Does Foreign Institutional Equity Participation Instigate Sustainable Corporate Investment Efficiency? Evidence from Emerging Economies

Abstract

:1. Introduction

2. Literature Review and Hypothesis

2.1. Theoretical Background

2.2. Empirical Context

3. Research Methodology

3.1. Research Design and Model

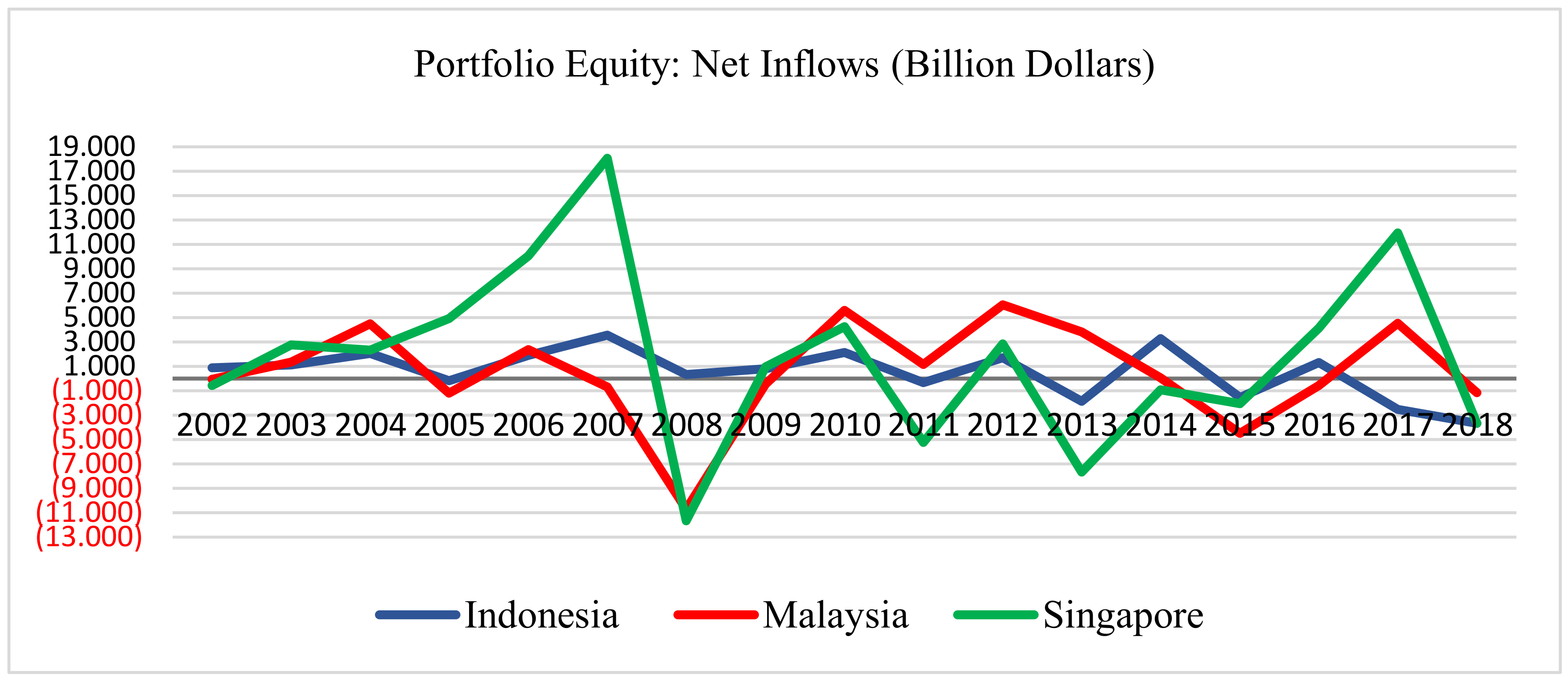

3.2. Data Description

4. Empirical Results

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Inferential Statistics

4.4. Robustness Check

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cao, Y.; Dong, Y.; Lu, Y.; Ma, D. Does institutional ownership improve firm investment efficiency? Emerg. Mark. Financ. Trade 2020, 56, 2772–2792. [Google Scholar] [CrossRef] [Green Version]

