Investors’ Aspirations toward Social Impact: A Portfolio-Based Analysis

Abstract

:1. Introduction

2. Theoretical Background

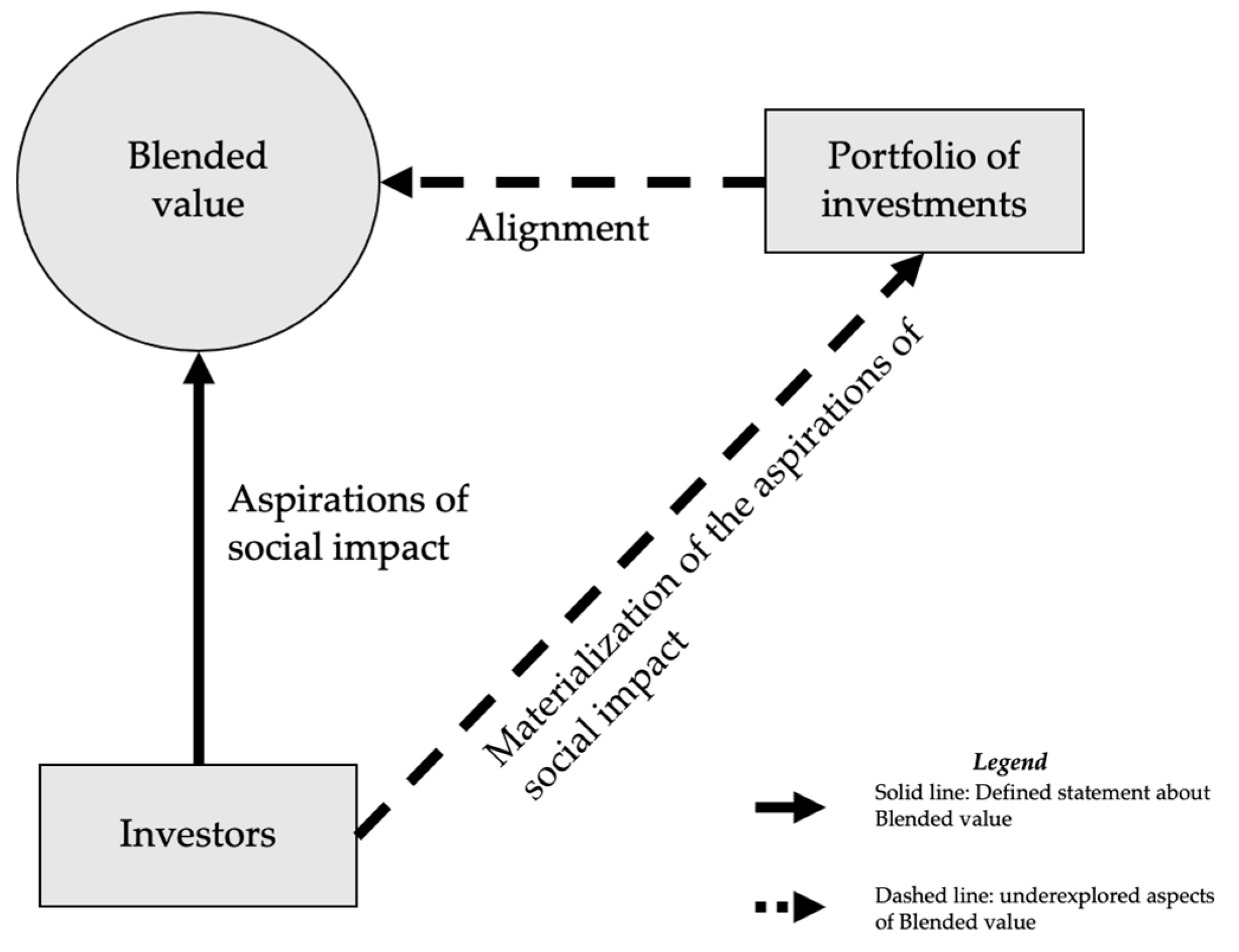

2.1. The Framework of Blended Value Finance

2.2. The Aspirations toward Social Impact

3. Hypothesis

3.1. The Alignment of Aspirations toward Social Impact between Investor and Investees

3.2. The Boundary Conditions: Context Characteristics at the Portfolio and Investor Levels

4. Data and Method

4.1. Sample Identification

4.2. Variables

4.2.1. Dependent Variable

4.2.2. Independent Variable

“We invest in ambitious founders using technology to tackle big social and environmental problems that aim to radically improve millions of lives.”—Bethnal Green Ventures their mission statement in 2019.

