Strategic Investment Decisions for Emerging Technology Fields in the Health Care Sector Based on M&A Analysis

Abstract

:1. Introduction

2. Literature Review

2.1. Emerging Technology Trend Assessment

- Timeliness of knowledge database: this is a particular problem in contemporary analyses, because they rely on data that are only available after publication [11]. Dynamic estimation approaches of investment determinants are recommended with respect to the dynamic nature of investment decisions [34].

- Exclusion of “uncertainty and ambiguity”: the uncertainty of emerging technologies is difficult to measure and, thus, is often neglected [37].

- Absence of policymaker participation for strategic technology and R&D investment management: customer-based technology forecasts, combined with the computer-based analytic approach, have gained popularity as a demonstration of market acceptance [25].

| Reference | Research Objective (Relationship between X and Y) | Data Type | Characteristics of Proposed Model (or Findings) | Research Context | Methodology |

|---|---|---|---|---|---|

| [38] | (X) Crowdfunding; (Y) Venture Capital (VC) investments | Financial | Confirms impact of crowdfunding campaigns on a subsequent increase in VC investments | Hardware, Media, Fashion industries | Non-stationarity and Granger causality of time-series |

| [39] | (X) Government policies; (Y) R&D investment | Financial | Confirms the impact of public R&D subsidies and collaboration increases R&D investment | Agricultural biotechnology industry | Econometric |

| [40] | (X) Technology convergence; (Y) Market convergence forecast | M&A Activity | Predicts future market converging pattern based on technology convergence | Biotechnology industry | DEMATEL, Link prediction algorithm |

| [41] | (X) IPO activity; (Y) M&A activity paradigm | M&A Activity | Evaluates firm’s trade-off in being acquired based on the extent of the synergies arising from a potential M&A activity | Technology industry and Young Innovative Companies in US | Text-based similarity, time-series regression |

| [42] | (X) Technological characteristics of patent; (Y) Citation performance of patent | Patent | Proposes a machine learning approach utilizing multiple patent indicators to identify an early-stage emerging technology | Pharmaceutical technology | Feed-forward multilayer neural network |

| [37] | (X) research capability of research organizations; (Y) Promising research frontiers | Patent, Bibliometric | The results from scientific papers and patents are proper to suggest themes for research in the relatively long-term and short-term perspective, respectively | Information and communication technology | Bibliometric analysis |

| [43] | (X) Investment strategy in big data analytics; (Y) Financial profit | Financial | Predicts the impact of (i) differentiated consumer densities firms on quality competition; and (ii) big data analytics investment strategy on financial profit | Health Care services | Game theory |

| [44] | (X) Entropy and binding force of International Patent Classification; (Y) Interaction and attraction of technological convergence | Patent | Services with adapted wireless communication networks have the highest binding force; and visible signaling systems are associated with technology convergence | Information and communication technology | Entropy and gravity, social network, and association rule analyses |

| [45] | (X) Technological knowledge flow matrix; (Y) Interdisciplinary trend | Patent | Illustrates a visual map that shows pattern of industrial technology fusion | New and renewable energy-based railway technology | Patent network analysis |

| [46] | (X) Patent citation indicators; (Y) Overlapping technology fields and the emergence of new technological opportunities | Patent | Uses different patent citation indicators to recognize trajectory changes in the industry and technology convergence trends | RFID value chain | Patent citation analysis |

| [47] | (X) Investment policy; (Y) Economic growth | Financial | Confirms infrastructure and building–residential investments have direct relations with the GDP | Construction industry in Turkey | Granger causality, Engle-Granger cointegration |

| [48] | (X) Academic publications; (Y) Emerging research topic | Bibliometric | Predicts the future core articles via the betweenness centralities in the citation network of the research | Regenerative medicine | Topological clustering method, visualize citation networks analysis |

| [49] | (X) Geographic proximity; (Y) R&D collaboration | Co-publication | Identifies firms collaboration strategies and their choices for the R&D sites’ location | Pharmaceutical industry | Regression and Zero-inflated gravity model |

| This study | (X) M&A activity number and value; (Y) Emerging technology | Financial | Illustrates future emerging technology based on the historical M&A activity data with time-lag perspective | Health Care Industry | Promising Index analysis |

