Developing Generalised Equation for the Calculation of PayBack Period for Rainwater Harvesting Systems

Abstract

1. Introduction

2. Materials and Methods

2.1. Materials

2.2. Payback Period Calculation

2.3. Methodology

3. Results

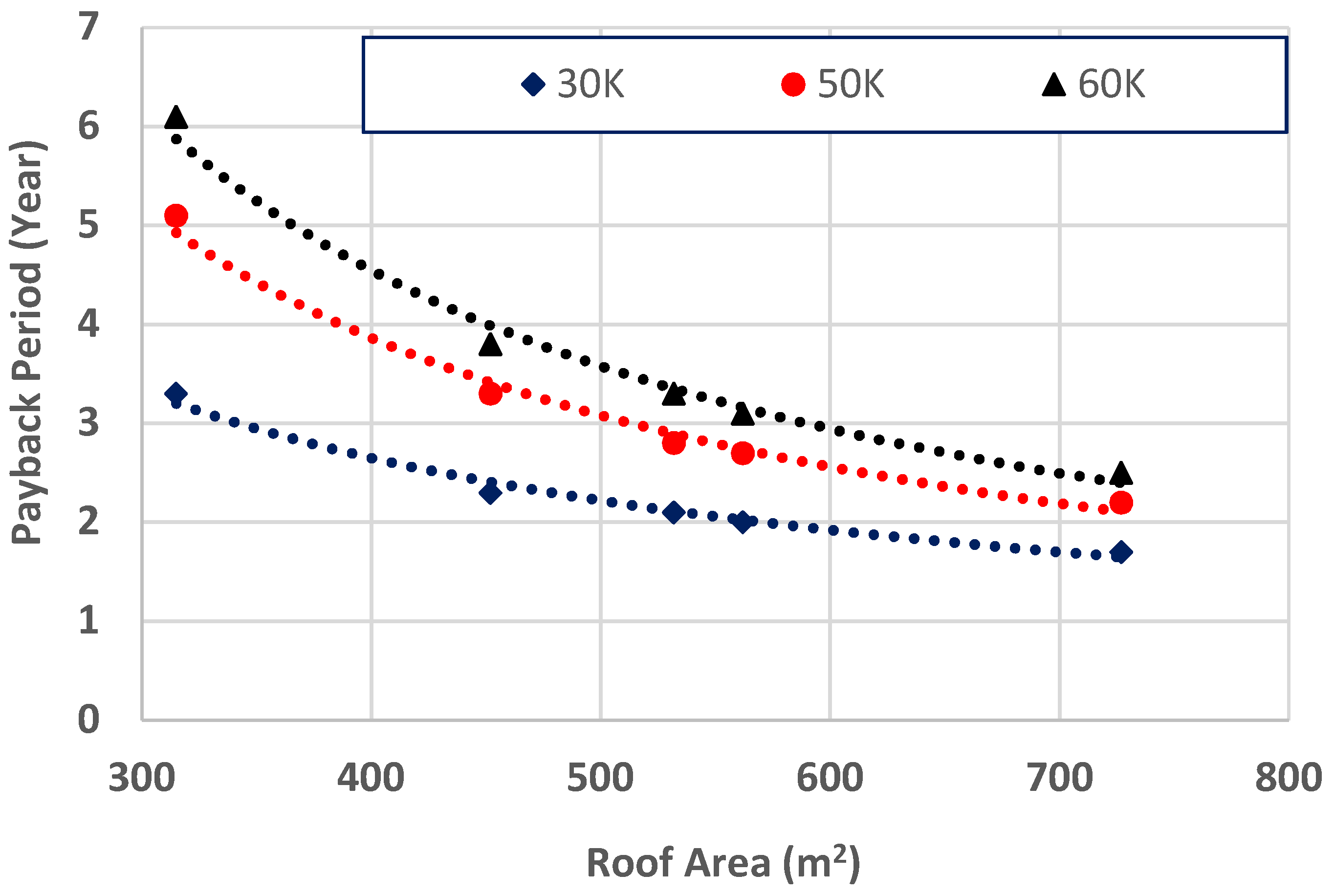

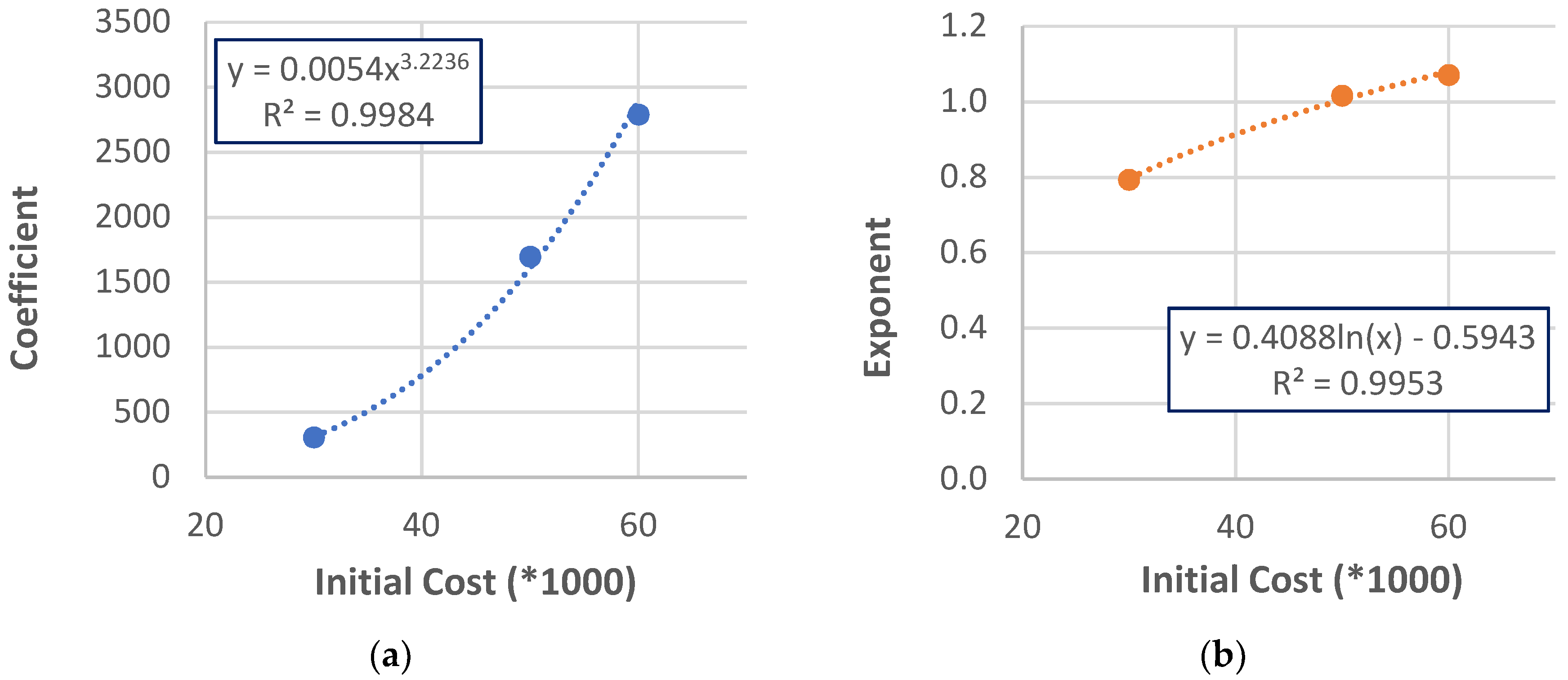

3.1. Derivation of the Equation

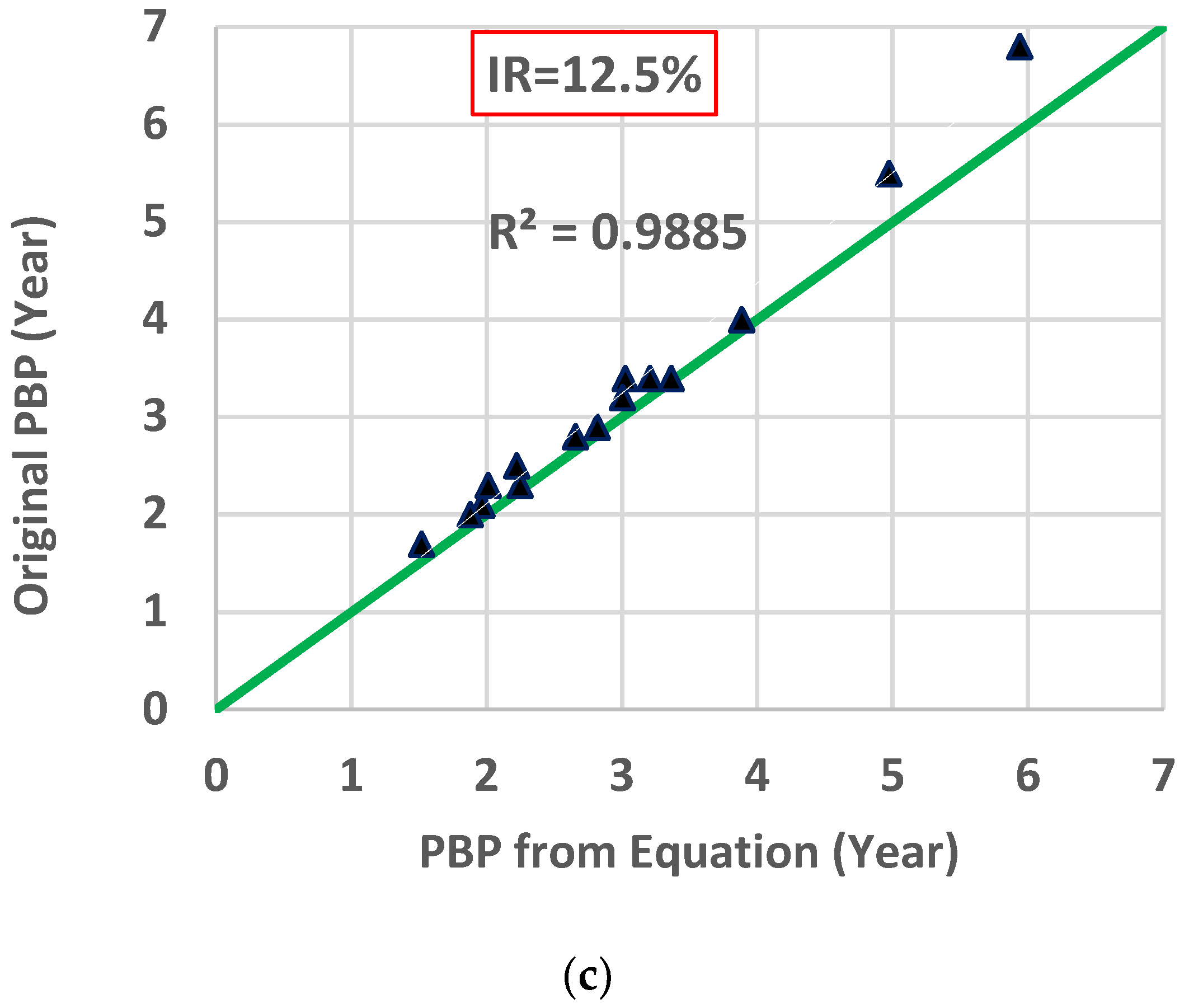

3.2. Comparison with the Equation Results

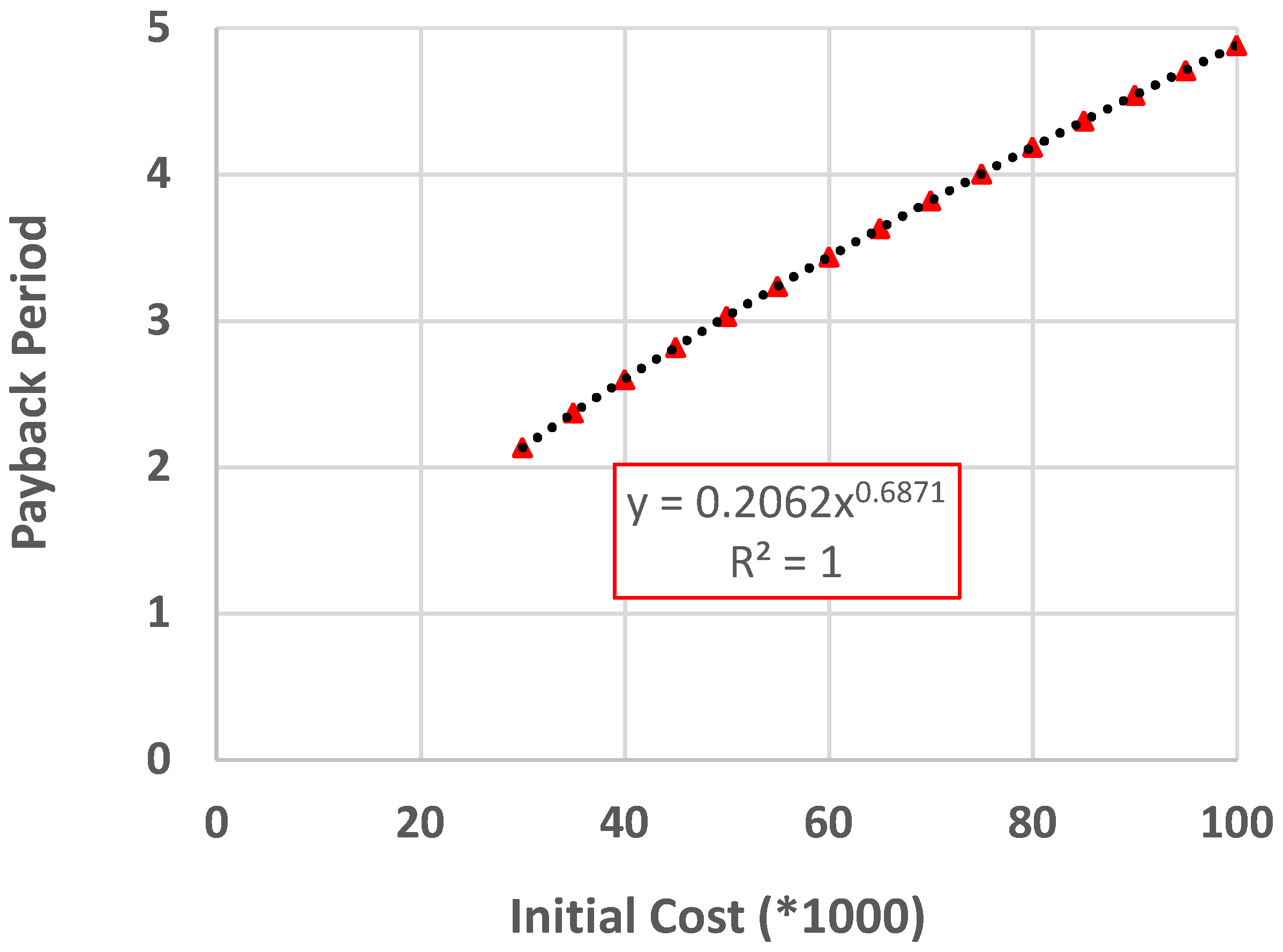

3.3. Specific Scenario

