1. Introduction

Sustainability is a business strategy for generating long-term value by considering how a company functions in terms of the environment’s ecological, social, and economic factors. Such strategy aims to have a beneficial impact on one or both areas, thereby contributing to solving some of the world’s most ongoing issues. The sustainability concept established various measures, thus promoting company’s sustainability [

1,

2]. Over the years, intellectual capital has been the focus of intense discussion among researchers. Furthermore, intellectual capital is a resource that allows the sustainable progression. Intellectual capital consists of human capital, structural capital, and relational capital. Various past studies examined the influence of intellectual capital on the company’s performance and competitive advantages. Earlier reports revealed a positive correlation amid intellectual capital and sustainable growth [

3]. Additionally, some research determined how businesses use their intellectual capital to move toward more sustainable practices [

4]. It was shown that intellectual capital has a strong impact on an enterprise’s competitiveness and long-term sustainability [

5]. Intellectual capital definitions have various representations, which depend on their scales. Most researchers in the field of intellectual capital have reached a general consensus that intellectual capital provides additional benefits or items that are simple to understand by its employees. In this perception, the present study for the first time presents intellectual capital as an intangible asset that generates value for acquiring wealth [

6].

The majority of the studies conducted in the field of intellectual capital included the component of human capital, which can be considered as the most important component of intellectual capital [

7]. Some scholars’ viewed human capital as both implicit and explicit knowledge that can produce values to the firm [

8]. Human capital can be a catalyst for creating growth and competitive advantages and increase firm profitability [

9]. Earlier study defined structural capital as the non-human storehouse of knowledge in the organization at an early stage [

10]. Meanwhile, other studies viewed structural capital as non-physical assets, like databases, organization charts, management processes, and business strategies [

11,

12]. The main objective of structural capital is to collect and transmit information throughout an organization, allowing for interaction with others [

13,

14]. On the other hand, relational capital contained knowledge implied in all the external relationships a firm could evolve with its stakeholders, such as customers, suppliers, and trading partners, who enhance the firms in gaining a sustainable competitive advantage [

10]. Various past studies classified intellectual capital into three dimensions (human, structural, and relational capital) [

15,

16,

17,

18]. A significant correlation between intellectual capital components and firm high values was reported that eventually generates implications for firms [

19].

Over the last two decades, the impact of intellectual capital on the firm performance emerged as a recurring theme in economic growth research, particularly in the context of SMEs. Nonetheless, few studies were conducted to address the important function of intellectual capital on firm performance in the manufacturing sector [

20], especially those operating in Malaysia [

21].

Table 1 summarizes the findings of the past studies conducted to examine the impact of intellectual capital on firm performance in manufacturing sector in different countries, including Malaysia. The majority of the studies conducted in the manufacturing sector were in China and Pakistan, whereas only one study was conducted in one manufacturing sub-sector in Malaysia in the past five years.

Most Malaysian SMEs continue to use traditional performance measurement methods designed decades ago, involving mostly tangible assets, like buildings and equipment. Currently, Malaysia and many other countries have been establishing a knowledge-based business environment requiring a new model that includes intangible assets. Therefore, the intellectual capital model is getting more attention in this scenario. Despite significant contribution towards GPD, the Malaysian SMEs faced numerous challenges in their day-to-day operations. Although they play sizable roles in economic improvement, the social uplifting and political instability in Malaysia lowered the SME’s contribution to the growth domestic product (GDP) development compared to other SMEs in developing or developed countries [

33]. In brief, the SMEs in Malaysia are not gaining beneficial performance wherein the SMEs contribution toward GDP is merely 32.7% (SME Corp, 2018/2019). Compared to other emerging nations, the Malaysian SMEs’ contribution towards the nation’s GDP is comparatively lower [

33]. Malaysian SMEs’ GDP contribution dropped significantly from 21.7 in 2014 to 20.1 in 2018 (

Figure 1). Some studies indicated that the manufacturing sector’s financial performance over the past few years is low due to their marginal contribution to the nation’ GDP (SME Corp, 2014–2018/2019). The low performance of Malaysian manufacturing SMEs during 2014–2018 enable us to determine the factors that can increase their performance.

