Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia

Abstract

:1. Introduction

2. Literature Review

2.1. Sustainability of Investments and ESG Themes and Issues

2.2. Financial Literacy Improvement as Financial Well-Being Factor

2.3. Investors’ Attitudes toward ESG Investing and Financial Well-Being under COVID-19

3. Results

3.1. Data and Research Methodology

3.2. Research Results and Discussion

- whether the improvement of the level of financial literacy since the beginning of 2020 depends on the level of education, income level and savings/investment experience of the Latvian population;

- whether the increase in the desire to create savings and to invest since the beginning of 2020 depends on the level of education, income level and savings/investment experience of the Latvian population;

- whether the willingness to invest in the field of ESG depends on the level of education, income level and savings/investment experience of the Latvian population.

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tseng, M.L.; Tan, P.A.; Jeng, S.Y.; Lin, C.W.R.; Negash, Y.T.; Darsono, S.N.A.C. Sustainable Investment: Interrelated among Corporate Governance, Economic Performance and Market Risks Using Investor Preference Approach. Sustainability 2019, 11, 2108. [Google Scholar] [CrossRef] [Green Version]

- Badía, G.; Pina, V.; Torres, L. Financial Performance of Government Bond Portfolios Based on Environmental, Social and Governance Criteria. Sustainability 2019, 11, 2514. [Google Scholar] [CrossRef] [Green Version]

- United Nations Development Programme, 2015. Available online: https://www.undp.org/sustainable-development-goals. (accessed on 11 March 2021).

- OECD’s Global Relations—Making OECD Standards and Policies Count on a Global Scale. Available online: https://www.oecd.org/mcm/2020/C-MIN-2020-4.en.pdf (accessed on 23 April 2021).

- Silinskas, G.; Ranta, M.; Wilska, T.A. Financial Behaviour under Economic Strain in Different Age Groups: Predictors and Change across 20 Years. J. Consum. Policy 2021, 44, 235–257. [Google Scholar] [CrossRef]

- Palma-Ruiz, J.M.; Castillo-Apraiz, J.; Gómez-Martínez, R. Socially responsible investing as a competitive strategy for trading companies in times of upheaval amid COVID-19: Evidence from Spain. Int. J. Financ. Stud. 2020, 8, 41. [Google Scholar] [CrossRef]

- Diez-Cañamero, B.; Bishara, T.; Otegi-Olaso, J.R.; Minguez, R.; Fernández, J.M. Measurement of Corporate Social Responsibility: A Review of Corporate Sustainability Indexes, Rankings and Ratings. Sustainability 2020, 12, 2153. [Google Scholar] [CrossRef] [Green Version]

- Govindan, K.; Kilic, M.; Uyar, A.; Karaman, A.S. Drivers and value-relevance of CSR performance in the logistics sector: A cross-country firm-level investigation. Int. J. Prod. Econ. 2021, 231, 107835. [Google Scholar] [CrossRef]

- Umar, Z.; Kenourgios, D.; Papathanasiou, S. The static and dynamic connectedness of environmental, social, and governance investments: International evidence. Econ. Model. 2020, 93, 112–124. [Google Scholar] [CrossRef] [PubMed]

- Mavlutova, I.; Titova, S.; Fomins, A. Pension System in Changing Economic Environment: Case of Latvia. Procedia Econ. Financ. 2016, 39, 219–228. [Google Scholar] [CrossRef] [Green Version]

- Ciemleja, G.; Lace, N.; Titko, J. Financial literacy as a prerequisite for citizens’ economic security: Development of a measurement instrument. J. Secur. Sustain. Issues 2014, 4, 29–40. [Google Scholar] [CrossRef] [Green Version]

- Dimante, D.; Tambovceva, T.; Atstaja, D. Raising environmental awareness through education. Int. J. Contin. Eng. Educ. Life-Long Learn. 2016, 26, 259–272. [Google Scholar] [CrossRef]

- Arefjevs, I.; Spilbergs, A.; Natrins, A.; Verdenhofs, A.; Mavlutova, I.; Volkova, T. Financial Sector Evolution and Competencies Development in the Context of Information and Communication Technologies Research for Rural Development 2020. In Proceedings of the Proceedings 26th Annual International Scientific Conference “Research for Rural Development 2020”, Jelgava, Latvia, 13–15 May 2020; Volume 35, pp. 260–267. Available online: http://www2.llu.lv/research_conf/proceedings.htm (accessed on 20 August 2021). [CrossRef]