“Fledge Capital provides capital solutions to companies with robust business models, exceptional management teams, potential for growth and which are profitable (with profits exceeding R20-million)”—Fledge Capital mission statement in 2019.

4.2.3. Moderators

4.2.4. Control Variables

4.2.5. Econometric Specifications

5. Analyses

5.1. Descriptive Statistics

5.2. Regression Results

6. Robustness Check

7. Discussion

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ebrahim, A.; Rangan, V.K. What Impact? A Framework for Measuring the Scale and Scope of Social Performance. Calif. Manag. Rev. 2014, 56, 118–141. [Google Scholar] [CrossRef] [Green Version]

- Calderini, M.; Chiodo, V.; Michelucci, F.V. The Social Impact Investment Race: Toward an Interpretative Framework. Eur. Bus. Rev. 2018, 30, 66–81. [Google Scholar] [CrossRef]

- Arena, M.; Azzone, G.; Bengo, I. Performance Measurement for Social Enterprises. Voluntas 2015, 26, 649–672. [Google Scholar] [CrossRef]

- Emerson, J. The Blended Value Proposition: Integrating Social and Financial Returns. Calif. Manag. Rev. 2003. [Google Scholar] [CrossRef] [Green Version]

- Phillips, S.D.; Johnson, B. Inching to Impact: The Demand Side of Social Impact Investing. J. Bus. Ethics 2019, 1–15. [Google Scholar] [CrossRef]

- Bugg-levine, A.; Emerson, J. Transforming How We Make Money. Innov. Technol. Gov. Glob. 2011, 6, 9–18. [Google Scholar] [CrossRef]

- Agrawal, A.; Hockerts, K. Impact investing strategy: Managing conflicts between impact investor and investee social enterprise. Sustainability 2019, 11, 4117. [Google Scholar] [CrossRef] [Green Version]

- Bengo, I.; Borrello, A.; Chiodo, V. Preserving the Integrity of Social Impact Investing: Towards a Distinctive Implementation Strategy. Sustainability 2021, 13, 2852. [Google Scholar] [CrossRef]

- Bonini, S.; Emerson, J. Maximizing Blended Value—Building beyond the Blended Value Map to Sustainable Investing, Philanthropy and Organizations. 2005. Available online: http://community-wealth.org (accessed on 1 April 2021).

- Moore, M.L.; Frances, R.W.; Nicholls, A. The Social Finance and Social Innovation Nexus. J. Soc. Entrep. 2012, 3, 115–132. [Google Scholar] [CrossRef]

- Dees, G.J.; Anderson, B.B. Strategies for Spreading Social Innovations. Stanf. Soc. Innov. Rev. 2004, 1, 24–32. [Google Scholar] [CrossRef]

- Schaltegger, S.; Beckmann, M.; Hockerts, K. Sustainable entrepreneurship: Creating environmental solutions in light of planetary boundaries. Int. J. Entrep. Ventur. 2018, 10, 131–152. [Google Scholar] [CrossRef]

- Scarlata, M.; Walske, J.; Zacharakis, A. Ingredients Matter: How the Human Capital of Philanthropic and Traditional Venture Capital Differs. J. Bus. Ethics 2017, 145, 623–635. [Google Scholar] [CrossRef] [Green Version]

- Höchstädter, A.K.; Scheck, B. What’s in a name: An analysis of impact investing understandings by academics and practitioners. J. Bus. Ethics 2015, 132, 449–475. [Google Scholar] [CrossRef]

- Brandstetter, L.; Lehner, O.M. Opening the market for impact investments: The need for adapted portfolio tools. Entrep. Res. J. 2015, 5, 87–107. [Google Scholar] [CrossRef]

- Hawn, O.; Ioannou, I. Mind the gap: The interplay between external and internal actions in the case of corporate social responsibility. Strateg. Manag. J. 2016, 37, 2569–2588. [Google Scholar] [CrossRef] [Green Version]

- Battilana, J.; Lee, M. Advancing Research on Hybrid Organizing. Acad. Manag. Ann. 2014, 37–41. [Google Scholar] [CrossRef]

- Gamble, E.N.; Parker, S.C.; Moroz, P.W. Measuring the integration of social and environmental missions in hybrid organizations. J. Bus. Ethics 2019, 1–14. [Google Scholar] [CrossRef] [Green Version]

- EUROSIF. European SRI Study. 2018, pp. 1–68. Available online: https://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study.pdf (accessed on 1 April 2020).

