Abstract

The presented manuscript discusses a specific research study examining several variants of liquefied natural gas (LNG) carriage from chosen seaports to the port of Bratislava using the Danube waterway, assessing them using chosen multi-criteria analysis techniques. Two ports in Turkey and one port in Georgia are deemed export terminals. A total of twelve variants are compared, whereby the comparison is carried out based on multiple evaluation criteria defined by a panel of experts who laid particular stress on their importance. An economic calculation is performed in the first phase to assess LNG carriage in all the variants. This represents the very foundation for the multi-criteria evaluation, which is conducted using Multi-Criteria Decision Analysis (MCDA) and the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS). The evaluated variants differ not only in terms of export port location, but also in relation to transport technology. As for the second phase, four distinct technologies in three different scenarios are assessed—specifically, Small-Scale (SS) LNG-C tankers—while two modes of operation (i.e., time-charter, own tanker) and a river-sea LNG tanker with an LNG barge in two versions are considered. The first version considers the use of Marine Gasoil (MGO) fuel, while the second one considers LNG use. The results obtained provide interesting findings, wherein two out of three applied methods prefer the same transport option. Thus, it can be stated that our study presents a unique approach by comparing different scenarios of LNG distribution as a commodity inland along the river Danube, specifically to Central Europe, from a variety of standpoints. The manuscript evaluates carriage using traditional MGO fuels as well as alternative LNG fuels, and also brings a comparison from a technological point of view.

1. Introduction

In recent years, there has been an increase in demand for sustainable energy sources [1]. This is due to societal demand, the transformation of people’s thinking towards green resources and technologies, and also to the pressures on authorities on a global scale. Europe is no exception to this [2,3,4]. Liquefied natural gas imports to Europe still entail only a fraction of consumption. Although this is a growing trend, it is far from reaching the same volume as that of pipeline gas from Russia, the main natural gas supplier to the EU. The volume of natural gas supplies from Russia to Europe, including Turkey and Ukraine, is approximately 200 billion m3 of gas. The share of natural gas supplies from Russia to the EU is almost 50% [5,6]. Norway is the second-largest supplier of natural gas, with a 34% share, and the third place is represented by the cumulative supply of LNG, with a volume of about 11%. The largest LNG suppliers to the EU are as follows: Qatar, Nigeria, the USA, and Algeria. The United States has recently significantly increased its LNG supply to Europe, currently accounting for about 13% of the total LNG supply [7].

The EU intends to enable and facilitate the import of LNG into Europe in order to increase the security of its gas supply and diversify sources [8]. The price and reliability of energy supply are the most important parameters that influence the creation of individual countries’ supply strategy [9]. Opportunities to diversify resources are an important tool for increasing competitiveness, as is a non-binding nature from dominant suppliers. The price of natural gas plays a significant role in international trade and countries’ competitiveness [10]. Natural gas often makes up a highly important, and sometimes dominant, share of industrial enterprises’ total energy costs [11]. The price of natural gas varies considerably across the EU, in contrast to traditional fossil fuel prices [12]. Natural gas is becoming an integral part of global energy consumption. Its use in transport has continuously been increasing and it currently represents a notable alternative to traditional fuels [13].

The transport sector produces an eminent share of greenhouse gas emissions (GHGE) and is largely responsible for climate change and global warming. Transport accounts for almost a quarter of all emissions in Europe [5]. The introduction of LNG in the transport sector, especially for heavy cargo vehicles and long-distance transport, is one of the ways to ensure sustainability [14]. The use of natural gas in transport is possible in two basic forms—i.e., in the form of compressed natural gas (CNG) or liquefied natural gas (LNG). Both versions have their own specifics and present different possibilities for their use in haulage [15]. Whilst CNG is used mainly in light vehicles (especially passenger cars), LNG is utilized mainly in heavy transfer. LNG’s undoubted advantage is that liquefaction (at −162 °C) reduces its volume by 600 times, which creates many possibilities for its storage in fuel tanks [16]. The price of LNG is comparable to the price of conventional fossil fuels. Several studies that compare the cost of carrying LNG and traditional fossil fuels confirm this statement; e.g. [17].

The LNG supply chain encompasses natural gas carriage from the point of production to the point of liquefaction, where it is stored in liquid form or transported to the point of consumption in various ways. In the hinterland, mainly tank vehicles are used; in coastal areas, there are barges or SS LNG tankers [18,19]. Another option, subsequent transport, also finds application, especially where gas distribution through pipelines is not sufficiently developed.

2. Literature Review

Numerous studies and other literature sources dealing with the distribution of LNG to small terminals or directly to service stations in Europe and worldwide are available [20].

The available infrastructure limits the expansion of natural gas’s use in transport. Through the Alternative Fuels Directive 2014/94/EU, the European Commission seeks to support the development of infrastructure for alternative fuels, including LNG. In recent years, many LNG filling stations have been opened, especially in Western Europe. The expansion of infrastructure has increased the demand for LNG vehicles [21]. LNG distribution is carried out from large LNG terminals, which are continually being built. There are many more such terminals in Western Europe than in Central and South-Eastern Europe, where substantially fewer of them are located. From large LNG terminals, LNG is transported in special cryogenic tank vehicles (such as trucks, tankers, barges) to service stations or smaller terminals, as stated in the publication [22]. In Central and South-Eastern Europe, it is necessary to build smaller LNG terminals, which will become the particular region’s distribution point. This will increase the efficiency of LNG distribution in remote regions. Dvorak et al. conclude that for the long-term viability of the LNG fuel market [23], it is important to invest only in those projects that do not involve additional operating costs, which will have an impact on increasing fuel prices.

In the manuscript [24], the authors propose an optimal fleet and its navigation routes when distributing LNG in order to decrease CO2 emissions and, at the same time, minimize the transportation costs of LNG in central Indonesia. The transportation cost quantification was executed in the Green Ship Routing Problem approach, taking into consideration even emissions. The technique called Bin Packing Problem was implemented in order to minimize the total transportation cost as well as the emissions produced. Similarly, Andersson et al. focused on the maritime inventory routing problem (IRP) in the LNG supply chain, called the LNG-IRP, wherein they establish a novel route flow formulation for this problem emerging from an innovative decomposition scheme based on ship schedule parts [25]. Furthermore, the publication [26] deals with inter-terminal maritime LNG carriage among a number of supply ports and several sparsely allocated import ports with a specified demand, simultaneously involving cargo splitting features, numerous nodes, and multiple navigations among ports on identical route sections. The developed approach uses mixed integer-linear programming to search for an efficient supply chain system, reducing costs in relation to fuel procurement.

Whereas the previous research was related to the particular types of routing problem encountered in the context of LNG carriage, Iris and Lam elaborate a comprehensive literature review study to discuss individual operational strategies, innovative transport technology usage, alternative fuels, and energy management systems to enhance the energy efficiency and environmental performance of shipping, ports, and terminals, in which research gaps and future research directions are formulated as well [27]. On the other hand, the research study [28] presented by Vidmar et al. comprehensively examines the level of environmental risk that an LNG terminal situated in a port area and LNG distribution pose to the populated territory near to the port site.

Slovakia is located in Central Europe. The availability of LNG terminals is currently relatively low. One of the strategic development plans proposed for the port of Bratislava is to build an LNG terminal [29]. A feasibility study on this topic is currently underway. The terminal envisages the construction of a liquefaction station and the construction of floating or ground tanks. Dávid and Madudová state that the Bratislava port location is relatively strategic, as it is situated on the river Danube [30]. The planned terminal will be able to act as a distribution terminal and filling station not only for road vehicles but also for ships sailing on the river Danube [31]. The waterway availability also offers an alternative acquisition of LNG for the terminal in the form of LNG supplies in tankers.

In this study, we are dealing with this alternative. Based on the economic analysis of LNG transport to the port of Bratislava from the Black Sea region, the costs of transporting 1 m3 of LNG in twelve scenarios are quantified and described in detail. Subsequently, the scenarios are assessed using multi-criteria evaluation principles and examined using two multi-criteria decision-making methods—namely, Multi-Criteria Decision Analysis (MCDA) and Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS). A similar approach and methods have been used to assess the sustainability of fuels in maritime transport—for instance, in the paper [32]. Notwithstanding this, the authors develop a distinct unified criteria system to evaluate alternative marine fuels. A fuzzy group multi-criteria decision-making technique is implemented to sort these fuels when joining fuzzy logarithmic least squares fuzzy TOPSIS methods.

In our paper, three locations were selected to be export points. As for the first one, the Marmara Ereglisi terminal has been in operation in Turkey since 1994. Regarding the second node, the Aliaga terminal has been in operation in Turkey since 2006, with an extension to the Neptune terminal in 2016. In the port of Kulevi in Georgia, as the last export point, it is planned to build a terminal for natural gas liquefaction from Azerbaijan or Turkmenistan. The port of Kulevi, which, along with the Supse terminal (a terminal adapted for fuel transhipment), represents an opportunity to export natural gas from the countries outside the EU to Europe [33].

After all, in our research study, a unique methodological guideline to compare LNG carriage scenarios in a particular territory is developed. The individual scenarios being evaluated are compared to the whole range of perspectives when applying specific operations research techniques. The study analyses carriage using traditional MGO fuels and alternative LNG fuels and brings a comparison from a technological point of view.

3. Data and Methods

The data for the economic assessment of the possibility of transporting LNG by water transport to the port of Bratislava are obtained from the operators. The calculation of the economic costs of transporting 1 m3 of LNG to the port of Bratislava is based on the current capacity of the planned LNG terminal in the port of Bratislava. The calculation is made in several variants.

The first phase assesses three scenarios using an SS LNG-C tanker in the section between the seaports and Galati port. From Galati, the voyage continues using a tugboat and LNG barges. As for the first method, the calculation is performed by two alternatives. The first alternative uses a time-charter SS LNG-C tanker, and the second using its own SS LNG-C tanker. For both alternatives, all economic items entering the calculation of the 1 m3 LNG are comprehensively assessed.

The second phase considers the same three scenarios using a river-sea tanker and LNG barges. The river-sea LNG tanker is used on the entire section between the export port and the destination port of Bratislava. Due to the limited conditions on the river section, part of the cargo is transferred to the LNG barges in the port of Galati, thus providing the necessary draft, which is one of the limiting factors affecting smooth navigation on the Danube waterway. This method is economically assessed in the same way in two alternatives. The first alternative uses a river-sea tanker for MGO fuel, and the second uses LNG fuel.

3.1. Multi-Criteria Decision Analysis

Multi-criteria decision analysis is one of the methods used to compare several variants. It is based on a pairwise comparison of the degree of significance of individual criteria and the degree to which the evaluated solution variants meet these criteria. The evaluation of criteria and variants is based on the “Expert estimation”, in which experts in each field (panel of experts) compare the mutual influences of two factors. These are assessed based on the scale equal–weak–medium–strong–very strong (i.e., values of 1–3–5–7–9). The decision matrix also encompasses a mutual comparison of the same variables with the evaluation of the impact “1” (same influence) [34].