- Atstaja, D.; Susniene, R.; Jarvis, M. The Role of Economics in Education for Sustainable Development. The Baltic States’ Experience. Int. J. Econ. Sci. 2017, 6, 1–29. [Google Scholar] [CrossRef] [Green Version]

- Lesinskis, K.; Mavlutova, I.; Peiseniece, L.; Hermanis, J.; Peiseniece, E.; Pokatayeva, O. Modern Business Teaching: The Stable Market Provisions for Emerging Generations. J. Stud. Appl. Econ. 2021, 39, 1–7. [Google Scholar] [CrossRef]

- Uvarova, I.; Mavlutova, I.; Atstaja, D. Development of the green entrepreneurial mindset through modern entrepreneurship education. IOP Conf. Series Earth Environ. Sci. 2020, 628, 1–13. [Google Scholar] [CrossRef]

- Bengtsson, E. A History of Scandinavian Socially Responsible Investing. J. Bus. Ethics 2008, 82, 969–983. [Google Scholar] [CrossRef]

- Yan, S.; Ferraro, F.; Almandoz, J. The Rise of Socially Responsible Investment Funds: The Paradoxical Role of the Financial Logic. Adm. Sci. Q. 2018, 64, 466–501. [Google Scholar] [CrossRef] [Green Version]

- Durand, R.; Paolella, L. Category Stretching: Reorienting Research on Categories in Strategy, Entrepreneurship, and Organization Theory. J. Manag. Stud. 2011, 50, 1100–1123. [Google Scholar] [CrossRef]

- Paolella, L.; Durand, R. Category Spanning, Evaluation, and Performance: Revised Theory and Test on the Corporate Law Market. Acad. Manag. J. 2016, 59, 330–351. [Google Scholar] [CrossRef] [Green Version]

- Kempf, A.; Osthoff, P. The Effect of Socially Responsible Investing on Portfolio Performance. Eur. Financ. Manag. 2007, 13, 908–922. [Google Scholar] [CrossRef] [Green Version]

- Shiller, R.J. Capitalism and Financial Innovation. Financ. Anal. J. 2013, 69, 21–25. [Google Scholar] [CrossRef]

- Matallín-Sáez, J.C.; Soler-Domínguez, A.; De Mingo-López, D.V.; Tortosa-Ausina, E. Does socially responsible mutual fund performance vary over the business cycle? New insights on the effect of idiosyncratic SR features. Bus. Ethics A Eur. Rev. 2018, 28, 71–98. [Google Scholar] [CrossRef] [Green Version]

- Sievänen, R.; Rita, H.; Scholtens, B. European Pension Funds and Sustainable Development: Trade-Offs between Finance and Responsibility. Bus. Strat. Environ. 2017, 26, 912–926. [Google Scholar] [CrossRef] [Green Version]

- Clark, G.; Hebb, T. Why Should They Care? The Role of Institutional Investors in the Market for Corporate Global Responsibility. Environ. Plan. A Econ. Space 2005, 37, 2015–2031. [Google Scholar] [CrossRef] [Green Version]

- Fritz, T.M.; von Schnurbein, G. Beyond Socially Responsible Investing: Effects of Mission-Driven Portfolio Selection. Sustainability 2019, 11, 6812. [Google Scholar] [CrossRef] [Green Version]

- Durán-Santomil, P.; Otero-González, L.; Correia-Domingues, R.H.; Reboredo, J.C. Does Sustainability Score Impact Mutual Fund Performance? Sustainability 2019, 11, 2972. [Google Scholar] [CrossRef] [Green Version]

