In this case study, we deal with assessing the possibility of transporting LNG from the Black, Marmara, and Aegean (Mediterranean) sea area to the port of Bratislava using the Danube waterway. The port of Bratislava plans to build an LNG terminal in the Pálenisko basin. The minimum capacity of the terminal will be 4000 m

3 of LNG. The vessel’s maximum cargo capacity intended for filling LNG from and to the terminal will be 3500 m

3 of LNG. The terminal will embrace facilities for LNG transhipment and the refuelling of LNG fuel in riverboats. The terminal’s overall concept will also comprise a natural gas liquefaction plant with a capacity of at least 5 t per day. The terminal will further include a transhipment facility for filling LNG into road tanks [

42].

4.1. Economic Assessment Using a SS LNG-C Tanker

Several basic inputs and parameters need to be defined in the LNG transport economic assessment by SS LNG-C tankers. These relate mainly to navigation conditions on the individual river and sea sections and selected vessel parameters that will provide transport.

4.1.1. Proposal of LNG Transport Technology on the River Section between Galati and Bratislava

The proposal of the required transport capacity is based on the destination LNG terminal’s capacity in the port of Bratislava. The expected capacity is at the level of 12,000–14,000 m

3 per month. For LNG barges with six LNG cargo tanks, the transport capacity is set at 2049 m

3 ± 5%. For the Danube-Europa II barge with three cargo LNG tanks, the capacity is half as much. The optimal setting for the selected route is a push tugboat + two barges of LNG with six cargo tanks, with a total capacity of about 1700–1800 t (with a standard LNG density in the range of 0.42–0.45 t.m

−3) [

43].

Based on the navigation conditions on the lower and middle Danube, we propose to dimension the power of the pusher tugboat so that for 1 horsepower (hp) of nominal power, there will be 3–4 tons of displacement with a load [

44]. For the LNG convoy, the calculated displacement is set at D = 2514 t. For this reason, the power of the pusher tugboat for two barges is 1.3–1.6 thousand hp. By considering the large areas of LNG barges, we propose the power of the tugboat’s main engines from 1.8 to 2.0 thousand hp. (1300–1500 kW). Tugboats of the TR 2000 type of a Slovak company or of the Z type of a Hungarian company were selected as the most appropriate.

The distance from Galati to Bratislava on the Danube is 1717 km. The transport times on this Danube section is the same for all three scenarios. The Danube section is divided into three navigation sections (Galati–Turnu-Severin, Turnu-Severin–Mohacs, Mohacs–Bratislava). For upstream navigation, the voyage time is set at 10.3 days and, for downstream navigation, it is 5.15 days. In the ports of Mohács, Bezdane and Veliko Gradište, 4 days are counted for inspections. A total of 1 day is set aside to ensure loading and unloading. Waiting for a sea SS LNG-C tanker’s arrival in the port of Galati, tugboat refuelling, and other extraordinary delays are, on average, 2–3 days.

Table 1 shows the time of the cruise, which lasts about 25 days. Eight LNG barges and four tugboats are needed to deliver the estimated amount of cargo. The estimated voyage time is determined based on data from operators.

4.1.2. Calculation of Costs of the Pushing Convoy on the River Section Galati–Bratislava

The optimal version of a convoy for this river section is on push tugboat TR 2000 and two LNG barges. The daily time-charter rate for renting a TR 2000 tugboat is 1850 EUR (based on the operator’s current price). The price does not subsume fuel costs. Each LNG barge must be operated by 2 professionally qualified crew members—Senior Boatswain and Gas Engineer to ensure the safe operation of the ship power and other equipment. These crew members ensure the performance of the prescribed technical maintenance as well as the continuous control of the physical and chemical properties of LNG. The daily salary cost for LNG barges is EUR 330 (EUR 4950 for a round trip). Other daily expenses of items for a tugboat and two LNG barges include: drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, insurance, depreciation for repairs. The total daily amount of these expenses is EUR 458.83. Total daily expenses for the convoy are EUR 2639.83. The price per 1 t MGO is EUR 724 (based on local price in this region). The average daily consumption for the upstream voyage is 4.08 t., for the downstream voyage it is 3.06 t., and for downtime it is 0.288 t. A detailed calculation was made based on the information obtained on tank vessels’ operation on the Danube river.

To determine the total cost of the voyage, it is necessary to take into account downstream, upstream, downtime, and all port fees or other costs in ports. The total costs for the voyage are shown in

Table 1.

