1. Introduction

Tourism is extremely vulnerable to fear. Adverse environmental, political or economic situations in a destination can cause a sharp fall in the demand for tourism. Throughout its history, tourism has never seen a global fear; a crisis that has not just affected tourism in one country or region, but the entire world. Restrictions imposed on travel and fear among potential tourists of infection from COVID-19 have paralyzed international tourism [

1]. Although the effects are widespread, the countries with the highest tourist activity have felt it the most [

1].

The pandemic has impacted Spain more than many other countries. Tourism is extremely important to the country’s economy, more so than in many other OECD countries, and accounts for 12.4% of the Spanish GDP [

2]. COVID-19 has taken a heavy toll on the country, causing a sharp fall in international tourism arrivals. After a full lockdown in March and April 2020, Spain finally opened its borders on 21 June 2020; however, the majority of tourists chose to either not travel at all, or to travel to alternative destinations. Thus, began the first empty summer in Spain.

In summer 2020 cities were empty, hotels closed, famous attractions had few visitors, and airports took on the rhythm of winter. The pattern of international tourism, however, has not been the same everywhere. In some cities, tourism reached an all-time low, while other inland regions experienced reasonable levels of tourist activity. Notable variations have also been registered regarding tourists’ countries of origin. The aim of this article is to describe the behavior pattern of international tourists in summer 2020 in Spain, and to determine the most important factors explaining spatial and temporal differences.

The article is organized as follows. Firstly, an overview of factors that may explain the behavior of international tourists during the pandemic is given. Secondly, this is followed by a section that outlines the methodology used to obtain data. Thirdly, the results of the study are set out. These enable the dynamics of different local destinations during the summer of 2020 in Spain to be compared. Finally, the last section presents the conclusions and limitations of the study, as well as some lines for future research.

2. Tourism in Times of Pandemic

The pandemic has affected all elements of the tourist chain: the tourist offer, job market, mobility, information and the ability to spend money. However, the most noticeable change arising from COVID-19 is how it has affected tourist behavior patterns. In summer 2020, the unprecedented situation and uncertainty marked tourism consumption patterns, and attitudes were characterized as prudent and conservative [

3]. In this case, tourists’ reaction to the pandemic has been more sensitive than in previous crises [

4]. The main changes observed in behavior patterns are the choice of destination, duration of the trip, mode of transport and the way people travel.

Changes in choice of destination. Fear is one of the main deterrents of tourist activity [

5,

6,

7]. Tourists have always avoided areas perceived as risky and will change their choice of destination if they perceive a health risk [

3,

5]. The global scale of the pandemic, in this case, has made the response to it considerably more complex.

Visitors have chosen to forgo more distant destinations, preferring to visit national or regional areas [

8]. One of the most relevant choice factors during this period has been proximity to the place of residence [

9]. Visitors have also avoided crowded places where the capacity for attracting tourists is greater. This has meant that less congested destinations have had a greater tourist demand [

10]. In addition, tourists have shown more interest in destinations in natural environments [

3,

11,

12] to the detriment of urban destinations [

9]. The fall in international tourist numbers in large cities has been dramatic. Studies linked to the 2003 SARS outbreak demonstrate this change in tourist behavior. Zeng et al. [

13] showed that “during the ‘Gold Tourism Week of October’, tourists visiting capital cities increased more slowly than visiting natural areas” [

13].

Changes in duration of the trip. COVID-19 has also shortened trips [

14]. Various authors have detected a preference for short trips during periods of crisis [

3,

15], and two reasons were found for this. On one hand, in a study on the behavior of tourists in Hong Kong, Lo et al. [

15] found that reducing trip duration is a strategy to reduce the risk of contagion. On the other hand, Chebli and Said [

14] state that the reduction in travel time is due to the decreased purchasing power of tourists [

14].

According to data from the INE [

16], the average stay in accommodation in the Spanish hotel sector in 2020 was 2.28 days, one day lower than in 2019. An analysis of the data on average stays in hotels, campsites and rural accommodation for July and August 2020 and the same period in 2019 (

Table 1) shows that the decrease in average stay occurs in all accommodation types except rural accommodation, which has remained at the same level as 2019, with July even showing an increase.

