1. Introduction

Sustainable development is currently a main concept of which governments are undertaking policies to meet broad economic objectives, such as price stability, high employment, and sustainable continuous economic growth. Such efforts include monetary and fiscal policies, regulation of financial institutions, trade, and tax policies. National central banks, and in particular, the Federal Reserve or the European Central Bank, are working to keep inflation growth under control; however, central banks’ efforts to control inflation have not been very successful. Moreover, our understanding of the forces driving inflation is still imperfect [

1]. Throughout history, attitudes to inflation have not been constant, but the monetary approach to inflation has dominated. The Keynesian approach and economic regulation theories have also contributed to the understanding of inflation.

The effect of economic policies was recently analyzed in Fullana et al. [

2]. These authors related the effectiveness of the stock market channel of monetary policy with bubble development, providing evidence on the response of stock prices to monetary policy shocks but condition the analysis both to the direction of monetary policy surprises and business conditions, since both sign- and state-dependent responses are stylized facts documented from the previously studied researchers. The results enabled authors to infer the degree of effectiveness of monetary policy in the relevant scenario: the one described by restrictive monetary policy shocks in an expansive phase of the business cycle in which stock market bubbles arise, showing evidence against the ability of monetary policy to control the growth of stock market bubbles [

2]. These authors observed that the effects of positive monetary shocks on stock market returns are not considered significant, except for in the expansion periods. This fact supported the relation of these results with the development of stock price bubbles because the poor effectiveness of contractionary monetary policy transmission is now concretely located in the phase of the business cycle in which these bubbles arise. Contrarily, the effect on the stock market returns of negative monetary policy shocks in expansion periods remained negative and significant. Subsequently, in expansion periods, negative monetary policy shocks supported to inflate bubbles, while positive monetary policy shocks did not impact on them. Such an asymmetrical behavior of the stock market channel of monetary policy transmission postulated monetary policy to be driven by short-term interest rates at the epicenter of the stock market bubble generation. Conclusively, Fullana et al. [

2] proved macroprudential monetary policy tools as more appropriate to deal with stock market bubbles than ‘conventional’ monetary policy tools [

2].

Inflation is one of the most important indicators of the economic health of the country, addressing an economic dimension of sustainability on a macro level. A long-term rise in the general price level of goods and services, manifested in a decrease in the purchasing power of a monetary unit, it is a reflection of the functioning of the economy as a whole. Economists sometimes compare it to temperature, which can be a symptom of some diseases. Like temperature, inflation is the result of a variety of economic factors. The usual measure of inflation is the rate of inflation. It is the annual percentage change in the general price index, usually the consumer price index (CPI). The consumer price index (CPI) is a statistical weighted estimate of the prices of a particular set of goods and services. This price index reflects changes in the prices of a given set of goods and services.

Scholars agree that inflation has not only a negative but also a positive effect on the economy. Inflation may discourage savings and investment in the future. If inflation is high enough, there could be a shortage of goods, as consumers would fear that those goods would become more expensive in the future and therefore start to accumulate them. It has also been observed that moderately rising inflation revives the economy and reduces unemployment. Although, recently, there are opinions that the opposite is true by way of economic recovery accelerate inflation. This position will be substantiated later.

Economists have noted that low or medium inflation rates are determined by a wide variety of factors [

3,

4,

5,

6]. On the other hand, those economists who belong to the Austrian School of Economics generally believe that the long duration of inflation, and in particular, the exceptionally high rate of inflation, is due to excessive growth in the money supply [

6]. In any case, there is no consensus about the reasons for inflation [

7].

In order to facilitate trade, money has emerged as a universal measure of exchange. For a long time, money itself had value because it was made from valuable, durable materials, mostly precious metals. With the abolition of the gold standard, money practically loses its intrinsic value, especially when it becomes just records in bank accounts. Nevertheless, inflation has remained, but its origins have shifted to cash flow and the level of trade, to the supply–demand ratio of goods and services [

8]. Thus, although the situation changed fundamentally after the abolition of the gold standard, the historical understanding of the nature of inflation has remained. Empirically, it has been observed that the rise in prices was increasingly driven by rising costs rather than an oversupply of money [

9].

With the development of general interest theory, a new approach to inflation is emerging. This approach also differs significantly from the position of central banks [

10] and other economists [

2,

3,

4,

5,

6], as described above.

The main input of this paper is a further development of a new approach to inflation by developing a new analytical model of aggregate inflation, representing the main drivers of inflation and thus contributing to the concept of controlled economic growth pursuing sustainable economic growth of the country.

Therefore, the main aim of the work is to examine the inflation from the point of view of sustainable economic growth as the outcome of financial saturation followed by an inflation bubble and to develop policy recommendations to enhance sustainable economic growth and mitigate negative effects of inflation.

The research methods utilized in this study were a systematic and comparative analysis of scientific sources, mathematical modeling, collection of empirical facts, the phenomenological method, economic logistic analysis and synthesis, data systematization and analysis, graphical data representation, comparison and interpretation, evaluation and generalization of theoretical, and empirical research results.

2. Literature Review

2.1. Classical Approaches to Inflation

Modern forms of inflation are very different from the old forms, but the essence of the causes and consequences of inflation remains relevant [

11].

Representatives of the Austrian school describe inflation as an artificial increase in the money supply. In their view, rising prices are a direct expression of money inflation and artificially low interest rates. Austrian economists are convinced that due to the constant improvement of technology, prices must naturally fall. They argue that inflation contributes to the depreciation of fixed capital, hinders the growth of savings, and acts as a tax that dampens the purchasing power of money as well as distorts economic forecasts [

12].

From the point of view of the Austrian School of Economics, inflation is always a monetary phenomenon. According to them, in the field of money, as in any production, competitive cooperation of market participants gives an incomparably better result than state regulation. State intervention in the money supply by money printing usually leads to an increase in their total amount in excess of what would have been achieved in the free market. This is what causes inflation. Inflation depreciates money, makes people trade less, becomes less active, and ultimately reduces their overall productivity. It can be said that the Austrian school’s approach to inflation has been shaped by centuries of dilution of precious metals in coins or deterioration in the coverage of paper money by reliable assets [

13].

Up to the 20th century, inflation was understood as a purely monetary phenomenon and was seen as a negative fact. The situation began to change with the emergence of Keynes’s theory [

14]. This approach was based on the need for large-scale government intervention in a market economy to control inflation. The state uses economic policies and applies various financial, credit, and monetary levers, including indirect ones. Meanwhile, the main object of state influence should be solvent demand. An additional issue of money must be used for this. According to this theory, in conditions of underemployment (i.e., when unemployment is high), an increase in the amount of money in circulation causes not so much an increase in prices as it stimulates production and the supply of goods. In situations of high unemployment, consumption levels are moderate, and the expanding of production is welcomed.

