1. Introduction

For many years, transfer fees and player salaries have seen mainly one direction, upwards. Fuelled by increasing match, sponsorship, and broadcasting revenues, particularly in the English Premier League (EPL), worldwide football transfer fees reached a record high of USD7.4B in the year 2019, almost tripling the fees paid in 2012 [

1]. The war for talents among football clubs is driven by the desire for on-field success and win maximisation [

2,

3]. Player salaries, as well as transfer fees, constitute the most important cost factor of clubs in modern professional football [

4]. Szymanski [

5] has shown a statistically significant and positive impact of clubs’ staff expenditures in the form of player salaries and transfer fees on their sporting success.

The coronavirus pandemic (COVID-19), which caught companies worldwide by surprise, has been nothing but a disaster for the sports industry so far and has raised the question of whether the sports industry, in particular the European football industry, is based on a sustainable business model (e.g., [

6,

7,

8]). While some football leagues such as France, Belgium, and the Netherlands abandoned the 2019/2020 season, other leagues continued without spectators, with significant revenue losses for the clubs in both cases. While several football industry professionals expressed the view that this could lead to a contraction of the player market in the near future [

9], no academic study has so far investigated the possible effects of the coronavirus epidemic. Our paper sheds light on this issue by examining the likely consequences of COVID-19 for professional football.

Using data from the EPL, we develop an empirical model to achieve two objectives. First, we aim to study the importance of club revenues on player salaries and transfer costs. In particular, we examine how changes in the different income sources of football clubs (TV revenues, match revenues, and commercial revenues) affect player salaries, player market values, and net transfer expenses. Second, we seek to estimate the impact of a major market downturn such as the COVID-19 pandemic in the EPL. In particular, we predict the (likely) development of player salaries, net transfer expenses, and player market values in the forthcoming EPL season in three possible coronavirus scenarios.

The main contribution of our paper is to determine the relative impact of the three main revenue sources in professional football on the unprecedented growth of player salaries, market values, and net transfer expenses in the last three decades. In addition, our study adds to the understanding of the economic impacts of the COVID-19 pandemic on sports. Thus, our study aims at providing new insights to sport management professionals on what to expect for the development of the football labour markets in crises. Our study also serves as a reference point for future research on sports labour markets, and managers of football leagues and clubs.

The remainder of the paper is organised as follows:

Section 2 introduces the background with the COVID-19 pandemic and the main variables of our model.

Section 3 describes the data and the empirical model.

Section 4 presents the results of the empirical investigation and predicts the impact of the COVID-19 pandemic.

Section 5 provides a discussion, and the paper concludes with

Section 6.

5. Discussion

What is commonly referred to as the peculiarities of the sports industry describes a set of characteristics that distinguishes the sports industry from conventional industries. These peculiarities are as follows: (i) constant industry output, (ii) competitors are needed to produce an output, (iii) a league is naturally a monopoly, and (iv) output quality increases with the quality of the competitors [

51,

52].

Another point that distinguishes professional football from other industries is that clubs have not been profitable for most of their history [

53]. A total of 18 out of 20 football clubs of the English Premier League published their financial accounts for the 2018/2019 season in March 2020, immediately before the COVID-19 outbreak. In defiance of having achieved the 20th consecutive record revenue high in a row, 16 out of these 18 clubs posted net income losses. While companies in most industries seek to maximise profits and are thus able to build up financial reserves, European football is often considered a win-maximisation industry, where additional revenue is used to acquire playing talent [

2,

3,

25] to maintain competitiveness in the rat race of winning titles and avoiding relegation. In football clubs, the by far largest part of their operating costs are player salaries, which regularly account for between 60% and 72% of revenues in each of the five large European football leagues [

4], and account for between 70% and 80% of total operating costs in the EPL.

Against this background, the COVID-19 pandemic has raised the question of whether the football industry is based on a sustainable business model (e.g., [

6,

7,

8]), or whether the modus operandi needs to change to be sustainable and to prevent bankruptcies of clubs in the event of external shocks such as the current COVID-19 pandemic.

Thus, one of the key contributions of our paper is to examine the relationship between the different revenue sources and the main cost drivers of professional football clubs. In particular, we show how changes in the different income sources of football clubs (TV revenues, match revenues, and commercial revenues) affect player salaries, player market values, and net transfer expenses. Our results suggest that TV revenues are by far the most important source of income for player salaries and market values, followed by match revenues and commercial revenues. Not surprisingly, each revenue source seems to have a similar impact on net transfer expenses.