- Chen, R.; El Ghoul, S.; Guedhami, O.; Wang, H. Do state and foreign ownership affect investment efficiency? Evidence from privatizations. J. Corp. Financ. 2017, 42, 408–421. [Google Scholar] [CrossRef]

- Sakawa, H.; Watanabel, N. Institutional ownership and firm performance under stakeholder-oriented corporate governance. Sustainability 2020, 12, 1021. [Google Scholar] [CrossRef] [Green Version]

- Naeem, K.; Li, M.C. Corporate investment efficiency: The role of financial development in firms with financing constraints and agency issues in OECD non-financial firms. Int. Rev. Financ. Anal. 2019, 62, 53–68. [Google Scholar] [CrossRef]

- Ratny, S.; Fonseka, M.M.; Tian, G.-L. Access to external financing and firm investment efficiency: Evidence from China. J. Dev. Areas 2019, 53, 109–122. [Google Scholar] [CrossRef]

- MacCallum, R.C.; Browne, M.W.; Preacher, K.J. Comments on the Meehl-Waller (2002) procedure for appraisal of path analysis models. Psychol. Methods 2002, 7, 301–306. [Google Scholar] [CrossRef] [PubMed]

- Myers, S.C.; Majluf, N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef] [Green Version]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Guariglia, A.; Yang, J. A balancing act: Managing financial constraints and agency costs to minimize investment inefficiency in the Chinese market. J. Corp. Financ. 2016, 36, 111–130. [Google Scholar] [CrossRef] [Green Version]

- Castro, F.; Kalatzis, A.E.G.; Martins-Filho, C. Financing in an emerging economy: Does financial development or financial structure matter? Emerg. Mark. Rev. 2015, 23, 96–123. [Google Scholar] [CrossRef]

- Mulier, K.; Schoors, K.; Merlevede, B. Investment-cash flow sensitivity and financial constraints: Evidence from unquoted European SMEs. J. Bank. Financ. 2016, 73, 182–197. [Google Scholar] [CrossRef]

- Guariglia, A. Internal financial constraints, external financial constraints, and investment choice: Evidence from a panel of UK firms. J. Bank. Financ. 2008, 32, 1795–1809. [Google Scholar] [CrossRef] [Green Version]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–213. [Google Scholar] [CrossRef] [Green Version]

- Chen, F.; Hope, O.K.; Li, Q.; Wang, X. Financial reporting quality and investment efficiency of private firms in emerging markets. Account. Rev. 2011, 86, 1255–1288. [Google Scholar] [CrossRef]

- Biddle, G.C.; Hilary, G.; Verdi, R.S. How does financial reporting quality relate to investment efficiency? J. Account. Econ. 2009, 48, 112–131. [Google Scholar] [CrossRef]

- Gomariz, M.F.C.; Ballesta, J.P.S. Financial reporting quality, debt maturity and investment efficiency. J. Bank. Financ. 2014, 40, 494–506. [Google Scholar] [CrossRef] [Green Version]

- Khan, M.K.; He, Y.; Kaleem, A.; Akram, U.; Hussain, Z. Remedial role of financial development in corporate investment amid financing constraints and agency costs. J. Bus. Econ. Manag. 2018, 19, 176–191. [Google Scholar] [CrossRef] [Green Version]

- Cella, C. Institutional investors and corporate investment. Financ. Res. Lett. 2020, 32, 101169. [Google Scholar] [CrossRef]

- Chung, C.Y.; Kim, H.; Ryu, D. Foreign investor trading and information asymmetry: Evidence from a leading emerging market. Appl. Econ. Lett. 2017, 24, 540–544. [Google Scholar] [CrossRef]

- Tran, Q.T. Foreign ownership and investment efficiency: New evidence from an emerging market. Int. J. Emerg. Mark. 2020, 15, 1185–1199. [Google Scholar] [CrossRef]

- Aggarwal, R.; Erel, I.; Ferreira, M.; Matos, P. Does governance travel around the world? Evidence from institutional investors $. J. Financ. Econ. 2011, 100, 154–181. [Google Scholar] [CrossRef]

