Impact of Environmental Regulation Intensity on Green Technology Innovation: From the Perspective of Political and Business Connections

Abstract

:1. Introduction

2. Literature Review and Research Hypothesis

2.1. Impact of Environmental Regulation Intensity on GTI

2.2. Impact of Political Connections and Environmental Regulation Intensity on GTI

2.3. Impact of Business Connections and Environmental Regulation Intensity on GTI

3. Methods

3.1. Model and Tests

3.2. Definition of Variables

3.2.1. Green Technology Innovation (GTI)

3.2.2. Environmental Regulation Intensity (ERI)

3.2.3. Political Connection (PC)

3.2.4. Business Connection (BC)

3.2.5. Other Control Variables

3.3. Sample and Data

4. Results

4.1. Descriptive Statistics

4.2. Results of Multivariate Analysis

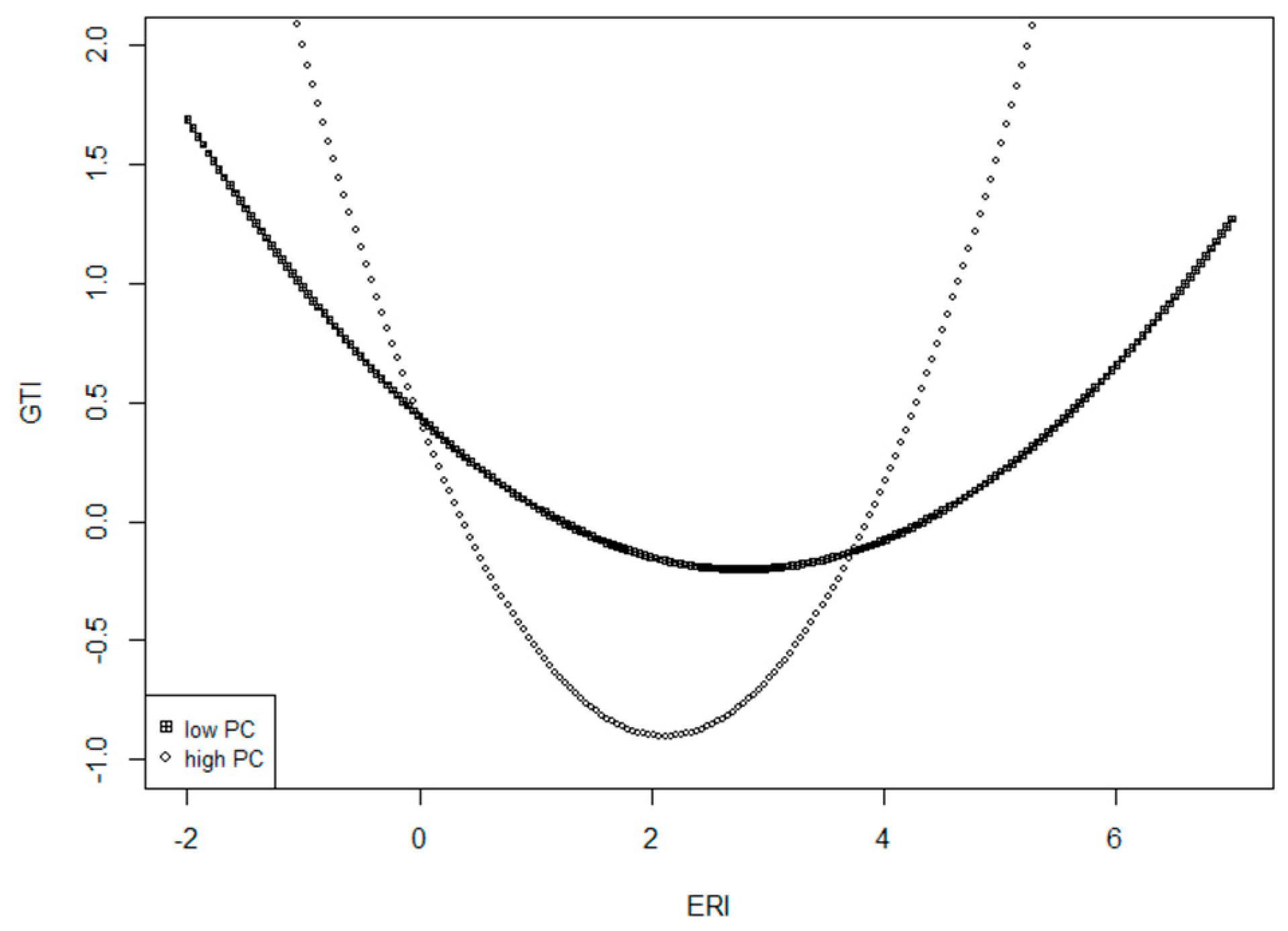

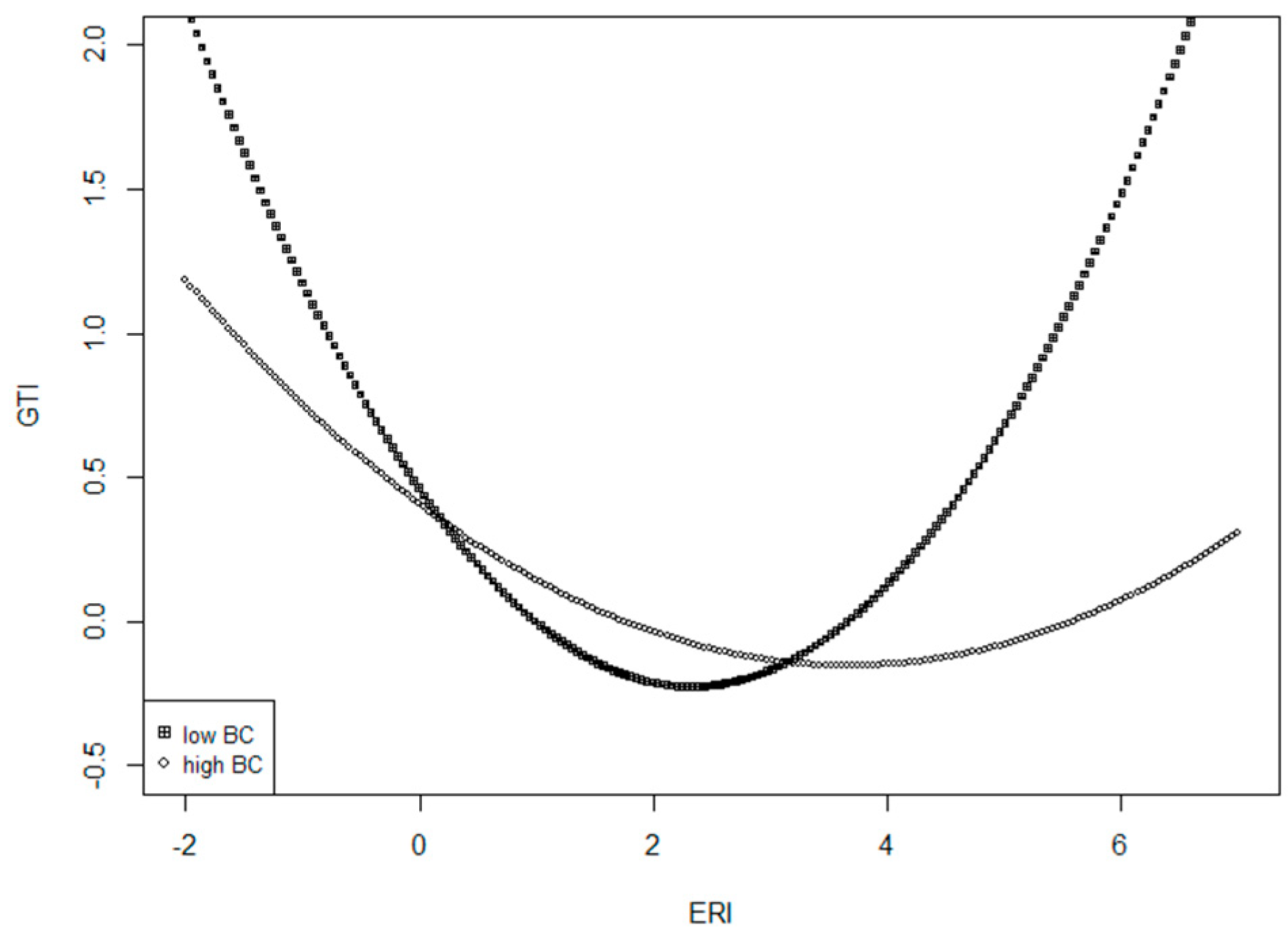

4.3. Impact of the Interactions between PC, BC, and ERI on GTI

4.4. Heterogeneity Analysis in Sub-Samples

4.5. Robustness Tests

5. Conclusions, Policy Implications, and Discussions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ministry of Ecology and Environment Announces the Outline of the National Ecological Environment Quality in 2019. Available online: http://www.mee.gov.cn/xxgk2018/xxgk/xxgk15/202005/t20200507_777895.html (accessed on 23 March 2021).

- World Health Organization Regional Office for Europe. Air Quality Guidelines for Europe, 2nd ed.; WHO Regional Publications: Copenhagen, Denmark, 2000; pp. 186–193. [Google Scholar]