Changes in mode of transport. Public transportation has been significantly affected by the pandemic. Air transport has been especially impacted, with both domestic and international flights practically griding to a halt. According to data from the International Air Transport Association [

17], international passenger demand in 2020 was 75.6% lower than in 2019. This explains the increase in trips using private transport, especially cars. This behavior regarding transport had already been detected in studies related to SARS in 2003 [

12]. Car trips, therefore, have been one of the most characteristic elements of tourism during COVID-19. Gössling et al. [

4] states that a report by the Norwegian Tourism Organization highlights that car rental companies have been one of the tourism sectors least exposed to the crisis.

Changes in the way people travel. The pandemic has altered the behavior patterns of visitors at the destination. Bae and Chang [

18] studied the predisposition of Korean tourists to ‘untact’ tourism. ‘Untact’ tourism is individuals’ evasive behavior due to the pandemic, accentuating mechanical and digital systems and reducing personal interaction to a minimum. Tourists have created ‘bubbles’ to isolate them from other visitors as well as the local residents in the destination. On the other hand, health and safety standards have gained core value in visitor behavior [

11,

12], changing the way tourists access tourism subsectors [

18].

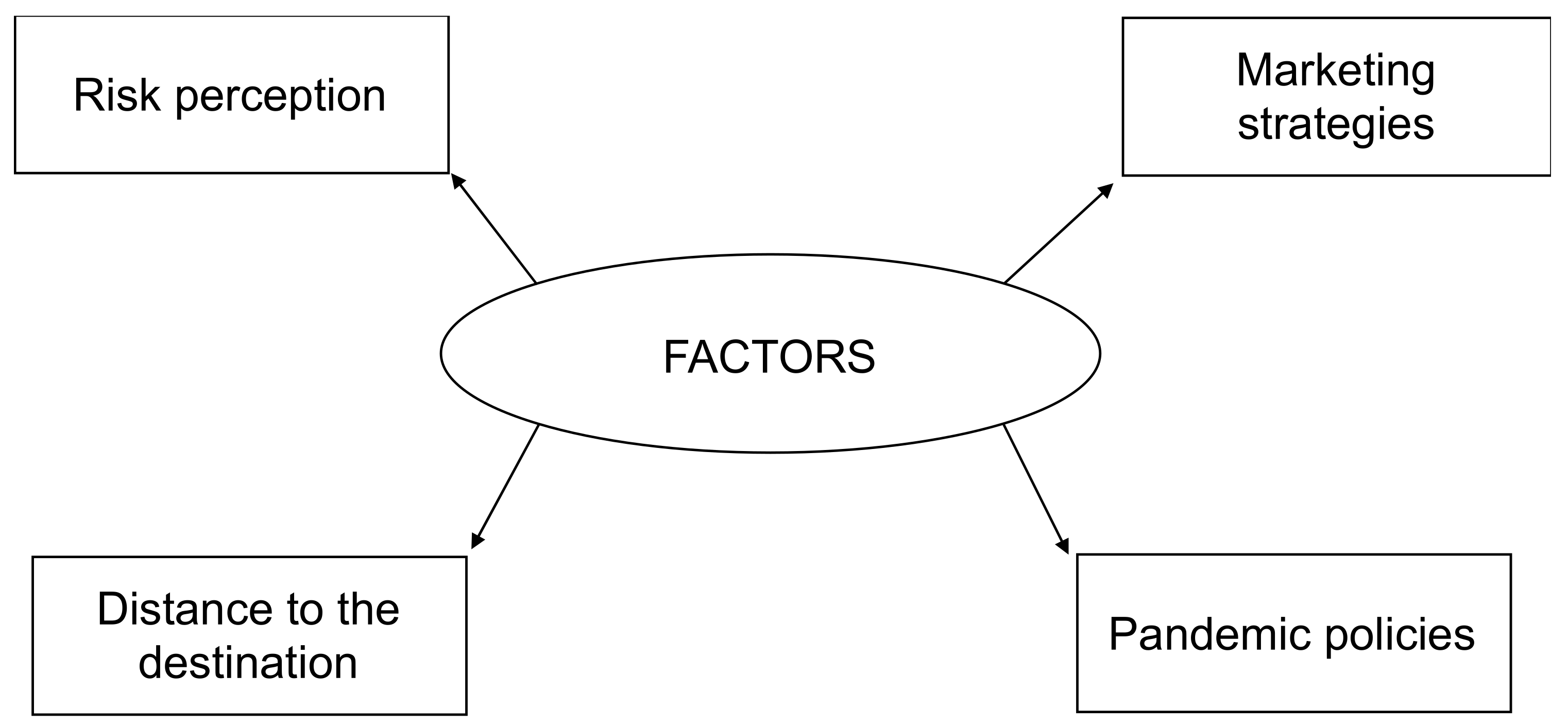

As mentioned above, these changes occur heterogeneously. Significant differences can be found between destinations, periods of the year, or between tourists of different origins. Although the pandemic has had a global effect, its impact has been uneven. Understanding tourist behavior during a crisis can help destinations to manage their response to subsequent crisis situations. A diverse set of factors explain variations in tourist behavior in destinations facing a crisis.

Figure 1 shows the four main factors: (1) risk perception [

18]; (2) distance to the destination [

9]; (3) destination marketing strategies [

19] and (4) management policies at the destination during the crisis [

11].

2.1. The Risk Perception Factor in Times of COVID-19

Risk is considered a measurable criterion. There are activities, means of transport, geographical spaces, or situations that imply an objective risk. However, tourists’ response to risk depends more on their subjective perception of it than the objective conditions of the risk. Tourists’ perception of risk reduces their propensity to travel, and this is one factor explaining the drop in tourism on a global scale [

1,

3,

20]. This risk perception can also affect the choice of destination or tourist behavior in the tourism space [

3,

21].

According to Li et al. [

3] there are six risk perception attributes: health risk, psychological risk, social risk, performance risk, image risk and time risk. Thus, research on risk perception may be associated with terrorism [

6,

22,

23], criminality [

14,

24], natural disasters [

6,