- Brickley, J.A.; Lease, R.C.; Smith, C.W. Ownership structure and voting on antitakeover amendments. J. Financ. Econ. 1988, 20, 267–291. [Google Scholar] [CrossRef]

- Almazan, A.; Hartzell, J.C.; Starks, L.T. Active institutional shareholders and costs of monitoring: Evidence from executive compensation. Financ. Manag. 2005, 34, 5–34. [Google Scholar] [CrossRef]

- Ferreira, M.A.; Matos, P. The colors of investors’ money: The role of institutional investors around the world. J. Financ. Econ. 2008, 88, 499–533. [Google Scholar] [CrossRef]

- Lee, S.C.; Rhee, M.; Yoon, J. Foreign monitoring and audit quality: Evidence from Korea. Sustainability 2018, 10, 3151. [Google Scholar] [CrossRef] [Green Version]

- Lee, J.; Kim, S.J.; Kwon, I. Corporate social responsibility as a strategic means to attract foreign investment: Evidence from Korea. Sustainability 2017, 9, 2121. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Carletti, E.; Marquez, R. Stakeholder governance, competition, and firm value. Rev. Financ. 2015, 19, 1315–1346. [Google Scholar] [CrossRef] [Green Version]

- Bena, J.; Ferreira, M.A.; Matos, P.; Pires, P. Are foreign investors locusts? The long-term effects of foreign institutional ownership. J. Financ. Econ. 2017, 126, 122–146. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report 2017: Investment and the Digital Economy; United Nations Publication: Geneva, Switzerland, 2017; ISBN 9789211129113. [Google Scholar]

- Panda, B.; Leepsa, N.M. Agency theory: Review of theory and evidence on problems and perspectives. Indian J. Corp. Gov. 2017, 10, 74–95. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of Ownership and Control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Stein, J.C. Efficient capital markets, inefficient firms: A model of myopic corporate behavior. Q. J. Econ. 1989, 104, 655–669. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO overconfidence and corporate investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef] [Green Version]

- Koo, J.; Maeng, K. Foreign ownership and investment: Evidence from Korea. Appl. Econ. 2006, 38, 2405–2414. [Google Scholar] [CrossRef]

- Liu, J. Fixed investment, liquidity, and access to capital markets: New evidence. Int. Rev. Financ. Anal. 2013, 29, 189–201. [Google Scholar] [CrossRef]

- Sirsly, C.A.T.; Sur, S. Strategies for sustainability initiatives: Why ownership matters. Corp. Gov. 2013, 13, 541–550. [Google Scholar] [CrossRef]

- Admati, A.R.; Pfleiderer, P. The “wall Street Walk” and shareholder activism: Exit as a form of voice. Rev. Financ. Stud. 2009, 22, 2645–2685. [Google Scholar] [CrossRef] [Green Version]

- Huang, R.D.; Shiu, C.Y. Local effects of foreign ownership in an emerging financial market: Evidence from qualified foreign institutional investors in Taiwan. Financ. Manag. 2009, 38, 567–602. [Google Scholar] [CrossRef]

- Bae, K.H.; Ozoguz, A.; Tan, H.; Wirjanto, T.S. Do foreigners facilitate information transmission in emerging markets? J. Financ. Econ. 2012, 105, 209–227. [Google Scholar] [CrossRef]

- Kim, I.J.; Eppler-Kim, J.; Kim, W.S.; Byun, S.J. Foreign investors and corporate governance in Korea. Pacific Basin Financ. J. 2010, 18, 390–402. [Google Scholar] [CrossRef]

- Wu, J.; Li, S.; Selover, D.D. Foreign direct investment vs. foreign portfolio investment: The effect of the governance environment. Manag. Int. Rev. 2012, 52, 643–670. [Google Scholar] [CrossRef]

- Choi, S.; Hasan, I. Ownership, governance, and bank performance: Korean experience. Financ. Mark. Inst. Instrum. 2005, 14, 215–242. [Google Scholar] [CrossRef]

- Park, H.Y.; Chae, S.J.; Cho, M.K. Controlling shareholders’ ownership structure, foreign investors’ monitoring, and investment efficiency. Invest. Manag. Financ. Innov. 2016, 13, 159–170. [Google Scholar] [CrossRef] [Green Version]