2.2. M&A Data-Based Approach

3. Methods

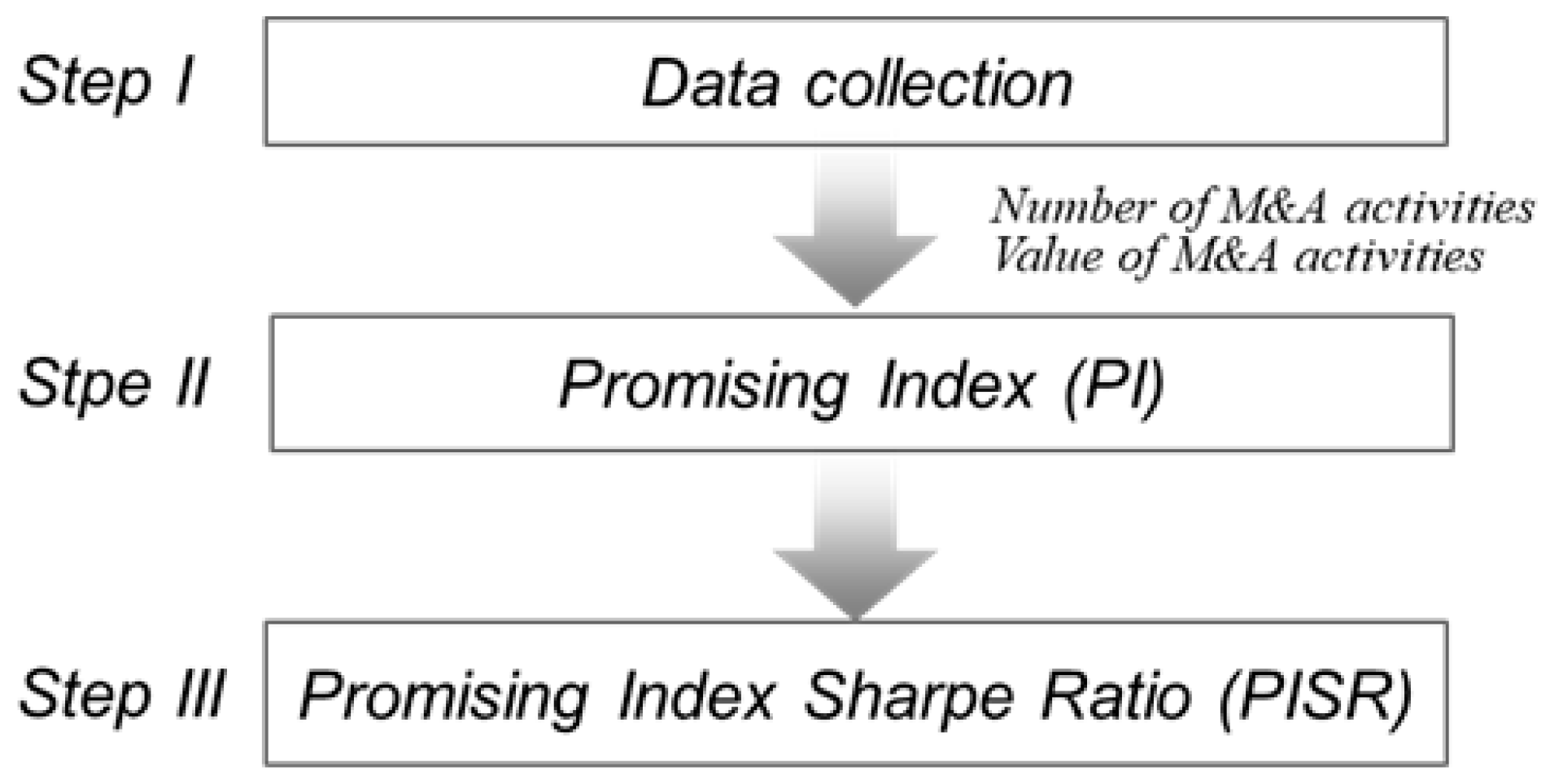

3.1. Research Framework

3.2. Data Collection

3.3. Promising Index

3.4. Promising Index Sharpe Ratio

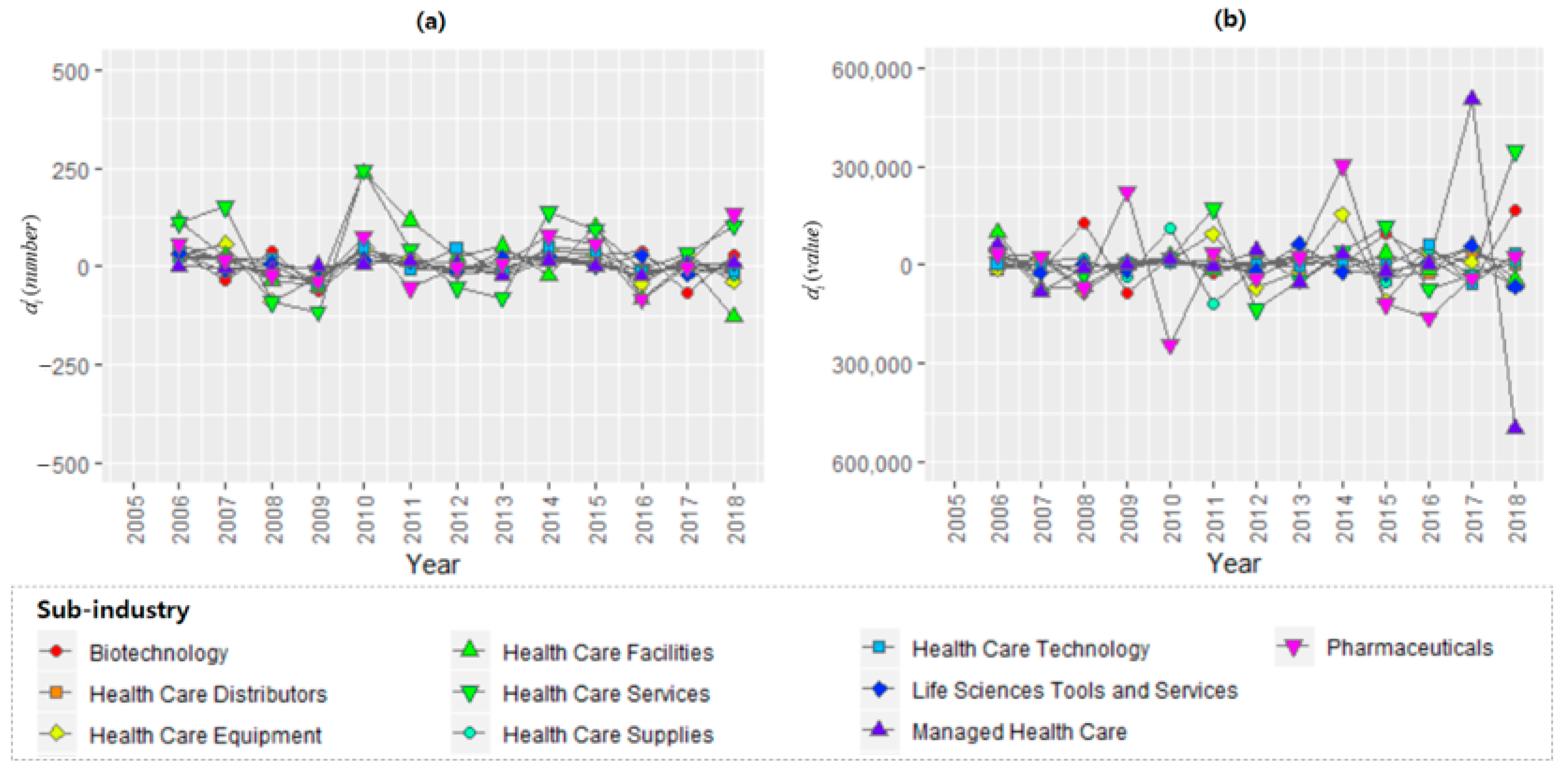

4. Longitudinal Analysis of M&A Trends in the Health Care Sector

5. Main Results

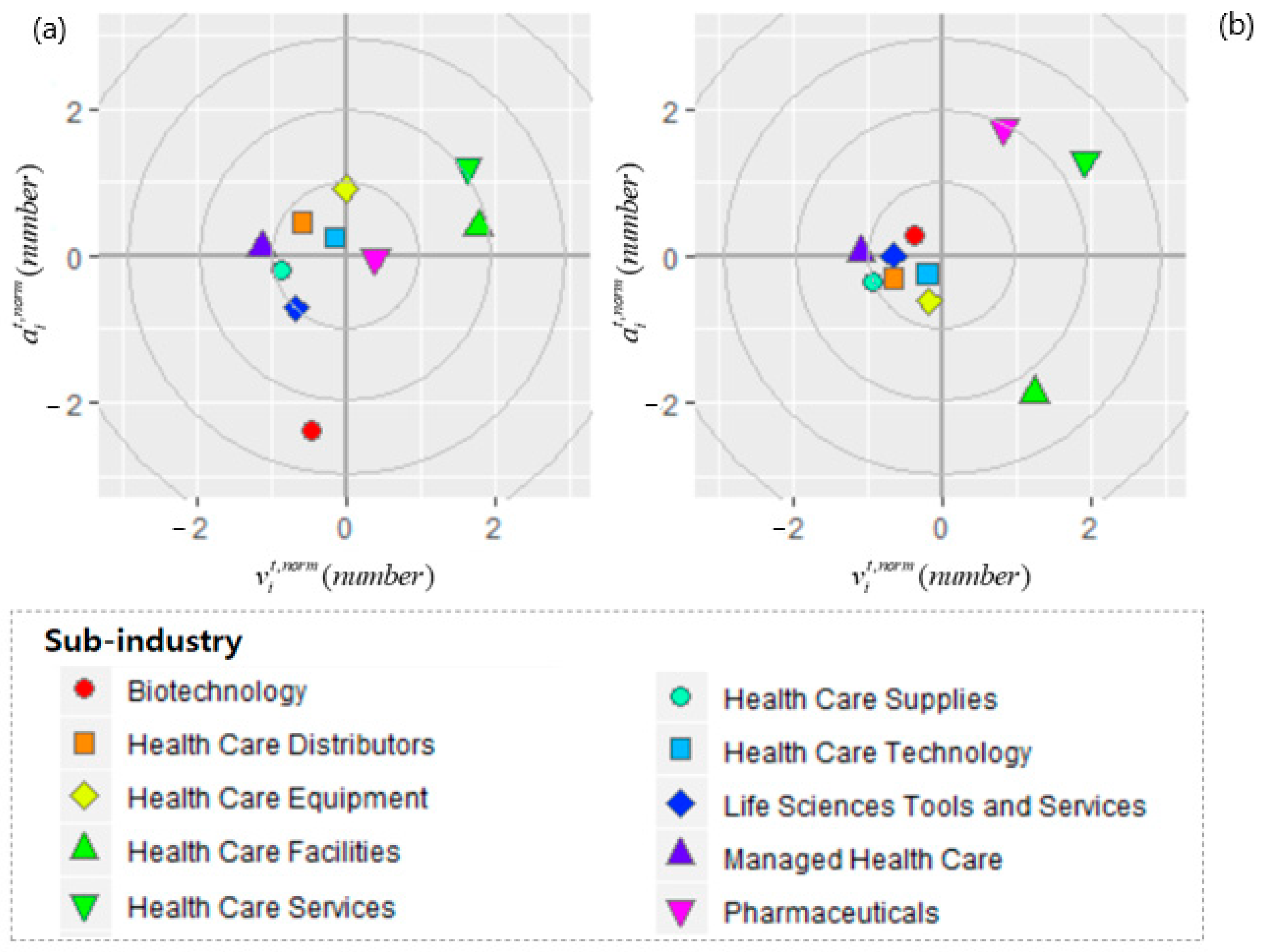

5.1. Overall Emerging Trend Assessment in the Health Care Sector

5.2. Integrative Emerging Trend Assessment and Benchmarking Approaches

- Evaluation period adjustment function: the decision maker defines a target period for calculating Promising Index (PI) and the PISR rank, which evaluates based on the average and standard deviation of PI.

- Weight adjustment function: it provides a function to adjust the weight of the weight variables, including wvn, wvv, wan, and wav. The sum of each weight equals 1.

6. Discussion

6.1. Integrating M&A Information to Resolve the Time Lag Issue in Emerging Technology Foresight

6.2. Dealing with Market Trend Irregularity

6.3. Managing Expectations of Investors for Emerging Technology and Industry

7. Conclusions and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ghosh, J. Big data analytics: A field of opportunities for information systems and technology researchers. J. Glob. Inf. Technol. Manag. 2016, 19, 217–222. [Google Scholar] [CrossRef]