The first step is to determine the matrix Sij, for which i, j = 1, 2, …, n. The following principle applies to the given matrix [35]: C—Criterion; i—number of rows of the matrix; j—number of matrix columns.

The second step is to determine the values of the custom vector of the matrix for the individual rows of the decision matrix (see Equation (1)) based on the relation to the calculation of the geometric mean [36]:

for each i = 1, 2, …, n.

The last step is to determine the normalized custom vector of the matrix (see Equation (2)) [37]:

for each i = 1, 2, …, n.

The result is to determine individual variants’ order and select the highest-rated variant, which represents the optimal variant.

3.2. The Technique for Order of Preference by Similarity to Ideal Solution

One of the methods used to assess the problem of choosing the most suitable mode of transport is the TOPSIS method. The task of this method is to find such a solution to the decision problem (in our case, the choice of variant) which is closest to the ideal variant (the ideal solution, after taking into account all aspects, actually rarely exists) [38].

The first step is to create a normalized criterion matrix (see Equation (3)) [39]:

where:

- -

- yij—elements in ith line in jth column;

- -

- y2ij—all values of the respective column.

The second step is to calculate the normalized weighted criteria matrix (expert basis, same as for MCDA)—Equation (4):

where:

- -

- wj—normalized matrix elements.

The subsequent step is to create an ideal variant (h1, h2, …) and basal variant (d1, d2, …) (see Equation (5)) [40]:

The calculation of the distance from the ideal variant (IH) is as follows (see Equation (6)):

The quantification of the distance from the basal variant (BH) is as follows (see Equation (7)):

In the next step, the criteria ideal and basal values are searched for (these are the maximum and minimum criteria in each row).

- -

- gij—level of importance.

The final step of this procedure is to quantify the relative indicator of the distance from the basal variant (UV)—Equation (8) [41]:

The variant with the highest UV score is considered to be the most suitable variant.

4. Case Study—Economic Assessment of LNG Carriage to the Port of Bratislava

In this case study, we deal with assessing the possibility of transporting LNG from the Black, Marmara, and Aegean (Mediterranean) sea area to the port of Bratislava using the Danube waterway. The port of Bratislava plans to build an LNG terminal in the Pálenisko basin. The minimum capacity of the terminal will be 4000 m3 of LNG. The vessel’s maximum cargo capacity intended for filling LNG from and to the terminal will be 3500 m3 of LNG. The terminal will embrace facilities for LNG transhipment and the refuelling of LNG fuel in riverboats. The terminal’s overall concept will also comprise a natural gas liquefaction plant with a capacity of at least 5 t per day. The terminal will further include a transhipment facility for filling LNG into road tanks [42].

We have proposed the port of Marmara Ereglisi (Scenario 1) as the LNG export point in the Sea of Marmara, the port of Aliaga (Scenario 2) in the Aegean Sea, and the port of Kulevi in the Black Sea (Scenario 3). The first two export points are already in operation. The third scenario from the port of Kulevi can be planned as a liaison point for importing natural gas to Europe from the countries outside the EU (e.g., Azerbaijan, Turkmenistan). The potential of these countries in terms of LNG production is evaluated in the study [6].

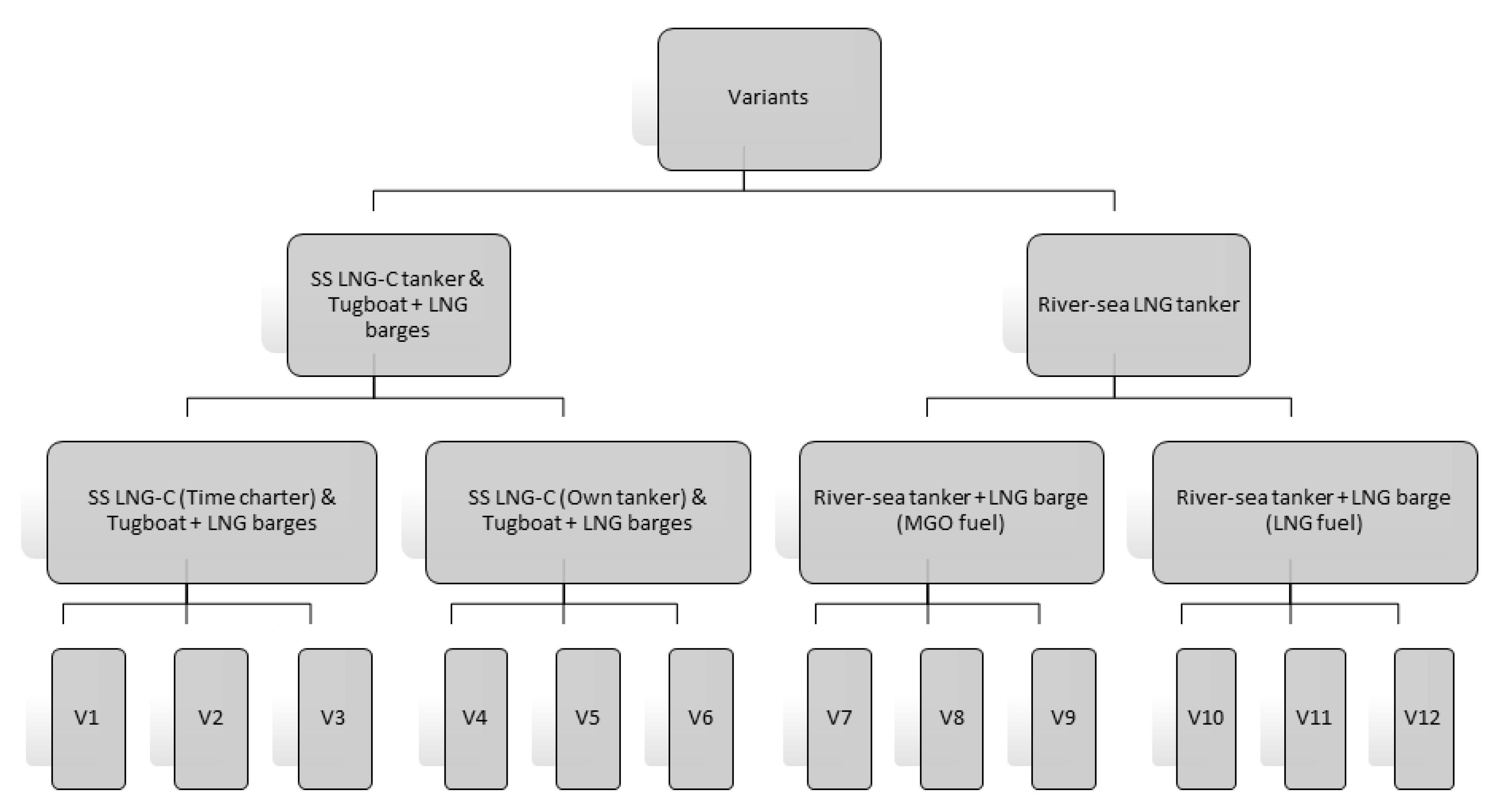

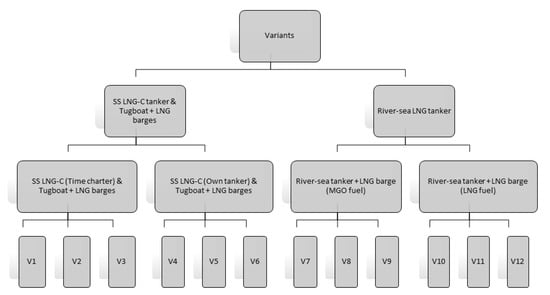

In the following Figure 1, the scheme of individual proposed variants regarding assessing the economic efficiency of LNG transport by various technologies is depicted.

Figure 1.

Proposed variants in terms of assessing the economic efficiency of LNG transport by various technologies.

4.1. Economic Assessment Using a SS LNG-C Tanker

Several basic inputs and parameters need to be defined in the LNG transport economic assessment by SS LNG-C tankers. These relate mainly to navigation conditions on the individual river and sea sections and selected vessel parameters that will provide transport.

4.1.1. Proposal of LNG Transport Technology on the River Section between Galati and Bratislava

The proposal of the required transport capacity is based on the destination LNG terminal’s capacity in the port of Bratislava. The expected capacity is at the level of 12,000–14,000 m3 per month. For LNG barges with six LNG cargo tanks, the transport capacity is set at 2049 m3 ± 5%. For the Danube-Europa II barge with three cargo LNG tanks, the capacity is half as much. The optimal setting for the selected route is a push tugboat + two barges of LNG with six cargo tanks, with a total capacity of about 1700–1800 t (with a standard LNG density in the range of 0.42–0.45 t.m−3) [43].

Based on the navigation conditions on the lower and middle Danube, we propose to dimension the power of the pusher tugboat so that for 1 horsepower (hp) of nominal power, there will be 3–4 tons of displacement with a load [44]. For the LNG convoy, the calculated displacement is set at D = 2514 t. For this reason, the power of the pusher tugboat for two barges is 1.3–1.6 thousand hp. By considering the large areas of LNG barges, we propose the power of the tugboat’s main engines from 1.8 to 2.0 thousand hp. (1300–1500 kW). Tugboats of the TR 2000 type of a Slovak company or of the Z type of a Hungarian company were selected as the most appropriate.

The distance from Galati to Bratislava on the Danube is 1717 km. The transport times on this Danube section is the same for all three scenarios. The Danube section is divided into three navigation sections (Galati–Turnu-Severin, Turnu-Severin–Mohacs, Mohacs–Bratislava). For upstream navigation, the voyage time is set at 10.3 days and, for downstream navigation, it is 5.15 days. In the ports of Mohács, Bezdane and Veliko Gradište, 4 days are counted for inspections. A total of 1 day is set aside to ensure loading and unloading. Waiting for a sea SS LNG-C tanker’s arrival in the port of Galati, tugboat refuelling, and other extraordinary delays are, on average, 2–3 days. Table 1 shows the time of the cruise, which lasts about 25 days. Eight LNG barges and four tugboats are needed to deliver the estimated amount of cargo. The estimated voyage time is determined based on data from operators.

Table 1.

The total cost of the voyage on the river section and the price of the transport of 1 m3 LNG.