- Baygan, G.; Freudenberg, M. The Internationalization of Venture Capital Activity in OECD Countries: Implications for Measurement and Policy; STI Working Papers 2000/7; OECD: Paris, France, 2000. [Google Scholar]

- Dimov, D.; Gordon, M. Literature Survey of Venture Capital Support Schemes in Europe. 2001. Available online: https://www.researchgate.net/profile/Gordon-Murray-2/publication/267399816_Literature_Survey_of_Venture_Capital_Support_Schemes_in_Europe/links/54c20ebb0cf2d03405c5f31f/Literature-Survey-of-Venture-Capital-Support-Schemes-in-Europe.pdf (accessed on 1 April 2020).

- Mike, W.; Pruthi, S.; Lockett, A. International Venture Capital Research: From Cross-Country Comparisons to Crossing Borders. Int. J. Manag. Rev. 2005, 7, 135–165. [Google Scholar] [CrossRef]

- Cooper, L.; Evnine, J.; Finkelman, J.; Huntington, K.; Lynch, D. Social finance and the postmodern portfolio: Theory and practice. J. Wealth Manag. 2016, 18, 9–21. [Google Scholar] [CrossRef]

- Block, J.H.; Hirschmann, M.; Fisch, C. Which criteria matter when impact investors screen social enterprises? J. Corp. Financ. 2021, 66, 101813. [Google Scholar] [CrossRef]

- Brest, P.; Born, K. When can impact investing create real impact. Stanf. Soc. Innov. Rev. 2013, 11, 22–31. [Google Scholar]

- Harji, K.; Jackson, E.T. Accelerating Impact: Achievements, Challenges and What’s Next in Building the Impact Investing Industry; The Rockefeller Foundation: New York, NY, USA, 2012. [Google Scholar]

- Nicholls, A. The institutionalization of social investment: The interplay of investment logics and investor rationalities. J. Soc. Entrep. 2010, 1, 70–100. [Google Scholar] [CrossRef]

- Eccles, R.G.; Lee, L.E.; Stroehle, J.C. The social origins of ESG: An analysis of Innovest and KLD. Organ. Environ. 2020, 33, 575–596. [Google Scholar] [CrossRef]

- O’Donohoe, N.; Leijonhufvud, C.; Saltuk, Y.; Bugg-Levine, A.; Brandenburg, M. Impact Investments: An Emerging Asset Class; JP Morgan: New York, NY, USA, 2010; p. 6. [Google Scholar]

- Cort, T.; Esty, D. ESG Standards: Looming Challenges and Pathways Forward. Organ. Environ. 2020, 33, 491–510. [Google Scholar] [CrossRef]

- Maas, K. Corporate Social Performance: From Output Meaasurement to Impact Measurement. Bus. Soc. 2009, 46. [Google Scholar] [CrossRef] [Green Version]

- Maas, K.; Kellie, L. Social Impact Measurement: Classification and Methods. In Environmental Management Accounting and Supply Chain Management; Springer: Berlin, Germany, 2011. [Google Scholar]

- Hinkin, T.R.; Bruce, T.J.; Enz, C.A. Scale Construction: Developing Reliable and Valid Measurement Instruments. J. Hosp. Tour. Res. 1997, 21, 100–120. [Google Scholar] [CrossRef]

- Costa, E.; Caterina, P. Social Impact Measurement: Why Do Stakeholders Matter? Sustain. Account. Manag. Policy J. 2016, 7, 99–124. [Google Scholar] [CrossRef]

- Mura, M.; Mariolina, L.; Pietro, M.; Daniela, B. The Evolution of Sustainability Measurement Research. IJMR 2018, 20, 661–695. [Google Scholar] [CrossRef]