Theoretically, inflation is an imbalance between aggregate demand and aggregate supply. Neoclassicals explain inflation as an increase in the cost of production, that is, a change in supply, while Keynes ’followers believe that inflation is caused by increased demand at full employment. As a result, two main theories are distinguished when examining inflation: demand-driven inflation and cost-driven inflation [

9].

Proponents of Keynesian theory argue that consumption and government spending drive economic growth, and that increased GDP determines a country’s economic power. Keynesian supporters see austerity as a brake on economic development. They are proponents of deficit consumption and tend to raise inflation and maintain artificially low interest rates to increase aggregate demand. On the basis of such considerations, the concept of controlled inflation was developed [

13].

Controlled inflation can be treated as stable inflation. It has a positive effect on people’s expectations. With stable inflation, people can realistically estimate their spending and income. It encourages people to save and invest. Controlled inflation stimulates economic growth. We will see later that the opposite is true: controlled economic growth drives inflation [

15].

And indeed, despite the efforts of many Western governments, controlled inflation has risen to soaring inflation in the late 1970s. All of this encouraged some views of Keynesian theory to be viewed critically. Despite its shortcomings, Keynes’s theory stood out for some very important insights [

13].

2.2. The Main Drivers of Inflation

In macroeconomic models, the balance of individual goods and services has to be combined into the real volume of domestic production and the prices of individual goods into a single overall price called the price level. That aggregation of the prices of individual goods and services to the price level, as well as the aggregation of the volume of all goods and services into the real volume of national production, is considered to be macroeconomic aggregation. Keynes in his works focused on aggregated macroeconomic variables, such as aggregate interest rate, aggregate demand (AD), and aggregate supply (AS). M. Blaug claims that one of Keynes’ most important contributions to modern economic theory was that the object of analysis was shifted from the activities of enterprises and households to the study of changes in gross (aggregate) values.

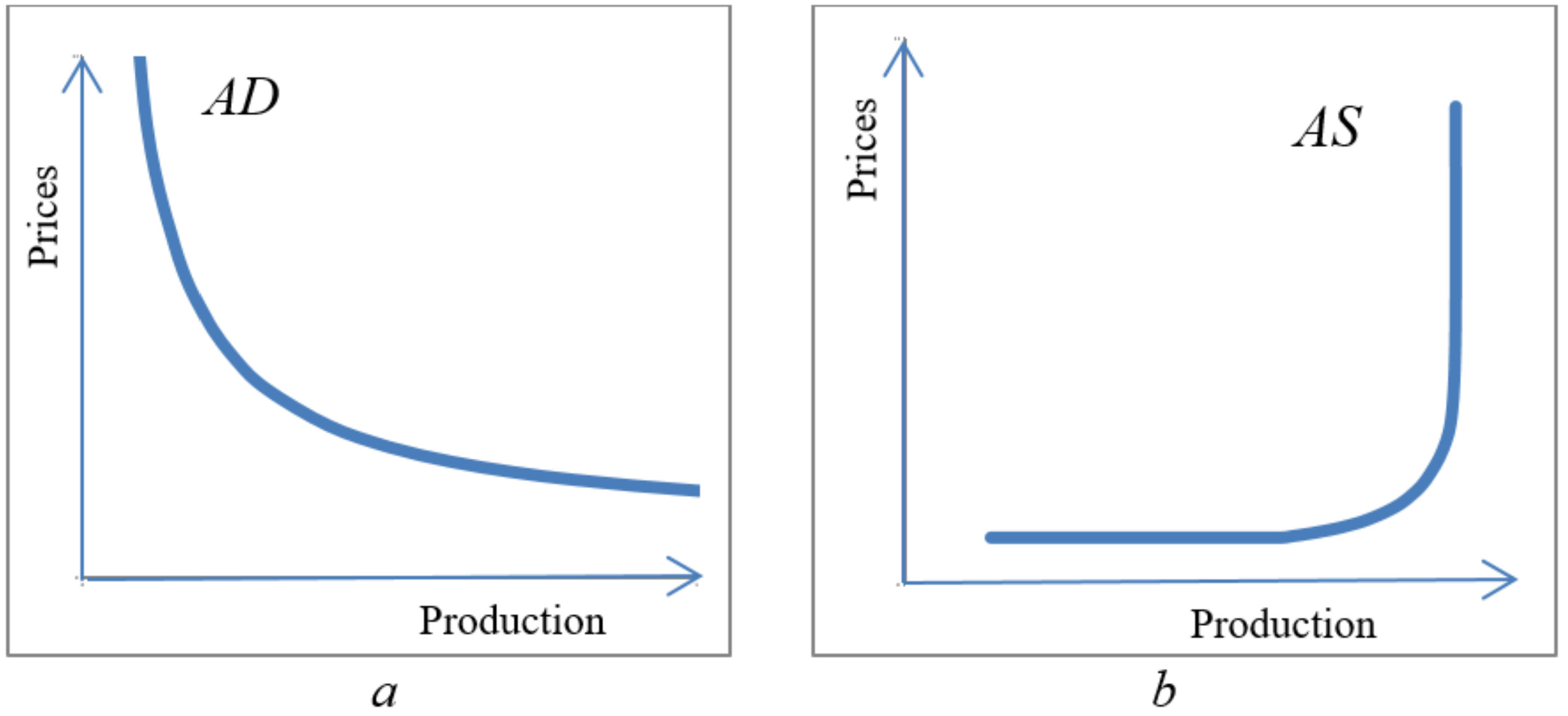

In this work, the emphasis is also placed on aggregate indicators, firstly on aggregate demand and aggregate supply. Aggregate demand (

AD) shows the real amount of national output that consumers, businesses and government can and want to buy at a given price level. Keynes divided aggregate demand into four parts, corresponding to the structural parts of the national product, calculated by the expenditure method of GDP [

9].

The aggregate demand curve

AD shows the inverse relationship between the price level and the volume of aggregate output (

Figure 1a). The nature of the aggregate demand curve (

AD) is determined by three factors: the impact of interest rates, the balance of assets or real cash, and impact of import purchases.

The impact of interest rates shows that rising prices raise interest rates, while higher interest rates reduce consumer spending and investment. This in turn leads to a decline in aggregate demand.