- CO2 Emission from Fuel Combustion: Overview. Available online: https://www.iea.org/reports/co2-emissions-from-fuel-combustion-overview (accessed on 23 March 2021).

- Continuously Promote the Green and Low Carbon Circular Development of Industry and Adjustment of Industrial Structure in the Fourteenth Five Year Plan. Available online: http://www.cinn.cn/gongjing/202103/t20210319_239922.shtml (accessed on 23 March 2021).

- Qu, Y.; Yu, Y.; Appolloni, A.; Li, M.R.; Liu, Y. Measuring green growth efficiency for Chinese manufacturing industries. Sustainability 2017, 9, 637. [Google Scholar] [CrossRef] [Green Version]

- Guo, Y.; Xia, X.; Sheng, Z.; Zhang, D.P. Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.M.; Liang, G.Q.; Feng, T.W.; Yuan, C.L.; Jiang, W.B. Green innovation to respond to environmental regulation: How external knowledge adoption and green absorptive capacity matter? Bus. Strategy Environ. 2020, 29, 39–53. [Google Scholar] [CrossRef]

- Miao, C.L.; Fang, D.B.; Sun, L.Y.; Luo, Q.L. Natural resources utilization efficiency under the influence of green technological innovation. Resour. Conserv. Recycl. 2017, 126, 153–161. [Google Scholar] [CrossRef]

- Blum-Kusterer, M.; Hussain, S.S. Innovation and corporate sustainability: An investigation into the process of change in the pharmaceuticals industry. Bus. Strategy Environ. 2001, 10, 300–316. [Google Scholar] [CrossRef]