- Bart, C.K.; Maureen, H. Mission Statements in Canadian Hospitals. J. Health Organ. Manag. 2004, 18, 92–110. [Google Scholar] [CrossRef] [Green Version]

- Bowen, S.A. Mission and vision. In The International Encyclopedia of Strategic Communication; Wiley Online Library: Hoboken, NJ, USA, 2018; pp. 1–9. [Google Scholar]

- Gergen, K.J.; Whitney, D. Technologies of representation in the global corporation: Power and polyphony. In Postmodern Management and Organization Theory; Boje, D.M., Gephart, R.P., Thatchenkery, T.J., Eds.; Sage: Thousand Oaks, CA, USA, 1996; pp. 331–357. [Google Scholar]

- Ireland, R.; Duane, M.; Hitt, A. Mission Statements: Importance, Challenge, and Recommendations for Development. Bus. Horiz. 1992, 35, 34–42. [Google Scholar] [CrossRef]

- Battilana, J.; Silvia, D. Building Sustainable Hybrid Organizations: The Case of Commercial Microfinance Organizations. Acad. Manag. J. 2010, 53, 1419–1440. [Google Scholar] [CrossRef] [Green Version]

- Pache, A.C.; Filipe, S. Inside the Hybrid Organzation: Selective Coupling as a Repsonse to Competing Institutional Logics. Acad. Manag. J. 2013, 56, 972–1001. [Google Scholar] [CrossRef] [Green Version]

- Haigh, N.; Andrew, J.H. The New Heretics: Hybrid Organizations and the Challenges They Present to Corporate Sustainability. Organ. Environ. 2014, 27, 223–241. [Google Scholar] [CrossRef]

- Lee, M. The Viability of Hybrid Social Ventures. Acad. Manag. Proc. 2014, 2014, 13958. [Google Scholar] [CrossRef]

- Battilana, J.; Metin, S.; Anne, C.P.; Jacob, M. Harnessing Productive Tensions in Hybrid Organizations: The Case of Working Integration Social Enterprises. Acad. Manag. J. 2015, 58, 1658–1685. [Google Scholar] [CrossRef]

- Haffar, M.; Cory, S. How Organizational Logics Shape Trade-off Decision-Making in Sustainability. Long Range Plan. 2019, 52, 101912. [Google Scholar] [CrossRef]

- Godfrey, P.C. The Relationship between Corporate Philanthropy and Shareholder Wealth: A Risk Management Perspective. Acad. Manag. Rev. 2005, 30, 777–798. [Google Scholar] [CrossRef] [Green Version]

- Godfrey, P.C.; Craig, M.B.; Jared, M.H. The Relationship between Corporate Social Responsibility and Shareholder Value: An Empirical Test of the Risk Management Hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Flammer, C. Corporate Social Responsibility and Shareholder Reaction: The Environmental Awareness of Investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef] [Green Version]

- Cheng, B.; Ioannis, I.; George, S. Corporate Social Responsibility And Access To Finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef] [Green Version]

- Hall, B.H.; Josh, L. The Financing of R&D and Innovation; NBER Working Paper Series; NBER: Cambridge, MA, USA, 2010. [Google Scholar]

- Gompers, P.A. Optimal Investment, Monitoring, and the Staging of Venture Capital. J. Financ. 1995, 50, 1461–1498. [Google Scholar] [CrossRef]

- Berrone, P.; Gelabert, L.; Fosfuri, A. The Impact of Symbolic and Substantive Actions on Environmental Legitimacy; Working Paper WP-778; IESE Business School: Barcelona, Spain, 2009. [Google Scholar]

- Durand, R.; Paolella, L. Category stretching: Reorienting research on categories in strategy, entrepreneurship, and organization theory. J. Manag. Stud. 2013, 50, 1100–1123. [Google Scholar] [CrossRef]

- Zuckerman, E.W. The categorical imperative: Securities analysts and the illegitimacy discount. Am. J. Sociol. 1999, 104, 1398–1438. [Google Scholar] [CrossRef] [Green Version]

- Zuckerman, E.W. On networks and markets by Rauch and Casella, eds. J. Econ. Lit. 2003, 41, 545–565. [Google Scholar] [CrossRef]