4.1.2. Calculation of Costs of the Pushing Convoy on the River Section Galati–Bratislava

The optimal version of a convoy for this river section is on push tugboat TR 2000 and two LNG barges. The daily time-charter rate for renting a TR 2000 tugboat is 1850 EUR (based on the operator’s current price). The price does not subsume fuel costs. Each LNG barge must be operated by 2 professionally qualified crew members—Senior Boatswain and Gas Engineer to ensure the safe operation of the ship power and other equipment. These crew members ensure the performance of the prescribed technical maintenance as well as the continuous control of the physical and chemical properties of LNG. The daily salary cost for LNG barges is EUR 330 (EUR 4950 for a round trip). Other daily expenses of items for a tugboat and two LNG barges include: drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, insurance, depreciation for repairs. The total daily amount of these expenses is EUR 458.83. Total daily expenses for the convoy are EUR 2639.83. The price per 1 t MGO is EUR 724 (based on local price in this region). The average daily consumption for the upstream voyage is 4.08 t., for the downstream voyage it is 3.06 t., and for downtime it is 0.288 t. A detailed calculation was made based on the information obtained on tank vessels’ operation on the Danube river.

To determine the total cost of the voyage, it is necessary to take into account downstream, upstream, downtime, and all port fees or other costs in ports. The total costs for the voyage are shown in Table 1.

Transport of 1 m3 of LNG with a tugboat TR 2000 with LNG barges on the river section between the port of Bratislava and the Romanian port of Galati costs EUR 36.55.

4.1.3. Economic Calculation of the Sea Section—Time-Charter SS LNG-C

The subsequent carriage of LNG cargo by sea is carried out in two variants—using the lease of a marine SS LNG-C tanker or as transport with an SS LNG-C tanker in exclusive ownership. The distances and estimated time of the voyage to the three export ports of Marmara Ereglisi, Aliaga, and Kulevi are summarized in Table 2.

Table 2.

Distance of ports of export and time of voyage to Galati.

The Small-Scale LNG tanker’s voyage (SS LNG-C) from Aliaga or Kulevi at a speed of 12.5 knots in stable and typical weather for this region is 1.7–2 days. The return journey in ballast lasts approximately the same. The voyage from the Sea of Marmara to Galati takes 1 day. The loading and unloading process takes 1.5 days. Waiting for permission to cross the Turkish straits and refuelling the vessel takes 1–1.5 days. Securing the IGS (Inert Gas System) takes 0.5 days. According to the times in Table 2, one SS LNG-C with a carrying capacity of 3000–3500 m3 can ensure the utilization of river formations along the Danube for three selected scenarios in the volume of about 12,000–14,000 m3 LNG per month. According to the experience of tanker operators of this type, the cost of qualified management is approximately EUR 9000 per month.

The use of an SS LNG-C tanker is being considered for a sea voyage. The standard type of fuel for this tanker is the fuel oil IFO 60–IFO 180 and diesel MGO (prospectively, it can be changed to LSFO–Low-Sulfur Fuel Oil). The price per 1 t. of IFO 180 is EUR 439 and for MGO is EUR 570 (Based on local price in this region). The average daily fuel consumption of IFO 180 voyage is 8.9 t., MGO downtime is 1.4 t., MGO unloading/IGS is 2.8 t. and MGO loading is 1.4 t. The total daily expenses for the voyage are EUR 15,816.64, for IGS are EUR 1596.49, for loading and downtime are the same EUR 12,711.38, for unloading EUR 14,307.87. It is currently not known to provide SS LNG-C tankers for long-term time-charter. The time-charter rates for SS LNG-C are very similar to the rates for semi-refrigerated and full-refrigerated LPG tankers. A tanker with a space capacity of 5000 m3 is deemed the proper one in terms of capacity [45]. The representative rate is EUR 10,028.95 per day based on market research. This rate also enters into the following economic calculations. Port and channel fees for SS LNG-C tankers are listed in Table 3.

Table 3.

Port and channel fees for SS LNG-C tankers.

Fuel costs represent from 30% to 35% of the operating costs of a SS LNG-C tanker. These costs change most often while in operation. Into the cost calculation, also enter variable items (drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, time-charter rate). The total amount of variable items is EUR 11,913.13. The values are obtained as average values provided by tanker operators in the region. The values apply to all three scenarios.

To determine the voyage’s total cost in all three scenarios, it is necessary to consider voyage, IGS, downtime, loading, unloading, and port fees. The total costs for the voyage, as well as the calculation of the price per 1 m3 LNG, are shown in Table 4.

Table 4.

Total voyage costs—all scenarios, time-charter SS LNG-C tanker.

The above comparison of three scenarios within the particular variant, where the time-charter of a SS LNG-C tanker of LNG is envisaged, shows that the most economical scenario is scenario 1. The transport of 1 m3 of LNG on the sea section costs EUR 38.47.

4.1.4. Economic Calculation of the Sea Section—Own SS LNG-C Tanker

Another way to deliver a supply of LNG to the port of Galati is by using its own SS LNG-C tanker. When procuring a new tanker, the cost of the ship’s initial registration is negligible and does not need to be considered. The further calculation is made at current prices; therefore, cash flow discounting will not be used. The calculation also does not take inflation into account.

There are a small number of LNG-C tankers on the market, and thus there is room for speculative rates. Therefore, we calculate the OPEX (Operating Exchange) based on the order to construct a marine LNG-C tanker and calculate the bareboat/time-charter rate. The cost of building one mass-produced tanker (as much as possible with a capacity similar to the parameters required by the terminal in Bratislava) up to 5000 m3 for a customer in a South Korean shipyard would be around EUR 44 million, according to the available data. The following equation can express the construction price of a new tanker not produced in series with a capacity of 3500 m3 (non-series production—increase by 20%):

where:

C3500 ≈ (C5000 · 1.2/DWCC5000) · DWCC3000 = (EUR 44 mil. · 1.2/5000) · 3000 ≈ EUR 36 mil.,

- -

- C3000—the price of a new tanker with a capacity of 3000 m3;

- -

- C5000—the price of a new tanker with a capacity of 5000 m3;

- -

- DWCC5000—tanker capacity (5000 m3);

- -

- DWCC3000—tanker capacity (3000 m3).

To this end, we regard the linear depreciation of the new tanker with a typical limited operating time of 30 years. The amount obtained from the ship’s sale at the end of its operation (scrapping) can be determined as the determined displacement of the empty ship multiplied by the ship’s approximate selling price, increased by 20–30% due to a large amount of non-ferrous metals. This cash flow (reversal) can bring approximately:

where:

R0 = D0 · CD0/1mt · 1.3 ≈ 1200 · 236 · 1.3 ≈ EUR 368,160,

- -

- D0—empty ship displacement;

- -

- CD0/1mt—selling price of the ship.

In this case, the depreciation factor is of (EUR 36 mil. − EUR 368,160)/30/12 = EUR 100,000 per month (EUR 3333 per day). In this study, we consider the cost of performing a “Class” repair (with an inspection to confirm the vessel’s class). The approximate model of tanker repair costs is derived from the operation of analogous tankers. The average costs of repair and maintenance (Table 5) are determined based on private companies’ information.

Table 5.

Indicative costs for SS LNG-C repairs.

In our study, we propose a volume of 3200 m3 LNG tanks in 10 tanks. The approximate reasonable price of technical maintenance of cryogenic equipment is EUR 716.97/5 years (in terms of 1 m3). This is based on the average values of costs provided by manufacturers in this segment. These costs will be lower for LNG evaporators and heaters installed for 1–2 supply tanks of the vessel’s fuel system. This number is reduced in the projected SS LNG-C tankers. From a design point of view, cryogenic LNG tanks do not have actively corroding and wearing parts. Therefore, approximately 67% of maintenance costs after 5 years of operation are fuel system pumps, compressors and valves. Approximately half of these mechanisms are not required for the cargo system of the proposed tanker. Based on these data, adjusted and specific costs per 1m3 of LNG tank volume (EXP1m3lng/c) will be accepted for further indicative calculation:

EXP1m3lng/c = 716.97 · (1 − 0.67/2) = EUR 476.79.

In connection with the maintenance of many types of one tank, there is a cost reduction effect. The effect of cost reduction is defined by a coefficient, which is in the range of 0.6–0.8. Because the planned number of tanks is small, we use a coefficient of 0.8. Based on the above, the price of repairs and 5 years of technical maintenance of the cryogenic equipment of the SS LNG-C tanker will be:

EXP1m3lng/c = 476.79 · 0.8 · 3200 = EUR 1,220,582.

This corresponds to a depreciation of EUR 113.00 per day for 30 years of operation and the last repair of the cryogenic equipment in the 25th year. We used the amount of depreciation costs and depreciation for repairs as the basis for calculating the bareboat charter rate. The approximate bareboat charter rate (B/c hire) will be:

B/c hire = EUR 3333 + EUR 150.28 + EUR 113.00 = EUR 3596.28 per day.

Considering the daily wage costs of the crew for EUR 1608.00 (Captain EUR 233.92, Chief Mate EUR 187.13, 2nd Mate EUR 99.41, 3rd Mate EUR 52.63, Chief Engineer EUR 219.30, 2nd Engineer EUR 181.29, 3rd Engineer EUR 87.72, Electrical Engineer EUR 131.58, Gas Engineer EUR 131.58, Motormen—AB EUR 52.63, 2 × AB − motorman EUR 46.78, Boatswain EUR 64.32, Cook—AB EUR 73.10), the ongoing depreciation for the operation of SS LNG-C (including depreciation) can be expected at the level of EUR 5204.28 per day.

According to the above scenarios, the calculation of economic indicators of the sea transport with the transhipment of goods to river pushing convoy sets is performed based on information collection and based on experience with the operation of maritime SS LPG tankers. Other variable cargo items for SS LNG-C tanker include crew wages, depreciation for repairs, drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, insurance, depreciation). The total value of these items is EUR 6151.85. Values are obtained as average values provided by tanker operators and from previous calculations. The values listed apply to all three scenarios.

In order to determine the total cost of the voyage in all three scenarios in this variant (own SS LNG-C tanker), it is necessary to consider voyage, IGS, downtime, loading, unloading and port fees. The fuel price and the average consumption is the same as in the calculations in the last part of the study, Section 4.1.3.

The total costs for the voyage, as well as the calculation of the price per 1 m3 LNG, are shown in Table 6.

Table 6.

Total voyage costs—all scenarios, own SS LNG-C tanker.

From the above comparison of three scenarios regarding this variant where the acquisition of own SS LNG-C tanker is expected, it follows that scenario no. 1 seems to be the most economical. The transport of 1 m3 of LNG on the sea section costs EUR 25.86.