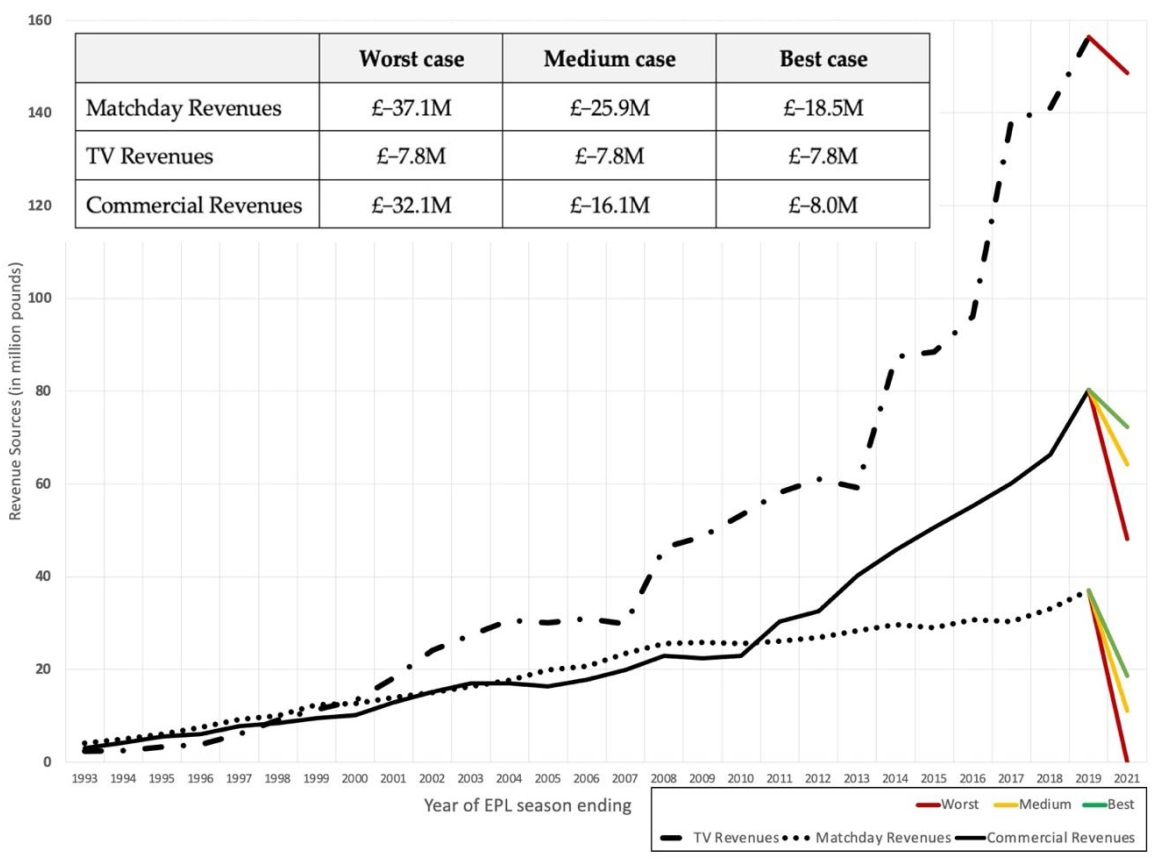

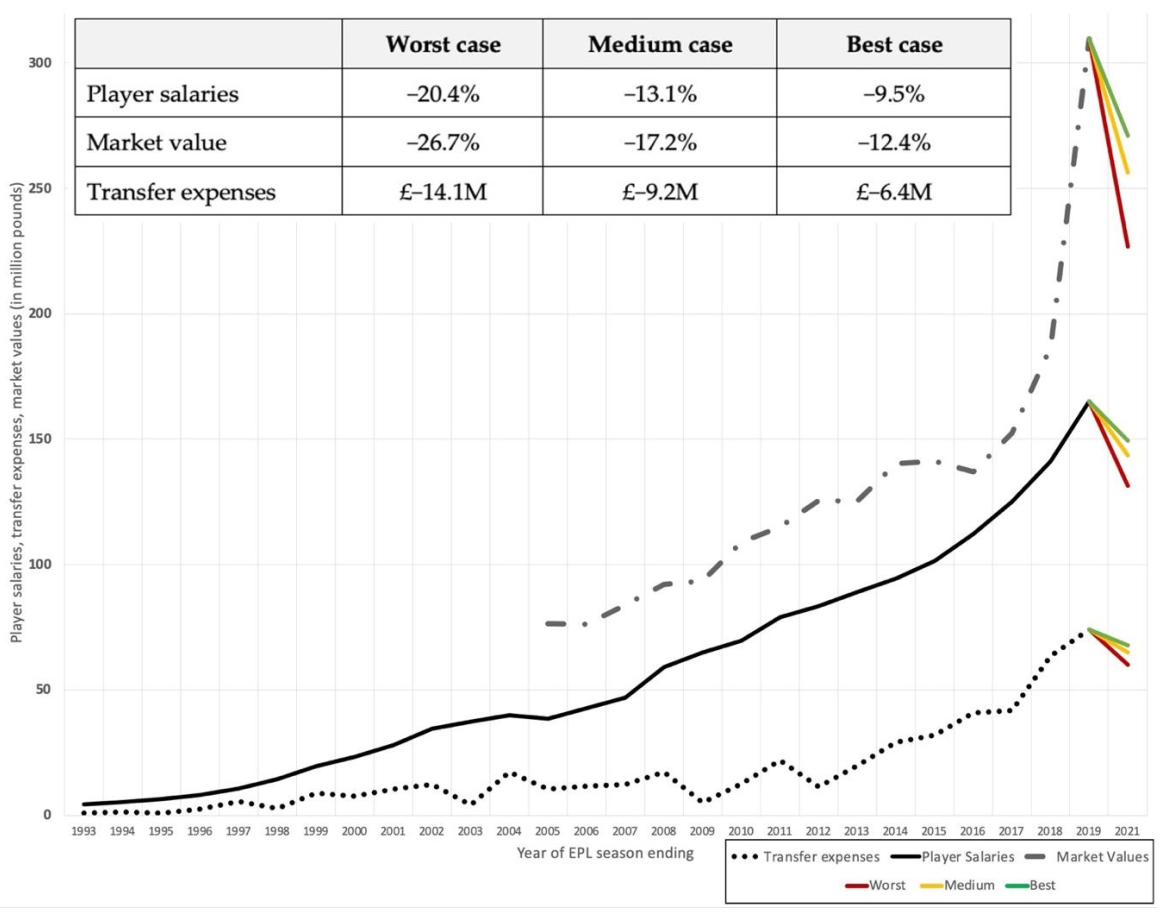

Based on our regression estimations, we estimate the expected impact on the three revenue sources of EPL clubs and predict their impact on player salaries, market values, and transfer expenses in three possible coronavirus scenarios. We conjecture that the COVID-19-induced negative effects on EPL club revenues will translate into reductions in team wage bills, squad market values, and net transfer expenses. In particular, we expect total club revenues to decrease by 28% (worst case), 18% (medium case), and 13% (best case) in the forthcoming EPL season, 2020/2021.

Match revenues will most likely suffer the most (in the worst-case scenario they will be zero), while TV revenues are the least affected of the three revenue sources (only −5%). Our empirical model suggests that player salaries, market values, and transfer expenses will all decrease in the forthcoming season. The magnitude of the reduction depends on the scenario and ranges from −20.4% to −9.5% for player salaries, from −26.7% to −12.4% for player market values, and from £−14.1 M to £−6.4 M for transfer expenses. Thus, with an average annual salary for an EPL player of approximately £4 M, this means a loss of salary of £400,000 (best case) or £800,000 (worst case) per year. The traditionally negative transfer balances of most English clubs, on the other hand, will fall from an average of £74.1 M to £60.1 M (worst case) or £67.7 M (best case).

When splitting the sample into the Big 6 clubs and the remaining 14 teams, our model predicts that player salaries will decline more in the Big 6 clubs than in the other 14 teams, while the opposite is true for net transfer expenses. Player market values are expected to decrease equally across all 20 clubs.