- Vinaja, R. Data Analytics Applications in Latin America and Emerging Economies. J. Glob. Inf. Technol. Manag. 2020, 23, 79–81. [Google Scholar] [CrossRef]

- Gammeltoft, P.; Hobdari, B. Emerging market multinationals, international knowledge flows and innovation. Int. J. Technol. Manag. 2017, 74, 1–22. [Google Scholar] [CrossRef]

- Daim, T.U.; Rueda, G.; Martin, H.; Gerdsri, P. Forecasting emerging technologies: Use of bibliometrics and patent analysis. Technol. Forecast. Soc. Chang. 2006, 73, 981–1012. [Google Scholar] [CrossRef]

- Cho, Y.; Daim, T. Technology Forecasting Methods. In Green Energy and Technology; Springer: London, UK, 2013; Volume 60, pp. 67–112. ISBN 9781447150961. [Google Scholar]

- Kavanagh, S.; Williams, D. Making the Best Use of Judgmental Forecasting. In Government Finance Review; Government Finance Officers Association: Chicago, IL, USA, 2014; pp. 8–16. [Google Scholar]

- Mitchell, V.-W. Using Delphi to forecast in new technology industries. Mark. Intell. Plan. 1992, 10, 4–9. [Google Scholar] [CrossRef]

- Stewart, T.R. The Delphi technique and judgmental forecasting. Clim. Chang. 1987, 11, 97–113. [Google Scholar] [CrossRef]

- An, J.; Kim, K.; Mortara, L.; Lee, S. Deriving technology intelligence from patents: Preposition-based semantic analysis. J. Informetr. 2018, 12, 217–236. [Google Scholar] [CrossRef]