25], political instability and wars [

6,

7,

14], economic crises [

21,

22,

25] or infectious diseases [

7,

13,

19].

Although these all play an important role in risk perception, there are two that stand out from the others in the context of the current pandemic: health risk and psychological risk [

3]. The risk of falling ill either on the way to or at the destination curbs international tourism [

3,

7,

26]. There is also a psychological risk, as demonstrated by Smith [

1] in the case of SARS in 2003. Fear of the disease, uncertainty and the high death rates at the destination caused alarm and fear of not only disease itself, but how it would affect the destination.

2.2. The Distance to the Destination in Times of COVID-19

Geography has traditionally been evaluated by visitors as a push and pull factor [

23,

27]. Remoteness is perceived simultaneously as a factor of attraction, because of its exoticism and difference, and a factor of withdrawal due to its lack of security and unfamiliarity as tourists perceive greater risks in unknown and remote environments [

23,

26]. In a time of crisis, the weight of negative factors increases, and destinations farther away augment the perception of insecurity, making potential visitors opt for alternatives closer to home [

15,

19].

This has meant that the tendency to go further on long-distance trips has slowed during the pandemic, and the main geographical factor of tourism during the pandemic has been proximity to home [

9].

The sharp fall in international tourism during the pandemic has been partially offset by domestic tourism. Wen, Wang and Kozak [

28] point out that the rise in tourism that occurred in China during May Day 2020 was because Chinese tourists chose domestic tourism over traveling abroad. A study carried out by Elizabeth, Adam, Dayour and Badu Baiden [

29] on a sample of students and workers from educational institutions in Macau concludes that the perception of risk has limited individuals’ predisposition to travel outside the island. This has prompted the government to launch a plan to reactivate the tourism sector, offering initiatives designed for domestic tourism. Other initiatives to reactivate domestic tourism have been undertaken in various European countries. This follows the suggestions from academics that reinforcing initiatives in domestic tourism is an essential mechanism for reactivating the sector [

8].

2.3. The Destination Marketing Strategies Factor in Times of COVID-19

Previous studies in the literature have observed that marketing a destination is essential in order to attract visitors and influence their decisions and on-site behavior [

30,

31,

32]. In a situation of global alarm, marketing a destination as safe and responsible can partially compensate for the damaged image, and to some degree, restore tourists’ trust [

14]. For example, after Taiwan was removed from the list of areas affected by SARS in 2003, it began an aggressive tourism marketing campaign to attract visitors and revive the sector, enabling it to recover tourism rapidly, reaching an all-time high [

19].