Since manufacturing SMEs are the second-largest contributor toward Malaysian GDP after the service sector, it considered as an important sector to the nation’s economy. In recent times, the declining trends in the Malaysian manufacturing SMEs showed a significant impact on the overall economy. Malaysian manufacturing SMEs faced a major problem in terms of GDP contribution together with services or constructions. Thus, the current study considered as a significant contrition to address this issue. Hence, a careful study must be conducted to address the performance dealing issues of manufacturing SMEs and their low contribution to Malaysian GDP [

21,

34]. Past study has indicated that a lack of information is one of the factors that can contribute to the manufacturing SMEs’ low performance [

35]. Nonetheless, high competition has forced various manufacturing SMEs in Malaysia to utilize intangible resources for survival and financially sustenance. Manufacturing SMEs faced intense market pressure, increasing technical progress, shorter product life cycle, and increasing changes in the consumer needs. These challenges caused the manufacturing SMEs to move away from mass production to customization options, where consumer awareness became important [

36]. Depending on these factors, this work analyzed the impacts of various key components of intellectual capital. The study’s contrition was to develop a theoretical framework in the intellectual capital area, which has never conducted before in the manufacturing sector perspective, especially in Malaysia, to address the lack of previous studies. The main motive to conduct this study was the need of an urgent research to address the issue of low contribution of manufacturing sector toward the nation’s GDP [

21]. Moreover, past studies have not addressed these issues from intellectual capital-firm performance perspective. Furthermore, intellectual capital has been addresses to solve many issues regarding firm performance [

21,

37]. Likewise, a good and unambiguous correlation amid intellectual capital and firm performances was found in a meta-analysis of 159 studies wherein the aim was to examine the relationship between intellectual capital and performance [

30].

The interaction between human capital, structural capital, and relational capital was explored to determine the strong impact of intellectual capital on the firm performance. Finally, the role of innovation capability as a mediating variable in the relationship between intellectual capital and firm performance was investigated.

Present study investigated the relationship between intellectual capital, innovation capability, and firm performance in manufacturing SMEs in Malaysia. Thus, the following research questions were addressed in the study.

Is there a positive relationship between intellectual capital and innovation capability?

Is there a positive relationship between innovation capability and firm performance?

Is there a positive relationship between intellectual capital and firm performance?

Does innovation capability mediate the intellectual capital and firm performance correlation?

2. Theoretical Framework and Literature Review

The capacity of a firm to generate new ideas and implementing them into new goods or services that improve the firm’s performance is referred to as innovation capability. A human-capital-supported firm becomes more creative by developing new capabilities and ideas that meet the market needs. Upon paying more attention to human capital investment, an organization’s potential for creativity can dramatically influence the innovation capability [

38]. As a result, high human capital made it easier for businesses to reach better levels of innovation capability, thus overcoming all possible challenges with their innovation plans. The importance of structural capital lies in the firm’s information technology-based systems that play a vital role in supporting the firm performance [

27]. When businesses place a premium on structural capital’s role in the innovation, they will benefit from improved knowledge-gathering, storage, sharing, and application of infrastructures [

9]. In addition, their ability to do the right thing in the proper way would gradually improve, resulting in improved quality, lower costs, and a more in-depth understanding that might contribute to organizational success [

39]

Conversely, structural capital may include guidance to avoid unnecessary innovation operations that can boost employees profitability and income generation [

40,

41]. Relational capital are resources that connect the firms with other parties such as governments and industries [

42,

43]. A firm’s potential to innovate can be enhanced through heavy investment in relational capital. The emergence and implementation of relational capital significantly contribute to the formation of circumstances that enable a corporation and its surrounding subjects to initiate, innovate, build, and maintain interactions amongst members of a specific organization [

44]. Firms with greater relational capital have access to technological information that is difficult to duplicate. In this view, relational capital techniques are critical in establishing an organization’s strategic plans in order to improve the innovation processes [

45,

46]. Organizations become more effective and profitable by investing heavily in relational capital, thus supporting the creation of innovative processes [

47].

By definition, through the innovation capacity a firm is capable of identifying novel concepts and then transforms these ideas into newfangled products and services, thus improving the company’s performance. Alternatively, performance of a firm is characterized by its capacity to accomplish excellent economic benefits, such as revenue generation, profits, lowering of products’ cost, enhancing sales, and assets return. Moreover, a firm with a substantial innovation capability can drive it into a high level of competitive advantages, thereby enhancing its performance by improving the process of innovating new ideas and processes that competitors cannot imitate. Earlier reports demonstrated that the innovation capability is a significant factor that can develop valuable resources into products, thus leading to the sustainable competitive advantages and superior performance of a firm [

48,

49]. Considering such benefits of achieving high performance of the firm, the innovation capability has gained much attention in the literature and addressed many issues [

50,

51].