- Fernando, Y.; Wah, W.X. The impact of eco-innovation drivers on environmental performance: Empirical results from the green technology sector in Malaysia. Sustain. Prod. Consum. 2017, 12, 27–43. [Google Scholar] [CrossRef]

- Xie, X.M.; Huo, J.G.; Zou, H.L. Green process innovation, green product innovation, and corporate financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. A tale of two market failures: Technology and environmental policy. Ecol. Econ. 2005, 54, 164–174. [Google Scholar] [CrossRef] [Green Version]

- Spulber, D.F. Regulation and Markets, 1st ed.; The MIT Press: Cambridge, MA, USA, 1989; p. 45. [Google Scholar]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building & construction sector in some EU regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar] [CrossRef]

- Simpson, R.D.; Bradford, R.L. Taxing variable cost: Environmental regulation as industrial policy. J. Environ. Econ. Manag. 1996, 30, 282–300. [Google Scholar] [CrossRef]

- Greenstone, M.; List, J.A.; Syverson, C. The effects of environmental regulation on the competitiveness of U.S. manufacturing. S. manufacturing. SSRN Electron. J. 2011. [Google Scholar] [CrossRef] [Green Version]

- He, J. Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 2006, 60, 228–245. [Google Scholar] [CrossRef] [Green Version]

- Duan, Y.W.; Ji, T.; Yu, T.T. Reassessing pollution haven effect in global value chains. J. Clean. Prod. 2021, 284, 124705. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Musah, I.; Ozturk, I. Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy 2017, 124, 706–719. [Google Scholar] [CrossRef]

- Porter, M.E. America’s green strategy. Sci. Am. 1991, 264, 193–246. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Lanjouw, J.O.; Mody, A. Innovation and the international diffusion of environmentally responsive technology. Res. Policy 1996, 25, 549–571. [Google Scholar] [CrossRef]

- Wang, H.Q.; Zhang, Y. Trade structure upgrading, environmental regulation and green technology innovation in different regions of China. China Soft Sci. 2020, 2, 174–181. [Google Scholar]

- Frondel, M.; Horbach, J.; Rennings, K. End-of-pipe or cleaner production? An empirical comparison of environmental innovation decision across OECD countries. Bus. Strategy Environ. 2004, 16, 571–584. [Google Scholar] [CrossRef] [Green Version]

- Hamamoto, M. Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Yuan, Y.J.; Chen, Z. Environmental regulation, green technology innovation and the transformation and upgrading of China’s manufacturing industry. Stud. Sci. Sci. 2019, 37, 1902–1911. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R.J.R.; Okubo, T. Trade, environmental regulations and industrial mobility: An industry-level study of Japan. Ecol. Econ. 2010, 69, 1995–2002. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.; Geng, H.; Xu, G.W.; Chen, J. Research on the influence of environmental regulation on green technology innovation. China Popul. Resour. Environ. 2019, 29, 168–176. [Google Scholar] [CrossRef]

- Jiang, F.X.; Wang, Z.J.; Bai, J.H. The dual effect of environmental regulations’ impact on innovation—An empirical study based on dynamic panel data of Jiangsu manufacturing. China Ind. Econ. 2013, 7, 44–55. [Google Scholar] [CrossRef]

- Wang, Z.Y.; Cao, Y.; Lin, S.L. The characteristics and heterogeneity of environmental regulation’s impact on enterprises’ green technology innovation-Based on green patent data of listed firms in China. Stud. Sci. Sci. 2020, 38, 1–22. [Google Scholar] [CrossRef]

- Shen, N. The threshold effect of environmental regulation on regional technological innovation. China Popul. Resour. Environ. 2012, 22, 12–16. [Google Scholar] [CrossRef]

- Sen, S. Corporate governance, environmental regulations, and technological change. Eur. Econ. Rev. 2015, 80, 36–61. [Google Scholar] [CrossRef]

- Li, X.A. Environmental regulation, government subsidies and regional green technology innovation--Based on the empirical research of provincial space panel. Econ. Surv. 2021, 28, 1–15. [Google Scholar] [CrossRef]

- Morgan, B.W. Strategy and Enterprise Value in the Relationship Economy, 1st ed.; Van Nostrand Reinhold: New York, NY, USA, 1998; pp. 47–68. [Google Scholar]

- Greve, A. Absorptive Capacity and Social Capital: Innovation and Environmental Regulation. In Energy, Natural Resources and Environmental Economics, 1st ed.; Bjorndal, E., Bjørndal, M., Pardalos, P., Rönnqvist, M., Eds.; Springer: Berlin, Germany, 2010; pp. 379–393. [Google Scholar]

- Cumming, D.; Rui, O.M.; Wu, Y.P. Political instability, access to private debt, and innovation investment in China. Emerg. Mark. Rev. 2016, 29, 68–81. [Google Scholar] [CrossRef]

- Zhang, C.; Lou, Z.K.; Zhan, D.B. Political connection, financial performance and corporate social responsibility—Evidence from listed companies of the chemical industry in China. Manag. Rev. 2014, 26, 130–139. [Google Scholar] [CrossRef]

- Zhang, C. Political connections and corporate environmental responsibility: Adopting or escaping? Energy Econ. 2017, 68, 539–547. [Google Scholar] [CrossRef]

- Li, J.; Xia, J.; Zajac, E.J. On the duality of political and economic stakeholder influence on firm innovation performance: Theory and evidence from Chinese firms. Strateg. Manag. J. 2018, 39, 193–216. [Google Scholar] [CrossRef]