In sum, while the impact will be economically relevant for each of these variables (player salaries, market values, and transfer expenses), their impact will remain rather small from a historical perspective. Even in the worst-case scenario, team wage bills, squad market values, and net transfer expenses only decline to the level in the 2017/2018 season. Nevertheless, if the coronavirus pandemic is going to last for a longer period of time and football clubs continue the current modus operandi, their business model is likely to fail, and bankruptcies of clubs can be expected.

One might argue that already the committed “costs” in terms of player salaries written down in long-term contracts prior to the coronavirus pandemic cannot be easily reduced when club revenues decline as a consequence of the crisis. However, the average contract length is approximately 2.3 years [

54], which means that more than 40% of all player contracts are renegotiated every year. This gives clubs ample possibility to lower their wage bill, apart from the voluntary salary cuts that have happened due to the coronavirus pandemic-induced reduction in club revenues [

55].

Thus, those clubs that have player contracts with longer contract durations, are less flexible to renegotiate player salaries downwards in contracting markets, such as witnessed in the current COVID-19 crises.

In contrast to the other Big 5 European football leagues, where most players agreed to voluntary pay cuts, the majority of EPL players refused to accept any salary reductions in light of COVID-19 [

56]. With average remaining contract lengths between 1.5 years (Crystal Palace) and 3.2 years (Tottenham Hotspur) [

57], it is, however, only a matter of time until lower player salaries will be observed across EPL teams too. Moreover, new player contracts are likely to include clauses allowing clubs to cut wages in the case of another pandemic or similar events leading to a lockout of fans.