Transport of 1 m3 of LNG with a tugboat TR 2000 with LNG barges on the river section between the port of Bratislava and the Romanian port of Galati costs EUR 36.55.

4.1.3. Economic Calculation of the Sea Section—Time-Charter SS LNG-C

The subsequent carriage of LNG cargo by sea is carried out in two variants—using the lease of a marine SS LNG-C tanker or as transport with an SS LNG-C tanker in exclusive ownership. The distances and estimated time of the voyage to the three export ports of Marmara Ereglisi, Aliaga, and Kulevi are summarized in

Table 2.

The Small-Scale LNG tanker’s voyage (SS LNG-C) from Aliaga or Kulevi at a speed of 12.5 knots in stable and typical weather for this region is 1.7–2 days. The return journey in ballast lasts approximately the same. The voyage from the Sea of Marmara to Galati takes 1 day. The loading and unloading process takes 1.5 days. Waiting for permission to cross the Turkish straits and refuelling the vessel takes 1–1.5 days. Securing the IGS (Inert Gas System) takes 0.5 days. According to the times in

Table 2, one SS LNG-C with a carrying capacity of 3000–3500 m

3 can ensure the utilization of river formations along the Danube for three selected scenarios in the volume of about 12,000–14,000 m

3 LNG per month. According to the experience of tanker operators of this type, the cost of qualified management is approximately EUR 9000 per month.

The use of an SS LNG-C tanker is being considered for a sea voyage. The standard type of fuel for this tanker is the fuel oil IFO 60–IFO 180 and diesel MGO (prospectively, it can be changed to LSFO–Low-Sulfur Fuel Oil). The price per 1 t. of IFO 180 is EUR 439 and for MGO is EUR 570 (Based on local price in this region). The average daily fuel consumption of IFO 180 voyage is 8.9 t., MGO downtime is 1.4 t., MGO unloading/IGS is 2.8 t. and MGO loading is 1.4 t. The total daily expenses for the voyage are EUR 15,816.64, for IGS are EUR 1596.49, for loading and downtime are the same EUR 12,711.38, for unloading EUR 14,307.87. It is currently not known to provide SS LNG-C tankers for long-term time-charter. The time-charter rates for SS LNG-C are very similar to the rates for semi-refrigerated and full-refrigerated LPG tankers. A tanker with a space capacity of 5000 m

3 is deemed the proper one in terms of capacity [

45]. The representative rate is EUR 10,028.95 per day based on market research. This rate also enters into the following economic calculations. Port and channel fees for SS LNG-C tankers are listed in

Table 3.

Fuel costs represent from 30% to 35% of the operating costs of a SS LNG-C tanker. These costs change most often while in operation. Into the cost calculation, also enter variable items (drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, time-charter rate). The total amount of variable items is EUR 11,913.13. The values are obtained as average values provided by tanker operators in the region. The values apply to all three scenarios.

To determine the voyage’s total cost in all three scenarios, it is necessary to consider voyage, IGS, downtime, loading, unloading, and port fees. The total costs for the voyage, as well as the calculation of the price per 1 m

3 LNG, are shown in

Table 4.

The above comparison of three scenarios within the particular variant, where the time-charter of a SS LNG-C tanker of LNG is envisaged, shows that the most economical scenario is scenario 1. The transport of 1 m3 of LNG on the sea section costs EUR 38.47.

4.1.4. Economic Calculation of the Sea Section—Own SS LNG-C Tanker

Another way to deliver a supply of LNG to the port of Galati is by using its own SS LNG-C tanker. When procuring a new tanker, the cost of the ship’s initial registration is negligible and does not need to be considered. The further calculation is made at current prices; therefore, cash flow discounting will not be used. The calculation also does not take inflation into account.

There are a small number of LNG-C tankers on the market, and thus there is room for speculative rates. Therefore, we calculate the OPEX (Operating Exchange) based on the order to construct a marine LNG-C tanker and calculate the bareboat/time-charter rate. The cost of building one mass-produced tanker (as much as possible with a capacity similar to the parameters required by the terminal in Bratislava) up to 5000 m

3 for a customer in a South Korean shipyard would be around EUR 44 million, according to the available data. The following equation can express the construction price of a new tanker not produced in series with a capacity of 3500 m3 (non-series production—increase by 20%):

where:

- -

C3000—the price of a new tanker with a capacity of 3000 m3;

- -

C5000—the price of a new tanker with a capacity of 5000 m3;

- -

DWCC5000—tanker capacity (5000 m3);

- -

DWCC3000—tanker capacity (3000 m3).