- Clarysse, B.; Wright, M.; Mustar, P. Behavioral additionality of R&D subsidies: A learning perspective. Res. Policy 2009, 38, 1517–1533. [Google Scholar] [CrossRef]

- He, Y.; Xu, L.; McIver, R.P. How does political connection affect firm financial distress and resolution in China? Appl. Econ. 2019, 51, 2770–2792. [Google Scholar] [CrossRef]

- Khwaja, A.I.; Mian, A. Do lenders favor politically connected firms? Rent provision in an emerging financial market. Q. J. Econ. 2005, 120, 1371–1412. [Google Scholar] [CrossRef]

- Shen, C.H.; Lin, C.Y. Political connections, financial constraints, and corporate investment. Rev. Quant. Financ. Account. 2015, 47, 343–368. [Google Scholar] [CrossRef]

- Faccio, M. Politically connected firms. Am. Econ. Rev. 2006, 96, 369–386. [Google Scholar] [CrossRef] [Green Version]

- Cai, D.; Huang, J.S.; Li, C.M.; Liu, H. The impact of political connections on Chinese private firms’ technical innovation. Econ. Rev. 2014, 2, 65–76. [Google Scholar]

- Zhou, W. Political connections and entrepreneurial investment: Evidence from China’s transition economy. J. Bus. Ventur. 2013, 28, 299–315. [Google Scholar] [CrossRef]

- Cingano, F.; Pinotti, P. Politicians at work: The private returns and social costs of political connections. J. Eur. Econ. Assoc. 2013, 11, 433–465. [Google Scholar] [CrossRef]

- Bussolo, M.; De Nicola, F.; Panizza, P.; Varghese, R. CEPR Discussion Paper. In Political Connections and Financial Constraints: Evidence from Central and Eastern Europe; CEPR Discussion Papers 14126; World Bank Group, Europe and Central Asia Region Office of the Chief Economist: London, UK, 2019. [Google Scholar]

- Luo, M.X.; Ma, Q.H.; Hu, Y.B. Political connection and firm technological innovation performance-A study on the mediating role of R&D investment. Stud. Sci. Sci. 2013, 31, 938–947. [Google Scholar] [CrossRef]

- Claessens, S.; Feijen, E.; Laeven, L. Political connections and preferential access to finance: The role of campaign contributions. J. Financ. Econ. 2008, 88, 554–580. [Google Scholar] [CrossRef] [Green Version]

- Hou, Q.S.; Hu, M.; Yuan, Y. Corporate innovation and political connection in Chinese listed firms. Pac. Basin Financ. J. 2017, 46, 158–176. [Google Scholar] [CrossRef]

- Yu, X.J.; Yao, Y.; Zheng, H.H.; Zhang, L. The role of political connection on overinvestment of Chinese energy firms. Energy Econ. 2020, 85, 104516. [Google Scholar] [CrossRef]

- Ling, L.; Zhou, X.R.; Liang, Q.X.; Song, P.P.; Zeng, H.J. Political connections, overinvestments and firm performance: Evidence from Chinese listed real estate firms. Financ. Res. Lett. 2016, 18, 328–333. [Google Scholar] [CrossRef]

- Zhang, J.H.; Li, X.Q.; Fung, H.G.; Qiao, P.H. Do political connections promote innovation in environmentally polluting enterprises? China World Econ. 2019, 27, 76–101. [Google Scholar] [CrossRef]

- Zhang, L.M.; Ye, F.; Yang, L.; Zhou, G.C. Impact of political connections on corporate environmental performance: From a green development perspective. Sustainability 2019, 11, 1317. [Google Scholar] [CrossRef] [Green Version]

- Huang, M.; Li, M.Y.; Liao, Z.H. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2020, 278, 123634. [Google Scholar] [CrossRef]

- Patatoukas, P.N. Customer-base concentration: Implications for firm performance and capital markets. Account. Rev. 2011, 87, 363–392. [Google Scholar] [CrossRef] [Green Version]

- Kim, Y.H.; Henderson, D. Financial benefits and risks of dependency in triadic supply chain relationships. J. Oper. Manag. 2015, 36, 115–129. [Google Scholar] [CrossRef]

- Gao, S.X.; Xu, K.; Yang, J.J. Managerial ties, absorptive capacity, and innovation. Asia Pac. J. Manag. 2008, 25, 395–412. [Google Scholar] [CrossRef]

- Shi, J.Y.; Yang, J.H.; Li, Y.X.; Zhang, Q.W. A slight move in one part may affect the situation as a whole: Supply network location, operational risk and corporate performance. China Ind. Econ. 2019, 33, 136–154. [Google Scholar] [CrossRef]

- Wang, N.; Huang, J.; Wang, B. A research on the relationship between board social capital and CEO power on R&D investment: An evidence from the GEM Listed Corporation. Sci. Res. Manag. 2019, 40, 244–253. [Google Scholar] [CrossRef]

- Ma, X.X.; Lu, H. The influence of top management team and external social capital on technology innovation: Taking executive incentive as moderator variables. Sci. Technol. Manag. Res. 2019, 39, 162–168. [Google Scholar] [CrossRef]

- Allen, F.; Qian, J.; Qian, M.J. Law, finance, and economic growth in China. J. Financ. Econ. 2003, 77, 57–116. [Google Scholar] [CrossRef] [Green Version]

- Ouyang, X.L.; Sun, C.W. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- Pang, D.L.; Su, H.W. Determinants of energy intensity in Chinese provinces. Energy Environ. 2017, 28, 451–467. [Google Scholar] [CrossRef]