4.1.5. Evaluation of all Variants Using a SS LNG-C Tanker

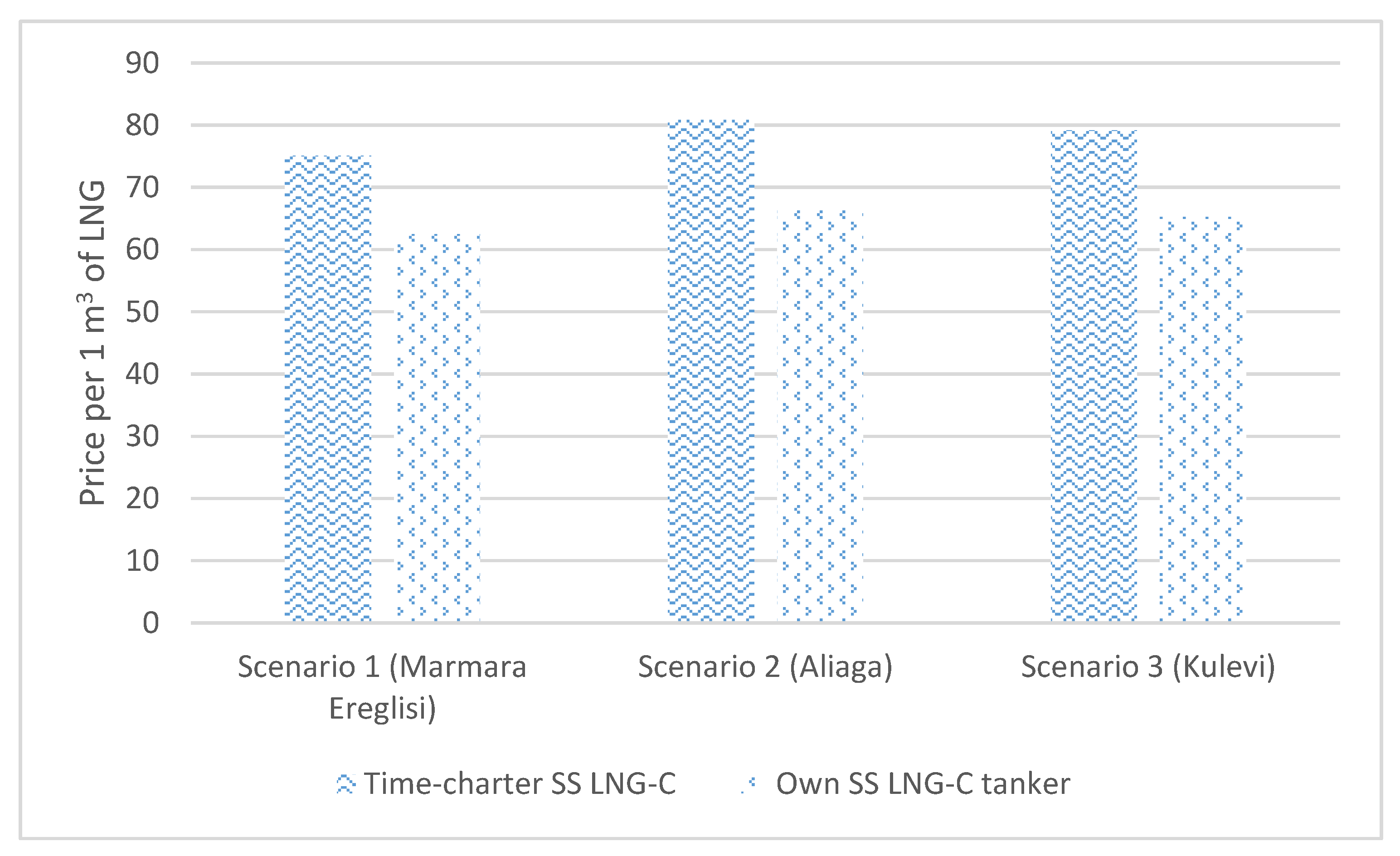

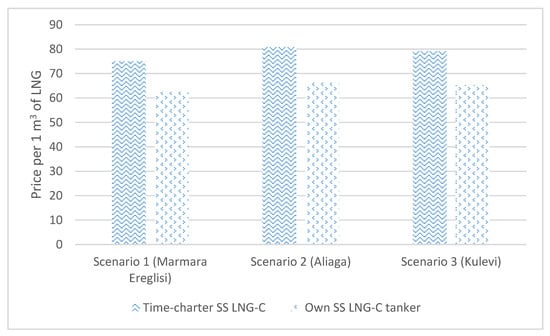

Based on the previous results, Figure 2 compares the prices for the transport of 1 m3 of LNG when considering the different ownership relationships to sea tankers. In all the scenarios examined, the Danube river’s transport is carried out by a pusher convoy consisting of a pusher tugboat with pusher LNG barges.

Figure 2.

Evaluation of the variants using an SS LNG-C tanker.

According to the relevant scenarios of sea transport performed by SS LNG-C tankers with the subsequent transhipment of goods to river tugboats with LNG barges in the Romanian port of Galati, the calculated price for transporting 1 m3 LNG is the lowest when procuring their own SS LNG-C tanker on the route Marmara Ereglisi–Galati–Bratislava–Marmara Ereglisi.

4.2. Assessment Using a River-Sea LNG Tanker and LNG Barge

The use of river-sea LNG tankers entails another possibility of transporting LNG to the port of Bratislava. The calculation is based on the same capacity requirements: 12,000–14,000 m3 LNG per month. LNG transport consists of two parts (sea and river). The export ports are the same as in the first variant (ports of Marmara Ereglisi, Aliaga and Kulevi). The river section is also defined between the port of Galati and Bratislava. The economic calculation using the river-sea LNG tanker and LNG barge is realized in two versions. The first version uses MGO as fuel, and the second uses a dual fuel system using LNG as fuel. As for LNG, we consider a price of EUR 324.56 per 1 t.

The estimated time of the voyage is 7.23 days upstream and 4.77 days downstream. Approximately 4.6 days are expected for technological downtime, including inspections in Mohács (HU), Bezdana, and Veliko Gradište (RSB); crew rest; crossing the locks; and the refuelling of the tanker. It is assumed 2 days for the whole convoy to unload the cargo. Waiting for the arrival of the river-sea LNG tanker to Galati and other extraordinary delays are 2 days. In this case, the total voyage, including the sea section, for one convoy consists of a river-sea LNG tanker and an LNG barge is about 26–28 days.

The convoy for navigation on river sections from the Romanian port of Galati to the Slovak port of Bratislava consists of a river-sea LNG tanker and one LNG barge (with 6 cryogenic tanks). The mooring of the convoy will take place at an anchorage intended for vessels with dangerous goods. When the mooring process is completed, and the security measures are met, part of the cargo is transferred from the river-sea LNG tanker to the LNG barge. This achieves the same draft for both vessels T = 1.60 m. During this draft, and while maintaining the Danube water level’s height at a statistically long-term mean level, the convoy should sail without delay in both directions. There may be navigation restrictions during the navigation period when crossing under bridges in Budapest and Novi Sad. This applies to cases of a high-water level. Due to their random occurrence throughout the season, we do not consider the delay time for reforming the convoy configuration. We are not even considering the case of using a river-sea LNG tanker without the LNG barge.

4.2.1. Calculation of Costs of the Convoy on the River Section Galati–Bratislava

The LNG barge will be waiting for the arrival of the river-sea LNG tanker at a dedicated berth in the port of Galati, in connection with which there will occur the costs for downtime. The expected speed of the convoy in the upstream voyage is set at 10 km/h, while the daily fuel consumption will be the highest compared to the consumption on the sea section or in the downstream voyage. The expected speed of the convoy in downstream navigation is 15 km/h. The times of sea voyage operations are shown in Table 7.

Table 7.

Distance from seaports and voyage time from Galati.

The voyage time of a river-sea LNG tanker from Aliaga or Kulevi at a speed of 12.5 knots in stable weather is 1.7–2 days. The return trip without cargo (in ballast) lasts about the same time. The voyage from the Sea of Marmara to Galati takes 0.8 days. Loading a tanker and transhipment of the part of the cargo to an LNG barge in Galati takes 1.5 days. Waiting for a permit and crossing the Turkish Strait and refuelling the vessel takes 1–1.5 days.

The estimated price of the serial new construction of a river-sea LNG tanker with tanks with a capacity of 3200 m3 in Slovenské Lodenice is approximately EUR 25 million (the price of the tugboat is estimated at EUR 6.8 million). The cost of the initial registration of a ship is negligible and does not need to be considered. The indicative price calculation for LNG barges can be determined by comparing the prices of custom river-sea tankers and river tankers.

The specific costs for the construction of a 1 t deadweight (DWt) river-sea tanker are as follows:

where:

EXP1mtDWt = Cblt/DWt = 6,800,000/5200 ≈ EUR 1308.00,

- -

- Cblt—price of the river-sea tanker without tanks;

- -

- DWt—dead weight.

The new construction of the tanker is estimated at EUR 1.5 mil. with a capacity (DWt) of 5000 t. The specific costs for the construction of 1 t tonnage (DWt) of this tanker will be:

EXP oil barge1mtDWt = Cbltbarge/DWtbarge = EUR 1,500,000/5000 ≈ EUR 300.00.

The approximate value of CAPEX (Capital Expenditure) in the construction of one LNG barge, based on the estimated price for the new construction of a river-sea LNG tanker and the ratios of specific costs for the construction of a river-sea tanker and barges will be:

CAPEX LNG barge ≈ EUR 25,000,000 · 300/1308 ≈ EUR 5,734,000.

The further calculation is performed at current prices; therefore, cash flow discounting will not be used. The calculation does not take inflation into account.

Our study considers the linear depreciation of a new tanker with a typically limited-service life of 30 years, similar to that for a marine LNG-C tanker.

The price obtained from the sale of ships after the end of their operation (scrap sale) can be calculated as the determined empty ship displacement (D0 for a river-sea LNG tanker = 2530 t; D0 for LNG barge = 1565 t) multiplied by the estimated sale price of the ship, increased by 20–30% due to a large amount of non-ferrous metals. This cash flow (Ro) for the river-sea LNG tanker is expected to be approximately:

where:

R0 = D0 · CD0/1mt · 1.3 ≈ 2530 · 236 · 1.3 ≈ EUR 776,204,

- -

- D0—empty ship displacement;

- -

- CD0/1mt—selling price of the ship/barge.

The cash flow for an LNG barge is expected to be approximately:

R0 = D0 · CD0/1mt · 1.3 ≈ 1565 · EUR 149 · 1.3 ≈ EUR 303,140 per barge.

In this case, the depreciation factor for the river-sea LNG tanker is (EUR 25,000,000–EUR 776,204)/30/12 = EUR 67,288 per month and EUR 2242 per day.

The amortization factor for an LNG barge is (EUR 5734,000–EUR 303,140)/30/12 = EUR 15,085 per month and EUR 502.83 per day.

The costs of carrying out the repair for the issue of classification (with an inspection to confirm the vessel’s class) and the dock’s repair is based on experience with the operation of analogue tankers with similar tonnage. The approximate cost of repairs is the same as for the SS LNG-C tanker, and thus at EUR 150.28 per day.