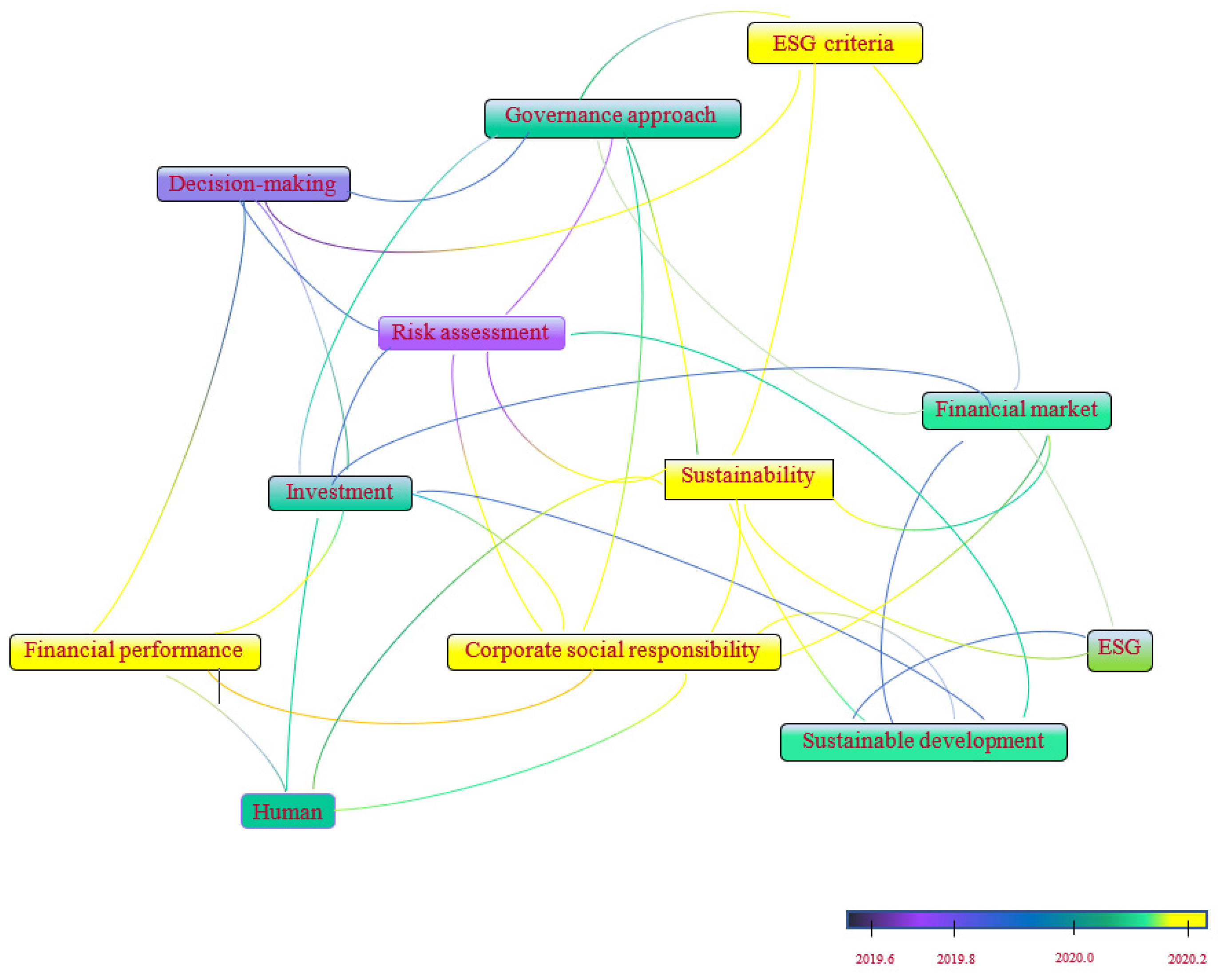

- VOSviewer. Available online: https://www.vosviewer.com/ (accessed on 28 June 2021).

- MSCI ESG Ratings Methodology. Available online: https://www.msci.com/documents/1296102/21901542/MSCI+ESG+Ratings+Methodology+-+Exec+Summary+Nov+2020.pdf (accessed on 15 July 2021).

- Vargas, M.; Vicente, R.; Muñoz, F. Searching for the most profitable and sustainable investment strategy: Evidence from sovereign bond funds. J. Bus. Econ. Manag. 2014, 15, 1034–1053. [Google Scholar] [CrossRef] [Green Version]

- Kölbel, J.F.; Heeb, F.; Paetzold, F.; Busch, T. Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact. Organ. Environ. 2020, 33, 554–574. [Google Scholar] [CrossRef]

- Naveed, M.; Sohail, M.K.; Abdin, S.Z.; Awais, M.; Batool, N. Role of ESG disclosure in determining asset allocation decision: An individual investor perspective. Paradigms 2020, 14, 157–165. [Google Scholar]

- Amel-Zadeh, A.; Serafeim, G. Why and how investors use ESG information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef] [Green Version]

- Sweicka, B.; Musiał, B. Enhancing Financial Literacy—Experiment Results. Argum. Oecon. Crac. 2018, 18, 129–140. [Google Scholar]

- OECD Reccomendation of the Council on Financial Literacy. Available online: https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0461 (accessed on 21 April 2021).