- Thirtle, C.G.; Vernon, W.R. The Role of Demand and Supply in the Generation and Diffusion of Technical Change, 1st ed.; University of Minnesota, Economic Development Center: Minneapolis, MN, USA, 1987; pp. 6–11. [Google Scholar]

- Tsai, K.H.; Liao, Y.C. Sustainability strategy and eco-innovation: A moderation model. Bus. Strategy Environ. 2017, 26, 426–437. [Google Scholar] [CrossRef]

- Lin, S.T.; Niu, H.J. Green consumption: Environmental knowledge, environmental consciousness, social norms, and purchasing behavior. Bus. Strategy Environ. 2018, 27, 1679–1688. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.P.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Wu, J.F.; Shanley, M.T. Knowledge stock, exploration, and innovation: Research on the United States electromedical device industry. J. Bus. Res. 2009, 62, 474–483. [Google Scholar] [CrossRef]

- Roper, S.; Hewitt-Dundas, N. Knowledge stocks, knowledge flows and innovation: Evidence from matched patents and innovation panel data. Res. Policy 2015, 44, 1327–1340. [Google Scholar] [CrossRef] [Green Version]

- Yuan, B.L.; Xiang, Q.L. Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean. Prod. 2018, 76, 895–908. [Google Scholar] [CrossRef]

- Cohen, M.A.; Tubb, A. The impact of environmental regulation on firm and country competitiveness: A meta-analysis of the Porter Hypothesis. J. Assoc. Environ. Resour. Econ. 2018, 5, 371–399. [Google Scholar] [CrossRef] [Green Version]

- Bellettini, G.; Ceroni, C.B.; Prarolo, G. Knowing the right person in the right place: Political connections and economic growth. SSRN Electron. J. 2009. Available online: https://www.researchgate.net/publication/228284853_Knowing_the_Right_Person_in_the_Right_Place_Political_Connections_and_economic_Growth (accessed on 26 April 2021).

- Yuan, J.G.; Hou, Q.S.; Cheng, C. The curse effect of enterprise political resources: Based on the investigation of political connection and enterprise technological innovation. Manag. World 2015, 31, 139–155. [Google Scholar] [CrossRef]

- Akcigit, U.; Baslandze, S.; Lotti, F. Connecting to power: Political connections, innovation, and firm dynamics. SSRN Electron. J. 2018, 3260274. [Google Scholar] [CrossRef] [Green Version]

- Murphy, K.M.; Shleifer, A.; Vishny, R.W. The allocation of talent: Implications for growth. Q. J. Econ. 1991, 106, 503–530. [Google Scholar] [CrossRef]

- Zhang, X.B.; Zhuang, C. Expansion and strengthening: Comprehensive application of environmental tort liability. Soc. Sci. China 2014, 3, 125–207. [Google Scholar]

- Li, H.B.; Zhou, L.A. Political turnover and economic performance: The incentive role of personnel control in China. J. Public Econ. 2005, 89, 1743–1762. [Google Scholar] [CrossRef]

- Cao, C.F.; Ma, L.F.; Shen, X.X. Fiscal pressure, promotion pressure, tenure of office and local state-owned companies overinvestment. Econ. Q. 2014, 4, 1415–1436. [Google Scholar] [CrossRef]

- Li, J.; Shi, X.; Wu, H.Q.; Liu, L.W. Trade-off between economic development and environmental governance in China: An analysis based on the effect of river chief system. China Econ. Rev. 2019, 60, 99–117. [Google Scholar] [CrossRef]

- Lin, Y.F.; Li, Z.Y. CCER, Peking University working paper. Policy Burden, Moral Hazard and Soft Budget Constraint; China Center for Economic Research: Beijing, China, 2006; NO. E2006004. [Google Scholar]

- Yu, W.; Wang, M.J.; Jin, X.G. Political connection and financing constraints information effect and resource effect. Econ. Res. 2012, 9, 125–139. [Google Scholar]

- Houston, J.F.; Jiang, L.L.; Lin, C.; Ma, Y. Political connections and the cost of bank loans. J. Account. Res. 2014, 52, 193–243. [Google Scholar] [CrossRef]

- Zhang, D.Y.; Guo, Y.M. Financing R&D in Chinese private firms: Business associations or political connection? Econ. Model. 2019, 79, 247–261. [Google Scholar] [CrossRef]

- Wang, Z.Y.; Yang, J.J.; He, H.Q.; Su, L. The mechanism of politically-connected managers on technological innovation for small and medium high-tech enterprises-Empirical evidence from listed firms in Chinese SMEs stock market. Int. J. Serv. Comput. Oriented Manuf. 2013, 1, 178–195. [Google Scholar] [CrossRef]

- Meuleman, M.; Maeseneire, W.D. Do R&D subsidies affect SMEs’ access to external financing? Res. Policy 2008, 41, 580–591. [Google Scholar] [CrossRef]

- Xu, K.; Huang, K.F.; Gao, S.X. The effect of institutional ties on knowledge acquisition in uncertain environments. Asia Pac. J. Manag. 2012, 29, 387–408. [Google Scholar] [CrossRef]

- Yan, Z.Q.; Li, Y. Signaling through government subsidy: Certification or endorsement. Financ. Res. Lett. 2018, 25, 90–95. [Google Scholar] [CrossRef]

- Bian, Y.J.; Qiu, H.X. The social capital of enterprises and its efficiency. Chin. Soc. Sci. 2000, 2, 87–99. [Google Scholar]