The costs of repair and maintenance of the cryogenic tanks for the river-sea LNG tanker can be set at the same amount of EUR 113.00 per day as calculated and reported for the SS LNG-C tanker. Each LNG barge’s cost, equipped with 6 cargo tanks, is determined in proportion to the cost for a river-sea LNG tanker equipped with 10 cargo tanks. Its amount will be EUR 70.84 per day per barge. The monthly expenses for the river-sea LNG tanker crew are EUR 28,200 (EUR 940.00 per day). The basic daily wages for individual positions are as follows: Captain EUR 200, Chief Mate EUR 160, 2nd Mate EUR 85, Chief Engineer EUR 183.33, Gas Engineer EUR 110, Electrician-Motormen—AB EUR 85, Boatswain EUR 55, Cook—AB EUR 60.

For river-sea LNG tankers using MGO fuel, considering crew wages, we can expect an ongoing depreciation for the operation of the river-sea LNG tanker (including depreciation) approximately at the level of EUR 4000 per day.

4.2.2. Total Cost Calculation—A River-Sea LNG Tanker, and LNG Barge

The daily variable costs for the operation of a river-sea LNG tanker include: crew wages, depreciation for repairs, drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricant, representation for captain, insurance, and depreciation. The total daily amount of these expenses for the river-sea LNG tanker is EUR 4000 and for the LNG barge EUR 943.03. These items are equal in both the sea and river sections. Values are obtained as average values provided by tanker operators and from previous calculations. The values listed apply to all three scenarios.

The standard type of fuel for this tanker is the fuel MGO. The price per 1 t. of MGO is EUR 570.18, and LNG is EUR 324.56. The average daily fuel consumption in the offshore section of a sea voyage is 9 t., unloading/IGS is 0.72 t, loading and downtime is 0.36 t.

The total daily expenses in the offshore section using MGO fuel for the voyage are EUR 9141.88, for unloading/IGS they are EUR 4420.83, for loading/downtime they are EUR 4215.56. Overall daily expenses in the offshore section using MGO fuel are EUR 17,778.27.

The average daily fuel consumption on the river for the downstream voyage is 7.8 t., for upstream is 12 t., for unloading/IGS is 0.72 t., and for loading/downtime 0.36 t. The total daily expenses on the river section using MGO fuel for the downstream voyage they are EUR 9400.70, for the upstream voyage they are EUR 11,795.44, for unloading/IGS they are EUR 5363.86, for loading/downtime they are EUR 5158.59, and for LNG barge downtime they are EUR 943.03. The overall daily expenses on the river section using MGO fuel are EUR 26,559.99.

The total daily expenses in the offshore section using LNG fuel for the voyage are EUR 6931.35, for unloading/IGS they are EUR 4243.985, and for loading/downtime they are EUR 4127.14. The overall daily expenses in the offshore section using LNG fuel are EUR 15,302.48.

The total daily expenses on the river section using LNG fuel for the downstream voyage are EUR 7484.91, for the upstream voyage are EUR 8848.07, for unloading/IGS are EUR 5187.01, for loading/downtime they are EUR 5070.17, and for LNG barge downtime they are EUR 943.03. Overall daily expenses on the river section using LNG fuel are EUR 21,519.99.

Table 8 presents the total costs of a voyage and the price of transporting 1 m3 of LNG using the river-sea LNG tanker and LNG barge for MGO fuel and LNG fuel as well. A calculation has been applied for all three scenarios.

Table 8.

Total voyage costs—all scenarios, LNG tanker, and LNG barge.

The above comparison of six plans (three for MGO fuel + three for LNG fuel) of LNG transport to the port of Bratislava shows that the transport scenario from Marmara Ereglisi appears to be the most economical for both fuel technologies.

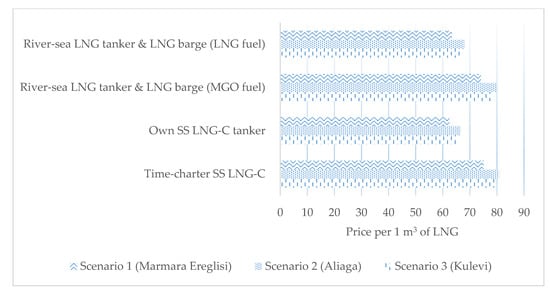

4.3. Overall Economic Comparison of Assessed Variants

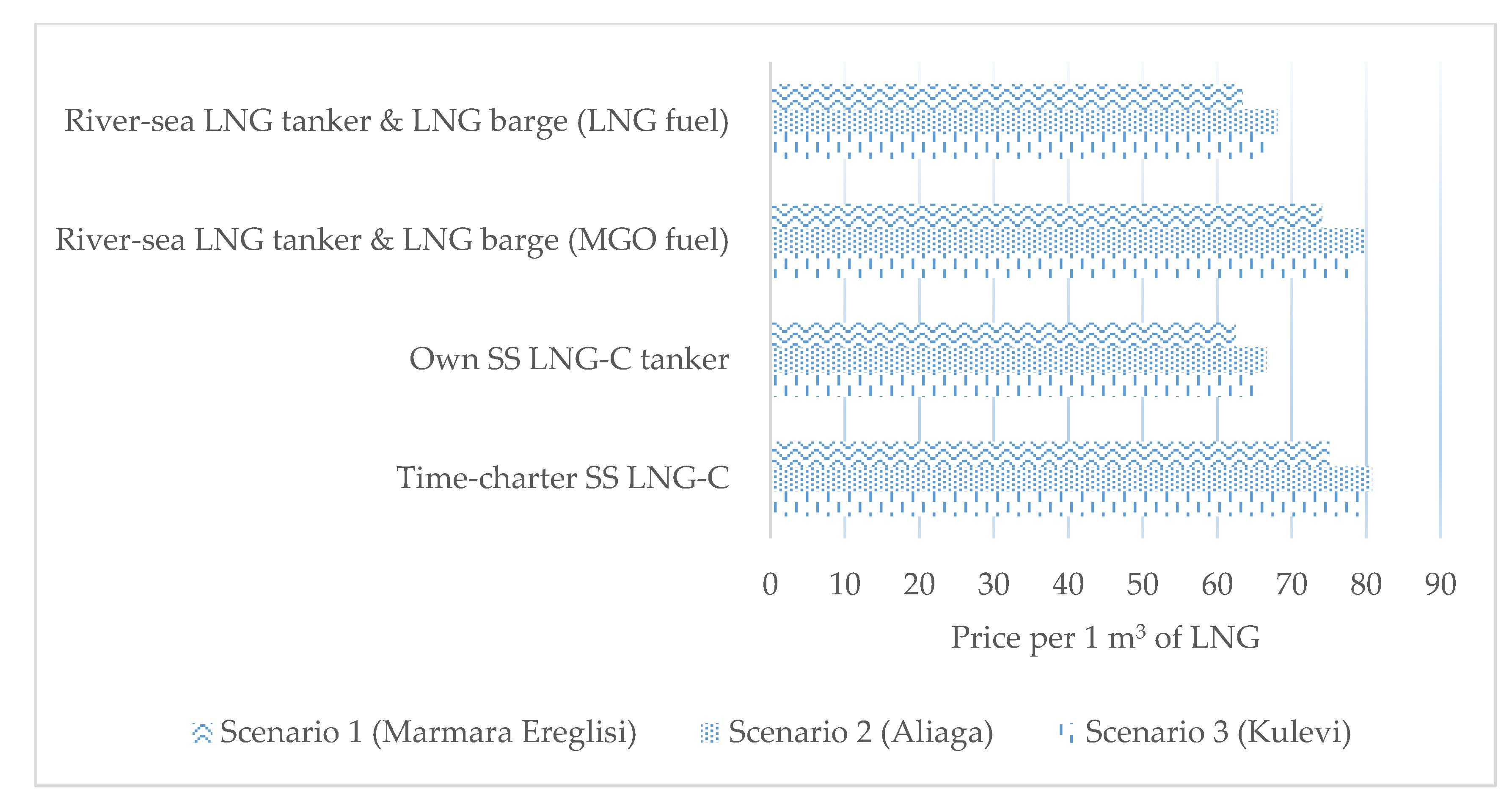

Figure 3 shows the economic comparison of the results. The first phase results show that its own SS LNG-C tanker acquisition is more advantageous than operation on a time-charter basis. When assessing the technology using a river-sea LNG tanker, it follows that the version using LNG fuel is more economically advantageous. For both methods, the transport price was the lowest for LNG transport from the port of Marmara Ereglisi.

Figure 3.

Evaluation of the economic results of all variants.

According to the previous assessment of all variants, the counted price for transporting 1 m3 of LNG is the lowest using the LNG tanker and LNG barge powered by LNG fuel on the route Marmara Ereglisi–Galati–Bratislava–Marmara Ereglisi. In the port of Galati, part of the cargo is transferred from the river-sea LNG tanker to the LNG barge. This achieves the same draft for both vessels T = 1.60 m.

5. Assessment of Variants Using the Operations Research Techniques

Certainly, even other factors except for the price of transport are important as well. Nowadays, in addition to the price of transport, transport time, transport safety, availability of infrastructure, and ecological aspects are imperative as well. Since this study should provide a comprehensive picture of LNG carriage’s possibilities to the port of Bratislava on the river of Danube, the study conducts a multi-criteria analysis. It is an assessment of transport variants based on selected criteria. A multi-criteria assessment is performed by two methods (MCDA and TOPSIS) to increase the quality of the results.

5.1. Multi-Criteria Decision Analysis

When choosing an adequate variant of LNG transport within waterborne transport, it is necessary to consider several aspects. At present, more and more emphasis is being placed on the quality of transport, transport (delivery) time, environmental aspects and, last but not least, safety [46]. Based on the results of the brainstorming panel of experts in our field of research, we determined the following criteria and their weights:

- C1—Transport price—transport prices of individual variants (alternatives and scenarios) are based on a previous economic assessment.

- C2—Transport time—the transport time is based on the data of the operators who actually provide the transport on similar routes.

- C3—Transport safety—determined based on a comparison of individual variants’ safety from a technological point of view (type of vessel, type of transhipment, number of transhipments).

- C4—Availability of resources—determined based on the source’s geographical location and LNG supply.

- C5—Environmental aspects—assesses the environmental security of transport in terms of the technologies and fuels used.

In our study, we assess a total of 12 variants based on the already implemented technical and economic assessment. They are based on the previous part of the study, where we compared two basic modes of transport (SS LNG-C and a river-sea LNG tanker and LNG barge). The weights of individual criteria are given in the following Table 9.

Table 9.

Determination of the weights of individual criteria based on expert assessment.

The next step of the MCDA is to compare the different variants based on each criterion (see Appendix A, Table A1, Table A2, Table A3, Table A4 and Table A5). These results, along with the mutual comparison of criteria (specifying the weights of individual criteria), from the inputs to the final assessment, the results of which are presented in the following Table 10.

Table 10.

MCDA results.