- National Strategy for Financial Literacy in Latvia 2021–2027. 2021. Available online: https://www.fktk.lv/wp-content/uploads/2021/05/ENG_FPS.pdf (accessed on 26 March 2021).

- National Council for Economic Education (NCEE) 2005, What American Teens & Adults Know about Economics. Available online: https://docplayer.net/131012-What-american-teens-adults-know-about-economics.html (accessed on 6 May 2021).

- National Strategies for Financial Education. OECD/INFE Policy Handbook. Available online: https://www.oecd.org/daf/fin/financial-education/national-strategies-for-financial-education-policy-handbook.htm (accessed on 19 April 2021).

- 2008 Annual Report to the Advisory Council on Financial Literacy. Advisory Council on Financial Literacy. Available online: https://www.treasury.gov/about/organizational-structure/offices/Domestic-Finance/Documents/PACFL_Draft-AR-0109.pdf (accessed on 15 April 2021).

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lusardi, A.; Michell, O.S. Financial Literacy and Planning: Implications for Retirement Wellbeing. Available online: https://www.nber.org/system/files/working_papers/w17078/w17078.pdf (accessed on 25 May 2021).

- Lusardi, A.; Tufano, P. Debt Literacy, Financial Experiences, and Overindebtedness; Working Paper 14808; National Bureau of Economic Research: Cambridge, MA, USA, 2009. [Google Scholar] [CrossRef]

- Sucuahi, W. Determinants of financial literacy of micro entrepreneurs in Davao city. Int. J. Account. Res. 2013, 1, 44–51. [Google Scholar] [CrossRef] [Green Version]

- Gale, W.G.; Levine, R. Financial Literacy: What Works? How Could It Be More Effective? Financ. Lit. Res. Consort. 2010, 1–31. [Google Scholar] [CrossRef] [Green Version]

- Bernheim, B.D.; Garrett, D.M. The effects of financial education in the workplace: Evidence from a survey of households. J. Public Econ. 2003, 87, 1487–1519. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O. How ordinary consumers make complex economic decisions: Financial literacy and retirement. Eur. Sci. J. 2017, 7, 3. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, A.; Oggero, N.; Yakoboski, P. The TIAA Institute—GFLEC Personal Finance Index: A New Measure of Financial Literacy; The George Washington University of Business: Washington, DC, USA; Global Financial Literacy Excellence Centre: New York, NY, USA, 2017. [Google Scholar]

- Świecka, B.; Terefenko, P.; Wiśniewski, T.; Xiao, J. Consumer Financial Knowledge and Cashless Payment Behavior for Sustainable Development in Poland. Sustainability 2021, 13, 6401. [Google Scholar] [CrossRef]

- OECD. Financial Education in Europe: Trends and Recent Developments; OECD Publishing: Paris, France, 2016. [Google Scholar] [CrossRef]

- OECD. PISA 2015 Assessment and Analytical Framework: Science, Reading, Mathematic and Financial Literacy; PISA; OECD Publishing: Paris, France, 2016. [Google Scholar] [CrossRef]

- Hung, A.; Parker, A.; Yoong, J.K. Defining and Measuring Financial Literacy; Working paper; Rand Labour and Population: Stanford, CA, USA, 2009. [Google Scholar]

- Habschick, M.; Seidl, B.; Evers, J. Survey of Financial Literacy Schemes in the EU27; VT Markt/2006/26H-Final Report; EVERS & JUNG: Hamburg, Germany, 2007. [Google Scholar]

- OECD/INFE 2020 International Survey of Adult Financial Literacy. Available online: www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 20 April 2021).

- Moore, D. Survey of Financial Literacy in Washington State: Knowledge, Behaviour, Attitudes, and Experiences; Technical Report Nr. 03-39; Washington State University, Social and Economic Sciences Research Center: Pullman, WA, USA, 2003. [Google Scholar]

- Warchlewska, A.; Jank, A.; Iwanski, R. Personal Finances in the Era of Modern Technological Solutions. J. Financ. Financ. Law 2021, 1, 155–174. [Google Scholar] [CrossRef]

- Alessie, R.; Bucher-Koenen, T.; Lusardi, A.; Van Rooij, M. Fearless Woman: Financial Literacy and Stock Market Participation; CEPR Discussion Papers Nr. 15913; C.E.P.R.: London, UK, 2021. [Google Scholar]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial Literacy and Stock Market Participation; NBER Working Paper No. 13565; National Bureau of Economic Research: Philadelphia, PA, USA, 2007; Available online: https://www.nber.org/system/files/working_papers/w13565/w13565.pdf (accessed on 23 December 2021).