- Gupta, A.K.; Sapienza, H.J. Determinants of venture capital firms’ preferences regarding the industry diversity and geographic scope of their investments. J. Bus. Ventur. 1992, 7, 347–362. [Google Scholar] [CrossRef]

- Norton, E.; Tenenbaum, B.H. Specialization versus diversification as a venture capital investment strategy. J. Bus. Ventur. 1993, 8, 431–442. [Google Scholar] [CrossRef]

- Matusik, S.F.; Fitza, M.A. Diversification in the venture capital industry: Leveraging knowledge under uncertainty. Strateg. Manag. J. 2012, 33, 407–426. [Google Scholar] [CrossRef]

- Bresnahan, T.; Gambardella, A.; Saxenian, A. ‘Old economy’inputs for ‘new economy’outcomes: Cluster formation in the new Silicon Valleys. Ind. Corp. Chang. 2001, 10, 835–860. [Google Scholar] [CrossRef] [Green Version]

- Fosfuri, A.; Rønde, T. High-tech clusters, technology spillovers, and trade secret laws. Int. J. Ind. Organ. 2004, 22, 45–65. [Google Scholar] [CrossRef] [Green Version]

- Lerner, J. Venture capitalists and the oversight of private firms. J. Financ. 1995, 50, 301–318. [Google Scholar] [CrossRef]

- Miller, T.L.; Curtis, L.W. Assessing Mission and Resources for Social Change: An Organizational Identity Perspective on Social Venture Capitalists’ Decision Criteria. Entrep. Theory Pract. 2010, 34, 705–733. [Google Scholar] [CrossRef]

- Chen, H.; Gompers, P.; Kovner, A.; Lerner, J. Buy local? The geography of venture capital. J. Urban Econ. 2010, 67, 90–102. [Google Scholar] [CrossRef]

- So, I.; Staskevicius, A. Measuring the “Impact” in Impact Investing 2015. Retrieved from Harvard Business School. Available online: http://www.hbs.edu/socialenterprise/Documents/MeasuringImpact.pdf (accessed on 15 December 2020).

- Wright, M.; Sapienza, H.; Busenitz, L. Introduction. Venture Capital; Edward Elgar: Cheltenham, UK, 2003; Volume I. [Google Scholar]

- Bruton, G.D.; Ahlstrom, D.; Wan, J.C.C. Turnaround in Southeast Asian firms: Evidence from ethnic Chinese communities. Strateg. Manag. J. 2003, 24, 519–540. [Google Scholar] [CrossRef]

- Bygrave, W.D.; Timmons, J. Venture Capital at the Crossroads. In University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship; The Academy of Entrepreneurial Leadership: Champaign, IL, USA, 1992. [Google Scholar]

- Nye, D.; Wasserman, N. Patterns of VC evolution: Comparing the Israeli and Indian venture capital industries. J. Priv. Equity 1999, 3, 26–48. [Google Scholar]

- Global Impact Investing Network. Annual Impact Investor Survey. 2018. Available online: https://thegiin.org/research/publication/annualsurvey2018 (accessed on 15 December 2020).

- Spieth, P.; Sabrina, S.; Thomas, C.; Daniel, E. Value Drivers of Social Businesses: A Business Model Perspective. Long Range Plan. 2019, 52, 427–444. [Google Scholar] [CrossRef]

- Kish, Z.; Fairbairn, M. Investing for profit, investing for impact: Moral performances in agricultural investment projects. Environ. Plan. A Econ. Space 2018, 50, 569–588. [Google Scholar] [CrossRef]

- Watts, N.A. Investing for Impact: Finance and Farming in the Southern Highlands of Tanzania. Ph.D. Thesis, University of Cambridge, Cambridge, UK, 2018. [Google Scholar]

- Bolzani, D.; Fini, R.; Napolitano, S.; Toschi, L. Entrepreneurial teams: An input-process-outcome framework. Found. Trends Entrep. 2019, 15, 56–258. [Google Scholar] [CrossRef]

- Alonso-Martínez, D. Social progress and international patent collaboration. Technol. Forecast. Soc. Chang. 2018, 134, 169–177. [Google Scholar] [CrossRef]

- Papke, L.E.; Wooldridge, J.M. Econometric methods for fractional response variables with an application to 401 (k) plan participation rates. J. Appl. Econom. 1996, 11, 619–632. [Google Scholar] [CrossRef] [Green Version]