Intellectual capital is the value of the firm’s employee expertise, skills, business training, or any proprietary information that may give the company a competitive advantage. Intellectual capital is a valuable resource and can be defined broadly as a company’s collection of all informational resources that can be used to increase revenues, attract new consumers, develop new products, or improve the business [

52]. Moreover, intellectual capital is the sum of a company’s employee skills, organizational processes, and other intangibles that contribute to the firm’s profits. Several extensive reviews in the intellectual capital’s field were carried out [

10,

53,

54,

55]. Even so, a substantial study on the three dimensions of intellectual capital framework, including human capital, structural capital, and relational capital, has been conducted intensively.

According to past studies, firms having higher intellectual capital display higher competency to innovating and increasing the performances. However, several studies assumed that high performance could be sustained via developing intellectual capital [

29,

46]. Earlier researches in the developing economies found that intellectual capital is an important source of competitive advantage for organizations [

8,

42,

46] that increase the firm’s performance. Hence, manufacturing SMEs in Malaysia should apply these strategies to penetrate and achieve market advantages, thus leading to superior firm performance. It is hoped that the findings of this study can assist the manufacturing firms in building intellectual capital to achieve improved firm performance deficient in the earlier works [

56]. Effective management is also important in administrating intellectual capital within the SMEs. Several scholars have emphasized the importance of developing a modern perspective to improve the firm’s performance [

11,

25].

Earlier investigations highlighted the relationship between intellectual capital on firm performance [

3,

8,

10]. Future research must examine whether there are any factors that can mediate the relationship between intellectual capital and firm performance [

30]. In the past, the role of innovation capability on intellectual capital and varied contributions on firm’s performance was examined [

30]. Furthermore, several mediating role between intellectual capital and performances were identified [

57]. For example, one study looked at the mediating influence on total quality management (TQM) practices and innovation performance. The impact of intellectual capital and strategic orientations on innovation capability and firm performance in Malaysian information and communication technology (ICT) SMEs was focused [

58]. In addition, the link between intellectual capital, innovation capability, and firm performance was determined [

59].