The results of the MCDA showed that, after considering several criteria (apart from the price), variant no. 10—i.e., LNG delivery from the port of Marmara Ereglisi using a river-sea LNG tanker powered by LNG—is preferred.

5.2. The Technique for Order of Preference by Similarity to Ideal Solution

Using the TOPSIS method, we assess LNG carriage variants to the port of Bratislava based on the analogous criteria. The weights remain unchanged (same as for MCDA).

The initial point is to normalize the criterion (Table 11) matrix, which considers the weights already determined based on experts’ results.

Table 11.

Normalized criterion matrix considering the weights of individual criteria.

The ideal variant is calculated in the following Table 12.

Table 12.

Ideal variant calculation.

The calculation of the basal variant is carried out in Table 13.

Table 13.

Basal variant calculation.

The relative indicator of the distance from the basal variant is specified in Table 14.

Table 14.

Relative indicator of the distance from the basal variant—determination of the optimal variant.

By assessing the variants of LNG transport to the port of Bratislava by water transport, we concluded that variant no. 10 from the port of Marmara Ereglisi is regarded as the most suitable option.

6. Results and Discussion

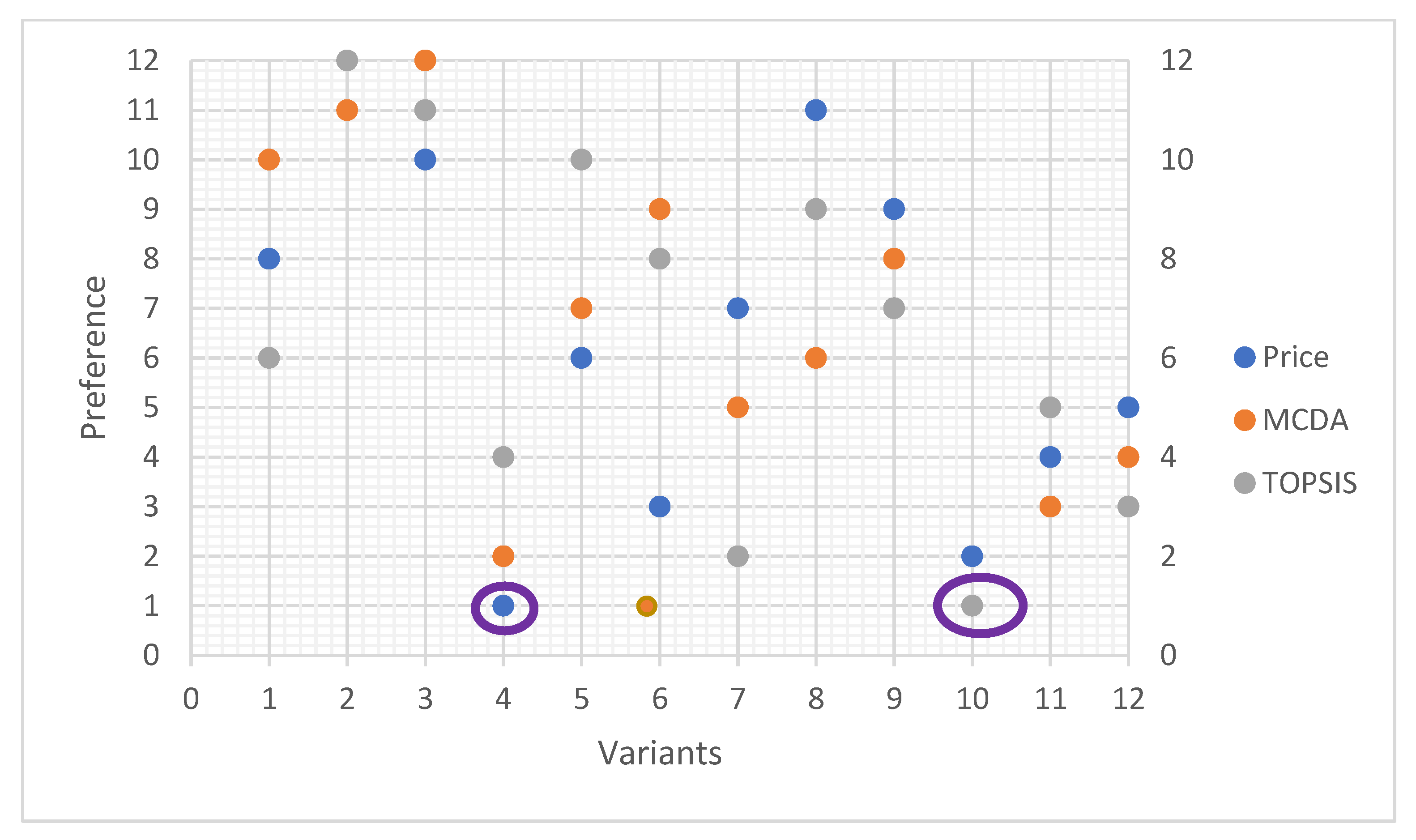

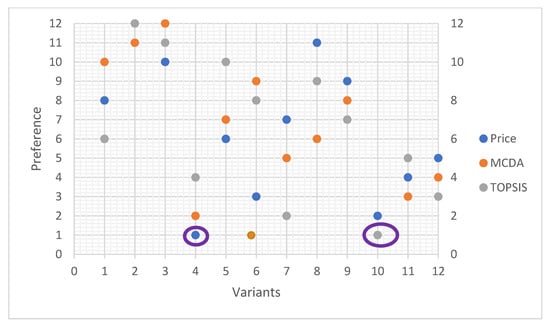

Based on a comprehensive and multi-criteria comparison of the possibility of LNG transport from the ports of Marmara Ereglisi, Aliaga, and Kulevi to the port of Bratislava using the Danube River, we can draw the following conclusions:

- In terms of the total costs of a transported commodity (LNG), variant no. 4 appears to be the best option, where it is planned to procure its own SS LNG-C tanker.

- When applying the TOPSIS method, we concluded that variant no. 10, where the use of a river-sea LNG tanker and LNG barge (operated on LNG fuel) is envisaged, renders the compromise variant.

- As far as the MCDA is concerned, by assessing the variants based on the set of five various criteria, the weights of which were specified by a panel of experts, we confirmed the identical conclusion as by the TOPSIS method.

- All the methods applied have confirmed the port of Marmara Ereglisi in Turkey as the proper export terminal.

The following Figure 4 depicts the graphical evaluation of the order of individual variants by three different methods.

Figure 4.

Evaluation of the order of variants by three operation research techniques.

Several similar studies addressing the use of natural gas in transport have been carried out in recent years. A political-economic study of natural gas use in heavy freight transport has also been carried out for Brazil [47,48]. The economic analysis finds out that if LNG trucks are up to 17% more expensive, the cost per kilometre is still the same as that for standard diesel-powered trucks. State regulations and underdeveloped infrastructure are the biggest problems in implementing LNG in heavy freight transport. The problem with insufficiently developed infrastructure (LNG filling stations) can also be seen in our geographical area—not only Slovakia, but also the surrounding countries.

Another study addressing the possibility of transporting LNG by SS LNG tankers was carried out in Indonesia [18]. It aimed to optimize LNG distribution using SS LNG carriers and perform an economic analysis in this region. The optimization consisted of maximization of the volume of cargo with a given capacity of the LNG vessel. From the results, it is clear that the cost of transporting LNG depends on the amount of demand for LNG and the transport distance. The results of our study, especially the comparison based on price as well as the MCDA method, confirm that the use of SS LNG tankers is economically profitable, with comparable deliveries, which in our case are based on the storage capacity of the planned LNG terminal in the port of Bratislava.

A study of a similar nature was also addressed by Lopez Alvarez et al. [20]. Their study addresses the design of the distribution network of the supply chain for LNG as a fuel. This case study clarifies the process of opening satellite terminals and justifies the investment in this segment.

In the study entitled “Economic assessment of liquefied natural gas (LNG) as a marine fuel for CO2 carriers compared to marine gas oil (MGO)” [49], economic scenarios of CO2 transport in the North Sea are compared. The use of different types of fuels (HFO, MGO, LNG) is investigated. Following the outcomes, it is clear that CO2 carriers powered by LNG fuel are more cost-effective than CO2 carriers using MGO based on the current price of fuel in a given period. The assessment also confirms this by the TOPSIS method in our study, where the scenario of a river-sea LNG tanker and LNG barge is preferred the most.

In the publication [50], multi-criteria comparisons of LNG and MGO fuels used in shipping are discussed. This analysis focuses on three main criteria: environment, economy, and safety. The results show that LNG-based technologies offer better sustainability performance than MGO. The low-pressure dual-fuel system provides a more sustainable alternative, with a 35% reduction in the overall sustainability impact compared to MGO due to the corresponding environmental benefits.

Our study extended the criteria set to encompass delivery time [51] and resource availability, which allowed us to obtain an even more comprehensive and profound assessment.

7. Conclusions

Natural gas looks to be the fuel of the future. The use of natural gas as a fuel has recently gained importance. In our research study, we focused on multiple options of transporting LNG from three seaports to the port of Bratislava. The ports of Marmara Ereglisi and Aliaga in Turkey and the port of Kulevi in Georgia were regarded as the export terminals.

Our study presents a unique approach by comparing LNG carriage as a commodity inland along the river of Danube, specifically to Central Europe, from several points of view. Besides the comparison in terms of price, the scenarios are also compared from other perspectives when using particular operation research techniques. The study evaluates carriage using traditional MGO fuels and alternative LNG fuels. Furthermore, it also brings a comparison from a technological point of view (the use of a SS LNG-C tanker and a river-sea LNG tanker and LNG barge).

Specifically, a total of twelve scenarios were compared in the study. The first part of the study quantified the transport costs of 1 m3 of LNG in various ways, where the following outcomes were achieved:

- -

- Variant no. 4 was designated as the most suitable scenario—i.e., LNG carriage from the port of Marmara Ereglisi in Turkey to the port of Bratislava using a SS LNG-C tanker on the sea section and a TR 2000 tugboat with two LNG barges on the river section.

- -

- With a very small difference, variant no. 10 was defined as the second most appropriate option. It entails the scenario of LNG carriage from the same port but by a different transport technology. This scenario implements the technology of a river-sea LNG tanker powered by LNG fuel. In this particular variant, part of the cargo is transhipped into an LNG barge located in the port of Galati.

- -

- The carriage price of 1 m3 of LNG for other variants varies from 5 to 29% more than for the two aforementioned transport scenarios (i.e., variant no. 4 and variant no. 10).

The second part of the study focuses on a multi-criteria evaluation of the predesignated variants. MCDA specified variant no. 10 as the adequate one. Variant no. 4 was determined as the second most suitable scenario, followed by variant no. 11. Thus, the change in the very order of variants is apparent compared to the assessment based only on the price of transport. This analysis corroborates that price currently plays an important role in choosing the appropriate transport mode, but its dominance is slightly declining. In line with this, other factors and standpoints have been gaining importance, such as the aspects of environmental impacts or transport time.