- Dormann, C.F.; Elith, J.; Bacher, S.; Buchmann, C.; Carl, G.; Carré, G.; Lautenbach, S. Collinearity: A review of methods to deal with it and a simulation study evaluating their performance. Ecography 2013, 36, 27–46. [Google Scholar] [CrossRef]

- O’brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

| Country of Origin | Frequency | Percent | Cum |

|---|---|---|---|

| Australia | 3 | 4.00 | 4.00 |

| Belgium | 1 | 1.33 | 5.33 |

| Canada | 2 | 2.67 | 8.00 |

| Finland | 1 | 1.33 | 9.33 |

| France | 3 | 4.00 | 13.33 |

| India | 6 | 8.00 | 21.33 |

| Liechtenstein | 1 | 1.33 | 22.67 |

| Luxembourg | 1 | 1.33 | 24.00 |

| Netherlands | 5 | 6.67 | 30.67 |

| Singapore | 1 | 1.33 | 32.00 |

| South Africa | 1 | 1.33 | 33.33 |

| Spain | 2 | 2.67 | 36.00 |

| Switzerland | 5 | 6.67 | 42.67 |

| United Kingdom | 6 | 8.00 | 50.67 |

| United States | 37 | 49.33 | 100 |

| Total | 75 | 100.00 |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Impact_Score | 75 | 0.59 | 0.25 | 0 | 1 |

| Impact_Investor_scale | 75 | 5.96 | 2.88 | 0 | 10 |

| Gini_portfolio | 75 | ≅0 | ≅1 | −2.98 | 4.51 |

| Spi_investor | 75 | 83.15 | 8.41 | 56.57 | 89.08 |

| Exits | 75 | 3.38 | 6.37 | 0 | 33 |

| Portfolio_size | 75 | 14.84 | 19.46 | 1 | 130 |

| Technology_intensity | 75 | 0.36 | 0.25 | 0 | 1 |

| US_investor | 75 | 0.49 | 0.50 | 0 | 1 |

| Impact_Investor_Scale | Gini_Portfolio | SPI_Investor | Exits | Portfolio_Size | Technology_Intensity | US_Investor | Impact_Score | |

|---|---|---|---|---|---|---|---|---|

| Impact investor_scale | 1.00 | |||||||

| Gini_portfolio | −0.0732 | 1.00 | ||||||

| SPI_investor | −0.0870 | 0.1815 | 1.00 | |||||

| Exits | −0.3921 * | 0.0263 | 0.0620 | 1.00 | ||||

| Portfolio_size | −0.0985 | −0.0044 | 0.0412 | 0.6422 * | 1.00 | |||

| Technology_intensity | −0.0287 | 0.0066 | 0.2021 | 0.1689 | 0.1015 | 1.00 | ||

| US_investor | −0.0919 | 0.2263 | 0.1157 | 0.2588 * | 0.2743 * | 0.0586 | 1.00 | |

| Impact_score | 0.3760 * | −0.1273 | 0.1276 | −0.1166 | 0.0944 | −0.2323 | 0.3364 | 1.00 |

| VIF | Tolerance | |

|---|---|---|

| Exits | 2.09 | 0.4774 |

| Portfolio_size | 1.73 | 0.5797 |

| Impact_investor_scale | 1.26 | 0.7918 |

| Us_investor | 1.26 | 0.7954 |

| Technology_inensity | 1.13 | 0.8831 |

| GINI_portfolio | 1.18 | 0.8498 |

| Spi_investor | 1.08 | 0.9247 |

| Mean VIF | 1.39 |

| Impact_Score | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Main independent variables | ||||

| Impact_investor_scale | 0.0745 *** (0.0268) | 0.0737 *** (0.0272) | −0.320 * (0.164) | −0.289 (0.188) |

| Gini_portfolio | −0.123 (0.0953) | −0.318 ** (0.158) | −0.120 (0.0934) | −0.310 * (0.159) |

| SPI_investor | 0.00102 (0.00640) | 0.000208 (0.00595) | −0.0295 ** (0.0148) | −0.0279 * (0.0164) |

| Exits | −0.0245 * (0.0149) | −0.0238 * (0.0138) | −0.0224 (0.0152) | −0.0219 (0.0142) |