- Rodriguez, A.; Tosyali, A.; Kim, B.; Choi, J.; Lee, J.M.; Coh, B.Y.; Jeong, M.K. Patent Clustering and Outlier Ranking Methodologies for Attributed Patent Citation Networks for Technology Opportunity Discovery. IEEE Trans. Eng. Manag. 2016, 63, 426–437. [Google Scholar] [CrossRef]

- Rotolo, D.; Hicks, D.; Martin, B.R. What is an emerging technology? Res. Policy 2015, 44, 1827–1843. [Google Scholar] [CrossRef] [Green Version]

- Yoon, B.; Magee, C.L. Exploring technology opportunities by visualizing patent information based on generative topographic mapping and link prediction. Technol. Forecast. Soc. Chang. 2018, 132, 105–117. [Google Scholar] [CrossRef]

- Jena, K.L. A bibliometric analysis of the journal “Indian Journal of Fibre and Textile Research, 1996–2004”. Ann. Libr. Inf. Stud. 2006, 53, 22–30. [Google Scholar]

- Kalyane, V.L.; Sen, B.K. Bibliometric study of the Journal of Oilseeds Research. Ann. Libr. Sci. Doc. 1995, 42, 121–141. [Google Scholar]

- Li, X.; Zhou, Y.; Xue, L.; Huang, L. Integrating bibliometrics and roadmapping methods: A case of dye-sensitized solar cell technology-based industry in China. Technol. Forecast. Soc. Chang. 2015, 97, 205–222. [Google Scholar] [CrossRef]

- Lindman, Å.; Söderholm, P. Wind energy and green economy in Europe: Measuring policy-induced innovation using patent data. Appl. Energy 2016, 179, 1351–1359. [Google Scholar] [CrossRef]