The higher prices reduce the real purchasing power of the population, making them poorer. The effect of import purchases can be also analyzed by applying the Mundell–Fleming model which shows that as the price level rises, the country’s exports fall: goods and services become more expensive there, and imported goods are relatively cheaper for the country’s population. As a result, imports are increasing and exports from the country are declining. It follows that the value of net exports is declining, which indicates a decrease in the volume of total (aggregate) output.

Demand-driven inflation is inflation that is driven by an increase in aggregate demand and indicates an imbalance between supply and demand in favor of demand. Demand inflation can be described as follows: aggregate demand in excess of existing production capacity leads to an increase of price levels. Inflation caused by this source starts with an increase in the prices of goods. This increase gradually spreads to the factors of production. However, increases in production factor prices, due to the specifics of investing in financial markets, lag behind increased product prices [

9].

All of this happens when there is more money in circulation (relative to the quantity of goods), a general deficit is formed, and prices rise as a result. In such a situation, when the financial saturation of the economic environment has been achieved (full employment), producers cannot increase the supply of goods in response to increased demand.

The causes of saturation can be [

16]:

Large targeted government orders;

Increased demand for means of production, when, under full employment, almost all capacity is already used;

Growth of the purchasing power of the population.

However, inflationary price rises can also occur in conditions where demand does not increase but falls. In this case, the reason must be an increase in the supply (cost). This is a different kind of inflation. This is called cost inflation. This inflation begins to take place as production costs rise [

16].

Cost driven inflation is inflation related to the rise in the prices of resources, factors of production, and other factors. Cost inflation is due to a decrease in aggregate supply. At the same time, real output and employment are falling and unemployment is rising.

The increase in production costs is due to the following reasons: increased raw material and fuel prices, changed production conditions, increased import prices, unfavorable changes in production conditions, increased transportation costs; and an increase in share of wages in total production costs, where this increase is not offset by an increase in labor productivity. This is usually due to pressure from trade unions. Manufacturers are beginning to reduce production. With steady demand but falling supply, the prices are rising and unemployment is rising as well [

17]. An exclusive market position of monopolies, oligopolies, or the state has also negative impact on inflation. This situation can be realized by raising prices in the market administratively.

The change in costs can also be sudden. A sudden jump in inflation is called an inflation shock. The reaction of the economy to inflation may vary depending on the behavior of economic agents and their inflation expectations. Some economists believe that, under certain conditions, the inflationary expectations of economic agents may activate the mechanism of the inflation spiral: an increase in inflation stimulates wage growth, and an increase in real wages stimulates an increase in inflation. However, there are also those who believe that both wage growth and inflation are caused by the financial saturation of markets and the formation of a general government deficit, i.e., the emergence of a situation where aggregate demand surpasses aggregate supply [

17].

The AS-AD model is a macroeconomic model that explains the relationship between gross output (or real GDP, sometimes GNI) and the general price level based on aggregate demand and aggregate supply curves. The AD-AS model can be used to analyze many macroeconomic phenomena, such as phases of economic cycles and stagflation.

In the short term, when other factors of production are constant, both the

AD and

AS curves show the relationship between price level and production level (

Figure 2).

The equilibrium is reached when, in the short term, aggregate demand becomes equal to aggregate supply. At the intersection of the two curves, two equilibrium values are recorded: the aggregate price level and the gross output. By using the AD-AS model, it is possible to roughly predict changes in prices and the main parameters of the system of national accounts depending on changes in aggregate demand or aggregate supply.

By summarizing various views of inflation, it can be said that the main drivers of inflation are either excess aggregate demand or excessive cost growth. Demand-driven inflation occurs when aggregate demand begins to grow faster than aggregate supply. It is then said that economic growth is too rapid. Economic growth slows when commodity prices rise, wages rise disproportionately, and the state or monopolies impact is negative in terms of growth of prices. When these factors become more active, cost-induced inflation occurs.

The main reasons of inflation are shown in

Figure 3 [

18].

As one can see from

Figure 3, supply driven inflation is propelled by increase in real wages, increase in taxes, devaluation and rising inflation expectations. The demand-driven inflation is perpetuated by reduction of interest rate, increased money supply, and also by increased real wages.

Particular attention should be paid here to the important cause of inflation, i.e., demand. Especially in a situation where aggregate demand begins to grow faster than aggregate supply. A similar situation is observed in microeconomics, where demand outstrips supply in some markets. Then we have a deficit in certain market and we are watching the rise in the prices of demanded goods. This is due to the so-called financial saturation of this market. If this situation persists for a longer period of time, we have a price or financial bubble. The strongest financial bubbles arise in the financial markets (these are the best conditions for financial markets saturation). By aggregating price bubbles, we get a financial bubble, and by aggregating financial bubbles, we get an inflation bubble. In order to properly analyze the nature of economic bubbles, it is necessary to return to microeconomics at least for a short time, to analyze the problem of economic overheating and to distinguish between specifics of bubbles. This is necessary for the understanding of the nature of the saturation phenomenon. Therefore, the development of an aggregated inflation model first requires an analysis of economic bubbles and their relationship with market saturation phenomena.

3. Theoretical Background for Developing Aggregated Inflation Model

3.1. Economic Bubbles and Saturation Phenomena

We begin the discussion of the economic bubble with an analysis of growth patterns. A general interest rate formula often used in calculations is:

where

K is the amount of capital accumulated during

t periods,

t is the time (number of accumulation periods),

K0 is the initial amount,

i is the growth (interest) rate.

Recall that the general interest rate Formula (1) is a special case of compound interest rate:

where

Kp is the potential (maximum possible, marginal) value of the capital involved in growth [

18].

It is not difficult to make sure that when Kp → ∞, the compound interest rate Formula (2) becomes the usual general interest rate Formula (1).

In the case of investment, if in any environment (market) the production resources are unlimited, then we say that it is possible to invest an unlimited amount of capital (Kp = ∞). Growth in such unlimited resource environment can then be modeled using the usual general interest rate Formula (1). However, in the limited resource environment (production resources are limited), the compound interest rate formula must be used (2).

The compound interest rate Formula (2) is intended for modeling environmental saturation and is suitable not only for interest rate research but also for other calculations, even non-financial ones. It has a wide range of applications not only in economics but also in biology, medicine, physics and other fields. Even the use of model (2) in finance or economics in general has its own specificity and diversity. There are 5 parameters in the general interest rate model that are interconnected. Depending on the field of application of the formula, these parameters are given different meanings. Due to its specificity, Kp is a unique growth limit or saturation parameter. For biological populations, it means the range capacity of those populations. In finances, the parameter Kp sets the financial limit up to which capital can be rationally invested in a given market. In macroeconomics, meanwhile, when modeling economic growth, the potential growth limit Kp is considered to be potential GDP. It indicates that economic growth, even in the short term, is finite. This means that the modeling of such growth is to be done using models of limited growth (in our case, the general interest rate model (2), and not the compound interest rate model (1).