To this end, we regard the linear depreciation of the new tanker with a typical limited operating time of 30 years. The amount obtained from the ship’s sale at the end of its operation (scrapping) can be determined as the determined displacement of the empty ship multiplied by the ship’s approximate selling price, increased by 20–30% due to a large amount of non-ferrous metals. This cash flow (reversal) can bring approximately:

where:

- -

D0—empty ship displacement;

- -

CD0/1mt—selling price of the ship.

In this case, the depreciation factor is of (EUR 36 mil. − EUR 368,160)/30/12 = EUR 100,000 per month (EUR 3333 per day). In this study, we consider the cost of performing a “Class” repair (with an inspection to confirm the vessel’s class). The approximate model of tanker repair costs is derived from the operation of analogous tankers. The average costs of repair and maintenance (

Table 5) are determined based on private companies’ information.

In our study, we propose a volume of 3200 m

3 LNG tanks in 10 tanks. The approximate reasonable price of technical maintenance of cryogenic equipment is EUR 716.97/5 years (in terms of 1 m

3). This is based on the average values of costs provided by manufacturers in this segment. These costs will be lower for LNG evaporators and heaters installed for 1–2 supply tanks of the vessel’s fuel system. This number is reduced in the projected SS LNG-C tankers. From a design point of view, cryogenic LNG tanks do not have actively corroding and wearing parts. Therefore, approximately 67% of maintenance costs after 5 years of operation are fuel system pumps, compressors and valves. Approximately half of these mechanisms are not required for the cargo system of the proposed tanker. Based on these data, adjusted and specific costs per 1m

3 of LNG tank volume (EXP

1m3lng/c) will be accepted for further indicative calculation:

In connection with the maintenance of many types of one tank, there is a cost reduction effect. The effect of cost reduction is defined by a coefficient, which is in the range of 0.6–0.8. Because the planned number of tanks is small, we use a coefficient of 0.8. Based on the above, the price of repairs and 5 years of technical maintenance of the cryogenic equipment of the SS LNG-C tanker will be:

This corresponds to a depreciation of EUR 113.00 per day for 30 years of operation and the last repair of the cryogenic equipment in the 25th year. We used the amount of depreciation costs and depreciation for repairs as the basis for calculating the bareboat charter rate. The approximate bareboat charter rate (B/c hire) will be:

Considering the daily wage costs of the crew for EUR 1608.00 (Captain EUR 233.92, Chief Mate EUR 187.13, 2nd Mate EUR 99.41, 3rd Mate EUR 52.63, Chief Engineer EUR 219.30, 2nd Engineer EUR 181.29, 3rd Engineer EUR 87.72, Electrical Engineer EUR 131.58, Gas Engineer EUR 131.58, Motormen—AB EUR 52.63, 2 × AB − motorman EUR 46.78, Boatswain EUR 64.32, Cook—AB EUR 73.10), the ongoing depreciation for the operation of SS LNG-C (including depreciation) can be expected at the level of EUR 5204.28 per day.

According to the above scenarios, the calculation of economic indicators of the sea transport with the transhipment of goods to river pushing convoy sets is performed based on information collection and based on experience with the operation of maritime SS LPG tankers. Other variable cargo items for SS LNG-C tanker include crew wages, depreciation for repairs, drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricants, representation for captain, insurance, depreciation). The total value of these items is EUR 6151.85. Values are obtained as average values provided by tanker operators and from previous calculations. The values listed apply to all three scenarios.

In order to determine the total cost of the voyage in all three scenarios in this variant (own SS LNG-C tanker), it is necessary to consider voyage, IGS, downtime, loading, unloading and port fees. The fuel price and the average consumption is the same as in the calculations in the last part of the study,

Section 4.1.3.

The total costs for the voyage, as well as the calculation of the price per 1 m

3 LNG, are shown in

Table 6.

From the above comparison of three scenarios regarding this variant where the acquisition of own SS LNG-C tanker is expected, it follows that scenario no. 1 seems to be the most economical. The transport of 1 m3 of LNG on the sea section costs EUR 25.86.