- Mund, C.; Neuhäusler, P. Towards an early-stage identification of emerging topics in science-The usability of bibliometric characteristics. J. Informetr. 2015, 9, 1018–1033. [Google Scholar] [CrossRef]

- Glänzel, W.; Schoepflin, U. A bibliometric study of reference literature in the sciences and social sciences. Inf. Process. Manag. 1999, 35, 31–44. [Google Scholar] [CrossRef]

- Rinia, E.J.; Van Leeuwen, T.N.; Bruins, E.E.W.; Van Vuren, H.G.; Van Raan, A.F.J. Citation delay in interdisciplinary knowledge exchange. Scientometrics 2001, 51, 293–309. [Google Scholar] [CrossRef]

- Rooney, D. A contextualising, socio-technical definition of technology: Learning from ancient Greece and Foucault. Prometheus 1997, 15, 399–407. [Google Scholar] [CrossRef]

- Day, G.S.; Schoemaker, P.J.H. Avoiding the pitfalls of emerging technologies. Calif. Manag. Rev. 2000, 42, 8–33. [Google Scholar] [CrossRef]

- Porter, A.L.; Roessner, J.D.; Jin, X.; Newman, N.C. Measuring national ‘emerging technology’ capabilities. Sci. Public Policy 2002, 29, 189–200. [Google Scholar] [CrossRef]

- Cozzens, S.; Gatchair, S.; Kang, J.; Kim, K.S.; Lee, H.J.; Ordóñez, G.; Porter, A. Emerging technologies: Quantitative identification and measurement. Technol. Anal. Strateg. Manag. 2010, 22, 361–376. [Google Scholar] [CrossRef]

- Small, H.; Boyack, K.W.; Klavans, R. Identifying emerging topics in science and technology. Res. Policy 2014, 43, 1450–1467. [Google Scholar] [CrossRef]

- Noh, H.; Song, Y.K.; Lee, S. Identifying emerging core technologies for the future: Case study of patents published by leading telecommunication organizations. Telecomm. Policy 2016, 40, 956–970. [Google Scholar] [CrossRef]

- Song, K.; Kim, K.; Lee, S. Identifying promising technologies using patents: A retrospective feature analysis and a prospective needs analysis on outlier patents. Technol. Forecast. Soc. Chang. 2018, 128, 118–132. [Google Scholar] [CrossRef]

- Daim, T.; Monalisa, M.; Dash, P.; Brown, N. Time lag assessment between research funding and output in emerging technologies. Foresight 2007, 9, 33–44. [Google Scholar] [CrossRef]

- Coenen, R. The use of technological forecasts in government planning. Res. Policy 1972, 1, 156–172. [Google Scholar] [CrossRef]

- Goodwin, P.; Wright, G. The limits of forecasting methods in anticipating rare events. Technol. Forecast. Soc. Chang. 2010, 77, 355–368. [Google Scholar] [CrossRef] [Green Version]

- Bañuls, V.A.; Salmeron, J.L. Foresighting key areas in the Information Technology industry. Technovation 2008, 28, 103–111. [Google Scholar] [CrossRef]

- Bengisu, M.; Nekhili, R. Forecasting emerging technologies with the aid of science and technology databases. Technol. Forecast. Soc. Chang. 2006, 73, 835–844. [Google Scholar] [CrossRef]

- Lee, S.; Kang, S.; Park, E.; Park, Y. Applying technology road-maps in project selection and planning. Int. J. Qual. Reliab. Manag. 2008, 25, 39–51. [Google Scholar] [CrossRef]

- Zhang, Y.; Guo, Y.; Wang, X.; Zhu, D.; Porter, A.L. A hybrid visualisation model for technology roadmapping: Bibliometrics, qualitative methodology and empirical study. Technol. Anal. Strateg. Manag. 2013, 25, 707–724. [Google Scholar] [CrossRef]

- Serrasqueiro, Z. Investment determinants: High-investment versus low-investment portuguese SMEs. Investig. Anal. J. 2017, 46, 1–16. [Google Scholar] [CrossRef]

- de Mingo-López, D.V.; Matallín-Sáez, J.C. Institutional investment management: An investor’s perspective on the relation between turnover and performance. Investig. Anal. J. 2018, 47, 81–94. [Google Scholar] [CrossRef]

- Campagnolo, G.M.; Nguyen, H.T.; Williams, R. The temporal dynamics of technology promises in government and industry partnerships for digital innovation: The case of the Copyright Hub. Technol. Anal. Strateg. Manag. 2019, 31, 972–985. [Google Scholar] [CrossRef]

- Park, I.; Yoon, B. Identifying promising research frontiers of pattern recognition through bibliometric analysis. Sustainability 2018, 10, 4055. [Google Scholar] [CrossRef] [Green Version]

- Kaminski, J.; Hopp, C.; Tykvová, T. New technology assessment in entrepreneurial financing–Does crowdfunding predict venture capital investments? Technol. Forecast. Soc. Chang. 2019, 139, 287–302. [Google Scholar] [CrossRef]

- Deng, H.; Hu, R.; Pray, C.; Jin, Y. Impact of government policies on private R&D investment in agricultural biotechnology: Evidence from chemical and pesticide firms in China. Technol. Forecast. Soc. Chang. 2019, 147, 208–215. [Google Scholar] [CrossRef]