6. Discussion

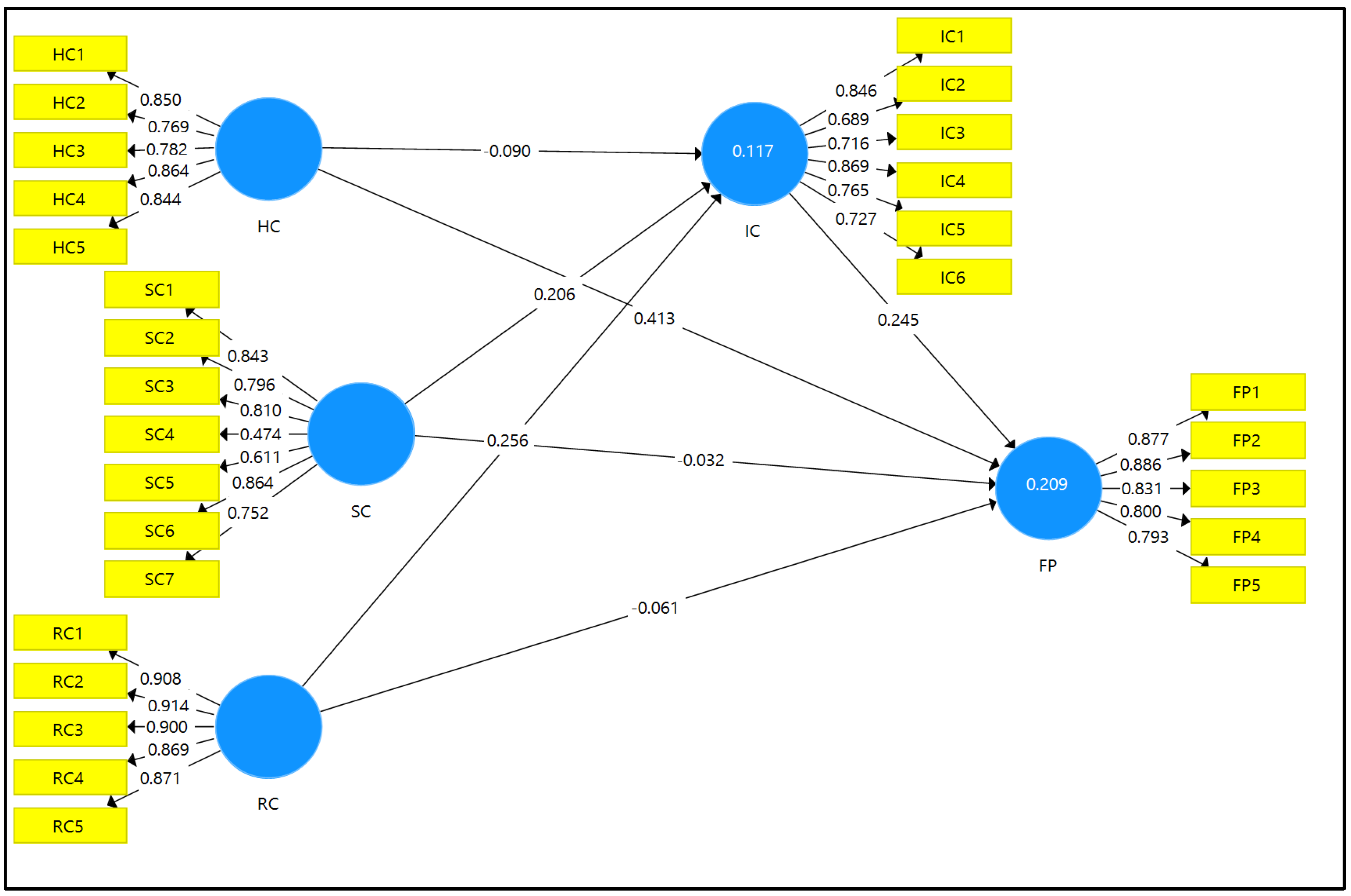

In this study, various hypotheses were developed to determine whether the intellectual capital components show a positive correlation to innovation capability and firm performance, which has been tested with the first and third hypotheses. The results of structural capital and relational capital relationship with innovation capability for H1b (

t-value = 2.936) and H1c (

t-value = 4.057) was strongly supported. Present results are in good agreed well with the reported findings that affirmed the positive role of structural capital and relational capital in enhancing the innovation capability [

40,

64,

66,

67,

69]. In addition, earlier works showed a strong correlation among relational capital and innovation capability [

46,

71,

72,

108]. These results support the assumption of (RBV) theory where effect utilization of internal resources enhanced competitive advantages for higher performance. This study was unable to support the human capital and innovation capability correlation (Hypothesis H1a). The obtained results (

t-value = 1.446) were consistent with past study that showed an insignificant human capital and innovation capability correlation [

109].

Innovation capability was tested in several contexts toward firm performance since innovation capability creates different benefits for SMEs. Among these benefits, and one of the most important ones, was the enhancement of firm performance. Furthermore, it was reaffirmed that firms’ high level of innovation capability generates higher firm performance in manufacturing SMEs in Malaysia rather than other factors. Hence, innovation capability has a significant positive relationship with firm performance H2 (

t-value = 4.223). The current results agreed well with the reported findings that affirmed a positive role of innovation capability in improving the firm performance [

48,

77,

78,

80,

110]. In short, we demonstrated that innovation capability plays a vital part in firms’ strategic considerations based on the assumption of (RBV) theory, which helped in enhancing the firm’s resources for higher competitive advantages and firm performance.

Regarding the direct relationship between the intellectual capital components and firm performance, it was reaffirmed that investing in human capital could improve firm performance in manufacturing SMEs in Malaysia rather than other intellectual capita; hence, only human capital has a significant and positive relationship on firm performance H3a (

t-value = 8.579). Present results reaffirmed a positive role of human capital in improving the firm performance [

42,

46,

84]. These results support and confirm the preposition of RBV theory, where human capital could be an effective resource in firms, leading to higher competitive advantages and superior performance [

110].

On the other hand, the relationship between structural and relational capital on firm performance was not significant for H3b (

t-value = 0.406) or H3c (

t-value = 1.027). These findings agreed well with other reports, reconfirming an insignificant correlation of structural capital [

24,

80,

111,

112,

113] and relational capital [

86,

87,

114,

115] with firm performance. Furthermore, a past study stated that enhanced innovation activities in firms will build a strong relationship with the customer; thus, the manufacturing firm’s capability will eventually improve firm performance directly [

29]. There must be a deliberate plan for gaining a competitive advantage in innovation capability. For example, the findings of this research highlighted the need for human capital to retain knowledgeable and skilled employees to foster innovation practices inside firms. In addition, those who are highly skilled and experienced have more extraordinary ability to create new ideas, which lead to an increase the firm performance. It was concluded that the strong effect of innovation capability on intellectual capital can enhance the performance of a firm, leading towards sustainable development. The last hypothesis of the current study, which was related to the innovation capability as a mediator, clearly showed that by enhancing the intellectual capital of the manufacturing firms, a high firm performance can be achieved through the application of the innovation capability.