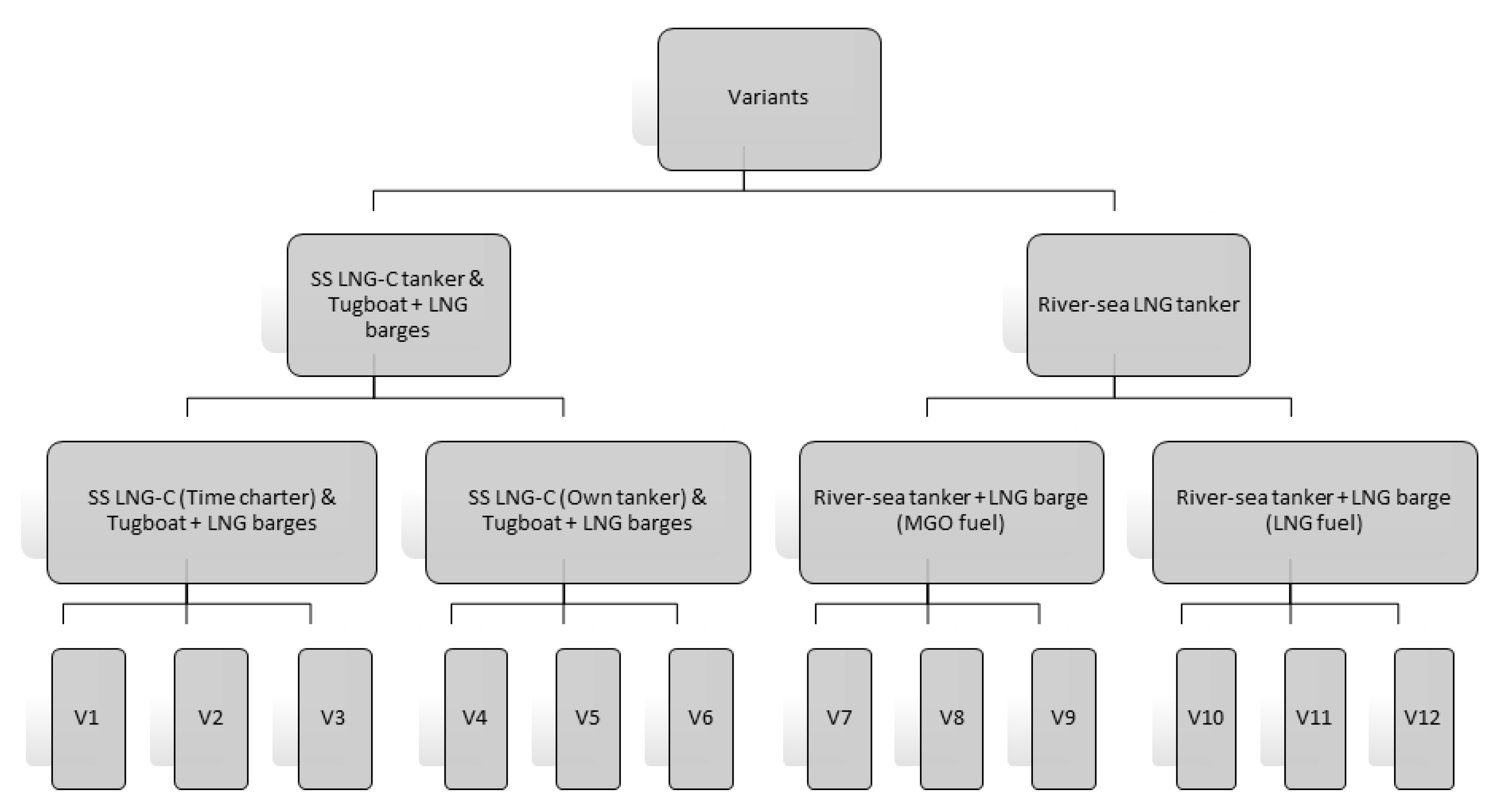

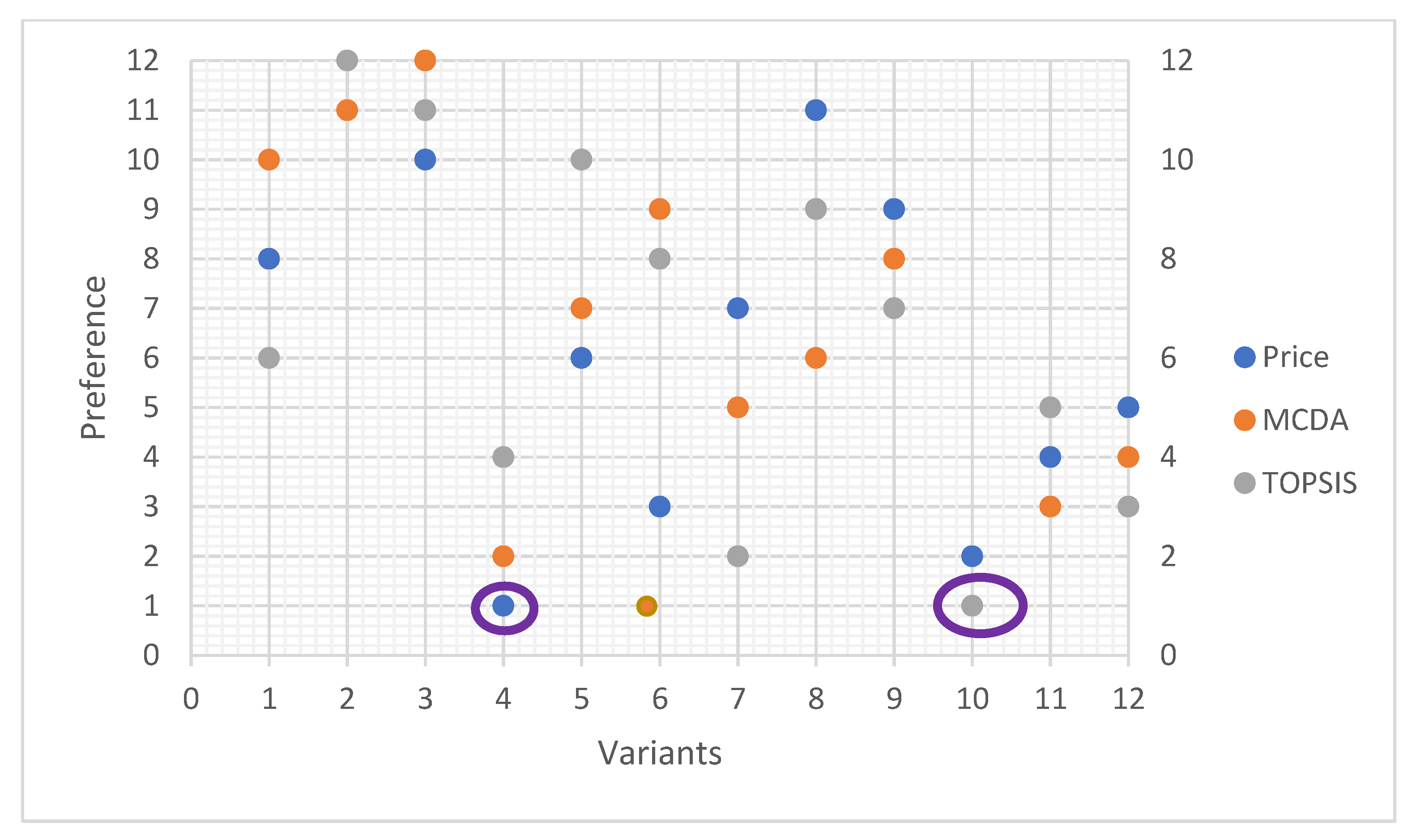

4.1.5. Evaluation of all Variants Using a SS LNG-C Tanker

Based on the previous results,

Figure 2 compares the prices for the transport of 1 m

3 of LNG when considering the different ownership relationships to sea tankers. In all the scenarios examined, the Danube river’s transport is carried out by a pusher convoy consisting of a pusher tugboat with pusher LNG barges.

According to the relevant scenarios of sea transport performed by SS LNG-C tankers with the subsequent transhipment of goods to river tugboats with LNG barges in the Romanian port of Galati, the calculated price for transporting 1 m3 LNG is the lowest when procuring their own SS LNG-C tanker on the route Marmara Ereglisi–Galati–Bratislava–Marmara Ereglisi.

4.2. Assessment Using a River-Sea LNG Tanker and LNG Barge

The use of river-sea LNG tankers entails another possibility of transporting LNG to the port of Bratislava. The calculation is based on the same capacity requirements: 12,000–14,000 m3 LNG per month. LNG transport consists of two parts (sea and river). The export ports are the same as in the first variant (ports of Marmara Ereglisi, Aliaga and Kulevi). The river section is also defined between the port of Galati and Bratislava. The economic calculation using the river-sea LNG tanker and LNG barge is realized in two versions. The first version uses MGO as fuel, and the second uses a dual fuel system using LNG as fuel. As for LNG, we consider a price of EUR 324.56 per 1 t.