Destination Marketing Organizations have increased tourism marketing and promotion through various channels in order to alleviate the effects of the pandemic on the sector [

14]. In the context of the pandemic, marketing strategies are not only striving to increase their presence in potential destinations, but more importantly, they are changing their conventional messages. For example, Cai, Hong, Xu et al. [

33] found that B&B marketing in China has recently been focusing on new attributes such as the natural environment, open spaces and security. Pasquinelli, Trunfio, Bellini and Rossi [

34] reported that five Italian cities changed their communication strategy after confinement, shifting the emphasis to natural spaces and integrating the marketing of outlying urban areas with that of the city.

2.4. The Management Policies Factor in Times of COVID-19

Managing the pandemic has been extremely complex as information on the most efficient response measures is continually changing as the crisis progresses. The impact of the crisis has been very uneven, and countries’ healthcare and logistical capacities differ widely. This has led to very diverse responses to managing the crisis throughout the summer of 2020. According to Wen, Huimin and Kavanaugh [

12], countries need to establish systems of action to deal with unpredictable and uncontrollable situations involving health crises. Adopting intervention measures such as guarantee systems for tourists [

12], surveillance systems [

6], information transparency systems [

5,

6,

12] or financial support plans for the sector are possible public policies that may affect the recovery capacity of the sector.

The destination image can be reinforced if precise regulations on health and safety are adopted [

11]. As suggested by Kim, Bonn and Hall [

35], enhancing biosecurity measures will be fundamental to the recovery of tourism after COVID-19. Establishing rapid, reliable surveillance systems and epidemiological tracking has also influenced decision-making [

6]. This requires sufficient human, technological and organizational resources to enable a response to the surveillance and early warning systems. In addition, governments must guarantee an efficient healthcare policy, which involves strengthening the medical and healthcare system [

36,

37]. Investing in health now means investing in future tourism.

An improvement is needed in both the objective conditions and the availability of information on measures taken as it is proven that efficient and transparent information increases trust among tourists [

5]. The more and better informed the visitor is, the safer they will feel [

6,

12].

As Yeh [

37] points out, information must be transparent, both at the origin and in the destination, and it is crucial that is comes from a single, official source. In this respect, different government agencies need to synchronize their efforts in order to produce a unified policy [

37].

Kreiner and Ram [

27] undertook the first study since COVID-19 to analyze the adoption of policies supporting employment and the economy by means of tourism; as well as action taken by various countries through national plans to mitigate socio-economic impacts of COVID-19 and hasten economic recovery. The study concludes that the general tendency of the countries studied is that: (1) they implement local solutions in the short term; (2) they do not have a common strategy, so each country adopted their own plan; (3) they do not design future strategies, and have chosen to focus on short-term tactics for restarting tourism; and finally (4) World Travel Organization recommendations were not perceived as ‘evidence-based policy’ and the majority of the countries did not implement them.

COVID-19 has revealed the shortcomings of the sector, exposing its immense vulnerability [

4]. Public policies need to be designed in such a way that they can guarantee the sector’s rapid recovery, while guaranteeing environmental and social sustainability [

11]. To do this, funds need to be generated for the sector [

38], residents need to participate in recovery strategies, labor rights protected, and salaries increased, especially those of the most vulnerable and lowest paid jobs [

9,

36]. Hall, Scott, and Gössling [

8] state that destinations now have a unique opportunity to contribute to sustainability and restore the tourism industry through new policies that are more aligned with the Sustainable Development Goals (SDGs).

3. Methodology

This study analyzes the pattern of international tourism in Spain during the months of July, August and September 2020. Compared with other European countries, Spain had one of the strictest confinements of the pandemic during March and April 2020 and also felt the impact of COVID-19 the hardest. The borders with the Schengen area opened on 21 June, the beginning of summer in the Northern Hemisphere. However, according to official data, international tourism fell by 75% in July and August, and in September, by 87%. Spain, which was the second most popular international destination in the world in 2019, has a diversified tourist offer. Although the two main poles of attraction are beach destinations and urban tourism, rural tourism and natural spaces are also well-established.

3.1. Data Collection

In Spain, official data on tourist behavior do not provide data at the local level. Statistical information is obtained either through a survey of a representative sample at the border, or from data supplied by accommodation establishments. In 2019, the Instituto de Estudios Turísticos de España (IET) launched a pilot plan aimed at analyzing international and domestic tourist mobility based on data from mobile phone signals. Results of the pilot project are open to the public, but the information it provides is incomplete. However, in the future, this may be a feasible way to measure mobility and improve knowledge of the behavior of tourists in a destination.