The discussion of the pros and cons of salary caps, which are common practice in North American Major League sports (e.g., [

58,

59]), have gained new momentum in light of the financial consequences of COVID-19 for football clubs. For a long time, legal specialists questioned whether salary caps are consistent with national and European anti-trust regulations. However, recent expertise by the Scientific Services of the German Parliament concludes that salary caps are compatible with national and European law if introduced and monitored by UEFA [

60].

According to media reports, UEFA is currently indeed assessing the possibility of introducing salary caps on a European level [

61]. Meanwhile, the English Football League has been a first mover and introduced salary caps for English third- and fourth-tier football in August 2020, with salary caps at £2.5 M and £1.5 M per annum, respectively [

62]. However, an arbitration panel ruled in February 2021, that the cap must be withdrawn after the Professional Footballers’ Association argued it was “unlawful and unenforceable” [

63].

The question remains whether salary caps can prevent those clubs that are willing to spend more than allowed, to do so in the absence of rigorous monitoring to detect and sanction violations [

64]. Monitoring the sources of players’ ancillary remuneration requires far more effort than monitoring possible “creative accounting” by clubs violating UEFA’s Financial Fairplay regulations.

6. Conclusions

All countries worldwide are affected by the coronavirus and most sports events have been postponed or cancelled. The year 2020 was supposed to be an important sports year, with major events such as the UEFA Euro 2020 and the Summer Olympics in Tokyo. Both events have been postponed to 2021, causing significant financial as well as political disturbances.

The economic consequences of the COVID-19 pandemic on the sports industry in general, and on European football in particular, are still underexplored. Our paper sheds light on the pandemic’s expected impact on professional football. Using data from the English Premier League (EPL), we develop a regression model to achieve two objectives. First, we examine the relationship between the different revenue sources (TV revenues, match revenues, and commercial revenues) and the main cost drivers of professional football clubs (player salaries and transfer expenses). Second, we seek to predict the likely impact of a major market downturn such as the COVID-19 pandemic in the EPL.

Our study shows that salaries, transfer fees, and market values are linked to the level of club revenues and adjust to emerging market conditions. However, market contractions lead to short-term losses, as clubs cannot make fast expenditure adjustment due to longer-term contracts and obligations and because they—driven by the rat race—do not build up reserves under favourable market conditions. As a result, clubs are reliant on external funding sources in unfavourable situations and the current model cannot be considered self-sustainable. However, as football clubs are in many cases treated as Trophy Assets, there might often be external funding possibilities.

Admittedly, our assumptions as well as the available data have influenced the results presented above in a particular way. First, while the coefficient of determination between club revenues on the one hand, and salaries (0.97), as well as market values (0.80), is high, club revenues explain only approximately 47% of the variation in net transfer expenses, indicating the possible existence of other influencing factors. Future research with an emphasis on complementing these factors would be beneficial. Second, apart from the categorisation of clubs into the Big 6 and the other 14, a comparative classification of club owner strategies would, in this respect, offer a good approach for further refining the analysis because differences in owner strategies are likely to translate into differences in spending behaviour—be it in wages or transfer fees. Third, because the future is inherently uncertain, all predictions into the future need to cope with uncertainties [

65,

66] and may already be outdated soon afterwards, as the most recent developments regarding the European Super League as well as the reform of the UEFA Champions League drastically show. The scenario analysis is a means of developing possible futures to deal with this uncertainty [

67]. The focus is thus not to look into the most likely development but to consider different possible developments under key assumptions, i.e., ‘What happens if…’? [

68]. We have thus specifically looked for each of the variables on how they could develop in each of the three cases and deduce the consequences according to our model. Our approach to predicting the revenue paths of EPL clubs post-COVID-19 may serve critics to develop their own (more realistic?) perspective and to come up with figures that are different from the ones that we have presented here.

However, the most recent developments clearly support our scenario approach. On 8 March 2021, the German Football Association reported that the match revenues of the 18 first division clubs had decreased by more than 30% and transfer expenses by 12% in the season 2019/2020 compared to the season before. Thus, since approximately three-quarters of that last season were still played in full stadiums, our best-case projections for the EPL are virtually identical with what actually happened to match revenues and transfer expenses in the Bundesliga in the last season already. This, in turn, suggests that the product, as well as the labour market, reacts very quickly in the expected duration.

Future research may replicate this study with data from other leagues where club financials are accessible, such as the French Ligue 1/2 or the English Championship. The economic consequences and implications of the COVID-19 pandemic remain a fertile and important line of inquiry for sport management scholars.