| Portfolio_size | 0.00610 (0.00393) | 0.00638 * (0.00375) | 0.00534 (0.00389) | 0.00567 (0.00373) |

| Technology_intensity | −0.353 (0.295) | −0.399 (0.291) | −0.375 (0.296) | −0.417 (0.290) |

| US_investor | 0.688 *** (0.153) | 0.616 *** (0.153) | 0.678 *** (0.151) | 0.611 *** (0.152) |

| Impact_investor_scale × Gini_portfolio | 0.0452 * (0.0260) | 0.0437 * (0.0263) | ||

| Impact_investor_scale × SPI_investor | 0.00467 ** (0.00215) | 0.00430 * (0.00240) | ||

| Constant | −0.481 (0.485) | −0.357 (0.450) | 2.115 * (1.130) | 2.030 (1.277) |

| Model diagnostics | ||||

| Loglikelihood | −46.77 | −46.51 | −46.65 | −46.41 |

| Chi-squared | 0.00 | 0.00 | 0.00 | 0.00 |

| Pseudo R2 | 0.0741 | 0.0794 | 0.0766 | 0.0815 |

| Number of observations | 75 | 75 | 75 | 75 |

| Impact Score | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Main independent variables | ||||

| Impact_investor_scale | 0.135 *** | 0.156 **** | −0.335 ** | −0.205 |

| (0.0497) | (0.0464) | (0.137) | (0.165) | |

| Gini_portfolio | −0.0269 | −0.377 ** | −0.0218 | −0.356 * |

| (0.104) | (0.177) | (0.101) | (0.182) | |

| SPI_investor | −0.00407 | −0.00410 | −0.0409 *** | −0.0322 ** |

| (0.00678) | (0.00616) | (0.0144) | (0.0154) | |

| Exits | 0.0436 | 0.0268 | 0.0537 | 0.0355 |

| (0.0492) | (0.0446) | (0.0513) | (0.0471) | |

| Portfolio_size | 0.00741 | 0.00930 * | 0.00544 | 0.00770 |

| (0.00699) | (0.00547) | (0.00654) | (0.00560) | |

| Technology_intensity | −0.0379 | −0.203 | −0.0585 | −0.211 |

| (0.320) | (0.335) | (0.324) | (0.332) | |

| Impact_investor_scale x Gini_portfolio | 0.0838 ** | 0.0790 ** | ||

| (0.0365) | (0.0374) | |||

| Impact_investor_scale x SPI_investor | 0.00559 *** | 0.00428 * | ||

| (0.00215) | (0.00233) | |||

| Constant | −0.662 | −0.642 | 2.453 *** | 1.737 * |

| (0.592) | (0.513) | (0.893) | (1.007) | |

| Model diagnostics | ||||

| Loglikelihood | 10.23 | 19.37 | 20.84 | 24.33 |

| Chi-squared | 0.1154 | 0.0222 | 0.0134 | 0.0184 |

| Pseudo R2 | 0.0514 | 0.0718 | 0.0579 | 0.0755 |

| Number of observations | 38 | 38 | 38 | 38 |

| US_Investor | Observations | Rank Sum | Expected |

|---|---|---|---|

| 0 | 38 | 1525.5 | 1501.5 |

| 1 | 37 | 1400.5 | 1424.5 |

| Combined | 75 | 2926 | 2926 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Boni, L.; Toschi, L.; Fini, R. Investors’ Aspirations toward Social Impact: A Portfolio-Based Analysis. Sustainability 2021, 13, 5293. https://doi.org/10.3390/su13095293

Boni L, Toschi L, Fini R. Investors’ Aspirations toward Social Impact: A Portfolio-Based Analysis. Sustainability. 2021; 13(9):5293. https://doi.org/10.3390/su13095293

Chicago/Turabian StyleBoni, Leonardo, Laura Toschi, and Riccardo Fini. 2021. "Investors’ Aspirations toward Social Impact: A Portfolio-Based Analysis" Sustainability 13, no. 9: 5293. https://doi.org/10.3390/su13095293

APA StyleBoni, L., Toschi, L., & Fini, R. (2021). Investors’ Aspirations toward Social Impact: A Portfolio-Based Analysis. Sustainability, 13(9), 5293. https://doi.org/10.3390/su13095293