- Peck-Ling, T.; Nai-Chiek, A.; Chee-Seong, L. Foreign ownership, foreign directors and the profitability of malaysian listed companies. Procedia Soc. Behav. Sci. 2016, 219, 580–588. [Google Scholar] [CrossRef] [Green Version]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M. Financial constraints, asset tangibility, and corporate investment. Rev. Financ. Stud. 2007, 20, 1429–1460. [Google Scholar] [CrossRef] [Green Version]

- Rafailov, D. Financial slack and performance of bulgarian firms. J. Financ. Bank Manag. 2017, 5, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Chen, T.; Xie, L.; Zhang, Y. How does analysts’ forecast quality relate to corporate investment efficiency? J. Corp. Financ. 2017, 43, 217–240. [Google Scholar] [CrossRef]

- Labra, R.; Torrecillas, C. Estimating dynmic Panel data. A practical approach to perform long panels. Rev. Colomb. Estad. 2018, 41, 31–52. [Google Scholar] [CrossRef] [Green Version]

| Variable Name | Variable Notation | Measurement |

|---|---|---|

| Corporate Investment | INV | Capital expenditures plus research and development expense, divided by lagged total assets |

| Cash Flow | CF | Cash flow from operating activities, divided by total assets |

| TobinQ | TQ | Market value of equity plus total liabilities, divided by book value of assets, calculated as (market value + total liabilities)/total assets. |

| Return on Assets | ROA | Ratio of net profit after tax to total assets |

| Firm Age | AGE | Number of years since listing on stock market |

| Investment Efficiency | INV_EF | Absolute residuals value obtained from the Equation (1) regression and multiplied by (−1) |

| Foreign Institutional Ownership | F_INST | Percentage of shares held by foreigner investors |

| Foreign Pressure-Resistant Institutional Ownership | FINST_PR | Percentage of shares held by foreigner pressure-resistant investors |

| Foreign Pressure-Sensitive Institutional Ownership | FINST_PS | Percentage of shares held by foreigner pressure-sensitive investors |

| Free Cash Flow | FCF | Difference of operating cash flow and capital expenditure scaled by total assets |

| Assets Tangibility | A_TAN | Net PPE scaled by lagged total assets |

| Financial Slack | SLACK | Ratio of cash to property plant and equipment |

| Other Receivables Claimant | ORC | Ratio of other receivables to total assets |

| Dividend Paid by Firm | DIV | An indicator variable with the value of 1 if a firm pays dividends, zero otherwise |

| Financial Leverage (a) | F_LEV | Ratio of total debt to book value of assets |

| Firm Size | SIZE | Natural logarithm of book value of assets |

| Financial Leverage (b) | F_LEV | Ratio of total debt to lagged assets |

| Loss Incurred by Firm | LOSS | An indicator variable that takes a value of 1 if net loss is incurred in a given year, and zero otherwise |

| Revenue | REV | Net sales revenue divided by lagged total assets |

| Variables | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| INV_EF | 6408 | 0.0000959 | 0.156685 | −0.37778 | 0.41485 |

