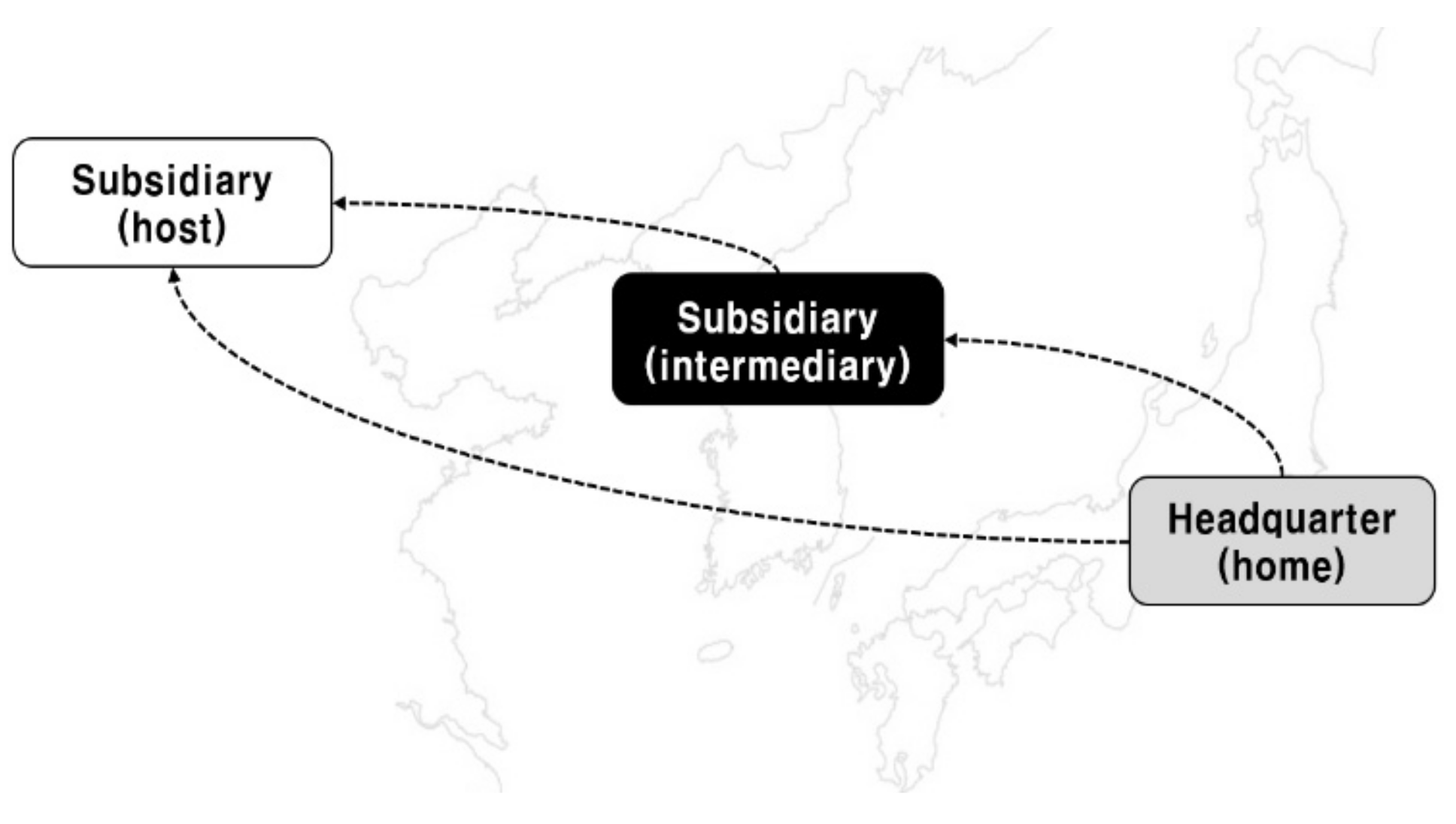

Determinants of Staff Localization in Headquarters-Subsidiary-Subsidiary Relationships