Another way to explore tourist behavior in spaces is to analyze credit card transaction data. Li, Xu, Tang et al. [

39] identified three tourism big data domains: User Generated Content data (generated by users), device data (generated by devices) and transaction data (generated by operations). Transaction data include web search data, website analytics, online booking data and credit card purchases. Analyzing purchase data enables visitor behavior at the destination to be measured indirectly. Using data from credit card transactions as a method to track tourists is uncommon due to the difficulty of accessing the data [

40].

The data for this study were provided by Banc de Sabadell, a financial entity which specializes in the tourism sector, and deals with 30% of the country’s tourism companies (38% in the case of small and medium enterprises (SMEs) and 70% in large tourism companies). This study therefore represents approximately a third of all credit card transactions carried out by tourists at the destination. In order to evaluate the impact of the pandemic, we have worked with relative data, not absolute data (total expenditure in each municipality). This means that the variation in monthly expenditure between 2020 and 2019 is available for each municipality studied. A value of 100% indicates that expenditure has not varied during the pandemic, while a value of 25% means that expenditure decreased by three quarters compared with the previous year.

Local areas were classified into five categories: (1) coastal municipalities with a high frequency of visitors (mass beaches); (2) charming coastal municipalities with average and low frequency of visitors (charming beaches); (3) large cities (cities); (4) historic, medium-sized cities (cultural cities); and (5) provinces located in natural areas (natural regions). In ‘beaches’ municipalities, data were collected from the 10 coastal tourism municipalities in the country with the largest hotel capacity. ‘Cities’ includes the six main cities in the urban tourism segment. In ‘charming beaches’, coastal municipalities with an average or low frequency of visitors were selected, as this was deemed representative of the geographical diversity of the country’s coast. The seven cities that make up the ‘cultural cities’ category are also representative of Spain’s historic cities. In the ‘natural regions’ category, values are provincial rather than municipal as the limits of natural spaces always exceed the scope of the municipality. Data were collected from seven provinces representative of the diversity of natural spaces in the country.

Figure 2 shows the locations of the destinations selected.

The overall variation in all international transactions and the behavior of the main countries of origin (according to official sources) were recorded. The countries were Germany, France, Italy, the United Kingdom, the Netherlands and the United States.

3.2. Data Analysis

Statistical analysis of data was carried out. Firstly, descriptive statistics were used in order to present global results. Secondly, a cluster analysis was performed. Cluster analysis was used to determine type of destination and type of source market. Cluster analysis is a multivariate classification technique which groups data into a reduced number of mutually exclusive clusters [

41].

Cluster analysis involves making relevant methodological decisions that influence the final result. First, a hierarchical method was considered fitting given that the sample of municipalities contained less than 200 cases. Second, Ward’s minimum variance method was selected as it optimizes minimum intragroup variance [

42], which tends to constitute hyperspheric shaped clusters and similar numbers of objects [

42]. Third, Euclidean distance was used alongside Ward’s method as recommended by Cea [

42]. Furthermore, in order to avoid any possible influence of the Squared Euclidean Distance in the resulting clusters, the variables were standardized to the Z score automatically using SPSS 21.0.

The same procedure was used for both cluster analyzes. First, for the type of destination cluster analysis, the average expenditure for the months of July, August and September was used as the dependent variable. Results were examined for 2, 3 and 4 groups. The 2-group option was considered the most suitable and coherent, according to the analysis of variance (ANOVA). However, we observed that the destinations Eivissa, Vera and Cantabria had a negative effect on the ANOVA results. They were therefore excluded from the cluster analysis, which was repeated. The final result for 2 groups is sufficiently coherent and explanatory.

Second, for the cluster analysis of the source market profile, mean tourist spending according to destination type (mass beaches, charming beaches, cities, cultural cities, natural regions) was used as the dependent variable. Results were examined for 2, 3, 4, 5 and 6 groups. From the ANOVA test, we concluded that the 3-group option was the most consistent and appropriate. To calculate the source market, the average of the three values for July, August and September was calculated, and thus the average spending behavior by market was obtained.