| F_INST | 5743 | 0.0549844 | 0.077149 | 0.0001 | 0.405474 |

| FINST_PR | 4538 | 0.0407418 | 0.052238 | 0.0001 | 0.31080 |

| FINST_PS | 2418 | 0.0559310 | 0.0964404 | 0.00008 | 0.456272 |

| FCF | 7556 | 0.0140367 | 0.1091604 | −0.3717271 | 0.3570234 |

| A_TAN | 7288 | 0.3618012 | 0.2605447 | 0.0029903 | 1.27241 |

| SLACK | 7453 | 1.150727 | 3.584122 | 0.0029227 | 27.69412 |

| ORC | 6626 | 0.0332029 | 0.0557522 | 0.0000858 | 0.3298002 |

| DIV | 8020 | 0.6649626 | 0.472033 | 0 | 1 |

| F_LEV | 7484 | 0.2183304 | 0.2052407 | 0 | 0.932771 |

| SIZE | 7576 | 5.414979 | 0.7188431 | 3.848565 | 7.314333 |

| Variables | F_INST | FINST_PR | FINST_PS | FCF | A_TAN | SLACK | ORC | DIV | F_LEV | SIZE |

|---|---|---|---|---|---|---|---|---|---|---|

| F_INST | 1.0000 | |||||||||

| FINST_PR | −0.0708 | 1.0000 | ||||||||

| FINST_PS | −0.0024 | 0.0897 | 1.0000 | |||||||

| FCF | 0.0088 | −0.0256 | 0.0181 | 1.0000 | ||||||

| A_TAN | −0.0425 | 0.0487 | −0.0418 | −0.1233 | 1.0000 | |||||

| SLACK | 0.0165 | −0.0519 | −0.0343 | −0.0718 | −0.2789 | 1.0000 | ||||

| ORC | −0.0297 | −0.0650 | 0.0622 | −0.1251 | −0.2610 | 0.1002 | 1.0000 | |||

| DIV | 0.0246 | 0.0064 | −0.0009 | 0.2426 | 0.0890 | −0.1283 | −0.2368 | 1.0000 | ||

| F_LEV | −0.1117 | 0.1154 | −0.0425 | −0.3226 | 0.1738 | −0.0442 | 0.1015 | −0.0878 | 1.0000 | |

| SIZE | −0.0172 | 0.1474 | 0.0401 | −0.0192 | 0.1898 | −0.1410 | −0.0375 | 0.1963 | 0.4528 | 1.0000 |

| 0.4281 *** (38.22) | 0.0519 (1.58) | −0.0513 *** (−7.04) | 0.0039 ** (2.19) | 0.000704 ** (2.01) | −0.0043 *** (−2.92) | −0.0072 (−1.21) | 0.2545 |

| Variables | Basic Models | Endogeneity of Foreign Institutional Ownership | Robust Check | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Instrumental Variable, Second Stage | GMM | ||||||||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| F_INST | 0.103 *** (2.89) | 0.945 *** (4.34) | 0.277 ** (2.56) | ||||||

| FINST_PR | 0.0711 ** (2.09) | 0.0991 ** (2.57) | 0.0772 ** (2.08) | ||||||

| FINST_PS | 0.00693 (0.16) | 0.2209 ** (2.25) | 0.0444 (1.00) | ||||||

| FCF | 0.172 *** (6.37) | 0.285 *** (12.83) | 0.141 *** (6.71) | 0.151 *** (12.51) | 0.245 *** (37.70) | 0.174 *** (18.89) | 0.149 *** (5.23) | 0.230 *** (8.37) | 0.119 *** (5.66) |

| A_TAN | 0.369 *** (16.25) | −0.0726 *** (−7.64) | −0.0503 *** (−3.44) | 0.346 *** (45.51) | −0.0339 *** (−13.81) | −0.0293 *** (−4.98) | 0.308 *** (9.98) | −0.0553 *** (−4.87) | −0.0437 ** (−2.54) |

| SLACK | −0.00344 *** (−4.76) | −0.00178 * (−1.87) | −0.000341 (−0.99) | −0.0032 *** (−6.76) | 0.000623 * (1.71) | −0.00035 (−0.87) | −0.0030 *** (−2.83) | 0.0009 (1.06) | −0.00058 (−1.02) |

| ORC | −0.0612 * (−1.87) | 0.0296 (0.85) | 0.0465 (1.32) | 0.0352 (1.32) | 0.0221 * (1.78) | 0.0682 *** (3.17) | |||

| DIV | −0.00899 ** (−2.12) | −0.00817 *** (−2.80) | −0.0106 ** (−2.54) | −0.0077 ** (−2.40) | −0.00983 *** (−6.63) | −0.0076 *** (−2.93) | |||

| F_LEV | −0.0440 ** (−2.32) | 0.0000174 (0.33) | −0.00233 (−1.38) | 0.0589 *** (6.40) | −0.00114 (−0.30) | 0.0002 (0.03) | |||

| SIZE | −0.0517 *** (−4.24) | −0.0160 * (−1.73) | 0.0103 (0.77) | −0.0296 *** (4.88) | −0.00848 *** (−6.49) | 0.00115 (0.18) | −0.127 *** (−5.84) | −0.0390 *** (−4.57) | −0.0044 (−0.29) |