Abstract

:1. Introduction

2. Background and Hypothesis Development

2.1. Local Responsiveness and Staff Localization of MNEs

2.2. Cultural Distance

2.3. Hypothesis Development

3. Sample and Methods

3.1. Data Source

3.2. Measurement

3.2.1. Dependent Variable

3.2.2. Explanatory Variables

3.2.3. Control Variables

3.3. Methodology

4. Results

5. Discussion

5.1. Implications

5.2. Limitations

5.3. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kogut, B.; Singh, H. The effect of national culture on the choice of entry mode. J. Int. Mark. 1988, 19, 411–432. Available online: https://www.jstor.org/stable/155133 (accessed on 1 October 2021). [CrossRef]

- Xu, D.; Shenkar, O. Institutional Distance and the Multinational Enterprise. Acad. Manag. Rev. 2002, 27, 608–618. Available online: https://www.jstor.org/stable/4134406 (accessed on 1 October 2021). [CrossRef]

- Beugelsdijk, S.; Kostova, T.; Kunst, V.E.; Spadafora, E.; van Essen, M. Cultural Distance and Firm Internationalization: A Meta-Analytical Review and Theoretical Implications. J. Manag. 2018, 44, 89–130. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Belderbos, R.; Du, H.S.; Goerzen, A. Global cities, connectivity, and the location choice of MNE regional headquarters. J. Manag. Stud. 2017, 54, 1271–1302. [Google Scholar] [CrossRef] [Green Version]

- James, B.E.; Sawant, R.J.; Bendickson, J.S. Emerging market multinationals’ firm-specific advantages, institutional distance, and foreign acquisition location choice. Int. Bus. Rev. 2020, 29, 101702. [Google Scholar] [CrossRef]

- Brouthers, K.D. Institutional, cultural and transaction cost influences on entry mode choice and performance. J. Int. Bus. Stud. 2002, 33, 203–221. Available online: https://www.jstor.org/stable/3069541 (accessed on 1 October 2021). [CrossRef]

- Quer, D.; Claver, E.; Rienda, L. Political risk, cultural distance, and outward foreign direct investment: Empirical evidence from large Chinese firms. Asia Pac. J. Manag. 2012, 29, 1089–1104. [Google Scholar] [CrossRef]

- Busse, M.; Hefeker, C. Political risk, institutions and foreign direct investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef] [Green Version]

- Ambos, T.C.; Fuchs, S.H.; Zimmermann, A. Managing interrelated tensions in headquarters–subsidiary relationships: The case of a multinational hybrid organization. J. Int. Bus. Stud. 2020, 51, 906–932. [Google Scholar] [CrossRef] [Green Version]

- Slangen, A.H. A communication-based theory of the choice between greenfield and acquisition entry. J. Manag. Stud. 2011, 48, 1699–1726. [Google Scholar] [CrossRef]

- Chang, Y.C.; Kao, M.S.; Kuo, A.; Chiu, C.F. How cultural distance influences entry mode choice: The contingent role of host country’s governance quality. J. Bus. Res. 2012, 65, 1160–1170. [Google Scholar] [CrossRef]

- Beugelsdijk, S.; Slangen, A.; Maseland, R.; Onrust, M. The impact of home–host cultural distance on foreign affiliate sales: The moderating role of cultural variation within host countries. J. Bus. Res. 2014, 67, 1638–1646. [Google Scholar] [CrossRef]

- Franco, S. The influence of the external and internal environments of multinational enterprises on the sustainability commitment of their subsidiaries: A cluster analysis. J. Clean. Prod. 2021, 297, 126654. [Google Scholar] [CrossRef]

- Almond, P.; Edwards, T.; Kern, P.; Kim, K.; Tregaskis, O. Global norm-making processes in contemporary multinationals. Hum. Resour. Manag. J. 2021. [Google Scholar] [CrossRef]

- Eden, L.; Miller, S.R. Distance matters: Liability of foreignness, institutional distance and ownership strategy. Adv. Int. Manag. 2004, 16, 187–221. [Google Scholar] [CrossRef]

- Meyer, K.E.; Li, C.; Schotter, A.P. Managing the MNE subsidiary: Advancing a multi-level and dynamic research agenda. J. Int. Bus. 2020, 51, 1–39. [Google Scholar] [CrossRef] [Green Version]