The estimated time of the voyage is 7.23 days upstream and 4.77 days downstream. Approximately 4.6 days are expected for technological downtime, including inspections in Mohács (HU), Bezdana, and Veliko Gradište (RSB); crew rest; crossing the locks; and the refuelling of the tanker. It is assumed 2 days for the whole convoy to unload the cargo. Waiting for the arrival of the river-sea LNG tanker to Galati and other extraordinary delays are 2 days. In this case, the total voyage, including the sea section, for one convoy consists of a river-sea LNG tanker and an LNG barge is about 26–28 days.

The convoy for navigation on river sections from the Romanian port of Galati to the Slovak port of Bratislava consists of a river-sea LNG tanker and one LNG barge (with 6 cryogenic tanks). The mooring of the convoy will take place at an anchorage intended for vessels with dangerous goods. When the mooring process is completed, and the security measures are met, part of the cargo is transferred from the river-sea LNG tanker to the LNG barge. This achieves the same draft for both vessels T = 1.60 m. During this draft, and while maintaining the Danube water level’s height at a statistically long-term mean level, the convoy should sail without delay in both directions. There may be navigation restrictions during the navigation period when crossing under bridges in Budapest and Novi Sad. This applies to cases of a high-water level. Due to their random occurrence throughout the season, we do not consider the delay time for reforming the convoy configuration. We are not even considering the case of using a river-sea LNG tanker without the LNG barge.

4.2.1. Calculation of Costs of the Convoy on the River Section Galati–Bratislava

The LNG barge will be waiting for the arrival of the river-sea LNG tanker at a dedicated berth in the port of Galati, in connection with which there will occur the costs for downtime. The expected speed of the convoy in the upstream voyage is set at 10 km/h, while the daily fuel consumption will be the highest compared to the consumption on the sea section or in the downstream voyage. The expected speed of the convoy in downstream navigation is 15 km/h. The times of sea voyage operations are shown in

Table 7.

The voyage time of a river-sea LNG tanker from Aliaga or Kulevi at a speed of 12.5 knots in stable weather is 1.7–2 days. The return trip without cargo (in ballast) lasts about the same time. The voyage from the Sea of Marmara to Galati takes 0.8 days. Loading a tanker and transhipment of the part of the cargo to an LNG barge in Galati takes 1.5 days. Waiting for a permit and crossing the Turkish Strait and refuelling the vessel takes 1–1.5 days.

The estimated price of the serial new construction of a river-sea LNG tanker with tanks with a capacity of 3200 m3 in Slovenské Lodenice is approximately EUR 25 million (the price of the tugboat is estimated at EUR 6.8 million). The cost of the initial registration of a ship is negligible and does not need to be considered. The indicative price calculation for LNG barges can be determined by comparing the prices of custom river-sea tankers and river tankers.

The specific costs for the construction of a 1 t deadweight (DWt) river-sea tanker are as follows:

where:

- -

Cblt—price of the river-sea tanker without tanks;

- -

DWt—dead weight.

The new construction of the tanker is estimated at EUR 1.5 mil. with a capacity (DWt) of 5000 t. The specific costs for the construction of 1 t tonnage (DWt) of this tanker will be:

The approximate value of CAPEX (Capital Expenditure) in the construction of one LNG barge, based on the estimated price for the new construction of a river-sea LNG tanker and the ratios of specific costs for the construction of a river-sea tanker and barges will be:

The further calculation is performed at current prices; therefore, cash flow discounting will not be used. The calculation does not take inflation into account.

Our study considers the linear depreciation of a new tanker with a typically limited-service life of 30 years, similar to that for a marine LNG-C tanker.

The price obtained from the sale of ships after the end of their operation (scrap sale) can be calculated as the determined empty ship displacement (D

0 for a river-sea LNG tanker = 2530 t; D

0 for LNG barge = 1565 t) multiplied by the estimated sale price of the ship, increased by 20–30% due to a large amount of non-ferrous metals. This cash flow (R

o) for the river-sea LNG tanker is expected to be approximately:

where:

- -

D0—empty ship displacement;

- -

CD0/1mt—selling price of the ship/barge.