Using the TOPIS method, we concluded that variant no. 10 is regarded as the most ideal transport option (likewise for MCDA). Variant no. 7 was quantified to be the second most suitable scenario, followed by variant no. 12.

Two out of three methods of evaluating variants bring equal results, wherein a variant when using a river-sea LNG tanker and LNG barge is considered the ideal variant of LNG carriage to the port of Bratislava on the Danube. Currently, the LNG terminal in Marmara Ereglisi (Turkey) appears to be the most appropriate export point, which is also confirmed by our findings. Regarding comparing the carriage price, variant no. 4 seems to be the most suitable option. Notwithstanding this, after considering even other outcomes, we can state that the most suitable means of LNG carriage to the port of Bratislava is to deploy a river-sea LNG tanker, whilst part of the cargo will be transhipped to an LNG barge in the port of Galati. This will ensure the desired draft for safe navigation on the Danube waterway to the Port of Bratislava.

As for further research in this particular field, activities should be aimed at evaluating the possibilities and design of relevant LNG infrastructure on the Danube river section. The specific variants recommended in this research study require having an adequate transport infrastructure for LNG bunkering (filling). Hence, it is imperative to create a logical network of filling stations in order to ensure the possibility of bunkering LNG throughout the river Danube. This will also contribute to a global effort focused on the river fleet replacement on the Danube (compliance with the EU transport strategy). However, it should also be emphasized that our study’s individual findings are intended to create the opportunity in order to diversify sources for ships/vehicles in the Danube region and not to ensure a majority volume of gas supply.

Author Contributions

Conceptualization, M.J. and T.K.; methodology, M.J. and O.S.; validation, T.K. and P.G.; formal analysis, M.J. and O.S.; investigation, M.J., T.K., O.S. and B.A.; resources, M.J. and T.K.; data curation, M.J. and T.K.; writing—original draft preparation, M.J.; writing—review and editing, M.J. and O.S.; visualization, P.G.; supervision, M.J., B.A. and O.S.; project administration, M.J. and T.K.; funding acquisition, M.J. and T.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Project VEGA No. 1/0128/20: Research on the Economic Efficiency of Variant Transport Modes in the Car Transport in the Slovak Republic with Emphasis on Sustainability and Environmental Impact, Faculty of Operation and Economics of Transport and Communications, University of Zilina, 2020–2022. This research is also the result of the Institutional research of the Grant system of the Faculty of Operation and Economics of Transport and Communications, University of Zilina.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Comparison of Variants Based on Criteria

Table A1.

C1—Price.

Table A1.

C1—Price.

| C1 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | ∏ S(ij) | w (i) | v (i) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 3.8 × 10−2 | 0.762 | 0.045 |

| V2 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 3.5 × 10−6 | 0.351 | 0.021 |

| V3 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 3.5 × 10−6 | 0.351 | 0.021 |

| V4 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 4,920,898.6 | 3.611 | 0.212 |

| V5 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 625.0 | 1.710 | 0.101 |

| V6 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 625.0 | 1.710 | 0.101 |

| V7 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 4.0 × 10−2 | 0.765 | 0.045 |

| V8 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 3.6 × 10−6 | 0.352 | 0.021 |

| V9 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 3.6 × 10−6 | 0.352 | 0.021 |

| V10 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 5,081,609.2 | 3.621 | 0.213 |

| V11 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 637.7 | 1.713 | 0.101 |

| V12 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 637.7 | 1.713 | 0.101 |

Table A2.

C2—Transport Time.

Table A2.

C2—Transport Time.

| C2 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | ∏ S(ij) | w (i) | v (i) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1 | 1.0 | 3.0 | 3.0 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 0.2 | 0.3 | 0.3 | 3.8 × 10−2 | 0.762 | 0.045 |

| V2 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 3.5 × 10−6 | 0.351 | 0.021 |

| V3 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 3.5 × 10−6 | 0.351 | 0.021 |

| V4 | 1.0 | 3.0 | 3.0 | 1.0 | 3.0 | 3.0 | 0.2 | 0.3 | 0.3 | 0.2 | 0.3 | 0.3 | 3.9 × 10−2 | 0.763 | 0.045 |

| V5 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 3.6 × 10−6 | 0.352 | 0.021 |

| V6 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 0.1 | 0.2 | 0.2 | 0.1 | 0.2 | 0.2 | 3.6 × 10−6 | 0.352 | 0.021 |

| V7 | 5.0 | 7.0 | 7.0 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 1.0 | 3.0 | 3.0 | 4,980,485.2 | 3.615 | 0.213 |

| V8 | 3.0 | 5.0 | 5.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 631.3 | 1.711 | 0.101 |

| V9 | 3.0 | 5.0 | 5.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 631.3 | 1.711 | 0.101 |

| V10 | 5.0 | 7.0 | 7.0 | 5.0 | 7.0 | 7.0 | 1.0 | 3.0 | 3.0 | 1.0 | 3.0 | 3.0 | 5,081,609.2 | 3.621 | 0.213 |

| V11 | 3.0 | 5.0 | 5.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 637.7 | 1.713 | 0.101 |

| V12 | 3.0 | 5.0 | 5.0 | 3.0 | 5.0 | 5.0 | 0.3 | 1.0 | 1.0 | 0.3 | 1.0 | 1.0 | 637.7 | 1.713 | 0.101 |

Table A3.

C3—Transport Safety.

Table A3.

C3—Transport Safety.

| C3 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | ∏ S(ij) | w (i) | v (i) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V2 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V3 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V4 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V5 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V6 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 2.9 × 10−4 | 0.507 | 0.030 |

| V7 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 1.0 | 1.0 | 1.0 | 3.0 | 3.0 | 3.0 | 421,875.0 | 2.943 | 0.173 |

| V8 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 1.0 | 1.0 | 1.0 | 3.0 | 3.0 | 3.0 | 421,875.0 | 2.943 | 0.173 |

| V9 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 1.0 | 1.0 | 1.0 | 3.0 | 3.0 | 3.0 | 421,875.0 | 2.943 | 0.173 |

| V10 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 0.3 | 0.3 | 0.3 | 1.0 | 1.0 | 1.0 | 28.7 | 1.323 | 0.078 |

| V11 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 0.3 | 0.3 | 0.3 | 1.0 | 1.0 | 1.0 | 28.7 | 1.323 | 0.078 |

| V12 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 0.3 | 0.3 | 0.3 | 1.0 | 1.0 | 1.0 | 28.7 | 1.323 | 0.078 |

Table A4.

C4—Availability of Resources.

Table A4.

C4—Availability of Resources.

| C4 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | ∏ S(ij) | w (i) | v (i) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 50,625.0 | 2.466 | 0.145 |

| V2 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.1 | 0.997 | 0.059 |

| V3 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 1.9 × 10−5 | 0.404 | 0.024 |

| V4 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 51,136.4 | 2.468 | 0.145 |

| V5 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 1.0 | 0.999 | 0.059 |

| V6 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 1.9 × 10-5 | 0.405 | 0.024 |

| V7 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 51,652.9 | 2.470 | 0.145 |

| V8 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 1.0 | 1.001 | 0.059 |

| V9 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 2.0 × 10−5 | 0.405 | 0.024 |

| V10 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 1.0 | 3.0 | 5.0 | 52,174.6 | 2.472 | 0.145 |

| V11 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 0.3 | 1.0 | 3.0 | 1.0 | 1.003 | 0.059 |

| V12 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 0.2 | 0.3 | 1.0 | 2.0 × 10−5 | 0.405 | 0.024 |

Table A5.

C5—Environmental Aspects.

Table A5.

C5—Environmental Aspects.

| C5 | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | ∏ S(ij) | w (i) | v (i) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.9 × 10−4 | 0.507 | 0.030 |

| V2 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.9 × 10−4 | 0.507 | 0.030 |

| V3 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.2 × 10−4 | 0.495 | 0.029 |

| V4 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.9 × 10−4 | 0.507 | 0.030 |

| V5 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.9 × 10−4 | 0.507 | 0.030 |

| V6 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 0.2 | 0.2 | 0.2 | 2.9 × 10−4 | 0.507 | 0.030 |

| V7 | 3.0 | 3.0 | 3.3 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 30.6 | 1.330 | 0.078 |

| V8 | 3.0 | 3.0 | 3.3 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 30.6 | 1.330 | 0.078 |

| V9 | 3.0 | 3.0 | 3.3 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 0.3 | 0.3 | 0.3 | 30.6 | 1.330 | 0.078 |

| V10 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 434,788.7 | 2.950 | 0.173 |

| V11 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 434,788.7 | 2.950 | 0.173 |

| V12 | 5,0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 1.0 | 434,788.7 | 2.950 | 0.173 |

References

- Caban, J.; Litak, G.; Ambrożkiewicz, B.; Gardyński, L.; Stączek, P.; Wolszczak, P. Impact-based piezoelectric energy harvesting system excited from diesel engine suspension. Appl. Comp. Scien. 2020, 16, 16–29. [Google Scholar] [CrossRef]

- Konečný, V.; Gnap, J.; Settey, T.; Petro, F.; Skrúcaný, T.; Figlus, T. Environmental Sustainability of the Vehicle Fleet Change in Public City Transport of Selected City in Central Europe. Energies 2020, 13, 3869. [Google Scholar] [CrossRef]

- Miola, A.; Ciuffo, B. Estimating air emissions from ships: Meta-analysis of modelling approaches and available data sources. Atmos. Environ. 2011, 45, 2242–2251. [Google Scholar] [CrossRef]

- Cockett, N. Neil Cocket on Bunkers; LLP Professional Publishing: London, UK, 1997. [Google Scholar]

- Kozmenko, S.; Teslya, A.; Shchegolkova, A. Economic conditions of the arctic natural gas transportation system. IOP Conf. Ser. Earth Environ. Sci. 2020, 539, 012161. [Google Scholar] [CrossRef]

- Jurkovic, M.; Kalina, T.; Kadnar, R.; Illes, L. Black Sea–Caspian Sea scenario of LNG transport. In Proceedings of the Transport Means–Proceedings of the International Conference 2019, Palanga, Lithuania, 2–4 October 2019; pp. 1229–1233, ISSN 1822-296X. [Google Scholar]

- Magnier, H.J.; Jrad, A. A minimal simplified model for assessing and devising global LNG equilibrium trade portfolios while maximizing energy security. Energy 2019, 173, 1221–1233. [Google Scholar] [CrossRef]

- Eurostat. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Natural_gas_price_statistics/sk#Ceny_zemn.C3.A9ho_plynu_pre_spotrebite.C4.BEov_mimo_dom.C3.A1cnosti (accessed on 10 January 2020).