| FIN_LEV | 0.564 *** (3.13) | −0.0043 ** (−2.39) | −0.0153 (−0.59) | ||||||

| LOSS | 0.194 *** (2.99) | 0.0047 (1.59) | 0.0065 * (1.75) | ||||||

| REV | −0.0311 ** (−2.27) | −0.0169 *** (−2.76) | −0.0098 * (−1.96) | ||||||

| Intercept | 0.134 ** (2.01) | 0.124 ** (2.42) | −0.0345 (−0.50) | 0.00122 (0.03) | 0.0662 *** (10.54) | −0.0181 (−0.47) | 0.0483 *** (4.66) | 0.272 *** (5.45) | 0.0465 (0.55) |

| Obs. | 4468 | 4142 | 1622 | 5465 | 4474 | 2663 | 4547 | 3295 | 1790 |

| F | 35.91 *** | 35.11 *** | 4.56 *** | 310.11 *** | 301.24 *** | 27.94 *** | |||

| R-squared | 0.3683 | 0.3004 | 0.1317 | 0.3463 | 0.3505 | 0.1739 | |||

| Hansen J | 55.91 | 151.12 | 93.84 | ||||||

| (p-value) | 0.330 | 0.198 | 0.485 | ||||||

| Wald F | 294.75 | 236.43 | 72.98 | ||||||

| P(AR1) | 0.000 | 0.000 | 0.000 | ||||||

| P(AR2) | 0.220 | 0.283 | 0.375 | ||||||

| Variables | Overall Foreign Institutional Equity Participation | |||||

|---|---|---|---|---|---|---|

| Continuous F_INST | D > 0% | D > 5% | D > 10% | D > 20% | D > 30% | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| F_INST | 0.103 *** | 0.00446 | 0.0103 *** | 0.0126 ** | 0.0334 *** | 0.0416 *** |

| (2.98) | (0.64) | (2.60) | (2.50) | (3.81) | (3.10) | |

| FCF | 0.172 *** | 0.162 *** | 0.162 *** | 0.162 *** | 0.162 *** | 0.162 *** |

| (13.45) | (12.44) | (12.43) | (12.48) | (12.48) | 12.49 | |

| A_TAN | 0.369 *** | 0.340 *** | 0.341 *** | 0.341 *** | 0.340 *** | 0.339 *** |

| (42.41) | (39.78) | (39.89) | (39.88) | (39.97) | 39.84 | |

| SLACK | −0.0034 *** | −0.0037 *** | −0.0033 *** | −0.0032 *** | −0.0032 *** | −0.0031 *** |

| (−6.45) | (−6.02) | (−6.05) | (−6.03) | (−6.08) | −5.86 | |

| ORC | −0.0612 ** | −0.0163 | −0.0168 | −0.0167 | −0.015 | −0.146 |

| (−2.06) | (−0.54) | (−0.56) | (−0.56) | (−0.52) | −0.49 | |

| DIV | −0.00899 ** | −0.0133 *** | −0.0132 *** | −0.0131 *** | 0.0130 *** | −0.013 *** |

| (−2.52) | (−3.68) | (−3.64) | (−3.62) | (−3.61) | −3.60 | |

| F_LEV | −0.0440 *** | −0.0474 *** | −0.0458 *** | −0.0471 *** | −0.046 *** | −0.0468 *** |

| (−4.26) | (−4.49) | (−4.34) | (−4.47) | (−4.460) | −4.45 | |

| SIZE | −0.0517 *** | −0.0258 *** | −0.0277 *** | −0.0268 *** | −0.0260 *** | −0.0268 *** |

| (−6.99) | (−3.58) | (−3.84) | (−3.74) | (−3.64) | −3.75 | |

| Intercept | 0.134 *** | 0.0332 | 0.0439 | 0.0405 | 0.0358 | 0.412 |

| (3.34) | (0.84) | (1.11) | (1.02) | (0.91) | 1.04 | |

| Obs. R2 | 4468 | 4468 | 4468 | 4468 | 4468 | 4468 |

| 0.3683 | 0.3390 | 0.3401 | 0.3400 | 0.3415 | 0.3406 | |

| Variables | Pressure−Resistant Foreign Institutional Equity Participation | |||||