Let us now return to the microeconomy and discuss another very important interpretation of this interest: the dependence of the growth rate of investments on the aforementioned financial saturation. To do this, we express the investments growth rate

i from the compound interest rate Equation (2) as a function of the size of the investment (variable

K (K0 < K < Kp)):

Based on the obtained Formula (3) and keeping the parameters K0, Kp and t constant, we plot the dependence of the growth rate of the general interest rate on the size of the investment K (from the degree of saturation). Since the potential (marginal) value of the investment Kp is considered constant, the saturation of K increases with the growth of the investment. The values in the graph are given in conditional units, i.e., K0 = 0.01, Kp = 1, t = 2, and the investment (capital) varies in the range (0.01; 1), i.e., 0.01 < K < 1.

The obtained compound interest rate dependence on financial saturation shows that with increasing saturation, the productivity rate also increases steadily (

Figure 4). As saturation approaches the potential limit, this increase becomes particularly intense (hyperbolic or explosive). The resulting interest rate dependence of saturation is called the saturation phenomenon or saturation paradox. And in fact, this dependence is paradoxical enough, because we are accustomed to the fact that as the saturation increases, the process conditions deteriorate and its efficiency weakens. Here it is the other way around. Such increase in the productivity rate is no exception or coincidence. A similar nature of the growth of internal rate of return is obtained by assessing the growth in another way-by discounting cash flows of various durations (investment projects) with the help of general interest rates. The situation does not change with the replacement of gross compound interest by other models of limited growth. In other words, the saturation paradox (saturation phenomenon) not only follows directly from the compound interest model, but is also detected by discounting cash flows, and this phenomenon is common to all types of limited growth models [

19,

20]. By considering that this unusual change is associated with an increase in system productivity, it is sometimes referred to as a phenomenon of increasing productivity. A preliminary definition of this phenomenon (saturation paradox) (from a microeconomic point of view) would be as follows: if capital is invested in a saturator, i.e., in a market with limited resources, this increases the return on investment as the financial saturation of that market increases.

Financial saturation in a given market means an increasing flow of financial investment and, at the same time, a higher volume of output; in other words a larger supply. Based on the supply–demand characteristic, the opposite should be the case: as supply increases (overproduction is formed), profitability should decrease. We see that in saturation conditions, it is different from what we are used to: profitability is not decreasing but growing. From a practical point of view, profitability increases due to the fact that saturation forms a deficit market in which demand outstrips supply. This is usually due to a sufficiently long technological cycle, when after investment there is demand but there is still no necessary supply.

It should be noted that the saturation effect is characterized not only by individual markets. As a result, aggregate growth can be modeled in the same way as for individual markets with the help of compound interest rate model. This is because the growth rate of an aggregate product, such as GDP or GNP, is proportional to its own size at each point in time.

It is possible to assume that the same interest rate models are appropriate from the point of view of microeconomics and macroeconomics [

19,

20,

21]. When aggregate demand surpasses aggregate supply, the economy becomes saturated (deficit). Meanwhile, the economic saturation parameter

Kp, as already mentioned, will be potential GDP. Potential GDP is gross domestic product but calculated on the assumption that full employment of the population has been achieved. It is worth noting here that in calculating this indicator, economists take into account a factor such as the natural unemployment rate, which would be the case for full employment. It has been established that full employment of resources is achieved in the absence of cyclical unemployment, the share of unused productive capacity is maintained at 10–20% of its total volume, and the natural unemployment rate covers 5.5–6.5% of the total labor force. However, it must be kept in mind that full employment of resources does not mean that investment in such an economy stops. Continuing the investment results in the stage of overemployment.

As a result, the macroeconomic meaning of the saturation phenomenon would be as follows: in a saturated economy, the return on investment is always higher than in an unsaturated one, and the rate of return depends on the degree of saturation. The process of saturation begins when the flow of investment (total investment) reaches the area of full employment. The area of overemployment is finite, and the end of that area is characterized by exceptionally high profitability.

It should be kept in mind that, from a microeconomic point of view, only limited (closed) markets can be financially saturated. If the market is open (infinite capacity compared to investment flow), then the phenomenon of increasing productivity will not occur in it. In the Keynesian economy, the overemployment is an employment rate that exceeds the natural level of unemployment. Overemployment is a characteristic of the work process. The nature of the post-industrial economy leads to more intensive, productive and productive work. It is due to high investment pressures, increased demand and the formation of a deficit market. It should be noted that the post-industrial economy is characterized by increased market saturation. In an industrial economy, due to limited technological capabilities, over-employment, and thus financial saturation, was much less likely. For the same reasons, such situations were particularly rare in the pre-industrial economy.

It must be appreciated that the extremely high level of employment is leading to increased demand for labor. Rising employee qualifications and difficulties in filling vacancies also increase salaries. Increased demand causes increase in prices for goods and services. Thus, environmental saturation is created and over-employment accelerates demand inflation. Due to temporary (frictional) and structural unemployment, overemployment does not mean that unemployment is zero. It should be noted that overemployment is not long term. This is confirmed by the graph of the saturation phenomenon: the steep part of the graph characterizes the instability of growth. Rapid growth is unsustainable: slight fluctuations in saturation lead to significant (critical) changes in profitability.

The concept of the economic (financial) bubble is quite new [

21]. The recent global economic crisis has changed this situation. It turns out that the financial bubble and inflation is a cyclical process that takes place under the conditions of financial saturation of the market [

19,

21]. Feedback and the phenomenon of saturation play a key role in this process. The phenomenon of saturation creates optimistic or pessimistic expectations, and these turn into positive or negative feedback. In this way, feedback can be both positive and negative. It has long been known that in technical mechanisms, negative feedback stabilizes a dynamic process, while positive feedback always stimulates the process and ultimately destabilizes it.

At present, both theoretical and empirical explanations of the bubble formation mechanism already exist [

19,

22]. At the theoretical level, positive feedback is formed when economic (or other) growth becomes limited i.e., when investing disproportionately in markets of limited size with limited production resources. Due to the positive feedback, the cyclical investment process intensifies and resonates with sufficient frequency, the saturation phenomenon influences positive expectations, profitability increases, and the market heats up. In other words, the phenomenon of saturation raises expectations, expectations reinforce positive feedback, and this accelerates investment [

22]. At the empirical level, positive feedback occurs when, as a result of intensive investment, demand exceeds supply and a deficit market is formed. In a deficit situation, rising prices further increase demand, create optimistic expectations, form positive feedback and thus blow up the bubble. As investment slows, profitability declines, demand declines, deficits disappear, feedback becomes negative and growth becomes subdued. To boost profitability growth, financial saturation needs to be increased, but this needs to be conducted carefully so as not to form a financial bubble.