The current results supported the mediation hypotheses of innovation capability (H4b and H4c: t-value = 2.147 and 2.994, respectively). Despite the non-significant relationship between structural and relational capital on firm performance (H3b and H3c: t-value = 0.406 and 1.027, respectively), innovation capability as a mediator had an important role in enhancing this relationship for better performance, which affirms the presumption of RBV theory. The results show that manufacturing SMEs in Malaysia have governing reconfiguring insinuations for structural capital and relational capital. Additionally, the results show the importance of the connection between intellectual capital and firm performance mediated by innovation capability. In contrast, the study was unable to find enough evidence to support the mediating role of innovation capability between human capital and firm performance (t-value = 1.239); thus, H4a was not supported since no statistical evidence shows a significant relationship between human capital and innovation capability (t-value= 1.446). Therefore, this result was reasonable.

The obtained results revealed a noteworthy effect of innovation capability between the study’s concepts that concentrated on intellectual capital utilization. The current findings identified innovation as a capability that reduces the negative effects of increasing intellectual capital on manufacturing firm performance. As a result, it was underlined that the firm’s ability to restructure itself is closely related to its economic benefits. Thus, it is suggested that a planned strategy must be employed to obtain a favorable situation of intellectual capital. For instance, to become innovative in the rapidly altering business setting, a firm’s intellectual capital needs no plans for the firm for adjustments, like supplier and customer relationships, knowledge of properties, market stability, and competitors, that allow creating a value within and outside the firm [

114]. According to the study results, the research revealed a strategy for improving the intellectual capital of manufacturing SMEs in Malaysia looking to expand their core competency and gain the competitive advantages. The results agreed with the reported works [

21,

29].

6.1. Research Contribution

The present work contributed in terms of new knowledge related to intellectual capital and firm performance correlation. The study contribution was through measuring the intellectual capital resources in Malaysian manufacturing SMEs. Additionally, the study also attained the intellectual capital factors influencing and enhancing firm performance. The study concluded that the relationship between manufacturing firm’s intellectual capital and non-tangible assets is beneficial. The current study findings in the context of manufacturing SMEs in Malaysia are attributed to this disclosure. The current study enhances the knowledge and understanding regarding the influence of innovation capability as a mediator between intellectual capital and firm performance in Malaysian manufacturing firms. This result was highly supported by the assumption of resource-based view (RBV) theory that suitable utilization of firm intellectual resources will lead to highly competitive advantages for better performance. Moreover, the current study’s results expanded the knowledge of RBV theory by providing empirical evidence that intellectual capital enhance and improve the performance of the firm as well as the mediation role of innovation capability for stronger relationships. The study also explored the influence of innovation capability on a manufacturing firm’s intellectual capital into one single model and re-confirmed what was initially assumed to be stable. However, most previous studies in the context of intellectual capital and firm performance have addressed the issues in various sectors around the world. Hence, very limited studies conduct the same framework to explore the issue of the performance decline of manufacturing SMEs in Malaysia [

21]. However, this study focused on the declining of the manufacturing sector contribution toward the country’s GDP.

6.2. Research Implications

This research revealed the importance of intellectual capital in the manufacturing industry, mainly manufacturing SMEs in Malaysia. The development of intellectual capital can assist in the manufacturing sector’s firm performance. Consequently, the influence of various vital factors of intellectual capital that are responsible for the weak correlation among intellectual capital and indicators of firm performance in the Malaysian manufacturing SMEs were examined. These factors were shown to have a significant impact on national financial policies. Furthermore, the findings and analysis demonstrated some practical contributions to the mentioned topic. First, the study found that more emphasis on intellectual capital and innovation activities in manufacturing SMEs is required. However, it revealed some significant managerial implications for integrating intellectual capital and innovation capability, demonstrating that the two notions have a causal relationship.