|---|---|---|---|---|---|---|

| Continuous FINST_PR | D > 0% | D > 5% | D > 10% | D > 20% | D > 30% | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| FINST_PS | 0.0709 ** (2.52) | 0.000495 (0.12) | 0.00256 (1.02) | 0.00794 ** 2.30 | 0.0052 0.84 | 0.005 0.36 |

| FCF | 0.285 *** (30.86) | 0.286 *** (30.86) | 0.285 *** (30.84) | 0.2857 *** 30.90 | 0.285 *** 30.86 | 0.285 *** 30.86 |

| A_TAN | −0.0726 *** (−15.86) | −0.0735 *** (−16.08) | −0.0734 *** (−16.06) | −0.0731 *** −16.01 | −0.0733 *** −16.05 | −0.0734 *** 16.07 |

| SLACK | −0.0018 *** (−3.08) | −0.0017 *** (−3.10) | −0.0018 *** (−3.10) | −0.00179 *** −3.12 | −0.00178 *** −3.09 | −0.00178 *** −3.10 |

| ORC | 0.0295 (1.28) | 0.0323 (1.40) | 0.0321 (1.40) | 0.0309 1.35 | 0.0322 1.40 | 0.0324 1.41 |

| DIV | −0.00817 *** (−3.21) | −0.00843 *** (−3.31) | −0.0084 *** (−3.30) | −0.0082 *** −3.24 | −0.00834 *** −3.28 | −0.0084 *** −3.31 |

| F_LEV | 0.0000169 (0.02) | −0.0000555 (−0.07) | −0.0000275 (−0.03) | 0.00001 0.01 | −0.000039 −0.05 | −0.000045 −0.05 |

| SIZE | −0.0160 *** (−3.20) | −0.0126 ** (−2.58) | −0.0134 *** (−2.74) | −0.0142 *** −2.92 | −0.126 *** −2.62 | −0.124 ** −2.59 |

| Intercept | 0.124 *** (4.39) | 0.107 *** (3.90) | 0.112 *** (4.02) | 0.115 *** 4.18 | 0.1079 *** 3.92 | 0.1072 *** 3.90 |

| Obs. R2 | 4142 0.3004 | 4142 0.2991 | 4142 0.2993 | 4142 0.3002 | 4142 0.2993 | 4142 0.2992 |

| Variables | Pressure−Sensitive Foreign Institutional Equity Participation | |||||

|---|---|---|---|---|---|---|

| Continuous FINST_PS | D > 0% | D > 5% | D > 10% | D > 20% | D > 30% | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| FINST_PS | 0.00693 (0.23) | 0.00149 (0.25) | 0.00565 (0.88) | 0.0127 * (1.71) | 0.0193 1.37 | −0.00037 −0.04 |

| FCF | 0.141 *** (11.40) | 0.141 *** (11.40) | 0.141 *** (11.34) | 0.140 *** (11.30) | 0.1435 *** 11.67 | 0.1411 *** 11.47 |

| A_TAN | −0.0503 *** (−4.99) | −0.0502 *** (−4.98) | −0.0503 *** (−4.99) | −0.0505 *** (−5.02) | −0.0444 *** −4.60 | −0.0444 *** −4.59 |

| SLACK | −0.000341 (−0.72) | −0.000337 (−0.72) | −0.000346 (−0.74) | −0.000340 (−0.72) | −0.00489 −1.05 | −0.00047 −1.01 |

| ORC | 0.0465 (1.57) | 0.0465 (1.57) | 0.0463 (1.57) | 0.0449 (1.52) | 0.0368 1.28 | 0.03789 1.31 |

| DIV | −0.0106 *** (−2.96) | −0.0106 *** (−2.96) | −0.0107 *** (−2.97) | −0.0105 *** (−2.92) | −0.0096 *** −2.73 | −0.0096 *** −2.72 |

| F_LEV | −0.00233 (−1.42) | −0.00231 (−1.41) | −0.00217 (−1.31) | −0.00239 (−1.46) | −0.00275 * −1.69 | −0.00271 * −1.66 |