4. Results

Results from the descriptive data analysis show that in general, the three periods analyzed show a significant decrease in tourist spending in Spain’s international market, indicating in turn, a drop in the number of visitors. Average spending was around 39% for July and August, dropping to 33.7% for September (

Table 2). It is worth noting that the standard deviation for the three periods studied is relatively high, indicating a significant variability in the data. Minimum values are observed for some of the destinations that failed to reach a tourism expenditure of 10%, while in other cases international tourism expenditure is even higher than in the period prior to the pandemic.

A significant decrease in international tourist spending in the destinations analyzed was also observed, depending on the type of destination, indicating a decrease in the international tourist influx in Spain. However, destinations classified as ‘natural regions’ and ‘charming beaches’ have felt the effects of the pandemic significantly less. Although the standard deviation is lower in this case, it is also quite high, requiring a closer examination of these data.

The results in

Figure 3 show that ‘natural regions’, followed by ‘charming beaches’ have a greater influx of visitors, as was inferred by international tourist expenditure. In the case of natural regions, September showed a better performance than July and August. This was the opposite in all other destination types.

Focusing on ANOVA test results (

Table 3), it is observed that the mean % of tourist spending between the periods is statistically different among the various types of tourist destination (

p-value = 0.000). The results show that in natural regions, on average, international visitors accounted for between 65% and 80% of the tourist expenditure in the three months studied in the previous year. In contrast, tourist spending decreased significantly in cultural destinations, cities and mass coastal destinations compared with the previous year, with values ranging between 16.4% and 32.6%. Coastal destinations classified as ‘charming beaches’, however, were in a better position, accounting for around 60% of tourist spending in July and August and just over 40% in September. Consequently, this means that during the post-lockdown period after the first wave of COVID-19, demand can be clearly linked to tourist destinations in natural mountain environments, or coastal destinations where the main attraction is the landscape and nature.

In order to determine the possible existence of different destination profiles, a cluster analysis was carried out (

Table 4). The results in 2 groups was considered the most appropriate solution in terms of variance explained, and coherence. Cluster 1 is called ‘loser destinations’ (69.7% of cases), and includes destinations categorized as ‘cities’, ‘mass beaches’ and ‘cultural cities’. Cluster 2 is called ‘winner destinations’ (30.3% of the cases) and includes all the destinations categorized as ‘natural regions’ and ‘charming beaches’. The ANOVA test (

Table 5) confirms the statistical relationship between the clusters and each period studied (

p-value = 0.000). Results from the test show that Cluster 2 destinations have a significantly higher % of average tourist expenditure than the destinations in Cluster 1.

Results by nationality (

Figure 4) show a significant overall decrease compared with the same period the previous year.

Results of the ANOVA test (

Table 6) show that the mean % of tourist spending among the various source markets is statistically different between types of tourist destination (

p-value < 0.000). The results show that in loser destinations (Cluster 1), international visitors spent between 18.2% and 28.3% of the previous year’s expenditure. The behavior patterns among the various nationalities are relatively similar depending on the type of destination. As previously noted, the destinations with the highest influx of visitors (Cluster 2) are nature destinations and ‘charming beaches’, which accounted for between 64% and 70.5% of the previous year’s expenditure. Although this is also the pattern for French tourists, spending in nature destinations during the period studied is practically the same as the previous year. This indicates that nature destinations have maintained the same number of French visitors as previous years before the pandemic. Likewise, the data set for the French market shows a higher influx of French tourists compared with the other markets. This result could be explained by the proximity effect; however, further study is needed.

A cluster analysis was carried out to check whether specific behavior patterns characterizing each of the source markets could be found (

Table 7). In this case, the result for 3 groups was considered the most appropriate solution in terms of coherence and variance.

Cluster 1 is called ‘mid-distance origin’ and includes 4 of the 6 markets studied. These are tourists from Germany, Italy, the Netherlands and the United Kingdom. The second cluster is called ‘near origin’ and is made up of tourists from France. This source market is characterized by its geographical proximity to Spain. Finally, cluster 3 is called ‘far origin’, comprising tourists from the USA, a considerable geographical distance from Spain.