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Matos, C.; Santos, C.; Bentes, I.; Imteaz, M.A.; Pereira, S. Economic analysis of a rainwater harvesting system in a commercial building. Water Resour. Manag. 2015, 29, 3971–3986. [Google Scholar] [CrossRef]

- Şen, Z.; Alsheikh, A.A.; Al-Turbak, A.S.; Al-Bassam, A.M.; Al-Dakheel, A.M. Climate change impact and runoff harvesting in arid regions. Arab. J. Geosci. 2013, 6, 287–295. [Google Scholar] [CrossRef]

- Rahman, S.; Khan, M.; Akib, S.; Che Din, N.B.; Biswas, S.; Shirazi, S. Sustainability of rainwater harvesting system in terms of water quality. Sci. World J. 2014, 721357. [Google Scholar] [CrossRef]

- Karim, R.; Bashar, M.Z.I.; Alam-Imteaz, M. Reliability and economic analysis of urban rainwater harvesting in a megacity in Bangladesh. Resour. Conserv. Recycl. 2015, 104, 61–67. [Google Scholar] [CrossRef]

- Bashar, M.Z.I.; Karim, M.R.; Imteaz, M.A. Reliability and Economic Analysis of Urban Rainwater Harvesting: A Comparative Study within Six Major Cities of Bangladesh. Resour. Conserv. Recycl. 2018, 133, 146–154. [Google Scholar] [CrossRef]

- Lade, O.; Oloke, D. Modelling Rainwater Harvesting System in Ibadan Nigeria: Application to a University Campus Office block. Eur. Int. J. Sci. Technol. 2019, 8, 57–71. [Google Scholar]

- Monjaiang, P.; Limphitakphong, N.; Kanchanapiya, P.; Tantisattayakul, T.; Chavalparit, O. Assessing Potential of Rainwater Harvesting: Case Study Building in Bangkok. Int. J. Environ. Sci. Dev. 2018, 9, 222–225. [Google Scholar] [CrossRef][Green Version]