- Xiao, J. Handbook of Consumer Finance Research, 2nd ed.; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Kaiser, T.; Lusardi, A.; Menkhoff, L.; Urban, C. Financial Education Affects Financial Knowledge and Downstream Behaviors; Wharton Pension Research Council Working Paper No. 2020-07; National Bureau of Economic Research: Philadelphia, PA, USA, 2020; pp. 1–40. [Google Scholar]

- Ambuehl, S.; Bernheim, B.; Lusardi, A. A Method for Evaluating the Quality of Financial Decision Making, with an Application to Financial Education; NBER Working Paper No. 20618; National Bureau of Economic Research: Philadelphia, PA, USA, 2014. [Google Scholar]

- Xiao, J.; O’Neill, B. Consumer Financial Education and Financial Capability. Int. J. Consum. Stud. 2016, 40, 712–721. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011, 10, 497–508. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement preparedness: Evidence and implications for financial education. Bus. Econ. 2007, 42, 35–44. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement planning in the United States. J. Pension Econ. Financ. 2011, 10, 509–525. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, A.; Mitchell, O.S.; Curto, V. Financial literacy among the young. J. Consum. Aff. 2010, 44, 358–380. [Google Scholar] [CrossRef]

- Sarnovics, A.; Mavlutova, I.; Peiseniece, L.; Berzina, S. Financial Literacy Enhancement as a Task of Financial Education for Latvian Population, Business Challenges in Changing Economic Landscape. In Proceedings of the 14th Eurasia Business and Economic Society Conference, Barcelona, Spain, 23–25 October 2014; Bilgin, M., Danis, H., Demir, E., Can, U., Eds.; Springer: Cham, Switzerland, 2016; pp. 365–390. [Google Scholar]

- Financial and Capital Market Commission. Financial Literacy of the Latvian Population. 2019. Available online: https://www.klientuskola.lv/images/Publikacijas/PDF/Zinojums_Finansu_pratiba_2019_F.pdf (accessed on 21 November 2021).

- OECD. PISA 2015 Results (Volume IV): Students’ Financial Literacy; PISA; OECD Publishing: Paris, France, 2017. [Google Scholar] [CrossRef]

- Barrafrem, K.; Tinghög, G.; Västfjäll, D. Trust in the government increases financial well-being and general well-being during COVID-19. J. Behav. Exp. Financ. 2021, 31, 100514. [Google Scholar] [CrossRef]

- Oberndorfer, M.; Dorner, T.E.; Brunnmayr, M.; Berger, K.; Dugandzic, B.; Bach, M. Health-related and socio-economic burden of the COVID-19 pandemic in Vienna. Health Soc. Care Commun. 2021. [Google Scholar] [CrossRef] [PubMed]

- Herman, E.; Nicholas, D.; Watkinson, A.; Rodríguez-Bravo, B.; Abrizah, A.; Boukacem-Zeghmouri, C.; Cannon, L.P. The impact of the pandemic on early career researchers: What we already know from the internationally published literature. Prof. Inf. 2021, 30, 1–16. [Google Scholar] [CrossRef]

- Afifi, T.O.; Salmon, S.; Taillieu, T.; Stewart-Tufescu, A.; Fortier, J.; Driedger, S.M. Older adolescents and young adults willingness to receive the COVID-19 vaccine: Implications for informing public health strategies. Vaccine 2021, 39, 3473–3479. [Google Scholar] [CrossRef]

- Szromek, A.R. The Role of Health Resort Enterprises in Health Prevention during the Epidemic Crisis Caused by COVID-19. J. Open Innov. Technol. Mark. Complex. 2021, 7, 133. [Google Scholar] [CrossRef]

- Kubota, S.; Onishi, K.; Toyama, Y. Consumption responses to COVID-19 payments: Evidence from a natural experiment and bank account data. J. Econ. Behav. Organ. 2021, 188, 1–17. [Google Scholar] [CrossRef]

- Nakagawa, K.; Umazume, T.; Mayama, M.; Chiba, K.; Saito, Y.; Noshiro, K.; Watari, H. Survey of attitudes of individuals who underwent remote prenatal check-ups and consultations in response to the COVID-19 pandemic. J. Obstet. Gynaecol. Res. 2021, 47, 2380–2386. [Google Scholar] [CrossRef]