| SIZE | 0.0103 (1.28) | 0.0104 (1.29) | 0.0108 (1.34) | 0.0114 (1.41) | 0.00502 0.69 | 0.0053 0.72 |

| Intercept | −0.0345 (−0.81) | −0.0356 (−0.83) | −0.0386 (−0.90) | −0.0418 (−0.98) | −0.0084 −0.21 | −0.0076 −0.19 |

| Obs. R2 | 1622 0.1317 | 1622 0.1318 | 1622 0.1323 | 1622 0.1337 | 1622 0.1294 | 1622 0.1252 |

| Variables | D(INV_EF) | D(F_INST) | D(FCF) | D(A_TAN) | D(SLACK) | D(ORC) | D(DIV) | D(F_LEV) | D(SIZE) |

|---|---|---|---|---|---|---|---|---|---|

| D(INV_EF) | - | 8.315 (0.040) | 19.984 (0.000) | 82.357 (0.000) | 2.776 (0.428) | 3.528 (0.317) | 12.229 (0.007) | 1.706 (0.636) | 57.360 (0.000) |

| D(F_INST) | 3.020 (0.389) | - | 0.197 (0.978) | 5.730 (0.126) | 1.548 (0.671) | 6.509 (0.089) | 3.861 (0.277) | 0.875 (0.831) | 6.766 (0.080) |

| D(FCF) | 12.380 (0.006) | 0.623 (0.891) | - | 2.853 (0.415) | 7.560 (0.056) | 0.399 (0.941) | 41.513 (0.000) | 14.236 (0.003) | 8.529 (0.036) |

| D(A_TAN) | 24.015 (0.000) | 0.680 (0.878) | 21.940 (0.000) | - | 4.230 (0.238) | 13.271 (0.004) | 16.180 (0.001) | 12.046 (0.007) | 79.811 (0.000) |

| D(SLACK) | 0.649 (0.885) | 20.982 (0.000) | 1.296 (0.730) | 0.883 (0.830) | - | 3.811 (0.283) | 1.521 (0.677) | 1.011 (0.799) | 2.051 (0.562) |

| D(ORC) | 10.005 (0.019) | 0.316 (0.957) | 6.573 (0.087) | 12.332 (0.006) | 11.977 (0.008) | - | 1.451 (0.694) | 5.201 (0.158) | 35.382 (0.000) |

| D(DIV) | 11.671 (0.009) | 5.485 (0.140) | 18.995 (0.000) | 11.792 (0.008) | 0.294 (0.961) | 0.520 (0.915) | - | 5.883 (0.118) | 53.084 (0.000) |

| D(F_LEV) | 7.090 (0.069) | 3.834 (0.280) | 16.235 (0.001) | 5.220 (0.156) | 2.035 (0.565) | 15.261 (0.002) | 4.504 (0.212) | - | 26.939 (0.000) |

| D(SIZE) | 7.892 (0.048) | 1.254 (0.740) | 0.384 (0.944) | 5.231 (0.156) | 8.251 (0.041) | 9.490 (0.023) | 17.478 (0.001) | 10.243 (0.017) | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Riaz, S.; Hanifa, M.H.; Zainir, F. Does Foreign Institutional Equity Participation Instigate Sustainable Corporate Investment Efficiency? Evidence from Emerging Economies. Sustainability 2021, 13, 4190. https://doi.org/10.3390/su13084190

Riaz S, Hanifa MH, Zainir F. Does Foreign Institutional Equity Participation Instigate Sustainable Corporate Investment Efficiency? Evidence from Emerging Economies. Sustainability. 2021; 13(8):4190. https://doi.org/10.3390/su13084190

Chicago/Turabian StyleRiaz, Sabahat, Mohamed Hisham Hanifa, and Fauzi Zainir. 2021. "Does Foreign Institutional Equity Participation Instigate Sustainable Corporate Investment Efficiency? Evidence from Emerging Economies" Sustainability 13, no. 8: 4190. https://doi.org/10.3390/su13084190

APA StyleRiaz, S., Hanifa, M. H., & Zainir, F. (2021). Does Foreign Institutional Equity Participation Instigate Sustainable Corporate Investment Efficiency? Evidence from Emerging Economies. Sustainability, 13(8), 4190. https://doi.org/10.3390/su13084190