- Gaur, A.S.; Lu, J.W. Ownership strategies and survival of foreign subsidiaries: Impacts of institutional distance and experience. J. Manag. Stud. 2007, 33, 84–110. [Google Scholar] [CrossRef] [Green Version]

- Fang, Y.; Jiang, G.L.F.; Makino, S.; Beamish, P.W. Multinational firm knowledge, use of expatriates, and foreign subsidiary performance. J. Manag. Stud. 2010, 47, 27–54. [Google Scholar] [CrossRef]

- Doz, Y.L.; Bartlett, C.A.; Prahalad, C.K. Global competitive pressures and host country demands managing tensions in MNEs. Calif. Manag. Rev. 1981, 23, 63–74. [Google Scholar] [CrossRef]

- Doz, Y.; Prahalad, C.K. Patterns of strategic control within multinational corporations. J. Int. Bus. Stud. 1984, 15, 55–72. Available online: https://www.jstor.org/stable/154232 (accessed on 1 October 2021). [CrossRef]

- Ghoshal, S.; Bartlett, C.A. The multinational corporation as an interorganizational network. Acad Manag. Rev. 1990, 15, 603–626. [Google Scholar] [CrossRef]

- Ghoshal, S.; Nohria, N. Internal differentiation within multinational corporations. Strateg. Manag. J. 1989, 10, 323–337. [Google Scholar] [CrossRef]

- Edwards, R.; Ahmad, A.; Moss, S. Subsidiary autonomy: The case of multinational subsidiaries in Malaysia. J. Int. Bus. Stud. 2002, 33, 183–191. Available online: https://www.jstor.org/stable/3069580 (accessed on 1 October 2021). [CrossRef]

- Prahalad, C.K.; Doz, Y.L. The Multinational Mission: Balancing Global Integration with Local Responsiveness; Free Press: New York, NY, USA, 1987; pp. 154–196. [Google Scholar]

- Spender, J.C.; Grevesen, W. The multinational enterprise as a loosely coupled system: The global integration–local responsiveness dilemma. Manag. Financ. 1999, 25, 63–84. [Google Scholar] [CrossRef]

- Kobrin, S.J. An empirical analysis of the determinants of global integration. Strateg. Manag. J. 1991, 12, 17–31. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Morrison, A.; Hulland, J. Structural and competitive determinants of a global integration strategy. Strateg. Manag. J. 1995, 16, 637–655. [Google Scholar] [CrossRef]

- Johnston, S.; Menguc, B. Subsidiary size and the level of subsidiary autonomy in multinational corporations: A quadratic model investigation of Australian subsidiaries. J. Int. Bus. Stud. 2007, 38, 787–801. Available online: https://www.jstor.org/stable/4540457 (accessed on 1 October 2021). [CrossRef]

- Slangen, A.H.; Hennart, J.F. Do multinationals really prefer to enter culturally distant countries through greenfields rather than through acquisitions? The role of parent experience and subsidiary autonomy. J. Int. Bus. Stud. 2008, 39, 472–490. [Google Scholar] [CrossRef] [Green Version]

- Wang, S.L.; Luo, Y.; Lu, X.; Sun, J.; Maksimov, V. Autonomy delegation to foreign subsidiaries: An enabling mechanism for emerging-market multinationals. J. Int. Bus. Stud. 2014, 45, 111–130. [Google Scholar] [CrossRef]

- Beugelsdijk, S.; Jindra, B. Product innovation and decision-making autonomy in subsidiaries of multinational companies. J. World Bus. 2018, 53, 529–539. [Google Scholar] [CrossRef]

- Dowling, P.J. Completing the Puzzle: Issues in the development of the field of international human resource management. Manag. Int. Rev. 1999, 15, 27. Available online: https://www.jstor.org/stable/40835829 (accessed on 1 October 2021).

- Delios, A.; Beamish, P.W. Survival and profitability: The roles of experience and intangible assets in foreign subsidiary performance. Acad. Manag. J. 2001, 44, 1028–1038. Available online: https://www.jstor.org/stable/3069446 (accessed on 1 October 2021).