3.2. Main Types of Economic Bubbles

So far, there has been no clarity on how to classify price and financial bubbles [

23]. Often, the bubble is still described in the literature as a significant deviation of the market value of a certain category of goods from their fundamental value caused by speculative expectations [

24]. The bubble is a self-sustaining process, when the expectations of market participants to increase prices are strengthened by the increase in demand (and prices) caused by those expectations [

25]. There are more similar definitions. The definition given by the economic historian Kindleberger is considered classic: “A large increase in the price of an asset class is a continuing process where the initial price increase creates expectations of further growth and attracts new buyers, mainly speculators who care about asset trading rather than the ability of property to generate income” [

26]. It turns out that the forecast itself is the main reason for its fulfillment. Similar definitions are provided by other authors [

27]. Such definitions were driven by a misunderstanding of the nature of the bubble, a disregard for the saturation phenomenon, and positive feedback.

According to the logistic growth theory developed on the basis of compound interest rates, economic bubbles need to be divided into price, financial (resonant), and inflationary, based on global market changes [

28]. Each bubble type has its own specifics and is different from the others (

Figure 5).

Price bubbles are usually formed for single, rare but in-demand goods. These are usually auction-bought rare items or collectibles, as well as similar items. These are unique works of art, exclusive diamonds, rare stamps and other distinctive goods. The history of the origin and ownership of a work or thing, in other words its provenance, is also important here. Impressive stories of things make them attractive and in demand, taking them to the heights of admiration and recognition.

A price bubble will occur when the market value of some goods or services will be inadequately high relative to the fundamental value. The basic price would be equal to the price that would have prevailed in the market if there were enough of those goods to meet the needs of all those who wanted to buy it (supply would be equal to demand). The phenomenon of saturation that forms the price bubble in this case does not manifest itself directly, but through the rarity and attractiveness of the product. The problem of the price bubble (formerly known as the value paradox or popularly the water–diamond paradox) has not given peace to many philosophers since ancient times. It was mistakenly thought that the value paradox could be explained by the theory of marginal utility. Eventually, when the phenomenon of saturation was found, the issue became resolved.

There are several examples of price bubbles. There are many works of art whose cost of creation has been relatively low, but the impact of collecting visions, the enthusiasm of the buyer, or the impression of provenance raises their prices to cosmic heights [

29].

Financial bubbles are usually formed in single markets or even in separate asset classes, such as real estate, oil, and some cryptocurrencies. An essential element in the formation of a financial bubble is the phenomenon of saturation in a particular market as a result of financial saturation. The saturation phenomenon in the financial bubble model is presented as a growth impulse. The financial bubble is characterized by the fact that it occurs only when the market is financially saturated. Market saturation turns it into a deficit market. In such a market, every investment creates a growth-boosting impetus through the effects of the saturation phenomenon. Excited growth expectations are boosting demand due to to feedback.

A modern definition of a financial bubble would be that a financial bubble is an intense increase in asset prices resulting from repetitive and resonant investment cycles with positive feedback formed by optimistic expectations resulting from rising returns in a deficit market as a result of financial saturation.

Well-known examples of financial bubbles are the tulip mania in the Netherlands (17th century) or the internet company bubble (1995–2000) and many others. A fairly new, classic example of the financial bubble is the jump in bitcoin prices at the end of 2017. In early 2017, bitcoin cost less than USD 1000. Due to limited supply and demand, a resonant rise in prices began. As a result, at the end of December, its price exceeded USD 19,500. However, sudden (hyperbolic) growth is unsustainable: with a slight change in the demand-supply ratio, prices have fallen dramatically. Bitcoin suddenly fell in price to USD 10,000. Bitcoin extended its existence by fluctuating around this amount, even though it had reached a value of USD 3500. It has been established that even now the absolute majority of bitcoin transactions are only speculative trading in the stock market; bitcoin has become a specific gambling instrument.

Bubbles of gold prices is a popular phenomenon. The first decade after the abolition of the gold standard was marked by a particularly rapid rise in the price of gold. During the mentioned period, the average annual increase in the price of gold (the stage of bubble blowing) reached as much as 27%. However, the sharp rise in the price of gold was followed by a period (from 1980 to 2000) during which the price of gold lost more than 60% of its value and the price bubble has collapsed. There have been more similar periods observed. Money is, among other things, a measure of value, so the unit of measurement should be stable.

The inflation bubble can be viewed in two ways, from both a microeconomic and a macroeconomic perspective. From a microeconomic point of view, neither price nor financial bubbles alone create inflation. Inflation is created by the totality of such bubbles. Therefore, the inflation bubble will occur when financial bubbles occur in many of the country’s economic markets simultaneously. The financial bubble then becomes a source of demand-driven inflation.

It should be noted that the price increase caused by the financial resonance affects the surrounding markets and activates the price increase in them due to the increased costs in the adjacent markets. The real estate bubble is affecting the construction industry, the prices of land, materials and services. Similar interconnections exist in other markets. After evaluating all the processes that take place at the microeconomic level in this way, we observe the inflation bubble.

The concepts of aggregate demand and aggregate supply can also be used to examine the inflation bubble through macroeconomic instruments. We will use a tool used in microeconomics: the growth rate of general compound interest and the saturation phenomenon. We can do this because aggregate macroeconomic indicators meet all the requirements of growth models and at any point in time, GDP growth rate is proportional to its own size. GDP has its own growth threshold-potential GDP. The GDP growth rate correlates with inflation. In this way, the general compound interest model makes it possible to model GDP growth and saturation. Under saturation conditions, GDP growth triggers economic warming, bubble formation and, at the same time, inflation. Demand inflation is a consequence, not a cause, of financial saturation and economic overheating.

Some economists pay close attention to inflation expectations [

9]. However, the importance of inflation expectations is overestimated. Inflation is affected by two types of expectations: direct and indirect. In most cases, expectations act indirectly (in the case of the financial bubble), through an increase in profitability due to the feedback. Indirect inflation expectations are reflected in consumer behavior, which is influenced by rising profitability in saturated markets. Meanwhile, direct inflation expectations accelerate investment when inflation is high and its main cause is costs.

The inflation bubble is organically linked to the problem of economic overheating, which has been studied in sufficient depth. Knowledge of economic overheating can enhance a comprehensive understanding of the inflation bubble [

30].