- Bullinger, H.J.; Auernhammer, K.; Gomeringer, A. Managing innovation networks in the knowledge-driven economy. Int. J. Prod. Res. 2004, 42, 3337–3353. [Google Scholar] [CrossRef]

- Sheng, S.B.; Zhou, Z.K.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xie, X.M.; Tam, C.M. Relationship between cooperation networks and innovation performance of SMEs. Technovation 2010, 30, 181–194. [Google Scholar] [CrossRef]

- Fang, E.; Palmatier, R.; Evans, K.R. Influence of customer participation on creating and sharing of new product value. J. Acad. Mark. Sci. 2008, 36, 322–336. [Google Scholar] [CrossRef]

- Sanchez-Gonzalez, G.; Gonzalez-Alvarez, N.; Nieto, M. Sticky information and heterogeneous needs as determining factors of R&D cooperation with customers. Res. Policy 2009, 38, 1590–1603. [Google Scholar] [CrossRef]

- Poppo, L.; Zenger, T.R. Do formal contracts and relational governance function as substitutes or complements? Strateg. Manag. J. 2002, 23, 707–725. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W.K. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef] [Green Version]

- Burt, R.S. Structural Holes: The Social Structure of Competition, 1st ed.; Harvard University Press: Cambridge, MA, USA, 1992; pp. 8–81. [Google Scholar] [CrossRef]

- Ganesan, S. Determinants of long-term orientation in buyer-seller relationships. J. Mark. 1994, 58, 1–19. [Google Scholar] [CrossRef]

- Roden, S.; Lawson, B. Developing social capital in buyer-supplier relationships: The contingent effect of relationship-specific adaptations. Int. J. Prod. Econ. 2014, 151, 89–99. [Google Scholar] [CrossRef]

- Zhang, M.; Qi, Y.N.; Wang, Z.Q.; Zhao, X.D.; Pawar, K. Effects of business and political ties on product innovation performance: Evidence from China and India. Technovation 2019, 80–81, 30–39. [Google Scholar] [CrossRef]

- Uzzi, B. Social structure and competition in inter-firm networks: The paradox of embeddedness. Adm. Sci. Q. 1997, 42, 35–67. [Google Scholar] [CrossRef]

- Autry, C.; Griffis, S.E. Supply chain capital: The impact of structural and relational linkages on firm execution and innovation. J. Bus. Logist. 2008, 29, 157–173. [Google Scholar] [CrossRef]

- Calel, R.; Dechezleprêtre, A. Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef] [Green Version]

- Qi, S.Z.; Zhang, Q.; Wang, B.B. Market-oriented incentives to the innovation of new energy companies-Evidence from venture capital and companies’ patents. China Ind. Econ. 2017, 12, 95–112. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; Millimet, D.L. Is there a ’California effect’ in US environmental policy making? Reg. Sci. Urban Econ. 2002, 32, 737–764. [Google Scholar] [CrossRef]

- Wang, F.Z.; Chen, F.Y. Board governance, environmental regulation and green technology innovation-Empirical test based on listed companies in China’s heavy polluting industry. Stud. Sci. Sci. 2018, 36, 361–369. [Google Scholar] [CrossRef]

- Tole, L.; Koop, G. Do environmental regulations affect the location decisions of multinational gold mining firms? Econ. Geogr. 2011, 11, 151–177. [Google Scholar] [CrossRef] [Green Version]

- Johnstone, N.; Haščič, I.; Popp, D. Renewable energy policies and technological innovation: Evidence based on patent counts. Environ. Resour. Econ. 2010, 45, 133–155. [Google Scholar] [CrossRef]

- Cole, M.A.; Fredriksson, P.G. Institutionalized pollution havens. Ecol. Econ. 2009, 68, 1239–1256. [Google Scholar] [CrossRef] [Green Version]

- Raymond, F.; Wang, Y.X. The mortality cost of political connections. Rev. Econ. Stud. 2015, 82, 1346–1382. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.F.; Jin, B.X.; Ren, Y. Impact mechanism of corporate social responsibility on technological innovation performance: The mediating effect based on social capital. Sci. Res. Manag. 2020, 41, 87–98. [Google Scholar]

- Cai, H.B.; Fang, H.M.; Xu, L.X. Eat, drink, firms, government: An investigation of corruption from the entertainment and travel costs of Chinese firms. J. Law Econ. 2011, 54, 55–78. [Google Scholar] [CrossRef] [Green Version]

- Haans, R.F.J.; Pieters, C.; He, Z.L. Thinking about U: Theorizing and testing U- and inverted U-shaped relationships in strategy research. Strateg. Manag. J. 2016, 37, 1177–1195. [Google Scholar] [CrossRef]

- Notice of the State Council on Issuing the Action Plan for Prevention and Control of Water Pollution. Available online: http://www.gov.cn/zhengce/content/2015-04/16/content_9613.htm (accessed on 24 March 2021).

- Environmental Protection Law of the People′s Republic of China. Available online: http://www.gov.cn/zhengce/2014-04/25/content_2666434.htm (accessed on 24 March 2021).

- Notice of the State Council on Issuing the 13th Five Year Plan for Ecological Environment Protection. Available online: http://www.gov.cn/zhengce/content/2016-12/05/content_5143290.html (accessed on 24 March 2021).

- Notice of the State Council on Issuing the 13th Five Year Comprehensive Work Plan for Energy Conservation and Emission Reduction. Available online: http://www.gov.cn/zhengce/content/2017-01/05/content_5156789.htm (accessed on 24 March 2021).