This main finding of this work indicated that increased intellectual capital that results from innovation capability accumulation can have a significant impact on firm performance with significant practical implications. According to earlier studies, the firm’s performance is evaluated in terms of the firm’s internal resources; therefore, keeping employees with high knowledge capital and skills rather than a high number of employees is more important for the firm’s survival. Intellectual capital can help to improve the resolutions and decisions taken by the firm. The ability to innovate demonstrates a focus on intelligent knowledge management. Essential resources, such as knowledge creation, are internalized or employed differently in different stages and activities in this way. The current disclosure confirmed that intellectual capital-based success is a vital component and requirement in every firm’s sustainability. However, this could be one method for raising the profile of intellectual capital utilization in the manufacturing industry while also providing a consistent platform for stakeholders to better utilize intellectual capital assets. This argument can help owners/managers design successful and practical plans in competitive markets, giving academics more information about the relationship between intellectual capital and firm performance. In order to achieve a high degree of firm performance, researchers must examine the integration of intellectual capital and innovation capability, particularly in the manufacturing sector.

This study provided valuable information and strategy for owner/managers of manufacturing SMEs, academics, and policymakers to follow. Moreover, researchers, business owners, and policymakers all agreed on the necessity of taking a more active role in fostering the creation of intellectual capital in their firms. The study’s framework will enable them to obtain meaningful and practical measurements for identifying intellectual capital in multi-dimensional connections. According to the current study, manufacturing firms might acquire precise norms for recognizing and growing their strategic resources and skills [

29]. However, when it comes to innovation practices contribution, analytical methods are typically used to monitor and assess the research context and performance. As a result, it is proposed that relevant collaboration, whether on an academic or business level, may be necessary to detect the right timing for manufacturing SMEs success. It was concluded that innovation capability mainly concentrates on generating new ideas for products or services in order to enhance the firm performance.

6.3. Limitations and Recommendation for Future Studies

Nowadays, manufacturing firms are facing various challenges regarding environmental and market changes. In this case, valuable resources in firms, like intellectual capital, are assimilated or used in various ways at different stages and activities. However, the integration of intellectual capital and innovation activates proved to be an essential resource in manufacturing firms to enhance performance. This could be one method for raising the profile of intellectual capital utilization in the manufacturing SMEs in Malaysia while also providing a consistent platform for owner/managers to better exploit intellectual capital property’s potential. This assertion can help manufacturing owner/managers design winning and realistic strategies in the competitive market scenarios, giving academics more information about the relationship between intellectual capital and firm performance. In order to achieve a high level of firm performance, future researchers are highly recommended to examine the integration of intellectual capital and innovation capabilities, particularly in the manufacturing sector. Future research could also examine other factors that could influence intellectual capital and innovation capabilities or intellectual capital against firm performance. Future research could also examine other mediating or moderating factors that could enhance present study theoretical framework. The present study was limited to one single country, and therefore, the findings cannot be generalized to other countries; thus, future studies could force on other countries than Malaysia. Future research could assess the mechanism through which firm sustainability-orientation innovation capability and research and investment decision affect firm sustainable innovation and financial performance [

115,

116]. Moreover, the study was based on a cross-sectional designed to access the causal relationship of the variable.

6.4. Conclusions

This study reaffirmed that in the competitive market scenarios, intellectual capital plays a paramount role to improving the firm’s innovation capabilities and subsequently increasing the firm’s performance. Additionally, this work addressed the previous research gaps and bridged them. The role of manufacturing SMEs’ firm performance in Malaysian growth of intellectual capital resources was explored for the first time. The main limitation was related to identifying the internal capabilities and resources in enhancing the performance in developing countries especially in Malaysia, which was grounded under the resource-based view. Previous researchers did not fully explore the impact of innovation capability on the firm’s performance in the Malaysian manufacturing sector. With this perception, we determined the critical role of innovation capability as a mediator, which disclosed that the innovation capability can enhance and strengthen the relationship between intellectual capital and firm performance of manufacturing SMEs in Malaysia. It was suggested that the owners and managers of manufacturing SMEs must invest more to enhance and develop the internal resources in firms, thus recognizing the problems and tendencies. It was demonstrated that in order to enhance the performance of the firms, managers should implement a new strategy to improve their daily routines and action to move the firms into a higher level of financial growth [

29]. The findings strongly supported the role of intellectual capital and innovation capability in achieving better firm’s performance [

117,

118]. Overall, our results are consistent with the reported state-of-the-art reported works. It was asserted that the difficulty of assessing intellectual capital components that affects performance of the Malaysian manufacturing SMEs must be surmounted; thus, future pilot studies are worth performing [

21,

29].