- DvoŔák, M.; Rovný, P.; Grebennikova, V.; Faminskaya, M. Economic impacts of COVID-19 on the labor market and human capital. Terra Econ. 2020, 18, 78–96. [Google Scholar] [CrossRef]

- Cheng, Z.; Mendolia, S.; Paloyo, A.R.; Savage, D.A.; Tani, M. Working parents, financial insecurity, and childcare: Mental health in the time of COVID-19 in the UK. Rev. Econ. Househ. 2021, 19, 123–144. [Google Scholar] [CrossRef]

- Boll, C. Die ökonomische Situation von Familien zwischen März und Mai 2020, den ersten zwei Monaten der COVID 19-Pandemie. List Forum 2021, 46, 379–389. [Google Scholar] [CrossRef]

- Tan, W.; Zhang, J. Good Days, Bad Days: Stock Market Fluctuation and Taxi Tipping Decisions. Manag. Sci. 2021, 67, 3965–3984. [Google Scholar] [CrossRef]

- Anderton, R.; Botelho, V.; Consolo, A.; Silva, A.D.; Foroni, C.; Mohr, M.; Vivian, L. The Impact of the COVID-19 Pandemic on the Euro Area Labour Market. European Central Bank. 2020. Available online: https://www.ecb.europa.eu/pub/economicbulletin/articles/2021/html/ecb.ebart202008_02~bc749d90e7.en.html (accessed on 17 June 2021).

- Waliszewski, K.; Warchlewska, A. How we can benefit from personal finance management applications during the COVID-19 pandemic? The polish case. Entrep. Sustain. Issues 2021, 8, 691–699. [Google Scholar] [CrossRef]

- Levantesi, S.; Zacchia, G. Machine learning and financial literacy: An exploration of factors influencing financial knowledge in Italy. J. Risk Financ. Manag. 2021, 14, 120. [Google Scholar] [CrossRef]

- De’, R.; Pandey, N.; Pal, A. Impact of digital surge during COVID-19 pandemic: A viewpoint on research and practice. Int. J. Inf. Manag. 2020, 55, 102171. [Google Scholar] [CrossRef]

- BBVA Group. The Crisis Has Revealed the Importance of Financial Literacy among the Most Vulnerable. Available online: https://www.bbva.com/en/sustainability/the-crisis-has-evidenced-the-importance-of-financial-literacy-among-the-most-vulnerable/ (accessed on 2 June 2021).

- Barrafrem, K.; Västfjäll, D.; Tinghög, G. Financial well-being, COVID-19, and the financial better-than-average-effect. J. Behav. Exp. Financ. 2020, 28, 100410. [Google Scholar] [CrossRef] [PubMed]

- Ben-David, I.; Bos, M. Impulsive Consumption and Financial Well-Being: Evidence from an Increase in the Availability of Alcohol. Rev. Financial Stud. 2020, 34, 2608–2647. [Google Scholar] [CrossRef]

- Selimović, J.; Pilav-Velić, A.; Krndžija, L. Digital workplace transformation in the financial service sector: Investigating the relationship between employees’ expectations and intentions. Technol. Soc. 2021, 66, 101640. [Google Scholar] [CrossRef]

- Panos, G.A.; Wilson, J.O.S. Financial literacy and responsible finance in the FinTech era: Capabilities and challenges. Eur. J. Financ. 2020, 26, 297–301. [Google Scholar] [CrossRef] [Green Version]

- Statista. Do You Plan to Increase Your Allocation to Environmental, Social, and Corporate Governance (ESG) Investments (Not Limited to ESG ETFs) over the Next Year? Available online: https://www.statista.com/statistics/1191755/esg-etf-increased-investment-next-year-worldwide/ (accessed on 24 November 2021).

- Wild, D. Sustainable Investments Give Back in Return. What Investors Should Know about ESG. Credit Suisse Group AG, 2020. Available online: https://www.credit-suisse.com/ch/en/articles/private-banking/nachhaltige-geldanlagen-lohnen-sich-was-anleger-zu-esg-wissen-sollten-202006.html (accessed on 31 March 2021).

- Authors’ Survey. Available online: https://docs.google.com/forms/d/e/1FAIpQLSeBegMbhaGORdLqWzffTxPX9N_2te92vgmi53zq3Zb_6KaFOw/viewform (accessed on 21 November 2021).