- Opinions of the State Council on Comprehensively Strengthening Ecological and Environmental Protection and Firmly Campaign for Pollution Prevention and Control. Available online: http://www.gov.cn/zhengce/2018-06/24/content_5300953.htm (accessed on 24 March 2021).

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. Rand J. Econ. 2000, 31, 82–100. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, Z.Q.; Yang, D.M.; Cao, W. Research on the catering behavior of enterprise and government subsidy performance: Based on the analysis of the enterprise’s profitability. China Ind. Econ. 2015, 7, 130–145. [Google Scholar] [CrossRef]

- Yu, H.Y.; Huang, X.Z.; Cao, X. The relationship between corporate social responsibility and corporate performance, the moderating role of enterprises’ social capital. J. Manag. Rev. 2015, 27, 169–180. [Google Scholar] [CrossRef]

| Variable | Mean | Std.Dev | Min | Max | Observations |

|---|---|---|---|---|---|

| GTI | 0.345 | 0.738 | 0.000 | 4.001 | 884 |

| ERI | 0.271 | 0.605 | 0.000 | 6.835 | 884 |

| PC | 0.131 | 0. 147 | 0.000 | 0.940 | 884 |

| BC | 0.286 | 0.124 | 0.032 | 0.883 | 884 |

| Size | 22.737 | 1.228 | 19.138 | 27.971 | 884 |

| Lia | 0.423 | 0.178 | 0.035 | 1.073 | 884 |

| Roa | 0.065 | 0.075 | −0.302 | 0.680 | 884 |

| Equ | 0.154 | 0.106 | 0.012 | 0.607 | 884 |

| Age | 2.386 | 0.665 | 1.000 | 3.296 | 884 |

| Variable | Model (1) | Model (2) | ||

|---|---|---|---|---|

| Coefficient | T-Value | Coefficient | T-Value | |

| ERI | −0.173 ** | −1.99 | −0.181 ** | −2.09 |

| ERI2 | 0.030 * | 1.93 | 0. 027 * | 1.74 |

| PC | −0.341 *** | −3.39 | ||

| BC | 0.596 ** | 2.42 | ||

| Size | −0.199 ** | −2.47 | −0. 246 *** | −2.99 |

| Lia | 0.619 ** | 2.09 | 0.637 ** | 2.13 |

| Roa | 0.659 * | 1.81 | 0.716 ** | 1.99 |

| Equ | −0.575 * | −1.76 | −0.510 * | 1.66 |

| Age | −0.030 | −0.22 | −0.017 | −0.13 |

| Constant | 4.825 *** | 2.67 | 5.720 *** | 3.10 |

| Yearly effect Firm effects | Yes | Yes | ||

| Yes | Yes | |||

| F-statistic | 7.70 | 6.78 | ||

| F/PROB | 0.0000 | 0.0000 | ||

| Sample size | 884 | 884 | ||

| Variable | Model (3) | Model (4) | Model (5) | |||

|---|---|---|---|---|---|---|

| Coefficient | T-Value | Coefficient | T-Value | Coefficient | T-Value | |

| ERI | −0.167 * | −1.73 | −0.395 ** | −1.99 | −0.168 ** | −2.50 |

| ERI2 | 0.027 * | 1.66 | 0.104 ** | 2.55 | 0.024 *** | 3.03 |

| PC | −0.293 ** | −2.48 | −0.068 *** | −3.26 | ||

| ERI × PC | −0.491 | −1.30 | ||||

| ERI2 × PC | 0.161 * | 1.87 | 0.004 * | 1.87 | ||

| BC | 0.636 ** | 2.27 | 0.123 *** | 2.87 | ||

| ERI × BC | 0.565 | 1.11 | ||||

| ERI2 × BC | −0.177 * | −1.83 | −0.006 * | −1.92 | ||

| Size | −0.222 *** | −2.74 | −0.235 ** | −2.88 | −0.427 *** | −3.13 |

| Lia | 0.614 ** | 2.07 | 0.691 ** | 2.28 | 0.167 ** | 2.30 |

| Roa | 0.692 * | 1.94 | 0.740 ** | 2.11 | 0.076 ** | 2.12 |

| Equ | −0.484 | −1.41 | −0.572 ** | −2.17 | −0.079 * | −1.91 |

| Age | −0.035 | −0.25 | −0.006 | −0.04 | −0.014 | −0.12 |

| Constant | 5.388 *** | 2.96 | 5.348 *** | 2.93 | 0.060 | 1.23 |

| Yearly effects | Yes | Yes | Yes | |||

| Firm effects | Yes | Yes | Yes | |||

| F | 6.54 | 6.84 | 6.24 | |||

| F/PROB | 0.0000 | 0.0000 | 0.0000 | |||

| Sample size | 884 | 884 | 884 | |||

| Variable | Model (6) | Model (7) | Model (8) | |||||

|---|---|---|---|---|---|---|---|---|

| HP | Non-HP | HP | Non-HP | HP | Non-HP | |||

| ERI | −0.072 (−0.91) | −0.430 *** (−2.70) | −0.114 (−0.49) | −0.137 (−0.37) | −0.0241 (−0.47) | −0.308 *** (−2.92) | ||