The recent global economic crises have intensified the examination of the causes of economic shocks [

31]. In the public sphere, economic overheating is defined as a macroeconomic phenomenon where aggregate demand exceeds productive capacity, i.e., creating excess demand [

32]. Other economists point to the following signs of overheating: rising inflation, overly optimistic assessments of economic agents, rapidly rising indebtedness, rising stock and real estate prices, widening trade deficits, wage growth exceeding productivity growth rates, etc. [

33]. According to the World Bank, economic overheating is the inability of a country’s production capacity to meet increased demand for goods and services. All the authors agree that an overheated economy is a consequence of long-term active economic growth, which has led to a significant increase in inflation. It has been observed that the overheated economy grows unevenly (at an unsustainable rate).

Experts generally point to two main signs of economic overheating: inflation and unemployment. According to the World Bank, overheating is characterized by nine signs [

34]:

GDP growth of 7–8% per year or more;

High inflation rates, which cannot be reduced;

Rapid wage growth;

Stock market boom (growth in the number of investors and transactions);

Decrease in the unemployment rate in the country;

Capacity utilization is close to maximum;

Operation of manufacturing firms at the limit of possibilities;

Low labor productivity compared to developed countries;

the budget deficit.

Most signs of overheating correspond to the signs that shape the saturation phenomenon. Here are some equivalents: inflation—rising profit rates, full employment—low unemployment, saturation—stock market boom, etc. We can assume that economic overheating is an element of the process of saturating inflation.

The empirical observations presented and analysis performed allow to formulate demand inflation as an aggregate result of the financial saturation process. The inflation bubble or is a macroeconomic phenomenon in which aggregate demand (the sum of demand-generating financial resources) exceeds productive capacity (reaches overemployment) and generates overheating due to the effects of financial saturation accompanied by rising prices and bubble formation.

The economic bubble’s theory based on the saturation phenomenon shows that economic bubbles are demand-driven inflation bubbles. It can also be concluded that demand inflation is a consequence of economic growth, not a cause, as many economists believe.

3.3. Phillips Curve and Saturation

The Phillips curve shows the relationship between unemployment and inflation, displaying that the higher the unemployment, the lower the inflation and vice versa. This dependence was also noted by the American economist Irving Fisher (1867–1947). The British economist A. W. Phillips (1914–1975) examined the relationship between the change in the unemployment rate and the nominal wage (later adjusted for inflation). In 1958, Phillips finally declared the relationship between wages and unemployment. This dependence was transformed into a link between inflation and unemployment and received the name of the Phillips curve. Phillips’ dependence was believed to manifest itself in all cases. This caused confusion among later economists and cast doubt on the reliability of some theories. It was thought that the unemployment rate could be reduced by raising inflation. However, it later became clear that both unemployment and inflation could rise or fall at the same time. However, E. S. Phelps did not support this view and developed a new theory of unemployment and inflation. This theory shows that inflation depends not only on unemployment but also on inflation expectations, i.e., expected inflation rate in the future. E. S. Phelps argued that in the long run, actual inflation is in line with expected inflation, which means that there is no relationship between unemployment and inflation at all [

9].

It is possible to state that E. S. Phelps greatly overestimated expectations. This can be explained by the fact that at that time, the saturation paradox was not known. Our research on the saturation paradox (both theoretical and empirical) shows that inflation is a consequence of the economic saturation of the economy.

Based on the analysis presented, it can be argued that the saturation phenomenon is the key to price or financial bubbles and, at the same time, to demand-driven inflation. Moreover, based on the phenomenological method, there is reason to believe that the dependence of the productivity (interest) rate on the degree of saturation is a prototype of the Phillips curve. To make sure, it is enough to redraw the saturation phenomenon curve-to plot employment instead of unemployment. Since Employment + Unemployment = 1 (100%), then Employment = 1 − Unemployment. We have a graph of the saturation phenomenon thus rearranged in

Figure 6. Visually, the graph (dashed line) depicts the Phillips curve.

Looking at the Phillips curve from the other side, it can be seen that it is a slightly modified graph of the saturation phenomenon. On the horizontal axis of the saturation graph is the employment rate, which is assumed to be linearly related to unemployment in our model, though because of unregistered work and the voluntary leave from the labor markets it is not always true in practice. The vertical axis, meanwhile, has profitability that can be transformed into inflation.

In summary, it is concluded that Formula (3) can be also a generalized model of aggregate inflation. The necessary economic parameters must be selected for this. Preliminary examination showed that the Phillips curve data from 1961–1969 in the United States can be approximated with acceptable accuracy by the saturation phenomenon Equation (3). As comprehensive analysis of gross interest rates shows that they are closely linked to inflation and can therefore be used to model inflation.

4. Development of Aggregated Inflation Model

The aggregate inflation model is formed from the saturation phenomenon Equation (3) assuming that the time parameter

t = 1

where

iA is an aggregate annual inflation,

Kp is the potential GDP of the country,

K0 is the GDP of the first year,

K is the GDP of the second year, and g is the aggregation coefficient determined on the basis of historical inflation indicators.

Formula (4) allows the calculation of annual aggregate inflation. It differs from inflation based on the consumer price index, but has valuable information that reflects the real situation of the economy. Modifications of this model are possible according to the interest rate, valuation duration, and other indicators.

According to the general theory of economic equilibrium is situation that aggregate demand equals aggregate supply, i.e., when AD = AS. The method of phenomenal analysis allows us to assume that economic equilibrium exists, but only in a free, financially unsaturated market.

In microeconomics, price and financial bubbles are measured by the balance of supply (D) and demand (S). When D = S we have that D/S = 1.

Similarly, when D < S, then D/S < 1, and when D > S, then D/S > 1. Since we relate these dependencies to markets, we have D/S = 1 or D/S ≈ 1 in the equilibrium market. Meanwhile, in a deficit market D > S or D/S > 1. When D < S or when D/S < 1. In such cases, it is said that the market is profitable however, if the situation does not change for a long time, such a market becomes unstable.

In macroeconomics, we use concepts of aggregate demand and aggregate supply. Just as we compare demand and supply in microeconomics, we can compare aggregate demand and supply in macroeconomics.

In

Figure 7, the main options for balancing aggregate supply and aggregate demand are presented. There are more intermediate options. With the help of these options, it is possible to tentatively characterize the state of the country’s economy. Equilibrium deviations are distinguished here:

AD >

AS and

AD <

AS.

Let us discuss separately the deviation from the equilibrium AD > AS. This deviation is created through the financial markets by the saturation of the markets, which results in the phenomenon of increasing productivity (profitability). If aggregate demand in the economy exceeds aggregate supply for a sufficient period of time, an aggregate deficit is formed. This situation is causing an overall rise in prices, also known as the economic bubble, and with it demand-driven inflation.