The cash flow for an LNG barge is expected to be approximately:

In this case, the depreciation factor for the river-sea LNG tanker is (EUR 25,000,000–EUR 776,204)/30/12 = EUR 67,288 per month and EUR 2242 per day.

The amortization factor for an LNG barge is (EUR 5734,000–EUR 303,140)/30/12 = EUR 15,085 per month and EUR 502.83 per day.

The costs of carrying out the repair for the issue of classification (with an inspection to confirm the vessel’s class) and the dock’s repair is based on experience with the operation of analogue tankers with similar tonnage. The approximate cost of repairs is the same as for the SS LNG-C tanker, and thus at EUR 150.28 per day.

The costs of repair and maintenance of the cryogenic tanks for the river-sea LNG tanker can be set at the same amount of EUR 113.00 per day as calculated and reported for the SS LNG-C tanker. Each LNG barge’s cost, equipped with 6 cargo tanks, is determined in proportion to the cost for a river-sea LNG tanker equipped with 10 cargo tanks. Its amount will be EUR 70.84 per day per barge. The monthly expenses for the river-sea LNG tanker crew are EUR 28,200 (EUR 940.00 per day). The basic daily wages for individual positions are as follows: Captain EUR 200, Chief Mate EUR 160, 2nd Mate EUR 85, Chief Engineer EUR 183.33, Gas Engineer EUR 110, Electrician-Motormen—AB EUR 85, Boatswain EUR 55, Cook—AB EUR 60.

For river-sea LNG tankers using MGO fuel, considering crew wages, we can expect an ongoing depreciation for the operation of the river-sea LNG tanker (including depreciation) approximately at the level of EUR 4000 per day.

4.2.2. Total Cost Calculation—A River-Sea LNG Tanker, and LNG Barge

The daily variable costs for the operation of a river-sea LNG tanker include: crew wages, depreciation for repairs, drinking water, managerial remuneration, ship-shore communications costs, travel costs, bank charges, technical supply, lubricant, representation for captain, insurance, and depreciation. The total daily amount of these expenses for the river-sea LNG tanker is EUR 4000 and for the LNG barge EUR 943.03. These items are equal in both the sea and river sections. Values are obtained as average values provided by tanker operators and from previous calculations. The values listed apply to all three scenarios.

The standard type of fuel for this tanker is the fuel MGO. The price per 1 t. of MGO is EUR 570.18, and LNG is EUR 324.56. The average daily fuel consumption in the offshore section of a sea voyage is 9 t., unloading/IGS is 0.72 t, loading and downtime is 0.36 t.

The total daily expenses in the offshore section using MGO fuel for the voyage are EUR 9141.88, for unloading/IGS they are EUR 4420.83, for loading/downtime they are EUR 4215.56. Overall daily expenses in the offshore section using MGO fuel are EUR 17,778.27.

The average daily fuel consumption on the river for the downstream voyage is 7.8 t., for upstream is 12 t., for unloading/IGS is 0.72 t., and for loading/downtime 0.36 t. The total daily expenses on the river section using MGO fuel for the downstream voyage they are EUR 9400.70, for the upstream voyage they are EUR 11,795.44, for unloading/IGS they are EUR 5363.86, for loading/downtime they are EUR 5158.59, and for LNG barge downtime they are EUR 943.03. The overall daily expenses on the river section using MGO fuel are EUR 26,559.99.

The total daily expenses in the offshore section using LNG fuel for the voyage are EUR 6931.35, for unloading/IGS they are EUR 4243.985, and for loading/downtime they are EUR 4127.14. The overall daily expenses in the offshore section using LNG fuel are EUR 15,302.48.

The total daily expenses on the river section using LNG fuel for the downstream voyage are EUR 7484.91, for the upstream voyage are EUR 8848.07, for unloading/IGS are EUR 5187.01, for loading/downtime they are EUR 5070.17, and for LNG barge downtime they are EUR 943.03. Overall daily expenses on the river section using LNG fuel are EUR 21,519.99.

Table 8 presents the total costs of a voyage and the price of transporting 1 m

3 of LNG using the river-sea LNG tanker and LNG barge for MGO fuel and LNG fuel as well. A calculation has been applied for all three scenarios.

The above comparison of six plans (three for MGO fuel + three for LNG fuel) of LNG transport to the port of Bratislava shows that the transport scenario from Marmara Ereglisi appears to be the most economical for both fuel technologies.