| ERI2 | 0.06 (0.63) | 0.128 *** (3.83) | 0.056 (1.26) | 0.117 (1.17) | 0.011 ** (2.52) | 0.036 ** (2.23) | ||

| PC | −0.282 (−0.99) | −0.410 *** (−2.85) | −0.088 * (−1.87) | −0.078 *** (−3.06) | ||||

| ERI × PC | −0.988 ** (−2.31) | 0.379 (0.54) | ||||||

| ERI2 × PC | 0.250 *** (3.23) | −0.526 ** (−2.56) | 0.0078 (1.05) | −0.009 ** (−2.08) | ||||

| BC | 0.537 * (1.75) | 0.764 * (1.86) | 0.100 ** (2.13) | 0.107 * (1.70) | ||||

| ERI × BC | 0.212 (0.30) | −0.905 (−0.84) | ||||||

| ERI2 × BC | −0.107 (−0.85) | 0.682 ** (2.13) | −0.0082 ** (−2.57) | 0.028 *** (3.48) | ||||

| Size | 0.232 (0.72) | −0.259 *** (−3.21) | 0.138 (0.44) | −0.256 *** (−3.16) | 0.345 (0.65) | −0.468 *** (−3.45) | ||

| Lia | 0.389 (0.87) | 0.592 (1.44) | 0.472 (1.09) | 0.669 (1.58) | 0.122 (1.17) | 0.144 (1.42) | ||

| Roa | 0.375 (0.56) | 0.944 ** (2.03) | 0.511 (0.78) | 0.887 * (1.88) | 0.041 (0.62) | 0.097 ** (2.05) | ||

| Equ | −0.873 * (−1.81) | −0.353 (−0.94) | −0.997 ** (−2.16) | −0.356 (−1.29) | −0.158 ** (−2.42) | −0.037 (0.347) | ||

| Age | −0.033 (−0.19) | 0.034 (0.19) | −0.006 (−0.03) | 0.032 (0.18) | −0.050 (−0.31) | 0.046 (0.30) | ||

| Constant | −4.893 (0.69) | 6.125 *** (3.42) | −3.029 (−0.44) | 5.737 *** (3.21) | −0.026 (−0.40) | 0.097 (1.30) | ||

| Yearly effect | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Firm effect | Yes | Yes | Yes | Yes | Yes | Yes | ||

| F | 5.84 | 12.25 | 7.63 | 8.50 | 15.61 | 12.02 | ||

| F/PROB | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||

| Sample size | 604 | 280 | 604 | 280 | 604 | 280 | ||

| Variable | Green Technology Innovation | ||||

|---|---|---|---|---|---|

| Model (9) | Model (10) | Model (11) | Model (12) | Model (13) | |

| ERI | −0.128 ** (−2.03) | −0.161 * (−1.88) | −0.172 ** (−2.01) | −0.367 * (−1.88) | −0.140 ** (−2.12) |

| ERI2 | 0.015 * (1.93) | 0.027 * (1.74) | 0.027 * (1.82) | 0.086 ** (2.47) | 0.020 *** (2.65) |

| PC | −0.304 *** (−2.93) | −0.327 *** (−2.78) | −0.071 *** (−3.23) | ||

| ERI × PC | −0.090 (−0.28) | ||||

| ERI2 × PC | 0.118 * (1.69) | 0.0079 * (1.95) | |||

| BC | 0.573 ** (2.32) | 0.543 ** (2.08) | 0.099 ** (2.49) | ||

| ERI × BC | 0.554 (1.00) | ||||

| ERI2 × BC | −0.171 * (−1.84) | −0.0087 ** (−2.03) | |||

| Size | −0.332 ** (−2.47) | −0.217 *** (−2.65) | −0.193 ** (−2.47) | −0.232 *** (−2.85) | −0.368 *** (−2.72) |

| Lia | 0.149 ** (2.09) | 0.615 ** (2.06) | 0.564 * (1.91) | 0.695 ** (2.30) | 0.155 ** (2.12) |

| Roa | 0.067 * (1.81) | 0.748 ** (2.10) | 0.733 ** (2.10) | 0.734 ** (2.09) | 0.081 ** (2.29) |

| Equ | −0.083 * (−1.76) | −0.536 * (−1.81) | −0.551 (−1.61) | −0.544 * (−1.78) | −0.071 * (−1.95) |

| Age | −0.027 (−0.22) | −0.035 (−0.26) | −0.054 (−0.39) | −0.020 (−0.15) | −0.041 (−0.34) |

| Constant | 4.592 *** (2.85) | 5.086 *** (2.78) | 4.692 *** (2.64) | 5.315 *** (2.88) | 0.073 (1.25) |

| Yearly effects | Yes | Yes | Yes | Yes | Yes |

| Firm effects | Yes | Yes | Yes | Yes | Yes |

| F | 7.56 | 7.26 | 8.01 | 7.77 | 7.52 |

| F/PROB | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ai, Y.-H.; Peng, D.-Y.; Xiong, H.-H. Impact of Environmental Regulation Intensity on Green Technology Innovation: From the Perspective of Political and Business Connections. Sustainability 2021, 13, 4862. https://doi.org/10.3390/su13094862

Ai Y-H, Peng D-Y, Xiong H-H. Impact of Environmental Regulation Intensity on Green Technology Innovation: From the Perspective of Political and Business Connections. Sustainability. 2021; 13(9):4862. https://doi.org/10.3390/su13094862

Chicago/Turabian StyleAi, Yu-Hong, Di-Yun Peng, and Huan-Huan Xiong. 2021. "Impact of Environmental Regulation Intensity on Green Technology Innovation: From the Perspective of Political and Business Connections" Sustainability 13, no. 9: 4862. https://doi.org/10.3390/su13094862