- Luo, Y.; Peng, M.W. Learning to compete in a transition economy: Experience, environment, and performance. J. Int. Bus. Stud. 1999, 30, 269–295. Available online: https://www.jstor.org/stable/155313 (accessed on 1 October 2021). [CrossRef]

- Hennart, J.F. A transaction costs theory of equity joint ventures. Strateg. Manag. J. 1998, 9, 361–374. [Google Scholar] [CrossRef]

- Berry, H.; Sakakibara, M. Resource accumulation and overseas expansion by Japanese multinationals. J. Econ. Behav. Organ. 2008, 65, 277–302. [Google Scholar] [CrossRef]

- Hartmann, E.; Feisel, E.; Schober, H. Talent management of western MNCs in China: Balancing global integration and local responsiveness. J. World Bus. 2010, 45, 169–178. [Google Scholar] [CrossRef]

- Lasserre, P.P.S.P.; Ching, P.S. Human resources management in China and the localization challenge. J. Asia Bus. 1997, 13, 85–100. [Google Scholar]

- Rosenzweig, P.M.; Singh, J.V. Organizational environments and the multinational enterprise. Acad. Manag. Rev. 1991, 16, 340–361. [Google Scholar] [CrossRef]

- Chen, N.Y.F.; Tjosvold, D. Guanxi and leader member relationships between American managers and Chinese employees: Open-minded dialogue as mediator. Asia Pac. J. Manag. 2007, 24, 171–189. [Google Scholar] [CrossRef]

- Gong, Y. Subsidiary staffing in multinational enterprises: Agency, resources, and performance. Acad. Manag. J. 2003, 46, 728–739. [Google Scholar] [CrossRef]

- Gaur, A.S.; Delios, A.; Singh, K. Institutional environments, staffing strategies, and subsidiary performance. J. Manag. 2007, 33, 611–636. [Google Scholar] [CrossRef]

- Hofstede, G.; Van Deusen, C.A.; Mueller, C.B.; Charles, T.A.; The Business Goals Network. What goals do business leaders pursue? A Study in fifteen countries. J. Int. Bus. Stud. 2002, 33, 785–803. Available online: https://www.jstor.org/stable/3069594 (accessed on 1 October 2021). [CrossRef]

- Stöttinger, B.; Schlegelmilch, B.B. Explaining export development through psychic distance: Enlightening or elusive? Int. Mark. Rev. 1998, 15, 357–372. [Google Scholar] [CrossRef]

- Peng, M.W.; Wang, D.Y.L.; Jiang, Y. An institution-based view of international business strategy: A focus on emerging economies. J. Int. Bus. Stud. 2008, 39, 920–936. [Google Scholar] [CrossRef] [Green Version]

- Cui, G.; Chan, T.S.; Huang, S. Global Firms Competing Locally: Management Localization and Subsidiary Performance in China. In Multinationals and Global Consumers; The AIB Southeast Asia Series; Chan, T.S., Cui, G., Eds.; Palgrave Macmillan: London, UK, 2013. [Google Scholar] [CrossRef]

- Kang, Y.; Jiang, F. FDI Location Choice of Chinese Multinationals in East and Southeast Asia: Traditional Economic Factors and Institutional Perspective. J. World Bus. 2008, 47, 45–53. [Google Scholar] [CrossRef]

- Dunning, J.H.; Lundan, S.M. Institutions and the OLI paradigm of the multinational enterprise. Asia Pac. J. Manag. 2008, 25, 573–593. [Google Scholar] [CrossRef]

- Chan, C.M.; Makino, S. Legitimacy and multi-level institutional environments: Implications for foreign subsidiary ownership structure. J. Int. Bus. Stud. 2007, 38, 621–638. Available online: https://www.jstor.org/stable/4540446 (accessed on 1 October 2021). [CrossRef]

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. Available online: https://www.jstor.org/stable/3094458 (accessed on 1 October 2021). [CrossRef]

- Barkema, H.G.; Bell, J.H.; Pennings, J.M. Foreign entry, cultural barriers, and learning. Strateg. Manag. J. 1996, 17, 151–166. Available online: https://www.jstor.org/stable/2486854 (accessed on 1 October 2021). [CrossRef]