- Aaldering, L.J.; Leker, J.; Song, C.H. Uncovering the dynamics of market convergence through M&A. Technol. Forecast. Soc. Chang. 2019, 138, 95–114. [Google Scholar] [CrossRef]

- Signori, A.; Vismara, S. M&A synergies and trends in IPOs. Technol. Forecast. Soc. Chang. 2018, 127, 141–153. [Google Scholar] [CrossRef]

- Lee, C.; Kwon, O.; Kim, M.; Kwon, D. Early identification of emerging technologies: A machine learning approach using multiple patent indicators. Technol. Forecast. Soc. Chang. 2018, 127, 291–303. [Google Scholar] [CrossRef]

- Wu, J.; Li, H.; Cheng, S.; Lin, Z. The promising future of healthcare services: When big data analytics meets wearable technology. Inf. Manag. 2016, 53, 1020–1033. [Google Scholar] [CrossRef]

- Han, E.J.; Sohn, S.Y. Technological convergence in standards for information and communication technologies. Technol. Forecast. Soc. Chang. 2016, 106, 1–10. [Google Scholar] [CrossRef]

- Ko, N.; Yoon, J.; Seo, W. Analyzing interdisciplinarity of technology fusion using knowledge flows of patents. Expert Syst. Appl. 2014, 41, 1955–1963. [Google Scholar] [CrossRef]

- Karvonen, M.; Kässi, T. Patent citations as a tool for analysing the early stages of convergence. Technol. Forecast. Soc. Chang. 2013, 80, 1094–1107. [Google Scholar] [CrossRef]

- Ozkan, F.; Ozkan, O.; Gunduz, M. Causal relationship between construction investment policy and economic growth in Turkey. Technol. Forecast. Soc. Chang. 2012, 79, 362–370. [Google Scholar] [CrossRef]

- Shibata, N.; Kajikawa, Y.; Takeda, Y.; Sakata, I.; Matsushima, K. Detecting emerging research fronts in regenerative medicine by the citation network analysis of scientific publications. Technol. Forecast. Soc. Chang. 2011, 78, 274–282. [Google Scholar] [CrossRef]

- Bignami, F.; Mattsson, P.; Hoekman, J. The importance of geographical distance to different types of R&D collaboration in the pharmaceutical industry. Ind. Innov. 2020, 27, 513–537. [Google Scholar] [CrossRef] [Green Version]

- Vanhaverbeke, W.; Duysters, G.; Noorderhaven, N. External technology sourcing through alliances or acquisitions: An analysis of the application-specific integrated circuits industry. Organ. Sci. 2002, 13, 714–733. [Google Scholar] [CrossRef] [Green Version]

- Cassiman, B.; Veugelers, R. In Search of Complementarity in Innovation Strategy: Internal R&D and External Knowledge Acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar] [CrossRef] [Green Version]

- Cefis, E.; Marsili, O. Crossing the innovation threshold through mergers and acquisitions. Res. Policy 2015, 44, 698–710. [Google Scholar] [CrossRef]

- Cefis, E. The impact of M&A on technology sourcing strategies. Econ. Innov. New Technol. 2010, 19, 27–51. [Google Scholar] [CrossRef] [Green Version]

- Trichterborn, A.; Zu Knyphausen-Aufseß, D.; Schweizer, L. How to improve acquisition performance: The role of a dedicated M&A function, M&A learning process, and M&A capability. Strateg. Manag. J. 2016, 37, 763–773. [Google Scholar] [CrossRef]

- MSCI. The Global Industry Classification Standard. Available online: https://www.msci.com/gics (accessed on 1 December 2020).

- Hattangadi, V. Explained: The Difference between Sector and Industry. Available online: https://www.financialexpress.com/opinion/explained-the-difference-between-sector-and-industry/1349168/ (accessed on 1 December 2020).

- Etherington, D. Apple Acquired 24 Companies In The Last 18 Months. Available online: https://techcrunch.com/2014/04/23/apple-acquired-24-companies-in-the-last-18-months/ (accessed on 1 December 2020).

- Kim, N.; Lee, H.; Kim, W.; Lee, H.; Suh, J.H. Dynamic patterns of industry convergence: Evidence from a large amount of unstructured data. Res. Policy 2015, 44, 1734–1748. [Google Scholar] [CrossRef]

- Choi, J.; Chang, Y.S. Development of a new methodology to identity promising technology areas using M&A information. Sustainability 2020, 12, 5606. [Google Scholar] [CrossRef]

- Chandrinos, S.K.; Sakkas, G.; Lagaros, N.D. AIRMS: A risk management tool using machine learning. Expert Syst. Appl. 2018, 105, 34–48. [Google Scholar] [CrossRef]

- Sharpe, W.F. The Sharpe Ratio. J. Portf. Manag. 2009, 21, 49–58. [Google Scholar] [CrossRef]

- Bacon, C. How sharp is the Sharpe ratio? Risk-adjusted Performance Measures. Available online: www.statpro.com (accessed on 6 December 2020).