- Lawrence, D.; Lopes, V.L. Reliability analysis of urban rainwater harvesting for three Texas cities. J. Urban. Environ. Eng. 2016, 10, 124–134. [Google Scholar] [CrossRef]

- Lani, N.H.M.; Yusop, Z.; Syafiuddin, A. A review of rainwater harvesting in Malaysia: Prospects and challenges. Water 2018, 10, 506. [Google Scholar] [CrossRef]

- Sakson, G. Cost analysis of a rainwater harvesting system in Poland. E3S Web Conf. 2018, 45, 00078. [Google Scholar] [CrossRef]

- Zhang, S.; Jing, X. Hydrologic Design and Economic Benefit Analysis of Rainwater Harvesting Systems in Shanghai, China. In Proceedings of the International Low Impact Development Conference China 2016, Beijing, China, 26–29 June 2016; American Society of Civil Engineers: Reston, VA, USA, 2016. ISBN 780784481042. [Google Scholar]

- Matos, C.; Santos, C.; Pereira, S.; Bentes, I.; Imteaz, M.A. Rainwater storage tank sizing: Case study of a commercial building. Int. J. Sustain. Built Environ. 2014, 2, 109–118. [Google Scholar] [CrossRef]

- Moniruzzaman, M.; Imteaz, M.A. Generalized equations, climatic and spatial variabilities of potential rainwater savings: A case study for Sydney. Resour. Conserv. Recycl. 2017, 125, 139–156. [Google Scholar] [CrossRef]

- Rahman, A.; Keane, J.; Imteaz, M.A. Rainwater Harvesting in Greater Sydney: Water Savings, Reliability and Economic Benefits. Resour. Conserv. Recycl. 2012, 61, 16–21. [Google Scholar] [CrossRef]

- Musz-Pomorska, A.; Widomski, M.; Gołebiowska, J. Financial Sustainability of Selected Rain Water Harvesting Systems for Single-Family House under Conditions of Eastern Poland. Sustainability 2020, 12, 4853. [Google Scholar] [CrossRef]

- Garrick, D.; Iseman, T.; Gilson, G.; Brozovic, N.; O’Donnel, E.; Matthews, N.; Miralles-Wilhelm, F.; Wight, C.; Young, W. Scalable solutions to freshwater scarcity: Advancing theories of change to incentivize sustainable water use. Water Secur. 2020, 9, 100055. [Google Scholar] [CrossRef]

- Dijk, S.V.; Lounsbury, A.; Hoekstra, A.; Wang, R. Strategic design and finance of rainwater harvesting to cost-effectively meet large-scale urban water infrastructure needs. Water Res. 2020, 184, 116063. [Google Scholar] [CrossRef] [PubMed]

- Semaan, M.; Day, S.; Garvin, M.; Ramakrishnan, N.; Pearce, A. Optimal sizing of rainwater harvesting systems for domestic water usages: A systematic literature review. Resour. Conserv. Recycl. 2020, 6, 100033. [Google Scholar] [CrossRef]

- Sangave, A.A.; Mohite, S.J.; Pawar, H.R.; Kulkarni, V.V.; Abhangrao, C.R. Design & Estimation of Rain Water Harvesting System for a college campus in Solapur City. Int. J. Eng. Adv. Technol. 2019, 8, 4629–4632. [Google Scholar]

- Strelets, K.; Ovchinnikov, P.; Dzampaev, T. Performance based evaluation of rainwater harvesting system in public buildings. Matec. Web Conf. 2016, 7, 03006. [Google Scholar] [CrossRef]

- Galal, K. The efficiency of rainwater harvesting systems in the Lebanese coastal zone. Archit. Plan. J. 2020, 26, 2. [Google Scholar]

- Imteaz, M.A.; Moniruzzaman, M. Spatial variability of reasonable government rebates for rainwater tank installations: A case study for Sydney. Resour. Conserv. Recycl. 2018, 133, 112–119. [Google Scholar] [CrossRef]

- Farreny, R.; Gabarrell, X.; Rieradevall, J. Cost-efficiency of rainwater harvesting strategies in dense Mediterranean neighbourhoods. Resour. Conserv. Recycl. 2011, 55, 686–694. [Google Scholar] [CrossRef]