- Baik, Y.; Kim, H.; Park, Y.-R. Environmental Multi-dimensionality and Staff Localization in Multinational Enterprises: The Case of Korean Firms. Can. J. Adm. Sci. 2021, 38, 68–79. [Google Scholar] [CrossRef]

- Boyacigiller, N. The role of expatriates in the management of interdependence complexity and risk in multinational corporations. J. Int. Bus. Stud. 1990, 21, 357–381. Available online: https://www.jstor.org/stable/154951 (accessed on 1 October 2021). [CrossRef]

- Harzing, A.W.; Pudelko, M. Do We Need to Distance Ourselves from the Distance Concept? Why Home and Host Country Context Might Matter More Than (Cultural) Distance. Manag. Int. Rev. 2016, 56, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Petersen, B.; Pedersen, T. Coping with liability of foreignness: Different learning engagements of entrant firms. J. Int. Manag. 2002, 8, 339–350. [Google Scholar] [CrossRef] [Green Version]

- Singh, D.; Pattnaik, C.; Lee, J.Y.; Gaur, A.S. Subsidiary staffing, cultural friction, and subsidiary performance: Evidence from Korean subsidiaries in 63 countries. Hum. Resour. Manag. 2019, 58, 219–234. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.A.; Kim, H. International diversification: Effects on innovation and firm performance in product-diversified firms. Acad. Manag. J. 1997, 40, 767–798. Available online: https://www.jstor.org/stable/256948 (accessed on 1 October 2021).

- Chen, M.J.; Miller, D. West meets East: Toward an ambicultural approach to management. Acad. Manag. Perspect. 2010, 24, 17–24. [Google Scholar] [CrossRef]

- Gates, S.R.; Egelhoff, W.G. Centralization in headquarters–subsidiary relationships. J. Int. Bus. Stud. 1986, 17, 71–92. Available online: https://www.jstor.org/stable/154584 (accessed on 1 October 2021). [CrossRef]

- Song, J. Firm capabilities and technology ladders: Sequential foreign direct investments of Japanese electronics firms in East Asia. Strateg. Manag. J. 2002, 23, 191–210. Available online: https://www.jstor.org/stable/3094361 (accessed on 1 October 2021). [CrossRef]

- Miller, S.R.; Parkhe, A. Is there a liability of foreignness in global banking? An empirical test of banks’ X-efficiency. Strateg. Manag. J. 2002, 23, 55–75. Available online: https://www.jstor.org/stable/3094274 (accessed on 1 October 2021). [CrossRef]

- Cavusgil, S.T.; Zou, S. Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. J. Mark. 1994, 58, 1–21. [Google Scholar] [CrossRef]

- Edström, A.; Galbraith, J.R. Transfer of managers as a coordination and control strategy in multinational organizations. Adm. Sci. Q. 1977, 22, 248–263. [Google Scholar] [CrossRef]

- Child, J. A configurational analysis of international joint ventures. Organ. Stud. 2002, 23, 781–815. [Google Scholar] [CrossRef]

- He, Z.L.; Wong, P.K. Exploration vs. exploitation: An empirical test of the ambidexterity hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

| Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | LOCAL | 0.74 | 0.34 | 1.00 | ||||||||||

| 2 | LISTED (IM) | 0.3 | 0.46 | 0.00 | 1.00 | |||||||||

| 3 | AGE (IM) | 25.76 | 12.98 | 0.16 *** | 0.34 *** | 1.00 | ||||||||

| 4 | SIZE (IM) | 25.7 | 1.61 | 0.03 | 0.51 *** | 0.28 *** | 1.00 | |||||||

| 5 | MNF (IM) | 0.87 | 0.34 | 0.07 * | −0.07 * | −0.02 | −0.20 *** | 1.00 | ||||||

| 6 | SIZE (HS) | 16.64 | 1.34 | −0.01 | 0.23 *** | 0.16 *** | 0.54 *** | 0.06 | 1.00 | |||||

| 7 | MNF (HS) | 0.89 | 0.32 | 0.11 ** | −0.14 *** | 0.05 | −0.36 *** | 0.45 *** | 0.09 * | 1.00 | ||||

| 8 | WOS (HS) | 0.65 | 0.48 | −0.11 *** | 0.00 | −0.22 *** | −0.13 *** | −0.12 *** | −0.33 *** | −0.07 | 1.00 | |||

| 9 | CD (HM-IM) | 68.33 | 14.17 | 0.01 | 0.01 | −0.18 *** | −0.05 | −0.08 * | −0.12 *** | −0.04 | 0.09 * | 1.00 | ||

| 10 | CD (HM-HS) | 75.51 | 14.67 | 0.14 *** | 0.11 ** | 0.03 | 0.07 | −0.08 * | −0.16 *** | −0.03 | −0.04 | 0.31 *** | 1.00 | |