Sometimes it can be problematic to distinguish between different types of inflation because they are interconnected, even when operating in different markets. With regard to both demand- and cost-driven inflation, and in particular the financial bubbles in individual markets, it is important to emphasize what the price level corresponds to a price level based on fundamental analysis. This is the price level at which demand equals supply, i.e., when the condition D ≈ S is satisfied. Whereas when aggregate demand equals aggregate supply, i.e., that is, when the condition AD ≈ AS is met, we have a natural level of inflation corresponding to economic growth of well-functioning free market.

In

Figure 8, a fragment of the inflation model forming the core of the inflation model is presented. Two cases are distinguished: when

AD/AS ≈ 1 and when

AD/AS > 1. In the first case (

AD ≈ AS) economic growth is sluggish, with cost increases due to higher raw material and energy resources, rising import prices, rising wages not linked with labor productivity growth. As a result, supply is falling, prices are rising, and unemployment is rising. The market is unsaturated and therefore a free market mechanism is well functioning. Stagflation is usually formed on the basis of cost inflation.

In the second case, demand exceeds supply (AD > AS) and as a result markets become financially saturated. As the economy becomes in deficit, aggregate demand increases. As the deficit grows, speculative business intensifies, and at the same time speculative demand increases. Hidden overproduction is forming and the market is heating up. Inflation here is consistent with the nature of the Phillips curve. A saturated market must be protected from possible overheating in order to keep functioning well.

As the market heats up, employment also increases. In general, full employment occurs at labor market equilibrium, with the number of unemployed equal to the number of job vacancies and the economy making full use of labor resources. If the pressure on the financial markets continues to increase, this means that saturation is increasing, aggregate demand will continue to rise, and labor shortages will occur, which will lead to higher wages and, as a result, increases in prices. When the economy is heating up, inflation is rising.

The detailed structure of the inflation model is presented in

Figure 9. The model is based on the evaluation of aggregated parameters, i.e., comparing aggregate demand (

AD) and aggregate supply (

AS). In the model block financial markets includes all types of investment. The analysis of the model starts with the formation of weakening aggregate demand and deflation, when aggregate demand is significantly lower than aggregate supply (

AD << AS). It should be noted that natural long-term economic growth occurs when aggregate demand is approximately equal to aggregate supply (

AD ≈ AS), when there are no shocks such as rising energy and natural resource prices, agricultural output deficits, exchange rate fluctuations, declining production efficiency, and so on. When stable, natural inflation is formed.

Additionally, when aggregate demand is approximately equal to aggregate supply (AD ≈ AS), markets (economies) can self-regulate. We consider such a market to be free. In all other cases, markets must be managed. We sometimes call them Keynesian markets.

The core of the inflation model is described in

Figure 9 and the drivers of cost and demand-driven inflation are presented. We have seen that supply driven inflation is stimulated by rising commodity and import prices, rising wages etc. Meanwhile, demand-driven inflation is facilitated by availability of financial resources, financial pressures, growing expectations. It should be noted that here expectations are involved in the cyclical process of price growth, and not directly in the process of rising inflation.

Finally, a case is presented where aggregate demand is significantly higher than aggregate supply. The satellite of such a situation is currency devaluation and, finally, hyperinflation.

The economy is constantly growing in the long run. The money market must be equal in value to all goods and services. When the function of money was performed by gold standard or other precious metals, it was quite difficult to maintain this proportion. In addition, gold or other substitutes for money blow bubbles, making it even more difficult to use them in the sphere of exchange.

The problem of the right amount of money in the market exists. Fractional reserve banking is now common. It’s an adaptive system, and it offers about as much money as the market needs at the time [

26]. Partial reserve banking has come a long way in its development, has established itself in commercial banks overseen by state-owned banks, and is now prevalent around the world.

Partial reserve banking is banking activities in which only a certain part of the bank’s deposit is treated as bank reserves in the form of cash or other liquid assets. It can be removed from the account at any time. When cash is deposited in a bank, only part of the funds is held in reserve and the remaining money can be issued as a loan. The loan issued is usually subsequently deposited with another bank, thus creating new deposits and allowing them to be re-issued with new credit. Each time the initial amount is repaid, its share remains smaller and smaller, so the total amount of money repaid is finite and its size depends on the multiplication factor. Thus, such lending increases the money supply in the country. It is often metaphorically expressed in society that private banks create money from the air. As a result, the money supply in the country is many times larger than the monetary base created by the country’s central bank. When an individual or a company takes out a loan, a commercial bank generates the entire amount lent from the air. When a borrower makes a loan, this money is withdrawn from circulation, figuratively speaking, they are converted back into air. For bank loans i.e., interest is charged on that money generated from the air. This means that when the loan is given, the large portion of income from interest (except cost of funding, the cost of regulatory capital, etc.) remains in the bank and increase the bank’s profits. As the economy grows, banks finance more loans, generate more money, and receive higher interest rates, hence banks are interested in issuing as many loans as possible. Therefore, in the case of banks landing excessive amounts to real estate markets and generating financial bubbles, strict state control policies and central bank landing regulations are necessary.

In any case, the amount of money generated by a bank will be in proportion to the assets that function in that economy. Money is growing at the same rate as the economy as a whole, which makes prices relatively stable. Therefore, partial reserve banks fundamentally change the money supply but, in the opinion of their representatives, do not cause additional inflation or deflation [

26]. In fact, banks manage the availability of investors ’money and thus accelerate or slow down investment processes, when aggregate demand exceeds aggregate supply, further investment heats the economy, blows the bubble, and causes inflation. That process must be monitored by the central banks and responded accordingly.

5. Discussion

Previous research studies attempted to provide a characterization of the dynamic links between risk, uncertainty, and monetary policy, using a simple vector autoregressive framework [

35], or stochastic simulations at investigating the extent of complement between price stability and financial stability [

36]. During the last decade of relevant research, the affection of monetary policies on how asset prices interact with the real economy has been noted. Moreover, the incorporation of exogenous bubbles in asset prices is noteworthy [

36]. In particular, the Federal Reserve’s pattern of providing liquidity to financial markets following market tensions, which became known as the “Greenspan put,” has been noticed as one of the contributing factors to the build-up of a speculative bubble prior to the 2007–2009 financial crisis [

35]. An asset bubble can affect real economic activity via the wealth effect on consumption, supporting firms’ financial decisions while valuing of assets on the balance sheet. In this context, it has been reported that central banks value a high complementary linkage between price stability and financial stability, whereas central bank policies could be unresponsive to changes in asset prices, except insofar as these are proving signal changes in expected goods and services inflation [

36].