The ANOVA test (

Table 8) corroborates the statistical relationship between the clusters characterizing the type of source market and 3 of the 5 destination types (

p-value < 0.050). Results of the test show that the markets of origin (clusters) correlate with visiting natural regions, charming beaches and cultural cities. In this respect, fewer variations in tourist spending were observed for visitors from ’near origins’ for all types of destinations compared with the previous year. Likewise, tourists from ‘far origins’ show a sharp decrease in spending compared with the average in both cultural destinations and medium-sized beach destinations. Values for tourists from ‘mid-distance origins’ are quite similar to the average, but show a higher preference for ‘charming beach’ destinations. In the case of ‘mass beach’ destinations, the pattern for all groups is similar, showing a general decrease in spending by international tourists compared with the previous year. The result is the same for city destinations, although these have a higher influx of French tourists than the other origin markets. These findings confirm a pattern of tourist behavior according to their origin.

5. Conclusions and Limitations

COVID-19 has created an unprecedented scenario in both Spanish and international tourism. Uncertainty, the reduction in the number of flights, health restrictions and reduced spending capacity have led to the most dramatic decrease in tourist activity in the history of tourism in Spain. However, not all destinations have reacted in the same way, nor has the response from tourists in the main countries of origin been the same. Tourist activity measured against the expenditure of international visitors was a third of the previous year’s, but the variations between the different tourist destinations are considerable.

The first factor that best explains the differences in behavior between the destinations is risk perception [

1,

3,

20,

21]. Tourists have essentially avoided two tourist typologies: large urban destinations and the main tourist hot spots on the coast, that is, spaces where the highest concentrations could occur. In contrast, the spaces least affected were natural spaces and coastal cities, which normally attract fewer tourists. Natural spaces are perceived as healthy, low-density environments, a factor that has also attracted domestic tourism [

9,

10,

11]. Paradoxically, by avoiding the most congested spaces in city and mass beach destinations, visitors have congested some natural destinations. Hence, charming coastal cities were perceived as an alternative to traditional resorts on the coast, and natural regions an alternative to urban destinations. All the spaces of these two types constitute the ‘winner destinations’ cluster, so it seems that differences in marketing and management policies have not influenced visitor behavior, but rather factors related to risk perception.

The second factor explaining internal differences between destinations is proximity to home. The closest markets (in this case, the French market) showed a better performance, particularly in natural destinations. In contrast, distant markets (North American) show the sharpest drop for all types. Finally, mid-distance markets have opted for destinations labeled ‘charming beaches’. This behavior is consistent with that observed in previous crises: shorter travel distances and a higher propensity towards natural regions and spaces with little congestion [

8].

The other two factors (marketing strategies and management policies in times of COVID-19) have not been studied directly in this research as the data from credit card transactions only show the behavior for the first two factors (risk perception and proximity). In order to study the influence of marketing strategies and management policies, specific data would have to be collected. In this line, previous studies can be taken as a reference. For example, studies by Cai et al. [

32] and Pasquinelli et al. [

33] focused on communication and marketing strategies, whereas Kreiner and Ram [

37] centered their study on management policies and policy implementation at a national level. Therefore, future research should focus on marketing and management policies used in Spain to attract tourists and minimize effects of pandemics; as well as testing the complete model proposed in this study, including the four factors.

Credit card information is not universal coverage, and therefore needs to be supplemented with other information. The data collected by the INE from the mobile phone register can help obtain more accurate data. In any case, Banc Sabadell deals with a third of tourist establishments in the country and can be considered a reliable source. Furthermore, the data collected are not absolute change values, but rather the rate of change relative to the previous year. This enables possible bias to be partially corrected.

The data on spending behavior are a proxy for actual visitor behavior. Several factors may distort the results. On one hand, not all financial transactions are carried out using a credit card; spending cash may also have reduced as a result of the pandemic. Variations in spending do not necessarily reflect variations in the visitor numbers as spending patterns are not linear. In times of crisis, spending decreases, and this may affect the interpretation of the results. In any case, the results are robust, and the factors identified have already been found in similar studies [

13,

15].

Big data opens up an opportunity to analyze responses on a micro scale, opening a door to obtaining more accurate data on the various responses that destinations have in the context of a crisis. Data on website queries, search queries, mobile phone signals or reservations on accommodation portals are more robust if they are cross-checked as this minimizes the biases of each source.

Finally, this study contributes to research by providing evidence of tourist behavior based on empirical data (data from credit card transactions of international tourists in Spain during summer 2020). This study therefore is based on effective behavioral data rather than perceptions and opinions.