| 11 | LOCEXP | 6.78 | 4.1 | 0.05 | 0.15 *** | 0.26 *** | 0.14 *** | 0.02 | 0.21 *** | −0.01 | −0.10 ** | −0.03 | −0.20 *** | 1.00 |

| 12 | CMPTN | 2.74 | 0.76 | 0.07 * | 0.04 | 0.23 *** | −0.08 * | 0.04 | −0.14 *** | 0.01 | 0.01 | −0.12 *** | −0.03 | 0.13 *** |

| DV: LOCAL | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| LISTED (IM) | −0.043 | −0.048 | −0.054 | −0.044 | −0.050 |

| (0.061) | (0.060) | (0.059) | (0.060) | (0.059) | |

| AGE (IM) | 0.004 ** | 0.004 ** | 0.004 * | 0.004 ** | 0.004 ** |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| SIZE (IM) | 0.030 | 0.027 | 0.028 | 0.025 | 0.026 |

| (0.020) | (0.020) | (0.020) | (0.020) | (0.020) | |

| MNF (IM) | 0.041 | 0.043 | 0.033 | 0.042 | 0.031 |

| (0.071) | (0.071) | (0.070) | (0.071) | (0.069) | |

| SIZE (HS) | −0.031 * | −0.026 | −0.029 | −0.024 | −0.027 |

| (0.019) | (0.019) | (0.019) | (0.019) | (0.019) | |

| MNF (HS) | 0.226 *** | 0.215 *** | 0.236 *** | 0.213 *** | 0.236 *** |

| (0.075) | (0.075) | (0.075) | (0.075) | (0.074) | |

| WOS (HS) | −0.077 | −0.069 | −0.071 | −0.071 | −0.073 |

| (0.050) | (0.050) | (0.049) | (0.050) | (0.049) | |

| CD (HM-IM) | 0.001 | 0.000 | 0.001 | −0.000 | 0.000 |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| CD (HM-HS) | 0.002 | 0.001 | 0.002 | 0.001 | |

| (0.001) | (0.002) | (0.002) | (0.002) | ||

| LOCEXP | 0.010 * | 0.010 * | |||

| (0.005) | (0.005) | ||||

| CD (HM-HS) * LOCEXP | 0.037 ** | 0.042 *** | |||

| (0.015) | (0.015) | ||||

| CMPTN | −0.002 | −0.003 | |||

| (0.020) | (0.020) | ||||

| CD (HM-HS) * CMPTN | −0.036 ** | −0.042 ** | |||

| (0.017) | (0.017) | ||||

| Constant | 0.128 | 0.046 | 0.045 | 0.062 | 0.065 |

| (0.475) | (0.478) | (0.470) | (0.489) | (0.479) | |

| N Chi2 | 520 | 520 | 520 | 520 | 520 |

| 23.39861 | 24.96160 | 34.43298 | 29.64265 | 41.08551 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, C.B.; Choi, S.-J.; Zhang, L. Determinants of Staff Localization in Headquarters-Subsidiary-Subsidiary Relationships. Sustainability 2022, 14, 249. https://doi.org/10.3390/su14010249

Kim CB, Choi S-J, Zhang L. Determinants of Staff Localization in Headquarters-Subsidiary-Subsidiary Relationships. Sustainability. 2022; 14(1):249. https://doi.org/10.3390/su14010249

Chicago/Turabian StyleKim, Chan Bok, Seong-Jin Choi, and Luyao Zhang. 2022. "Determinants of Staff Localization in Headquarters-Subsidiary-Subsidiary Relationships" Sustainability 14, no. 1: 249. https://doi.org/10.3390/su14010249