In our study, it was signified that inflation should be regulated and economic growth must be controlled, either to be stimulated, when it is low, or to be limited, when it is too high and in order. In parallel, overheating of the economy can be avoided by determining and undertaking the adoption of specific monetary policies, including the limitation of investments, and the formation of bubbles. In times of ample liquidity supplied by the central bank, investment managers have a tendency to engage in risky, correlated investments. To earn excess returns in a low interest rate environment, their investment strategies may entail risky, tail-risk sensitive, and illiquid securities. A tendency of herding behavior emerges due to the particular structure of managerial compensation contracts. Managers are evaluated vis-à-vis their peers and by pursuing strategies similar to others, ensuring that they do not under perform. This attributable channel of monetary policy transmission can lead to the formation of asset price bubbles and can threaten financial stability. Yet (by the time of one decade earlier) authors denoted that there was no empirical evidence on the links between risk aversion in financial markets and monetary policy [

35]. In response to this sparsely studied relationship between risk aversion in financial markets and monetary policies, [

35,

36], established specific simulations and models of investigating the operation of financial markets, especially through crisis periods and times of economic recession.

In particular, Bekaert [

35] introduced the VIX index as a popular indicator of risk aversion in financial markets. In particular, these authors decomposed this VIX index into a risk aversion and an uncertainty component, where an estimate of the expected future realized variance was needed. In this case “uncertainty” is termed as the “stock market volatility”. This estimate was customarily obtained by projecting future realized monthly variances (computed using squared 5-min returns) onto a set of current instruments. To select a good forecasting model, a horserace was conducted between a total of eight volatility forecasting models. The specific criteria of models selected were out-of-sample root mean squared error and mean absolute errors, and, for the estimated models, stability, especially through the crisis period. This procedure enabled researchers to select a two-variable model where the squared VIX and the past realized variance could be used as predictors [

35]. Bekaert et al. [

35] argued that a lax monetary policy can decrease both risk aversion and uncertainty, while the former effect, that of risk aversion, is stronger than the latter, thereby leading to the uncertainty.

In a methodological basis, it was shown that:

- -

The estimation a structural vector autoregressive model (SVAR) had been utilized on monthly US data for industrial production growth, inflation, the monthly federal funds rate, and monthly stock market returns. These authors utilized the residuals of the monthly federal funds rate in the SVAR equation as proxies of monetary policy shocks. Then, authors regressed contemporary stock market returns and monetary policy shocks controlling the expected monetary policy stance. This second step enabled authors to condition the analysis to achieve their research objective [

2].

- -

The structural vector autoregressive framework aims at controlling for business cycle movements and using a variety of identification schemes for the vector autoregression in general and monetary policy shocks in particular. The effect of monetary policy on risk aversion was also noticeable in regressions using high frequency data [

35]. Bekaert et al. [

35] concluded that monetary policy would not have a sufficiently strong effect on asset markets to pop a “bubble”. However, if monetary policy significantly affects risk appetite in asset markets, this conclusion may not hold. Indeed, if one channel is that lax monetary policy induces excess leverage, perhaps monetary policy is potent enough to weed out financial excess. Conversely, in times of crisis and heightened risk aversion, monetary policy can influence risk aversion and uncertainty in the marketplace, and subsequently affect real outcomes [

35].

6. Conclusions

Demand-driven inflation is one of the most important components of inflation in modern developed economies. Demand inflation is the result of economic growth (but not the other way around). The economy is growing rapidly and inflation is rising rapidly. To manage inflation, we first need to manage economic growth.

The fast-growing economy is causing a bubble and inflation, followed by an economic crisis. In order to achieve sustainable economic growth, economic growth must be controlled: stimulated when it is low and limited when it is too high. To avoid overheating of the economy, it is necessary to limit investments; this can reduce the financial saturation of the relevant markets. This requires the creation of investment rules.

It is necessary to adjust the established approach to inflation and its causes. The phenomenon of saturation is the key in explanation of price or financial bubbles and, at the same time, to demand-driven inflation. In financially saturated markets, due to the influence of the saturation paradox, profitability is higher than in unsaturated markets. As a result, demand surpasses supply.

In an economy in which aggregate financial saturation is formed and aggregate demand is greater than aggregate supply, the general theory of economic equilibrium discontinues to be applied. The market equilibrium mechanism is well-functioning in an open, financially unsaturated market where supply is approximately equal to demand.

When aggregate demand is approximately equal to aggregate supply (AD ≈ AS), the economy can self-regulate. In all other cases, due to the threat of a crisis, the economy must be regulated. Demand-driven inflation is a consequence of economic growth, not a cause. The natural level of inflation corresponding to natural economic growth will be when aggregate demand equals aggregate supply, i. i.e., when the condition AD ≈ AS is satisfied.

The macroeconomic meaning of the saturation phenomenon would be that in a saturated economy, the return on investment is always higher than in an unsaturated one, and the rate of return depends on the degree of saturation. The process of saturation begins when the flow of investment reaches the area of full employment, the most important part of which is the area of overemployment. The area of overemployment is finite, and the end of that area is characterized by exceptionally high profitability. The saturation phenomenon makes it possible to distinguish three types of financial saturation bubbles: the price bubble, the financial bubble, and the inflation bubble. The price bubble is indirectly affected by the saturation phenomenon.

The importance of inflation expectations is overestimated. In most cases, expectations work indirectly through profitability increases and through the positive feedback. To overcome stagnation (stagflation), it is necessary to mobilize a sufficient number of solvent investors who have expressed (enthusiastic) optimistic expectations.

Thus, economic growth must be regulated in order to ensure sustainable economic growth. Economic growth should be stimulated when it is low and controlled when it is too high. In order to avoid overheating of the economy, it is necessary to limit the financial saturation of the relevant markets.

The conducted study has several important limitations. First, in a developed aggregate inflation model, the employment rates are assumed to be linearly related to unemployment, though because of unregistered work and the voluntary leave from the labor markets, it is not always true in practice. Therefore, the validity of the theoretical model is affected. The empirical application of this model is necessary to verify its validity. Future research is foreseen for empirically testing of the developed theoretical model.

Therefore, though a theoretical model of aggregate inflation was developed by indicating the main drivers of inflation and thus contributing to the concept of controlled economic growth to pursue sustainable economic growth of the country, it is necessary to develop a case study and to apply the developed model for a specific country. A future study will present the empirical testing of the developed model for Lithuania and further test it for other European Union member states.