- Arianti, B.F. The influence of financial literacy, financial behavior and income on investment decision. Econ. Account. J. 2018, 1, 1–10. [Google Scholar] [CrossRef]

- Atkinson, A.; Messy, F. Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) Pilot Study. In OECD Working Papers on Finance, Insurance and Private Pensions; OECD Publishing: Paris, France, 2012. [Google Scholar] [CrossRef]

- Faniran, T.S.; Bakare, E.A.; Potucek, R.; Ayoola, E.O. Global and Sensitivity Analyses of Unconcerned COVID-19 Cases in Nigeria: A Mathematical Modeling Approach. WSEAS Trans. Math. 2021, 20, 218–234. [Google Scholar]

- Amirudin, A.; Saputra, J.; Afrizal, T.; Latip, M.; Tarmizi, A. Investigating the COVID-19 Self-Isolation Policy and Its Impact on Socioeconomic of Vulnerable Groups: An application of Rational and Non-Rational Thinking Models. WSEAS Trans. Environ. Dev. 2021, 17, 604–613. [Google Scholar] [CrossRef]

- Erlina, Y.; Elbaar, E.F. Impact of COVID-19 Pandemic on Local Rice Supply Chain Flow Patterns In Kapuas Regency, Central Kalimantan, Indonesia. WSEAS Trans. Bus. Econ. 2021, 18, 941–948. [Google Scholar] [CrossRef]

| 3 ESG Pillars | 10 ESG Themes | 35 ESG Issues | |

|---|---|---|---|

| Environment | Climate Change | Carbon Emissions Product Carbon Footprint | Financing Environmental Impact Climate Change Vulnerability |

| Natural Capital | Water Stress Biodiversity and Land Use | Raw Material Sourcing | |

| Pollution & Waste | Toxic Emissions & Waste Packaging Material and Waste | Electronic Waste | |

| Environmental Opportunities | Opportunities in Clean Tech Opportunities in Green Building | Opportunities in Renewable Energy | |

| Social | Human Capital | Labour Management Health & Safety | Human Capital Development Supply Chain Labour Standards |

| Product Liability | Product Safety & Quality Chemical Safety Financial Product Safety | Privacy & Data Security Responsible Investment Health and Demographic Risk | |

| Stakeholder Opposition | Controversial Sourcing Community Relations | ||

| Social Opportunities | Access to Communications Access to Finance | Access to Health Care Opportunities in Nutrition & Health | |

| Governance | Corportate Governance | Ownership & Control Board | Pay Accounting |

| Corporate Behaviour | Business Ethics Tax Transparency | ||

| Organisations and Authors | Definition |

|---|---|

| OECD (2015) | The combination of awareness, knowledge, skills, attitudes, and behaviours is needed to make sound financial decisions and ultimately achieve individual financial well-being. |

| OECD (2020) | Includes access to, and use of, formal financial products and services, including digital ones; budgeting and managing finances in the short term; saving and investment; credit management; planning and saving for retirement and pensions; and risk management and insurance. |

| President’s Advisory Council on Financial Literacy (PACFL) (2008) | The ability to use knowledge and skills to effectively manage financial resources in times of financial well-being. |

| National American Council for Economic Education (2005) | The development of skills and knowledge acquisitions concerning financial matters to make effective decisions and implement activities that meet an individual’s personal, family, and global community needs. |

| A. Lusardi and O. S. Mitchell (2014) | The ability of people to process economic information and make informed decisions about financial planning, wealth accumulation, debt, and pensions. the ability to apply knowledge to improve the financial position. |

| A. Lusardi and O. S. Mitchell (2006) | The ability and tools to plan and the ability to make retirement savings plans. Those with higher financial skills are more likely to save and invest in complex assets such as equities. |

| Lusardi and Tufano (2008) | The ability to make simple decisions regarding liability agreements, especially in terms of basic knowledge about interest rates within the context of everyday financial choices. |

| W. Sucuahi (2013) | Record-keeping, budgeting, personal finance, and savings were viewed to be more important to lower-income individuals. |

| Gale and Levine (2010) | The ability to make informed judgments and make effective decisions about the use and management of money and wealth. |

| Bernheim and Garrett (2003) | Not an isolated category but a specialized part of economic literacy related to the ability to provide income, move around the labour market, make payment decisions, and be aware of the possible consequences of one’s decisions on current and future income. |