- Imteaz, M.A.; Shanableh, A.; Rahman, A.; Ahsan, A. Optimisation of Rainwater Tank Design from Large Roofs: A Case Study in Melbourne, Australia. Resour. Conserv. Recycl. 2011, 55, 1022–1029. [Google Scholar] [CrossRef]

- Woon, Y.B.; Tan, W.L.; Chow, M.F. Community Rainwater Harvesting Financial Payback Analyses-Case Study in Malaysia. IOP Conference Series: Materials Science and Engineering. IOP Publ. 2019, 636. [Google Scholar] [CrossRef]

- Stec, A.; Słyś, D. Rainwater potential use in dormitory building: Drinking water savings and economic costs. Ecol. Chem. Eng. A 2017, 24, 43–64. [Google Scholar]

- Domínguez, I.; Ward, S.; Mendoza, J.G.; Rincón, C.I.; Oviedo-Ocaña, E.R. End-user cost-benefit prioritization for selecting rainwater harvesting and greywater reuse in social housing. Water 2017, 9, 516. [Google Scholar] [CrossRef]

- Abdulla, F. Rainwater harvesting in Jordan: Potential water saving, optimal tank sizing and economic analysis. Urban. Water J. 2020, 17, 446–456. [Google Scholar] [CrossRef]

- Gato-Trinidad, S.K. Gan Preliminary analysis of the cost effectiveness of rainwater tanks rebate scheme in Greater Melbourne, Australia. Water Soc. 2012, 153, 127–138. [Google Scholar]

- Nagaraj, N.; Pradhani, U.; Chengappa, P.G.; Basavaraj, G.; Kanwar, R.S. Cost Effectiveness of Rainwater Harvesting for Groundwater Recharge in Micro-Watersheds of Kolar District of India: The Case Study of Thotli Micro-Watershed. Agric. Econ. Res. Rev. 2011, 24, 217–223. [Google Scholar]

- Karim, M.R.; Sakib, B.M.S.; Sakib, S.S.; Imteaz, M.A. Rainwater harvesting potentials in commercial buildings in Dhaka: Reliability and economic analysis. Hydrology 2021, 8, 9. [Google Scholar] [CrossRef]

| Building Name | Catchment Area (m2) | Total Floors | Tank Size (m3) | Installation Cost (BDT *) | Maintenance Cost (BDT */year) |

|---|---|---|---|---|---|

| Evergreen Meher Tower | 315 | 2 Basement + 14 | 162 | 30,000 | 10,000 |

| Green Landmark Tower | 452 | 2 Basement + 13 | 209 | 40,000 | 13,000 |

| Green Satmahal | 532 | 2 Basement + 14 | 214 | 45,000 | 15,000 |

| Green City Regency | 562 | 2 Basement + 22 | 324 | 50,000 | 18,000 |

| Green City Edge | 727 | 2 Basement + 15 | 566 | 60,000 | 20,000 |

| Rate of Return | c | d | e | f |

|---|---|---|---|---|

| 3 | 0.0327 | 2.6237 | 0.3203 | 0.3293 |

| 8 | 0.0054 | 3.2236 | 0.4088 | 0.5943 |

| 12.5 | 0.0005 | 3.9443 | 0.5154 | 0.9322 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Imteaz, M.A.; Bayatvarkeshi, M.; Karim, M.R. Developing Generalised Equation for the Calculation of PayBack Period for Rainwater Harvesting Systems. Sustainability 2021, 13, 4266. https://doi.org/10.3390/su13084266

Imteaz MA, Bayatvarkeshi M, Karim MR. Developing Generalised Equation for the Calculation of PayBack Period for Rainwater Harvesting Systems. Sustainability. 2021; 13(8):4266. https://doi.org/10.3390/su13084266

Chicago/Turabian StyleImteaz, Monzur A., Maryam Bayatvarkeshi, and Md. Rezaul Karim. 2021. "Developing Generalised Equation for the Calculation of PayBack Period for Rainwater Harvesting Systems" Sustainability 13, no. 8: 4266. https://doi.org/10.3390/su13084266

APA StyleImteaz, M. A., Bayatvarkeshi, M., & Karim, M. R. (2021). Developing Generalised Equation for the Calculation of PayBack Period for Rainwater Harvesting Systems. Sustainability, 13(8), 4266. https://doi.org/10.3390/su13084266