- Sesini, M.; Giarola, S.; Hawkes, A.D. The impact of liquefied natural gas and storage on the EU natural gas infrastructure resilience. Energy 2020, 209, 118367. [Google Scholar] [CrossRef]

- Osadume, R.; Blessing, U.C. Maritime Trade and Economic Development: A Granger Causality and Bound Test Approach. LOGI Sci. J. Transp. Logist. 2020, 11, 23–32. [Google Scholar] [CrossRef]

- Nwokedi, T.C.; Okoroji, L.I.; Okonko, I.; Ndikom, O.C. Estimates of Economic Cost of Congestion Travel Time Delay between Onne-Seaport and Eleme-Junction Traffic Corridor. LOGI Sci. J. Transp. Logist. 2020, 11, 33–43. [Google Scholar] [CrossRef]

- Dorigoni, S.; Portatadino, S. LNG development across Europe: Infrastructural and regulatory analysis. Energy Policy 2008, 36, 3366–3373. [Google Scholar] [CrossRef]

- Galieriková, A.; Sosedová, J. Intermodal Transportation of Dangerous Goods. Nase More 2018, 65, 8–11. [Google Scholar] [CrossRef]

- Pfoser, S.; Schauer, O.; Costa, Y. Acceptance of LNG as an alternative fuel: Determinants and policy implications. Energy Policy 2018, 120, 259–267. [Google Scholar] [CrossRef]

- Solesvik, M. Exploitation of Compressed Natural Gas Carrier Ships in the High North. In Lecture Notes in Mechanical Engineering; Springer International Publishing: Berlin/Heidelberg, Germany, 2020; pp. 46–54. [Google Scholar] [CrossRef]

- Osorio-Tejada, J.L.; Llera, E.; Scarpellini, S. LNG: An alternative fuel for road freight transport in Europe. WIT Trans. Built Environ. 2015, 168, 235–246. [Google Scholar] [CrossRef]

- Pukalskas, S.; Kriaučiūnas, D.; Rimkus, A.; Przybyła, G.; Droździel, P.; Barta, D. Effect of hydrogen addition on the energetic and ecologic parameters of an SI engine fueled by biogas. Appl. Sci. 2021, 11, 742. [Google Scholar] [CrossRef]

- Budiyanto, M.A.; Riadi, A.; Buana, I.S.; Kurnia, G. Study on the LNG distribution to mobile power plants utilizing small-scale LNG carriers. HELIYON 2020, 6, e04538. [Google Scholar] [CrossRef] [PubMed]

- Illes, L.; Kalina, T.; Jurkovic, J.; Sulgan, M. LNG supply chain on Danube. In Proceedings of the Transport Means-Proceedings of the International Conference 2018, Trakai, Lithuania, 3–5 October 2018; pp. 1301–1307, ISSN 1822-296X. [Google Scholar]

- Lopez Alvarez, J.A.; Buijs, P.; Deluster, R.; Coelho, L.C.; Ursavas, E. Strategic and operational decision-making in expanding supply chains for LNG as a fuel. Omega 2020, 97, 102093. [Google Scholar] [CrossRef]

- Jurkovič, M.; Kalina, T.; Skrúcaný, T.; Gorzelanczyk, P.; Ľupták, V. Environmental Impacts of Introducing LNG As Alternative Fuel for Urban Buses–Case Study in Slovakia. Promet Traffic Transp. 2020, 32, 837–847. [Google Scholar] [CrossRef]

- Jurkovic, M.; Kalina, T.; Sosedová, J.; Tvrdá, E. Globalisation of the LNG trade in Caspian region. In Proceedings of the Globalization and Its Socio-Economic Consequences–16th International Scientific Conference Proceedings 2016, Rajecke Teplice, Slovakia, 5–6 October 2016; pp. 793–799, ISBN 978-80-8154-191-9. [Google Scholar]

- Dvorak, Z.; Rehak, D.; David, A.; Cekerevac, Z. Qualitative Approach to Environmental Risk Assessment in Transport. Int. J. Environ. Res. Public Health 2020, 17, 5494. [Google Scholar] [CrossRef] [PubMed]

- Siahaan, J.J.A.; Pratiwi, E.; Setyorini, P.D. Study of green-ship routing problem (G-VRP) optimization for Indonesia LNG distribution. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Surabaya, Indonesia, 18 July 2020; Volume 557. [Google Scholar] [CrossRef]

- Andersson, H.; Christiansen, M.; Desaulniers, G. A new decomposition algorithm for a liquefied natural gas inventory routing problem. Int. J. Prod. Res. 2016, 54, 564–578. [Google Scholar] [CrossRef]

- Bittante, A.; Pettersson, F.; Saxén, H. Optimization of a small-scale LNG supply chain. Energy 2018, 148, 79–89. [Google Scholar] [CrossRef]

- Iris, Ç.; Lam, J.S.L. A review of energy efficiency in ports: Operational strategies, technologies and energy management systems. Renew. Sustain. Energy Rev. 2019, 112, 170–182. [Google Scholar] [CrossRef]

- Vidmar, P.; Petelin, S.; Perkovič, M.; Gucma, L.; Gucma, M. The influence of large accidents on risk assessment for LNG terminals. In Proceedings of the 14th The International Congress of International Maritime Association of the Mediterranean, IMAM 2011, Genova, Italy, 13–16 September 2011; Volume 2, pp. 763–773. [Google Scholar]

- Public Ports. Strategic Development Plan for the Public Port of Bratislava – Phase II (internal materials). Bratislava, Slovakia, 2019. [Google Scholar]

- Dávid, A.; Madudová, E. The Danube river and its importance on the Danube countries in cargo transport. In Proceedings of the 13th International Scientific Conference on Sustainable, Modern and Safe Transport, TRANSCOM 2019, Novy Smokovec–Grand Hotel Bellevue High Tatras, Slovakia, 29–31 May 2019. Code 150446. [Google Scholar]

- Ližbetin, J. Methodology for determining the location of intermodal transport terminals for the development of sustainable transport systems: A case study from Slovakia. Sustainability 2019, 11, 1230. [Google Scholar] [CrossRef]

- Ren, J.; Liang, H. Measuring the sustainability of marine fuels: A fuzzy group multi-criteria decision making approach. Transp. Res. Part D Transp. Environ. 2017, 54, 12–29. [Google Scholar] [CrossRef]

- Gas Infrastructure Europe. 2019. Available online: https://www.gie.eu/maps_data/downloads/2020/GIE_EBA_BIO_2020_A0_FULL_471.pdf (accessed on 10 January 2020).

- Bayrak, O.U.; Bayata, H.F. Multi-criteria decision-based safety evaluation using microsimulation. Proc. Inst. Civ. Eng. Transp. 2020, 173, 345–357. [Google Scholar] [CrossRef]

- Vavrek, R.; Becica, J. Capital City as a Factor of Multi-Criteria Decision Analysis-Application on Transport Companies in the Czech Republic. Mathematics 2020, 8, 1765. [Google Scholar] [CrossRef]

- Neradilova, H.; Fedorko, G. The Use of Computer Simulation Methods to Reach Data for Economic Analysis of Automated Logistic Systems. Open Eng. 2016, 6, 700–710. [Google Scholar] [CrossRef]

- Ozcan, E.; Ahiskali, M. 3PL service provider selection with a goal programming model supported with multi-criteria decision making approaches. GAZI Univ. J. Sci. 2020, 33, 413–427. [Google Scholar] [CrossRef]

- Ge, X.; Yang, J.; Wang, H.; Shao, W. A fuzzy-TOPSIS approach to enhance emergency logistics supply chain resilience. J. Intell. Fuzzy Syst. 2020, 38, 6991–6999. [Google Scholar] [CrossRef]

- Zhu, C.; Gu, P.; Xu, Z. Domestic airport competitiveness evaluation based on entropy weight TOPSIS method. J. Beijing Jiaotong Univ. 2019, 43, 124–130. [Google Scholar] [CrossRef]

- Li, X.; Zhao, X.; Bai, D. Marine transport efficiency evaluation of cross-border logistics based on AHP-TOPSIS method. J. Coast. Res. 2020, 110, 95–99. [Google Scholar] [CrossRef]

- Rao, C.; Goh, M.; Zhao, Y.; Zheng, J. Location selection of city logistics centers under sustainability. Transp. Res. Part D Transp. Environ. 2015, 36, 29–44. [Google Scholar] [CrossRef]

- Danube, L.N.G.; EZHZ. Feasibility Study: Construction of an LNG Terminal in the Public Port of Bratislava; Technical Study (in preparation): Bratislava, Slovakia, 2020. [Google Scholar]

- Kalina, T.; Jurkovic, M.; Sapieta, M.; Binova, H.; Sapietova, A. Strength Characteristics of LNG Tanks and their Application in Inland Navigation. AD ALTA J. Interdiscip. Res. 2017, 7, 274–281. [Google Scholar]

- David, A.; Gasparik, J.; Galierikova, A. The Danube Ports as Multimodal Transport Hubs and their Logistics Services. In Proceedings of the 19th International Scientific Conference Business Logistics in Modern Management, Osijek, Croatia, 10–11 October 2019; pp. 353–365. [Google Scholar]

- Stelth Gas Inc. Annual Report. 2018. Available online: https://www.stealthgas.com/images/stories/investor-relations/StealthGas_Annual_Report_2018.pdf (accessed on 10 January 2021).

- Gnap, J.; Poliak, M.; Semanova, S. The issue of a transport mode choice from the perspective of enterprise logistics. Open Eng. 2019, 9, 374–383. [Google Scholar] [CrossRef]

- Macahdo, P.G.; Ichige, E.N.A.; Ramos, K.N.; Moutte, D. Natural gas vehicles in heavy-duty transportation–A political-economic analysis for Brazil. Case Stud. Transp. Policy 2020, 9, 374–382. [Google Scholar] [CrossRef]

- Jurkovic, M.; Kalina, T.; Gomes Teixeira, A.F. Possibilities of using alternative fuels for transport solution in Brazil. In Proceedings of the 21st International Scientific Conference Transport Means, Juodkrante, Lithuania, 20–22 September 2017; pp. 724–728, ISSN 1822-296X. [Google Scholar]

- Yoo, B.Y. Economic assessment of liquefied natural gas (LNG) as a marine fuel for CO2 carriers compared to marine gas oil (MGO). Energy 2017, 121, 772–780. [Google Scholar] [CrossRef]

- Iannaccone, T.; Landucci, G.; Tugnoli, A.; Salzano, E.; Cozzani, V. Sustainability of cruise ship fuel systems: Comparison among LNG and diesel technologies. J. Clean. Prod. 2020, 260, 121069. [Google Scholar] [CrossRef]

- Shubenkova, K.; Makarova, I. Evaluation of the actions aimed at the transition to sustainable public transport system. Archiv. Autom. Engin. Archiw. Motoryz. 2018, 81, 75–90. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).