| National Strategy for Financial Literacy in Latvia 2021–2027 (2021) | The combination of financial awareness, knowledge, skills, attitudes, and behaviours needed to make sound financial decisions and ultimately achieve the well-being of individuals. |

| Variable | n | % |

|---|---|---|

| Age group | ||

| 18–24 | 126 | 36.1% |

| 25–34 | 72 | 20.6% |

| 35–44 | 72 | 20.6% |

| 45–54 | 53 | 15.2% |

| 55–64 | 20 | 5.7% |

| 65+ | 6 | 1.7% |

| Education | ||

| Higher | 211 | 60.5% |

| Secondary-special | 30 | 8.6% |

| Secondary | 93 | 26.6% |

| Basic | 15 | 4.3% |

| Monthly net income | ||

| <750 | 100 | 28.7% |

| 750–1000 | 87 | 24.9% |

| 1000–1250 | 53 | 15.2% |

| 1250–1500 | 40 | 11.5% |

| 1500–1750 | 19 | 5.4% |

| 1750–2000 | 10 | 2.9% |

| 2000–2500 | 21 | 6.0% |

| 2500+ | 19 | 5.4% |

| Savings/investment experience | ||

| More than one year | 166 | 47.6% |

| Up to one year | 81 | 23.2% |

| No experience | 102 | 29.2% |

| Variable | n (%) | MV | SE | Values Range | Skewness |

|---|---|---|---|---|---|

| Daily income trend | 349 (100%) | 3.221 | 0.058 | 1–5 | −0.202 |

| Daily expenses trend | 349 (100%) | 2.934 | 0.060 | 1–5 | −0.003 |

| Digital skills development and knowledge of financial services | 349 (100%) | 3.375 | 0.043 | 1–5 | −0.087 |

| Savings | 349 (100%) | 3.229 | 0.053 | 1–5 | −0.237 |

| Willingness to invest | 349 (100%) | 3.089 | 0.064 | 1–5 | −0.233 |

| Changes in perceptions of investment principles during COVID-19 | 349 (100%) | 2.461 | 0.060 | 1–5 | 0.444 |

| Changes in attitude towards the need to ESG investments during COVID-19 | 349 (100%) | 3.570 | 0.074 | 1–5 | −0.841 |

| Changes in investment habits in favor of sustainable investment in the future during COVID-19 | 349 (100%) | 3.120 | 0.080 | 1–5 | −0.396 |

| # Hypothesis | n | k | P0 | zstat | p-Value |

|---|---|---|---|---|---|

| 1 | 349 | 137 | 0.5 | −4.0147 | 0.9999 |

| 2 | 349 | 121 | 0.5 | −5.7276 | 0.9999 |

| 3 | 349 | 236 | 0.5 | 6.5840 | <0.0001 |

| Education Level | Financial Literacy | Desire to Invest | Investm. in ESG |

|---|---|---|---|

| Higher | 43.1% | 32.2% | 72.0% |

| Secondary-special | 23.3% | 30.0% | 66.7% |

| Secondary | 36.6% | 40.9% | 59.1% |

| Basic | 33.3% | 40.0% | 60.0% |

| Sav./Invest. Exper. | Financial Literacy | Desire to Invest | Investm. in ESG |

|---|---|---|---|

| >1 year | 43.4% | 36.7% | 72.3% |

| <1 year | 45.7% | 40.7% | 65.4% |

| No | 27.5% | 26.5% | 61.8% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mavlutova, I.; Fomins, A.; Spilbergs, A.; Atstaja, D.; Brizga, J. Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia. Sustainability 2022, 14, 339. https://doi.org/10.3390/su14010339

Mavlutova I, Fomins A, Spilbergs A, Atstaja D, Brizga J. Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia. Sustainability. 2022; 14(1):339. https://doi.org/10.3390/su14010339

Chicago/Turabian StyleMavlutova, Inese, Andris Fomins, Aivars Spilbergs, Dzintra Atstaja, and Janis Brizga. 2022. "Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia" Sustainability 14, no. 1: 339. https://doi.org/10.3390/su14010339

APA StyleMavlutova, I., Fomins, A., Spilbergs, A., Atstaja, D., & Brizga, J. (2022). Opportunities to Increase Financial Well-Being by Investing in Environmental, Social and Governance with Respect to Improving Financial Literacy under COVID-19: The Case of Latvia. Sustainability, 14(1), 339. https://doi.org/10.3390/su14010339