Report in Financial Institutions. A Case Study: Banco Bilbao Vizcaya Argentaria (BBVA)" Sustainability 13, no. 6: 3075. https://doi.org/10.3390/su13063075