- Dowd, K. Adjusting for risk: An improved Sharpe ratio. Int. Rev. Econ. Financ. 2000, 9, 209–222. [Google Scholar] [CrossRef]

- Gilbert, E.; Meiklejohn, L. A comparative analysis of risk measures: A portfolio optimisation approach. Invest. Anal. J. 2019, 48, 223–239. [Google Scholar] [CrossRef]

- Tajdini, S.; Mehrara, M.; Tehrani, R. Double-sided balanced conditional Sharpe ratio. Cogent Econ. Financ. 2019, 7, 1–17. [Google Scholar] [CrossRef]

- Burmaoglu, S.; Sartenaer, O.; Porter, A. Conceptual definition of technology emergence: A long journey from philosophy of science to science policy. Technol. Soc. 2019, 59, 101126. [Google Scholar] [CrossRef]

- Im, K.S.; Dow, K.E.; Grover, V. Research Report: A Reexamination of IT Investment and the Market Value of the Firm-An Event Study Methodology. Inf. Syst. Res. 2001, 12, 103–117. [Google Scholar] [CrossRef]

- Borusyak, K.; Jaravel, X. Revisiting Event Study Designs. SSRN Electron. J. 2018. [Google Scholar] [CrossRef] [Green Version]

- Schmidheiny, K.; Siegloch, S. On Event Study Designs and Distributed-Lag Models: Equivalence, Generalization and Practical Implications. CESifo Work. Pap. 2019. [Google Scholar]

- Mishra, P.C.; Kishore, S.; Shivani, S. The Role of Information Technology for Knowledge Management: An Empirical Study of the Indian Coal Mining Industry. J. Glob. Inf. Technol. Manag. 2018, 21, 208–225. [Google Scholar] [CrossRef]

| Characteristics of M&A Data | Example |

|---|---|

| Information reliability |

|

| Standardized structure |

|

| Aggregated data |

|

| Timeliness information |

|

| Notation | Descriptions |

|---|---|

| Index of Health Care sub-industry (HCSI) (i = 1, …, 10) | |

| Index of period (t = 1, …, n) | |

| Number of M&A activities for HCSI i during a period of time t | |

| Number of M&A activities excluding activities with unavailable financial data for HCSI i during a period of time t | |

| Total value of M&A activities excluding activities with unavailable financial data for HCSI i during a period of time t | |

| , average value of M&A activities for HCSI i during a period of time t | |

| , estimated value of M&A activities for HCSI i during a period of time t | |

| Cumulative M&A activities number for HCSI i during a period of time t | |

| Cumulative M&A activities value for HCSI i during a period of time t | |

| Velocity of M&A activities number for HCSI i during a period of time t | |

| Velocity of M&A activities value for HCSI i during a period of time t | |

| Acceleration of M&A activities number for HCSI i during a period of time t | |

| Acceleration of M&A activities value for HCSI i during a period of time t | |

| Normalized values from 0 to 1 for | |

| Normalized values from 0 to 1 for | |

| Normalized values from 0 to 1 for | |

| Normalized values from 0 to 1 for | |

| Weight of the velocity of M&A activities number | |

| Weight of the acceleration of M&A activities number | |

| Weight of the velocity of M&A activities value | |

| Weight of the acceleration of M&A activities value |

| HCSI (i) | Number of M&A Activities | Value of M&A Activities | ||||

|---|---|---|---|---|---|---|

| Standardized Coefficient (β) | p-Value | R2 | Standardized Coefficient (β) | p-Value | R2 | |

| 1. Biotechnology | 6.404 | 0.0047 *** | 0.4995 | 13693 | 0.0022 *** | 0.4995 |

| 2. Health Care Distributors | 1.780 | ‒0.172 | 0.1497 | 2415 | 0.0482 ** | 0.1497 |

| 3. Health Care Equipment | 2.191 | 0.312 | 0.0847 | 3409 | 0.3095 | 0.0847 |

| 4. Health Care Facilities | 36.160 | 0.0001 *** | 0.7287 | 2292 | 0.4060 | 0.7287 |

| 5. Health Care Services | 35.569 | 1.77e−5 *** | 0.7963 | 17337 | 0.0137 ** | 0.7963 |

| 6. Health Care Supplies | 1.066 | 0.333 | 0.0780 | ‒9.037 | 0.997 | 0.0780 |

| 7. Health Care Technology | 15.099 | 1.46e−7 *** | 0.9076 | 4551 | 0.0018 *** | 0.9076 |

| 8. Life Sciences Tools & Services | 7.8593 | 3.26e−7 *** | 0.8945 | 2299 | 0.147 | 0.8945 |

| 9. Managed Health Care | 0.2484 | 0.707 | 0.0122 | 11063 | 0.231 | 0.0122 |

| 10. Pharmaceuticals | 10.730 | 0.0043 *** | 0.5070 | 1405 | 0.8445 | 0.5070 |

| i = 1 | i = 2 | i = 3 | i = 4 | i = 5 | i = 6 | i = 7 | i = 8 | i = 9 | i = 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2006 | 826 | −14,212 | −12,702 | 98,932 | 8321 | 15,845 | 3491 | 38,073 | 59,936 | 33,833 |

| 2007 | −21,985 | 2332 | 17,702 | −72,098 | 21,135 | 12,220 | 93 | −23,066 | −81,759 | 25,195 |

| 2008 | 127,116 | −777 | −82,527 | −62,625 | −29,567 | 19,391 | −4434 | 3914 | −11,354 | −70,358 |

| 2009 | −85,951 | −2572 | 6704 | 5161 | 4926 | −35,191 | 4345 | −14,484 | 1421 | 221,645 |

| 2010 | 24,882 | 9555 | 12,083 | 25,234 | 19,815 | 111,790 | 6325 | 18,334 | 15,092 | −242,581 |

| 2011 | −27,785 | 15,393 | 94,404 | −15,336 | 170,489 | −115,949 | −1998 | −2479 | −1907 | 36,348 |

| 2012 | 8526 | 8007 | −70,959 | 4484 | −135,401 | −2464 | 105 | −17,994 | 42,708 | −38,048 |

| 2013 | 8642 | −4326 | −20,488 | 31,148 | −46,128 | 26,342 | −1291 | 62,579 | −52,768 | 22,668 |

| 2014 | 3372 | 38,136 | 153,213 | −12,371 | 40,642 | 23,845 | 16,768 | −21,377 | 32,991 | 301,966 |

| 2015 | 97,083 | −43,684 | −111,674 | 35,554 | 115,717 | −54,980 | −1373 | −27,425 | −18,420 | −118,118 |

| 2016 | 16,465 | −21,938 | 38,956 | −13,620 | −72,574 | 44,796 | 62,633 | 8038 | 1737 | −159,665 |

| 2017 | −56,220 | 28,449 | 9520 | 57,151 | −30,385 | −31,644 | −55,821 | 57,743 | 502,499 | −38,442 |

| 2018 | 164,817 | 5770 | −62,298 | −42,670 | 345,514 | 4850 | 33,615 | −66,559 | −498,296 | 25,092 |

| Sub-Industry (i) | |||

|---|---|---|---|

| 1. Biotechnology | 0.456 | 0.243 | 5 |

| 2. Health Care Distributors | 0.499 | 0.195 | 1 |

| 3. Health Care Equipment | 0.477 | 0.216 | 2 |

| 4. Health Care Facilities | 0.450 | 0.194 | 7 |

| 5. Health Care Services | 0.369 | 0.218 | 10 |

| 6. Health Care Supplies | 0.454 | 0.205 | 6 |

| 7. Health Care Technology | 0.468 | 0.183 | 3 |

| 8. Life Sciences Tools & Services | 0.461 | 0.196 | 4 |

| 9. Managed Health Care | 0.406 | 0.171 | 8 |

| 10. Pharmaceuticals | 0.377 | 0.189 | 9 |

| Figure | wvn | wvv | wan | wav | |

|---|---|---|---|---|---|

| Strategic decision I | Short-Long strategy | 0.25 | 0.25 | 0.25 | 0.25 |

| Strategic decision II | Short strategy | 0.4 | 0.04 | 0.1 | 0.1 |

| Strategic decision III | Long strategy | 0.1 | 0.1 | 0.4 | 0.4 |

| HCSI (i) | PISR Measures | PISR Rank | ||||

|---|---|---|---|---|---|---|

| Short-Long | Short | Long | Short-Long | Short | Long | |

| 1. Biotechnology | 0.060 | −0.034 | 0.141 | 6 | 7 | 3 |

| 2. Health Care Distributors | 0.294 | 0.274 | 0.287 | 1 | 1 | 1 |

| 3. Health Care Equipment | 0.164 | 0.204 | 0.111 | 2 | 3 | 5 |

| 4. Health Care Facilities | 0.042 | 0.254 | −0.190 | 7 | 2 | 8 |

| 5. Health Care Services | −0.335 | −0.208 | −0.445 | 9 | 8 | 10 |

| 6. Health Care Supplies | 0.060 | 0.139 | −0.019 | 5 | 4 | 7 |

| 7. Health Care Technology | 0.145 | 0.059 | 0.238 | 3 | 6 | 2 |

| 8. Life Sciences Tools & Services | 0.098 | 0.097 | 0.084 | 4 | 5 | 6 |

| 9. Managed Health Care | −0.207 | −0.512 | 0.115 | 8 | 10 | 4 |

| 10. Pharmaceuticals | −0.344 | −0.365 | −0.293 | 10 | 9 | 9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, J.; Shin, N.; Chang, Y.S. Strategic Investment Decisions for Emerging Technology Fields in the Health Care Sector Based on M&A Analysis. Sustainability 2021, 13, 3644. https://doi.org/10.3390/su13073644

Choi J, Shin N, Chang YS. Strategic Investment Decisions for Emerging Technology Fields in the Health Care Sector Based on M&A Analysis. Sustainability. 2021; 13(7):3644. https://doi.org/10.3390/su13073644

Chicago/Turabian StyleChoi, Jinho, Nina Shin, and Yong Sik Chang. 2021. "Strategic Investment Decisions for Emerging Technology Fields in the Health Care Sector Based on M&A Analysis" Sustainability 13, no. 7: 3644. https://doi.org/10.3390/su13073644